- Headlines

- Charts of the Day

- United States

- Canada

- Europe

- Asia-Pacific

- Emerging Markets ex China

- Equities

- Fixed Income

- Commodities

- FX

Headlines

- President Trump announced a ceasefire between Israel and Iran, leading to an easing of geopolitical tensions in the region.

- The US Senate is reportedly nearing an agreement with the House on a large reconciliation bill that includes a revised cap on state and local tax deductions, with procedural votes expected to begin this week.

- The European Union is reportedly preparing retaliatory tariffs as the United States struggles to secure trade agreements with various partners ahead of a July 9 deadline.

- The US Supreme Court ruled to allow the administration’s policy of deporting certain illegal immigrants to countries where they are not citizens.

Charts of the Day

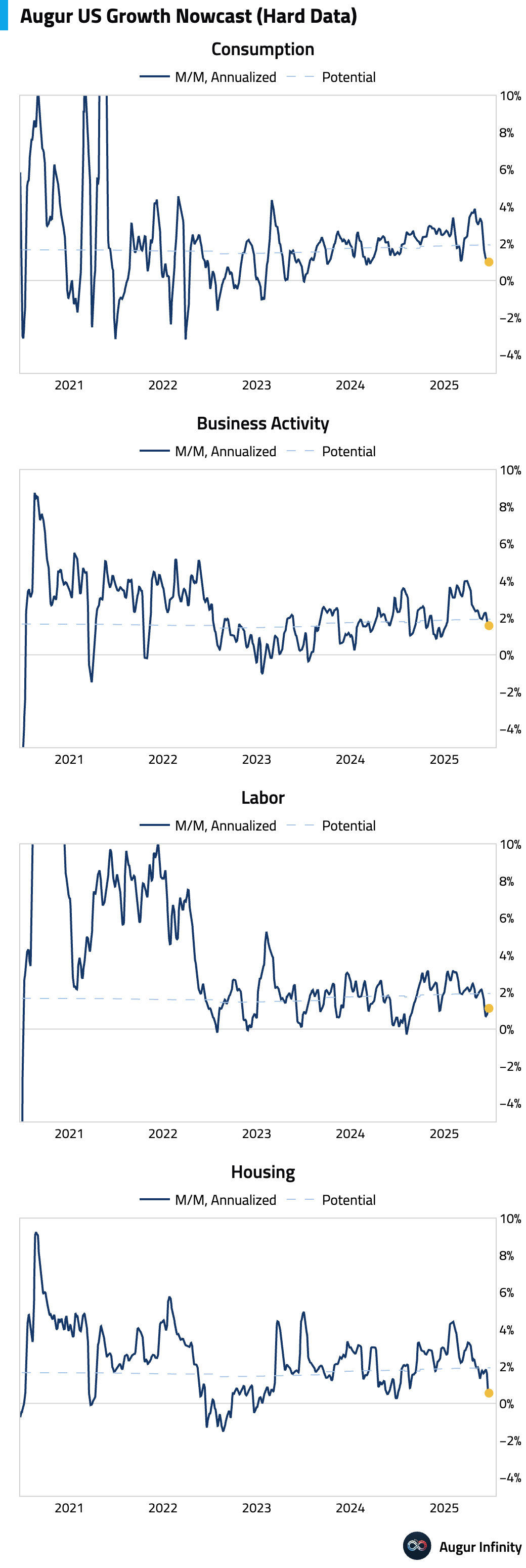

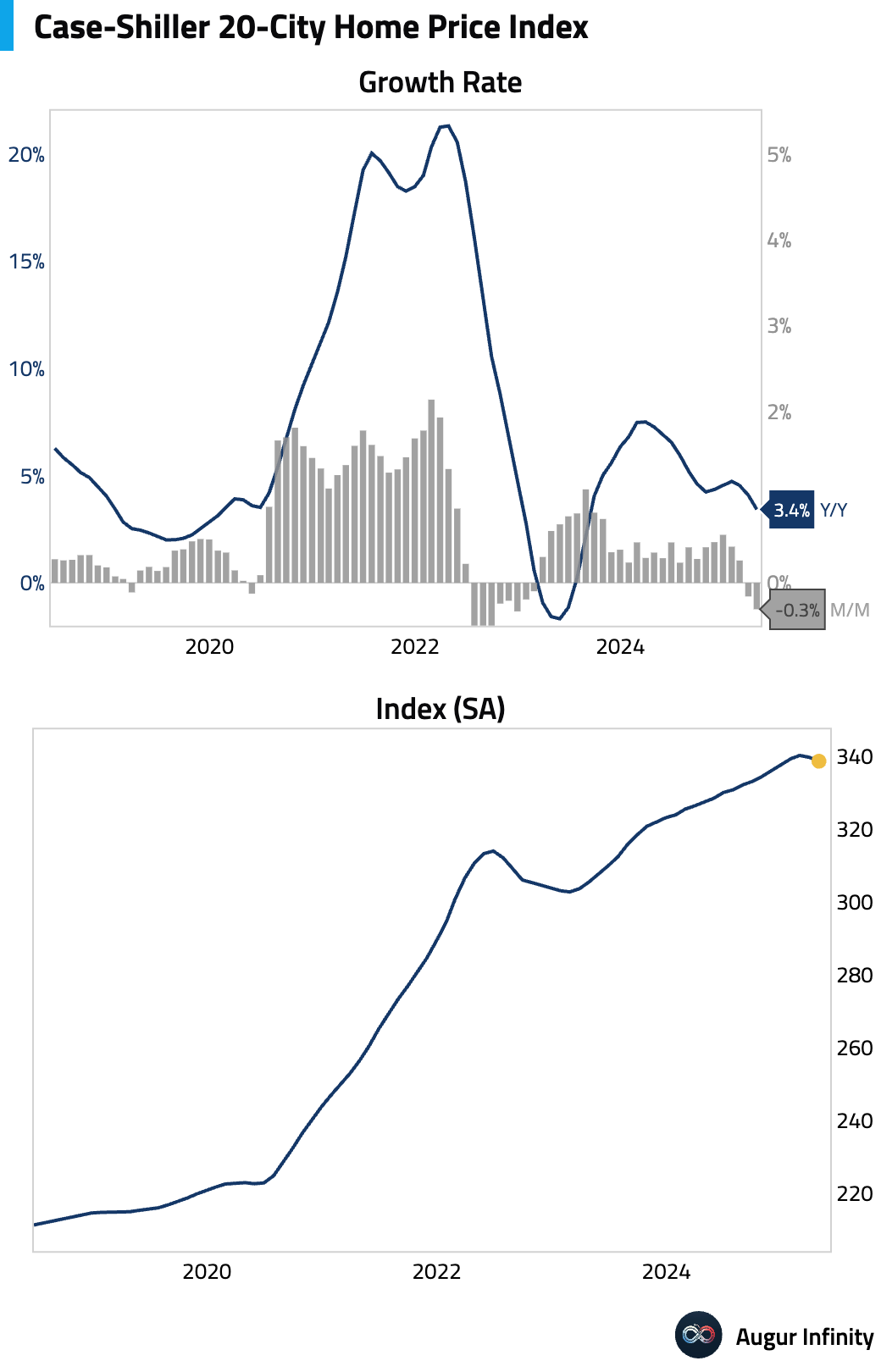

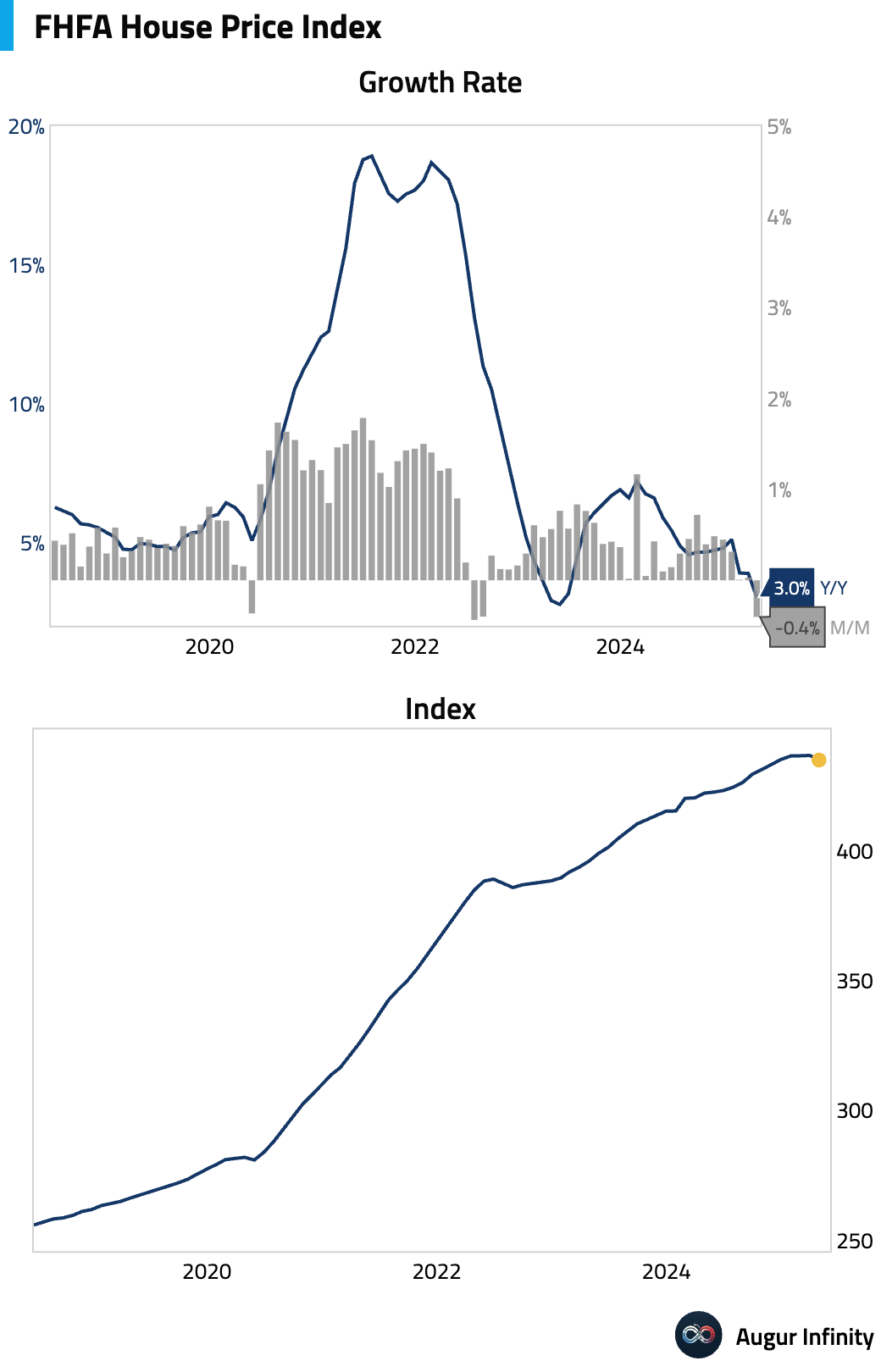

- There's been a broad-based slowdown in measured growth rates for the US. All the key components of US growth—consumption, business activities, labor market, and housing—are registering below-potential growth rates.

United States

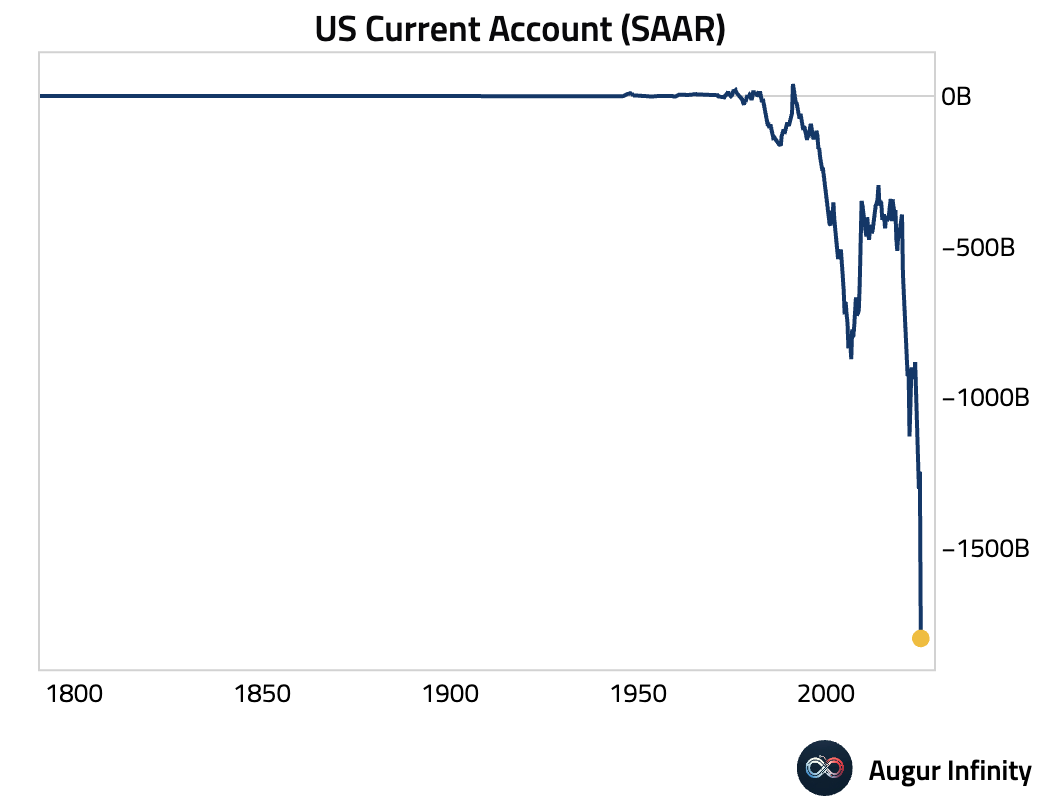

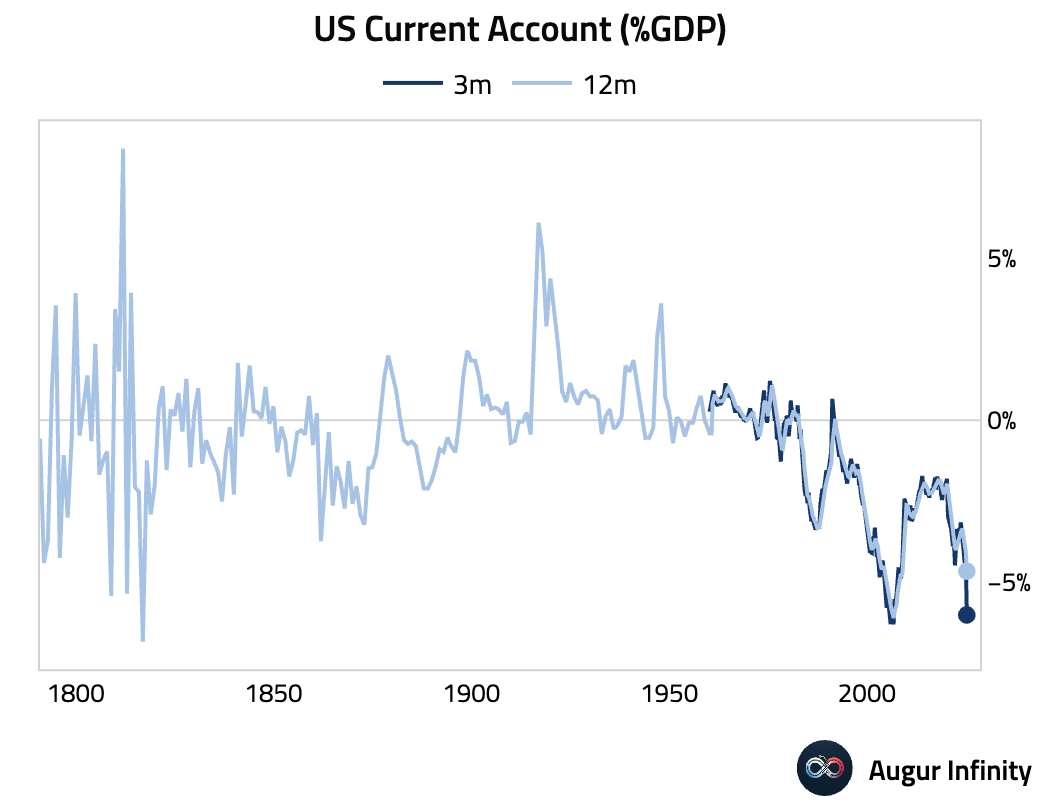

- The US current account deficit widened to an all-time low of -$450.2 billion in the first quarter, a larger deficit than the consensus forecast of -$443.3 billion and the prior quarter's -$312.0 billion. As a percentage of GDP, current account is also hovering near a record low.

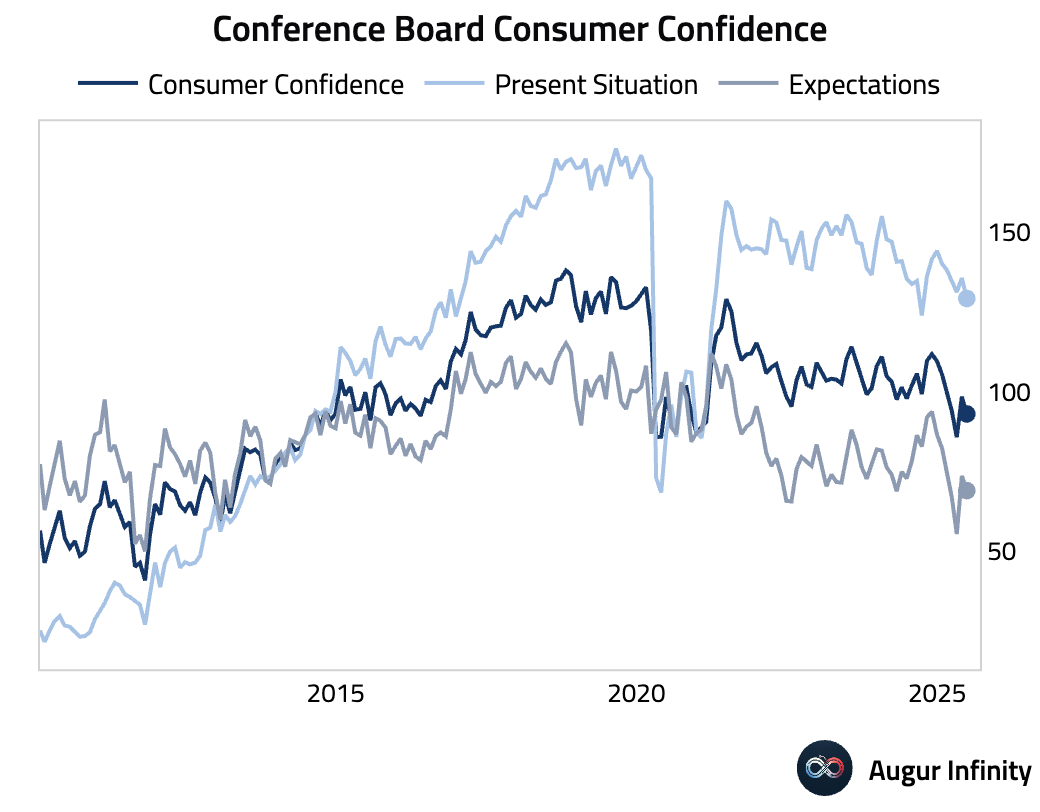

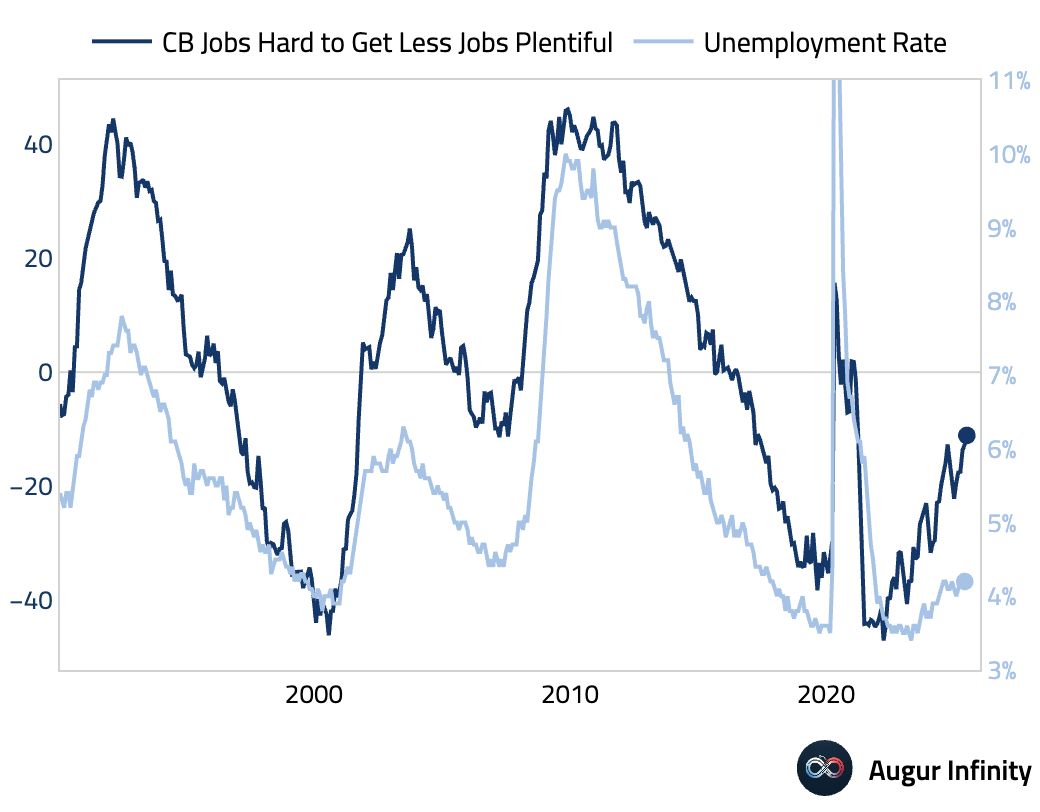

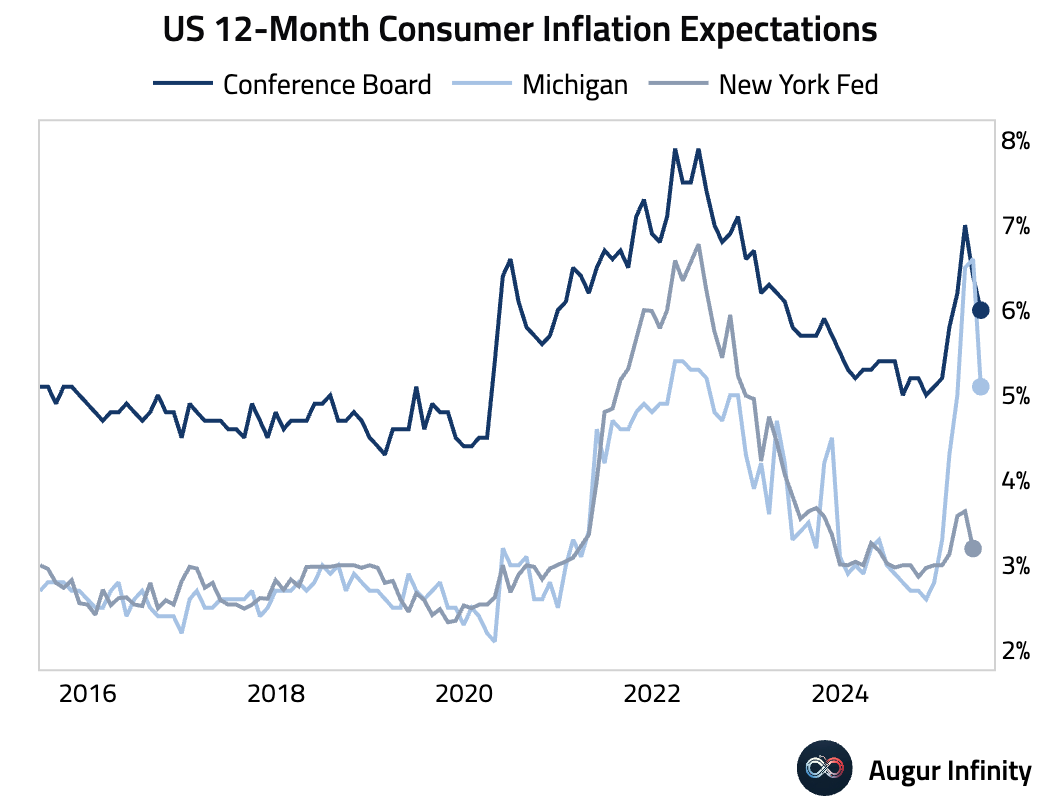

- Conference Board Consumer Confidence plunged to 93.0 in June, well below the 100.0 consensus and down from 98.4 in May. The drop was driven by broad pessimism, with the labor differential – the difference between those saying jobs are hard to get versus plentiful – falling to its lowest since March 2021. A silver lining was the decline in 1-year inflation expectations to 6.0% (a 0.4 percentage point decrease), suggesting price pressures may be easing despite souring sentiment.

- The S&P/Case-Shiller 20-City Home Price Index showed a notable slowdown in April, with the year-over-year increase at 3.4%, below the 4.0% consensus and down from 4.1% in March. Month-over-month, prices declined by 0.3% on a seasonally-adjusted basis.

- The FHFA House Price Index for April declined 0.4% M/M, bringing the year-over-year gain down to 3.0% from 3.9% previously.

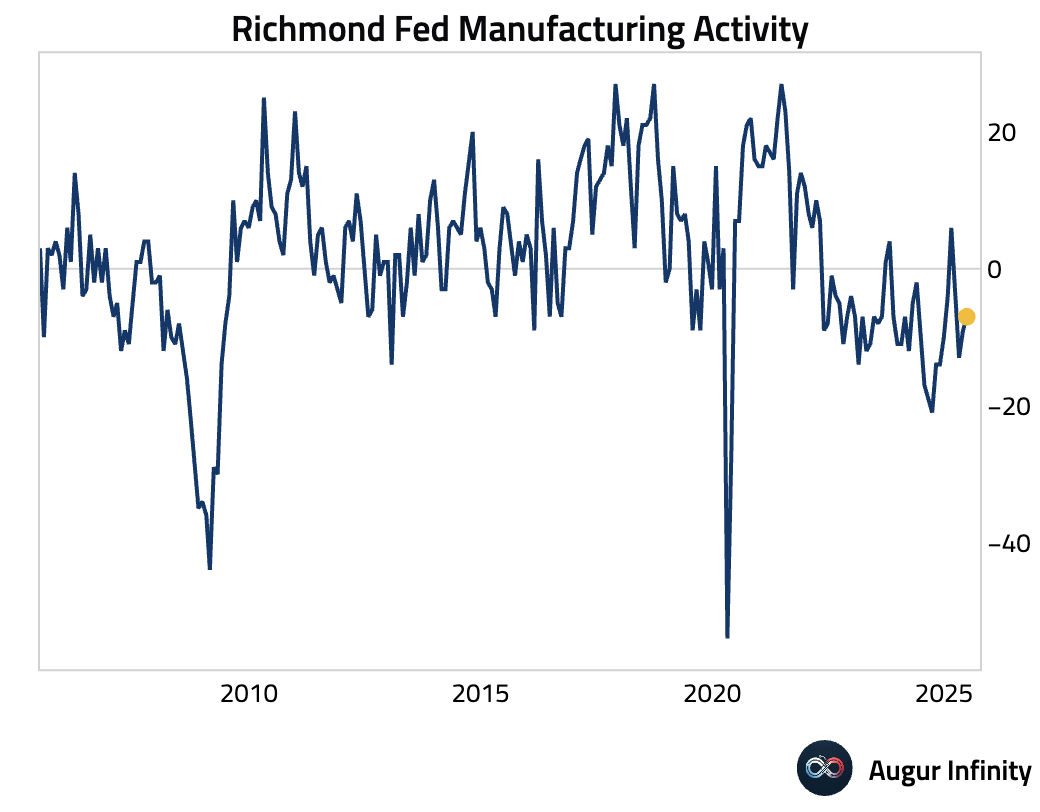

- The Richmond Fed Manufacturing Index came in at -7.0 in June, unchanged from consensus expectations but an improvement from May’s -9.0 reading.

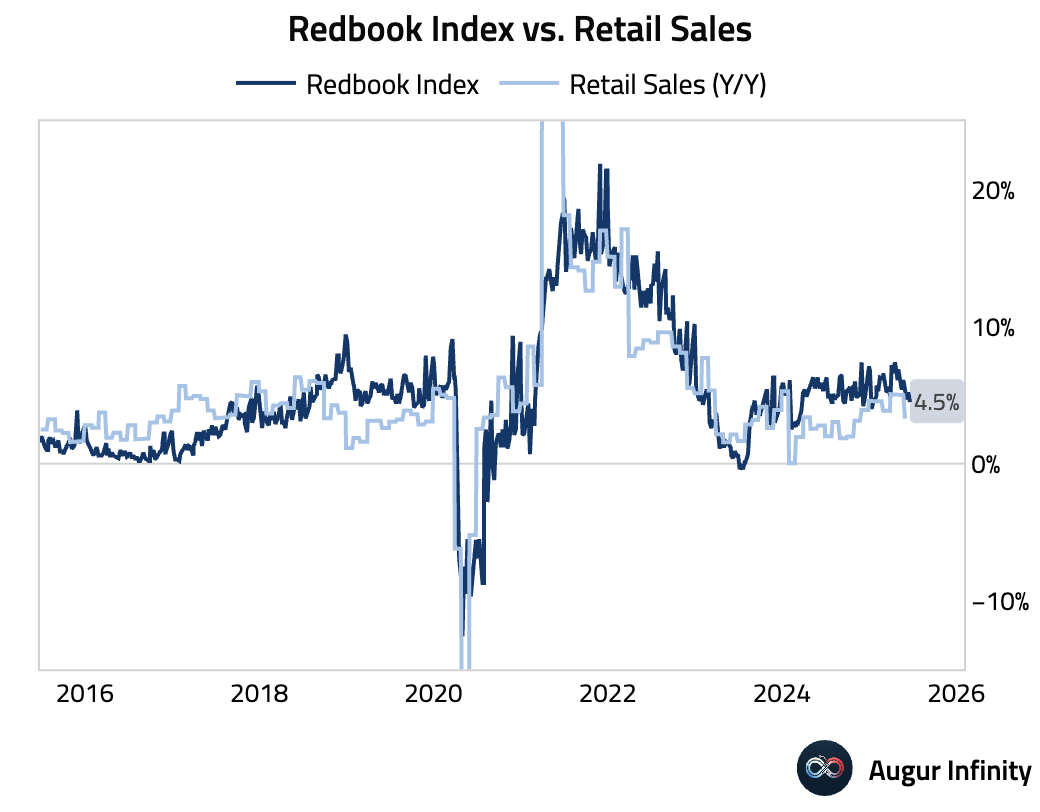

- The Redbook Index of retail sales rose 4.5% year-over-year for the week ending June 21, a slowdown from the prior week's 5.2% increase.

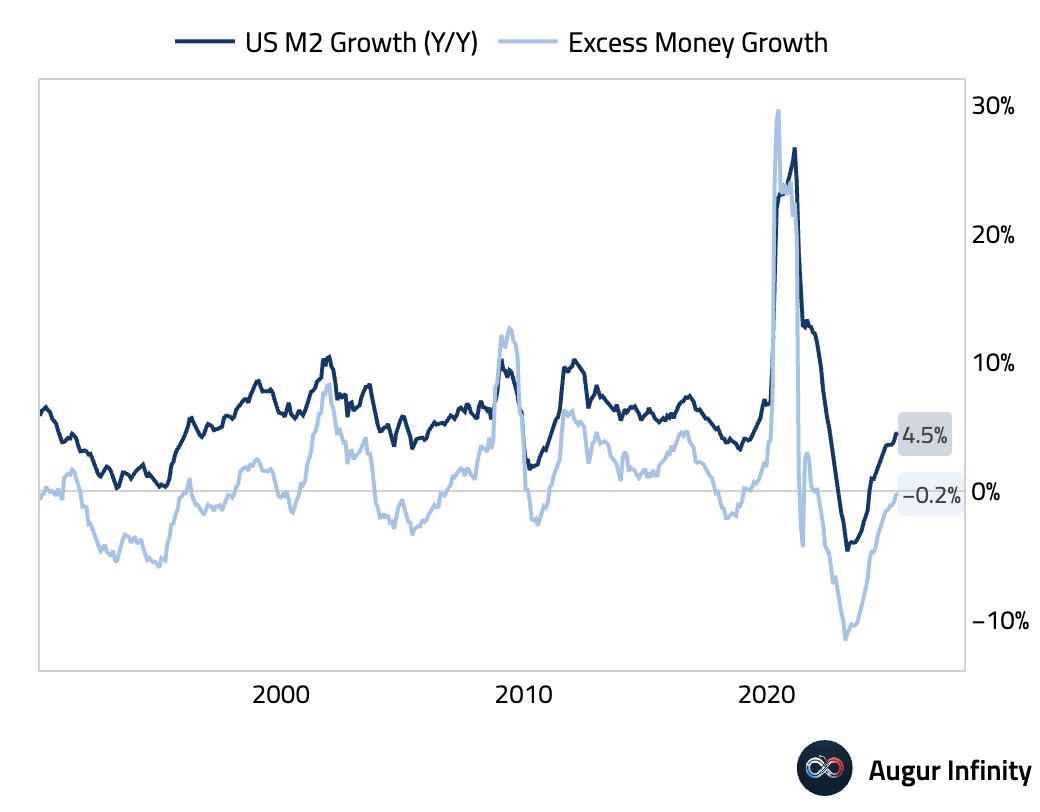

- The M2 money supply in the United States rose to an all-time high of $21.94 trillion.

Canada

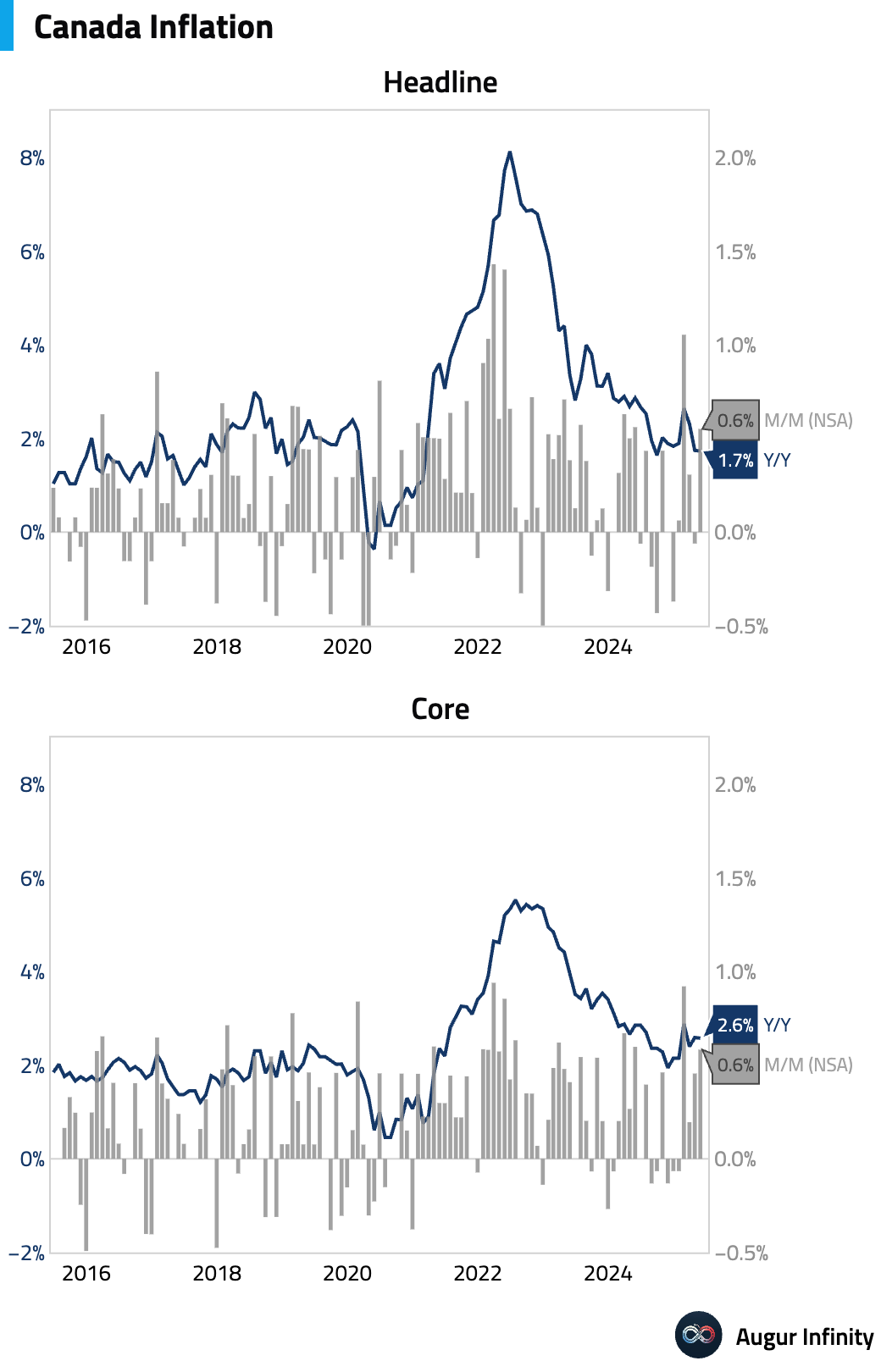

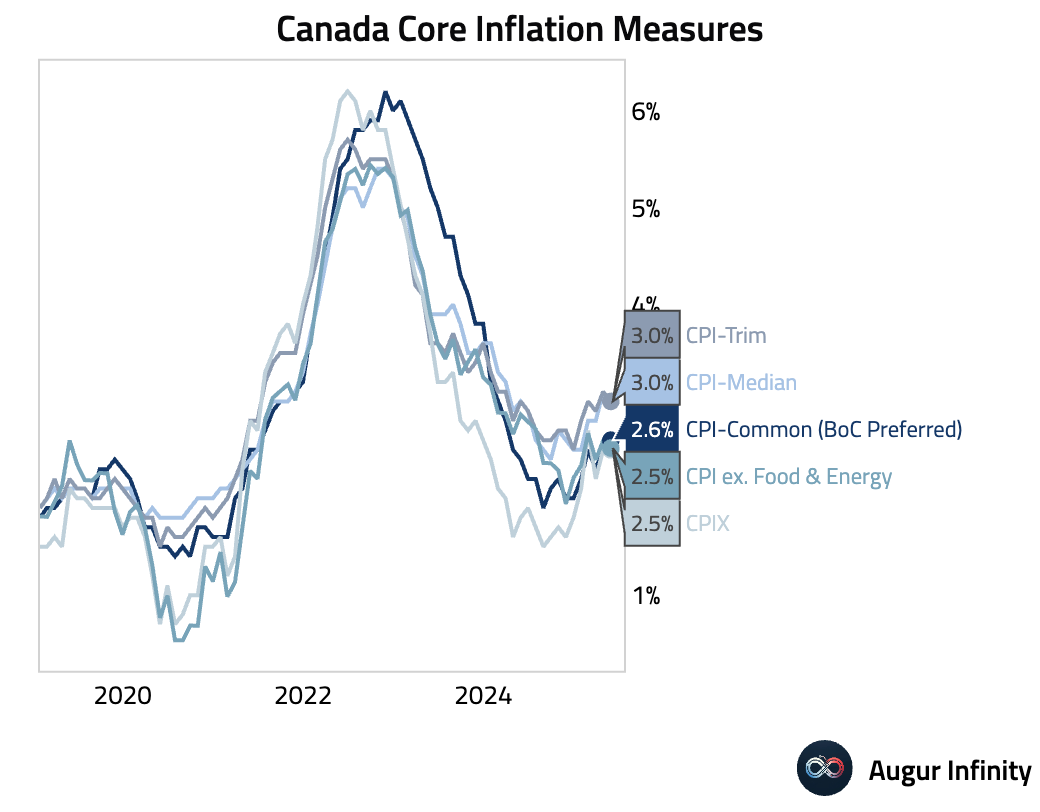

- Canadian headline inflation for May was stable at 1.7% Y/Y, matching consensus and the prior month's reading. However, the report was softer than the headline suggests, supporting a dovish Bank of Canada outlook. The BoC's preferred core measures, CPI-Trim and CPI-Median, both softened to 3.0% Y/Y, and their 3-month annualized average fell due to weaker shelter and travel-related prices. While some tariff-affected goods saw upticks, the impact is viewed as contained, raising the probability of a BoC rate cut arriving sooner than the expected October meeting.

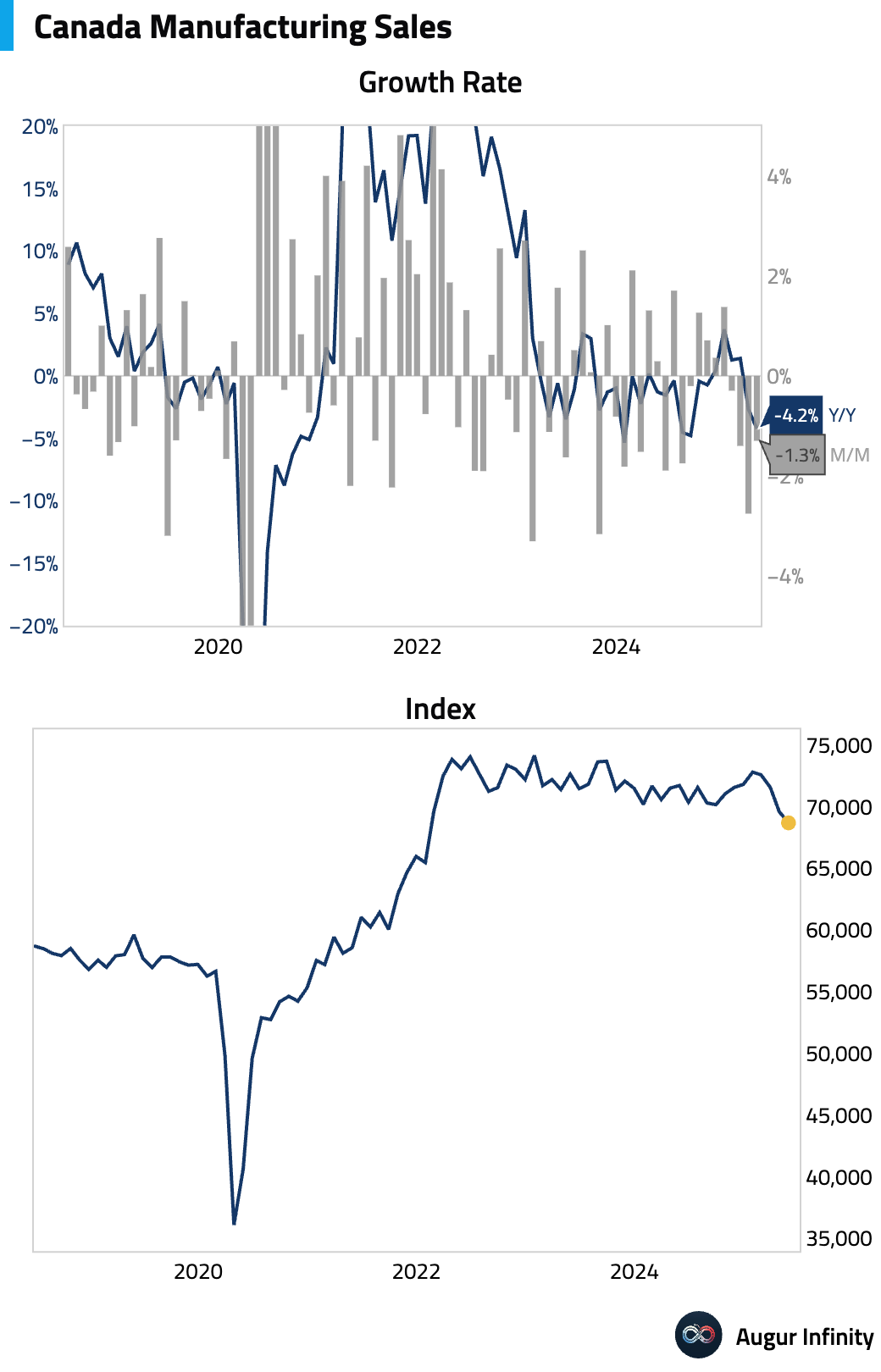

- Preliminary data for May shows Canadian manufacturing sales fell by 1.3% M/M, following a 2.8% decline in April.

Europe

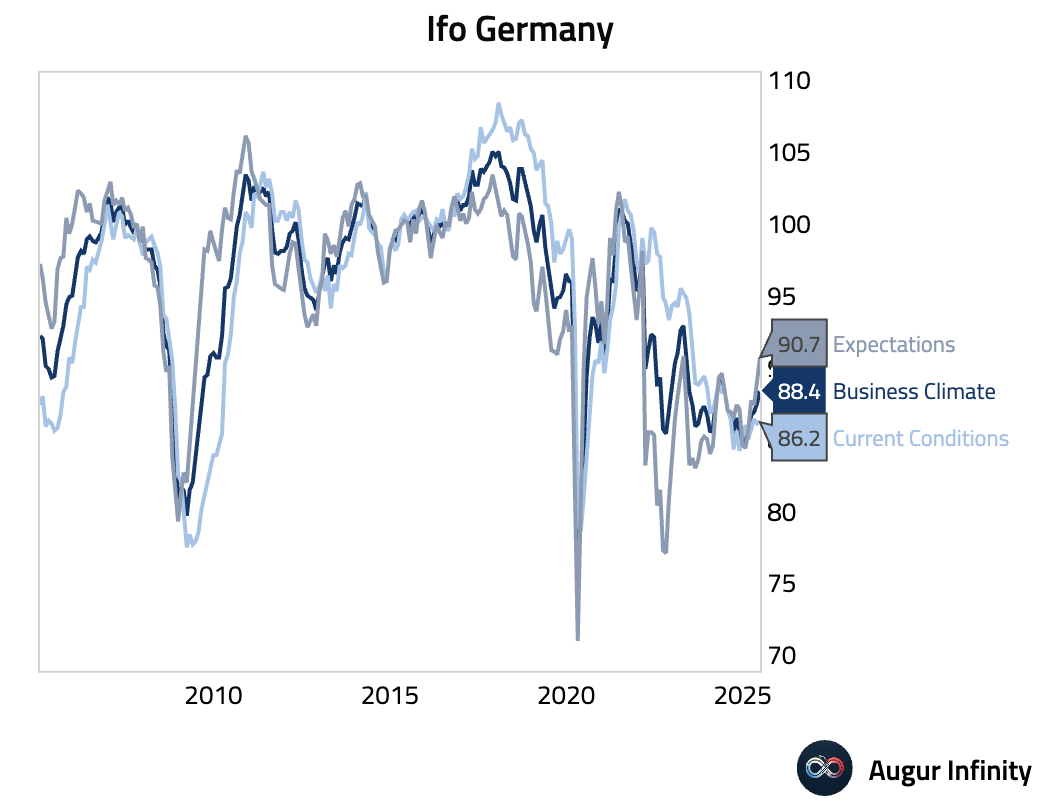

- Germany’s Ifo Business Climate Index for June rose to 88.4, slightly beating the 88.2 consensus. The increase was driven by a strong jump in the Expectations component to 90.7, helping to close the “unusual gap” with the more optimistic PMI survey and suggesting a clearer economic pickup may be underway. The surge in construction expectations was particularly striking, with retail being the only significant laggard.

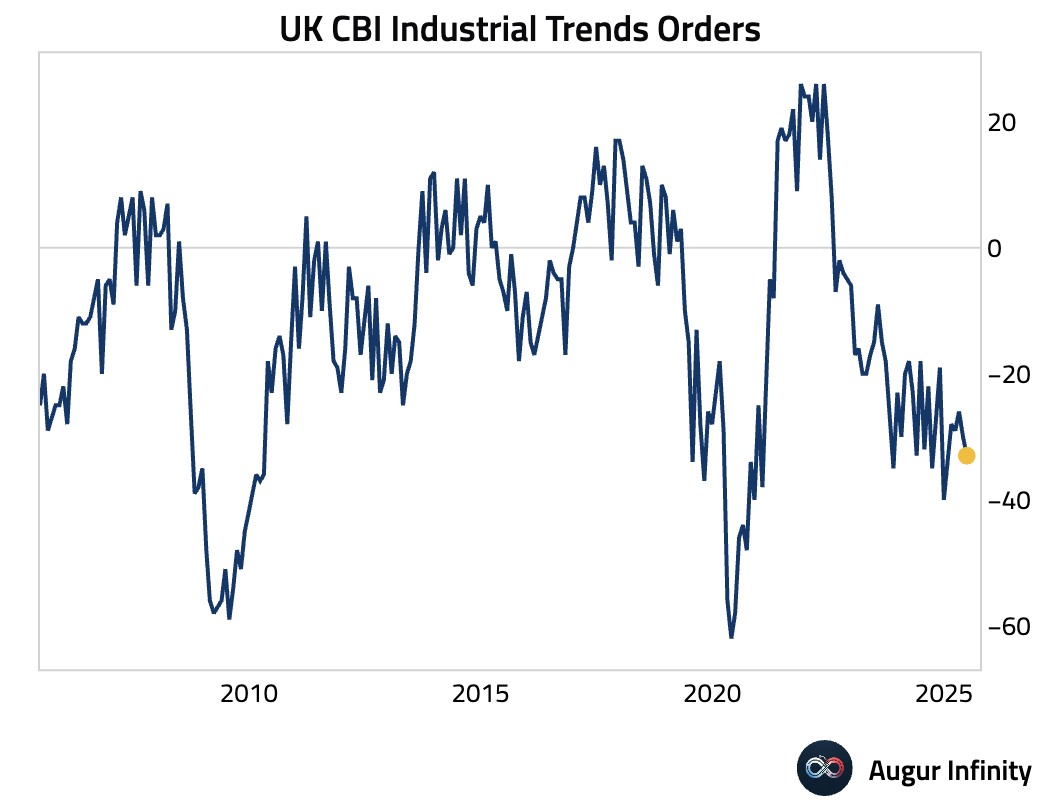

- The UK's CBI Industrial Trends Orders balance for June fell to -33, missing expectations of -27 and worsening from May’s -30 reading.

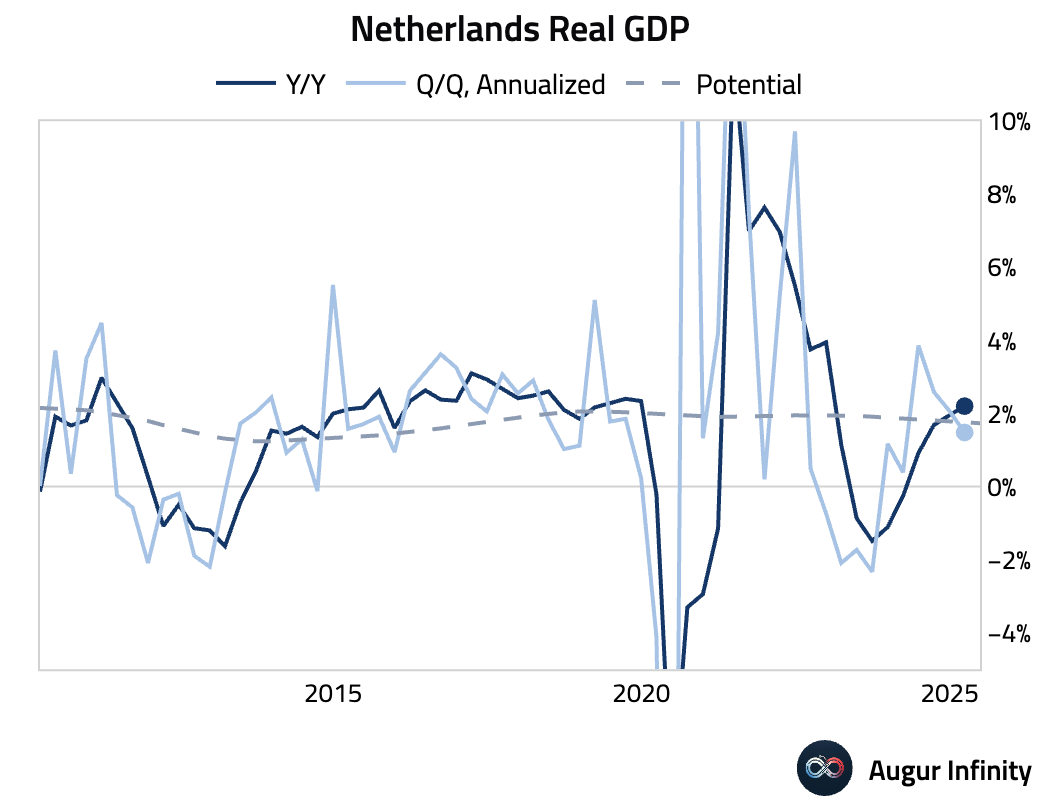

- Final data for the Netherlands showed that Q1 GDP growth was revised up to 0.4% Q/Q (from 0.1% initially) and 2.2% Y/Y (from 2.0%).

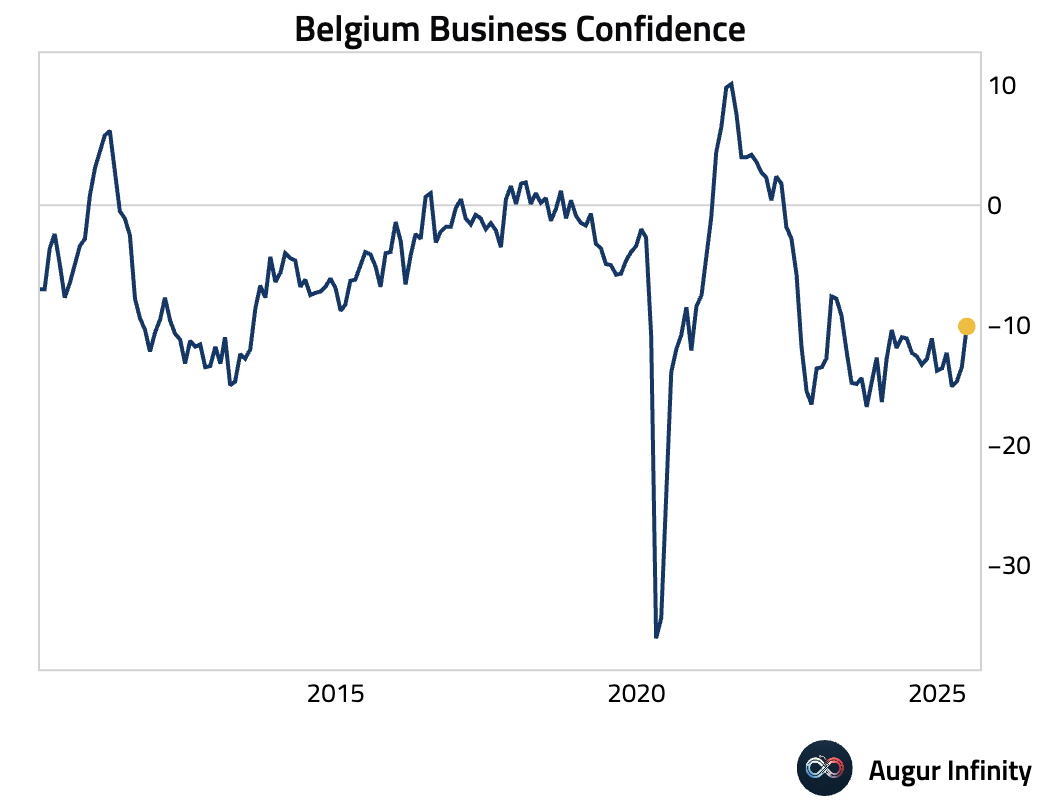

- Belgian business confidence improved to -10.1 in June from -13.5 in May, reaching its highest level in over a year.

Asia-Pacific

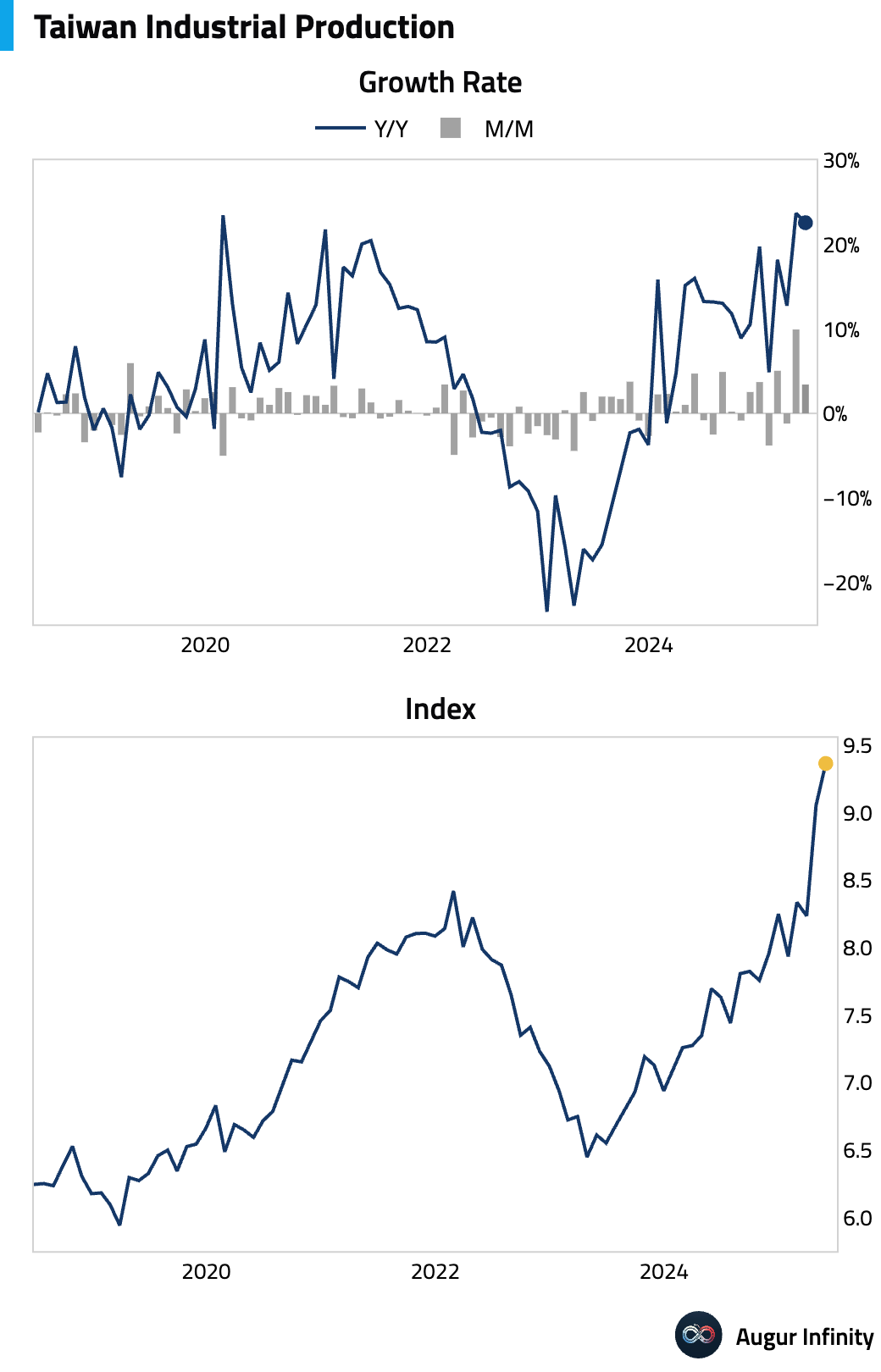

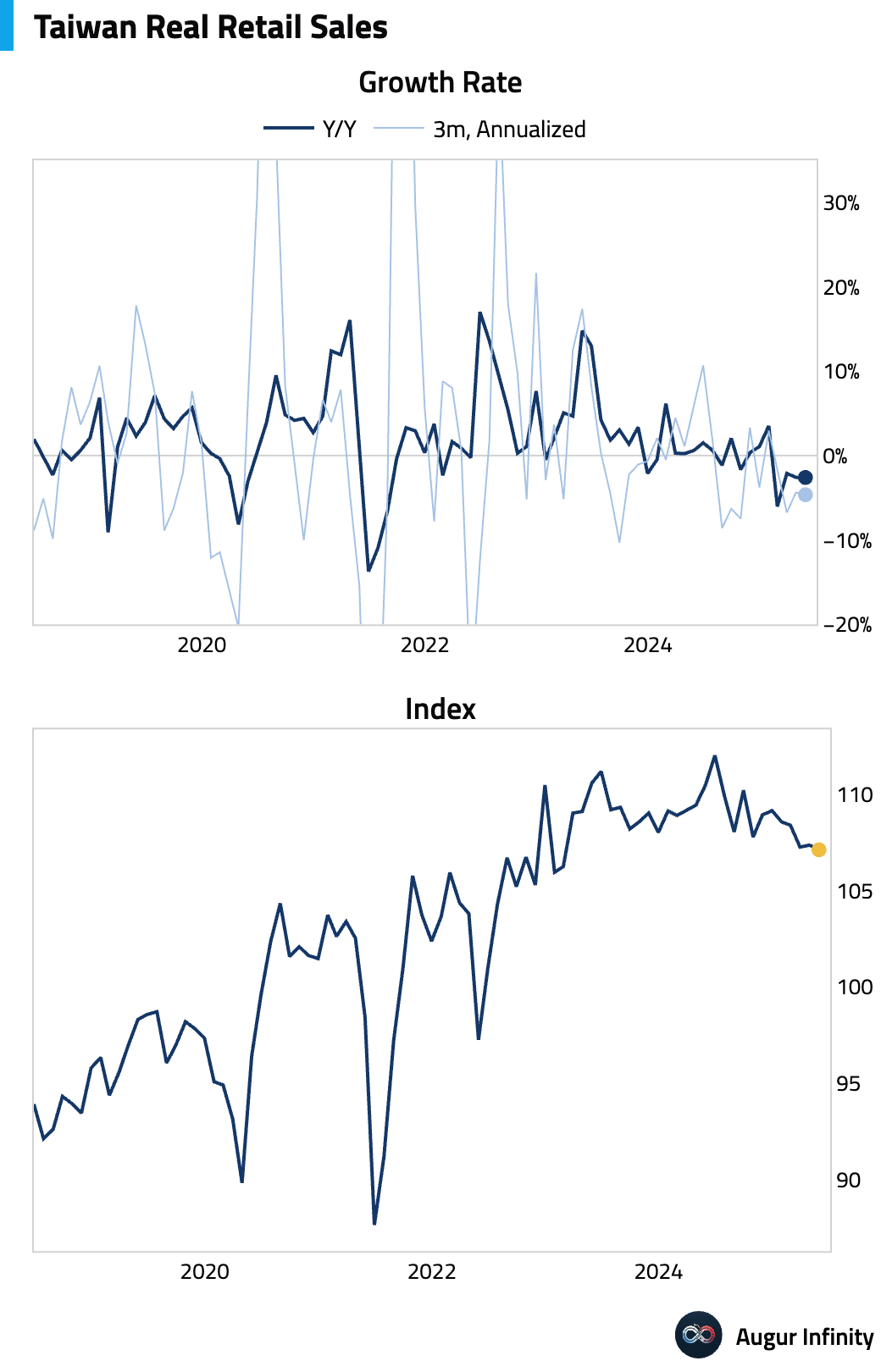

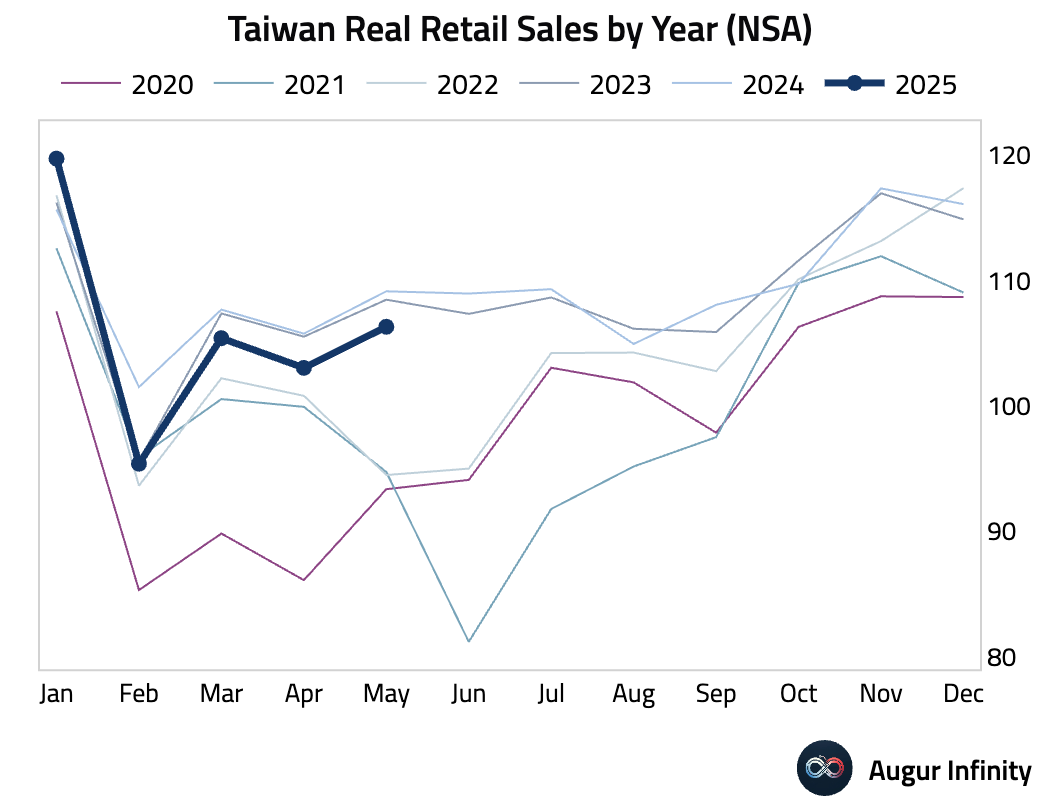

- Taiwan reported a two-speed economy in May. Industrial production surged 22.6% Y/Y, beating the 18.0% consensus, driven by an 89.3% boom in computer production for AI servers. This strength has led to an upward revision of the Q2 GDP forecast to 5.3% Y/Y. In contrast, non-tech sectors contracted, and domestic consumption remains soft, with retail sales falling 2.6% Y/Y amid weak consumer confidence. Given the split economy, the central bank is expected to keep its policy rate on hold at 2.00% through the end of 2026, as weak domestic demand should contain inflation.

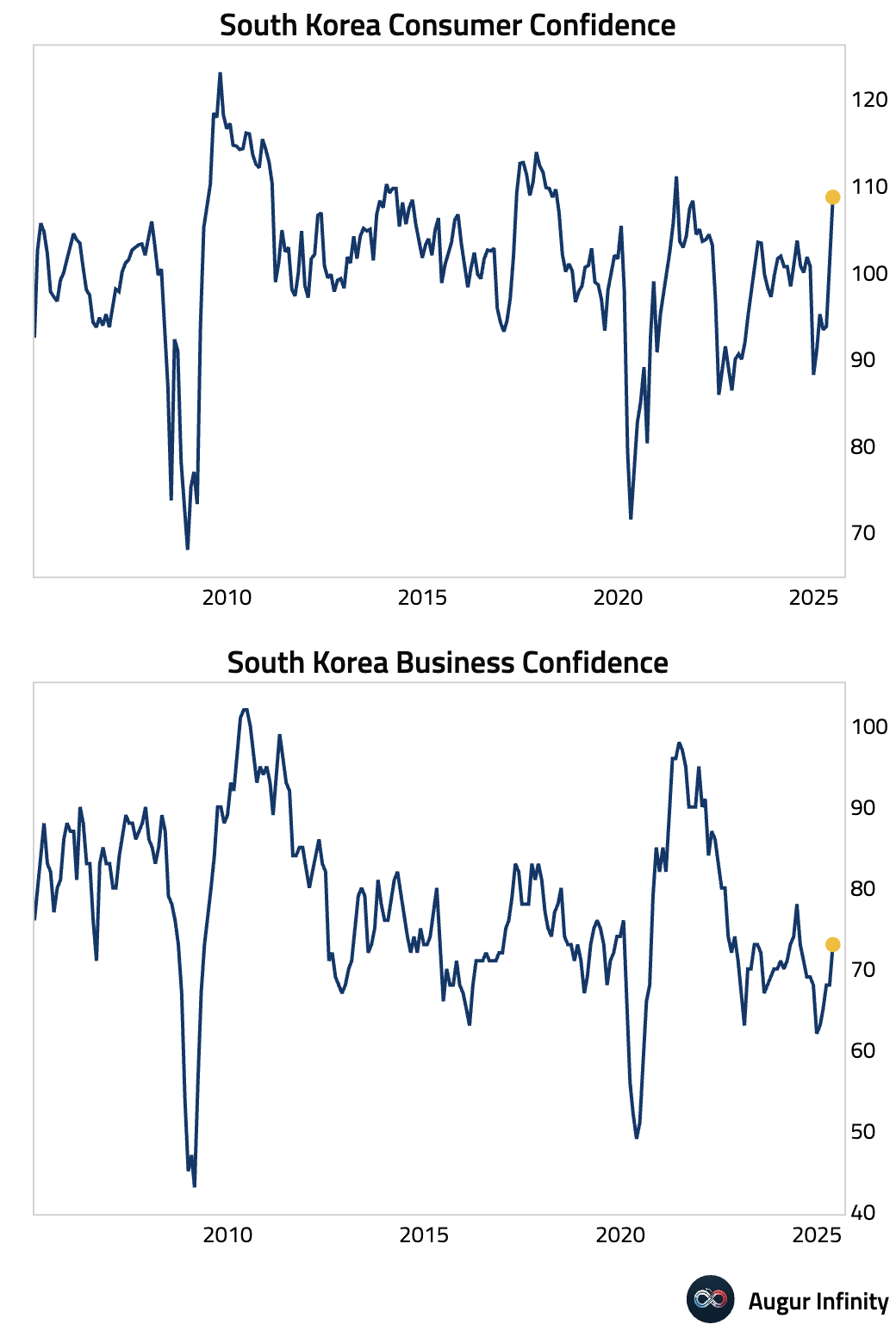

- South Korean consumer confidence rose to 108.7 in June from 101.8, reaching its highest level since June 2021.

Emerging Markets ex China

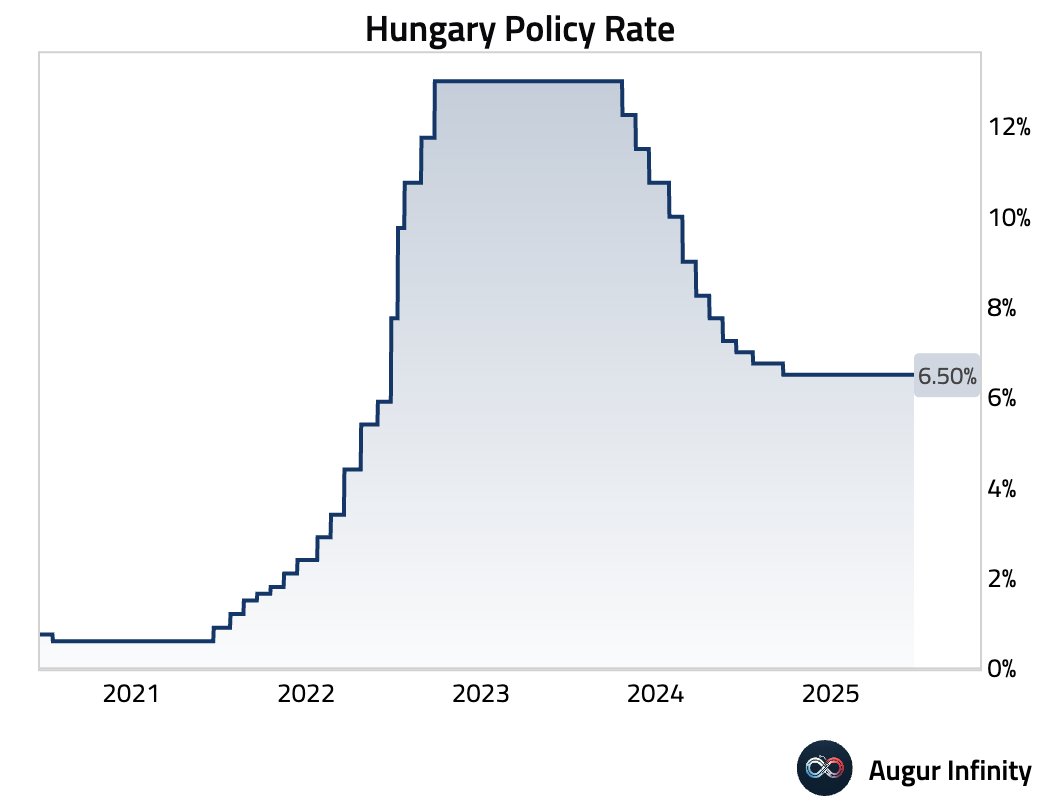

- Hungary's central bank held its key interest rate at 6.50%, in line with market expectations.

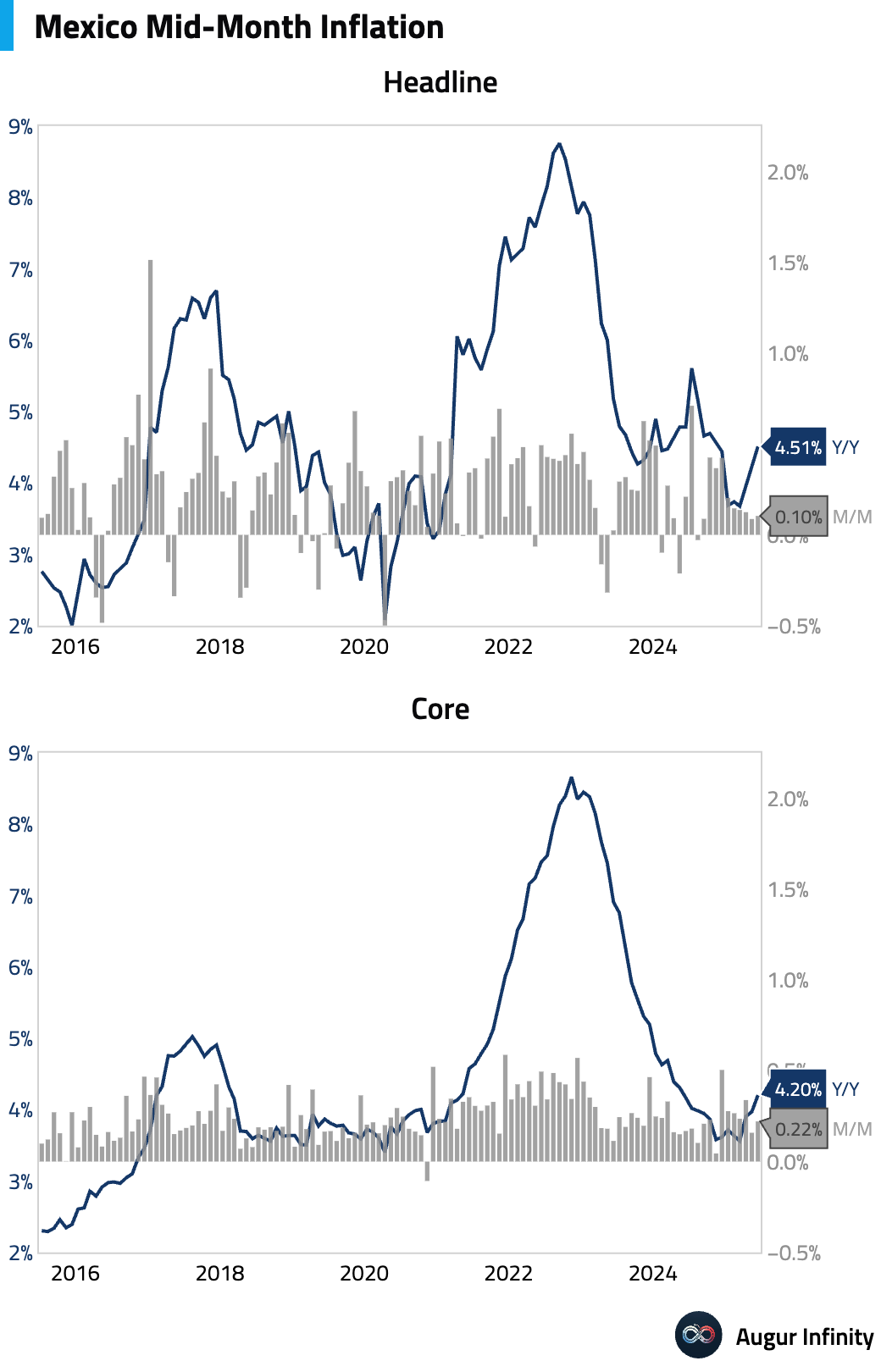

- Mexico's mid-month inflation rate ticked up to 4.51% Y/Y in early June from 4.22% in May, slightly above the 4.50% consensus. The core rate also accelerated to 4.20% Y/Y from 3.97%.

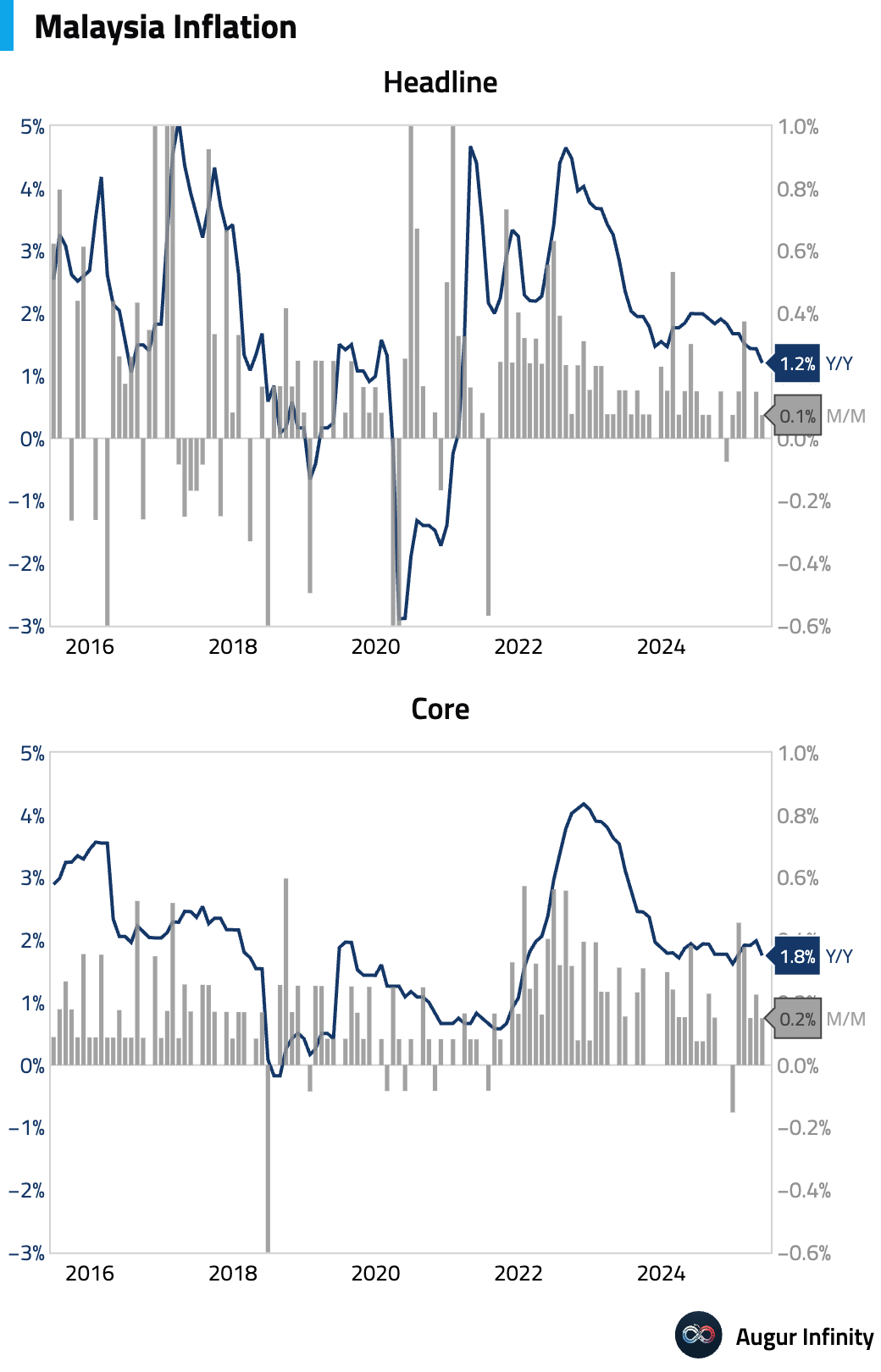

- Malaysia's annual inflation rate slowed to 1.2% in May from 1.4%, coming in below the 1.4% consensus. The monthly inflation rate was stable at 0.1%.

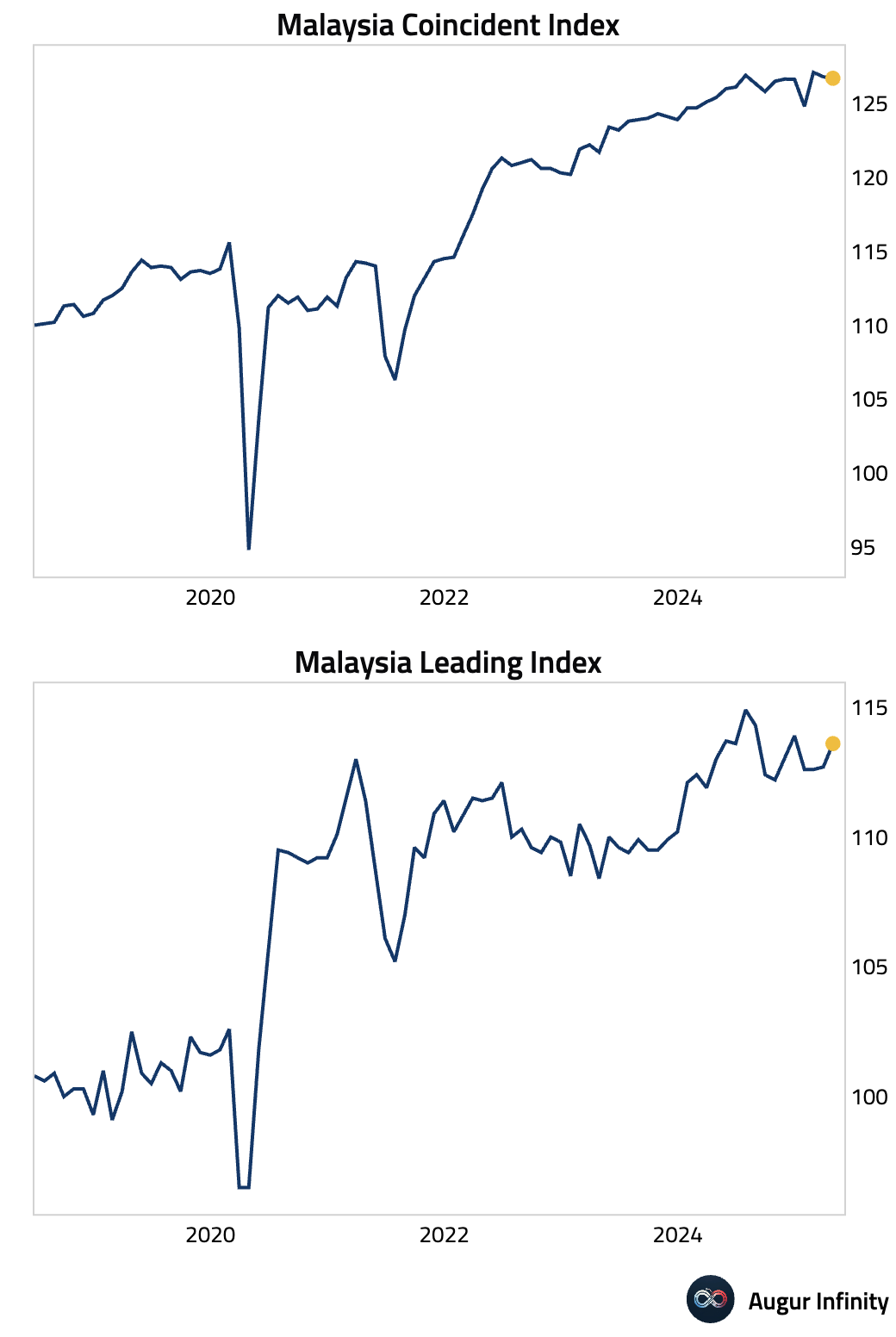

- The leading economic index for Malaysia rose 0.8% M/M in April, while the coincident index fell 0.1%.

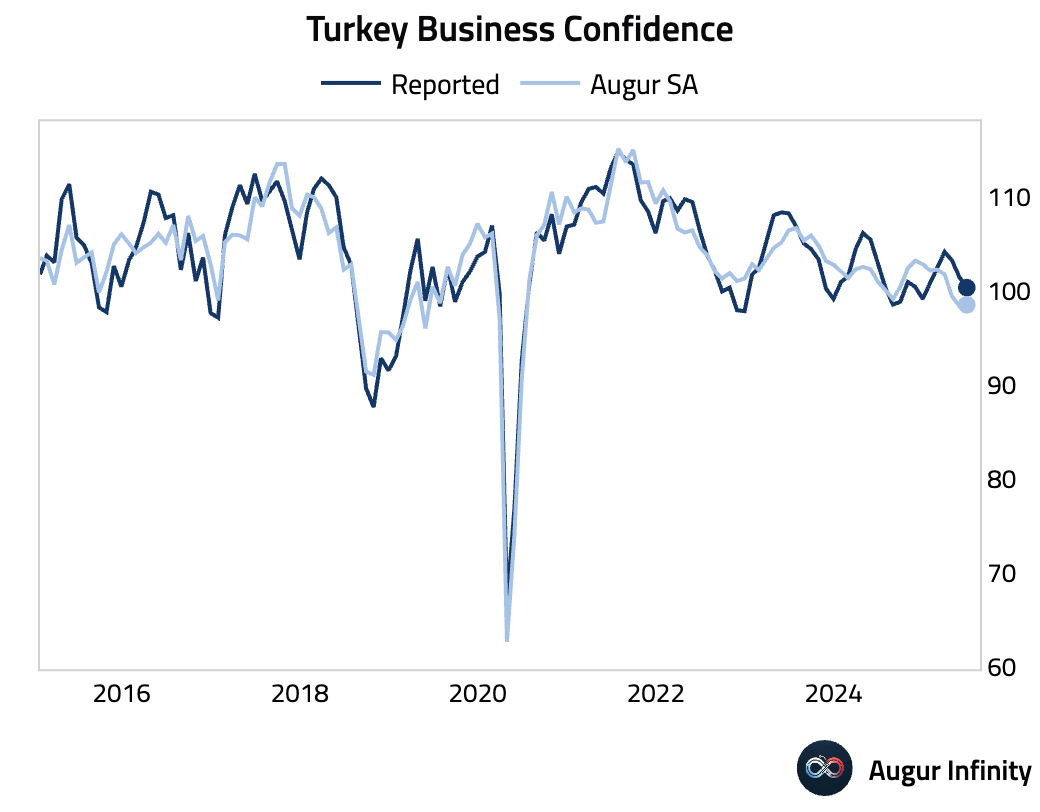

- Turkish business confidence fell to 100.3 in June from 101.4 in May.

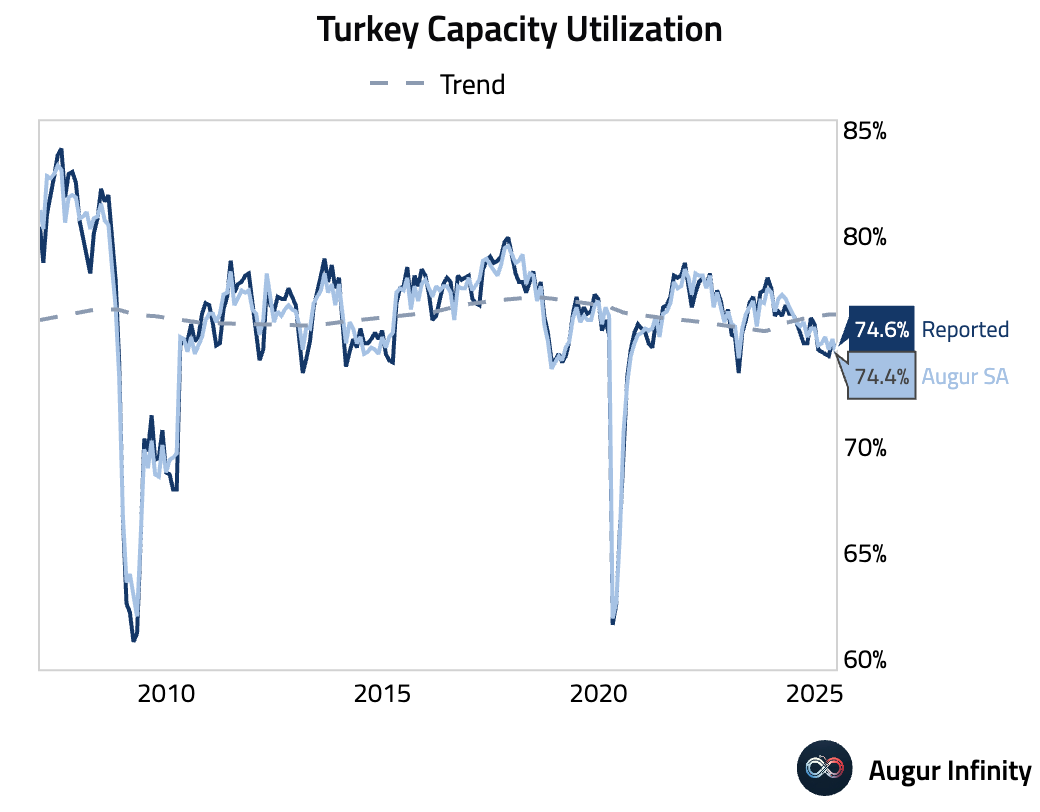

- Turkey's capacity utilization rate edged down to 74.6% in June from 75.0% in the prior month.

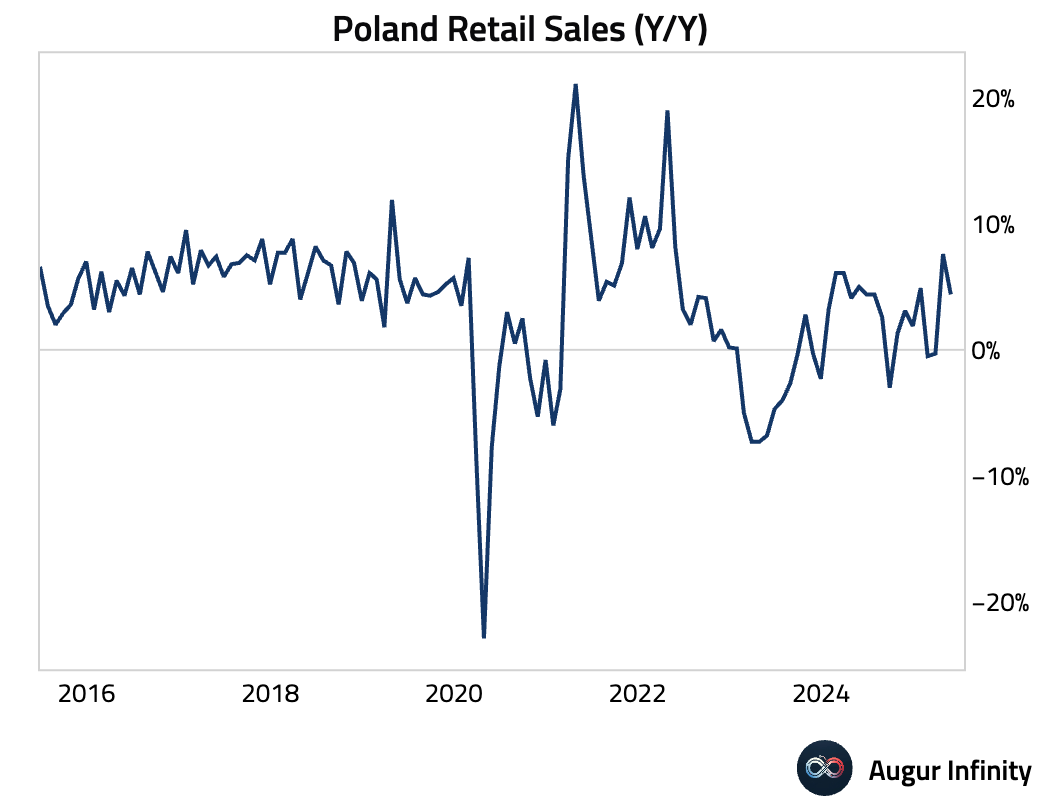

- Poland's retail sales growth decelerated to 4.4% Y/Y in May from 7.6% in April.

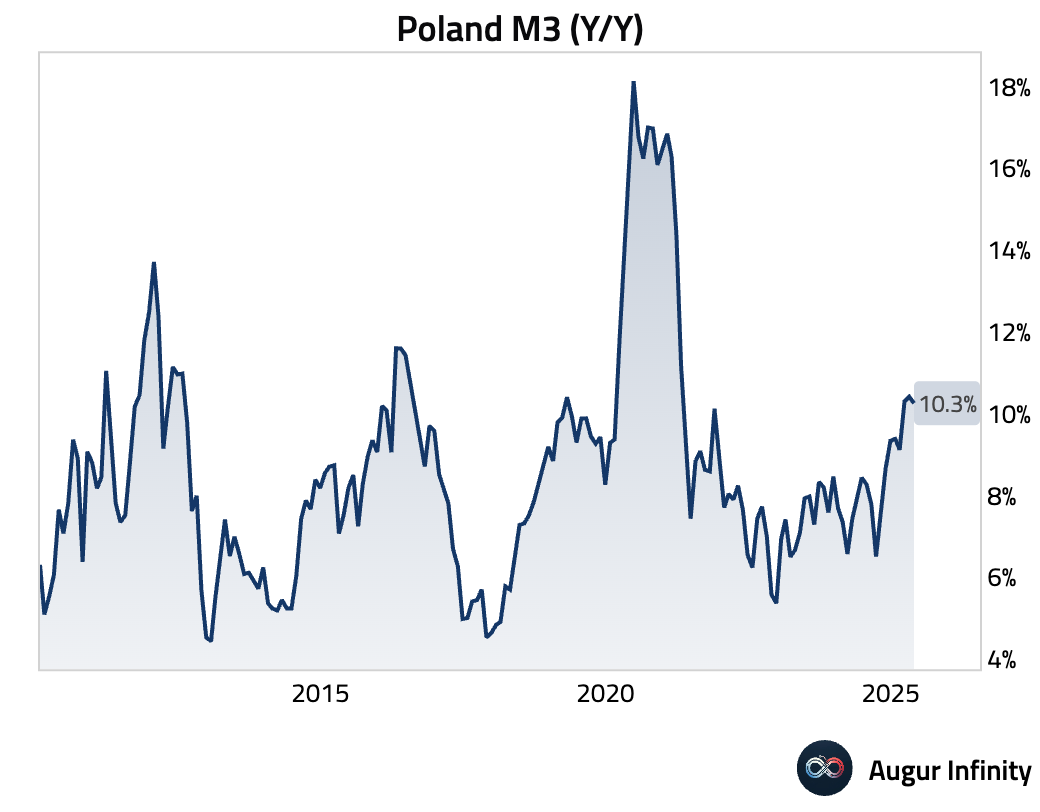

- Poland's M3 money supply growth slowed slightly to 10.3% Y/Y in May from 10.4% in April.

- Czech business confidence eased to 100.0 in June from 101.0, while consumer confidence held steady at 100.7.

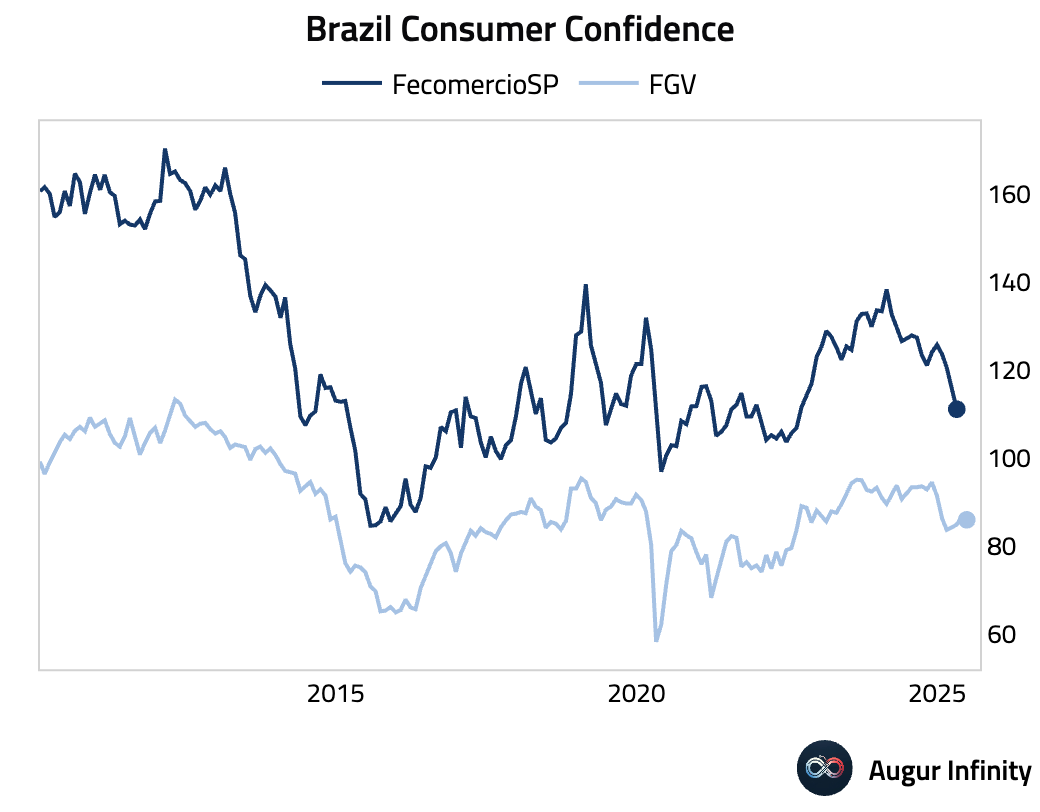

- Brazil's FGV consumer confidence index edged down to 85.9 in June from 86.7 in May.

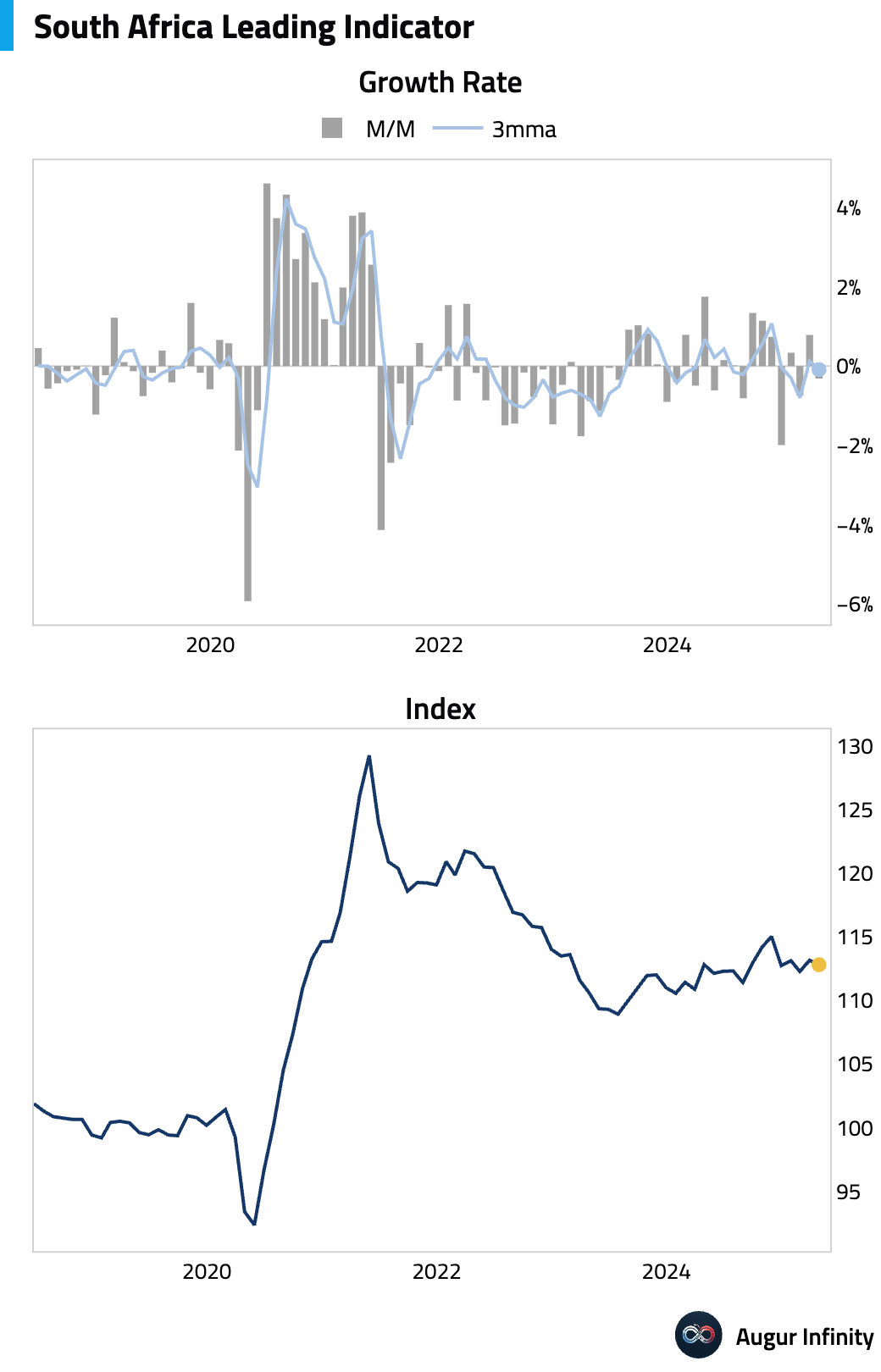

- South Africa’s leading business cycle indicator fell by 0.3% M/M in April, reversing a 0.8% gain in March.

Equities

- Global equities advanced, with US markets posting solid gains. The S&P 500 rose 1.1%, and the Nasdaq Composite added 1.4%. In Europe, German equities gained 1.6%, rising for a third consecutive day. South Korean equities were a standout performer, surging 4.7% for their fourth straight day of gains.

Fixed Income

- US Treasury yields fell across the curve following softer-than-expected economic data. The 10-year yield decreased by 2.4 basis points. The 2-year yield has now declined for five consecutive days, while the 5-, 10-, and 30-year yields have fallen for three straight days.

Commodities

- The American Petroleum Institute reported that US crude oil inventories fell by a larger-than-expected 4.28 million barrels last week, compared to the consensus forecast for a 0.6 million barrel draw.

FX

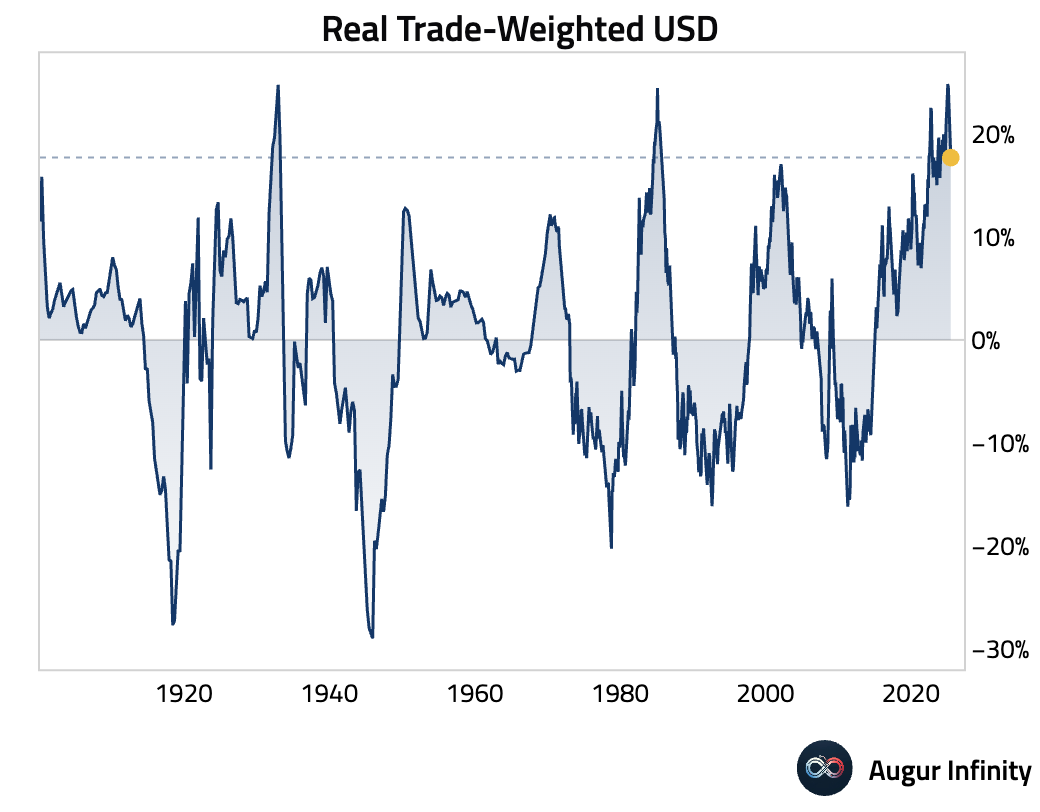

- The US dollar weakened against most G10 peers. The euro, British pound, and Swiss franc all extended their gains to a third day. The trade-weighted real US dollar has fallen nearly 8% from its recent peak but remains well above long-term average levels.

Disclaimer

Augur Digest is an automated newsletter written by an AI. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.