Headlines

- Stocks rallied into the green this afternoon when Treasury Secretary Scott Bessent said he would be speaking with his Chinese trade counterpart Friday evening. President Trump also reaffirmed that a meeting with China President Xi Jinping is still likely at the end of the month.

- Concerns over the health of US regional banks grew following a report that borrowing from the Federal Reserve’s standing repurchase facility exceeded $15 billion, the highest amount since the early pandemic.

- China’s Ministry of Commerce stated it would approve all license applications for civilian-use rare earth elements, clarifying that no export ban is in effect for the critical materials.

- A trade agreement is reportedly near completion under which South Korea would invest $350 billion in the United States.

- In Japan, the largest political parties agreed to hold a prime ministerial election on October 21.

Global Economics

United States

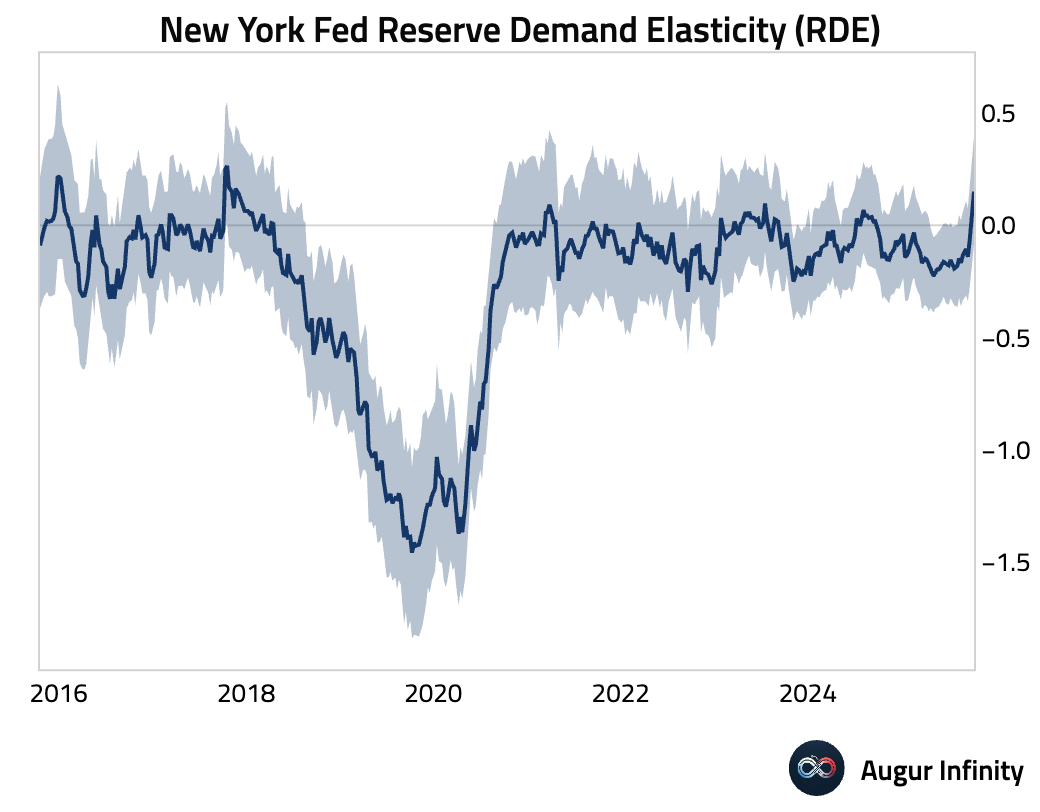

- New York Fed's Reserve Demand Elasticity measure rose sharply, indicating reserves have become less abundant.

Interactive chart on Augur Infinity

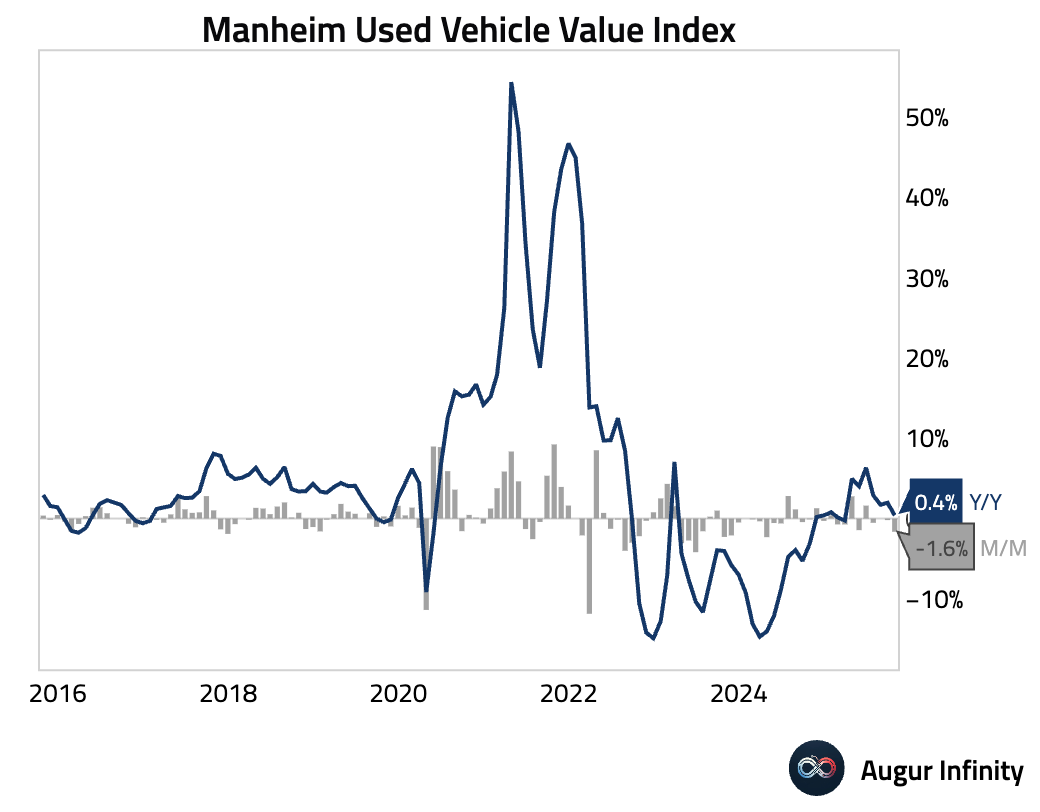

- Wholesale used-vehicle prices decreased from September in the first 15 days of October.

Source: Manheim

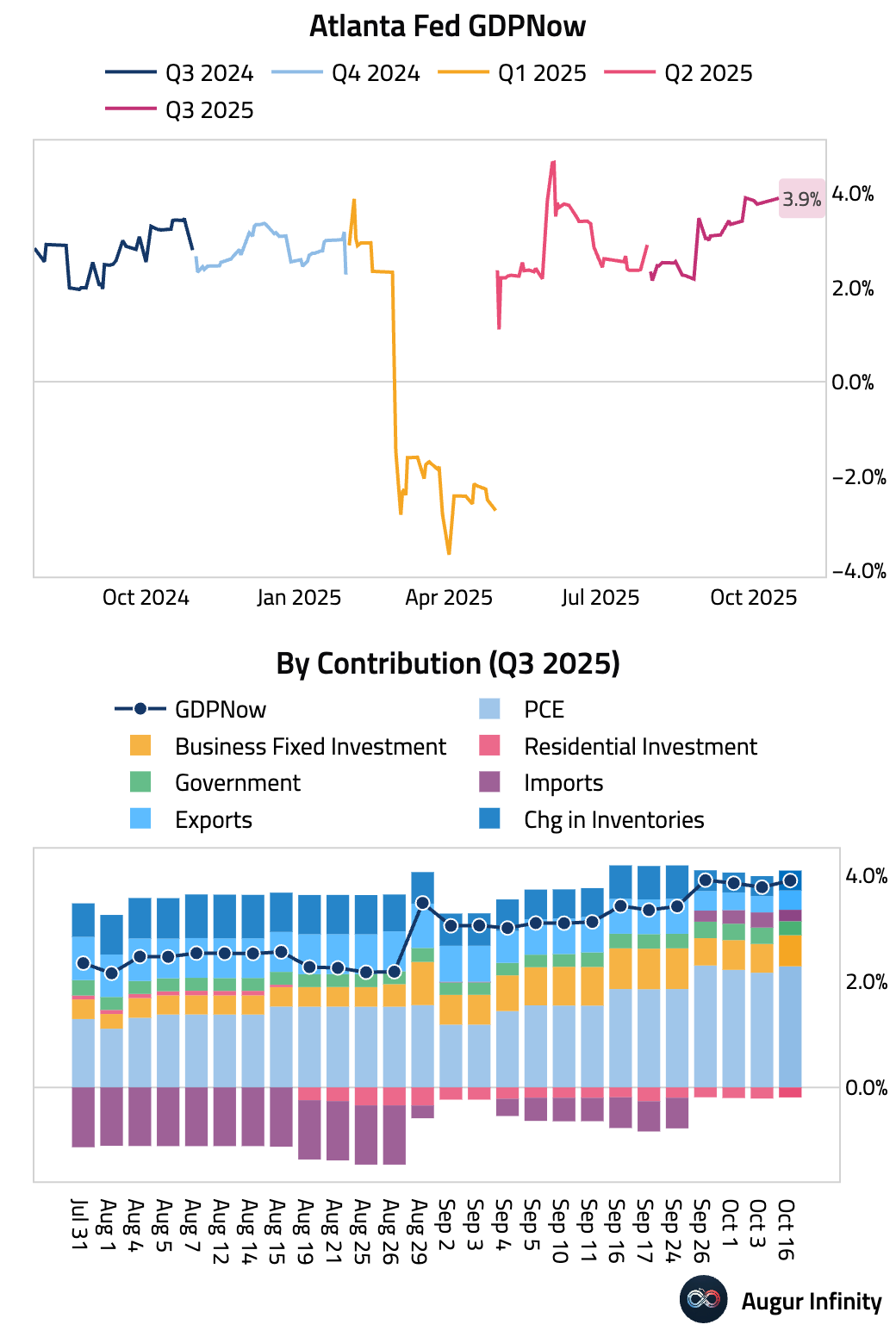

- The Atlanta Fed's GDPNow model is now tracking Q3 GDP at 3.9%, up from 3.8% on October 7.

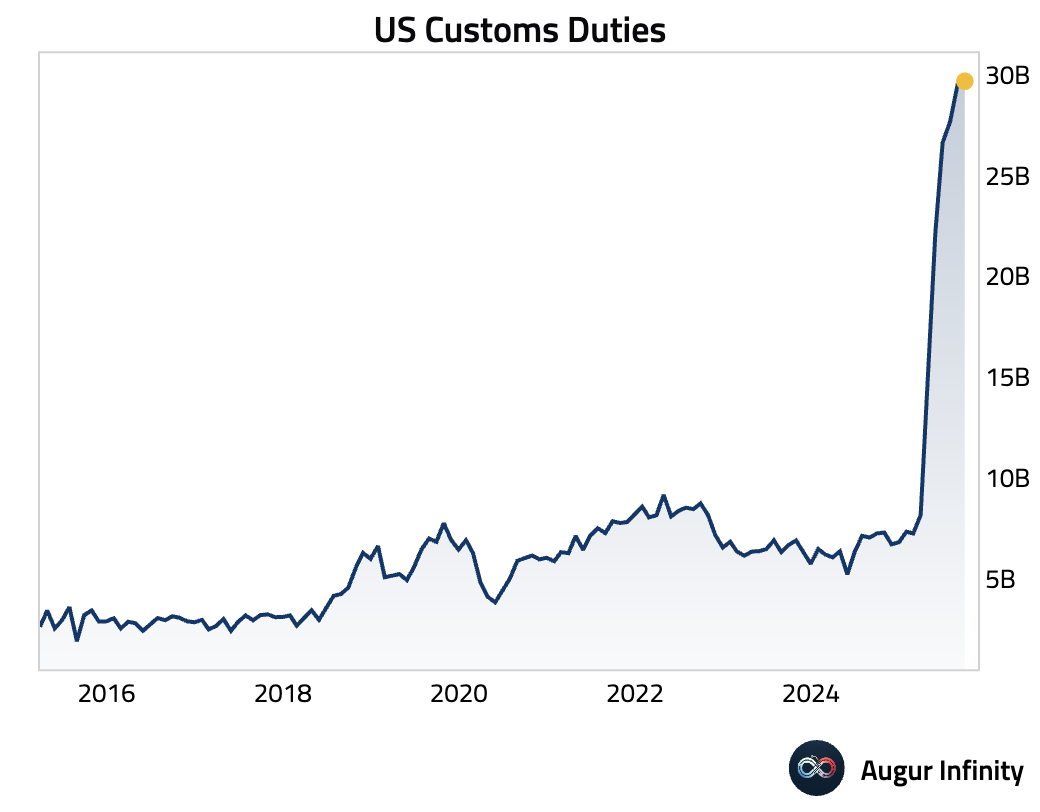

- Customs duties came in at $29.7B in September.

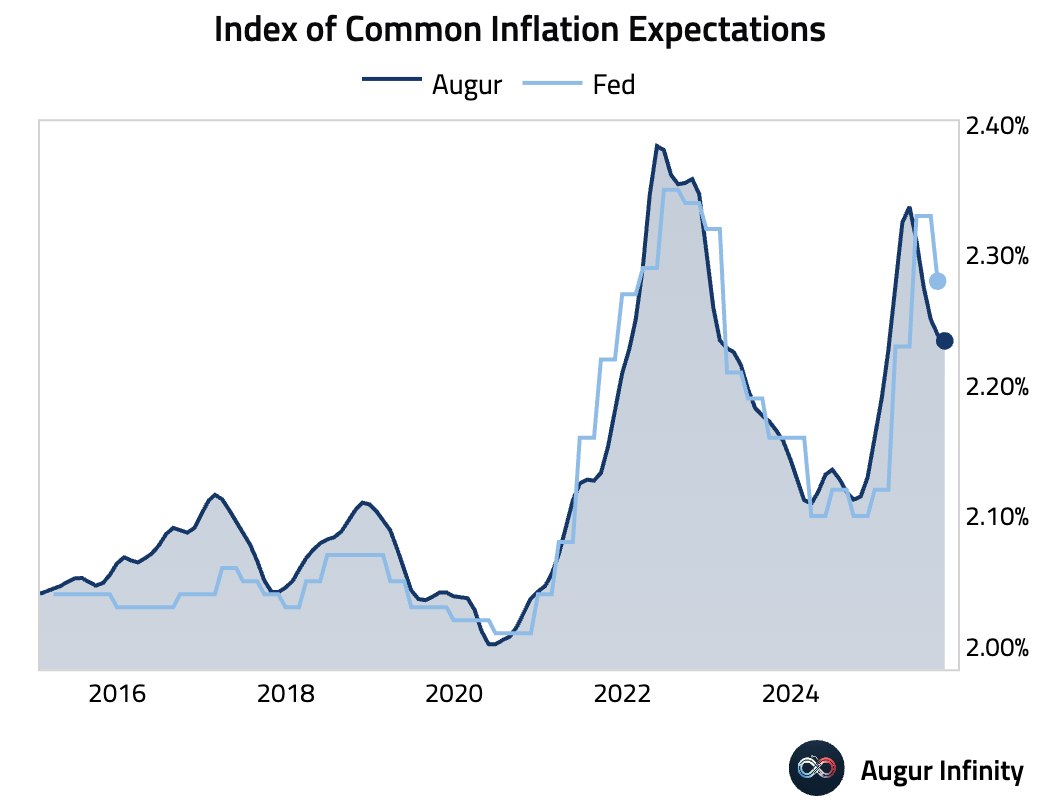

- The Fed's Index of Common Inflation Expectations declined in Q3. Our monthly tracking suggests further easing.

Interactive chart on Augur Infinity

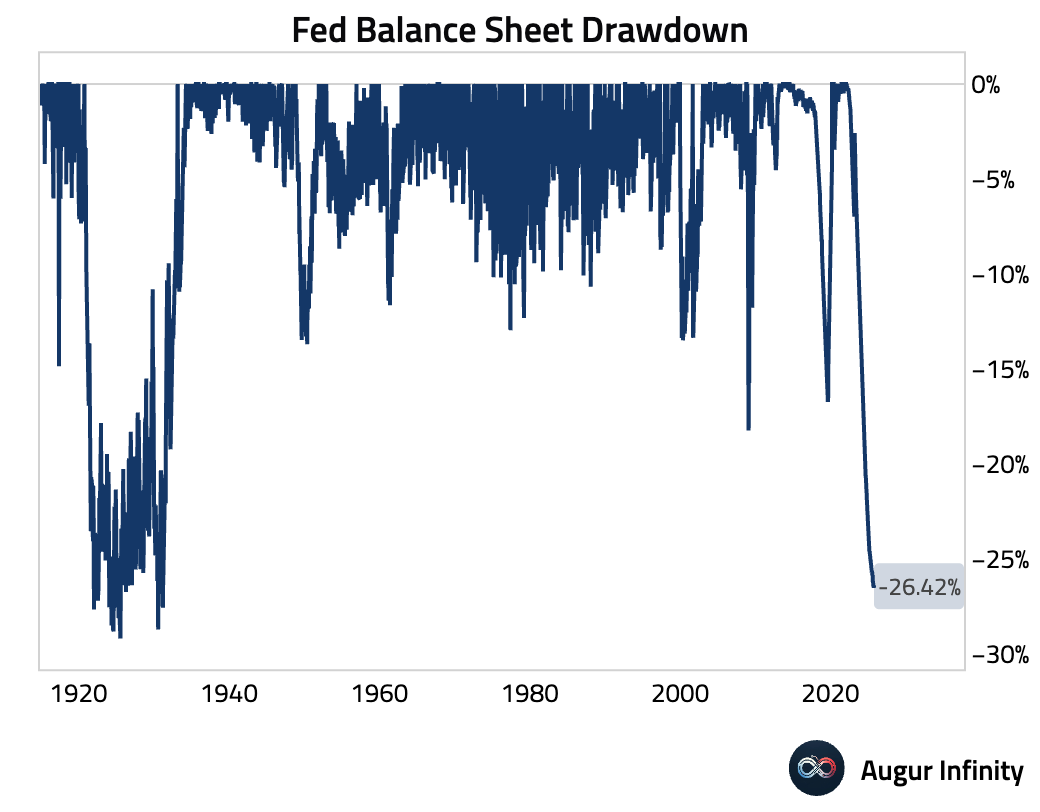

- The Federal Reserve’s balance sheet was unchanged last week (act: $6.59T, prev: $6.59T).

Interactive chart on Augur Infinity

Canada

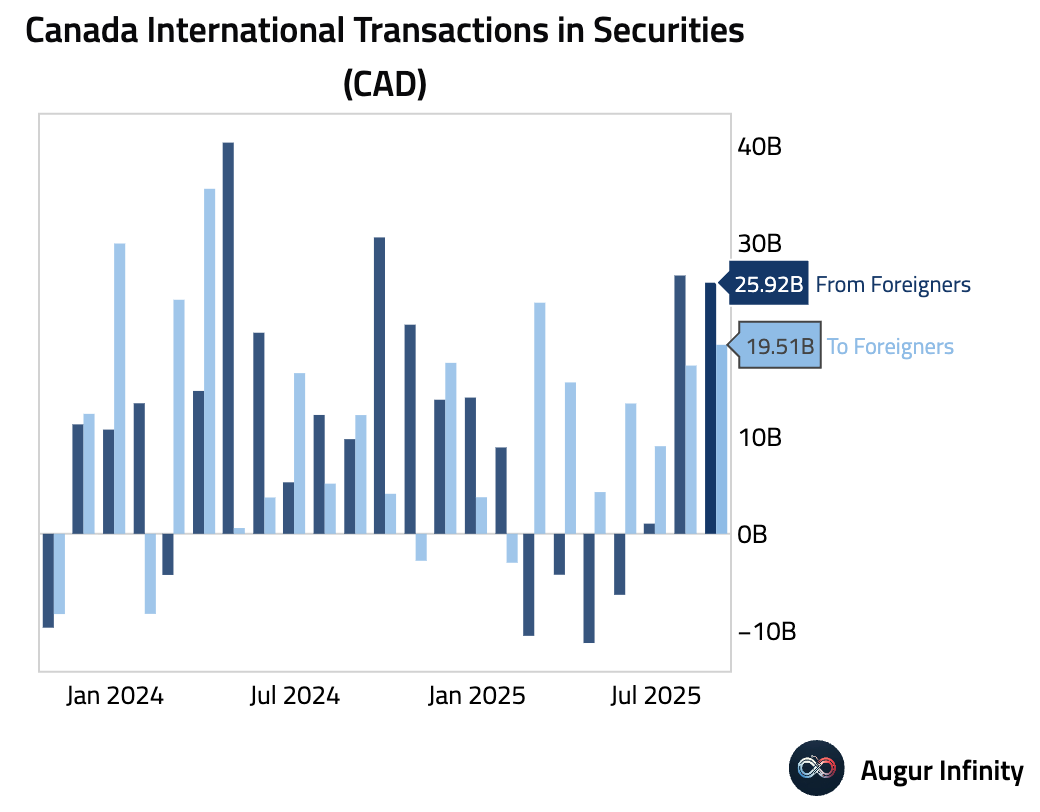

- Foreign investment in Canadian securities more than doubled expectations in August (act: C$25.92B, est: C$11.61B).

Europe

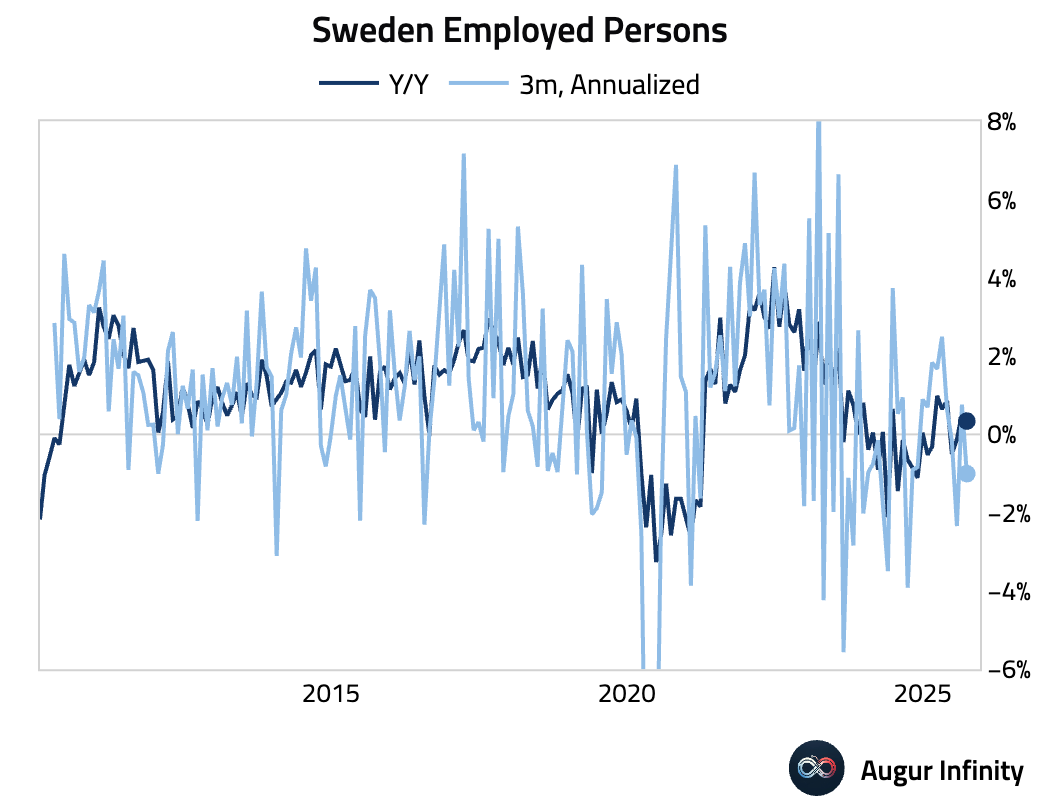

- The number of employed persons in Sweden declined in September (act: 5.238M, prev: 5.320M).

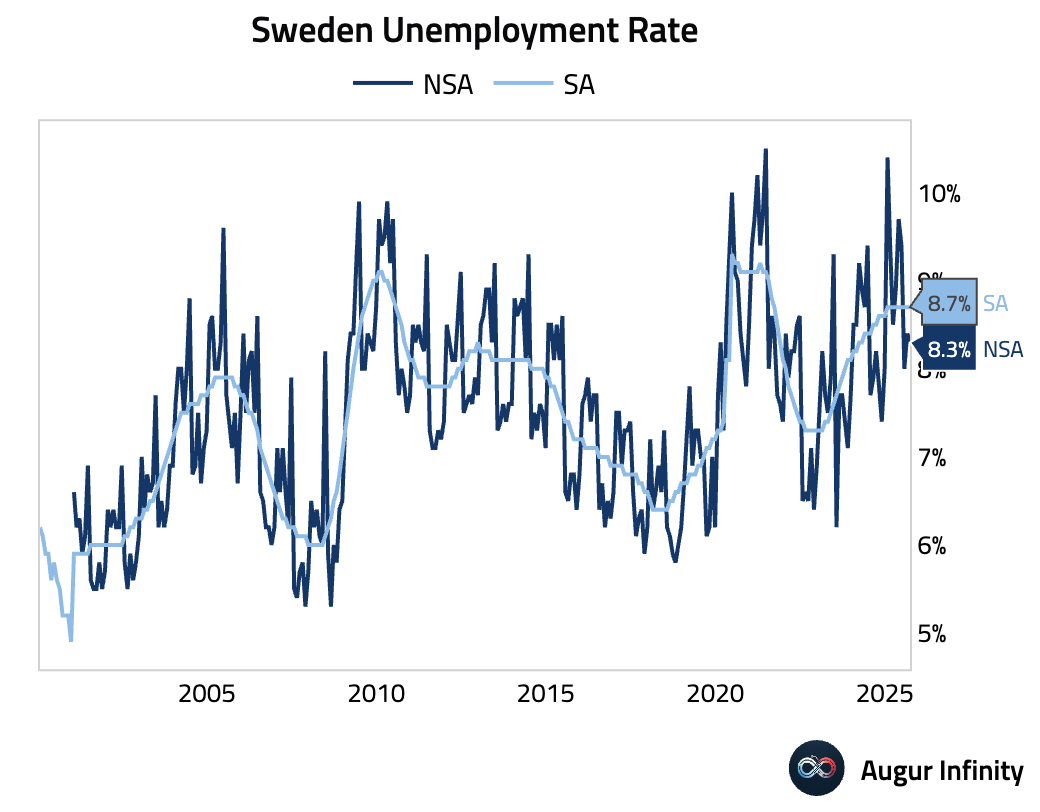

- Sweden’s unemployment rate ticked down slightly in September on a NSA basis, but was unchanged after seasonal adjustment.

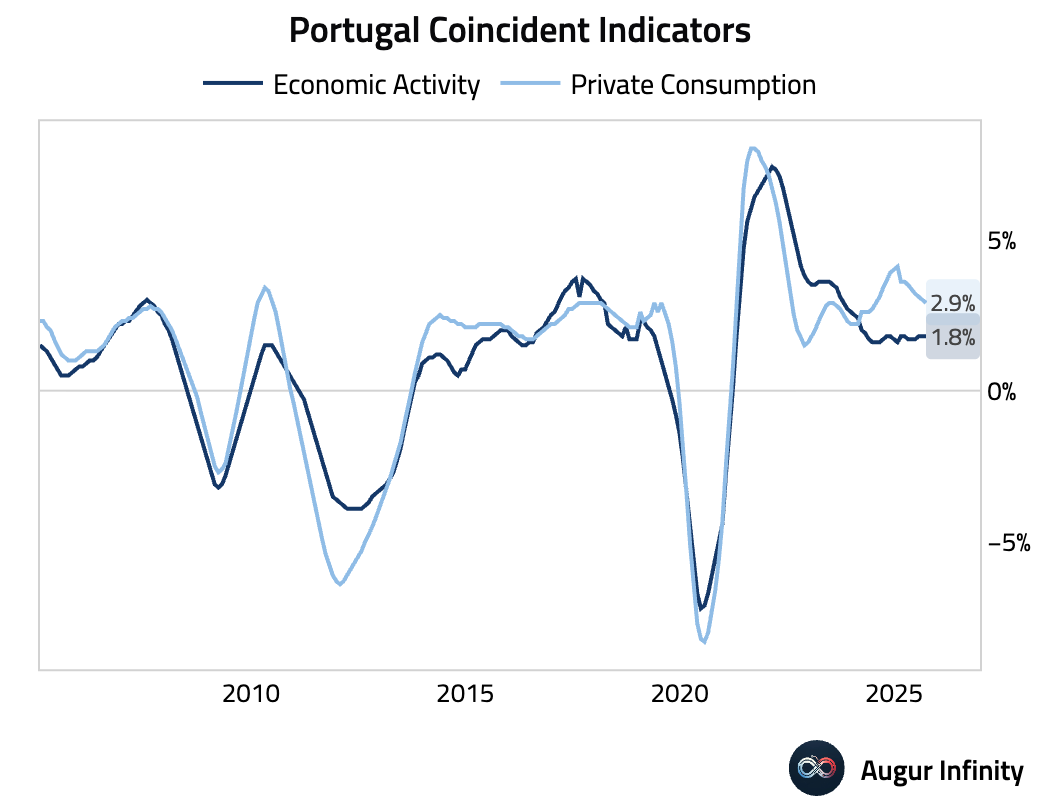

- Portugal’s economic activity indicator was stable, while the private consumption indicator softened slightly.

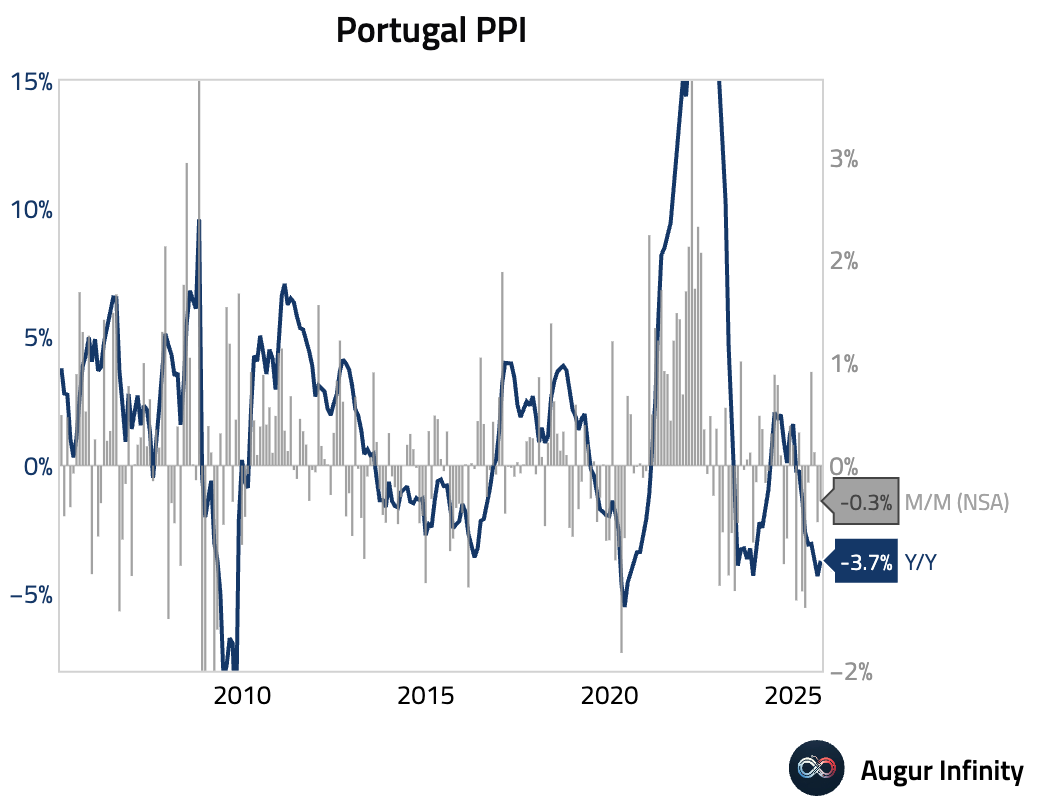

- Portuguese producer prices continued to fall in September, though the pace of deflation eased.

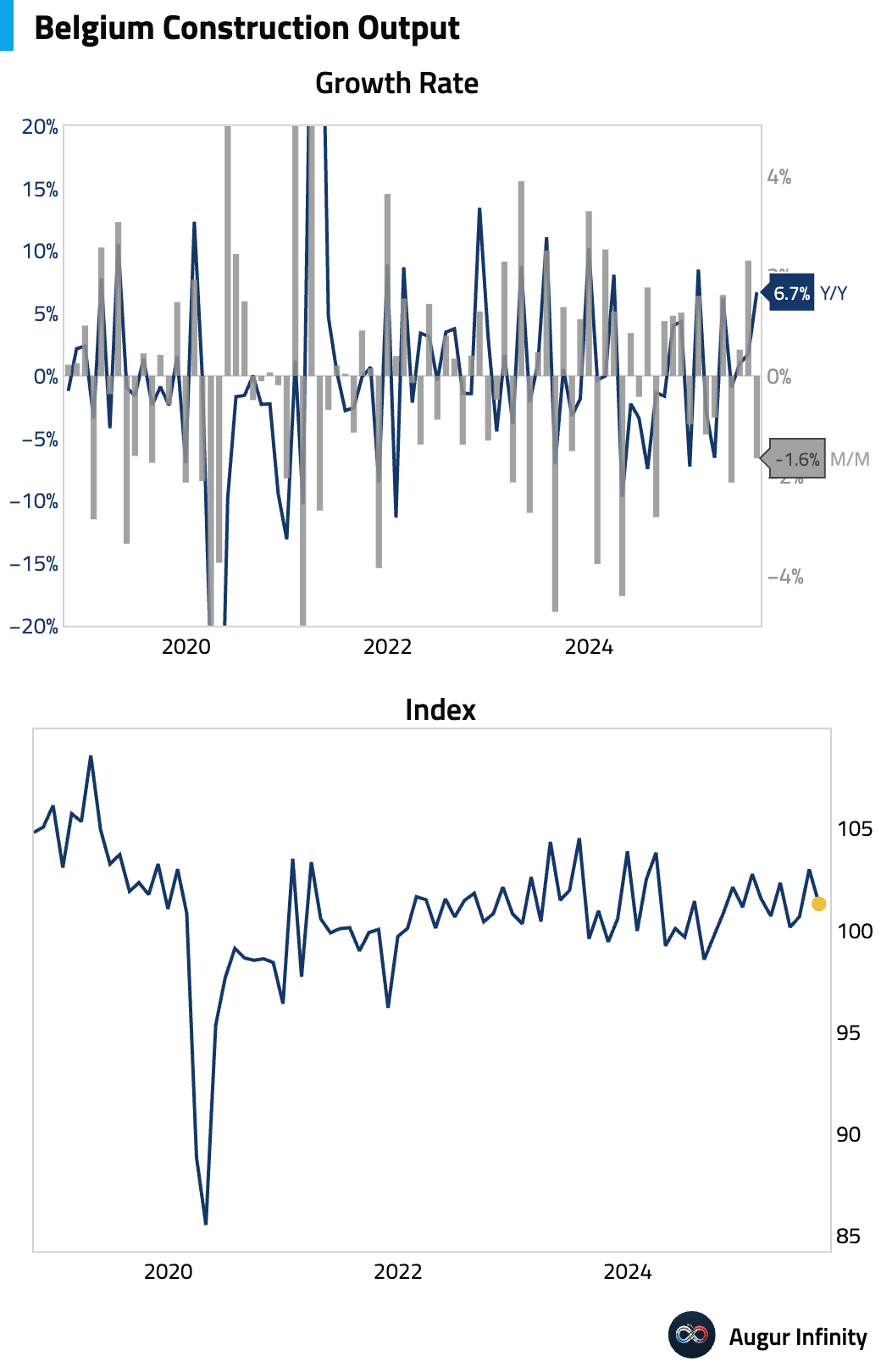

- Belgian construction output expanded at a faster pace in August.

Asia-Pacific

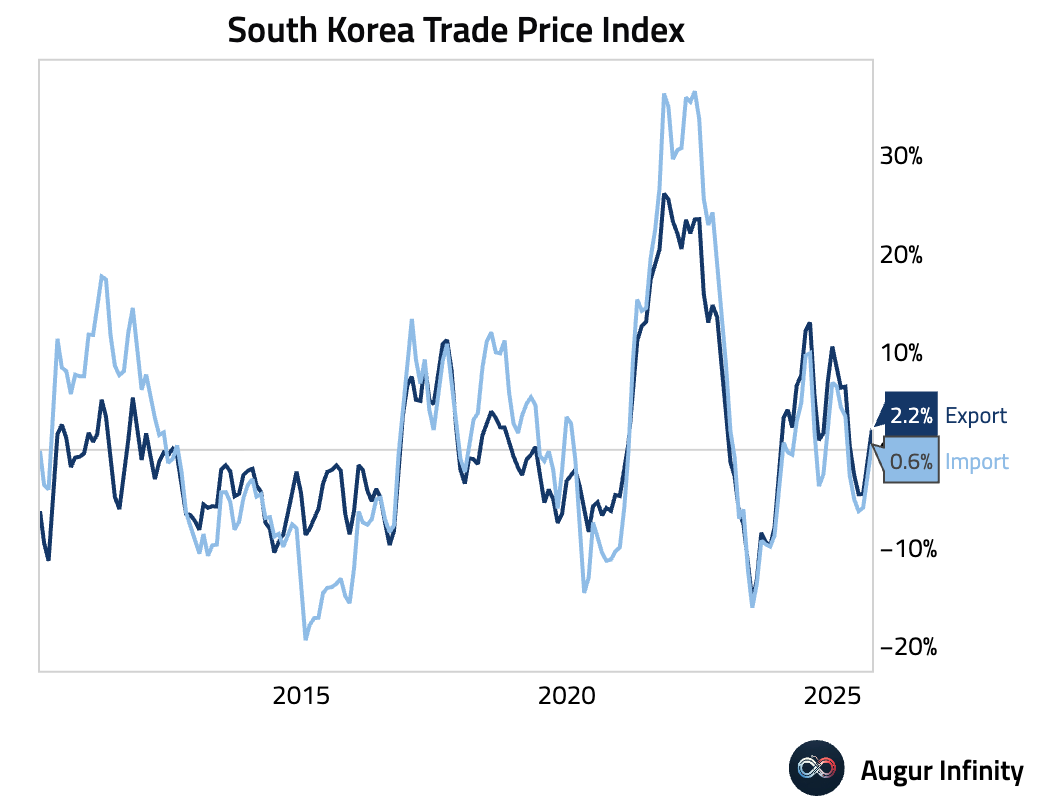

- South Korean export and import prices rose in September, reversing the prior month’s declines.

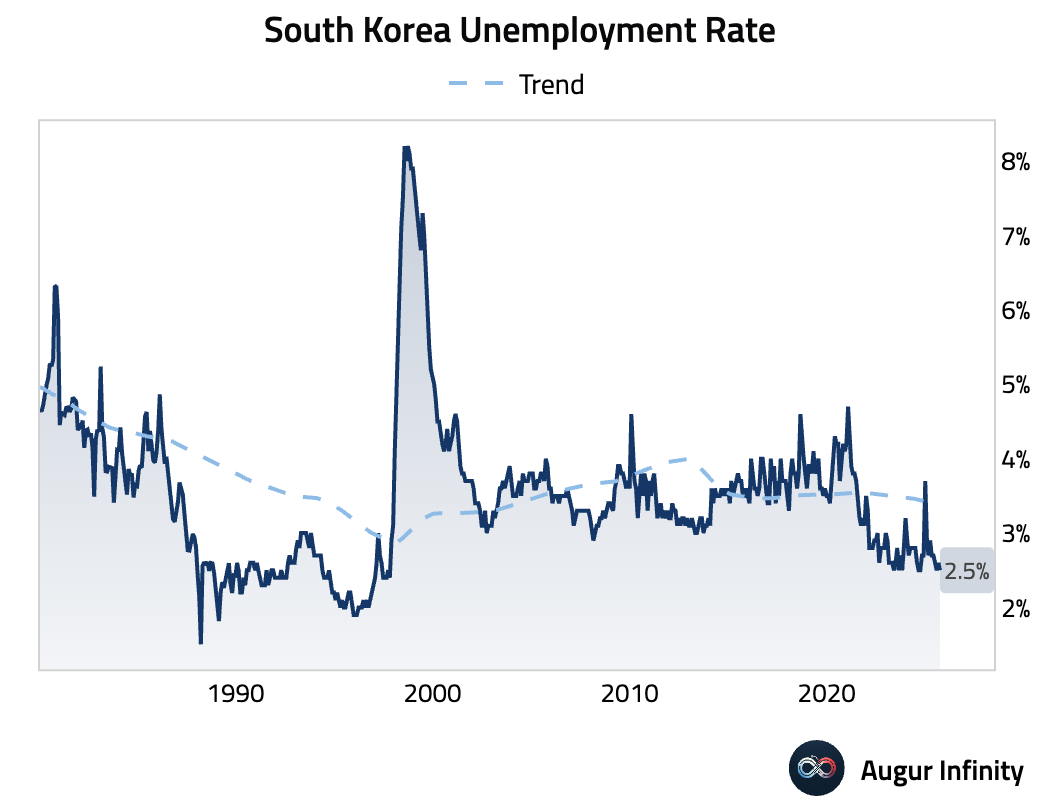

- South Korea’s unemployment rate edged down in September, as the number of employed persons rose and the labor force participation rate held steady.

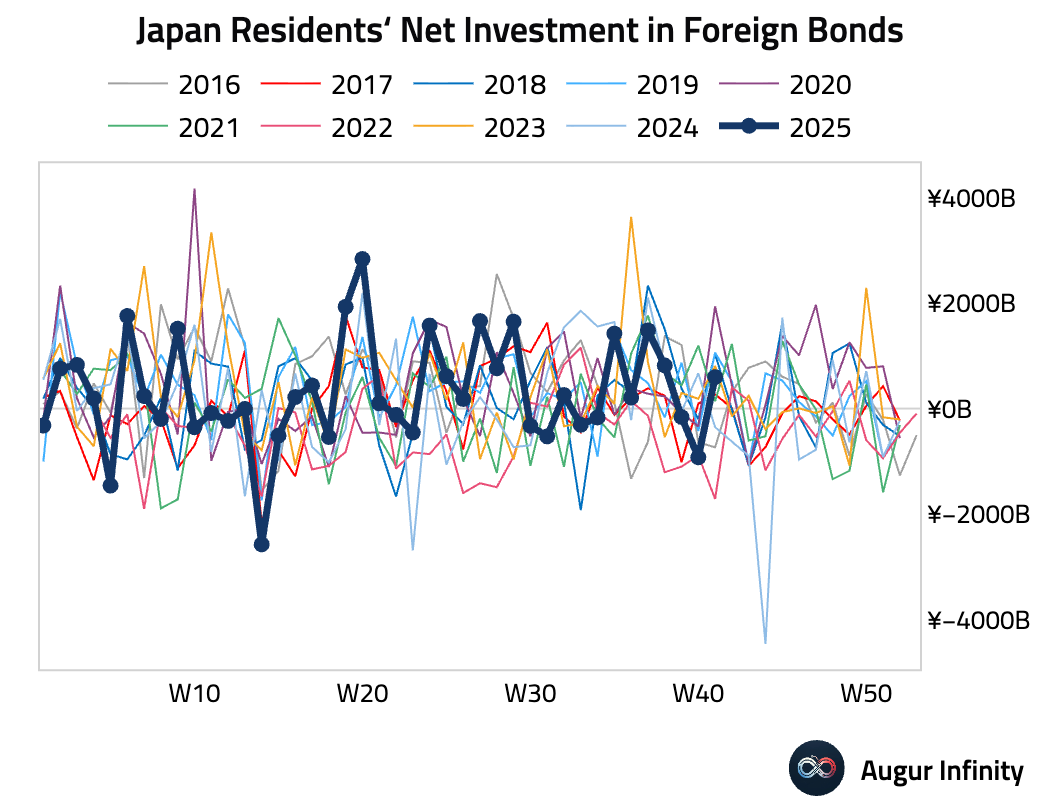

- Japanese investors turned net buyers of foreign bonds in the first week of October.

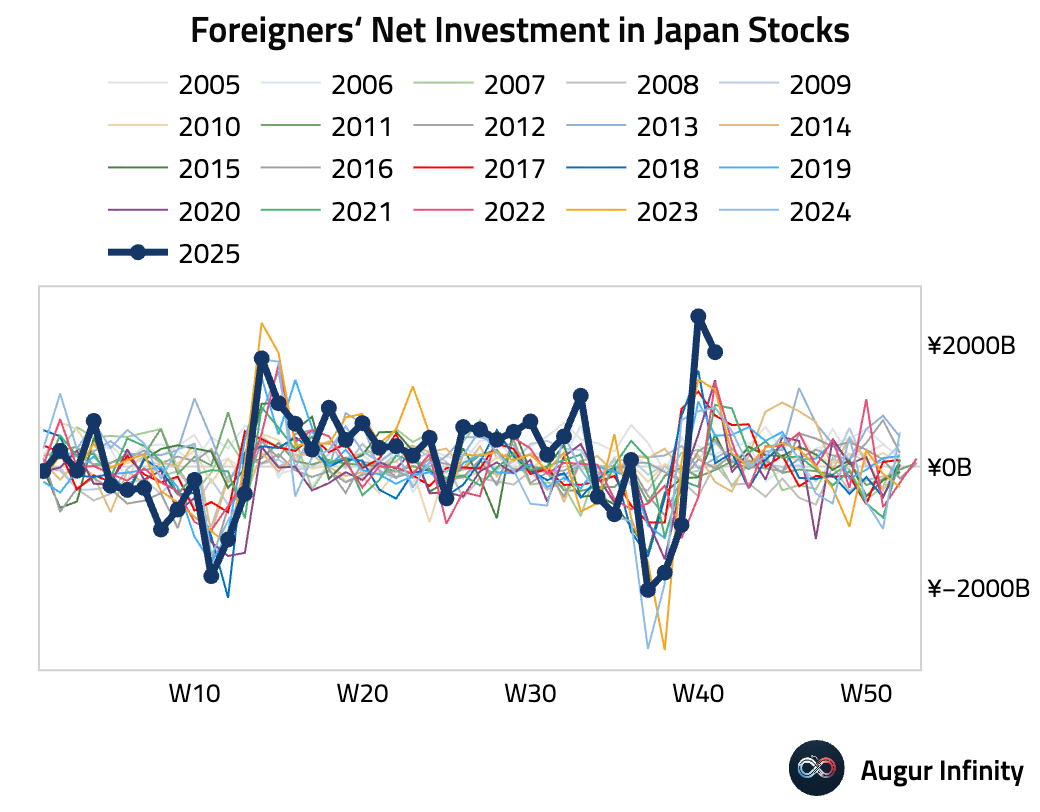

Foreign investors' net investment in Japan stocks declined from the prior week's record level, but it's still the 3rd highest reading on record

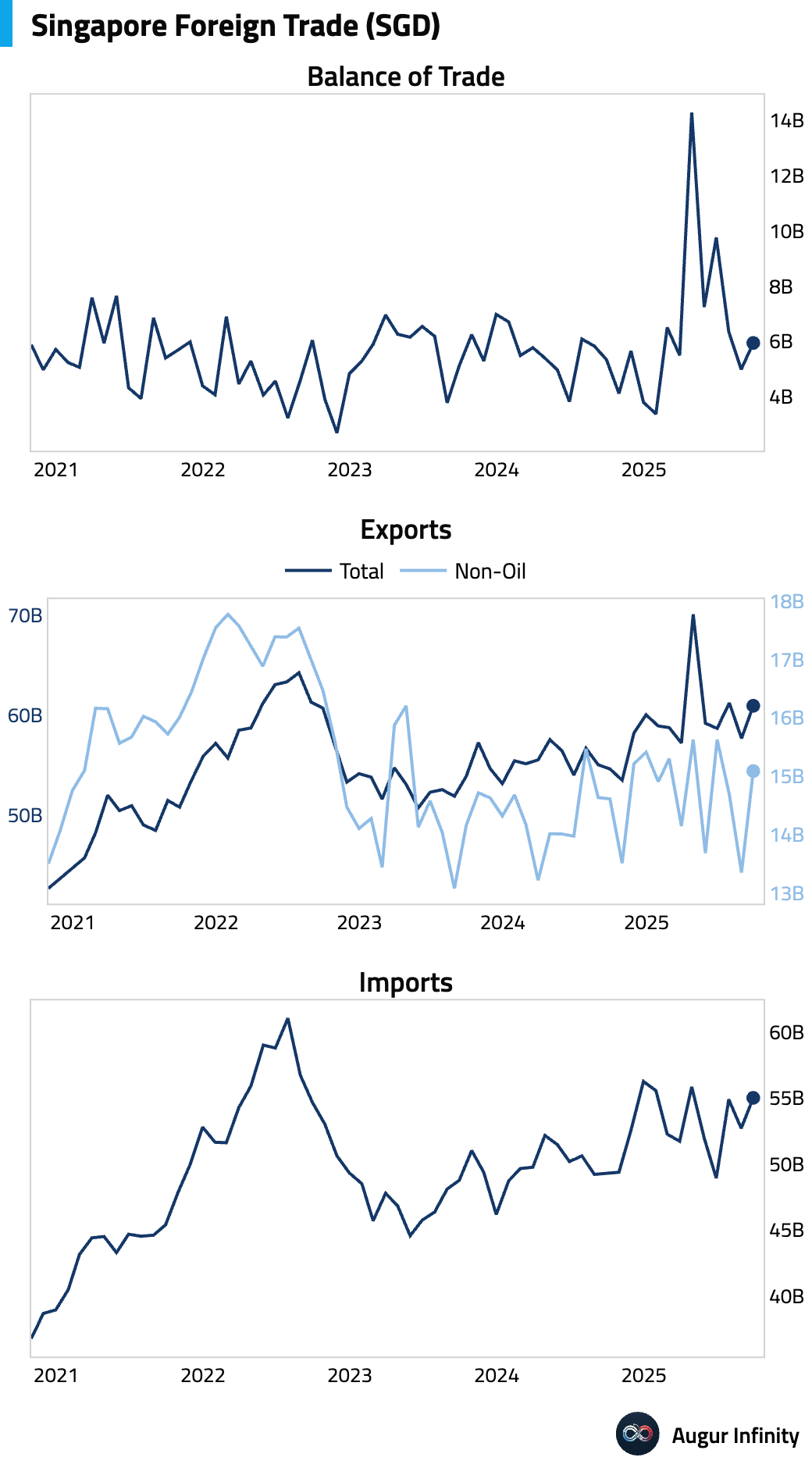

- Singapore’s non-oil exports surged in September, reversing the prior month’s decline and crushing forecasts (act: 13.0% M/M, prev: -9.1%; act: 6.9% Y/Y, est: -2.1%). The surprise was driven by a sharp rebound in electronics shipments to China, Hong Kong, and Taiwan. However, exports to the US and EU declined, and officials warn of a second-half slowdown as the effects of earlier tariff front-loading fade.

- Singapore’s trade surplus widened in September (act: S$5.95B, prev: S$4.99B).

Emerging Markets ex China

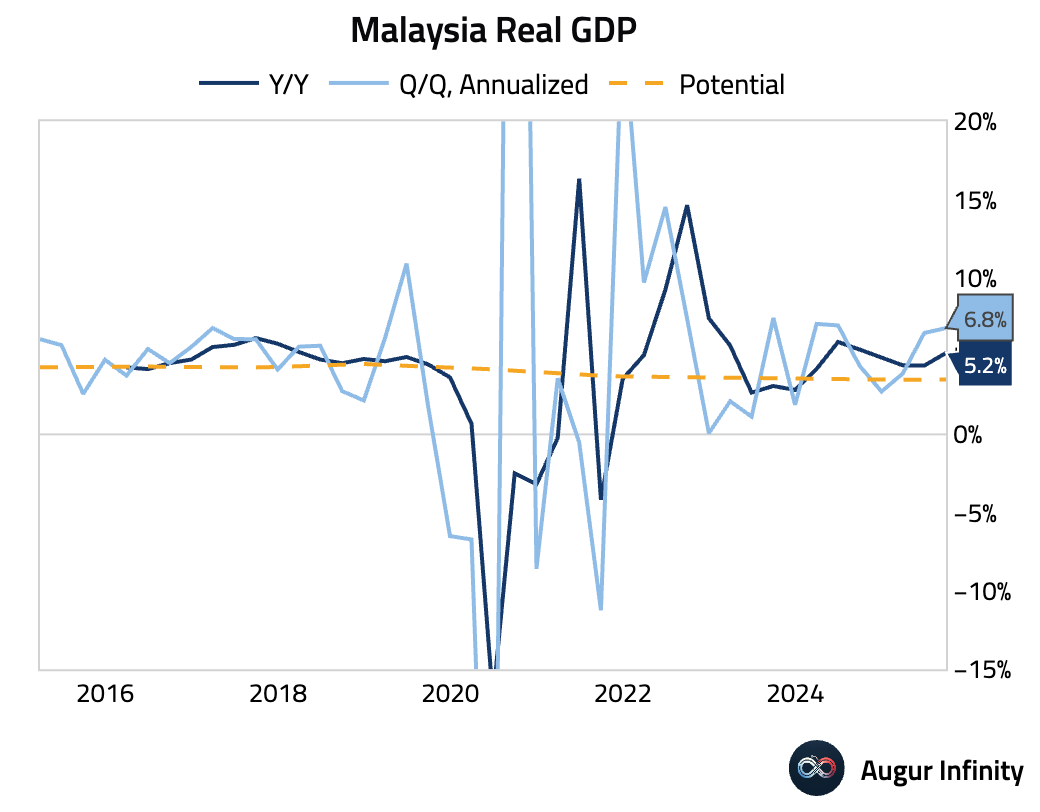

- Malaysia’s preliminary Q3 GDP growth accelerated to 5.2% Y/Y, beating expectations and rising from 4.4% in Q2. The surprise was driven by a sharp rebound in the mining sector from higher natural gas and oil production. A reversal in mining strength is expected in Q4.

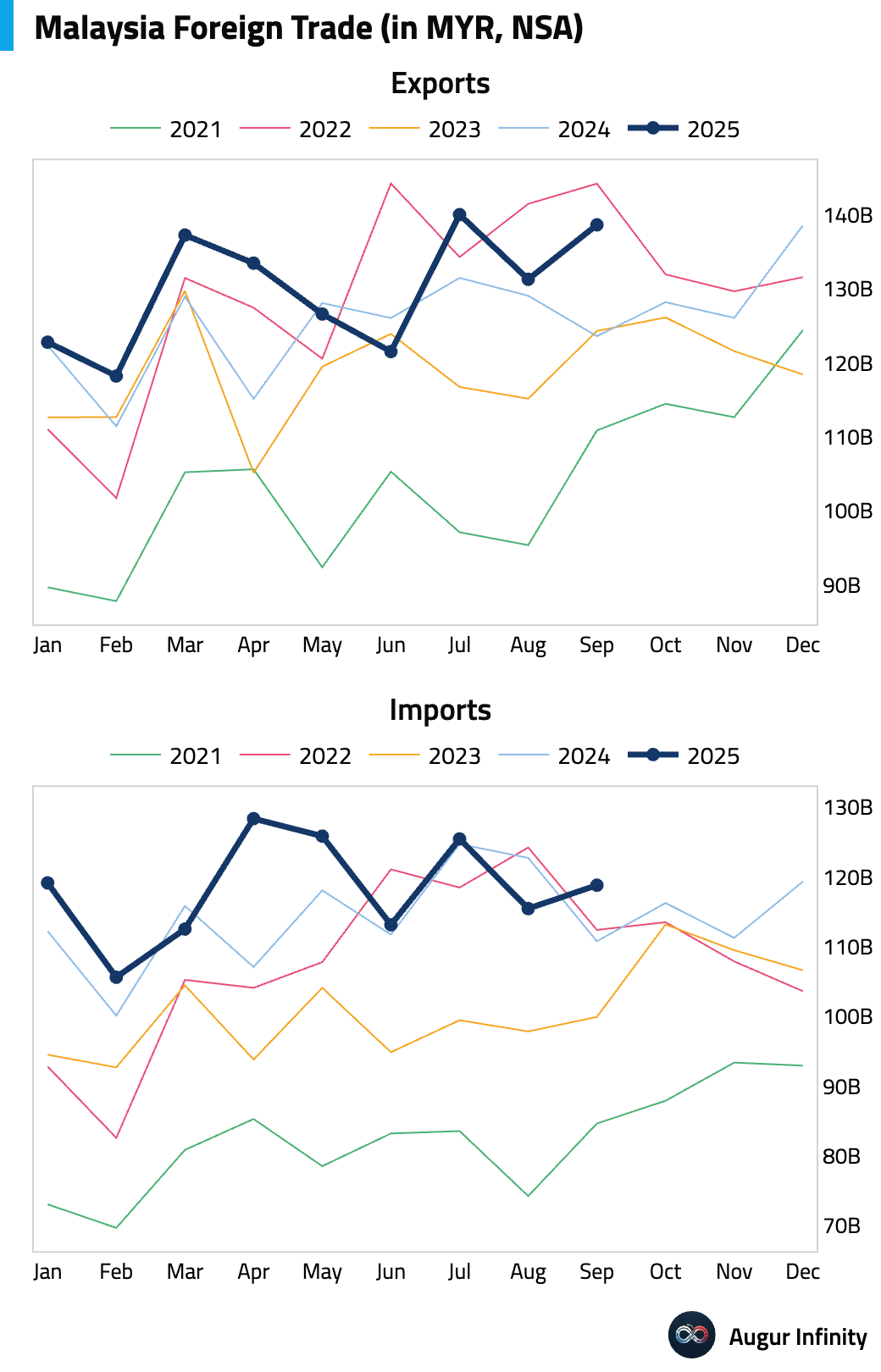

- Malaysia’s trade surplus widened more than expected in September. Exports grew much faster than anticipated, jumping 12.2% Y/Y against forecasts for a 3.5% rise. Imports also rebounded sharply, handily beating estimates and snapping three months of declines (act: 7.3% Y/Y, est: 1.4%).

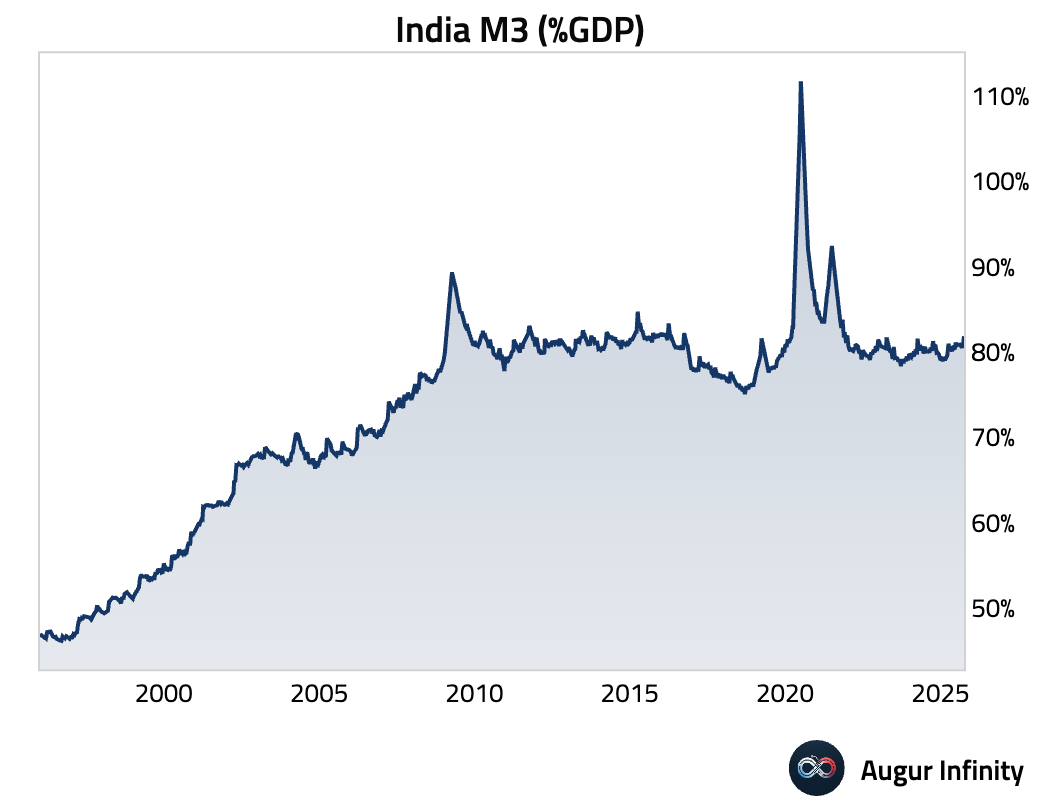

- India’s M3 money supply growth accelerated in the latest reading (act: 9.6% Y/Y, prev: 9.2%).

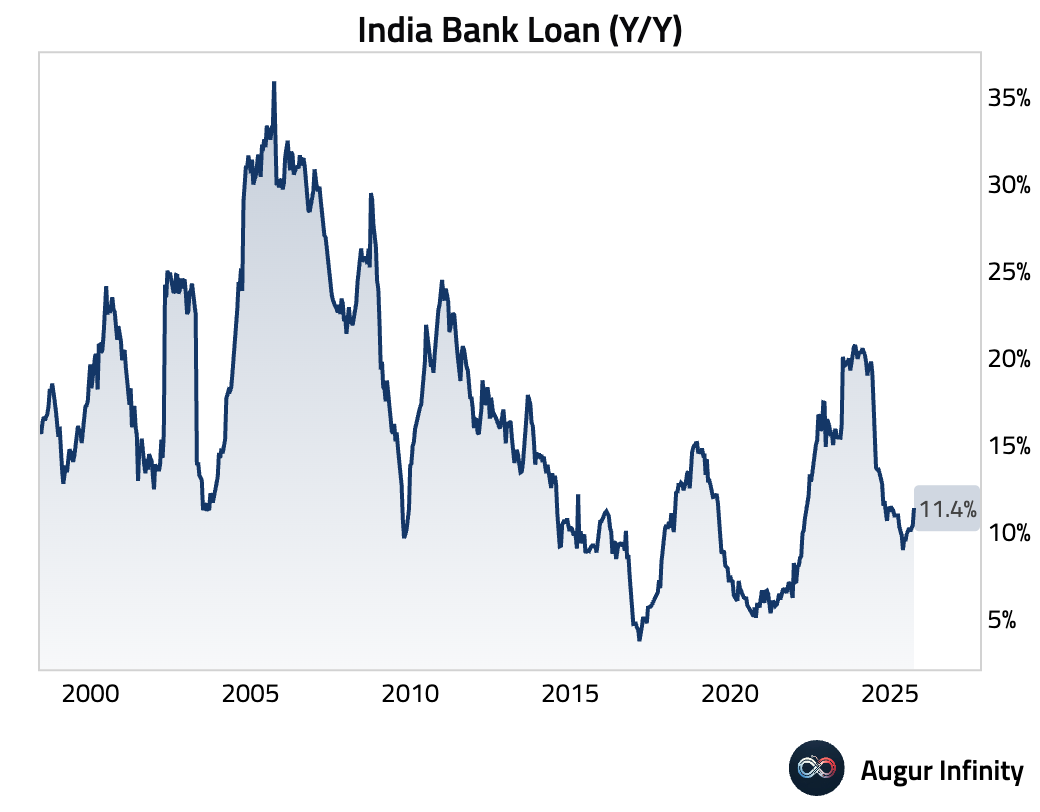

- Bank loan growth in India accelerated to a nine-month high.

Interactive chart on Augur Infinity

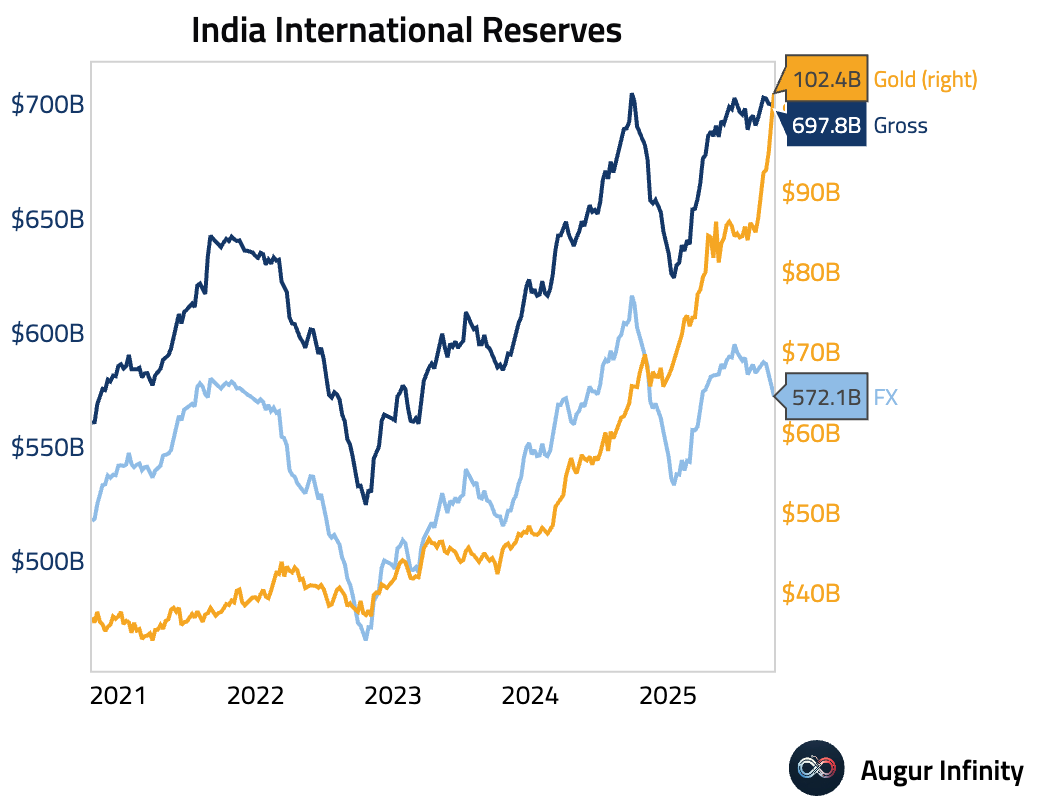

- India’s foreign exchange reserves declined in the latest week (act: $697.78B, prev: $699.96B).

Global Markets

Equities

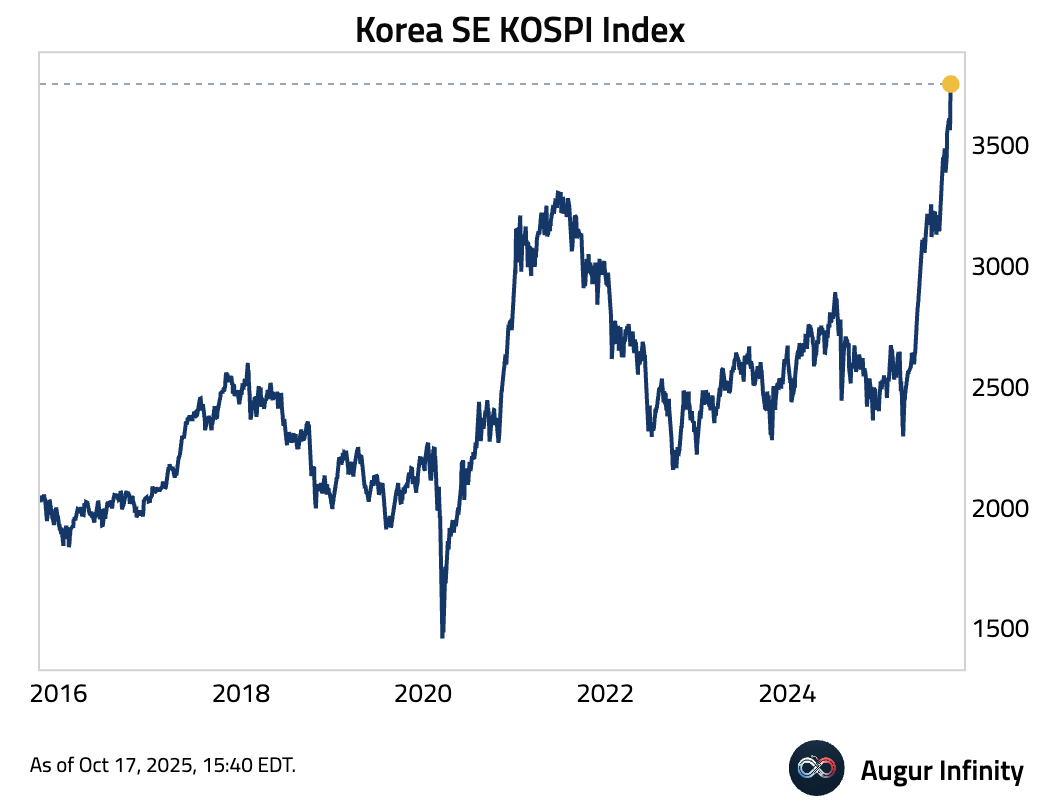

- US equities advanced, with the S&P 500 and Nasdaq Composite both closing up 0.5%. European markets were mixed; French equities gained 0.4%, marking their fifth consecutive daily advance. In Asia, South Korean stocks rose 0.8% for a third straight day of gains.

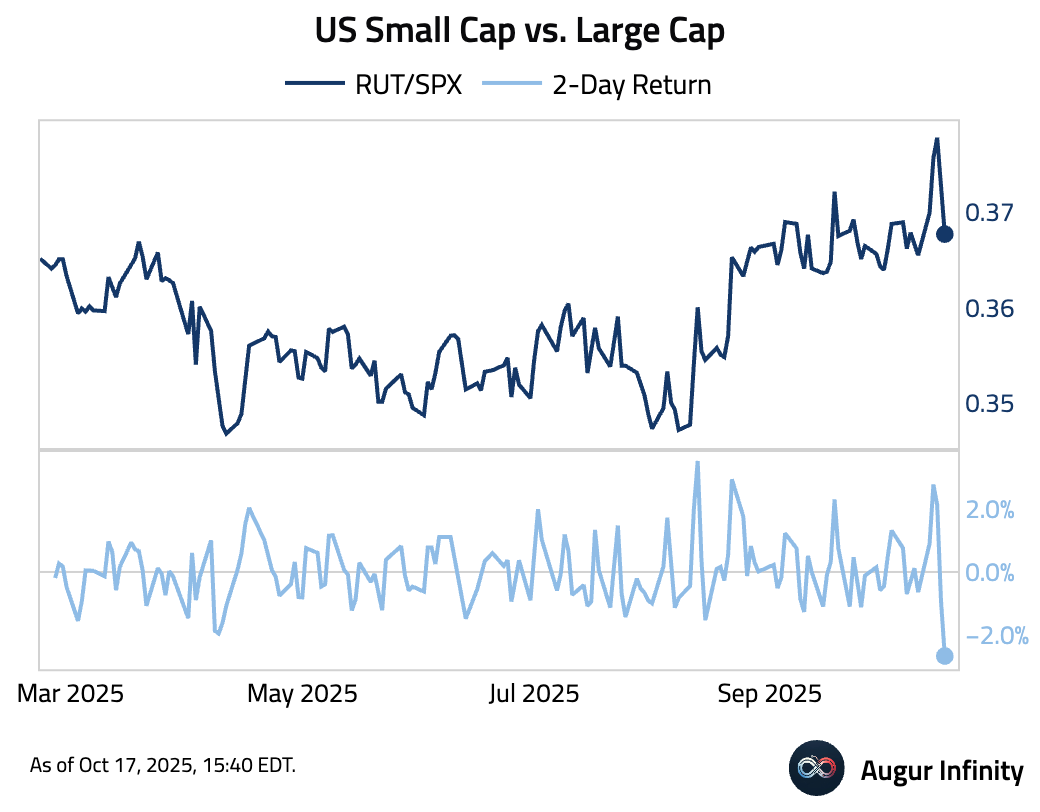

- The underperformance of US Small Cap relative to Large Cap over the past two days is the worst since April.

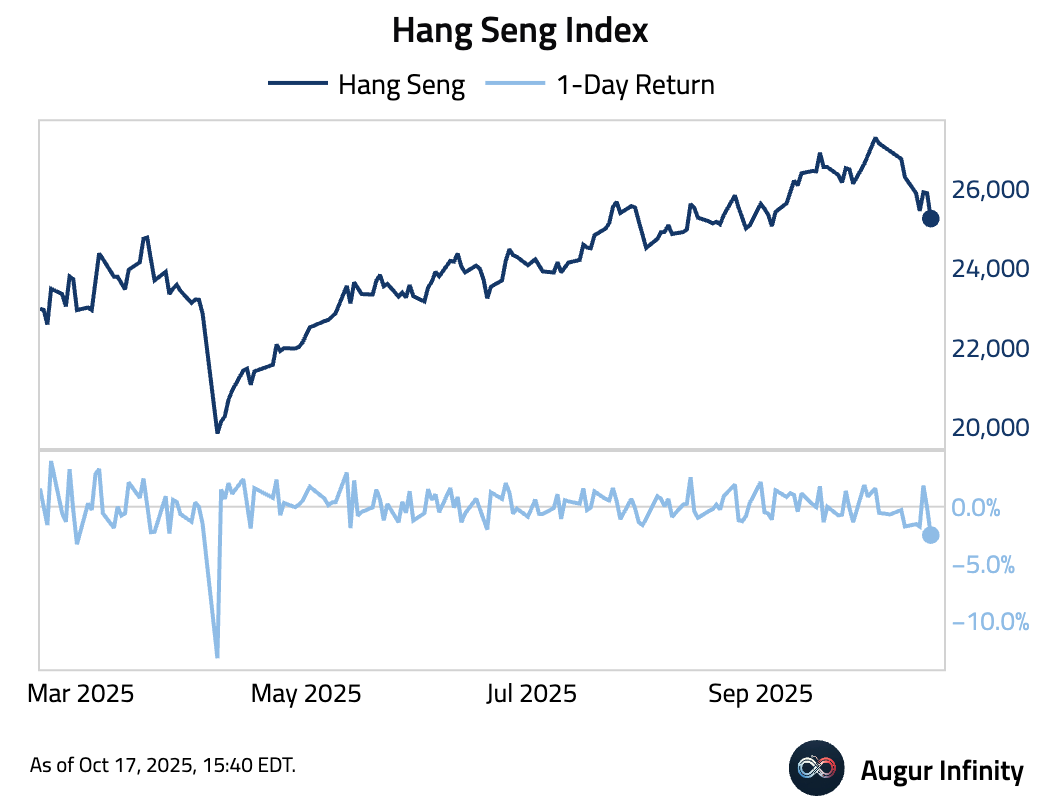

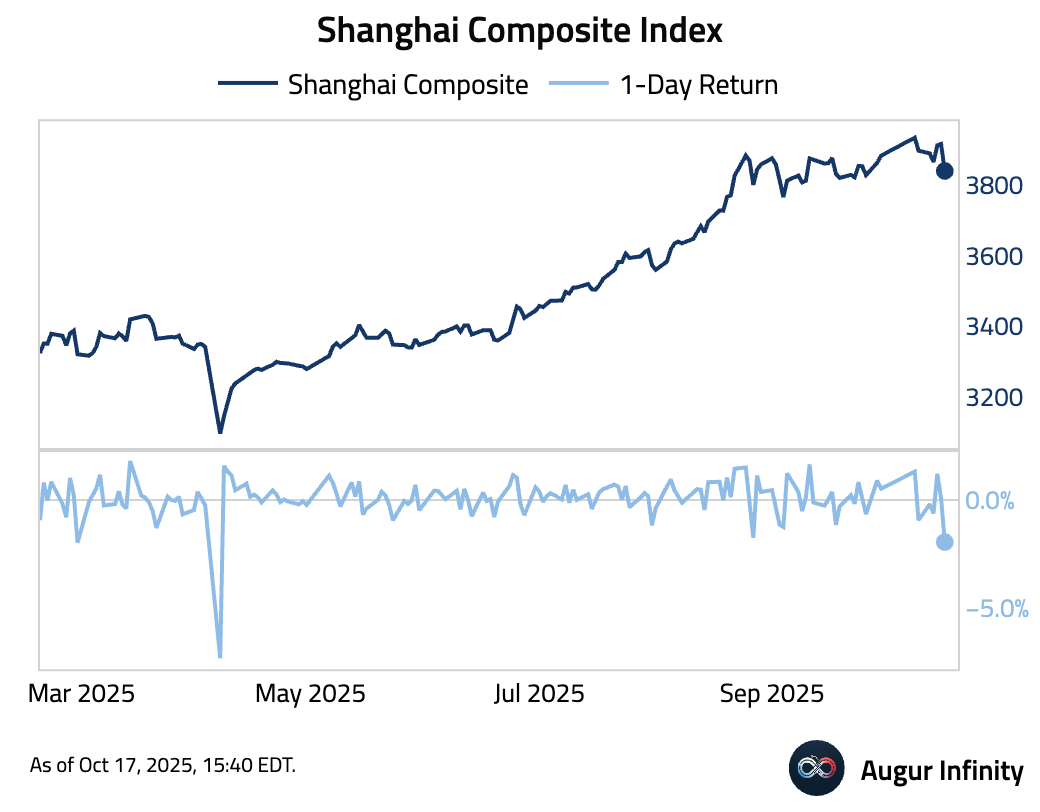

- The Hang Seng Index had the worst day since April …

… same for the Shanghai Composite Index.

- Korea SE KOSPI Index reached the 13th all-time high this year.

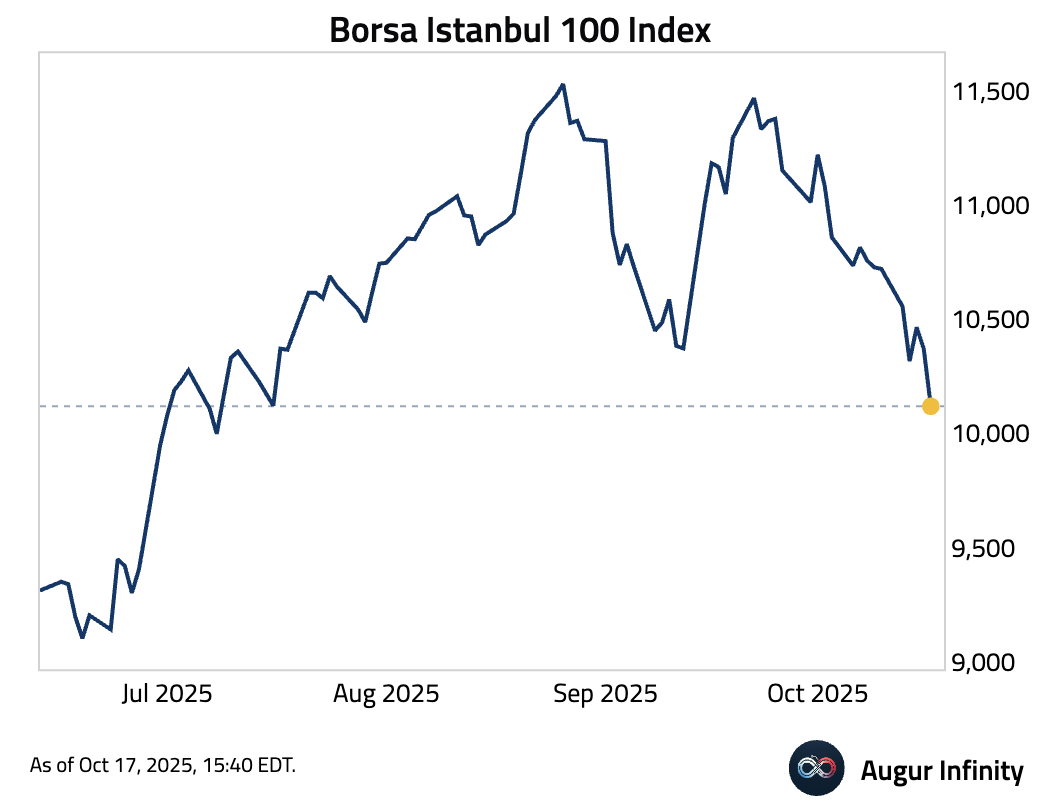

- Borsa Istanbul 100 fell to the lowest level since July.

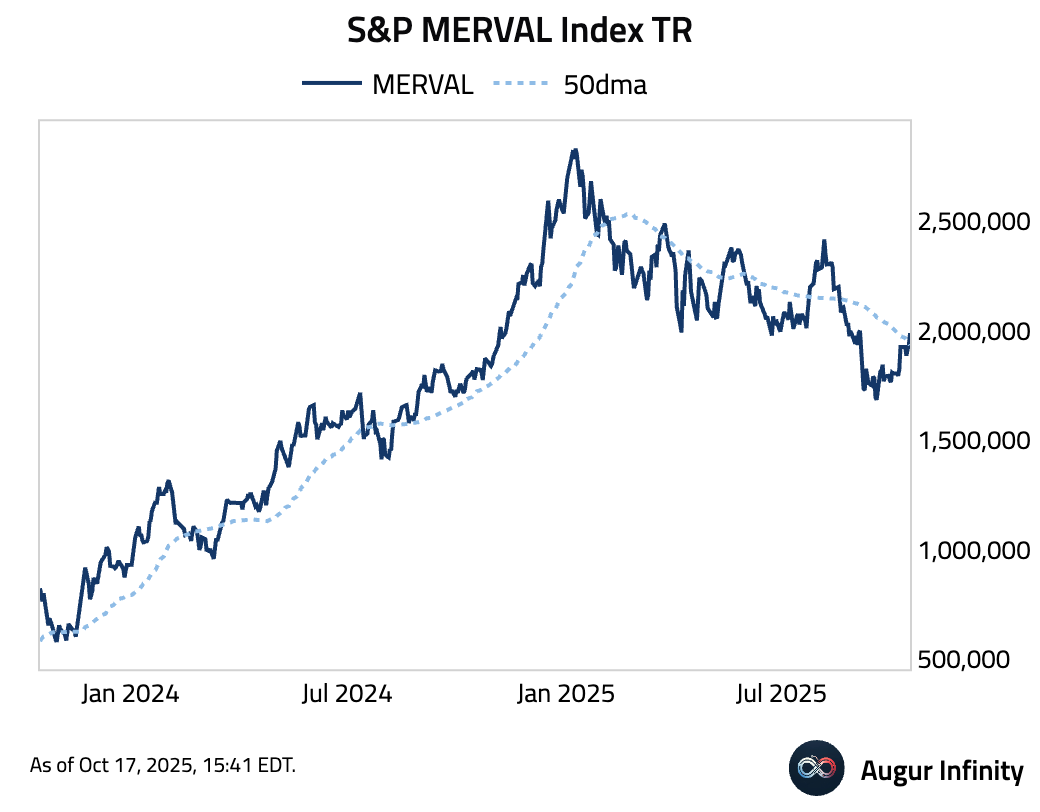

- S&P MERVAL climbed above its 50-day moving average.

Fixed Income

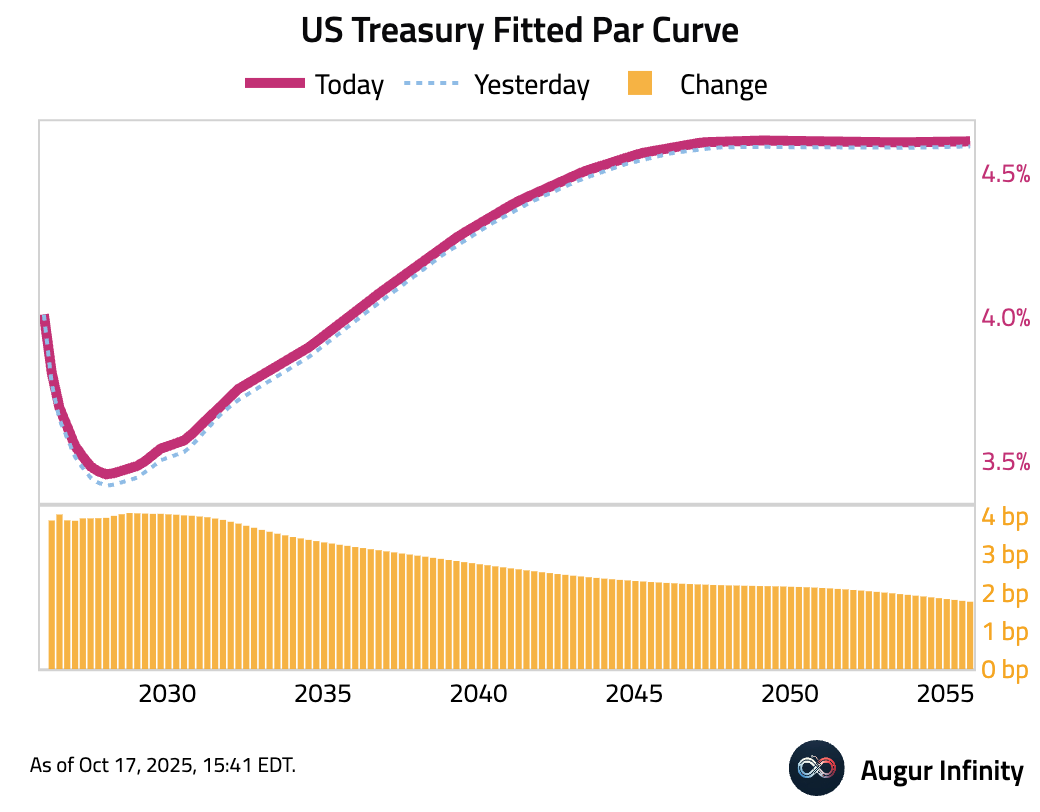

- US Treasury yields rose across the curve. The 2-year yield increased by 3.4 bps, while the 10-year yield climbed 2.8 bps.

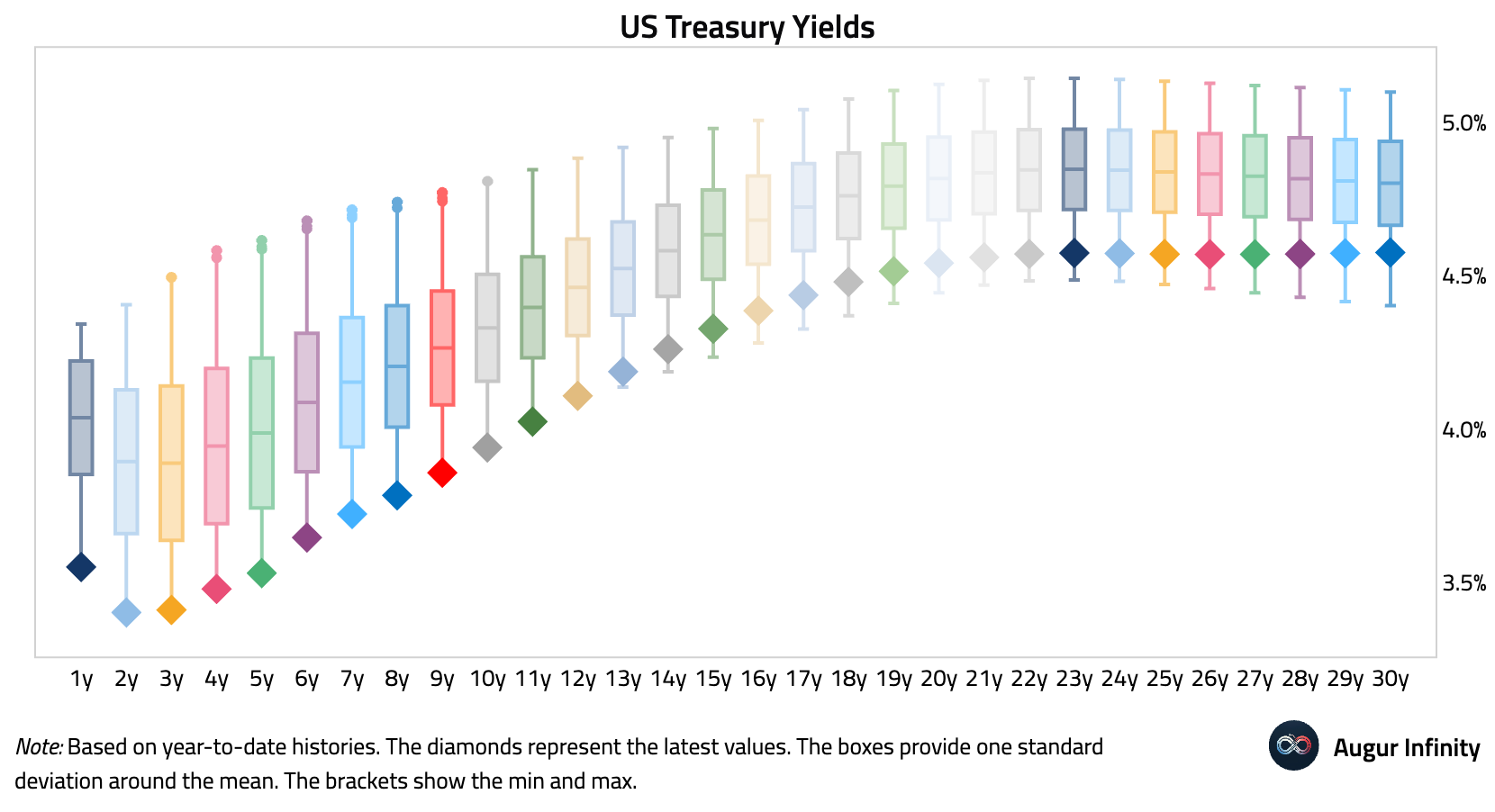

- Yields across the curve are near the lower end of the ranges.

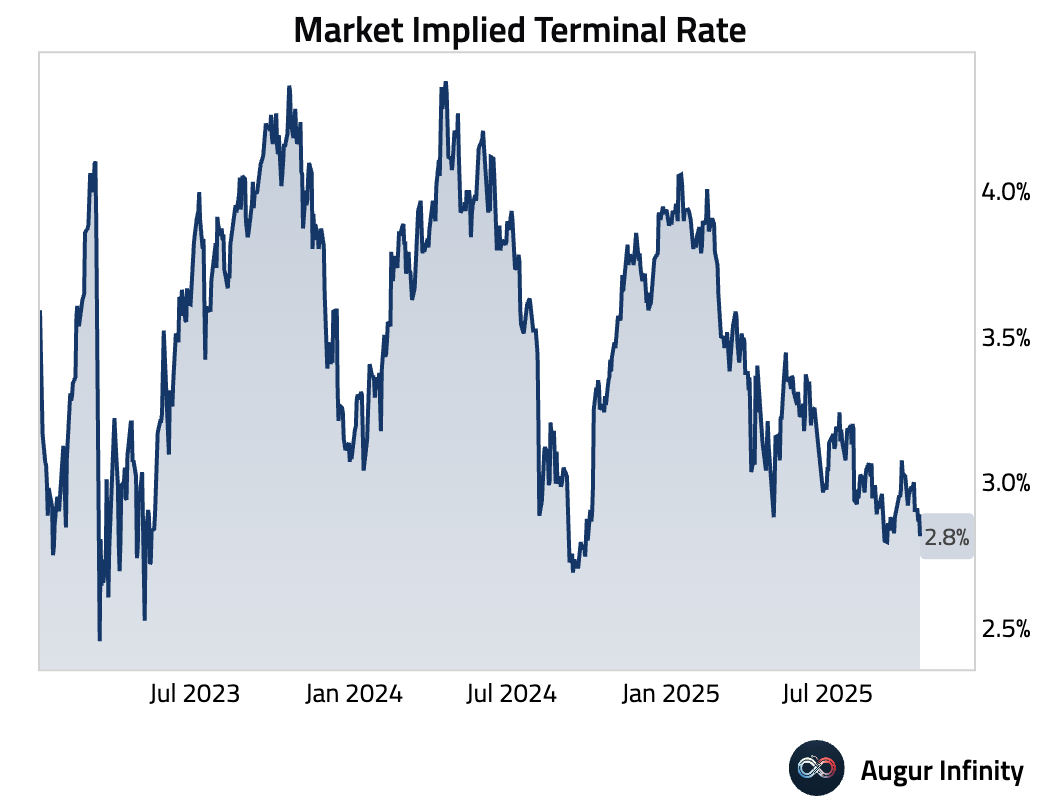

- The market's implied terminal rate has fallen to 2.8%.

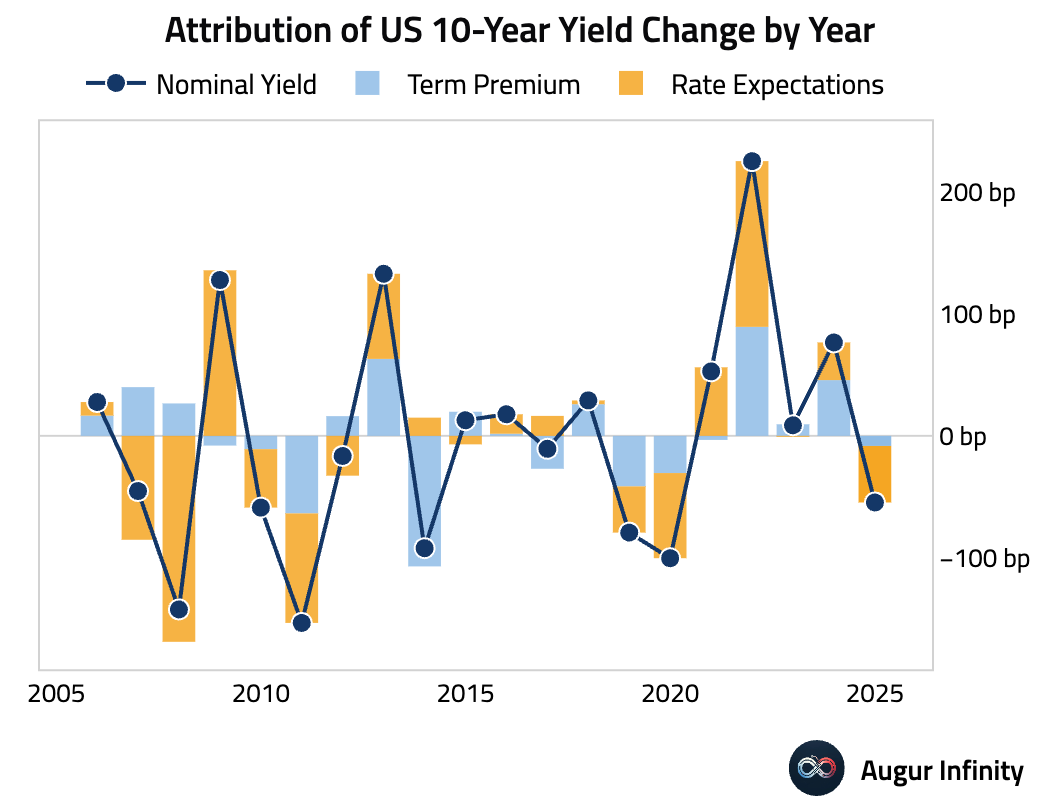

- The decline in the 10-year yield this year has been driven by a decline in rate expectations, while term premium has held steady.

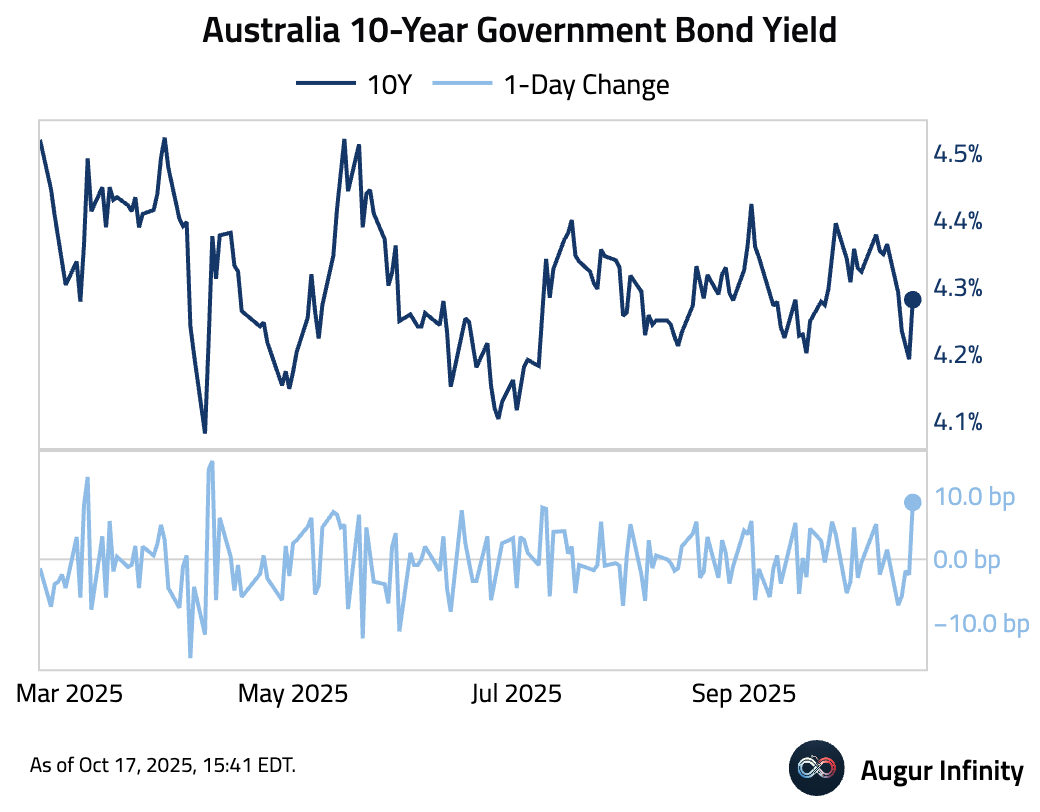

- Australia 10-year yield moved up by the most in a single day since April.

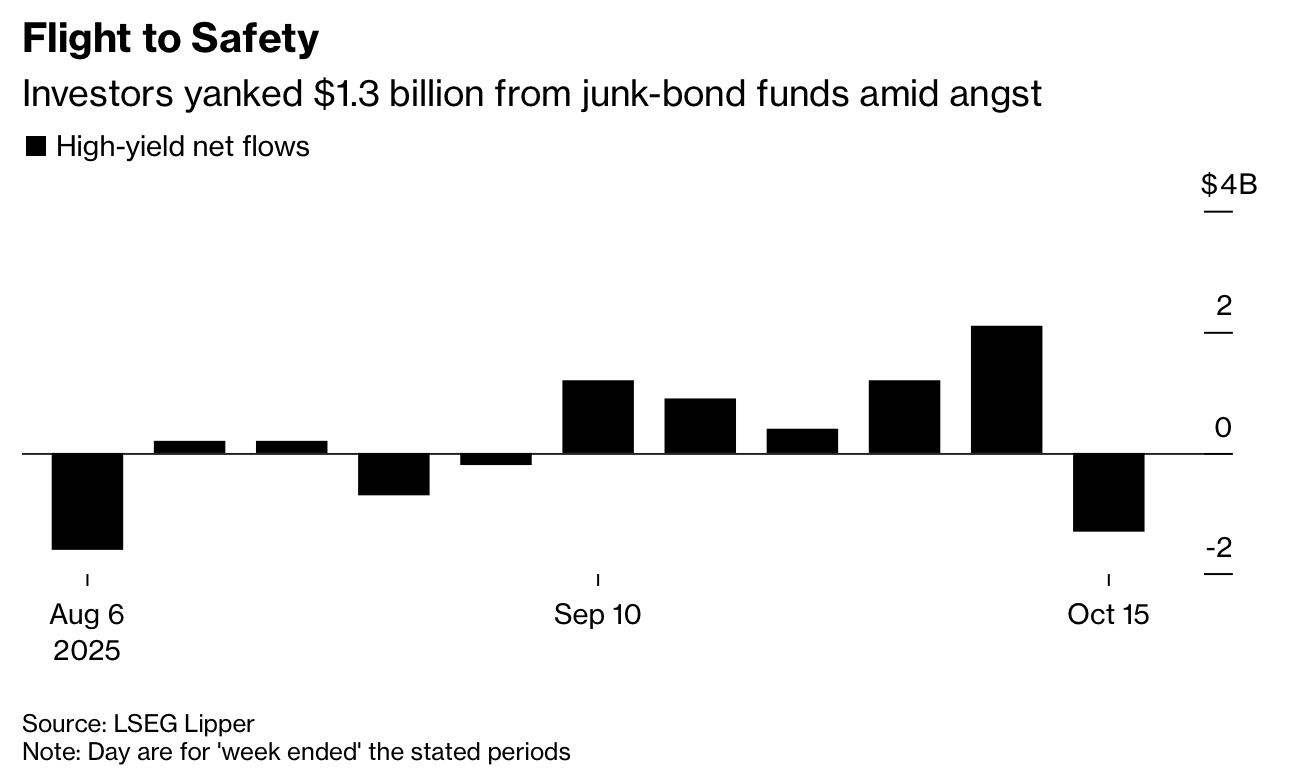

- Investors yanked $1.3 billion from junk-bond funds amid angst.

Source: Bloomberg

Commodities

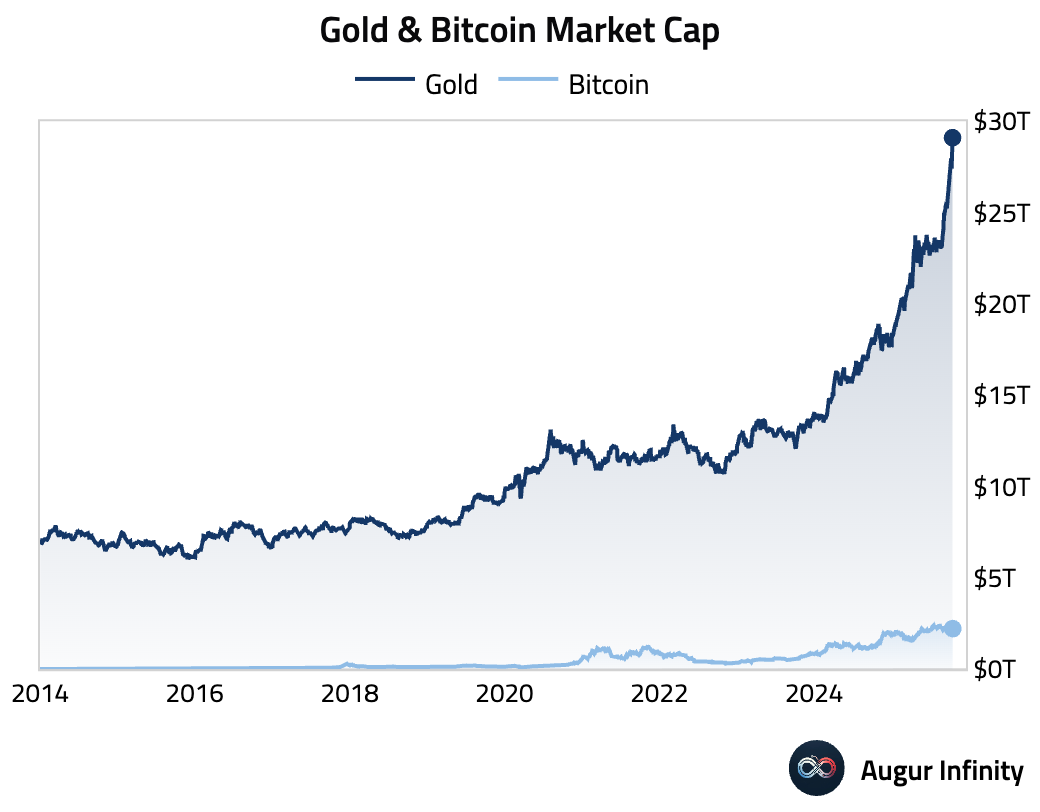

- Gold might've taken a breather today, but the total market value of gold has exceeded $29 trillion, while Bitcoin's market cap sits at around $2.2 trillion.

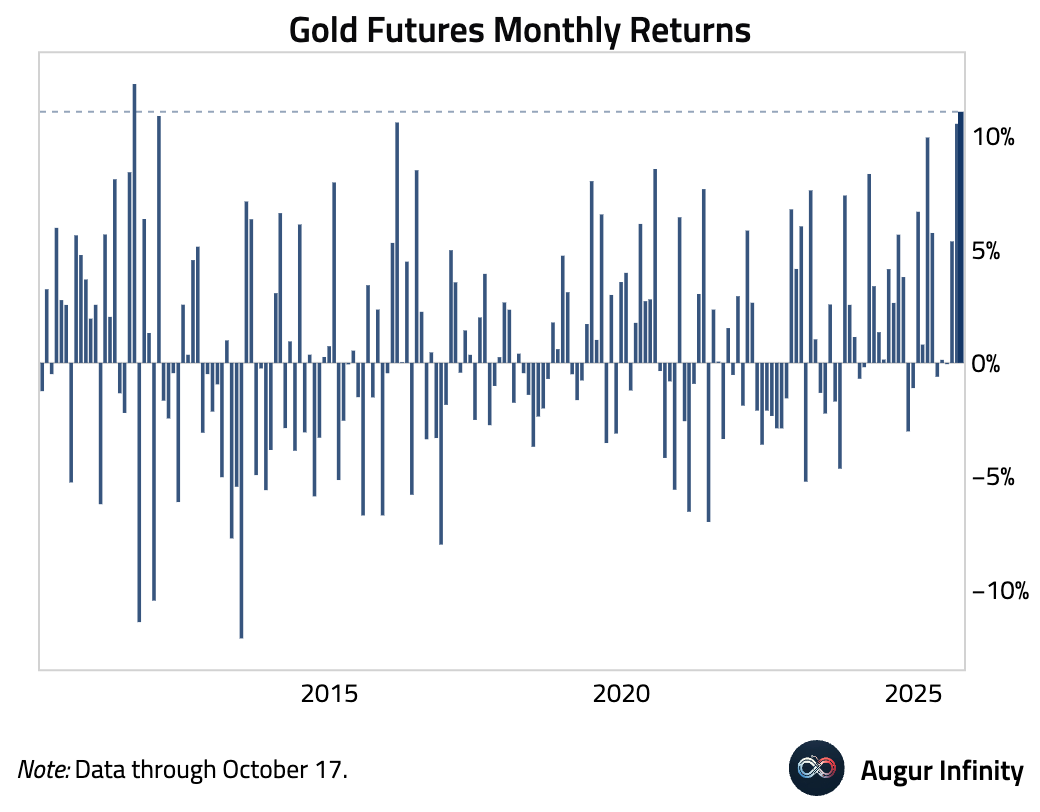

- The month-to-date return of gold is the best since 2011.

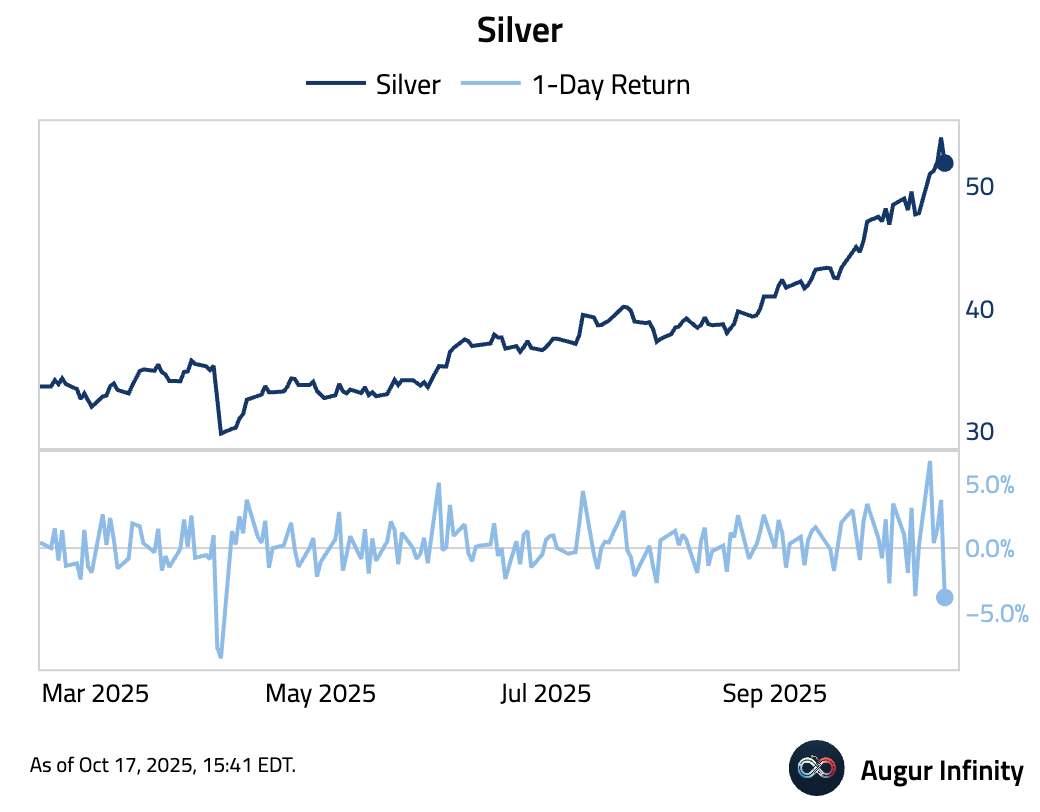

- Silver declined by the most since April today.

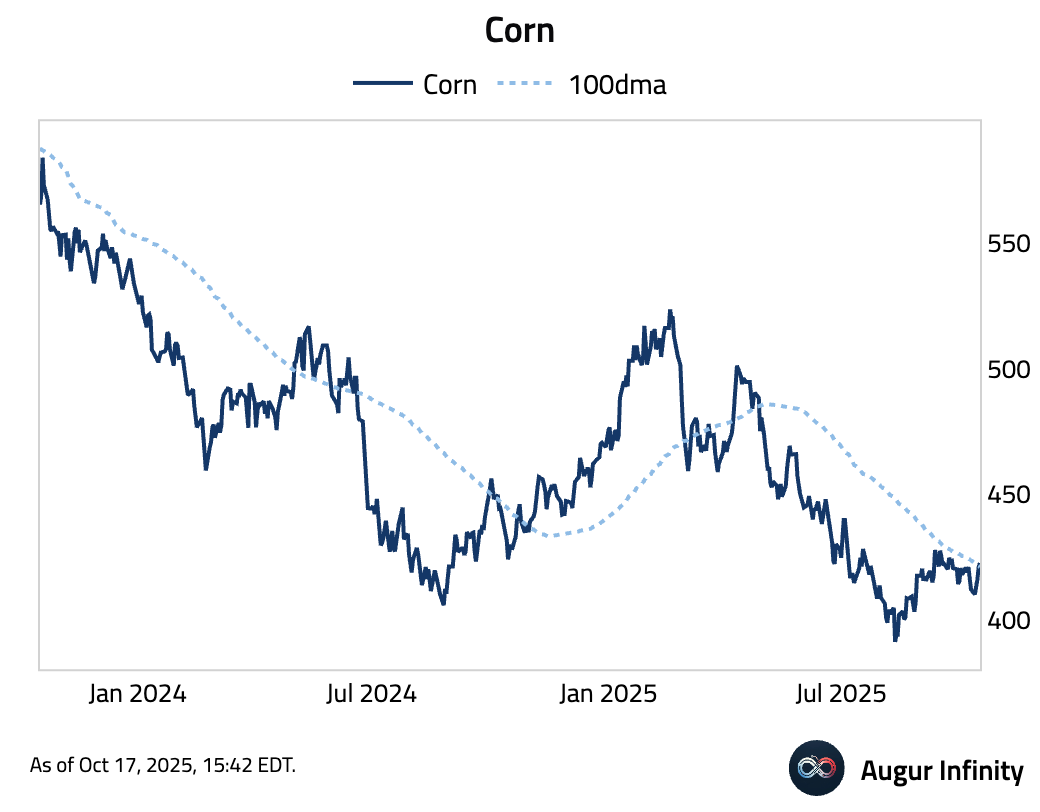

- Corn is above its 100-day moving average.

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.