Charts of the Day

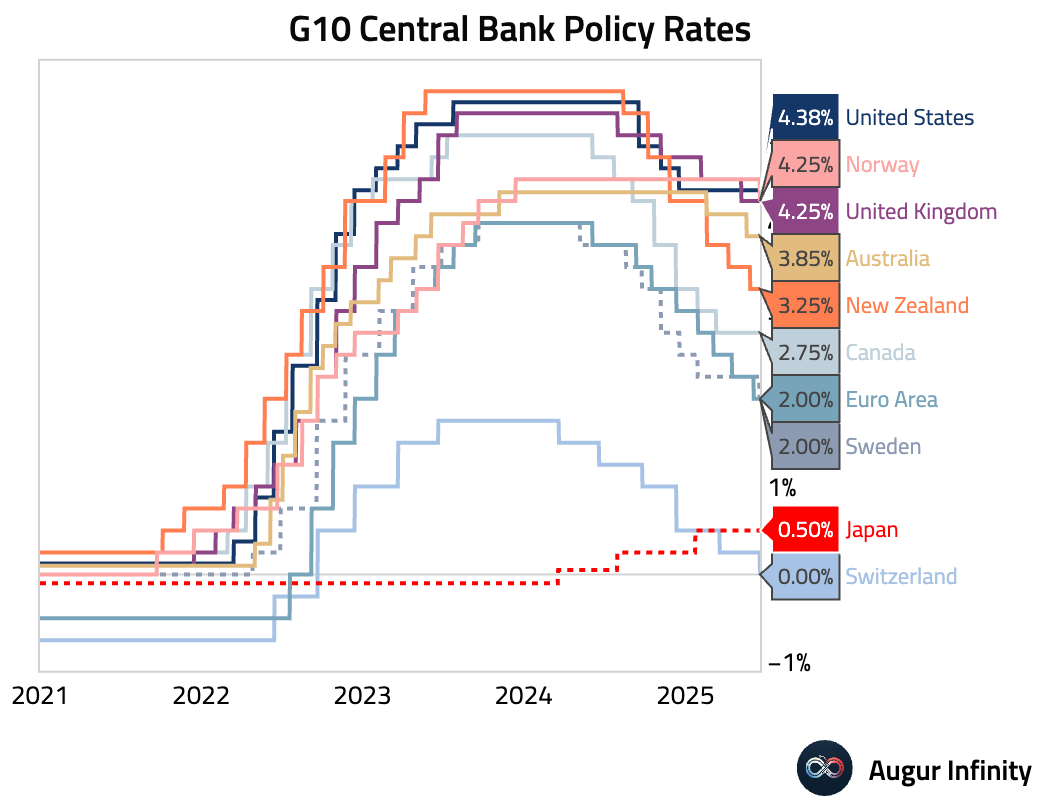

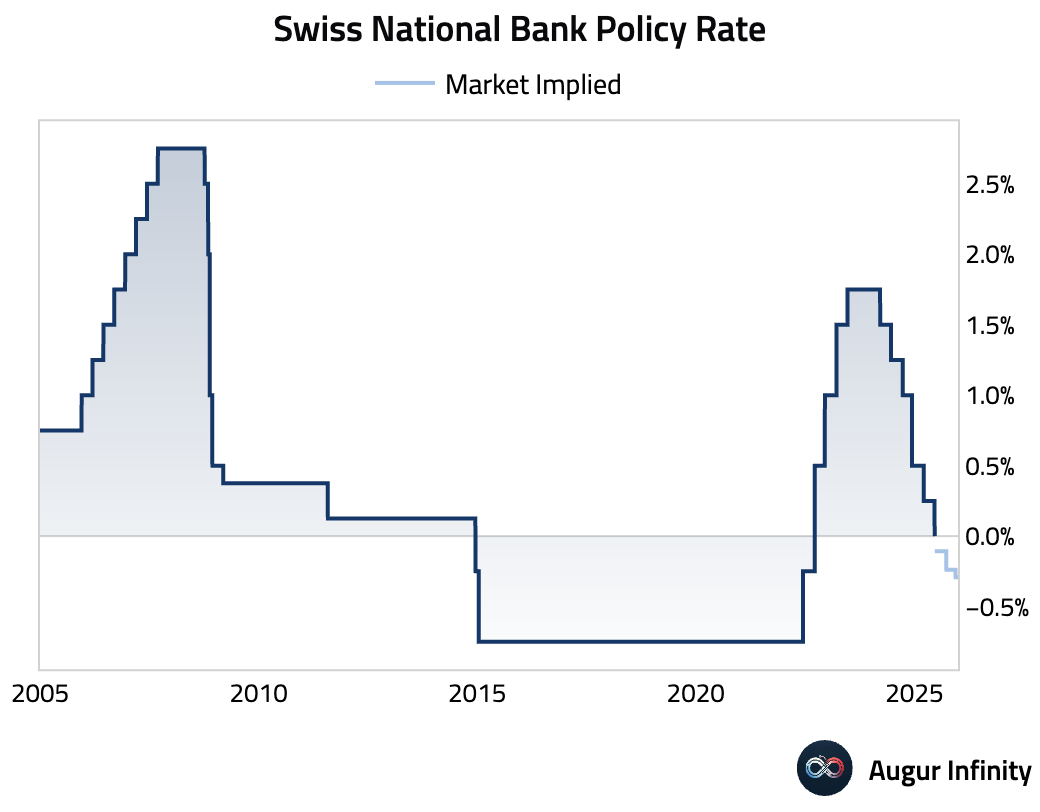

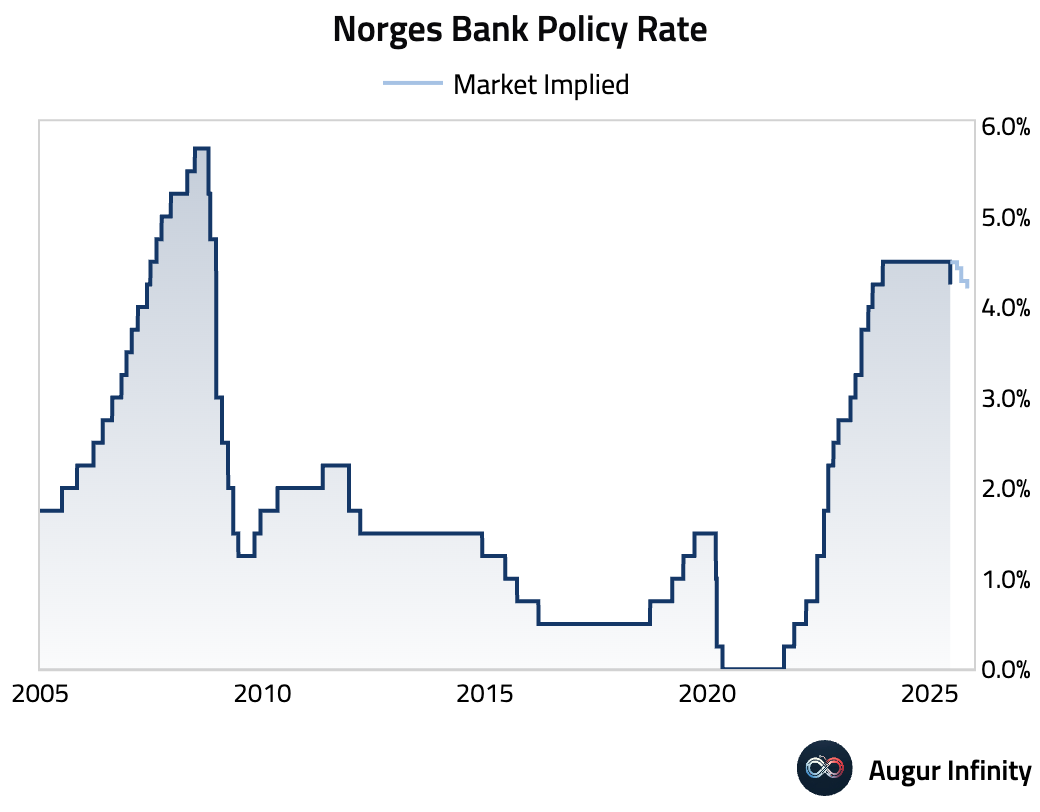

- Central banks were active, with the Swiss National Bank cutting its policy rate by 25 bps to 0.00% and Norges Bank delivering a surprise 25 bps cut to 4.25%. The Bank of England and the US Federal Reserve held their respective policy rates steady at 4.25%.

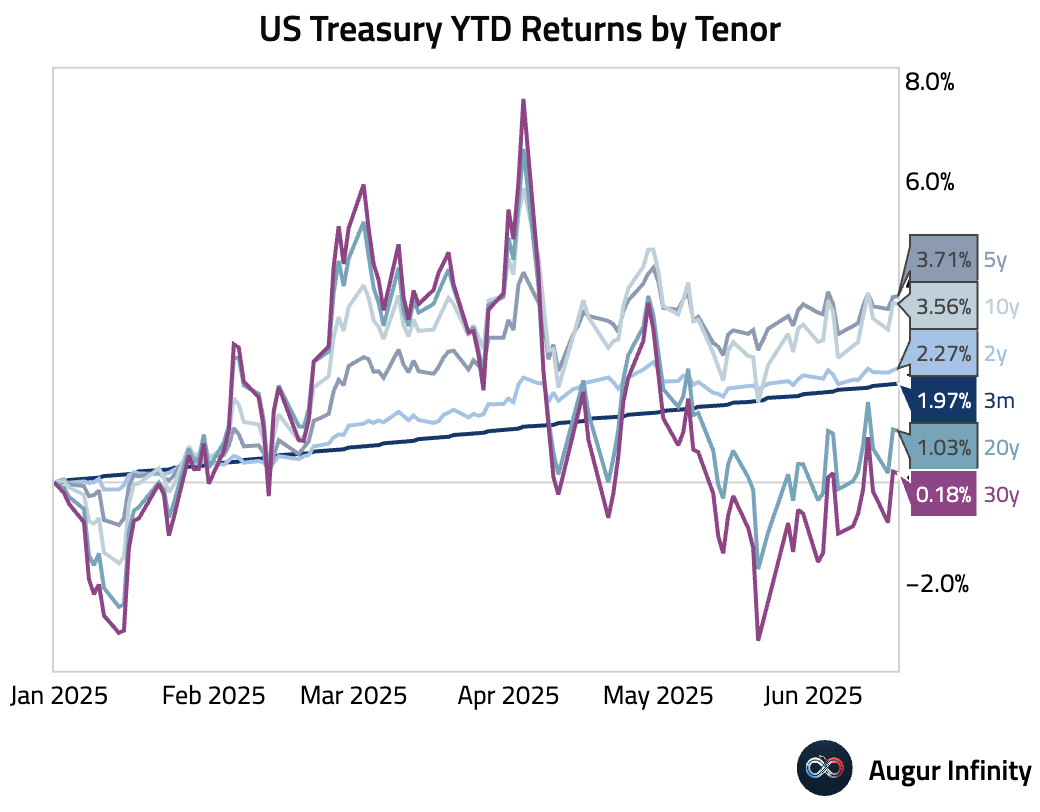

- US Treasuries across all tenors are in the black again.

Canada

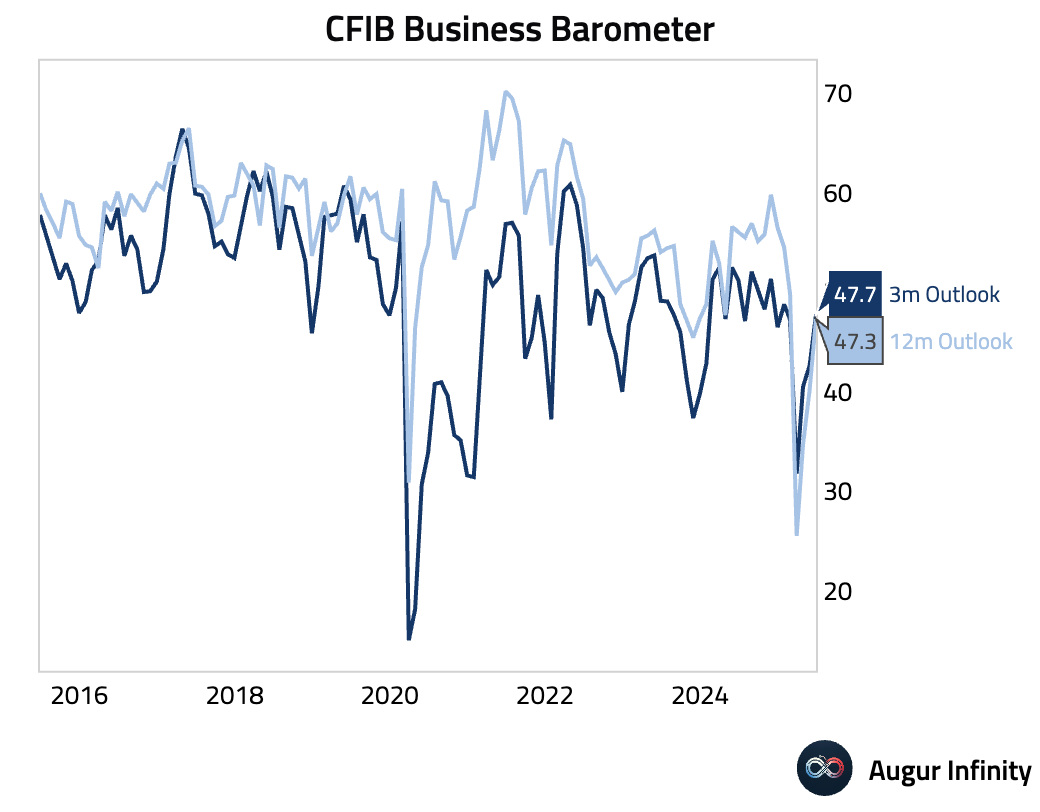

- The CFIB Business Barometer for June rose to 47.3 from 40.0 in May, reaching its highest level since February.

Europe

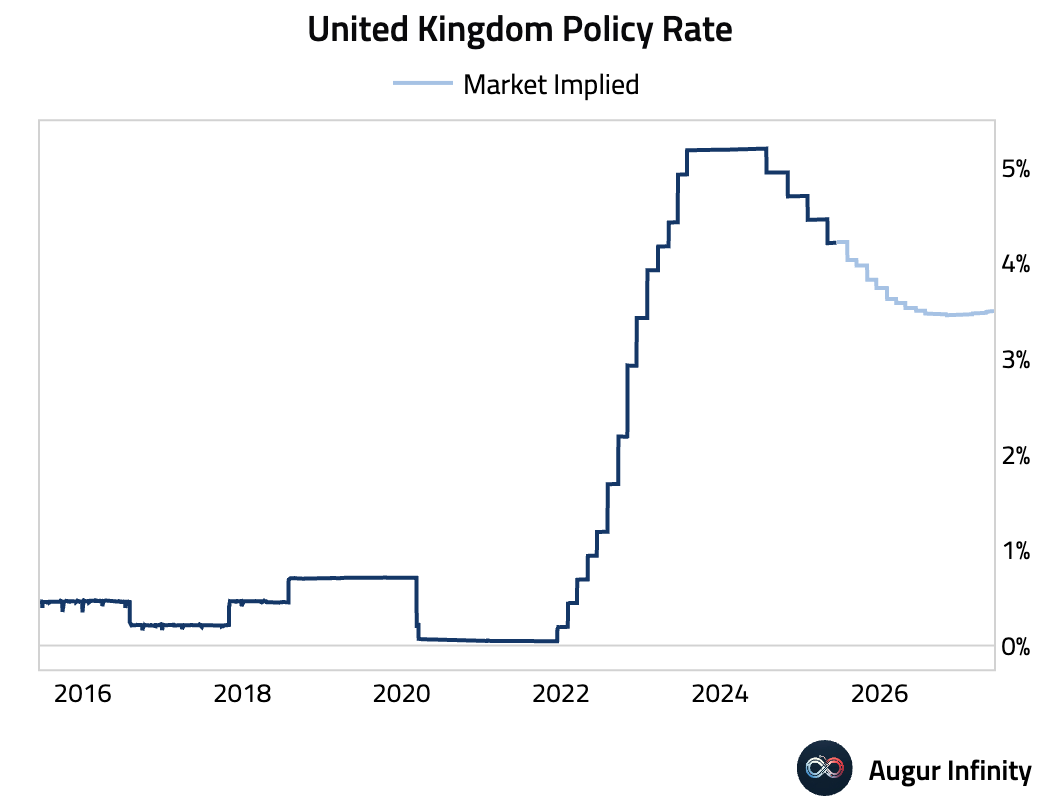

- The Bank of England held its policy rate at 4.25%, in line with expectations. The Monetary Policy Committee vote was split, with 69 members voting for no change, 39 for a cut (consensus was 29), and 9 for a hike.

- The Swiss National Bank cut its policy rate by 25 bps to 0.00%, as expected.

- Norges Bank unexpectedly cut its key policy rate by 25 bps to 4.25%. The market had anticipated that the central bank would hold rates steady.

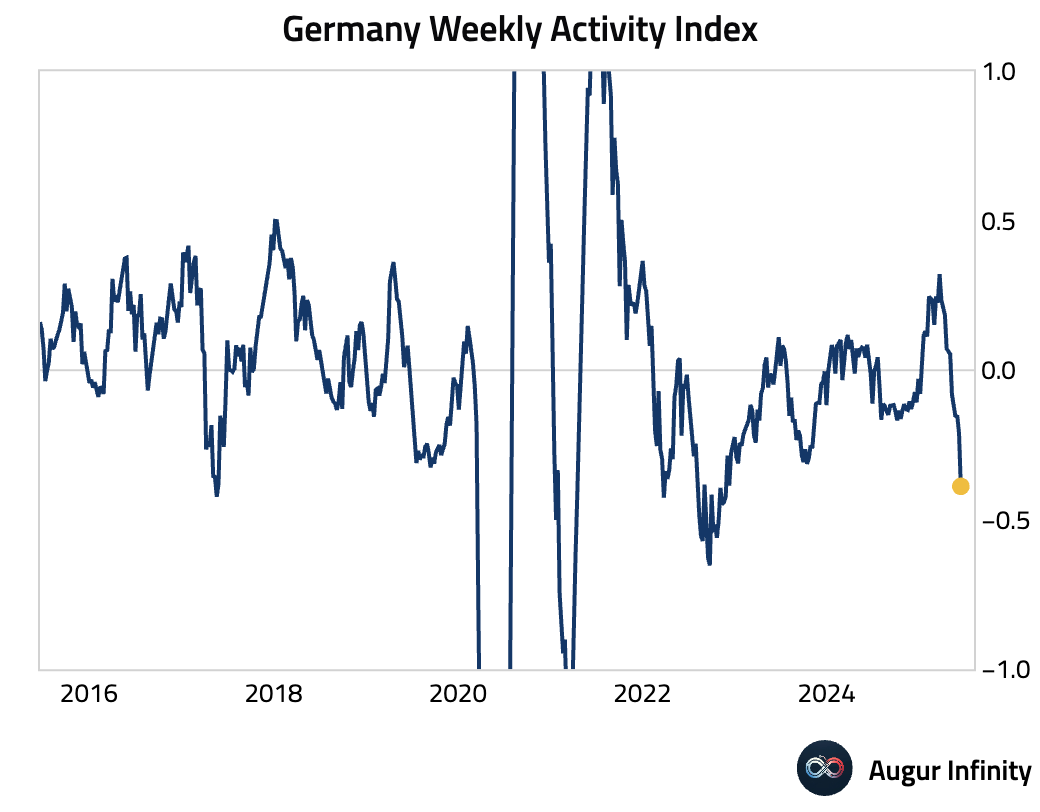

- The Weekly Activity Index for Germany has fallen to its lowest level since November 2022.

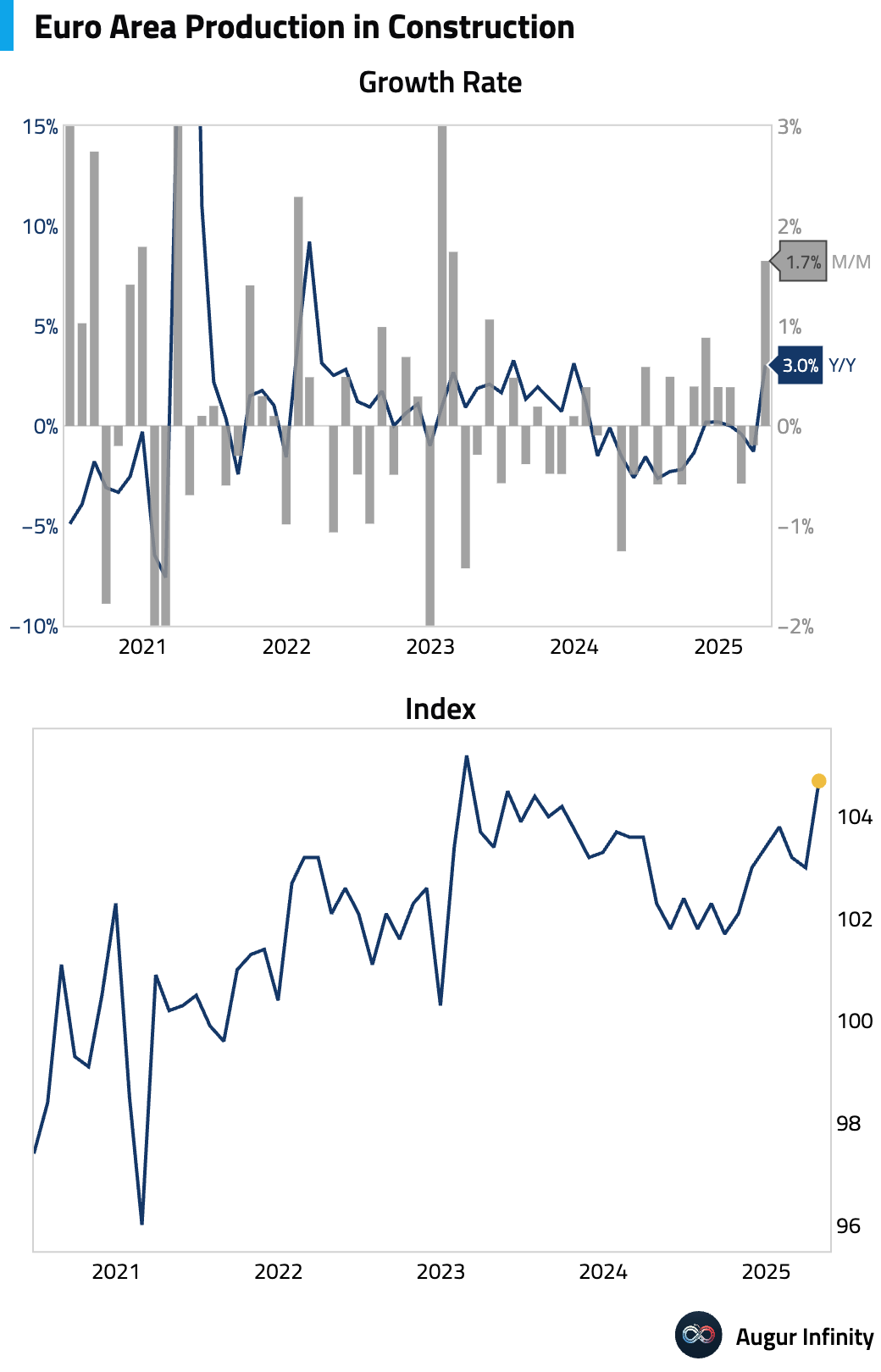

- Euro area production in construction expanded by 3.0% Y/Y in April, a sharp rebound from the 1.3% contraction in March.

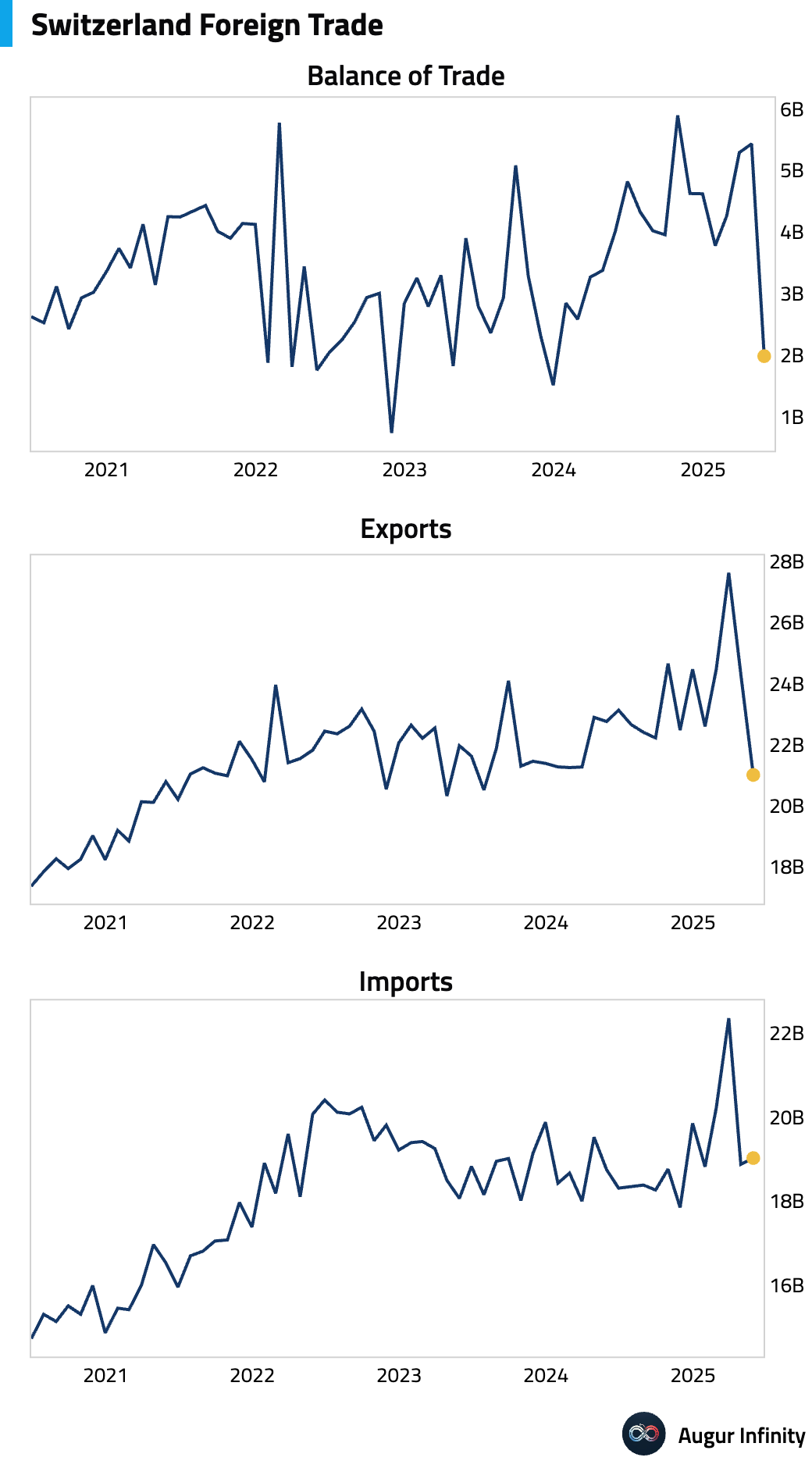

- Switzerland’s trade surplus narrowed to CHF 2.0 billion in May from CHF 5.4 billion in April, marking the smallest surplus since December 2023.

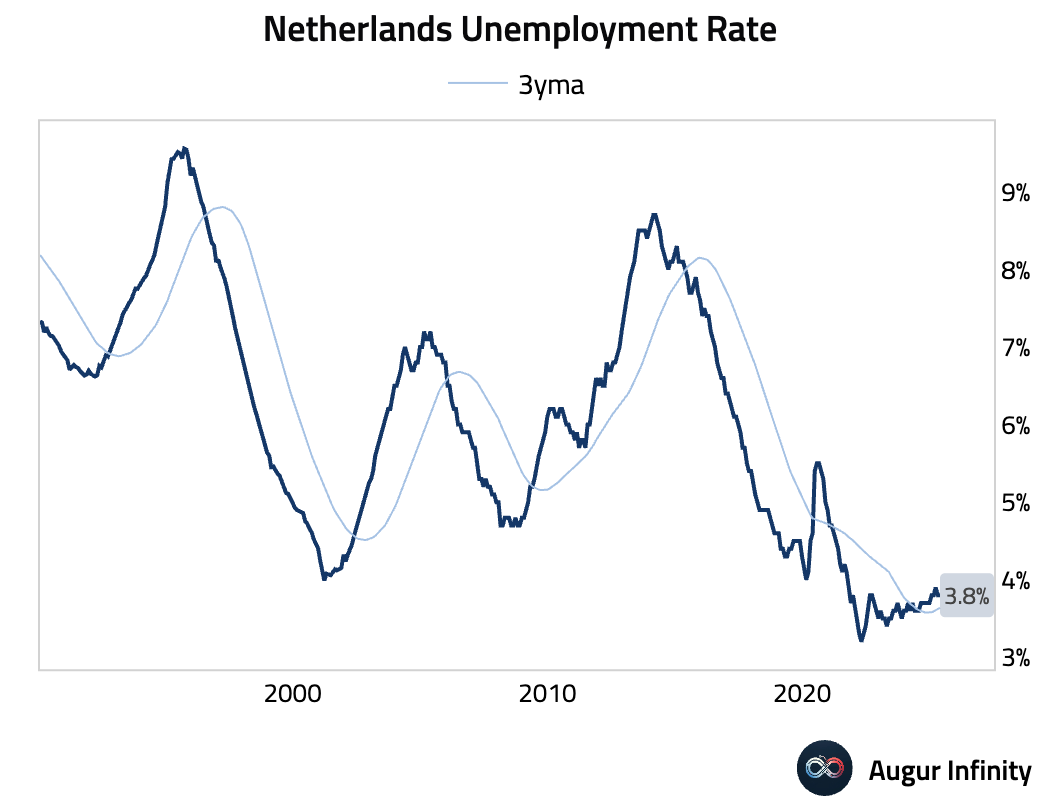

- The unemployment rate in the Netherlands was unchanged at 3.8% in May.

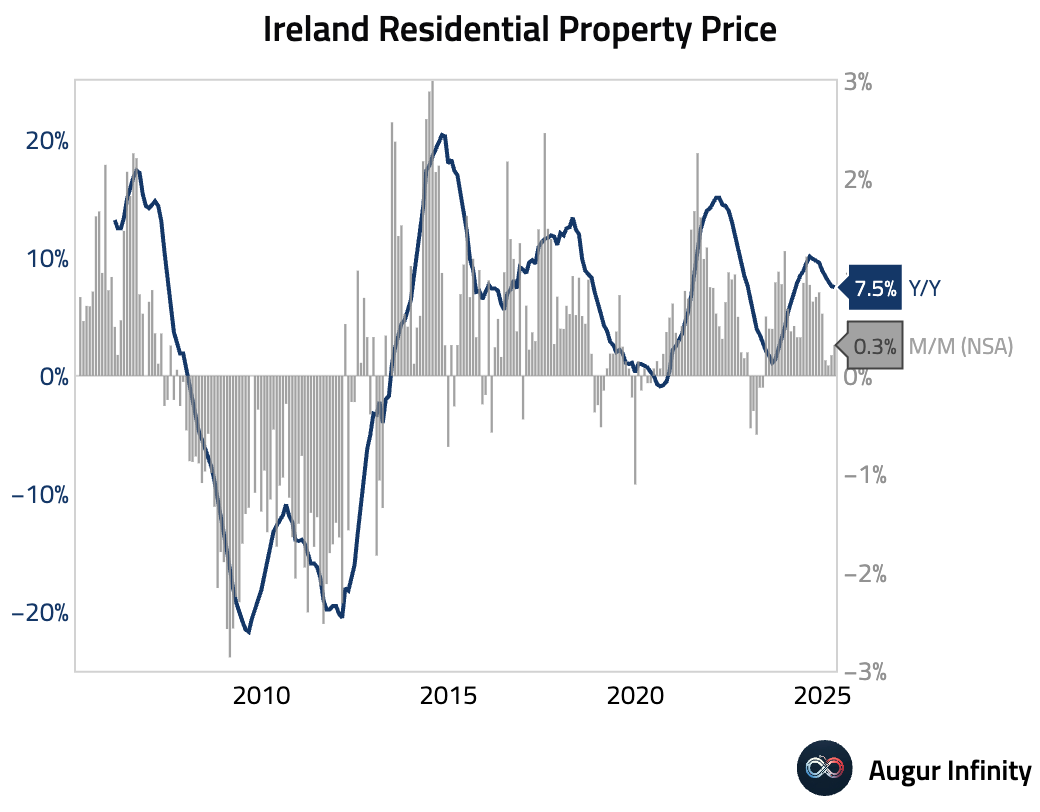

- Irish residential property prices rose 7.5% Y/Y in April, a slight moderation from the 7.6% increase in March. On a monthly basis, prices increased by 0.3%.

Asia-Pacific

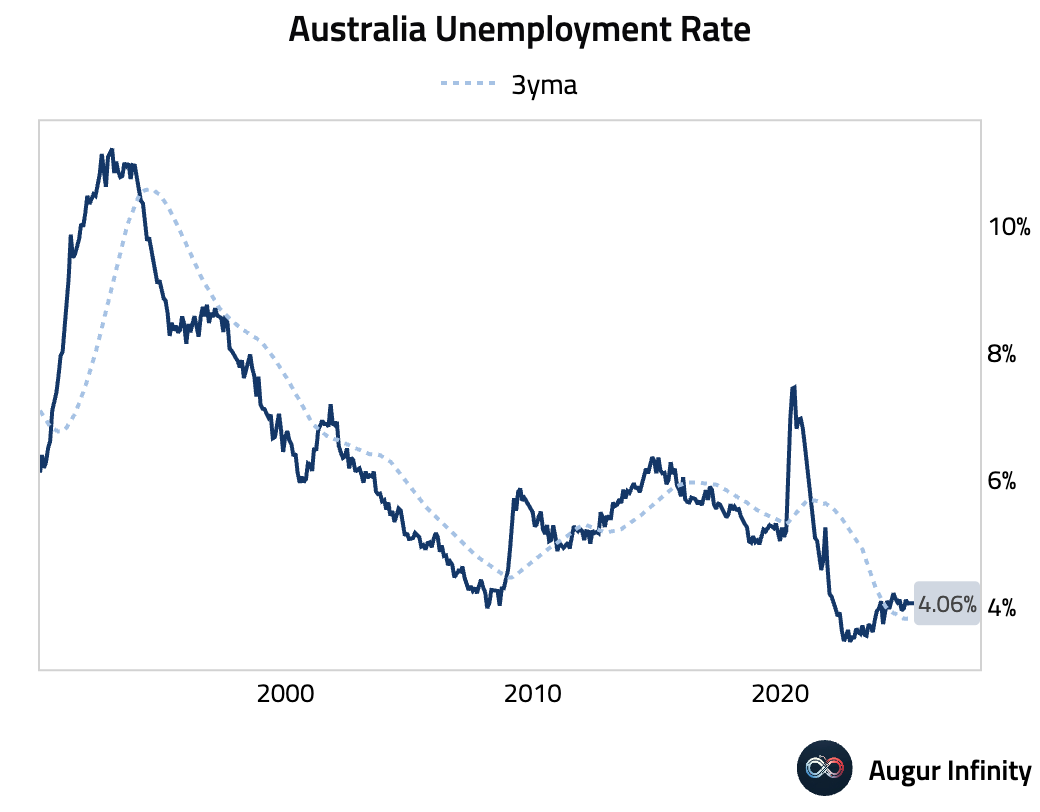

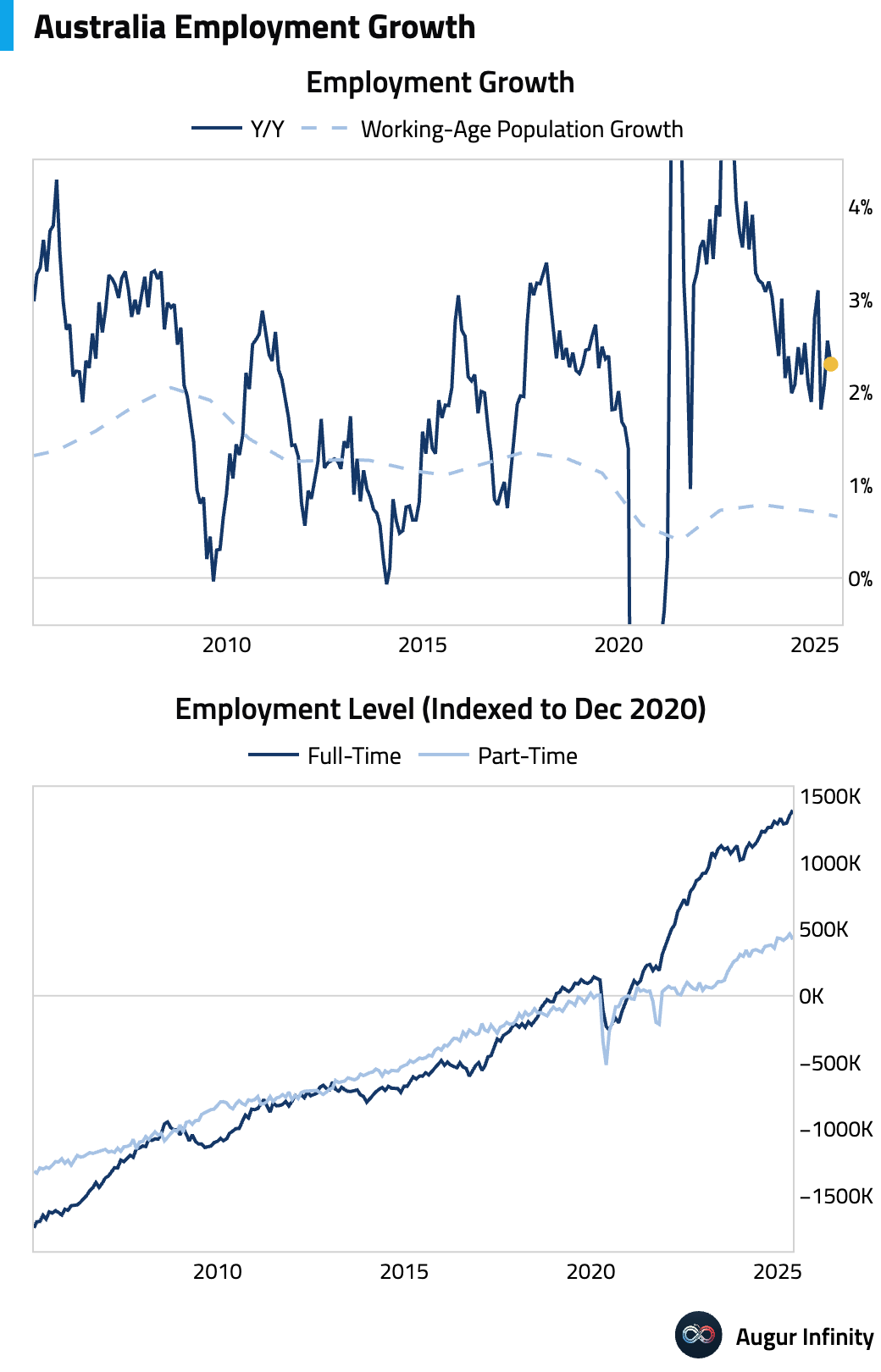

- Australian employment unexpectedly fell by 2,500 in May, significantly missing consensus expectations for a 25,000 gain. The decline was driven by a 41,200 drop in part-time jobs, while full-time employment rose by 38,700. The unemployment rate held steady at 4.1%, and the participation rate edged down to 67.0%.

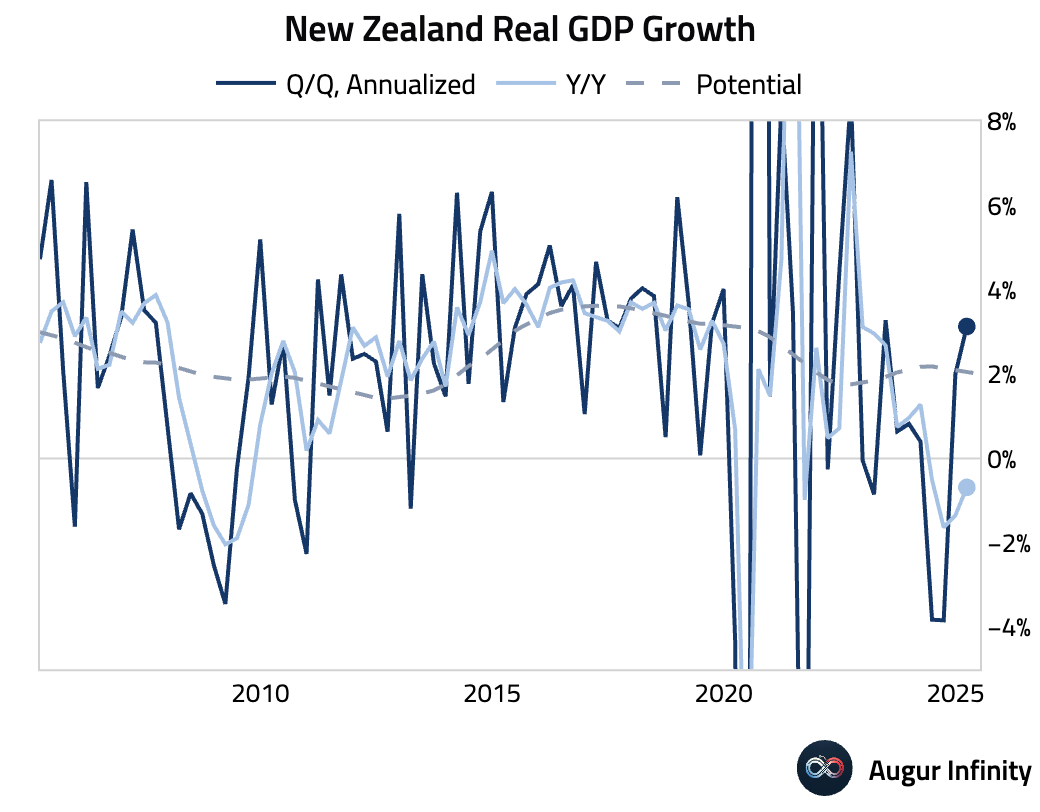

- New Zealand’s economy grew 0.8% Q/Q in the first quarter, beating consensus of 0.7% and accelerating from 0.5% in Q4 2024. This was the strongest quarterly growth since Q2 2023. The Y/Y contraction narrowed to 0.7% from 1.3% previously.

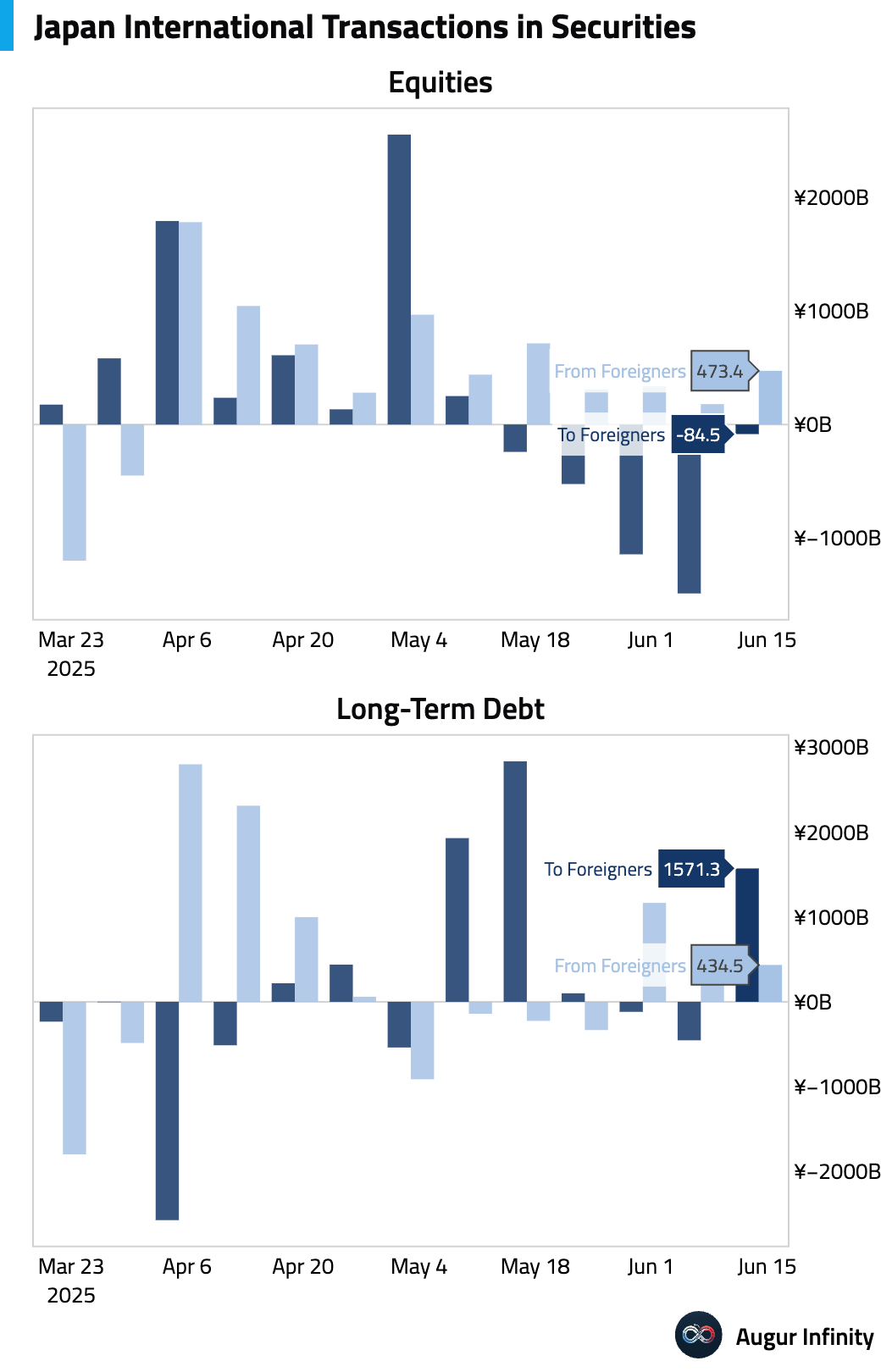

- Japanese investors purchased a net ¥1.57 trillion of foreign bonds in the week ending June 14, a sharp reversal from the ¥453.6 billion of net selling in the prior week. Foreign investors were net buyers of Japanese stocks, purchasing ¥473.4 billion.

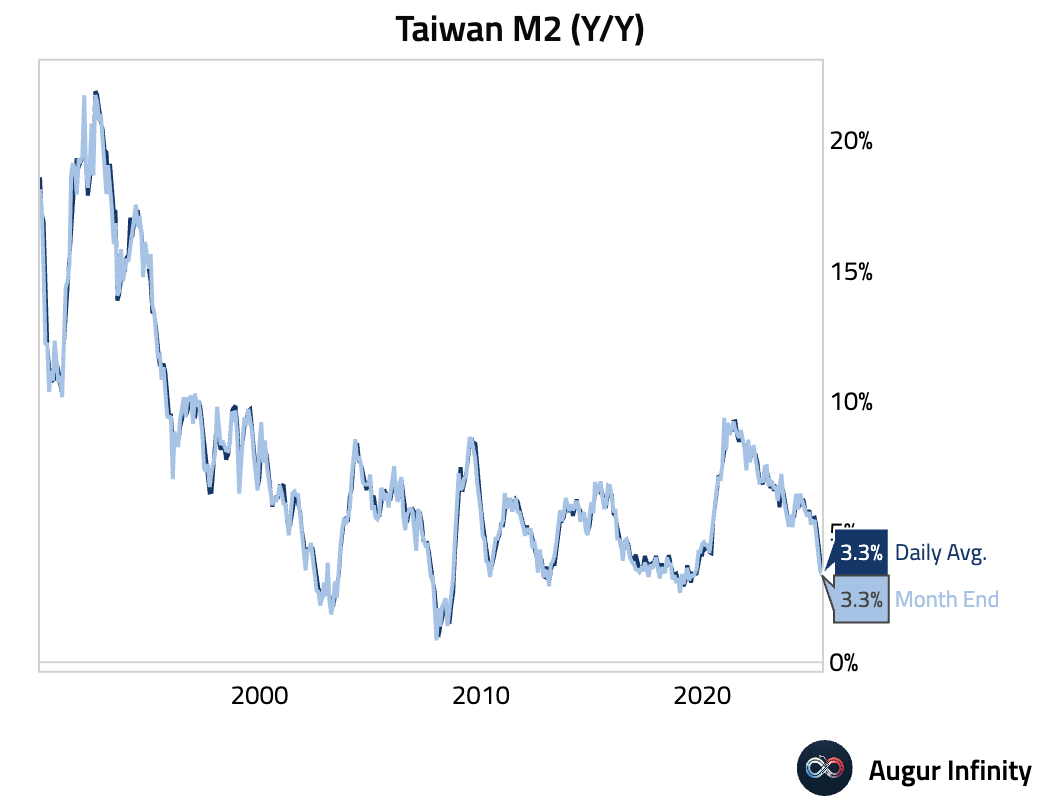

- Taiwan’s M2 money supply growth slowed to 3.33% Y/Y in May from 3.88% in April.

- Taiwan's central bank held its benchmark interest rate at 2.0%, as expected.

Emerging Markets ex China

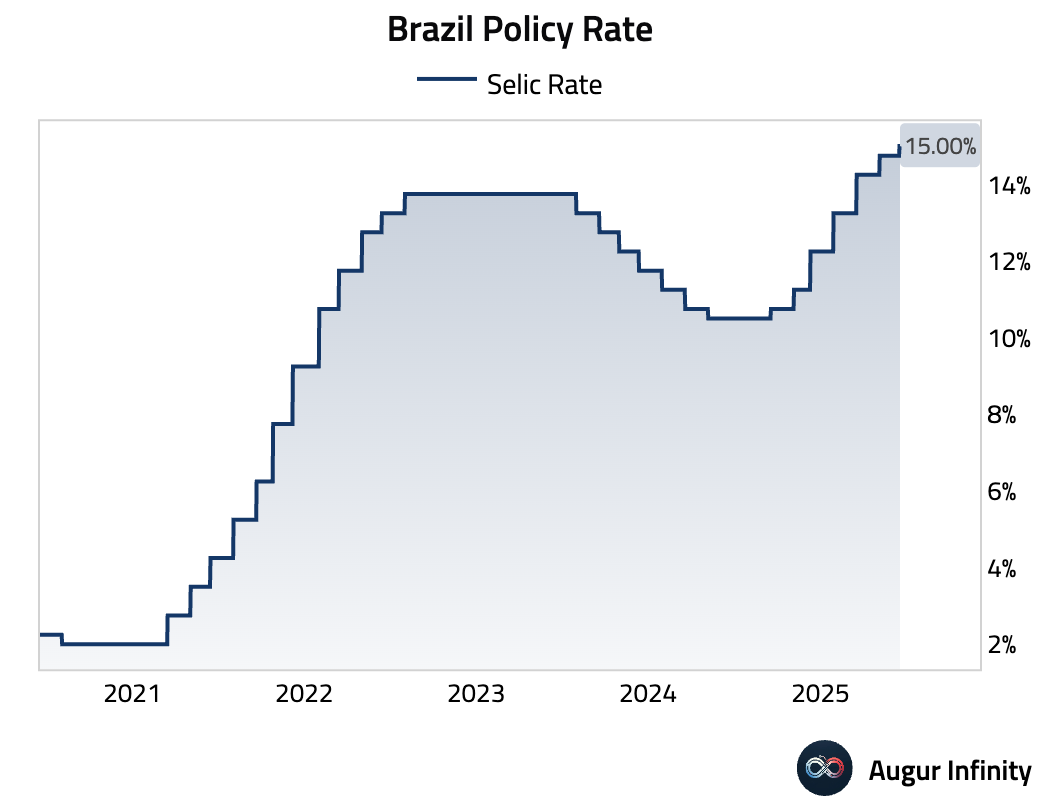

- Brazil's central bank held the Selic rate at 15.00%, slightly above the 14.75% consensus, marking the highest policy rate since July 2006.

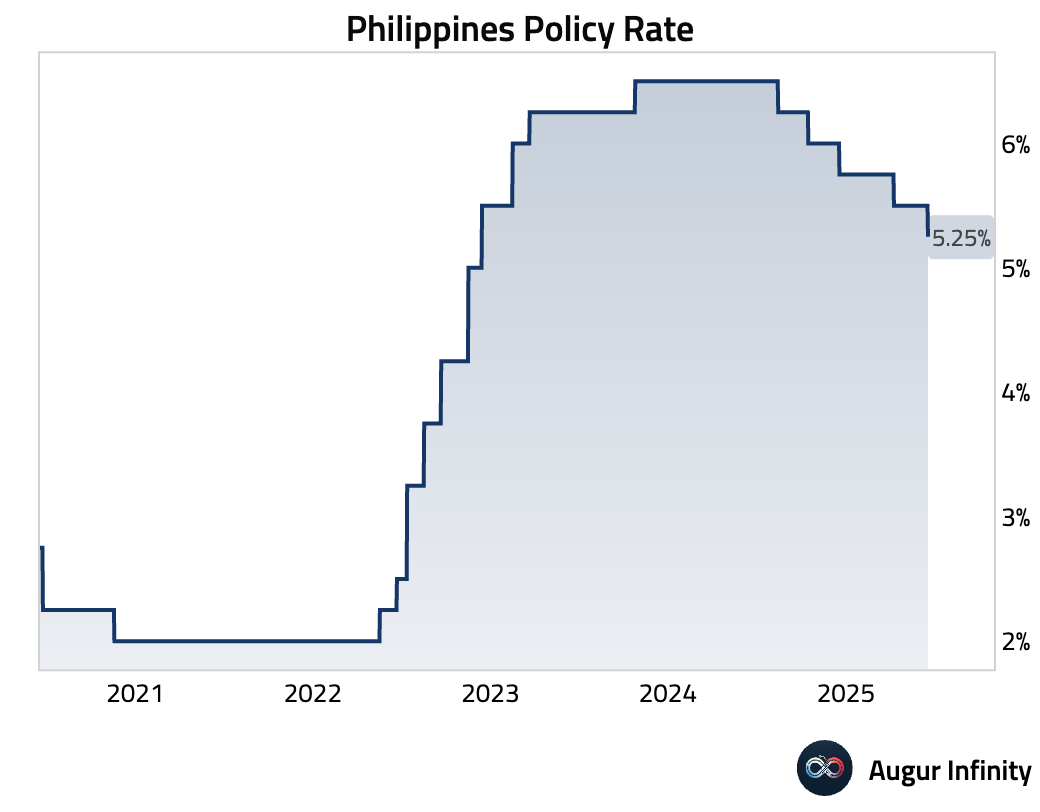

- The Central Bank of the Philippines cut its benchmark interest rate by 25 bps to 5.25%.

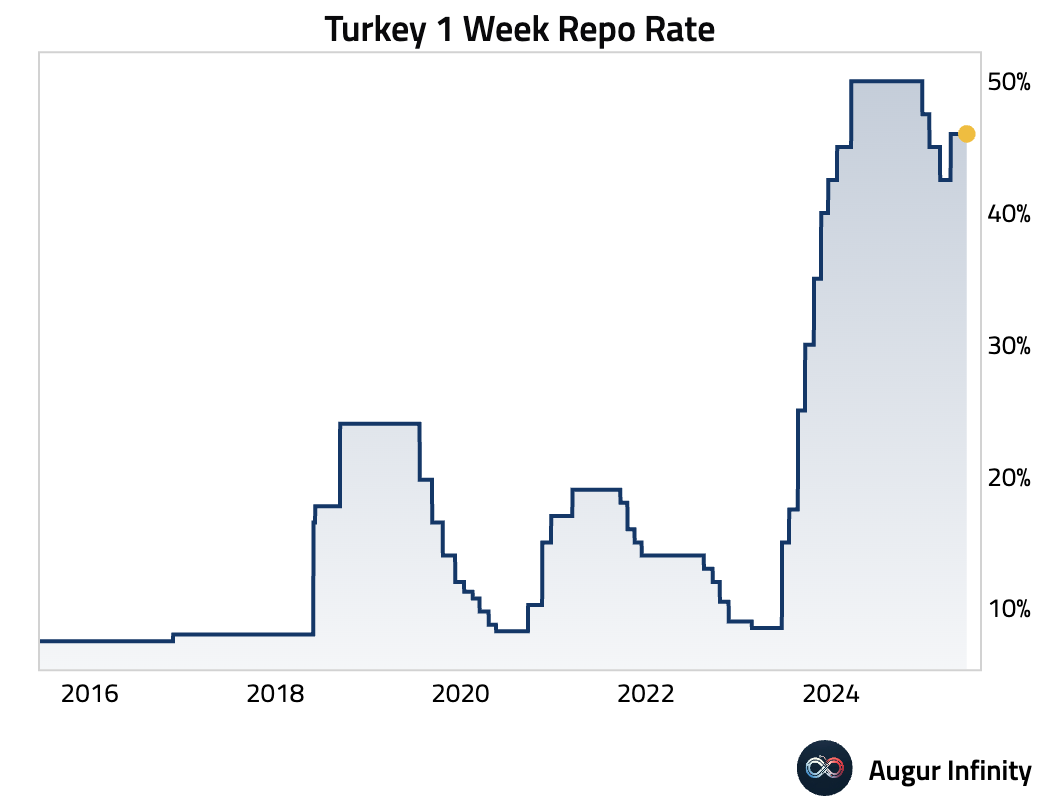

- The Central Bank of the Republic of Turkey (TCMB) maintained its one-week repo rate at 46.0%, in line with consensus. The overnight borrowing and lending rates were also held steady at 44.5% and 49.0%, respectively.

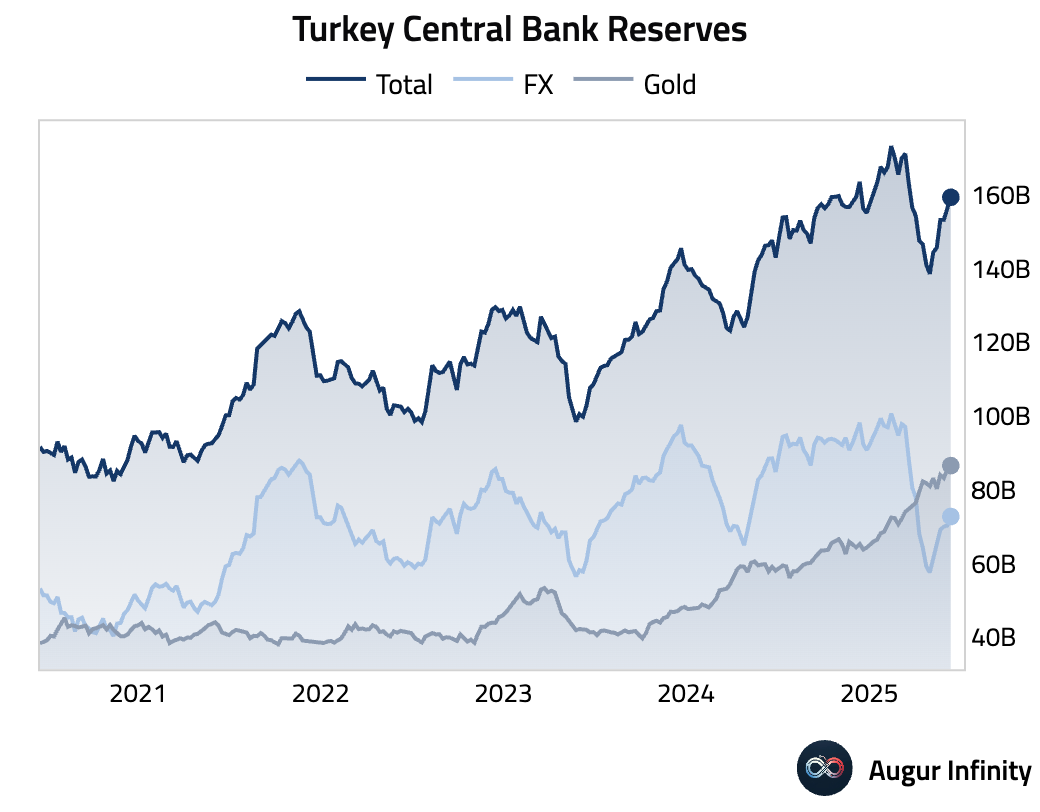

- Turkey’s foreign exchange reserves increased to $72.74 billion for the week ending June 13 from $70.31 billion the prior week.

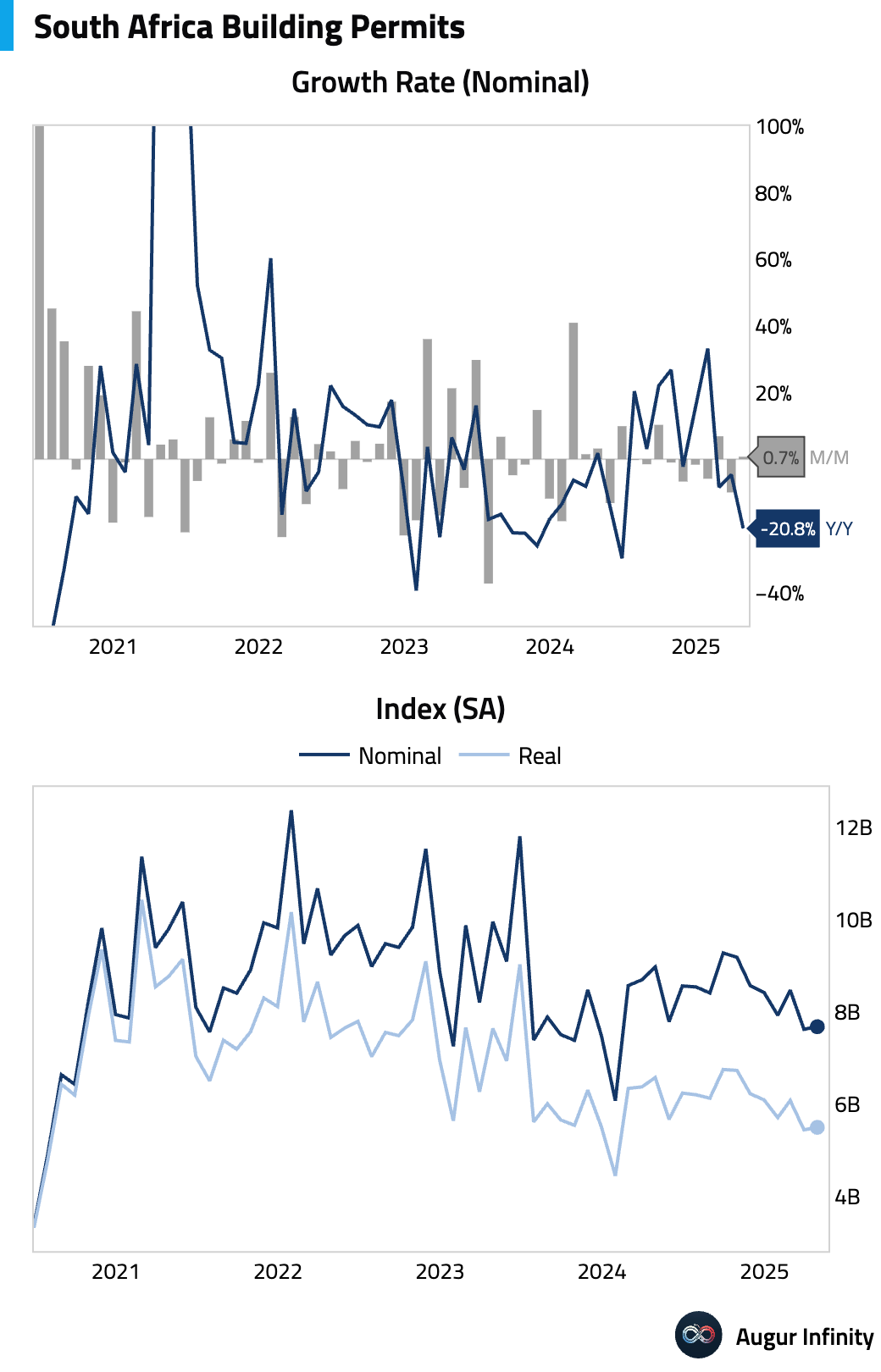

- South Africa’s building permits plunged 20.8% Y/Y in April after a 4.6% decline in March.

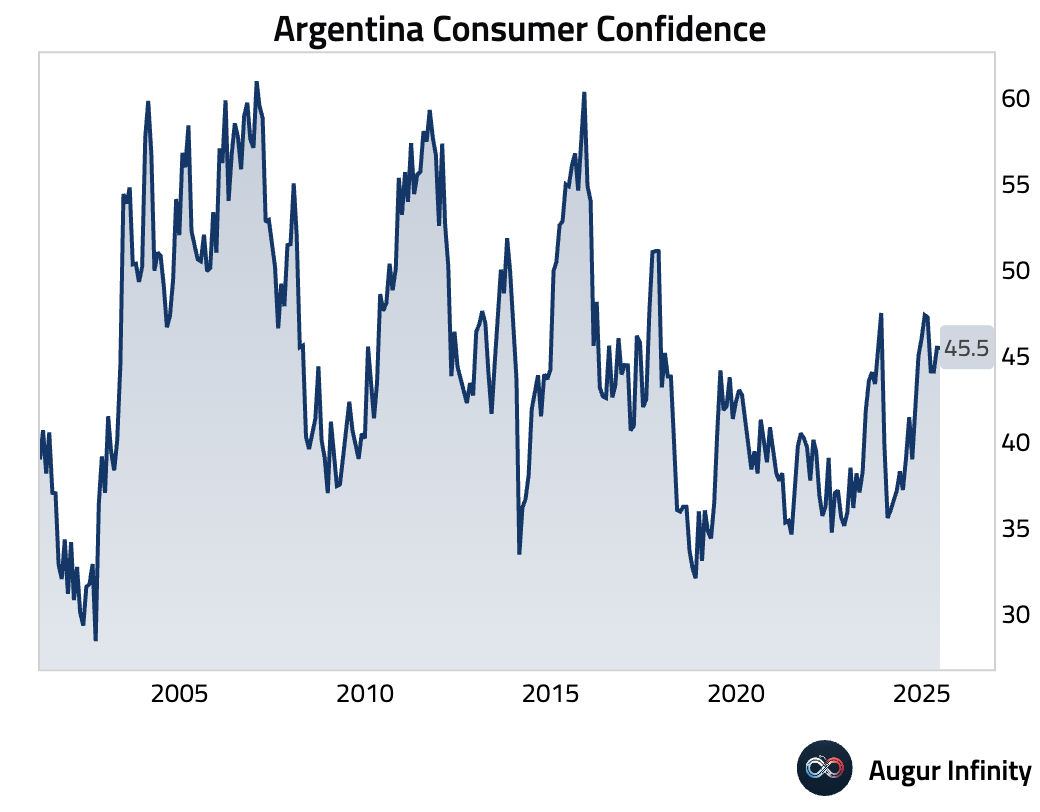

- Argentina's consumer confidence edged slightly lower to 45.48 in June from 45.49 in May.

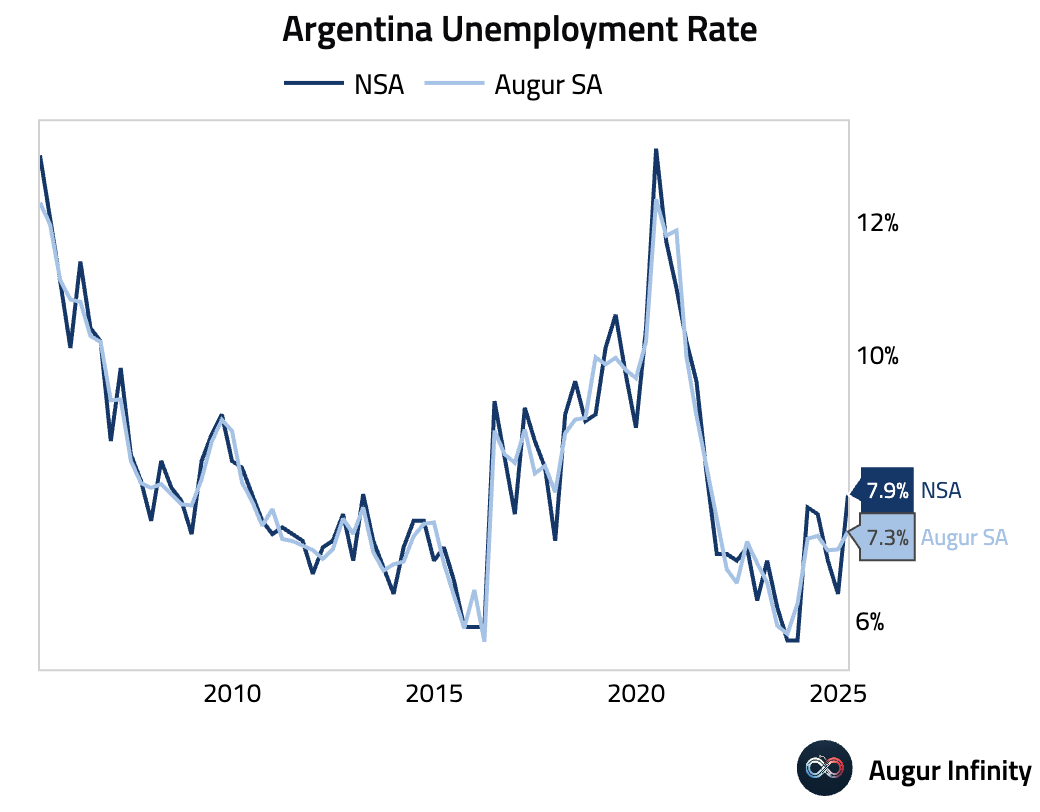

- Argentina's NSA unemployment rate for Q1 rose to 7.9%, significantly higher than the 6.3% consensus estimate. However, the increase was more modest after seasonal adjustment.

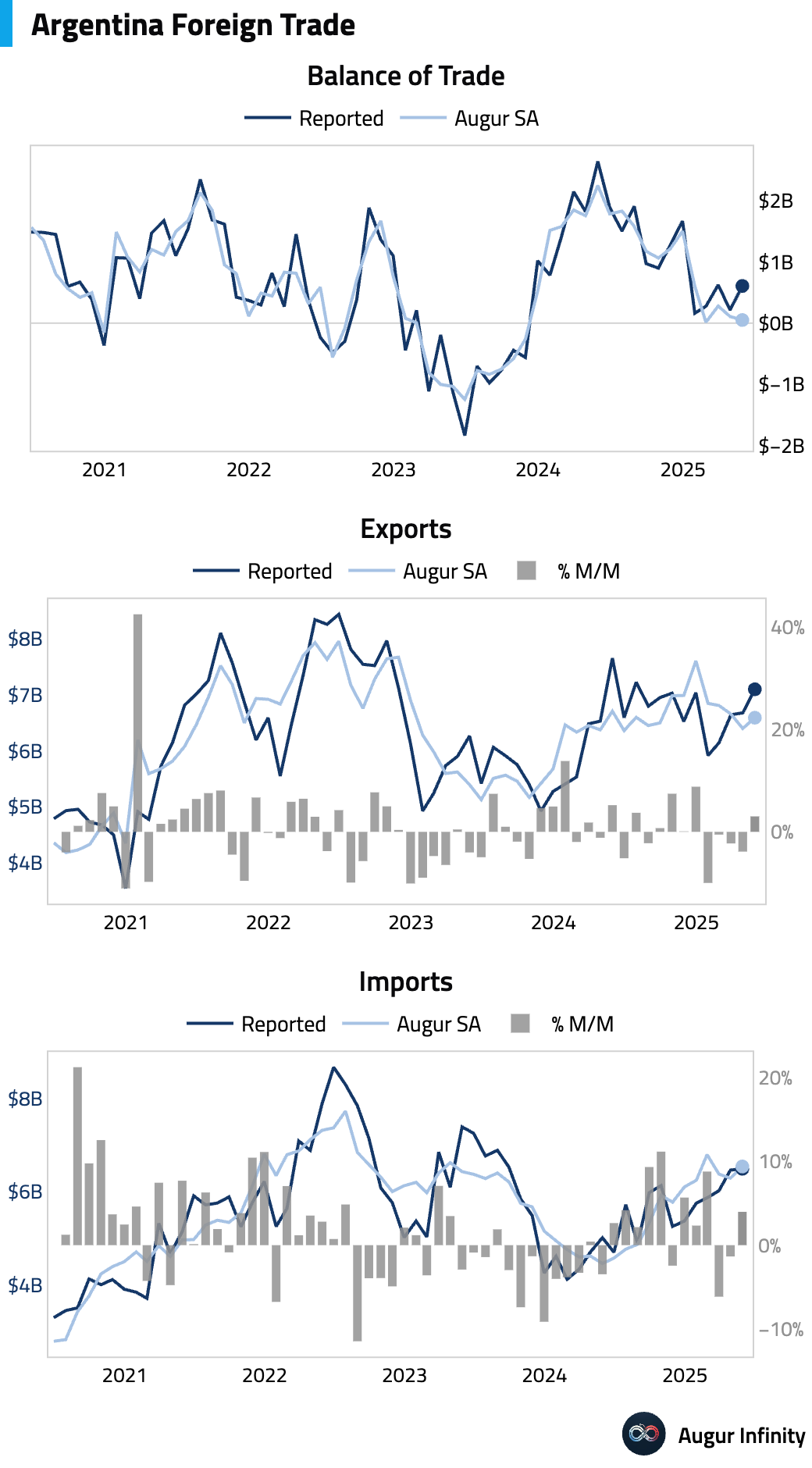

- Argentina posted a trade surplus of $608 million in May, wider than the $204 million surplus in April but below the consensus forecast of $859 million.

FX

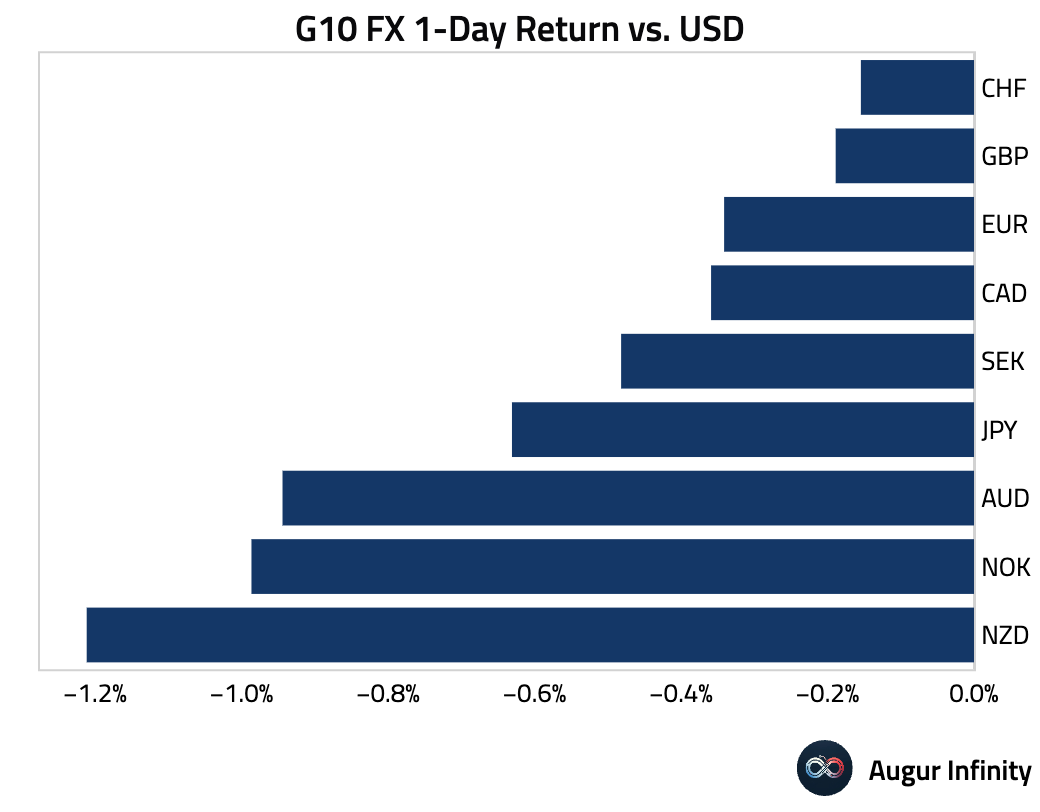

- The US dollar strengthened against all G10 peers. The New Zealand dollar was the weakest, falling 1.2%, followed by the Norwegian krone (-1.0%) and the Australian dollar (-0.9%). The Canadian dollar, euro, British pound, Swiss franc, and Swedish krona all posted their third consecutive day of losses against the greenback.

Disclaimer

Augur Digest is an automated newsletter written by an AI. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.