- Headlines

- United States

- Europe

- Asia-Pacific

- China

- Emerging Markets ex China

- Equities

- Fixed Income

- FX

Headlines

- The US Senate passed its version of the “One Big, Beautiful Bill” by a 51–50 vote, requiring a tiebreaking vote from the vice president. The legislation, which includes extensions of the 2017 tax cuts, various spending cuts, and a $5 trillion debt ceiling increase, now proceeds to the House for debate.

- The White House signaled it is not considering an extension of the tariff pause beyond its July 9 deadline. President Trump also expressed doubt that a trade deal with Japan will be reached, with reports indicating the administration will prioritize talks with India.

- In a public forum, Federal Reserve Chair Powell stated that the central bank would likely have already cut interest rates if not for the economic effects of the administration’s tariffs. Powell reiterated a "wait-and-see" policy stance, describing the US economy as "healthy overall," and did not commit to a July rate cut. He also floated the idea of publishing "alternative scenarios" in the future, a potential shift in the Fed's communication strategy.

United States

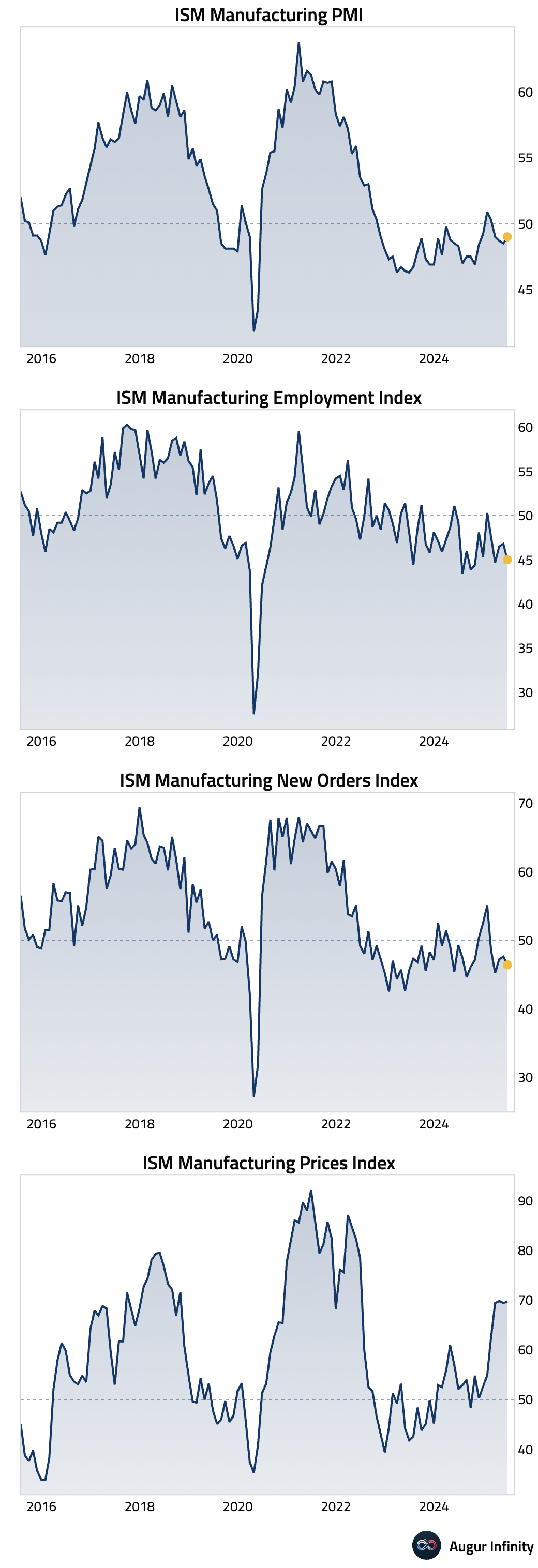

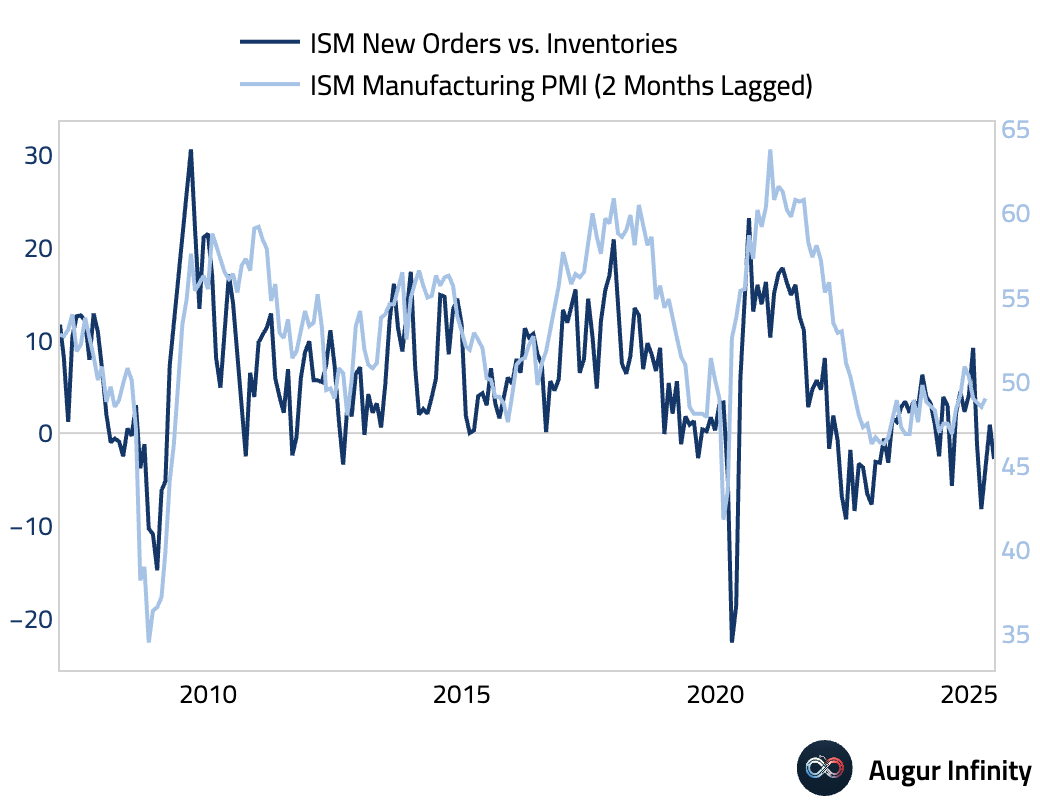

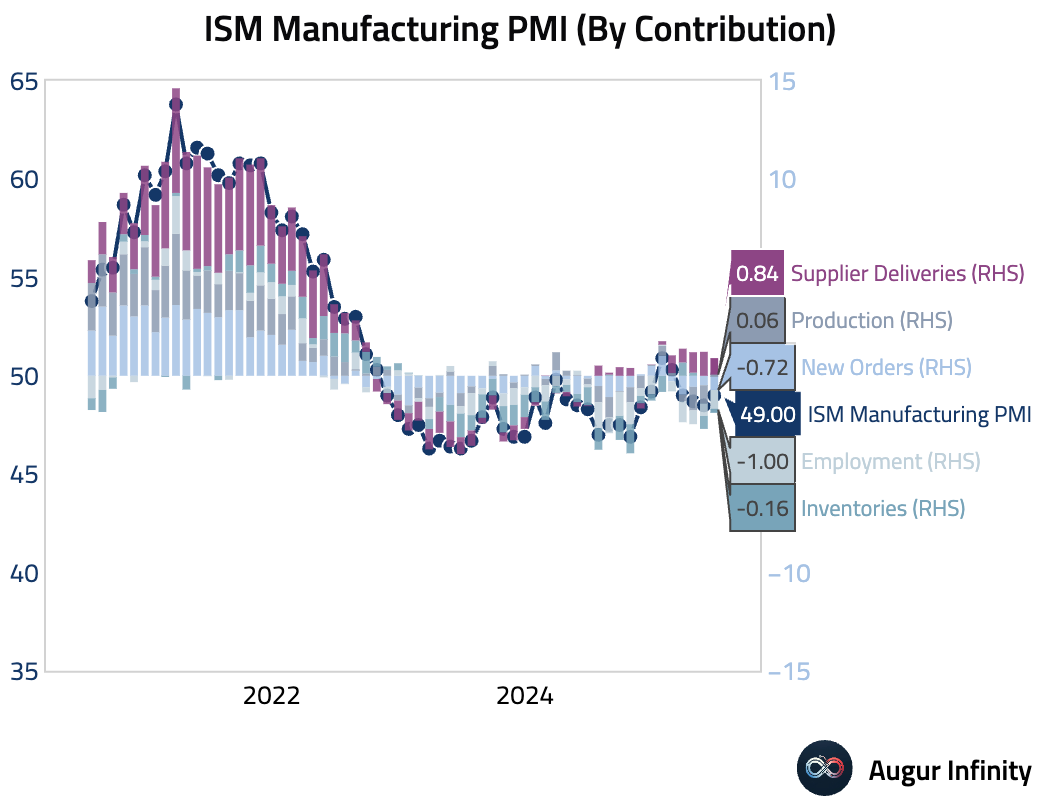

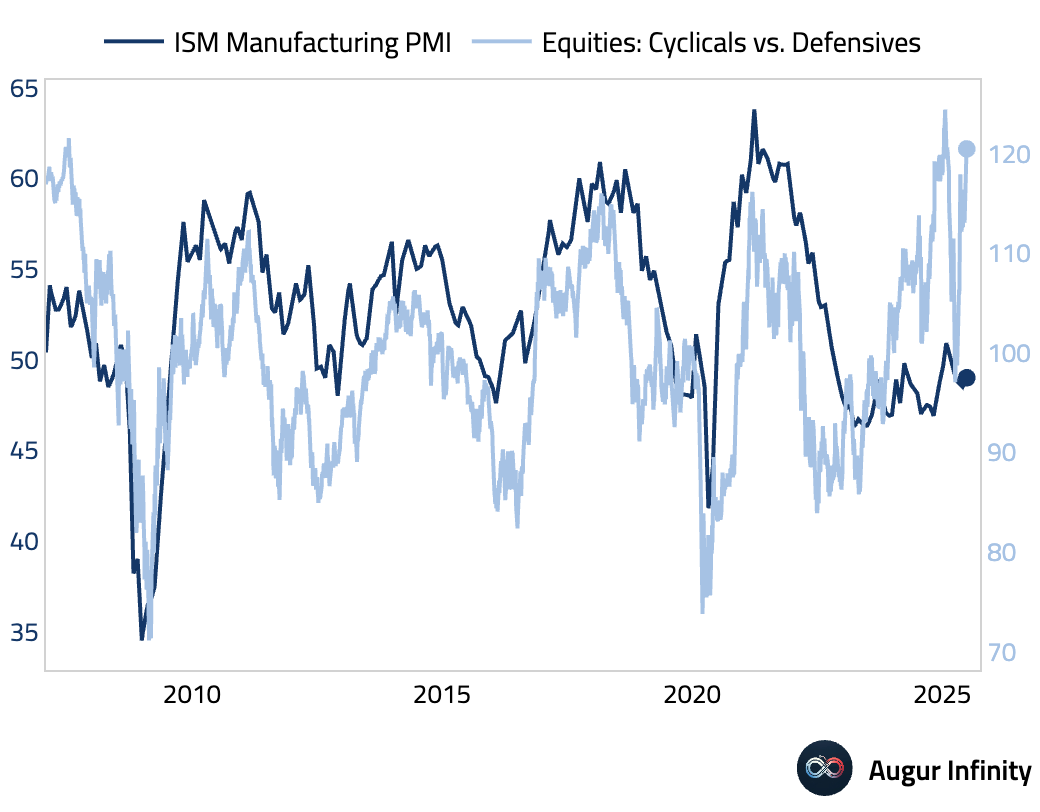

- The ISM Manufacturing PMI for June rose to 49.0 from 48.5, beating the consensus of 48.8. Despite the headline improvement, the report painted a mixed picture. The gain was driven entirely by a rebound in the Production index, which jumped 4.9 points to 50.3, entering expansionary territory. However, demand-side indicators weakened, with the New Orders index contracting faster at 46.4 (from 47.6) and the Employment index falling to 45.0 (from 46.8). The Prices Paid index remained highly inflationary at 69.7. Panelist commentary frequently cited tariff uncertainty as a cause for delayed spending and hiring decisions, with some in the transportation sector noting that "most electric vehicle (EV) projects have been delayed or canceled."

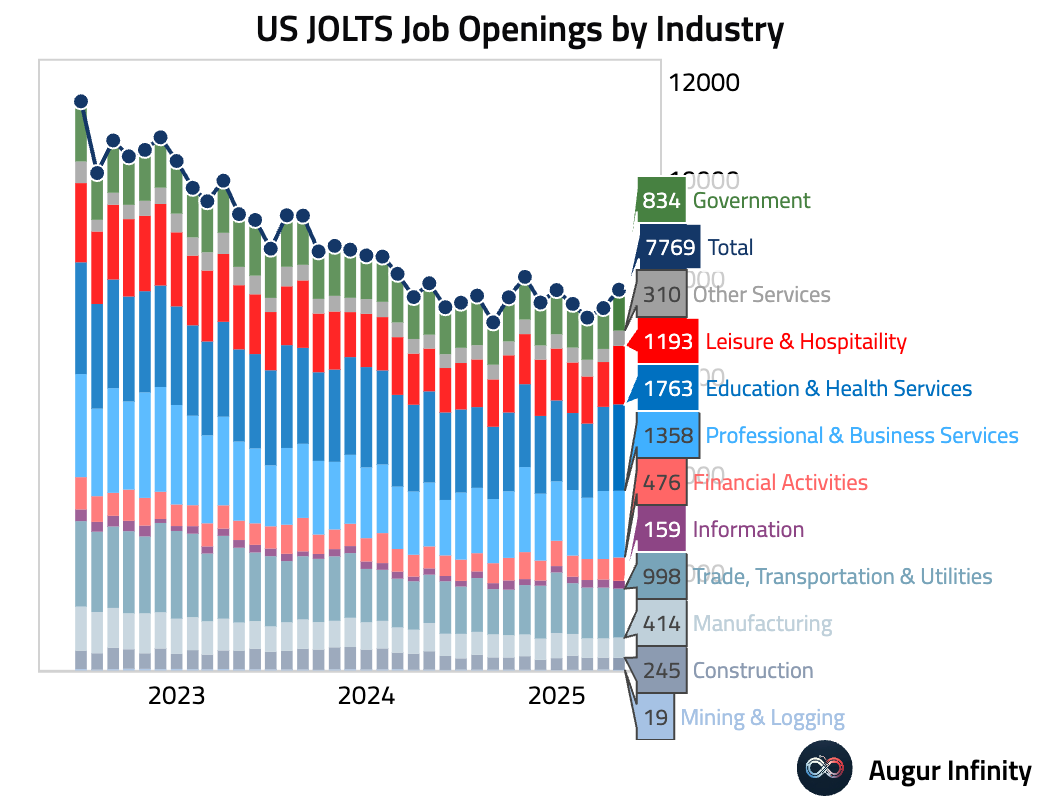

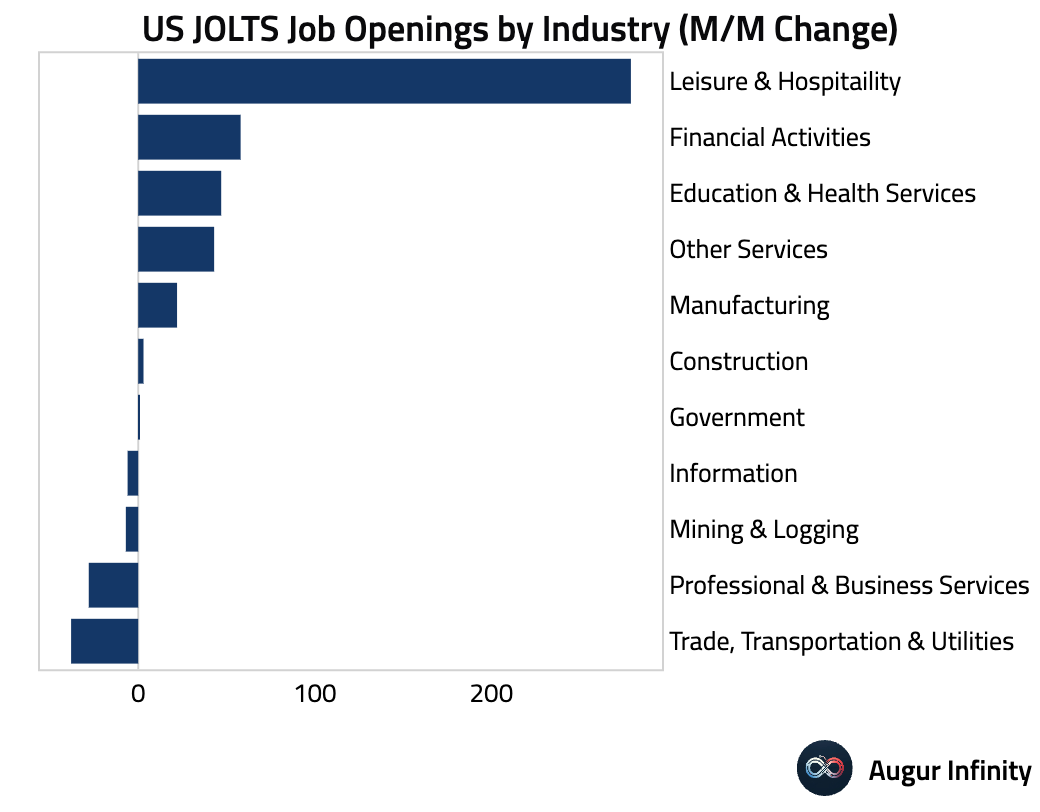

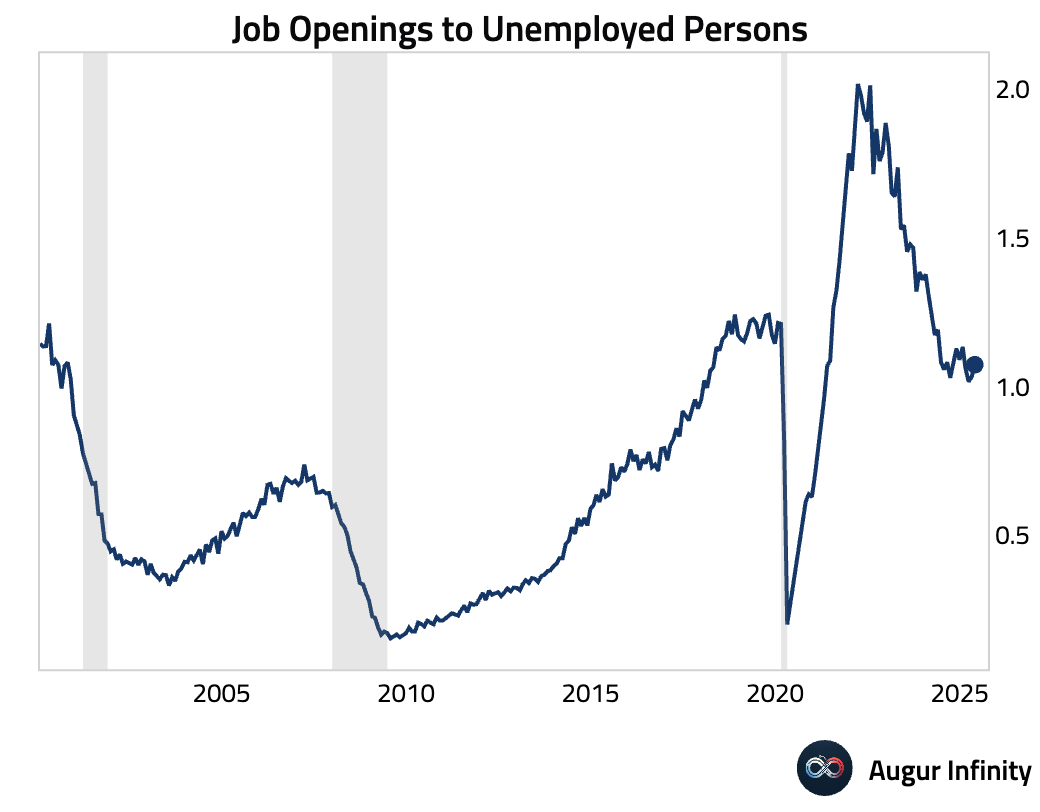

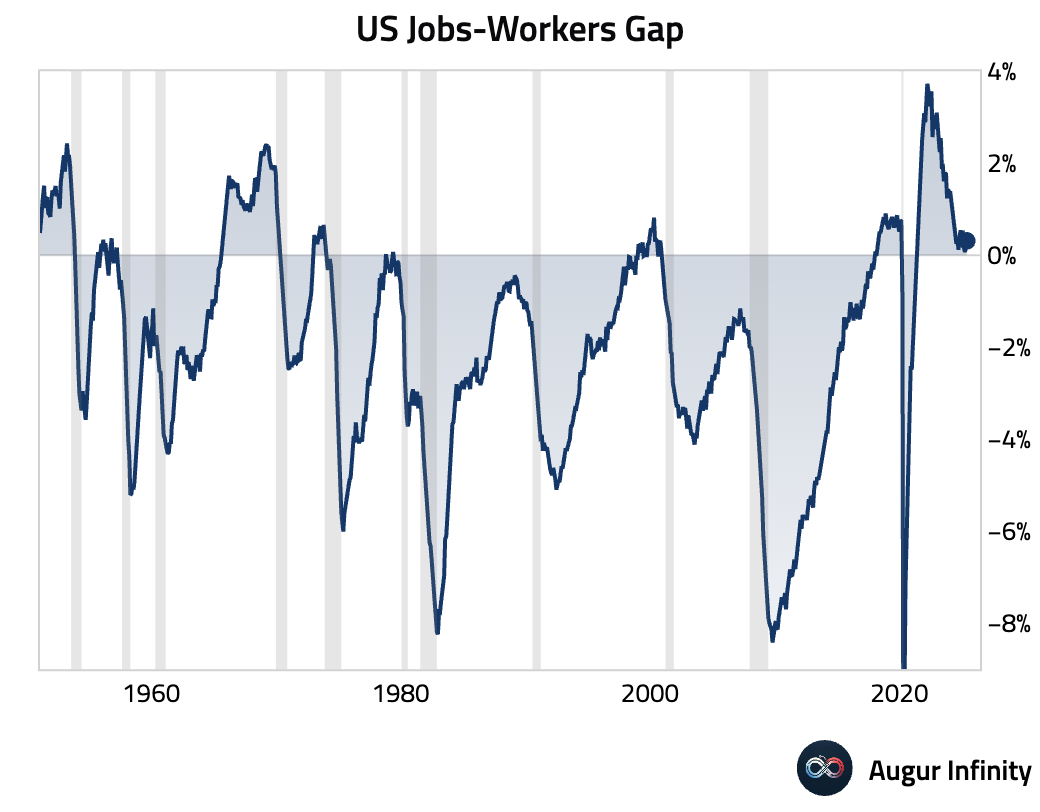

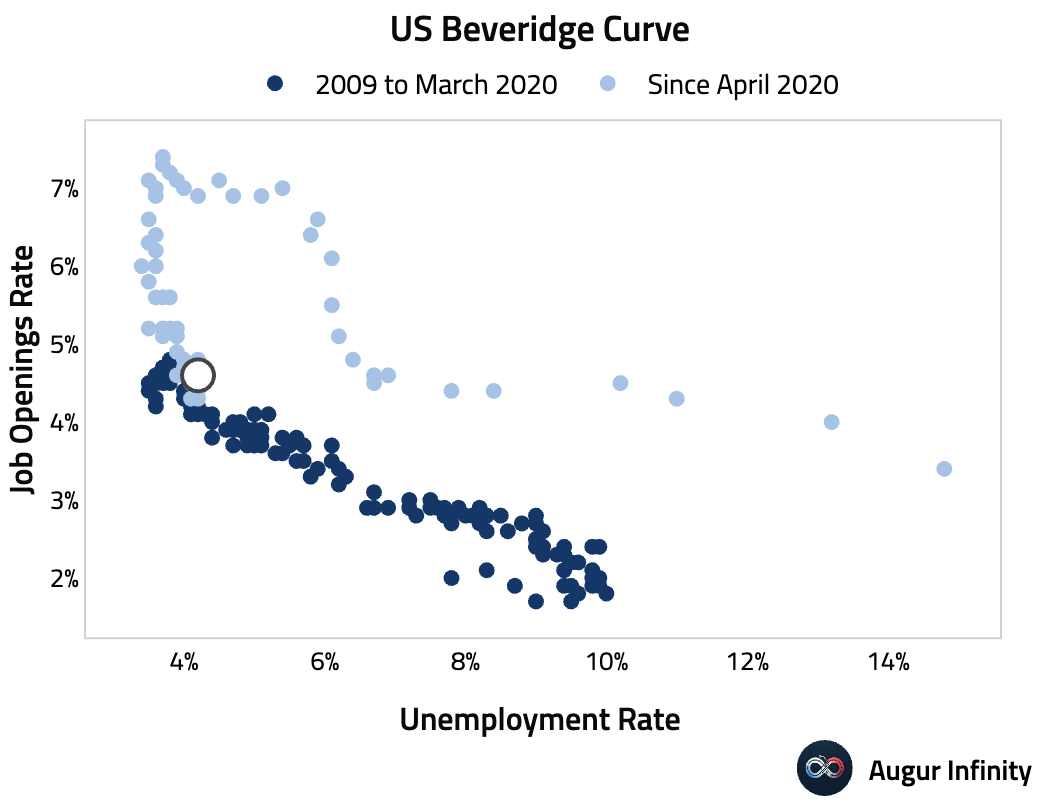

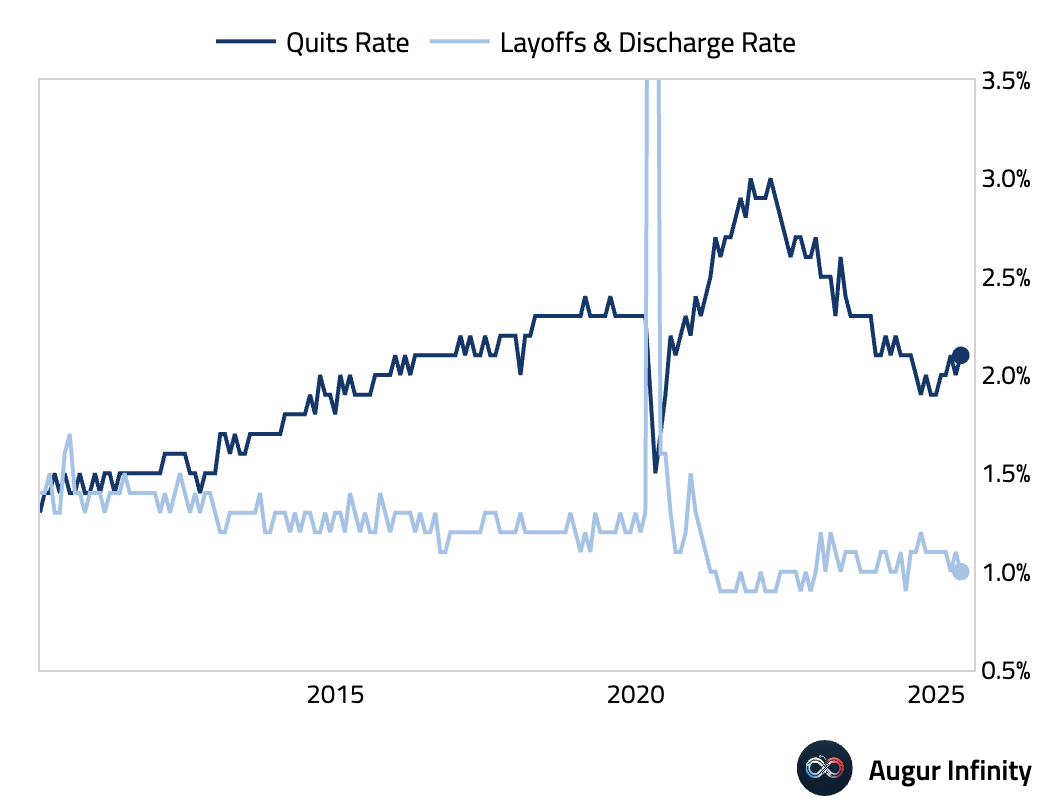

- The May JOLTs report showed job openings unexpectedly rose to 7.77 million, significantly above the 7.30 million consensus and April’s 7.40 million. This was the highest number of openings since November 2024. The job quits figure, a measure of worker confidence, also increased to 3.29 million from 3.22 million.

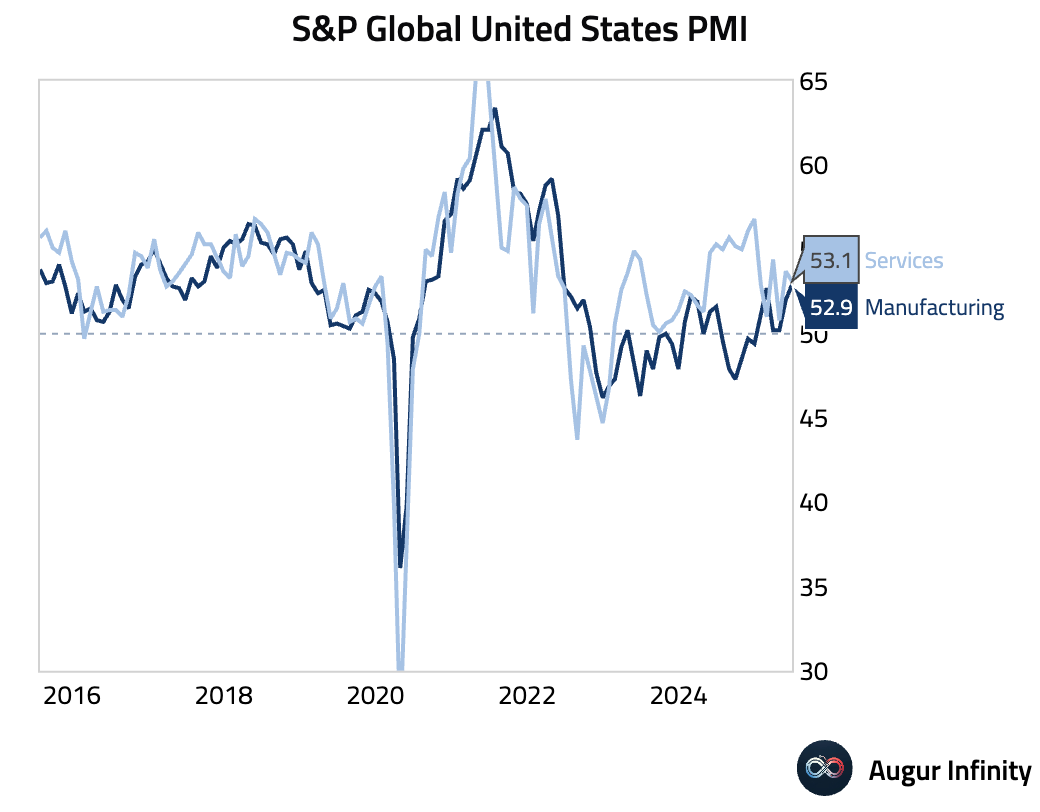

- The final S&P Global Manufacturing PMI for June was revised up to 52.9 from a preliminary 52.0, its best reading since May 2022. In contrast to the ISM survey, S&P Global reported robust growth in new orders and employment. The report highlighted significant inventory building as a key driver, with firms stocking up on inputs to front-run anticipated tariff-related price hikes. This pull-forward of activity contributed to input cost inflation reaching a near three-year high and suggests a potential for slower growth in the second half of the year.

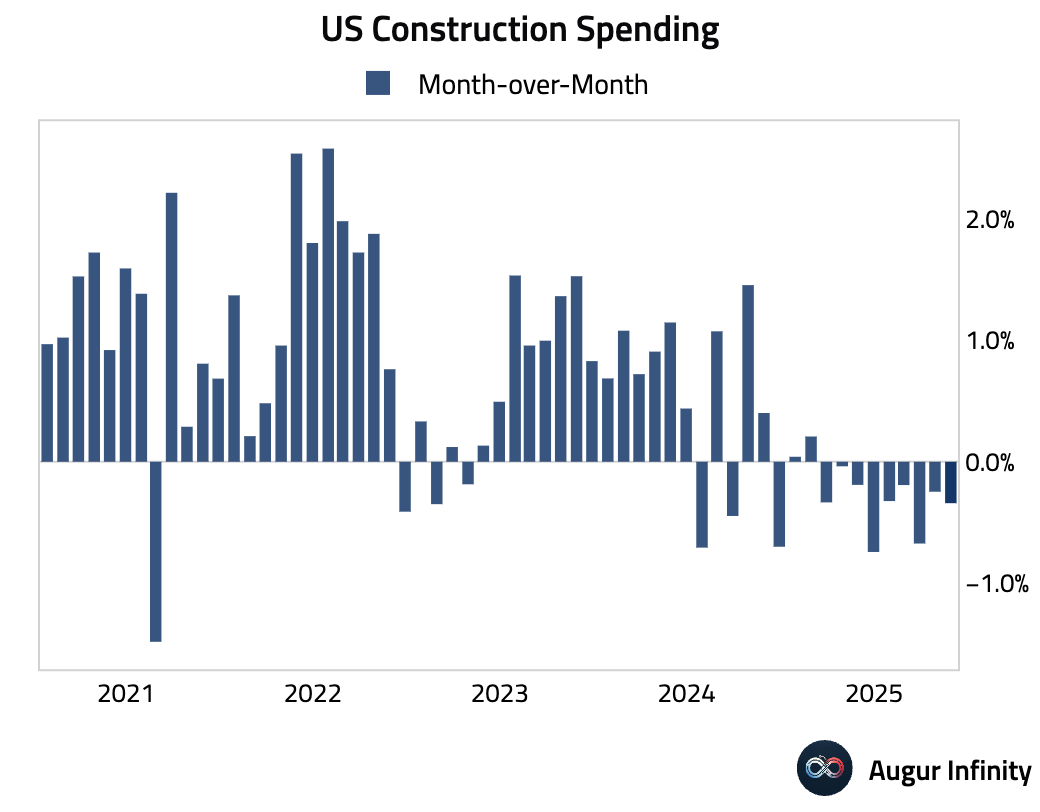

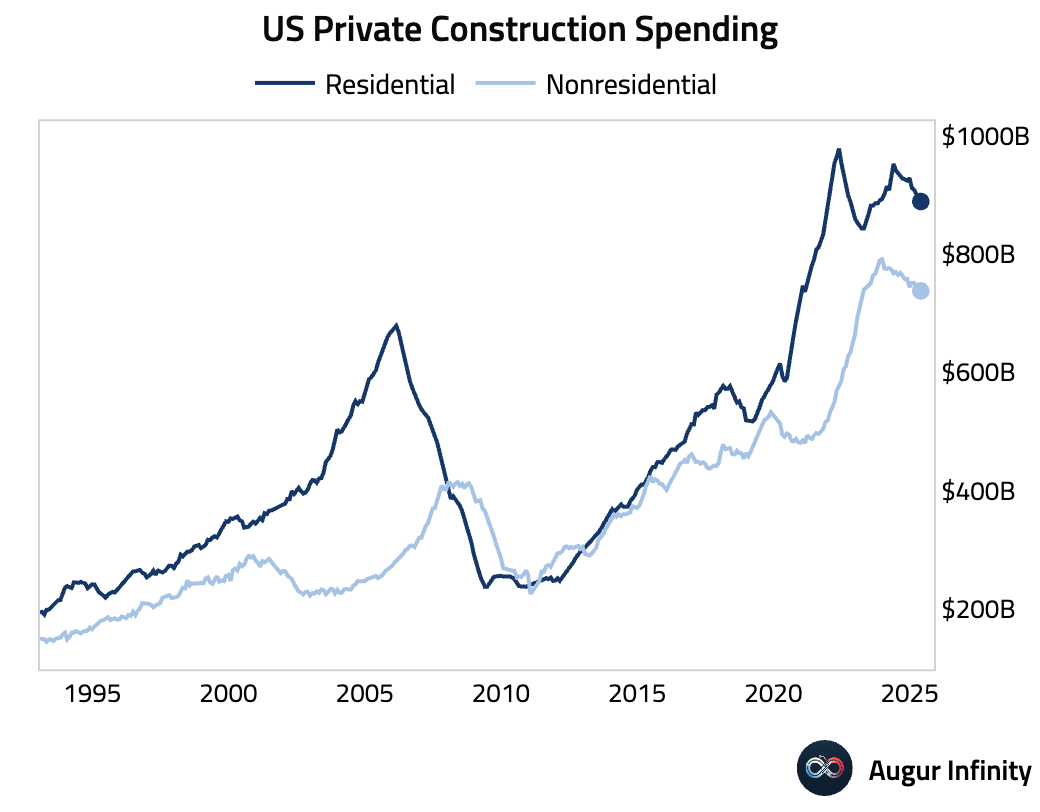

- Construction spending fell 0.3% M/M in May, a slightly larger decline than the -0.2% consensus and the -0.2% drop in April.

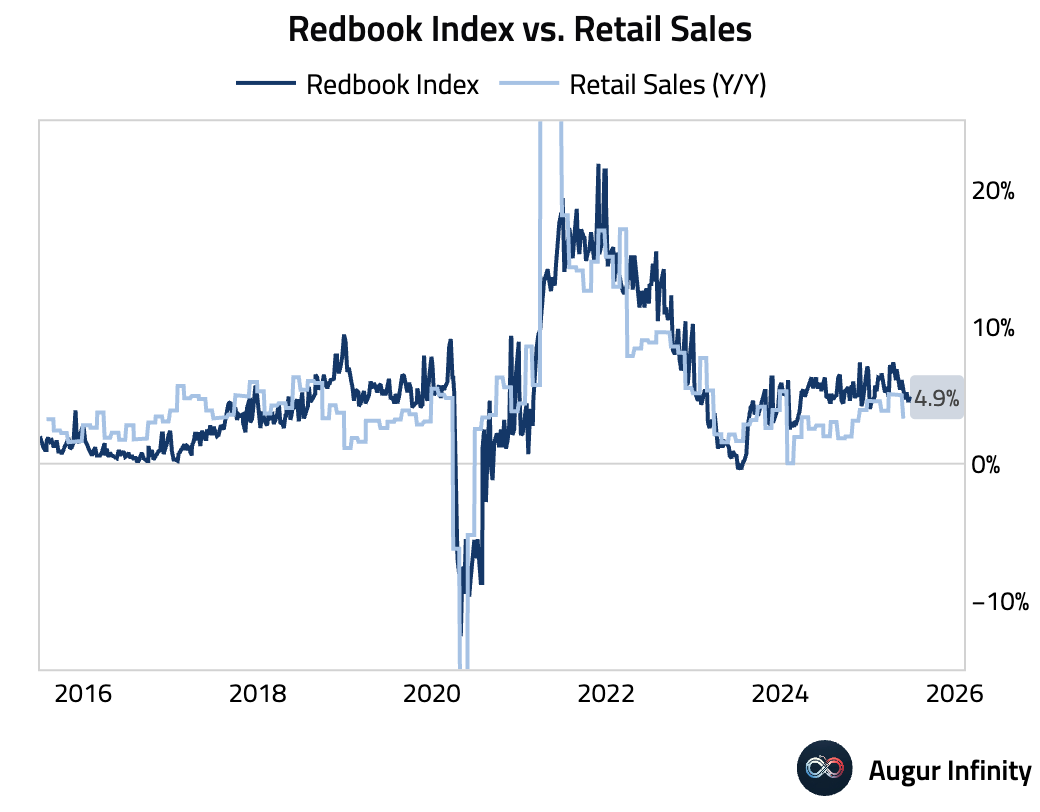

- The Redbook index of weekly retail sales rose 4.9% year-over-year for the week ending June 28, accelerating from 4.5% in the prior week.

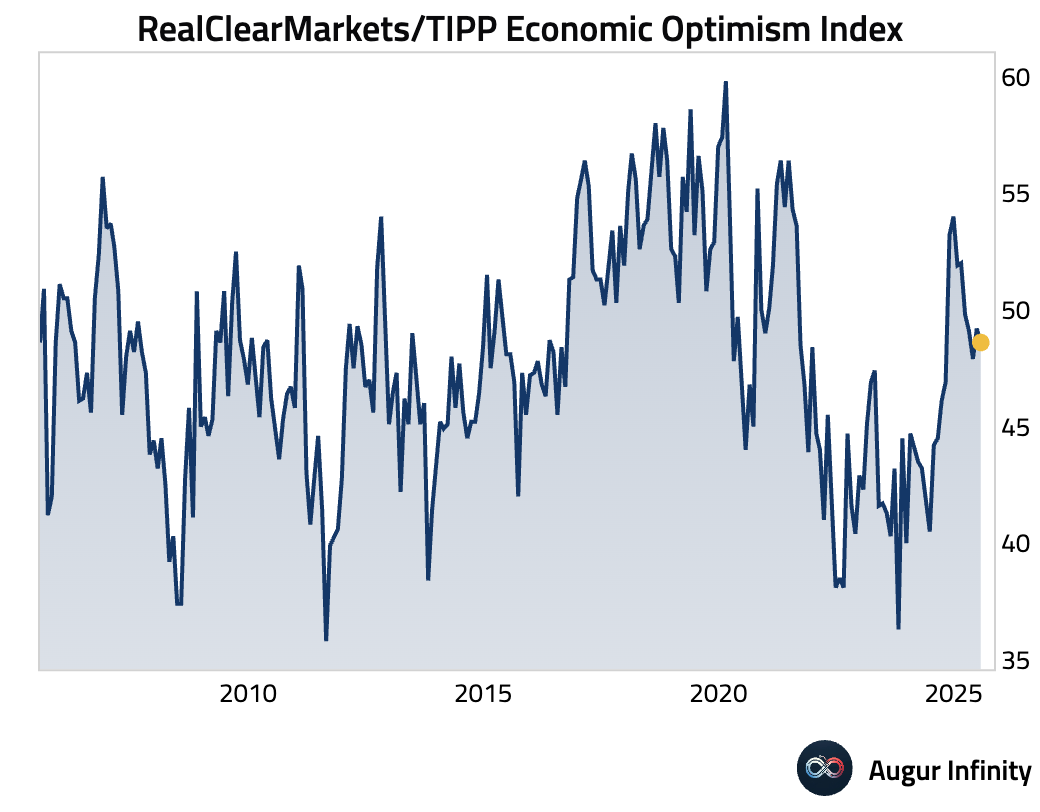

- The RCM/TIPP Economic Optimism Index fell to 48.6 in July from 49.2 in June, missing the consensus of 50.1.

Europe

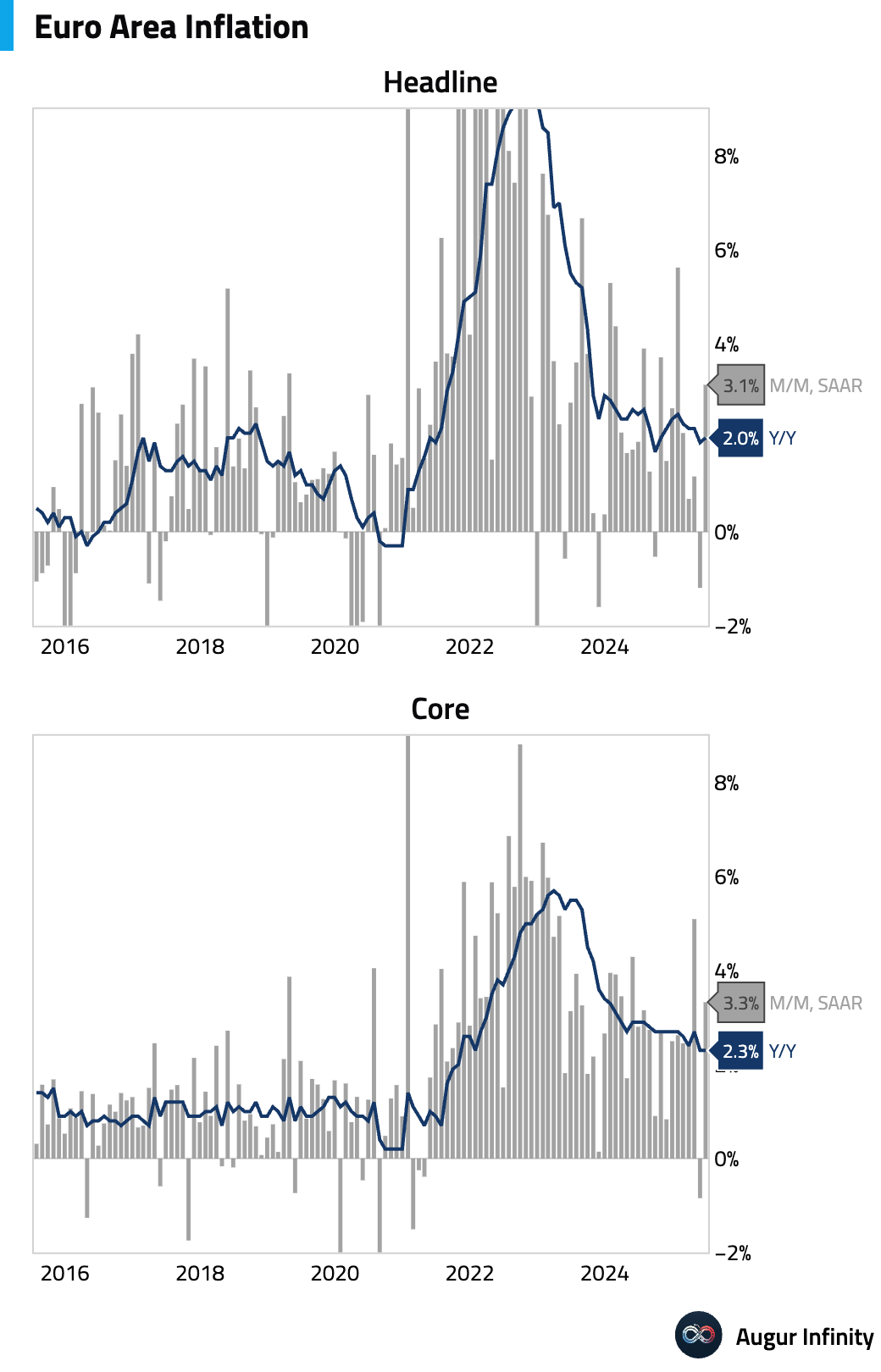

- The flash estimate for Eurozone inflation in June showed the headline HICP rate rising to 2.0% Y/Y, meeting the ECB's target. This was in line with consensus and up from 1.9% in May. The core rate held steady at 2.3% Y/Y, also matching expectations.

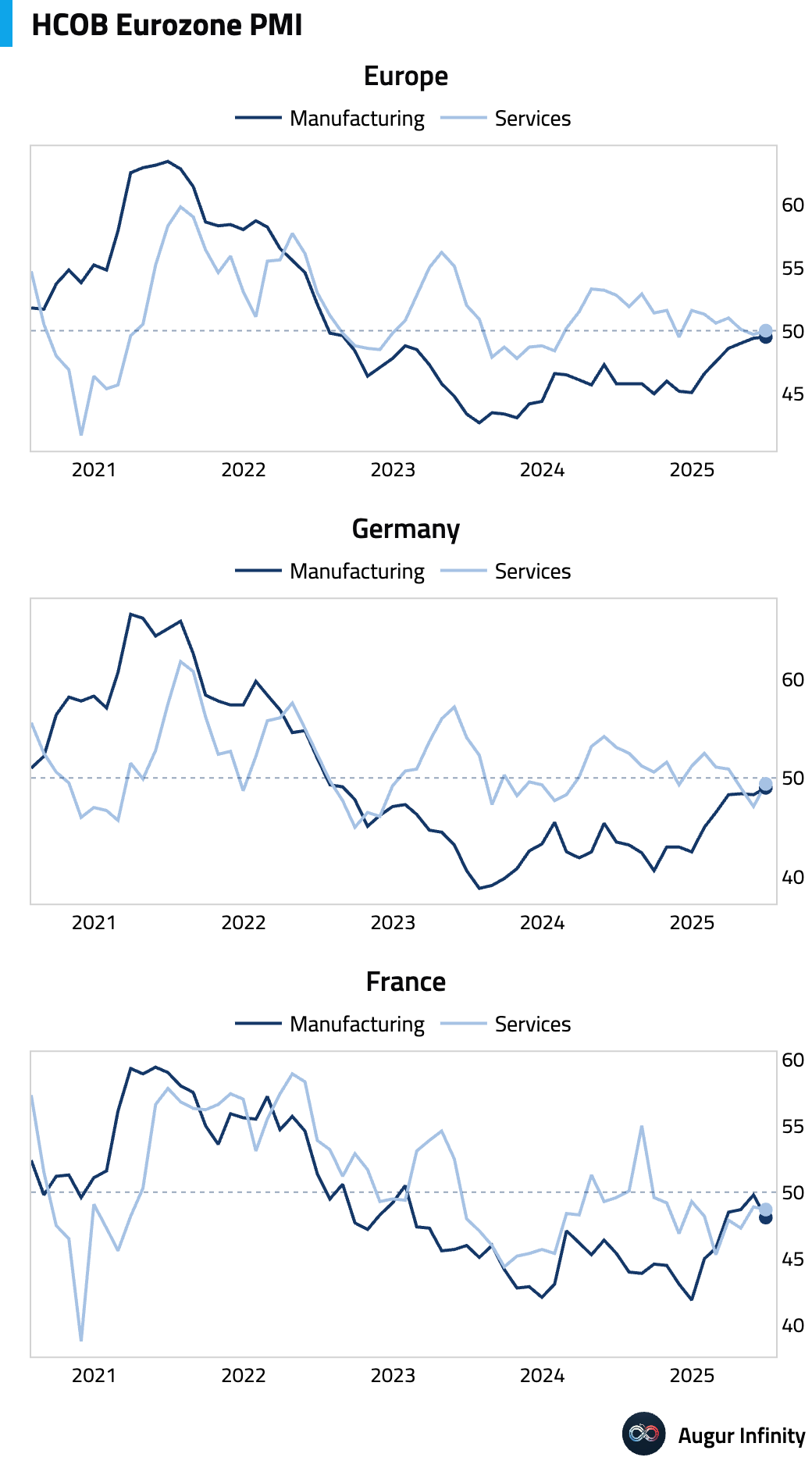

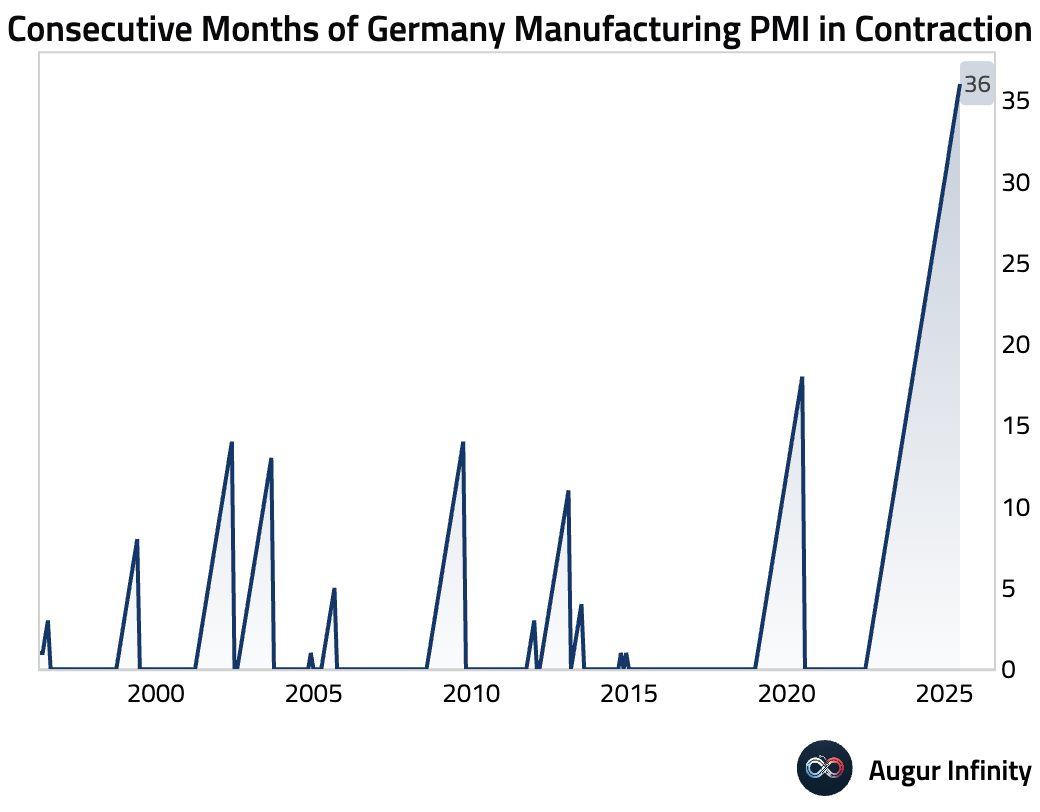

- Final June manufacturing PMIs showed a slight improvement for the Eurozone, though conditions varied. The Eurozone index rose to 49.5, a 34-month high, as new orders stabilized. Germany’s PMI hit a 34-month high of 49.0, boosted by domestic demand and US importers pre-empting tariffs, though job cuts accelerated. France’s PMI fell to 48.1, with an accelerated contraction in new orders ending a recent spell of output growth, particularly in the auto sector.

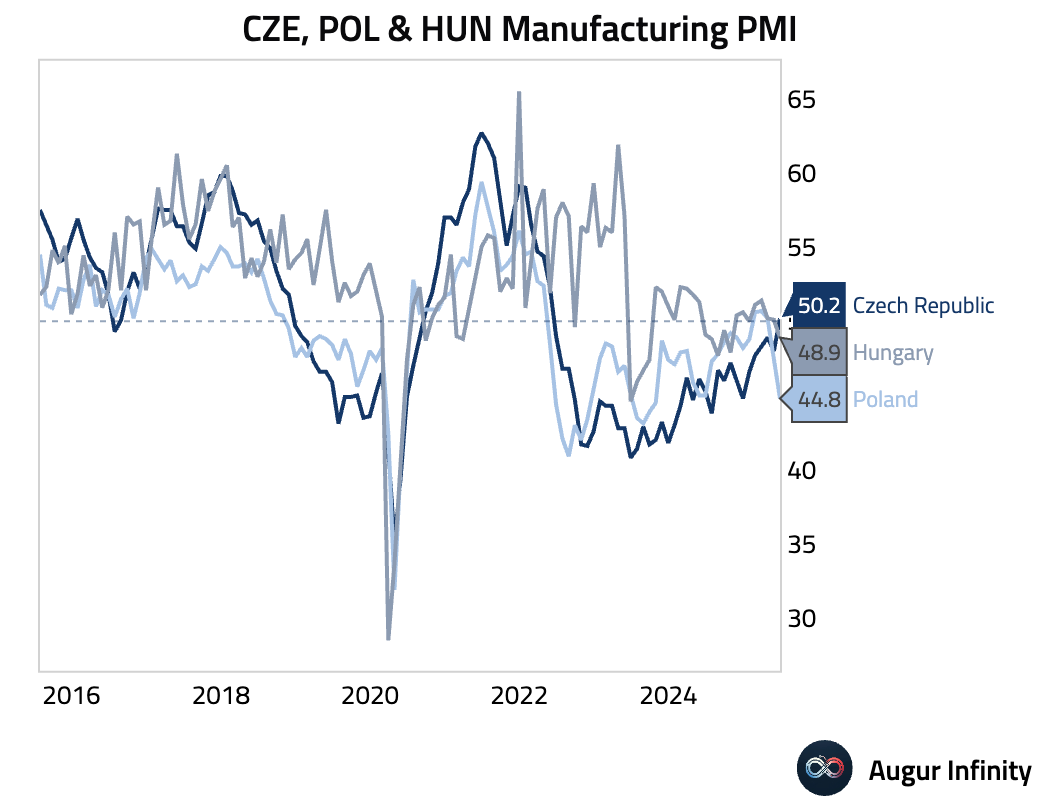

- Central and Eastern European manufacturing PMIs diverged in June. The Czech PMI rose to 50.2, its first expansion in over three years, driven by a sharp rise in domestic orders. Conversely, Poland’s PMI plunged to a 20-month low of 44.8 due to weak European demand, while Hungary’s PMI fell to 48.9.

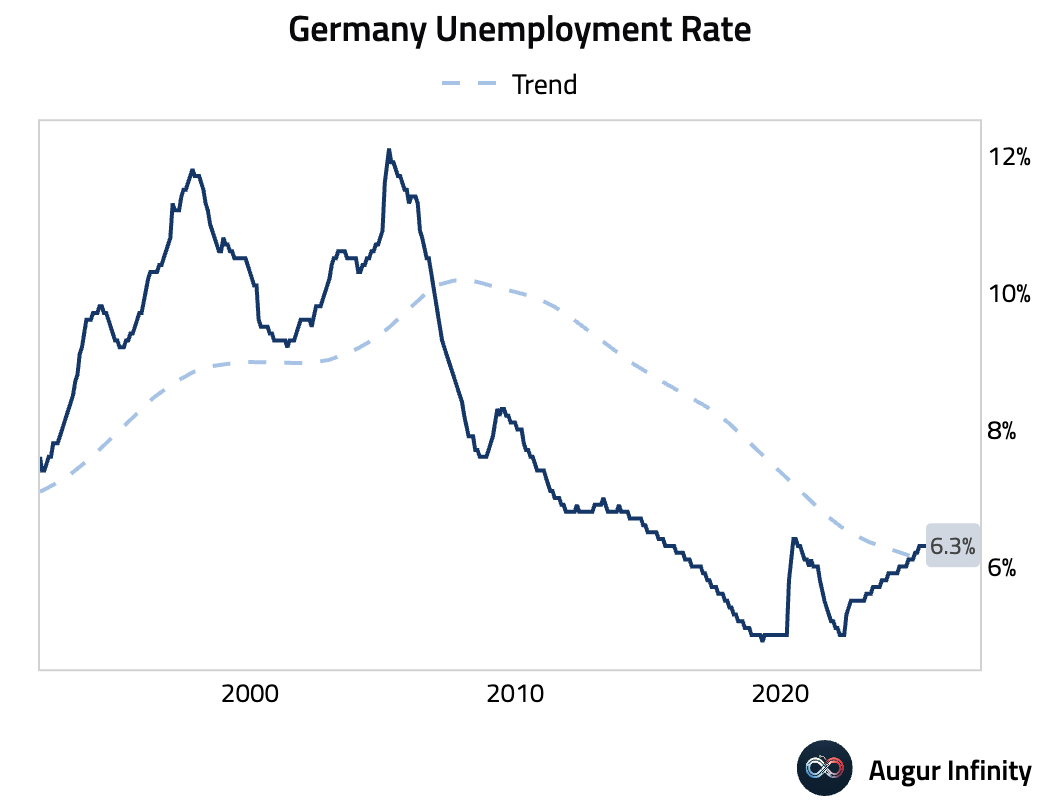

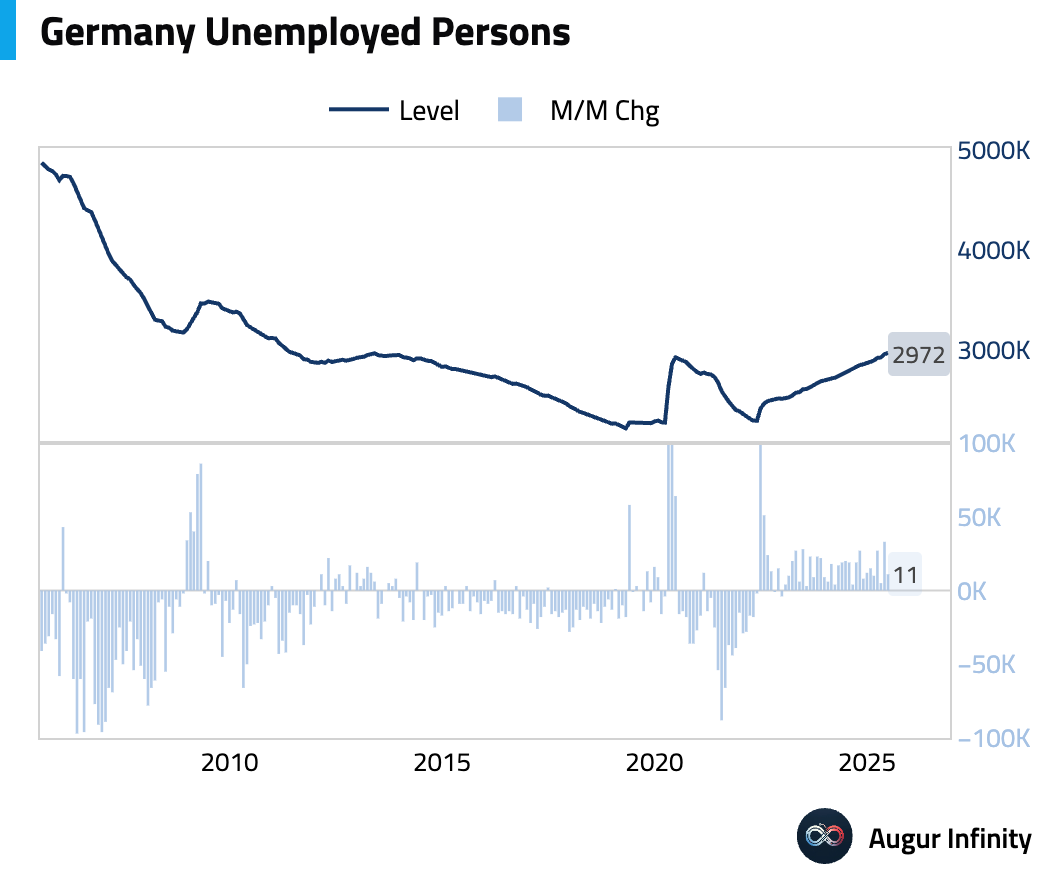

- Germany’s unemployment rate held steady at 6.3% in June, slightly better than the 6.4% consensus. The number of unemployed persons rose by a less-than-expected 11,000.

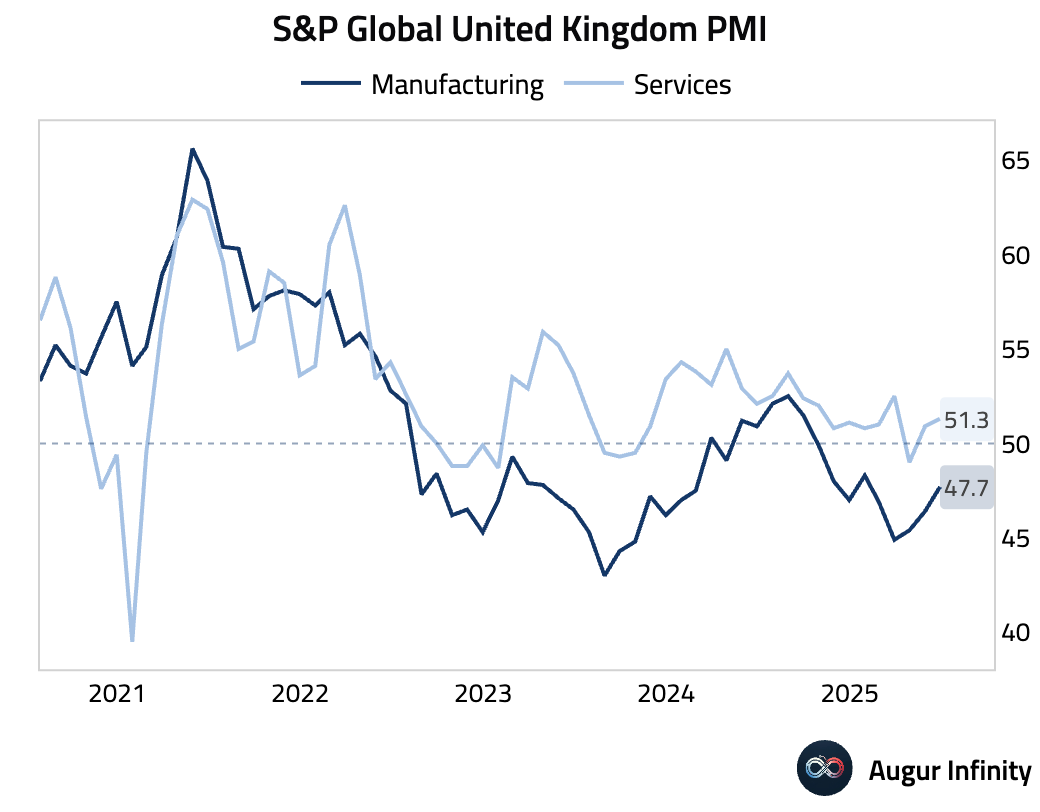

- The UK's S&P Global Manufacturing PMI for June rose to a five-month high of 47.7. While still in contraction, the report showed the slowest decline in output and new orders in nine months. The forward-looking orders-to-inventory ratio jumped to its highest level since August 2024, signaling potential for future improvement.

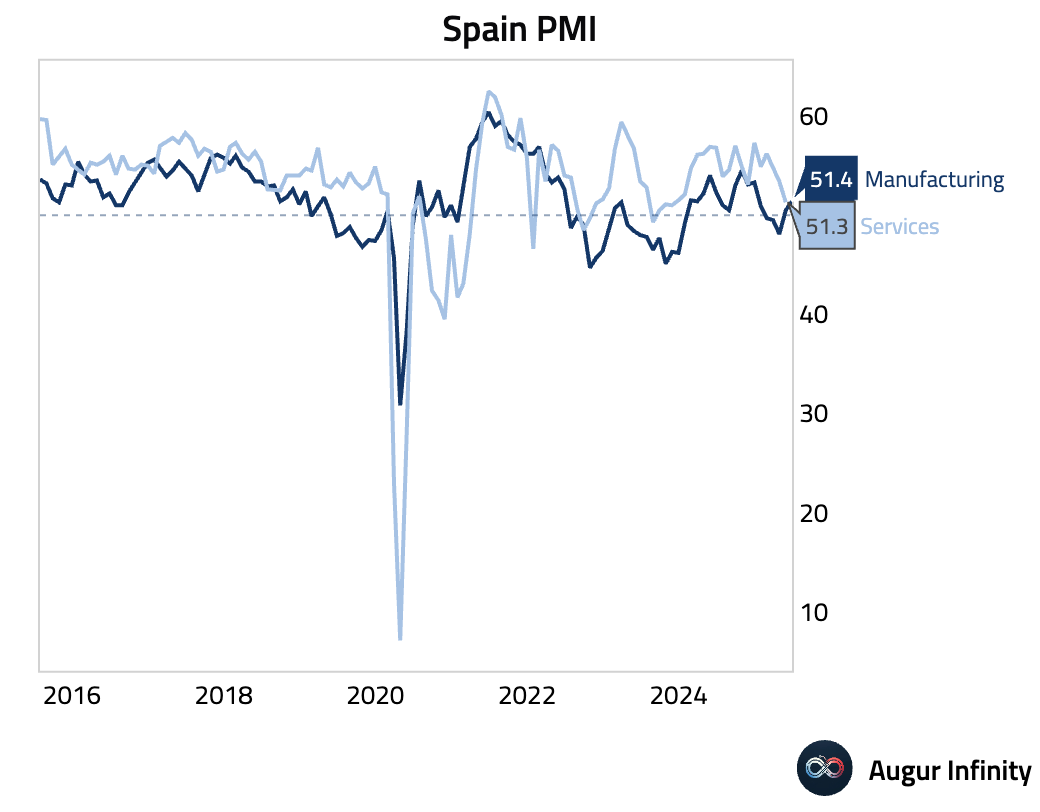

- Spain’s HCOB Manufacturing PMI rose to 51.4 in June, the best reading this year, as output growth hit a six-month high. New orders returned to marginal growth, though falling export sales linked to tariff uncertainty provided a significant drag.

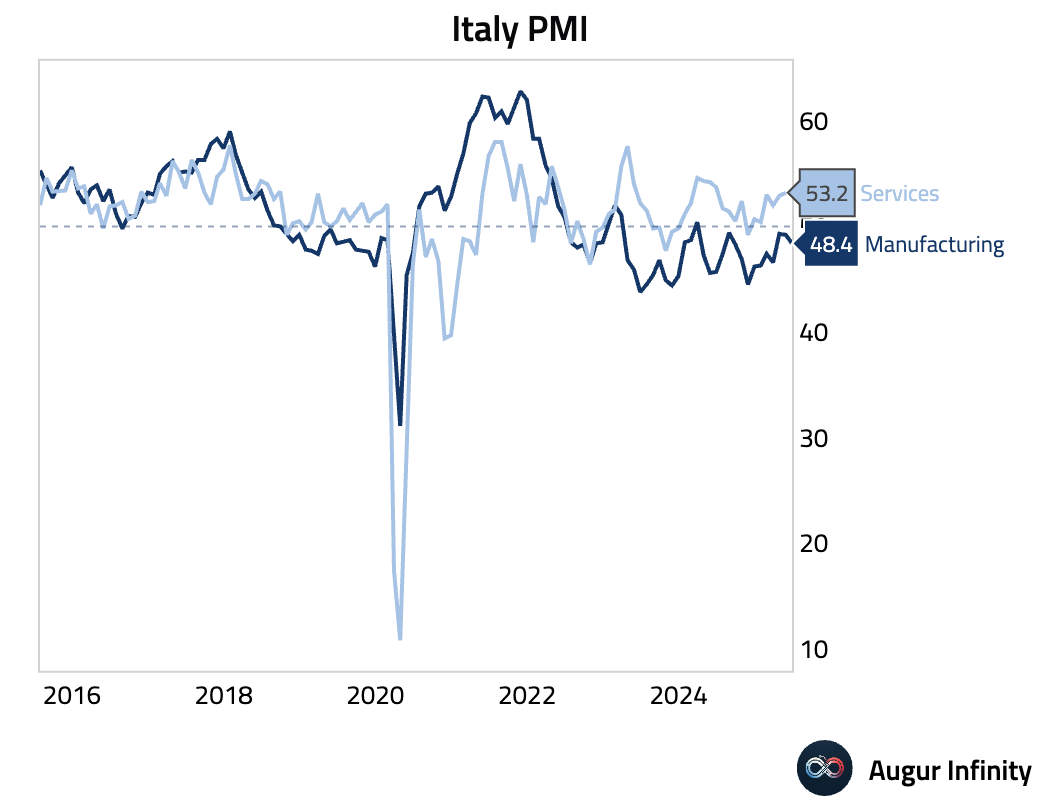

- Italy’s HCOB Manufacturing PMI fell to 48.4 in June from 49.2, missing the 49.5 consensus. This marked the fastest contraction in three months, as both output and new orders fell at an accelerated pace.

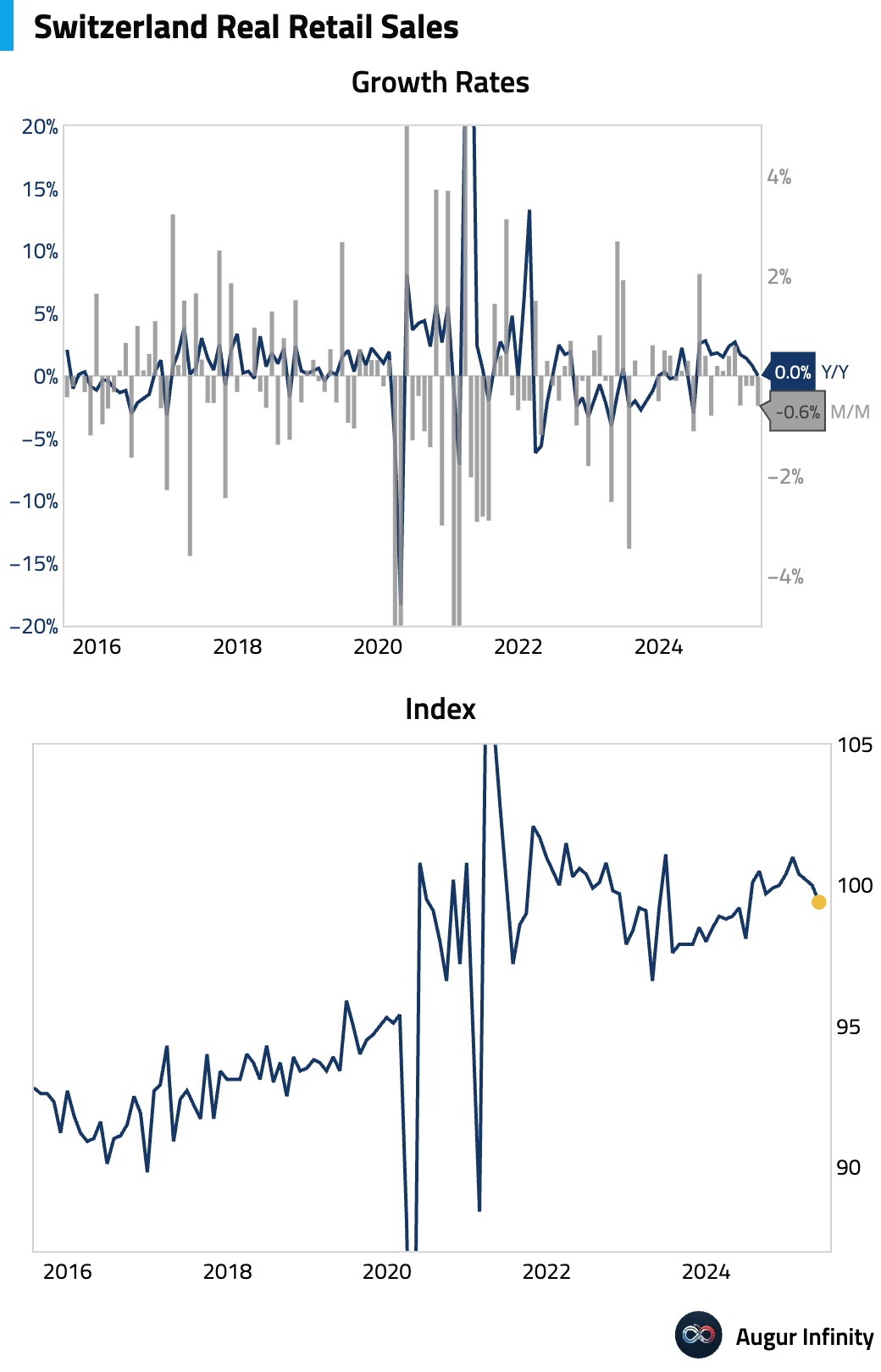

- Swiss retail sales were flat year-over-year in May, missing the 0.8% consensus. The M/M reading showed a 0.6% decline, deepening from the previous -0.2%.

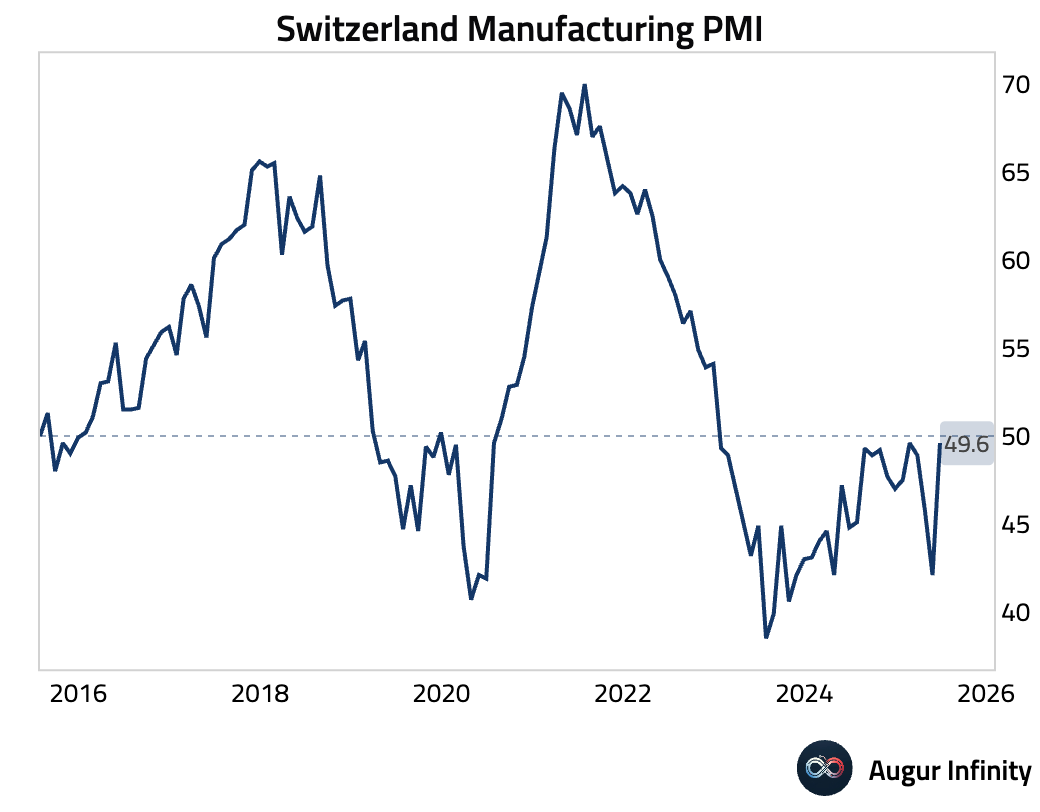

- Switzerland’s procure.ch Manufacturing PMI jumped to 49.6 in June from 42.1, significantly beating the 44.0 consensus.

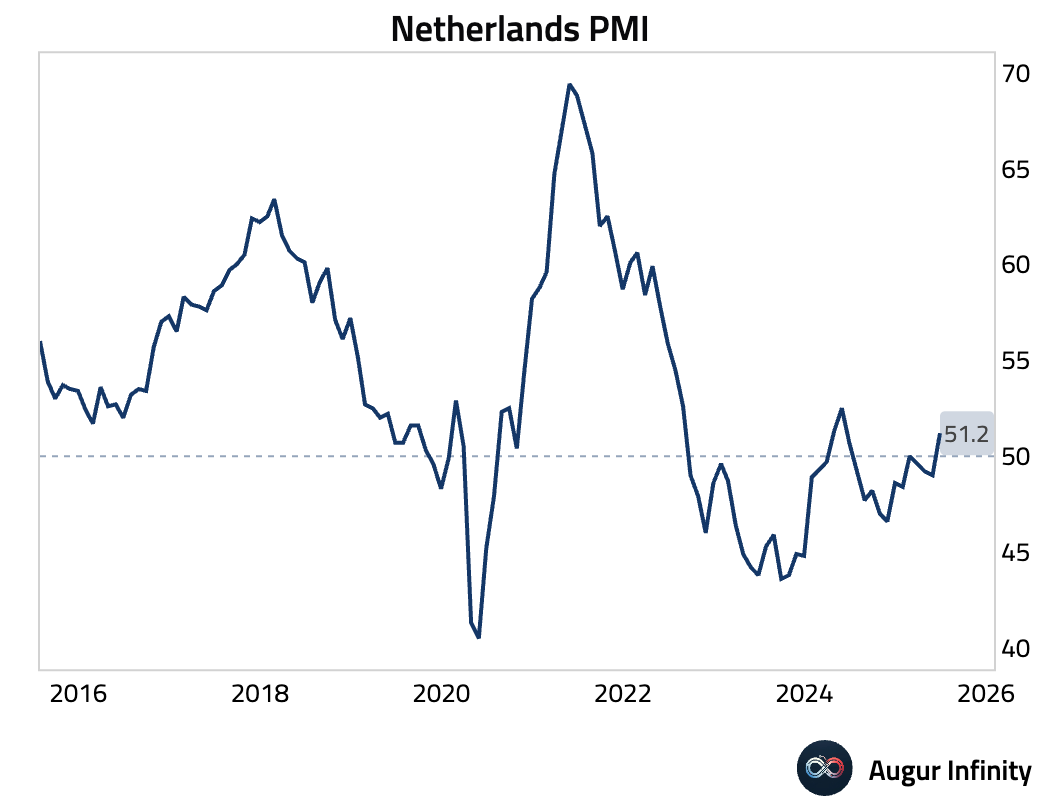

- The Netherlands’ NEVI Manufacturing PMI rose to 51.2 in June from 49.0, its first expansionary reading in a year, driven by strong new business linked to a German industrial recovery and chip sector strength.

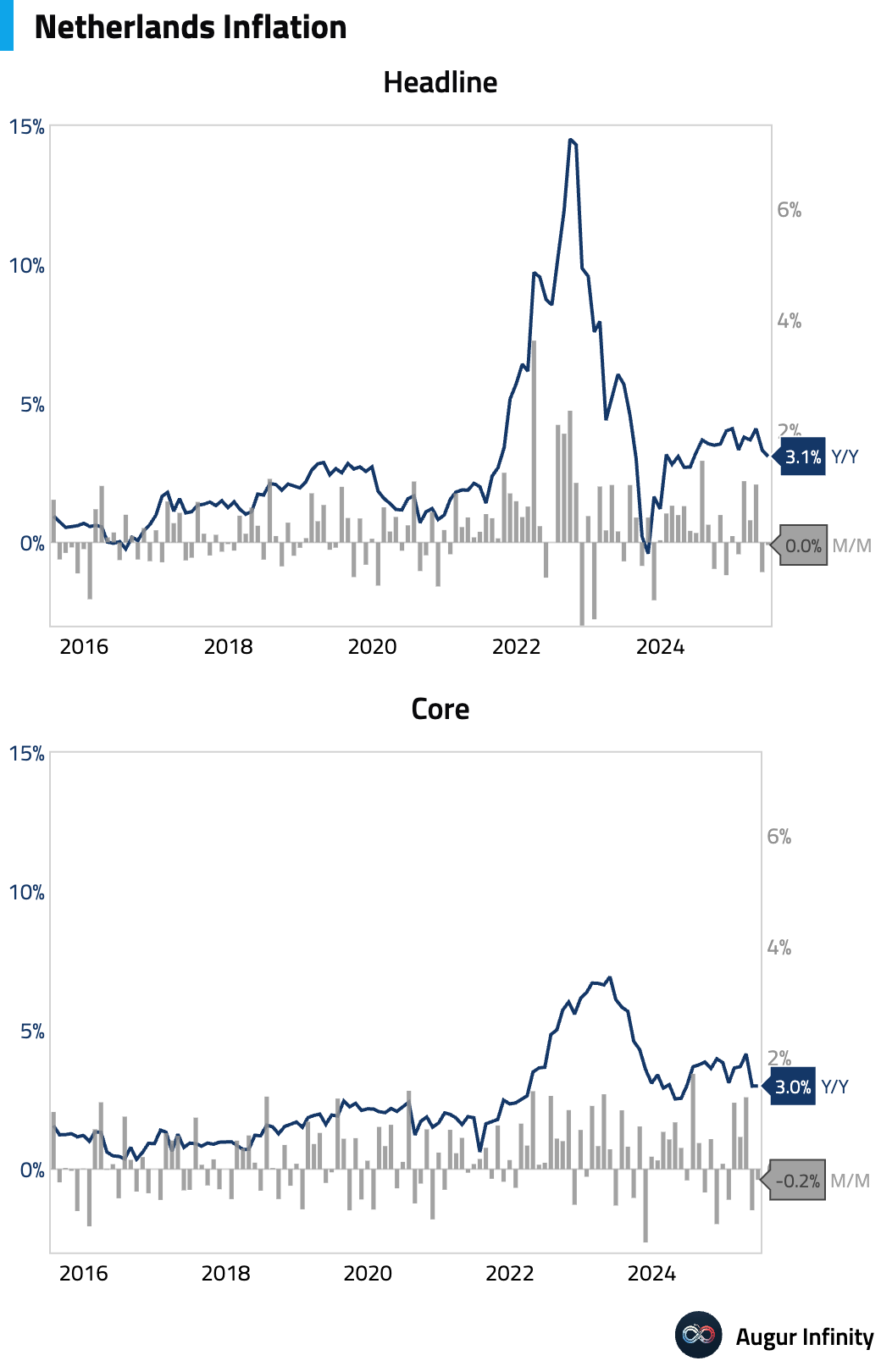

- Dutch preliminary inflation for June eased to 3.1% Y/Y from 3.3% in May.

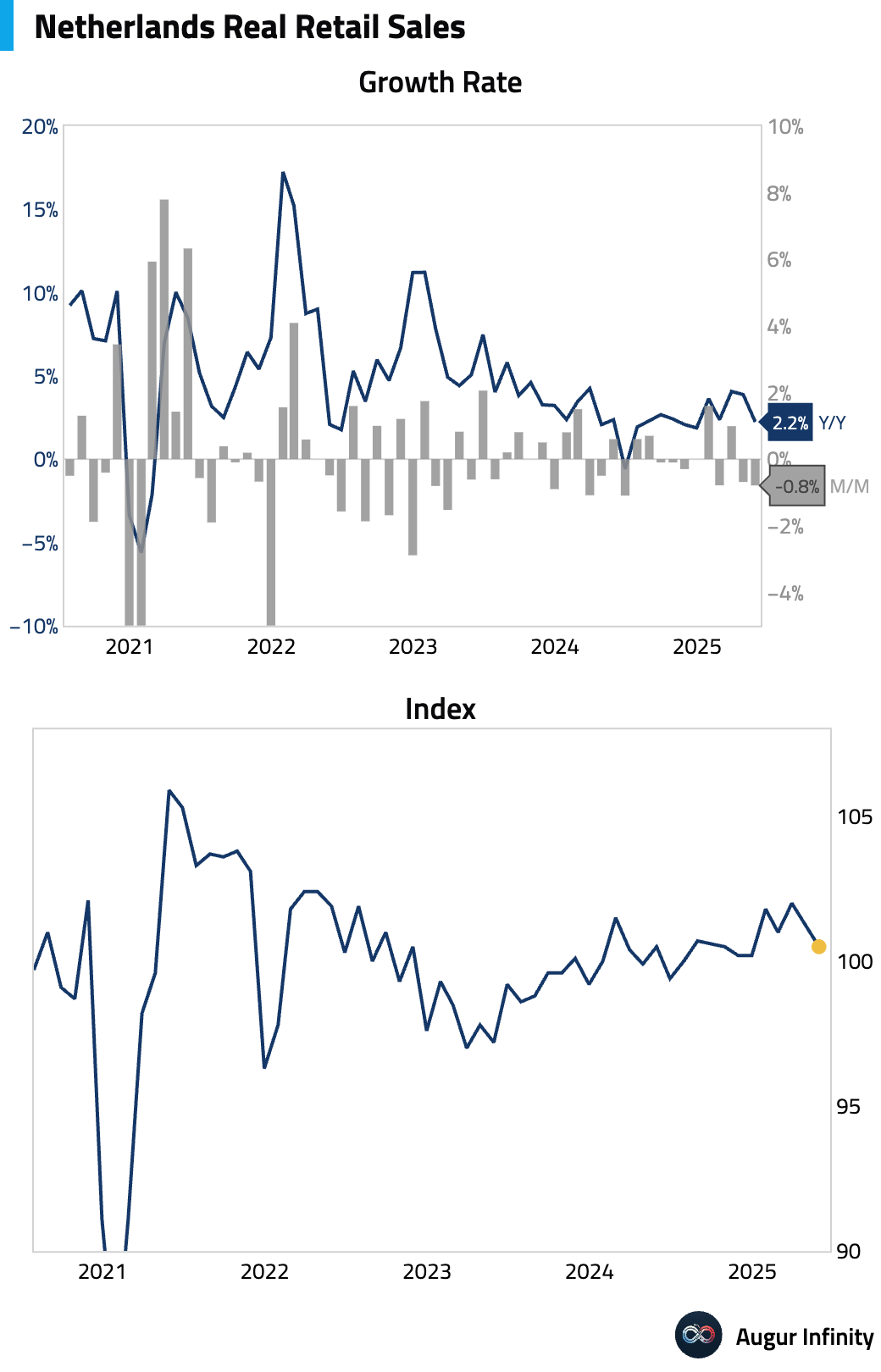

- Dutch retail sales growth slowed to 2.2% Y/Y in May from 3.9% in April.

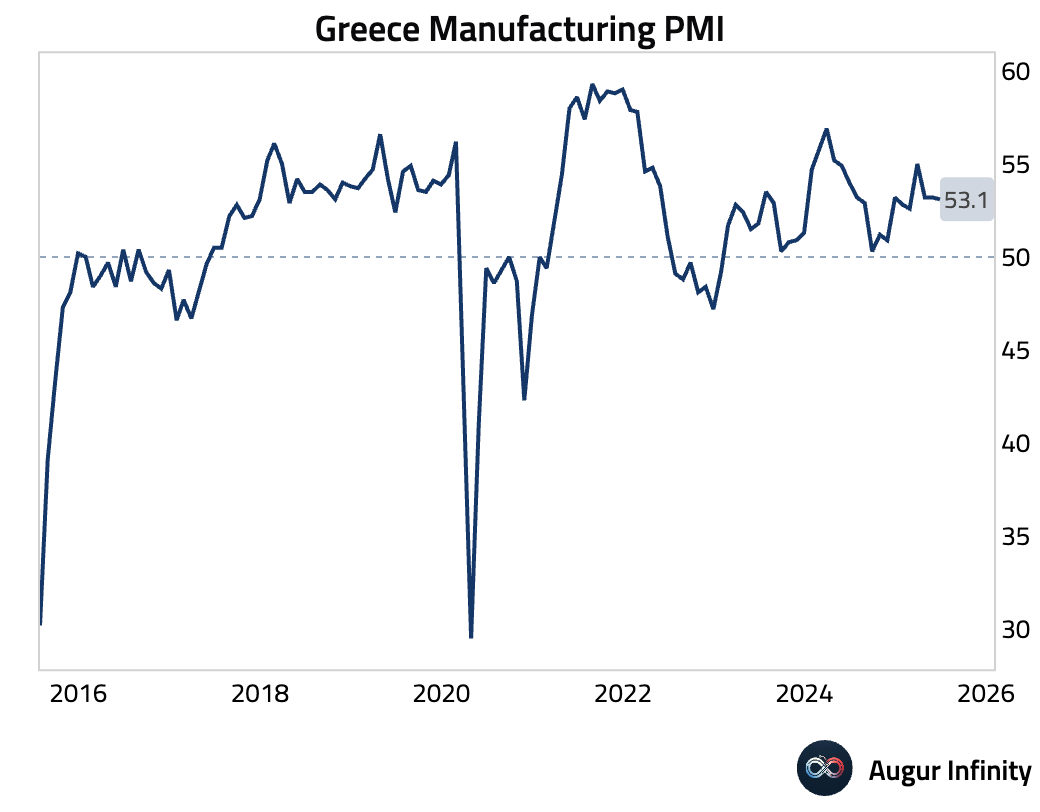

- Greece’s S&P Global Manufacturing PMI posted a solid 53.1 in June, driven by strong domestic orders. However, a sharp drop in export orders, hurt by global uncertainty, weighed on the reading, and business confidence fell to an eight-month low.

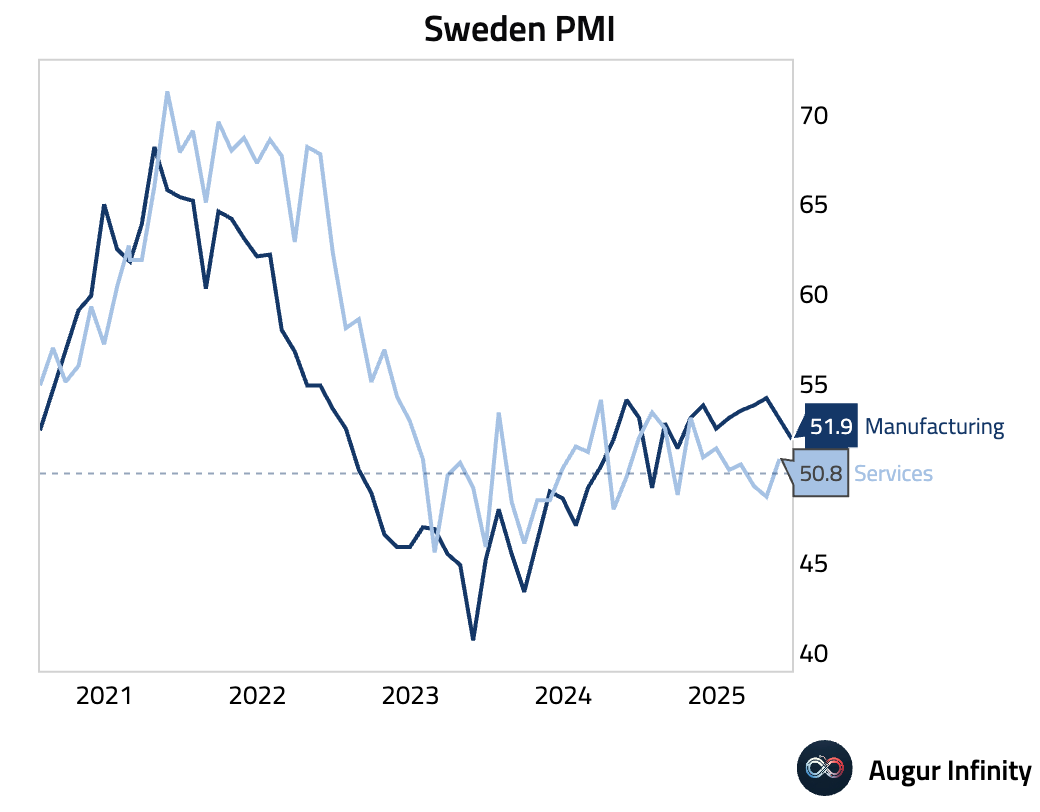

- Sweden’s Swedbank Manufacturing PMI for June fell to 51.9 from 53.1, its weakest reading since September 2024.

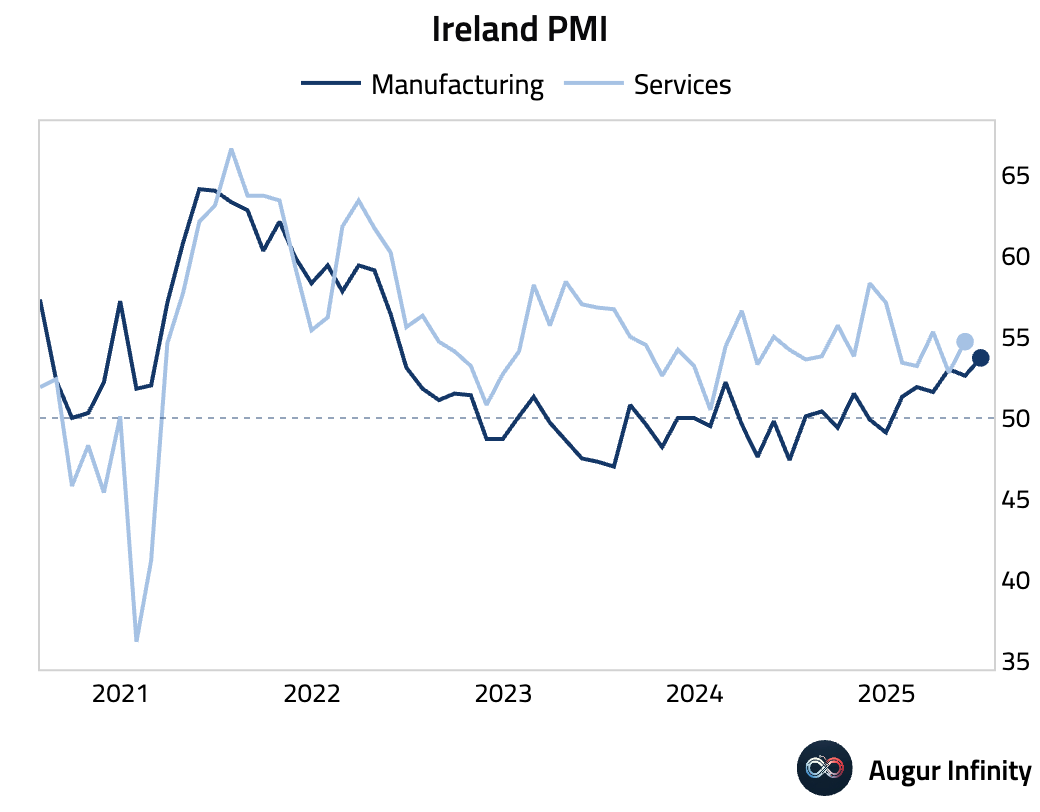

- Ireland's AIB Manufacturing PMI for June rose to 53.7 from 52.6, its highest level since May 2022.

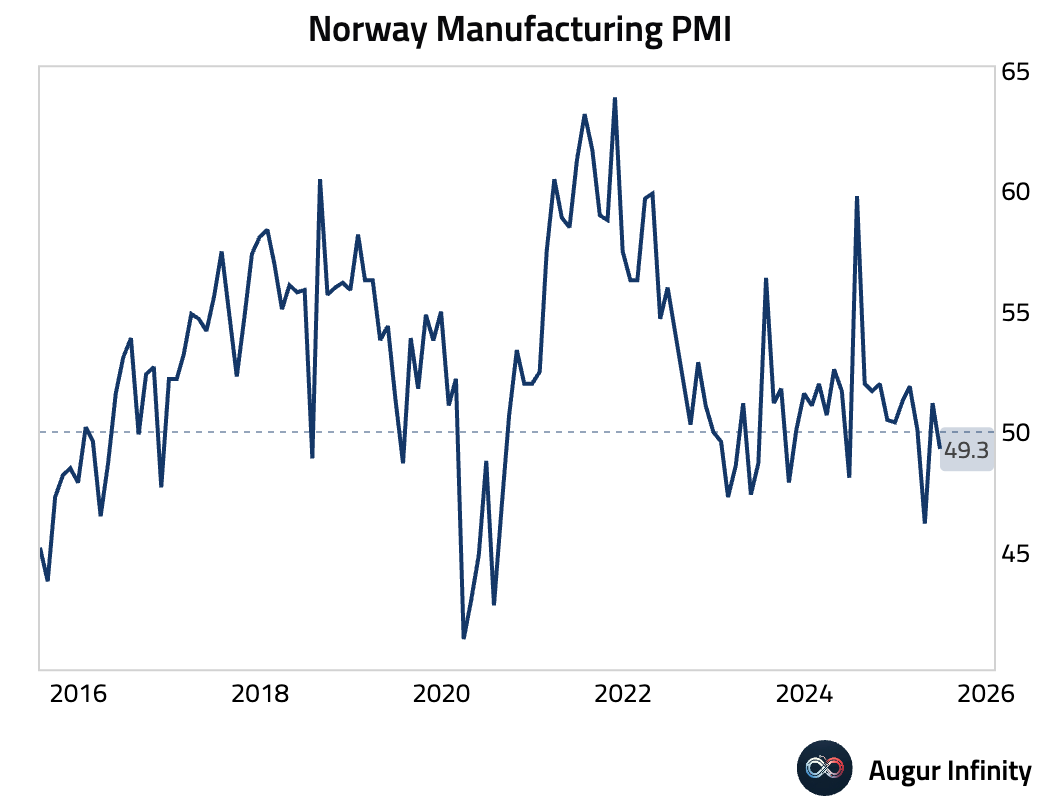

- Norway’s DNB Manufacturing PMI fell into contraction at 49.3 in June, down from 51.2 in May.

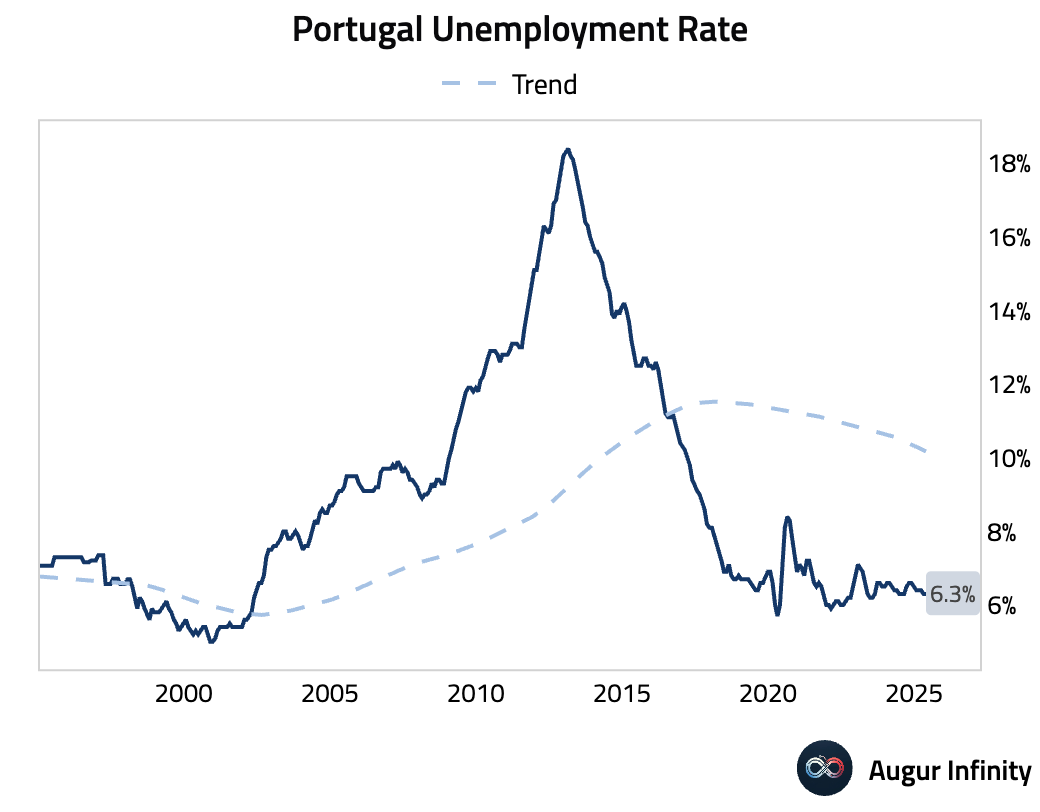

- Portugal’s unemployment rate held steady at 6.3% in May.

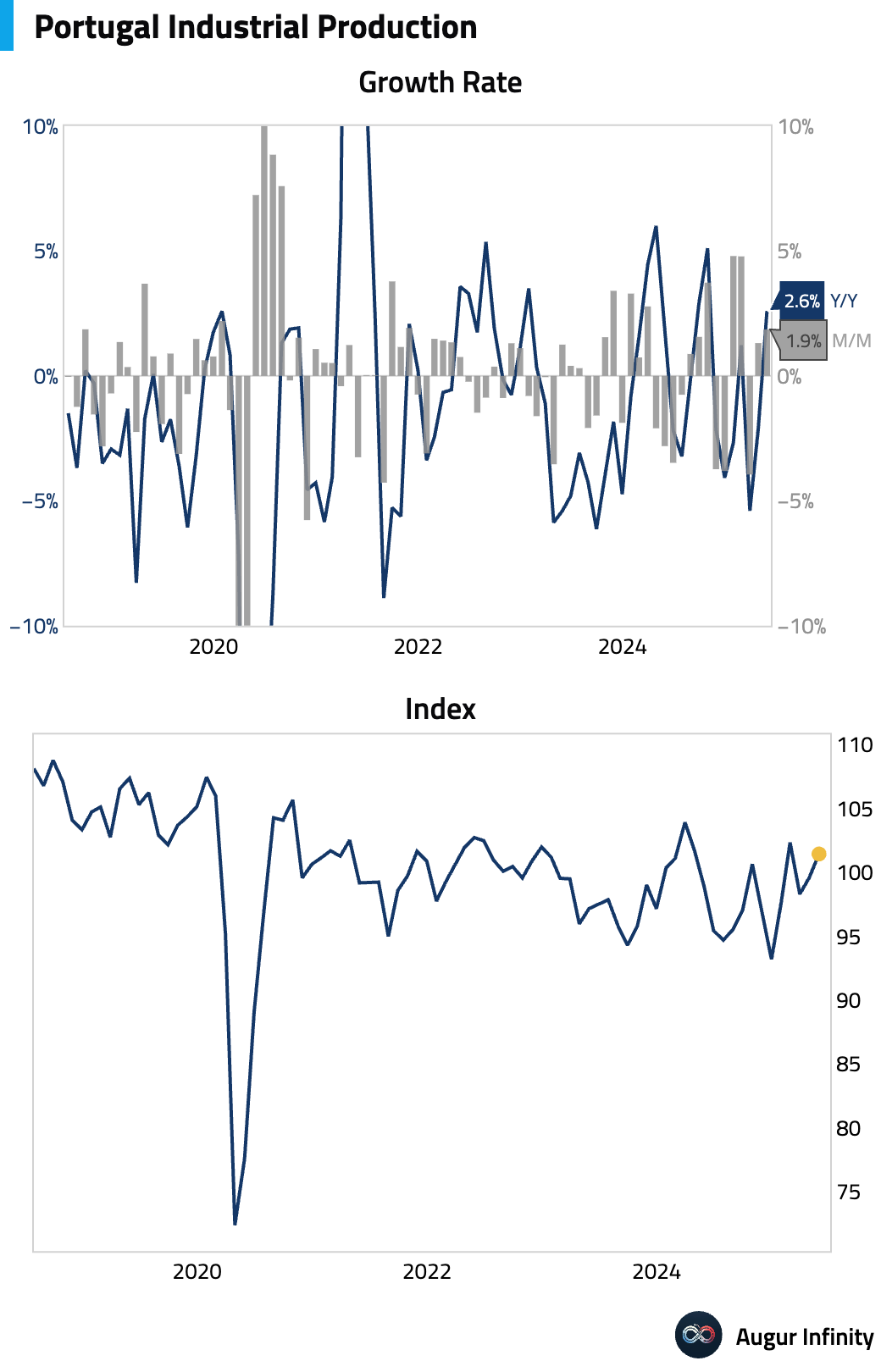

- Portuguese industrial production rebounded in May, rising 2.6% Y/Y after a 2.1% decline in April. M/M growth was 1.9%.

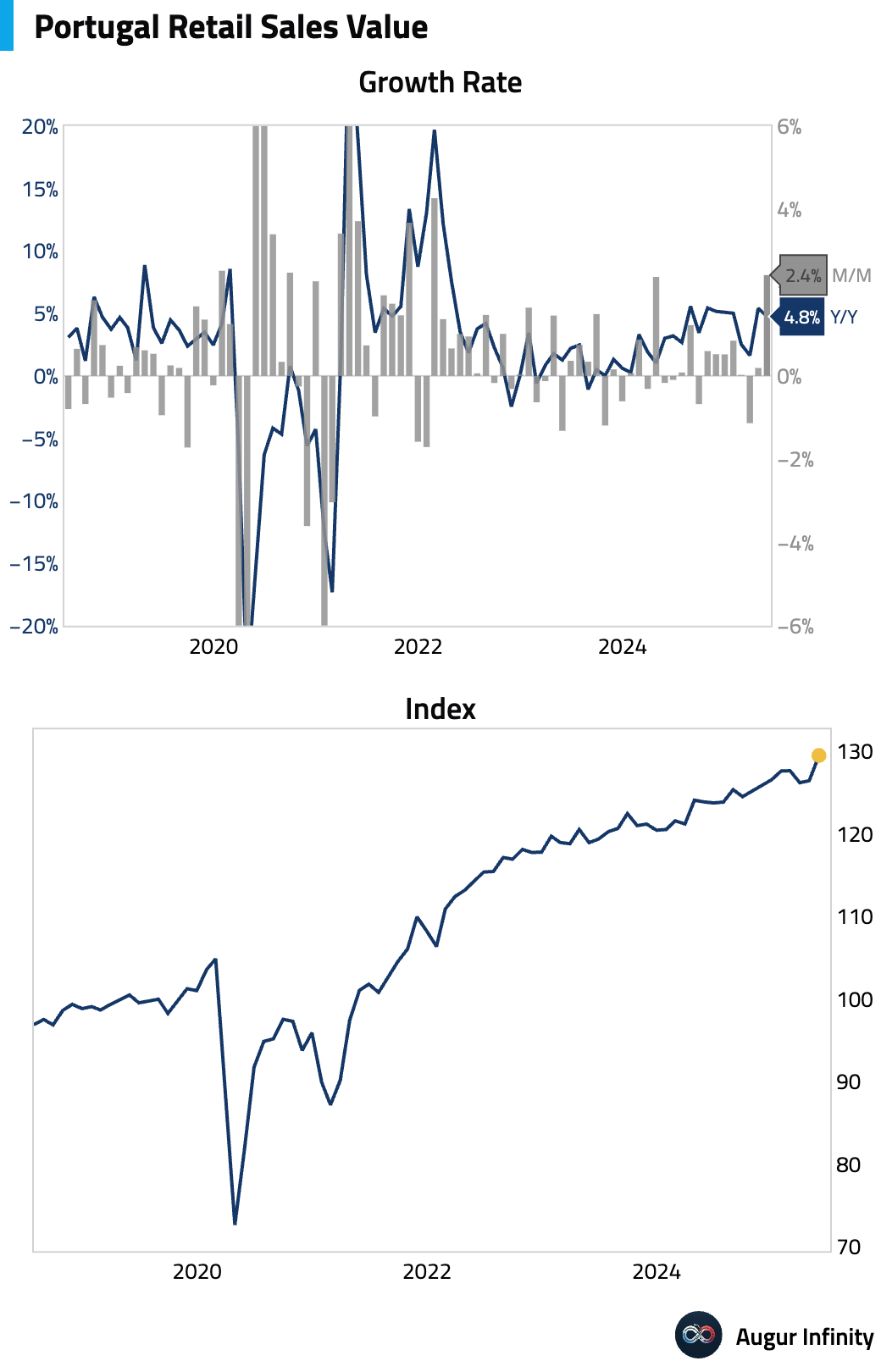

- Portuguese retail sales value rose 2.2% Y/Y in May, accelerating from 0.7% in April. The M/M gain was a strong 4.8%.

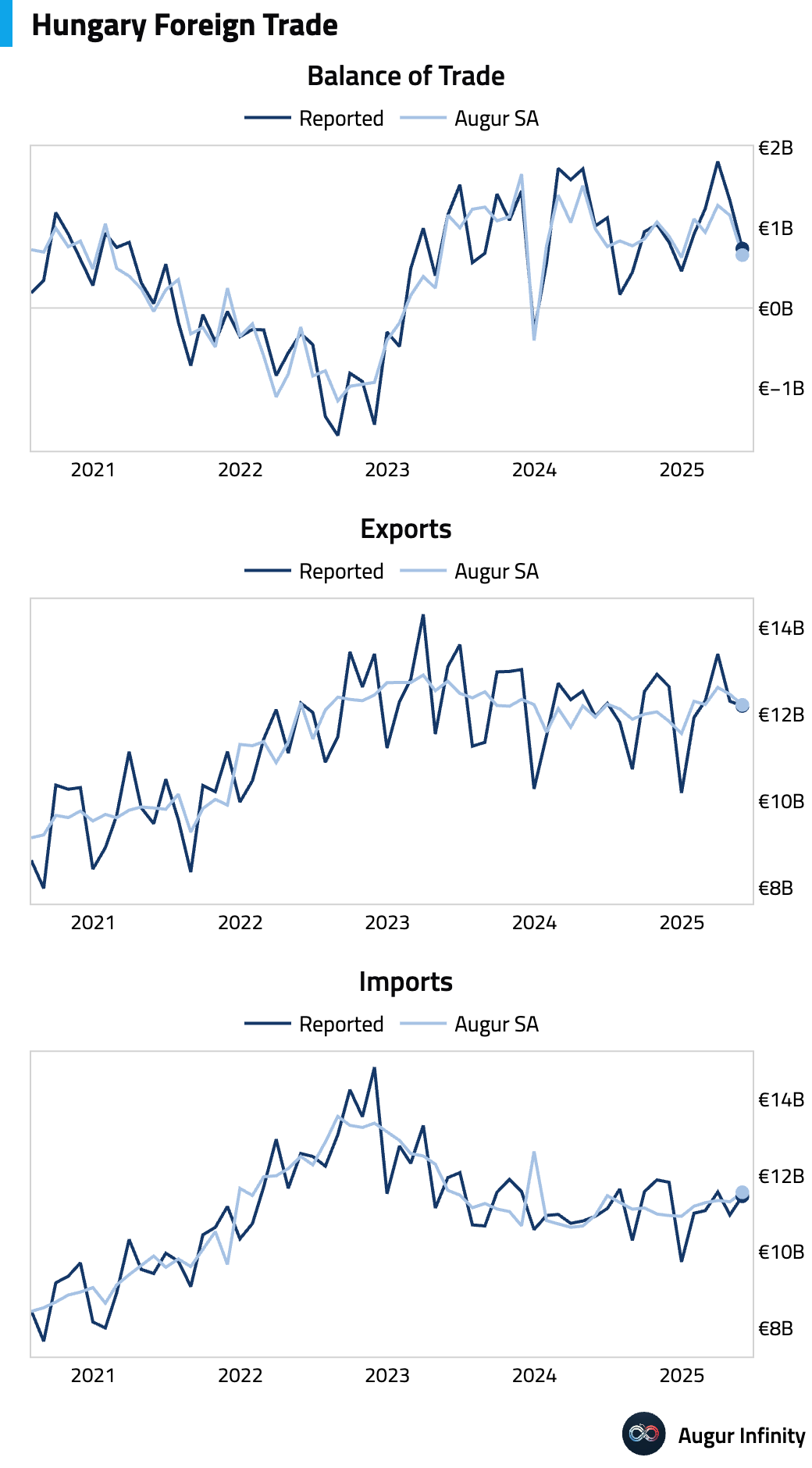

- Hungary's trade surplus narrowed to €739 million in May from €1.34 billion in April, missing the consensus of €1.38 billion.

Asia-Pacific

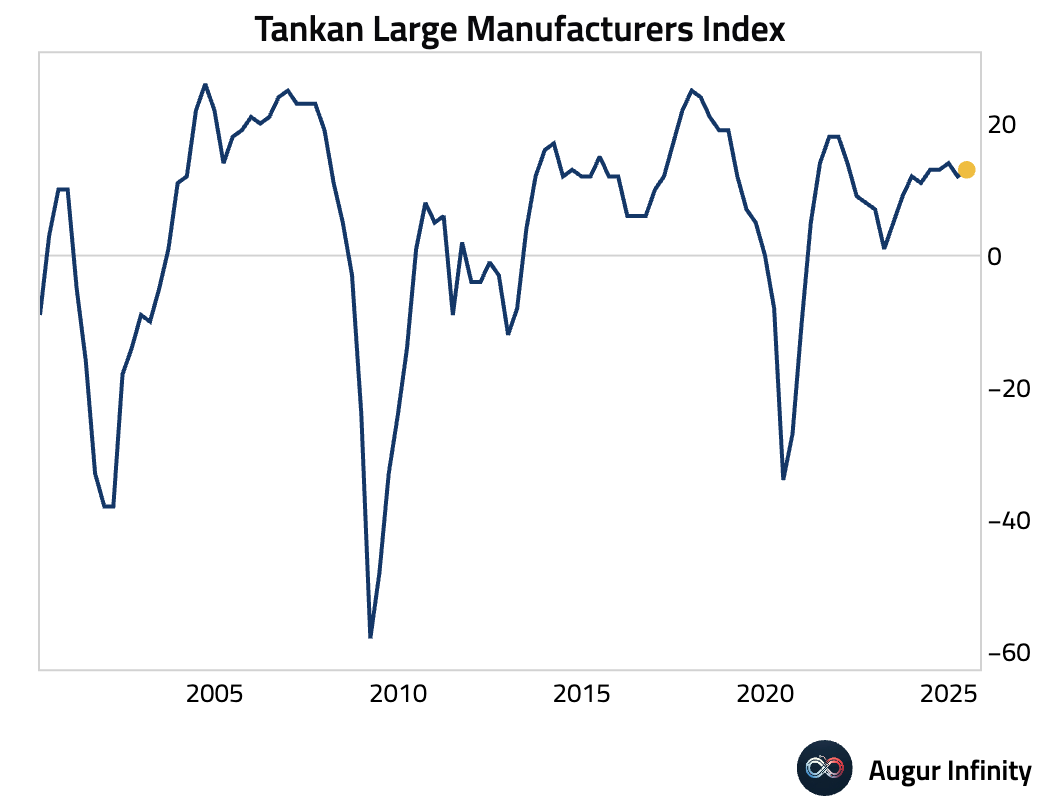

- Japan’s Tankan Large Manufacturers Index for Q2 rose to 13 from 12, beating the consensus of 10. The outlook component, however, held steady at 12, missing expectations for an increase to 13. The report suggests current conditions are better than expected, but optimism about the future is more muted.

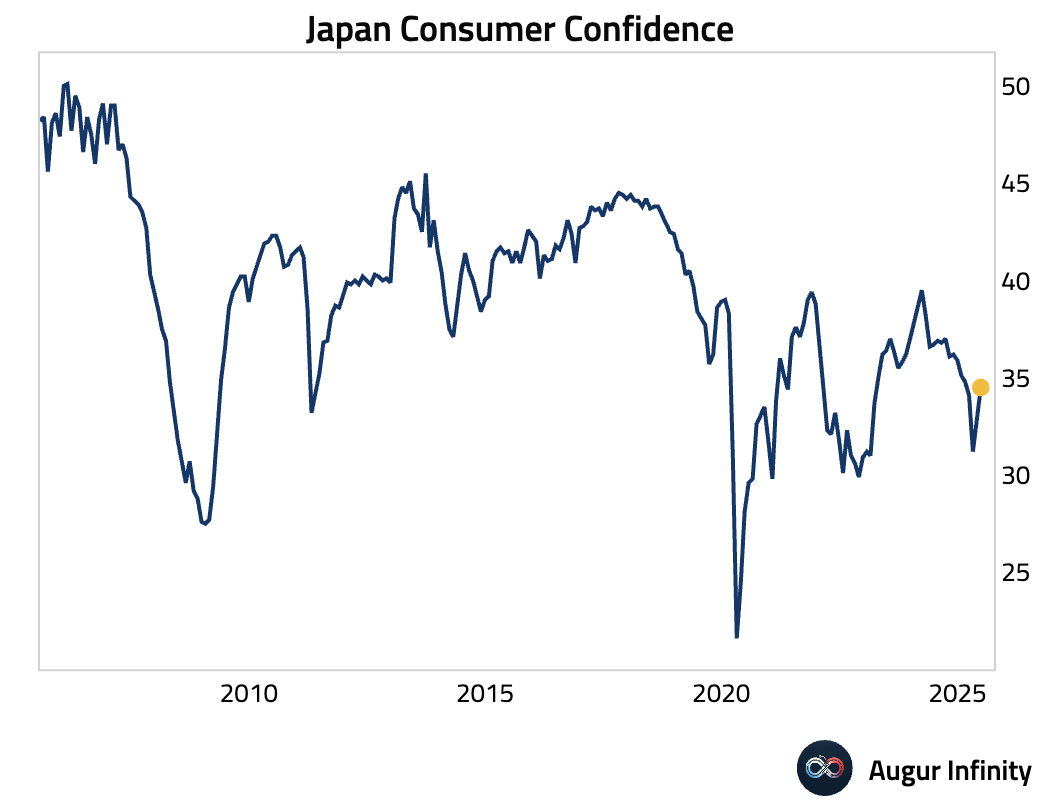

- Japan’s Consumer Confidence index for June rose to 34.5 from 32.8, well above the 33.6 consensus.

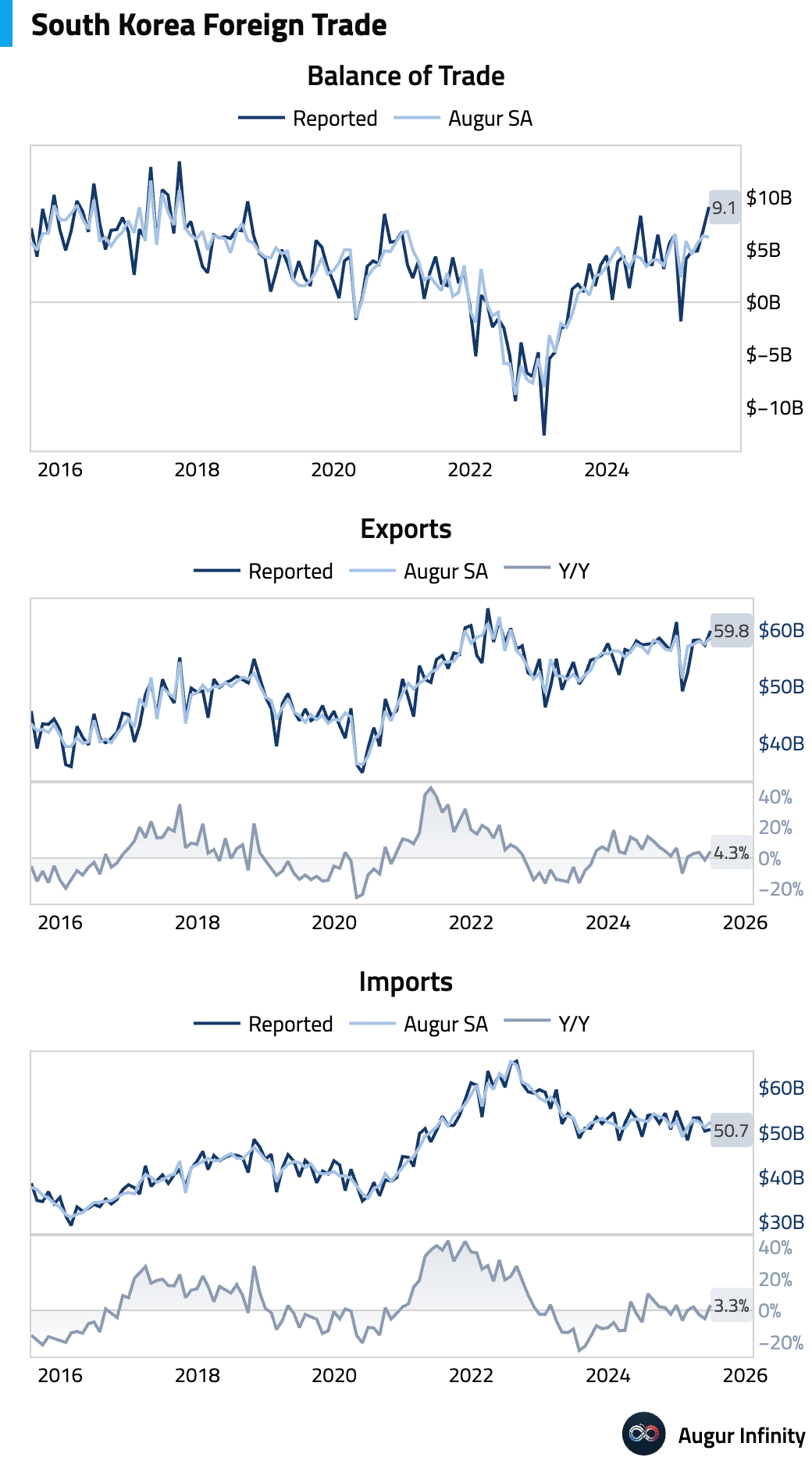

- South Korea’s exports rose 4.3% Y/Y in June, rebounding from May’s -1.3% but missing the 4.7% consensus. Imports also recovered, growing 3.3% Y/Y. This resulted in a trade surplus of $9.08 billion, beating the $8.40 billion consensus.

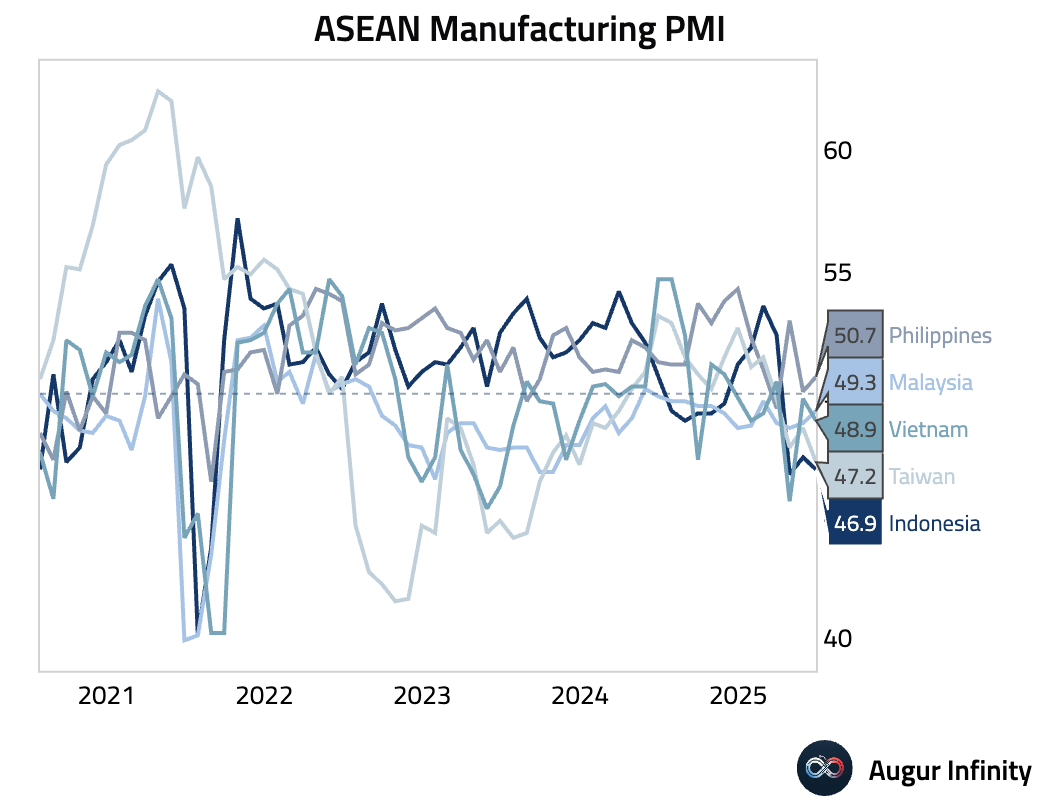

- June manufacturing PMIs across Asia presented a mixed but generally weak picture. Taiwan’s PMI fell to an 18-month low of 47.2, with new export orders declining at the sharpest pace in 1.5 years due to tariff uncertainty. Indonesia's PMI dropped to 46.9 as domestic demand weakened. In contrast, the Philippines' PMI rose to 50.7, driven by a rebound in production and strong job creation, while Malaysia’s PMI ticked up to 49.3.

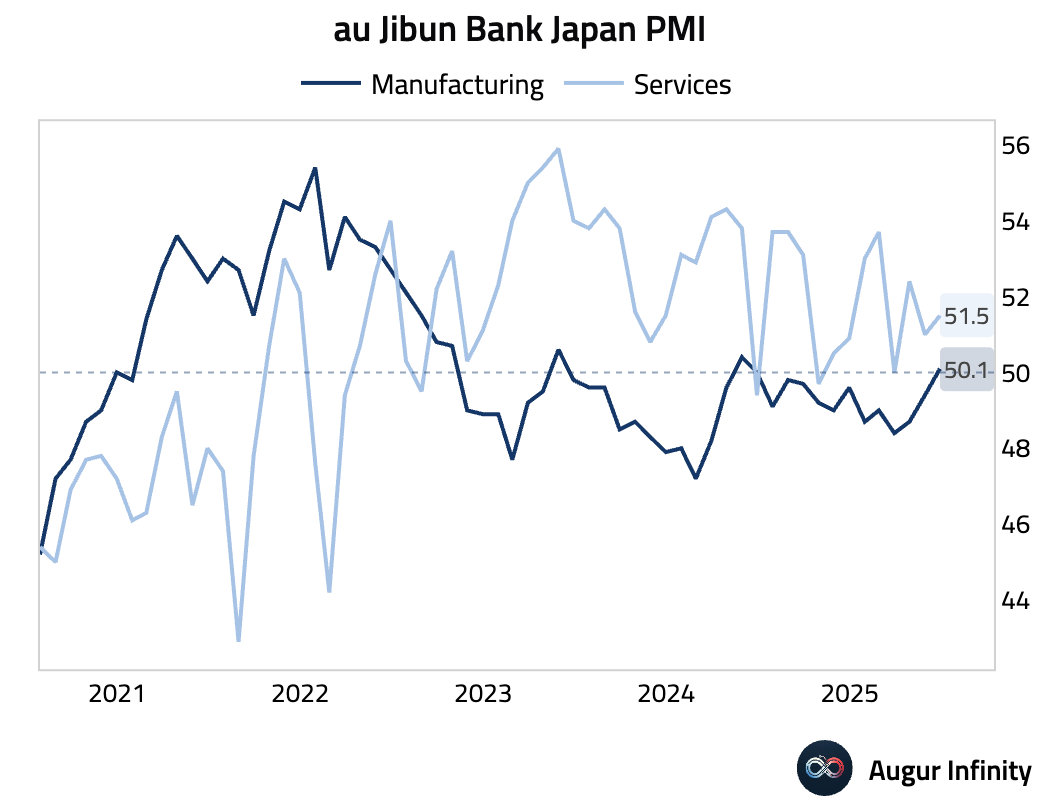

- Japan’s final Jibun Bank Manufacturing PMI for June edged into expansion at 50.1, its first time above 50 in a year. The gain was led by a rise in output and employment, though new orders and exports continued to fall amid concerns over US tariffs.

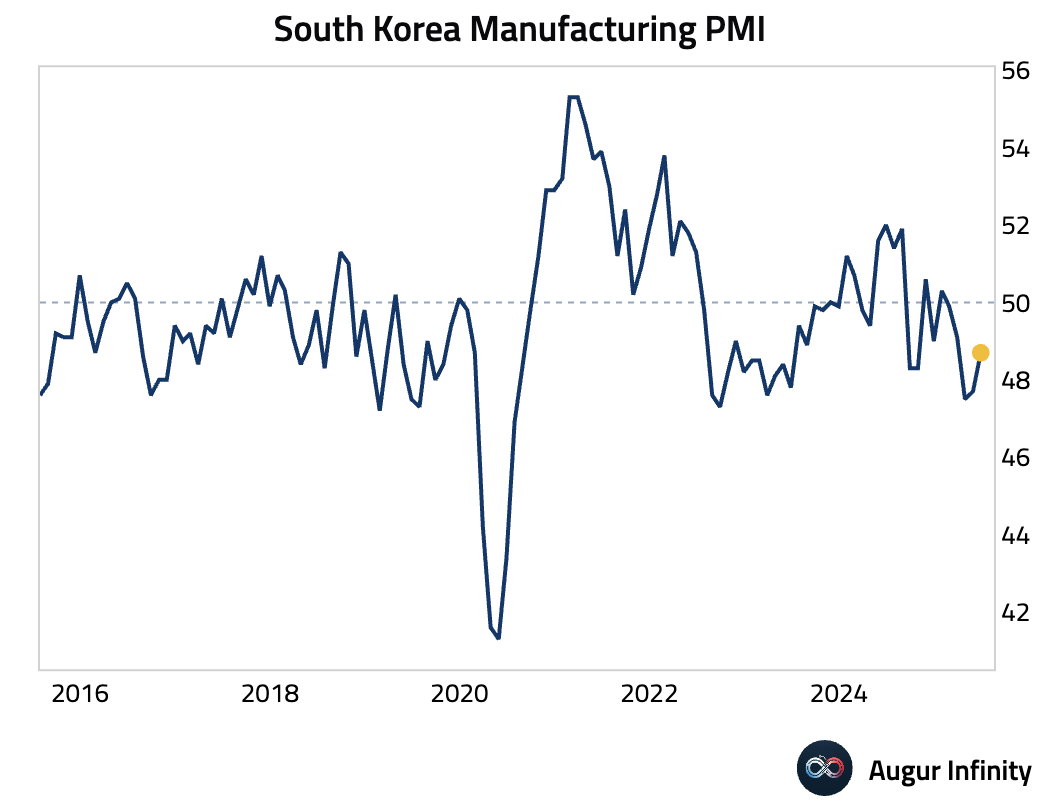

- South Korea’s S&P Global Manufacturing PMI rose to 48.7 in June from 47.7, signaling the softest contraction in three months. Despite a renewed drop in employment, business confidence hit a 13-month high on hopes for new products.

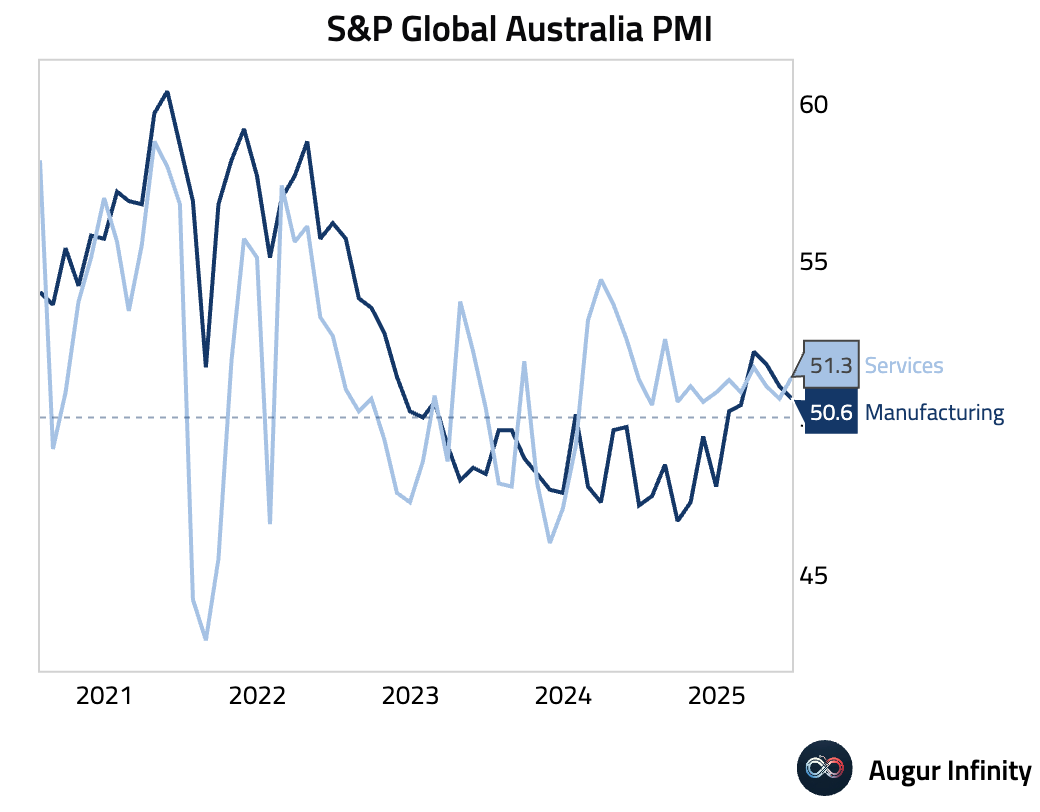

- Australia’s final S&P Global Manufacturing PMI for June was 50.6, revised down from a preliminary 51.0 and below the prior month's 51.0.

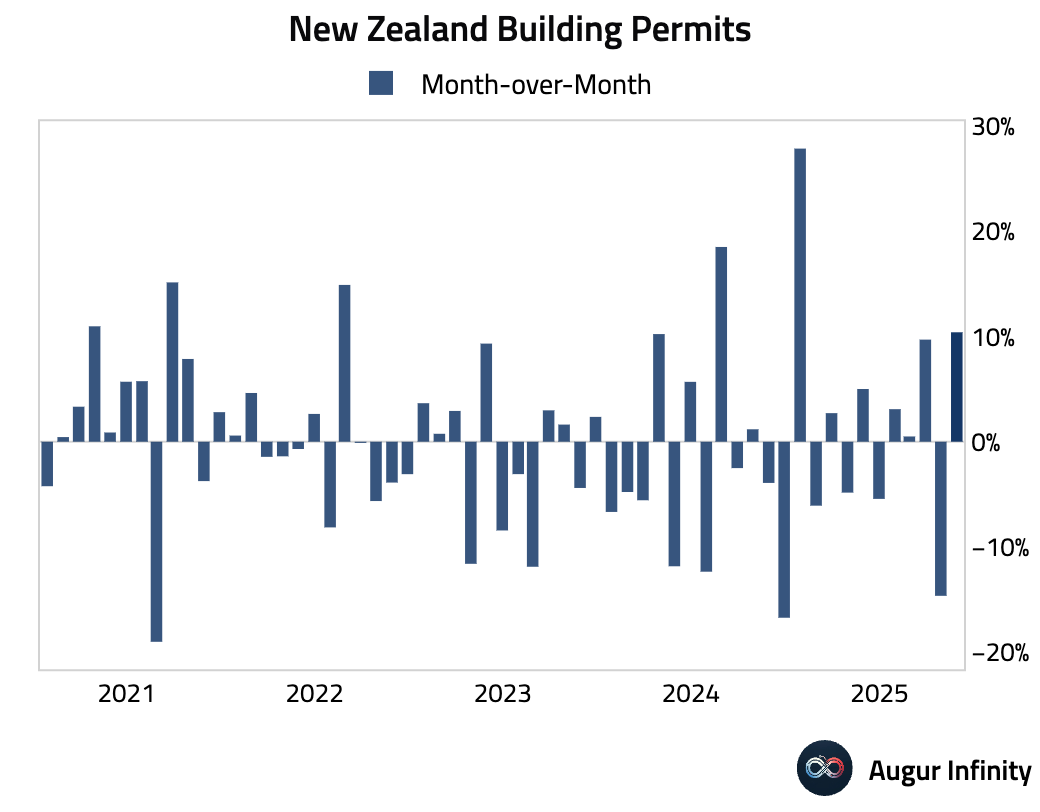

- New Zealand’s building permits rose 10.4% M/M in May, rebounding strongly from a 14.6% decline in April. This was the strongest monthly gain since July 2024.

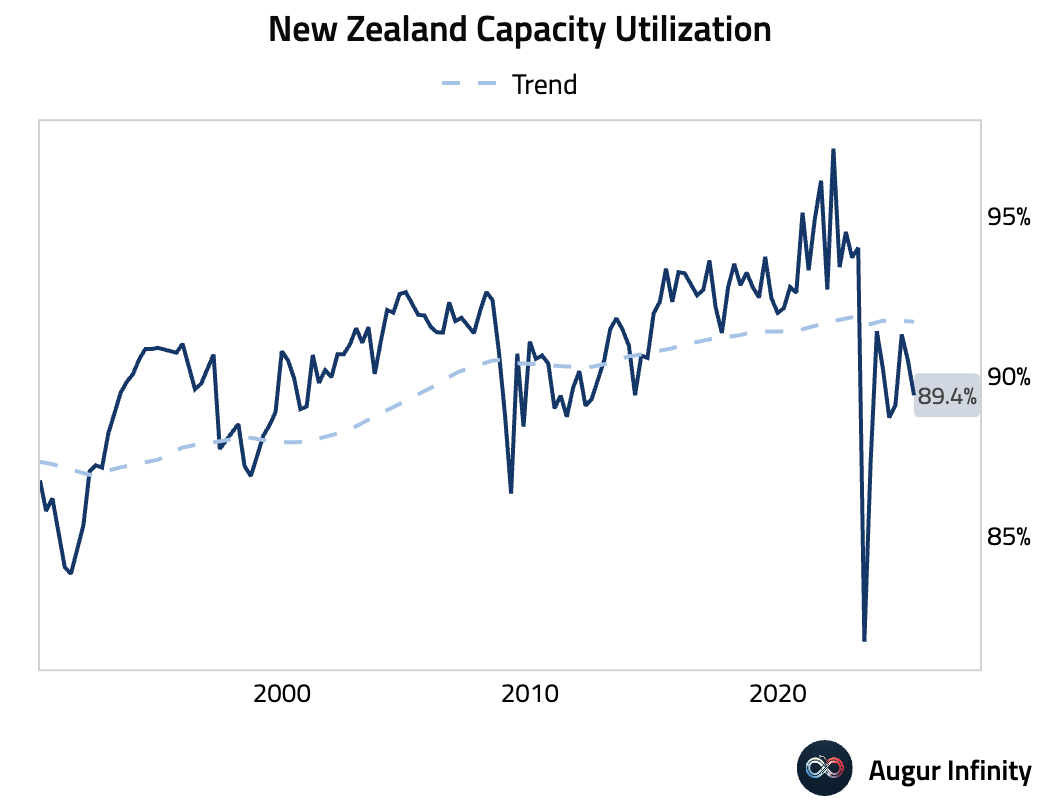

- New Zealand's NZIER capacity utilization fell to 89.4% in Q2 from 90.5% in Q1.

China

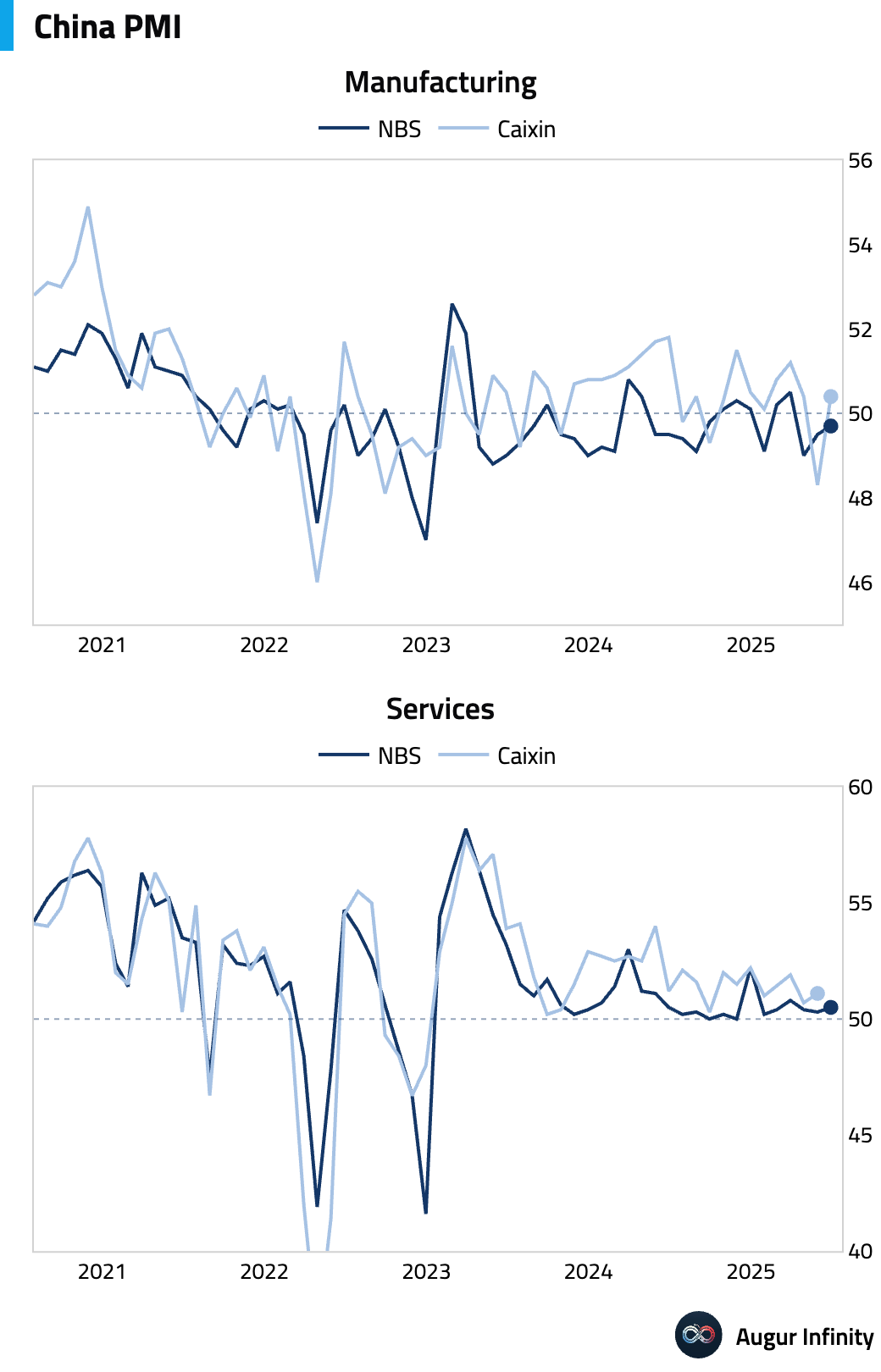

- China’s Caixin Manufacturing PMI for June rose to 50.4, rebounding from 48.3 in May and significantly beating the 49.0 consensus. The return to expansionary territory suggests an improvement in conditions for smaller, private-sector firms.

Emerging Markets ex China

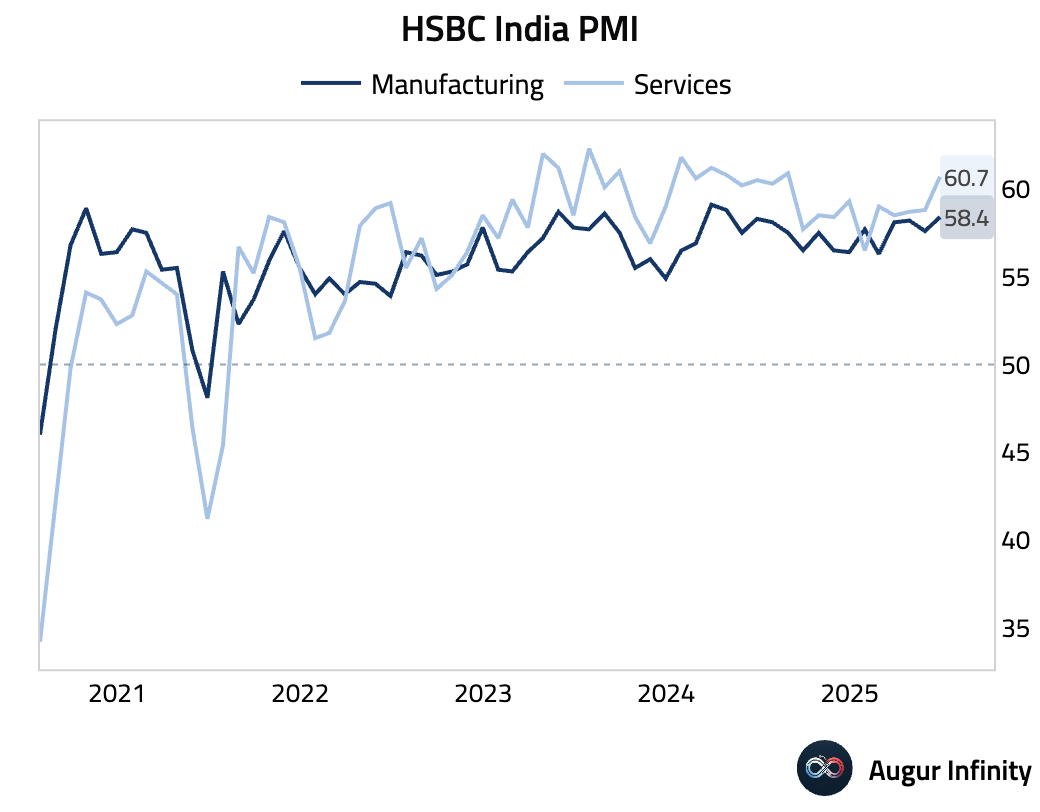

- India’s HSBC Manufacturing PMI held steady at a 14-month high of 58.4 in June. The strength was propelled by a near-record surge in new export orders, particularly from the US. A key divergence emerged as input cost inflation eased while firms raised selling prices markedly due to strong demand, expanding margins.

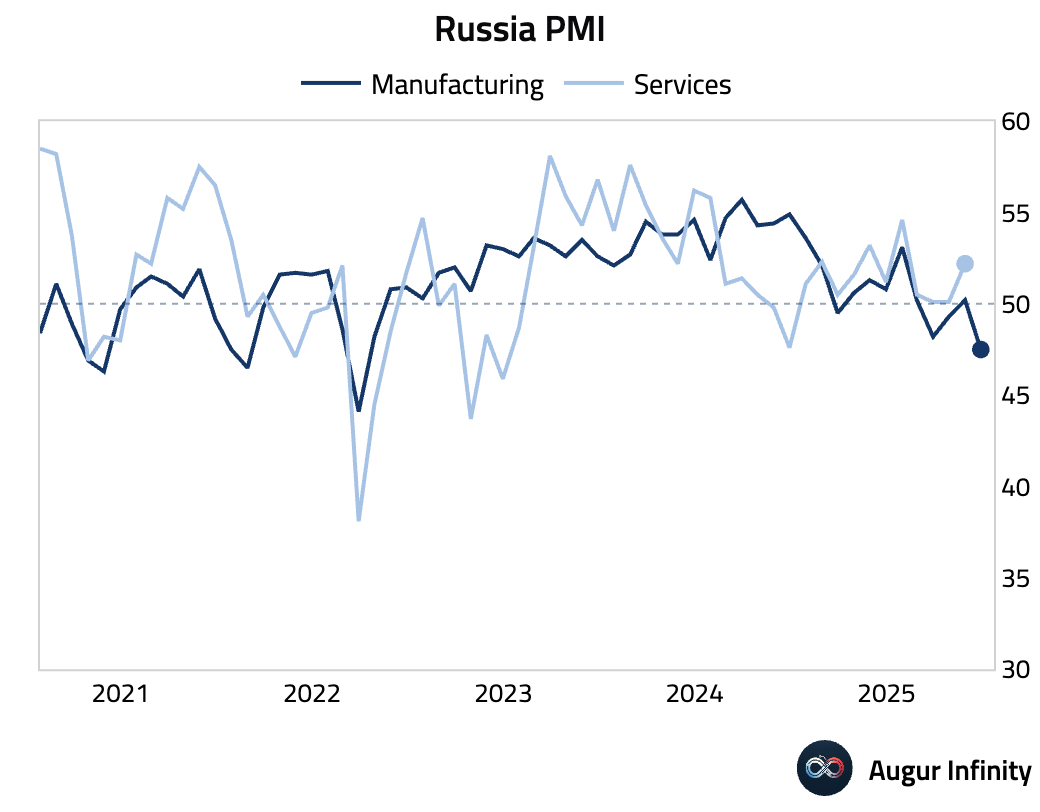

- Russia’s S&P Global Manufacturing PMI contracted sharply in June, falling to 47.5 from 50.2 in May. This was the steepest decline since March 2022, driven by new orders returning to contraction and employment falling at its fastest pace since April 2022.

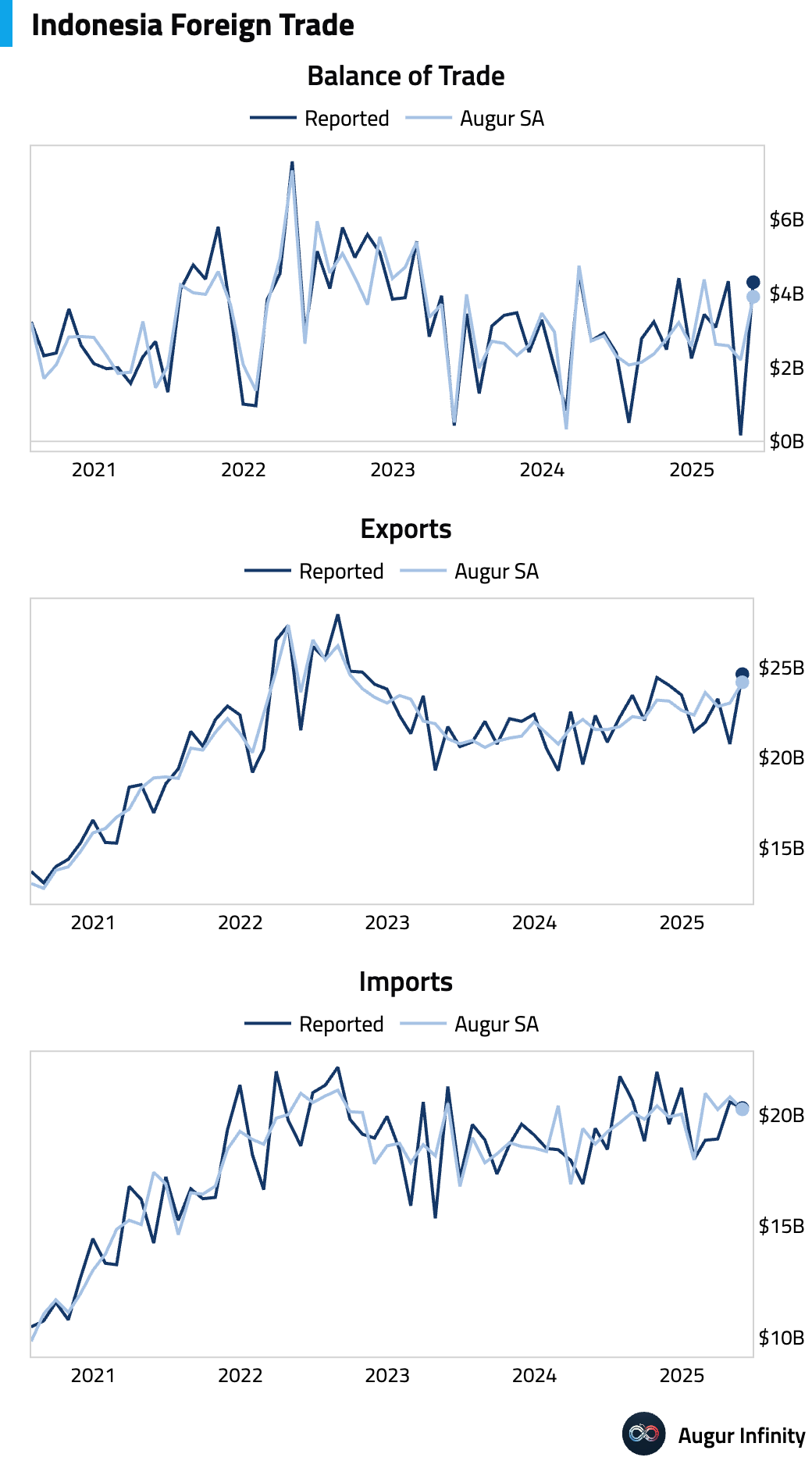

- Indonesia’s trade surplus in May soared to $4.30 billion, dramatically beating the $2.40 billion consensus and widening from April’s $0.16 billion. The result was driven by a 9.68% Y/Y surge in exports (vs. 1.0% consensus).

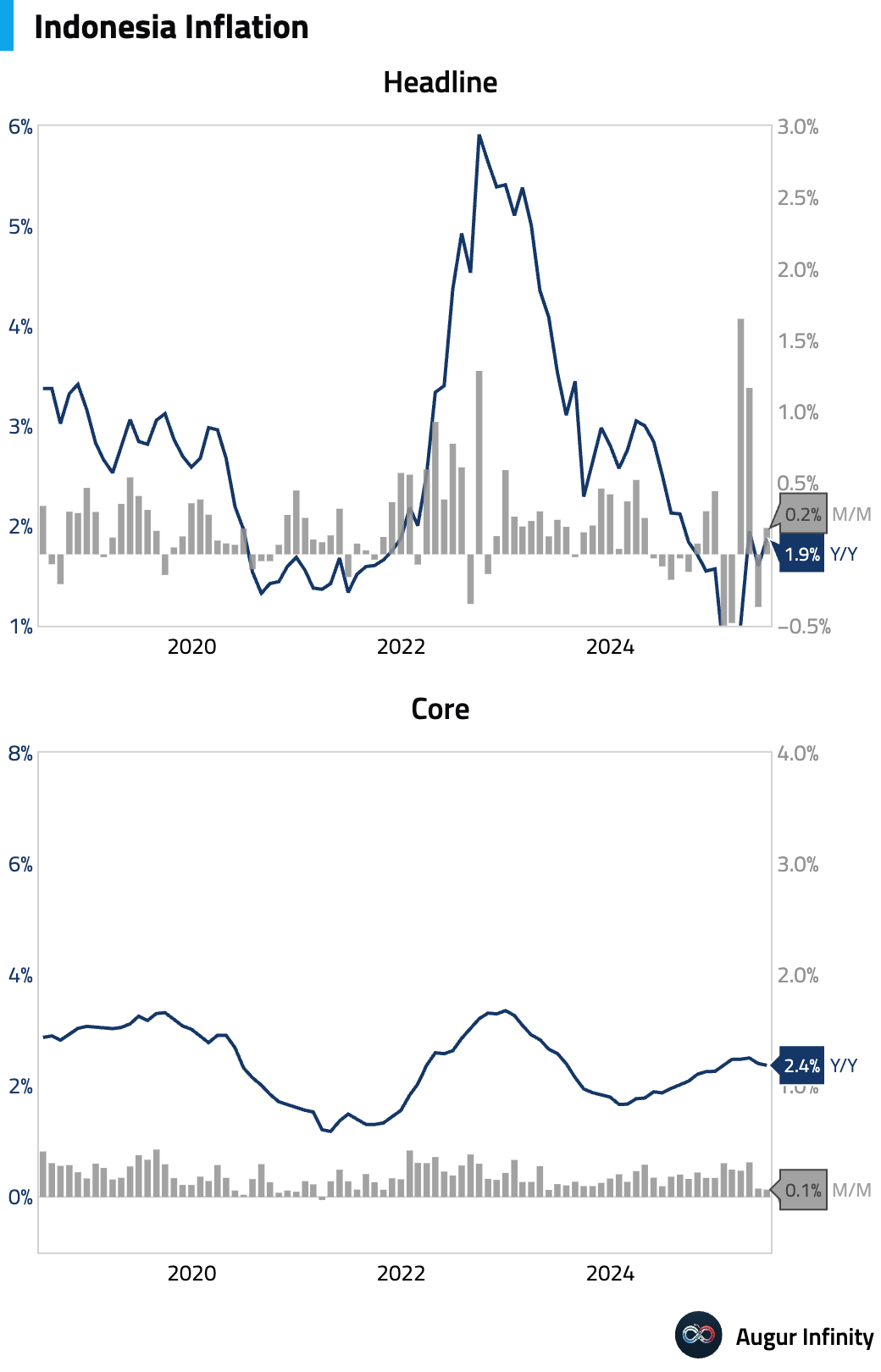

- Indonesian inflation accelerated in June, with the headline rate rising to 1.87% Y/Y from 1.60%, slightly above the 1.83% consensus. Core inflation, however, slowed to 2.37% Y/Y from 2.40%.

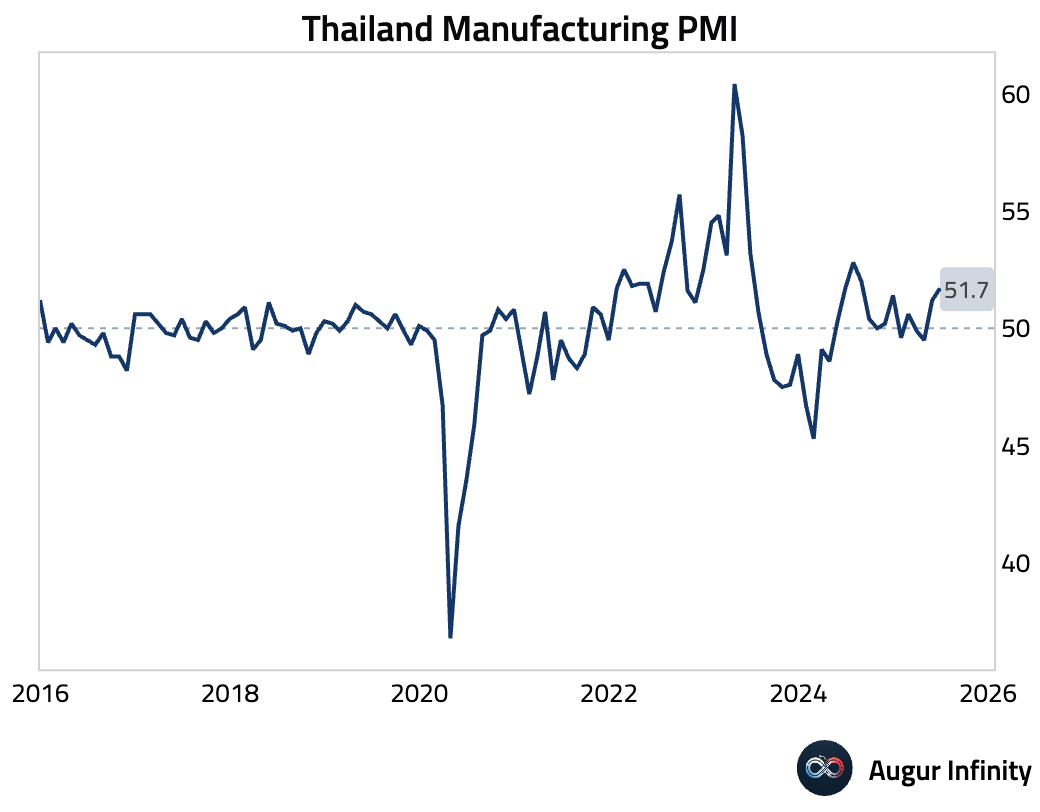

- Thailand's S&P Global Manufacturing PMI rose to a 10-month high of 51.7 in June, driven by faster production growth. However, employment stalled and business optimism fell to a one-year low, suggesting underlying caution.

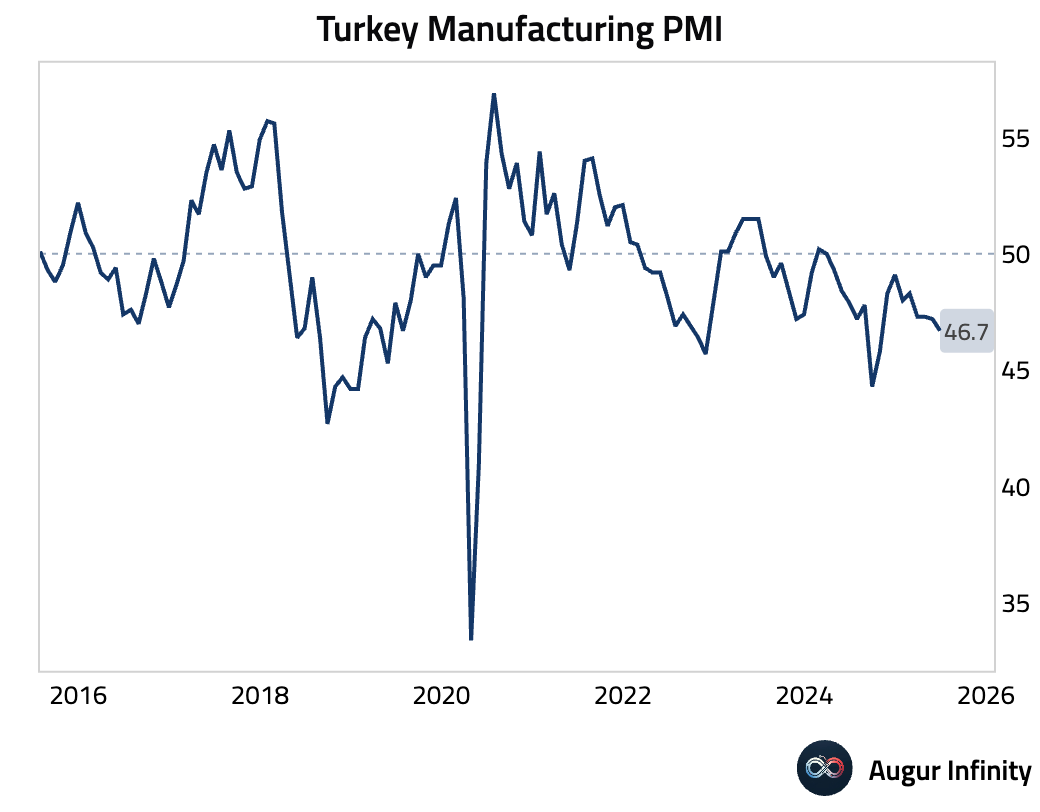

- Turkey’s manufacturing PMI fell to 46.7 in June from 47.2, signaling a deepening contraction. The sharpest fall in output since October 2024 was driven by weak demand, as firms' margins were squeezed by accelerating input costs and muted pricing power.

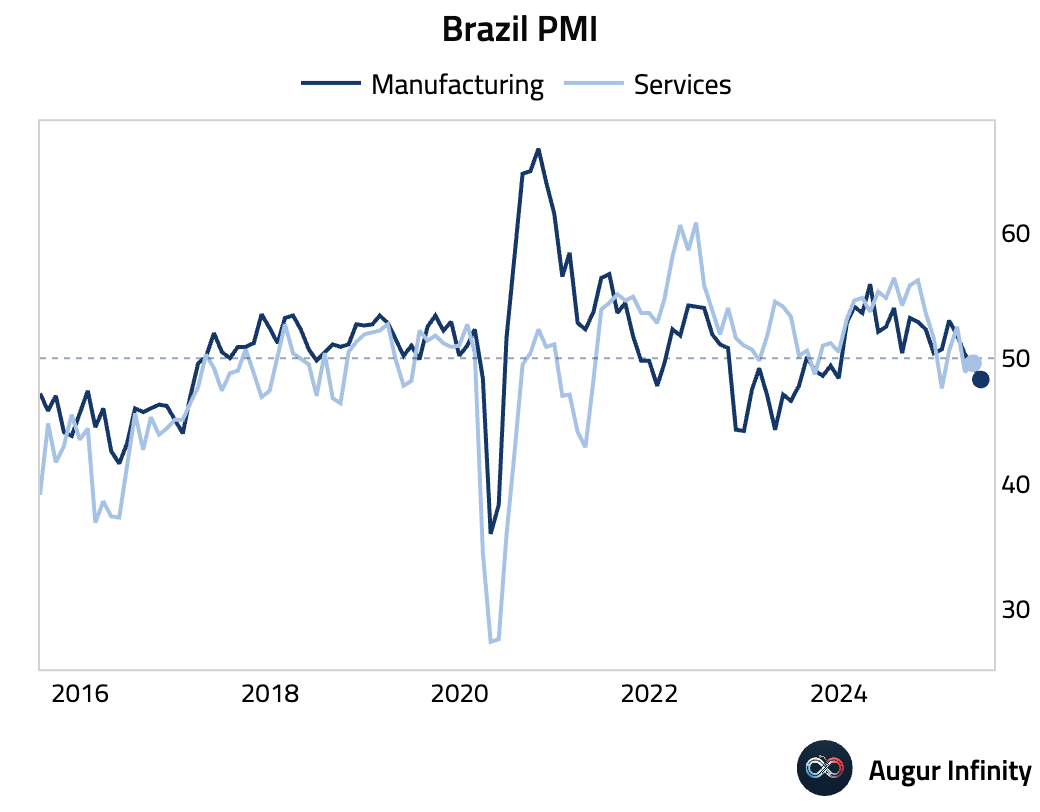

- Brazil’s S&P Global Manufacturing PMI fell to 48.3 in June from 49.4, its fastest contraction since July 2023. The downturn was driven by the steepest drop in export orders since January 2023, causing firms to cut jobs for the first time in 23 months.

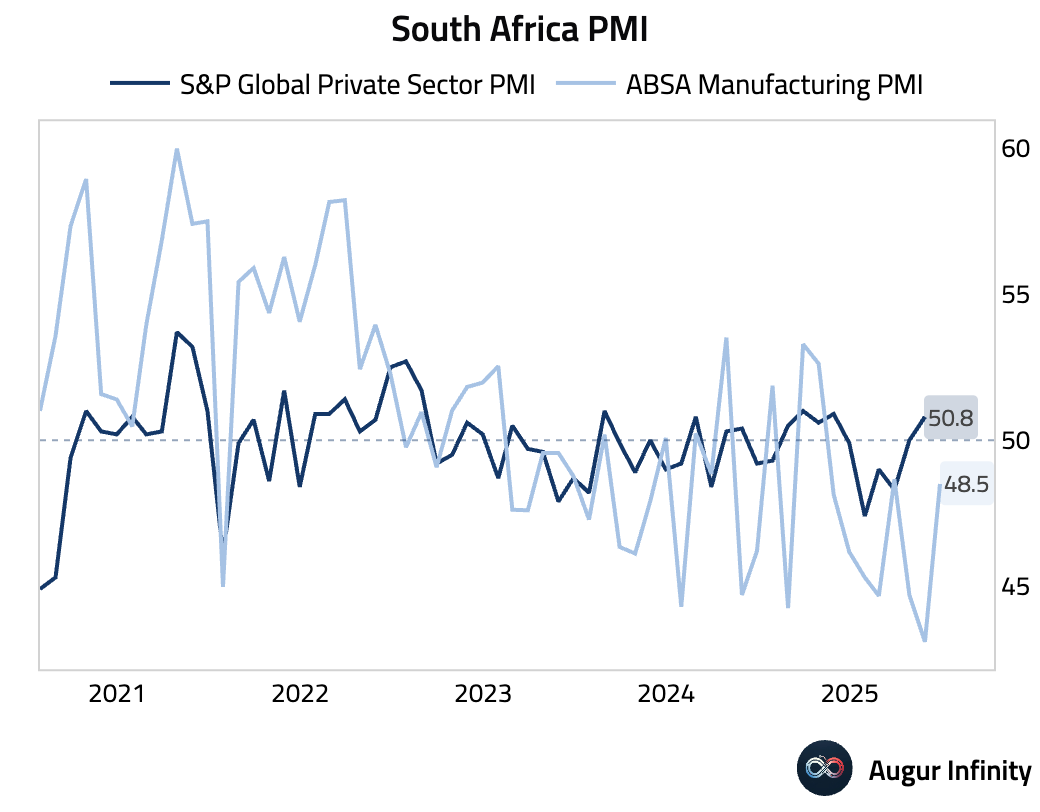

- South Africa’s ABSA Manufacturing PMI rebounded to 48.5 in June from 43.1 in May, indicating a slower pace of contraction.

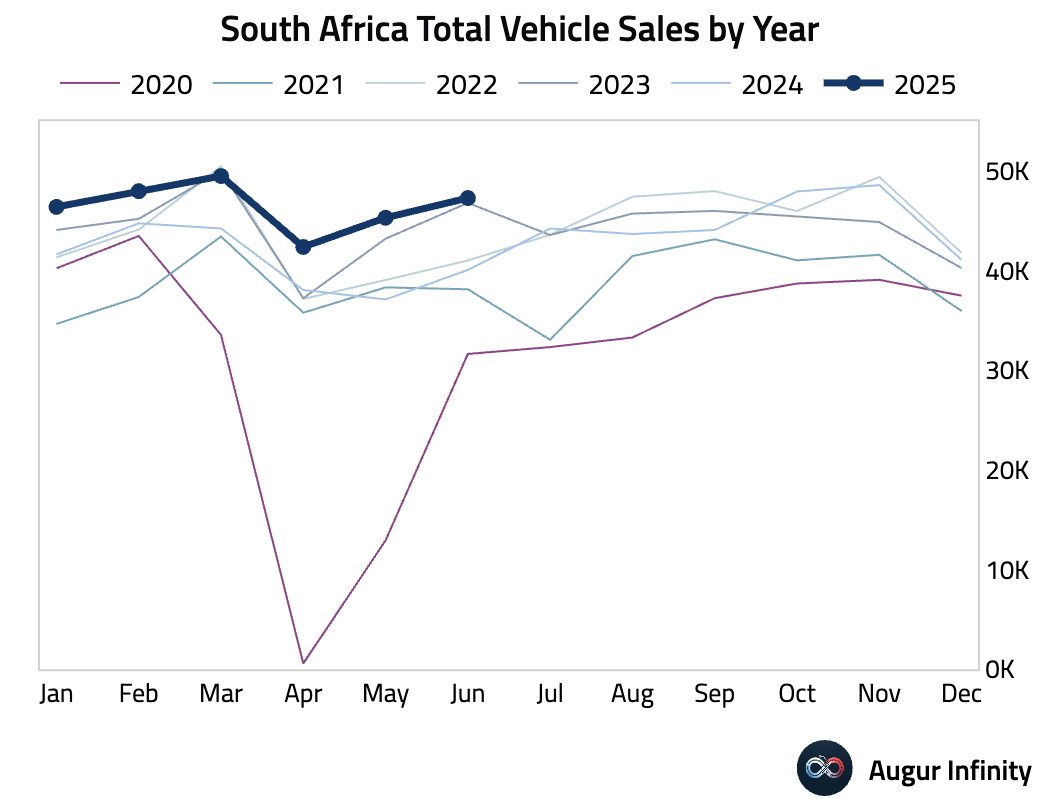

- South Africa's total new vehicle sales rose to 47,290 in June from 45,310 in May.

- Mexico’s S&P Global Manufacturing PMI fell to 46.3 in June from 46.7, indicating a continued contraction in the sector.

- Mexican business confidence edged down to 49.3 in June from 49.5 in May.

Equities

- US markets were slightly lower, with the S&P 500 down 0.1% and the Nasdaq Composite falling 0.8%. European markets were mixed, though France extended its winning streak to four days with a 0.2% gain. In emerging markets, Mexico continued its strong run, rising 0.9% for its sixth consecutive day of gains.

Fixed Income

- The US Treasury yield curve experienced a bear flattening, with yields rising across most of the curve, led by the short end. The 2-year yield increased by 6.3 bps, while the 10-year yield rose by a more modest 2.5 bps. The 30-year yield was an outlier, declining by 0.2 bps.

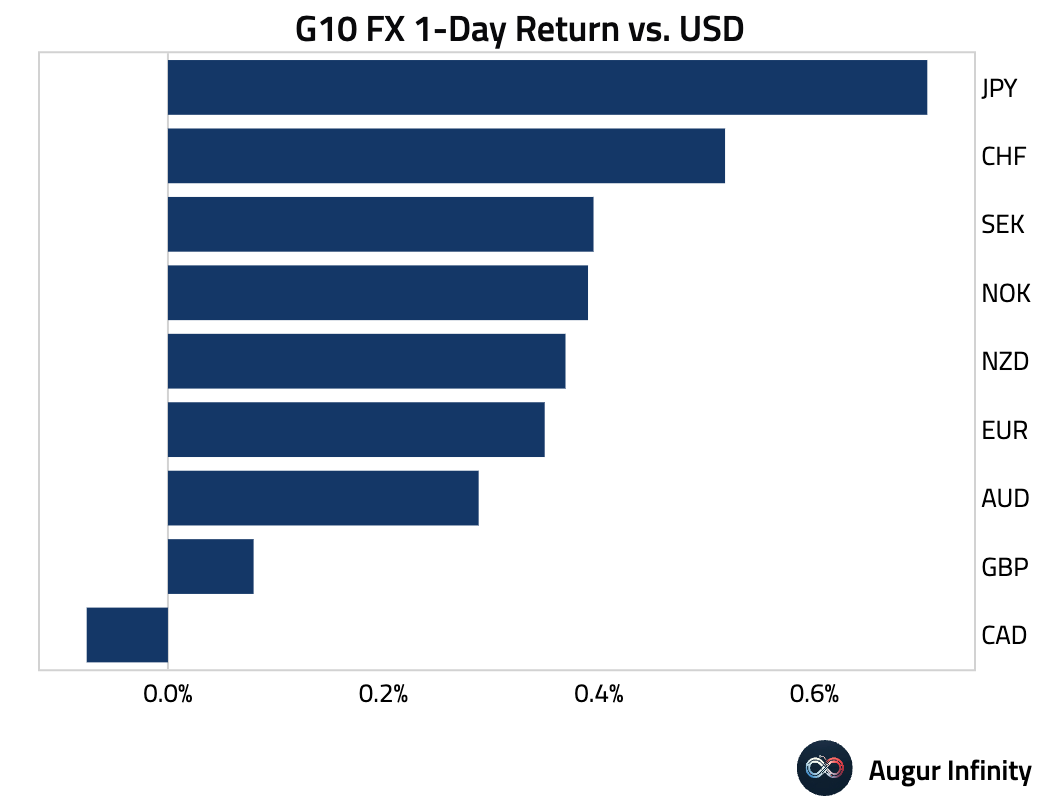

FX

- The US dollar weakened against all G10 peers. The euro was a standout performer, rising 0.3% against the dollar for its eighth consecutive day of gains. The Swiss franc also showed notable strength, appreciating 0.5% and posting its fourth straight daily gain.

Disclaimer

Augur Digest is an automated newsletter written by an AI. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.