- Headlines

- United States

- Canada

- Europe

- Asia-Pacific

- China

- Emerging Markets ex China

- Equities

- Fixed Income

- FX

Headlines

- Israel struck Iranian nuclear facilities, prompting a retaliatory missile strike from Iran and fueling concerns of a wider conflict in the Middle East.

- The military escalation caused crude oil prices to surge by more than 8%, as the market priced in risks of potential energy supply disruptions from the region.

- In a direct diplomatic fallout, Iran announced it would not participate in nuclear talks that had been scheduled for the upcoming weekend.

United States

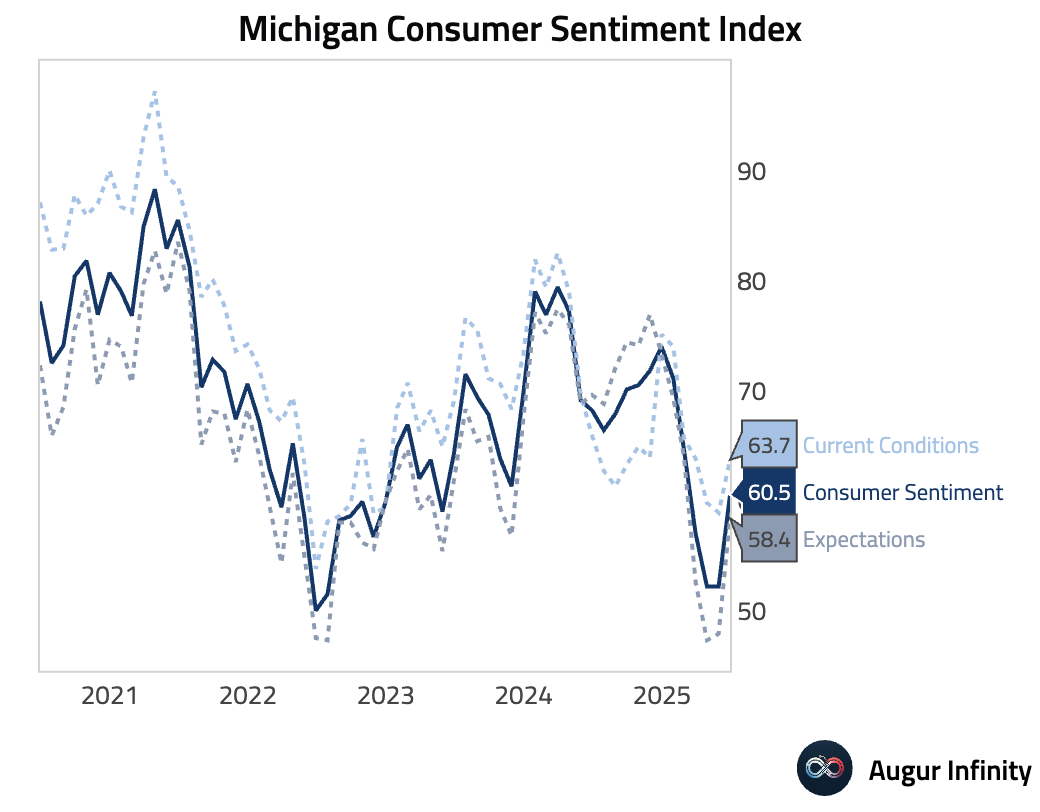

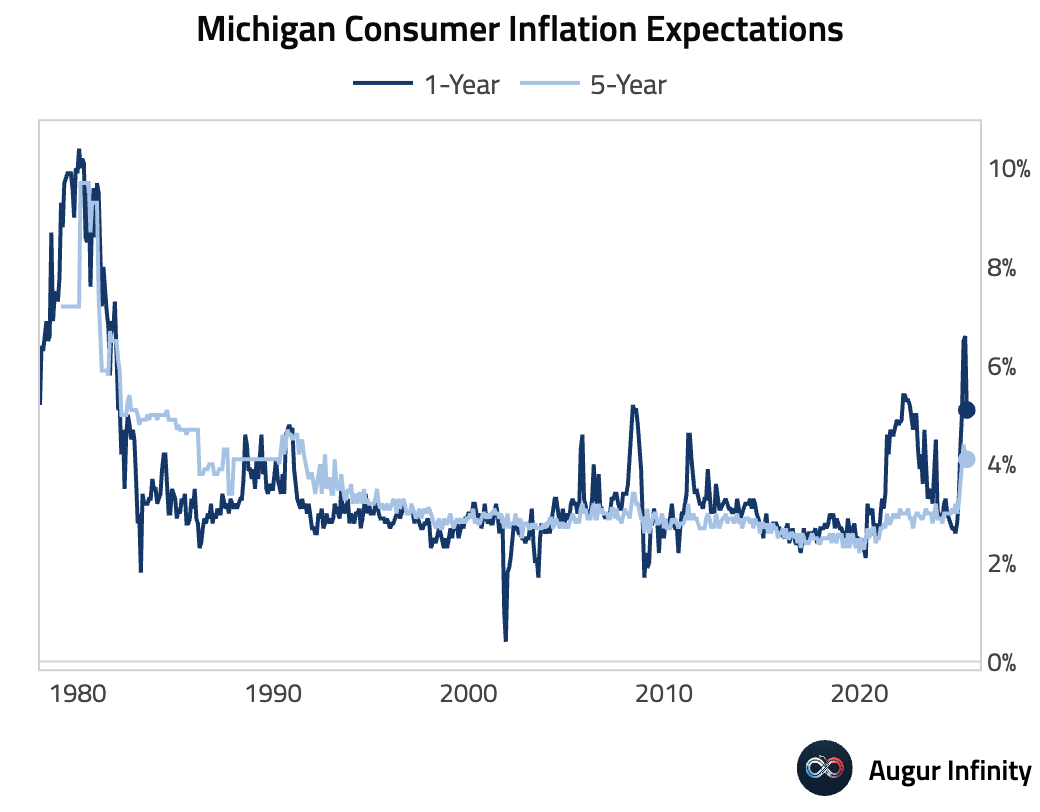

- The preliminary University of Michigan Consumer Sentiment index for June jumped 8.3 points to 60.5, well above the 53.5 consensus. According to the University of Michigan’s analysis, the improvement suggests that “Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed.” Both the current conditions (63.7 vs. 59.4 consensus) and expectations (58.4 vs. 49.0 consensus) subindices posted strong beats. Median one-year inflation expectations fell sharply to 5.1% from 6.6%, while five-to-ten year expectations edged down to 4.1% from 4.2%.

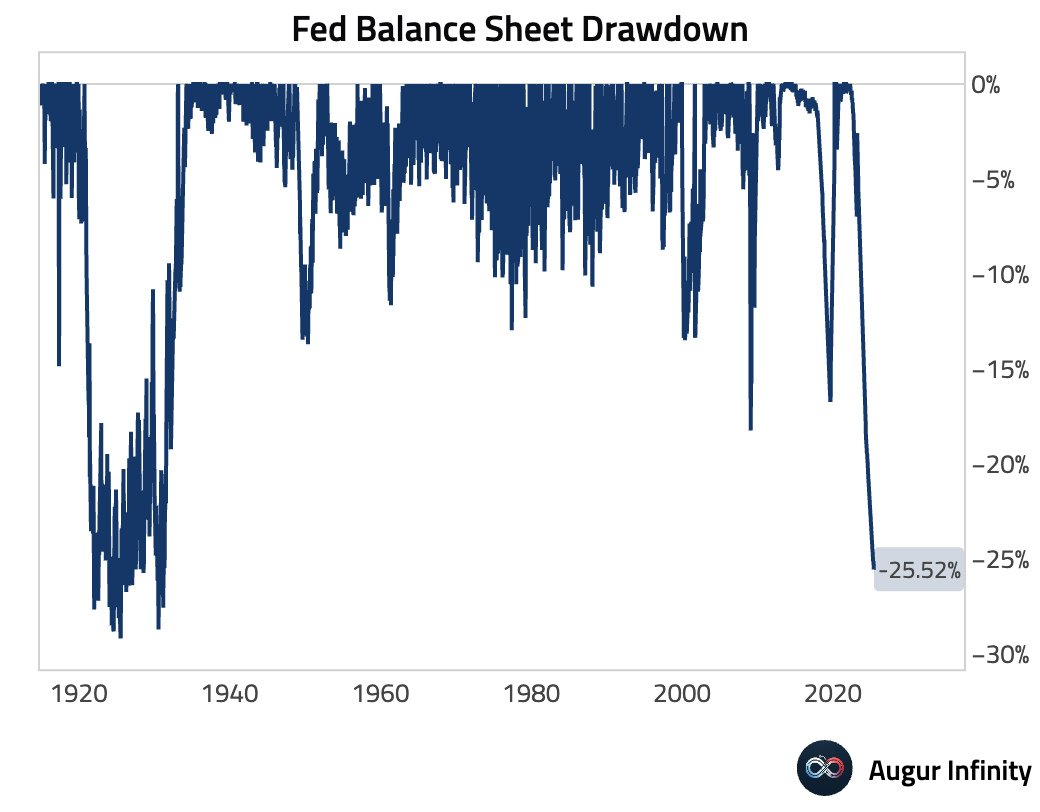

- The Federal Reserve's balance sheet increased slightly to $6.68 trillion for the week ending June 12, up from $6.67 trillion the prior week.

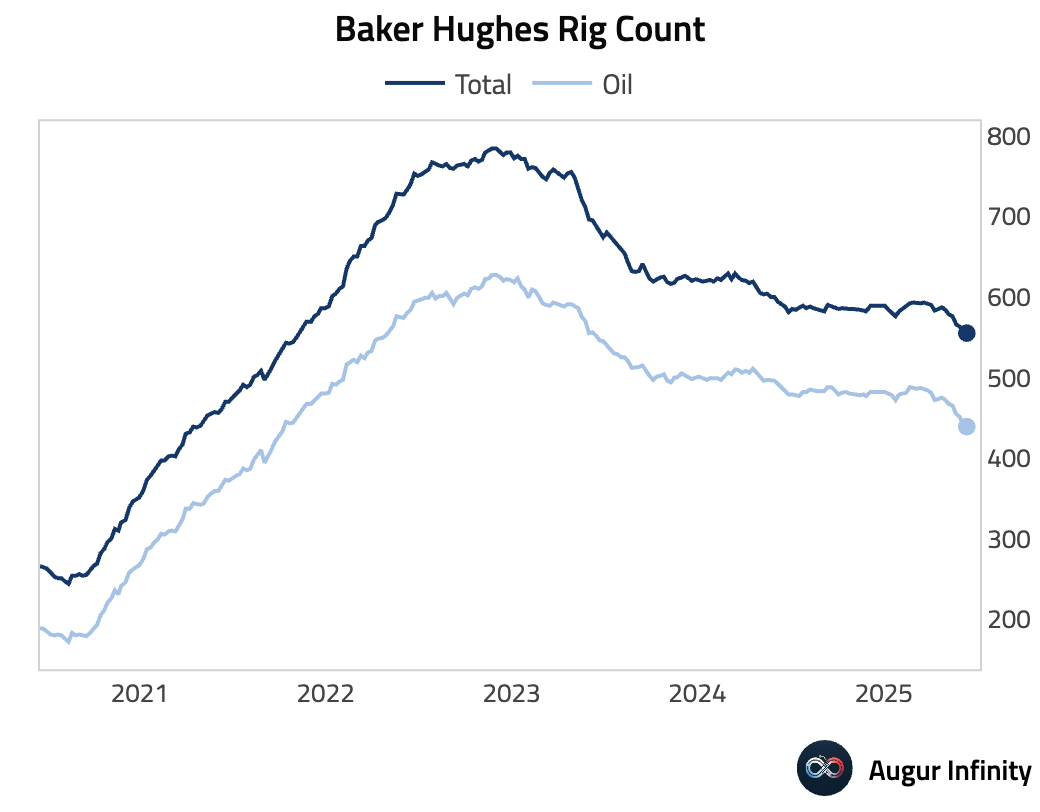

- The Baker Hughes total rig count fell by 4 to 555. The oil rig count decreased by 3 to 439, its lowest level since October 2021.

Canada

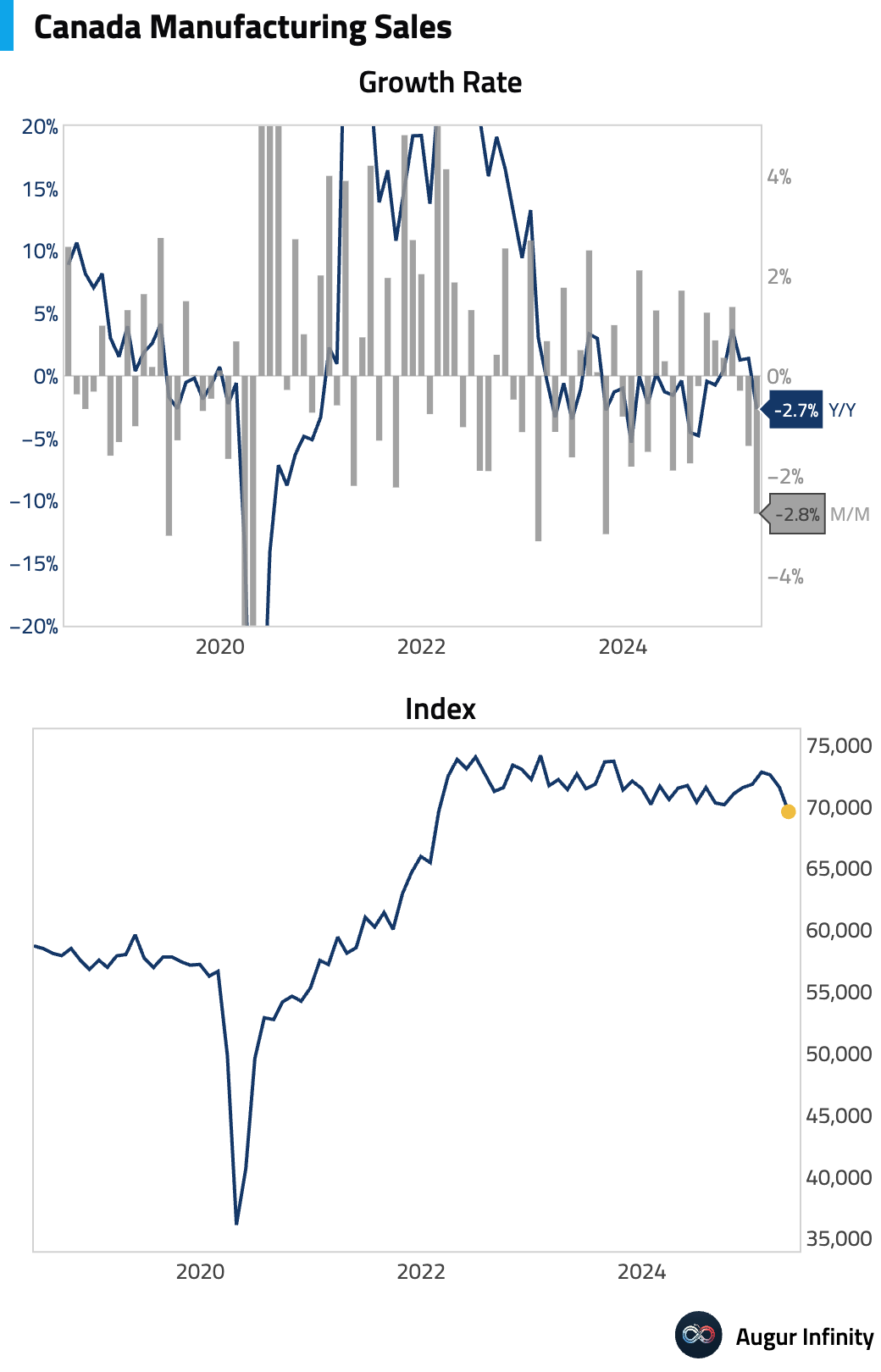

- Canadian manufacturing sales fell 2.8% M/M in April, a larger contraction than the -2.0% consensus and the prior month's -1.4% decline.

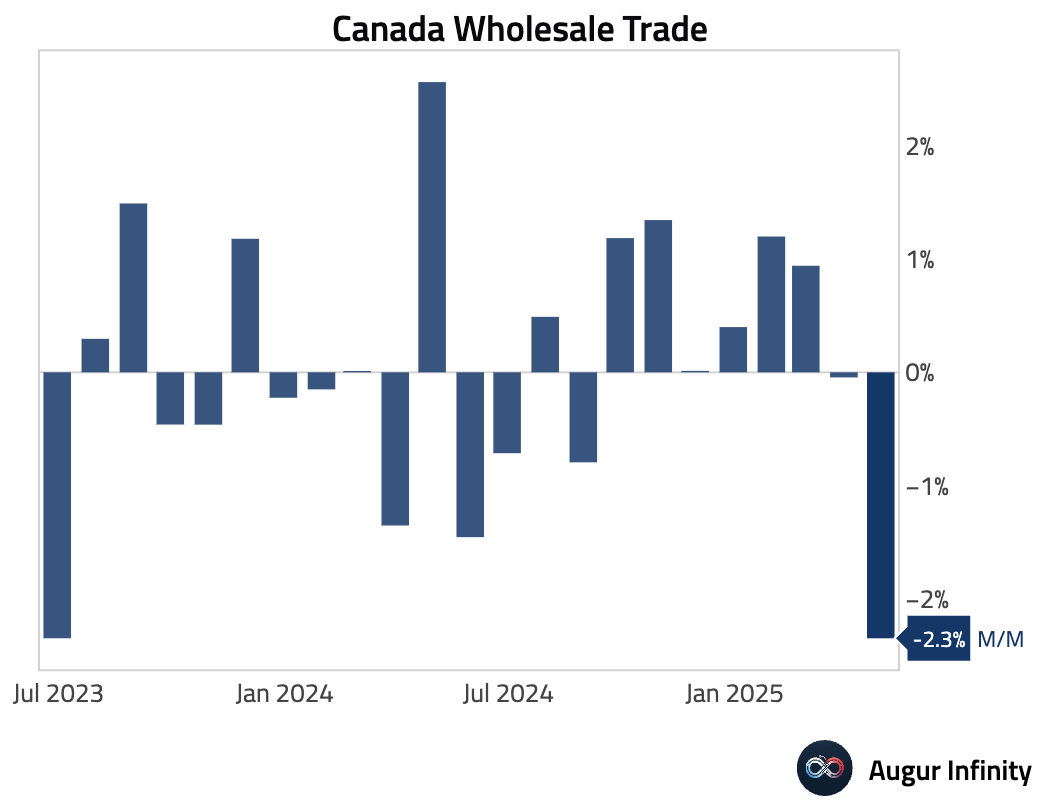

- Wholesale sales in April dropped 2.3% M/M, significantly below the -0.9% consensus. This marks the lowest reading since February 2023.

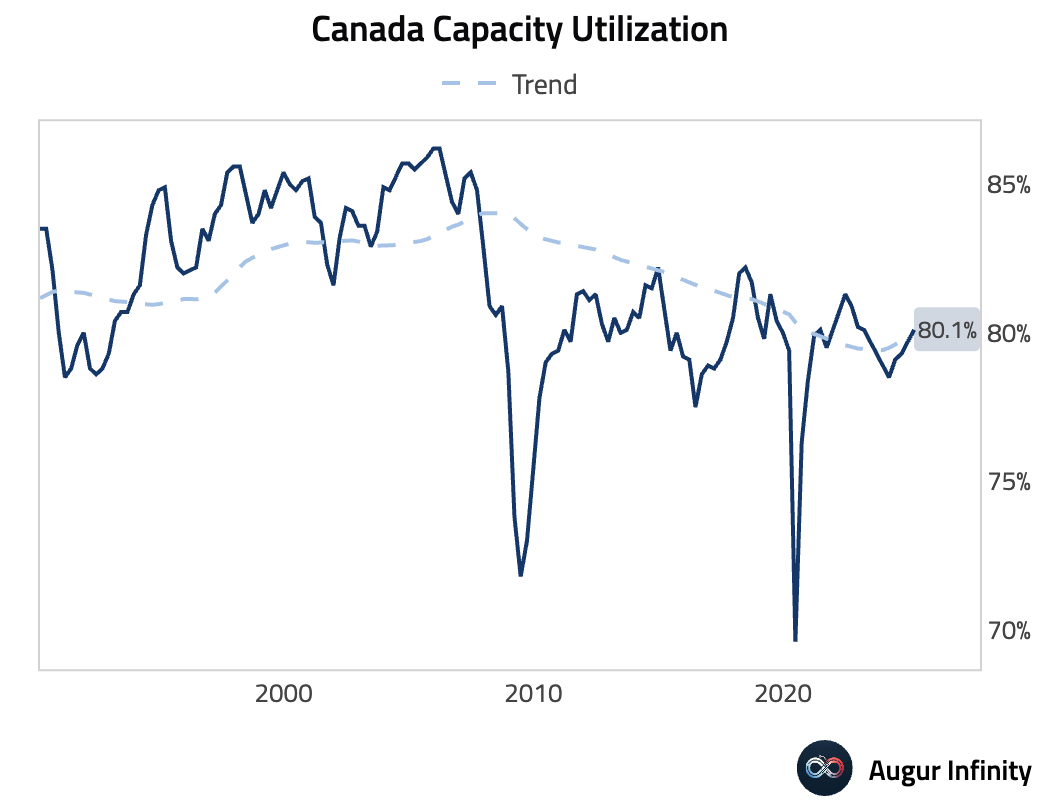

- Capacity utilization in the first quarter rose to 80.1% from a revised 79.7% in the previous quarter, slightly beating the 79.8% forecast.

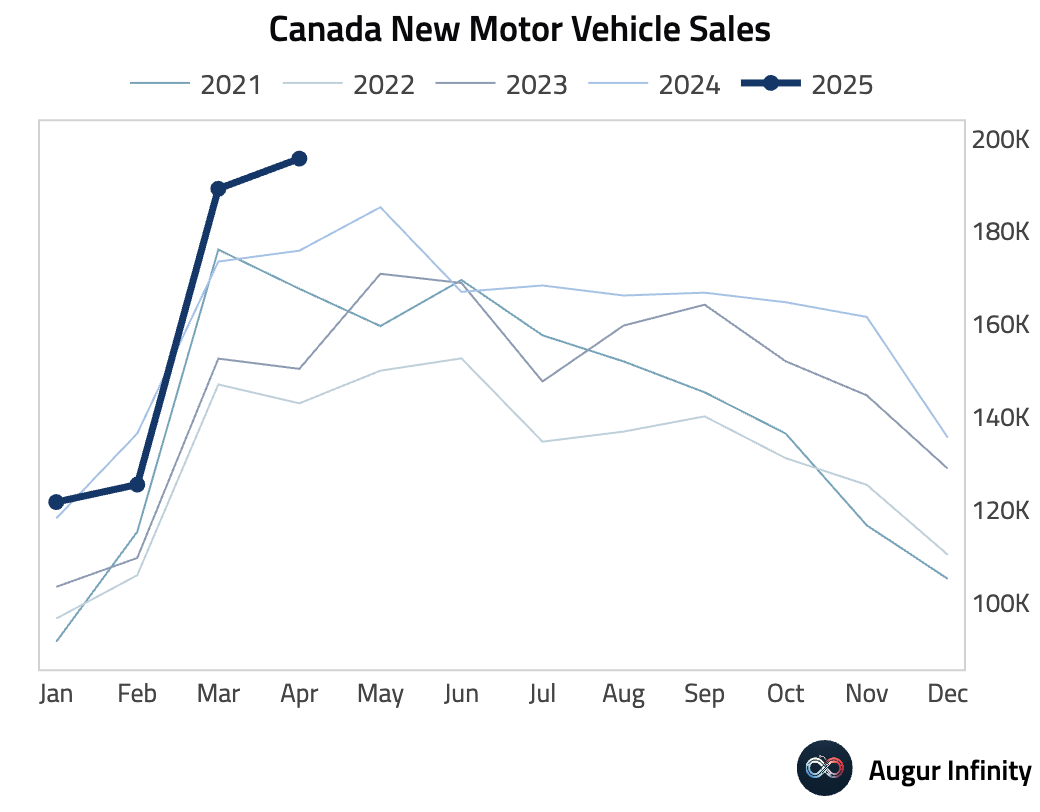

- New motor vehicle sales in April rose to 195.7k from 189.0k in March, reaching the highest level since May 2019.

Europe

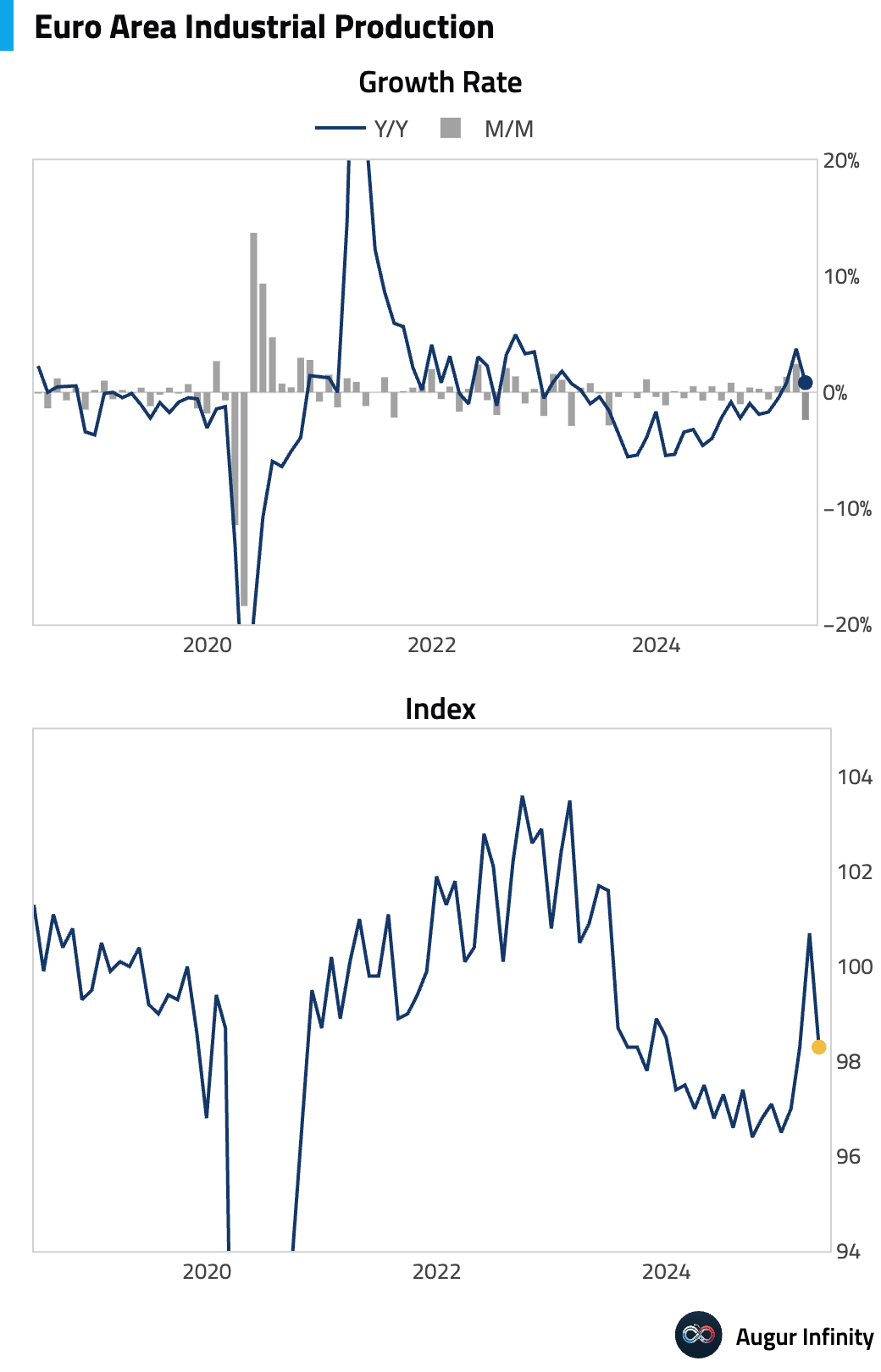

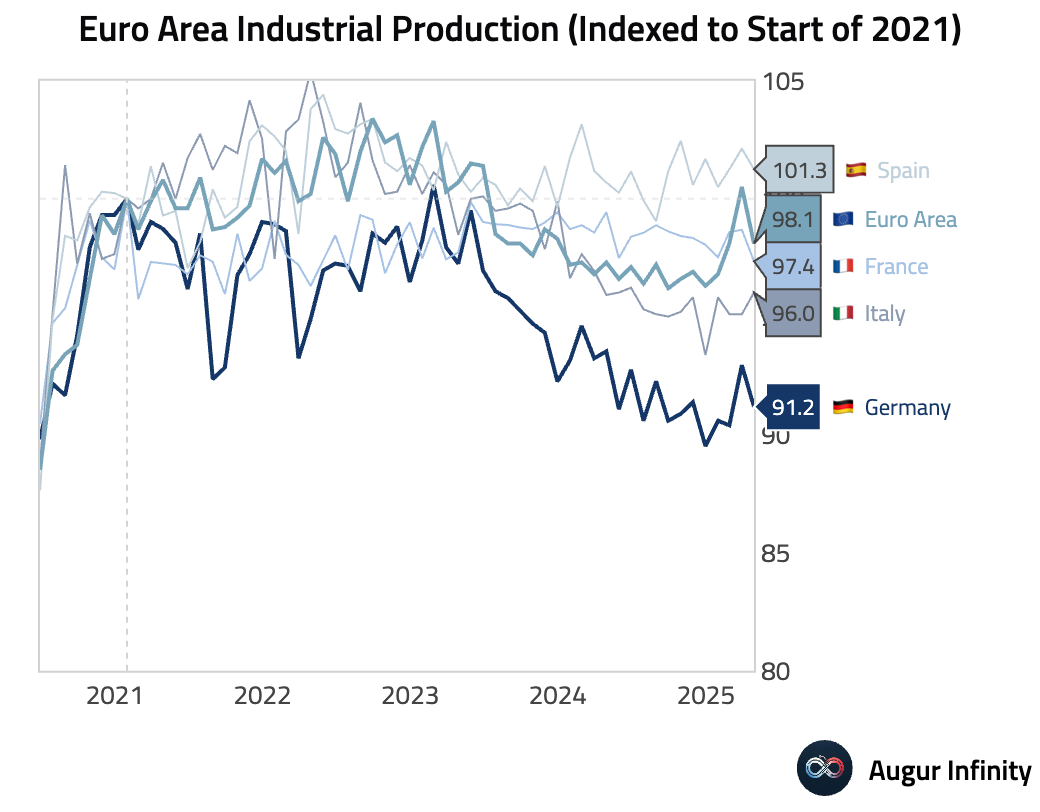

- Eurozone industrial production declined 2.4% M/M in April, a much weaker result than the -1.7% consensus and a sharp reversal from March's 2.4% increase. Year-over-year growth slowed to 0.8%, below the 1.4% forecast.

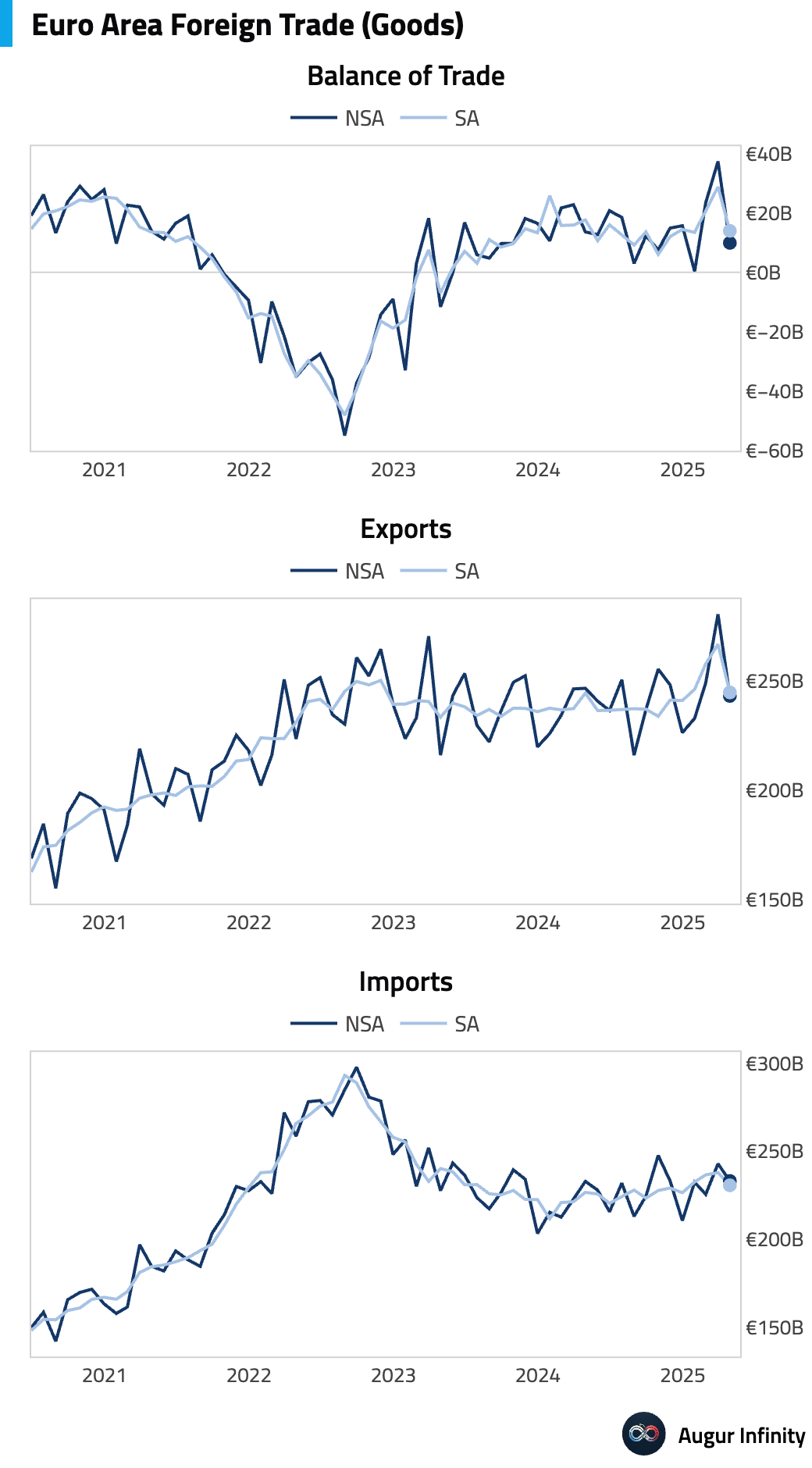

- The Eurozone's goods trade surplus narrowed to €9.9B in April, falling short of the €18.2B consensus and down from €37.3B in March.

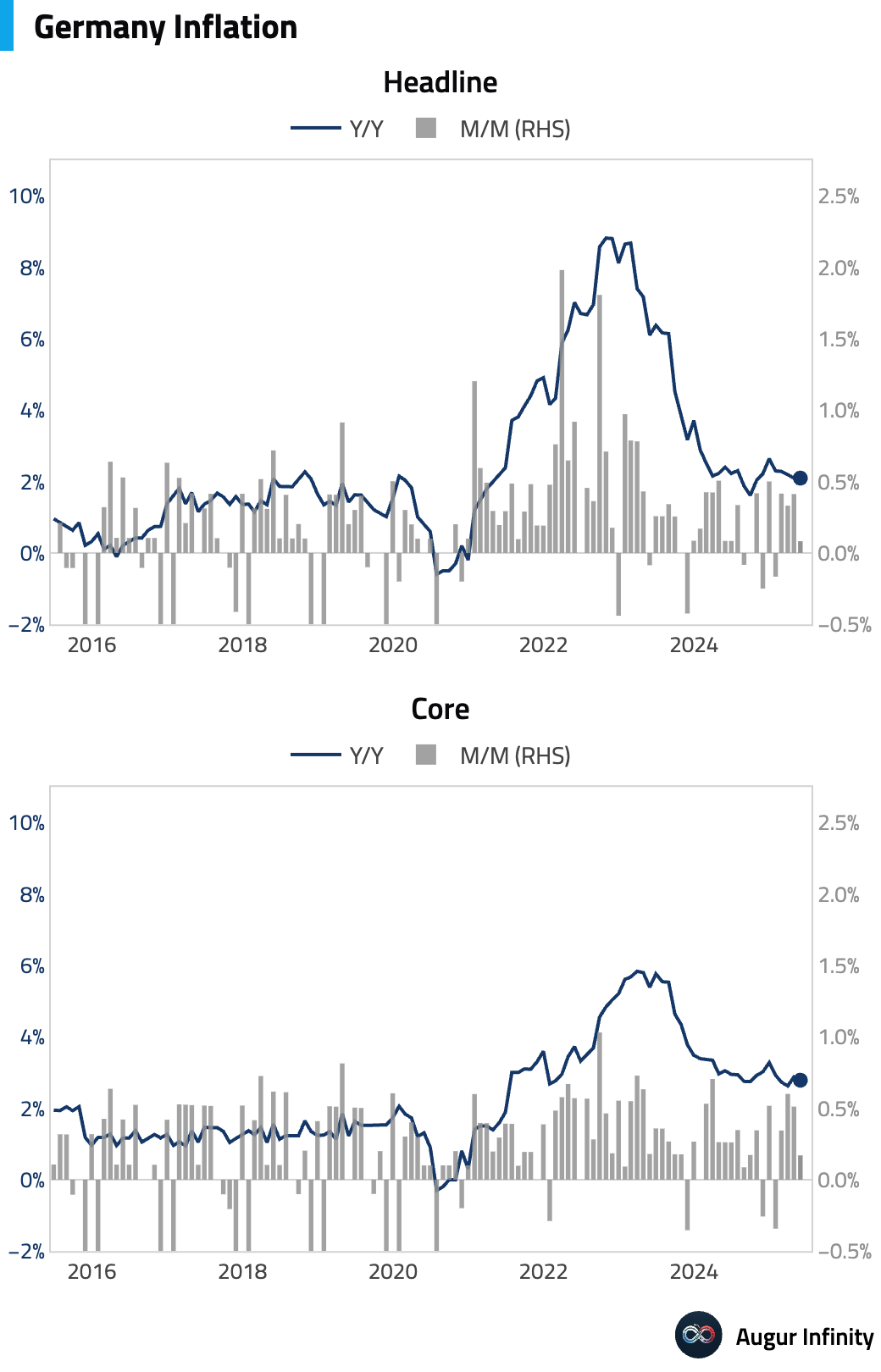

- Final May inflation data for Germany was unrevised, with the headline rate holding at 2.1% Y/Y and the EU-harmonised rate at 2.1% Y/Y.

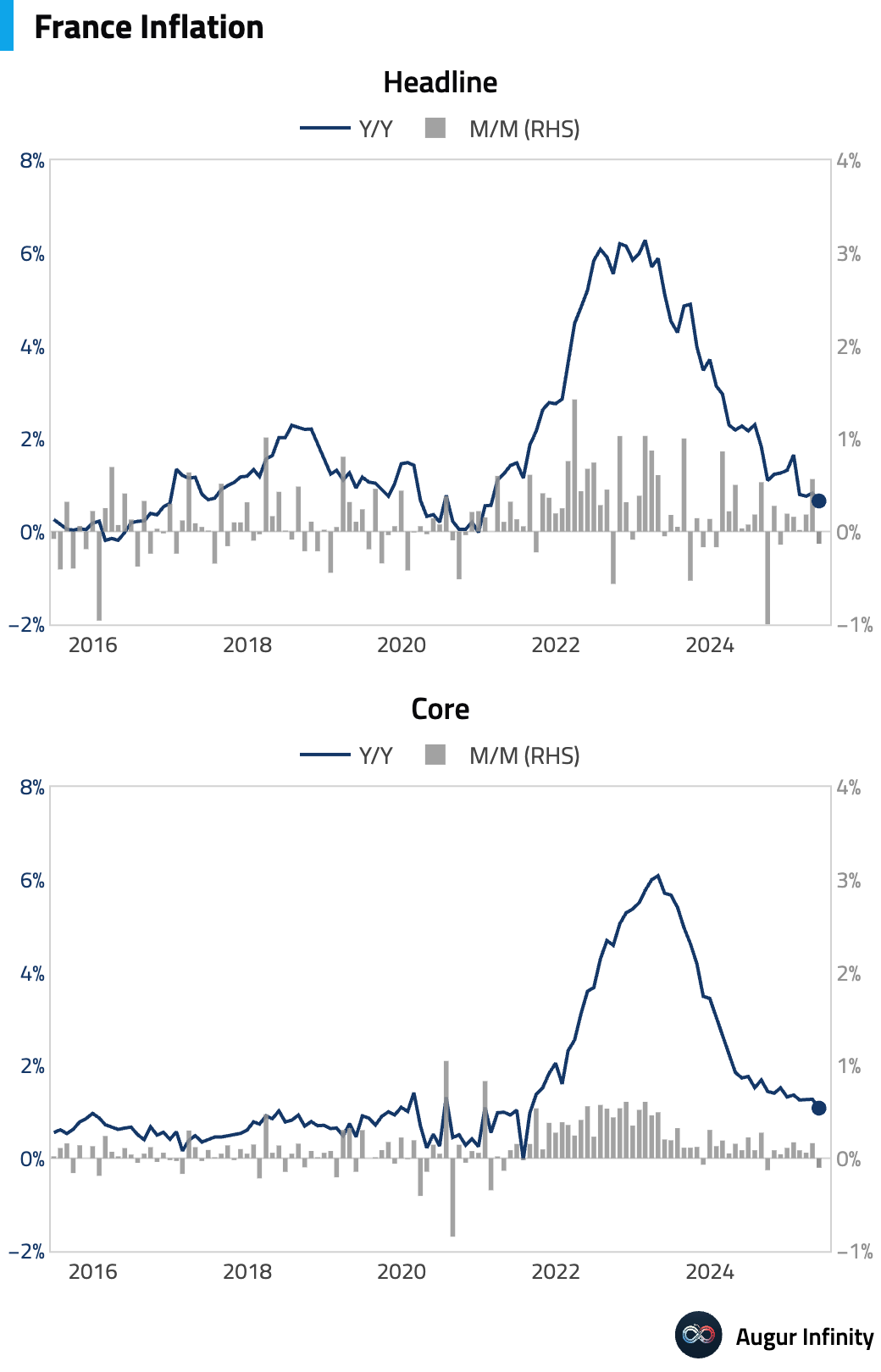

- Final May inflation figures for France were confirmed at 0.7% Y/Y, down from 0.8% in April. The EU-harmonised rate printed at 0.6% Y/Y.

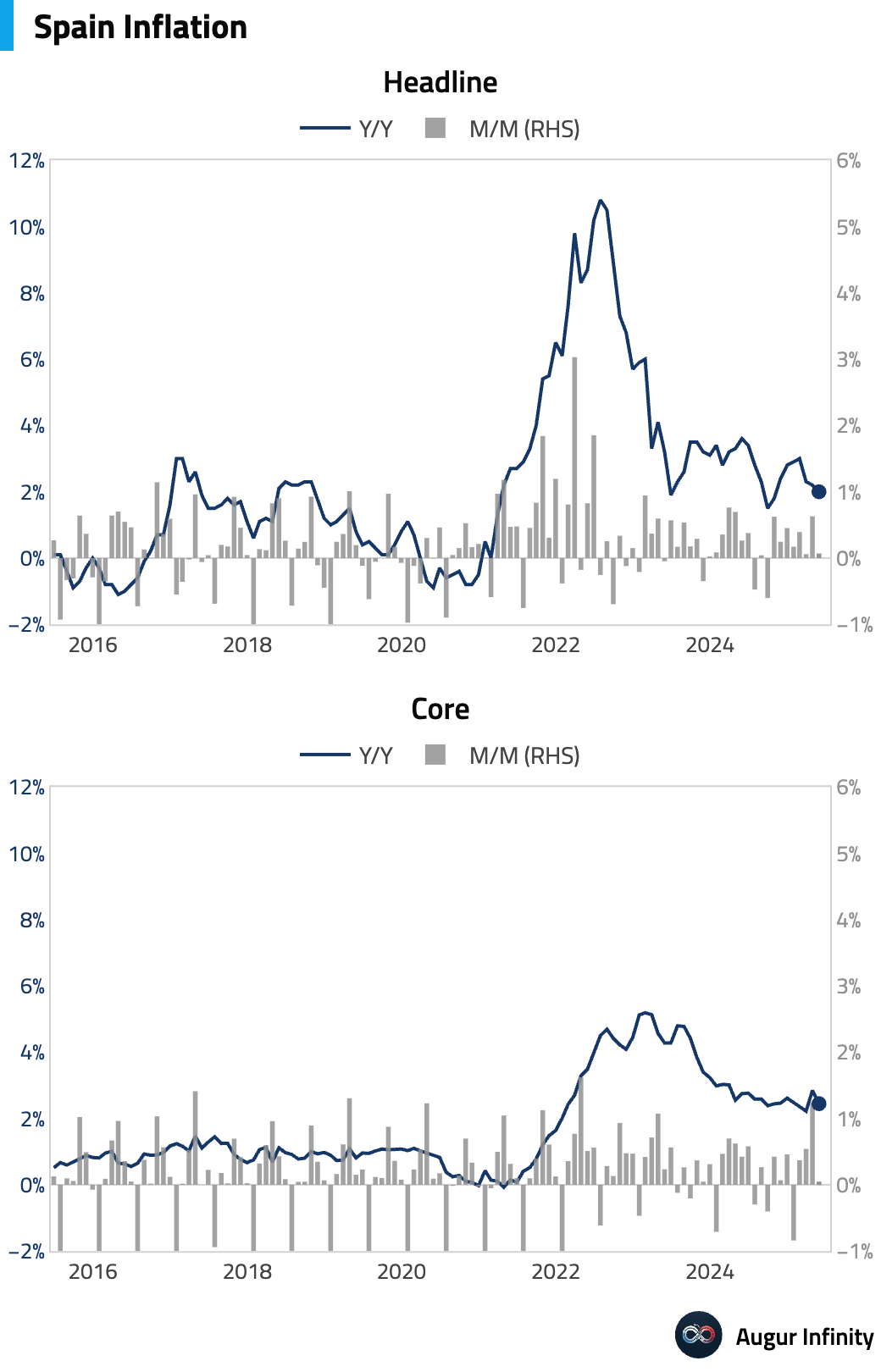

- Spain's final May CPI was confirmed at 2.0% Y/Y, a slight tick down from April's 2.2% reading and slightly above the 1.9% consensus. The core inflation rate also moderated to 2.2% Y/Y from 2.4%.

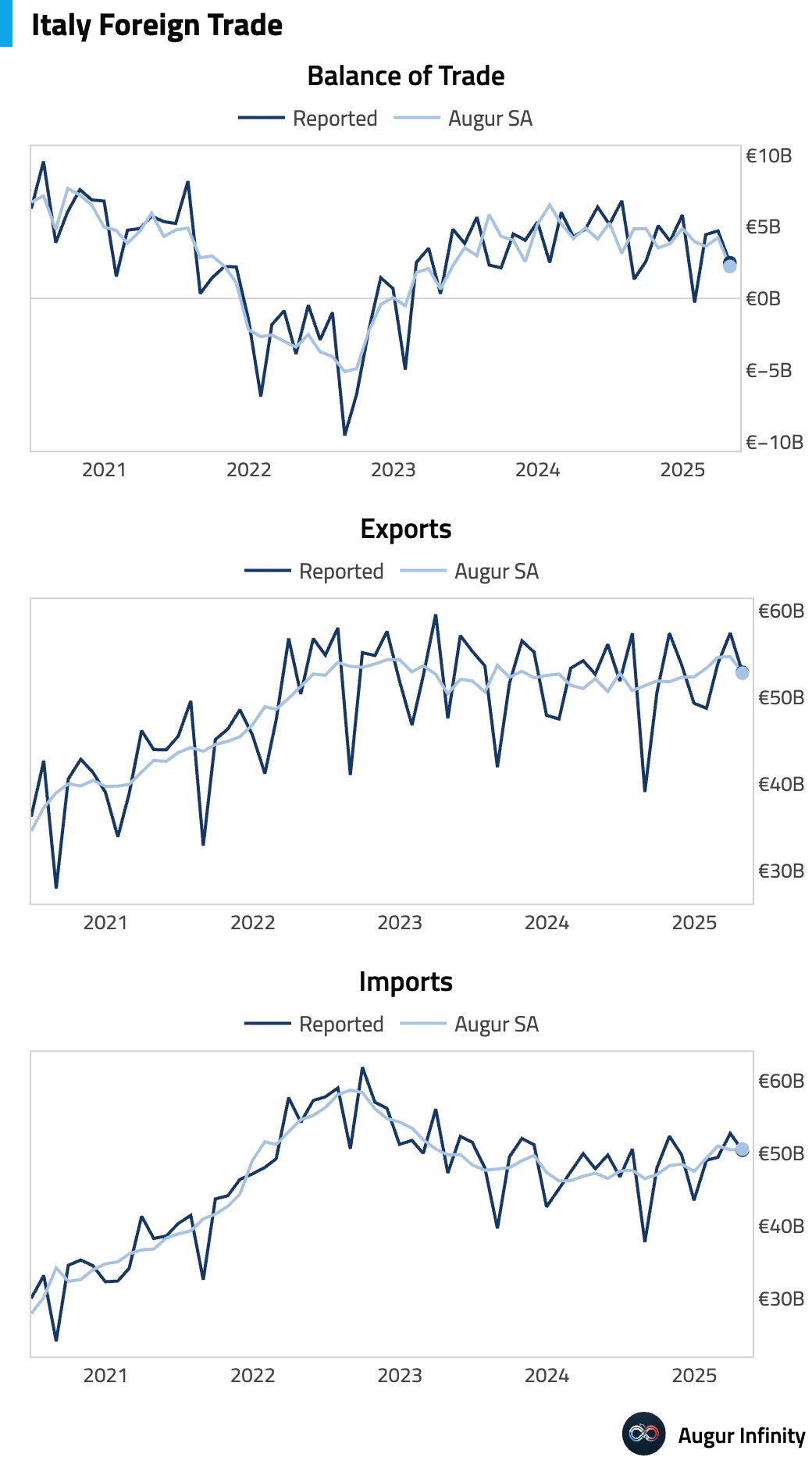

- Italy's trade surplus shrank to €2.48B in April, well below the €2.75B forecast and down from €4.71B in the previous month.

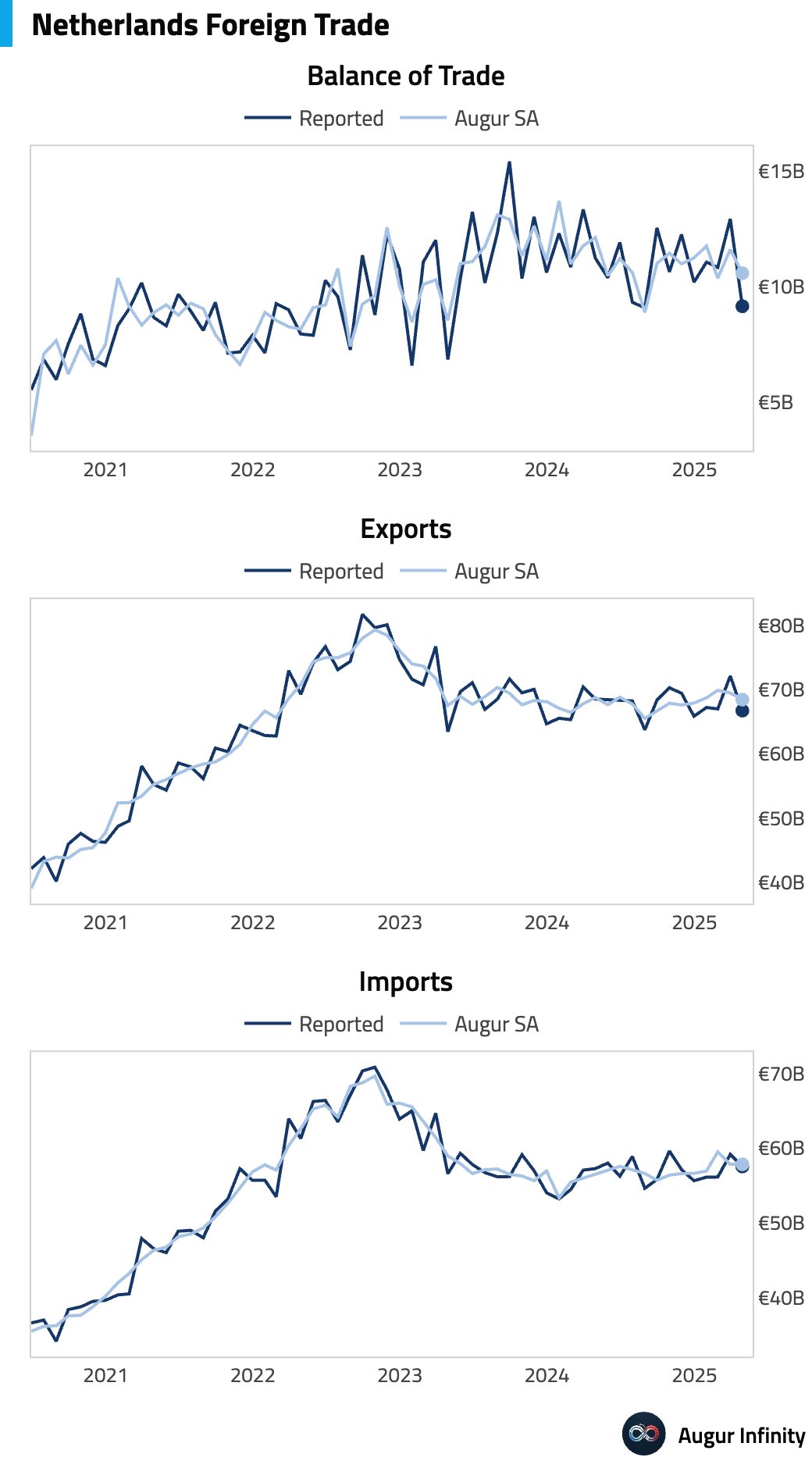

- The Netherlands' trade surplus narrowed to €9.14B in April from €12.92B in March.

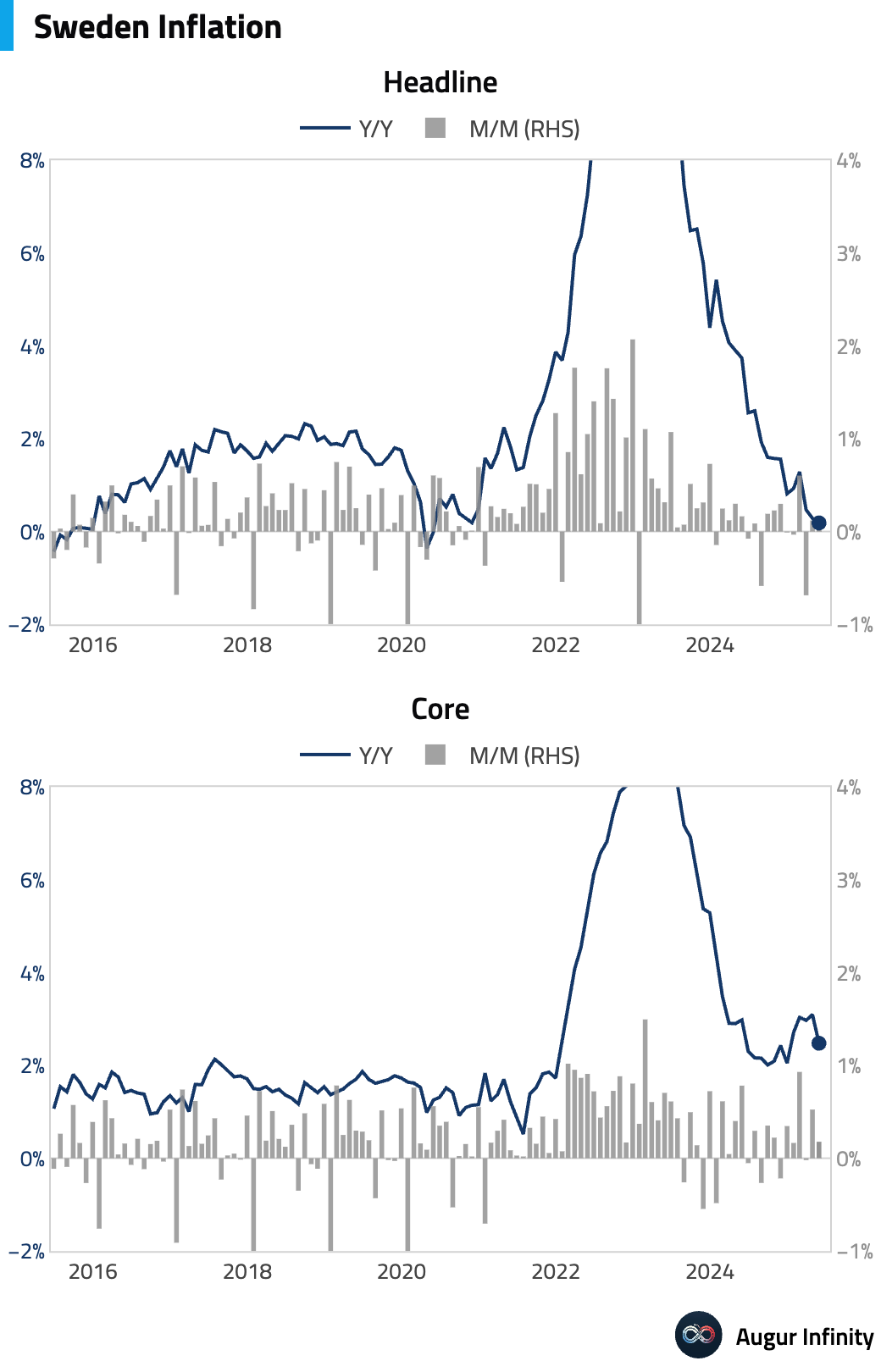

- Final May inflation data for Sweden was in line with expectations, with the headline rate at 0.2% Y/Y and the CPIF rate steady at 2.3% Y/Y.

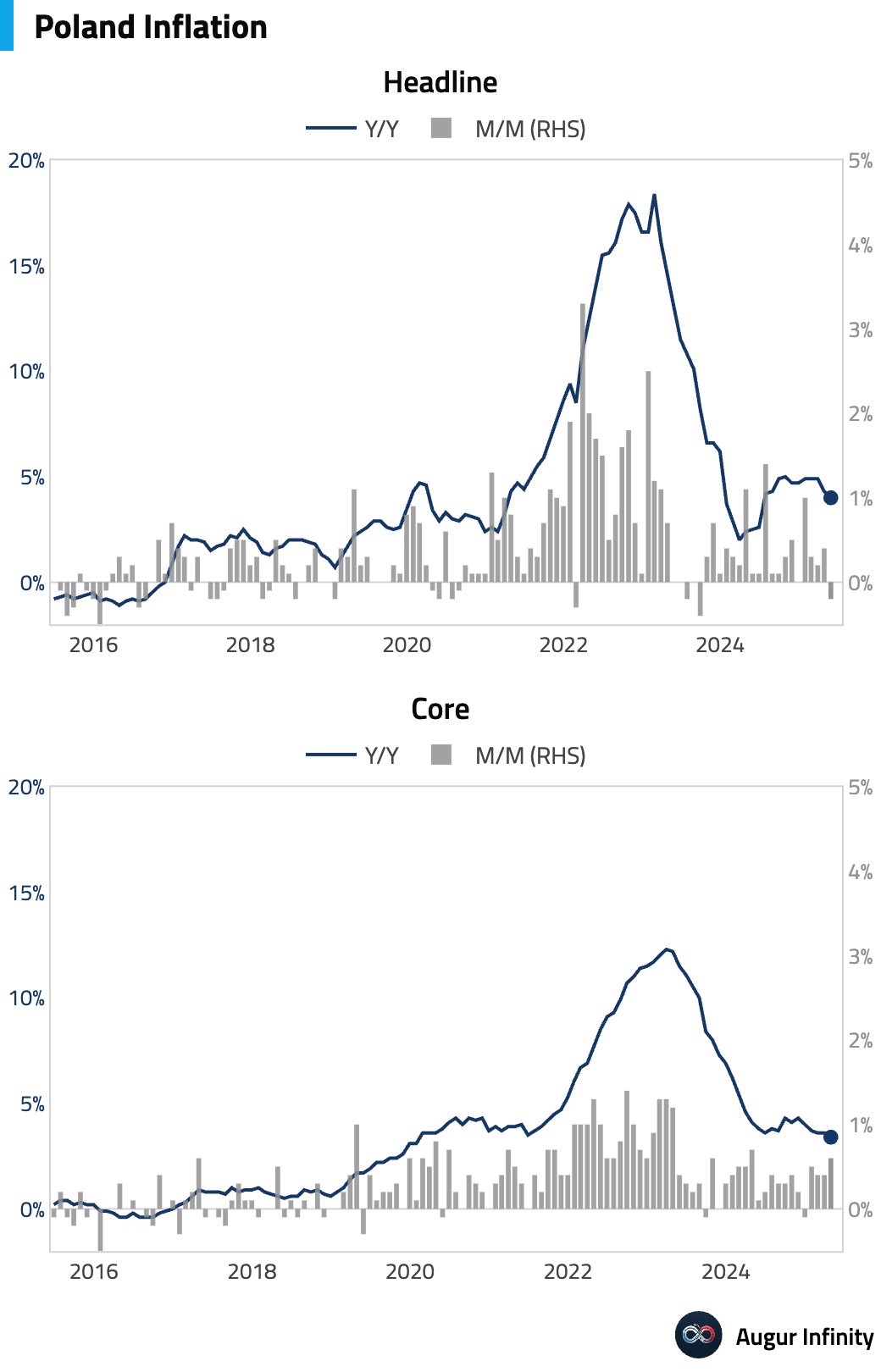

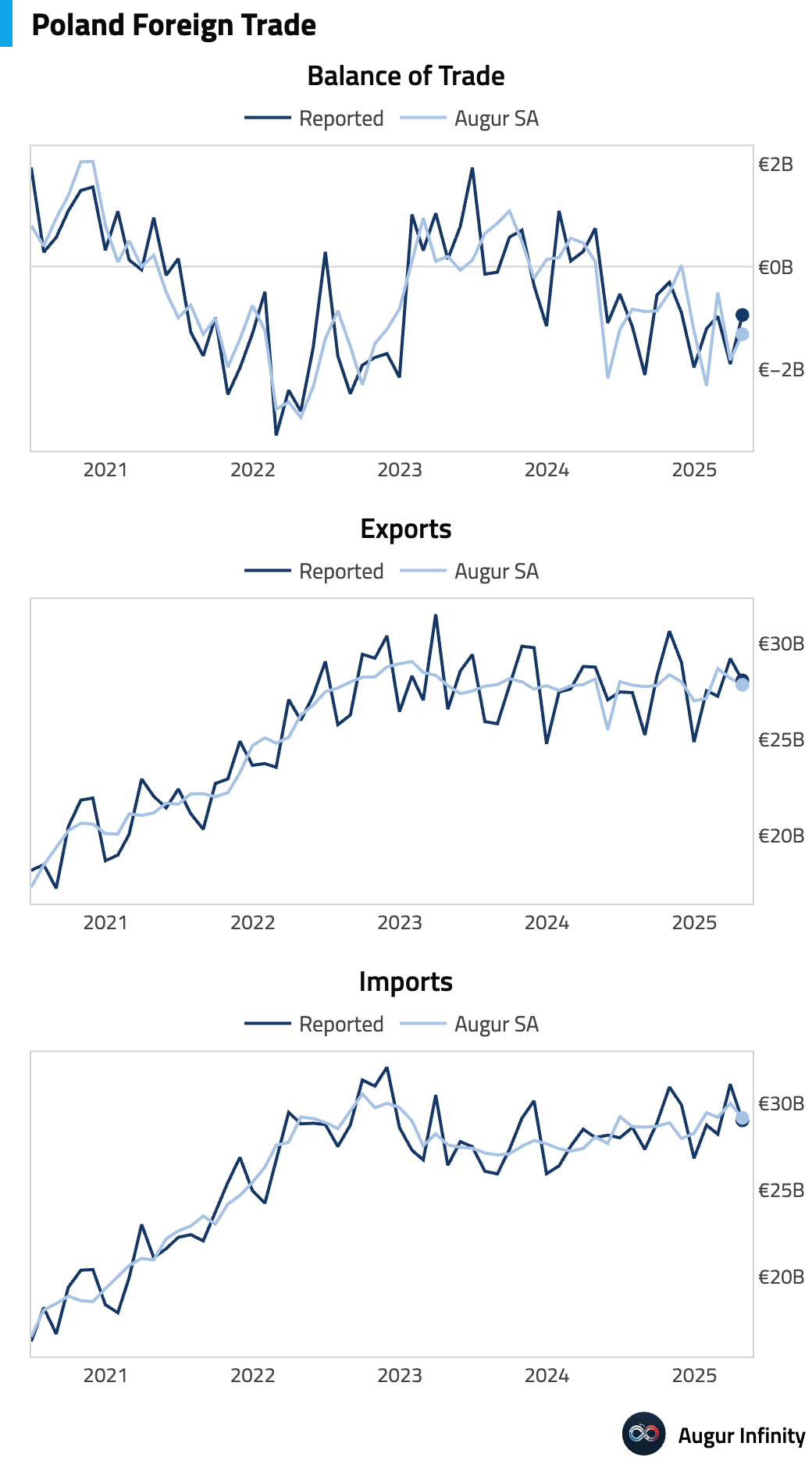

- Poland's final May CPI confirmed a moderation in inflation to 4.0% Y/Y from 4.3% in April, slightly below the 4.1% consensus. In April, the trade balance narrowed to a deficit of €0.94B, while the current account posted a smaller-than-expected deficit of €0.37B.

Asia-Pacific

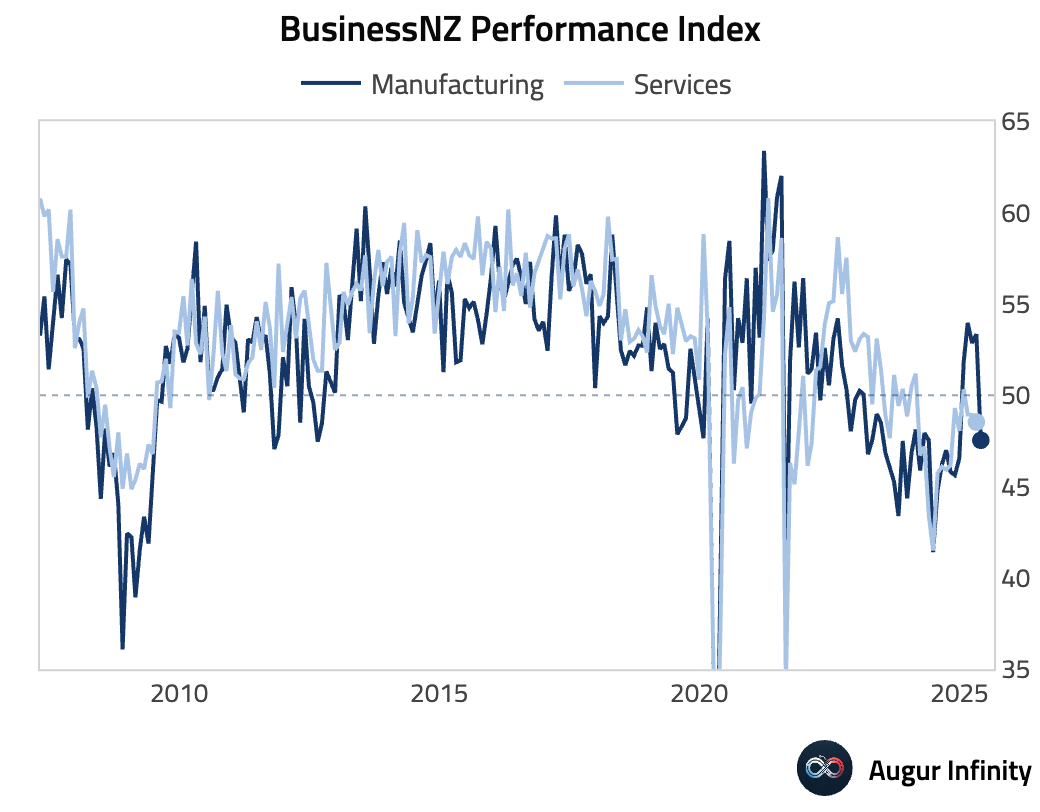

- New Zealand's Business NZ PMI fell to 47.5 in May from 53.3, dropping back into contractionary territory and marking its lowest reading in six months.

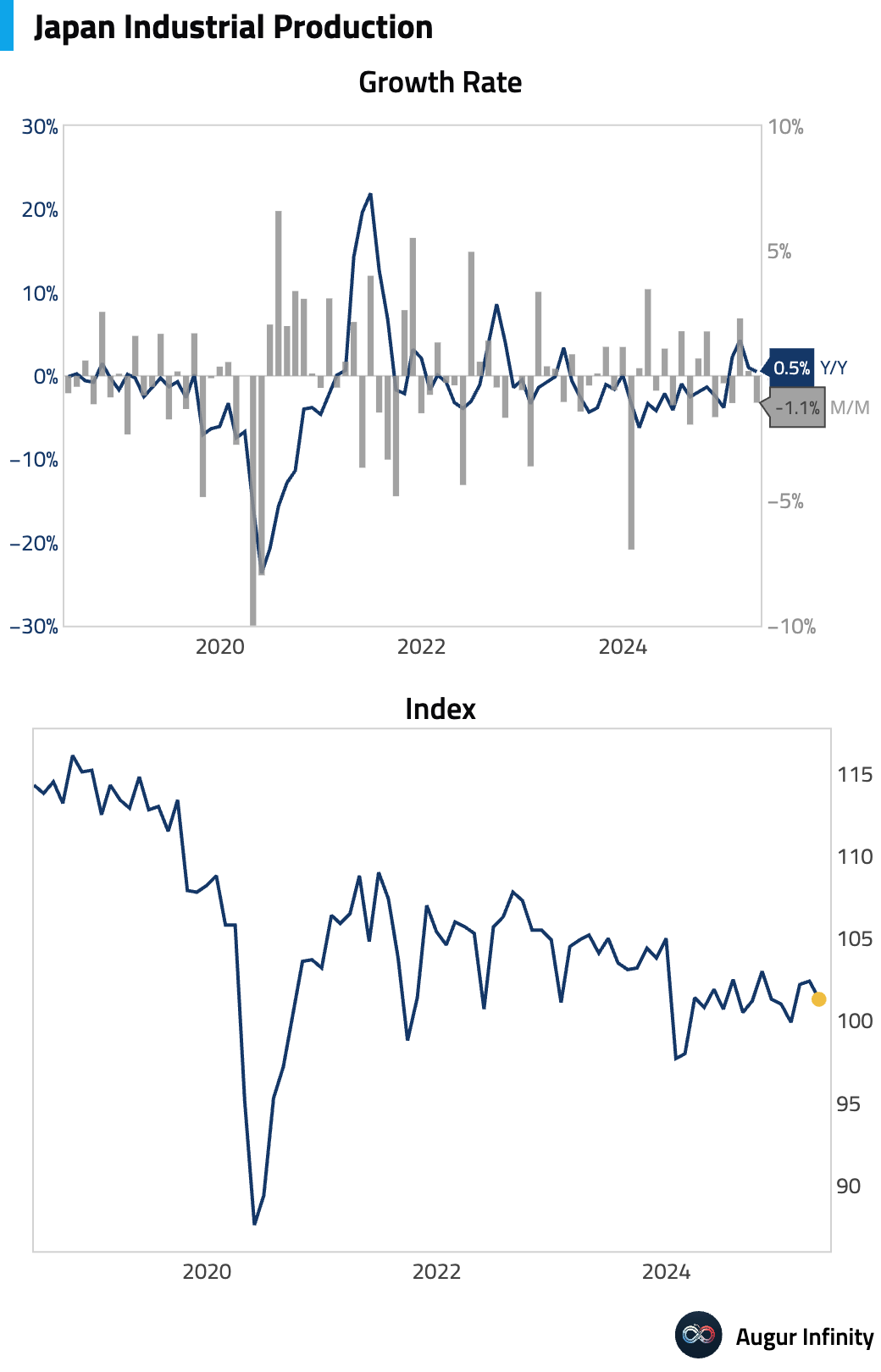

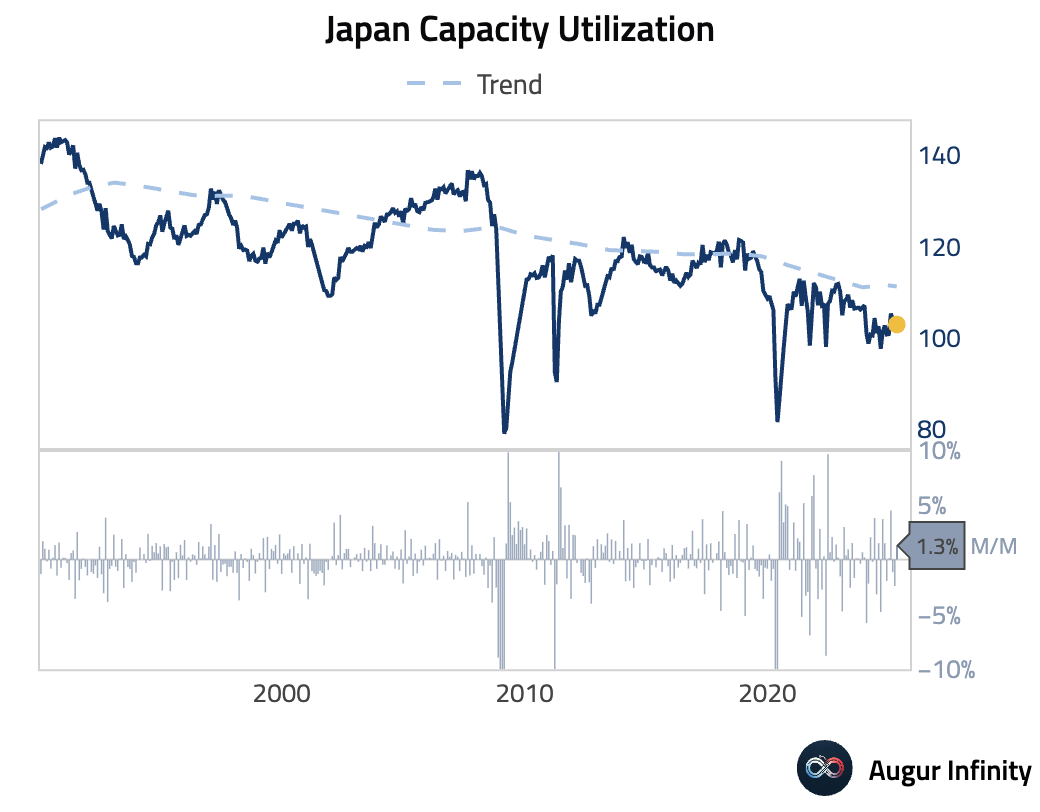

- In Japan, final April industrial production was revised to -1.1% M/M from a preliminary -0.9%, while the Y/Y figure was confirmed at 0.5%. Separately, capacity utilization rebounded by 1.3% M/M after a 2.4% fall in March.

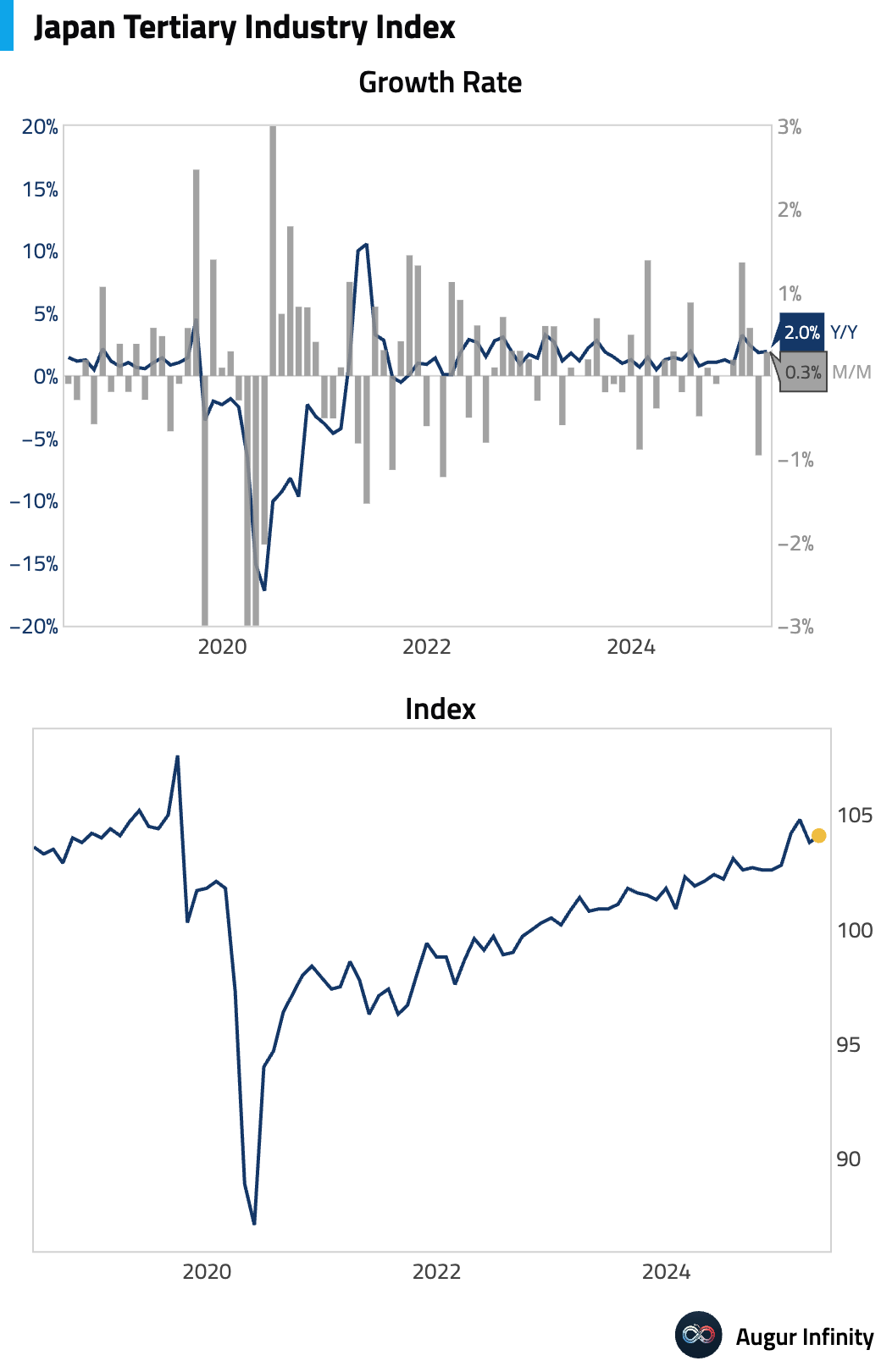

- Japan's Tertiary Industry Index, a measure of service sector activity, rose 0.3% M/M in April, slightly better than the 0.2% consensus.

China

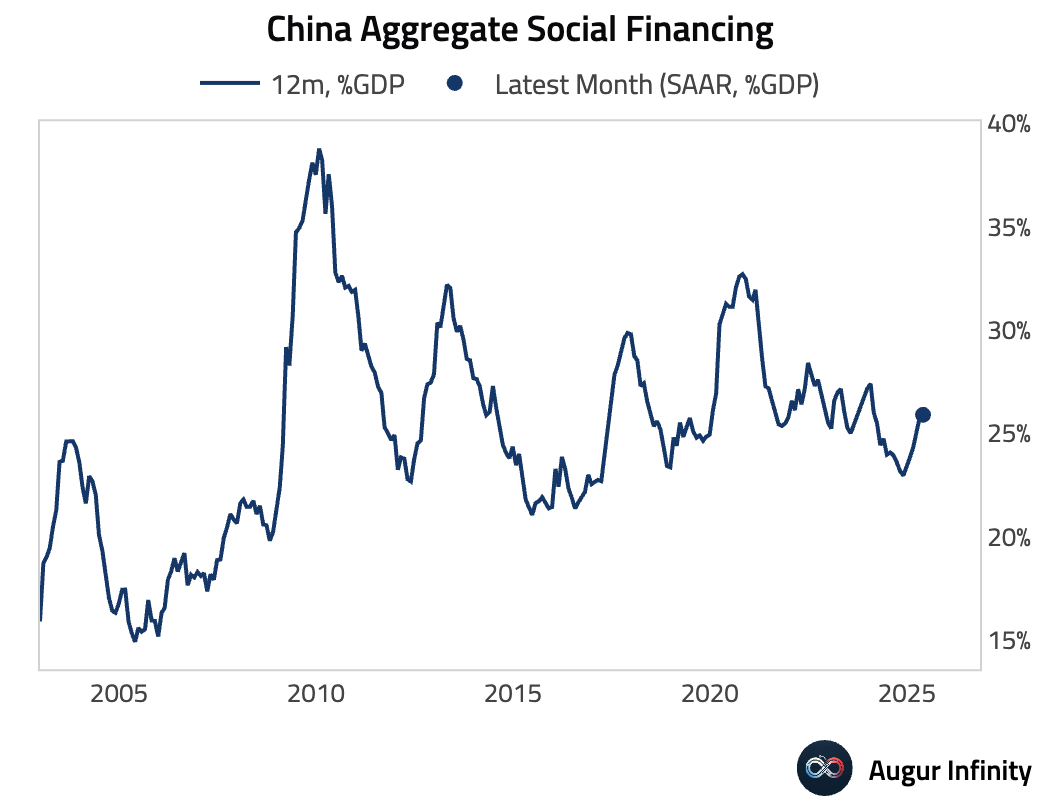

- Credit data for May showed weaker-than-expected growth. New yuan loans of ¥620B missed the ¥850B forecast, while total social financing of ¥2.29T was also slightly below the ¥2.30T consensus. M2 money supply growth slowed to 7.9% Y/Y from 8.0%, and outstanding loan growth decelerated to 7.1% Y/Y, a new record low.

Emerging Markets ex China

- Indonesia's retail sales contracted 0.3% Y/Y in April, a sharp slowdown from the 5.5% growth recorded in March.

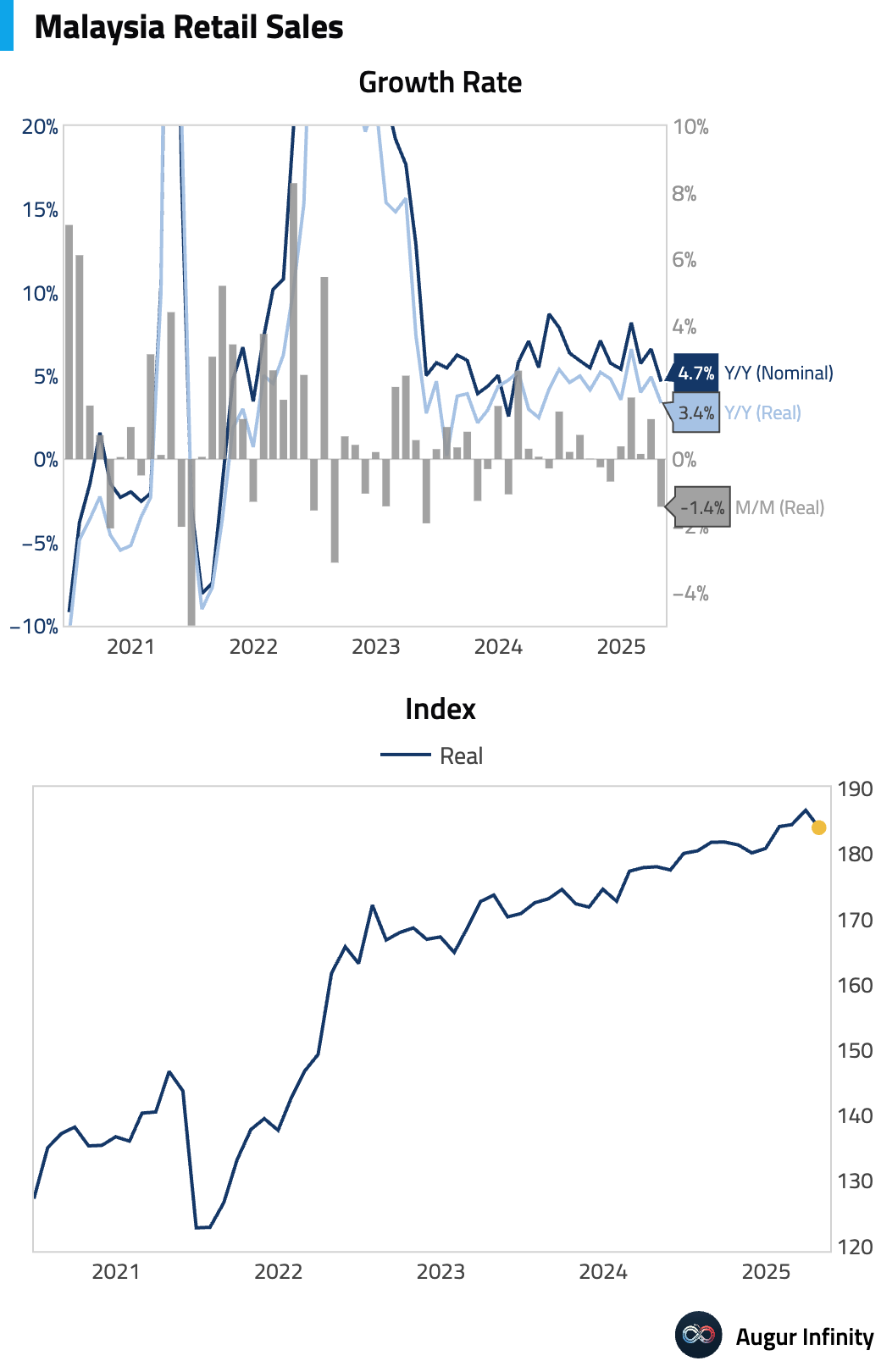

- Malaysia's retail sales growth moderated to 4.7% Y/Y in April from 6.6% in March.

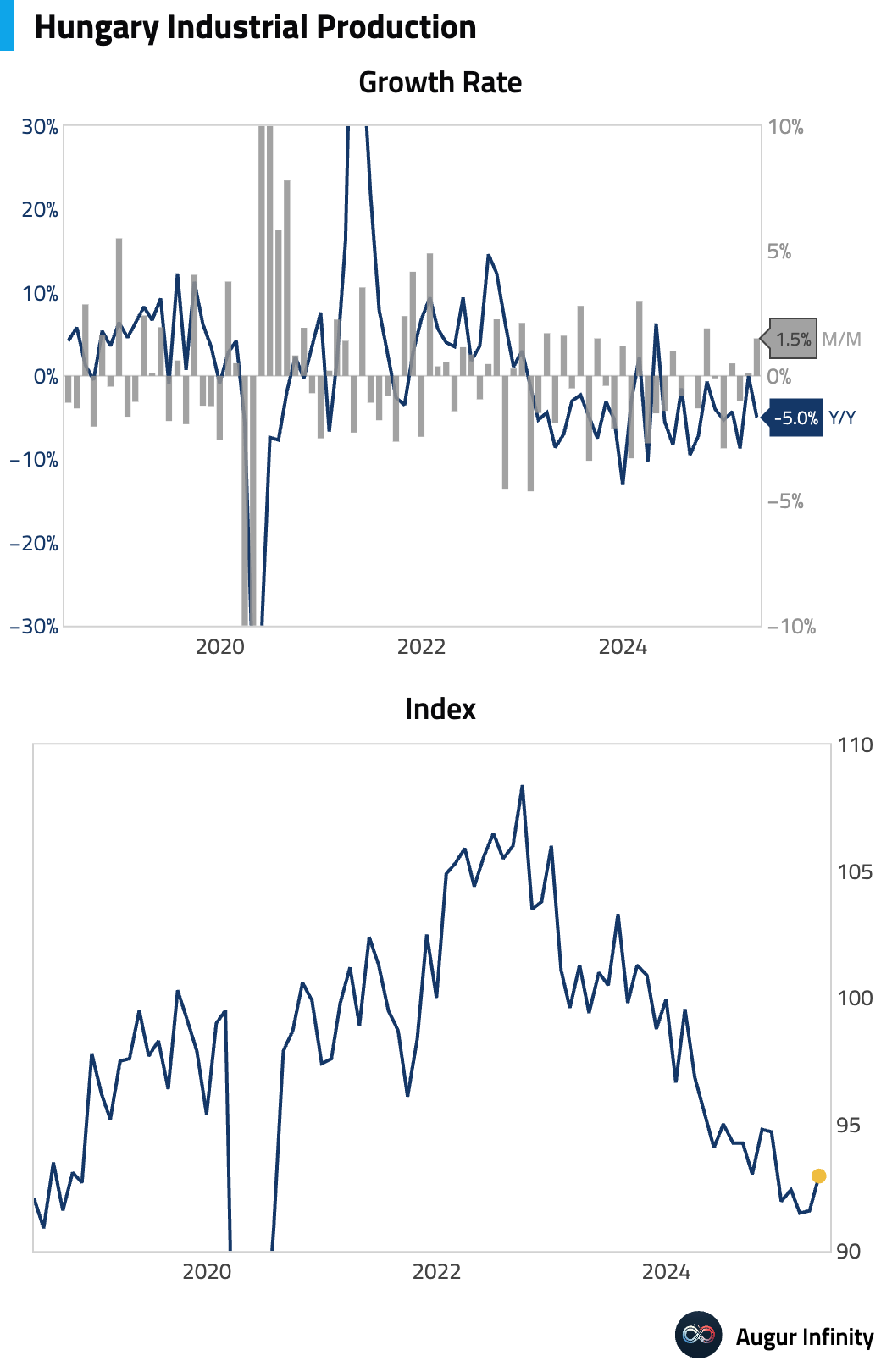

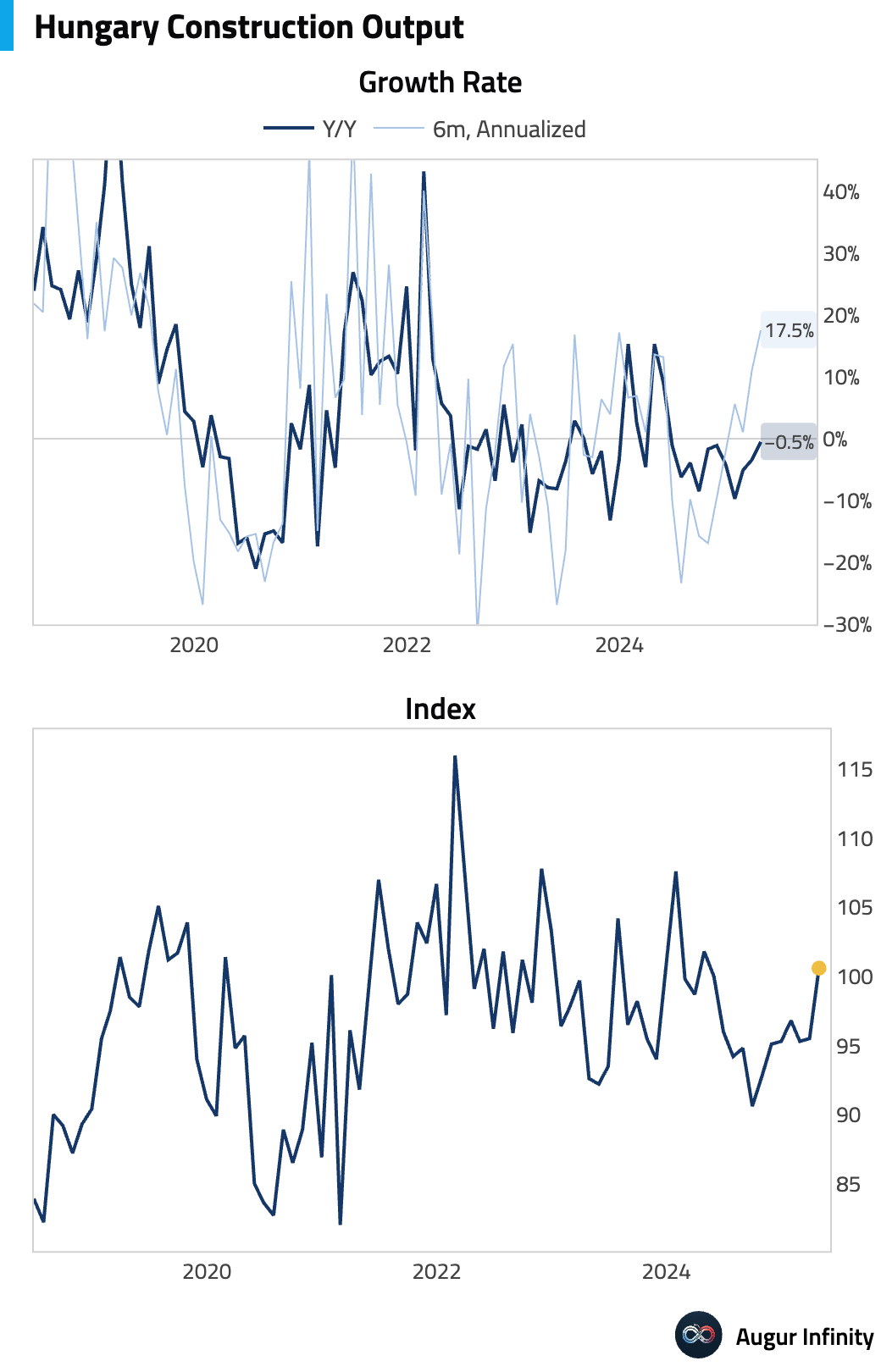

- In Hungary, April's final industrial production was confirmed at -5.0% Y/Y, while construction output improved to -0.5% Y/Y from -3.4% previously.

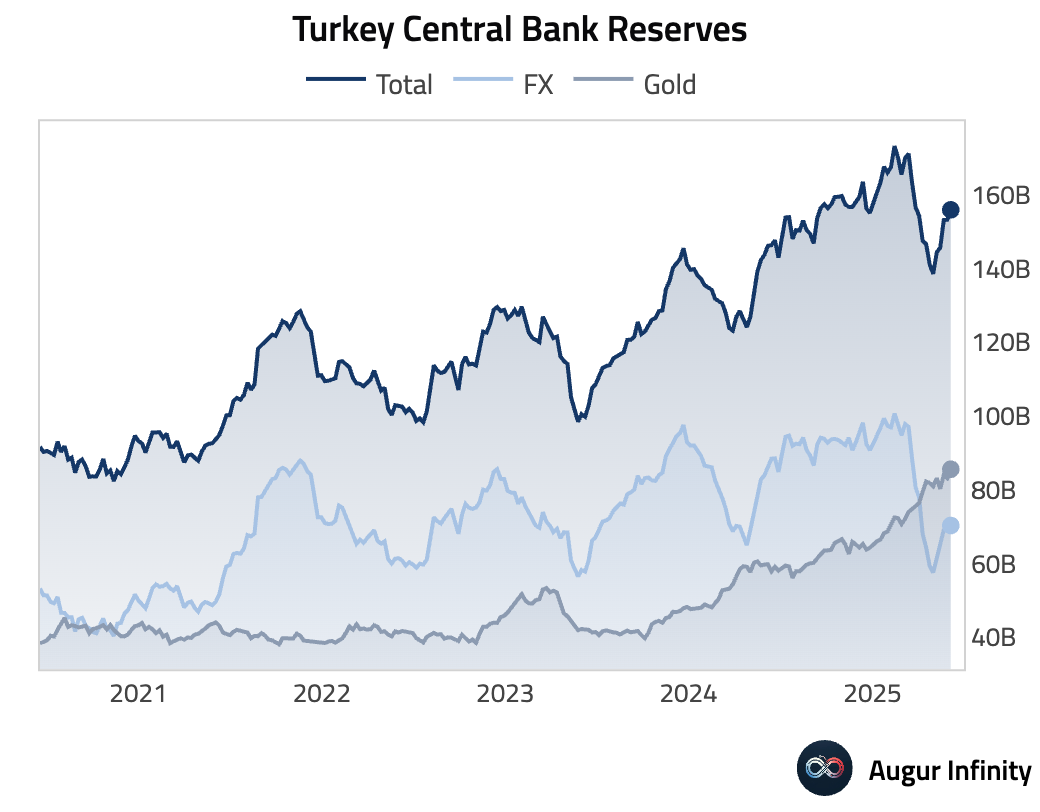

- Turkey's foreign exchange reserves rose to $70.31B in the first week of June, up from $70.03B.

- The Philippines recorded foreign direct investment of $500M in March, unchanged from the prior month.

- Thailand's official reserve assets increased to $257.6B in May from $256.8B in April.

Equities

- Global equity markets sold off amid rising geopolitical tensions in the Middle East. US markets fell, with the Nasdaq dropping 1.3% and the broader US market down 1.1%. European markets saw steeper declines, with Germany and France both falling 1.7%. In Asia, South Korean equities slid 1.9% and Chinese stocks were down 1.8%.

Fixed Income

- US Treasury yields rose across the curve in a risk-off move. The 10-year yield increased by 5.7 basis points, while the 2-year yield was up 5.2 basis points. The long end saw the largest move, with the 30-year yield climbing 6.2 basis points.

FX

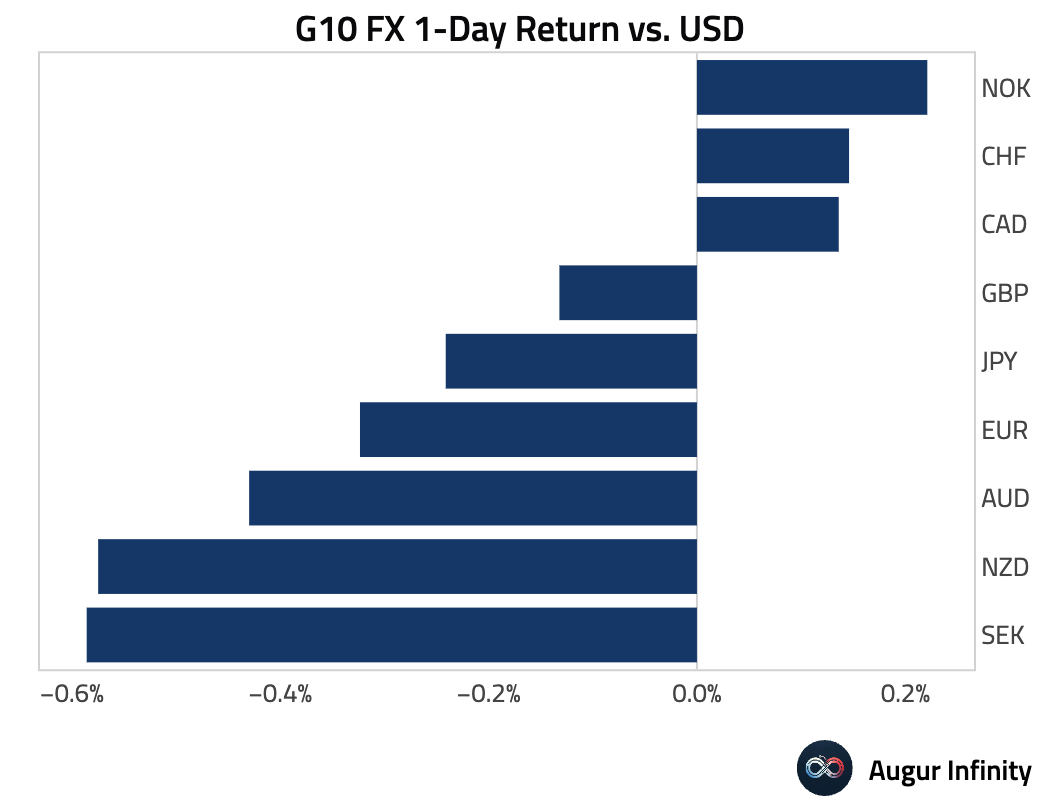

- The US dollar strengthened against most G10 peers amid a flight to safety. The New Zealand and Australian dollars were the main underperformers, down 0.6% and 0.4% respectively. The Canadian dollar and Swiss franc bucked the trend, gaining 0.1% each against the greenback; CAD has now strengthened for five consecutive days, while CHF has risen for three straight days.

Disclaimer

Augur Digest is an automated newsletter written by an AI. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.