- United States

- Canada

- United Kingdom

- The Eurozone

- Europe

- Japan

- Asia-Pacific

- China

- Emerging Markets

- Equities

- Rates

- Credit

- Energy

- Commodities

United States

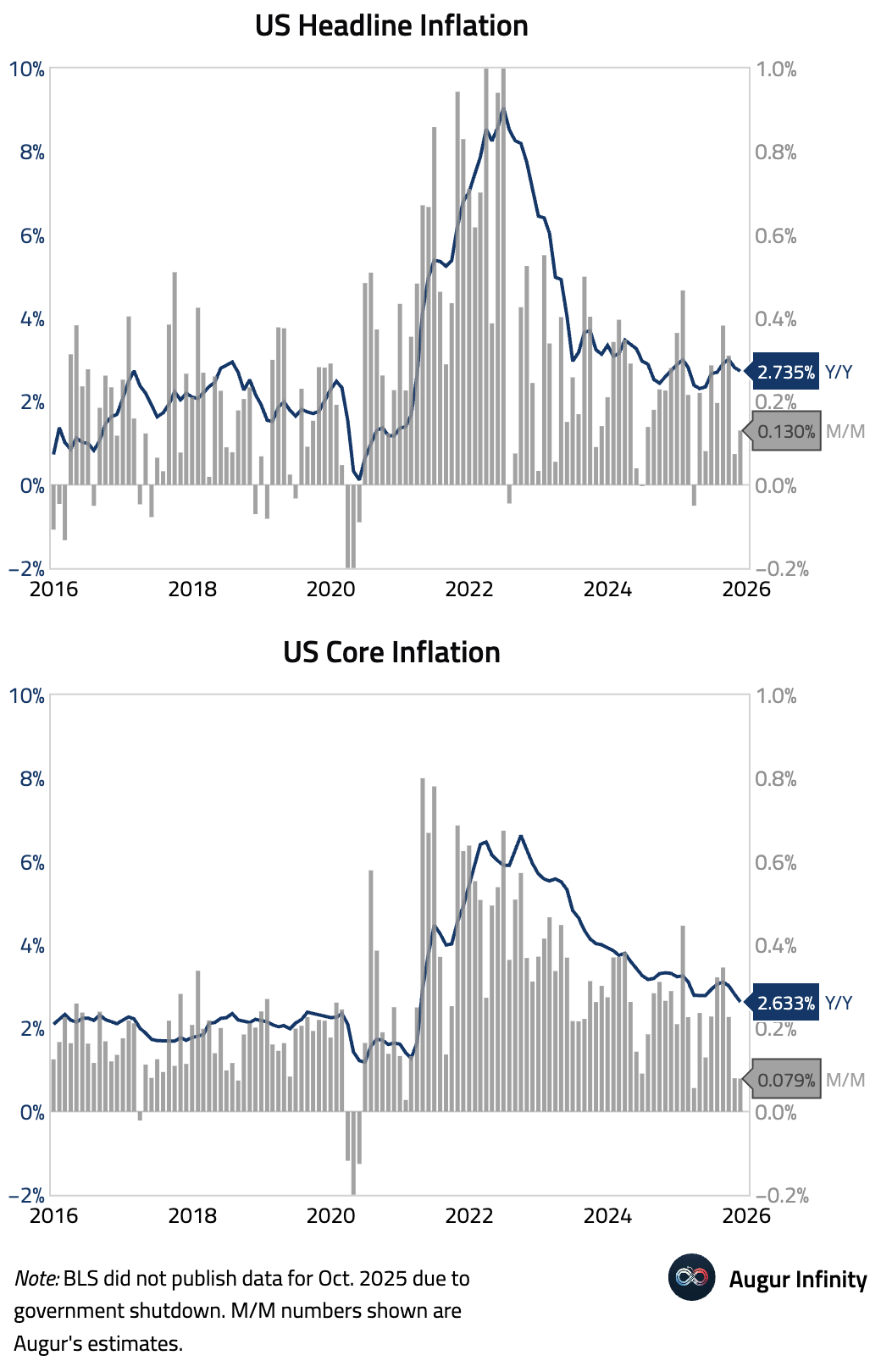

- Headline inflation for November cooled to 2.7% year over year and core inflation fell to 2.6% year over year, both significantly below consensus forecasts. Due to the government shutdown, data collection did not begin until the second half of November, which may have skewed the result due to Black Friday discounts.

Source: @economics

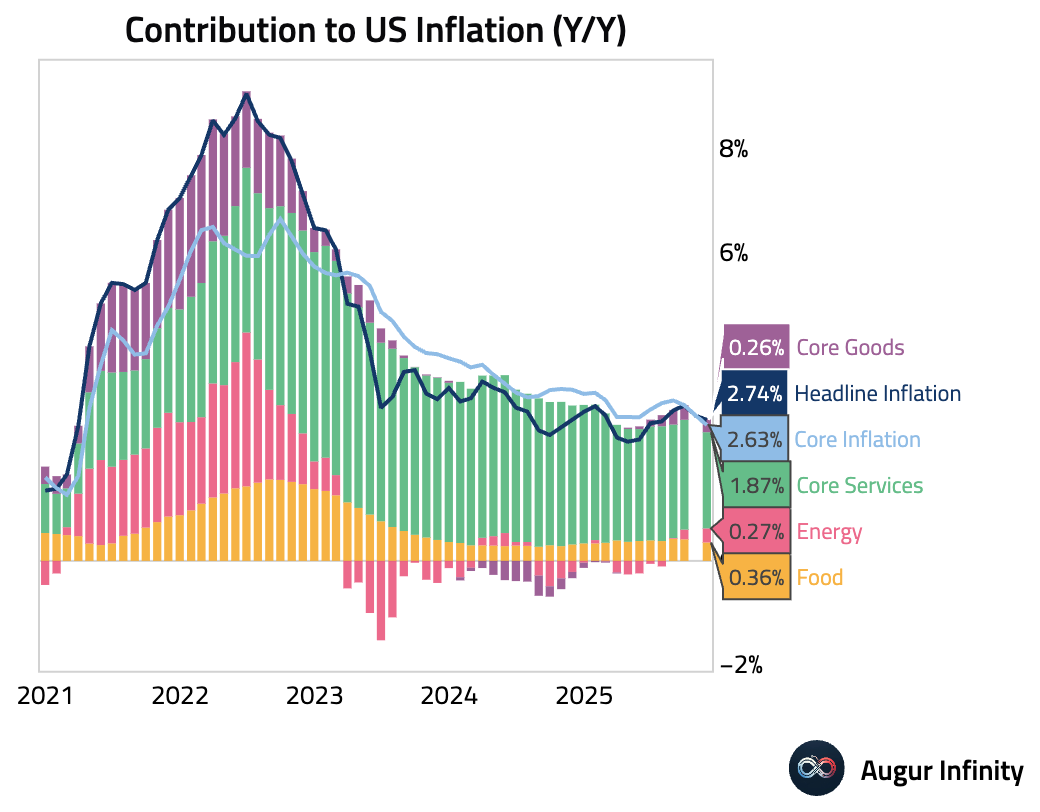

Here is an attribution of year-over-year inflation by component.

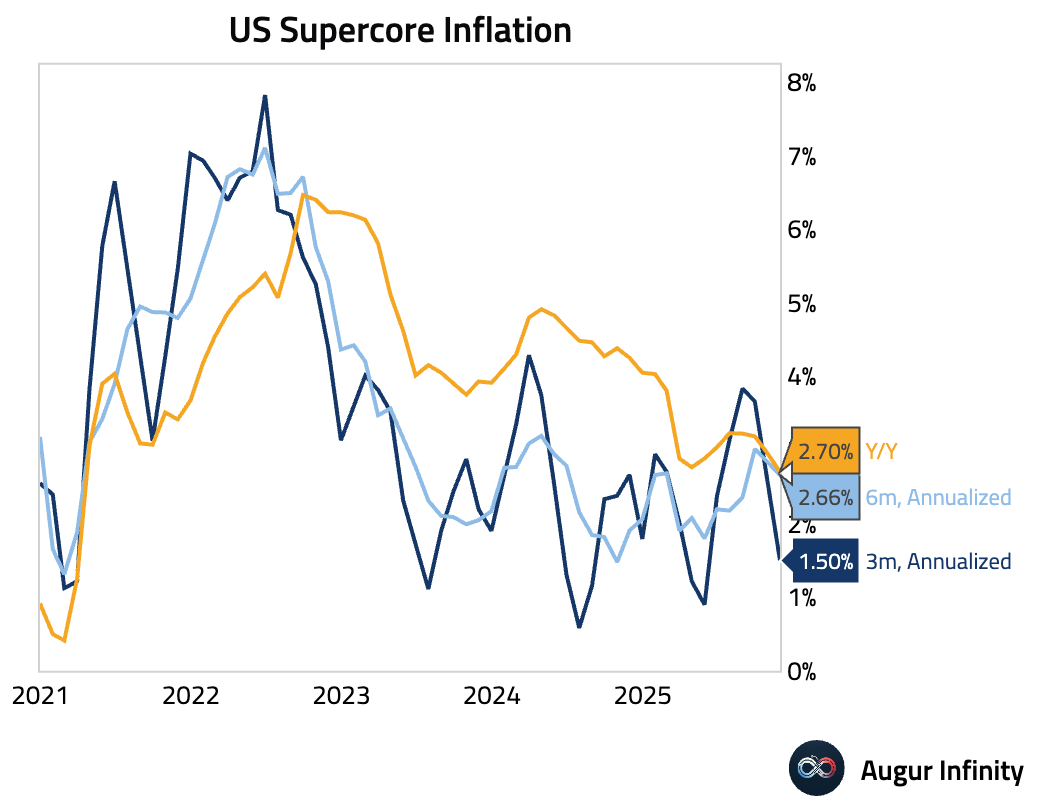

Here's supercore inflation over various trailing periods.

Interactive chart on Augur Infinity

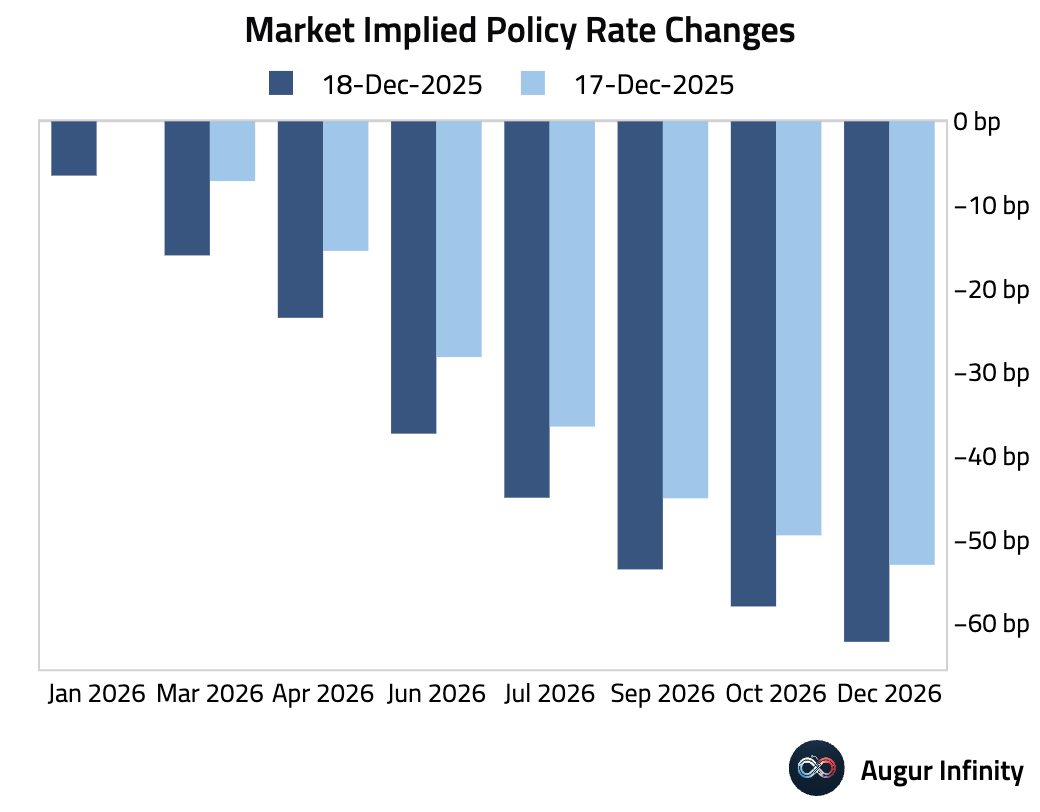

The amount of rate cuts priced in for 2026 rose.

Treasuries rallied across the curve.

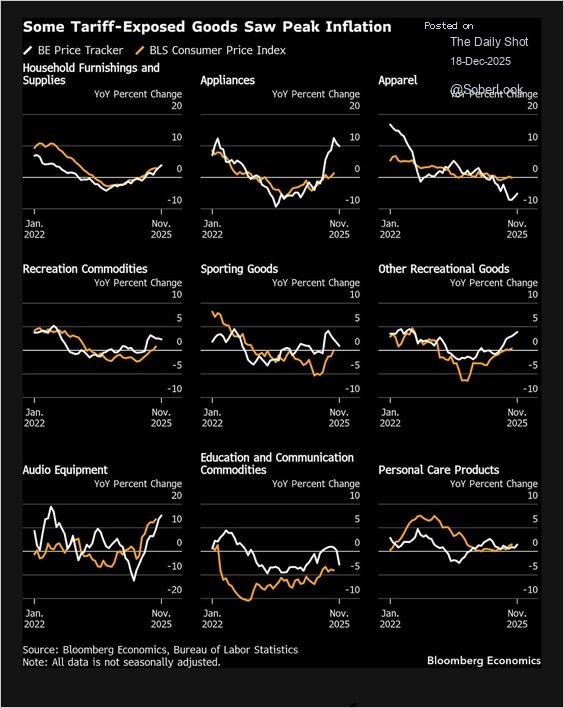

- Bloomberg’s CPI tracker shows inflation for many goods rolling over in November.

Source: Anna Wong

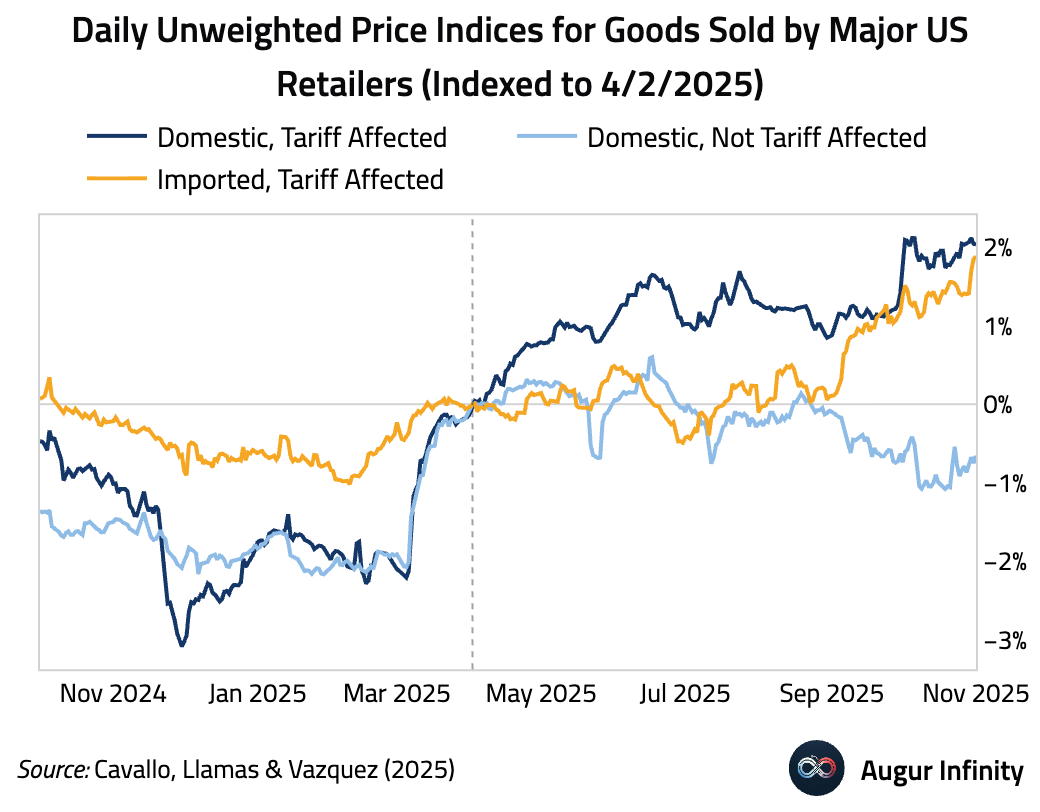

Inflation has accelerated in goods categories that are more exposed to tariff increases.

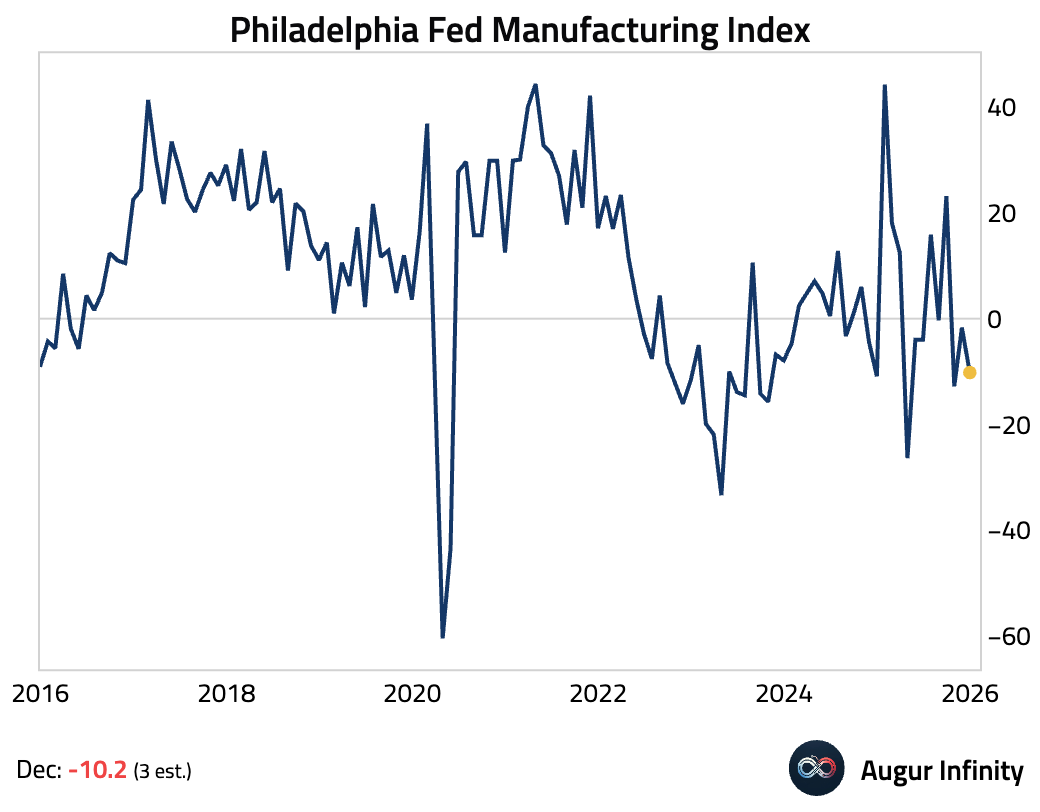

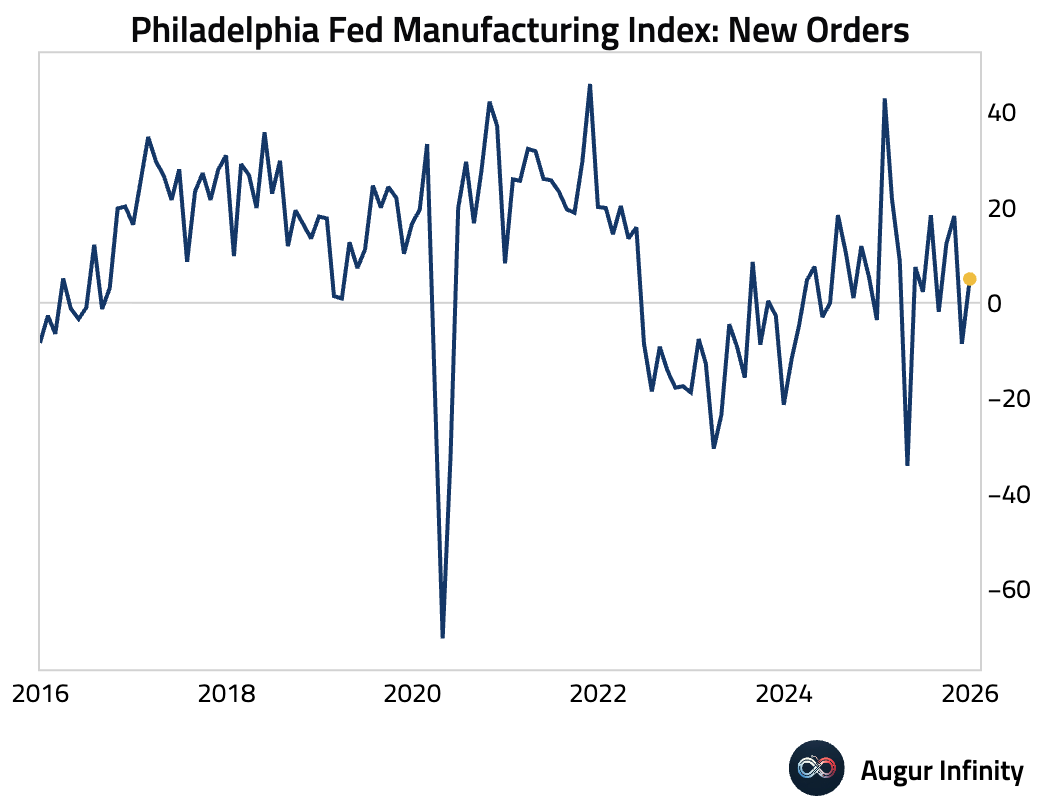

- The Philadelphia Fed’s manufacturing index unexpectedly fell in December, marking its third consecutive contraction.

Despite the weak headline figure, underlying details were more constructive, with the New Orders index rebounding into expansionary territory, …

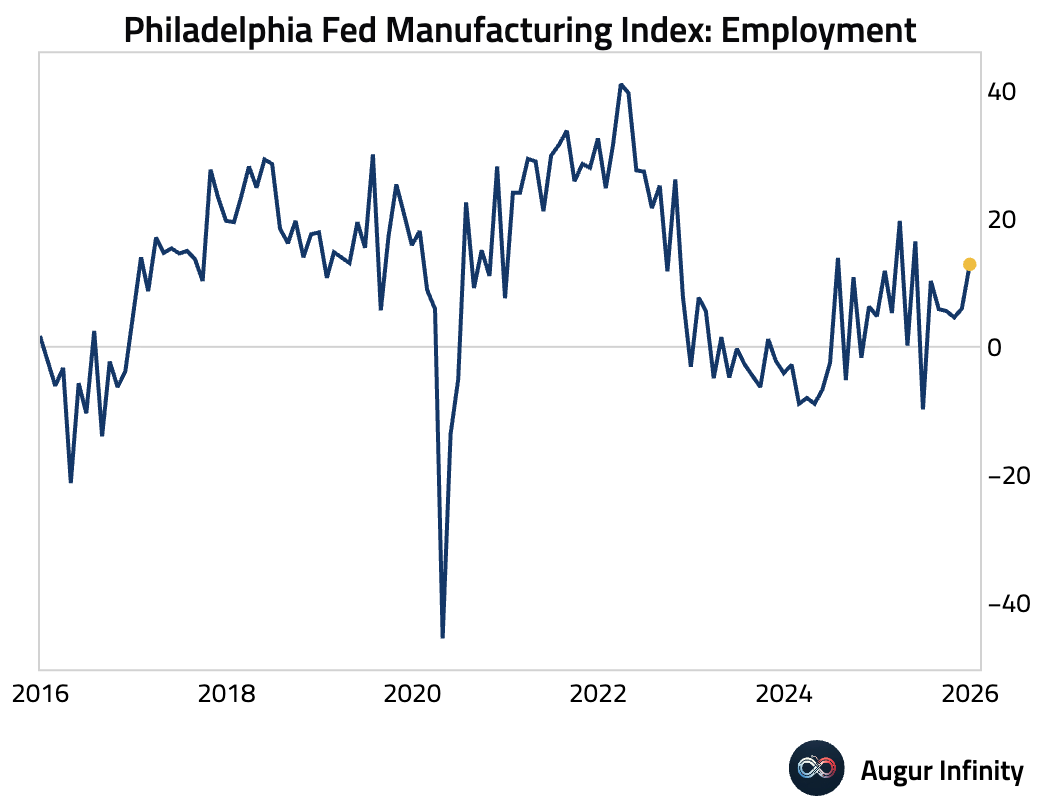

… and the employment component rising to its highest level since May.

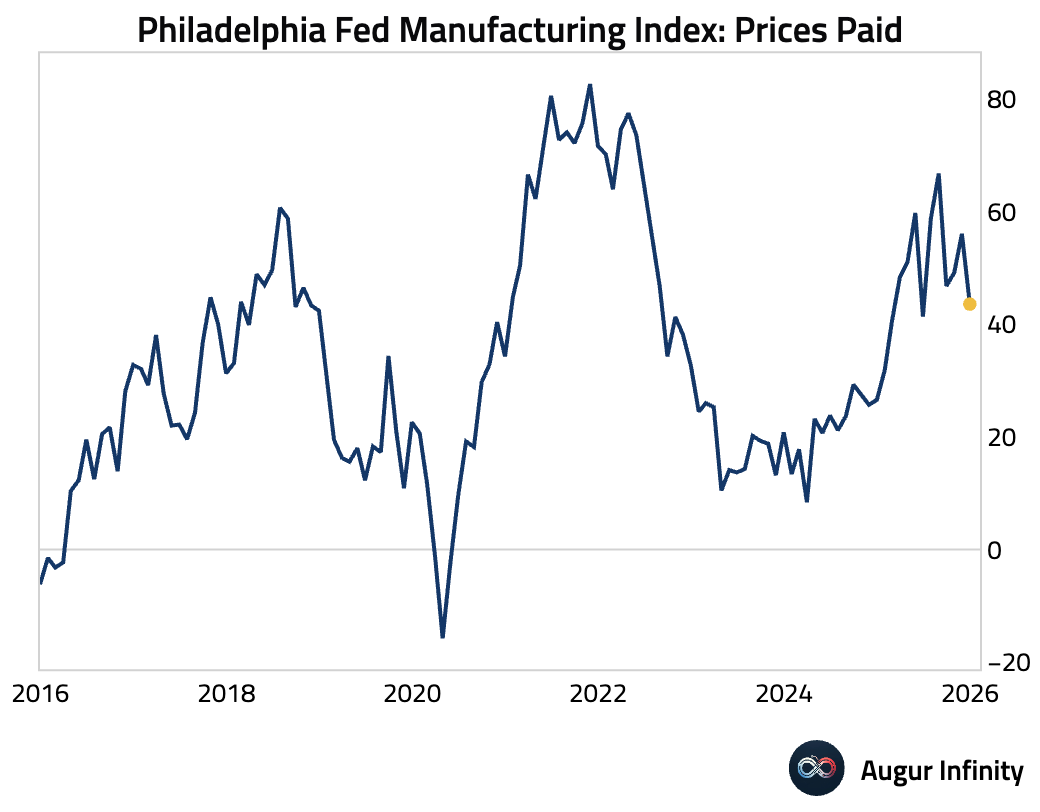

Price pressures were mixed, as prices paid by firms eased to a six-month low while prices received rose.

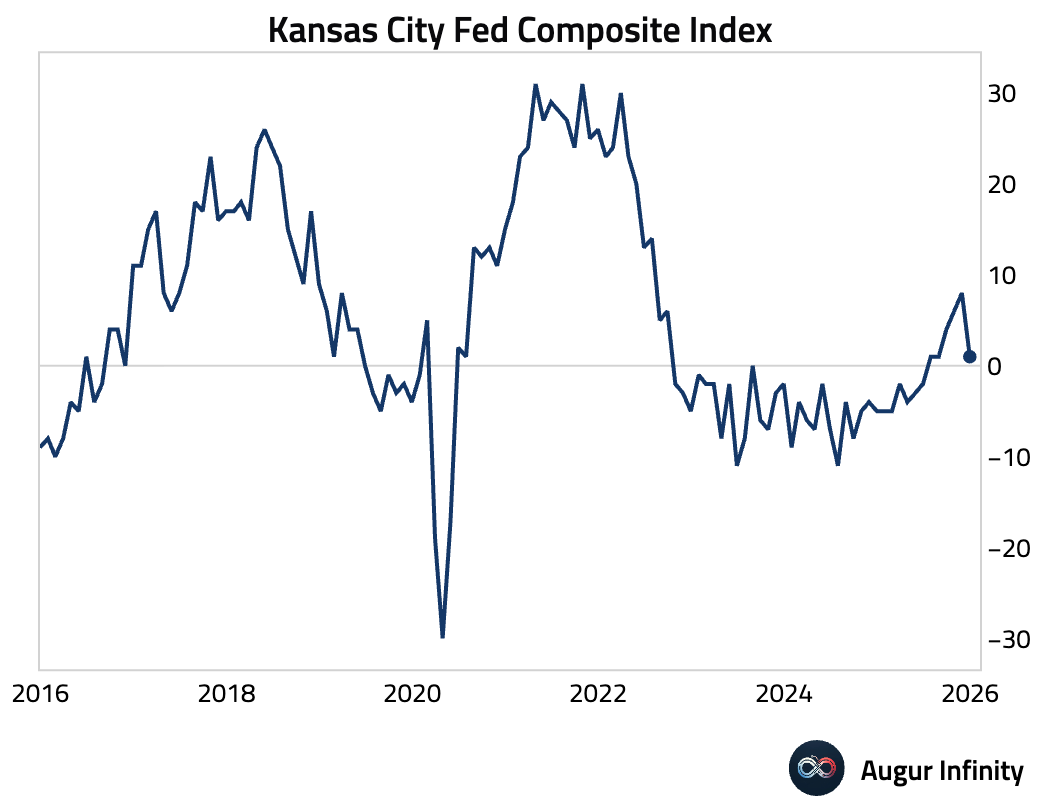

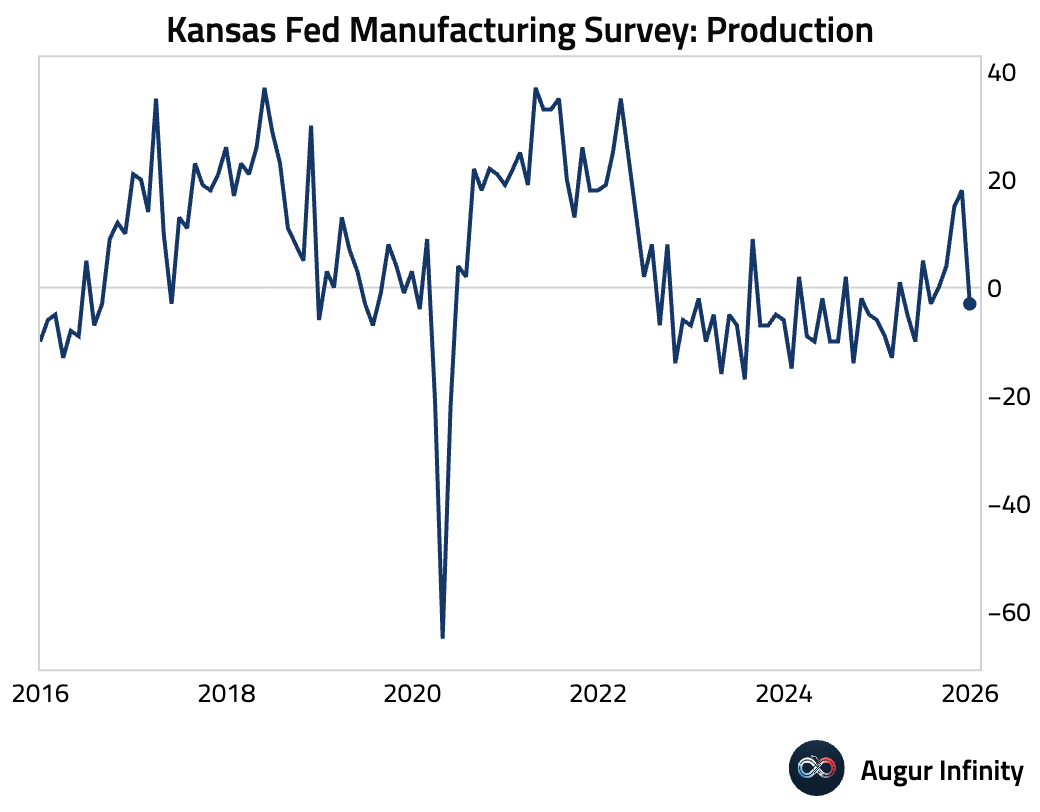

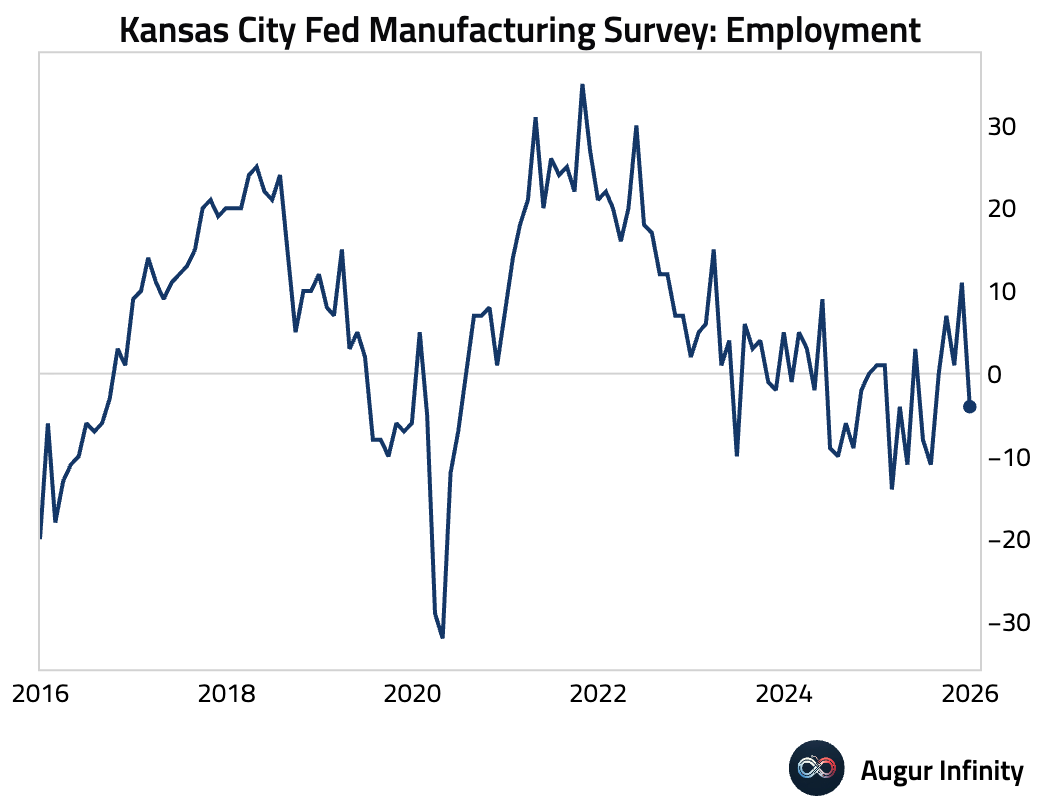

- The Kansas City Fed’s composite manufacturing index fell sharply in December, …

… as both production and employment sub-indices moved into contractionary territory.

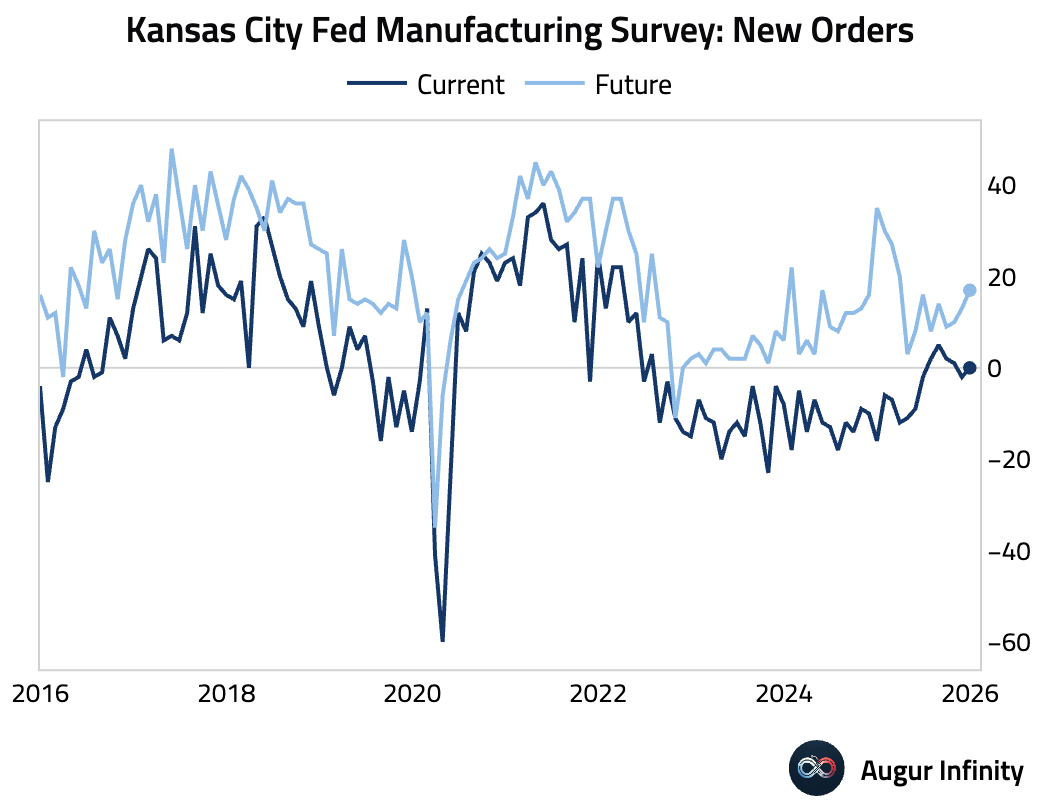

New orders improved, however, particularly future expectations.

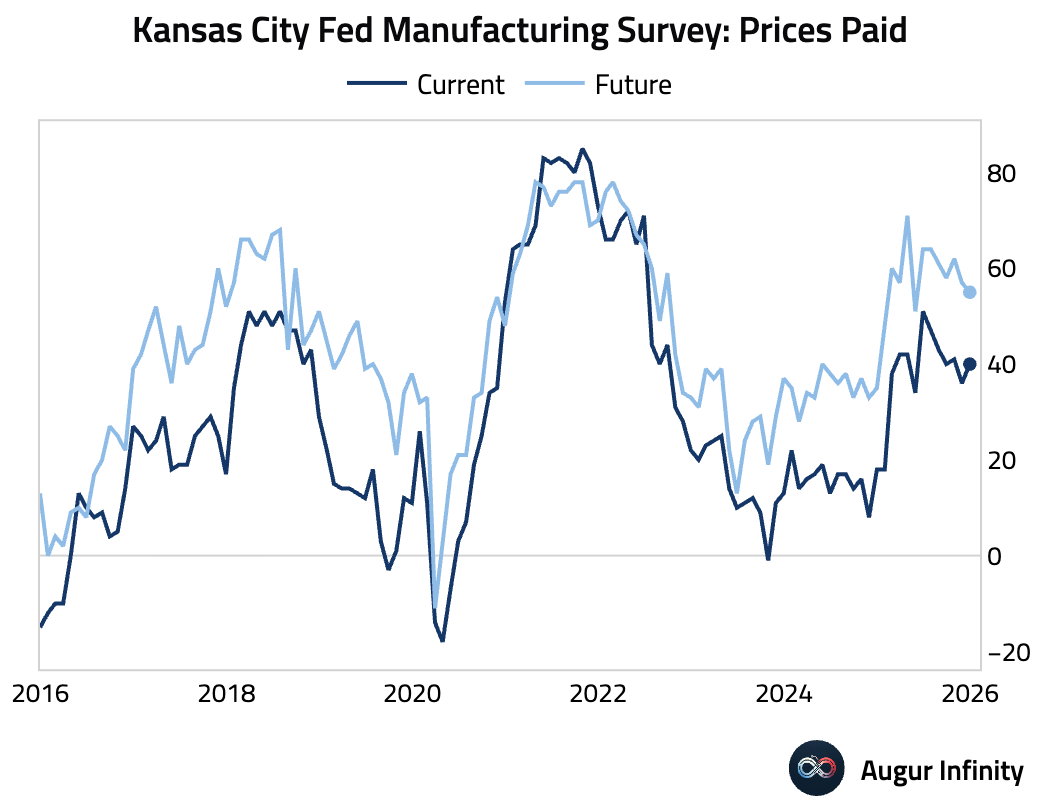

Current prices paid rose, but expected prices fell.

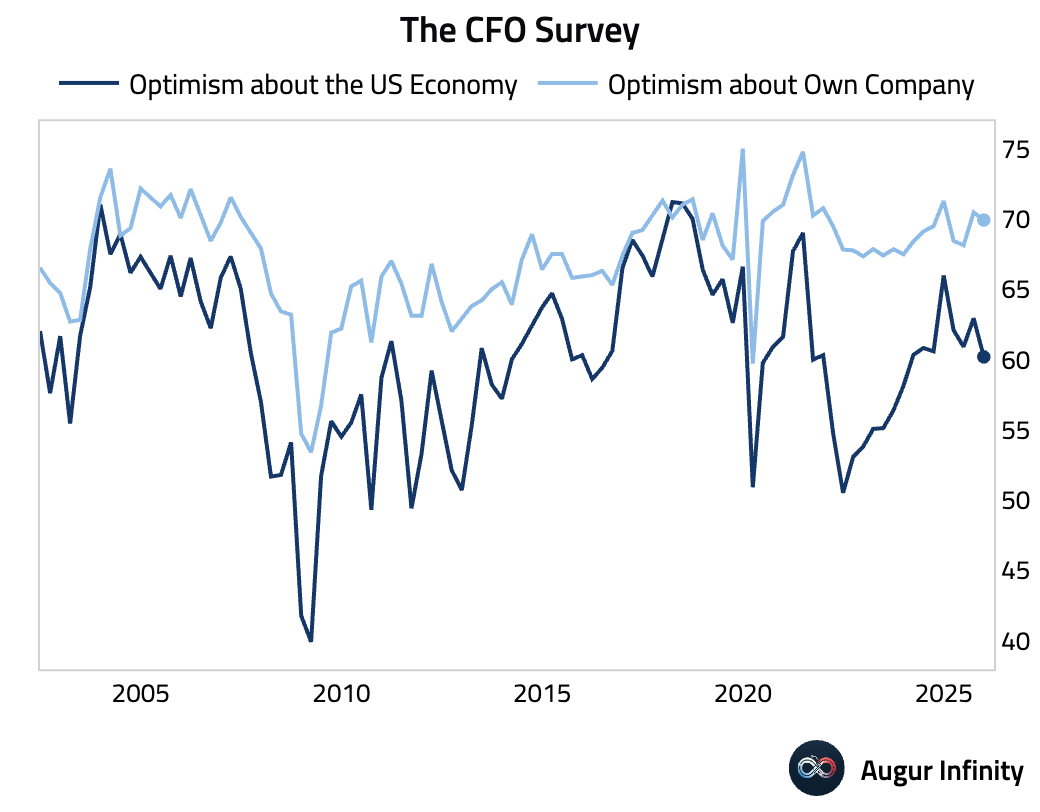

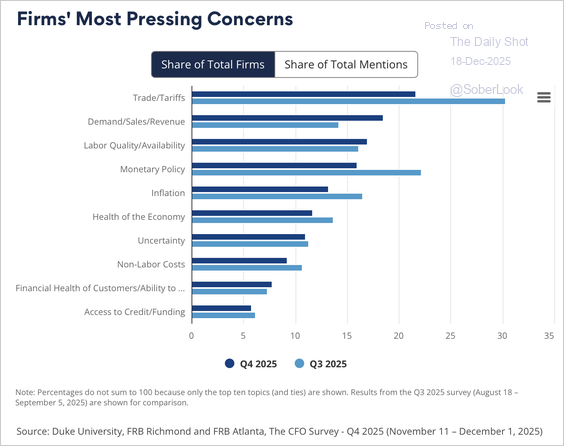

- CFO optimism declined in Q4, with optimism about the US economy falling to the lowest level in two years.

Trade policy and tariffs remained the top concern.

Source: Richmond Fed

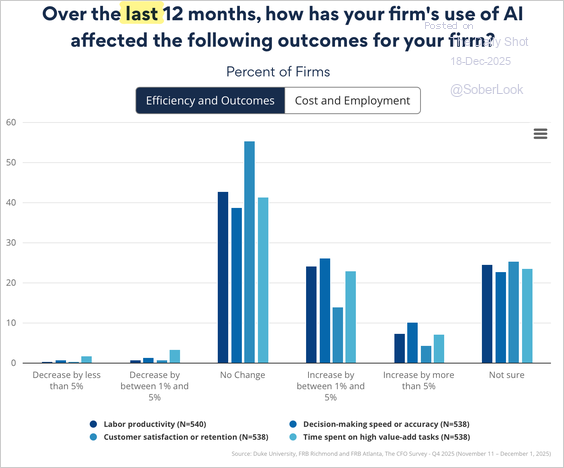

Most CFOs reported no changes to operational outcomes from using AI, …

Source: Richmond Fed

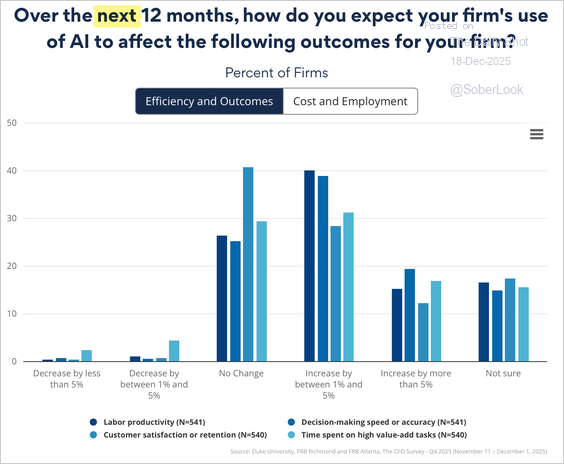

… although a higher percentage of firms expected improvements in the coming year.

Source: Richmond Fed

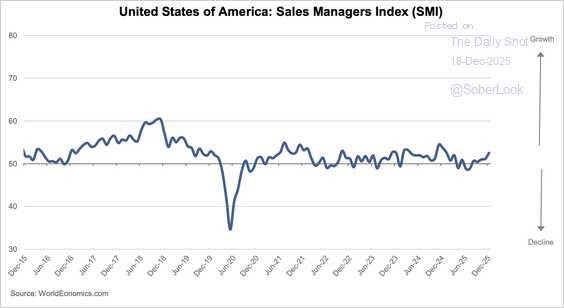

- The Sales Managers Index rose to the highest level in 11 months, signaling a modest acceleration in economic activity supported by solid holiday-season demand and improving business confidence.

Source: World Economics

Gains were broad-based.

Source: World Economics

Canada

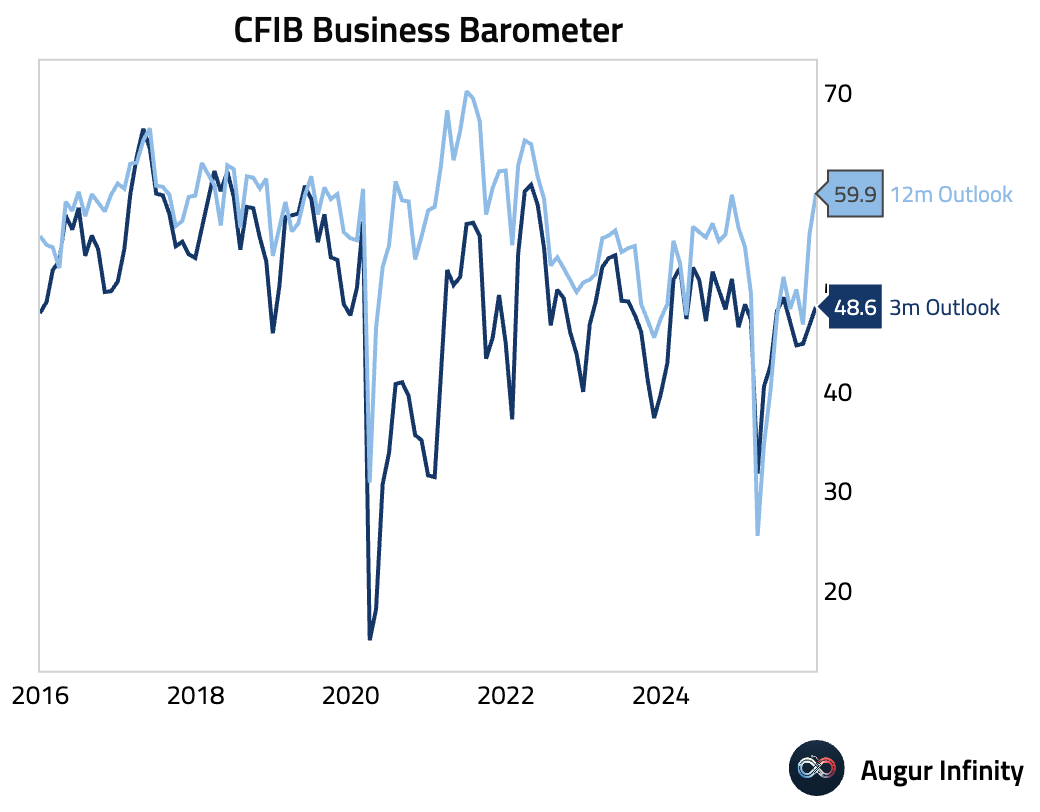

- Small business confidence jumped, with the 12-month outlook rising to its highest level since May 2022.

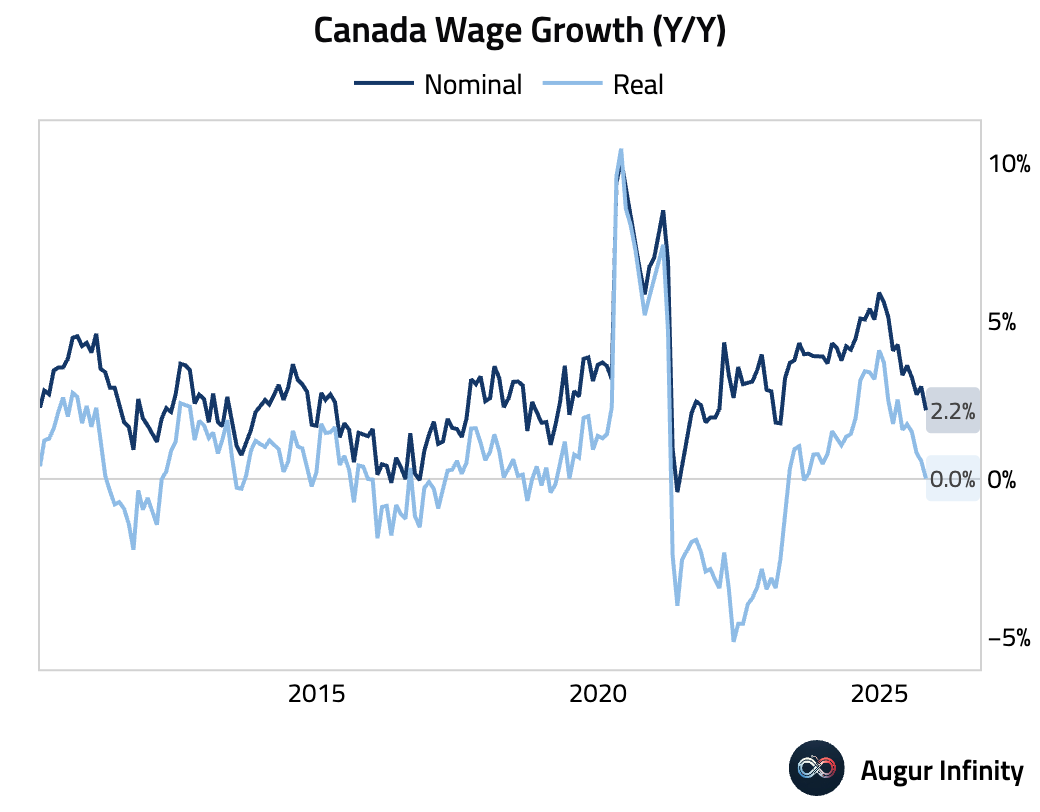

- Average weekly earnings growth slowed, with the real growth rate touching zero.

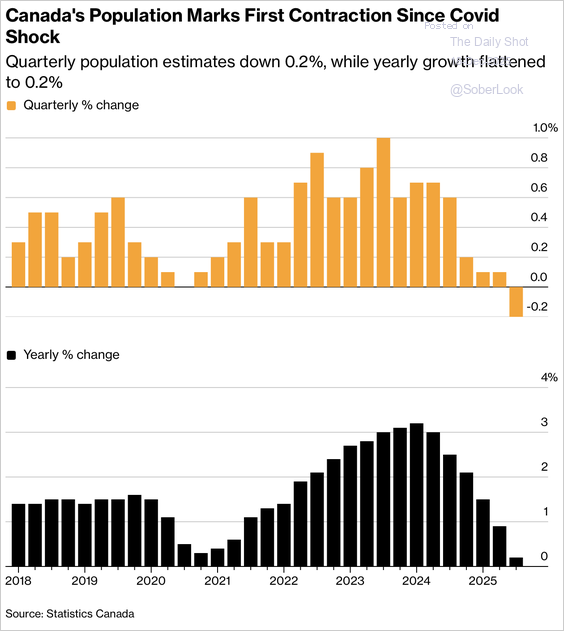

- Population fell 0.2% in Q3—the first quarterly contraction outside the pandemic—driven by a record decline in non-permanent residents as immigration curbs intensified.

Source: @economics

United Kingdom

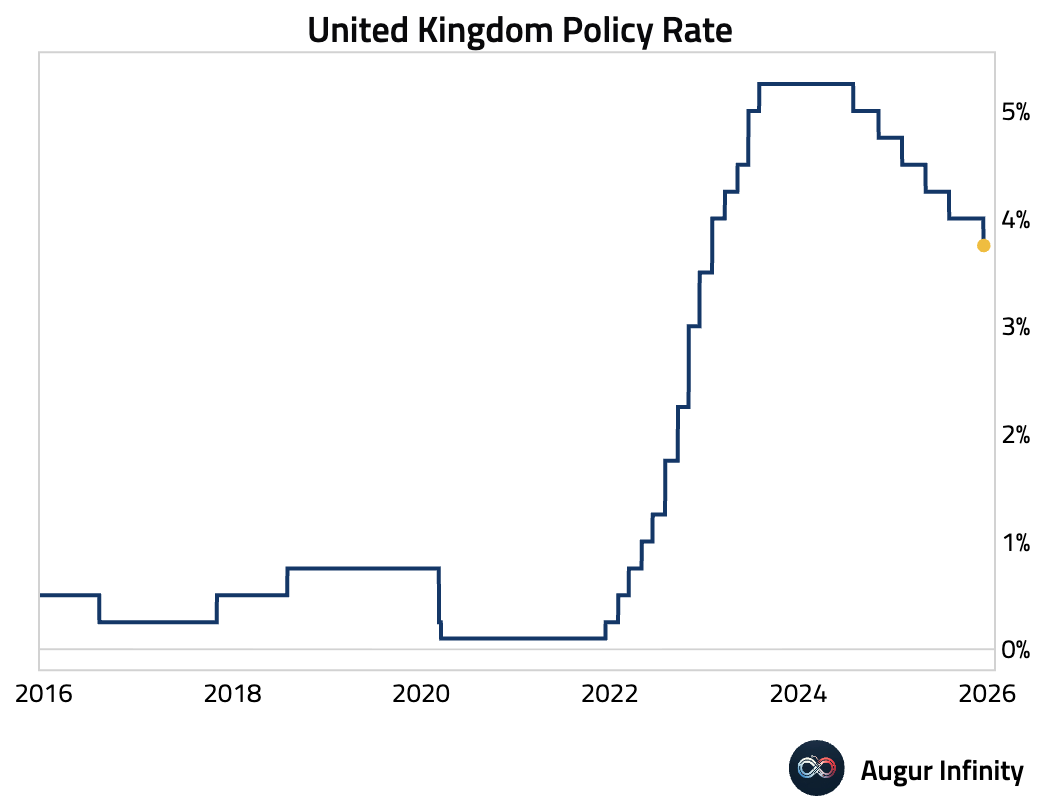

- The Bank of England’s Monetary Policy Committee cut the Bank Rate by 25 basis points to 3.75%, in line with expectations. However, the decision came via a narrow 5–4 vote, with four members dissenting in favor of a hold. This hawkish split signals a high bar for future easing, with the MPC’s guidance noting that further cuts will be a “closer call” amid risks from stubborn wage growth.

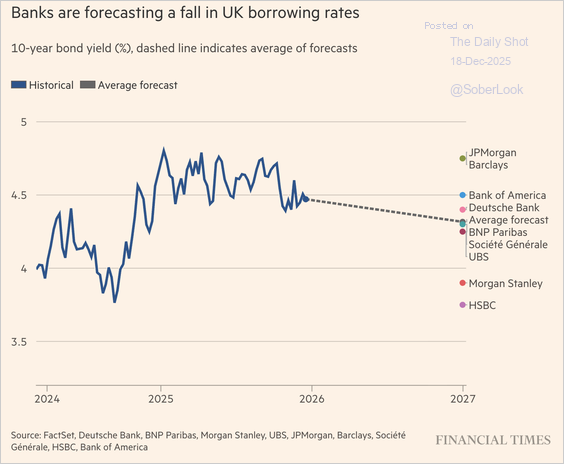

- Banks, on average, are forecasting a fall in gilt yields next year.

Source: @financialtimes

The Eurozone

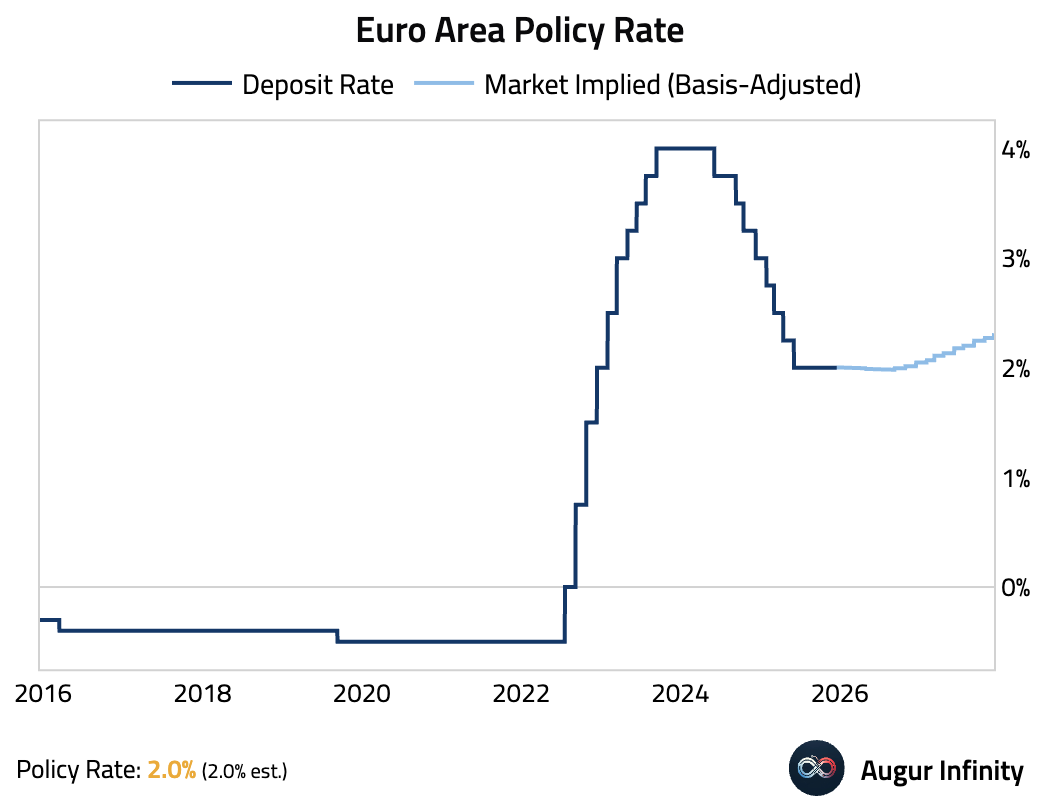

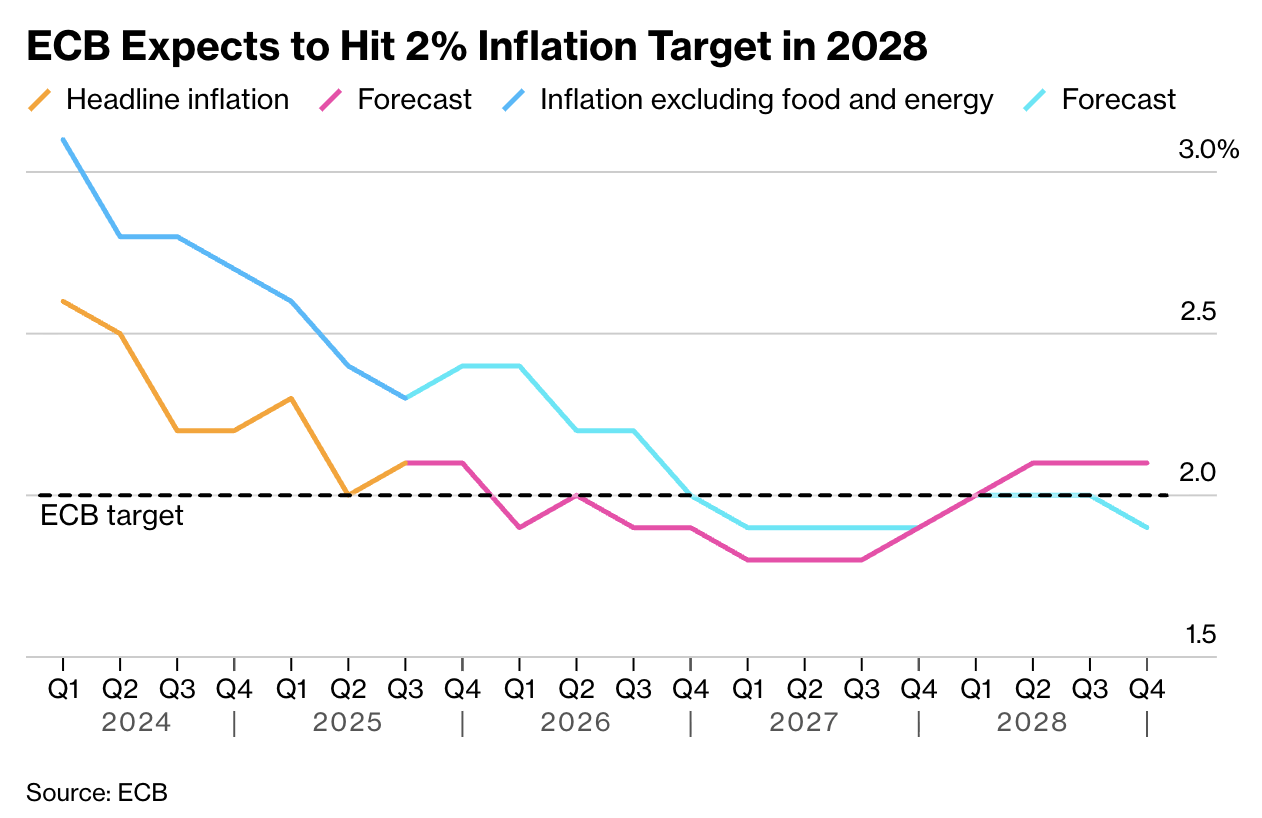

- The European Central Bank held its deposit facility rate at 2.0%, as expected. President Lagarde described the policy as being in a “good place,” while staff upgraded GDP growth forecasts for 2025 and 2026.

Source: @economics

A key hawkish detail was the upward revision of the 2026 core inflation forecast, driven by a slower-than-anticipated decline in services inflation, which indicates that persistent domestic price pressures remain a concern.

Source: @economics

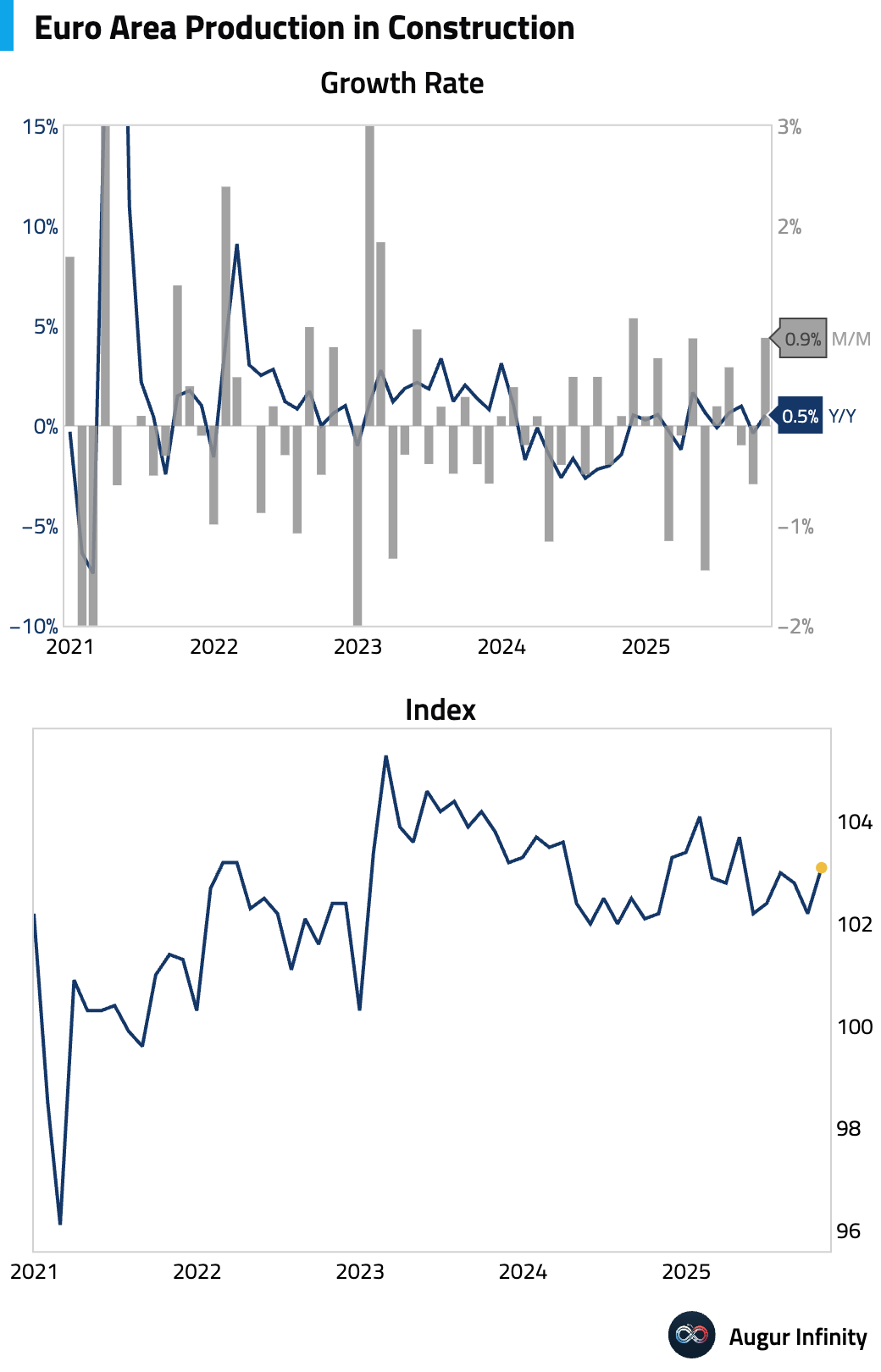

- Construction output in the euro area rose in October, marking a solid start to the fourth quarter. The increase was led by a surge in Germany.

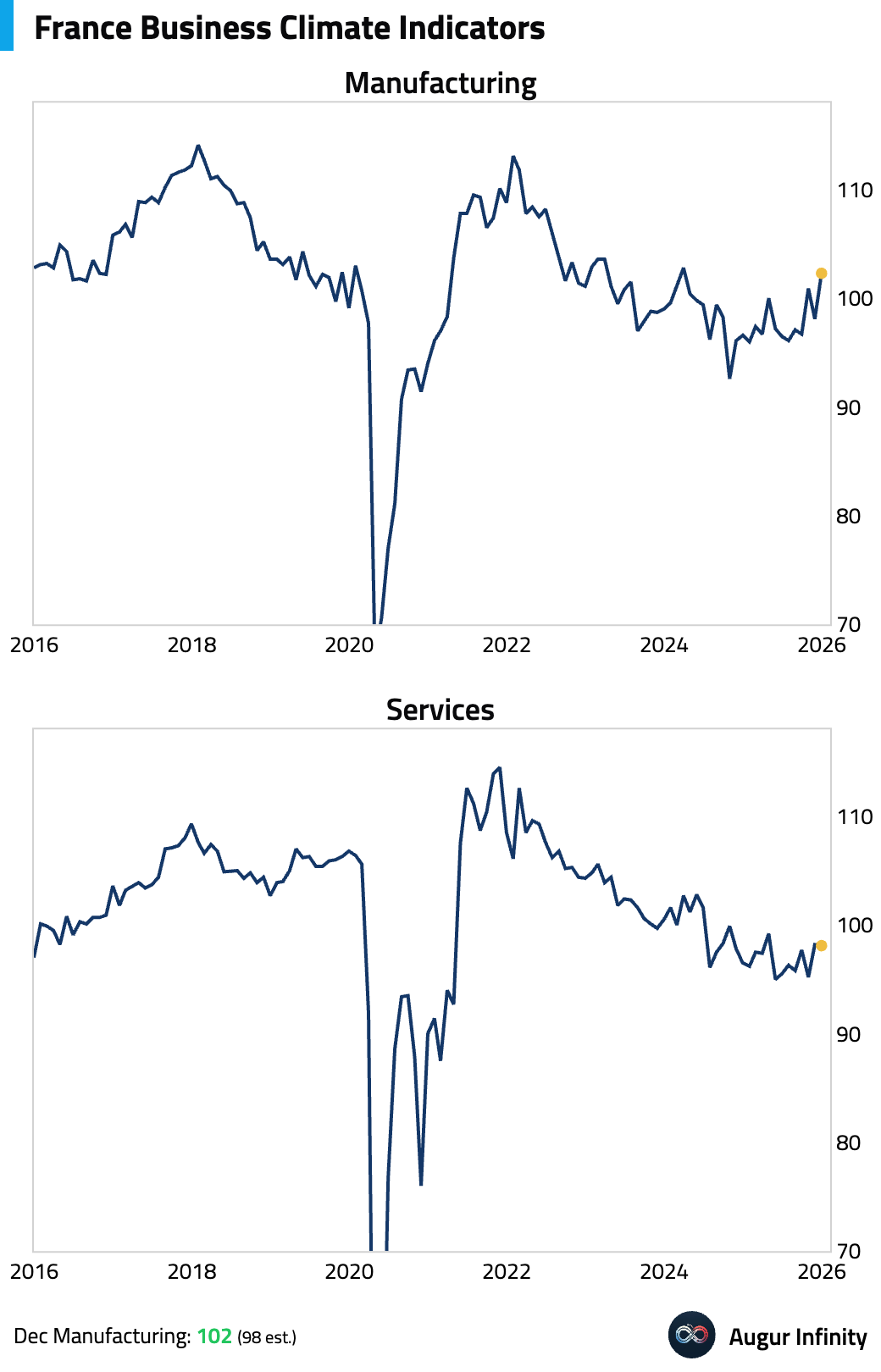

- French manufacturing confidence jumped, beating the consensus forecast, though the strength was concentrated in the volatile transport sector. Services confidence was roughly unchanged.

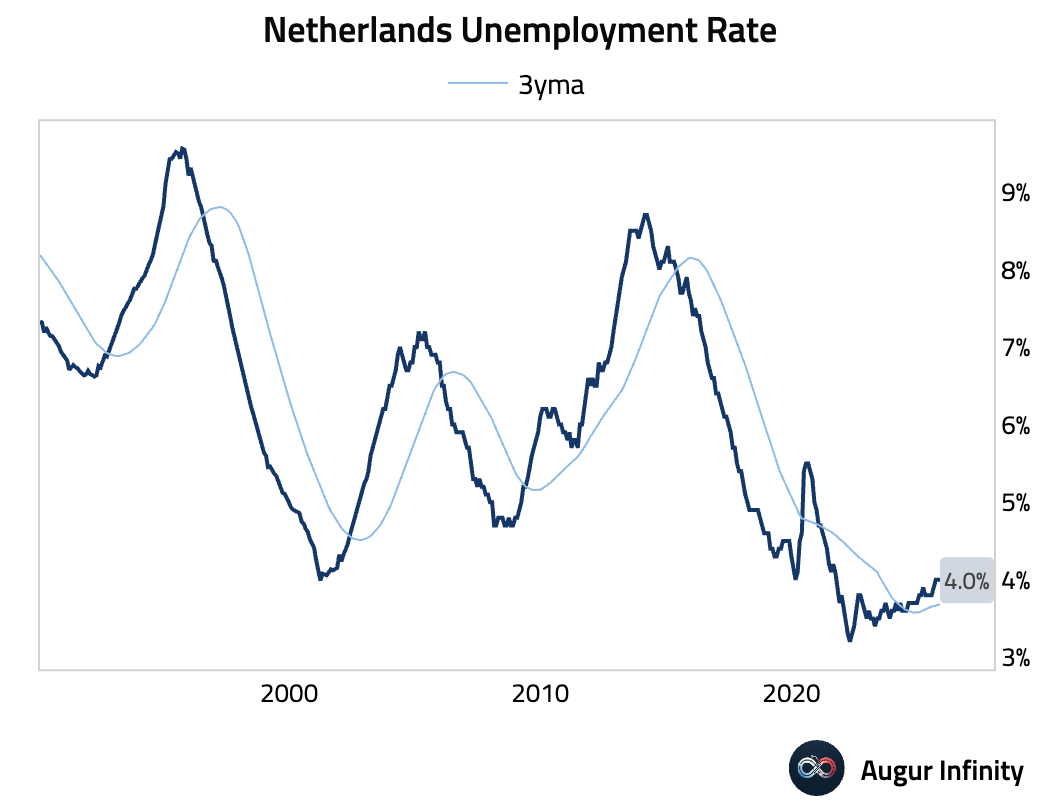

- The Dutch unemployment rate held steady in November.

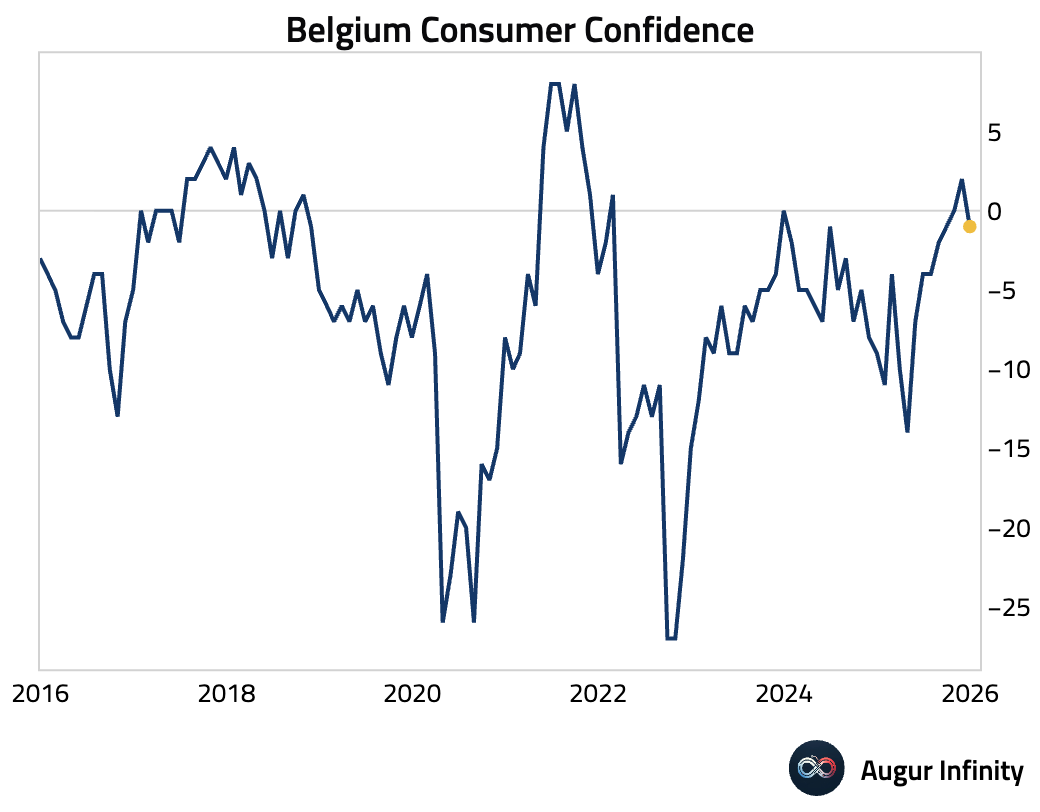

- Belgian consumer confidence declined in December, falling back into negative territory.

Europe

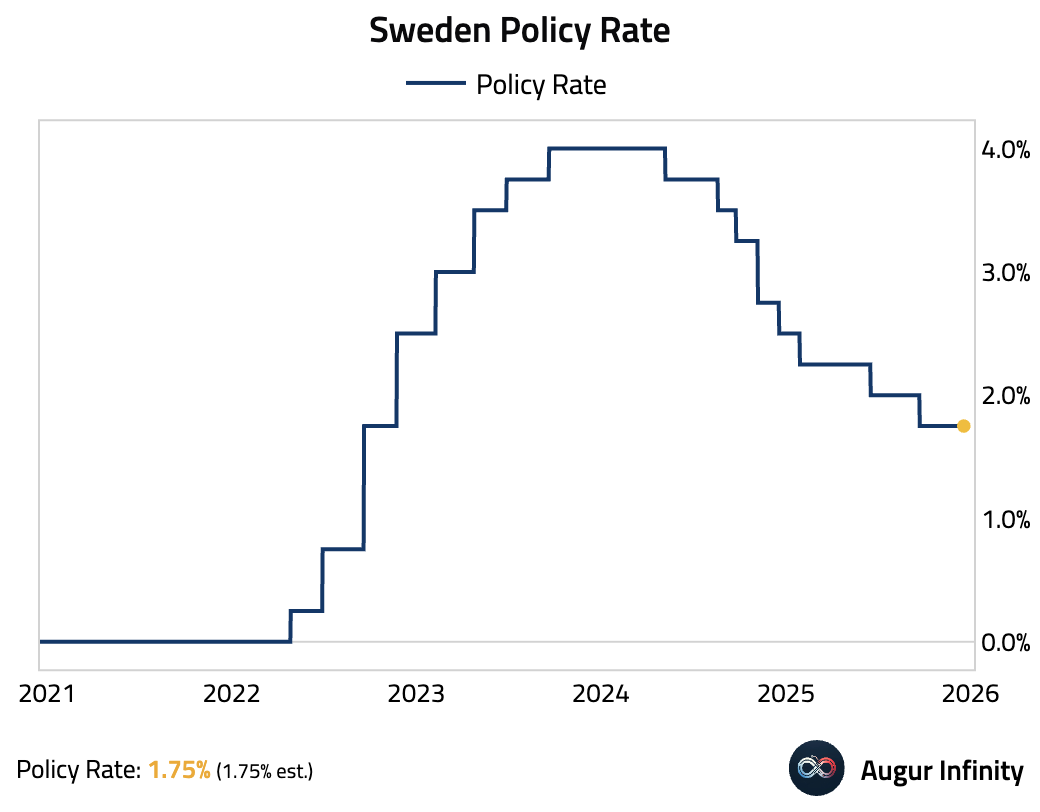

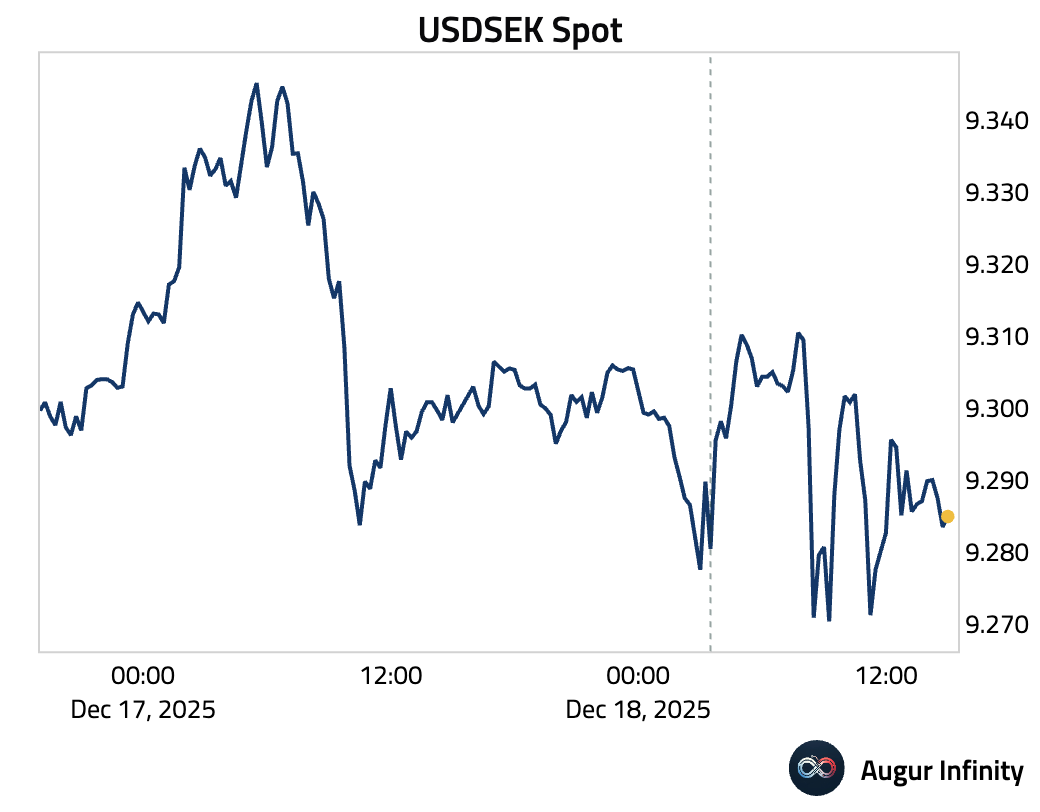

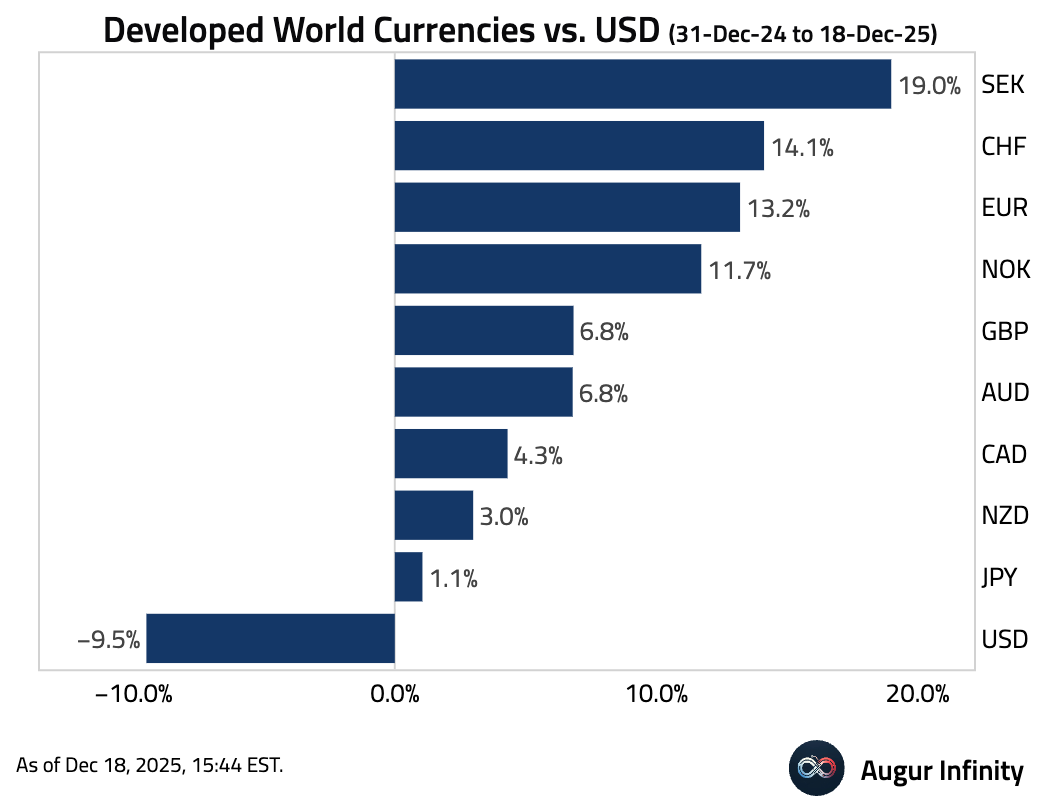

- Sweden’s Riksbank held its policy rate at 1.75%, in line with consensus expectations. Officials cited strengthening economic growth and cooling inflation, repeating strong forward guidance for no rate changes until 2027.

The Swedish krona weakened, …

… but remained the top-performing G10 currency in 2025.

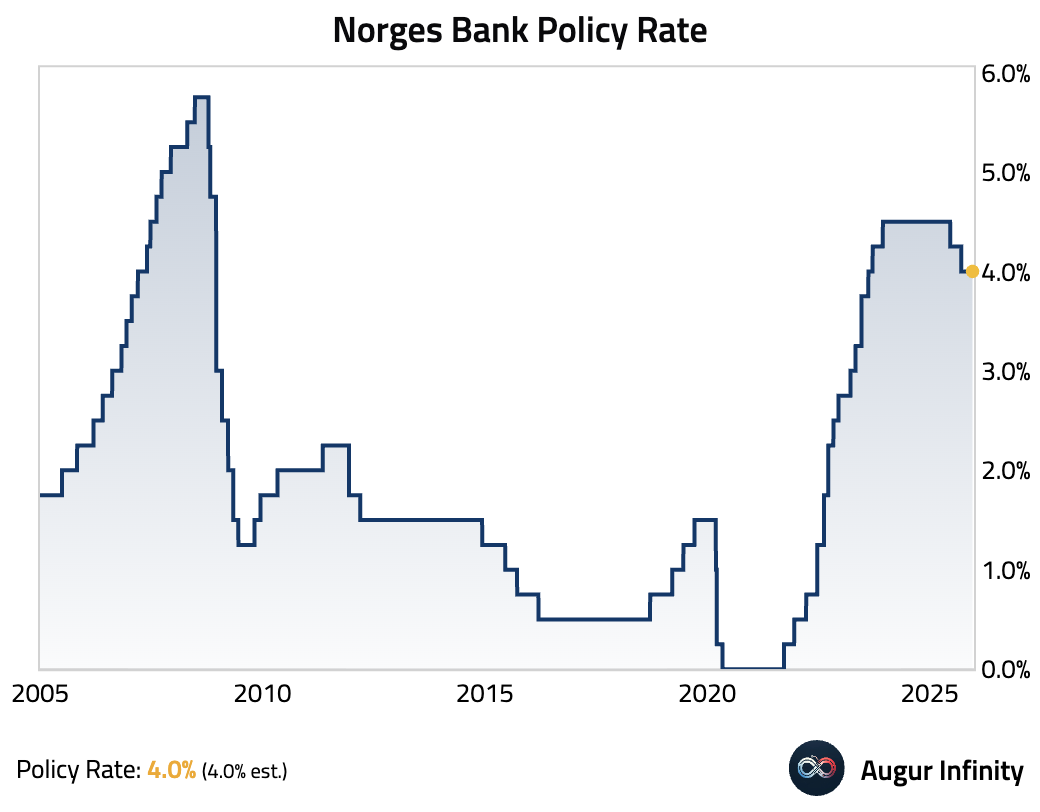

- Norway’s central bank held its policy rate at 4% and reiterated that it is in no rush to ease, citing sticky underlying inflation around 3%. However, officials still signaled gradual easing ahead.

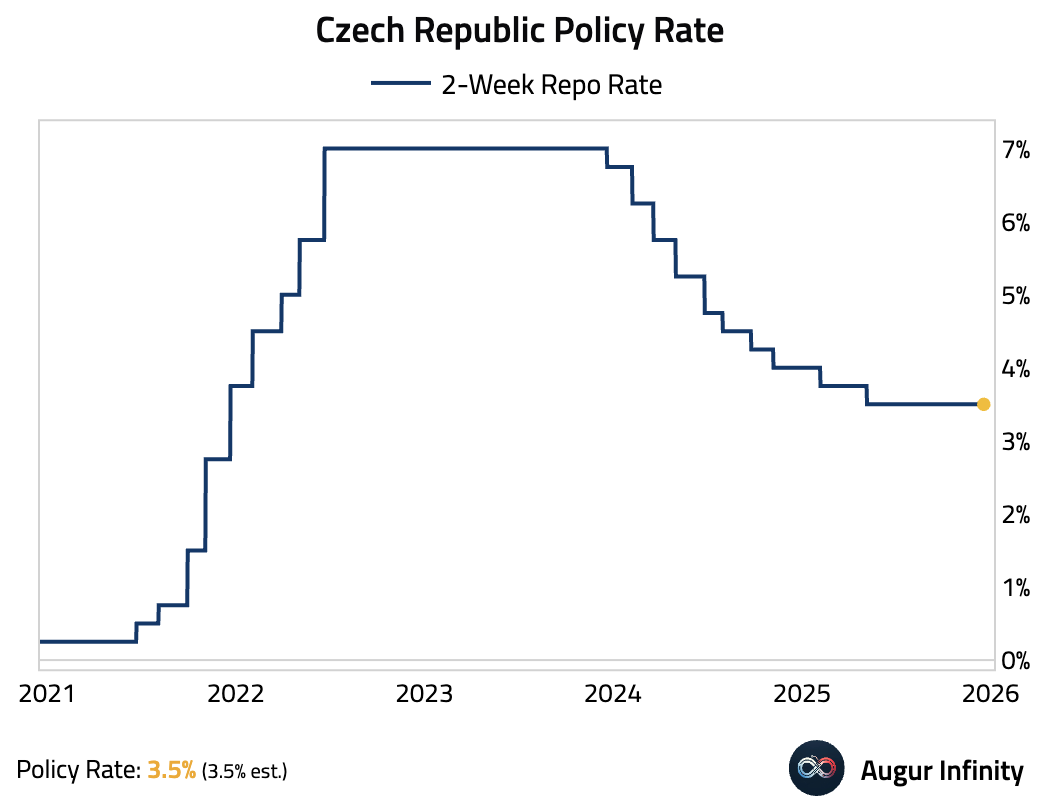

- The Czech National Bank held its policy rate steady at 3.5%, as expected.

Interactive chart on Augur Infinity

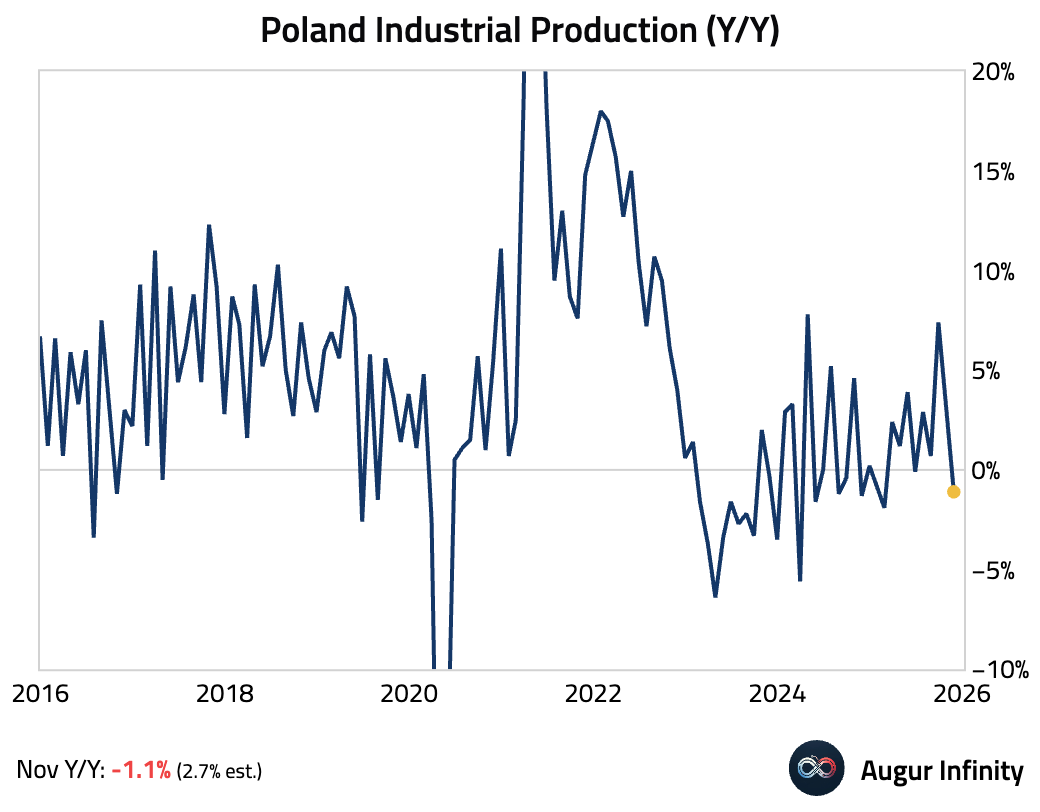

- Polish industrial production unexpectedly contracted by 1.1% year over year.

Japan

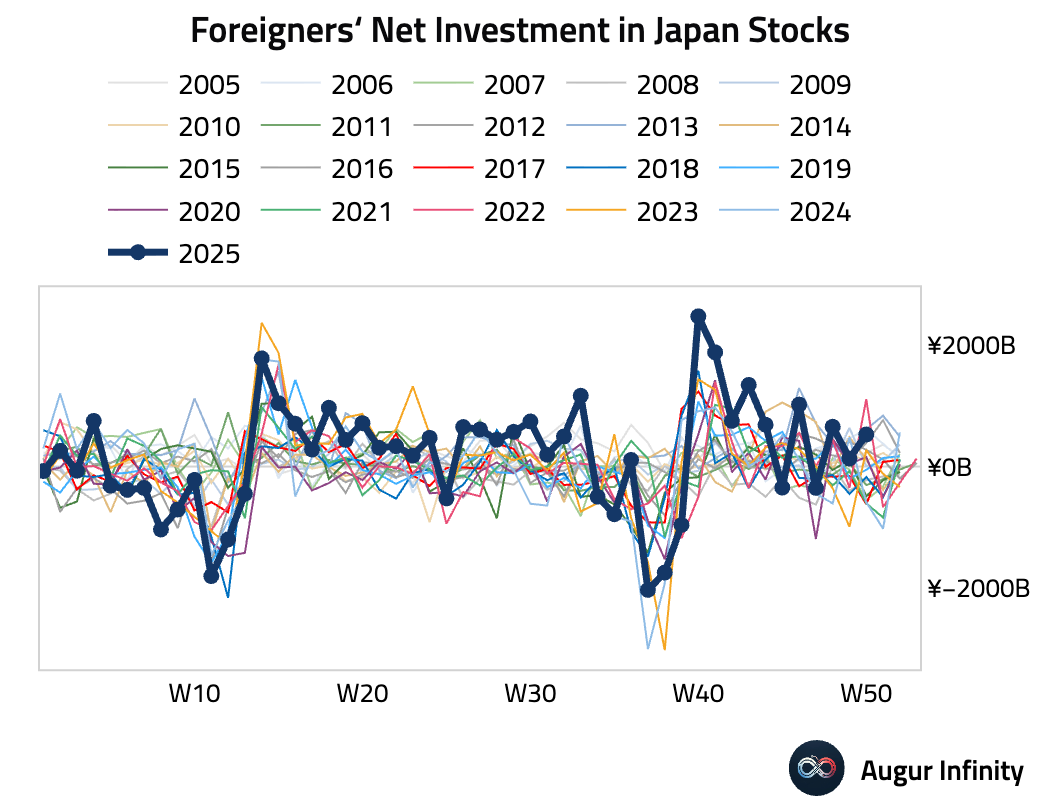

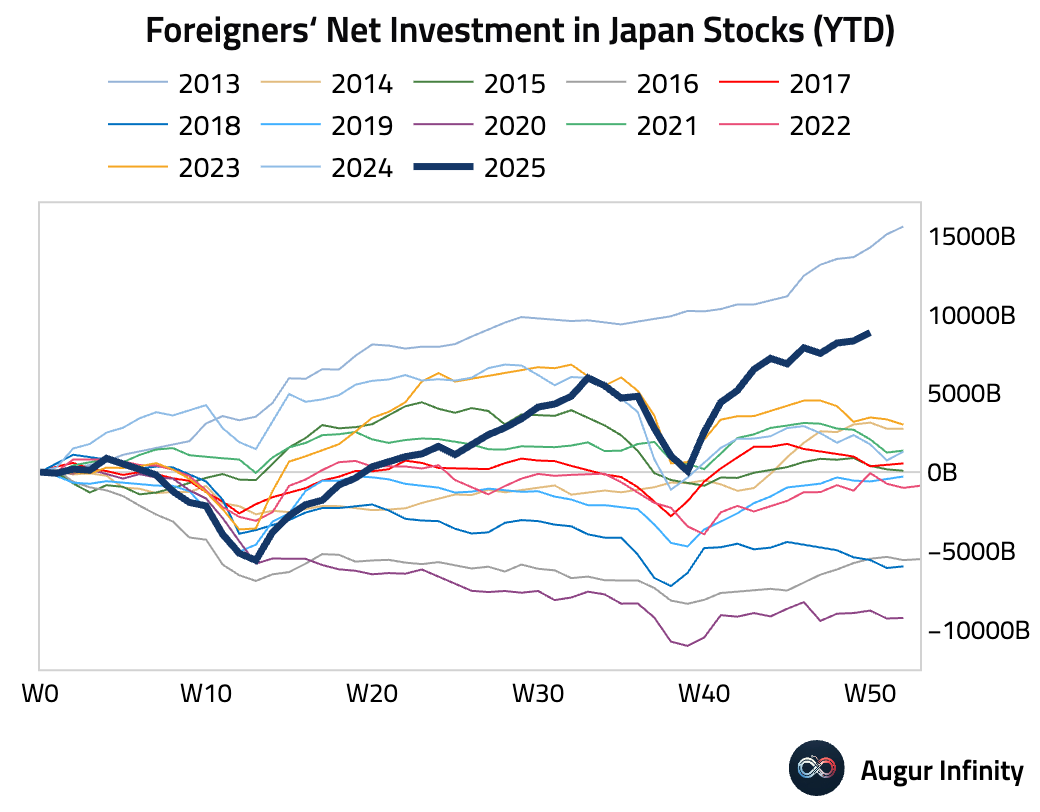

- Foreign investors remained net buyers of Japanese stocks.

The year-to-date net inflows into Japan stocks from foreigners are the highest since 2013.

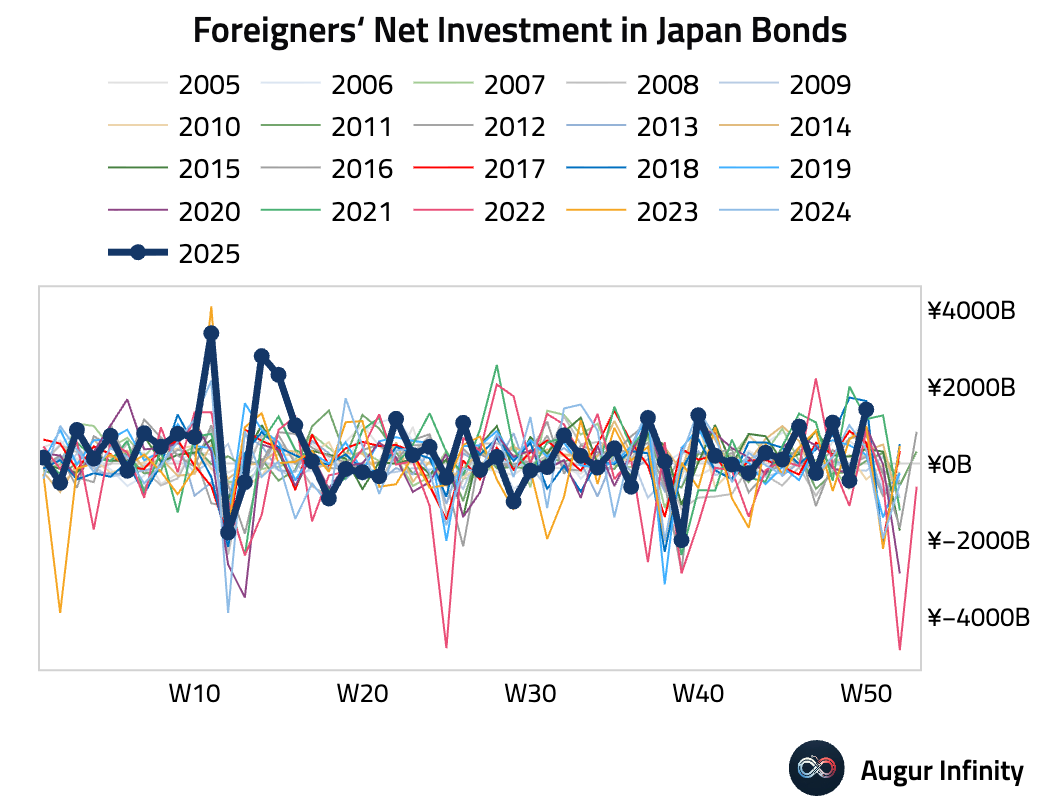

Foreign investors also bought the most Japanese bonds in eight months as rising yields attracted demand.

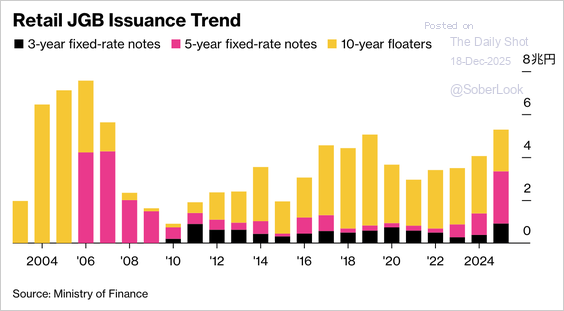

- Japan’s retail government bond sales surged in 2025, reaching their highest level since 2007, as rising yields following BOJ policy tightening drew household savings out of bank deposits.

Source: @markets

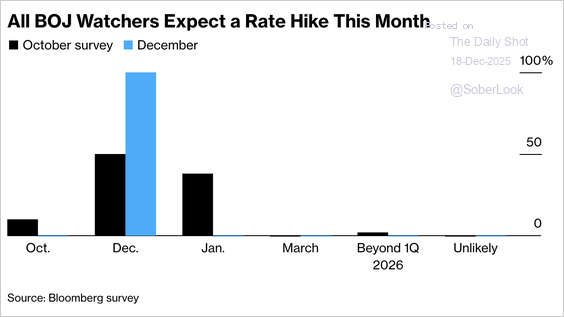

- The Bank of Japan is widely expected to raise its benchmark overnight rate to 0.75%, the highest level in three decades.

Source: @economics

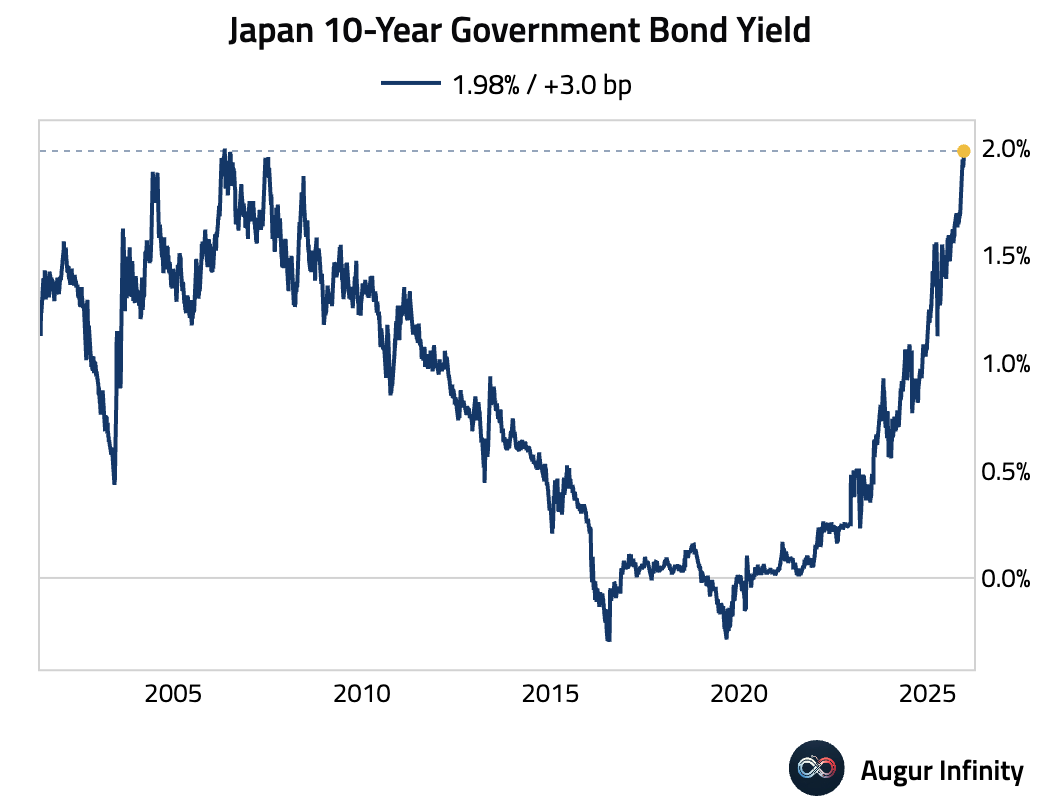

- The yield on the 10-year Japanese government bond is at its highest level since May 2006.

Asia-Pacific

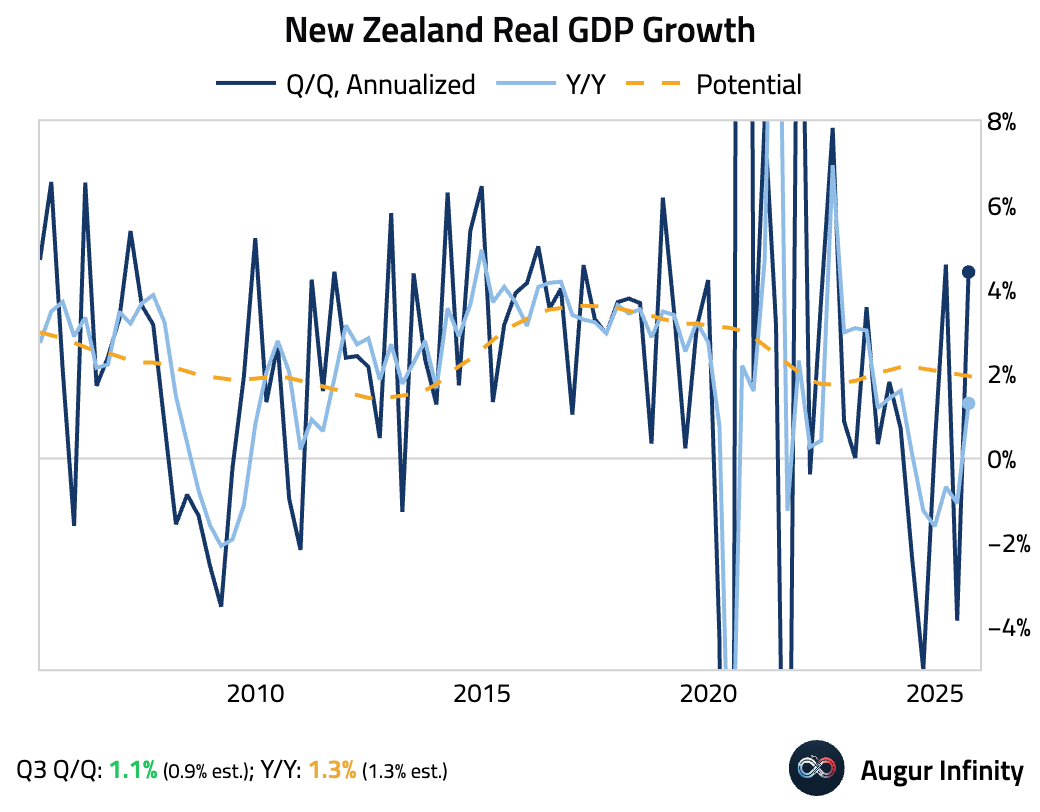

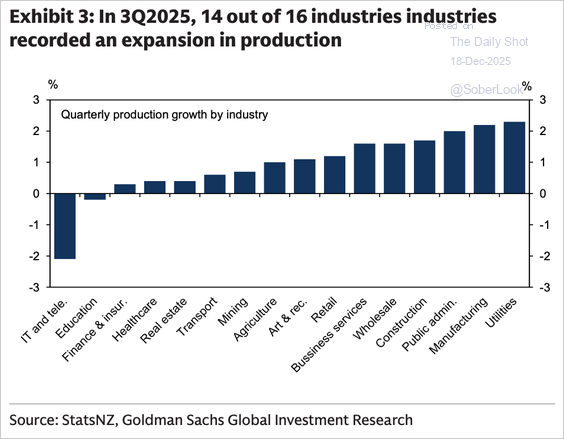

- New Zealand GDP rebounded sharply in Q3.

Source: @economics

The gains were broad-based across most industries, led by manufacturing, construction, and business services.

Source: Goldman Sachs

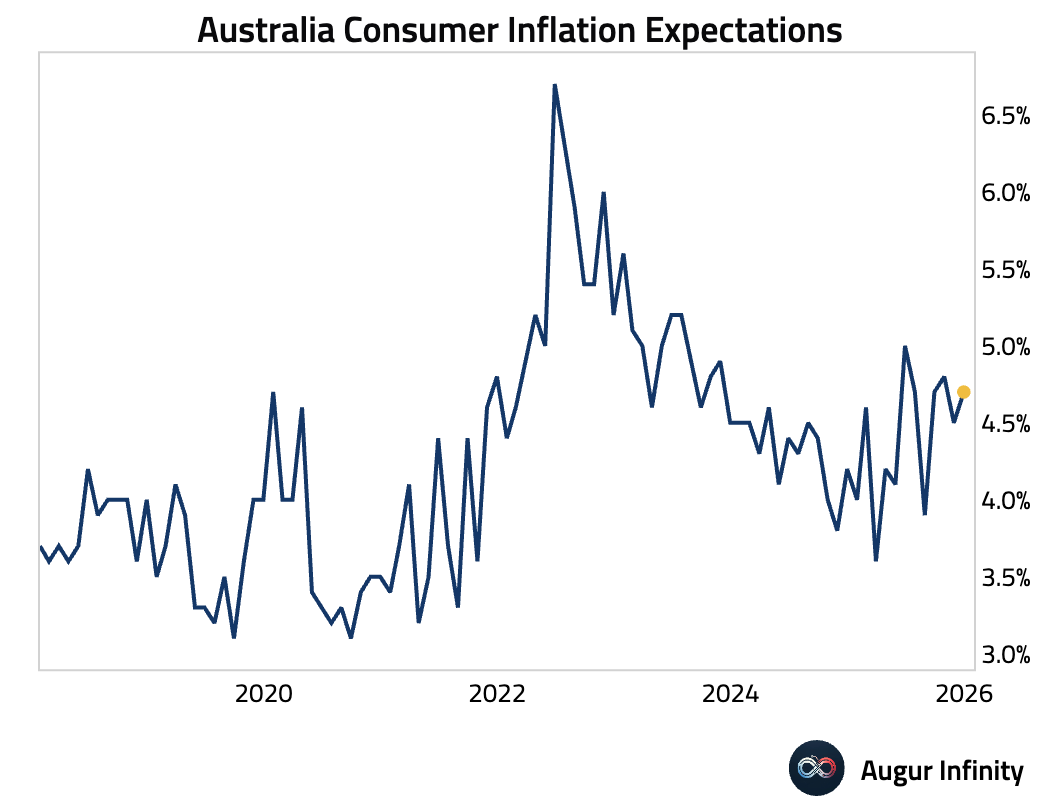

- Australian consumer inflation expectations ticked up in November.

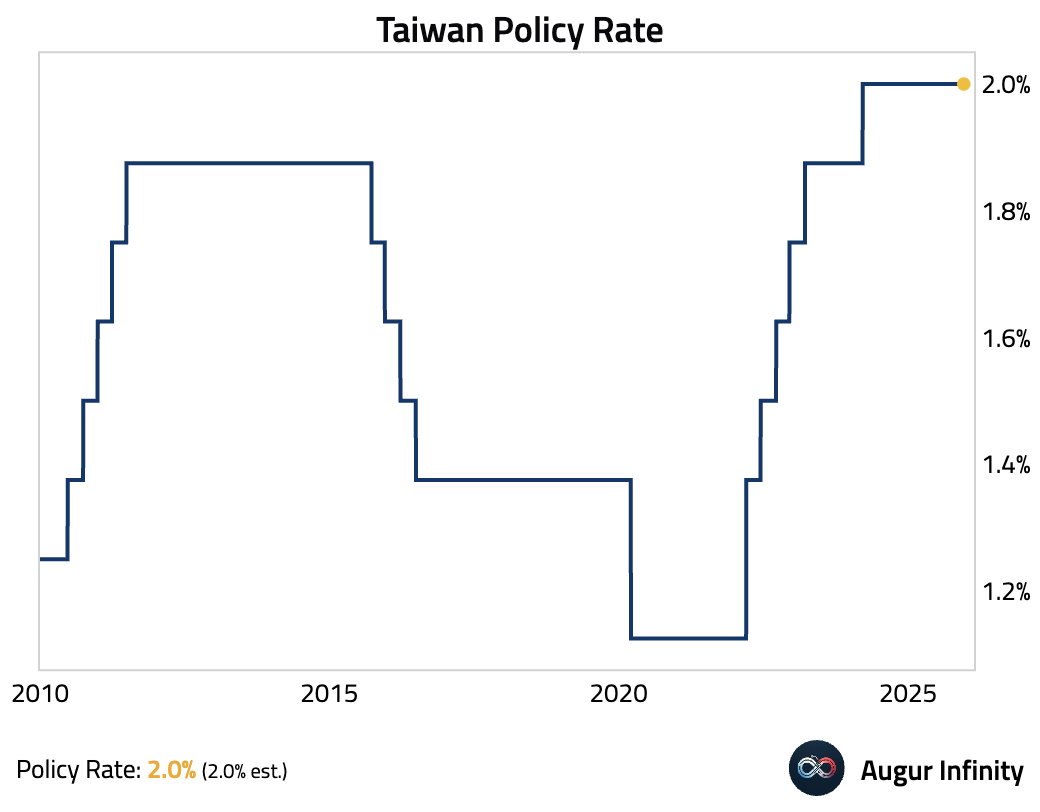

- Taiwan’s central bank held its benchmark interest rate steady at 2.0%, a move that was in line with expectations.

China

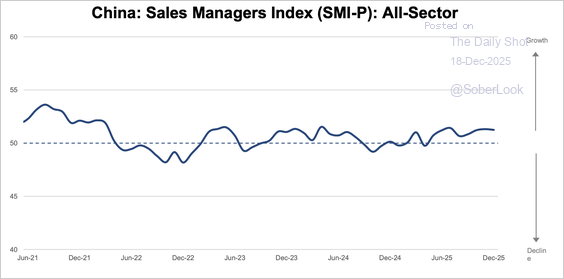

- The Sales Managers Index indicates continued moderate economic expansion.

Source: World Economics

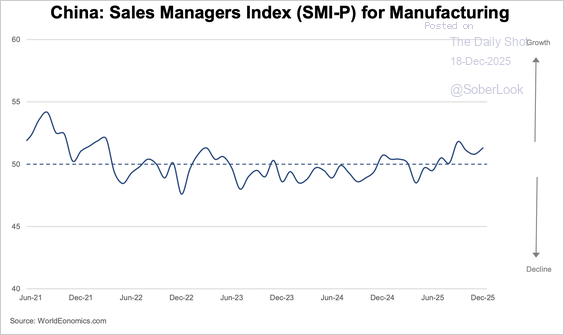

Manufacturing activity improved, …

Source: World Economics

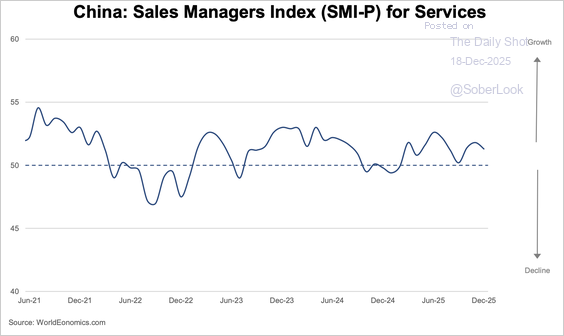

… while the services sector recorded a slight softening.

Source: World Economics

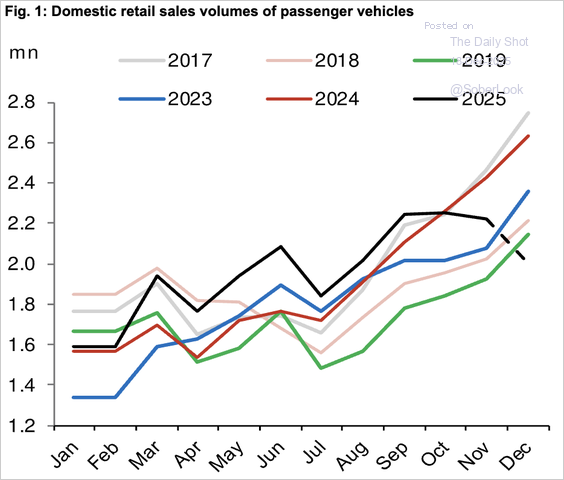

- China’s auto sales slumped sharply, with volumes down 24% year over year in the first two weeks of December, signaling a deeper payback effect from earlier trade-in incentives and continued demand weakness.

Source: Nomura Securities

Emerging Markets

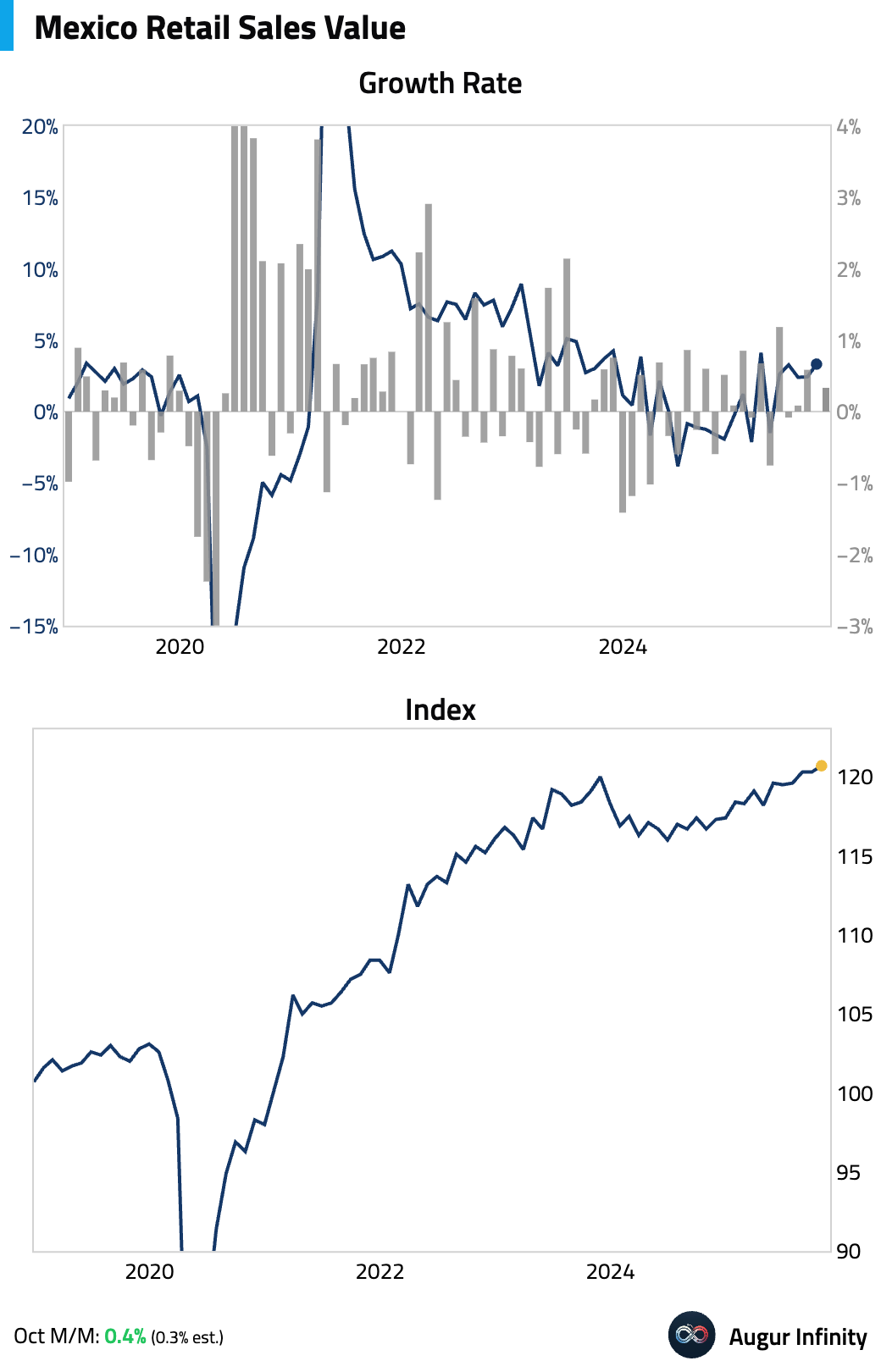

- Retail sales in Mexico improved in October, supported by a resilient labor market and strong growth in real wages, signaling healthy underlying momentum for consumer demand.

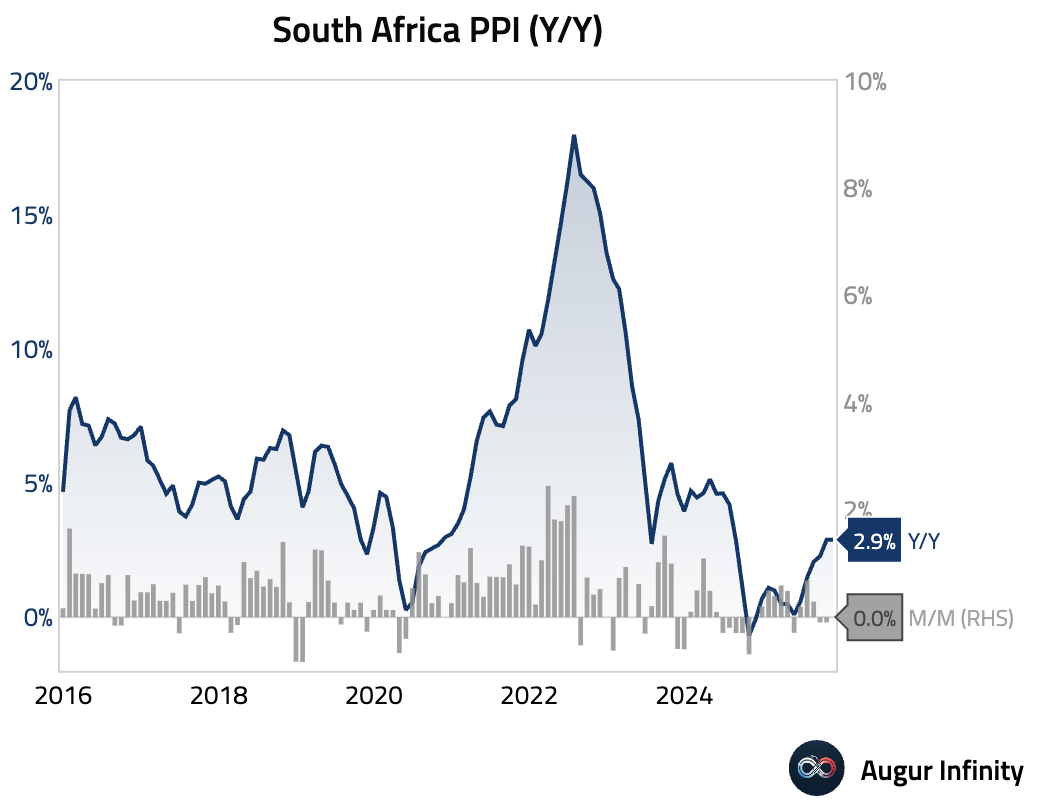

- South Africa’s producer prices were flat month over month in November.

Interactive chart on Augur Infinity

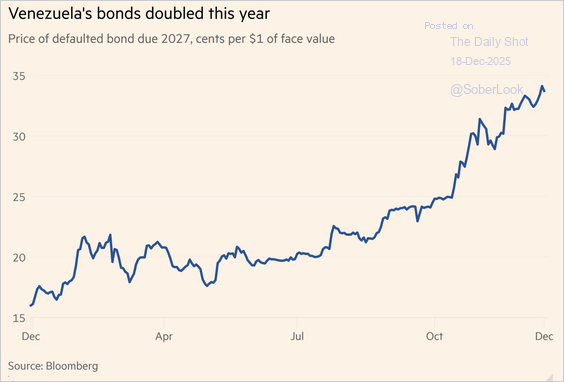

- Venezuelan sovereign and PDVSA bonds have surged to multiyear highs as investors bet that intensified US pressure on the Maduro regime could lead to political change and an eventual debt restructuring.

Source: @financialtimes

Equities

- Global equities rebounded following recent weakness, with risk sentiment supported by signs of disinflation. US markets gained 0.8%, while the tech-heavy Nasdaq led the recovery with a 1.4% advance after several days of losses. The positive sentiment was widespread, with notable gains in South Korea (+2.1%) and Mexico (+1.9%).

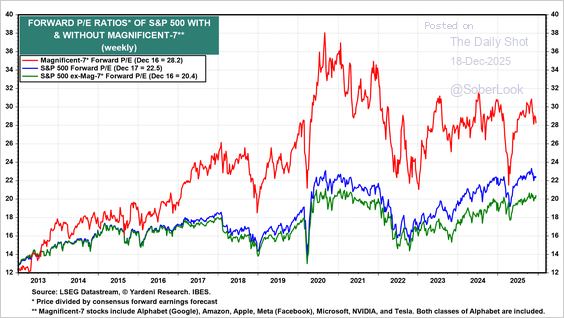

- Mag 7 forward P/E has eased but remains 38% higher than that of non-Mag 7 stocks.

Source: Yardeni Research

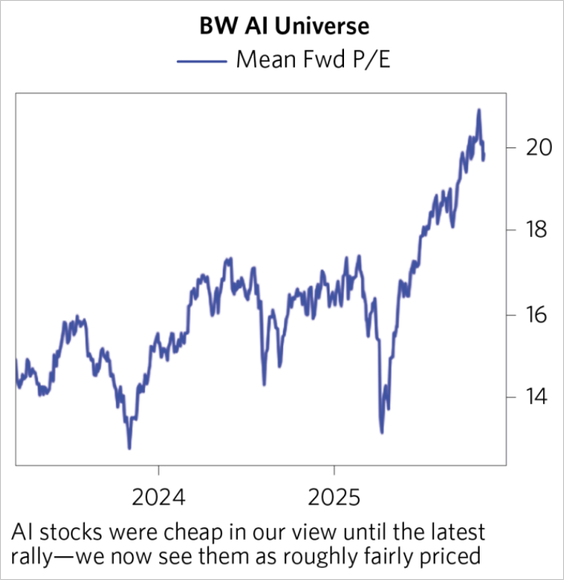

The mean forward valuation of Bridgewater’s global AI universe has risen sharply in the second half of the year.

Source: Bridgewater Associates

Rates

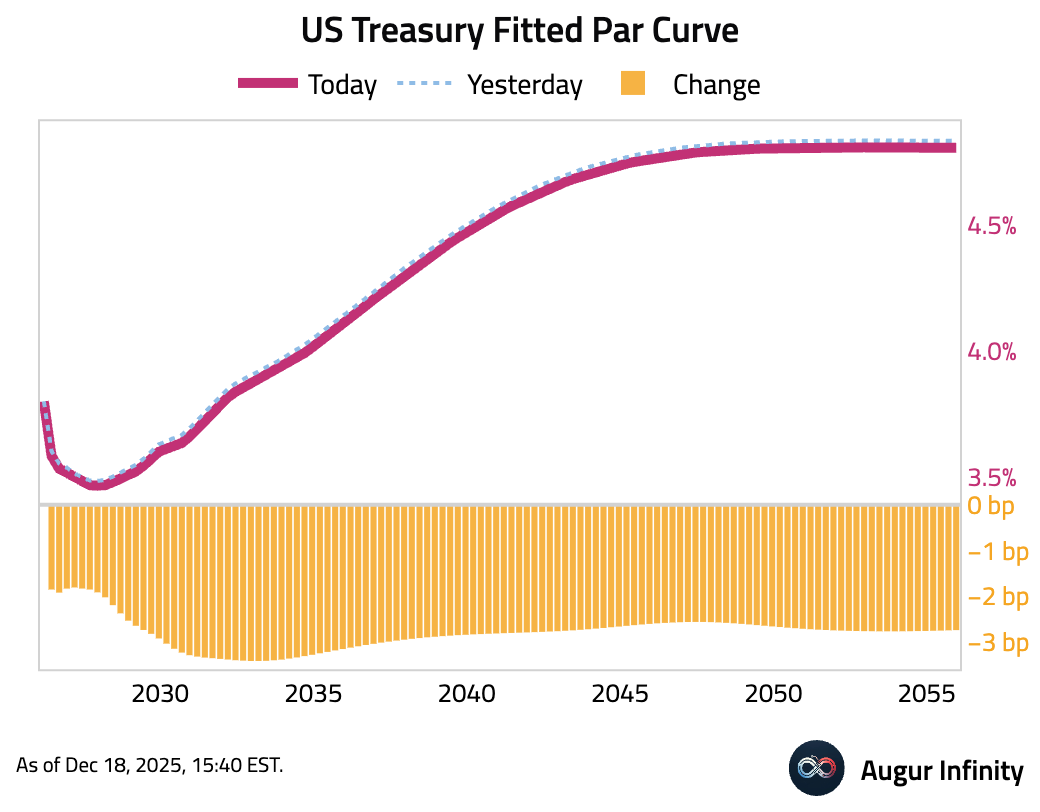

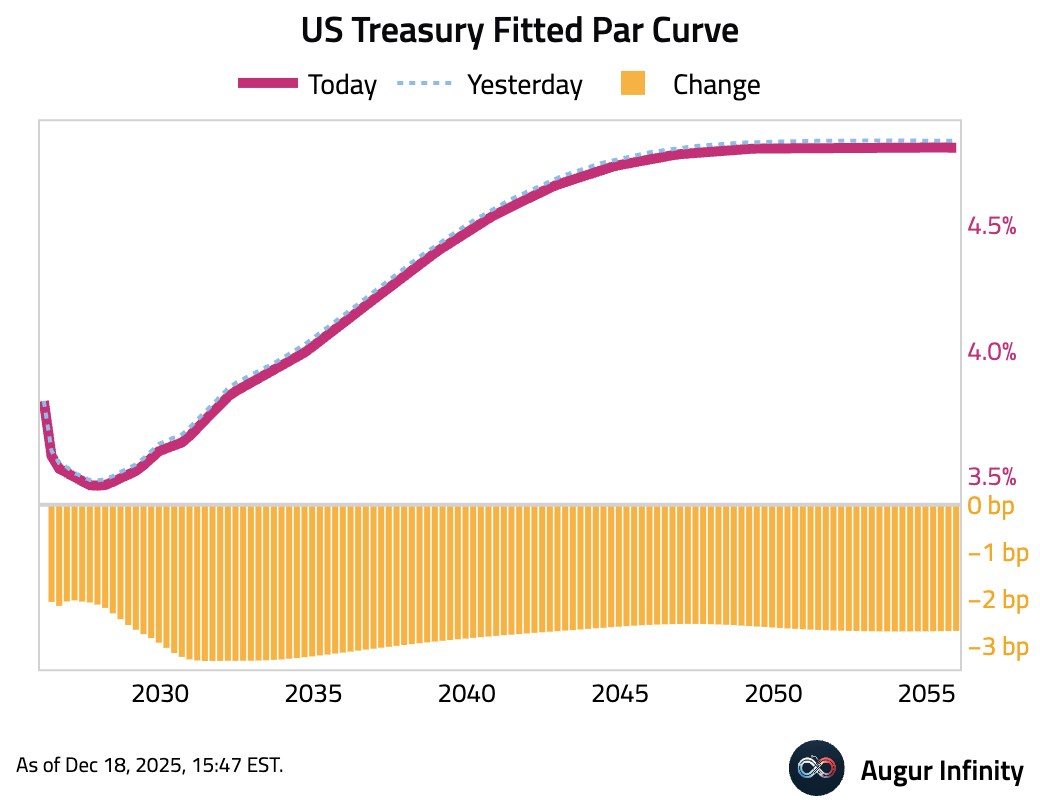

- US Treasury yields fell across the curve as cooler inflation data reinforced expectations for future central bank easing. The 10-year yield declined by 3.4 bps, while the 2-year yield was down 2.5 bps.

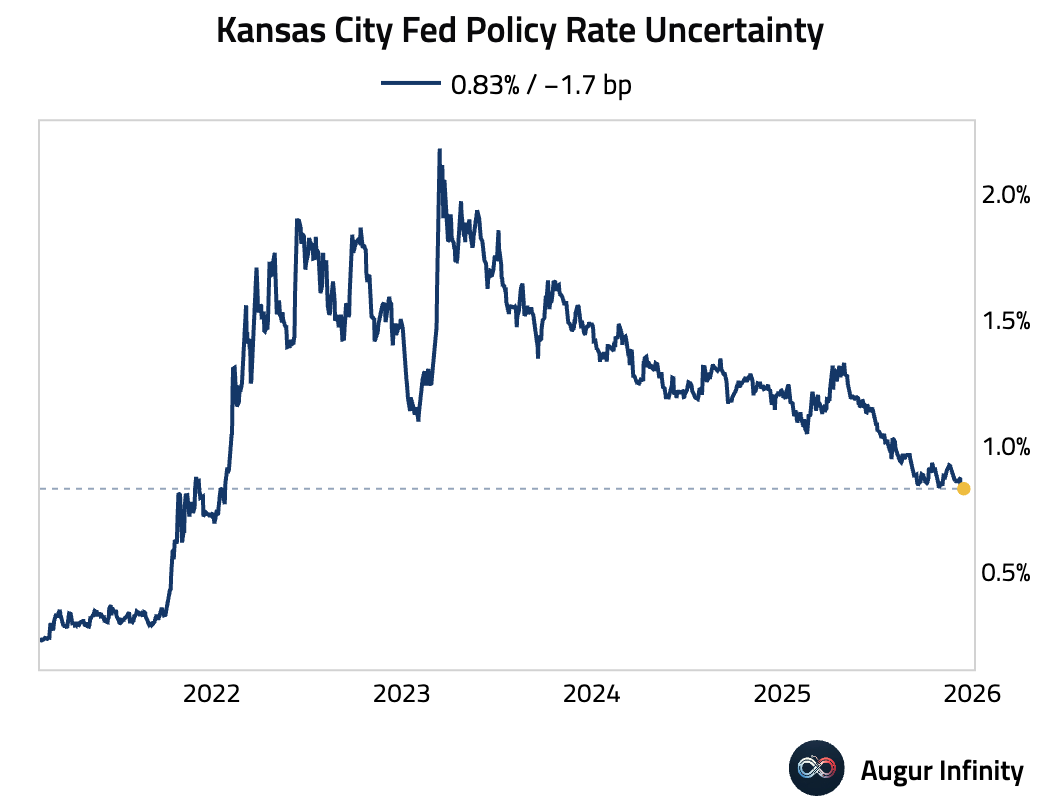

The Kansas City Fed Policy Rate Uncertainty indicator has fallen to the lowest level in three years.

Credit

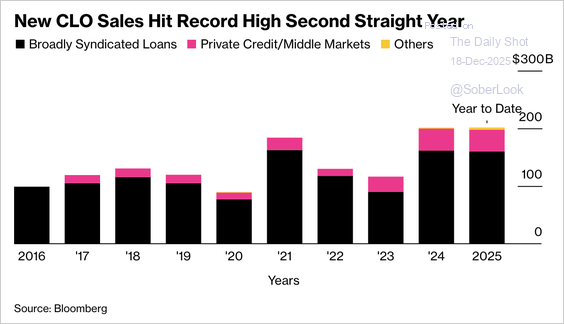

US CLO issuance hit a fresh record of $201.5bn in 2025, driven by strong investor demand for higher-yielding, senior-secured loan exposure and broad participation from banks, insurers, asset managers, ETFs, and Japanese investors.

Source: @markets

Energy

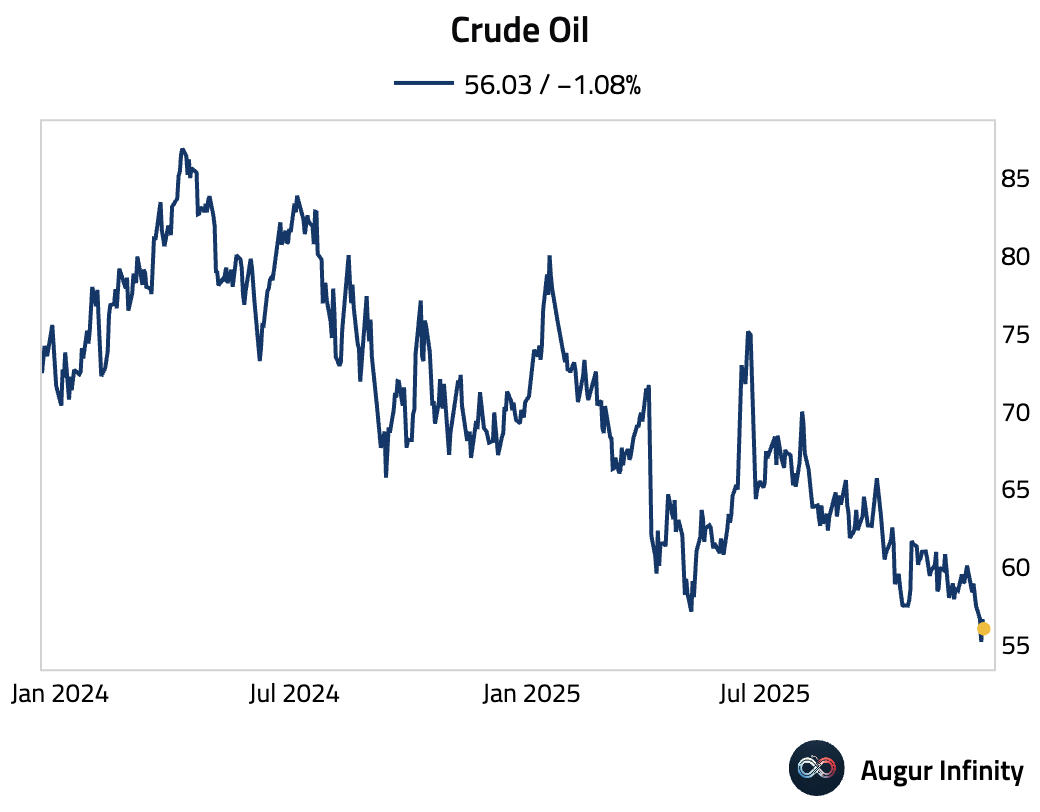

- Oil prices rose for a second day as heightened geopolitical risks—including a US blockade on sanctioned Venezuelan tankers and the threat of tougher sanctions on Russia’s energy sector—outweighed a still-bearish global supply outlook.

Source: @markets

Roughly 80% of Venezuelan crude exports go to China. An effective embargo—on output exceeding 900,000 barrels per day—would severely damage Venezuela’s economy.

Source: @financialtimes

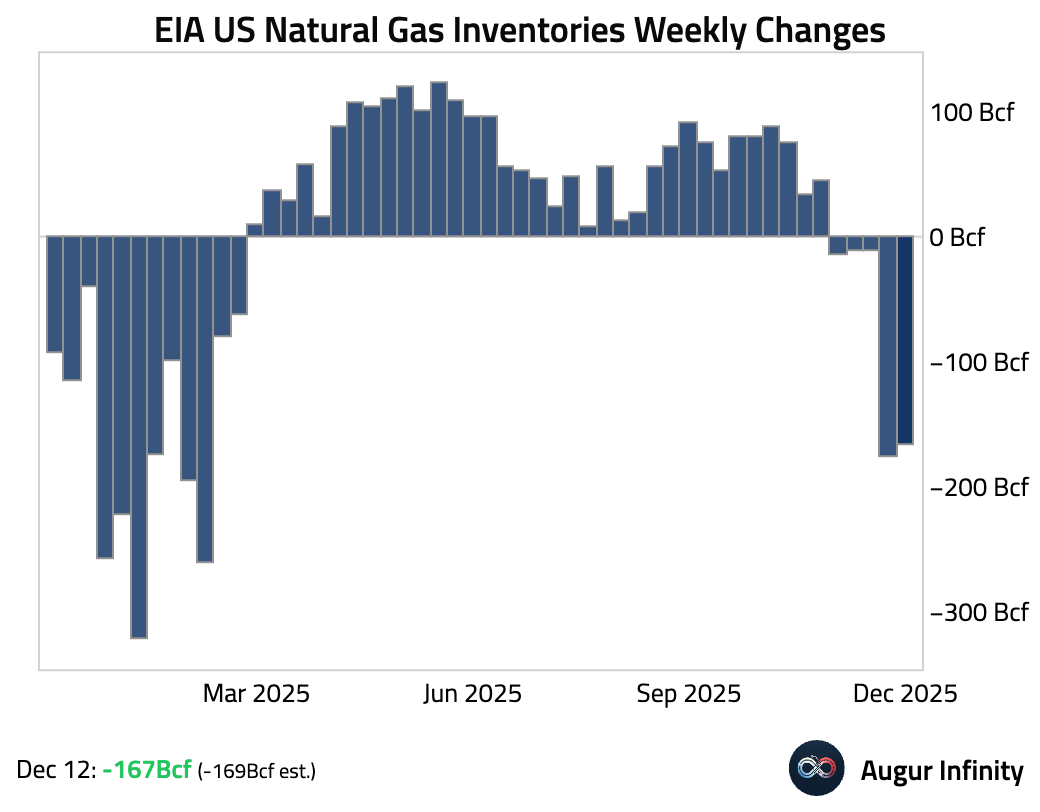

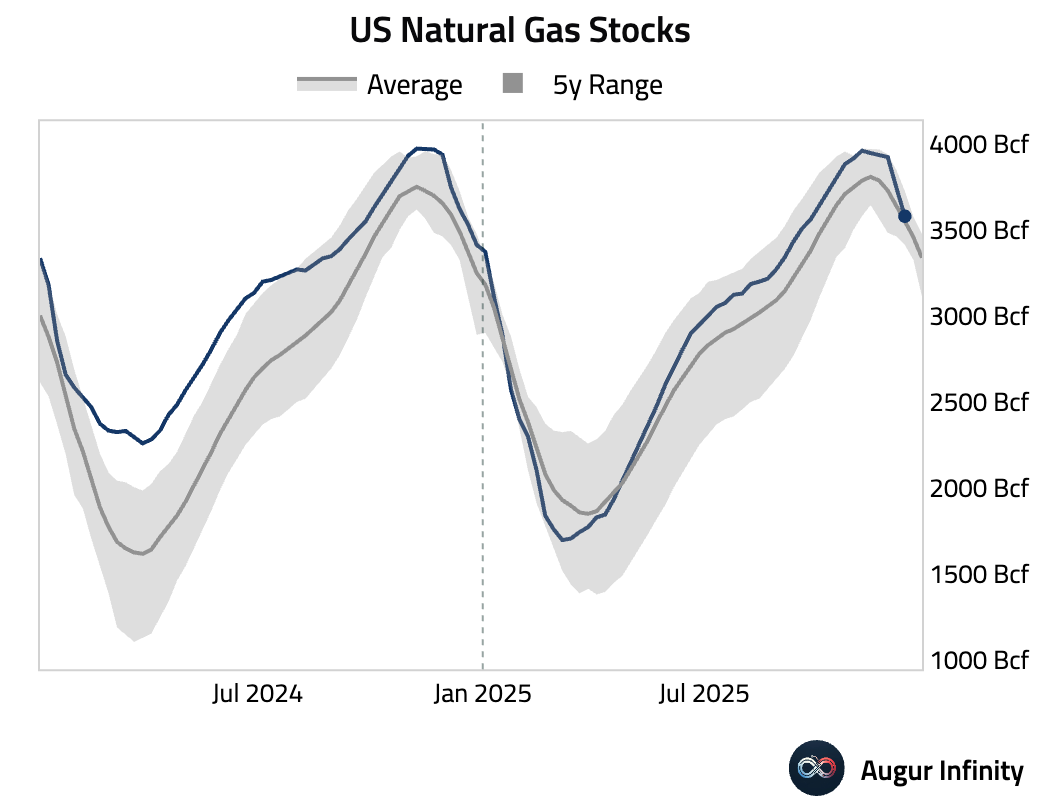

- US natural gas inventories saw a smaller-than-expected draw last week.

Commodities

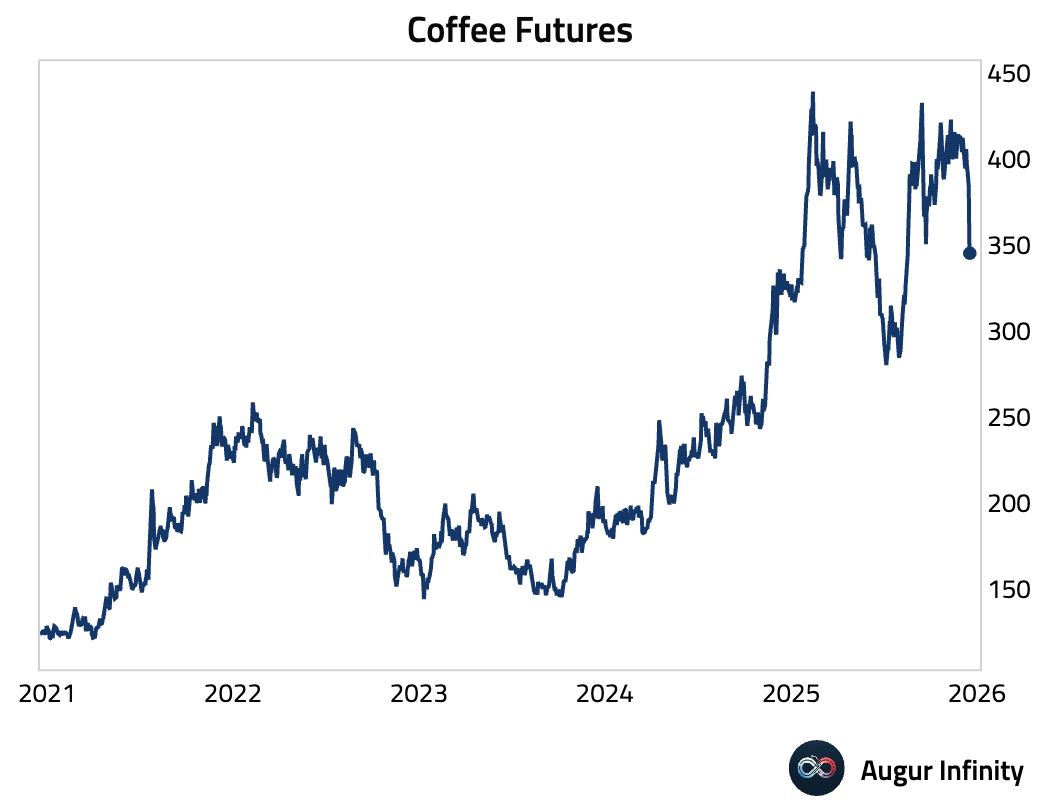

- Coffee entered a bear market.

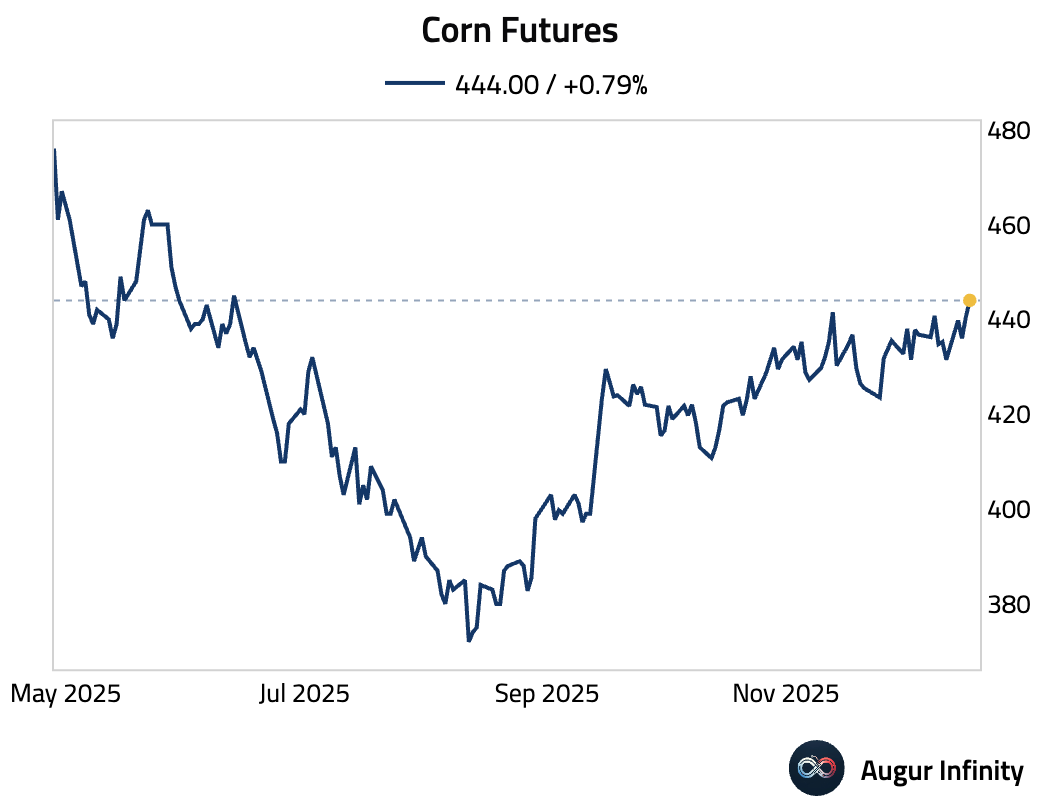

- Corn futures rose to the highest level since June.

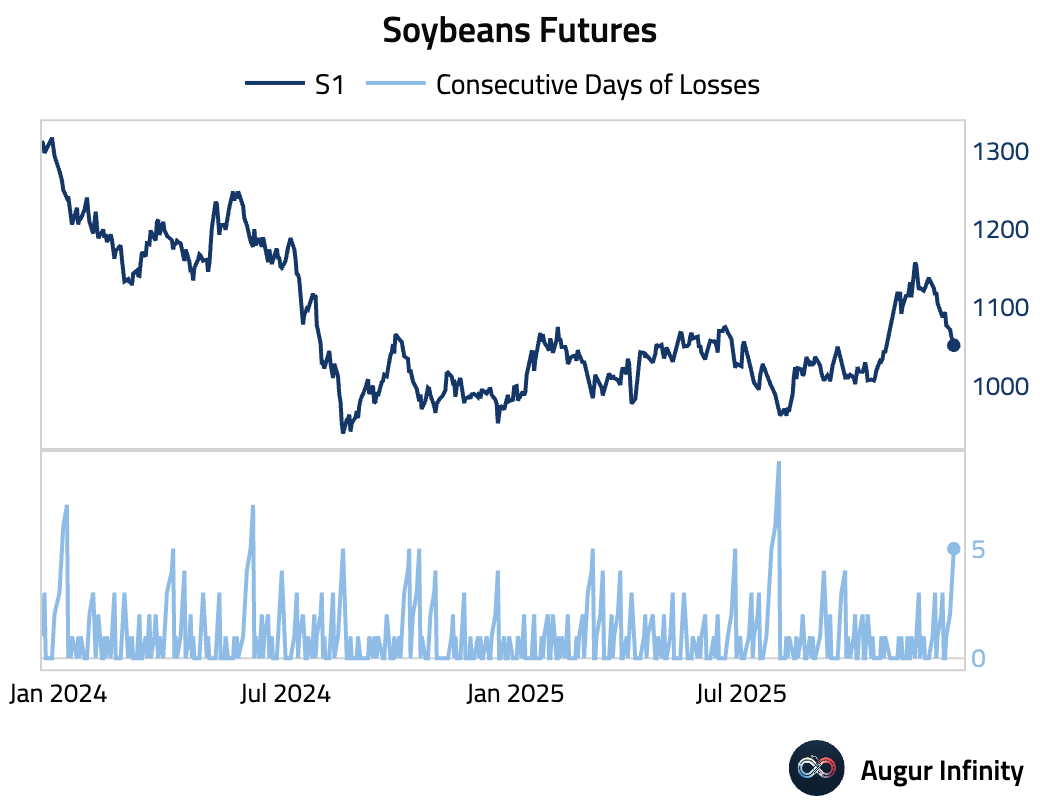

- Soybean futures fell for five consecutive days.

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.