- United States

- Canada

- United Kingdom

- The Eurozone

- Europe

- Japan

- Asia-Pacific

- China

- India

- Emerging Markets

- Equities

- Rates

- Energy

- Commodities

- Cryptocurrency

United States

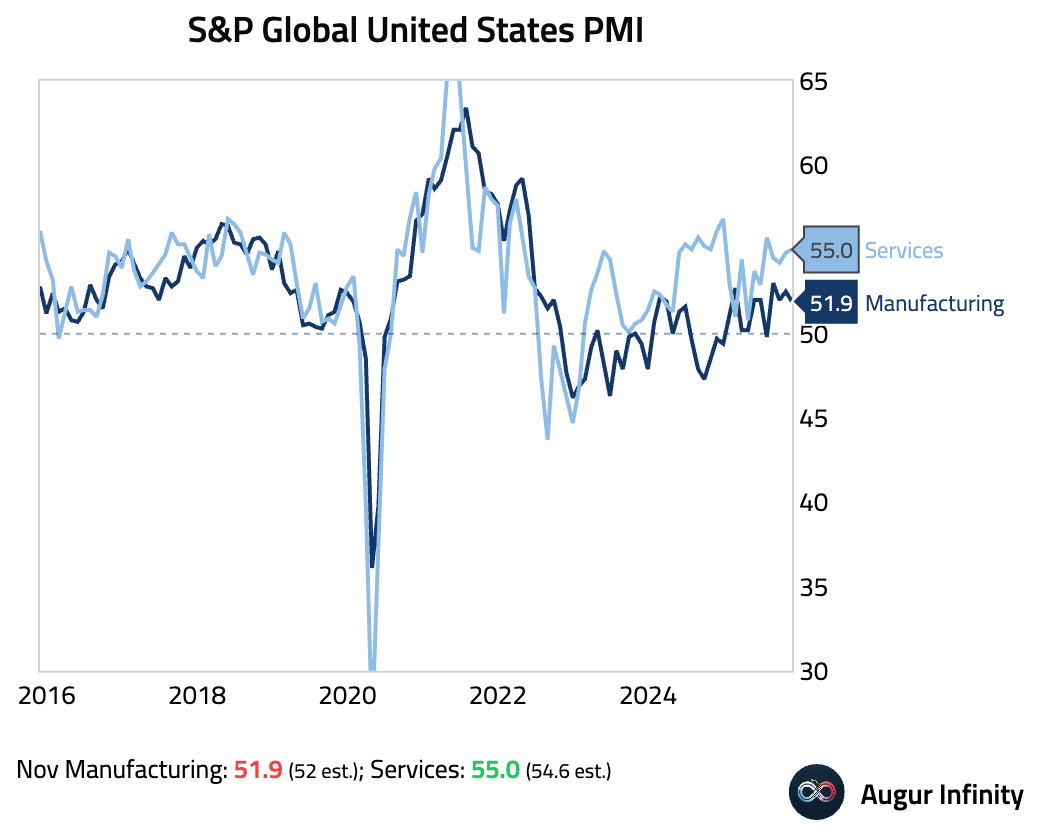

- US services sector expansion accelerated, fueled by the largest increase in new business this year. In contrast, the manufacturing PMI fell to a 4-month low. A major red flag is the combination of sharply weakening new orders and a record rise in unsold inventory.

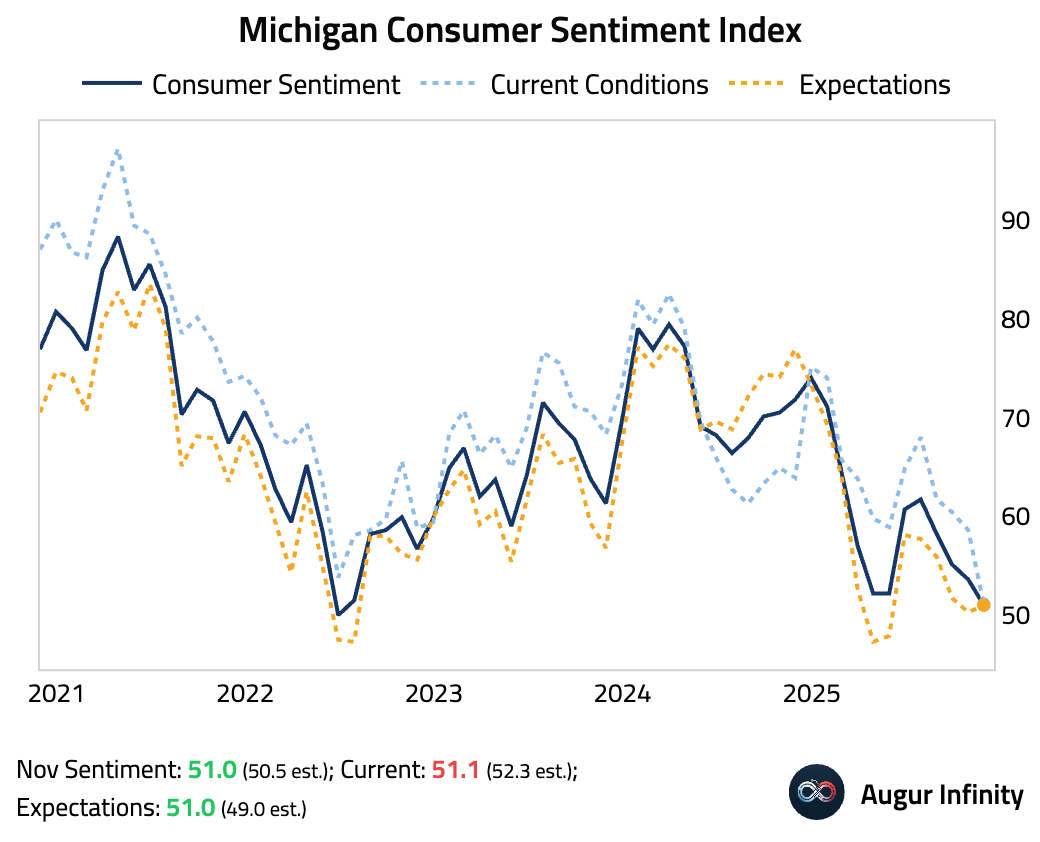

- The University of Michigan's final November consumer sentiment index fell to near record low levels but improved from initial readings.

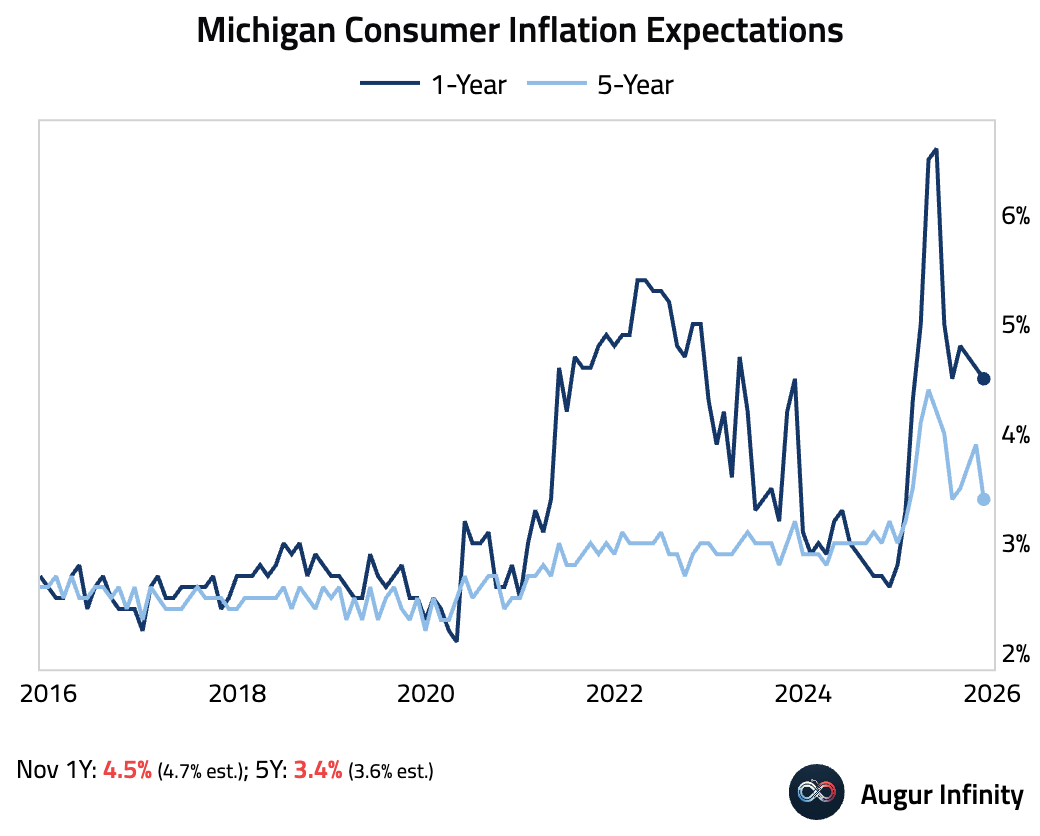

Consumer inflation expectations were revised down.

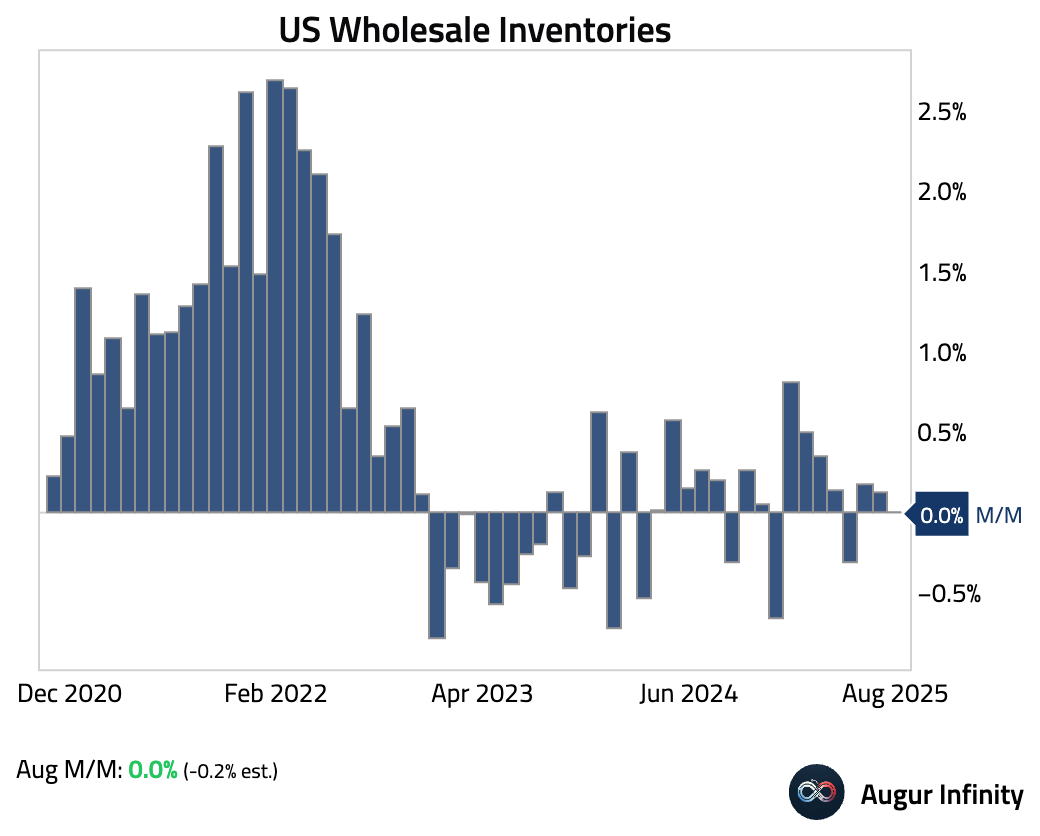

- Wholesale inventories were unchanged in October.

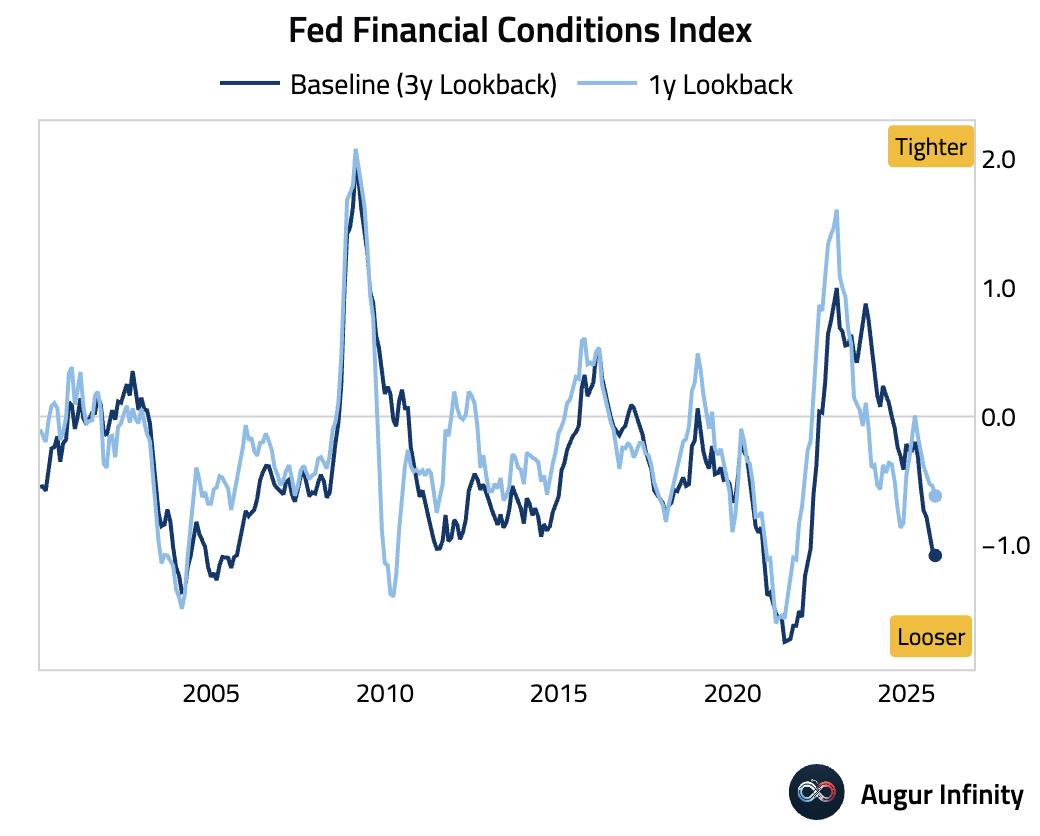

- According to the Fed’s FCI-G Index, financial conditions loosened further in October, with the baseline index reaching its most accommodative level since early 2022.

Interactive chart on Augur Infinity

Canada

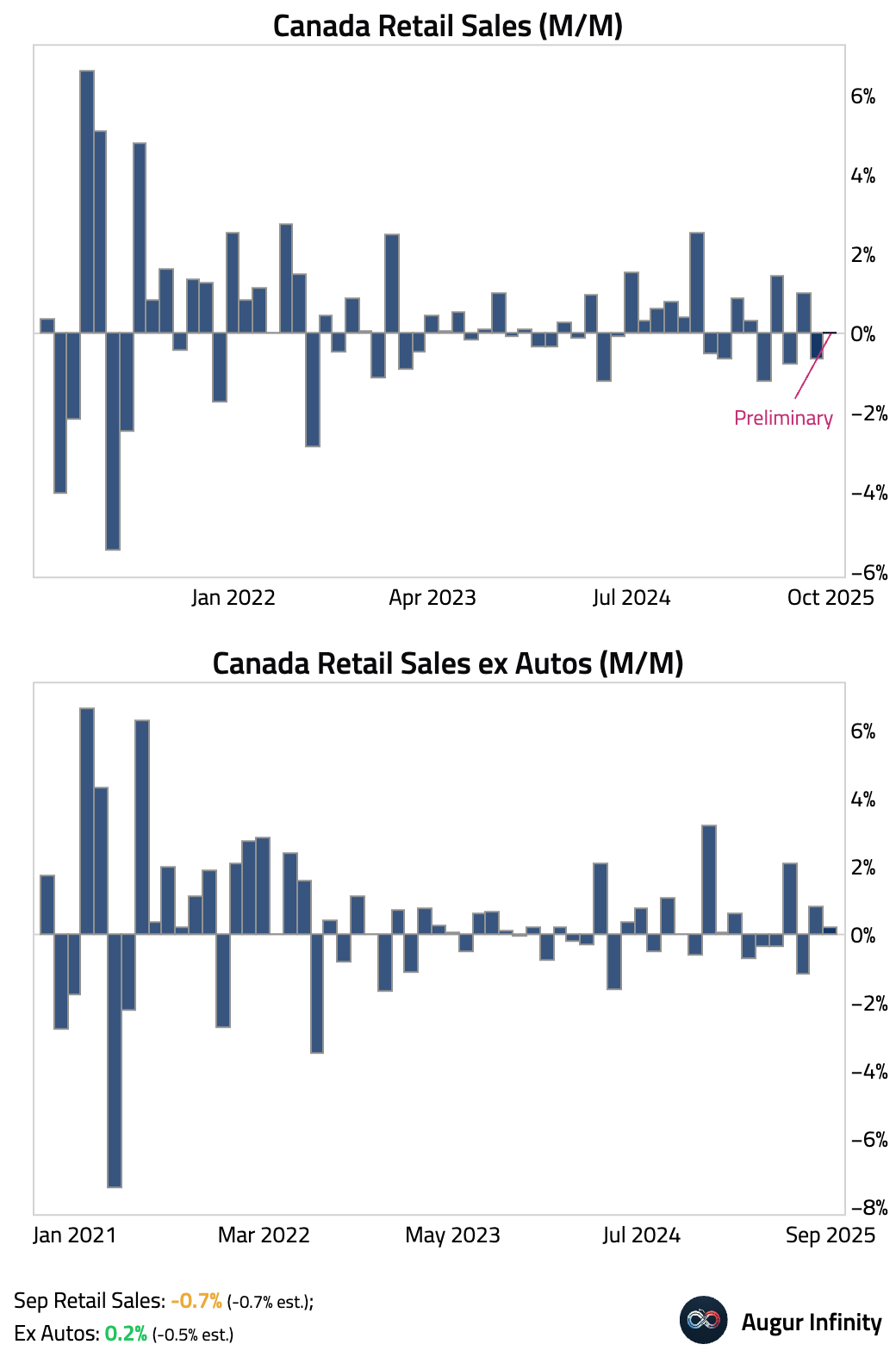

- Headline retail sales fell as expected in September. However, sales excluding autos rose, beating consensus forecasts for a decline. The preliminary estimate for October indicates that retail sales were flat.

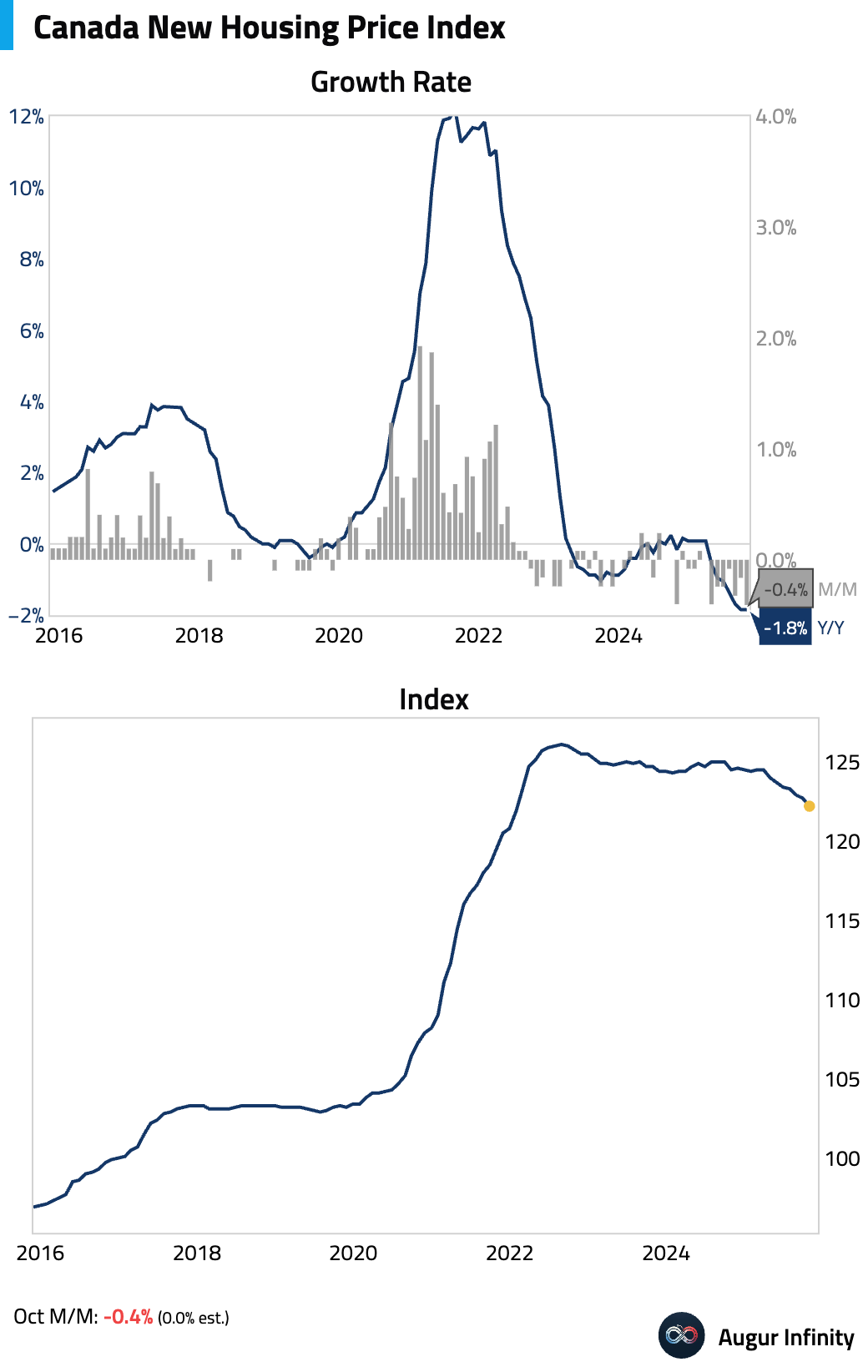

- New housing prices in Canada continued to fall and missed consensus expectations for a flat reading.

United Kingdom

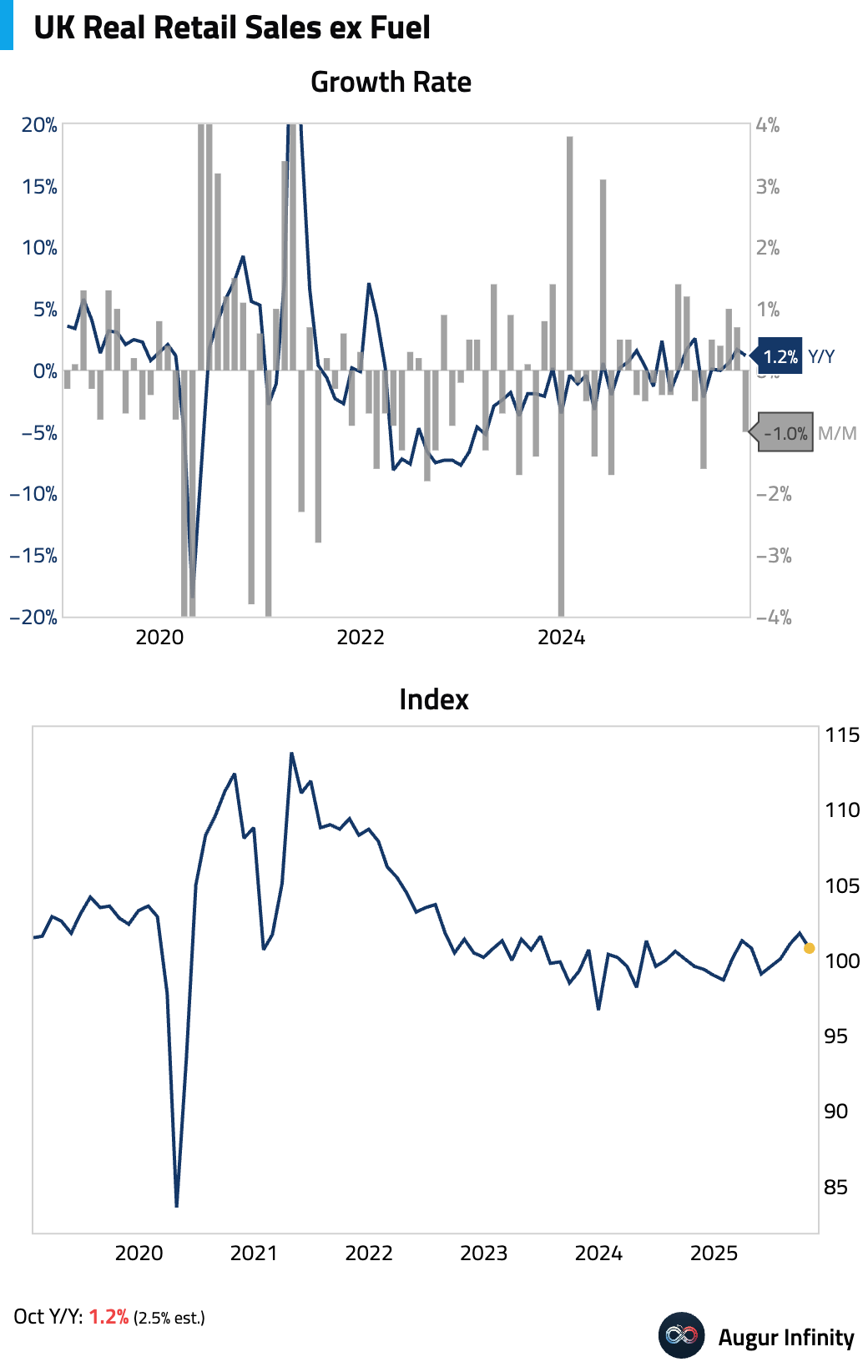

- UK retail sales weakened. The weakness was broad-based, with consumers reportedly delaying non-essential purchases, particularly clothing, ahead of holiday promotions.

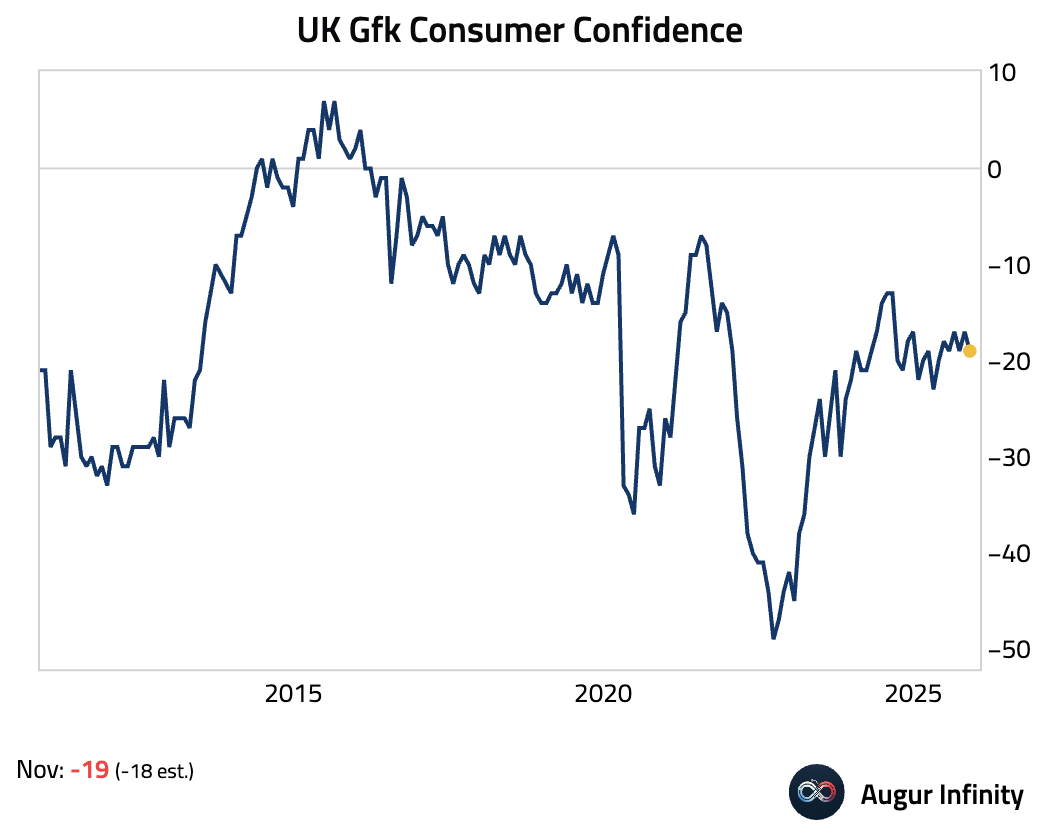

- Consumer confidence unexpectedly weakened in November, driven by speculation of tax hikes, but has otherwise been moving sideways.

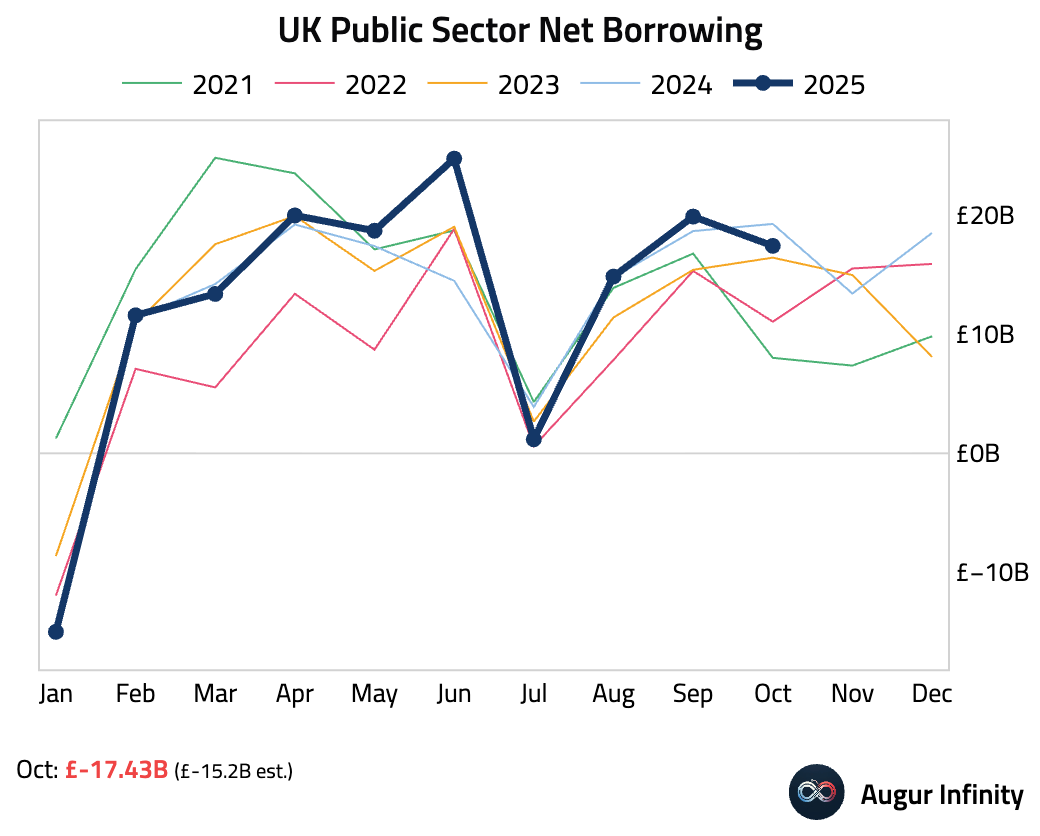

- Public sector net borrowing came in at £17.4 billion, overshooting the OBR’s projections and last year’s October figure. The higher figure reflects both weaker tax receipts and higher spending, underscoring the perilous state of the public finances as Chancellor Reeves prepares her budget.

Source: @economics

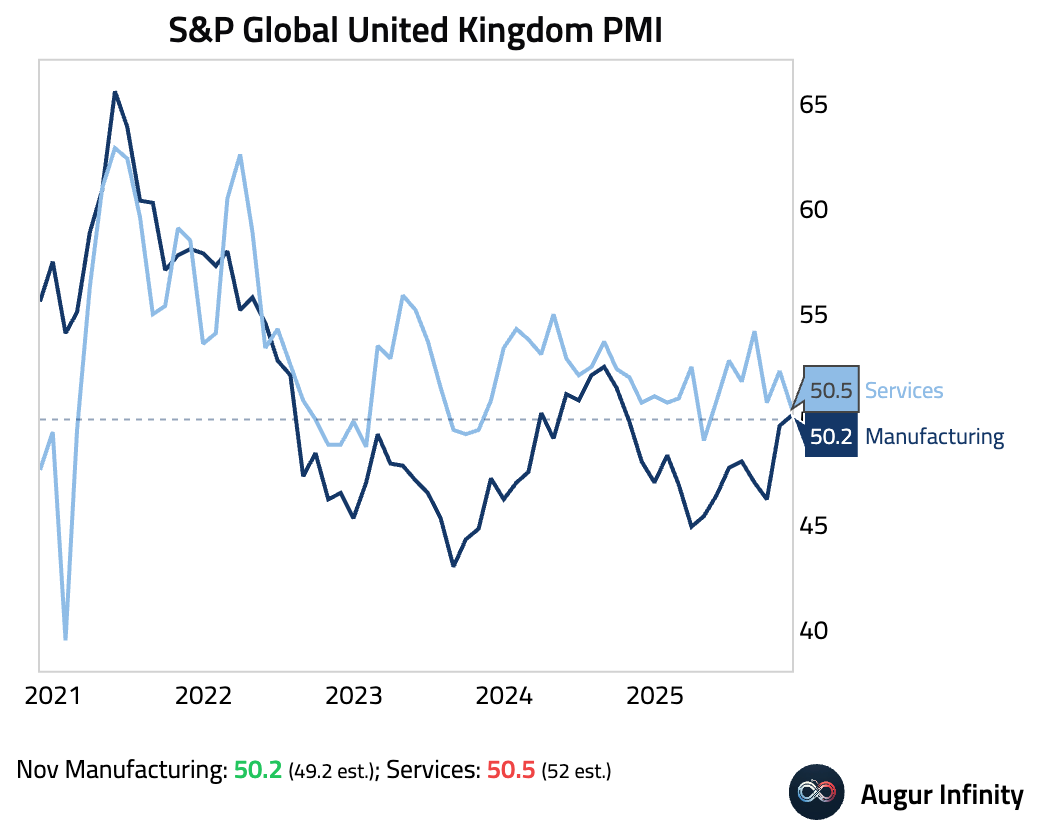

- UK factory activities returned to expansionary territory, with its PMI rising to a 14-month high, supported by the first increase in new orders in over a year. Services PMI declined but stayed above 50.

The Eurozone

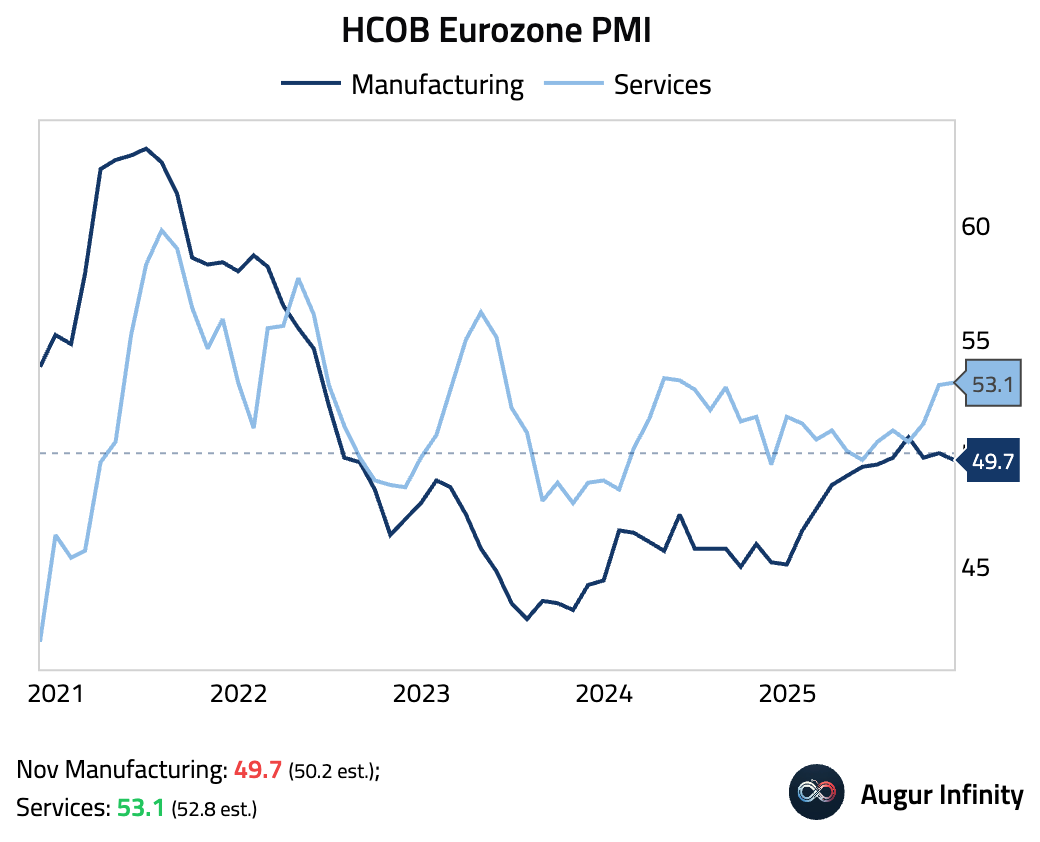

- Let's start with the PMI reports.

Eurozone: Manufacturing edged down while services held up.

Source: S&P Global PMI

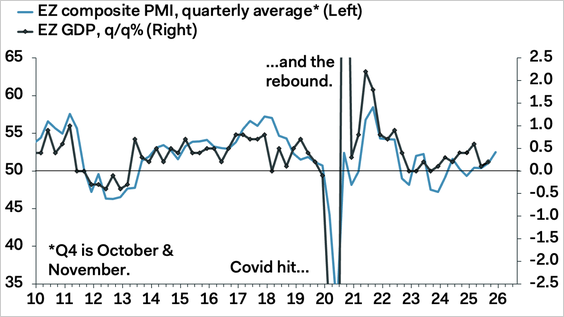

The composite PMI was little changed and continued to signal a rise in Q4 GDP growth.

Source: Pantheon Macroeconomics

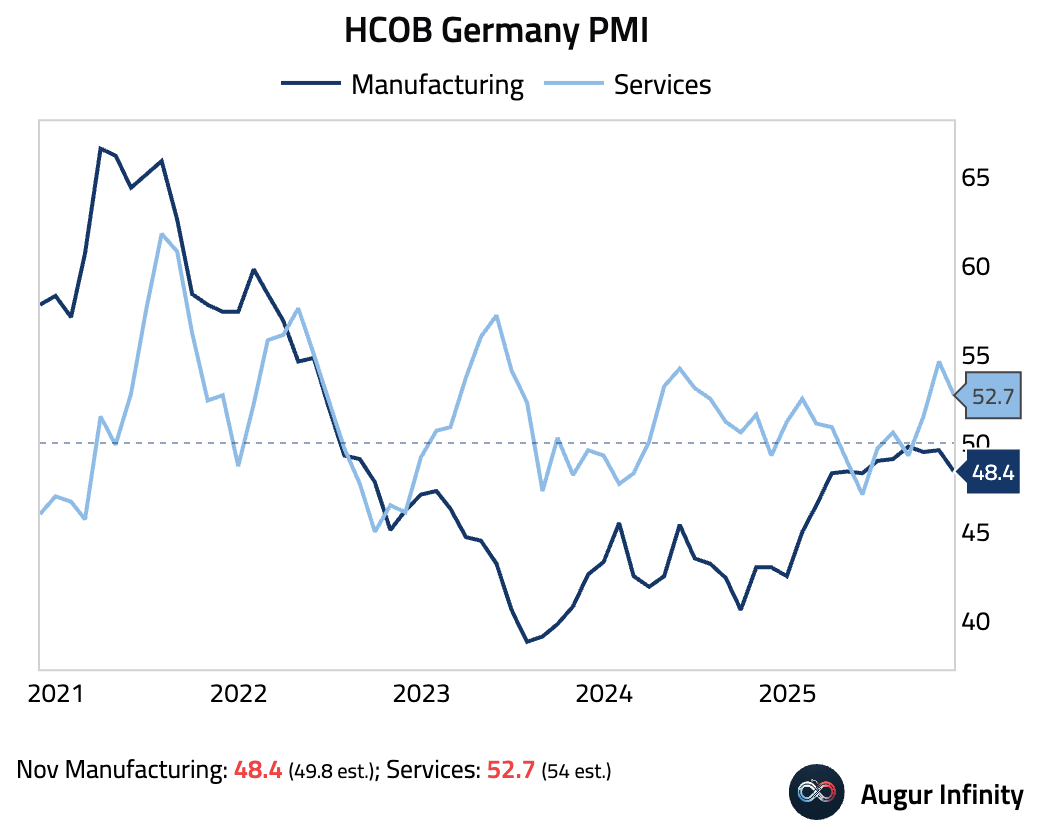

Germany: Manufacturing sank deeper into contraction, driven by worsening new orders; services moderated but remained in expansion.

Source: S&P Global PMI

Germany's manufacturing PMI has been stuck in contraction for 41 months.

Source: S&P Global PMI

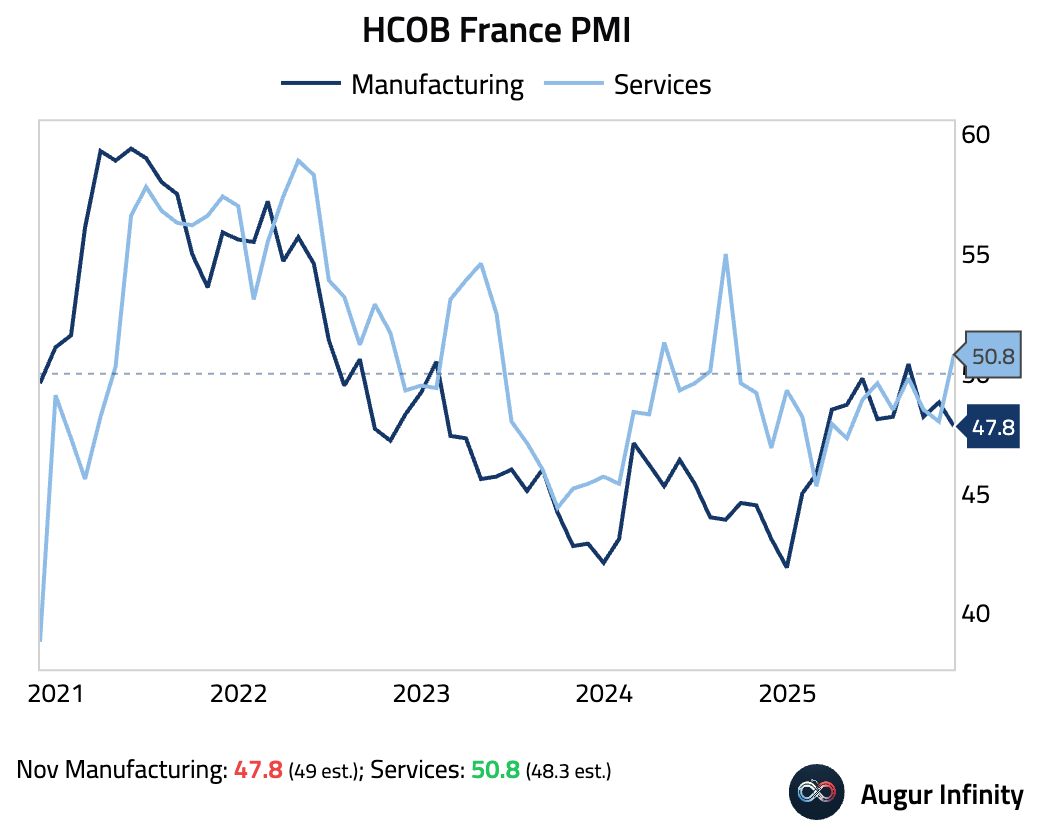

France: The services sector returned to expansion, offsetting a deepening manufacturing slump.

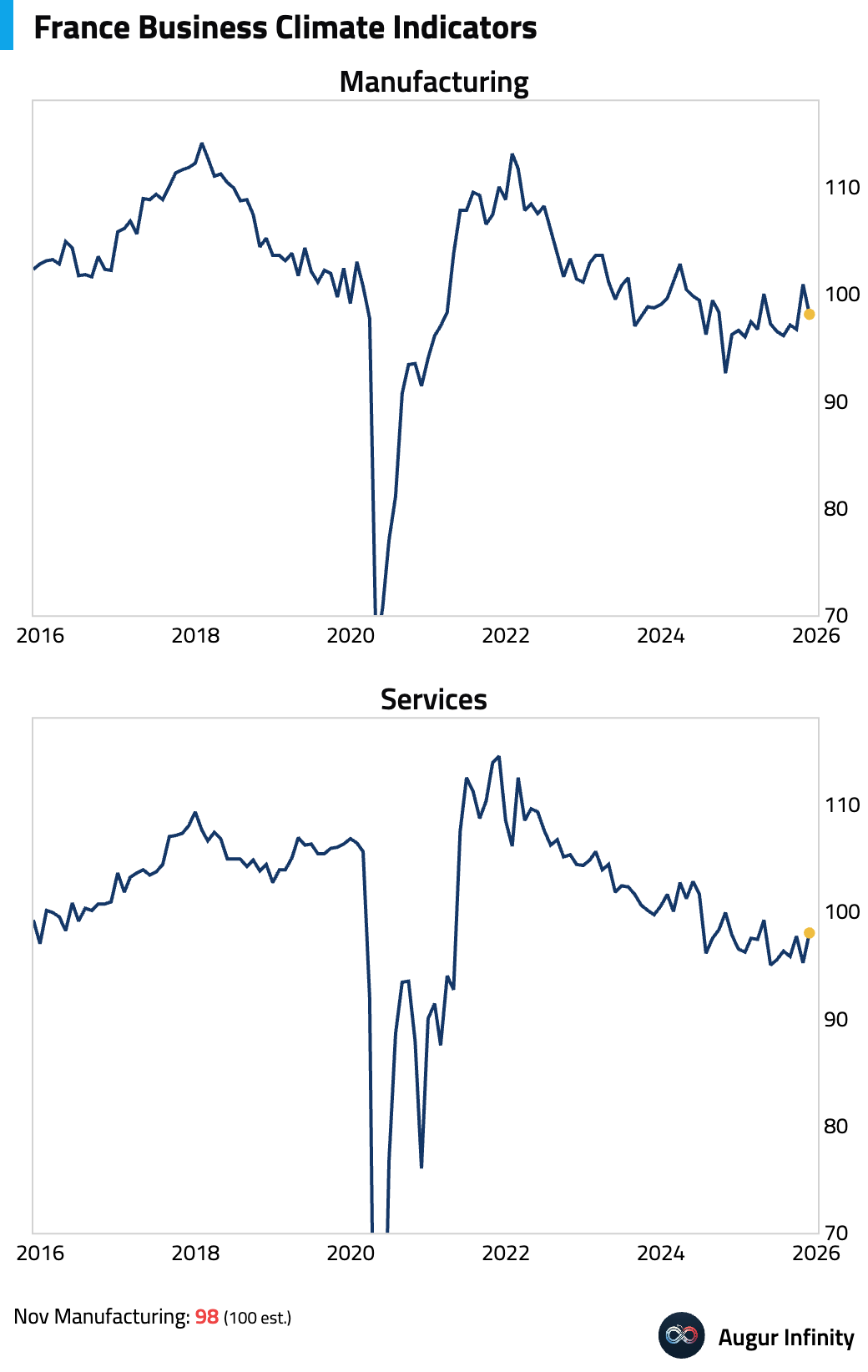

- The INSEE business confidence for France was directionally consistent with the PMI report: manufacturing softened while services confidence rose.

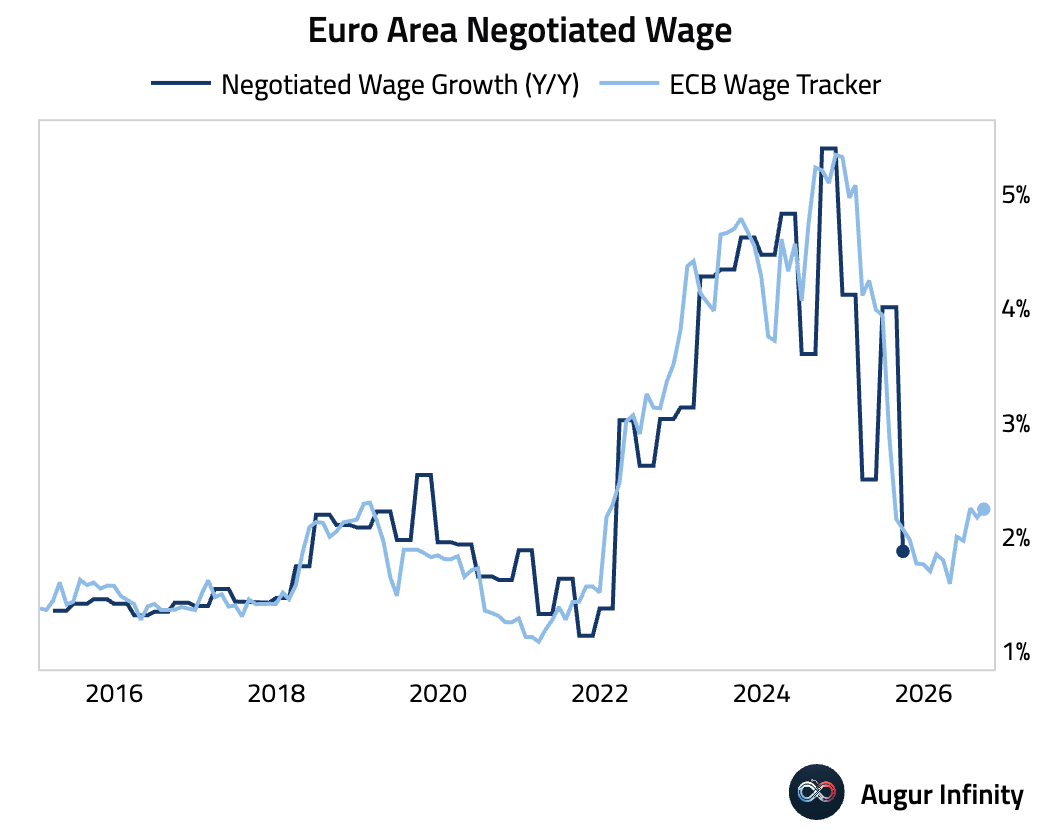

- Negotiated wage growth in the Eurozone slowed sharply, although ECB's wage tracker points to stabilization ahead.

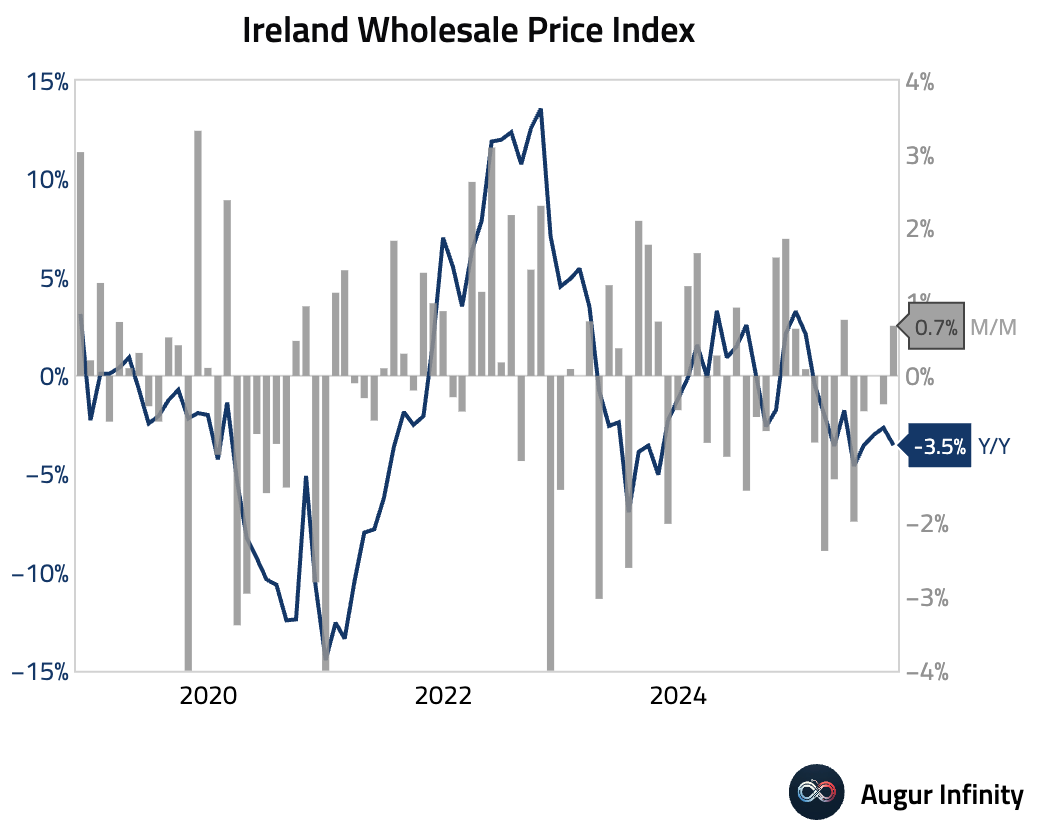

- Irish wholesale prices rose month-over-month in October but continued to fall on an annual basis, with the year-over-year decline accelerating.

Europe

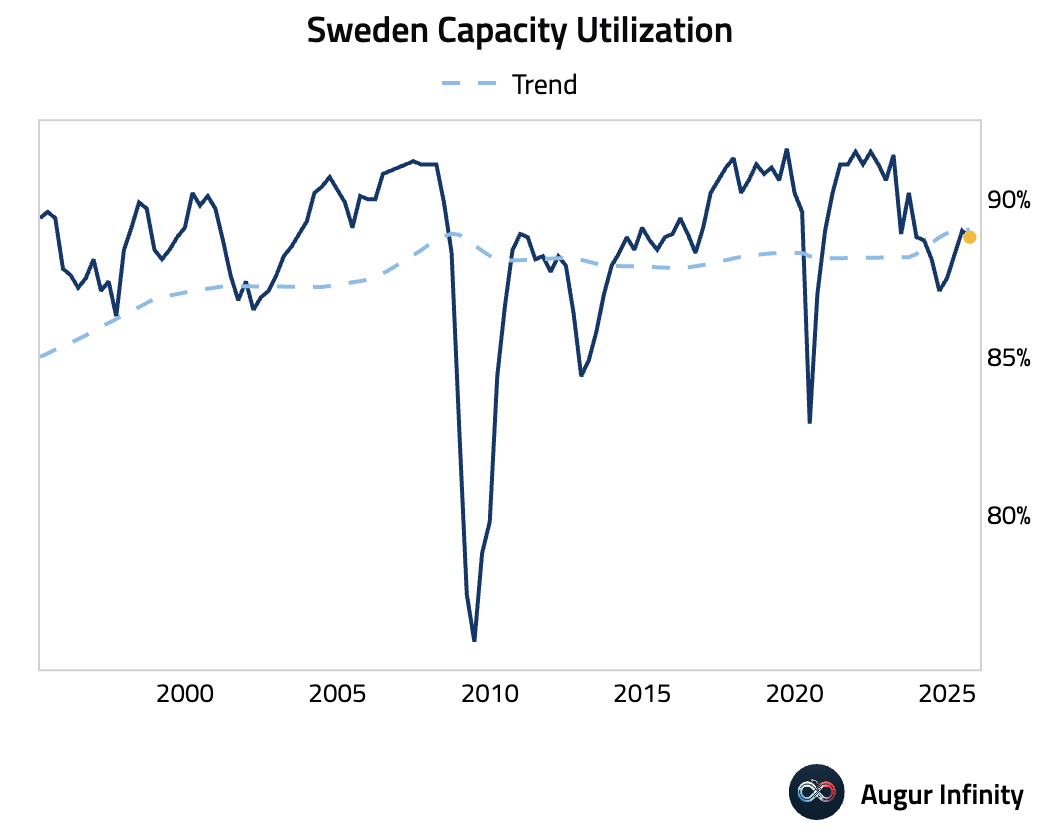

- Swedish industrial capacity utilization declined in Q3.

Japan

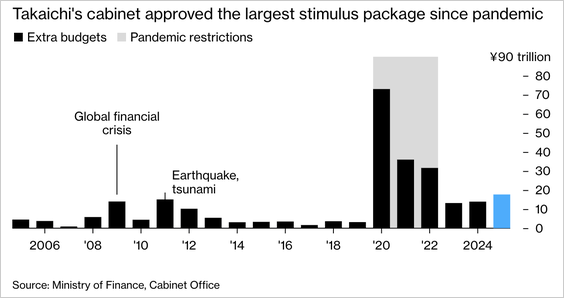

- Japan approved a ¥21.3 trillion stimulus package—the largest since the pandemic—focused on inflation relief, including tax cuts, energy subsidies, and household support. The measures aim to bolster consumption and political support but risk further pressuring bond markets amid rising yields and already-elevated debt levels.

Source: @economics

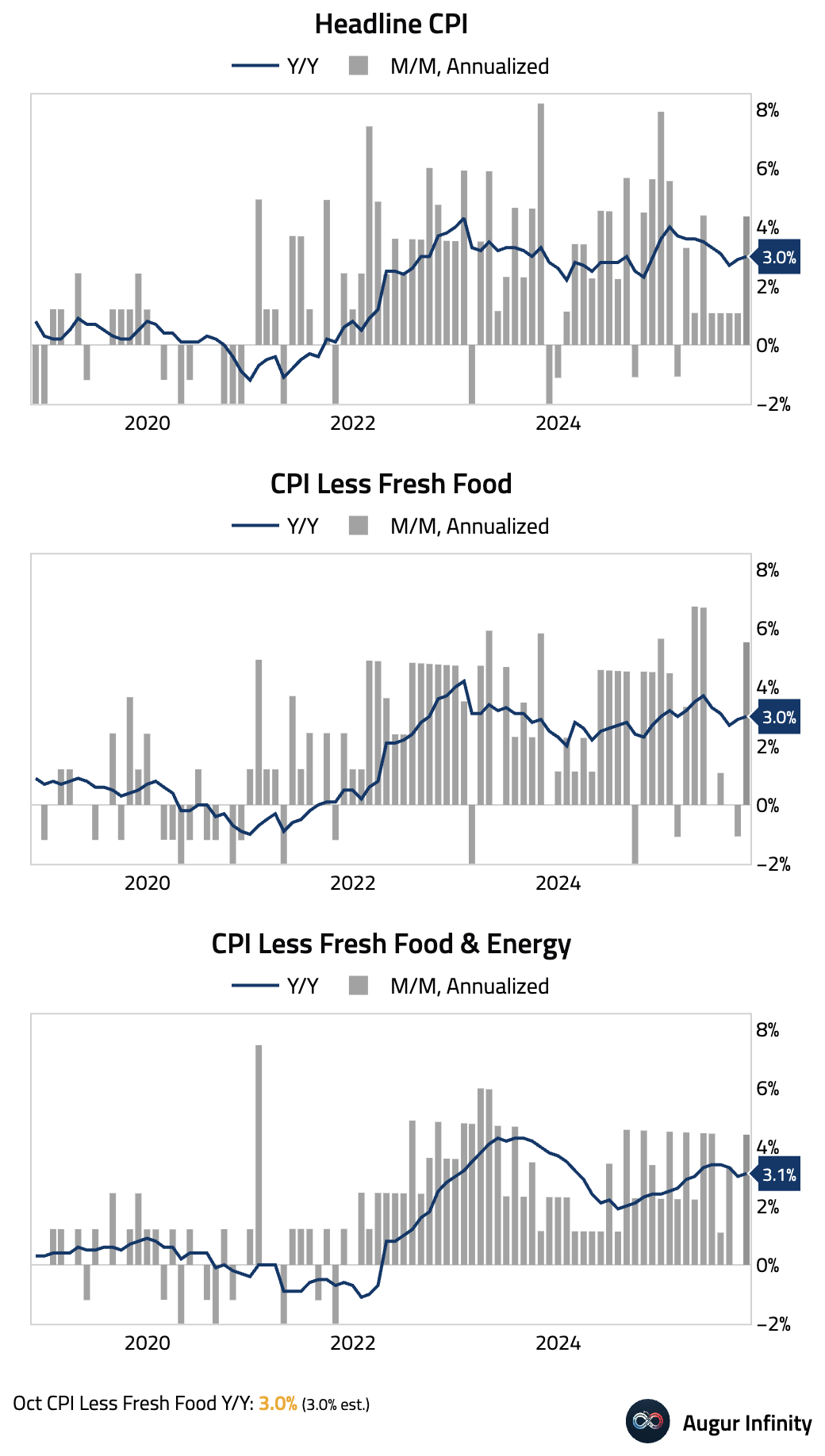

- Japan’s headline inflation accelerated to 3.0% Y/Y. Core inflation (ex-fresh food) also ticked up to 3.0%, while the “core-core” measure (ex-food and energy) rose to 3.1%. The increases were driven by yen-sensitive durable goods and accommodation charges.

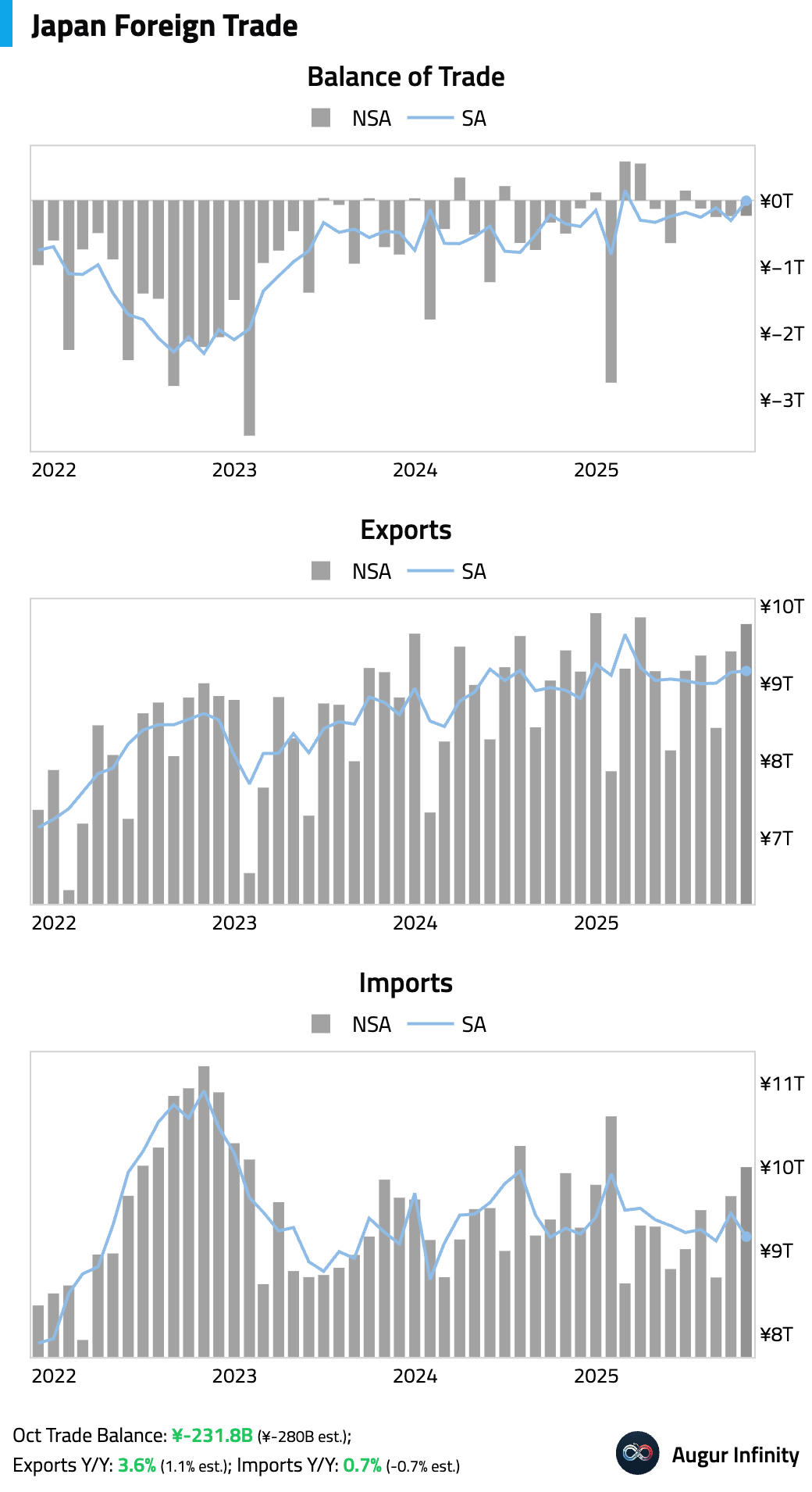

- Japan’s trade deficit narrowed more than expected in October. Both exports and imports rose more than expected.

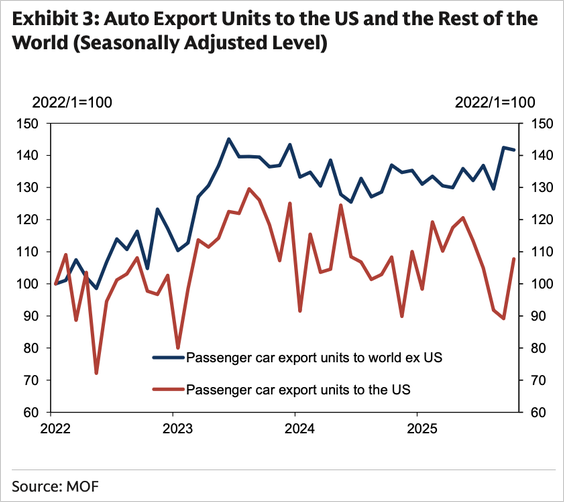

The export strength was driven by a 20% month-over-month surge in auto export volumes to the United States.

Source: Goldman Sachs

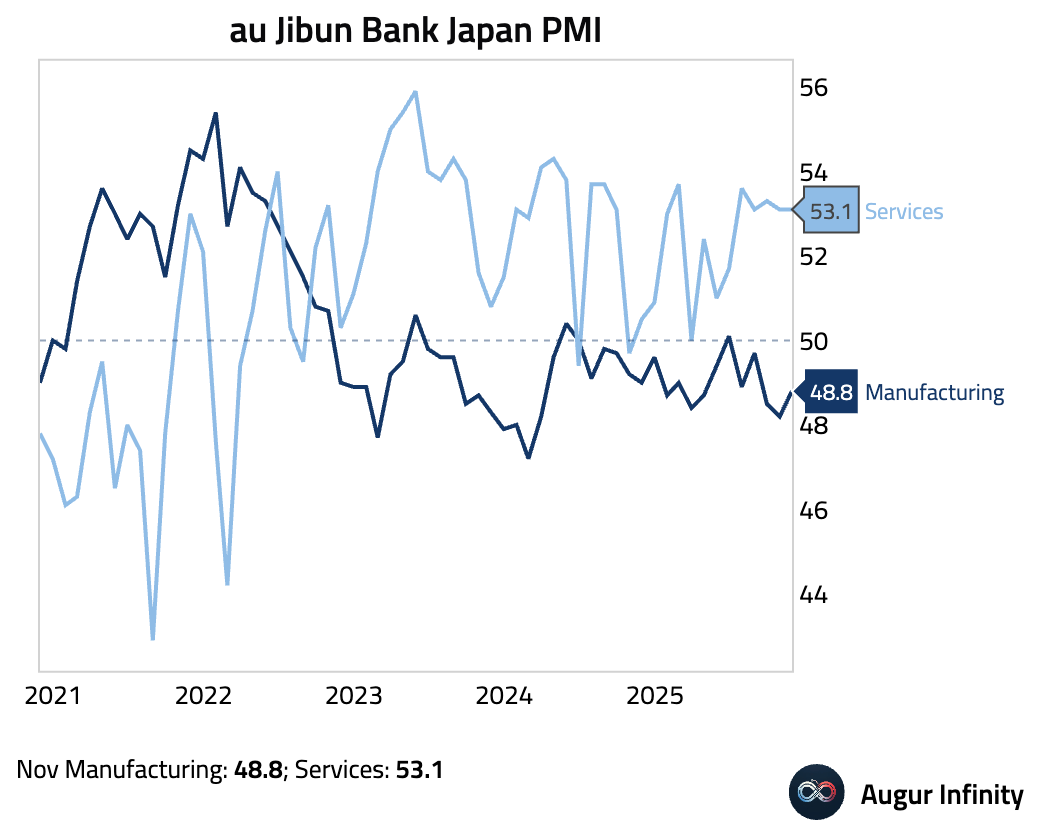

- Japan’s factory activity remained in contraction but edged up as output fell at the softest pace since August. Services continued to expand solidly.

Source: S&P Global PMI

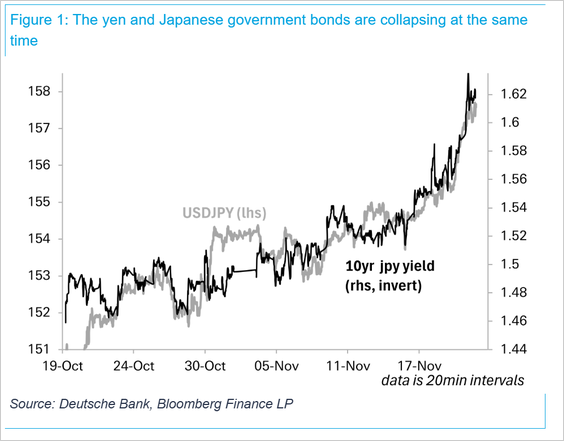

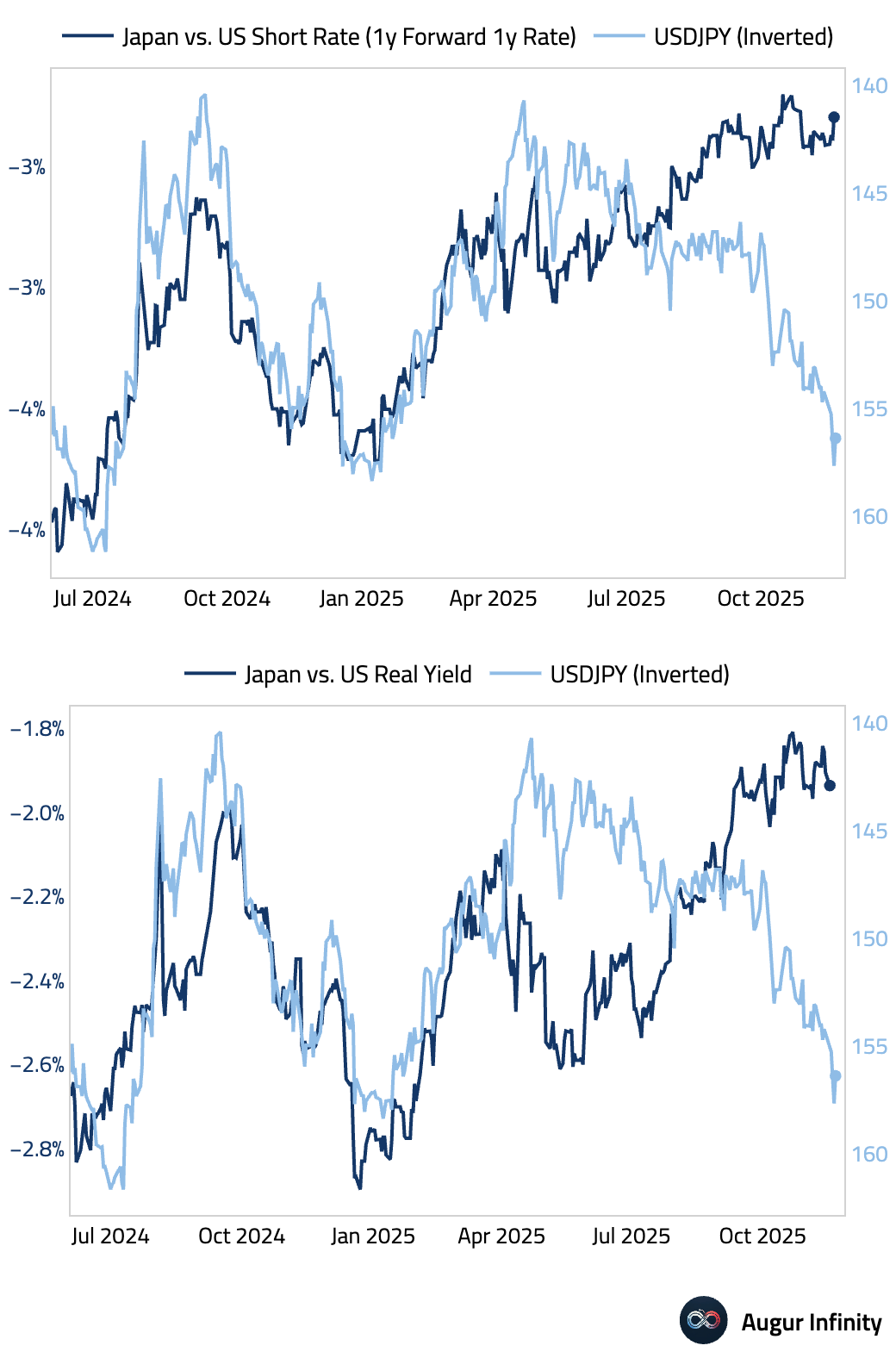

- The Japanese yen and bond market are declining in tandem, amid concerns about fiscal discipline, commitment to the inflation target, and risks of capital flight.

Source: Deutsche Bank Research

The yen has departed from its usual tight relationship with US-Japan interest rate differentials.

Asia-Pacific

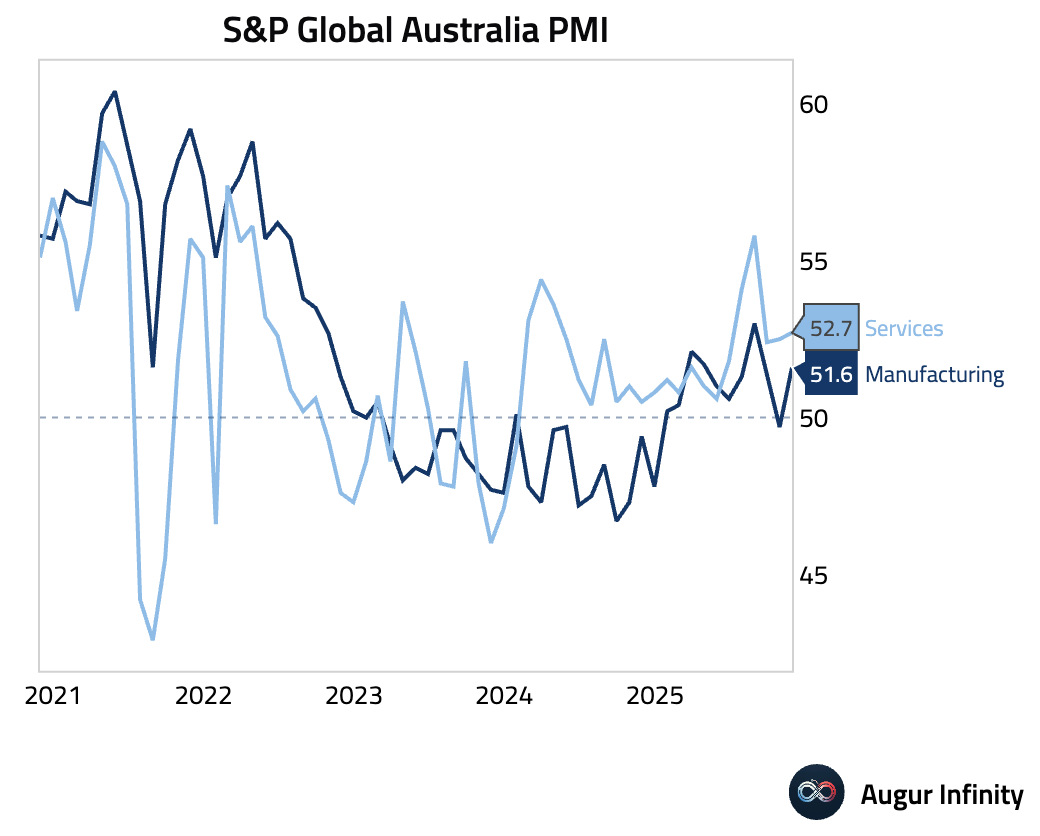

- Australia’s manufacturing sector returned to growth in November, with output and new orders rising for the first time in three months. Service-sector activity strengthened further on faster new-business growth and improving demand conditions.

Source: S&P Global PMI

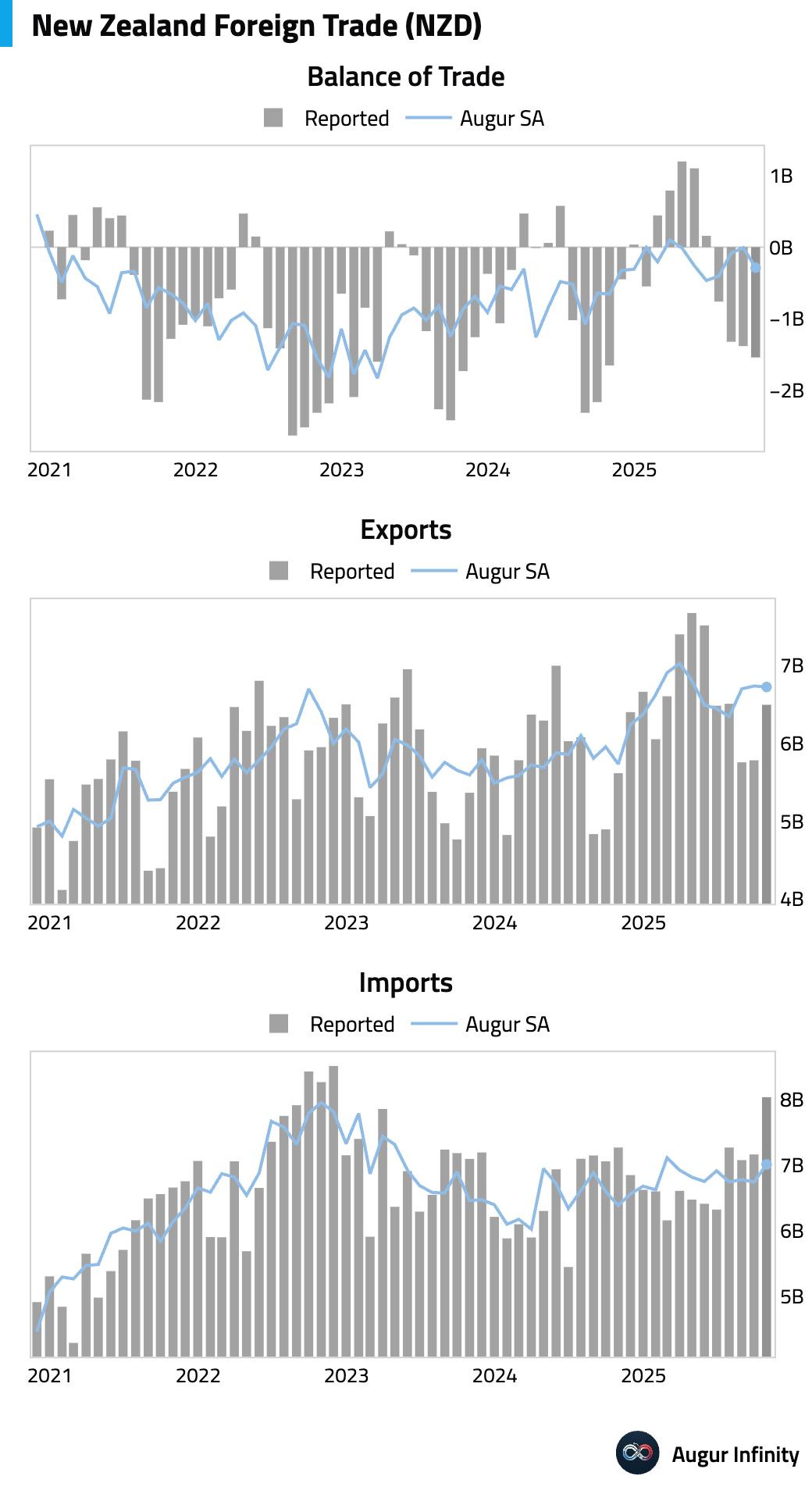

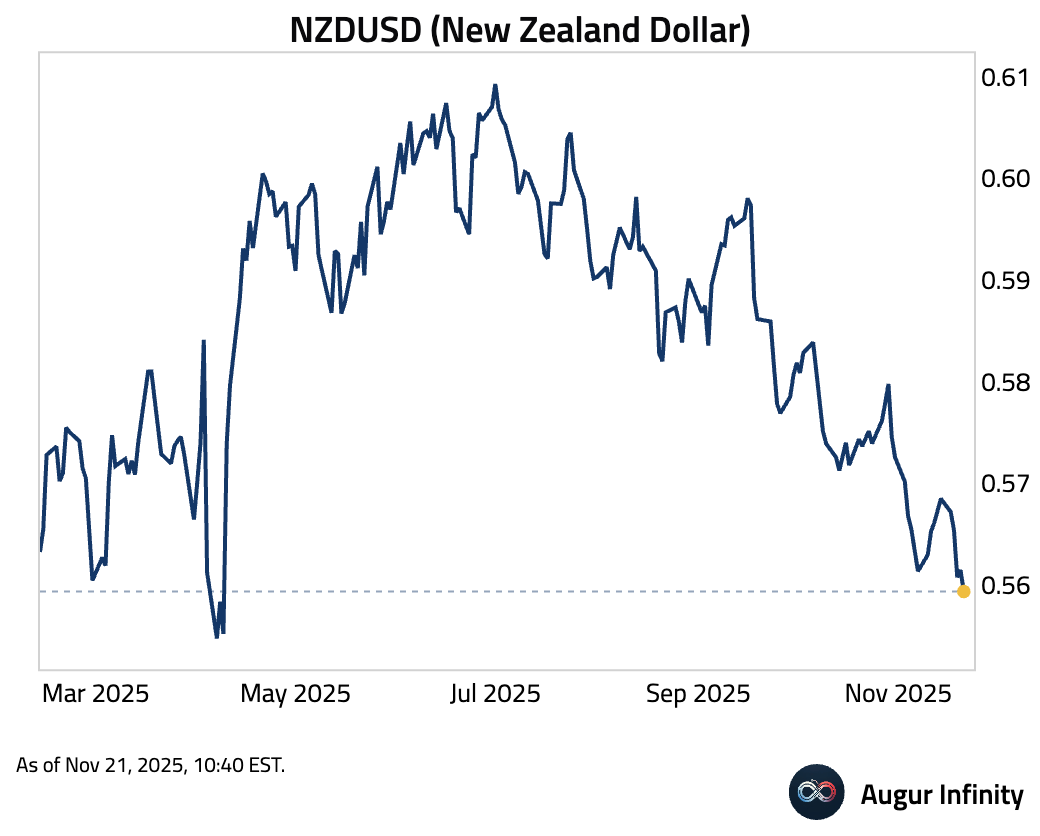

- New Zealand’s trade deficit widened in October.

Interactive chart on Augur Infinity

The New Zealand dollar has fallen to its lowest level against the US dollar since April.

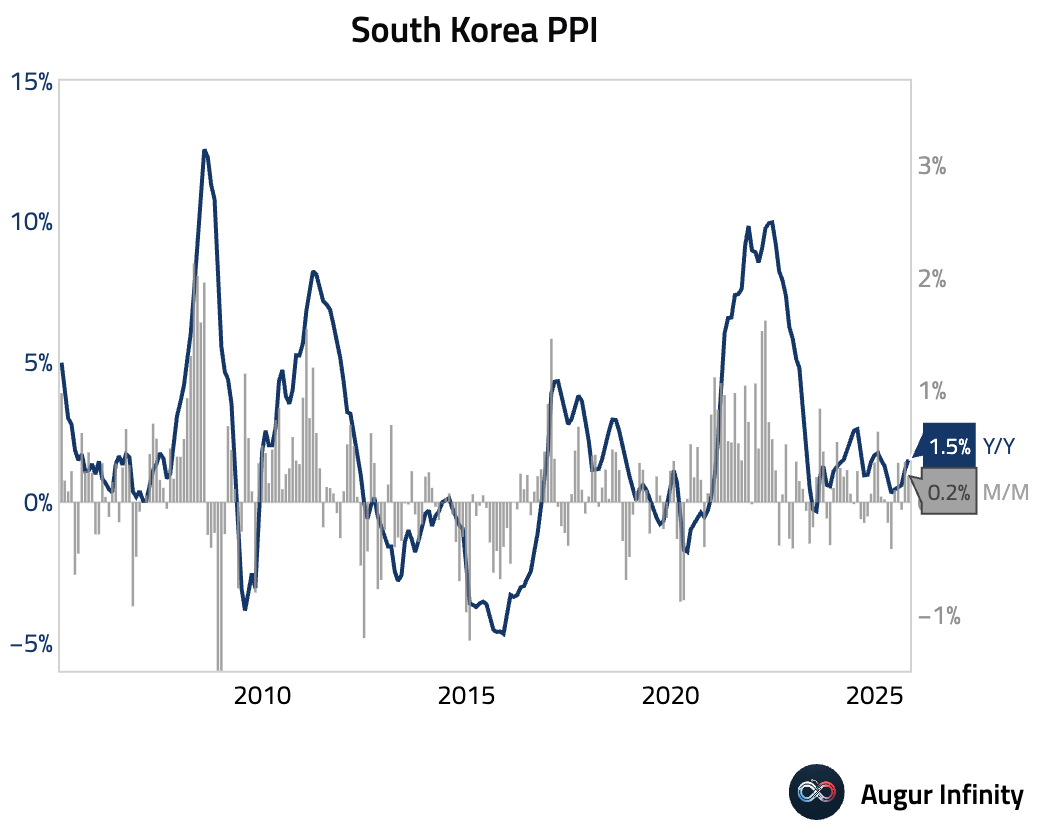

- South Korea’s producer price inflation accelerated, with the year-over-year rate at the highest level since January.

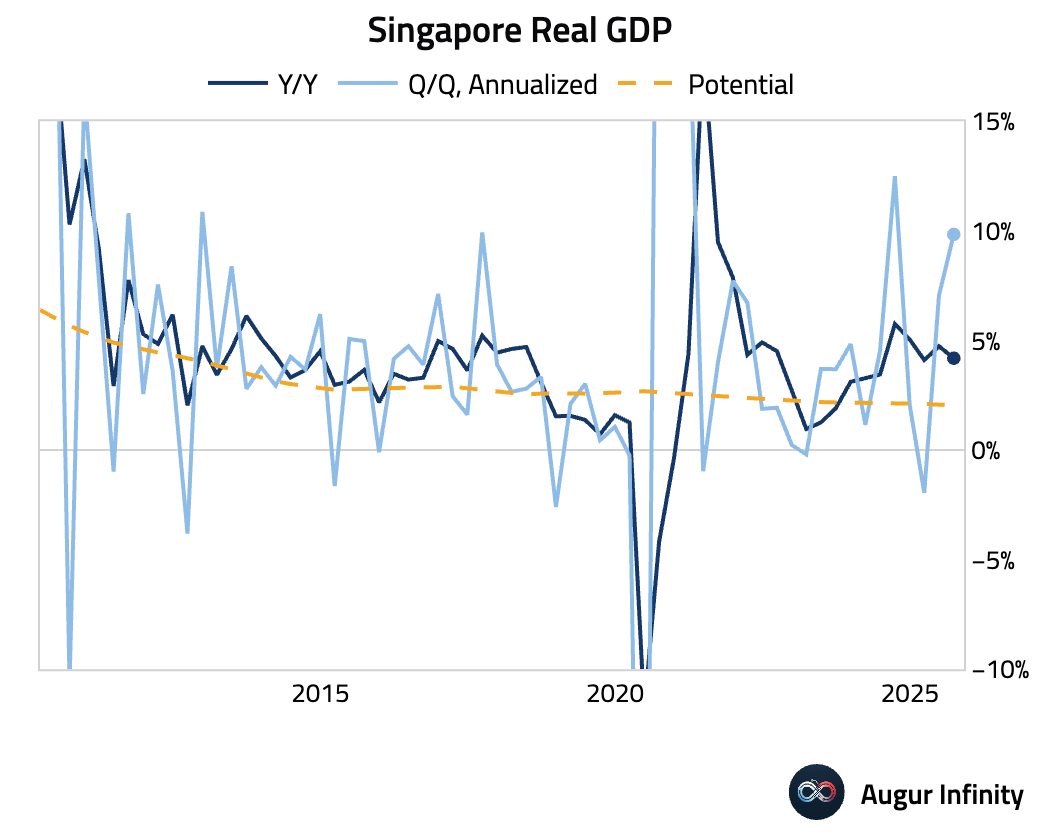

- Singapore’s final Q3 GDP was revised up sharply.

China

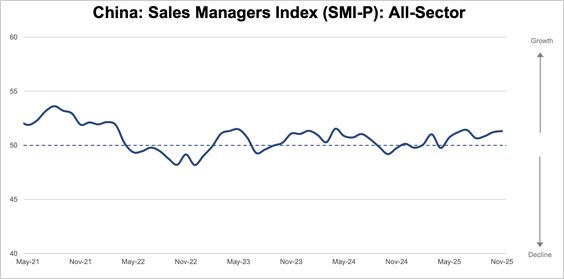

- China’s November Sales Managers Index rose to a four-month high, suggesting continued moderate expansion.

Source: World Economics

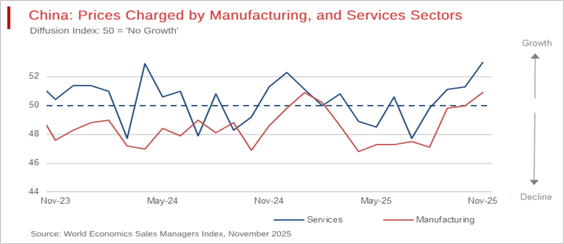

- Prices Charged jumped to the highest level in over three years, reflecting improving pricing power as firms pass on costs and rebuild margins after earlier price weakness.

Source: World Economics

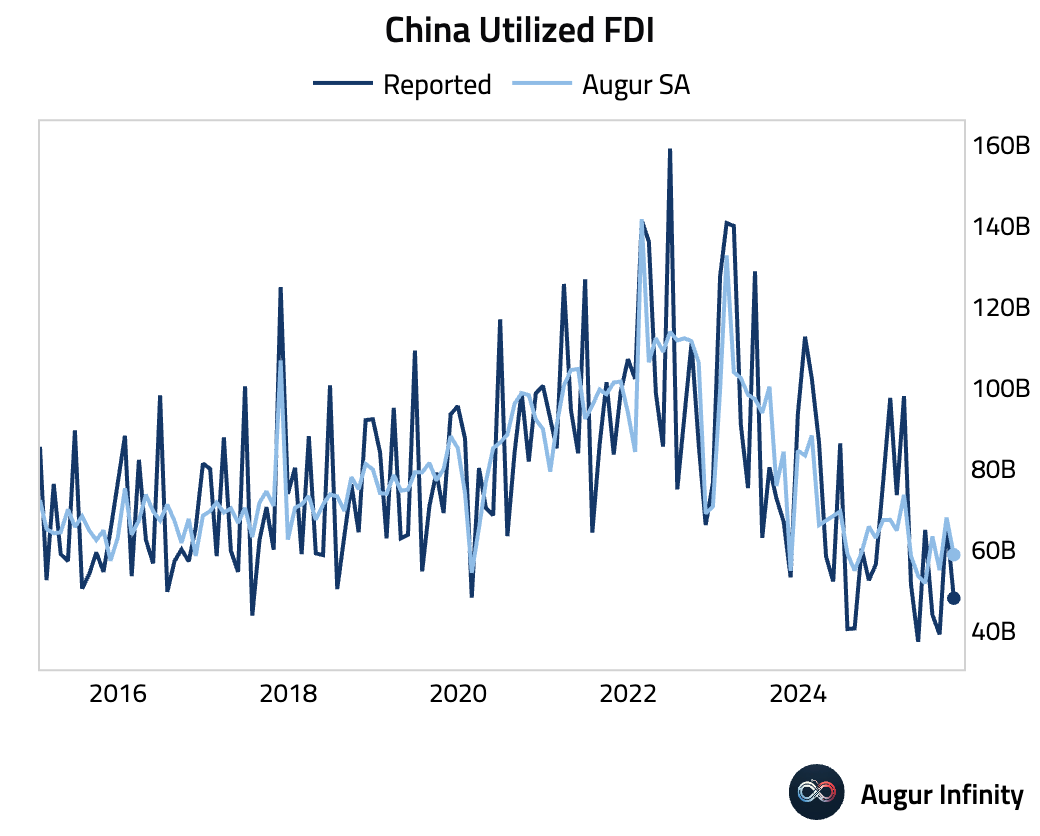

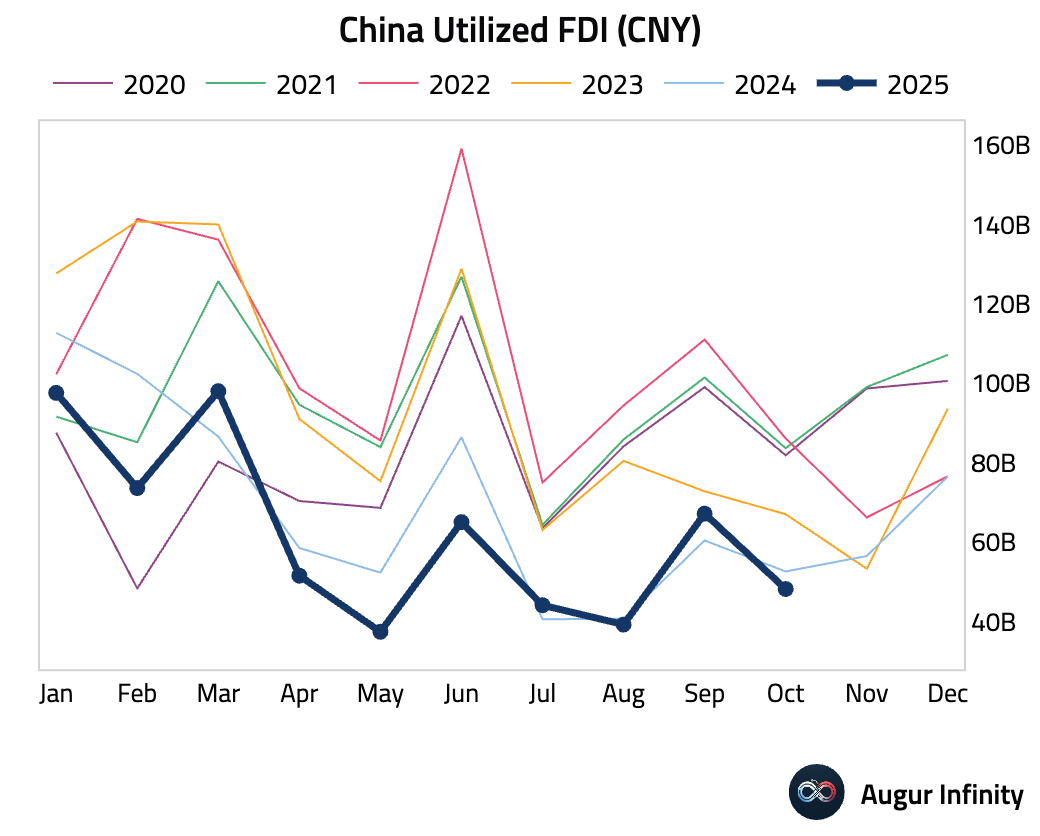

- Utilized foreign direct investment in China declined in October.

India

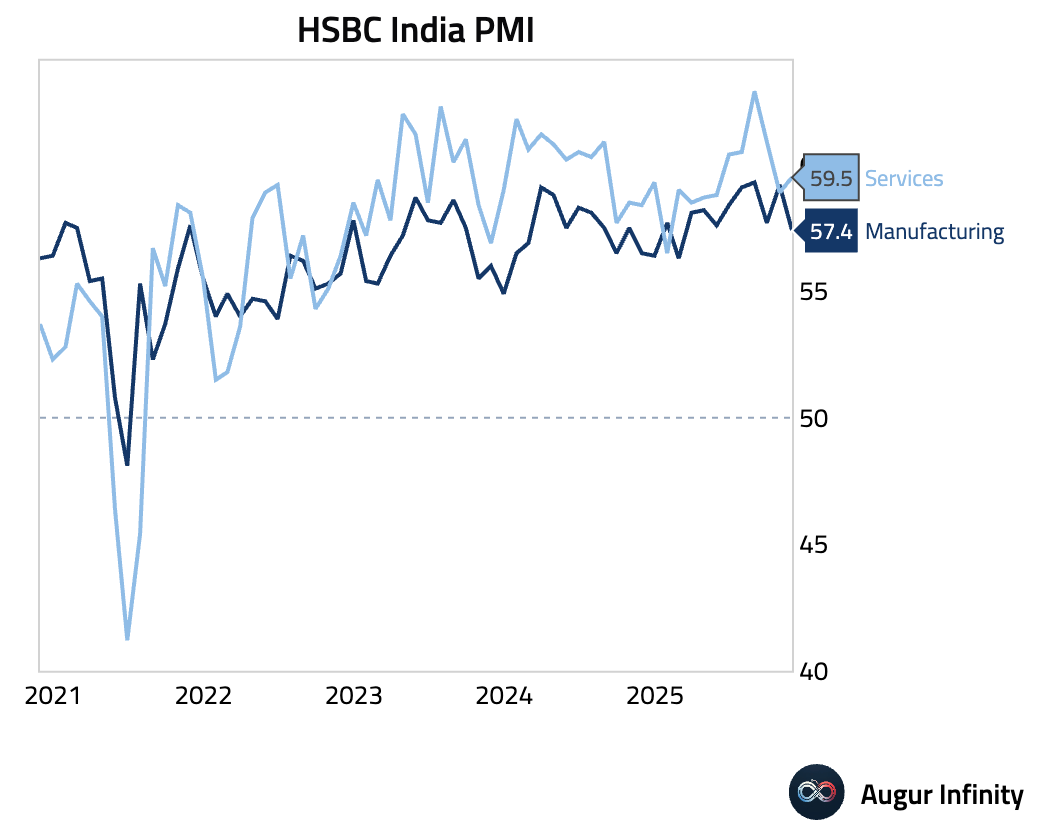

- The manufacturing PMI slipped to a nine-month low, while the services PMI rose. Both remained at very high levels.

Source: S&P Global

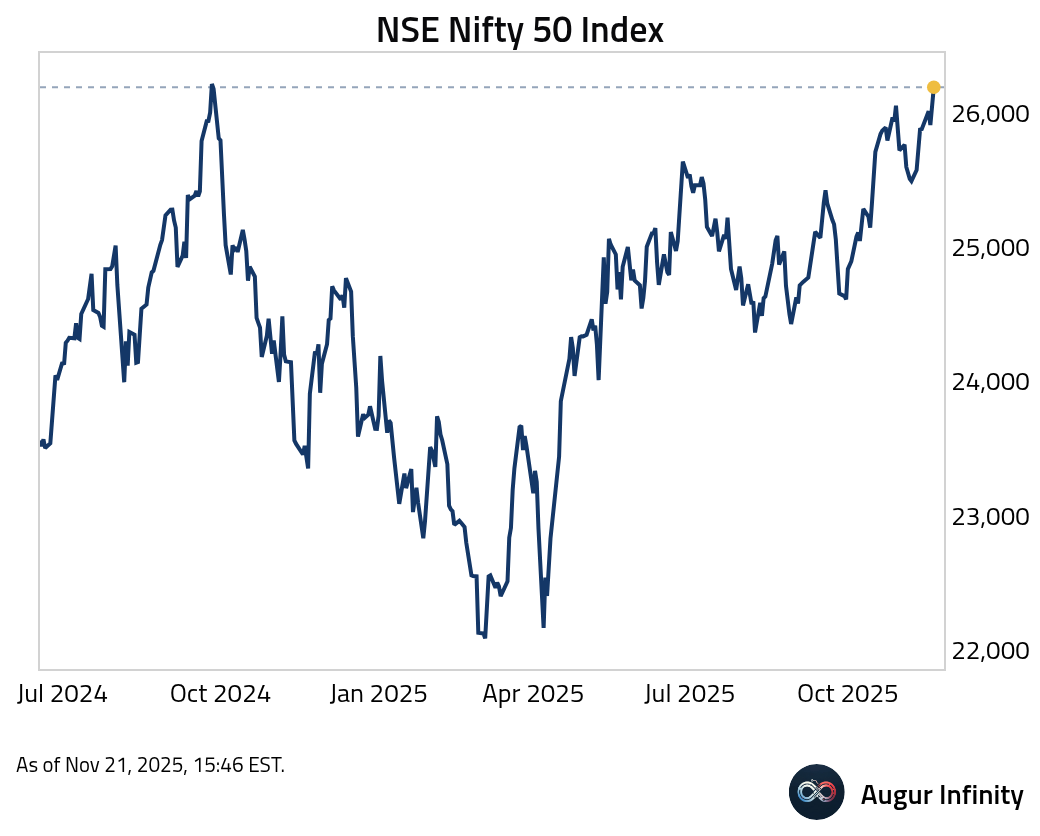

- The NSE Nifty 50 Index stumbled slightly today, but is still close to reaching a new all-time high.

Emerging Markets

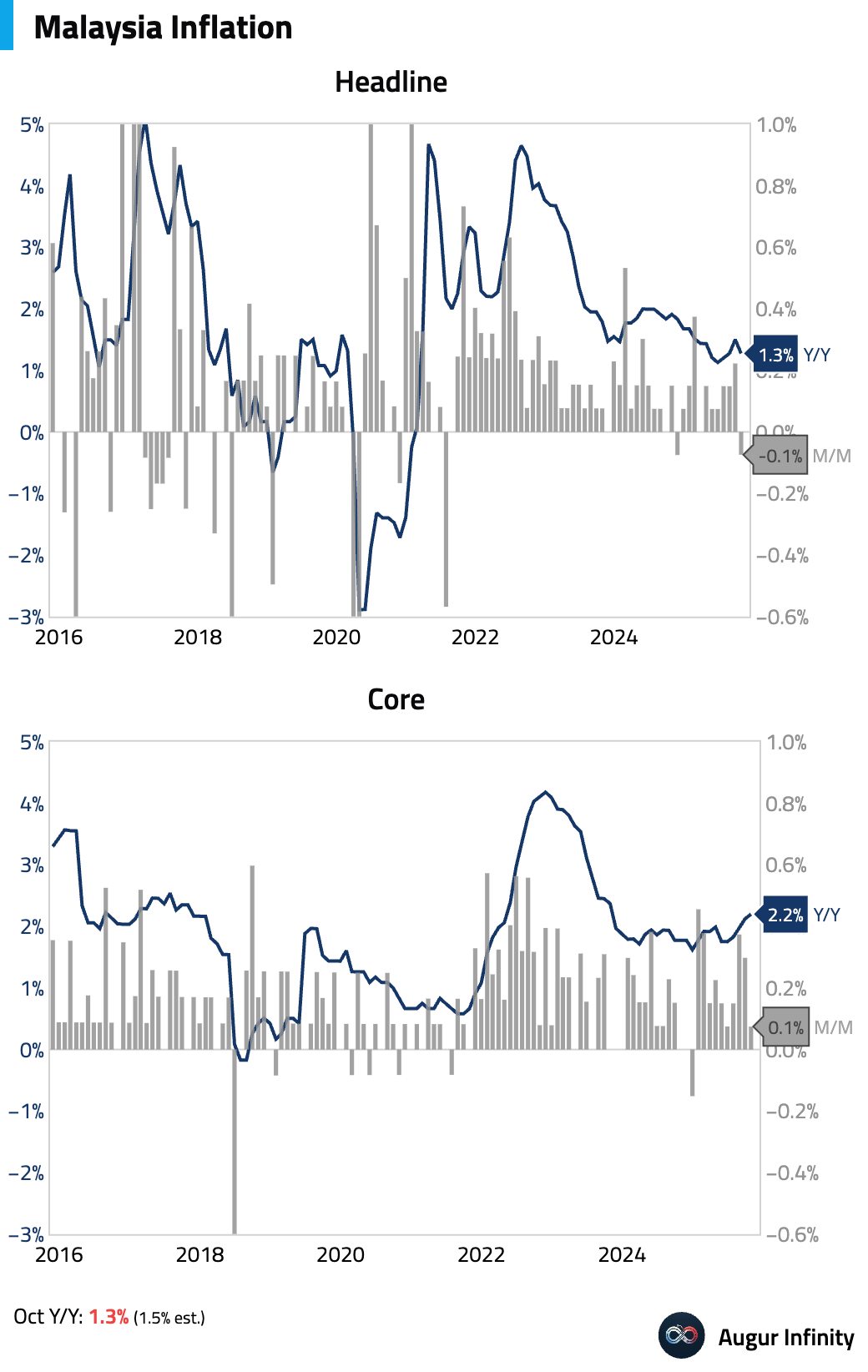

- Malaysia’s inflation rate came in below expectations.

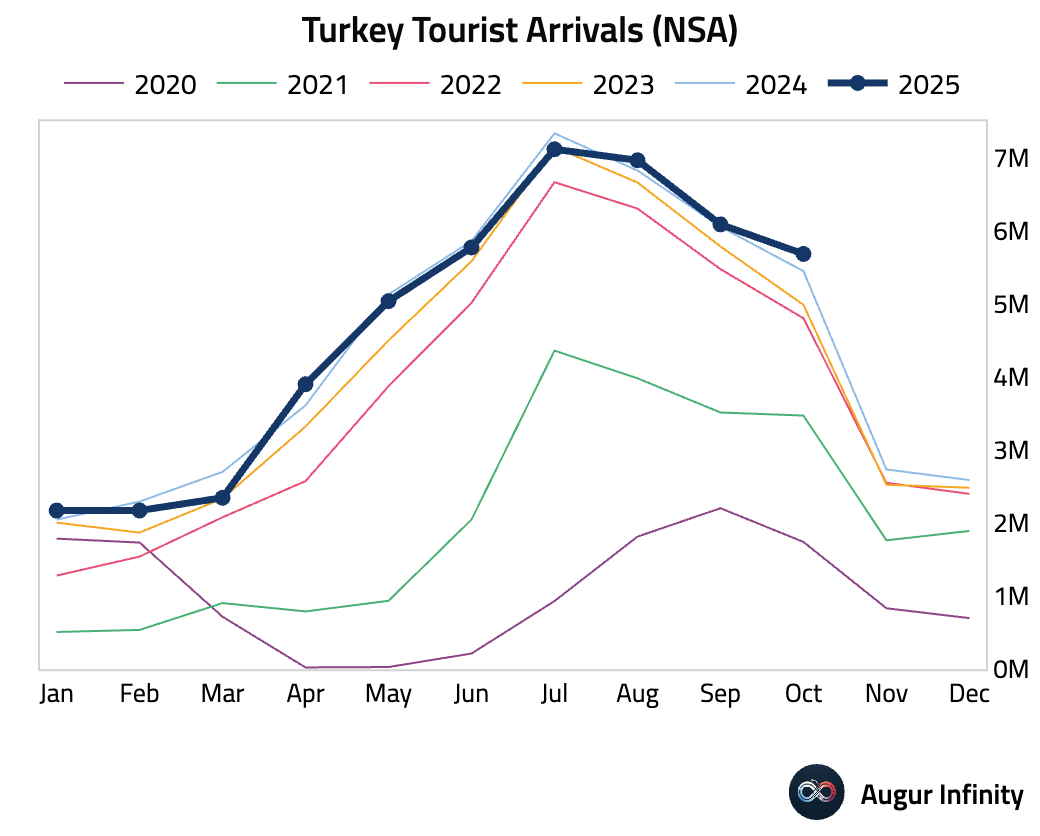

- Tourist arrivals to Turkey improved on a year-over-year basis in October.

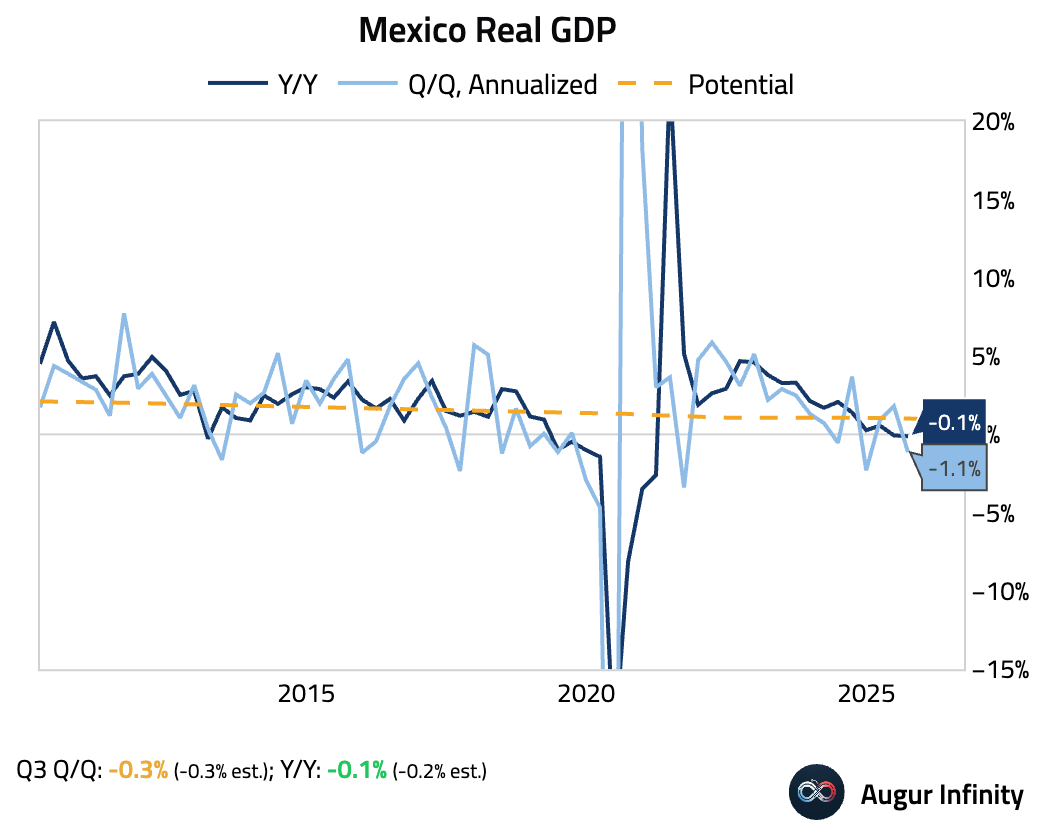

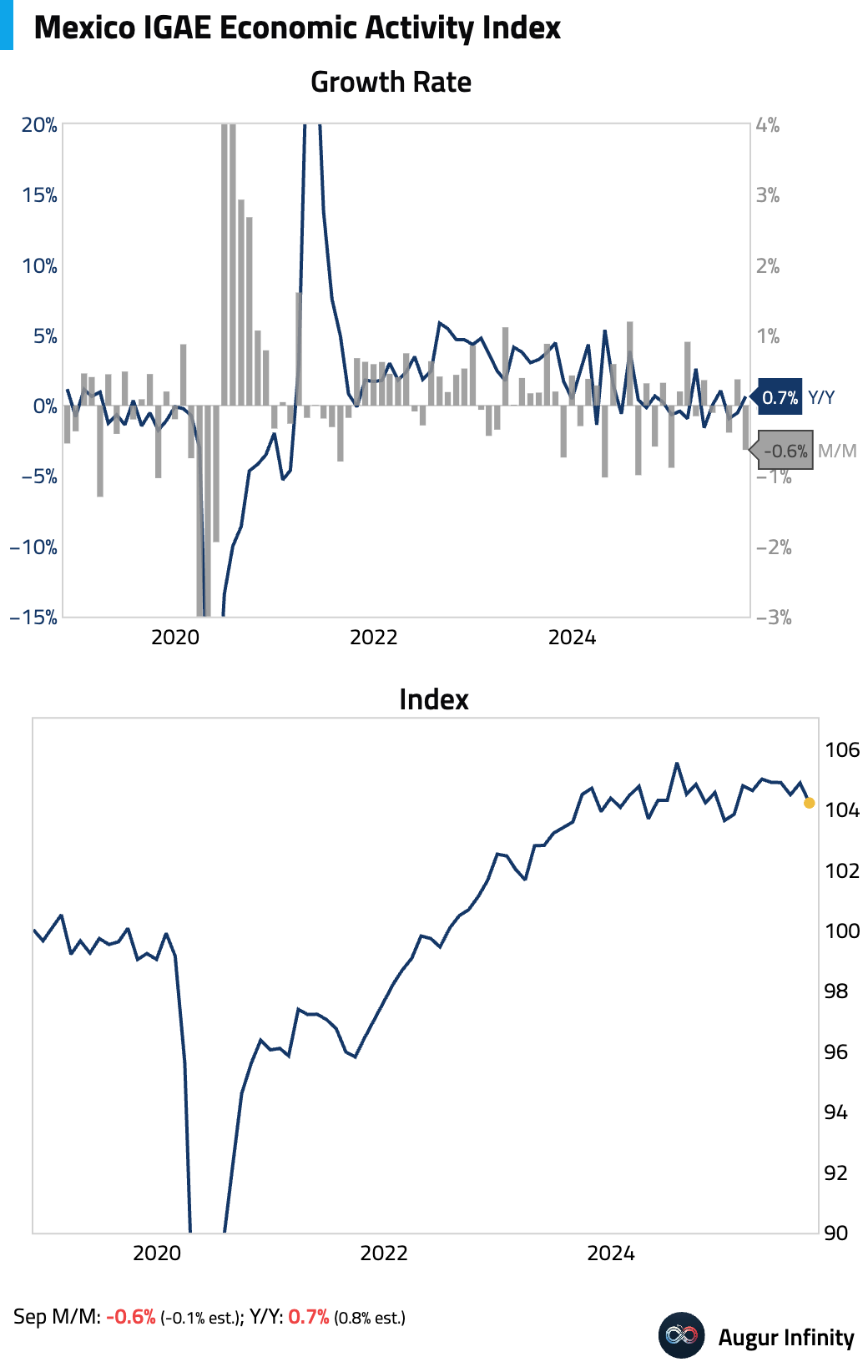

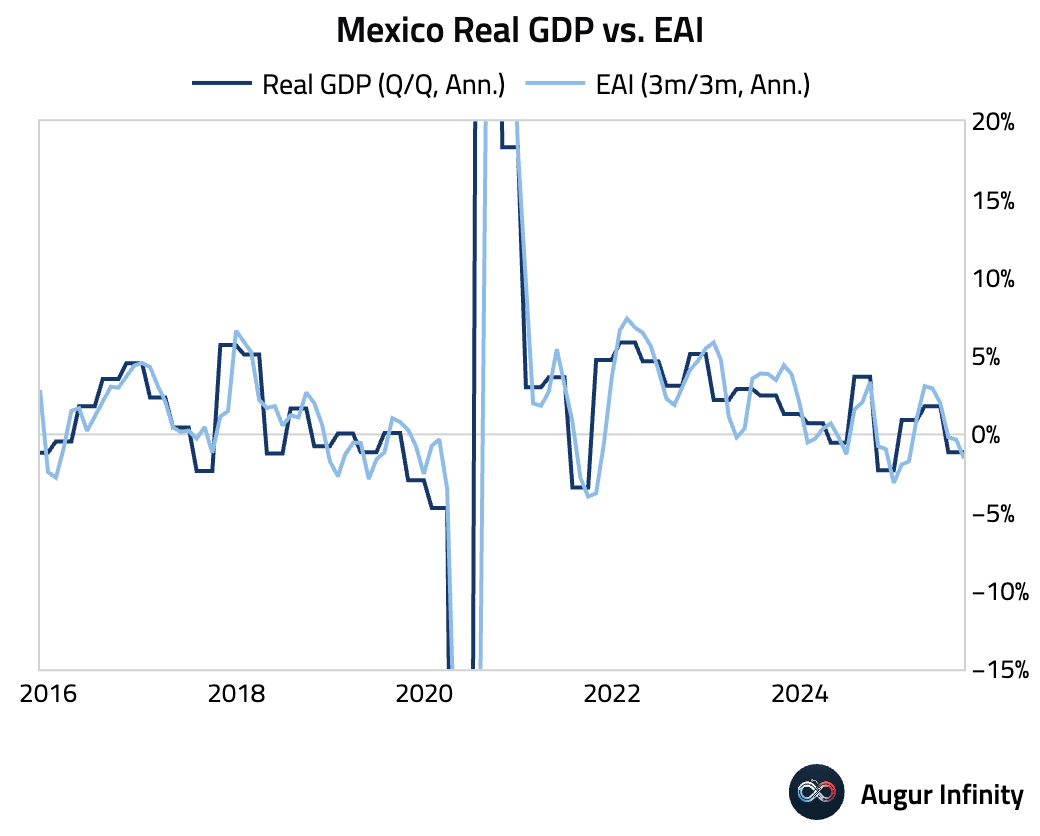

- Final Q3 GDP figures confirmed that Mexico’s economy contracted by 0.3% quarter-over-quarter (or -1.1% annualized).

Economic activity contracted sharply on a monthly basis in September, significantly missing expectations.

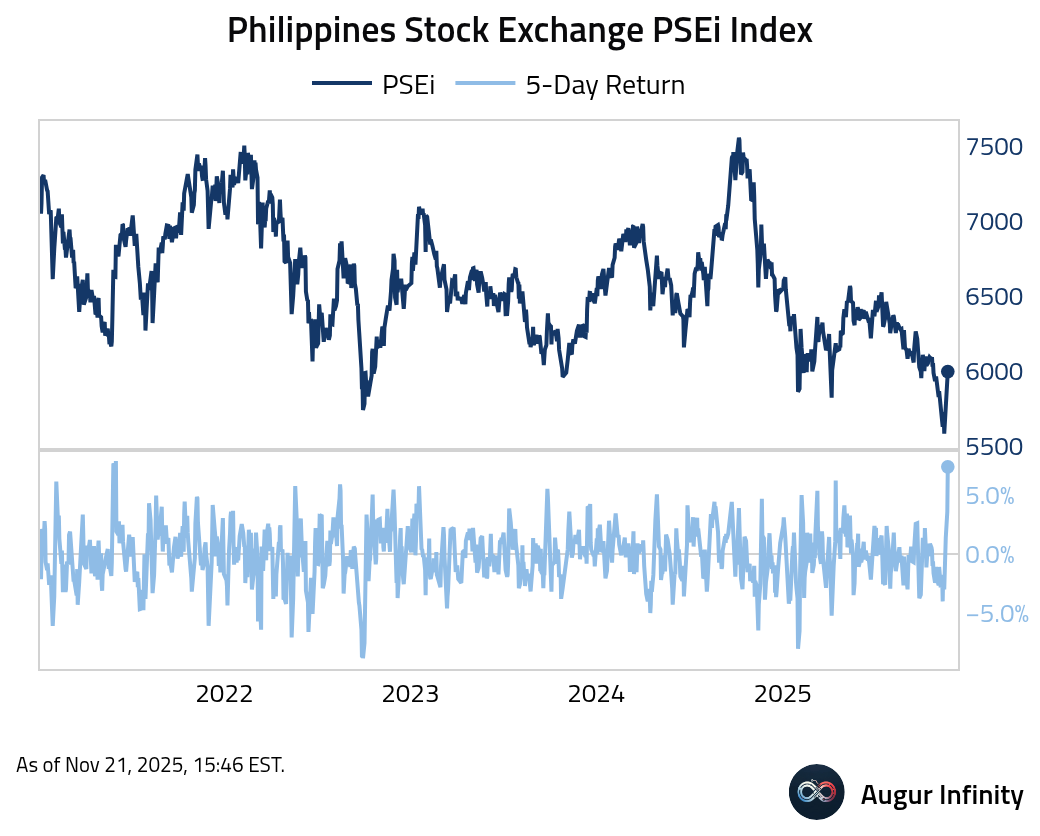

- The Philippine PSEi Index is rebounding, marking its best five-day period since 2021.

Equities

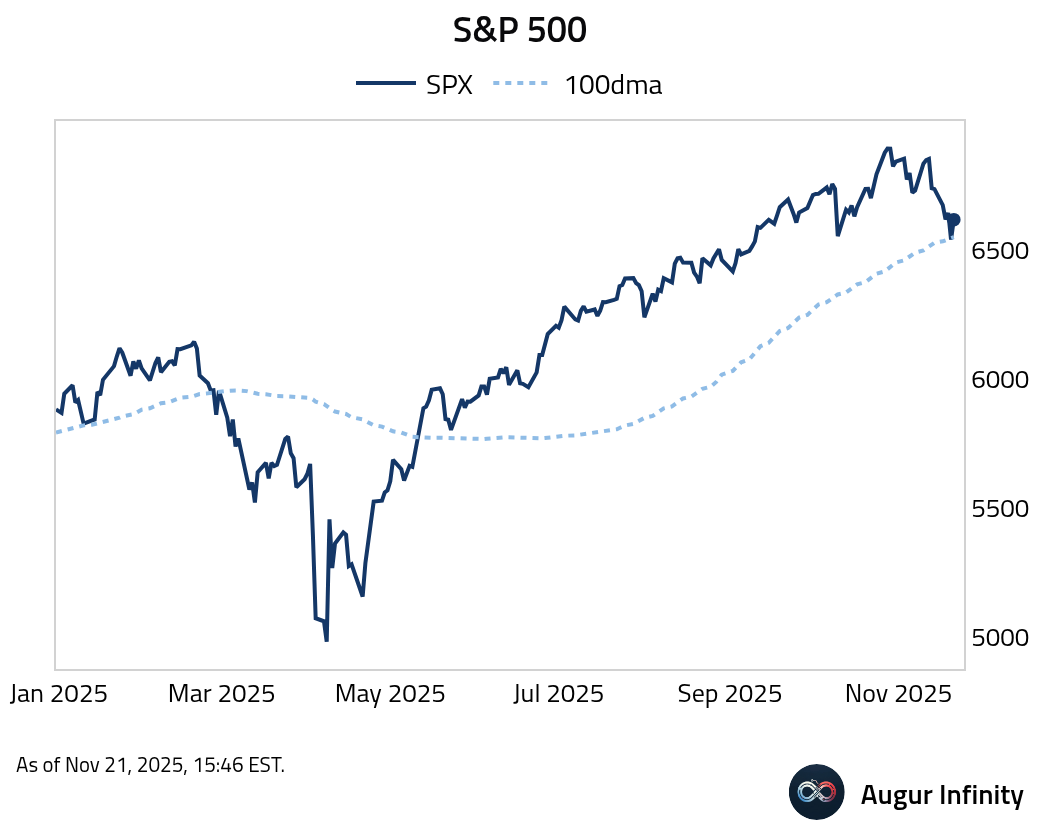

- The S&P 500 fell below its 100-day moving average briefly before rebounding, posting solid gains of 1.3%. European markets also saw broad-based strength, with the UK, France, and Germany all rising over 1%. Emerging market equities were unched.

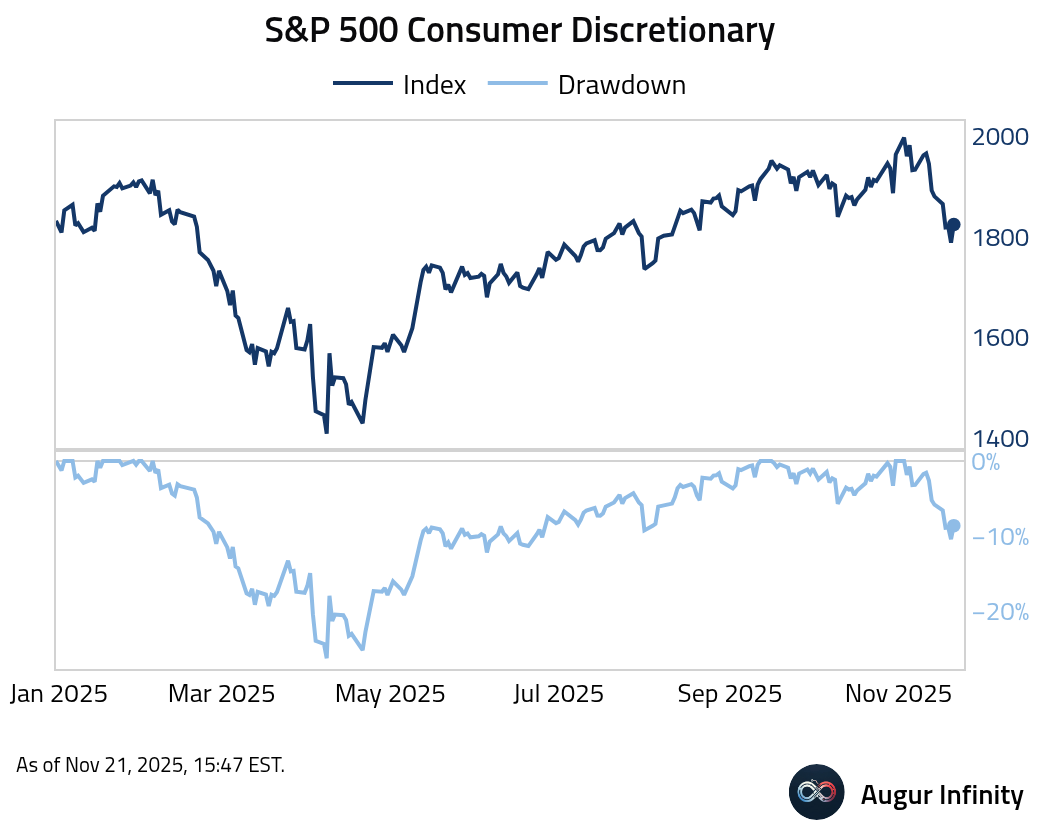

- The S&P 500 Consumer Discretionary sector entered correction territory before rebounding along with the rest of the market.

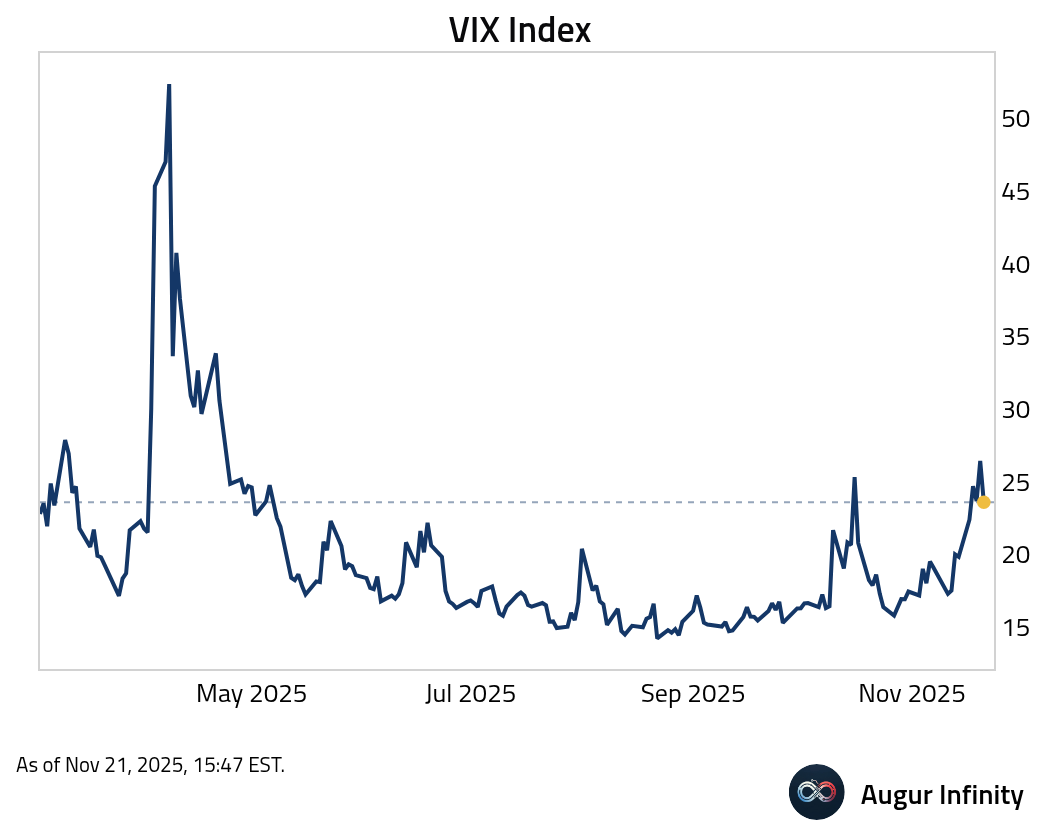

- The VIX did the opposite, losing all of the day's gains and then some.

Rates

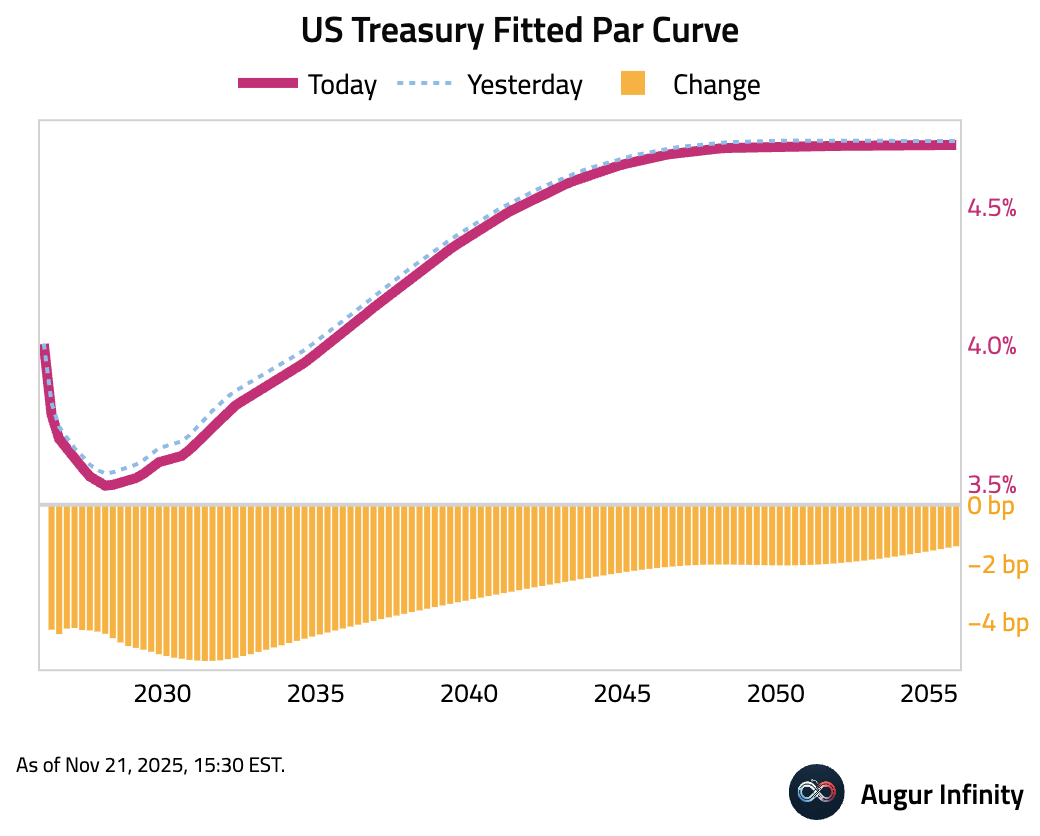

- US Treasury yields fell across the curve amid growing hope for a Federal Reserve rate cut in December. The 5-year yield led the decline, falling 5.7 bps, while the 10-year yield dropped 4.4 bps.

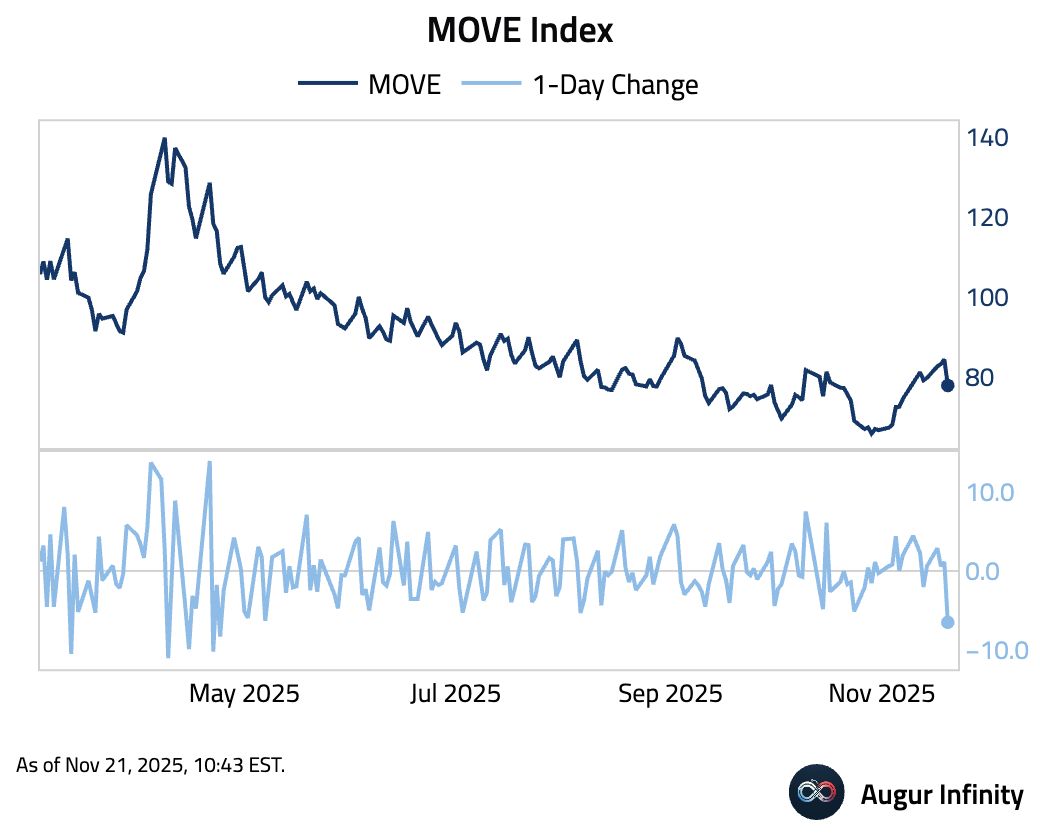

The MOVE Index posted its largest decline since April.

Energy

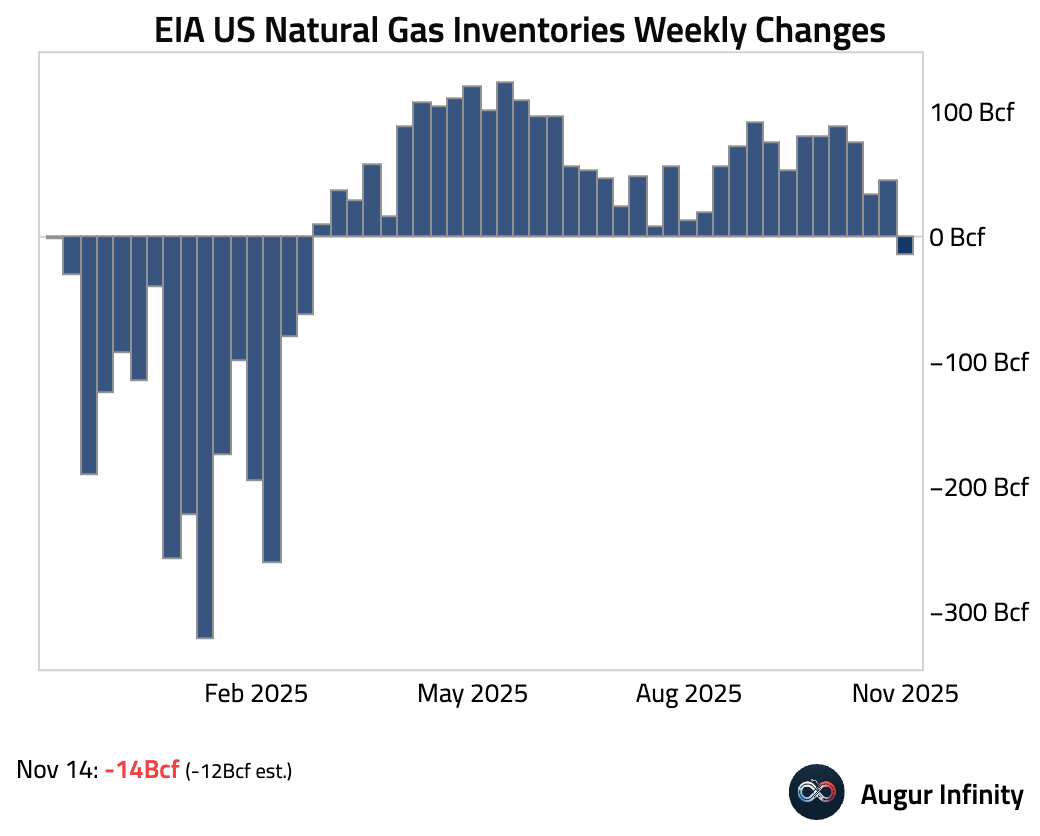

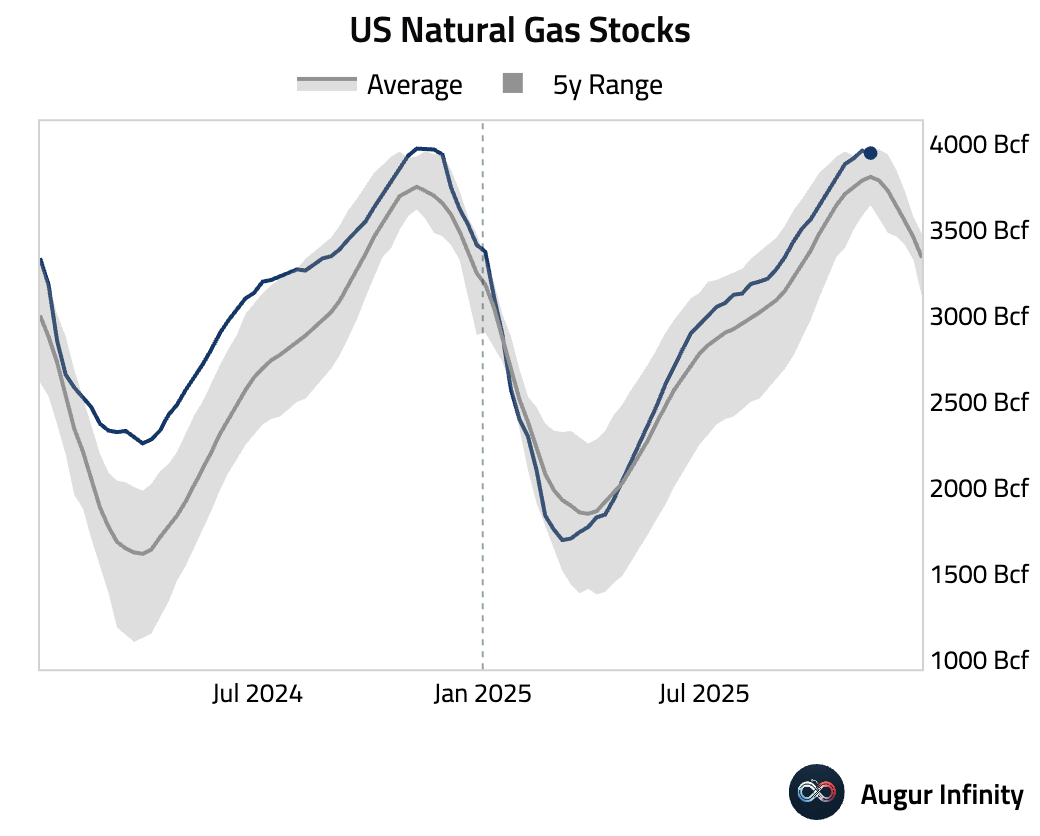

- US natural gas inventories fell by 14 billion cubic feet last week.

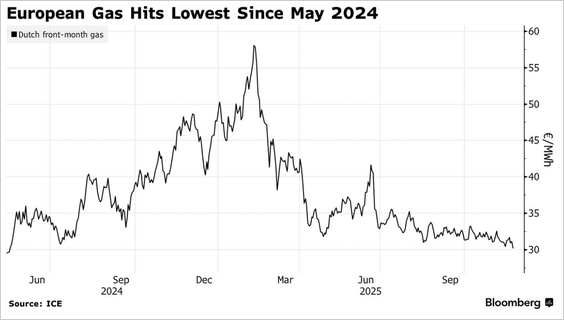

- European natural gas futures fell to an 18-month low as milder near-term weather forecasts and prospects of a Ukraine peace plan eased supply concerns.

Source: @markets

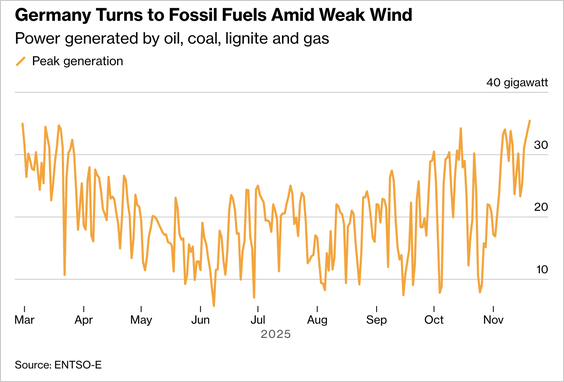

- German power prices spiked as weak wind output pushed fossil-fuel generation to a nine-month high.

Source: @markets

Commodities

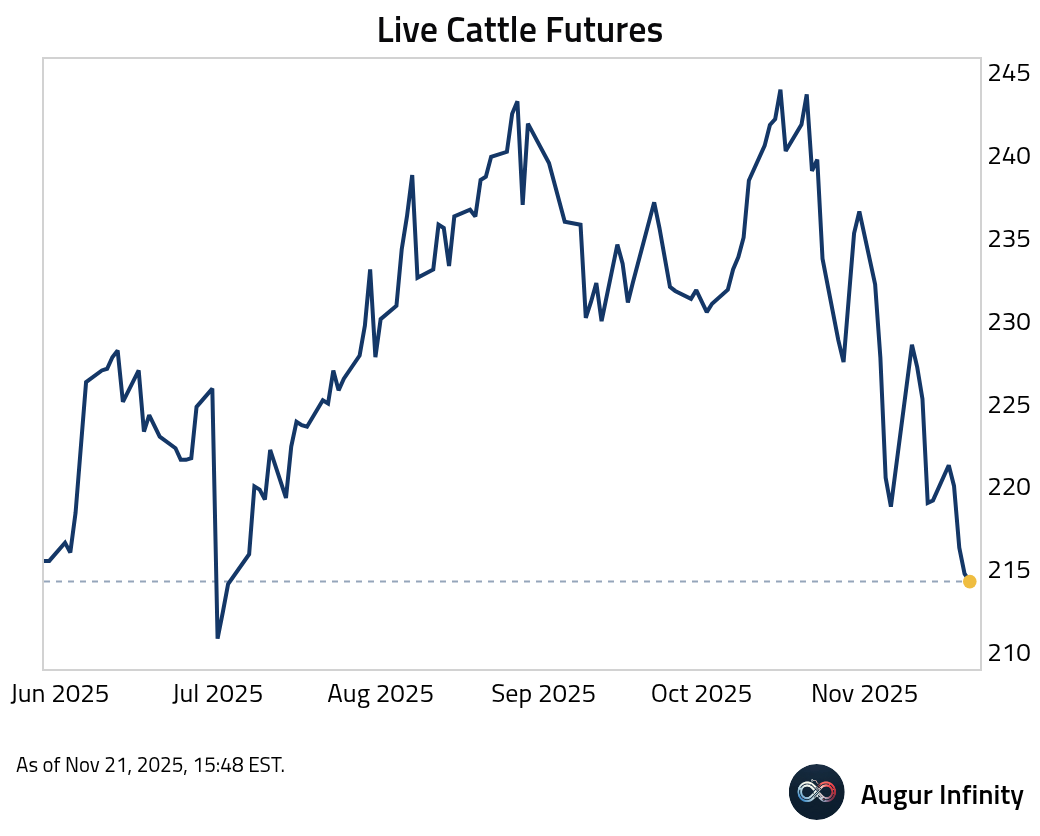

- Live cattle fell to the lowest level since July.

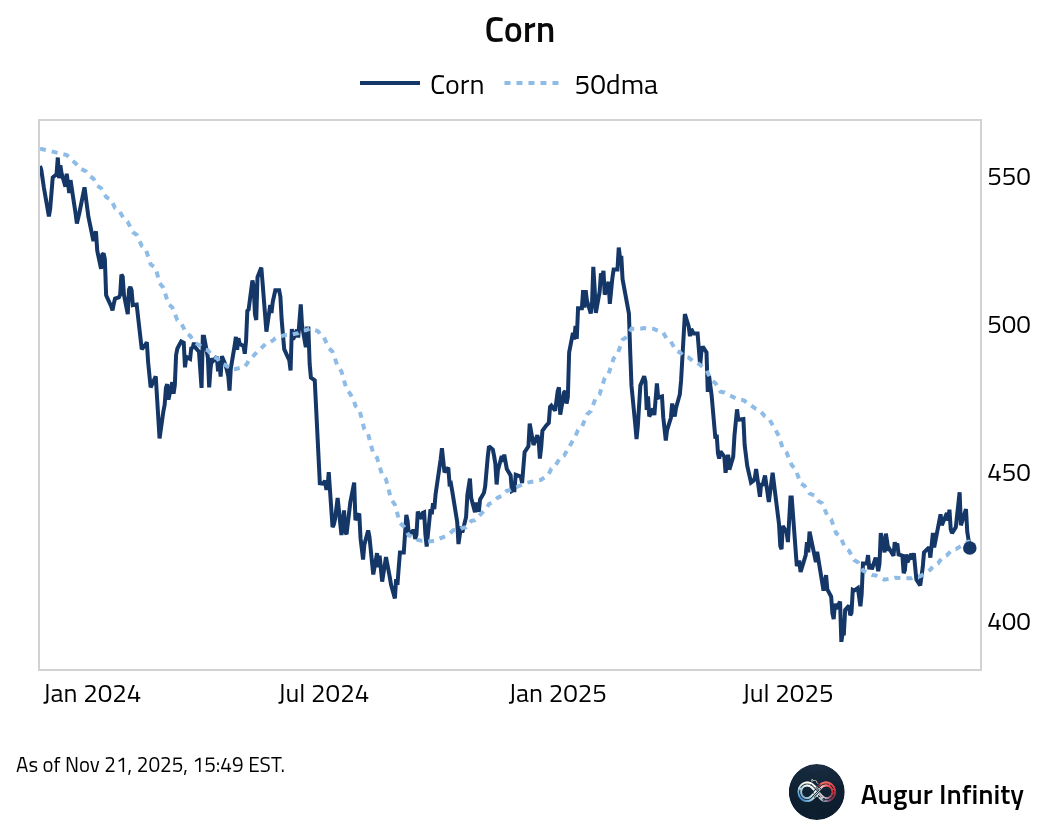

- Corn, on a roll-adjusted basis, is below its 50-day moving average.

Cryptocurrency

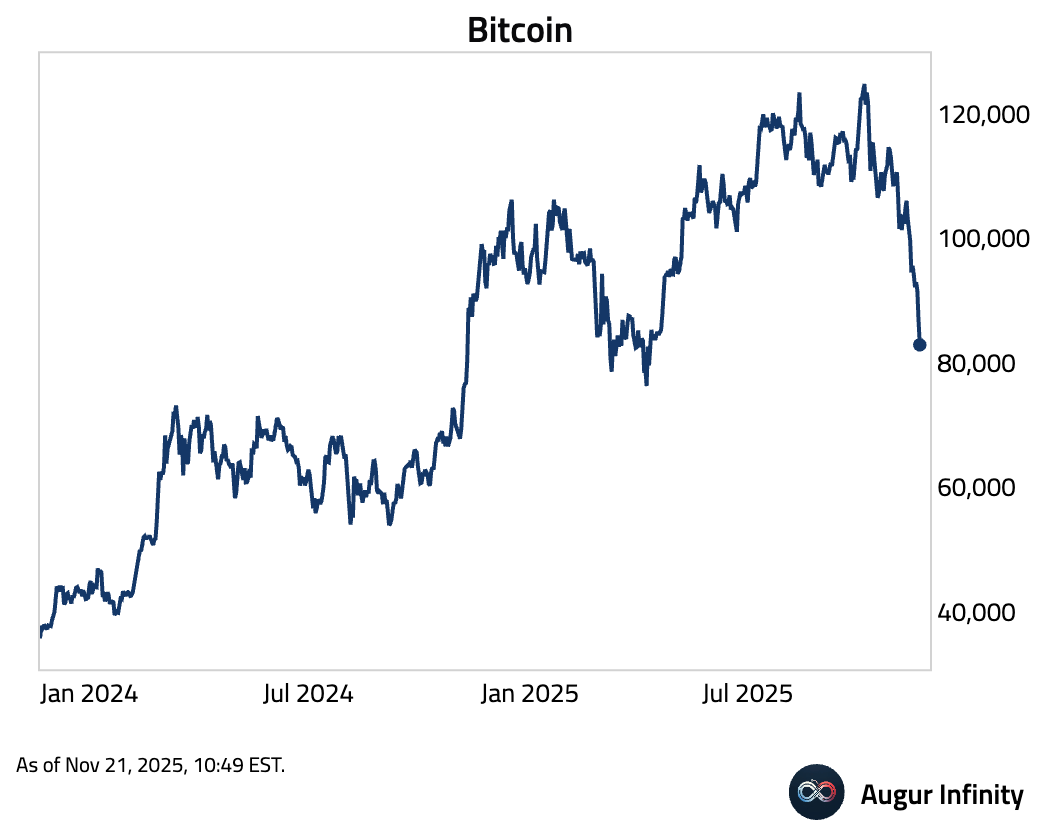

Bitcoin fell below 85K.

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.