Canada

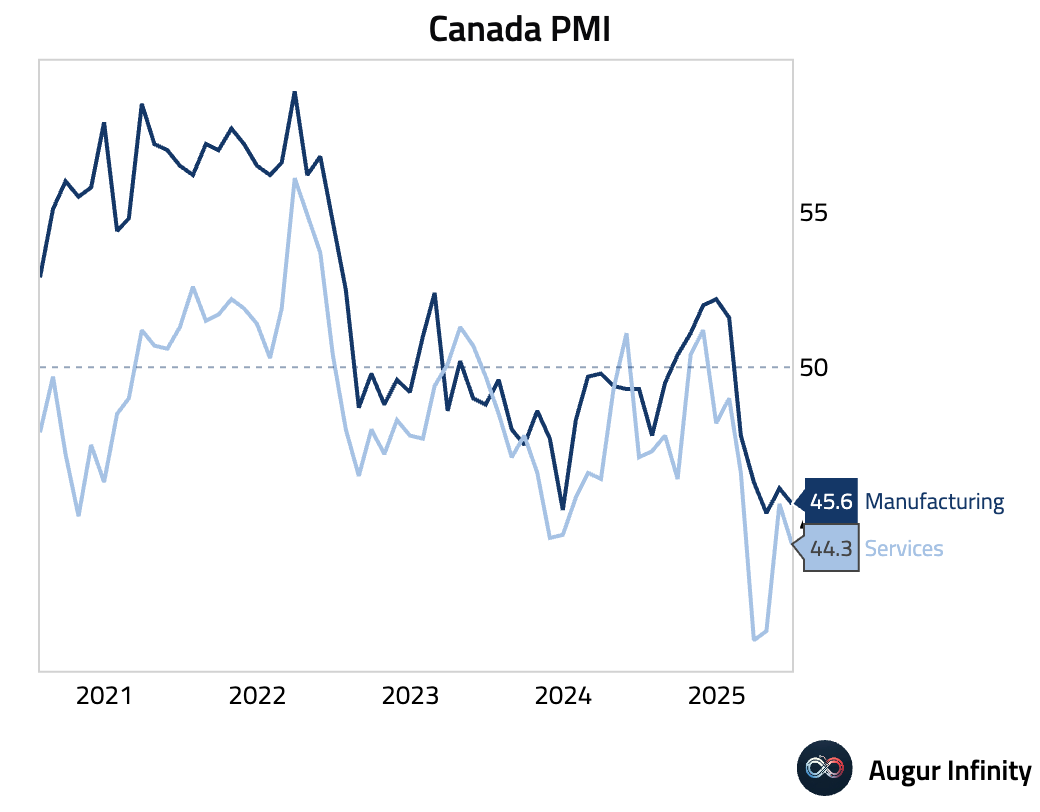

- Canada’s S&P Global Services PMI fell to 44.3 in June from 45.6, indicating a faster pace of contraction and the seventh consecutive month of contraction. The drop was driven by weak new business amid uncertainty over US trade policy and tariffs. Despite falling activity, input cost inflation hit its highest level since October 2022, forcing firms to raise selling prices at the fastest pace in over a year. Hiring was modest and largely part-time, signaling deep-seated caution among businesses.

Europe

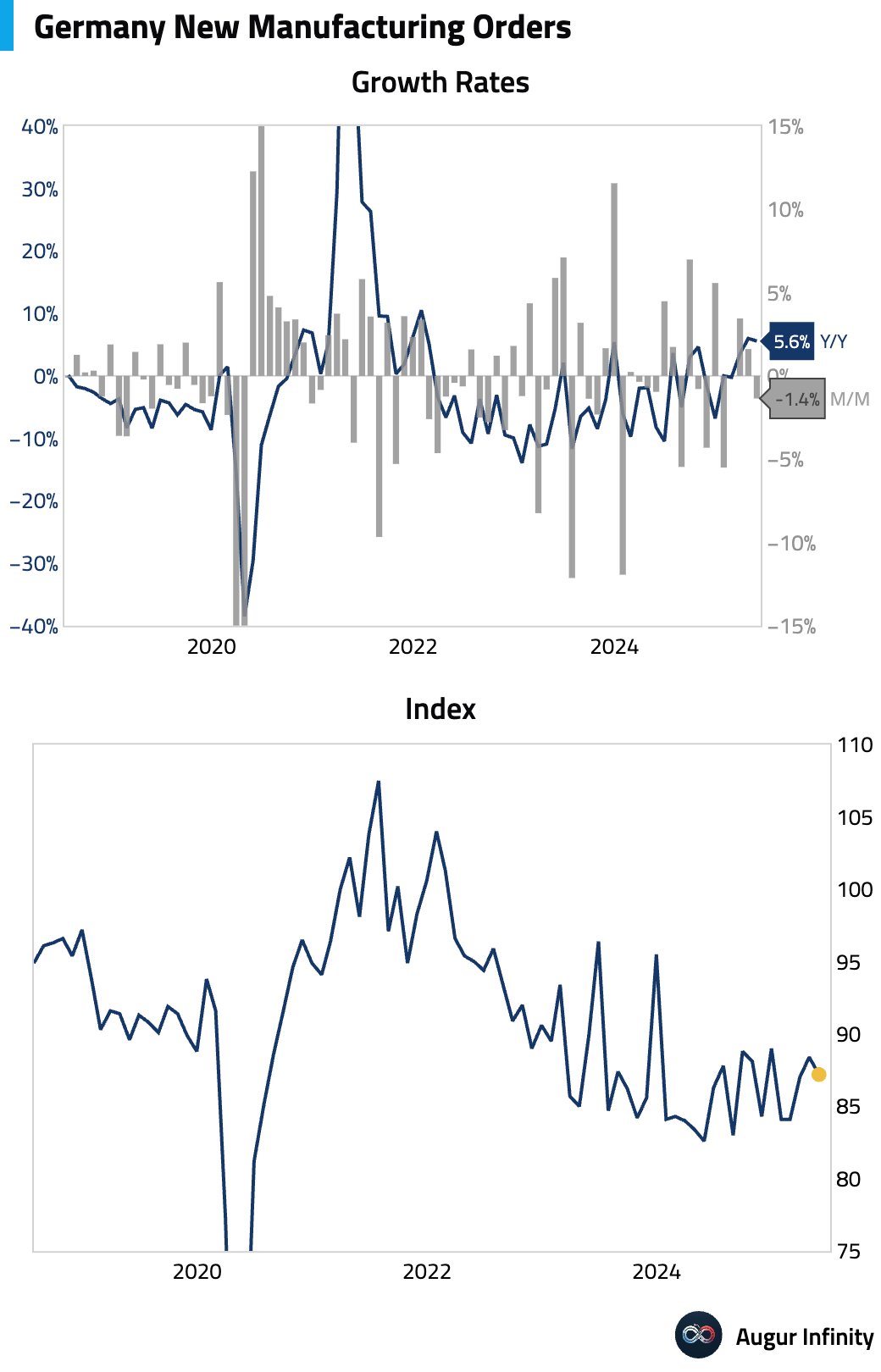

- German factory orders unexpectedly fell 1.4% M/M in May, significantly missing the consensus estimate of a 0.1% decline. The weakness was concentrated in domestic demand, which plunged 7.8% M/M, while export orders rose a solid 2.9%, driven entirely by non-Euro area demand. The decline suggests some payback after official data had been running ahead of softer PMIs. In a positive contrast, the auto sector showed signs of life as separate data indicated car production rose for a second month, providing a key offset to weakness elsewhere in the industrial sector.

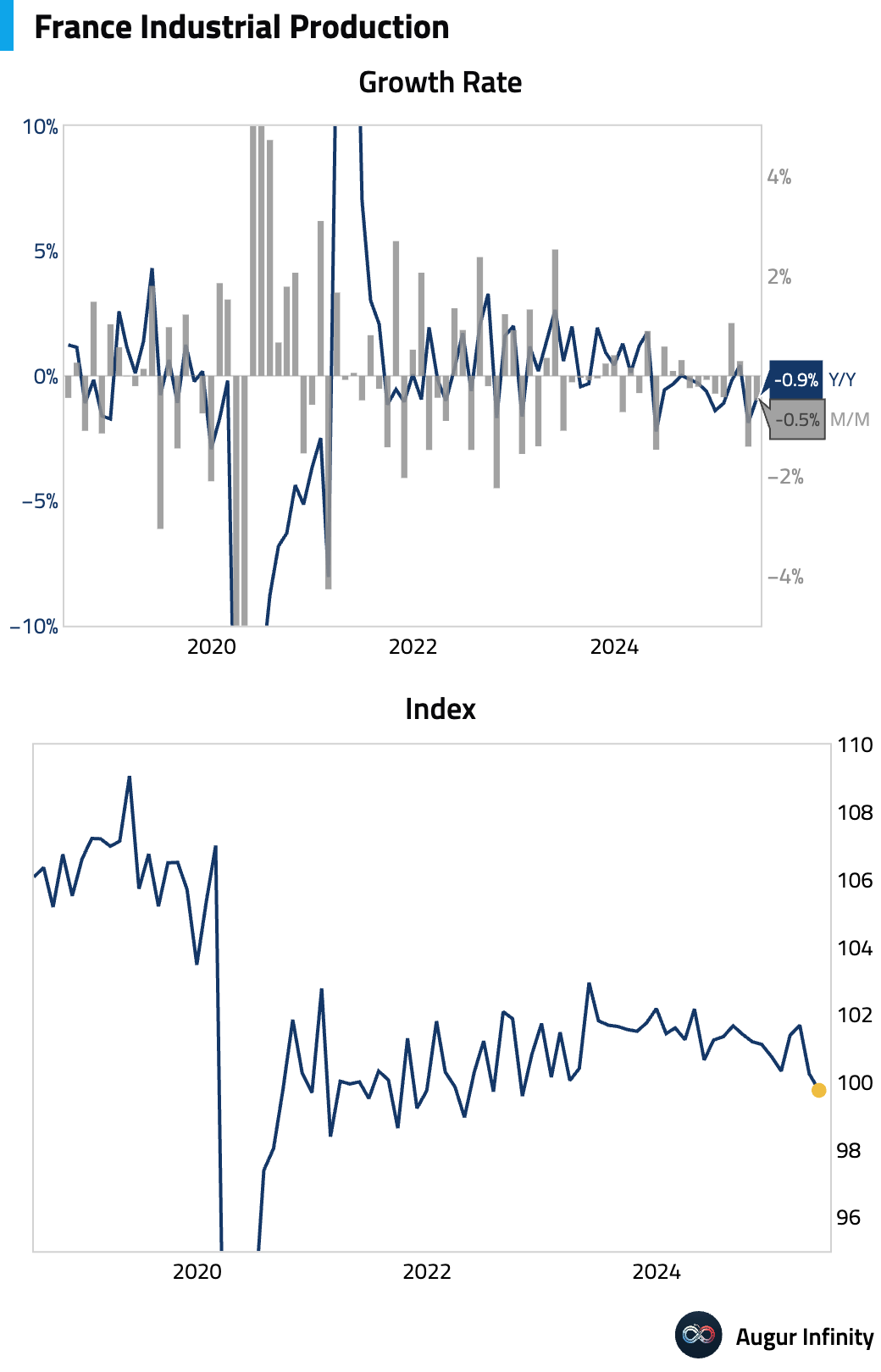

- French industrial production ex-construction unexpectedly dropped 0.5% M/M in May, widely missing consensus expectations for a 0.3% gain. The miss was driven by a sharp 1.0% M/M fall in manufacturing output, which saw broad-based declines. This appears to reflect genuine weakness, as US tariff front-loading effects seen in other countries were reportedly insignificant in France.

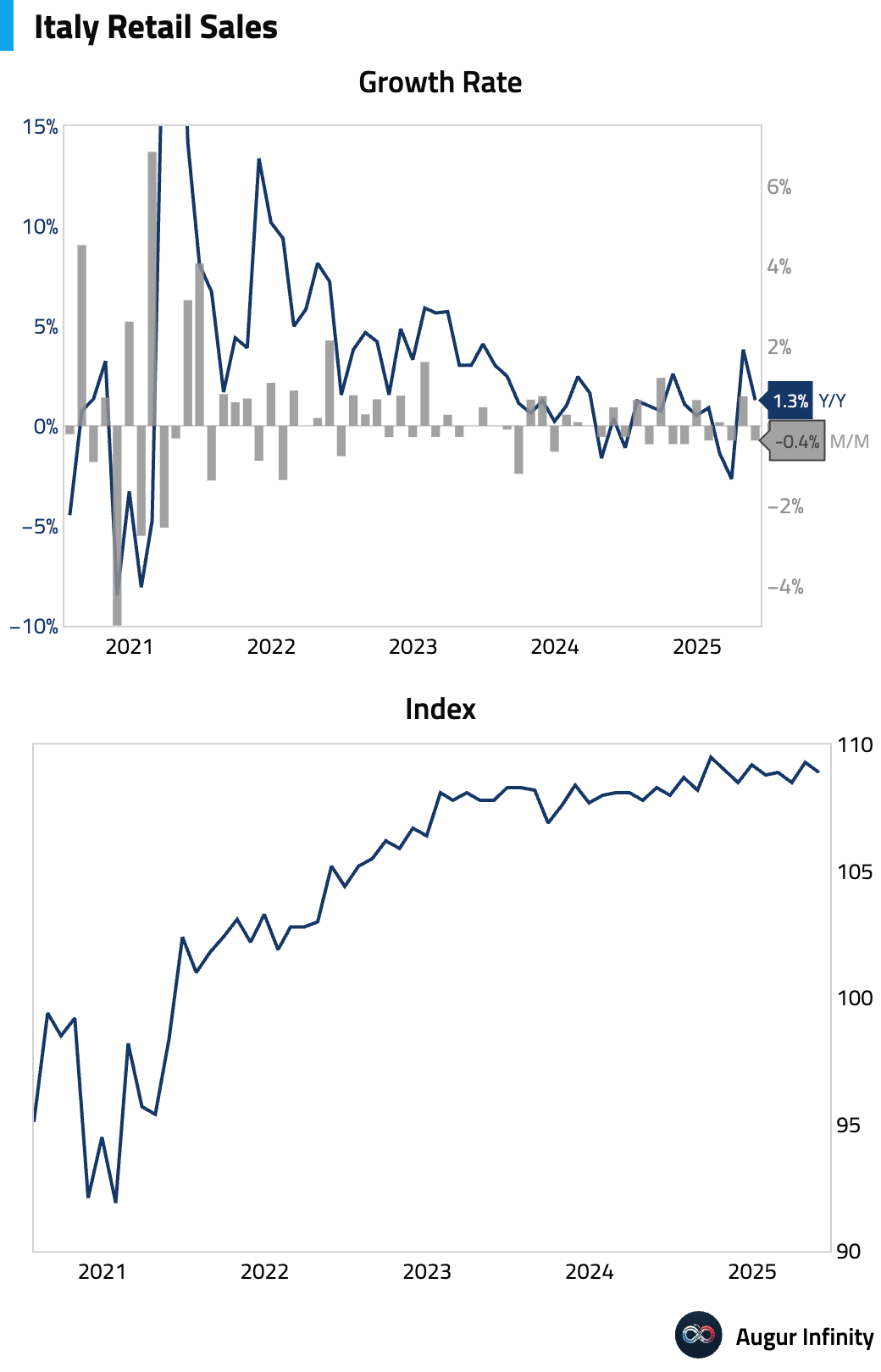

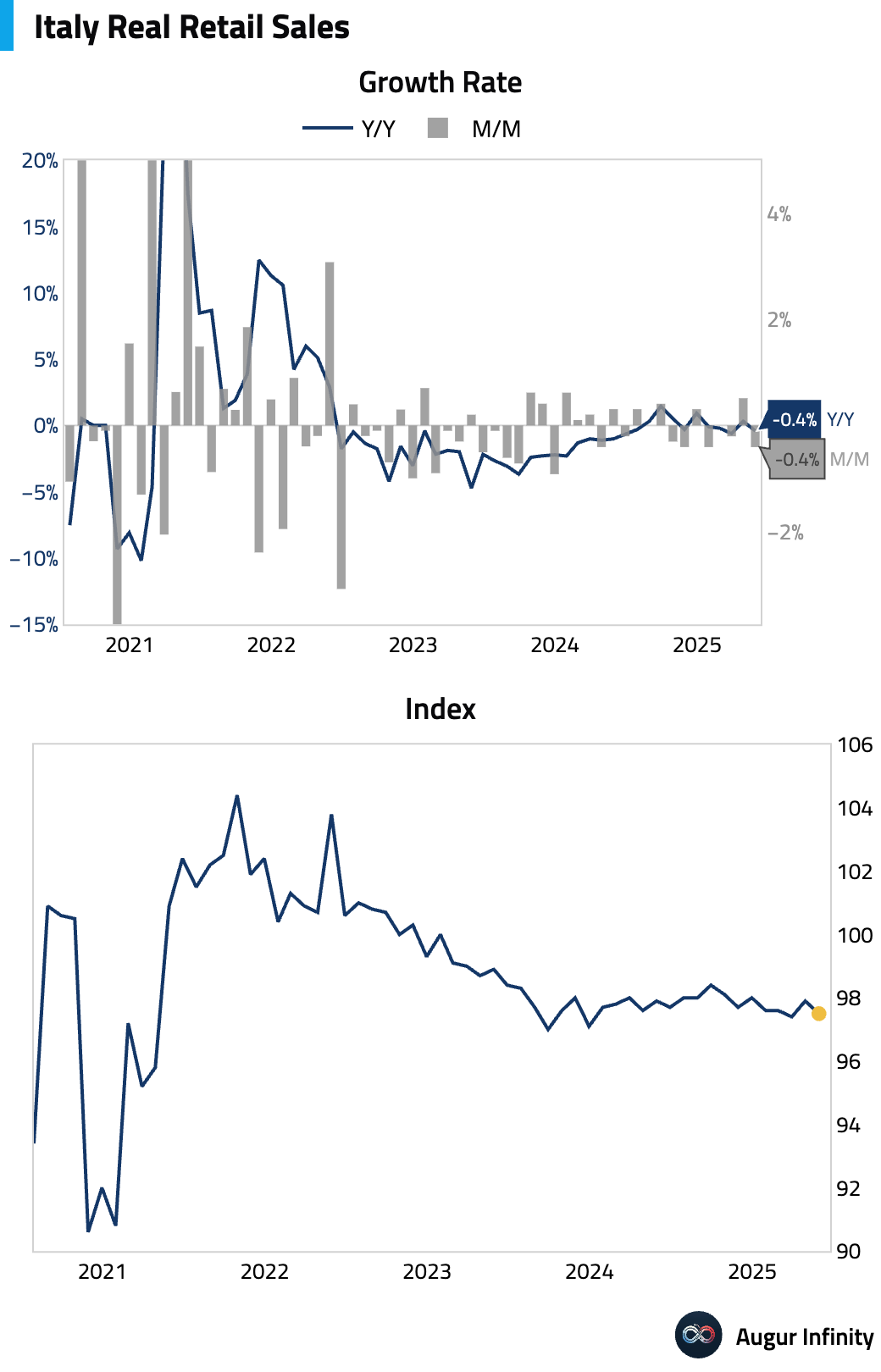

- Italian retail sales fell 0.4% M/M in May, missing the 0.5% consensus estimate and reversing a 0.7% gain in April. The Y/Y growth rate slowed sharply to 1.3% from 3.8%.

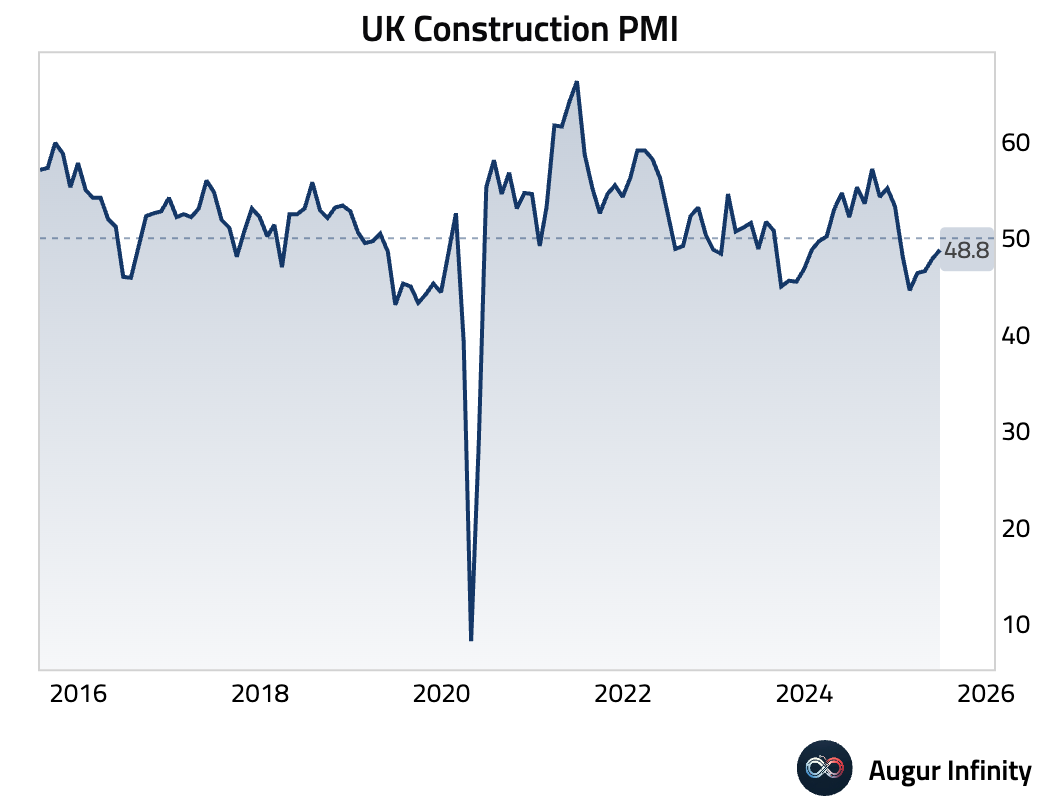

- The UK’s S&P Global Construction PMI rose to 48.8 in June from 47.9, beating the 48.4 consensus. While still in contractionary territory, the reading indicates a moderating pace of decline in the sector.

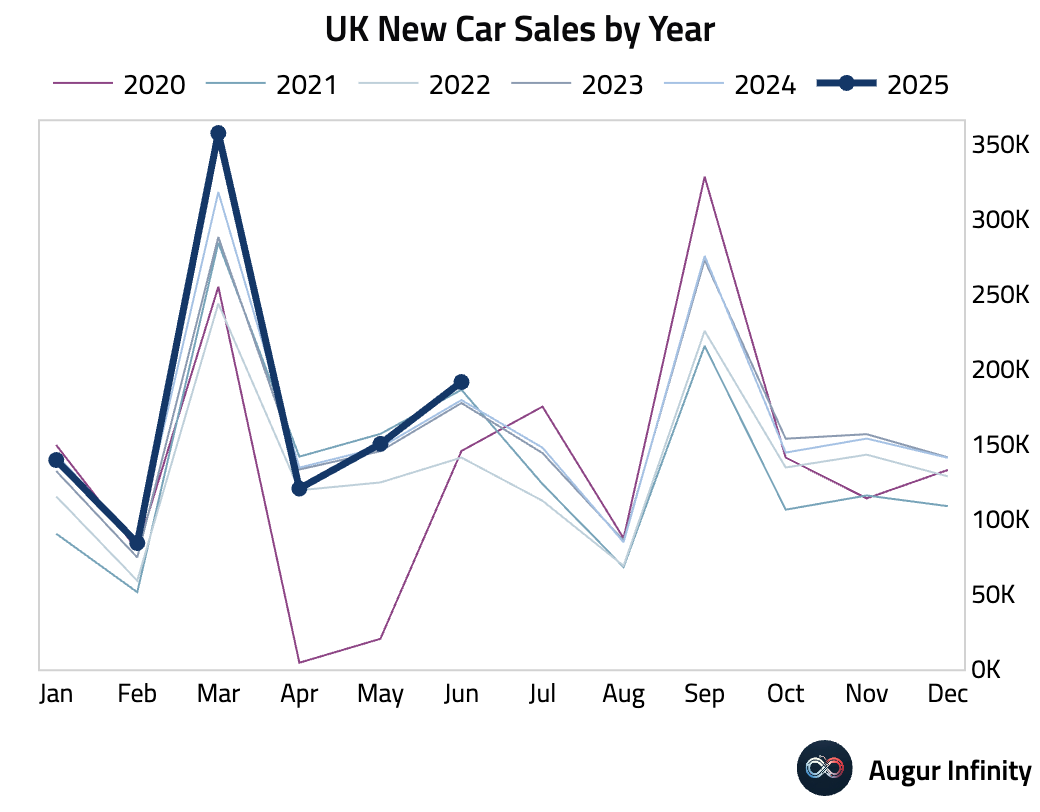

- UK new car sales grew 6.7% Y/Y in June, accelerating from the 1.6% pace recorded in May.

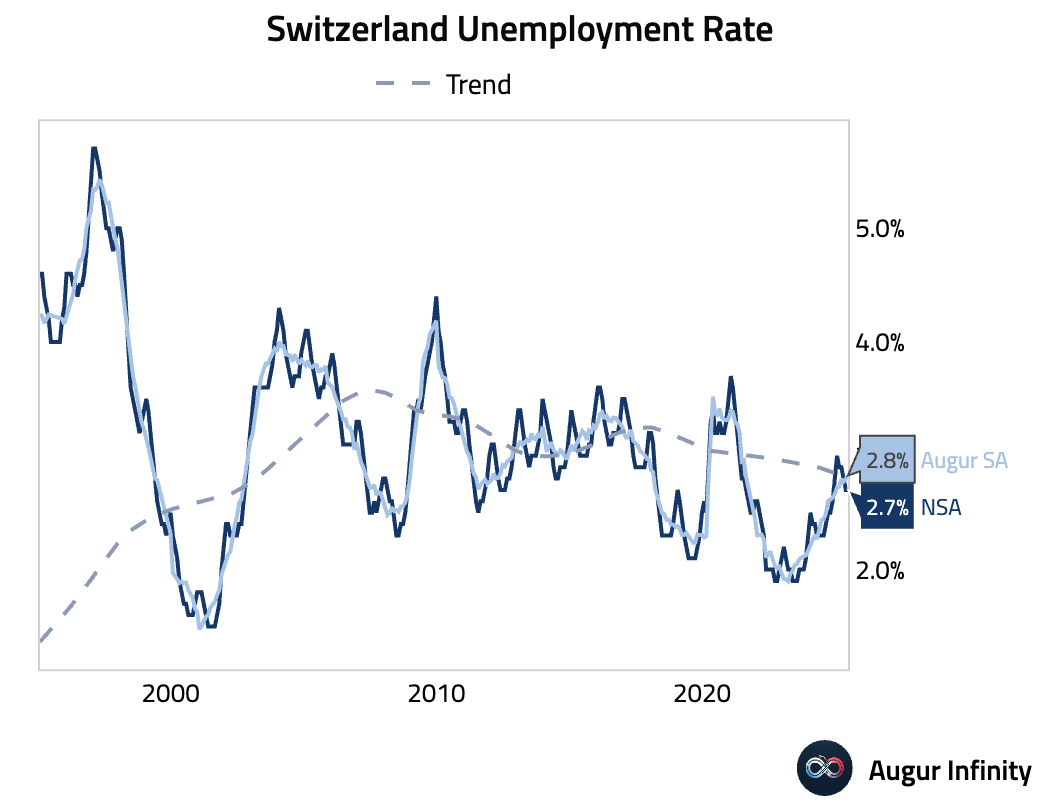

- Switzerland’s unemployment rate held steady at 2.7% in June.

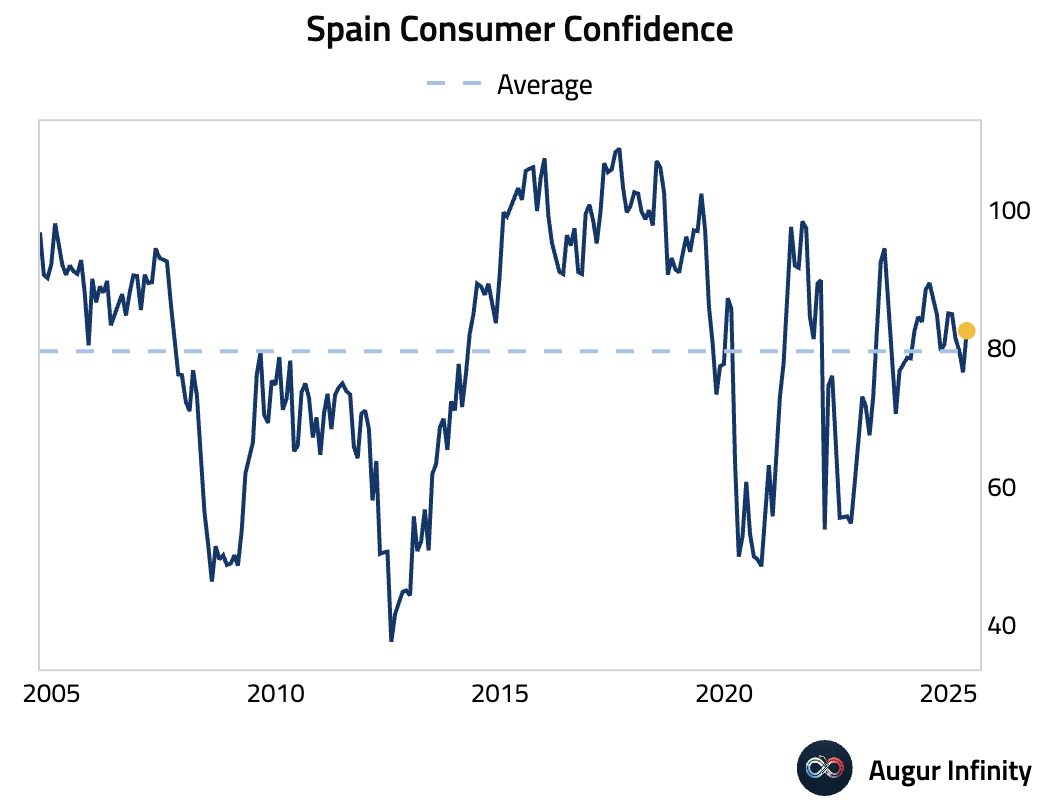

- Spanish consumer confidence jumped to 82.5 in June from 76.5 in May, marking a five-month high.

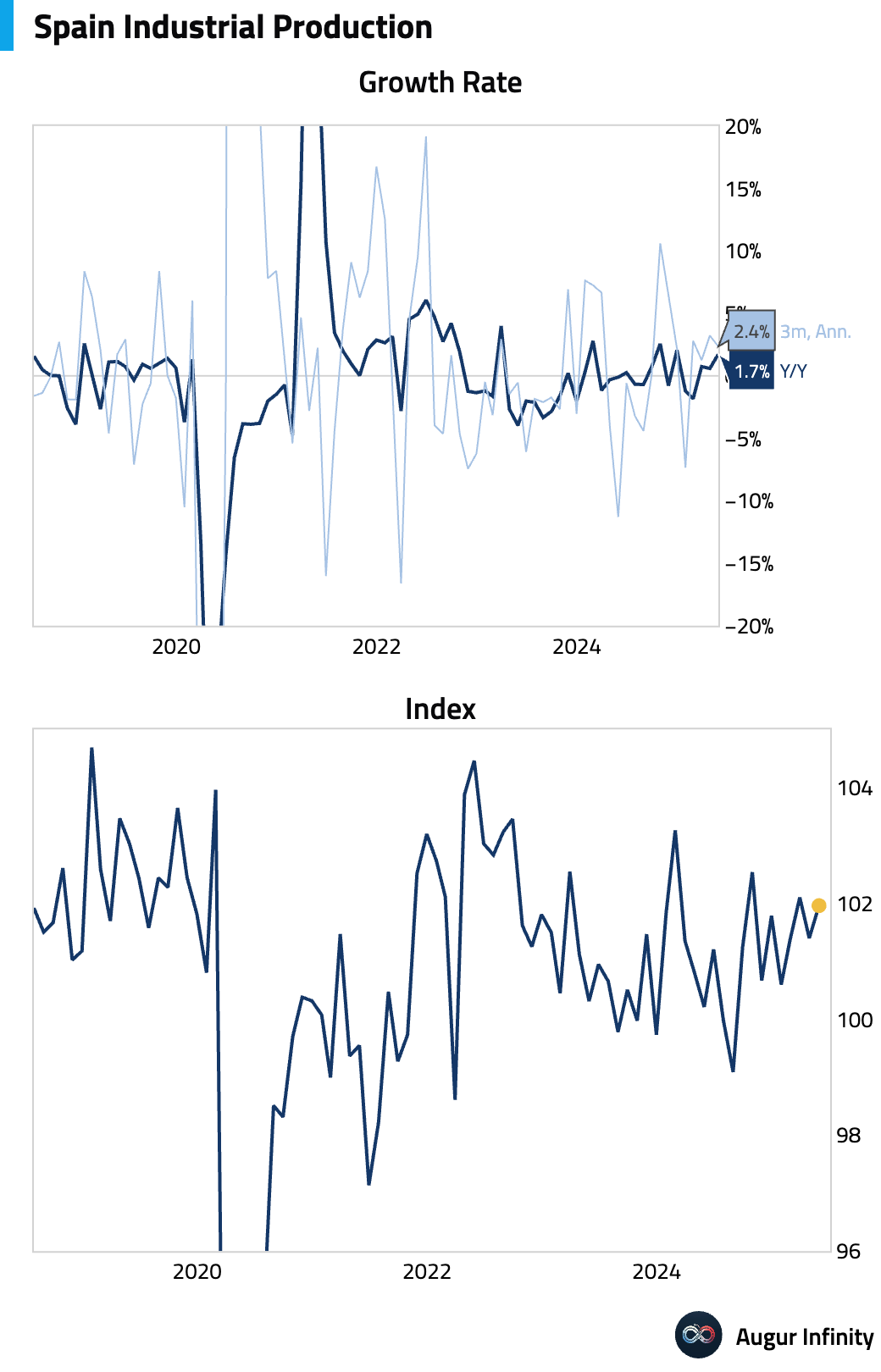

- Spain’s industrial production expanded by 1.7% Y/Y in May, accelerating from a 0.6% gain in the prior month.

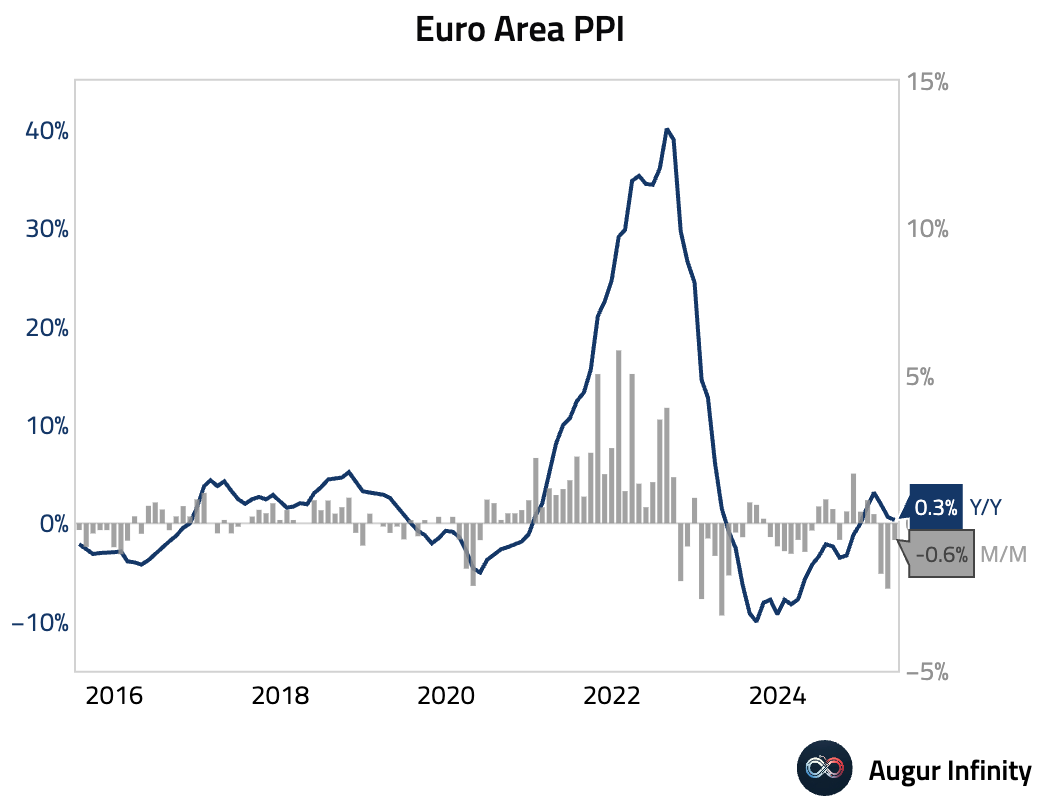

- The Eurozone Producer Price Index (PPI) declined 0.6% M/M in May, a slightly larger drop than the -0.5% consensus. The Y/Y rate decelerated to 0.3% from 0.7%.

Asia-Pacific

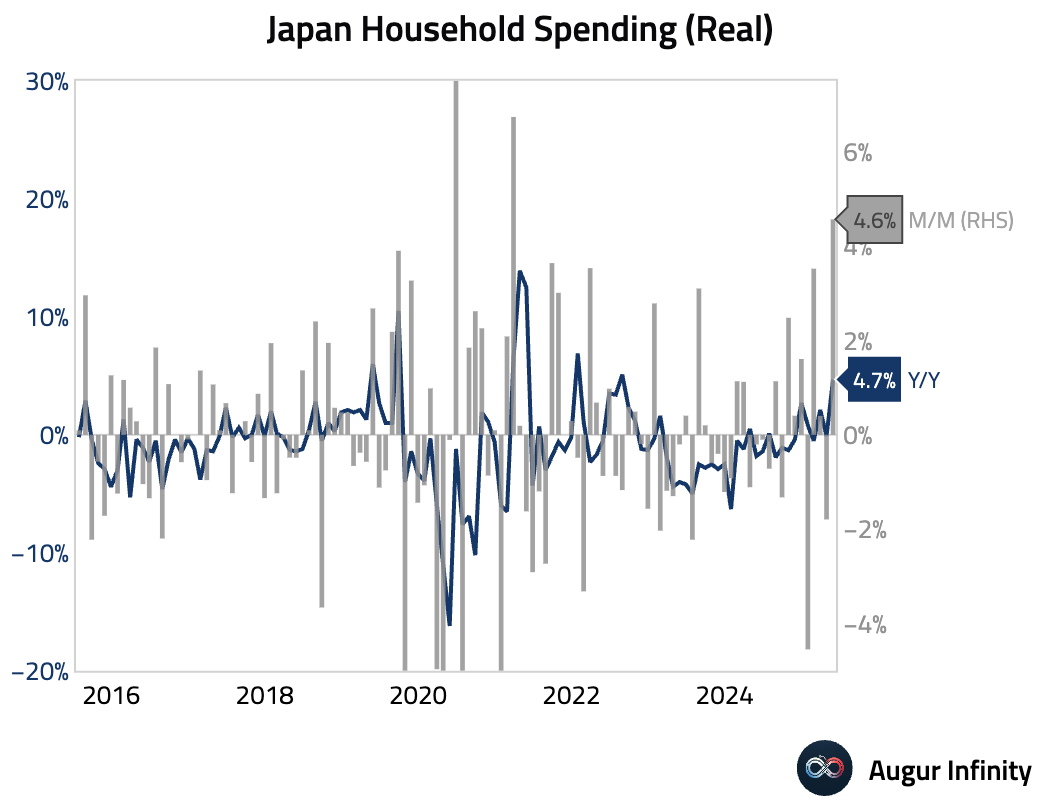

- Japanese household spending surged in May, rising 4.6% M/M (vs. 0.4% consensus) and 4.7% Y/Y (vs. 1.2% consensus). The monthly increase was the strongest since March 2021, while the annual gain was the largest since August 2022, suggesting a robust rebound in consumer activity.

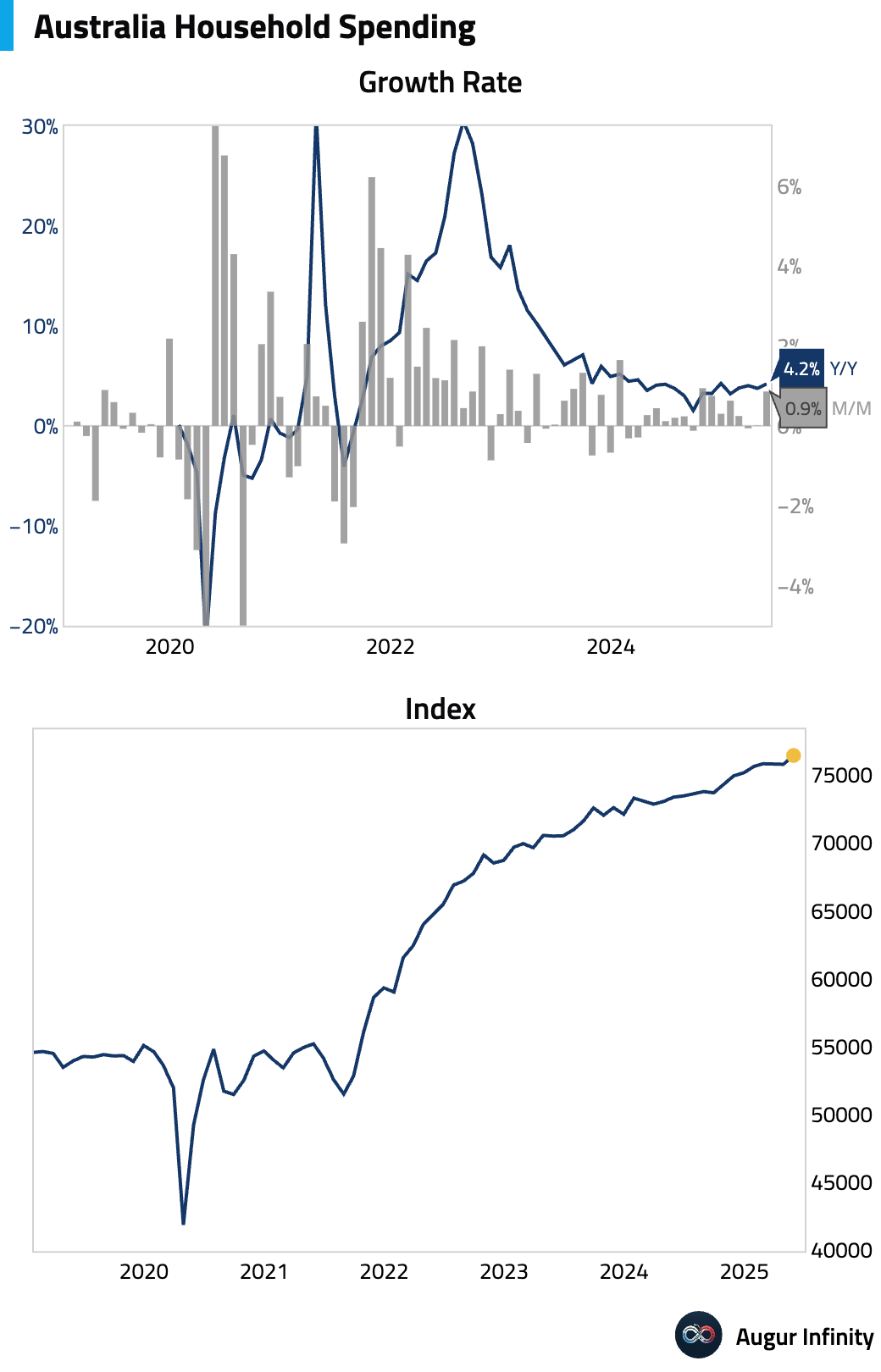

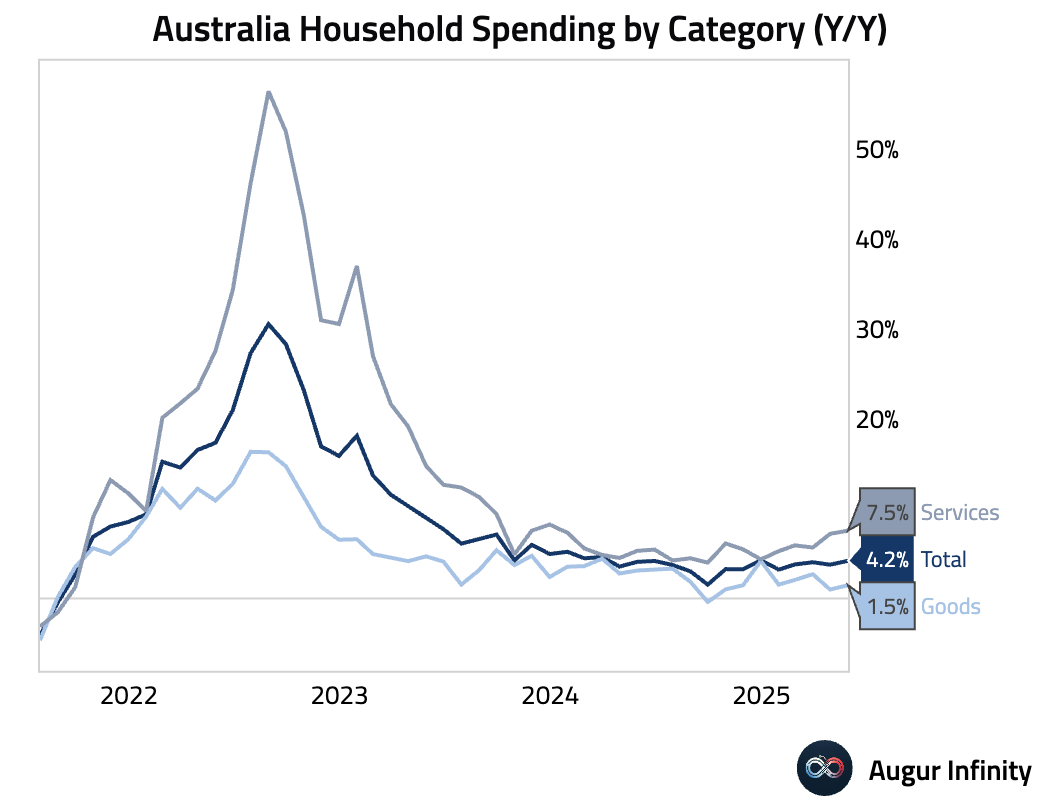

- Australian household spending rose 0.9% M/M in May, marking the strongest reading since October 2024. The Y/Y pace of spending also accelerated to 4.2%, its fastest since December 2024.

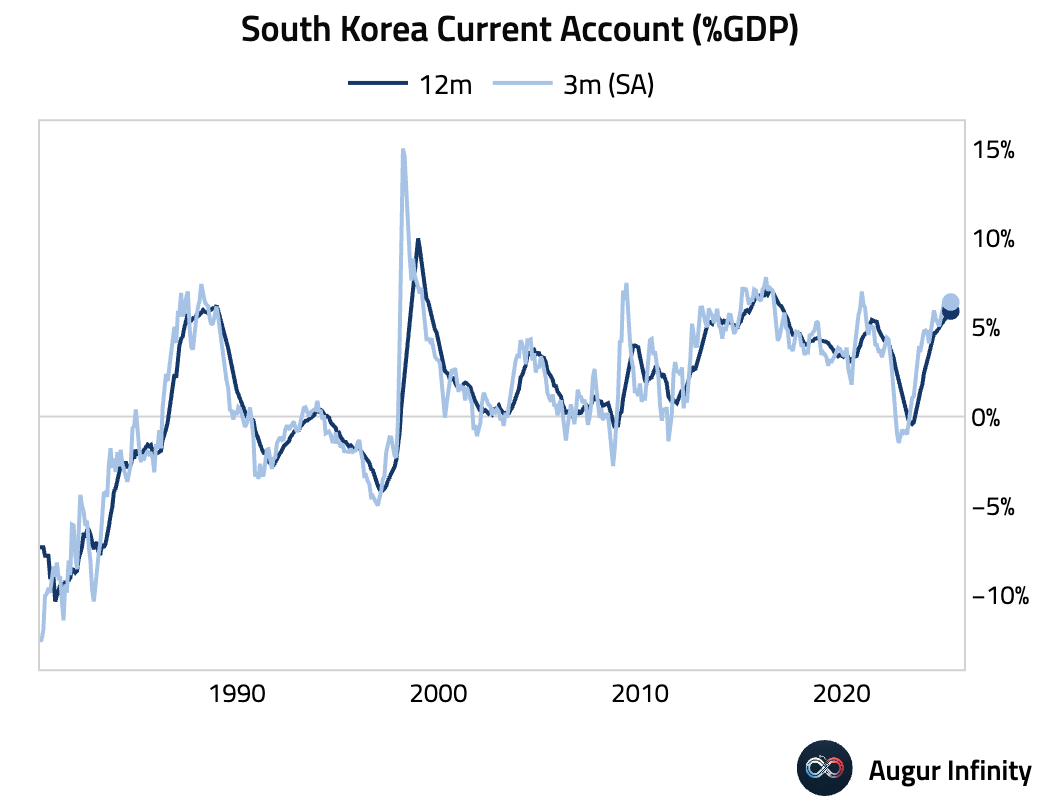

- South Korea’s current account surplus widened to $10.14 billion in May from $5.70 billion in April.

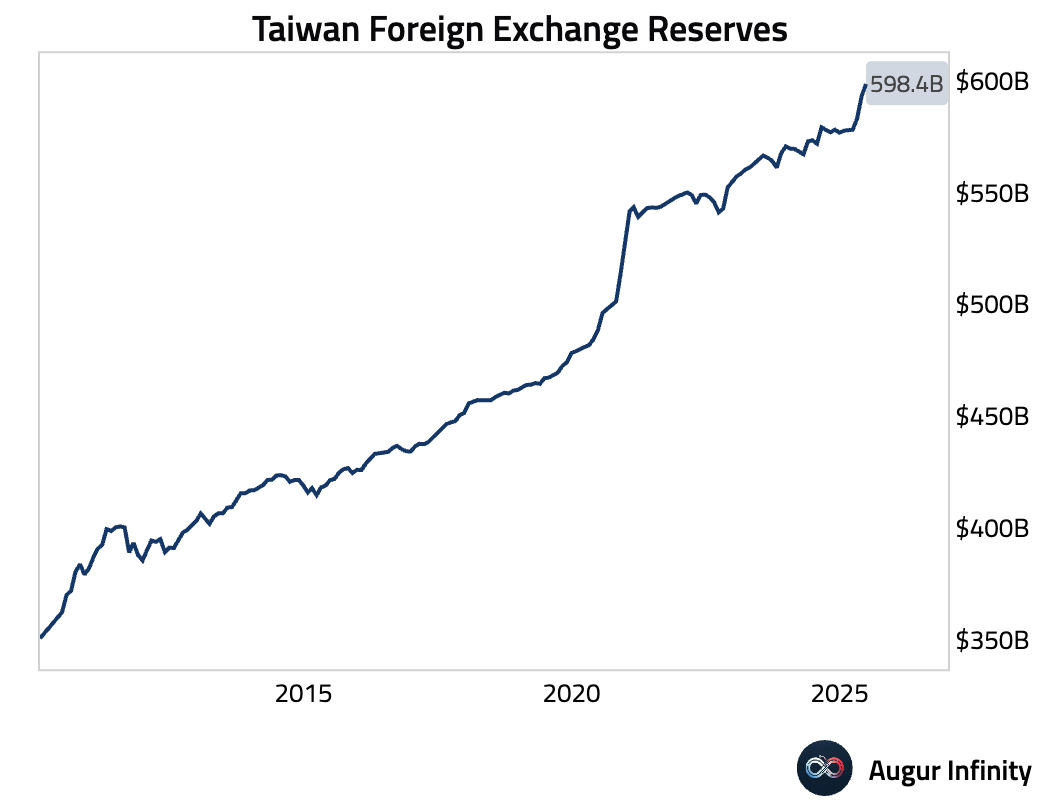

- Taiwan’s official foreign exchange reserves increased to a record $598.43 billion in June from $592.95 billion in May.

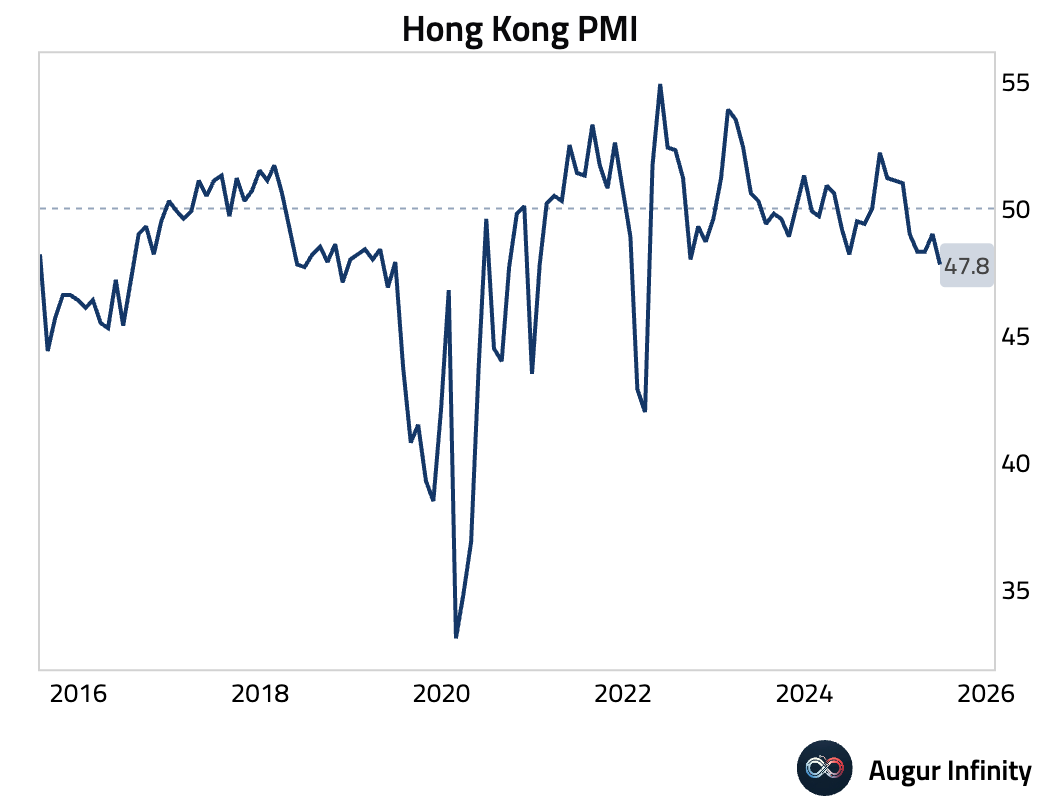

- Hong Kong’s S&P Global PMI fell to 47.8 in June from 49.0. The reading indicated a faster pace of private sector contraction and was the lowest since March 2022.

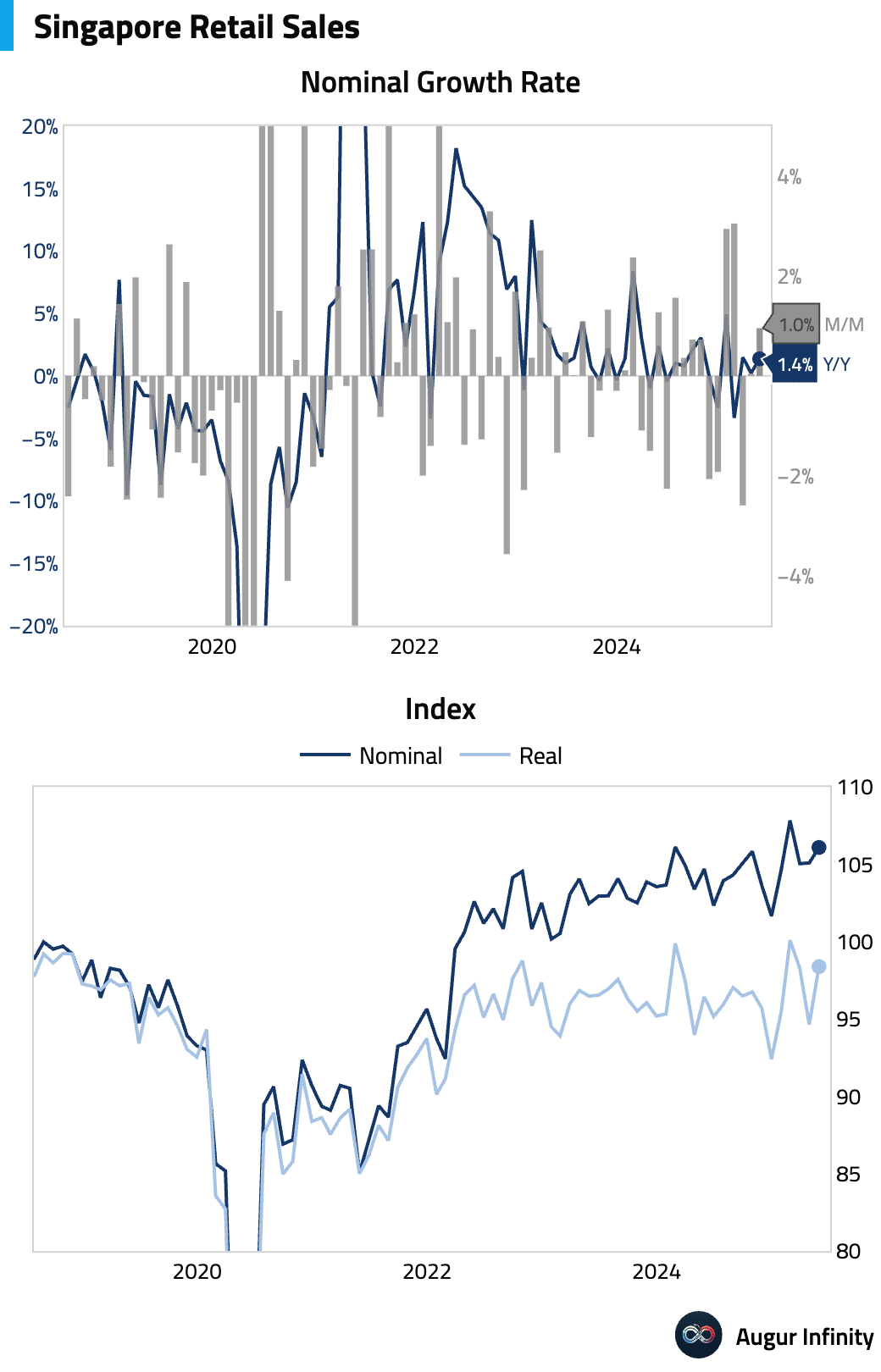

- Singapore’s retail sales increased 1.0% M/M in May, accelerating from a flat reading in April. Y/Y sales growth also picked up to 1.4% from 0.2%.

China

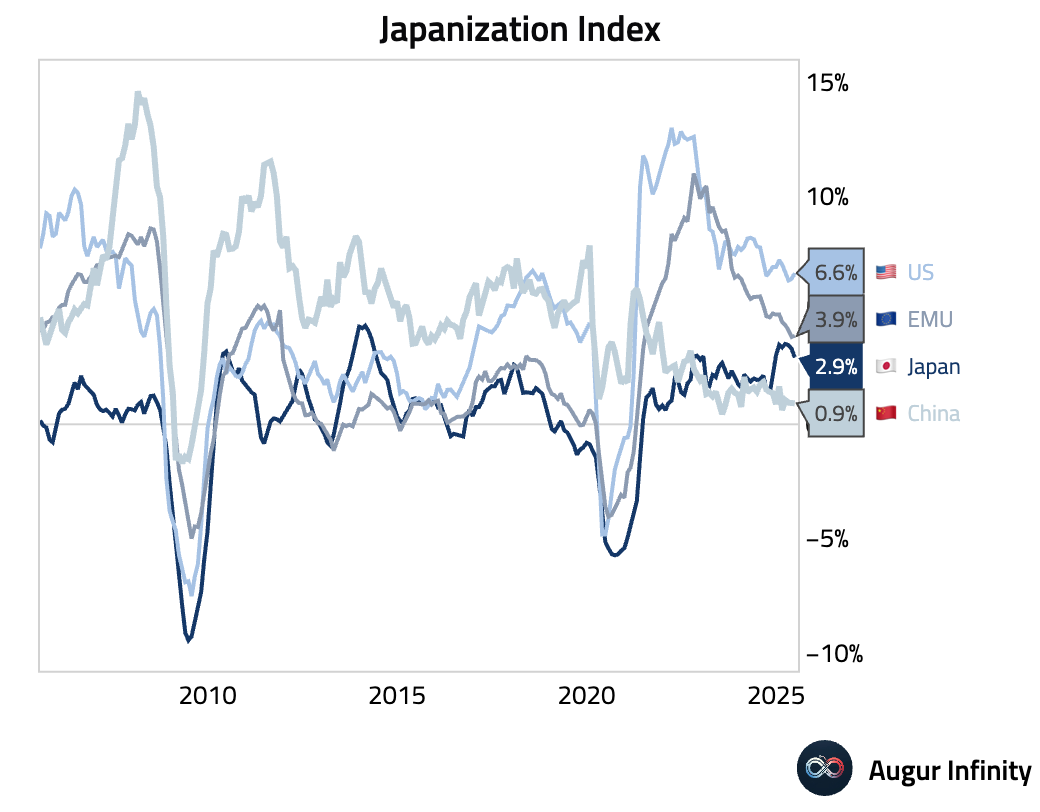

- According to Professor Takatoshi Ito’s Japanization indices, China remains more Japanized than Japan.

Emerging Markets ex China

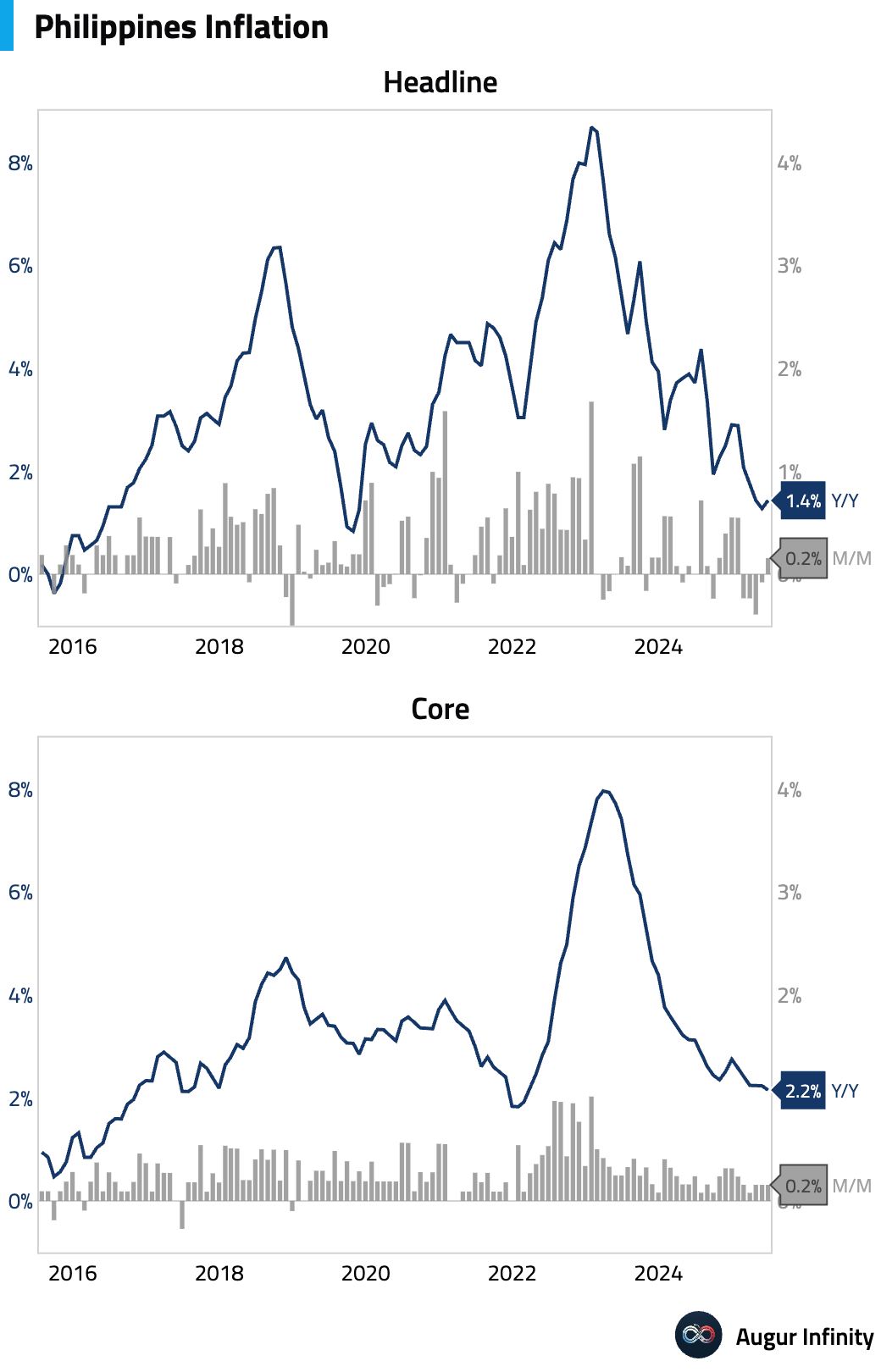

- The Philippines’ headline inflation rate ticked up to 1.4% Y/Y in June from 1.3% in May, coming in just below the 1.5% consensus forecast. Core inflation held steady at 2.2% Y/Y.

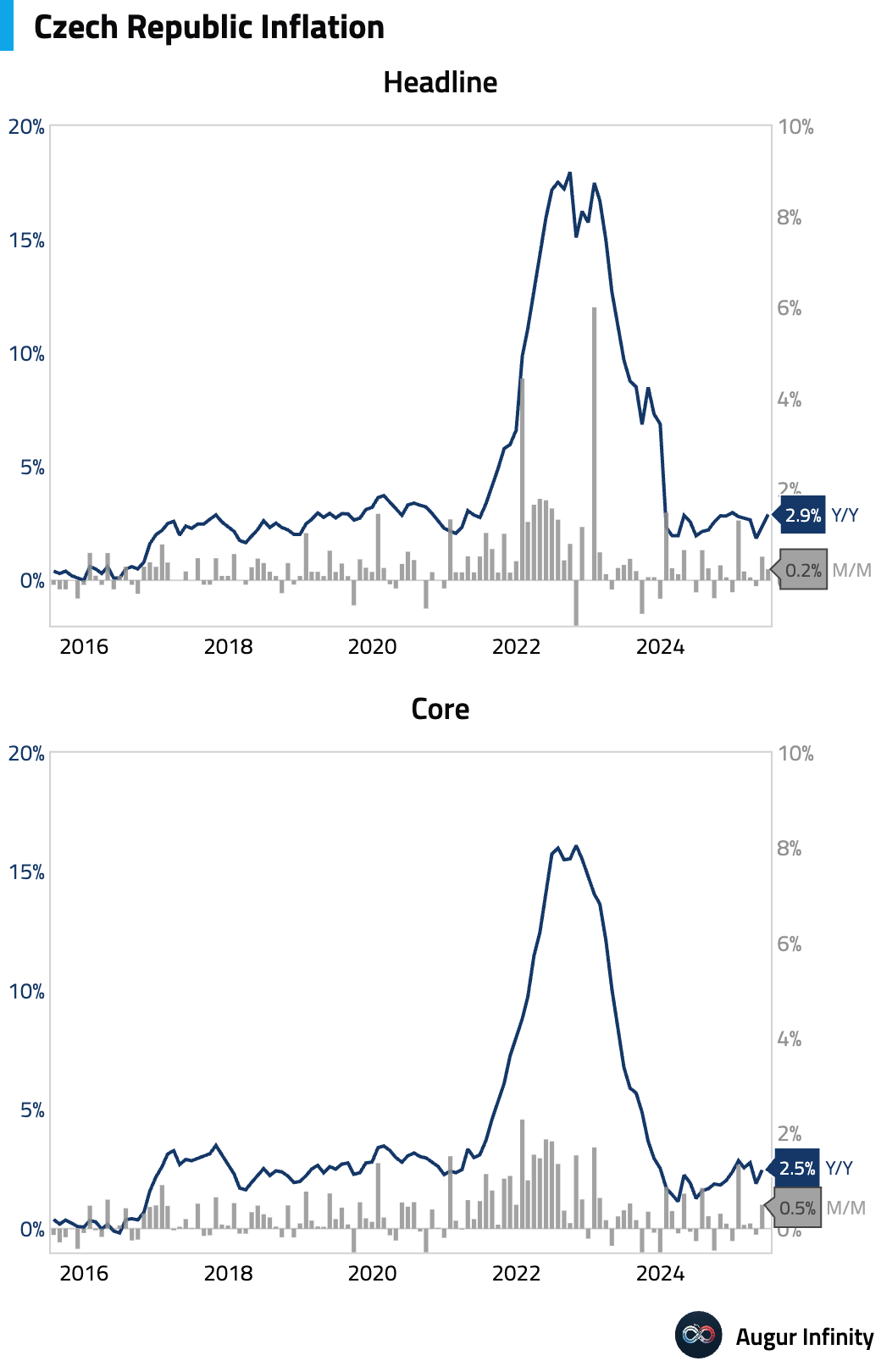

- The Czech Republic’s preliminary June inflation rate rose to 2.9% Y/Y from 2.4%, matching consensus expectations. The M/M increase was driven by slightly stronger food prices.

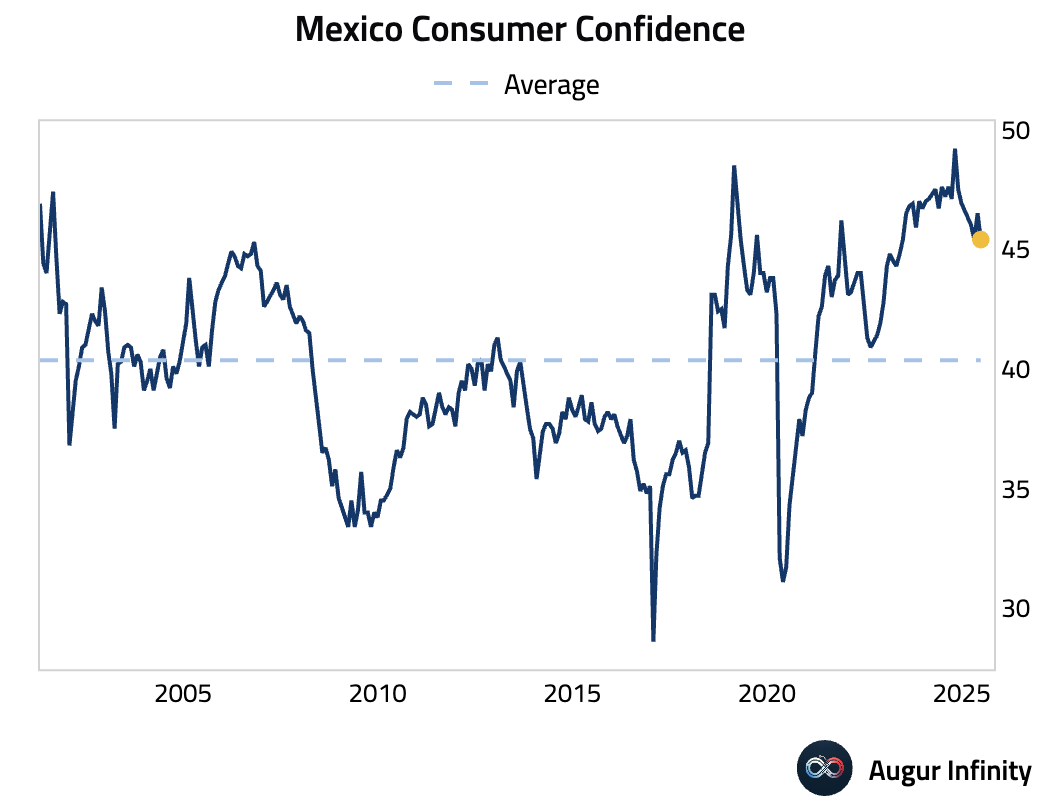

- Mexico’s consumer confidence index fell to 45.4 in June from 46.5 in May, reaching its lowest level in over a year.

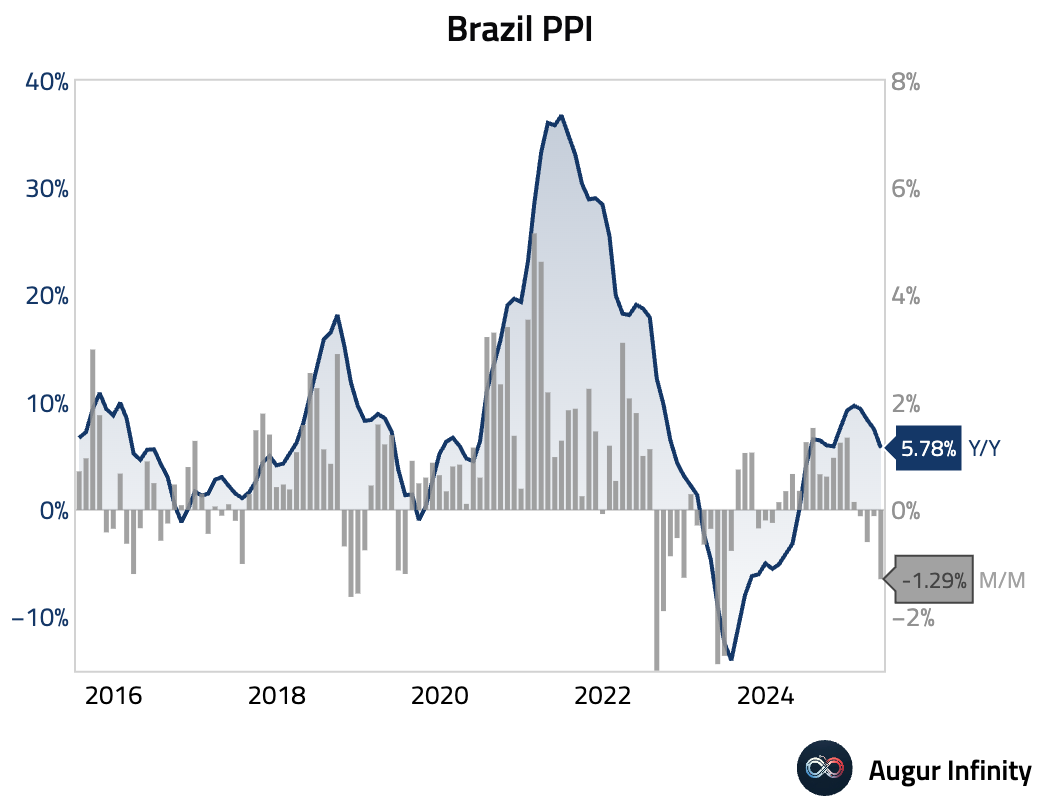

- Brazil’s producer prices fell 1.29% M/M in May, a sharp reversal from the prior month’s 0.12% decline and the largest monthly drop since June 2023. The annual PPI rate decelerated to 5.78% from 7.54%.

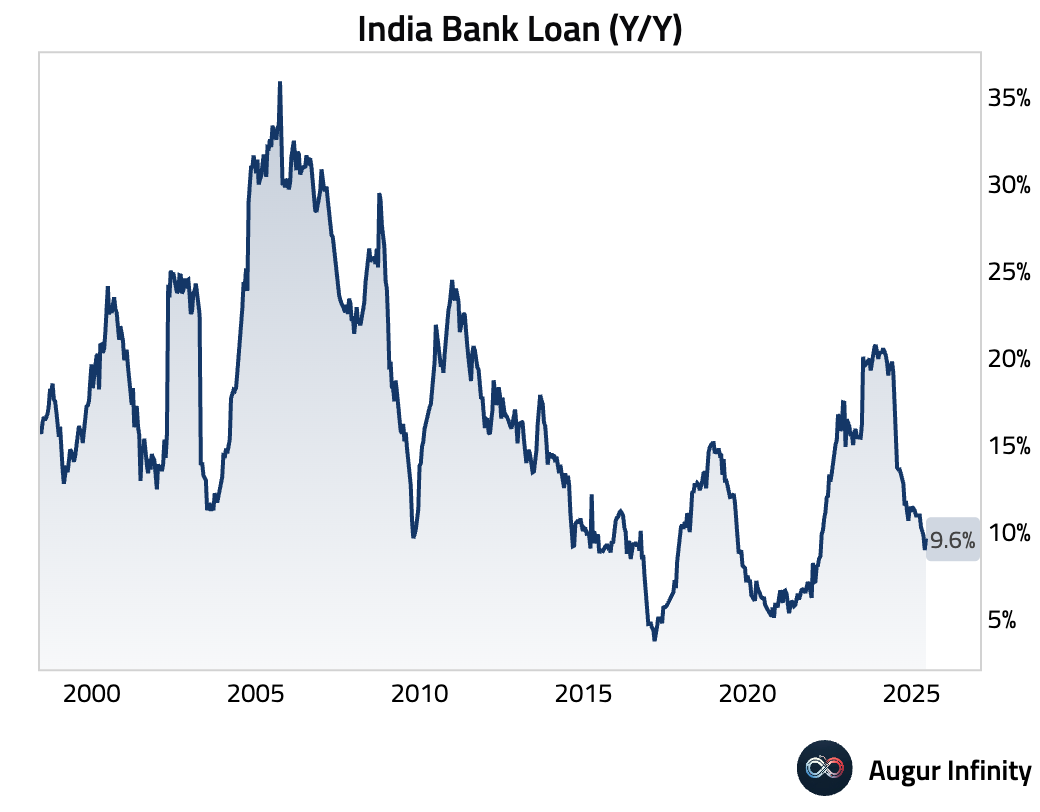

- Indian bank loan growth accelerated to 9.6% Y/Y for the two weeks ending in mid-June, up from 9.0% in the prior period.

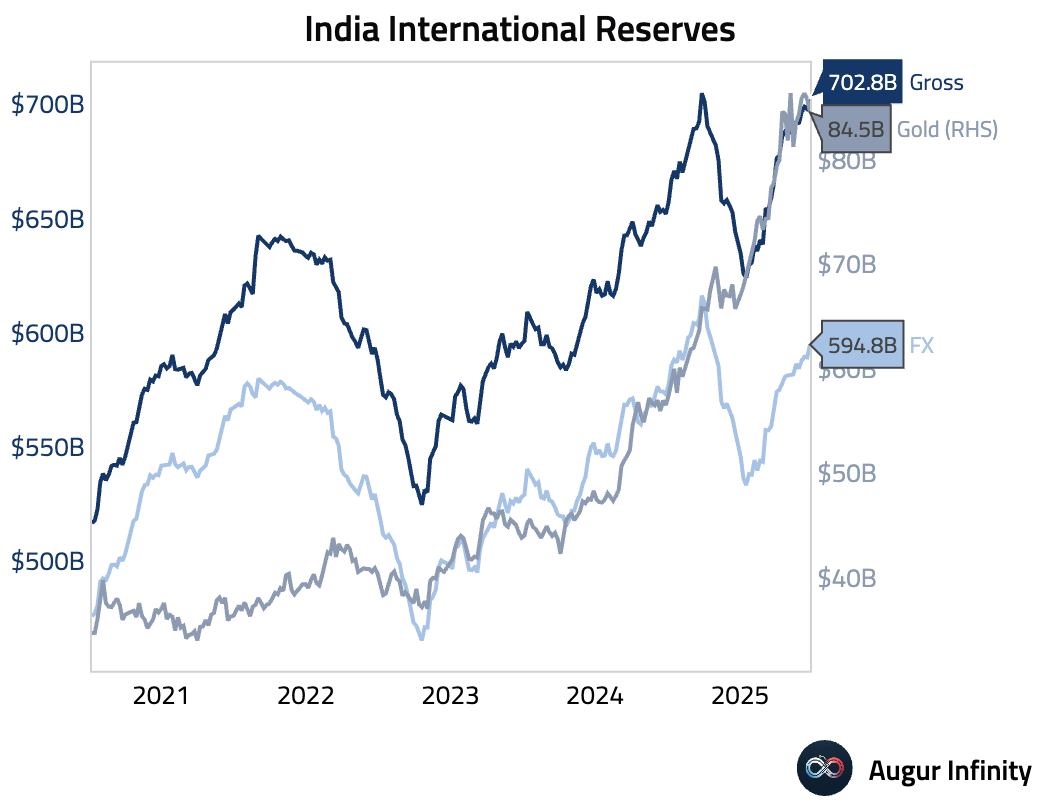

- India's official reserve assets rose to $702.78 billion in the latest week.

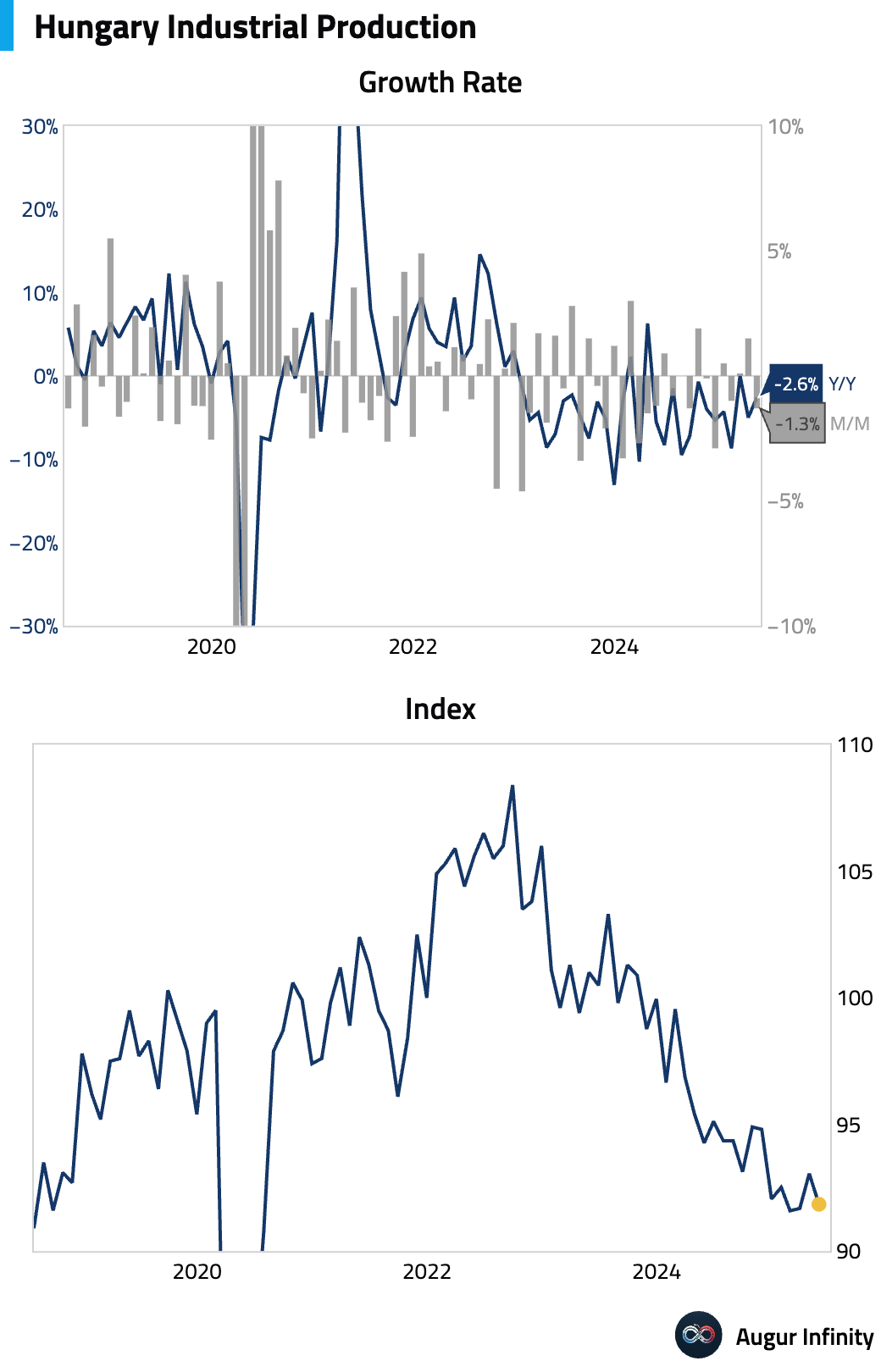

- Hungarian industrial production contracted 2.6% Y/Y in May on a preliminary basis, an improvement from the 5.0% decline recorded in April.

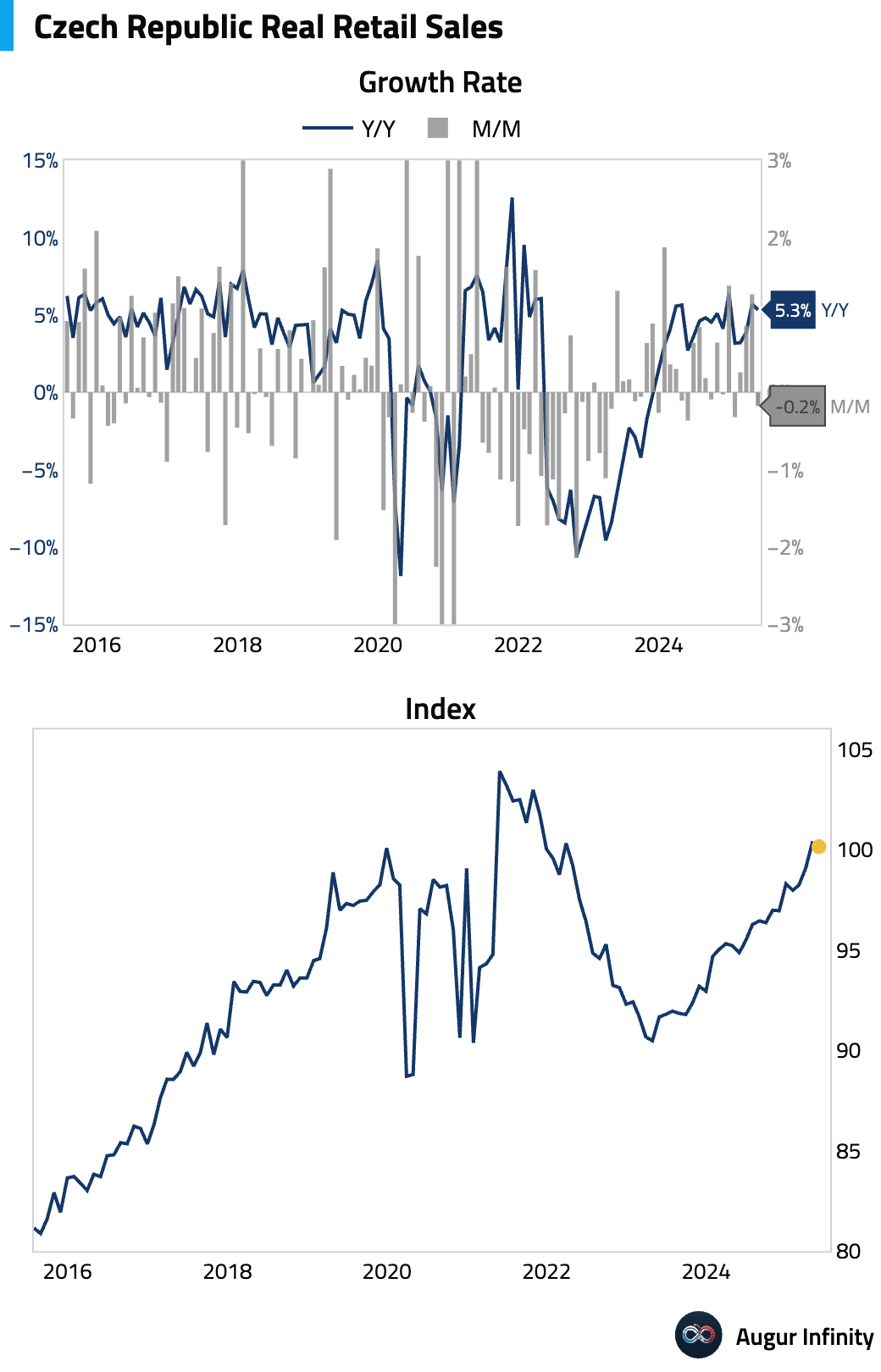

- Czech retail sales (ex-autos) declined 0.2% M/M in May, and the Y/Y growth rate eased to 5.3% from 5.7%.

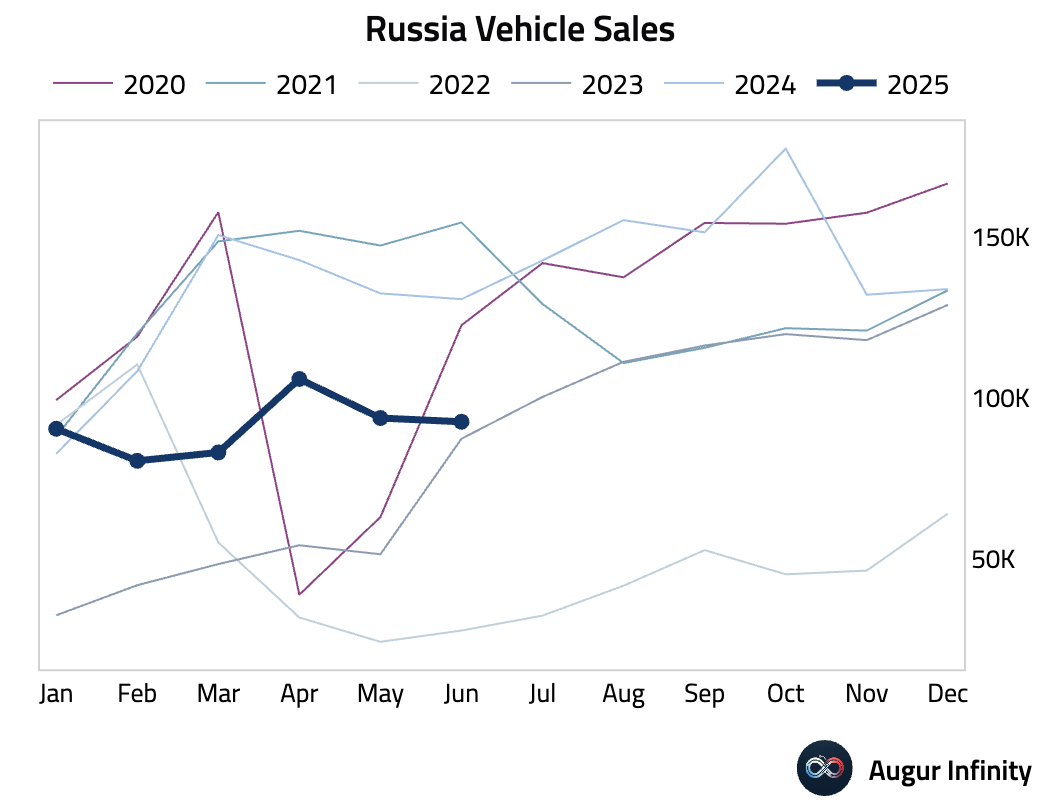

- Russian vehicle sales contracted 29.0% Y/Y in June, unchanged from May’s pace of decline.

Equities

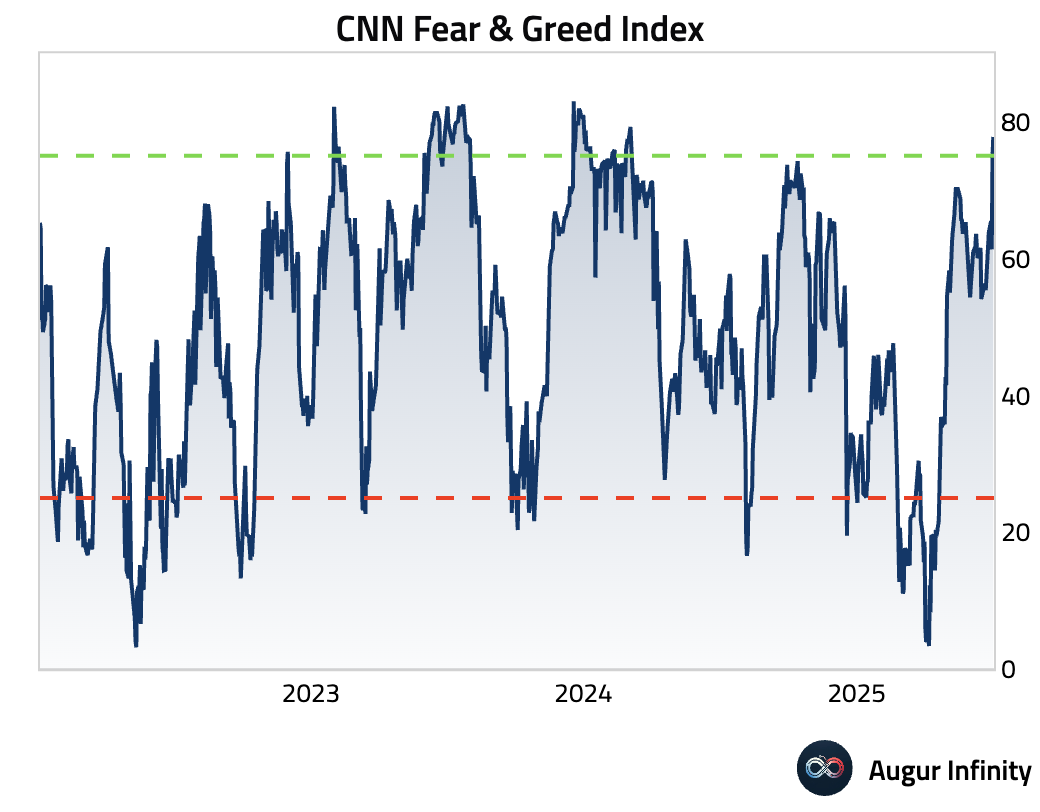

- The CNN Fear & Greed Index has moved back into “Extreme Greed” territory.

Source: CNN

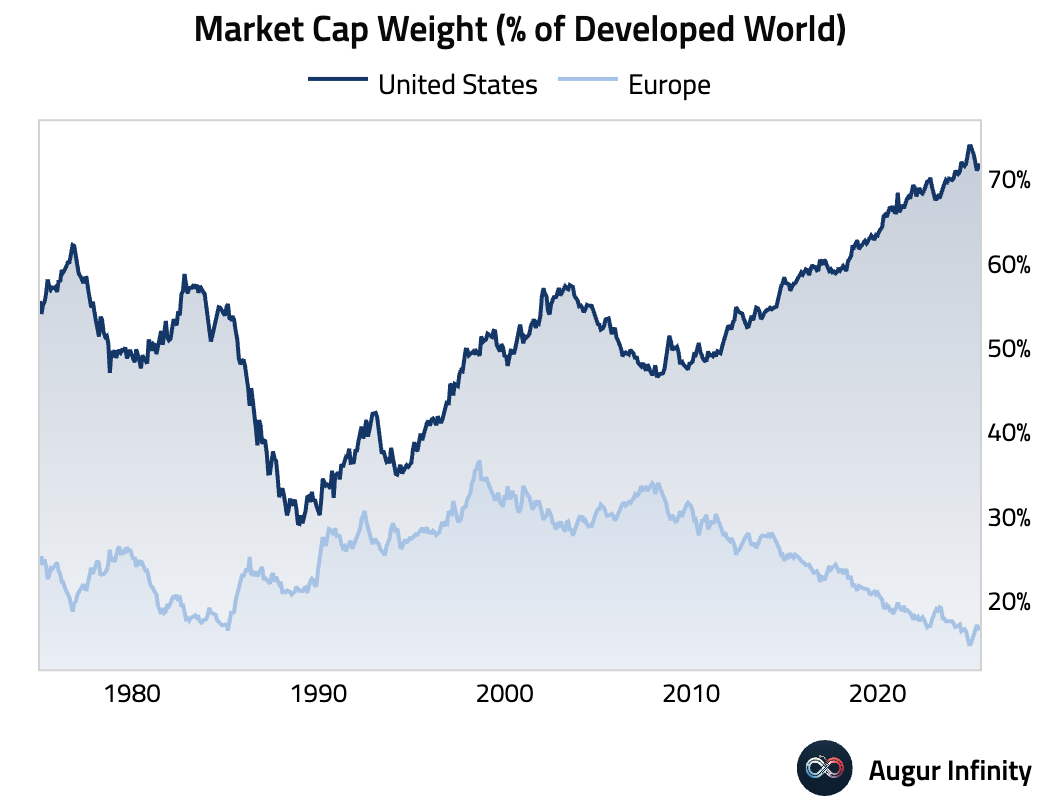

- US equity market cap as a percentage of the developed world total rose slightly to 71.9% at the end of June, while Europe’s weight declined slightly to 16.6%.

FX

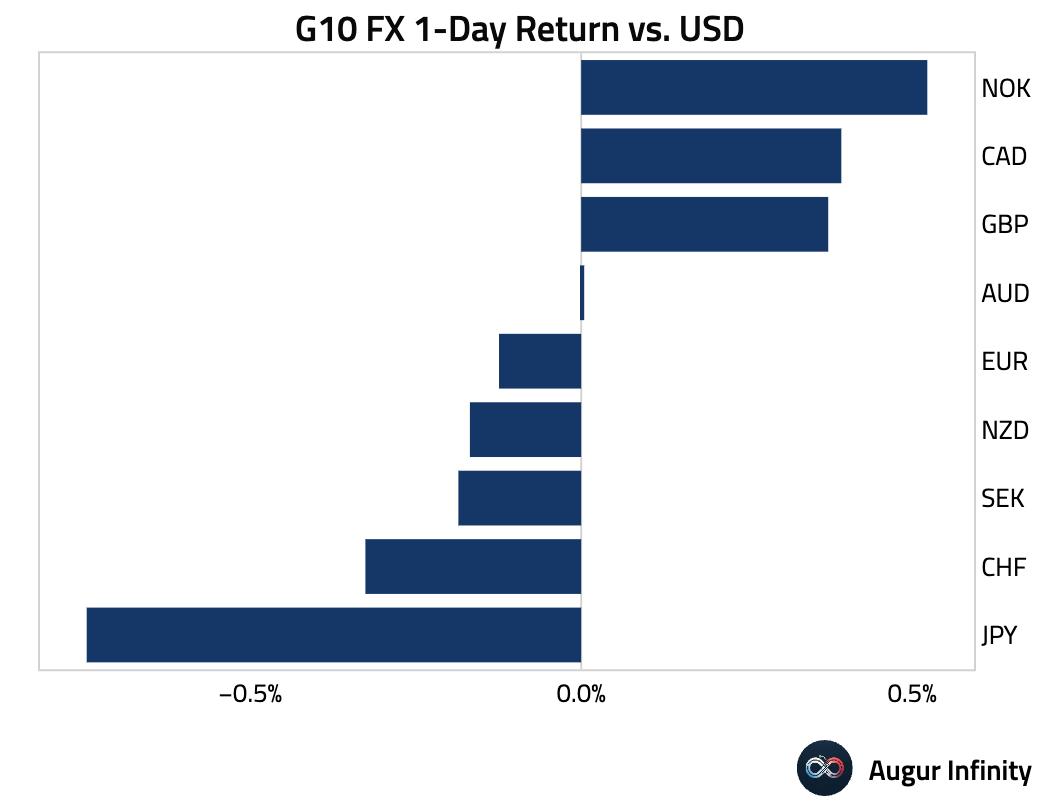

- The US dollar was mixed against G10 peers. The Japanese yen was the primary underperformer, weakening 0.7%, while commodity currencies like the Canadian dollar (+0.4%) and Norwegian krone (+0.5%) posted gains.

Disclaimer

Augur Digest is an automated newsletter written by an AI. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.