Headlines

- Stocks regain more than half of Friday's rout after President Trump softens his China stance.

Global Economics

United States

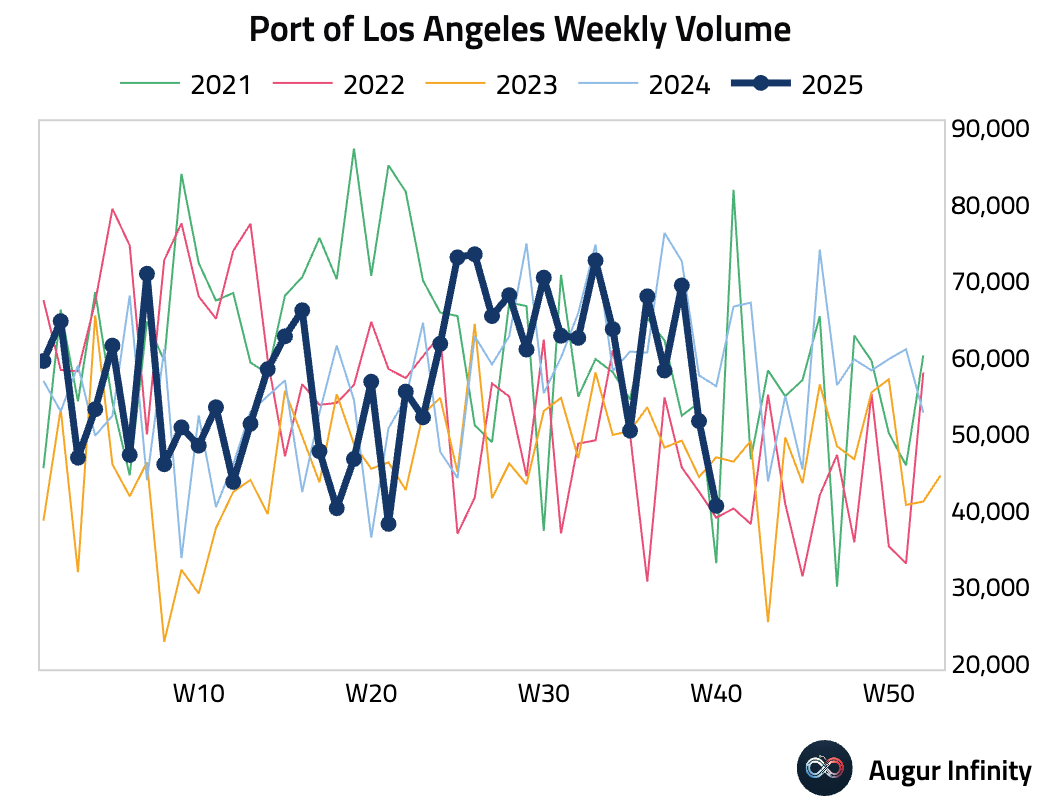

- Container volume at the Port of Los Angeles declined sharply over the past two weeks.

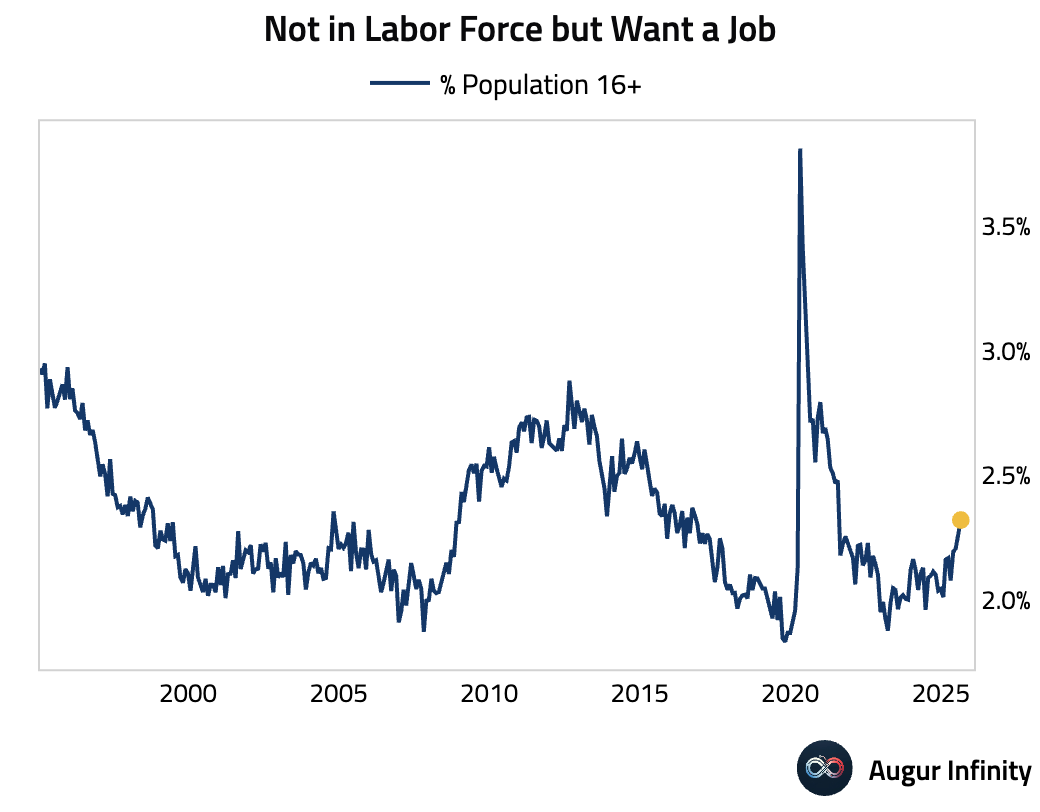

- Those who are not in the labor force but want a job have increased meaningfully this year.

Europe

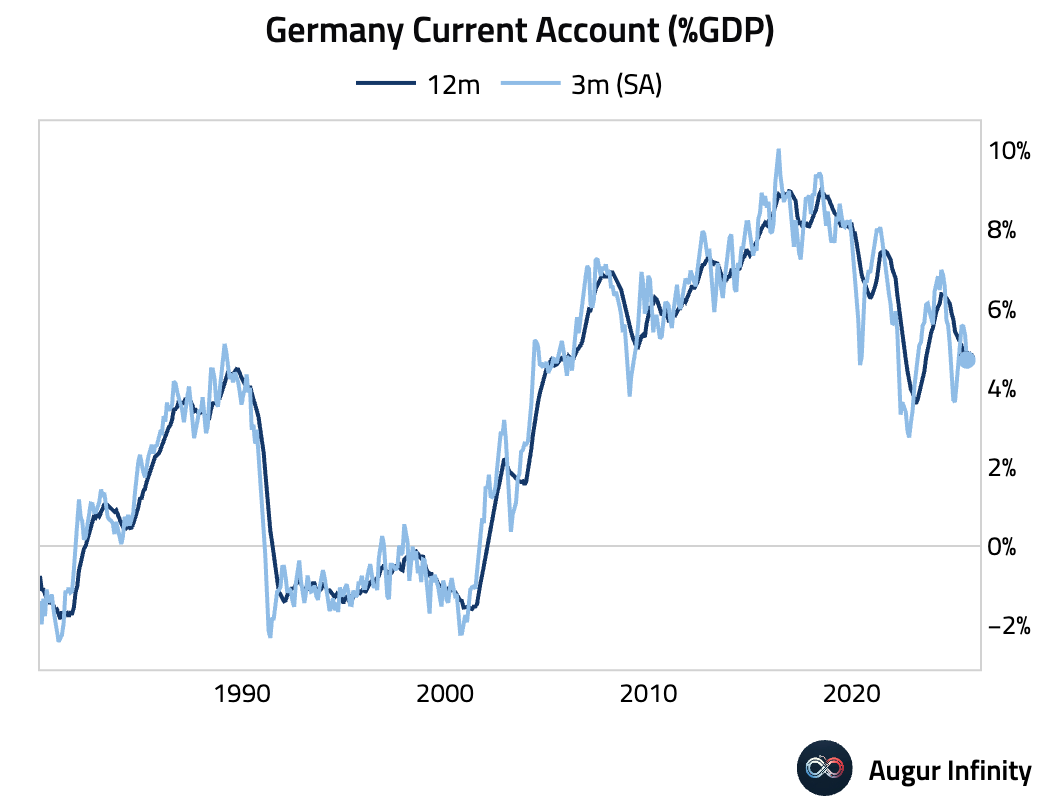

- Germany’s current account surplus narrowed (act: €8.3B, prev: €15.6B).

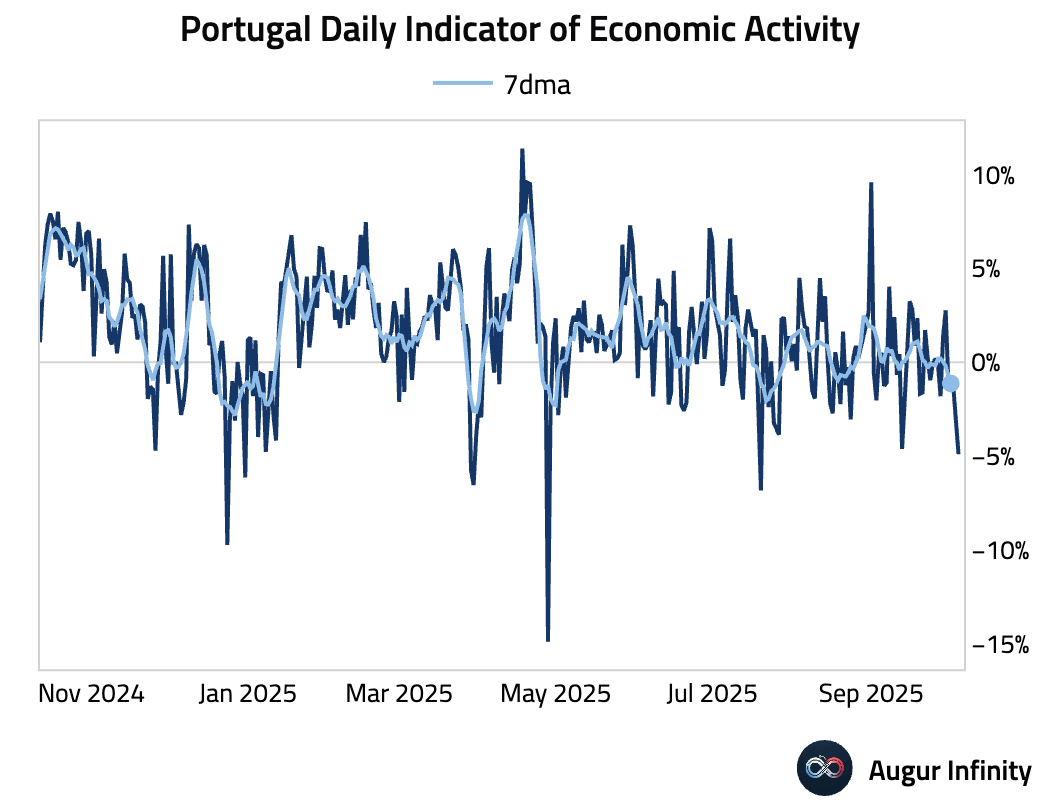

- Portugal's daily economic activity indicator declined.

Asia-Pacific

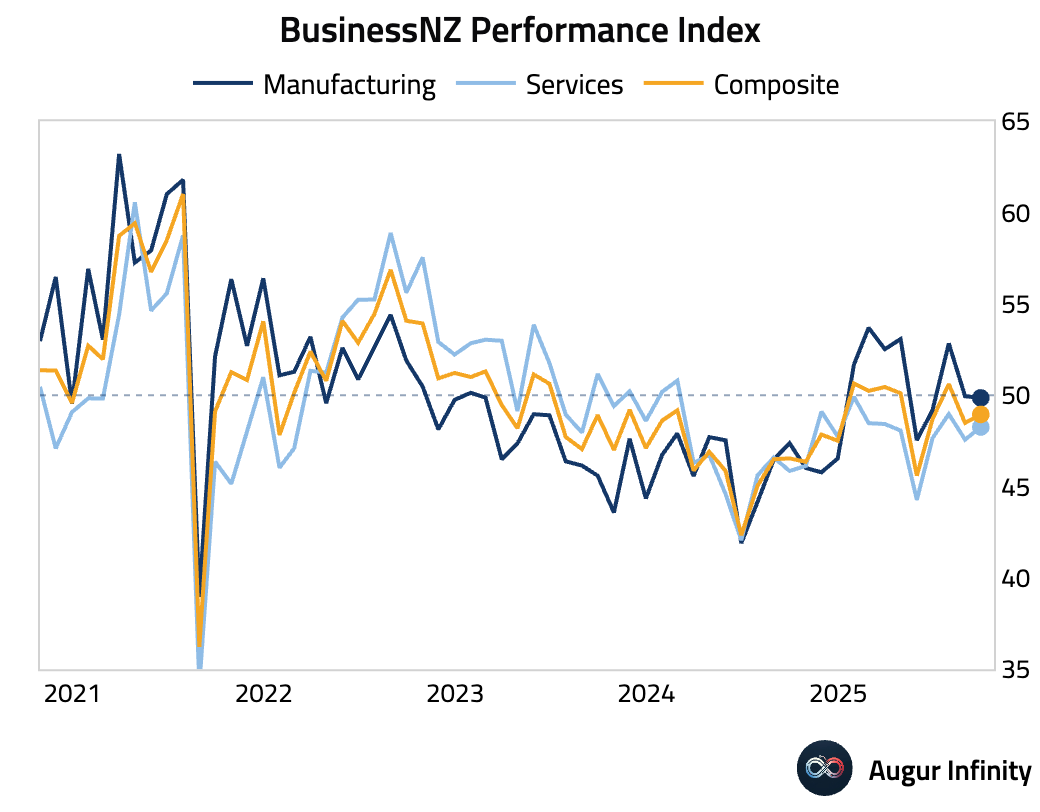

- New Zealand's services sector remained in contraction for the 19th consecutive month, even as the PSI rose slightly. The broader Composite Index (PCI) also pointed to ongoing economic contraction at 48.5.

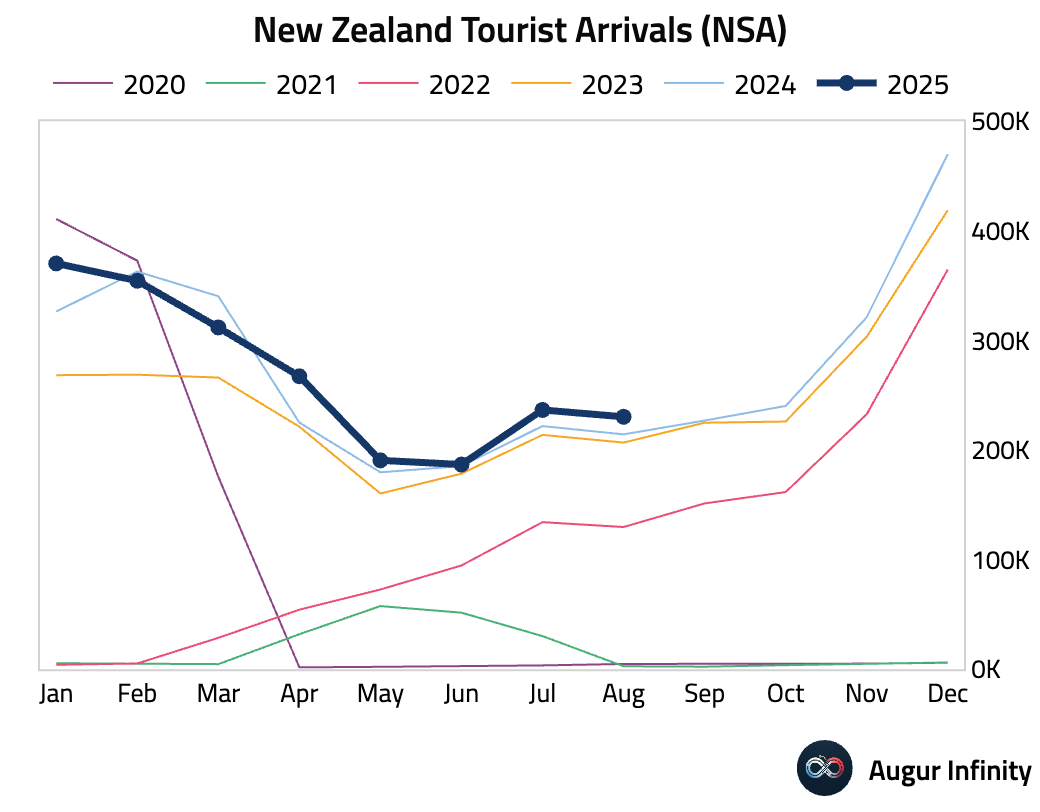

- New Zealand's visitor arrivals accelerated from 6.6% Y/Y to 7.5%.

China

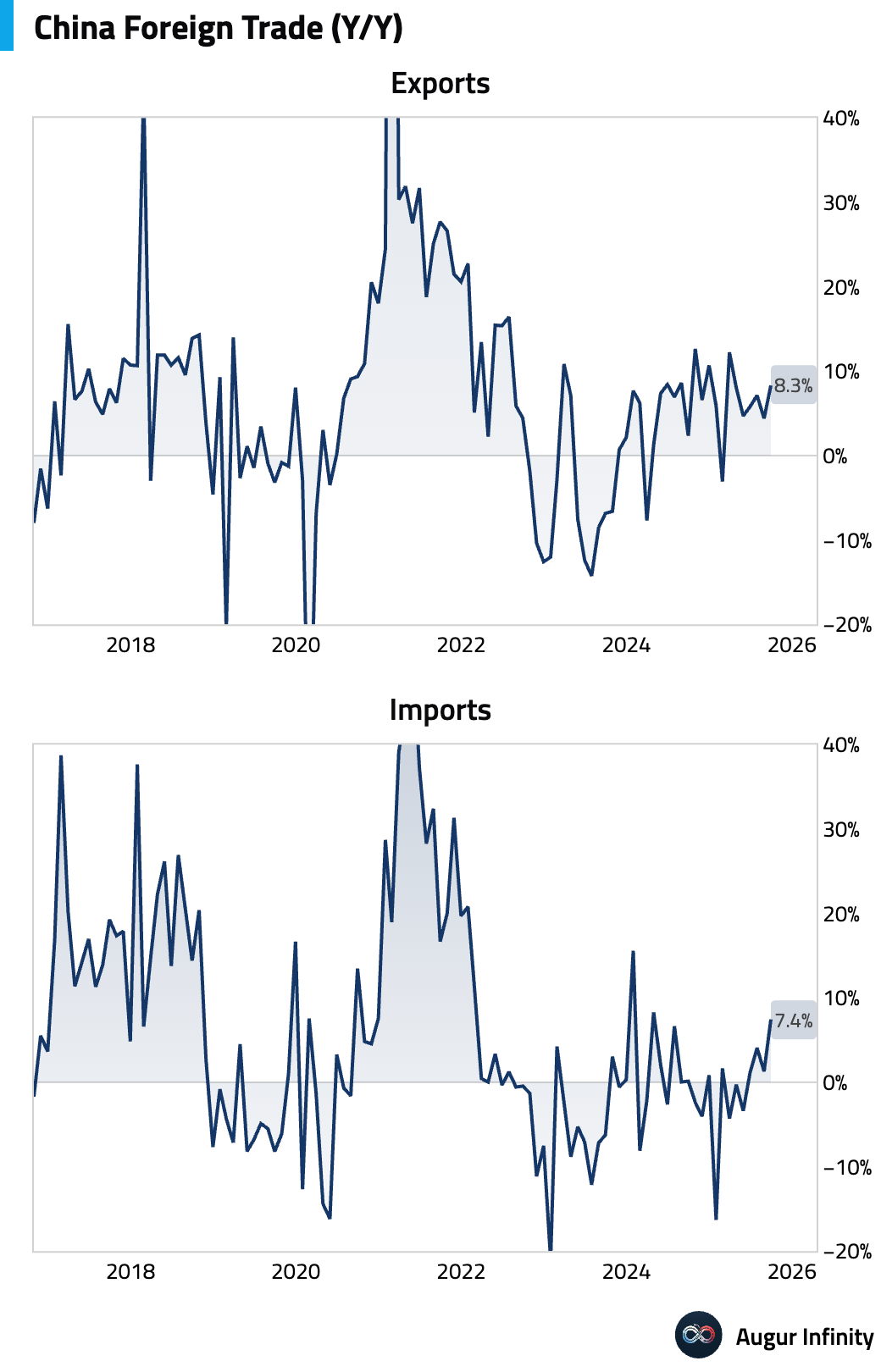

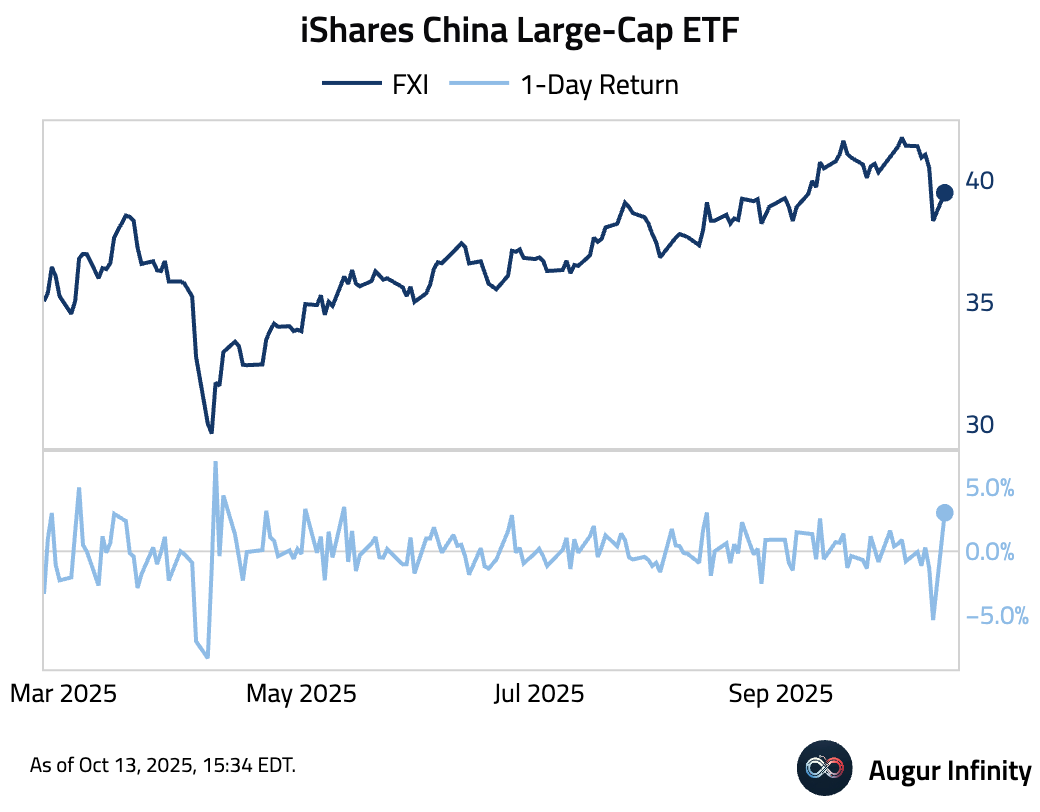

- China's exports rose 8.3% Y/Y (est: 6.0%), while imports surged 7.4% Y/Y (est: 1.5%). The strong export performance was driven by a rebound in shipments to the US. The broad-based import surprise points to firming domestic demand, helped by more working days and strong sequential gains.

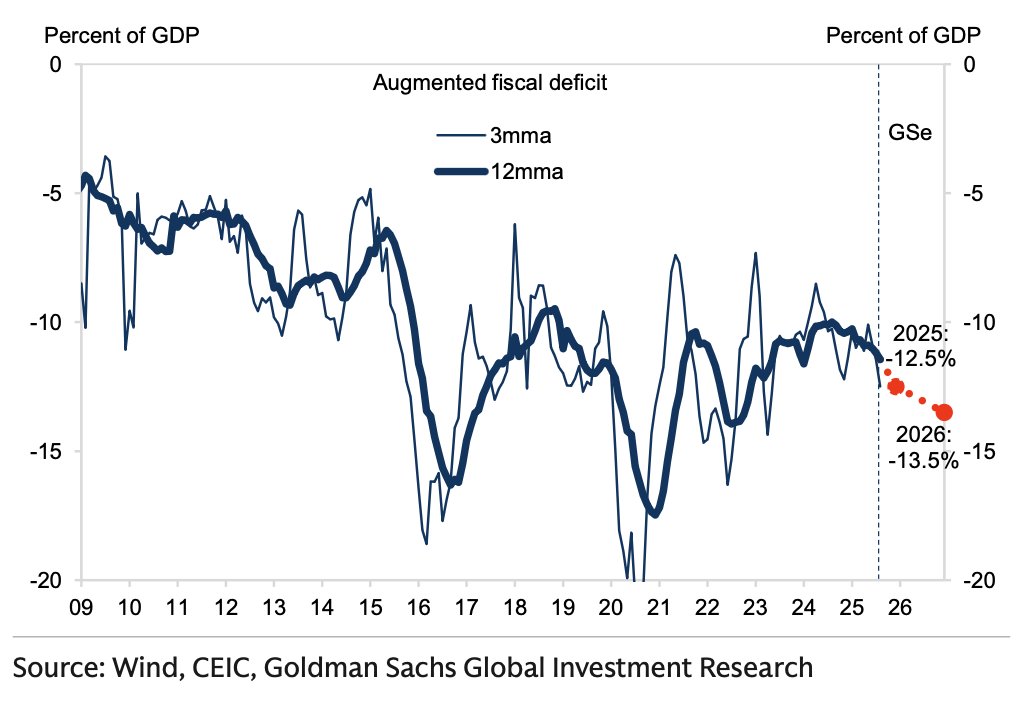

- Goldman's augmented fiscal deficit for China has widened in recent months.

Source: Goldman Sachs

Emerging Markets ex China

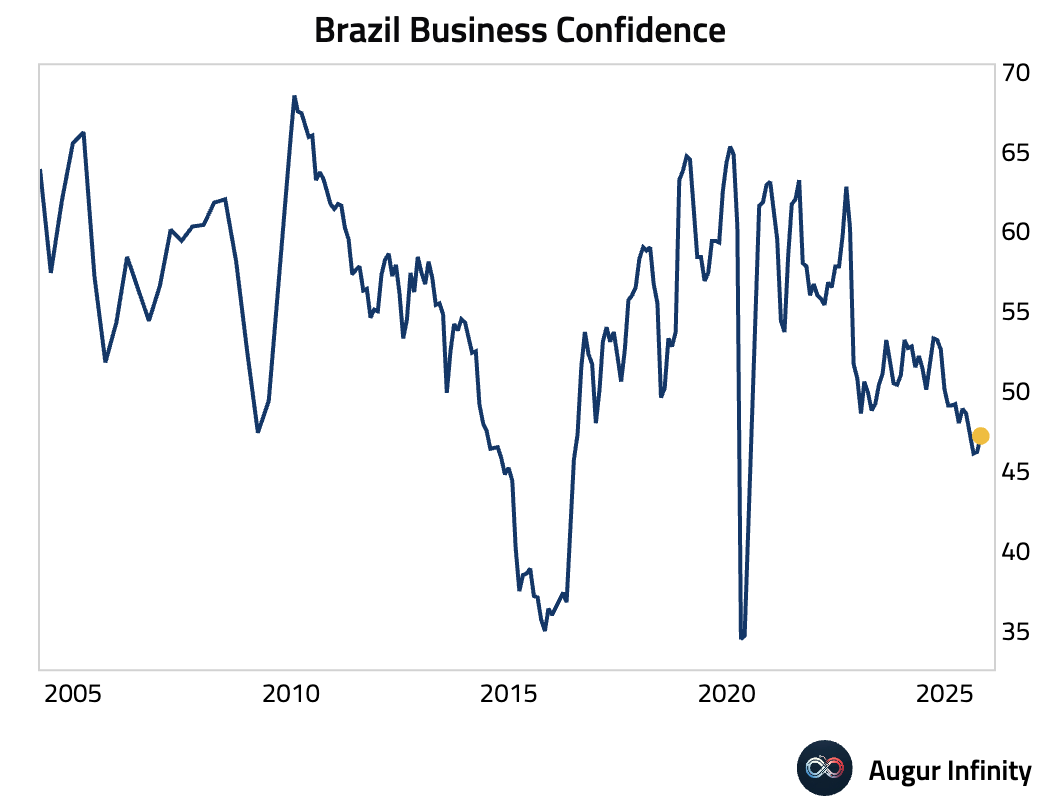

- Brazil business confidence rose.

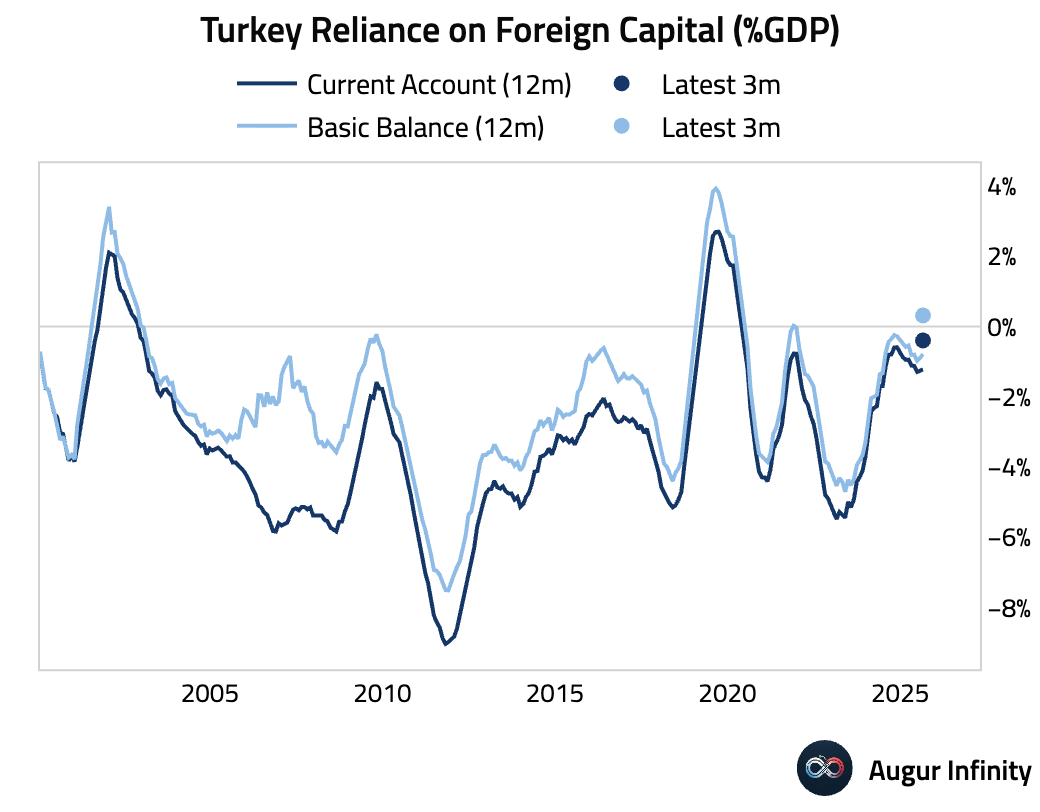

- Turkey's current account improved.

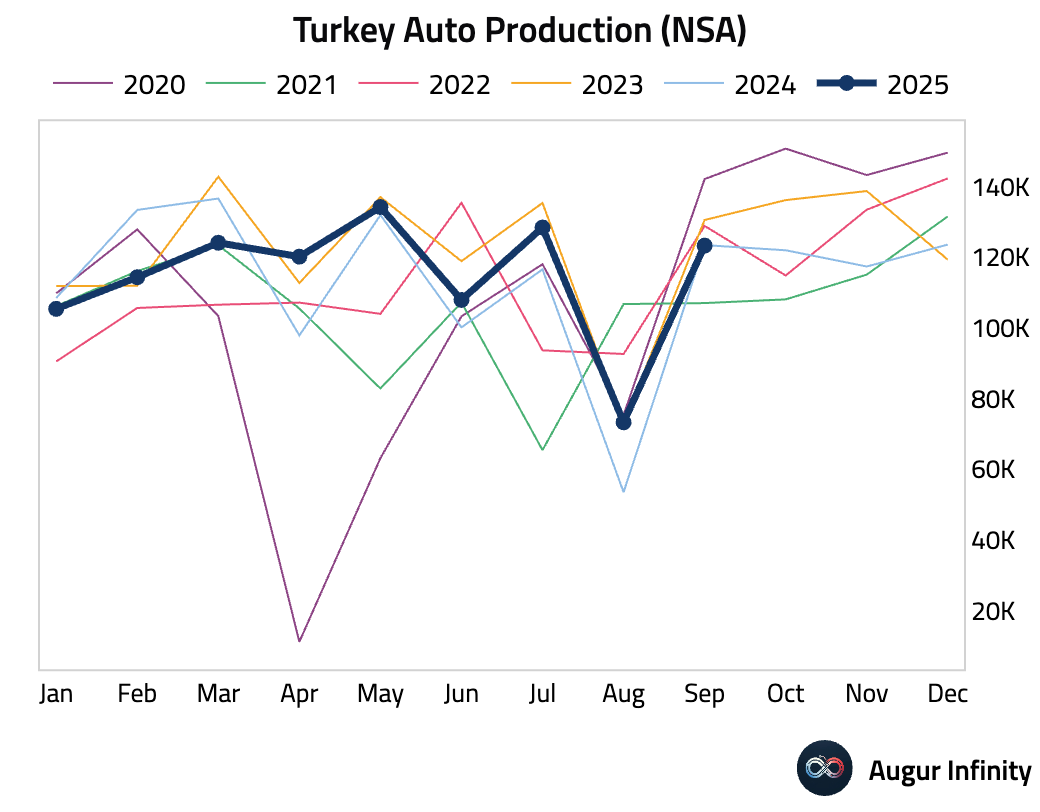

- Turkish auto production contracted slightly after a strong prior month (act: -0.1% Y/Y, prev: 37.0%).

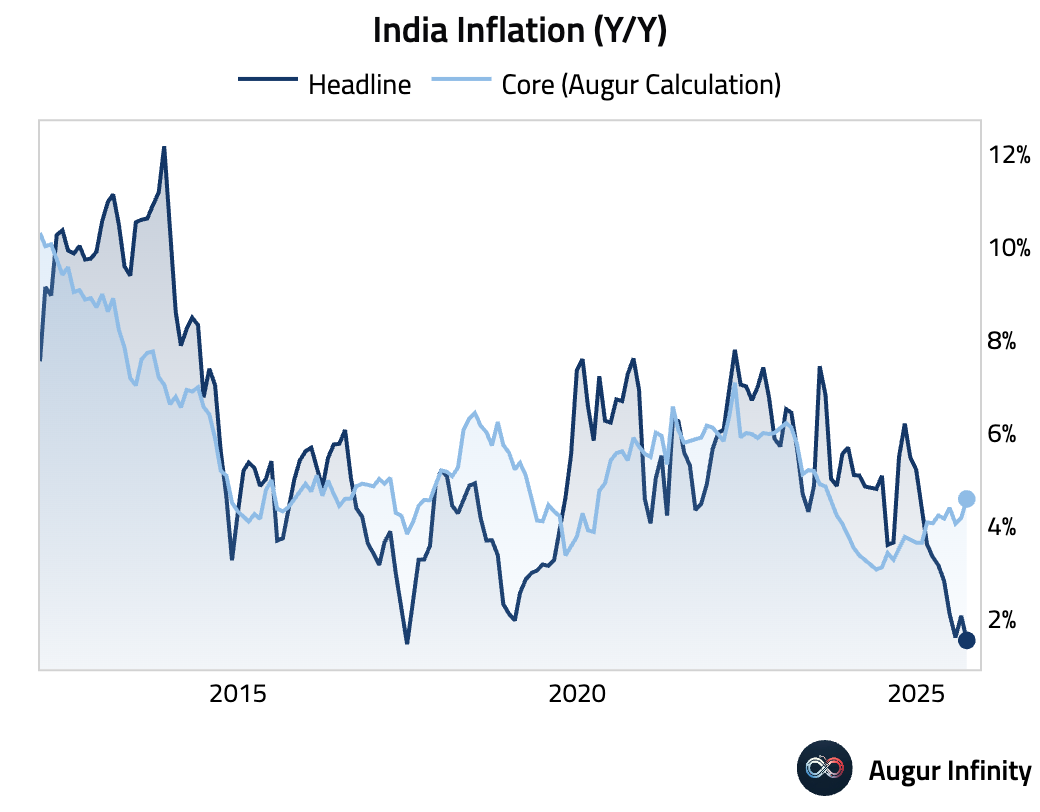

- India's headline inflation fell further to 1.54% Y/Y in September, below consensus and the RBI's 2–6% target range, primarily due to a sharp fall in vegetable prices. Core inflation rose, driven by higher housing and gold costs.

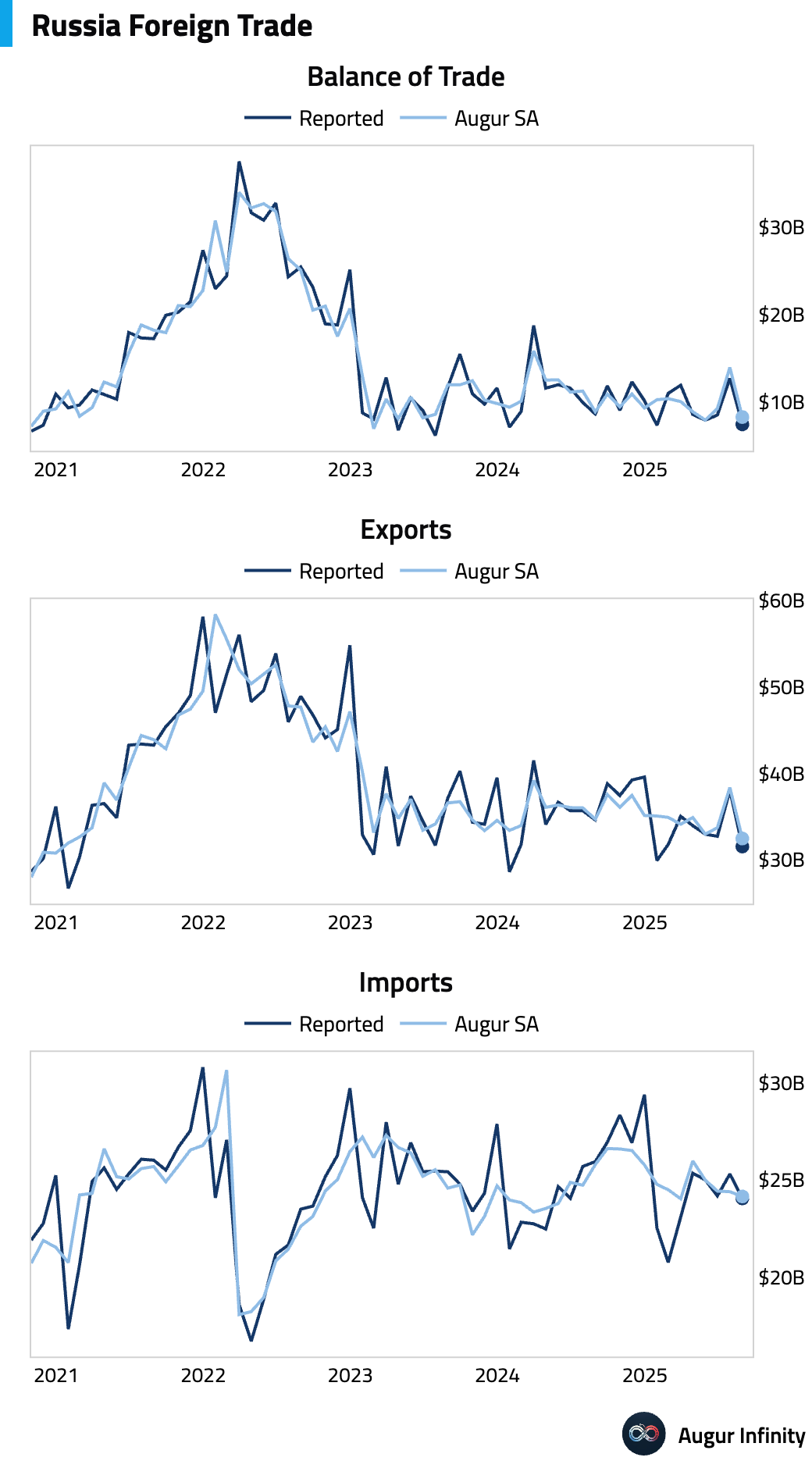

- Russia's trade surplus shrank in the latest period (act: $7.47B, prev: $12.7B).

Global Markets

Equities

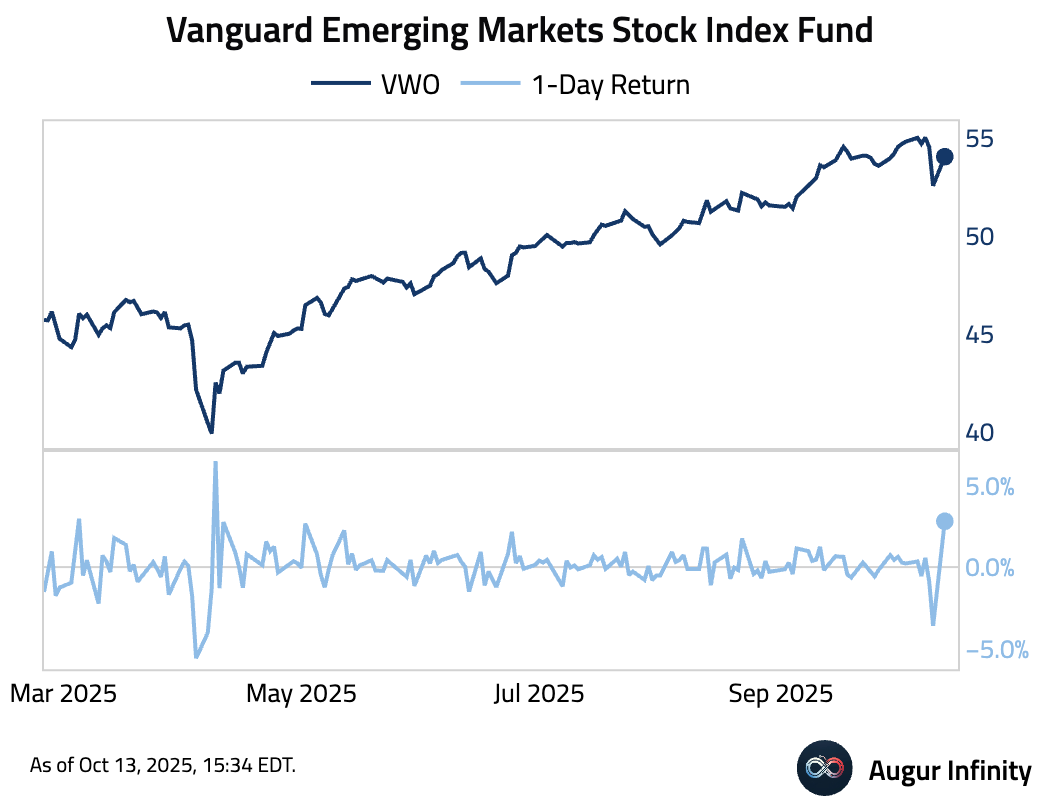

- Stocks staged a big comeback. Vanguard Emerging Markets Stock Index Fund had the best 1-day return since April …

… led by China.

Fixed Income

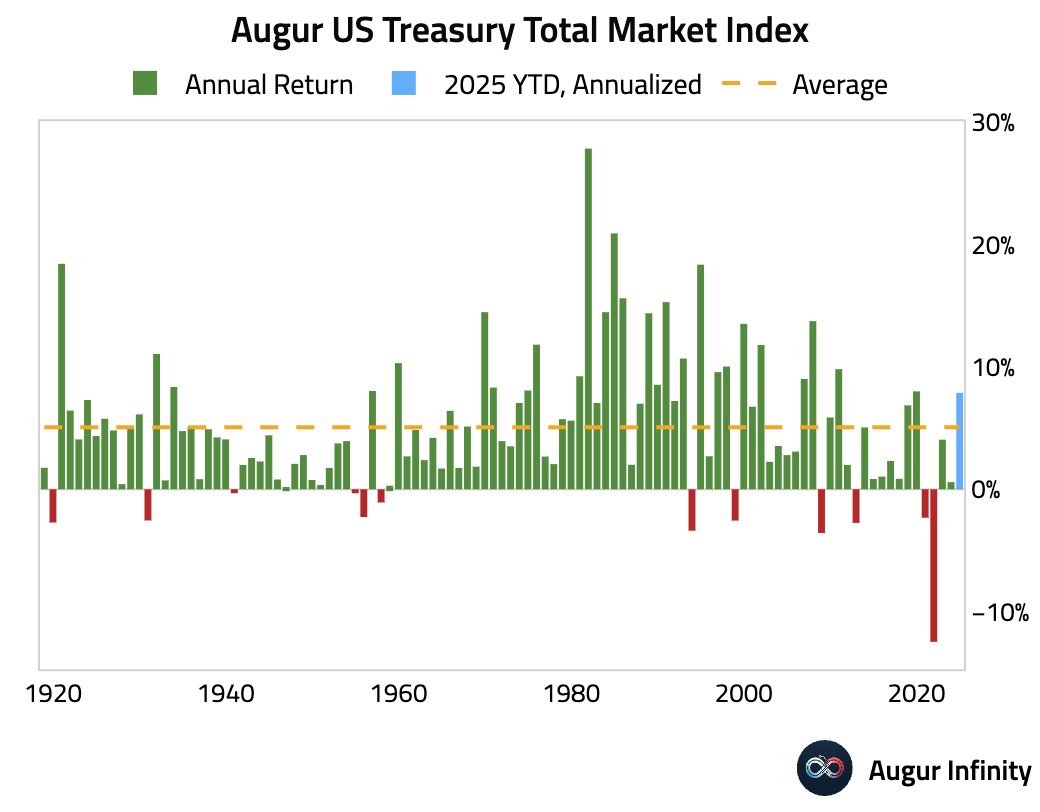

- The year-to-date Treasury return, when annualized, is the best in five years.

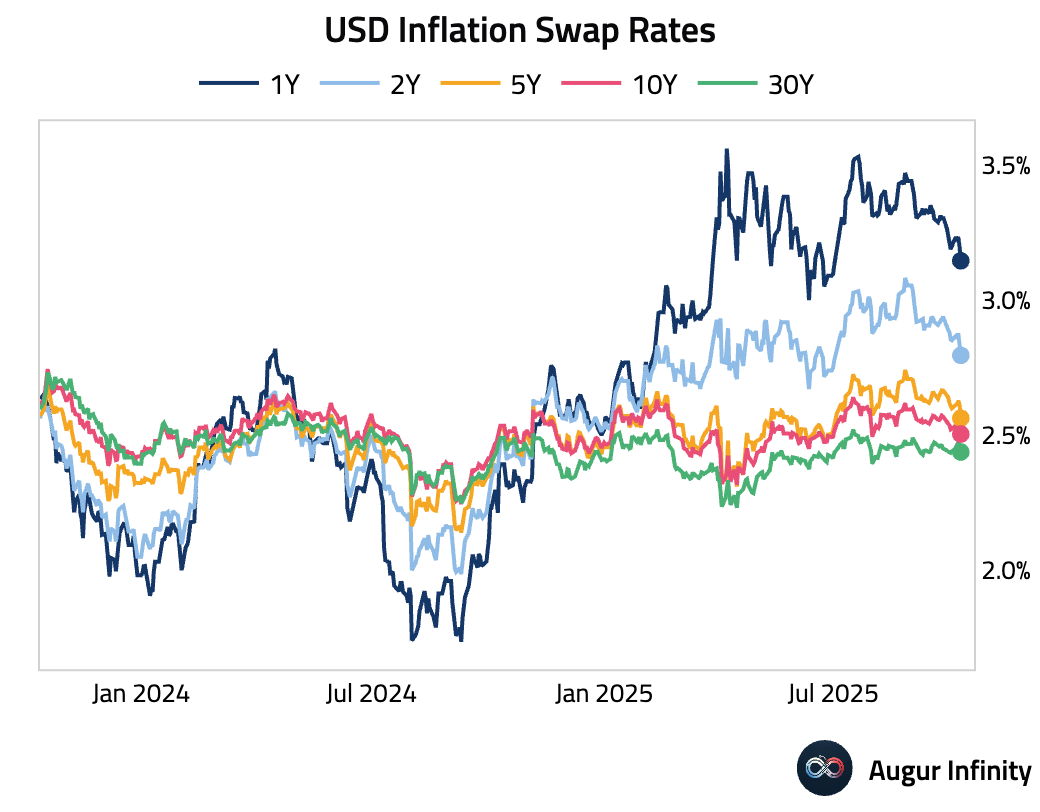

- Market-based inflation expectations have declined over the past few weeks.

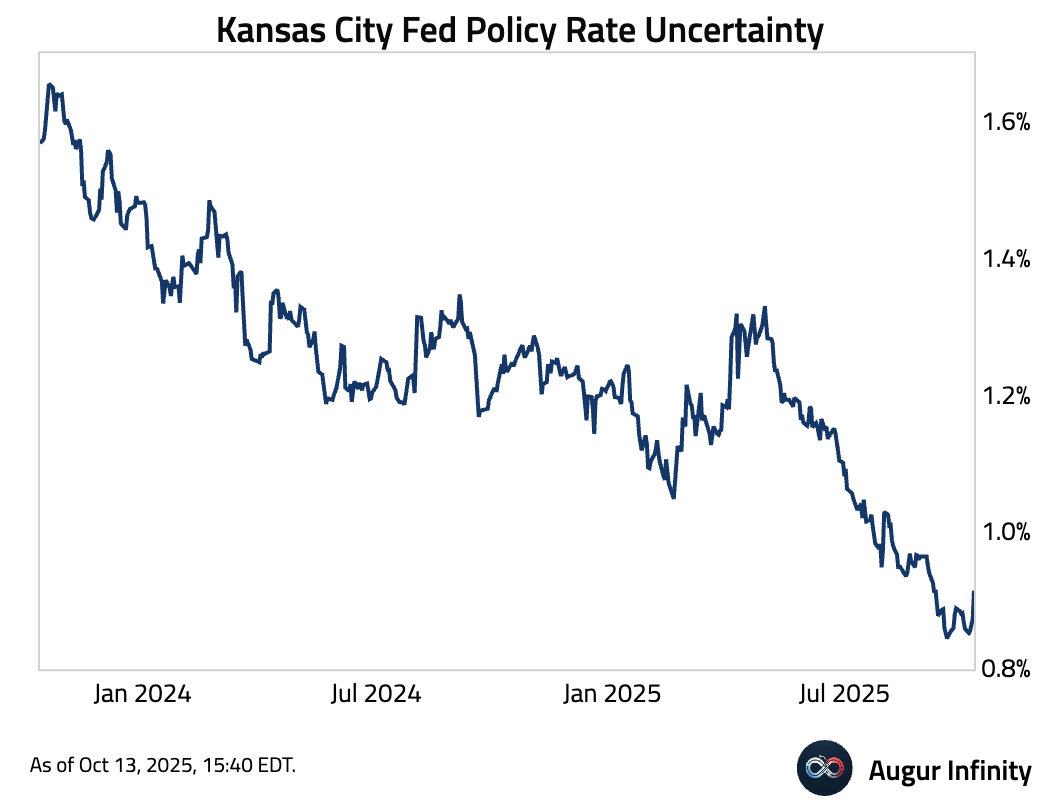

- Kansas City Fed Policy Rate Uncertainty rose.

FX

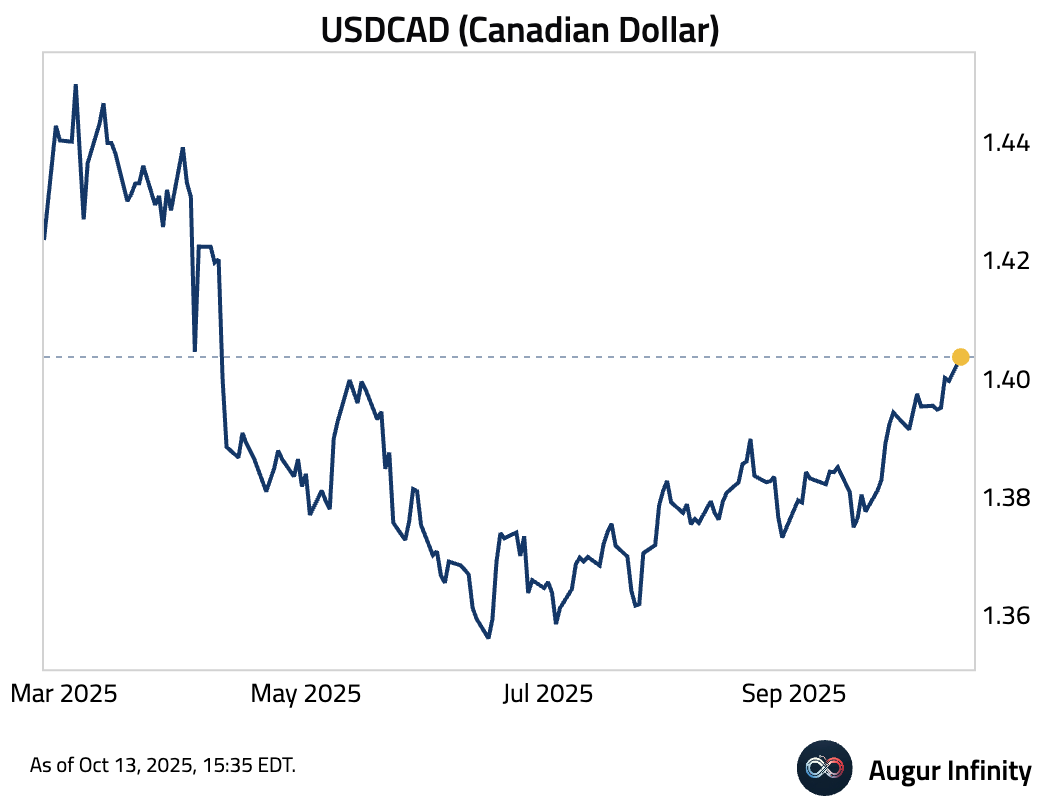

- The Canadian dollar weakened to the lowest level against USD since April.

Commodities

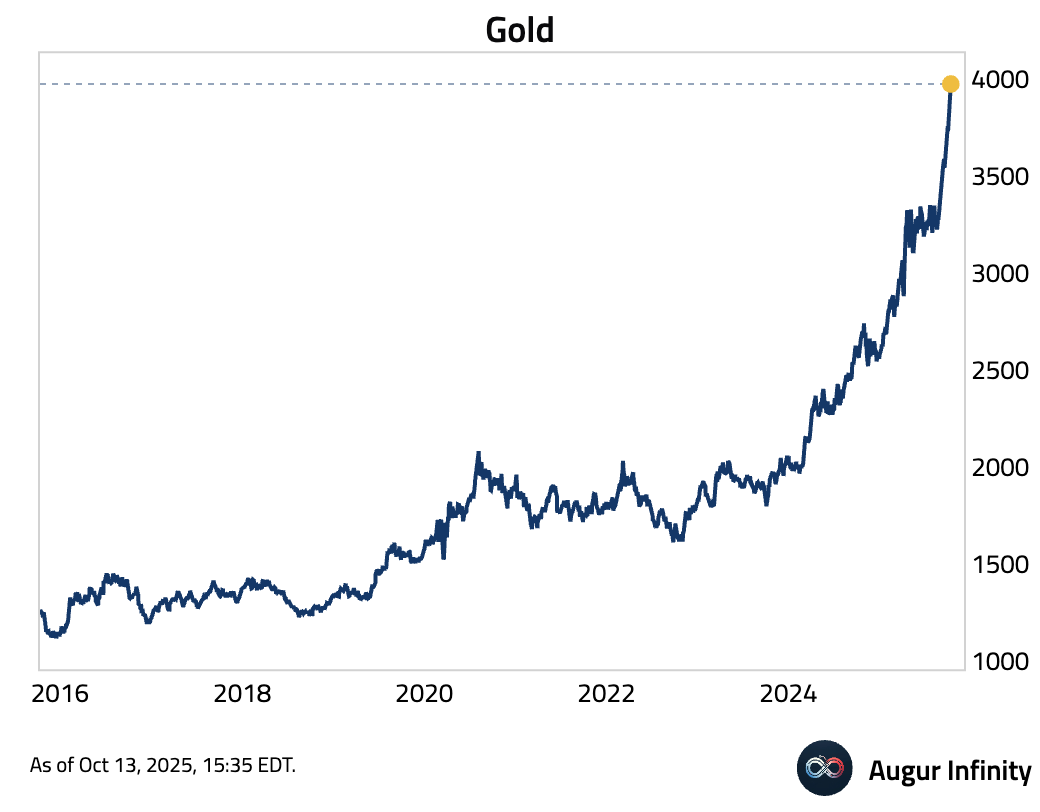

- Gold continues its relentless surge.

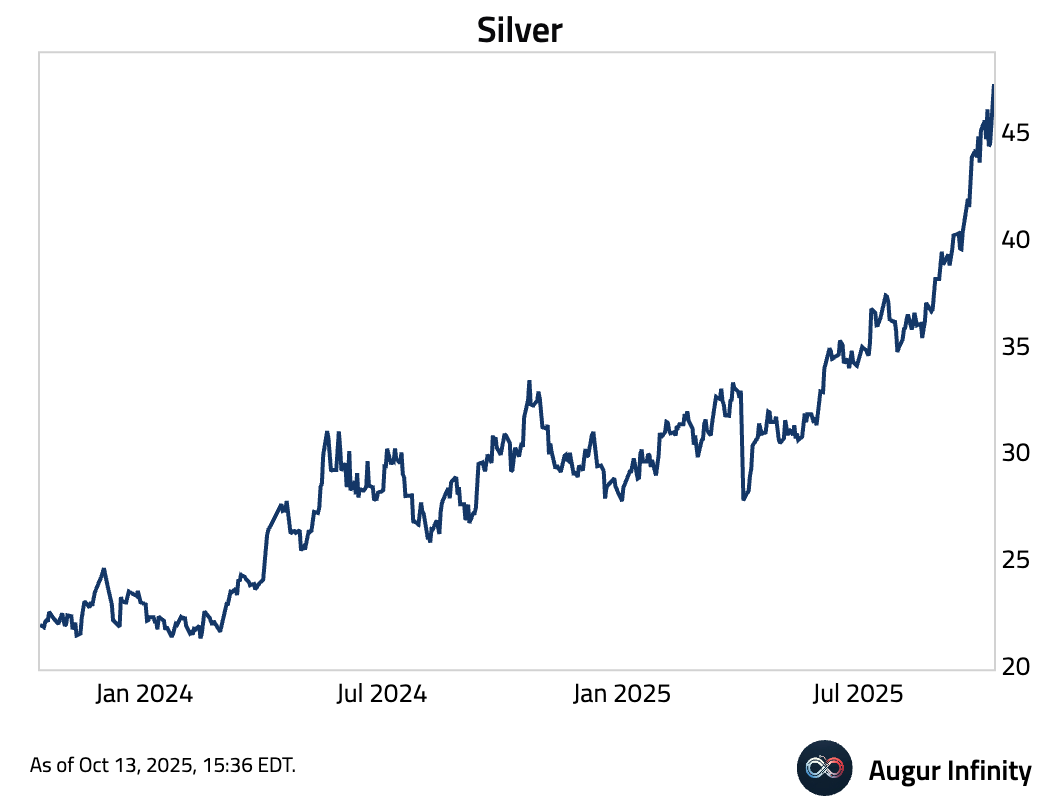

- Silver jumped by nearly 7% in a 3.7σ move.

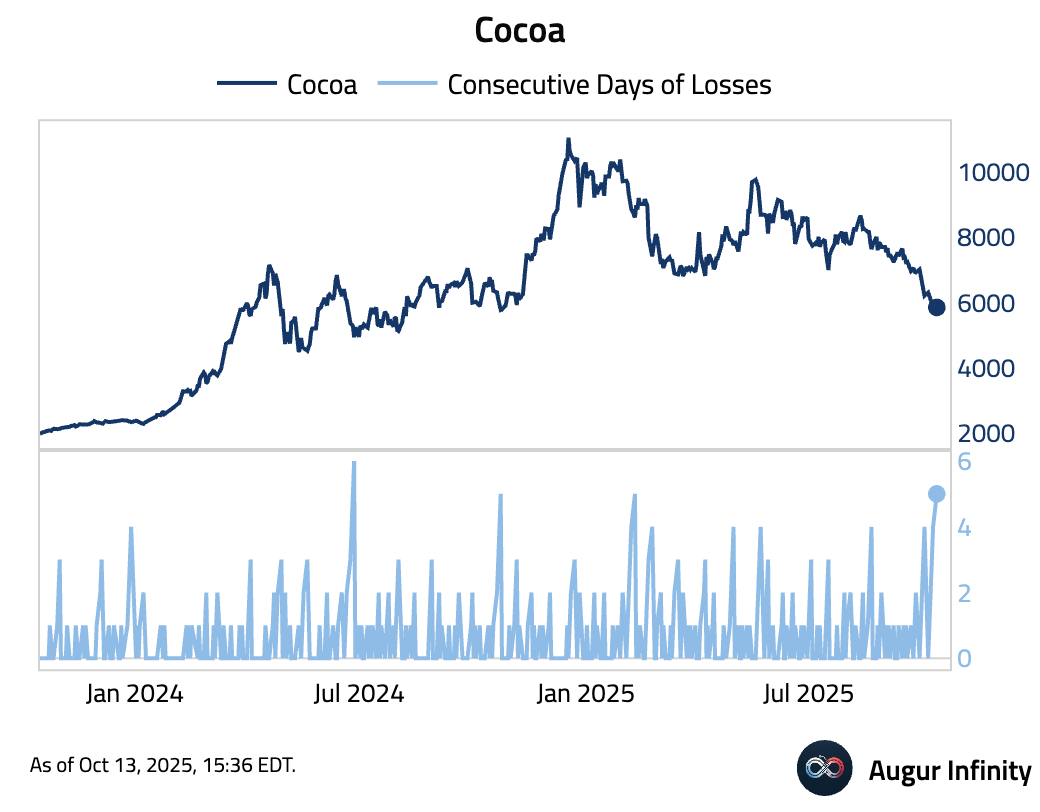

- Cocoa declined for the fifth consecutive session to the lowest level in a year.

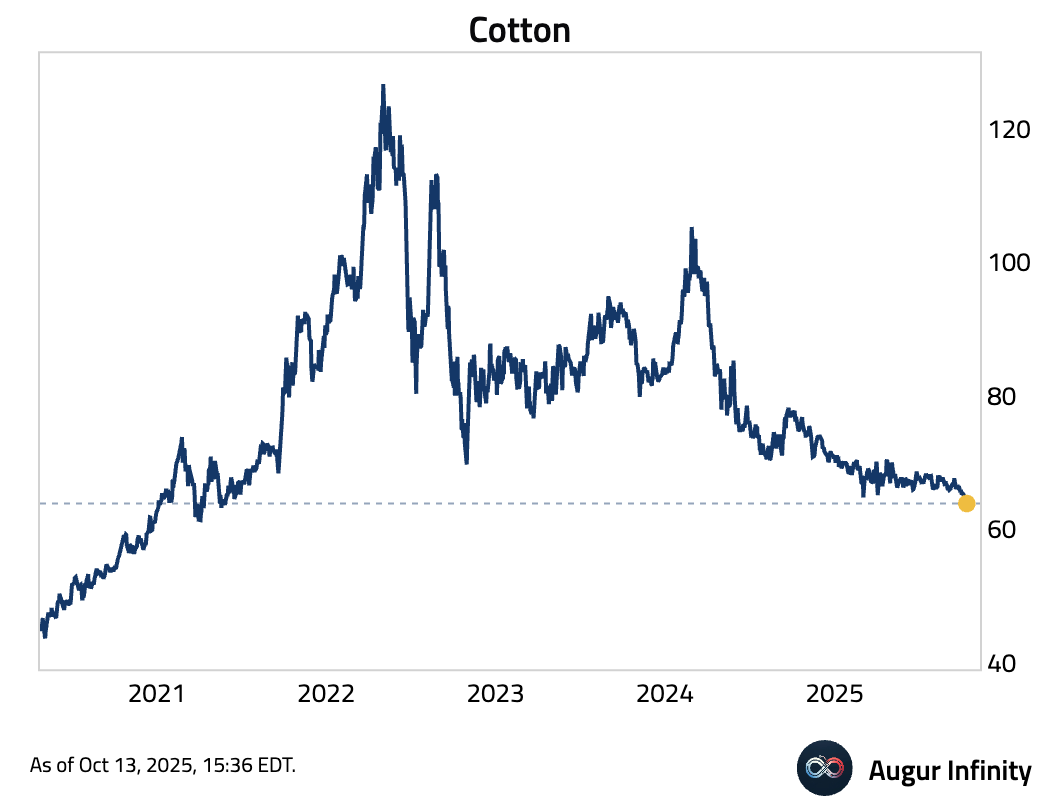

- Cotton, on a roll-adjusted basis, fell to the lowest level since 2021.

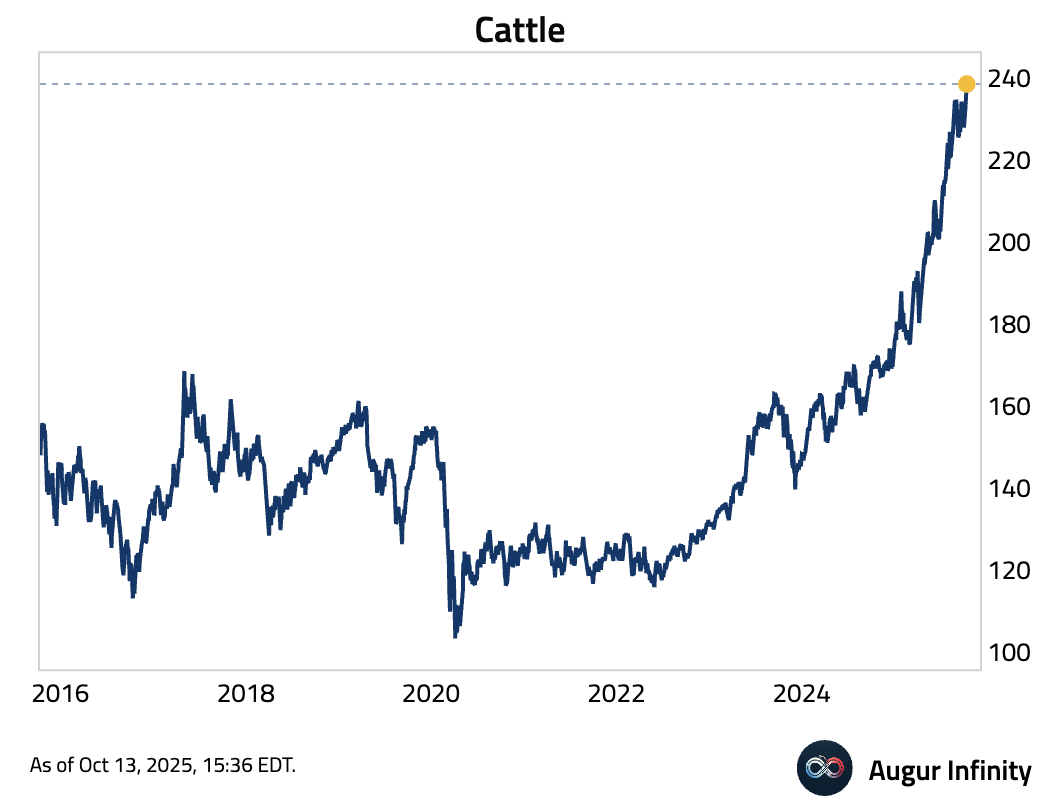

- Cattle prices have surged.

Cryptocurrency

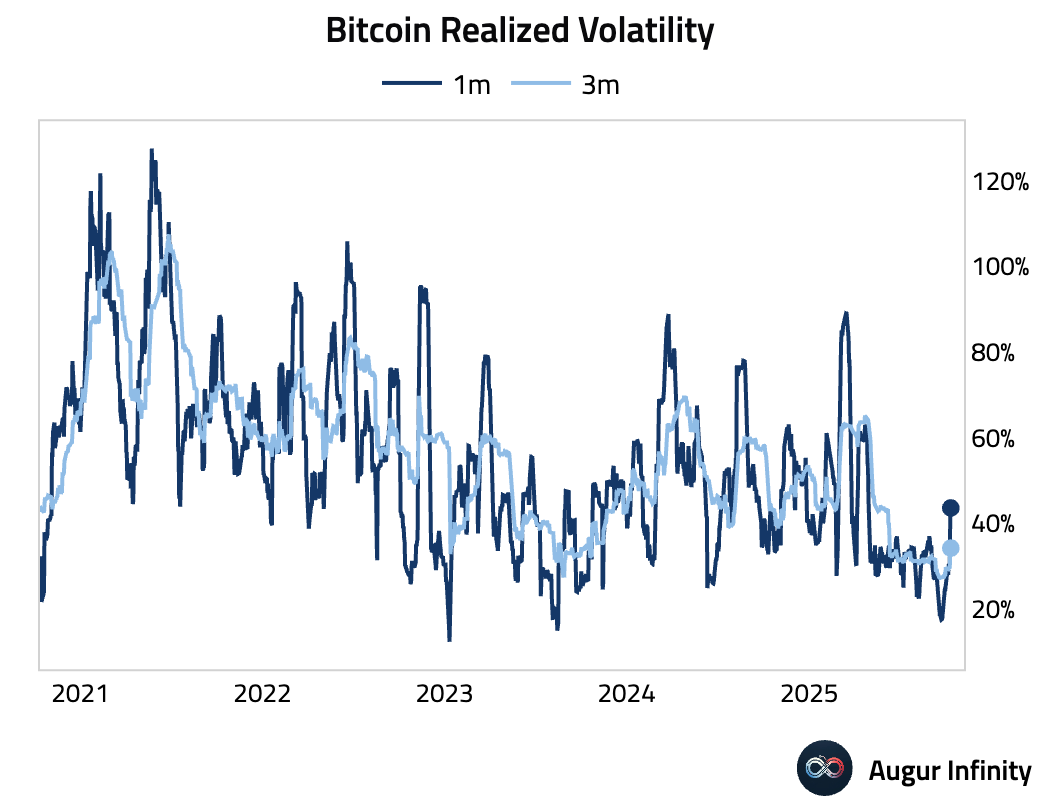

- Bitcoin volatility has risen.

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.