- Administrative Update

- Energy

- United States

- United Kingdom

- The Eurozone

- Japan

- Asia-Pacific

- China

- Emerging Markets

- Equities

- Rates

- Credit

- Commodities

- Cryptocurrency

Administrative Update

Starting February 2, Augur Digest will transition to require a paid subscription. As a thank you to our loyal readers, we will send out a special link with discounted pricing later this month.Back to Index

Energy

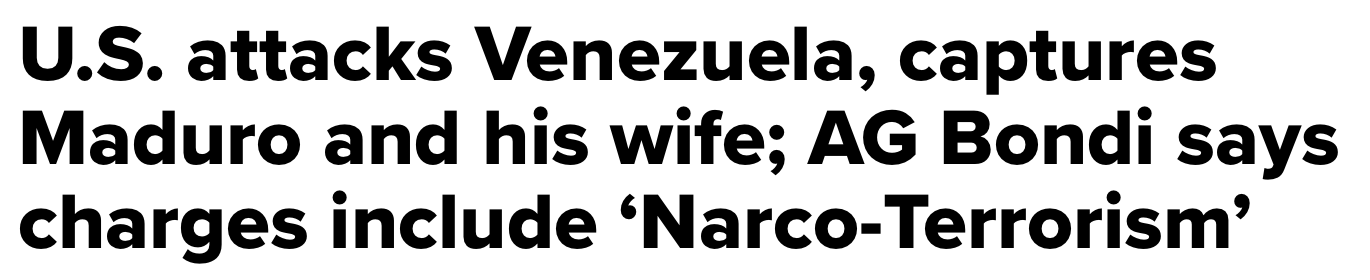

1 The US launched an unprecedented military operation against Venezuela, capturing Nicolás Maduro and flying him out of the country.

Source: CNBC Read full article

Source: CNBC Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

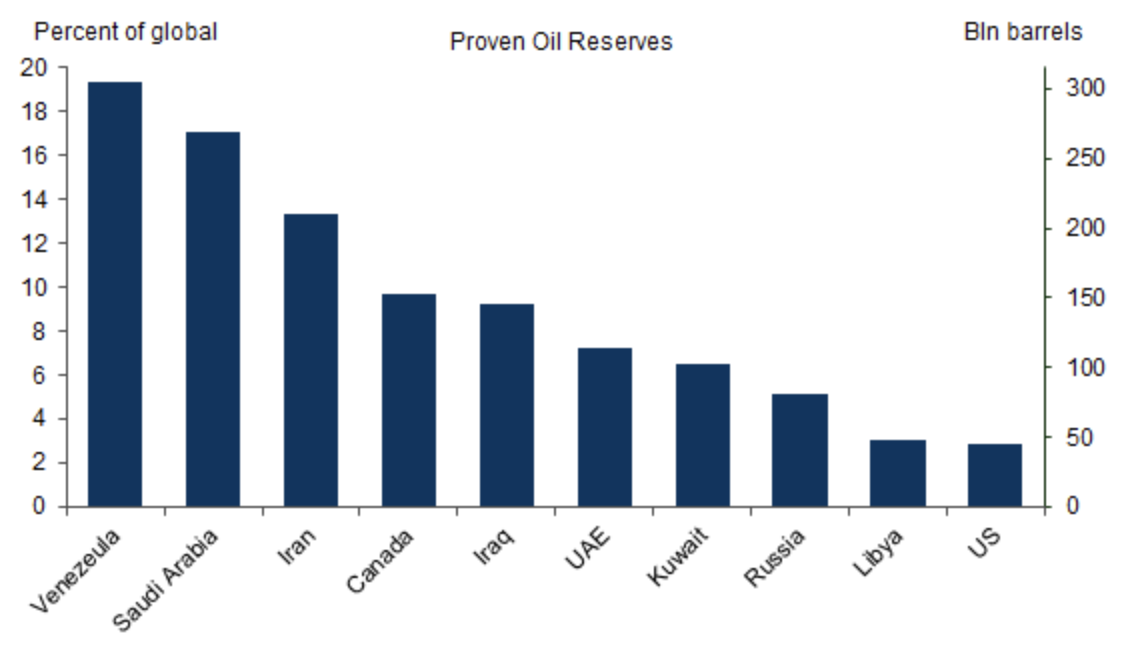

2 Venezuela holds nearly one-fifth of the global proven oil reserves.

Source: Goldman Sachs

Source: Goldman Sachs

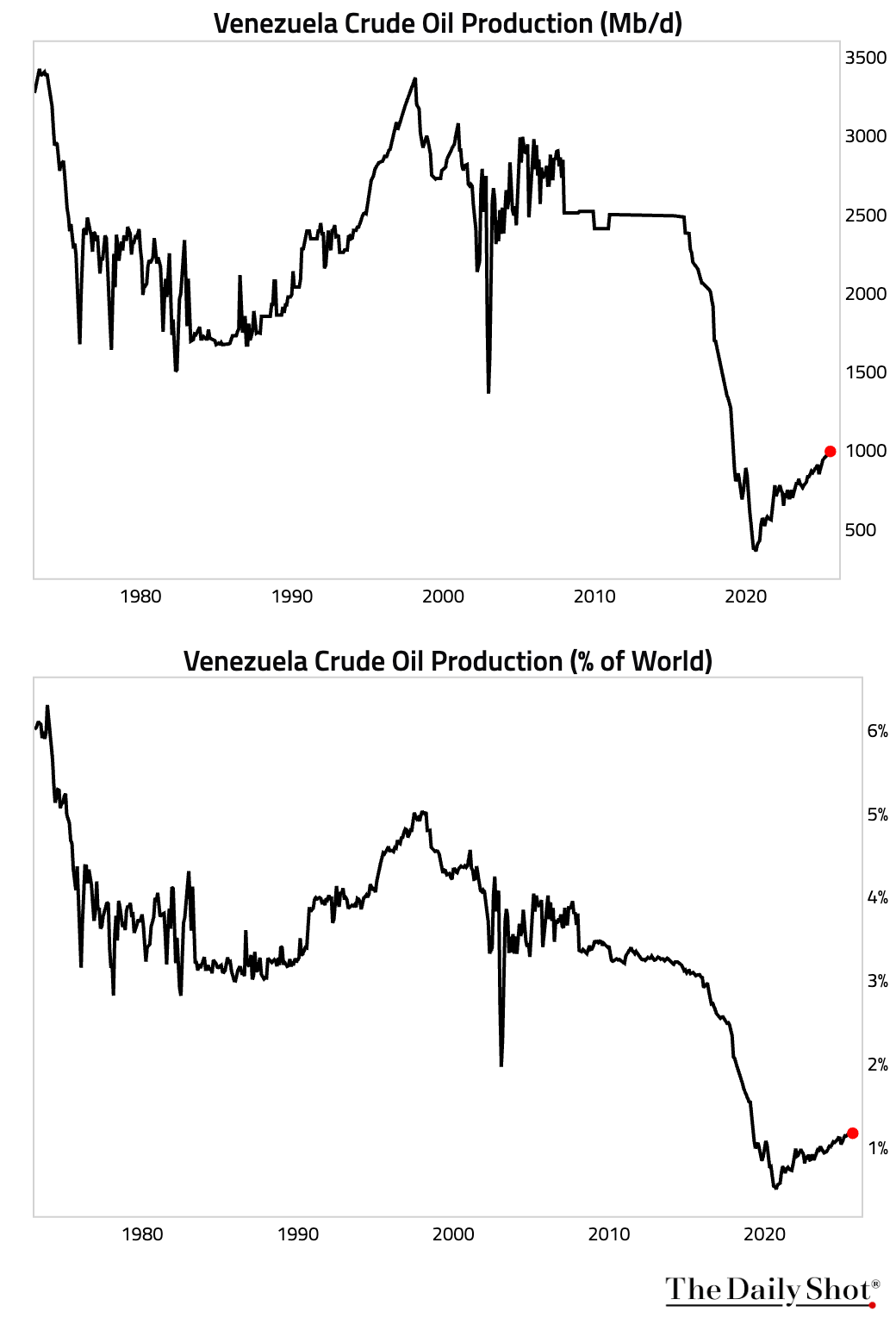

– These charts show Venezuela’s oil production over time.

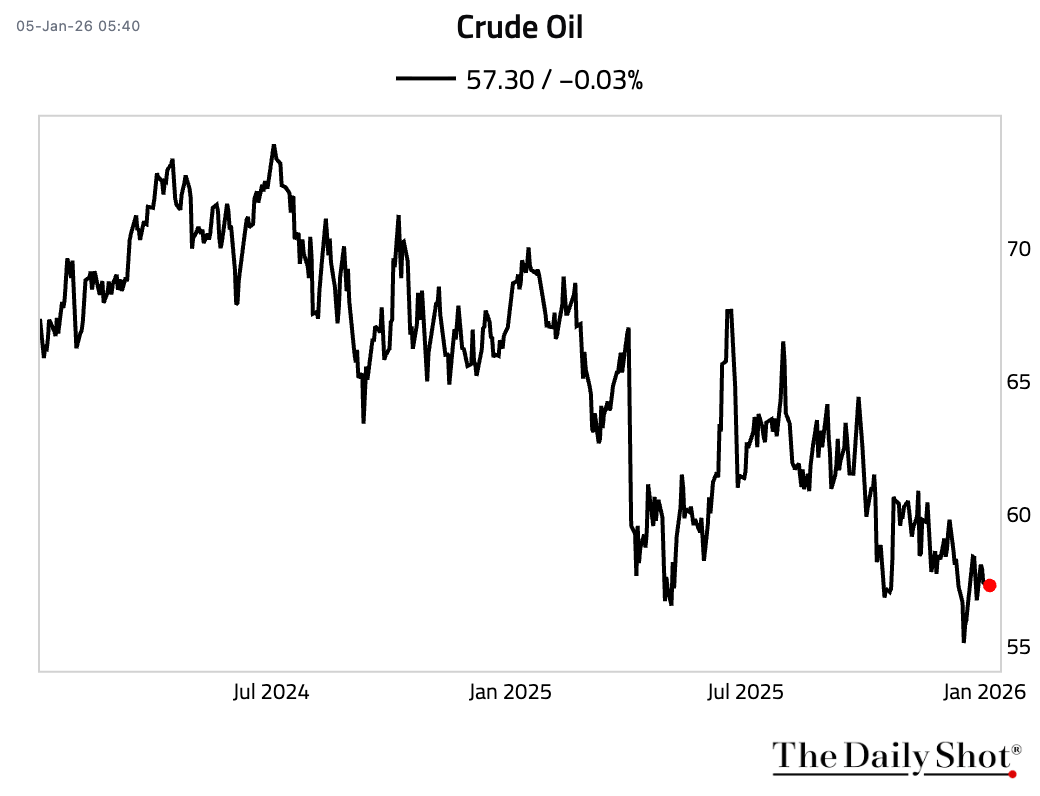

3 Crude prices edged up over the weekend. They continued higher today as markets judged that the capture of Maduro is unlikely to materially disrupt global supply.

Back to Index

United States

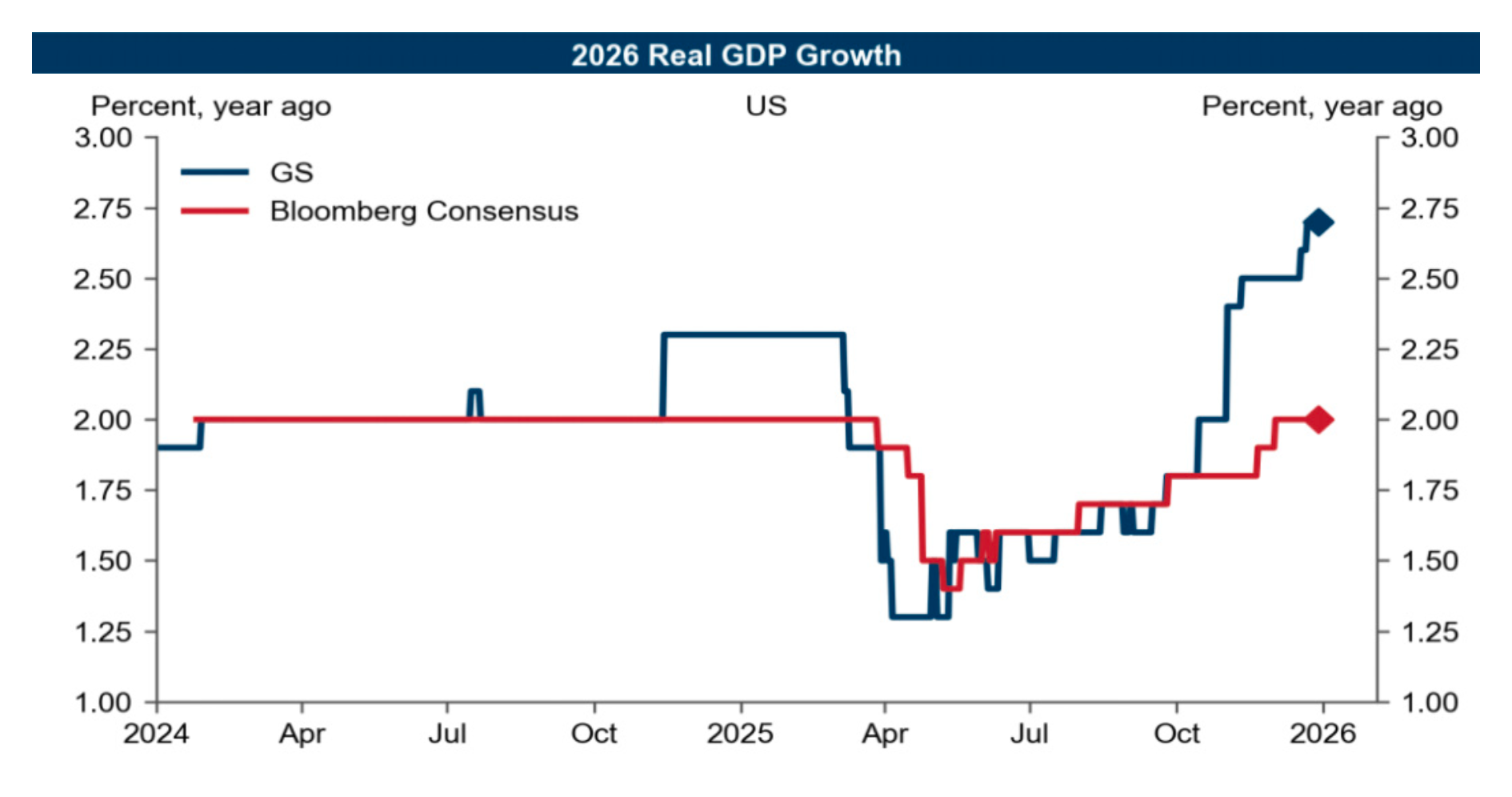

1 Let’s look at both analyst forecasts as well as expectations priced into markets for 2026.

• Economists forecast that US growth will remain solid in the new year.

Source: Goldman Sachs

Source: Goldman Sachs

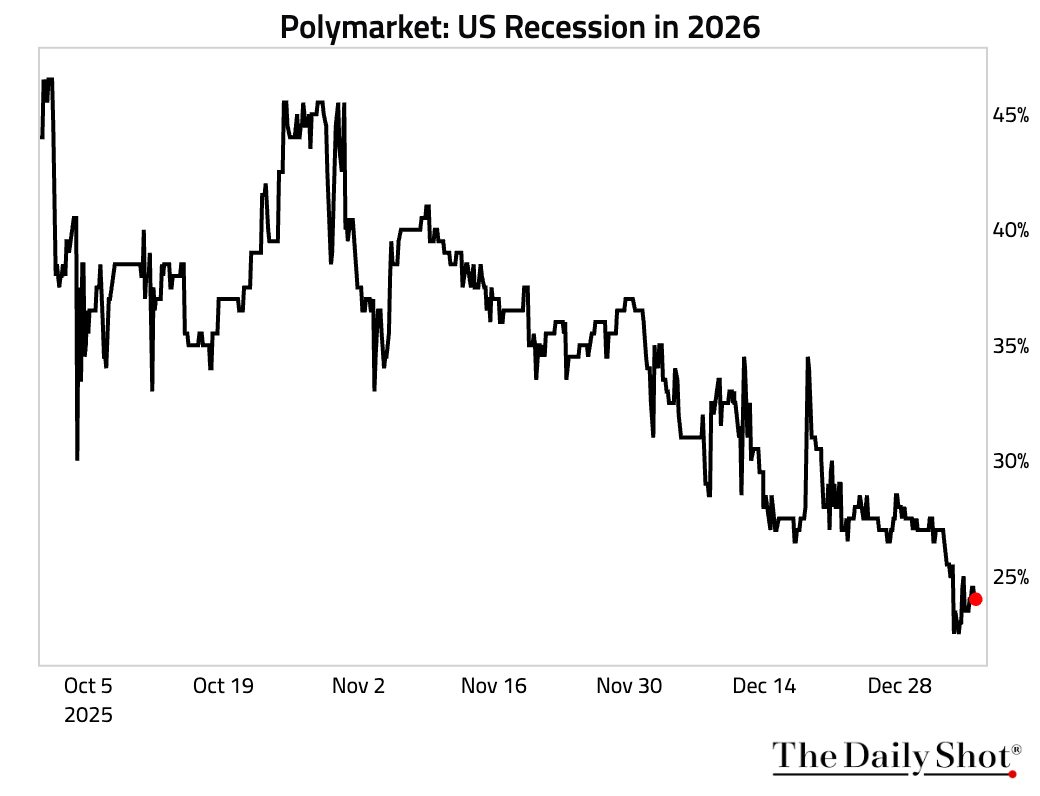

– Recession probability has steadily declined on betting markets, currently sitting at just under 25%.

Source: Polymarket

Source: Polymarket

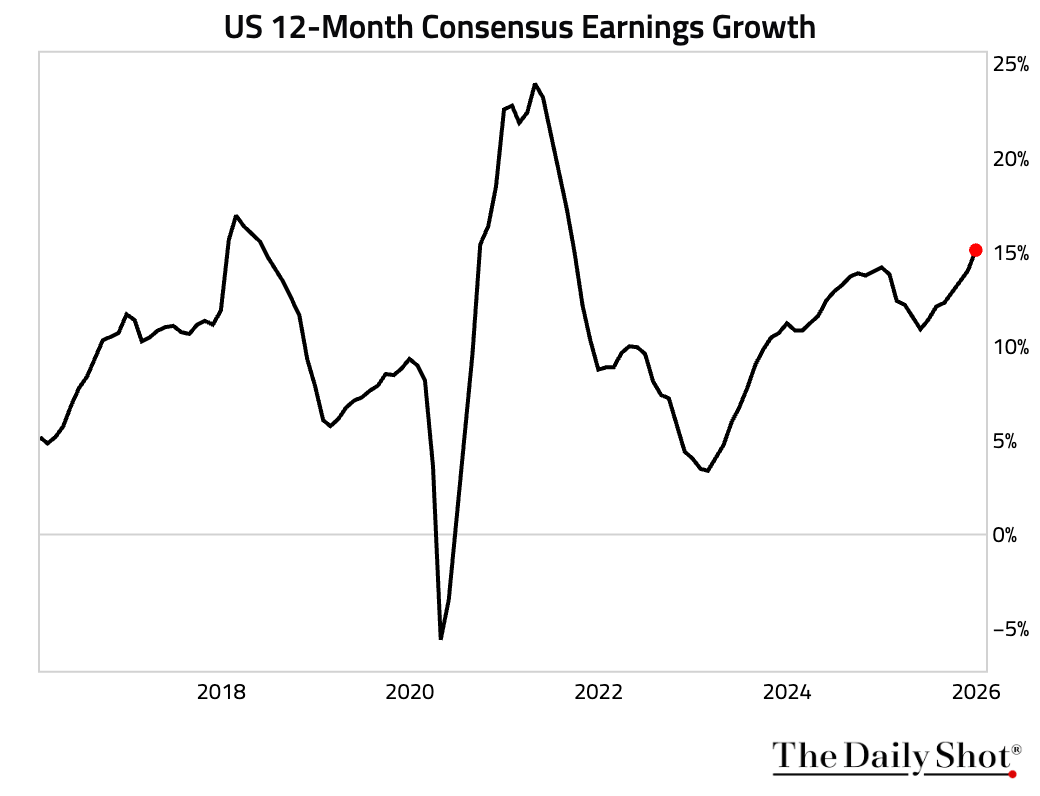

– Consensus estimates for 12-month-ahead earnings growth have reached the highest level since 2021.

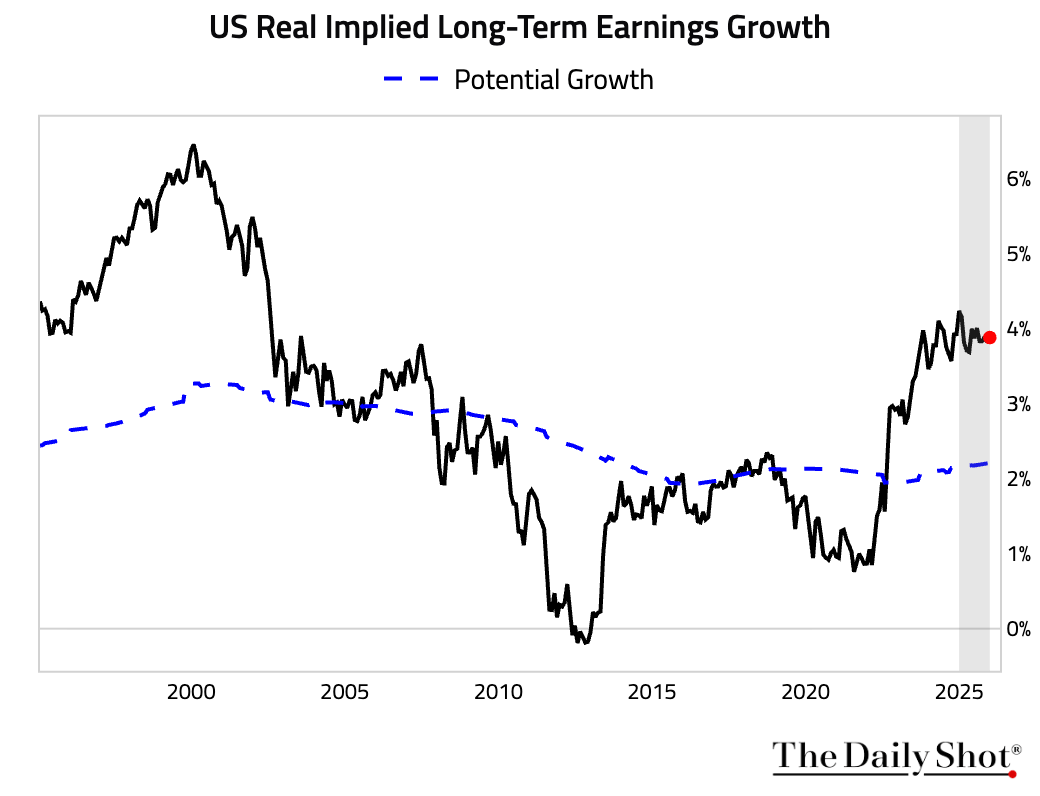

– The market’s pricing for long-term earnings growth has eased over the last 12 months but remains elevated.

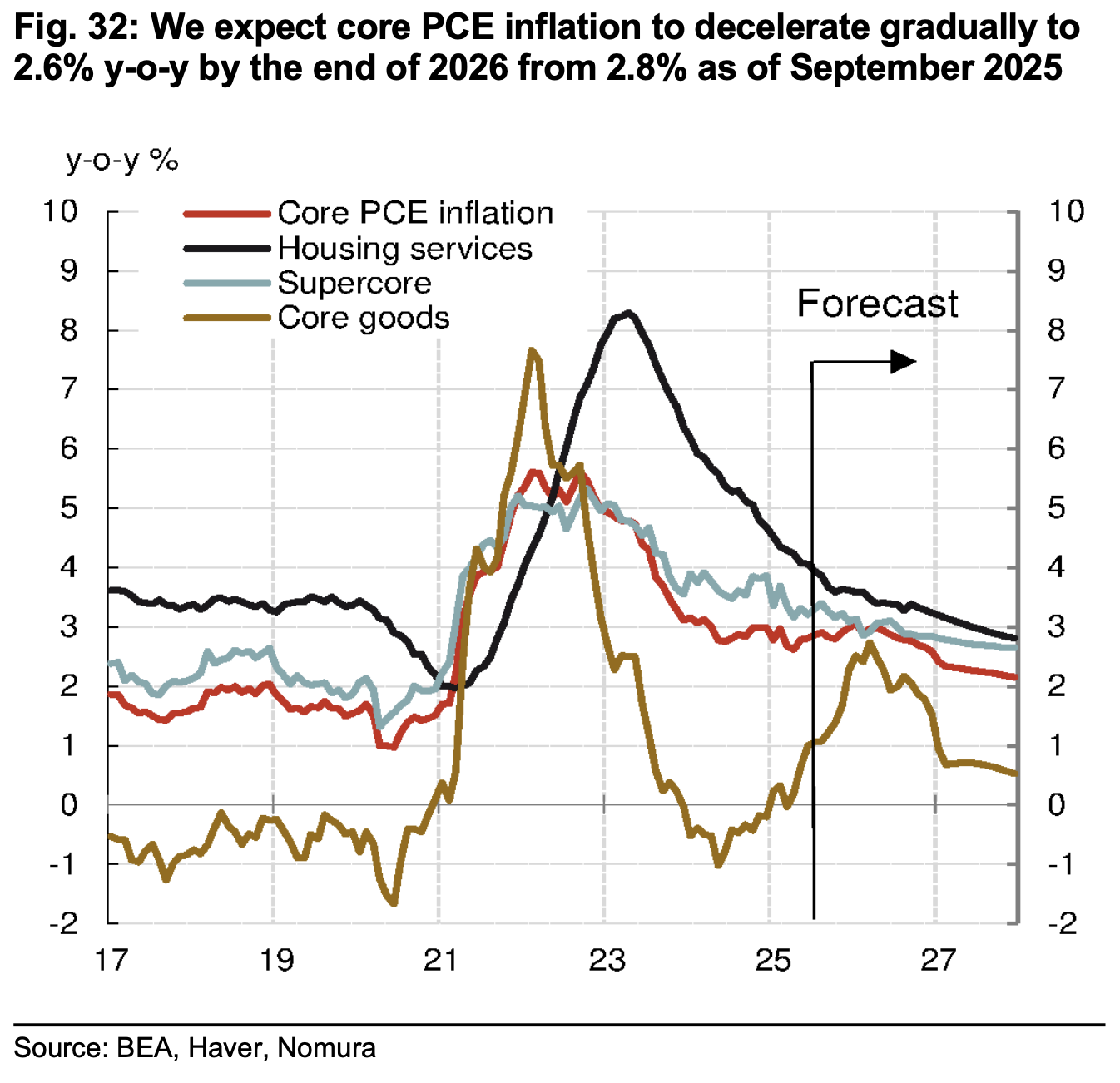

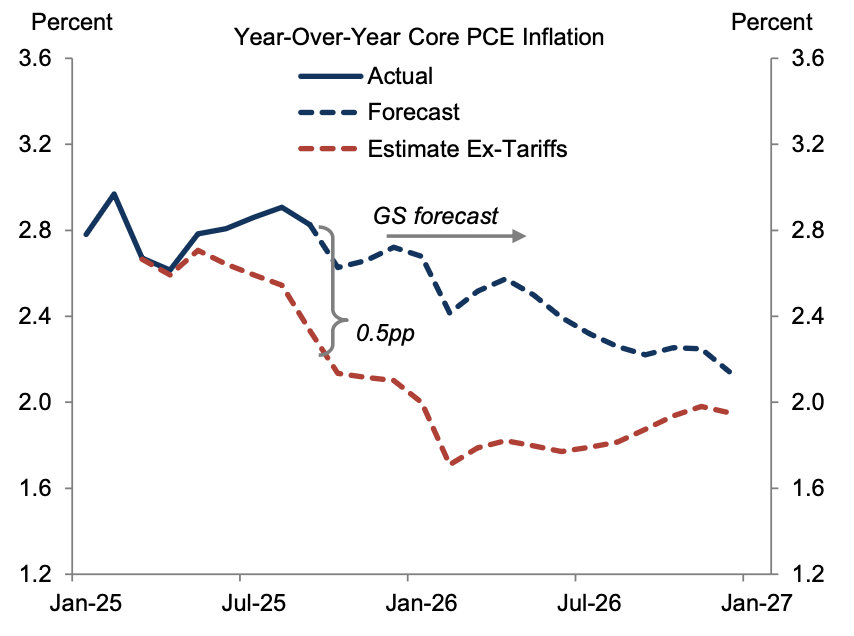

• Nomura expects core PCE inflation to decelerate gradually to 2.6% year over year by the end of 2026, …

Source: Nomura Securities

Source: Nomura Securities

Source: Goldman Sachs

Source: Goldman Sachs

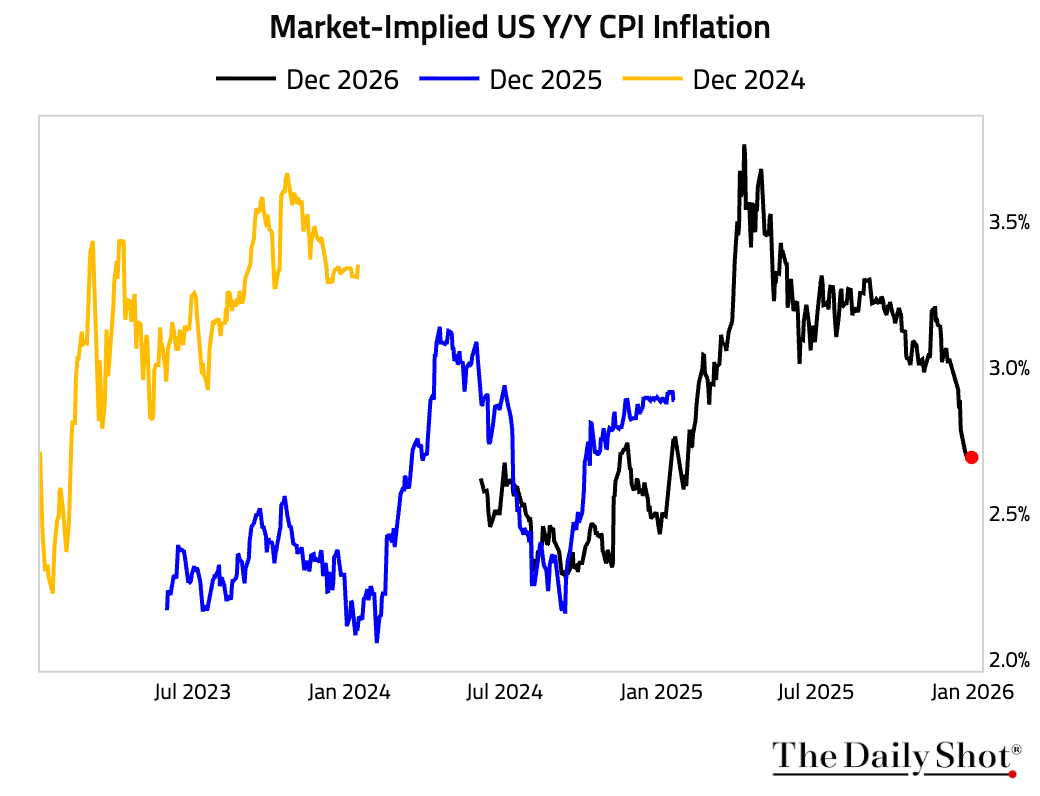

– The fixings market is pricing for December 2026 year-over-year CPI inflation to come in at 2.7%.

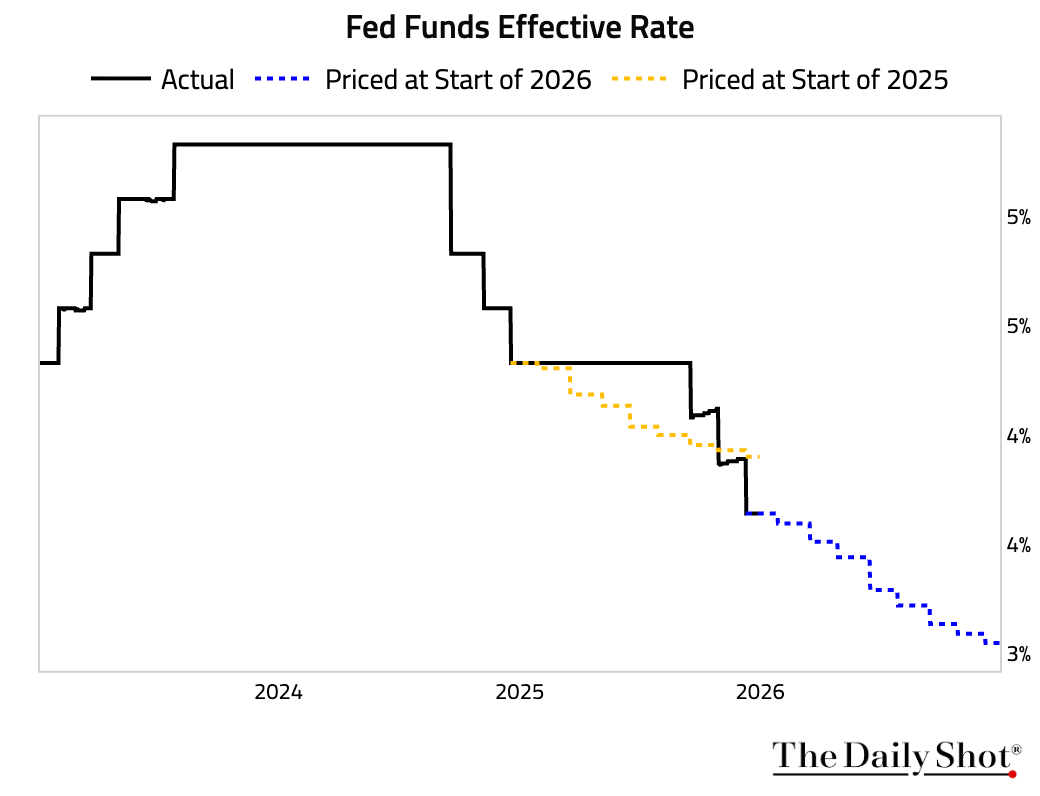

• Rates markets are pricing in about 60 bps of easing from the Fed in 2026.

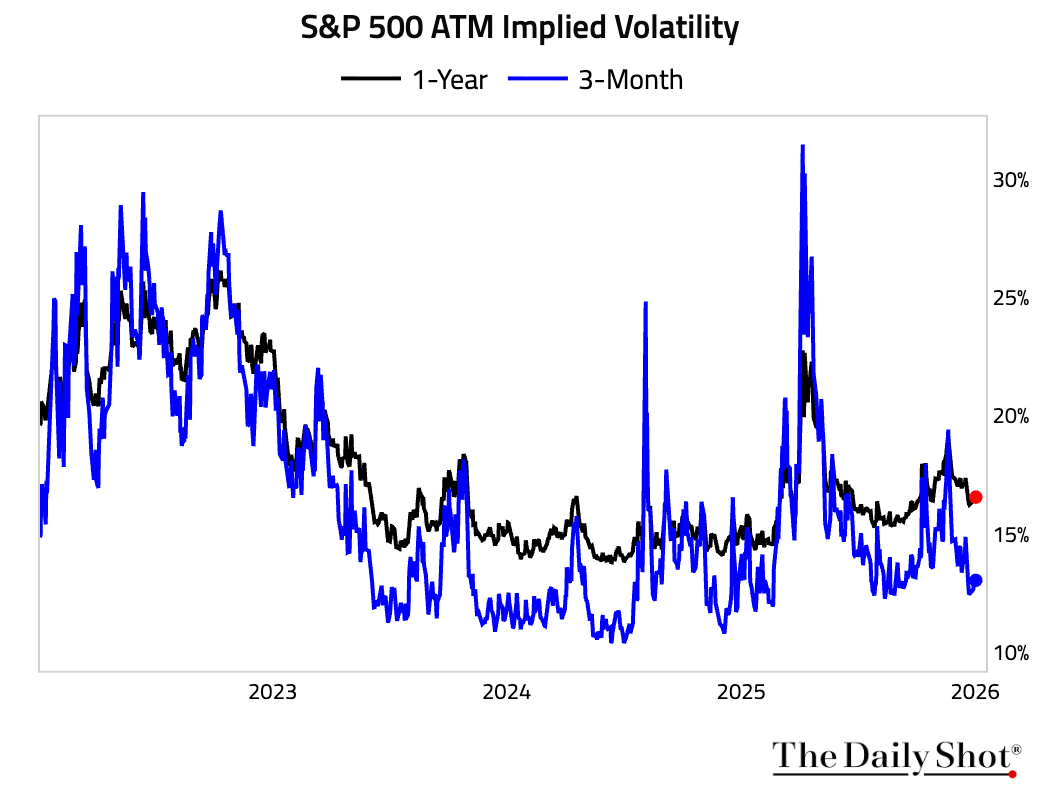

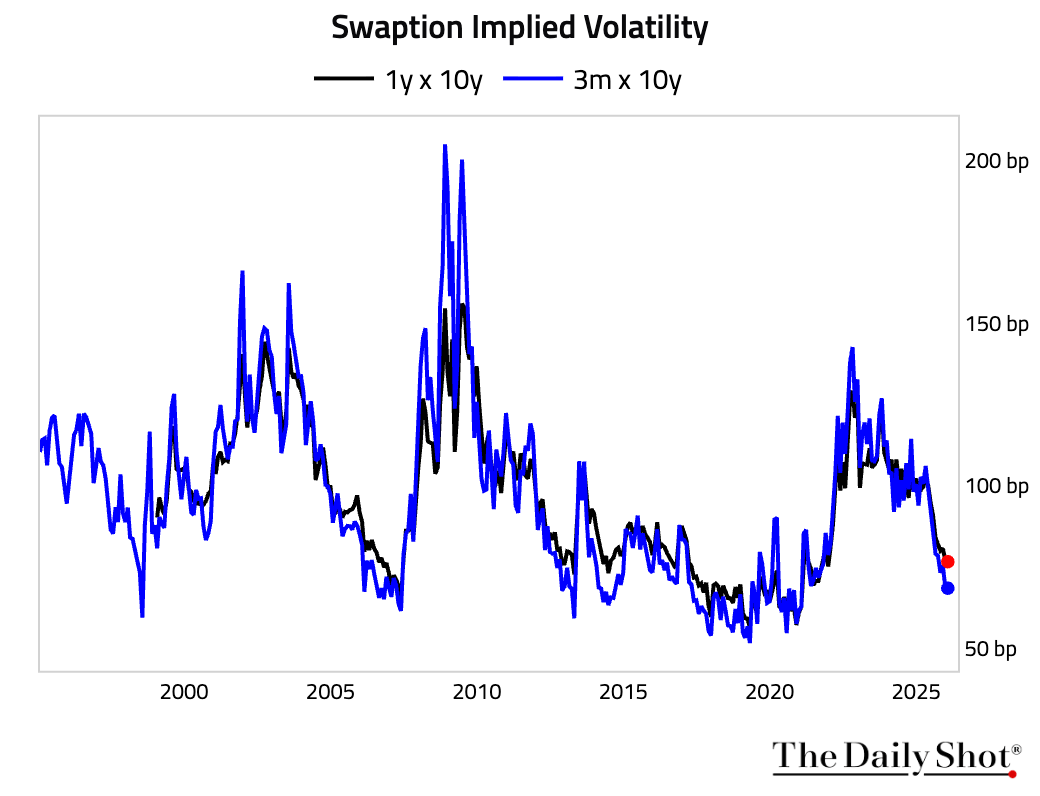

• Markets are also pricing in a relatively low-volatility environment for the year.

– Equities:

– Rates:

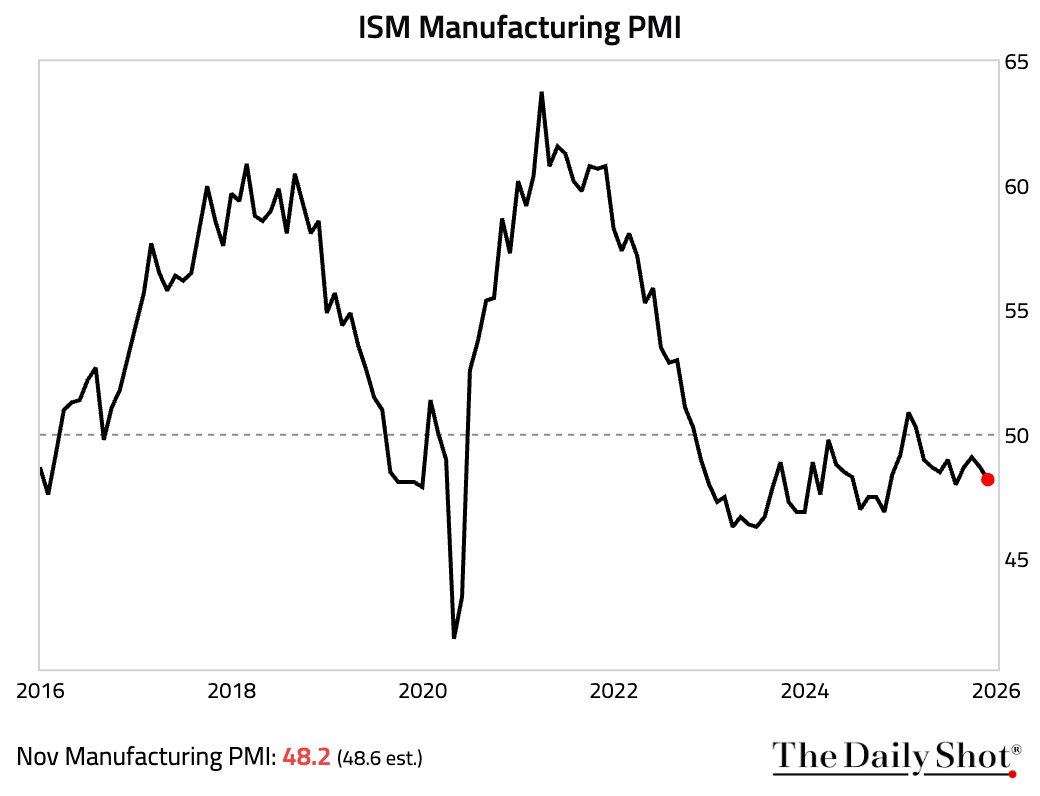

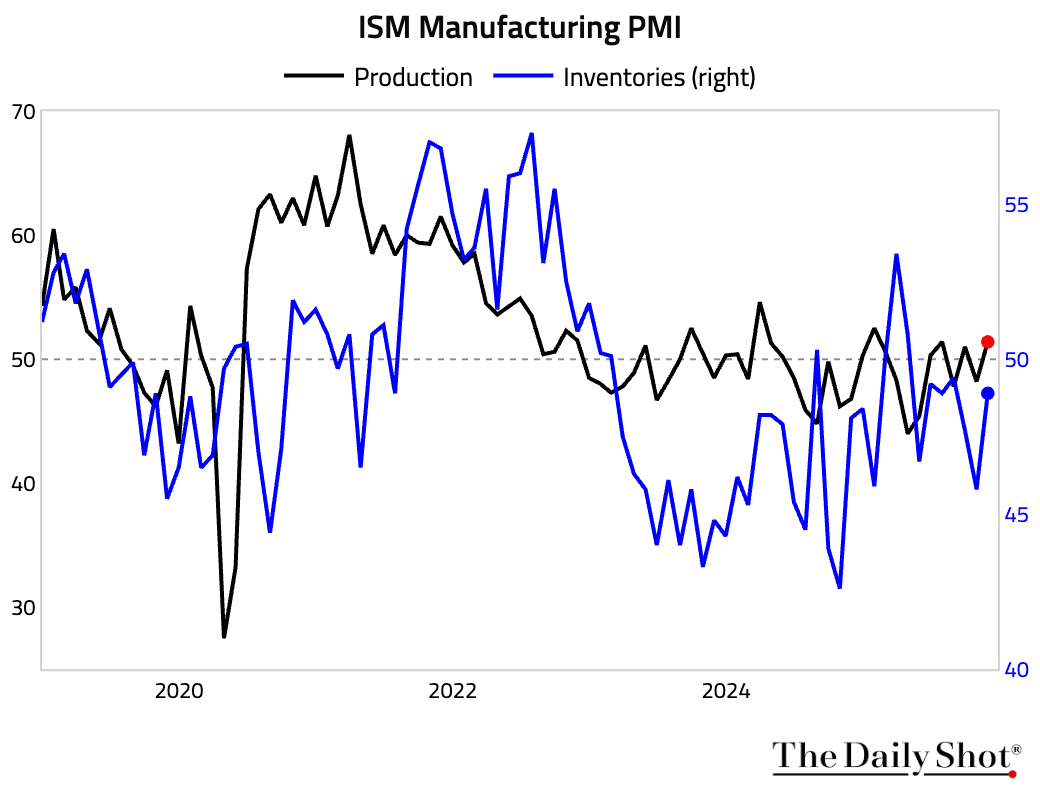

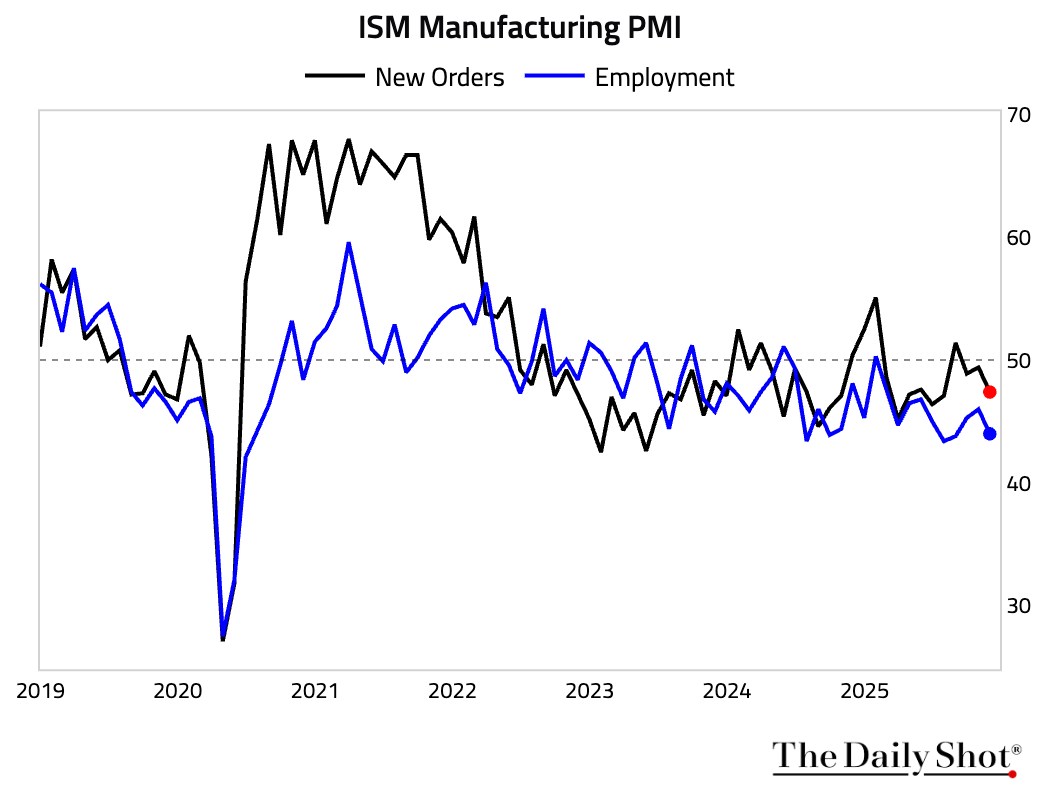

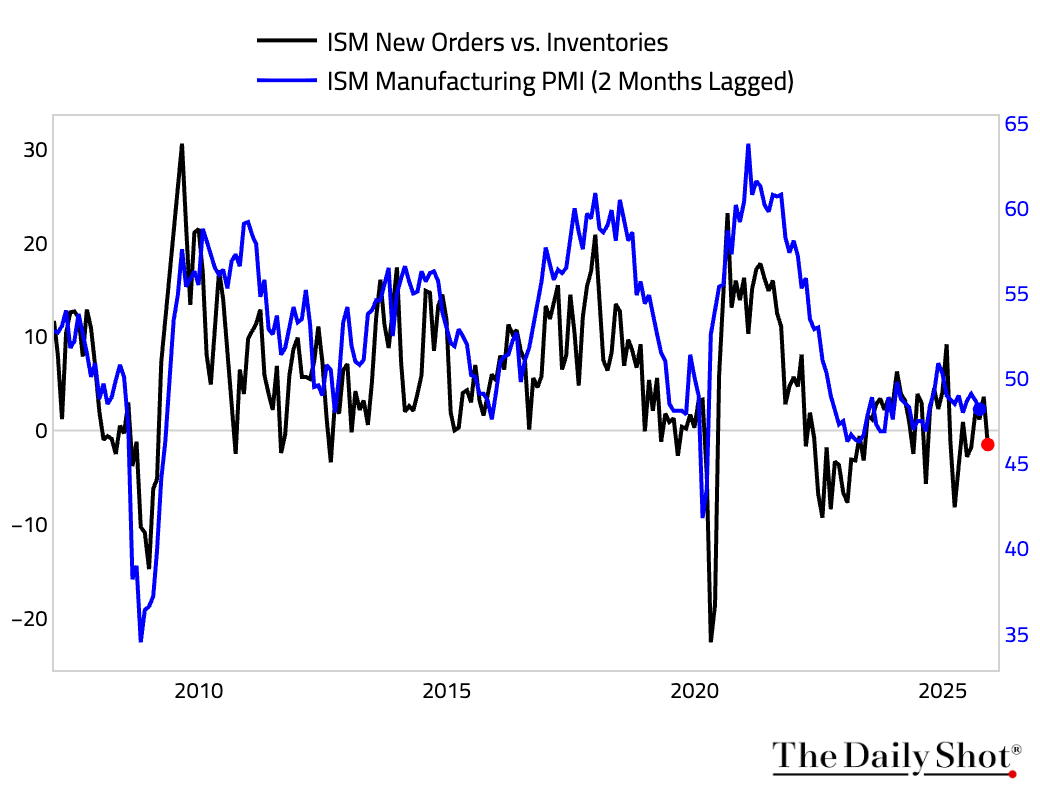

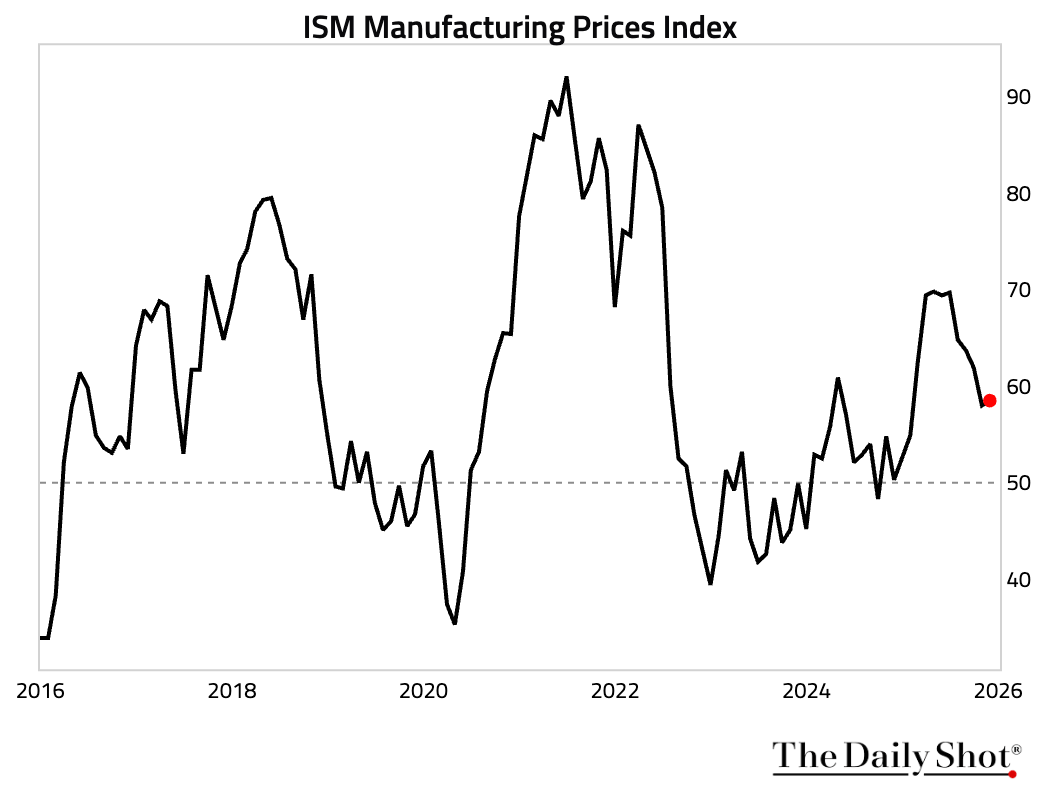

2 The ISM Manufacturing PMI unexpectedly fell further into contraction.

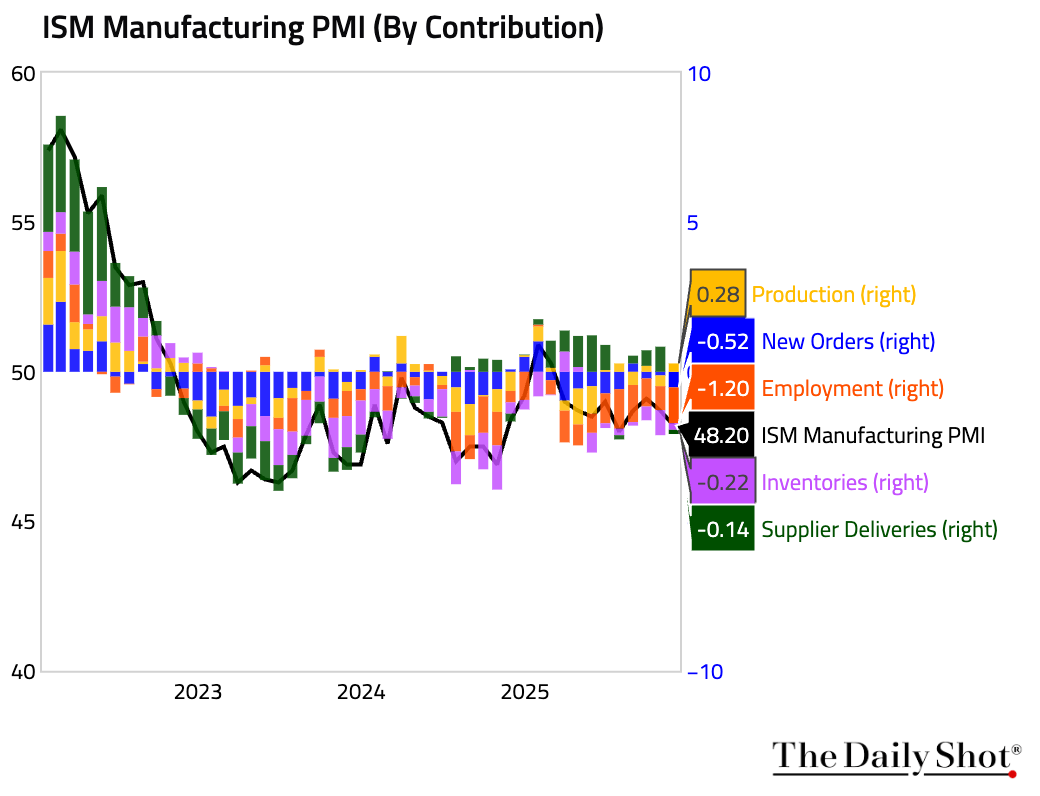

This chart shows the contributions to the index.

This chart shows the contributions to the index.

• The underlying details fared better than the headline index suggests, as the weakness was driven by a sharp decline in the inventories sub-index. Production also edged down but remained in expansion.

• Both new orders and employment ticked up.

• The spread between new orders and inventories signals potential improvement ahead.

• The prices index held steady.

Back to Index

United Kingdom

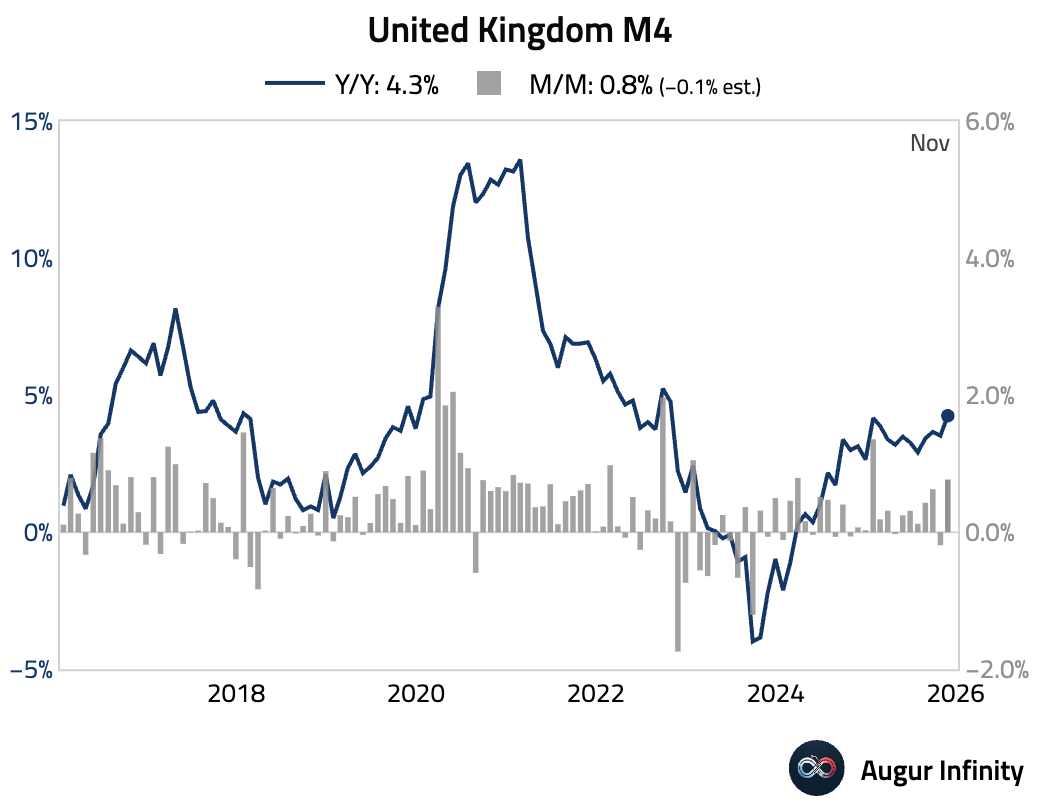

1 The M4 money supply grew in November, driven by a surge in households’ liquid assets, which posted their largest increase since October 2024.

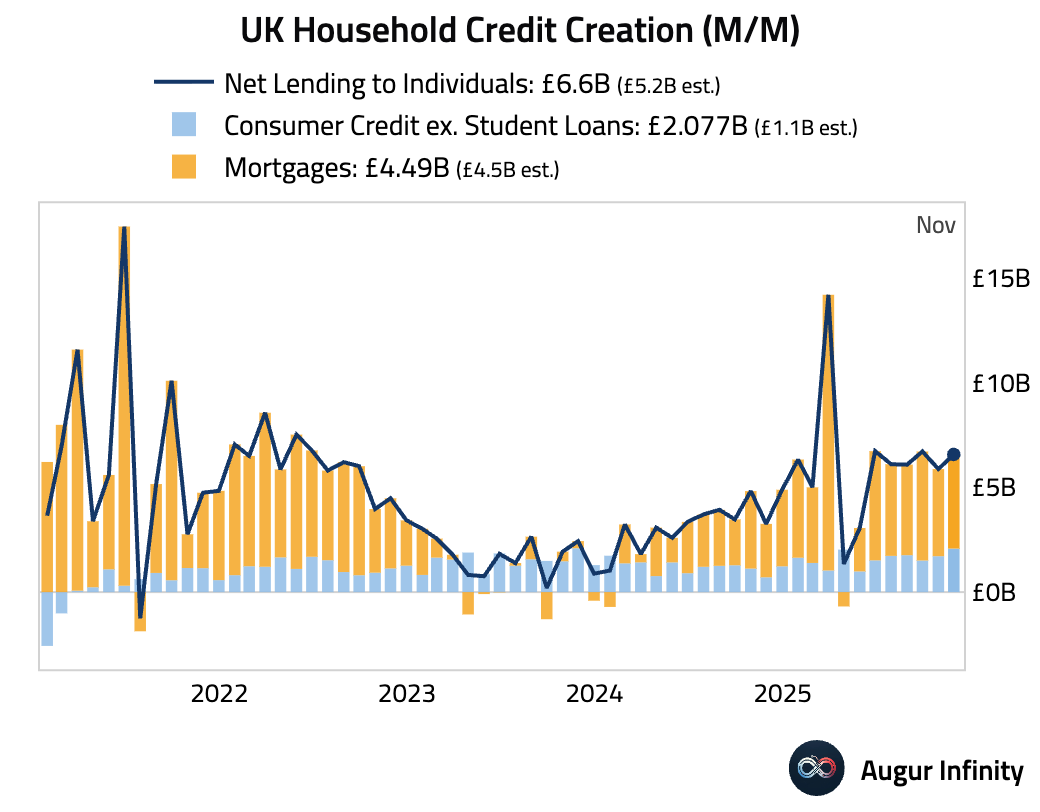

2 Household credit creation was stronger than expected in November, driven by consumer credit.

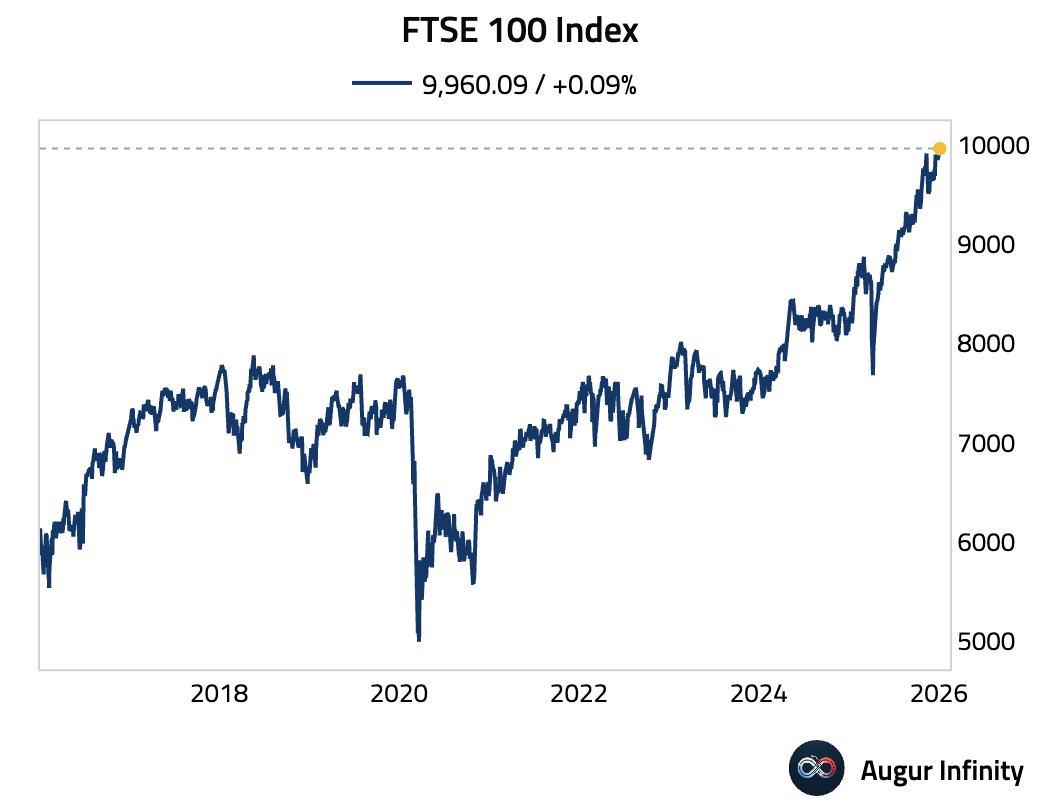

3 Mortgage approvals remained resilient in November, suggesting the housing market is holding up better than more pessimistic sentiment surveys had indicated.

4 The FTSE 100 Index closed at an all-time high.

Back to Index

The Eurozone

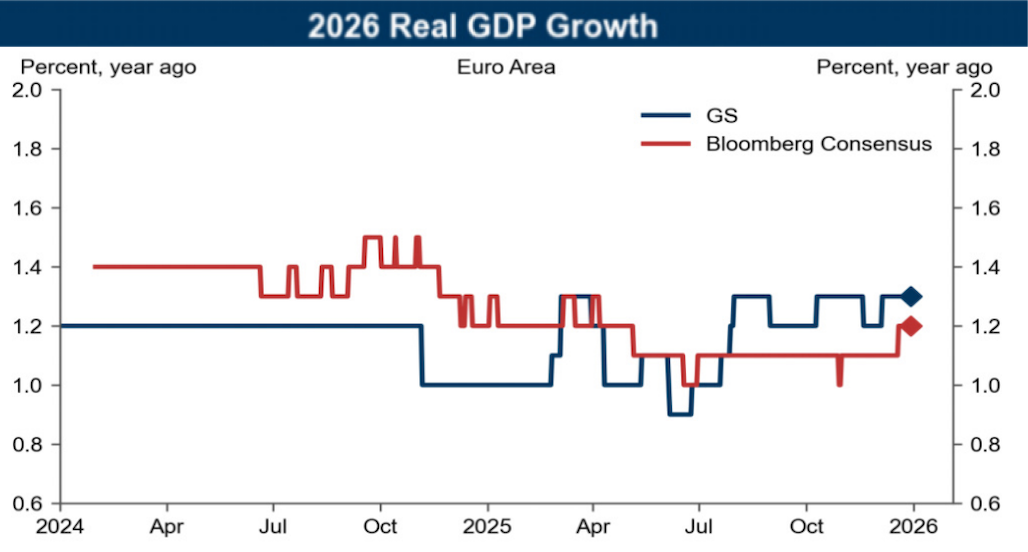

1 Here are the consensus and Goldman’s forecasts for euro area GDP growth in 2026.

Source: Goldman Sachs

Source: Goldman Sachs

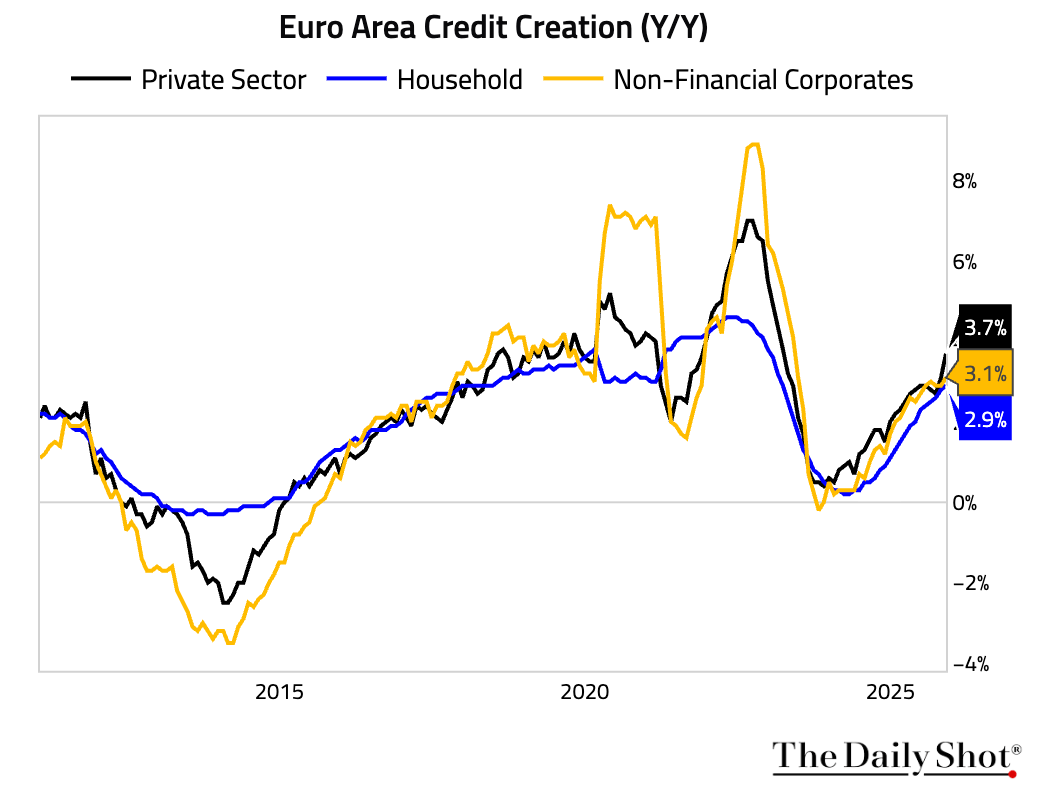

2 Private-sector lending in the euro area continued to firm, with both household and non-financial corporate credit creation accelerating, which should support growth.

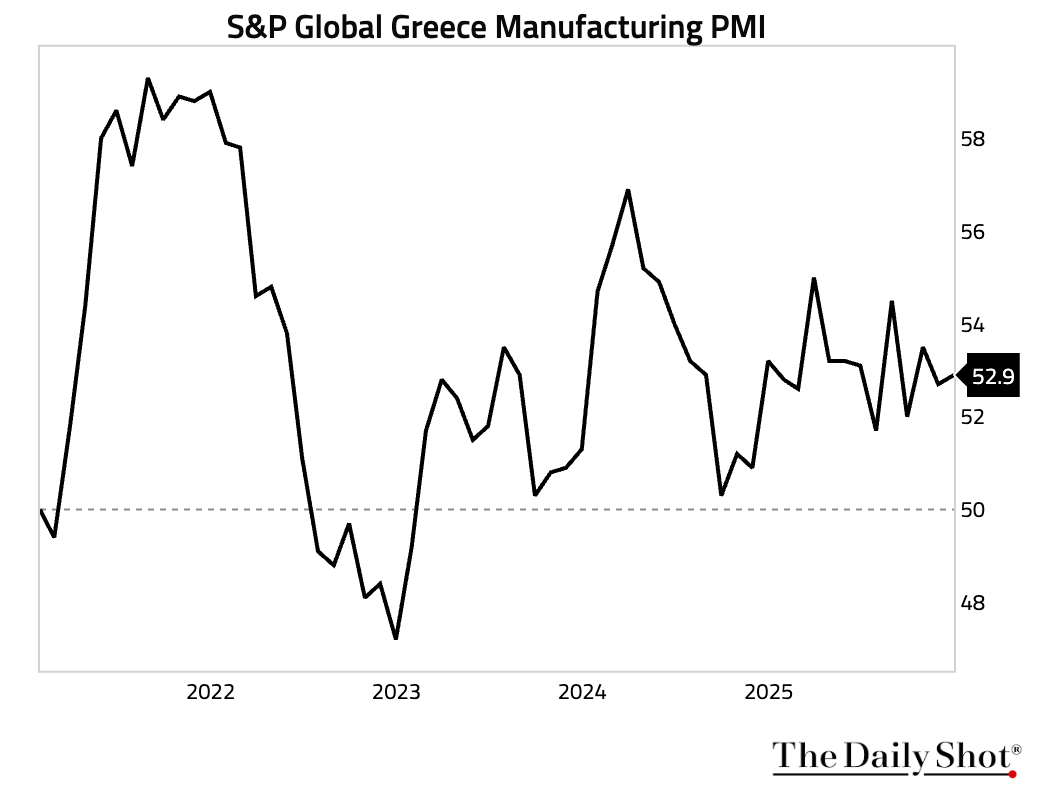

3 Greece’s manufacturing PMI rose, as improving demand led to faster growth in new orders.

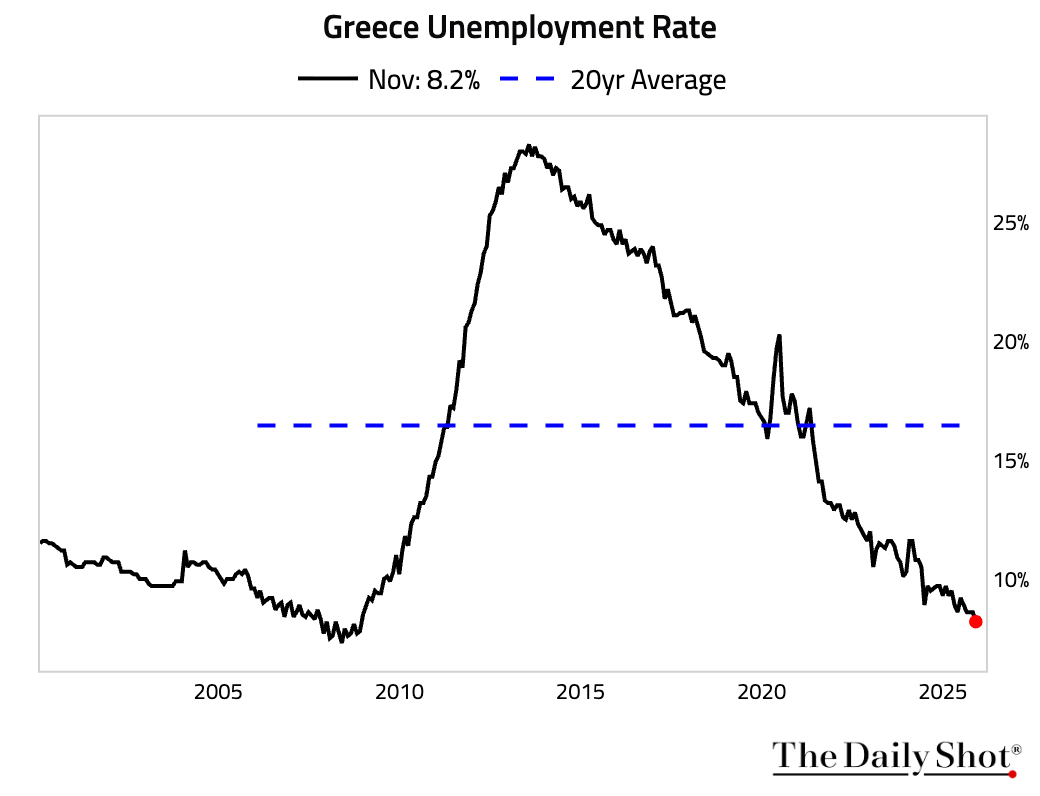

• The unemployment rate fell sharply to its lowest level since November 2008.

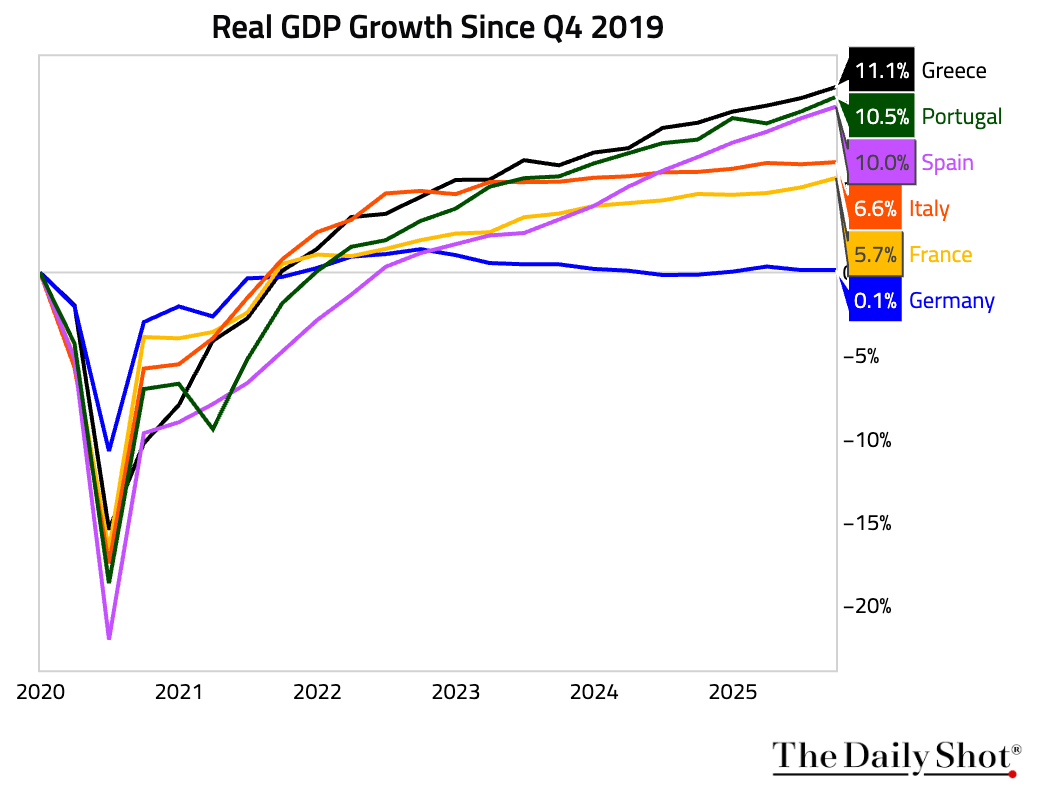

• The Greek economy has outperformed peers since Q4 2019.

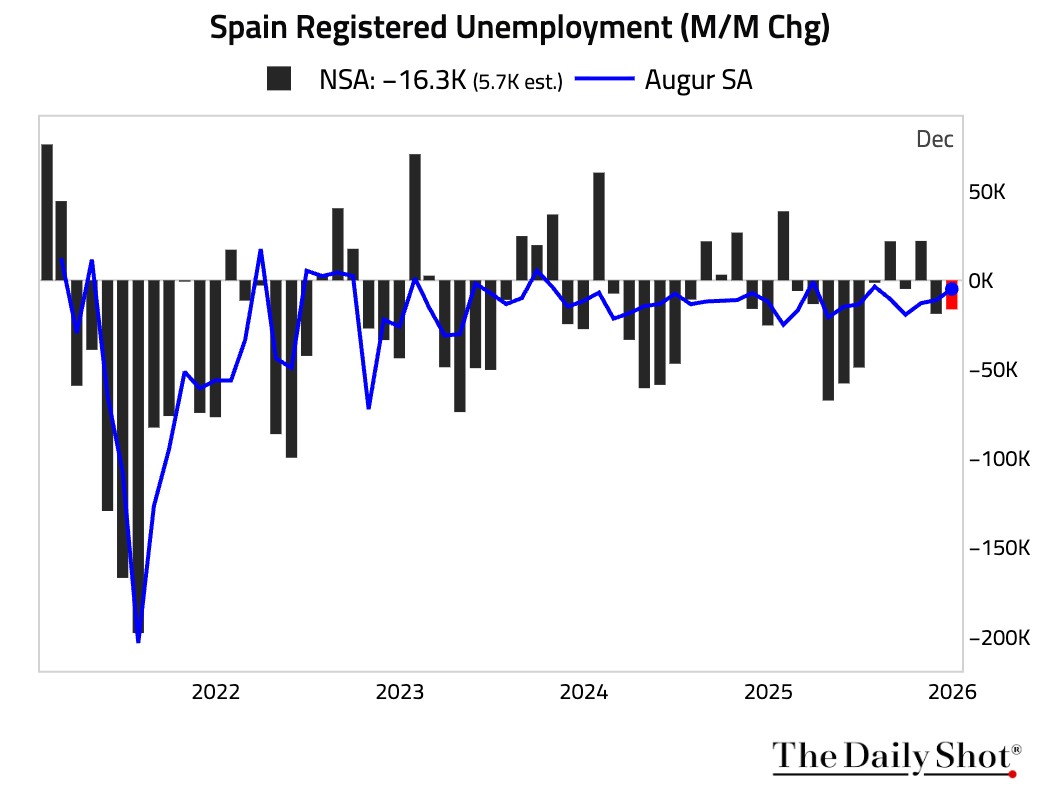

4 Spain registered an unexpected decline in unemployment for December.

Back to Index

Japan

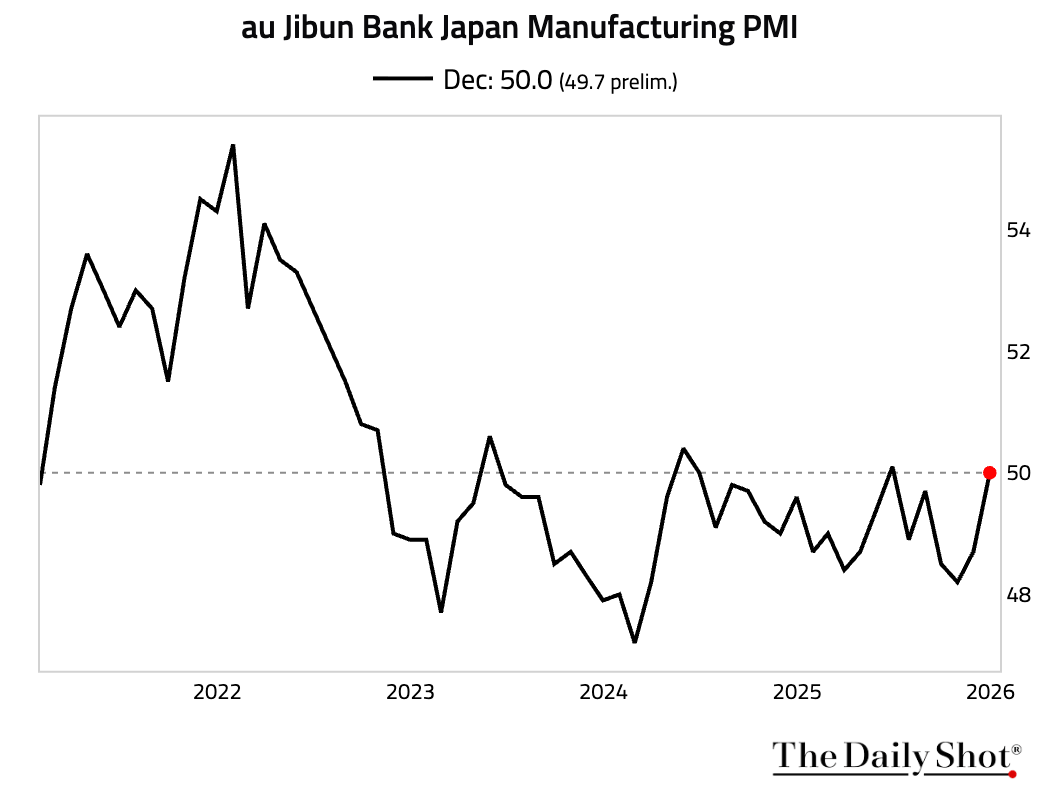

1 The manufacturing PMI was revised up to 50, ending a five-month contraction and driven by the slowest decline in new orders in 19 months and broadly stable output.

Source: S&P Global PMI

Source: S&P Global PMI

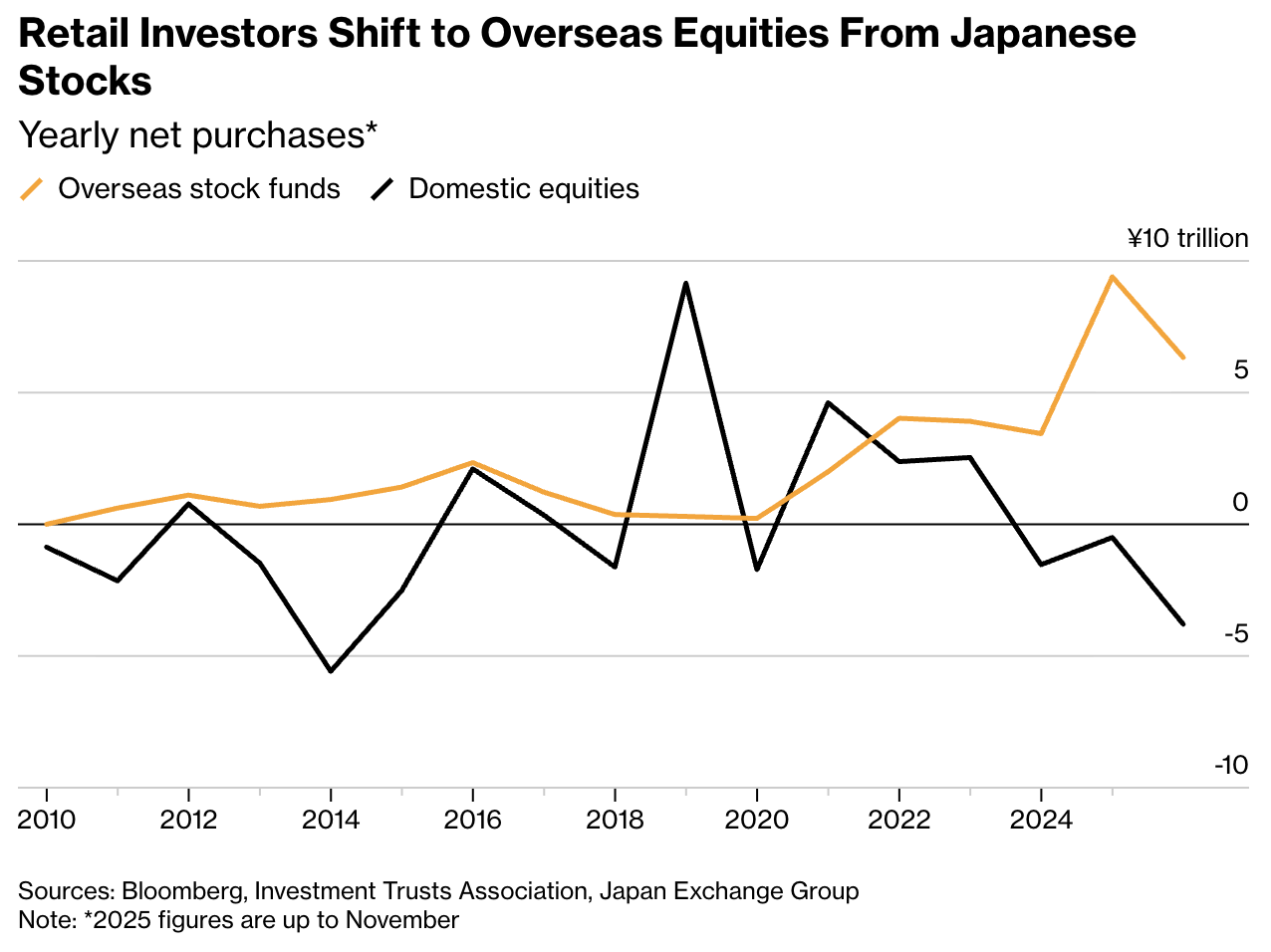

2 Retail investors are continuing to shift capital overseas, with near-record inflows into foreign funds—especially US stocks.

Source: @markets Read full article

Source: @markets Read full article

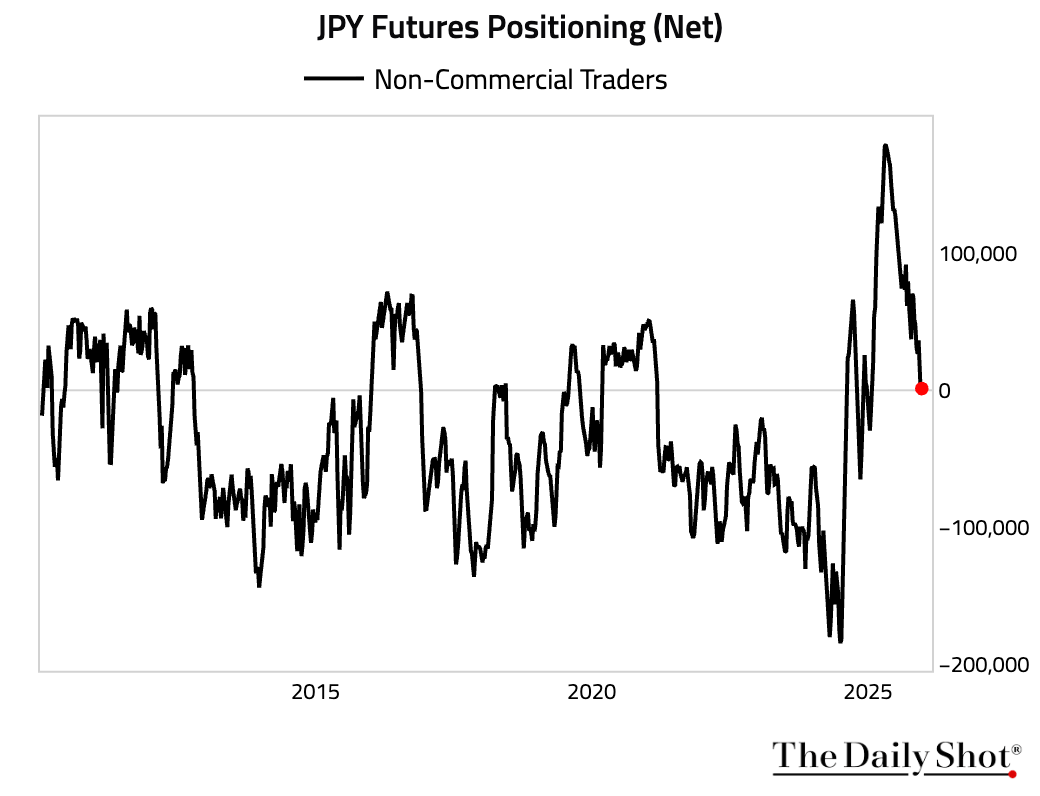

3 The net positioning of noncommercial traders in the yen is now roughly flat.

Back to Index

Asia-Pacific

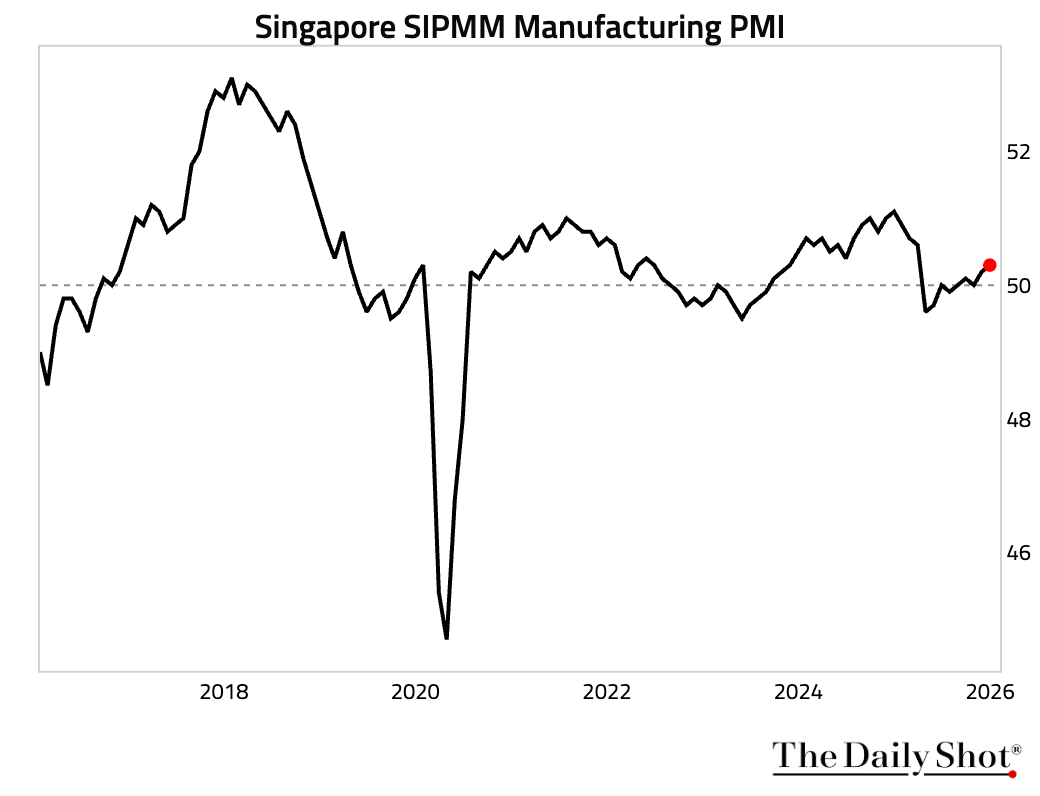

Singapore’s manufacturing PMI edged up further into expansionary territory.

Back to Index

China

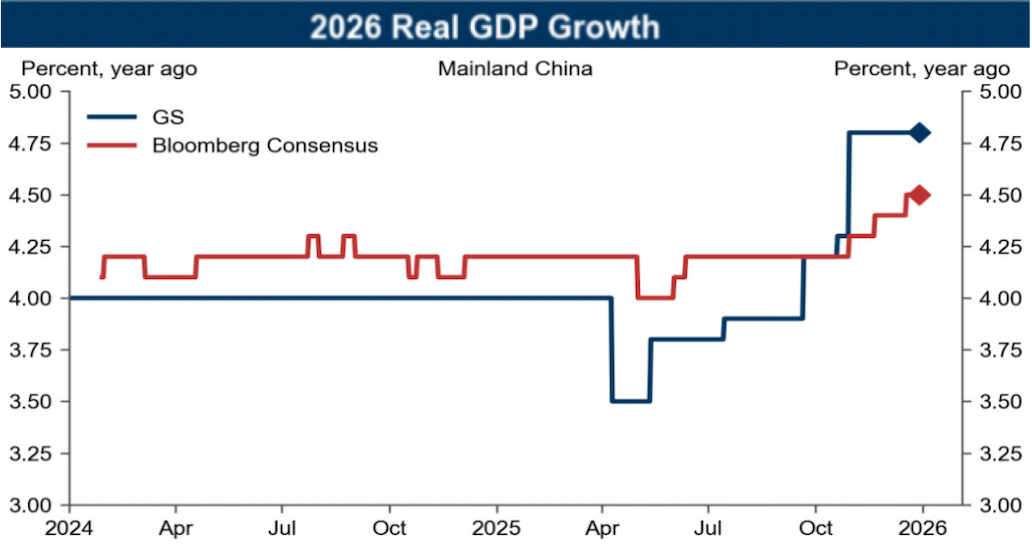

1 Here is a look at the consensus and Goldman’s 2026 GDP growth forecasts.

Source: Goldman Sachs

Source: Goldman Sachs

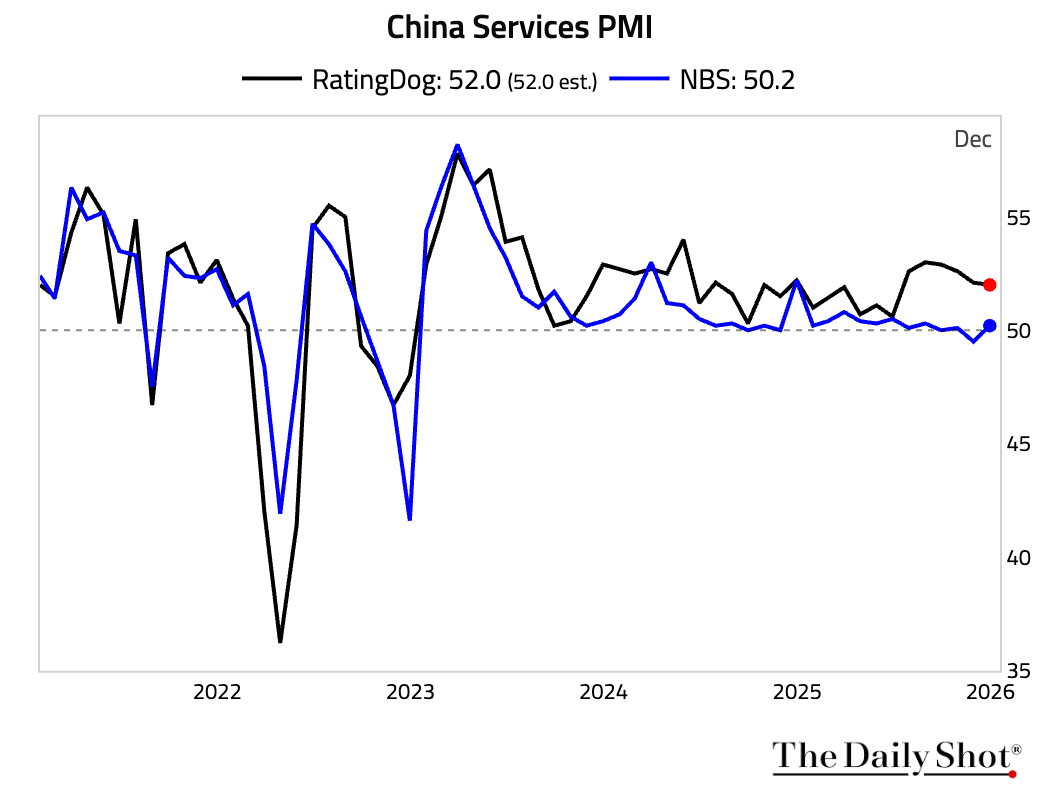

2 The RatingDog (formerly Caixin) Services PMI softened but remained firmly in expansionary territory.

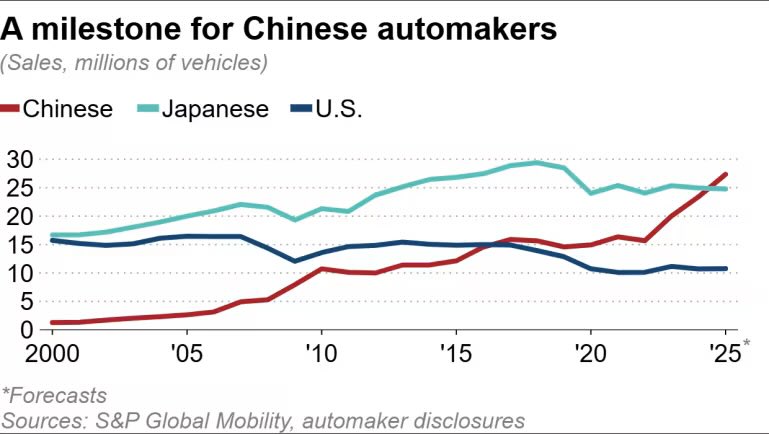

3 Chinese automakers are set to take the top spot in global new vehicle sales for the first time in 2025, knocking Japanese players, which held the position for more than 20 years, to second place.

Source: Nikkei Asia Read full article

Source: Nikkei Asia Read full article

Back to Index

Emerging Markets

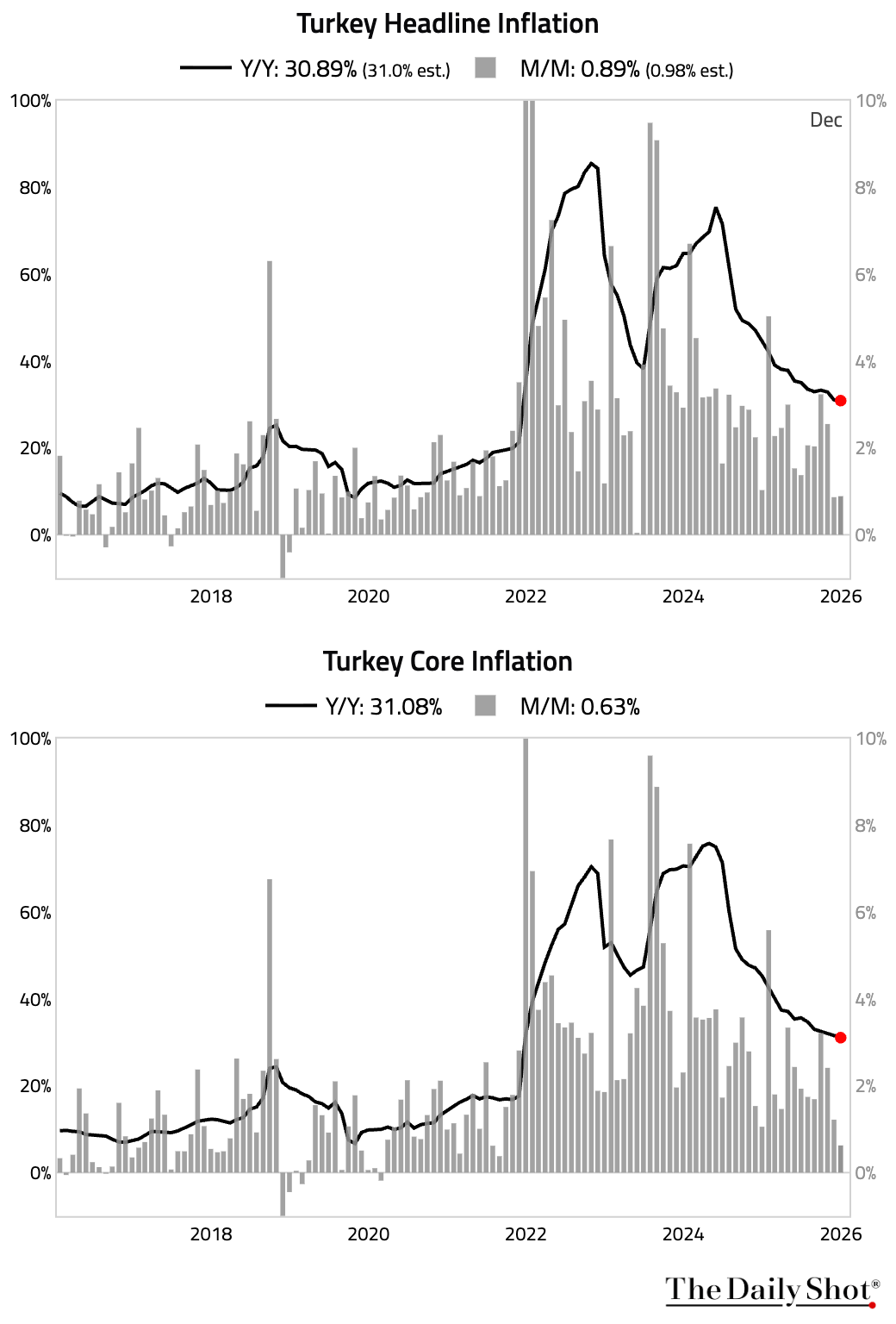

1 Turkey’s inflation eased in December, slightly below expectations, as declines in clothing and transportation prices offset firmer food costs.

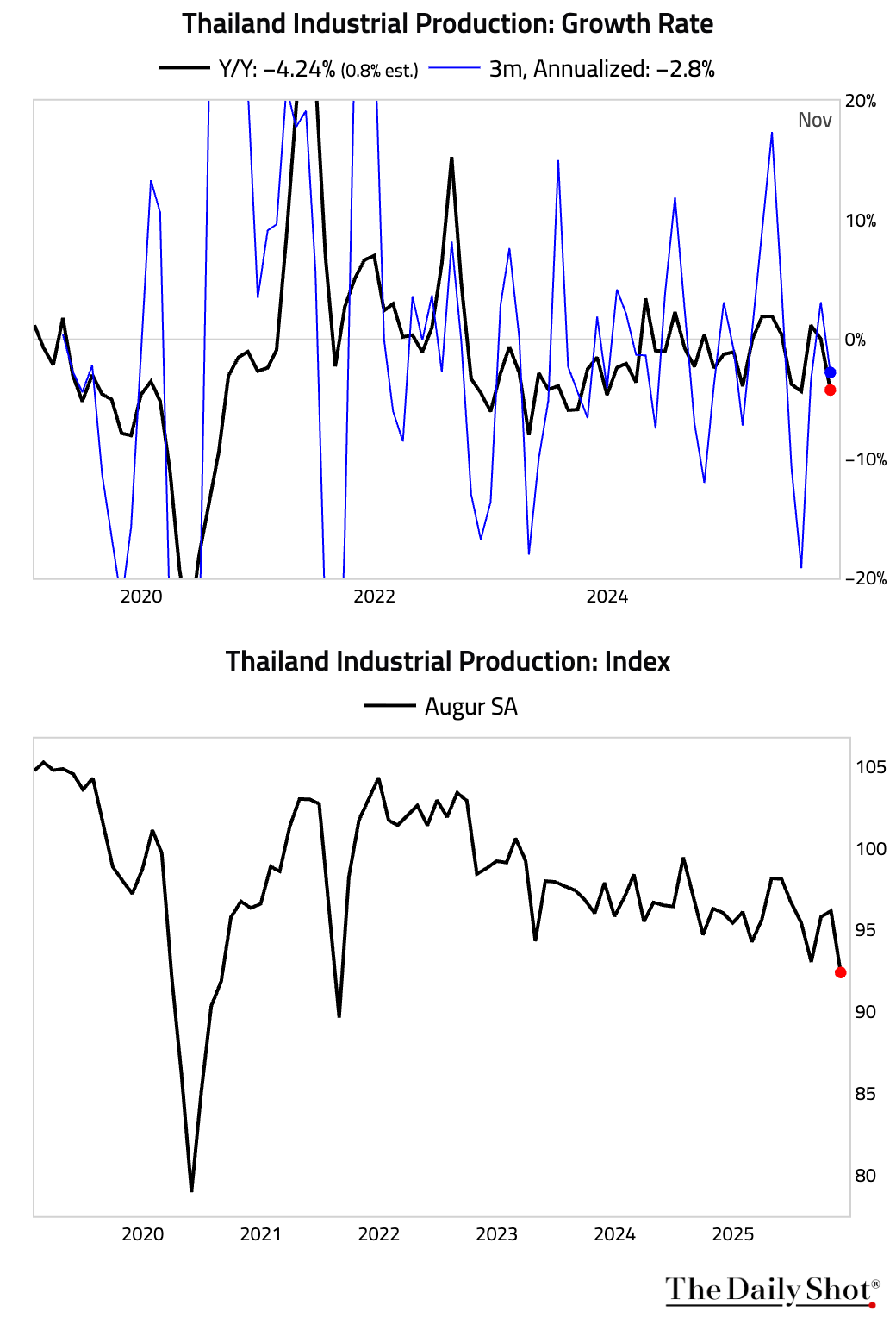

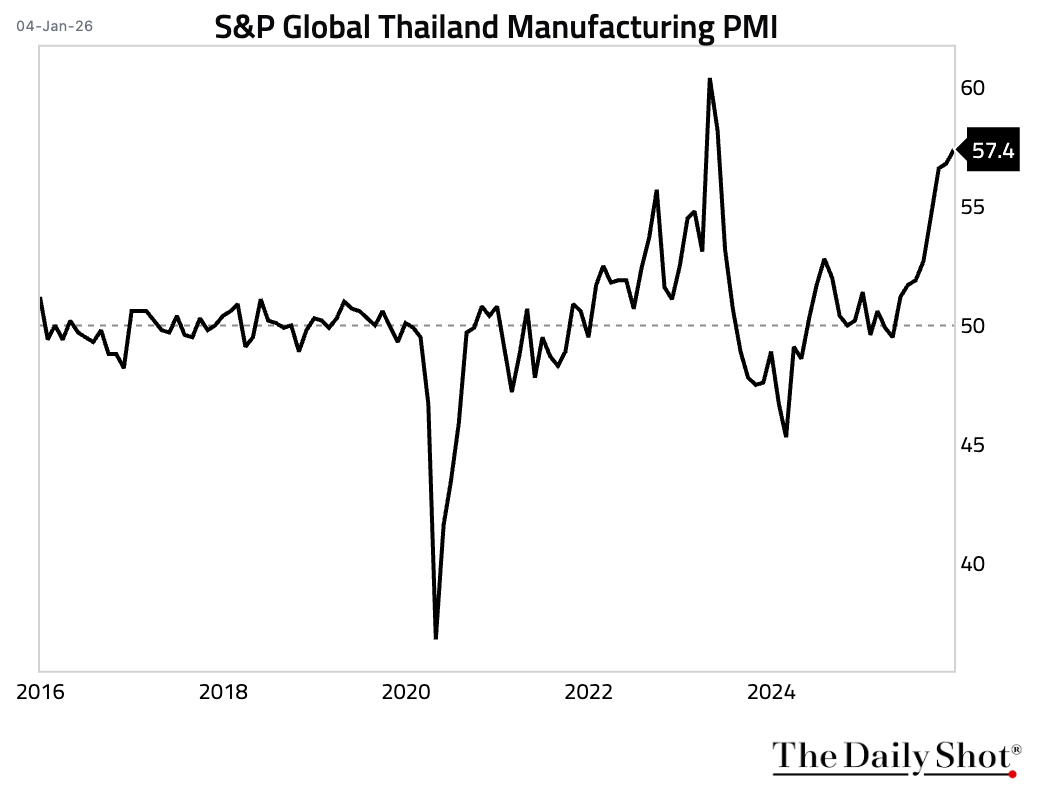

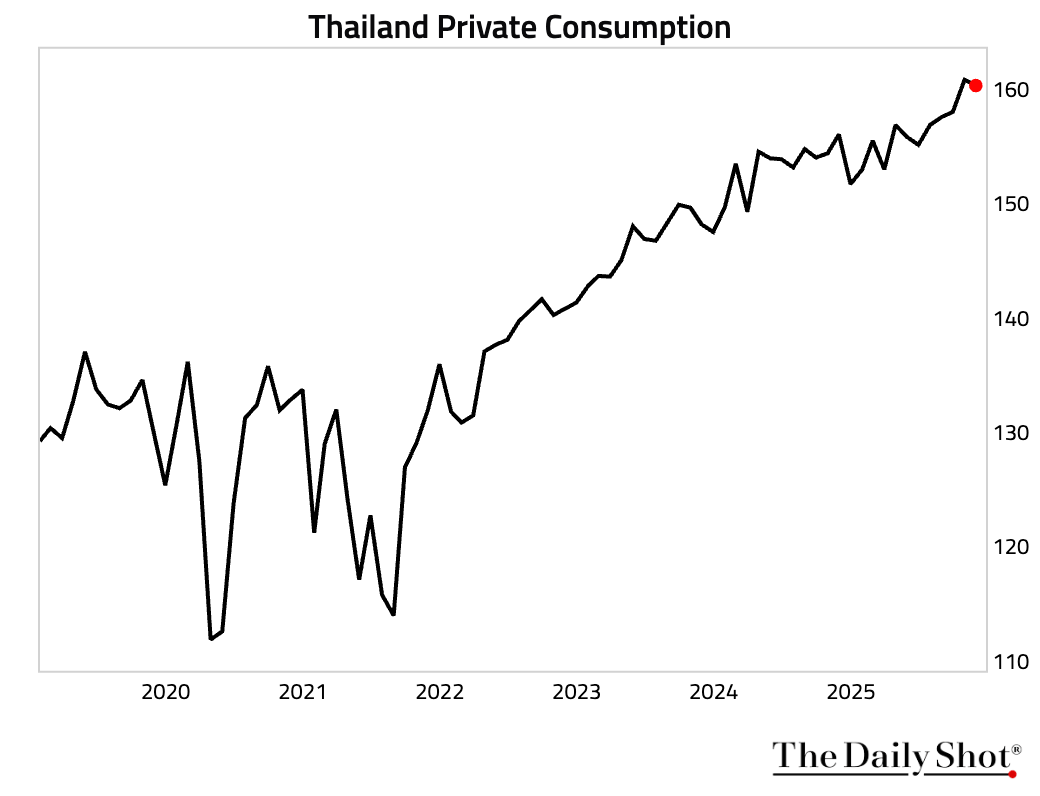

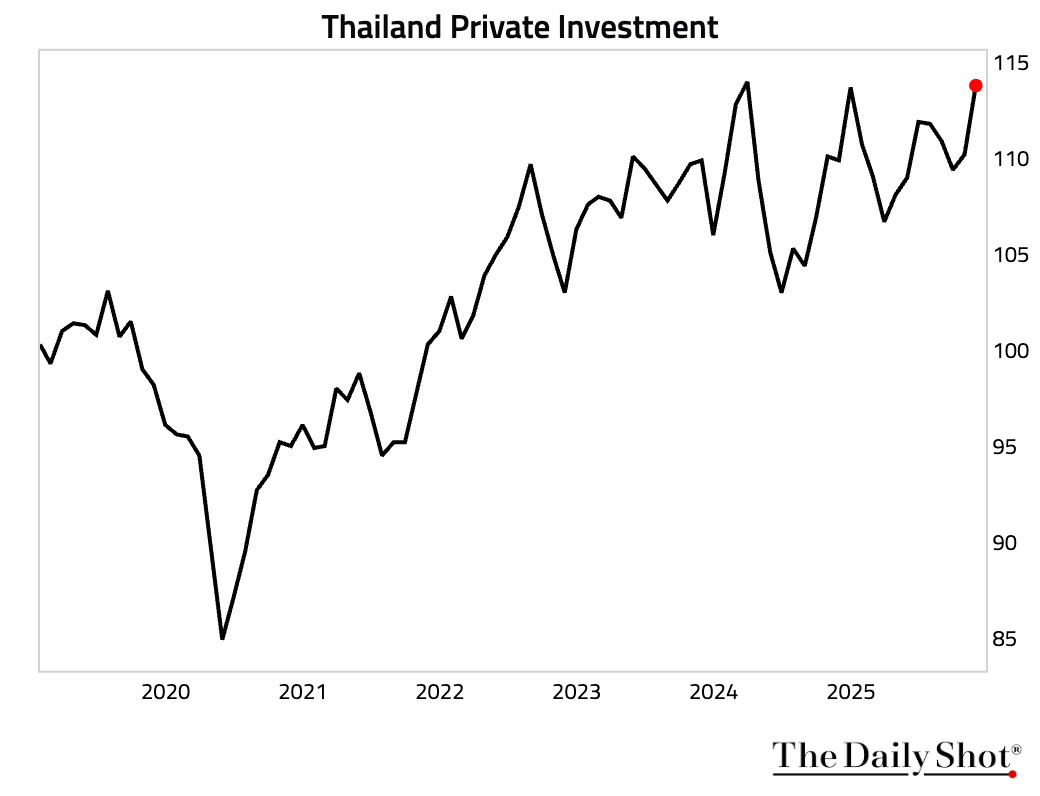

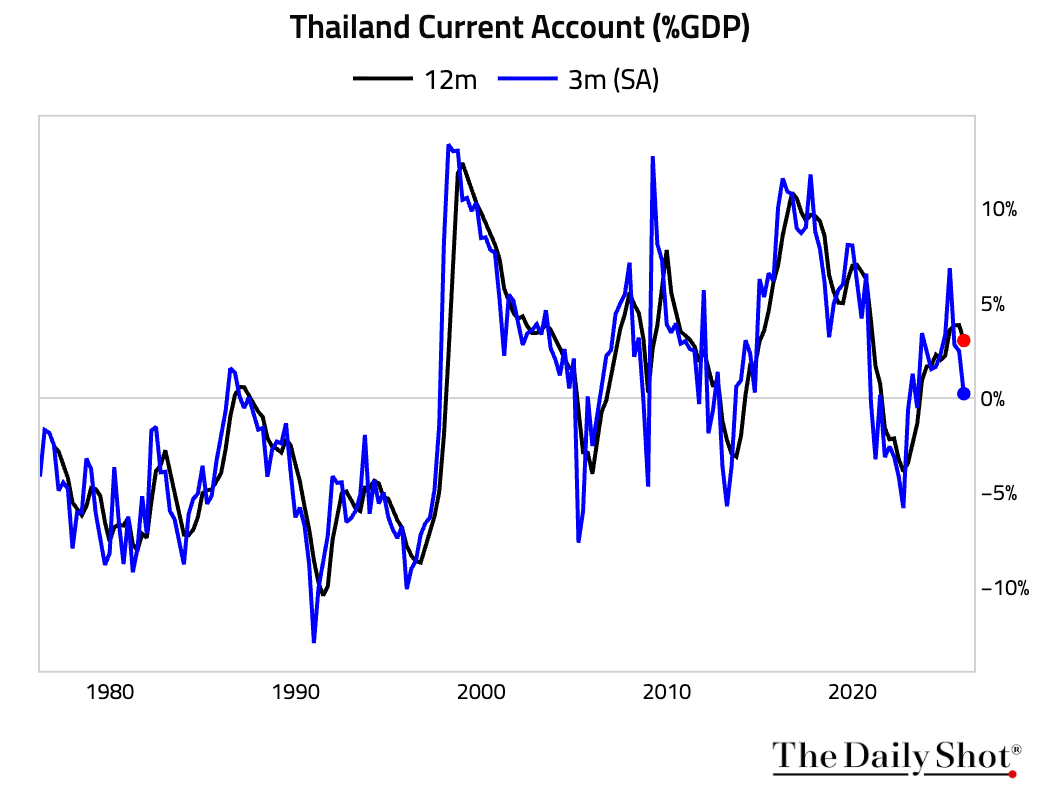

2 Here are some updates on Thailand.

• Industrial production unexpectedly contracted significantly in November.

• The manufacturing PMI continued to surge, driven by a record expansion in new domestic orders. This masks underlying weakness, as new export orders fell for the fifth month.

• Private consumption contracted, …

… but private investment continued to rebound.

… but private investment continued to rebound.

• Current account has deteriorated substantially, driven by a weak trade balance.

Back to Index

Equities

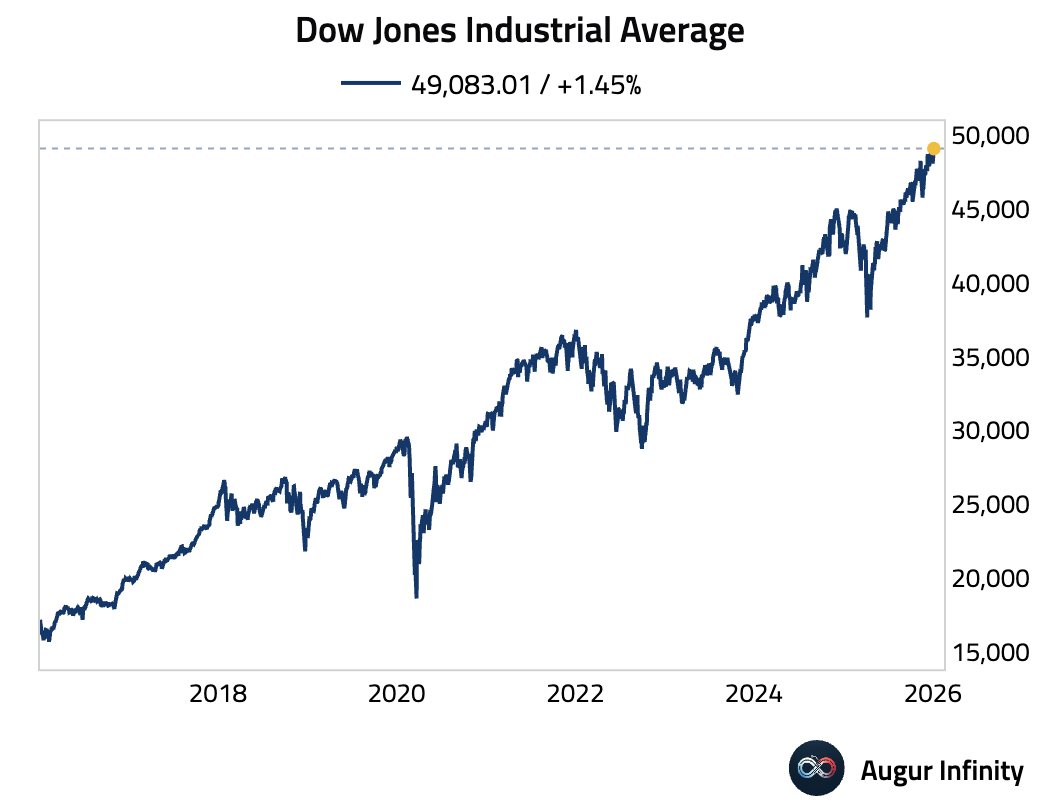

1 Equity markets started the year strong, with the Dow Jones Industrial Average has reached an all-time high.

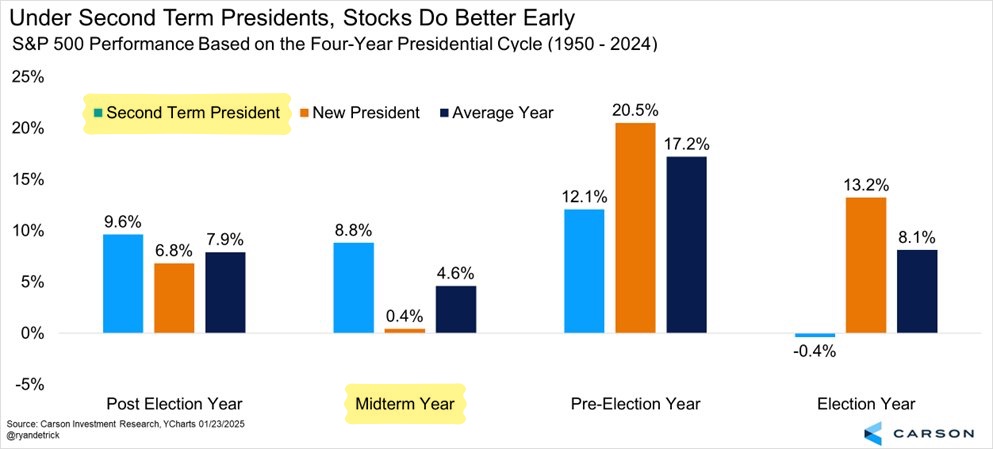

2 Historically, equities tend to be weak in midterm years, and 2026 is a midterm year. That being said, stocks tend to fare better during midterm years under second-term presidents.

Source: Ryan Detrick

Source: Ryan Detrick

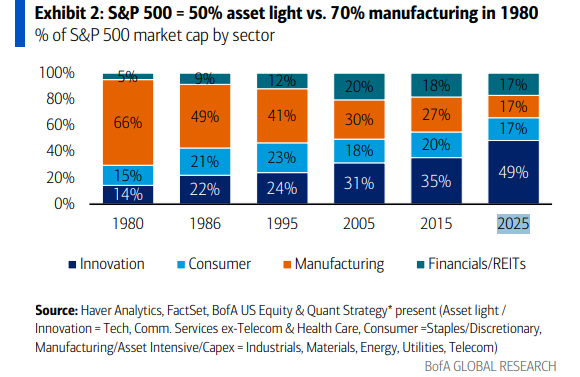

3 “Asset-light” companies have grown to account for 50% of the S&P 500.

Source: BofA Global Research via Mike Zaccardi

Source: BofA Global Research via Mike Zaccardi

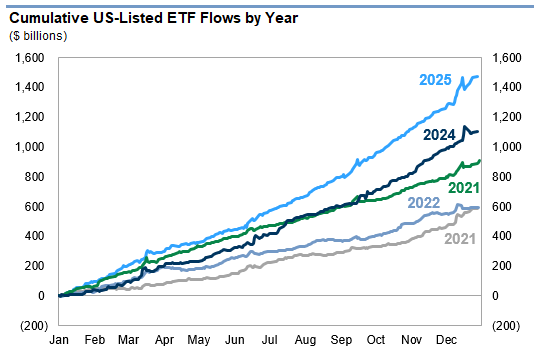

4 The US ETF industry added over $3 trillion in market value in 2025, its largest nominal year-over-year gain ever, reaching $13.4 trillion in assets under management.

Source: Goldman Sachs

Source: Goldman Sachs

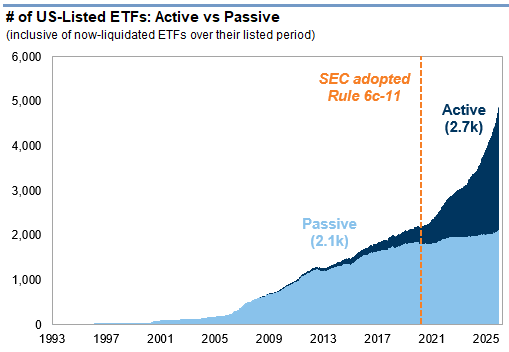

• For the first time ever, the US ETF market saw the total number of actively managed ETFs overtake their passive counterparts.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Rates

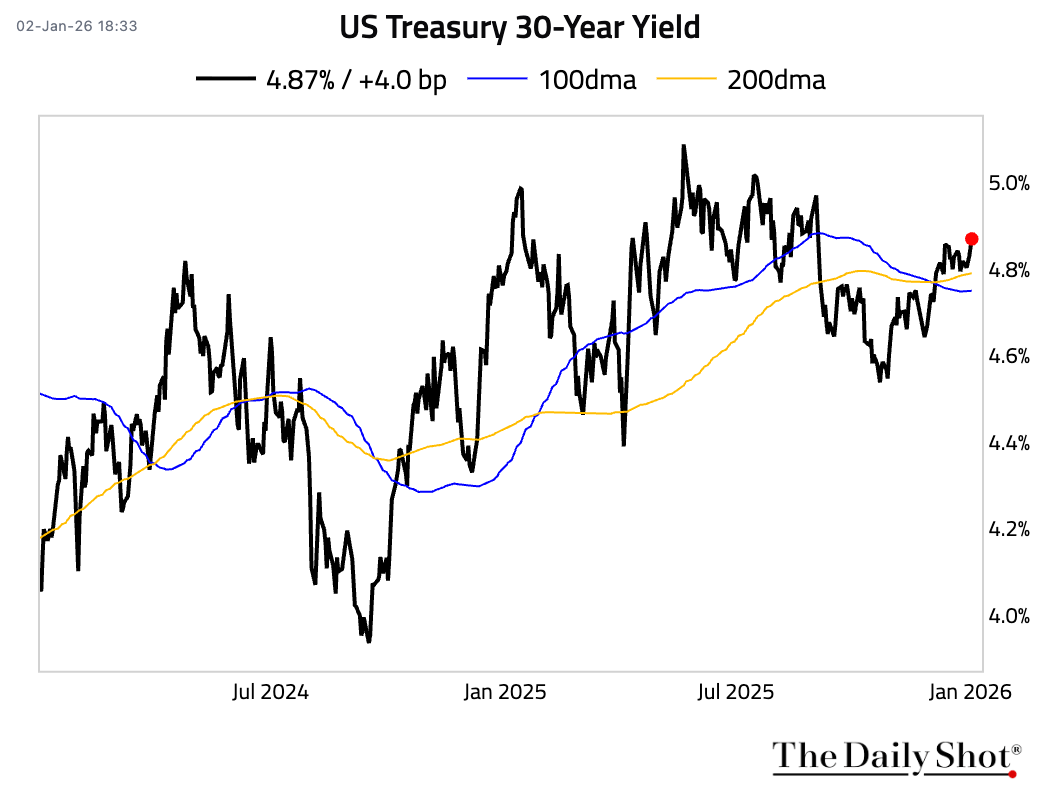

1 The 30-year yield has risen to the highest level since last September.

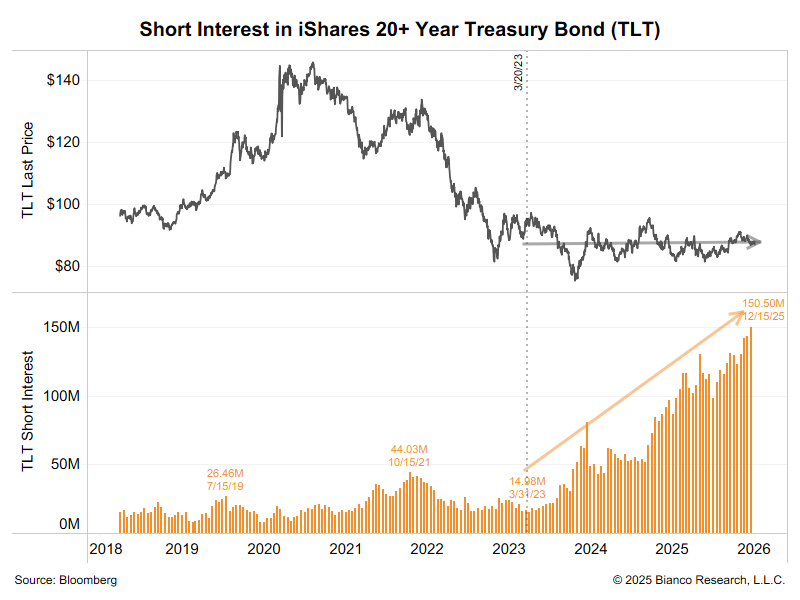

2 Short interest in TLT, the 20+ year Treasury Bond ETF, has surged.

Source: Jim Bianco

Source: Jim Bianco

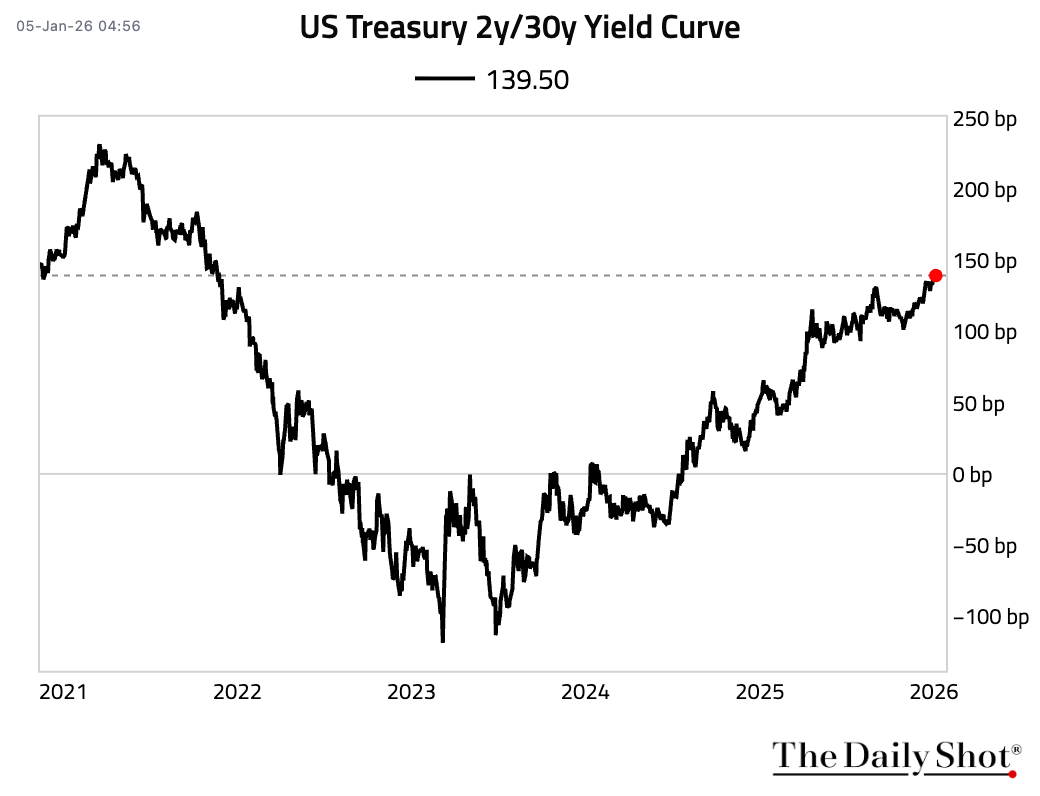

3 The yield curve continues to steepen, with the 2-year/30-year spread at its steepest level since November 2021.

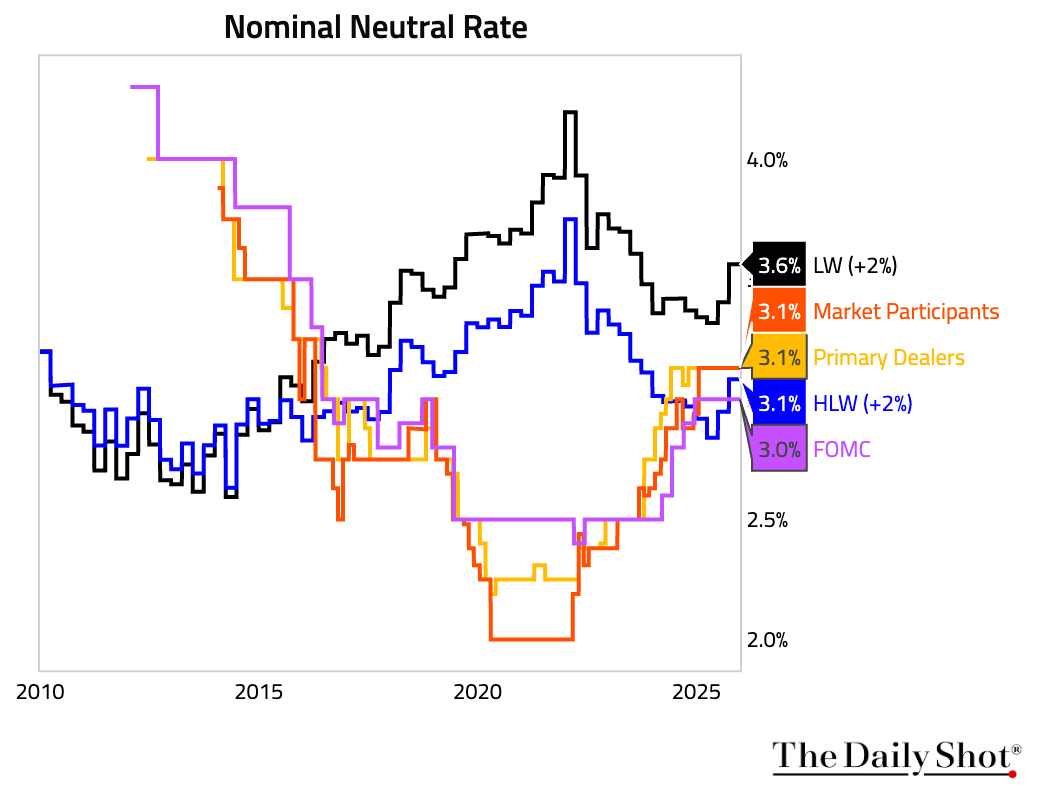

4 Neutral rate estimates for the US are all above 3% in nominal terms.

Back to Index

Credit

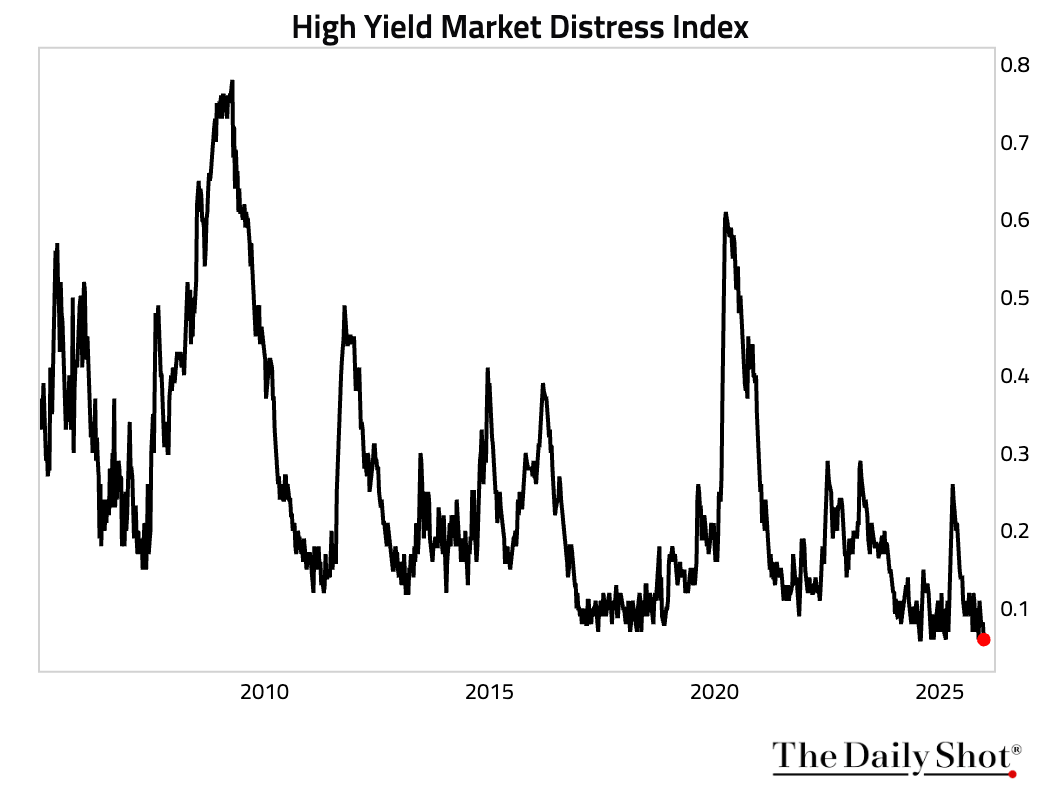

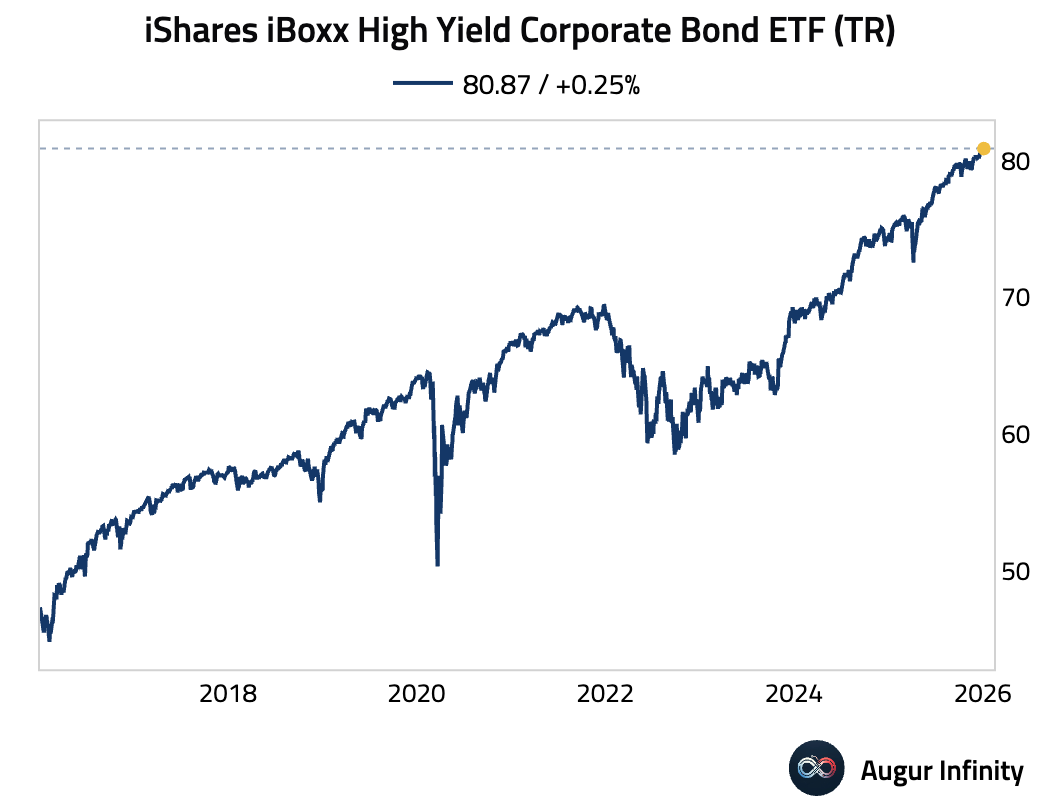

1 The New York Fed’s high-yield market distress index fell back to secularly low levels.

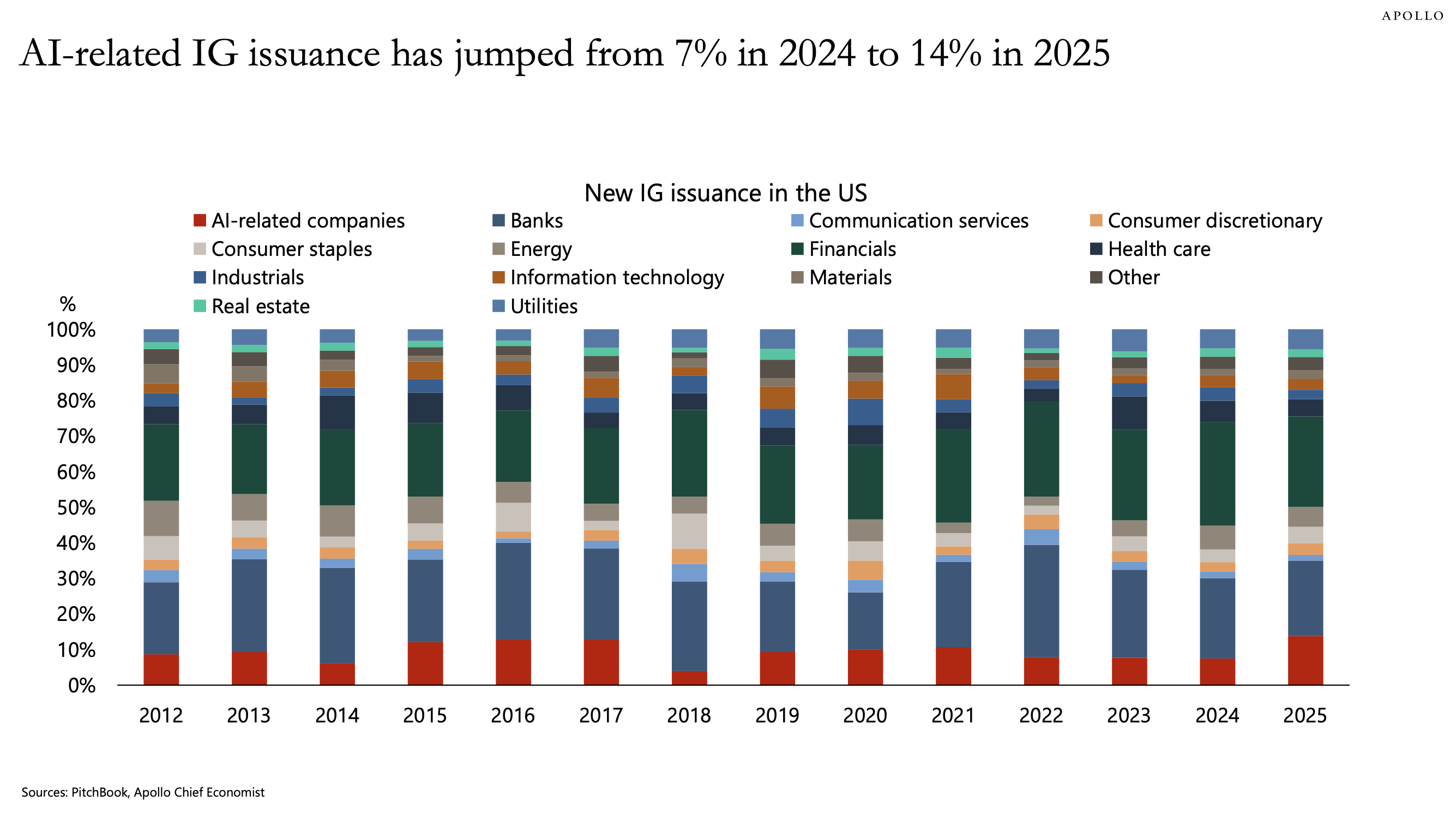

2 AI-related companies now represent an increasing share of investment-grade issuance.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

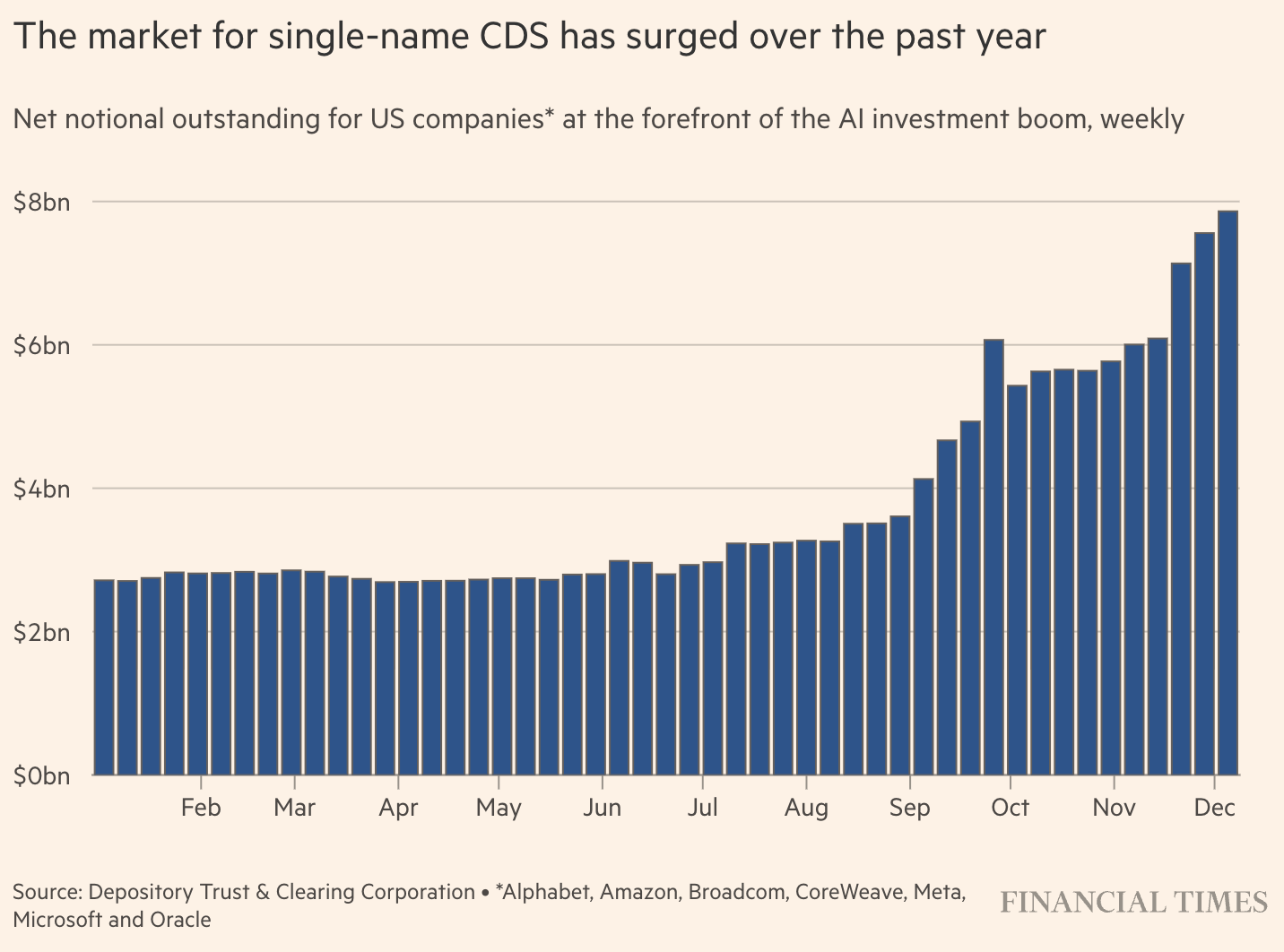

3 Investors are increasingly using credit default swaps to hedge against a potential AI-driven debt bust, as heavy borrowing by major tech firms to fund data centers and infrastructure raises concerns about future returns.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4 iShares iBoxx High Yield Corporate Bond ETF (TR) has reached an all-time high.

Back to Index

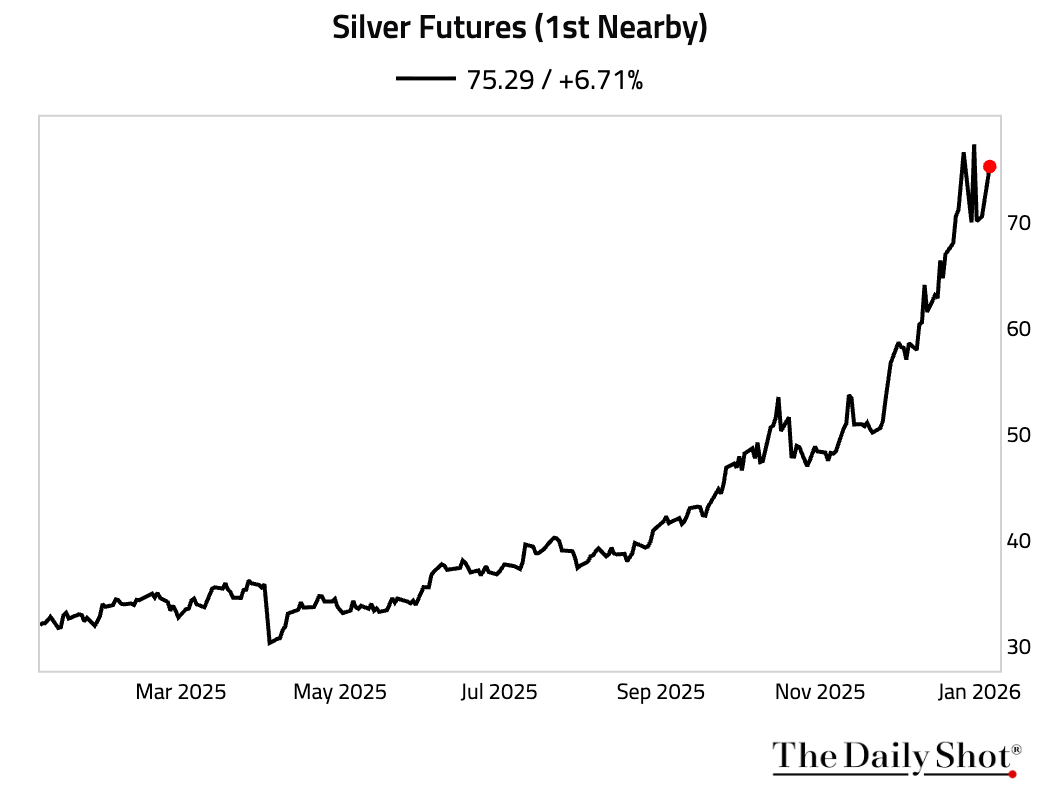

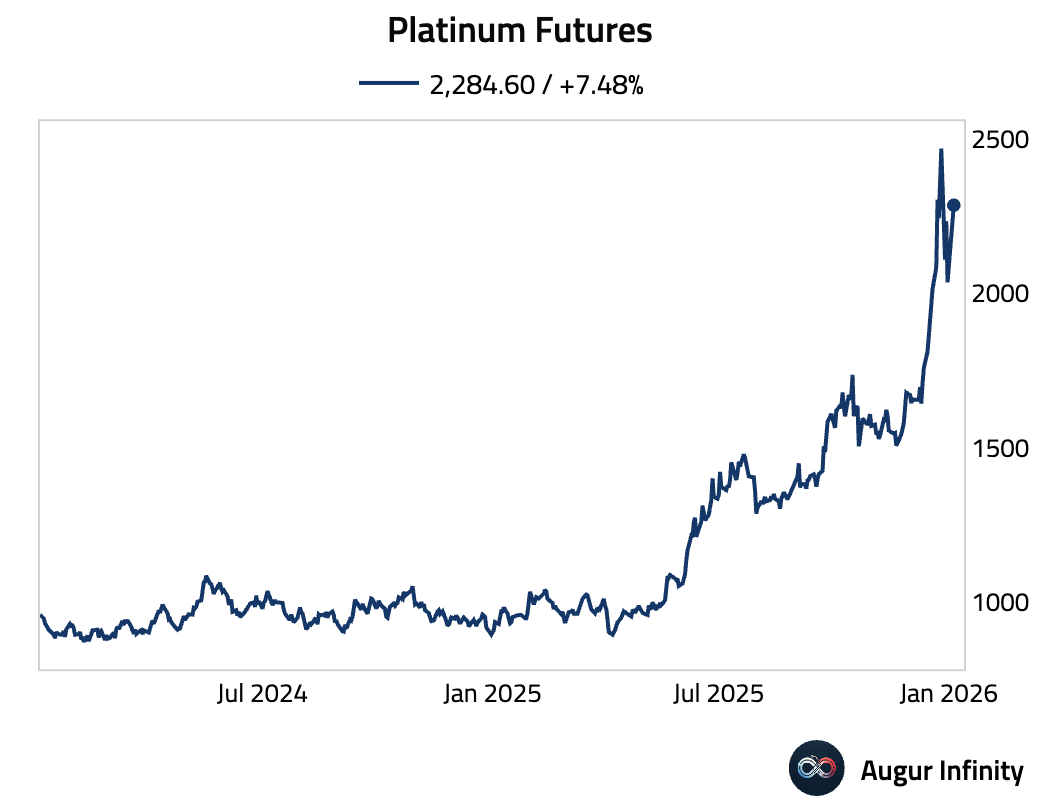

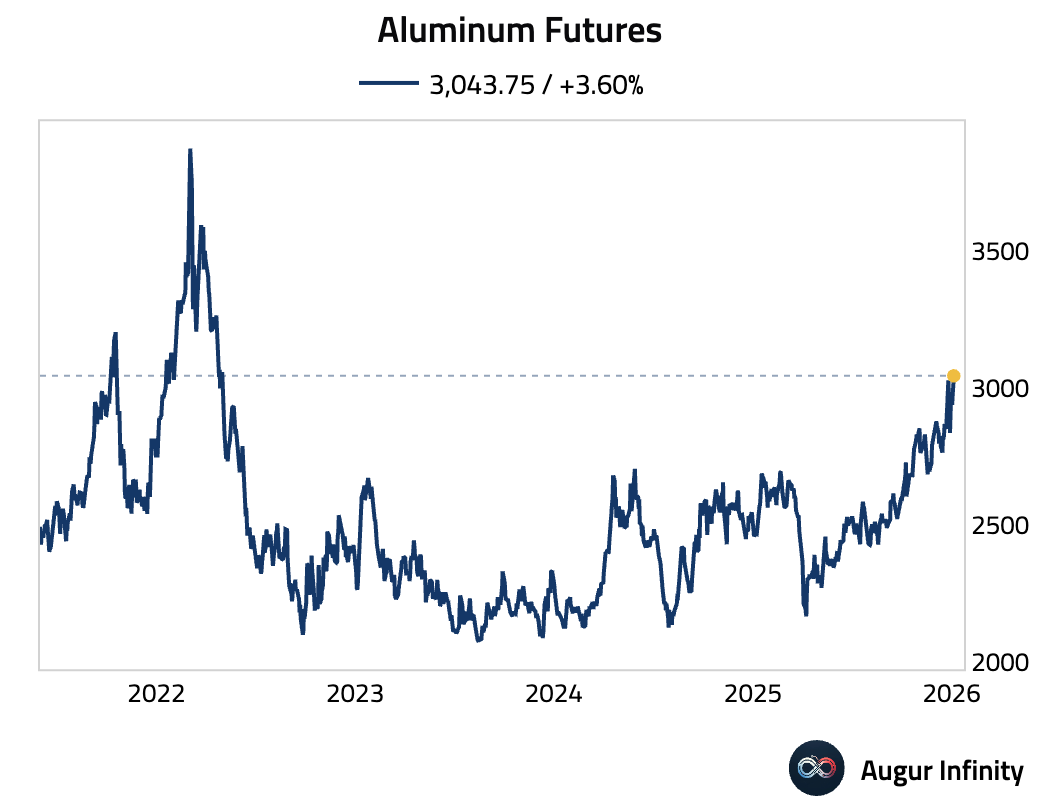

Commodities

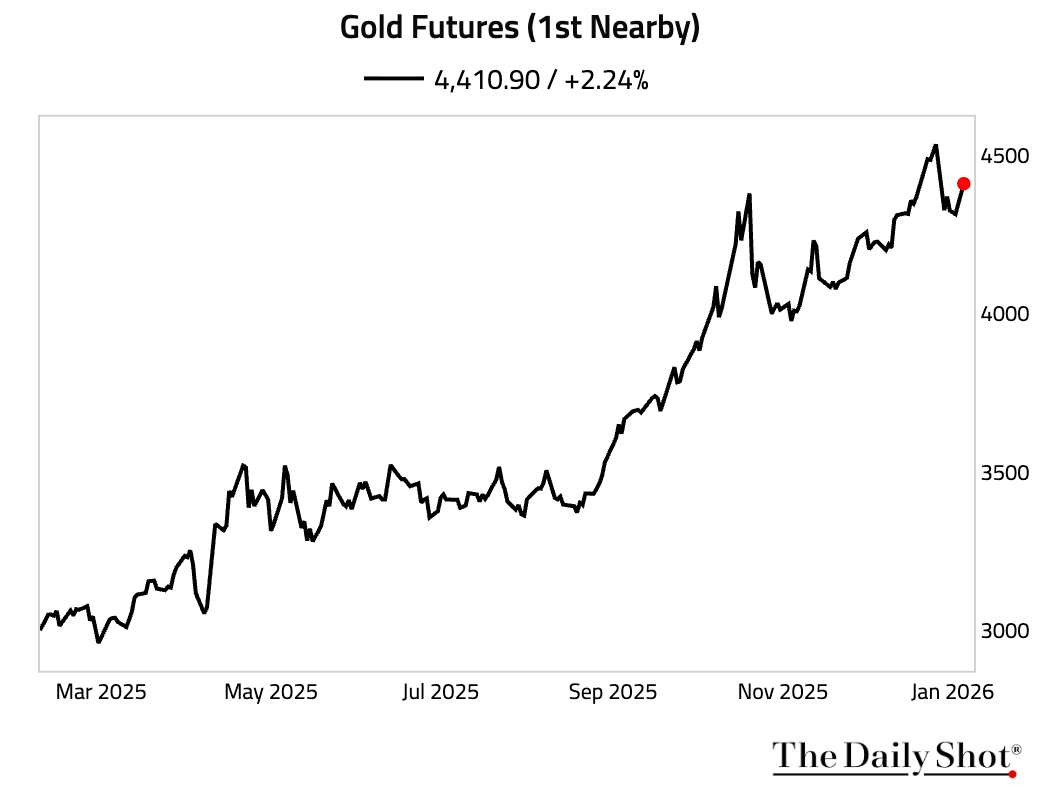

1 Gold and silver advanced, with investors seeking safe havens from geopolitical risk.

2 Platinum jumped in a 2.2σ move.

3 Aluminum futures are at the highest level since May 2022.

Back to Index

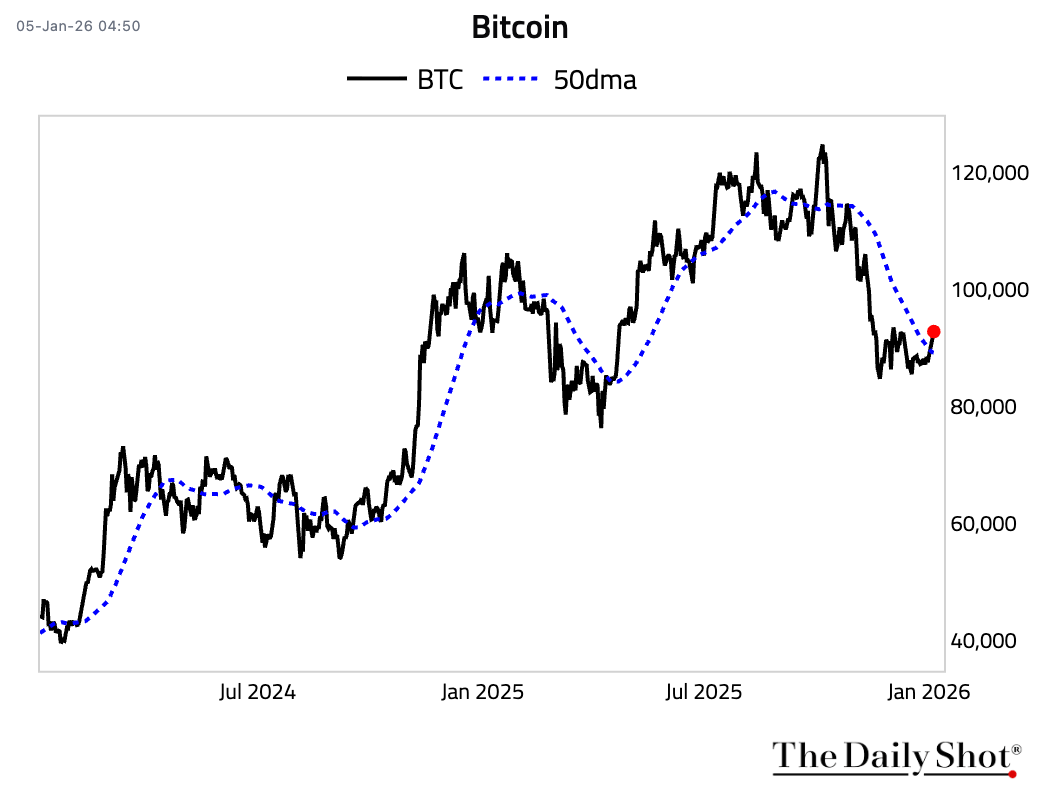

Cryptocurrency

1 Bitcoin is above its 50-day moving average.

Back to Index

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.