- United States

- The Eurozone

- Europe

- Japan

- Asia-Pacific

- China

- India

- Emerging Markets

- Equities

- Commodities

- Global Developments

United States

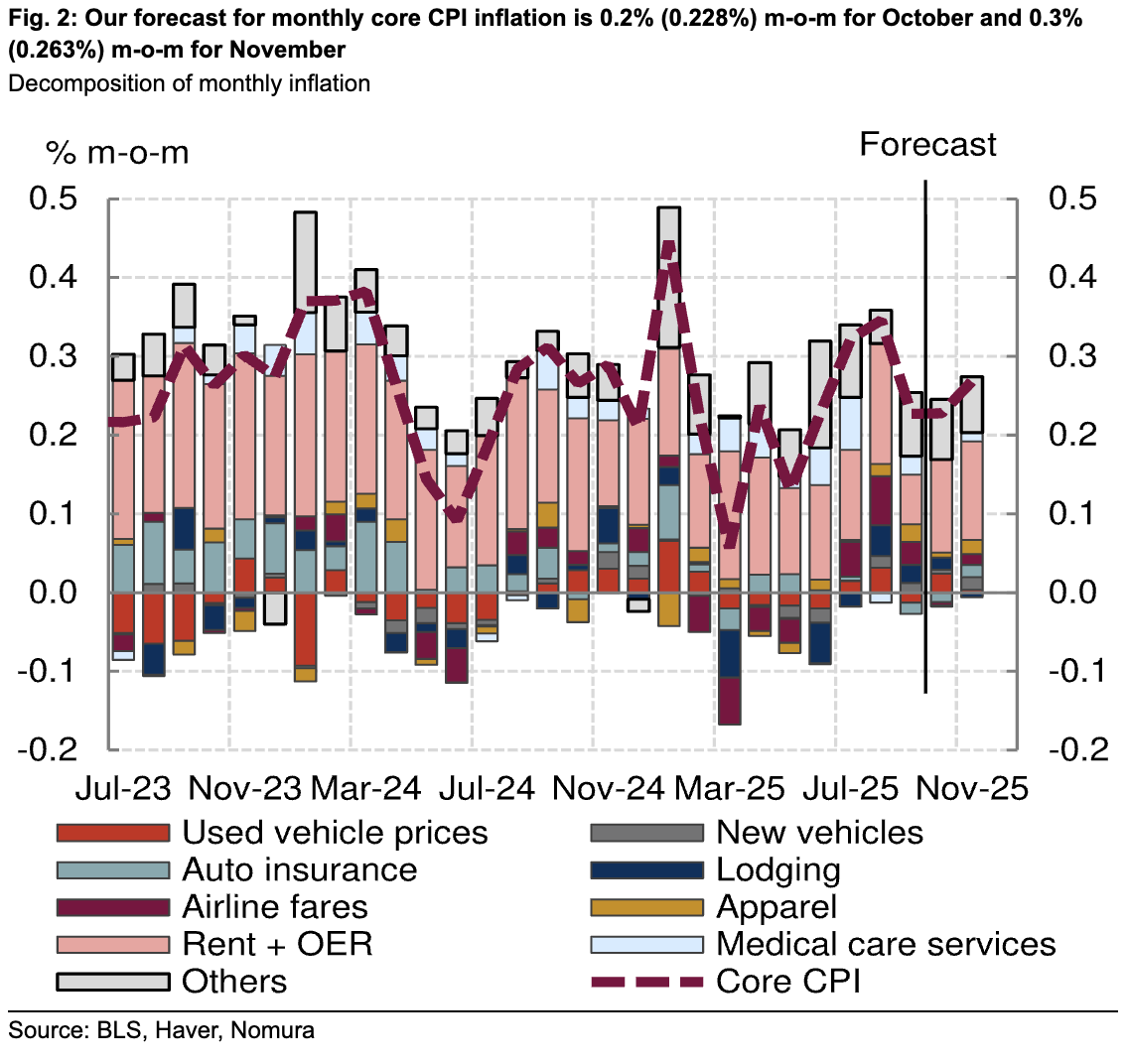

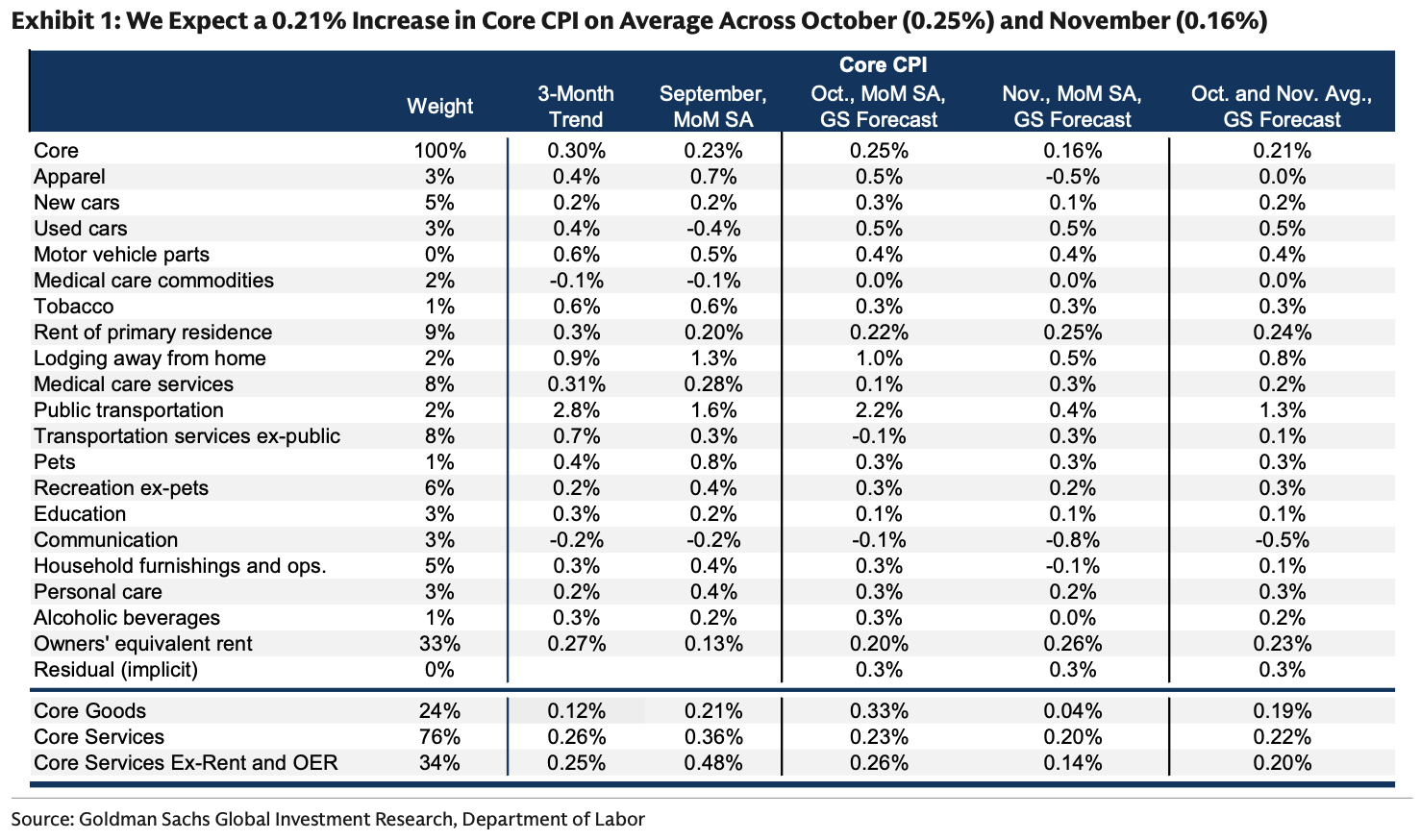

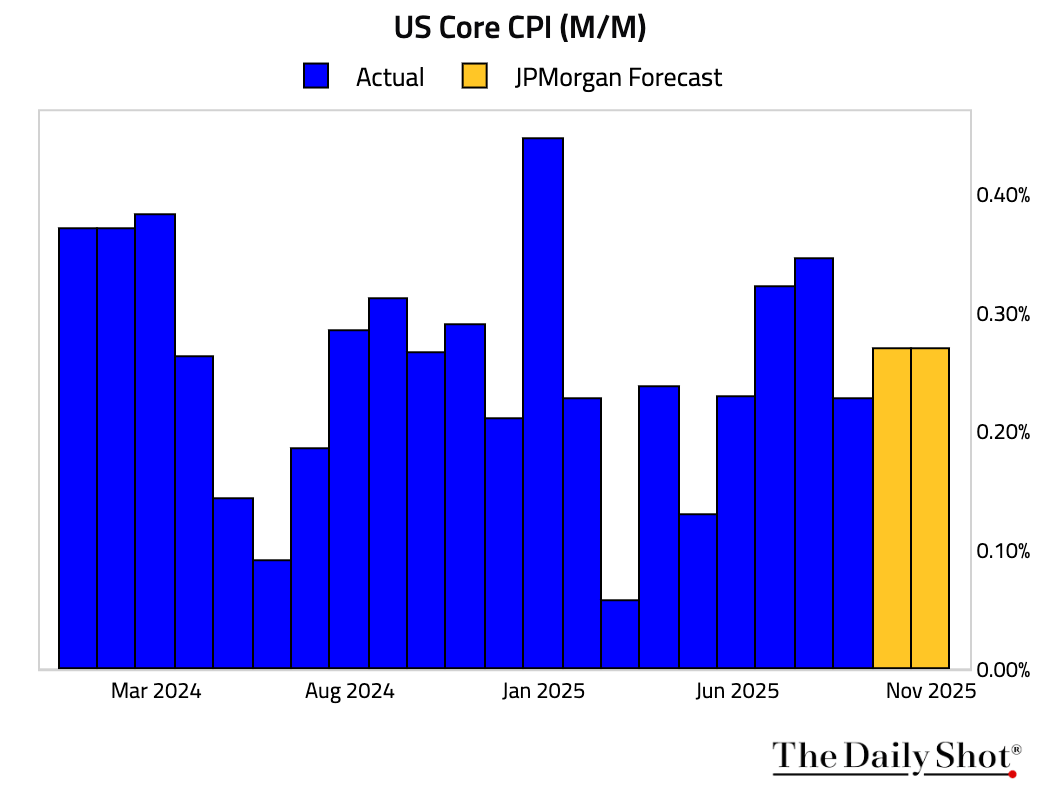

1 What should we expect from tomorrow’s CPI report?

– Nomura forecasts that core inflation rose by 0.451%.

Source: Nomura Securities

Source: Nomura Securities

– Morgan Stanley expects a 0.36% increase in core CPI.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

– Barclays forecasts core inflation at 0.35%.

2 The Fed has been served with grand jury subpoenas from the Justice Department threatening a criminal indictment over Chair Powell’s congressional testimony on the renovation of Fed headquarters—a move Powell says reflects broader political pressure on the central bank’s independence.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• Here are the market actions:

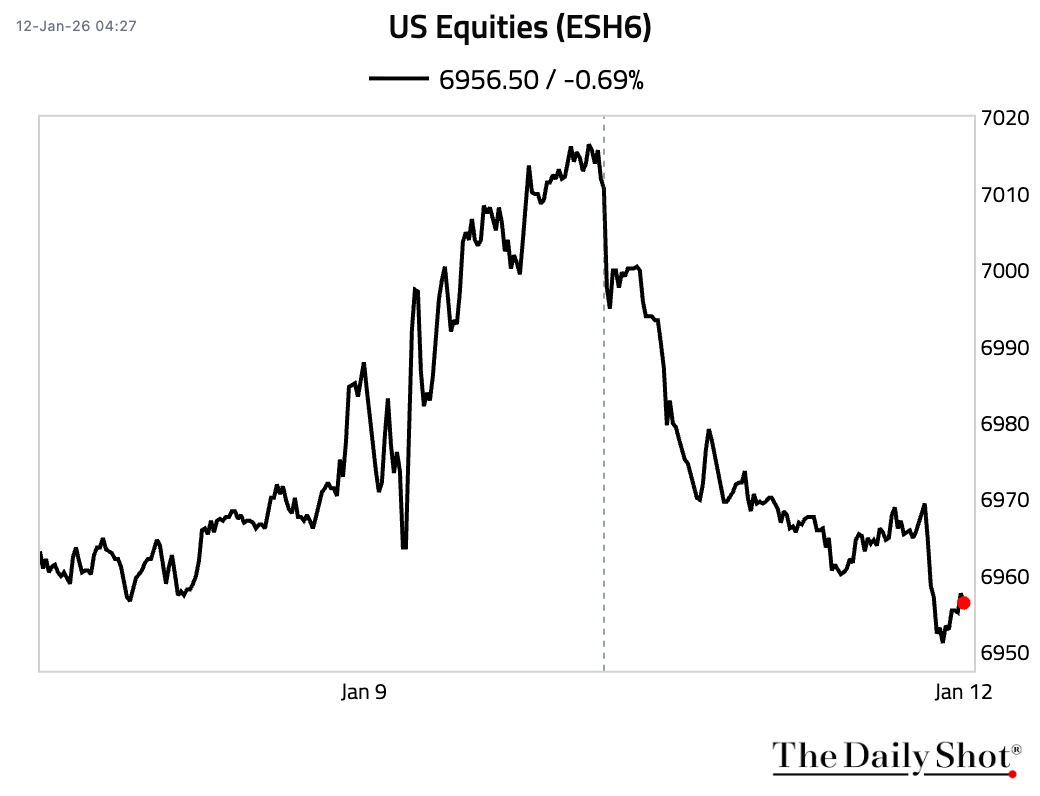

– Equities (sold off sharply initially but have since rebounded):

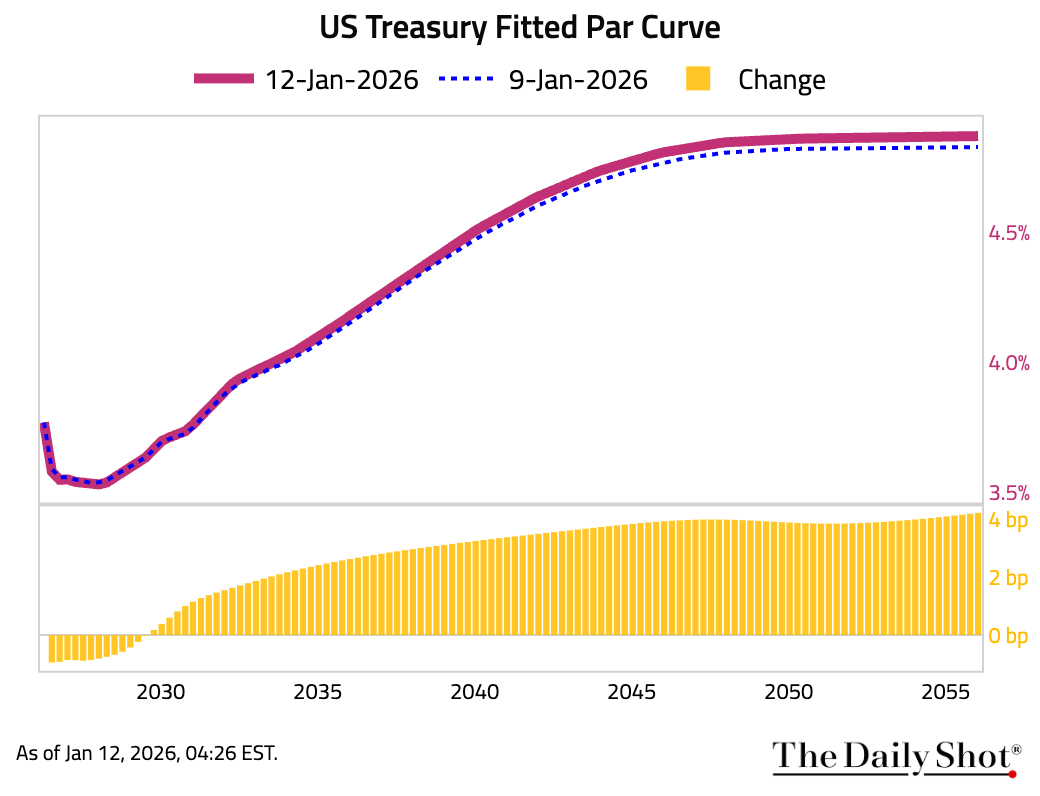

– Bonds (yields rose a tad):

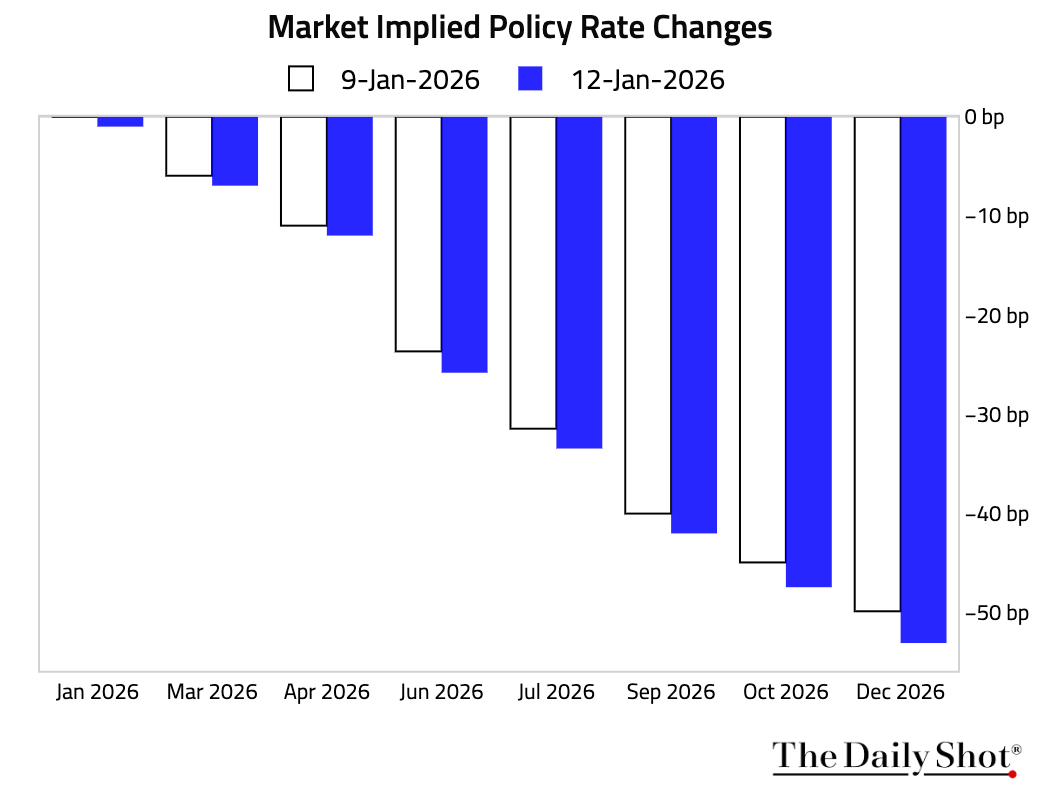

– Rate expectations (little changed):

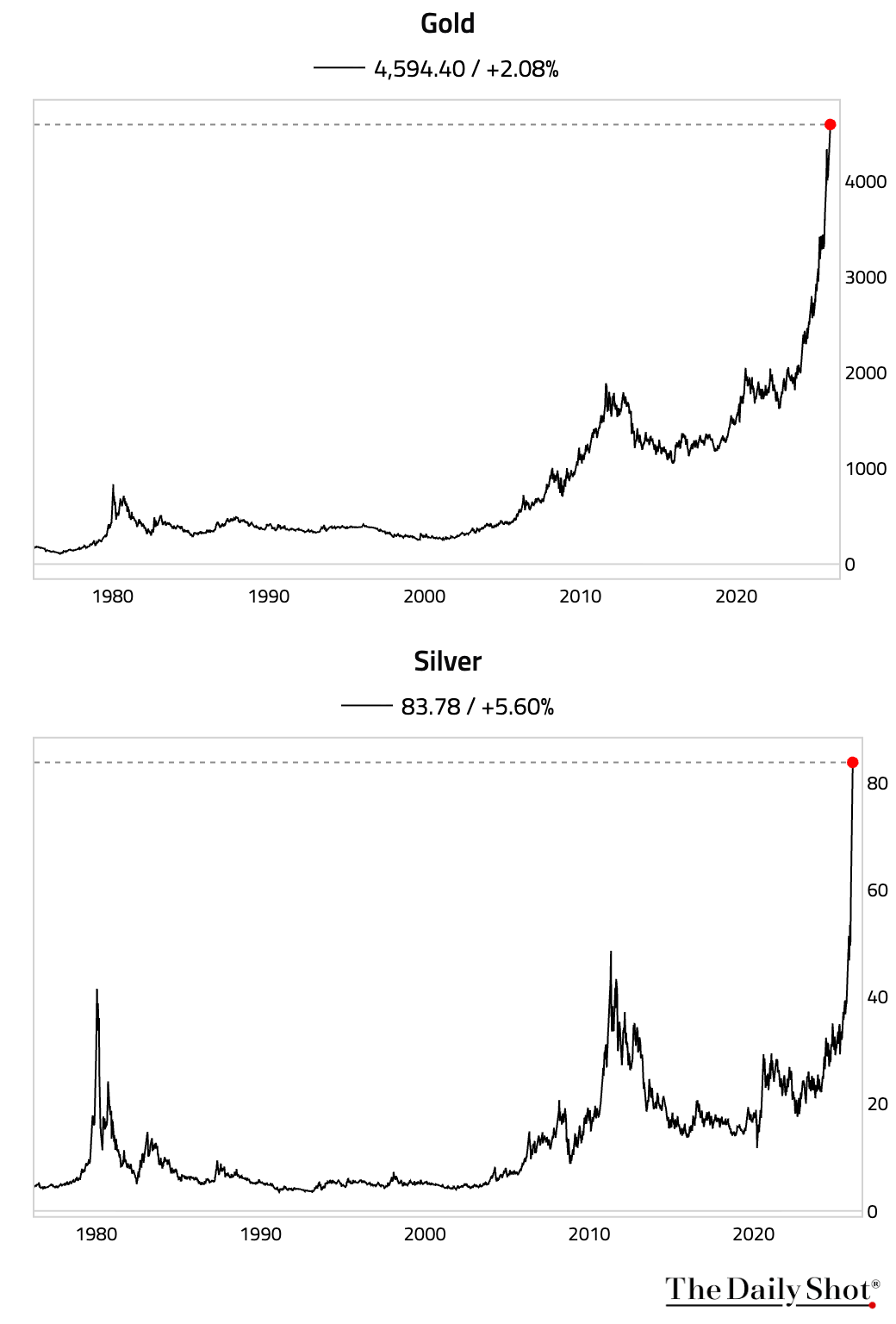

– Precious metals (rallied to new record highs):

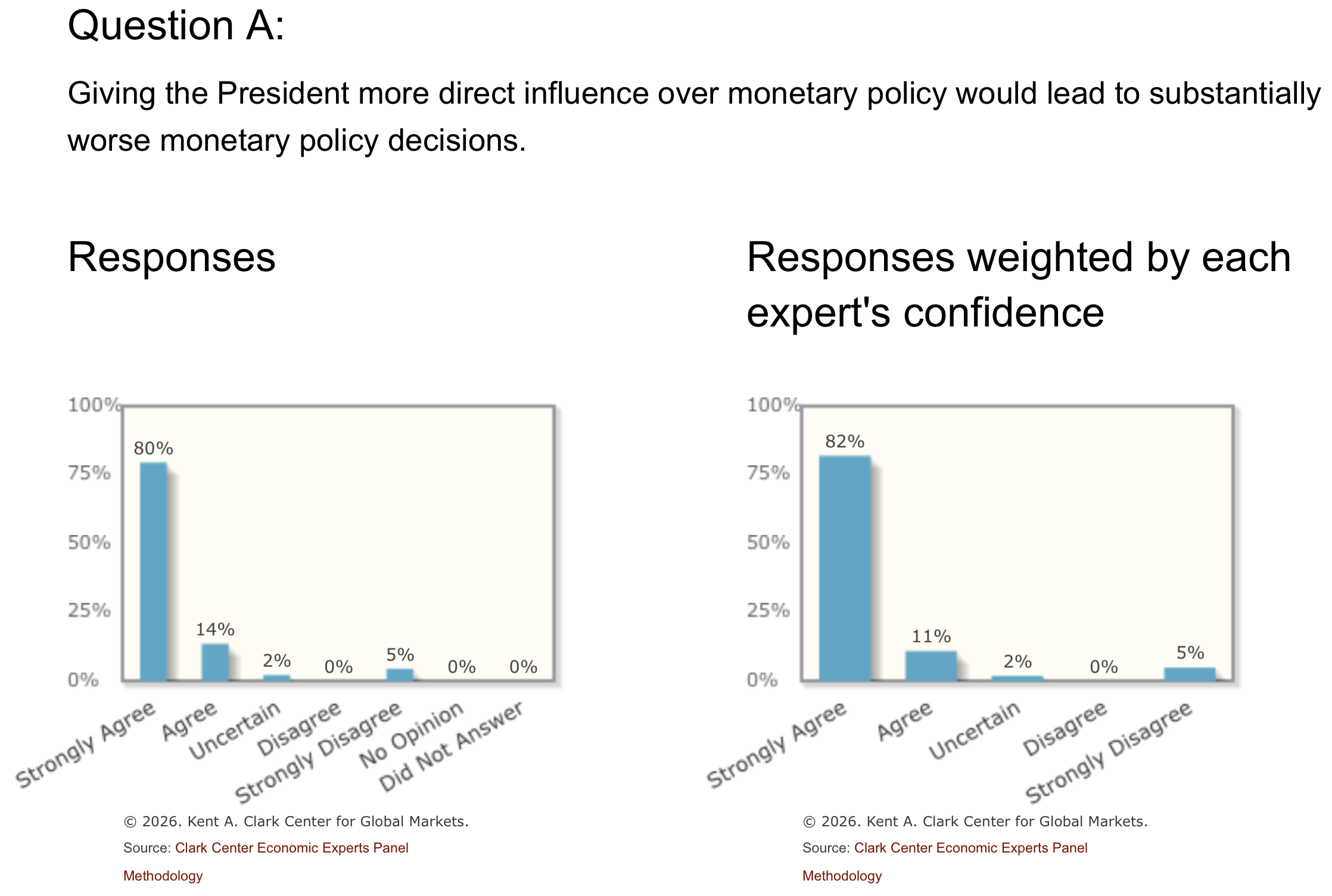

• Prominent economists widely agree that giving the president more direct influence over monetary policy would lead to substantially worse decisions.

Source: Kent A. Clark Center via Joey Politano

Source: Kent A. Clark Center via Joey Politano

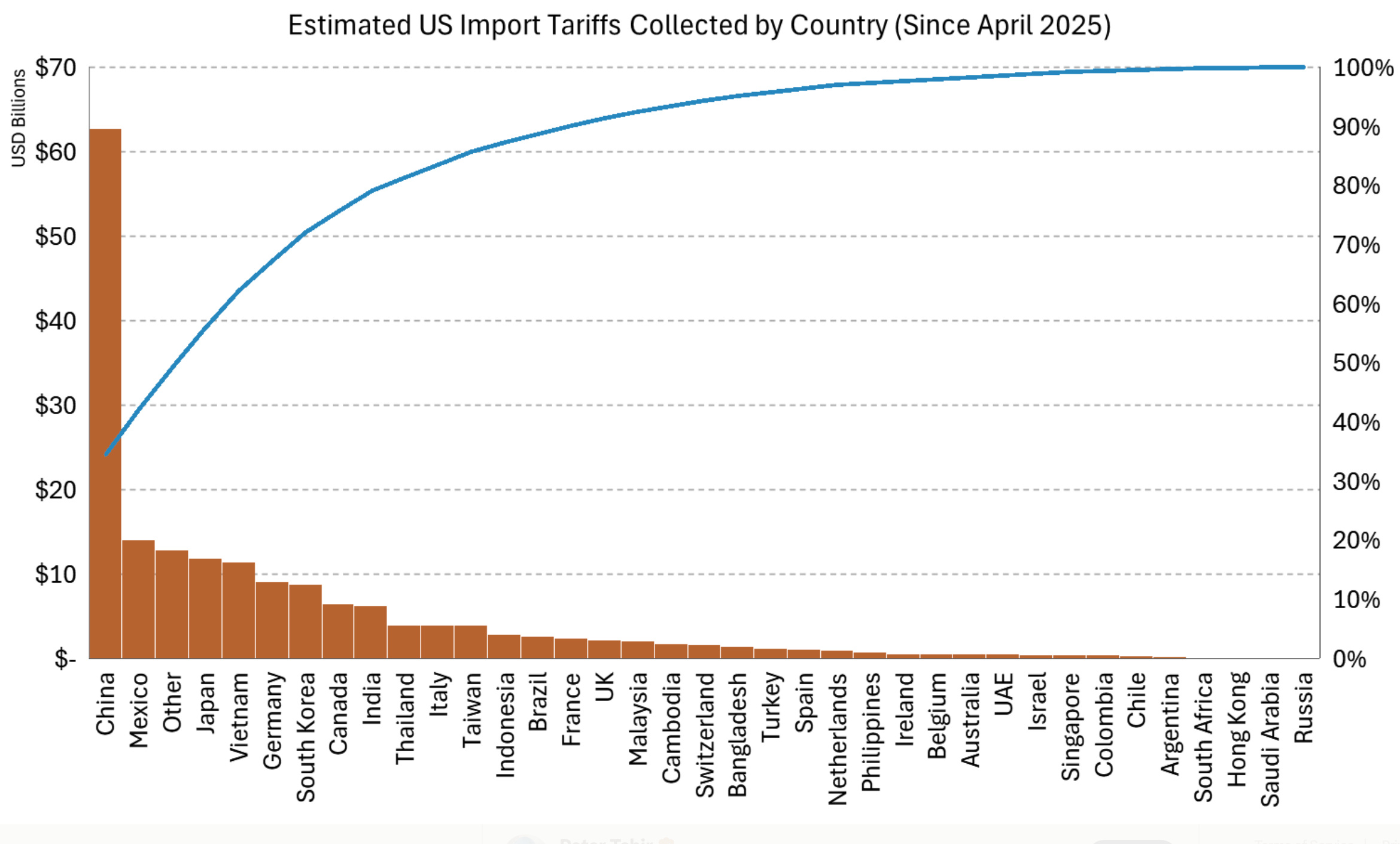

3 Here are the estimated import tariffs by country since April 2025.

Source: Michael McDonough

Source: Michael McDonough

Back to Index

The Eurozone

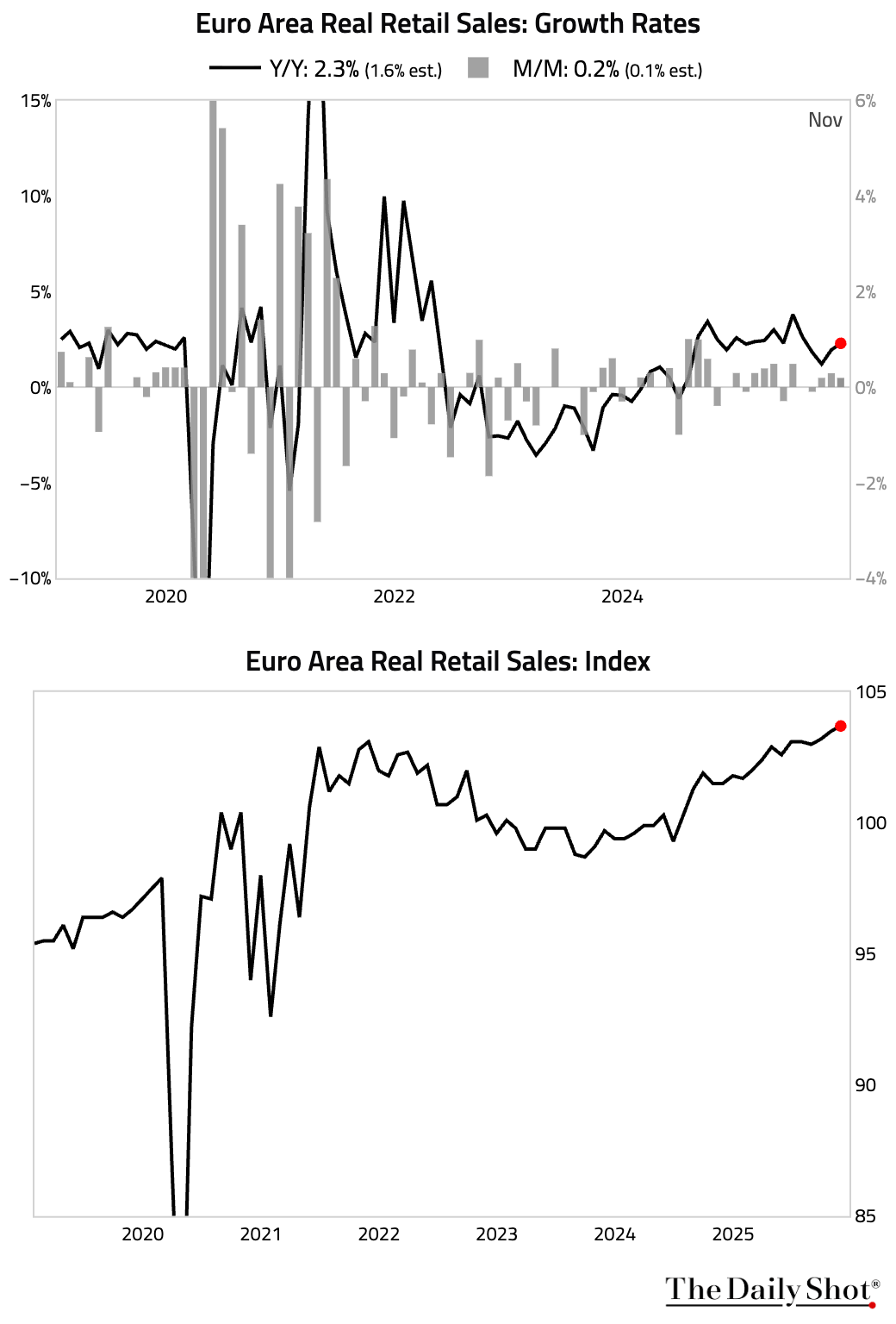

1 Retail sales in the euro area rose more than anticipated, suggesting that consumer spending remains resilient.

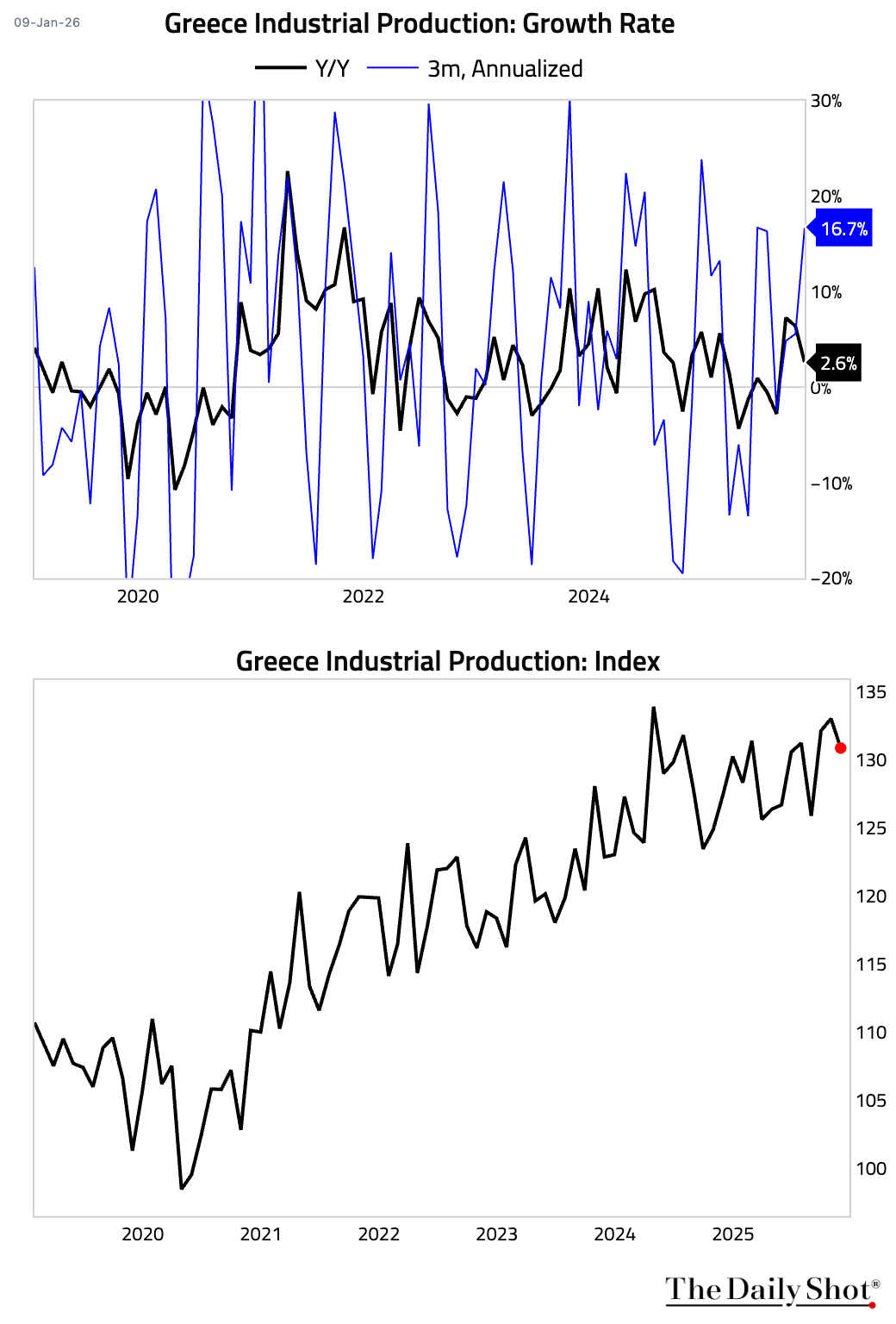

2 Greece industrial output eased.

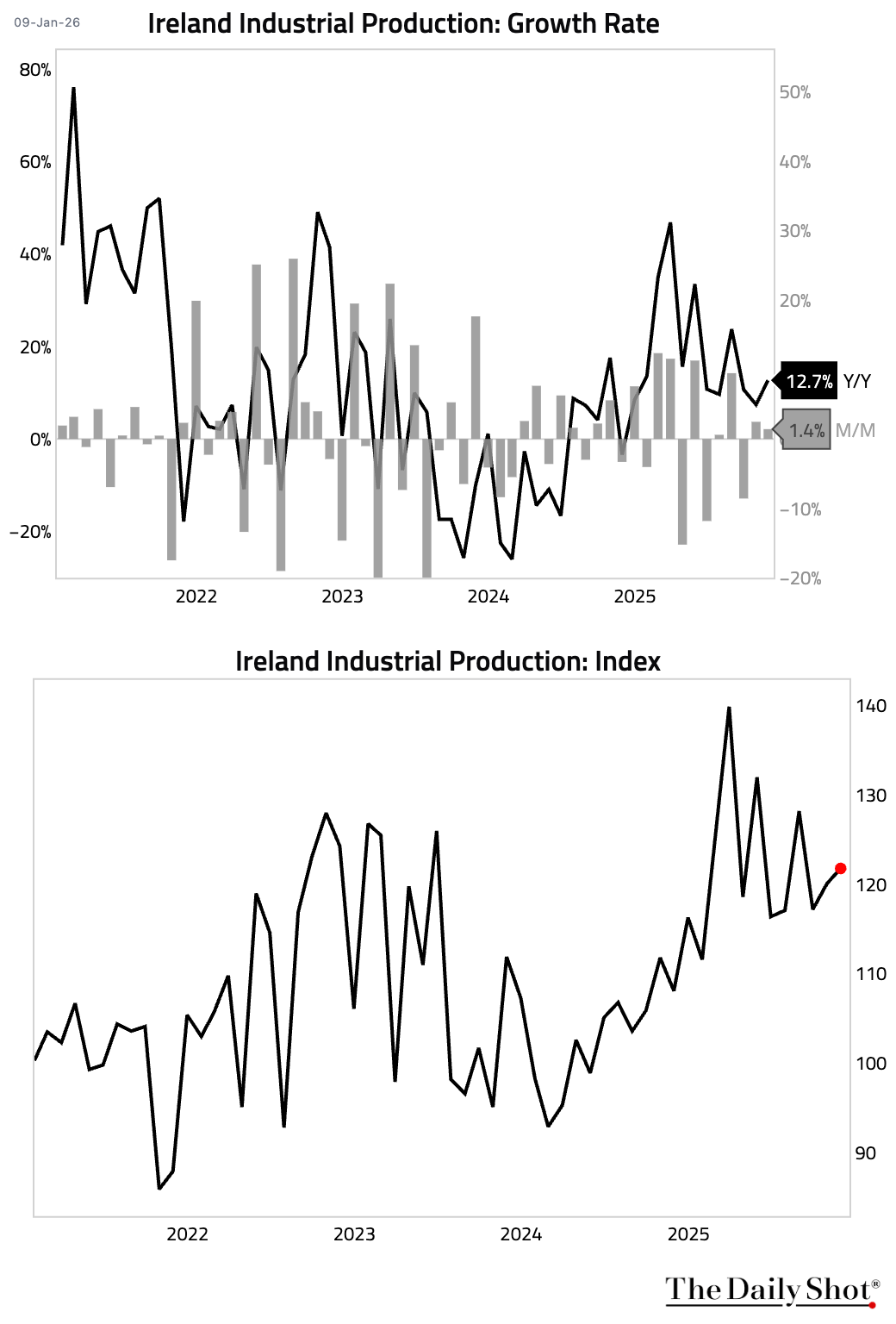

3 Ireland industrial output growth accelerated.

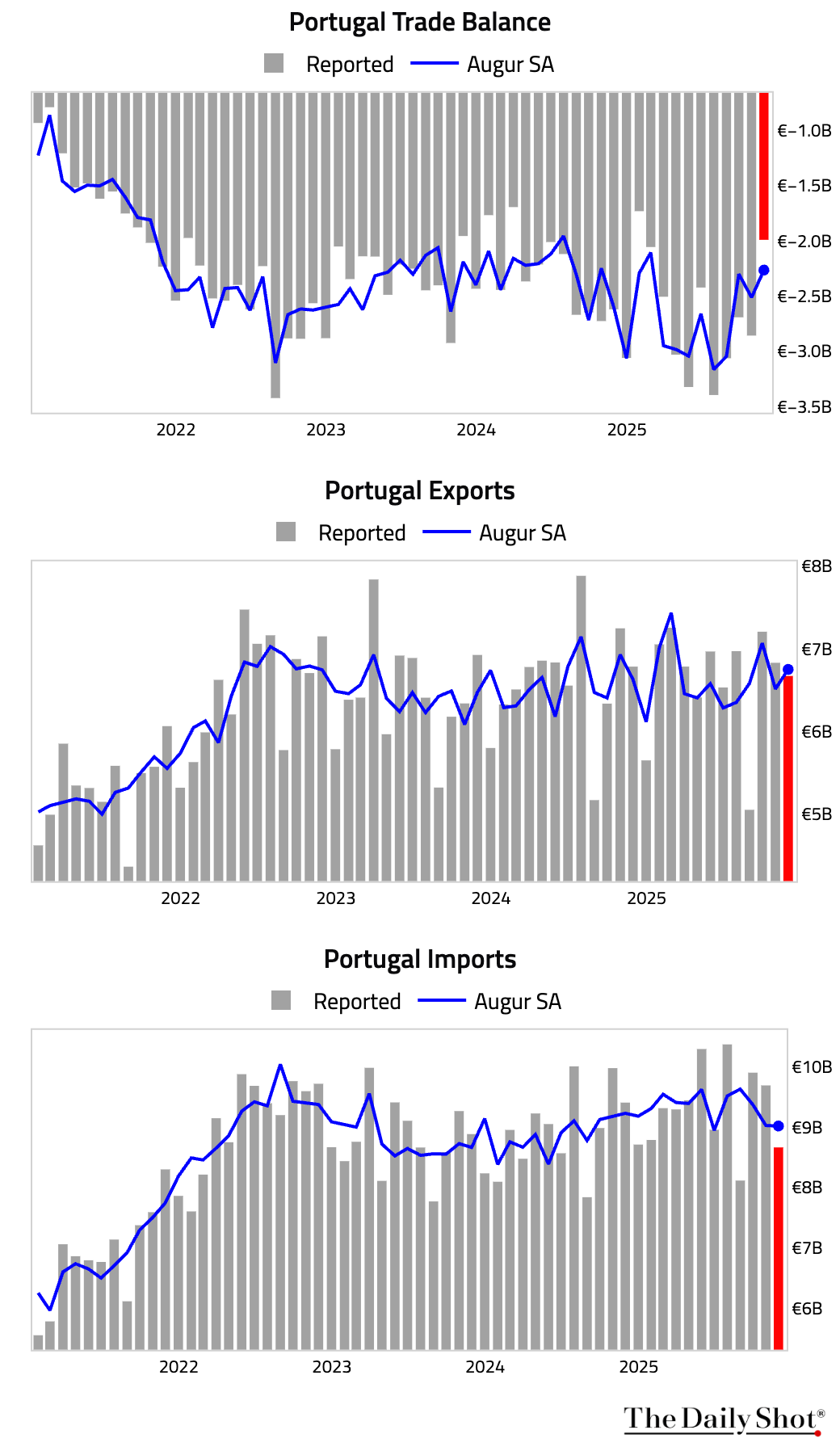

4 Portugal’s trade deficit narrowed.

Back to Index

Europe

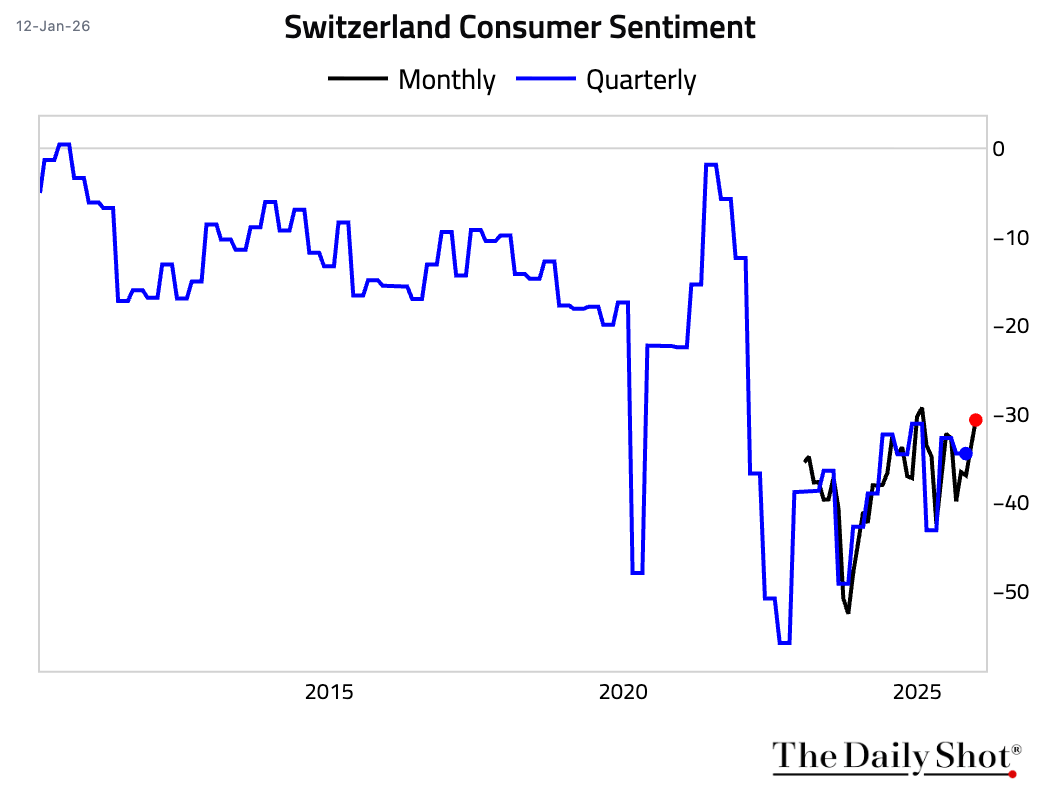

1 Swiss consumer confidence improved for the second consecutive month in January but remained deeply pessimistic.

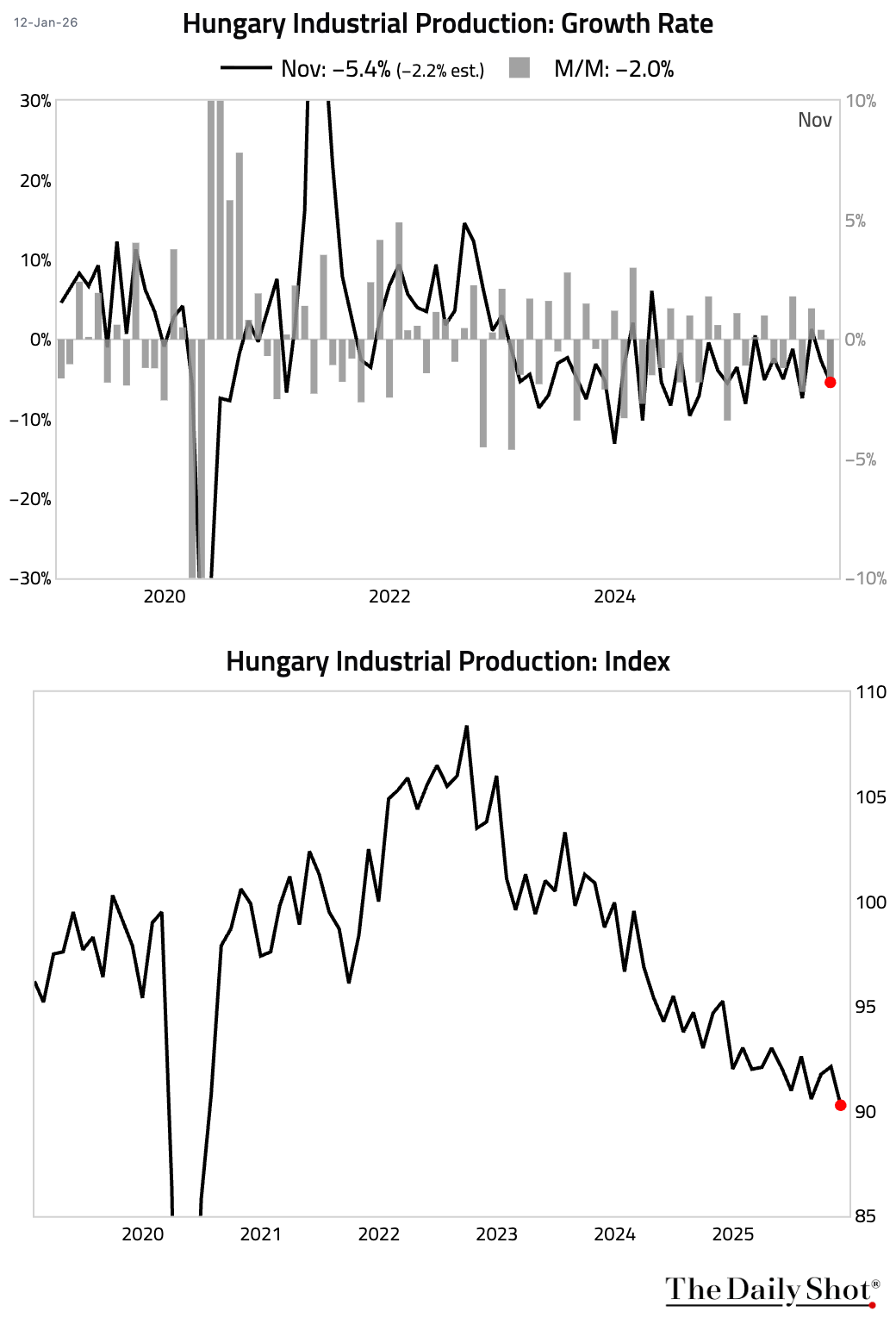

2 Hungarian industrial production contracted much more than expected.

Back to Index

Japan

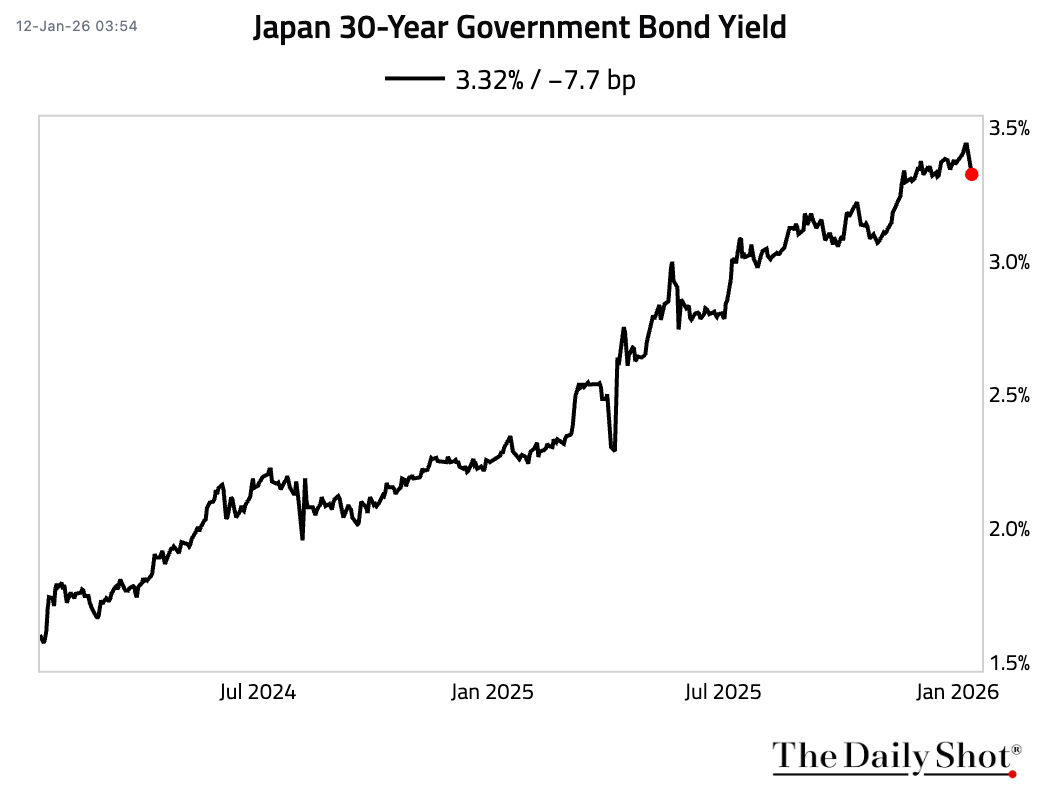

1 JGB 30-year yield fell by the most in a single day since May 2025.

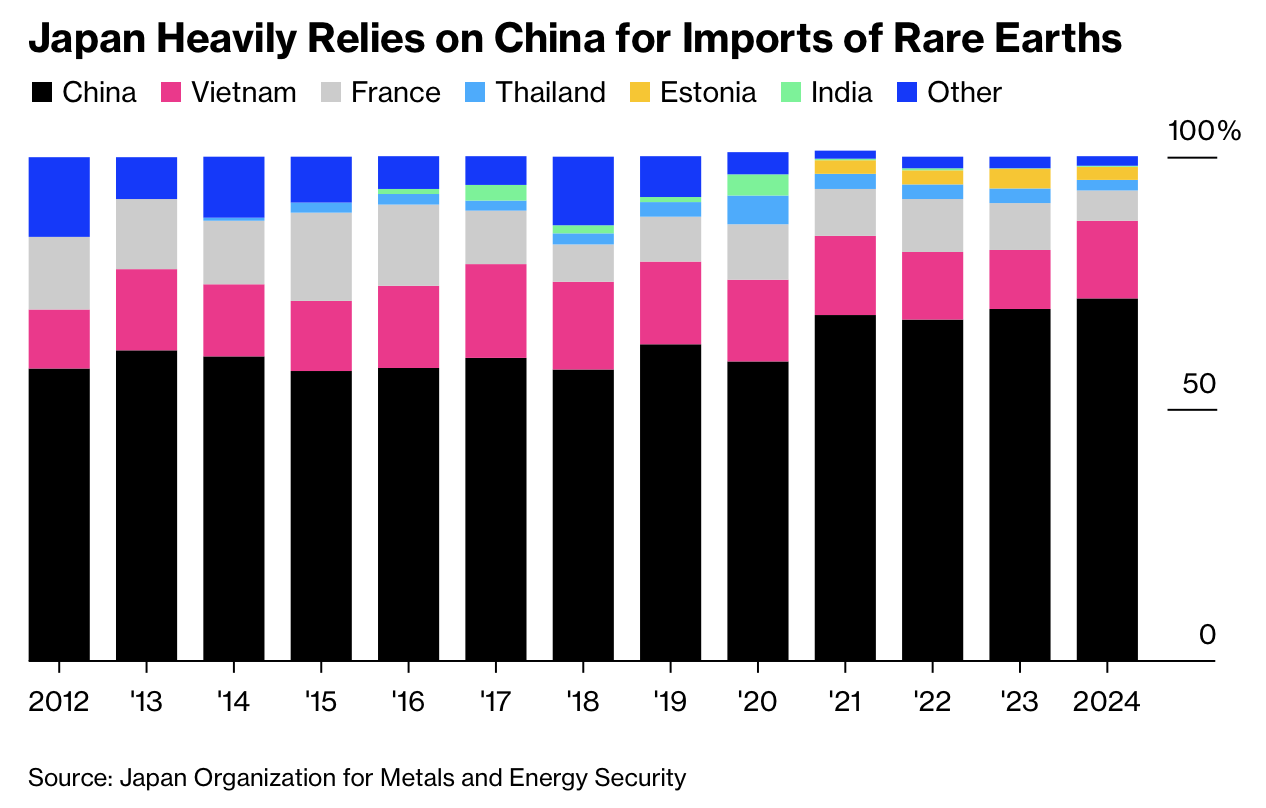

2 This chart shows Japan’s reliance on China for rare earths.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Back to Index

Asia-Pacific

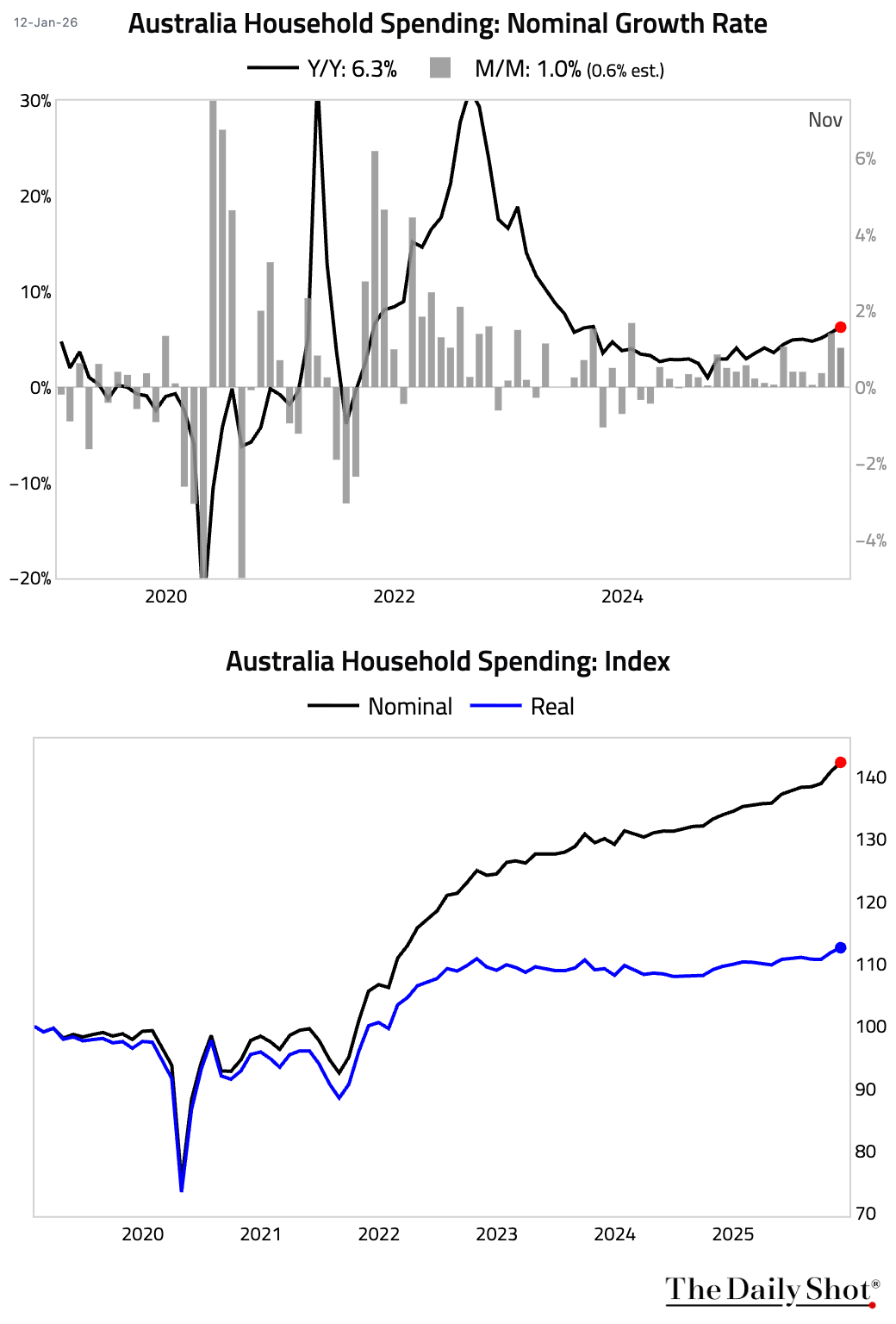

Australian nominal household spending rose faster than expected in November. The increase was broad-based, driven by Black Friday sales and major events.

• Job advertisements continued to decline in December, though at a slower pace.

Back to Index

China

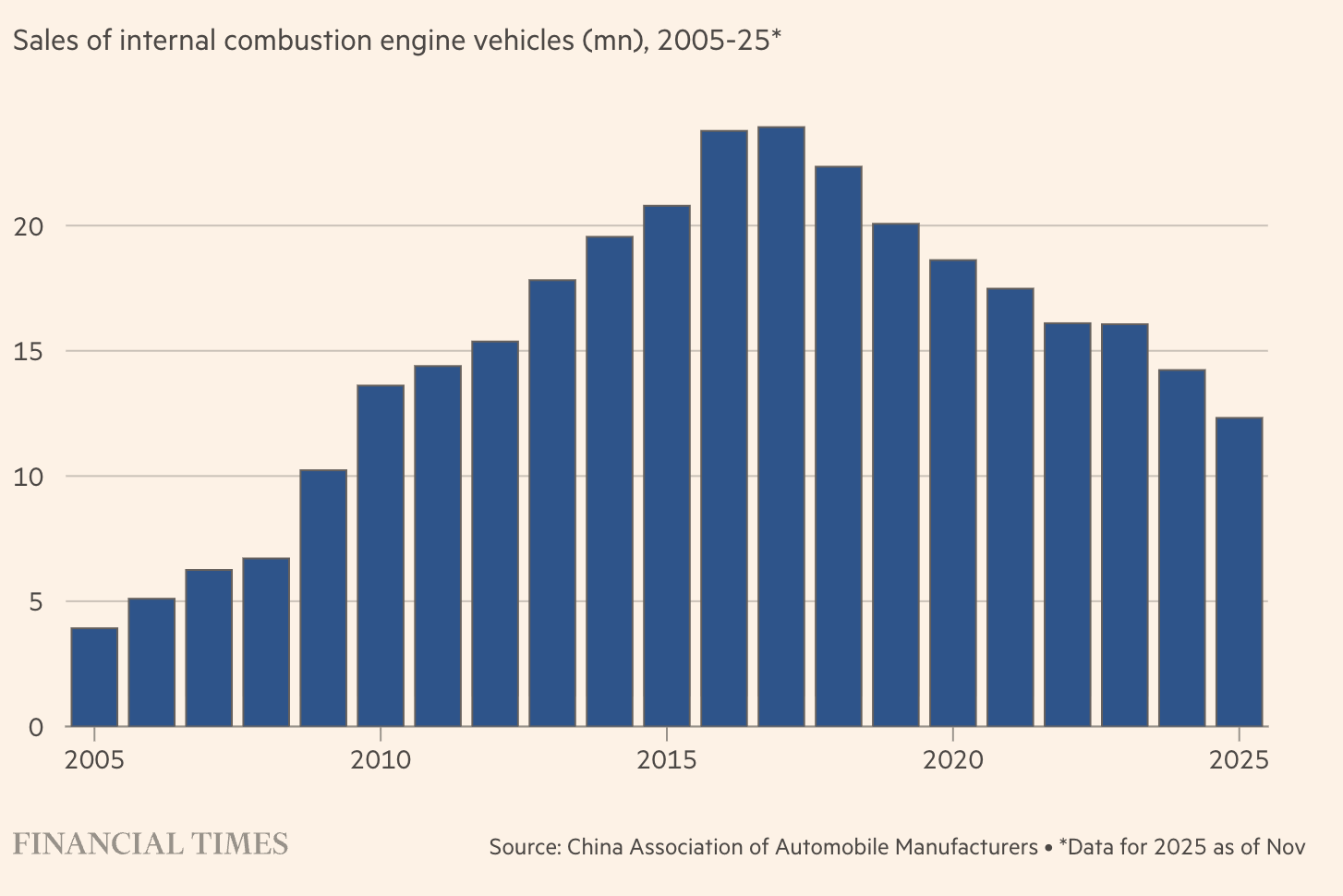

Sales of conventionally powered cars in China have fallen over the past decade. Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

India

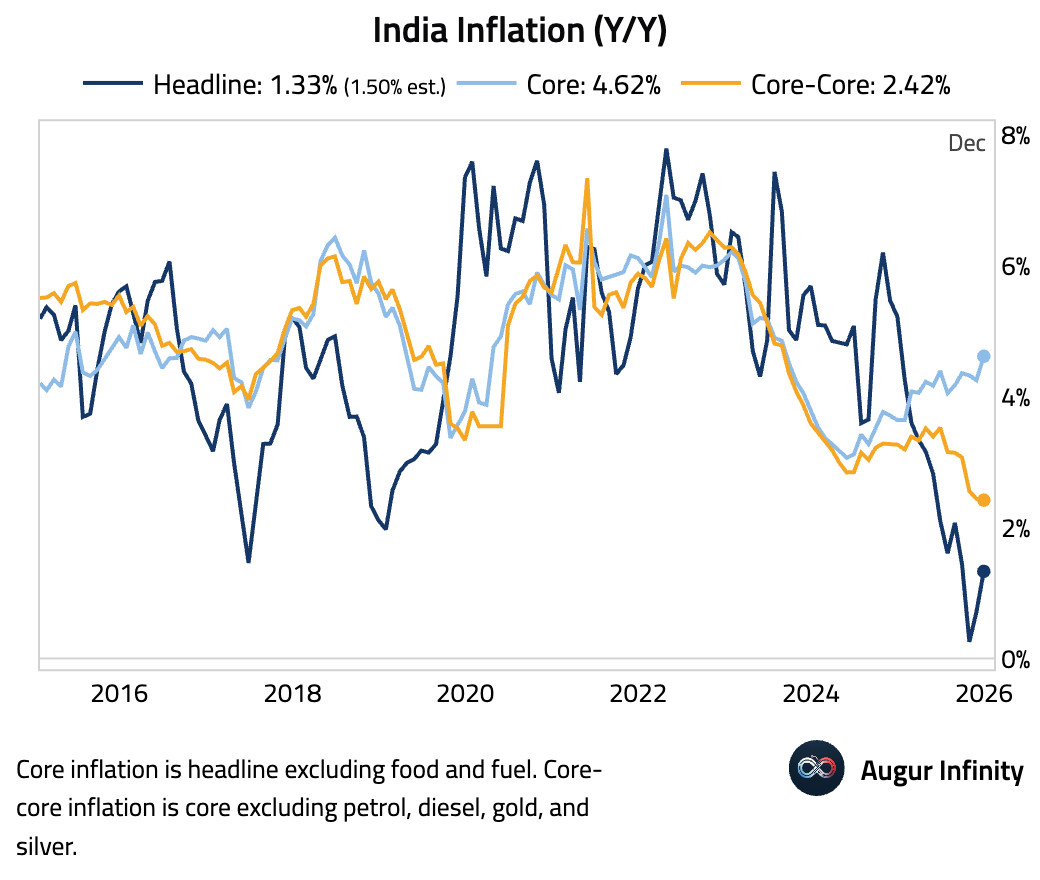

1 India’s headline inflation accelerated but came in below the consensus forecast. The miss was primarily driven by a smaller-than-expected sequential increase in vegetable prices. Core inflation ticked up, but a core measure excluding petrol, diesel, gold, and silver softened.

Back to Index

Emerging Markets

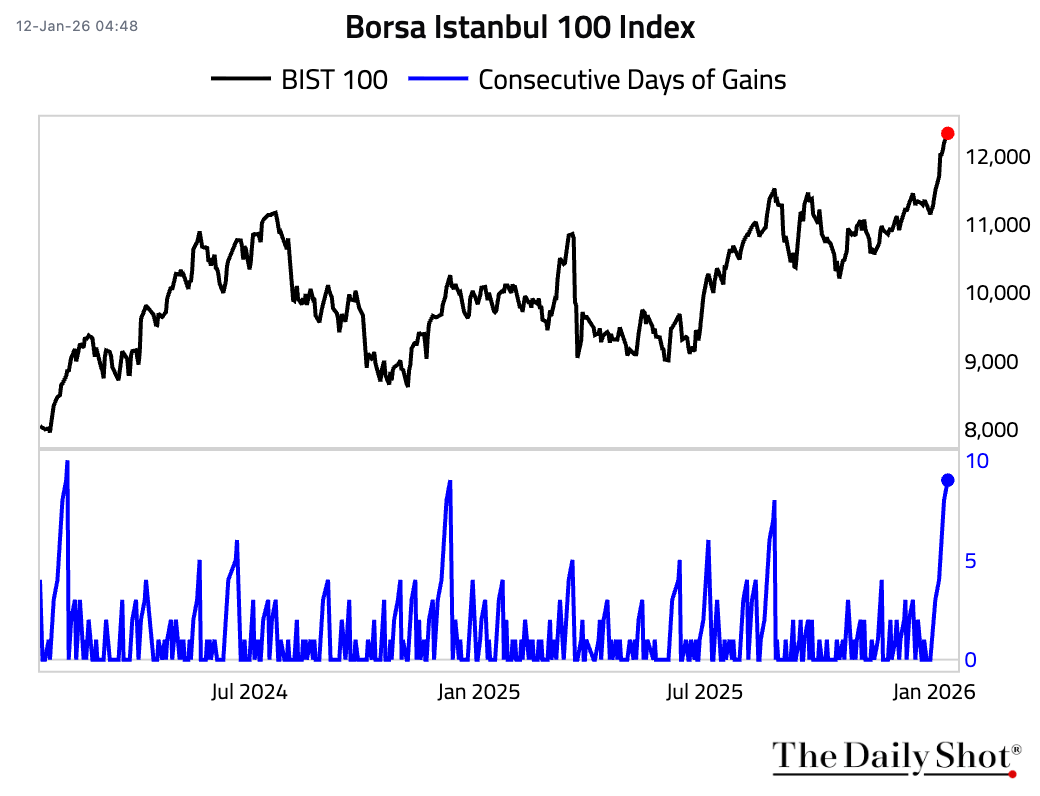

1 Turkey’s Borsa Istanbul 100 Index gained for the ninth consecutive day.

Back to Index

Equities

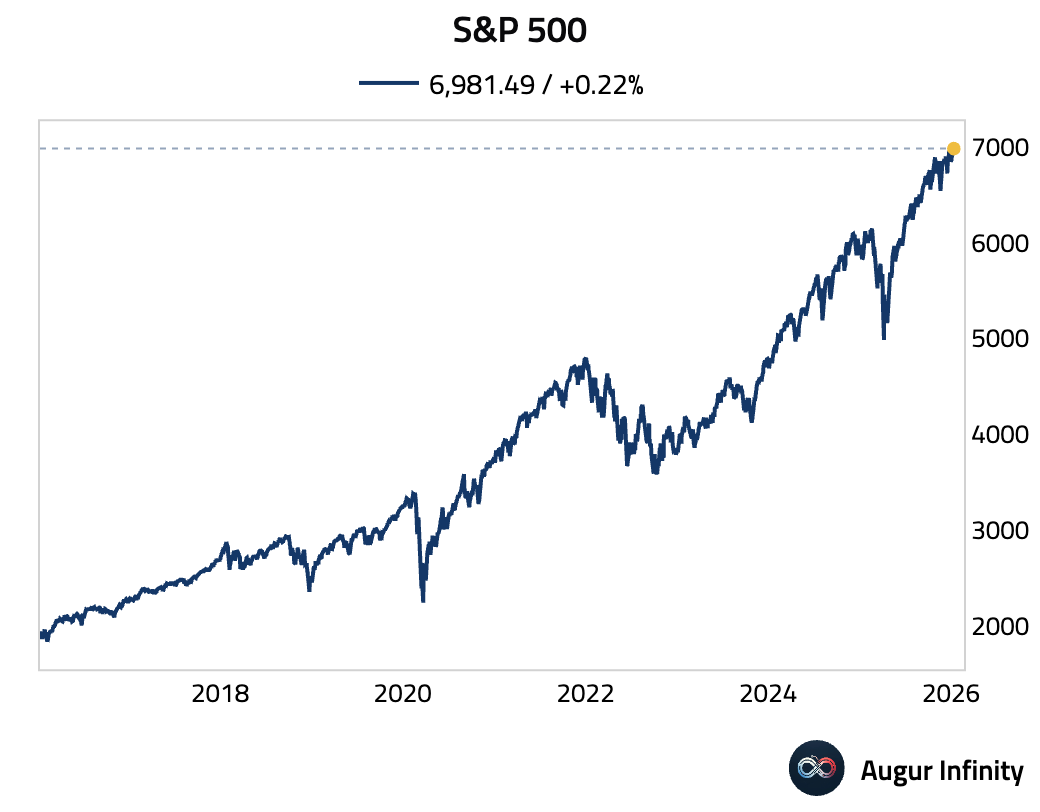

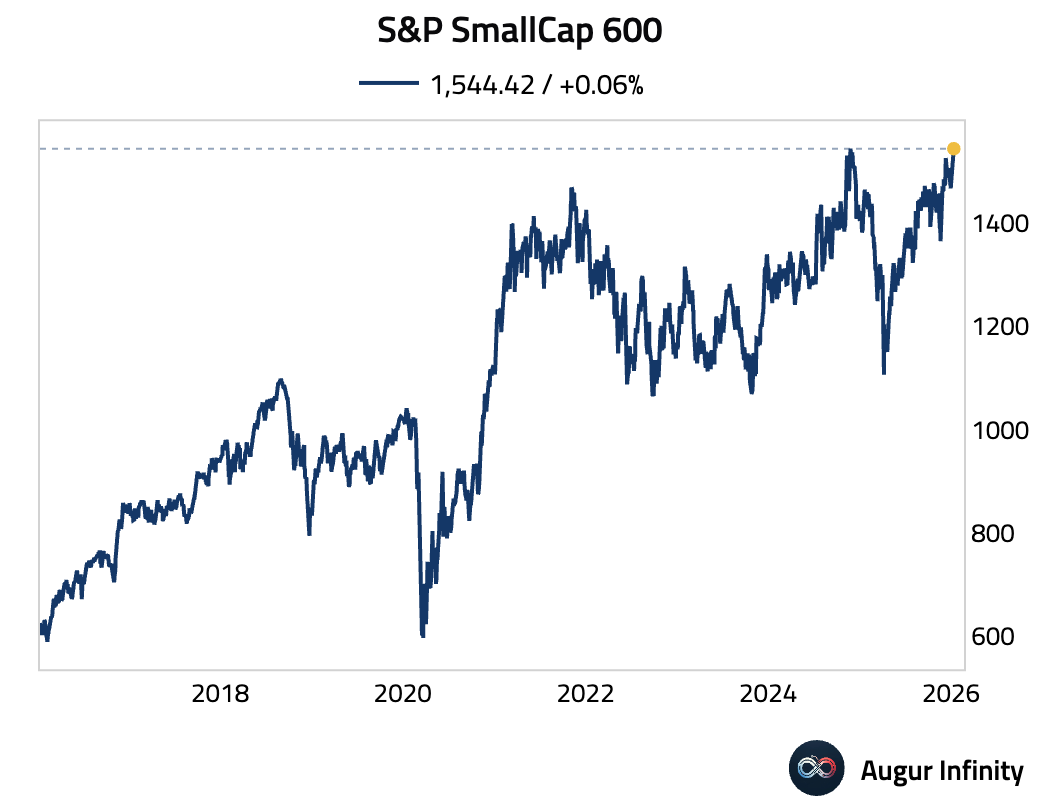

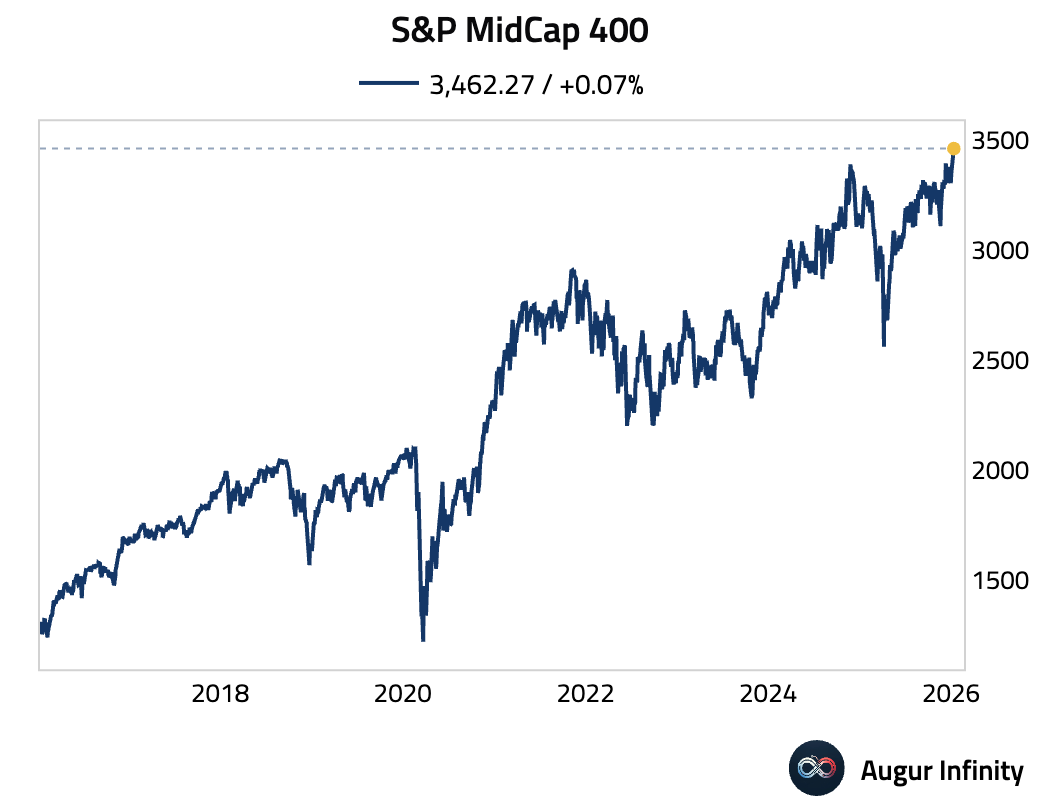

1 After a sharp reversal, major US equity indices closed at record highs:

• S&P 500:

• S&P SmallCap 600:

• S&P MidCap 400:

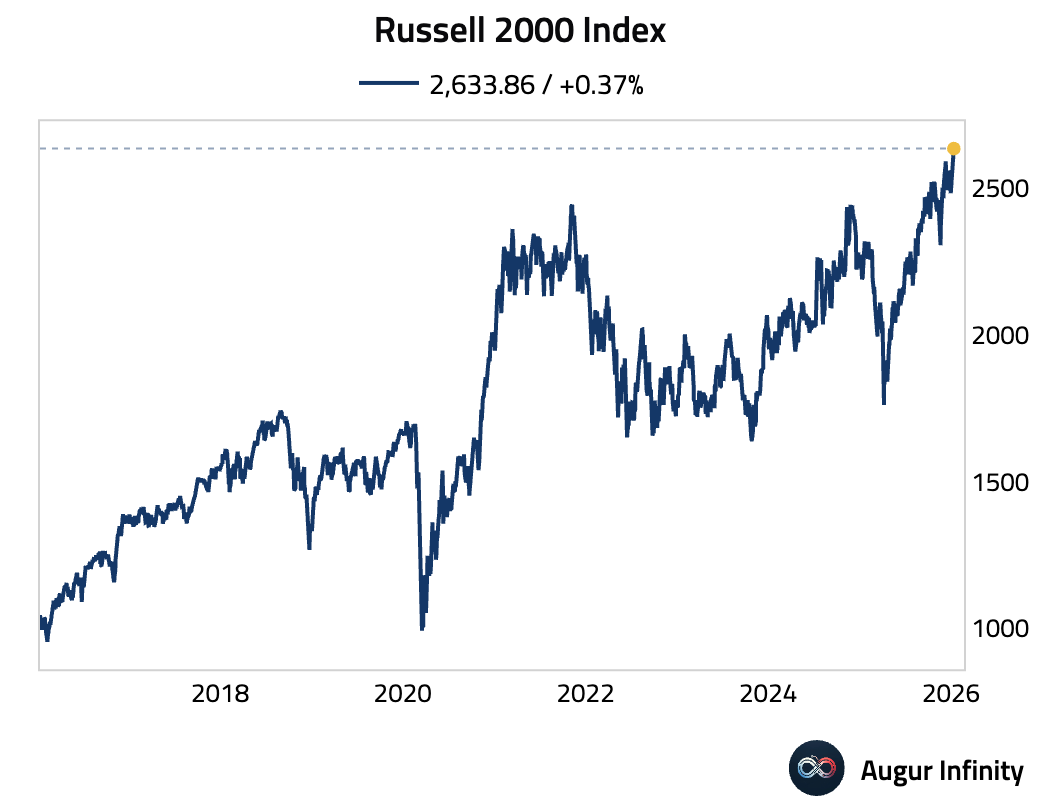

• Russell 2000:

2 Let's look at equity sectors:

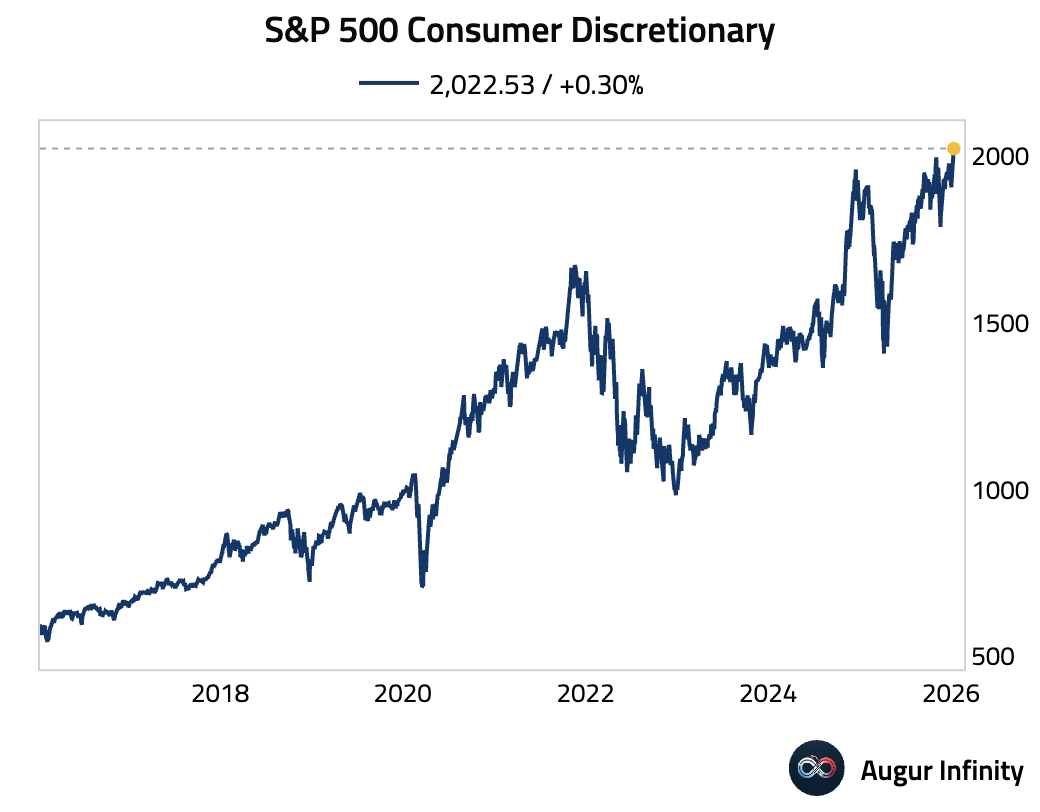

• Consumer Discretionary (record high):

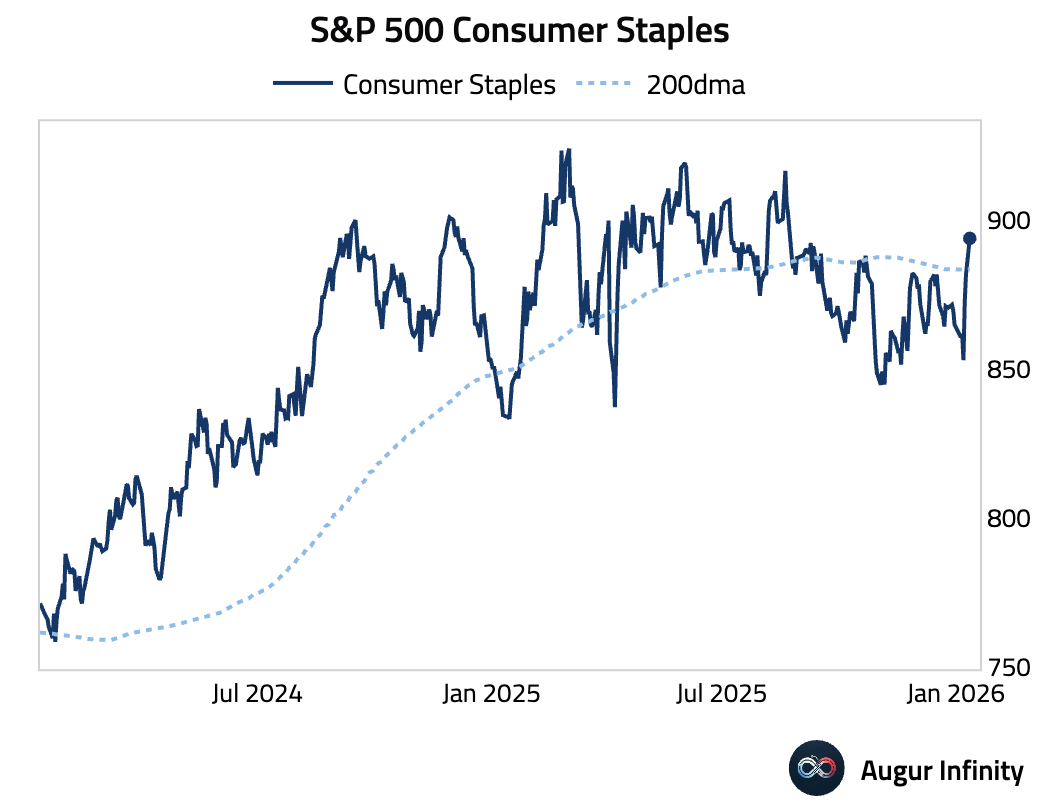

• Consumer Staples (above 200-day moving average):

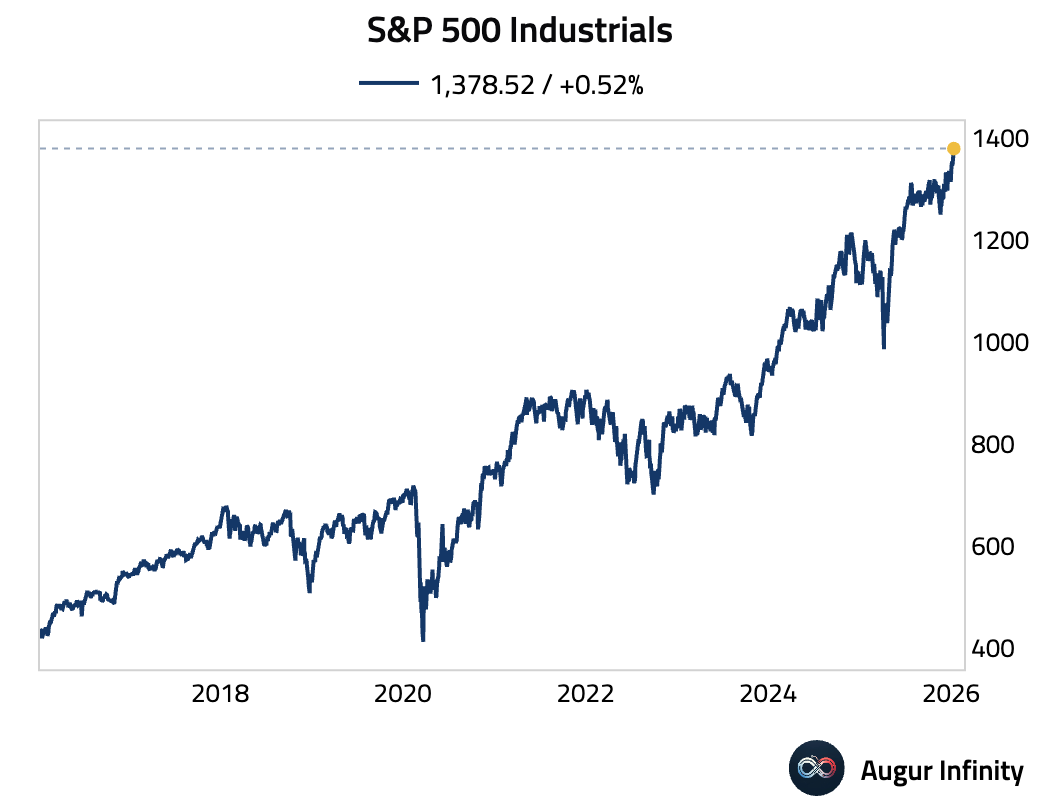

• Industrials (all-time high):

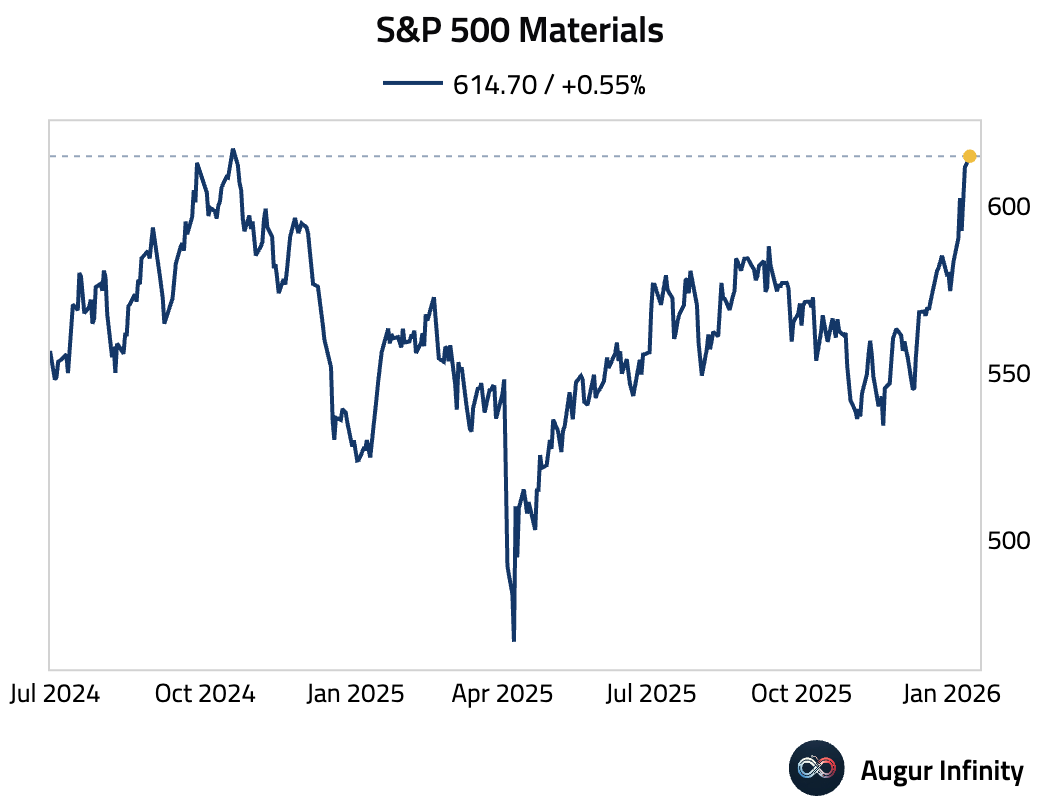

• Materials (highest level since October 2024):

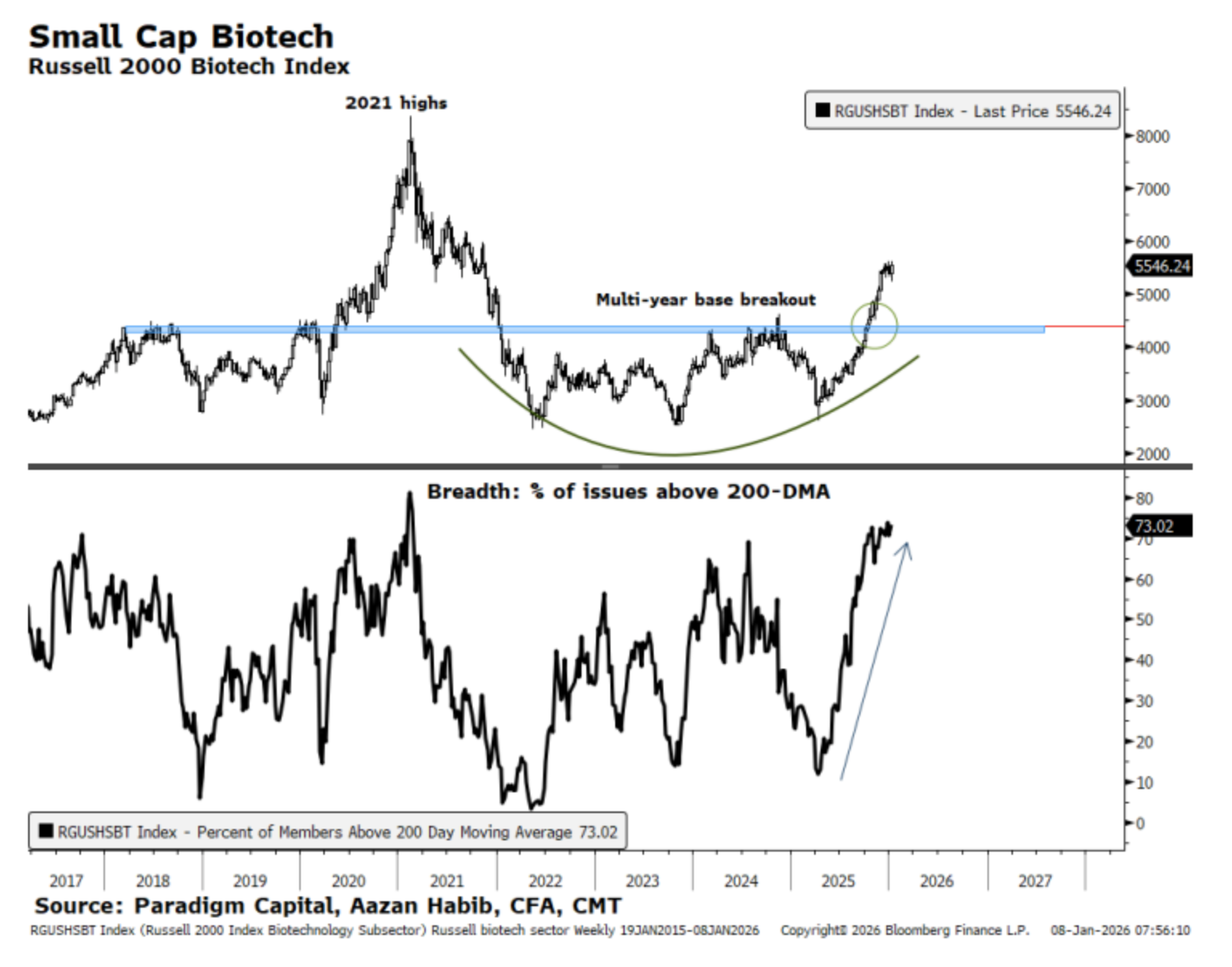

3 The Russell 2000 Biotech Index is in breakout mode with improving breadth.

Source: Paradigm Capital

Source: Paradigm Capital

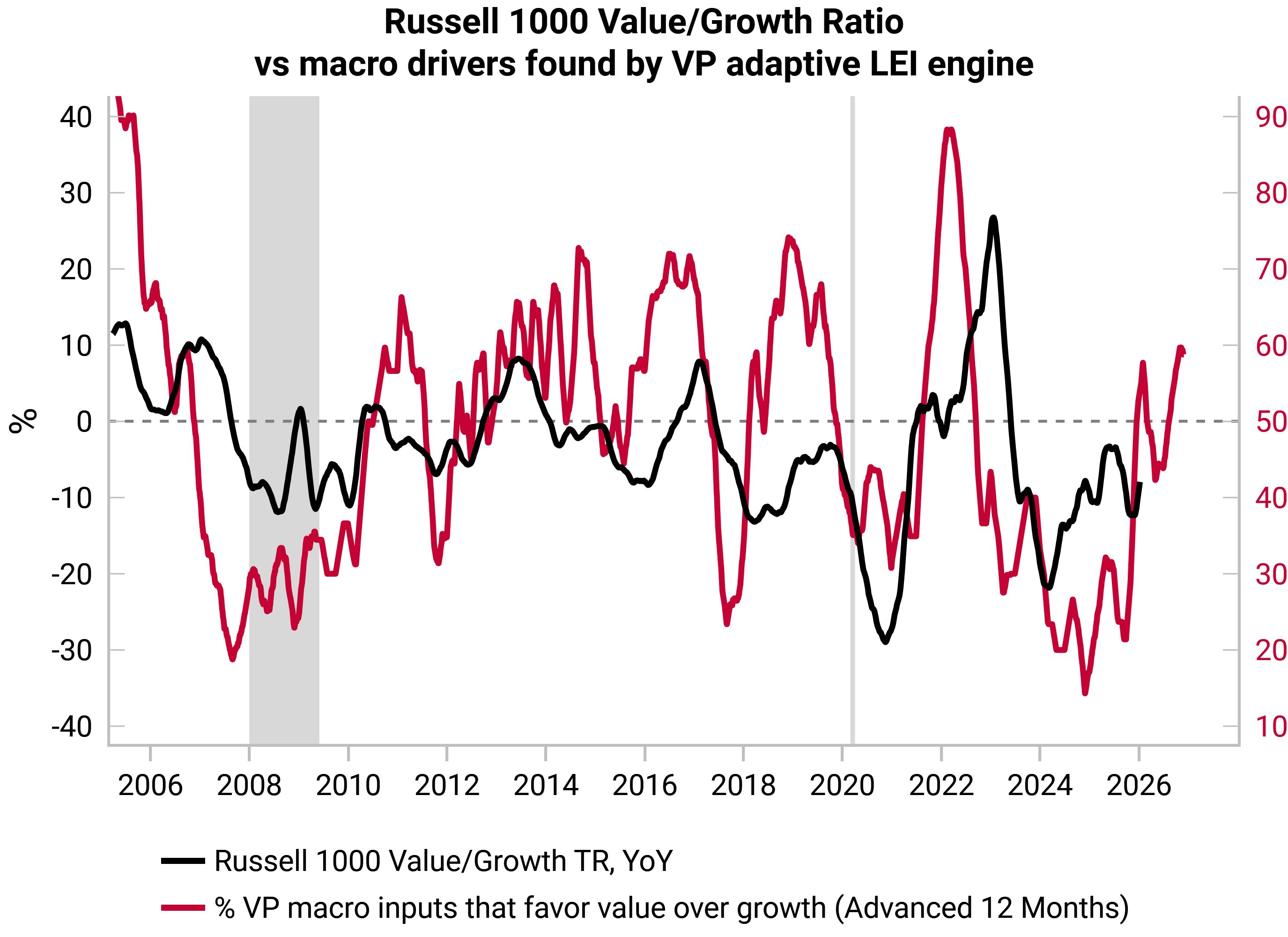

4 Variant Perception’s indicator points to upside potential for value stocks versus growth stocks.

Source: Variant Perception

Source: Variant Perception

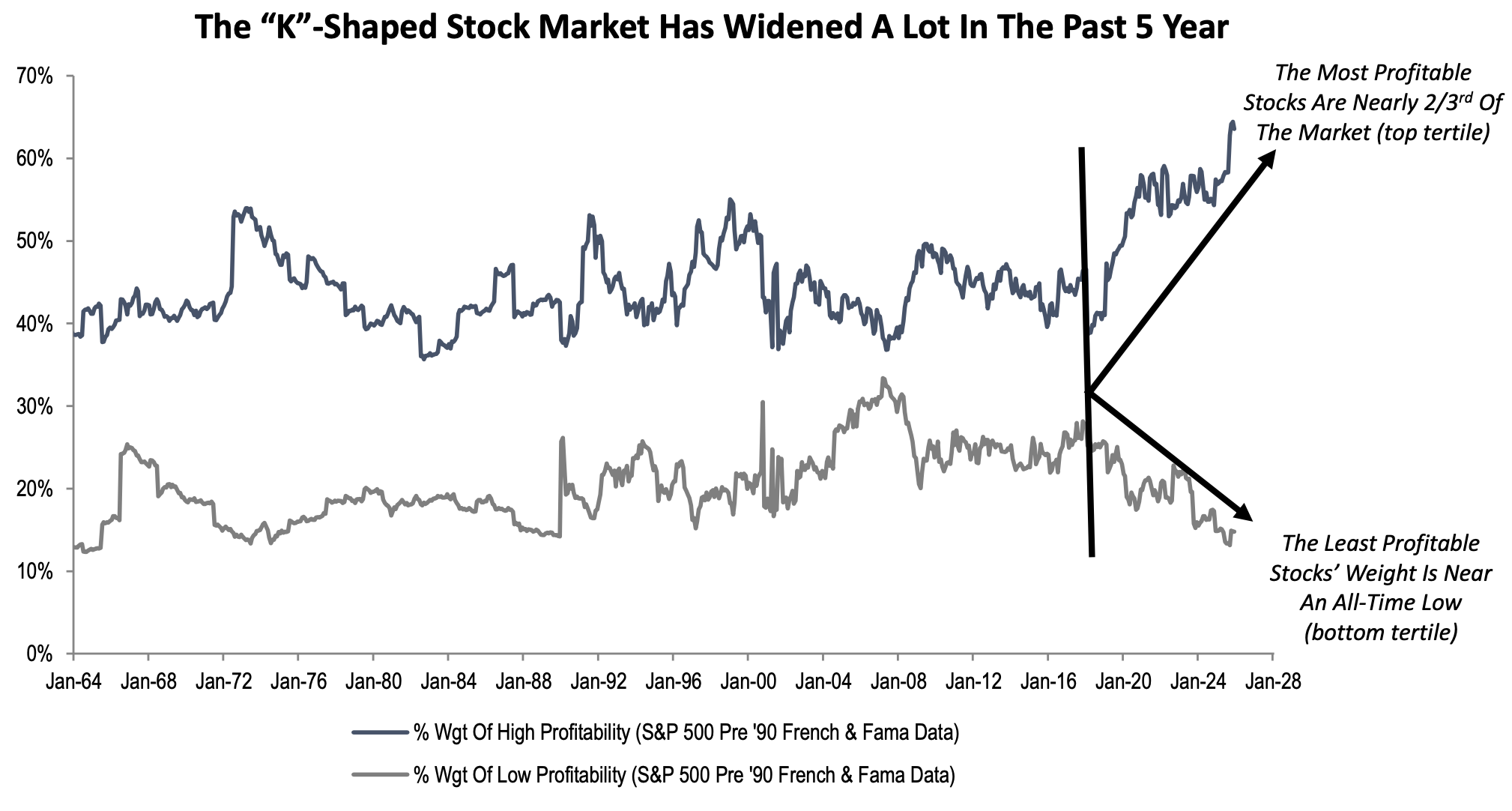

5 The most profitable companies now represent nearly two-thirds of the market.

Source: Piper Sandler

Source: Piper Sandler

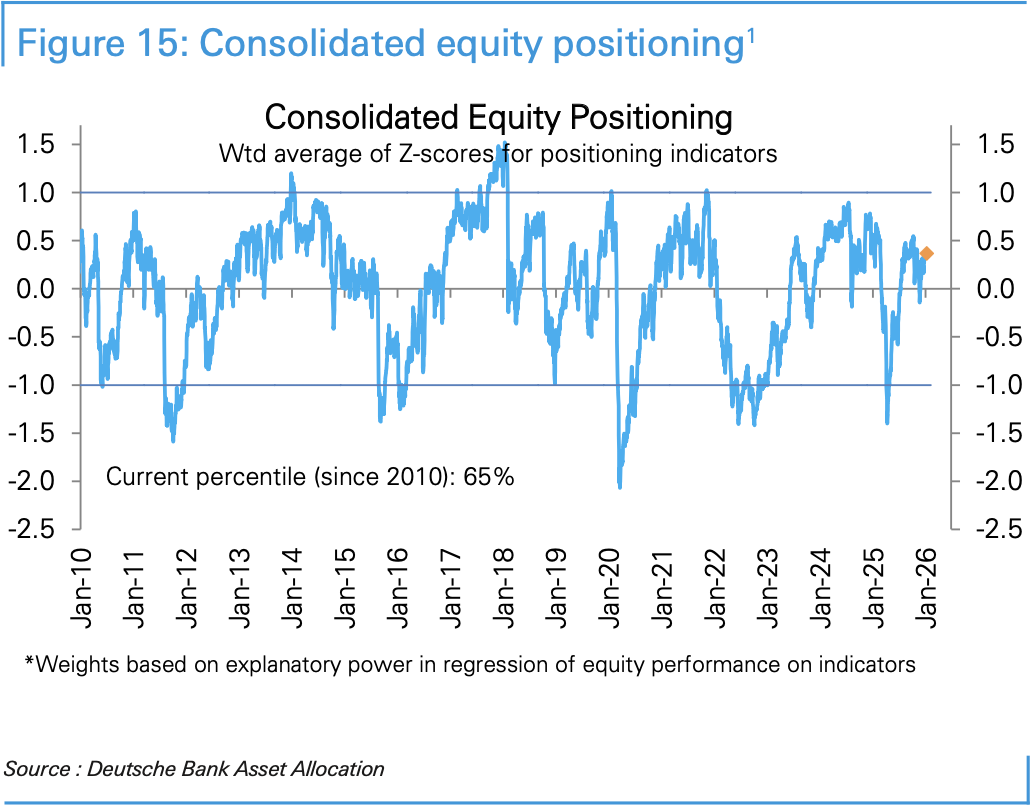

6 Deutsche Bank’s measure of equity positioning has trended sideways over the past two weeks and remains moderately overweight.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

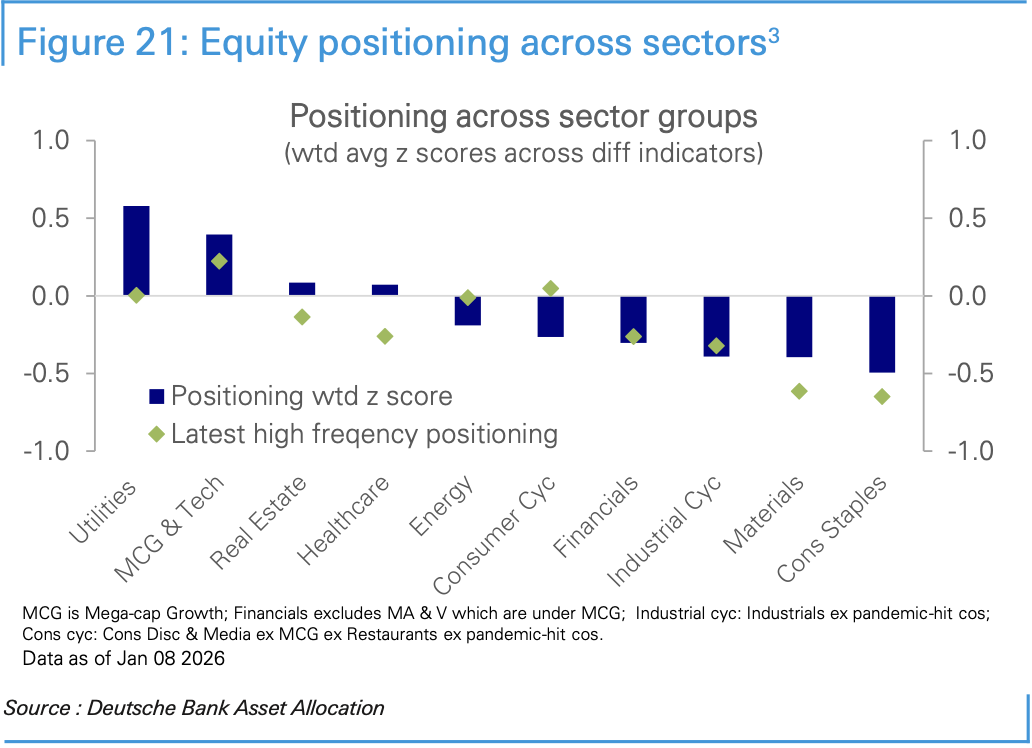

• Here is the positioning index by sector.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Commodities

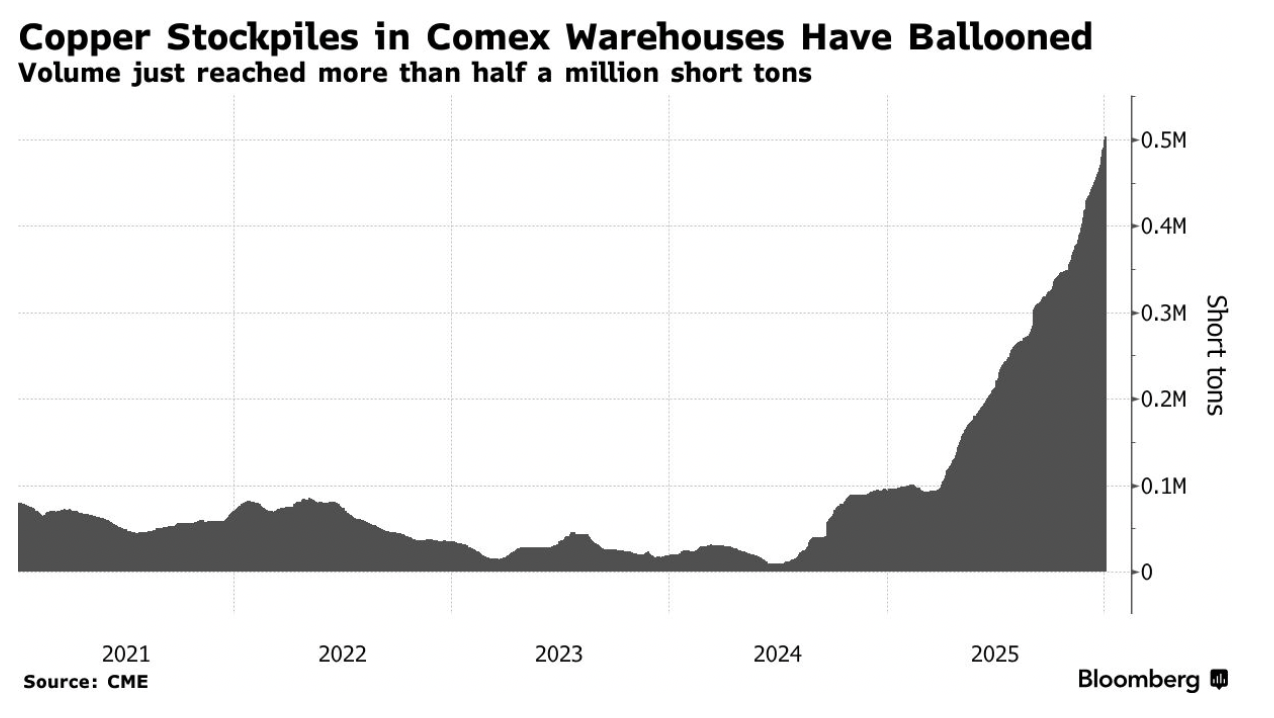

1 Copper stockpiles in Comex-tracked warehouses have surged to more than half a million short tons after 44 consecutive days of net inflows, reflecting a rush to ship metal into the US ahead of potential tariff changes.

Source: @markets Read full article

Source: @markets Read full article

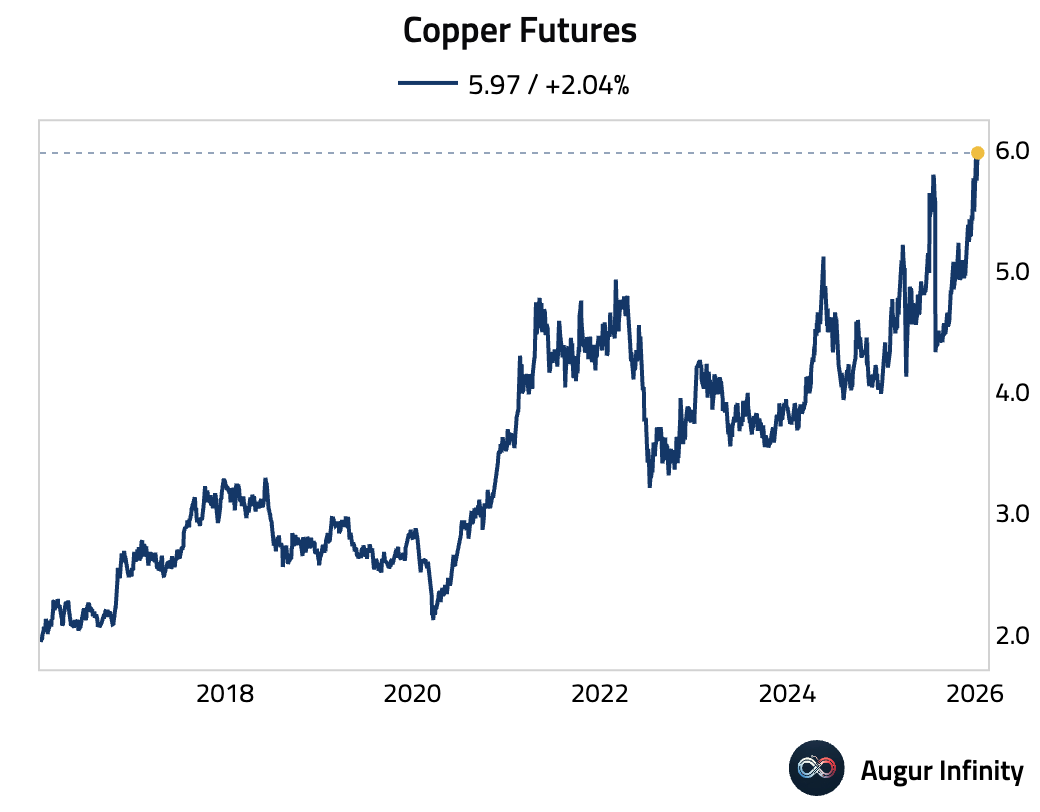

• Copper futures are trading at new record highs.

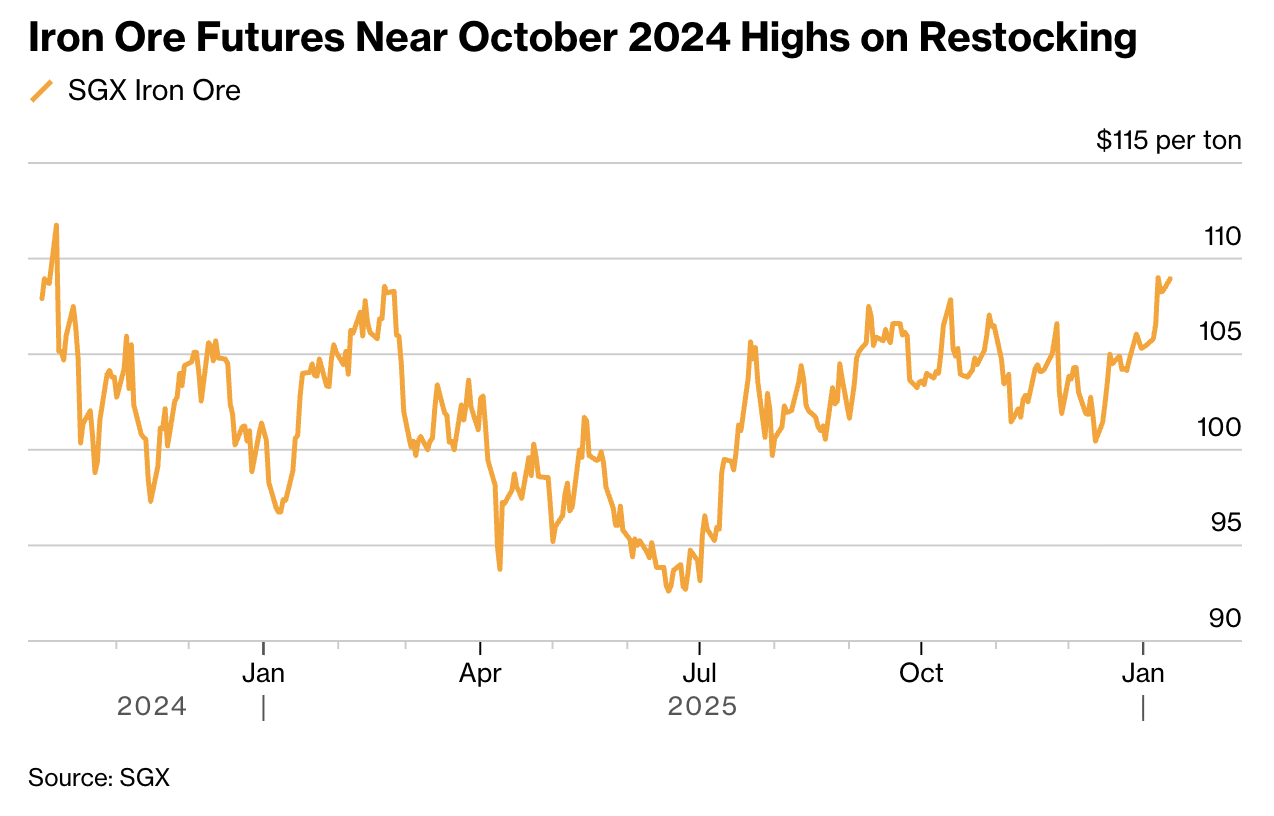

2 Iron ore prices rose to near 15-month highs as Chinese steelmakers ramped up pre–Lunar New Year restocking.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Global Developments

1 The Trump administration is preparing options to respond to Iran’s crackdown on protesters, including sanctions, cyber operations, and potential military strikes.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.