Headlines

- The US administration confirmed it will impose a 50 percent tariff on Brazil, prompting a response from Brazilian officials who cited the country’s Economic Reciprocity Law.

- Washington also confirmed a 50 percent tariff on copper imports, which is scheduled to take effect on August 1.

- In other developments, Indian officials plan to visit the United States for trade negotiations, while Japan’s Ministry of Finance announced a reduction in the size of its twenty-year government bond auction to bolster demand.

Charts of the Day

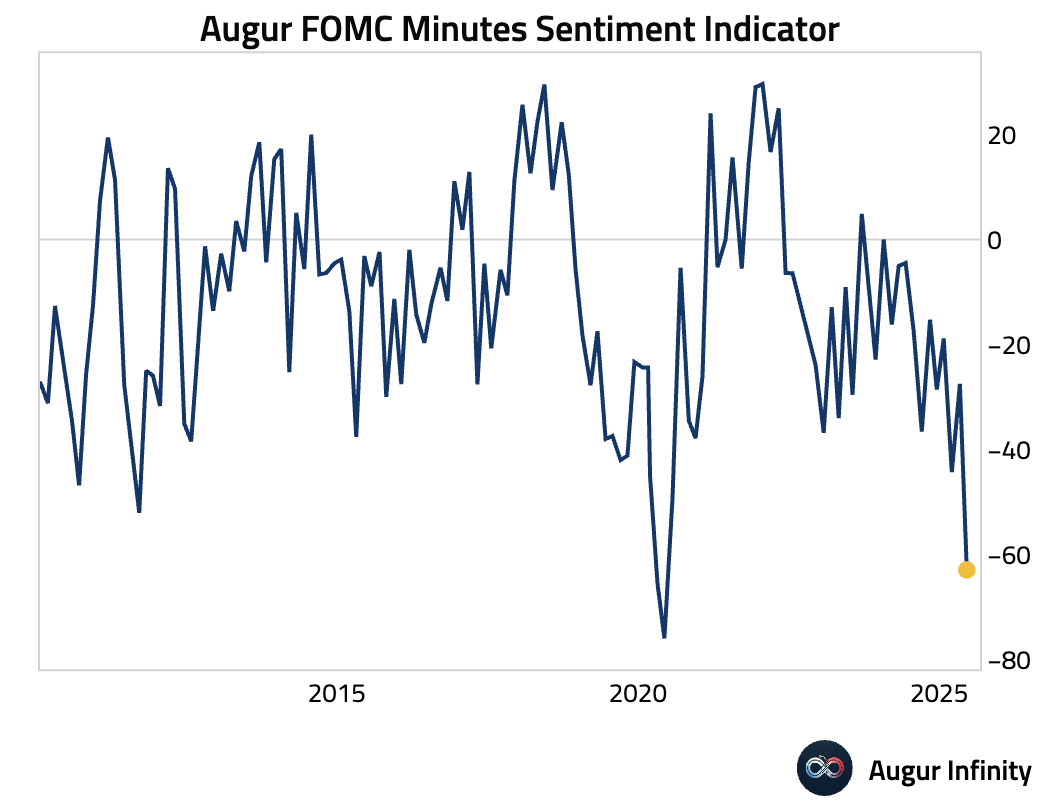

- Our FOMC Minutes Sentiment Indicator suggests that FOMC members have become markedly more downbeat.

Global Economics

United States

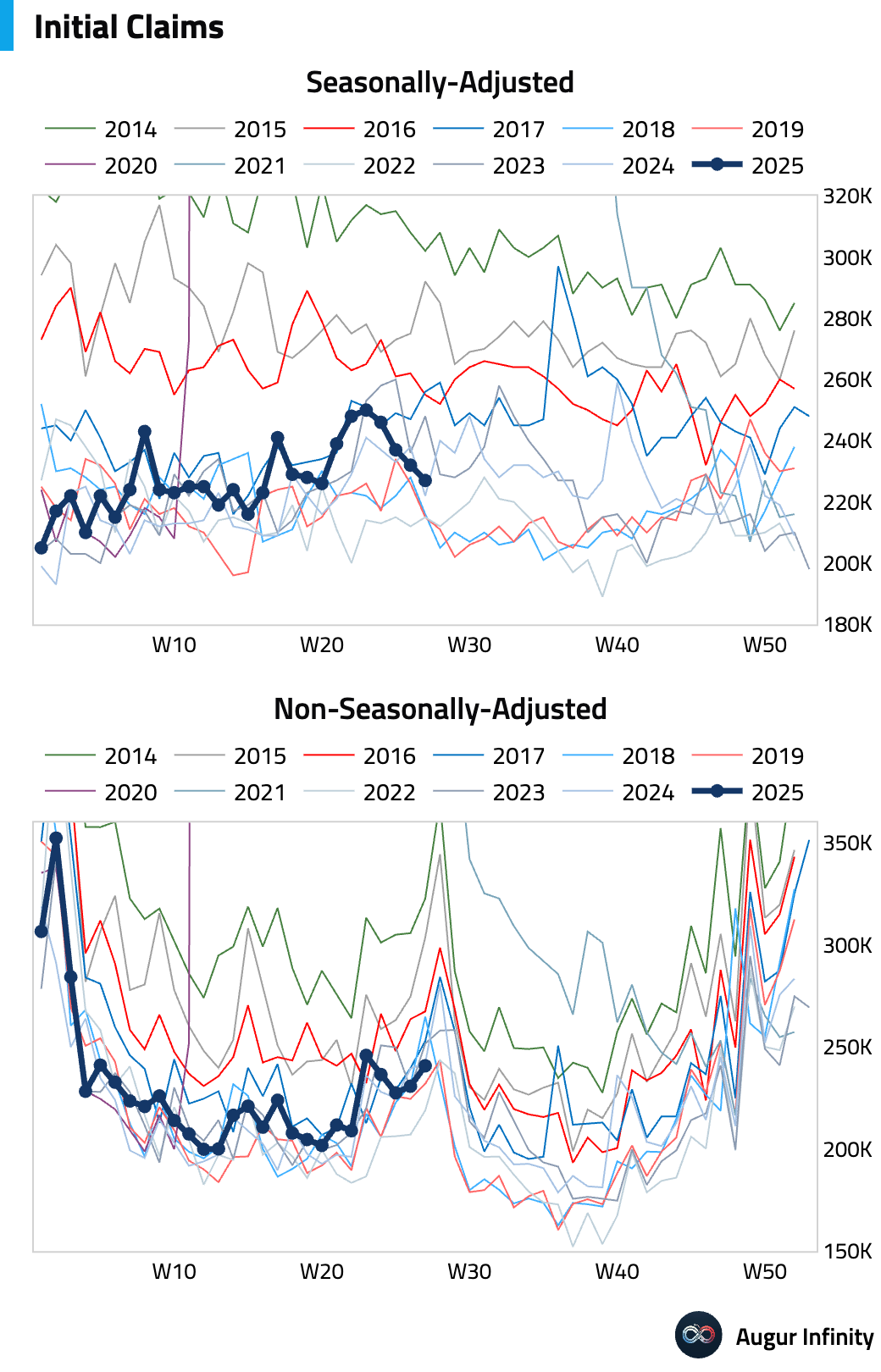

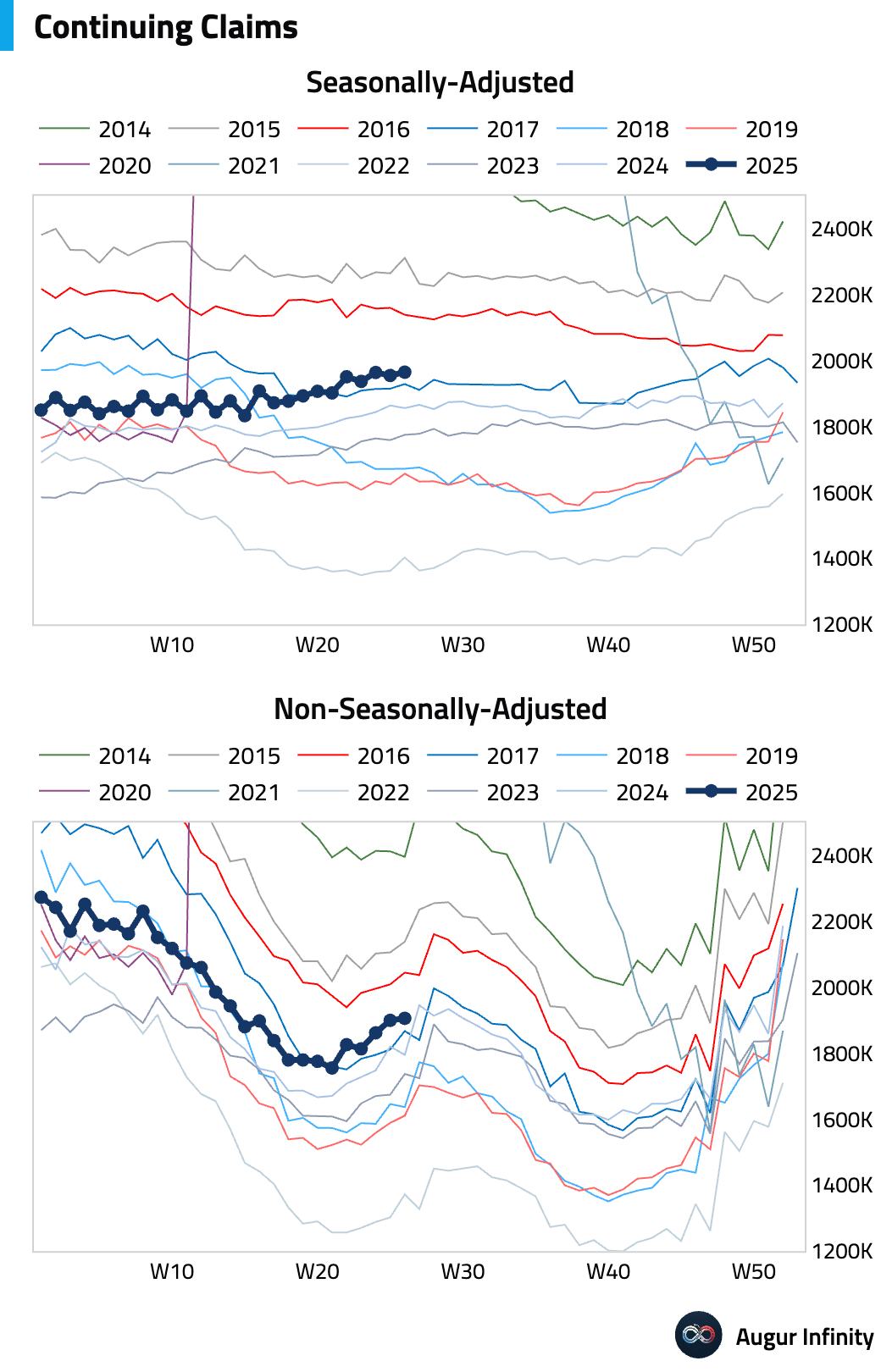

- US jobless claims data presented a mixed picture of the labor market. Initial claims fell to 227,000 for the week ending July 5, below the consensus estimate of 235,000. However, continuing claims for the week ending June 28 rose to 1.965 million, the highest level since November 2021. The four-week moving average of initial claims declined to 235,500.

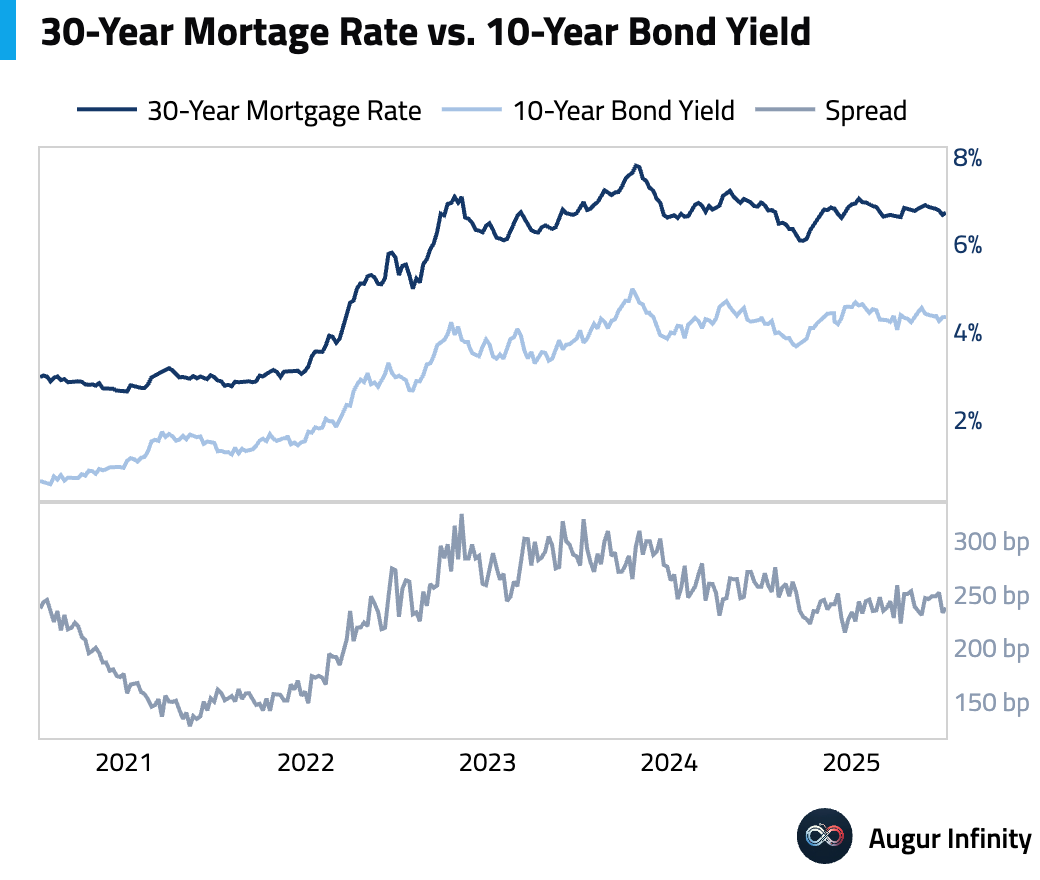

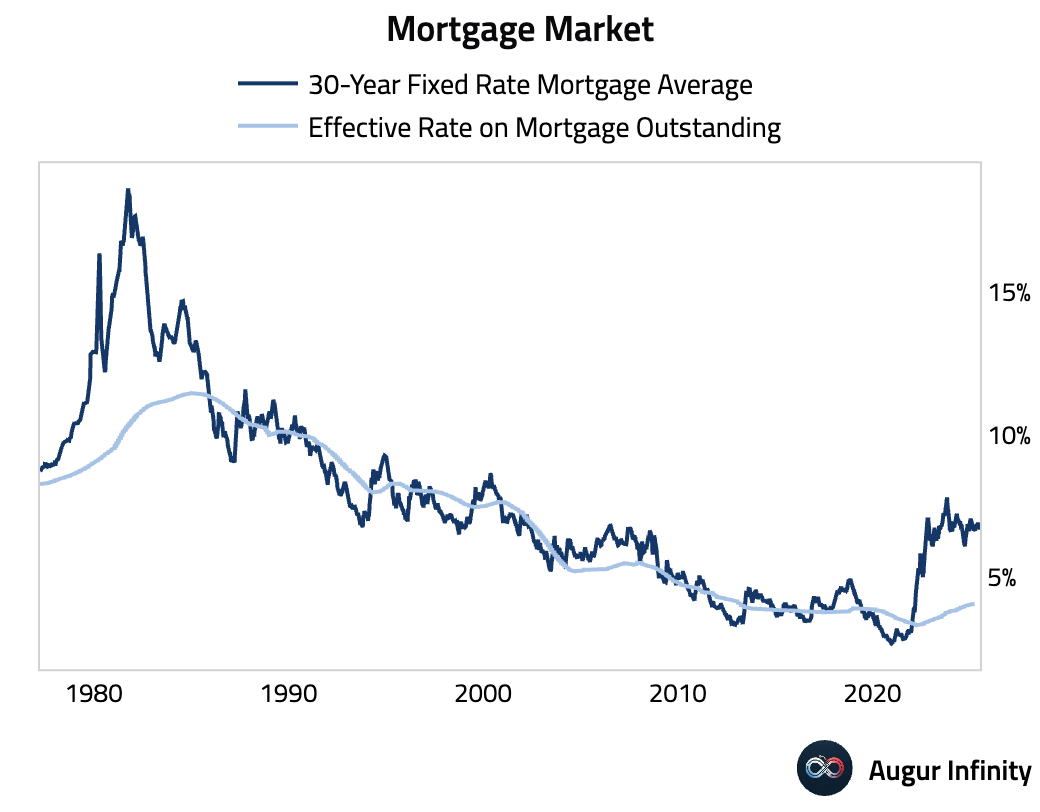

- Mortgage rates ticked higher, with the average 30-year fixed rate rising to 6.72 percent from 6.67 percent last week. The 15-year rate also increased to 5.86 percent from 5.80 percent.

Europe

- The UK RICS House Price Balance for June held steady at –7.0, slightly better than the consensus forecast of –8.0, indicating a continued but stable contraction in housing prices.

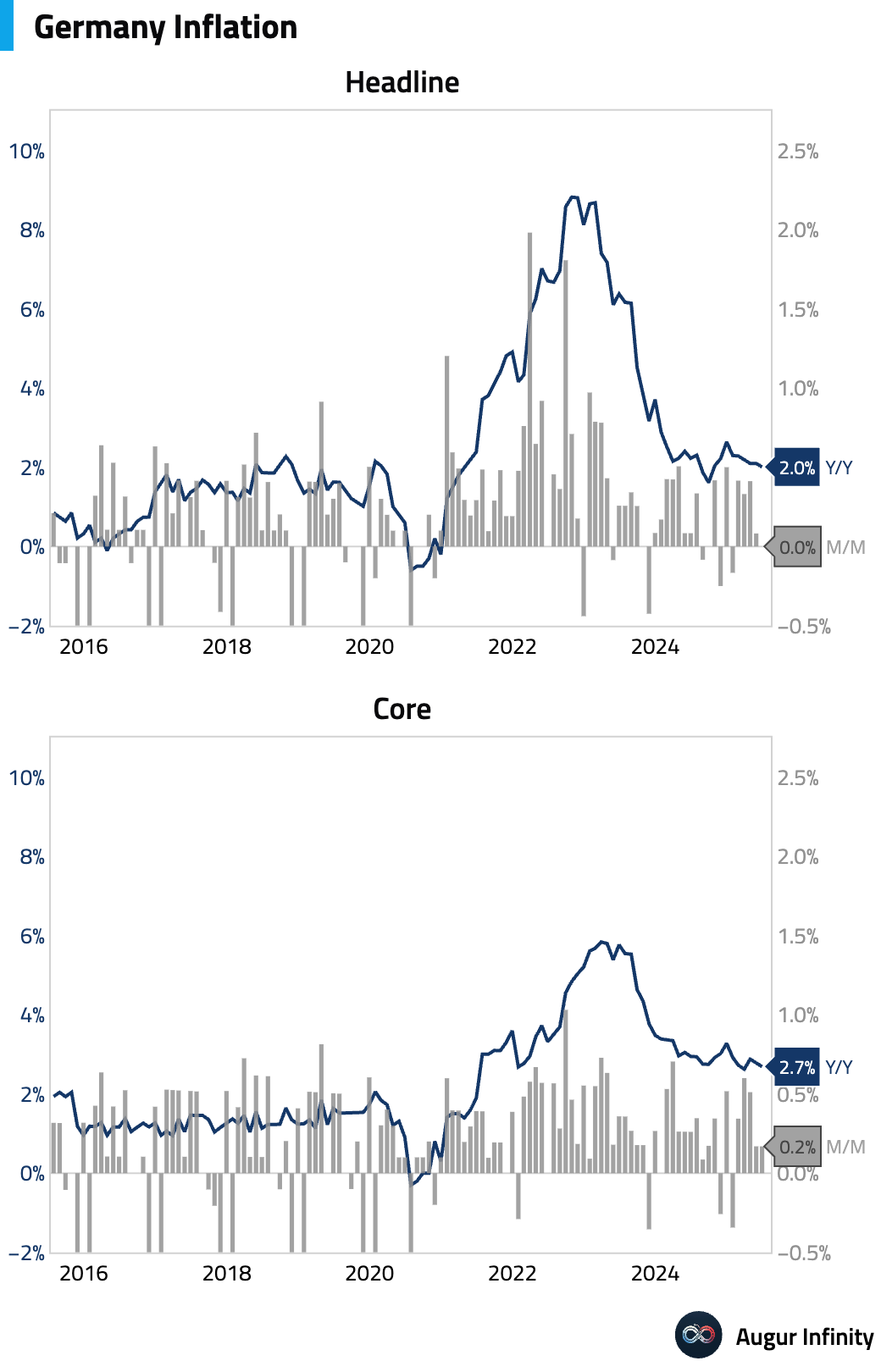

- Final German inflation for June was confirmed at 2.0% Y/Y and 0.0% M/M, both in line with preliminary estimates and consensus. The annual rate decelerated from 2.1% in May.

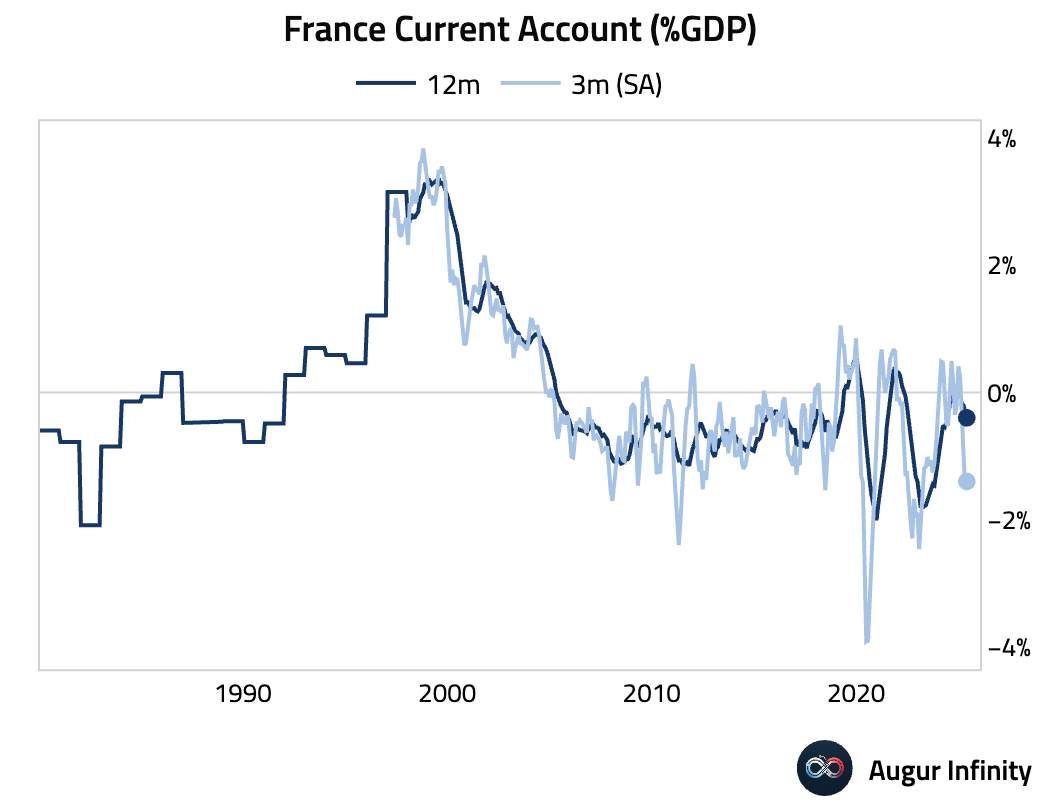

- France’s current account deficit narrowed significantly to €3.1 billion in May from a revised €6.6 billion in April, pointing to an improvement in the country's external balance.

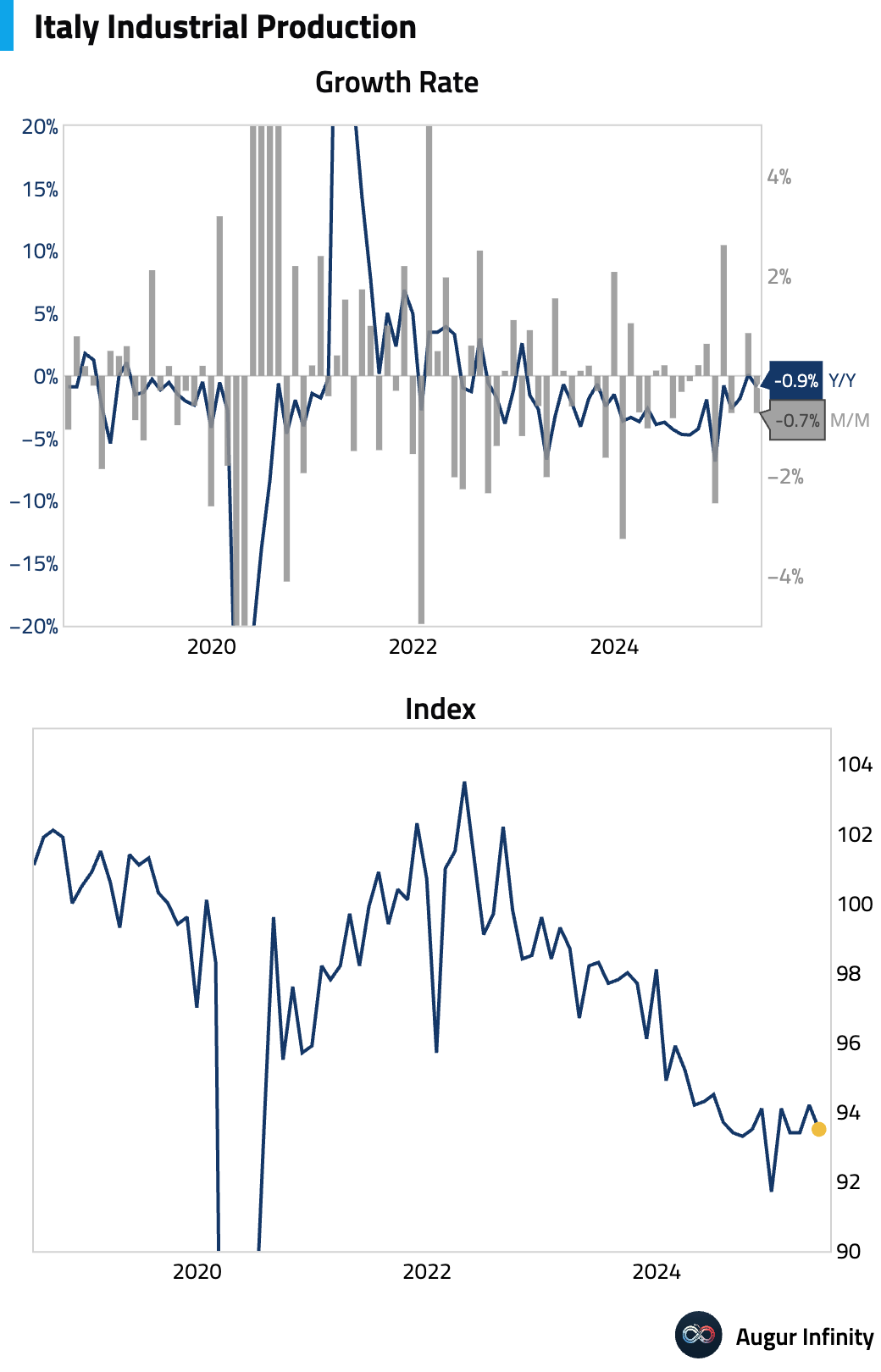

- Italian industrial production for May fell a worse-than-expected 0.7% M/M, against expectations of a flat reading. On a year-over-year basis, output declined 0.9%, also missing the consensus forecast for a 0.2% gain.

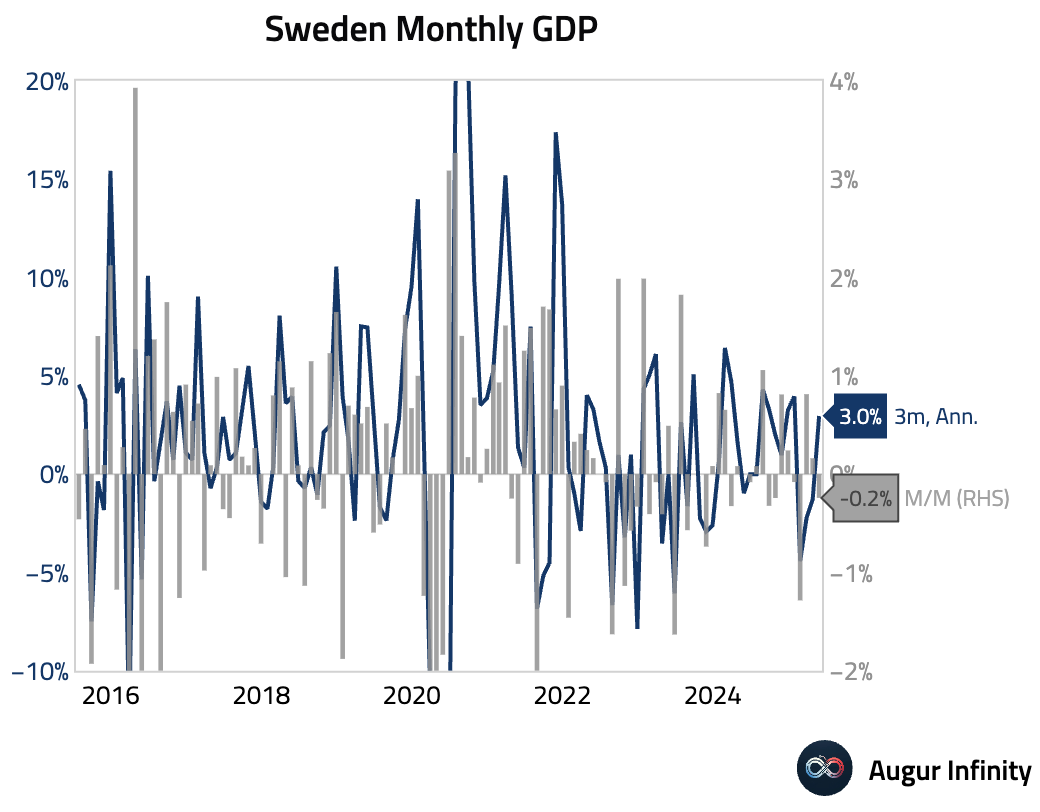

- Swedish economic data for May pointed to a slowdown. GDP contracted by 0.2% M/M, reversing the prior month's 0.2% expansion.

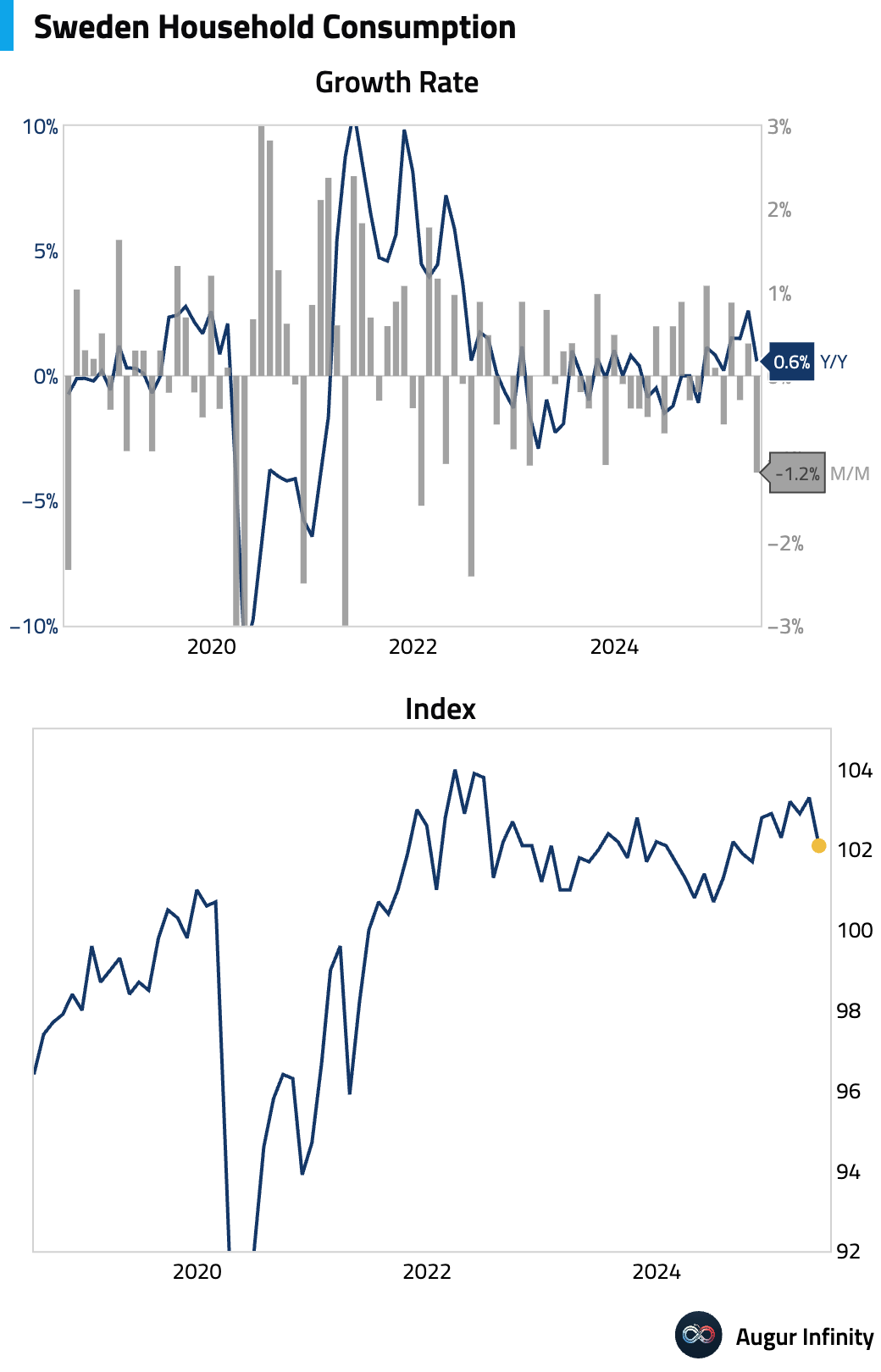

- Swedish household consumption declined by 1.2% M/M in May, a sharp reversal from the 0.4% increase in April and the weakest reading since July 2022. The Y/Y growth rate also decelerated sharply to 0.6% from 2.6%.

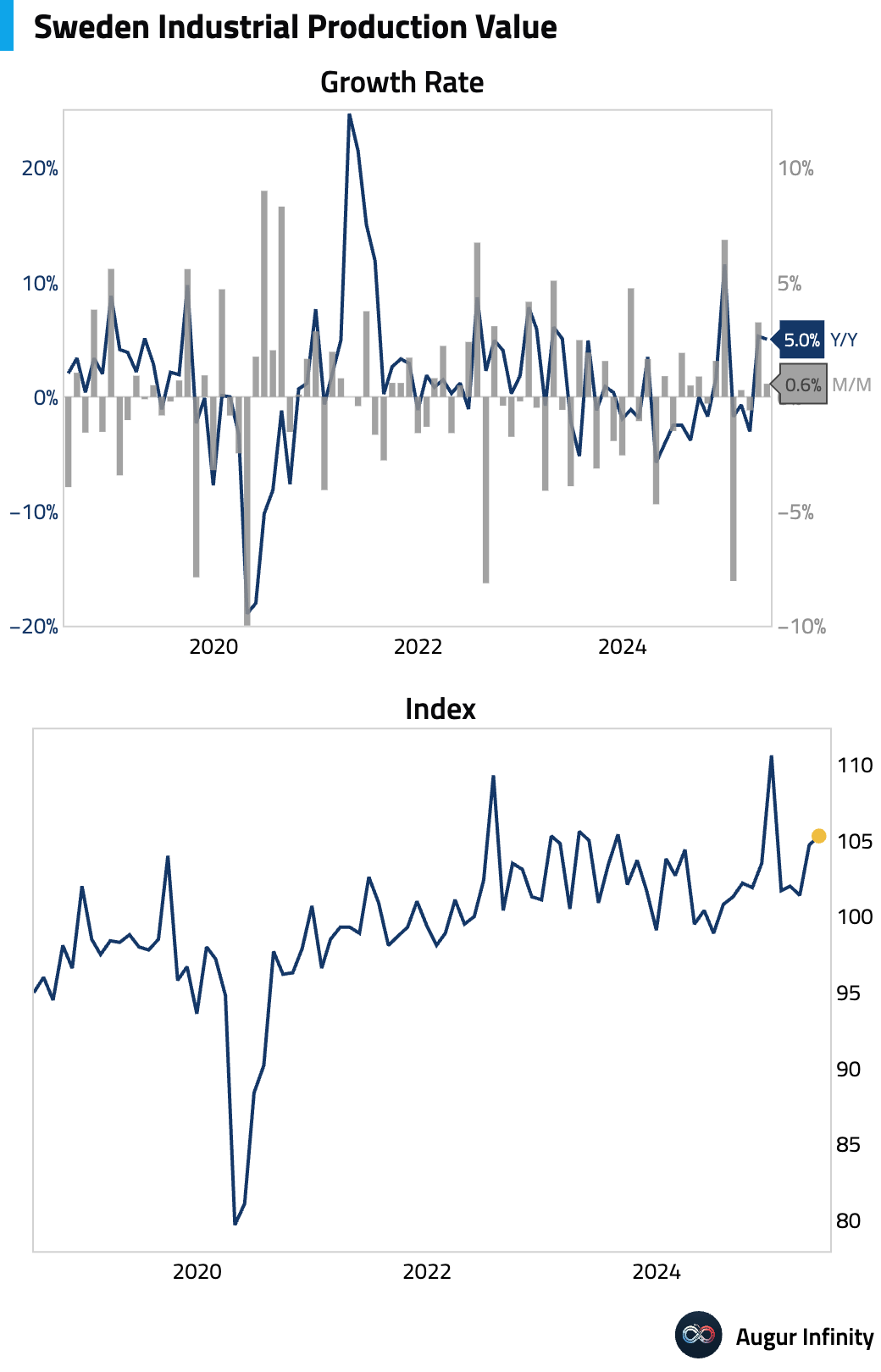

- Sweden's industrial production growth slowed in May, rising 0.6% M/M compared to 3.3% in April. The Y/Y rate eased to 5.0% from 5.3%.

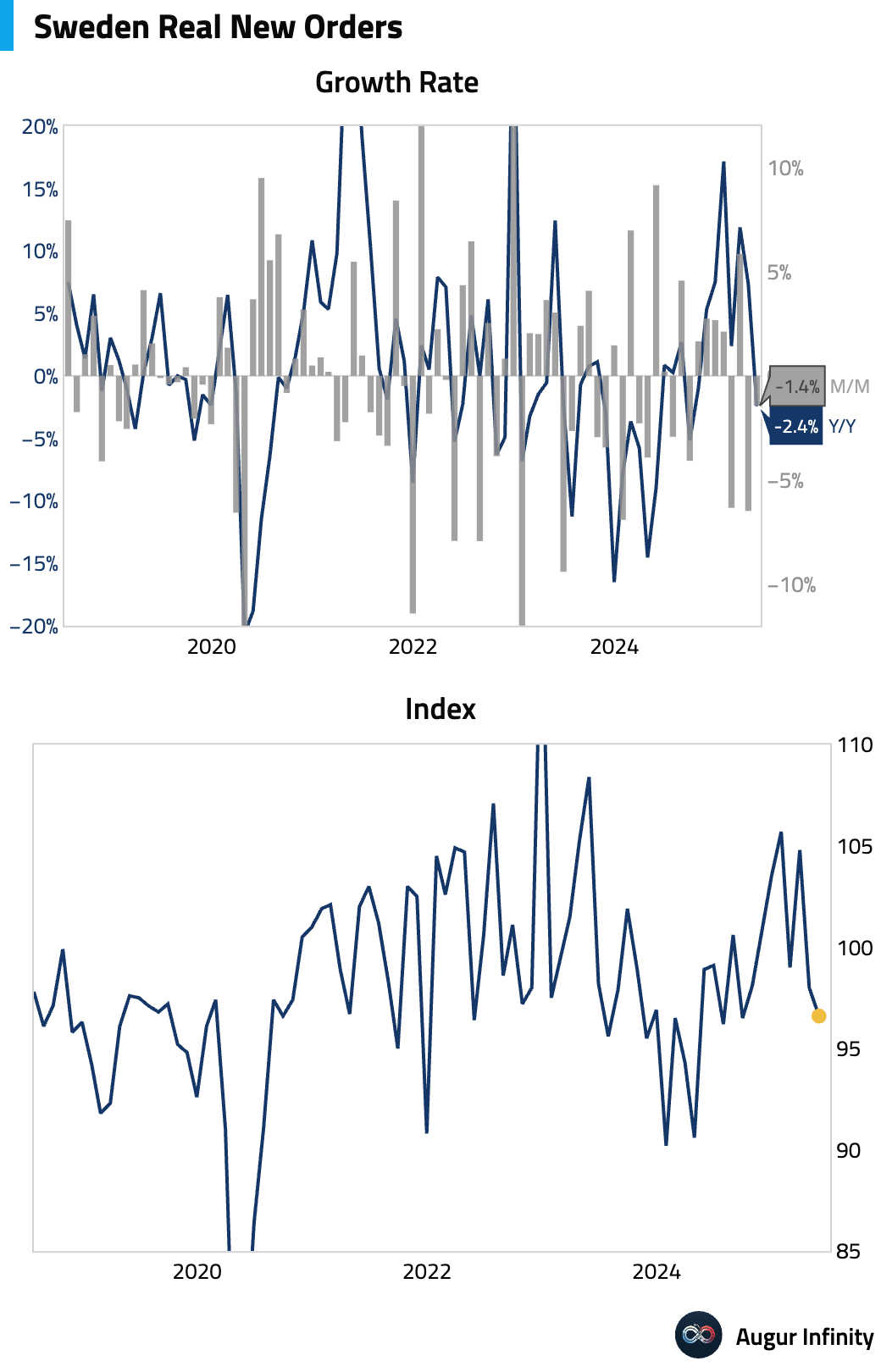

- New industrial orders in Sweden fell 2.4% Y/Y in May, a stark contrast to the 7.4% growth recorded in April.

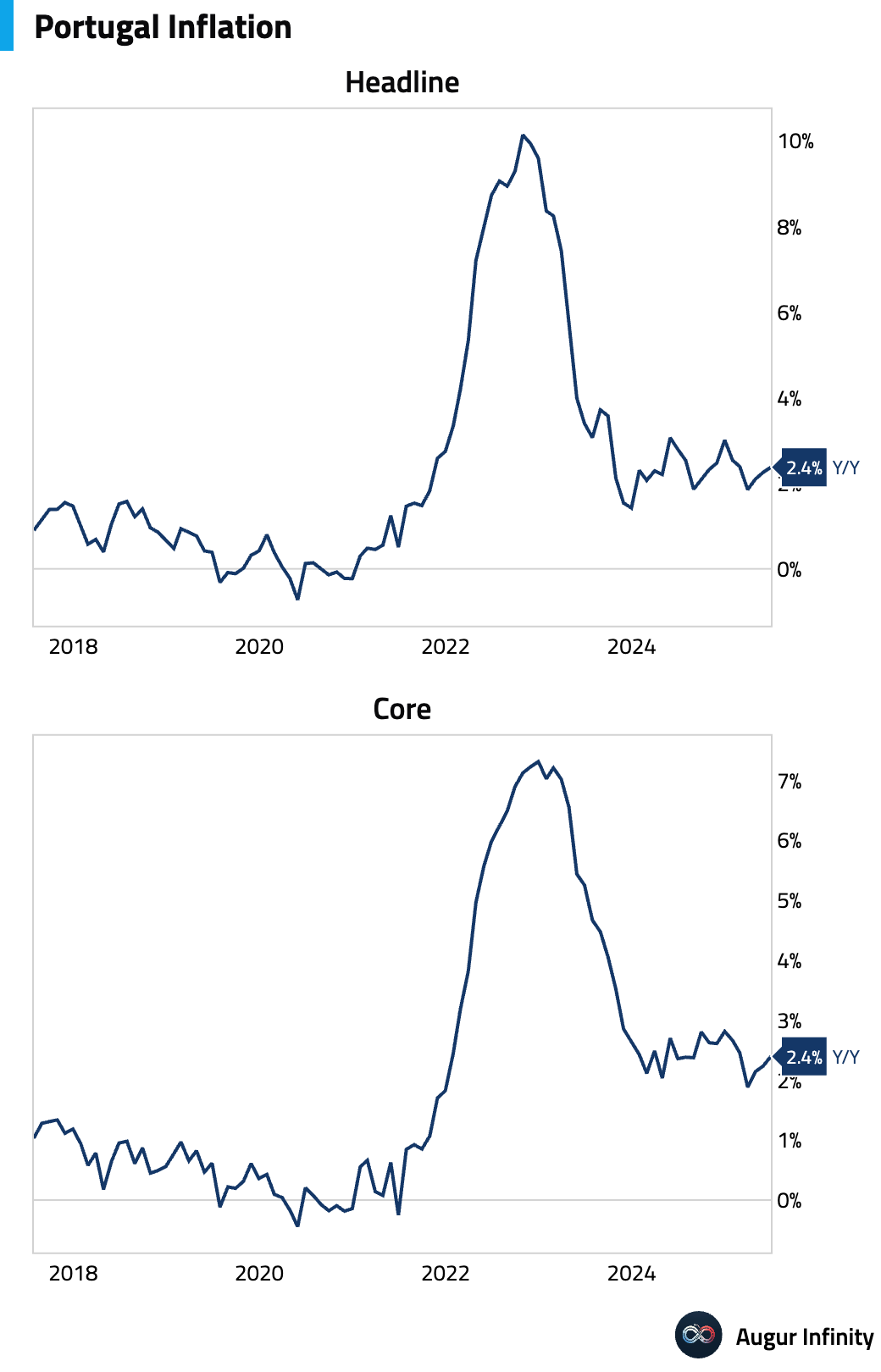

- Final Portuguese inflation for June was confirmed at 2.4% Y/Y, a slight acceleration from May's 2.3% and in line with estimates. The M/M rate was 0.1%.

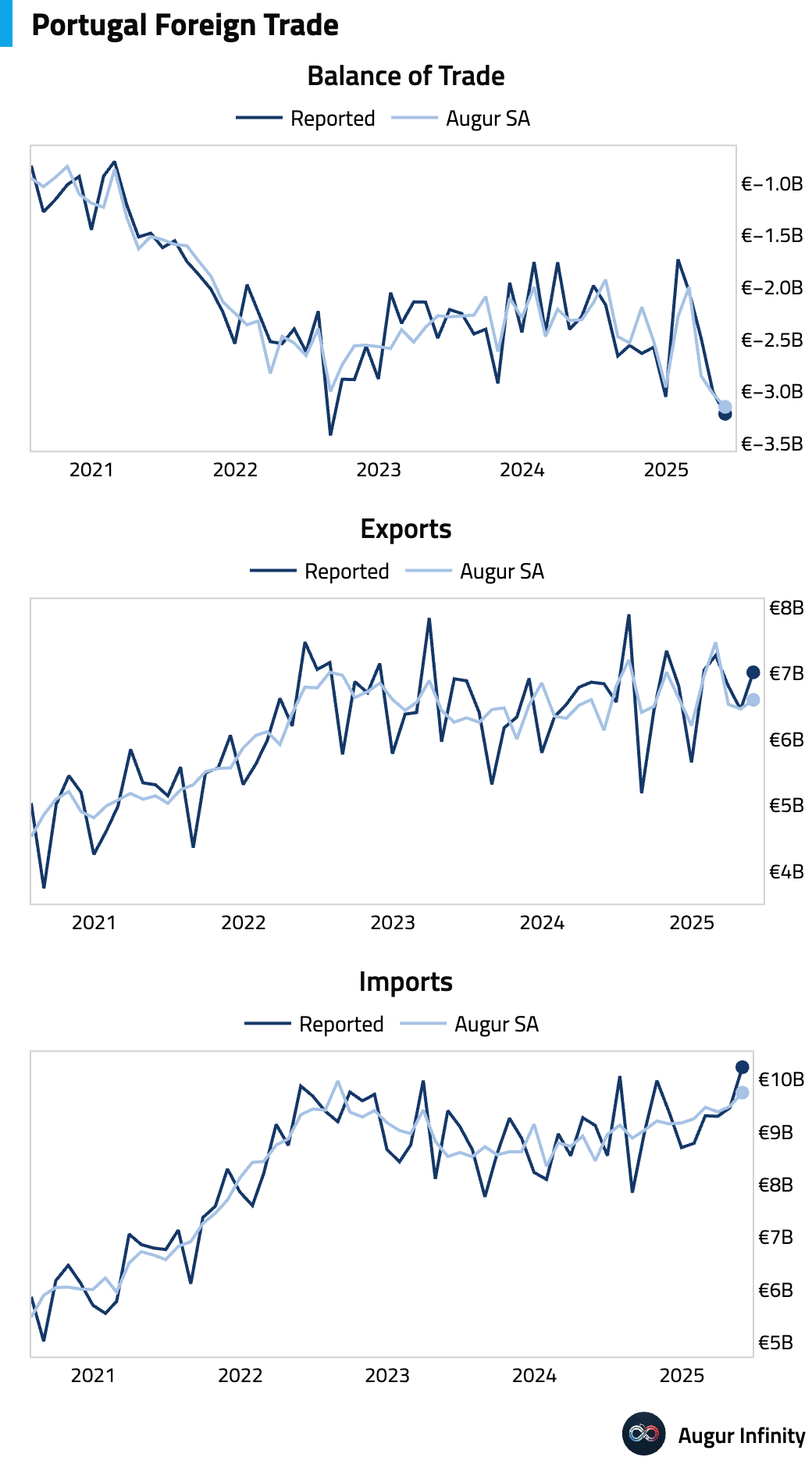

- Portugal's trade deficit widened to €3.22 billion in May from €3.01 billion in April.

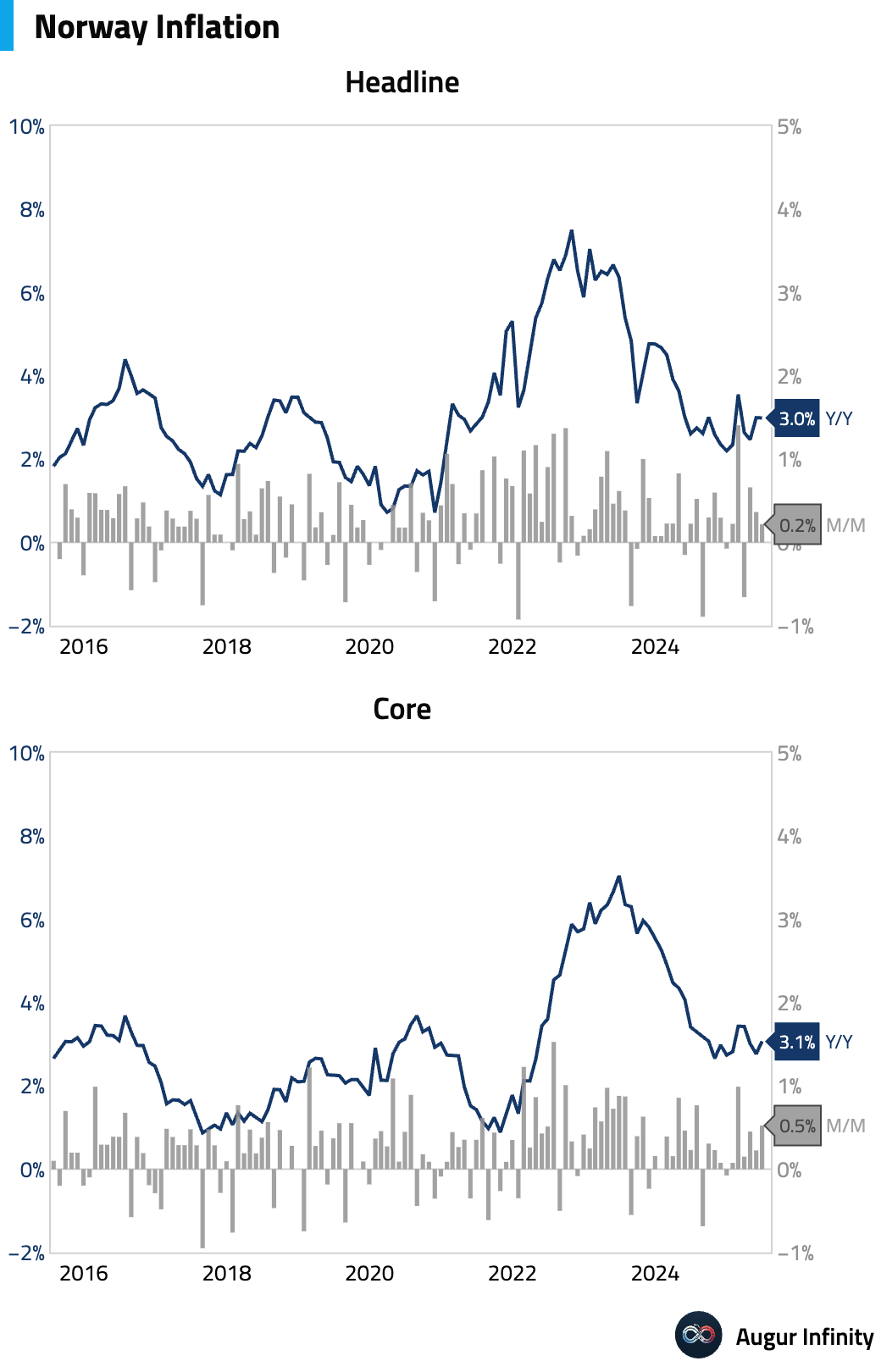

- Norway’s headline inflation rate was stable at 3.0% Y/Y in June, just below the 3.1% consensus. Core inflation, however, accelerated to 3.1% Y/Y from 2.8%, beating the 3.0% forecast.

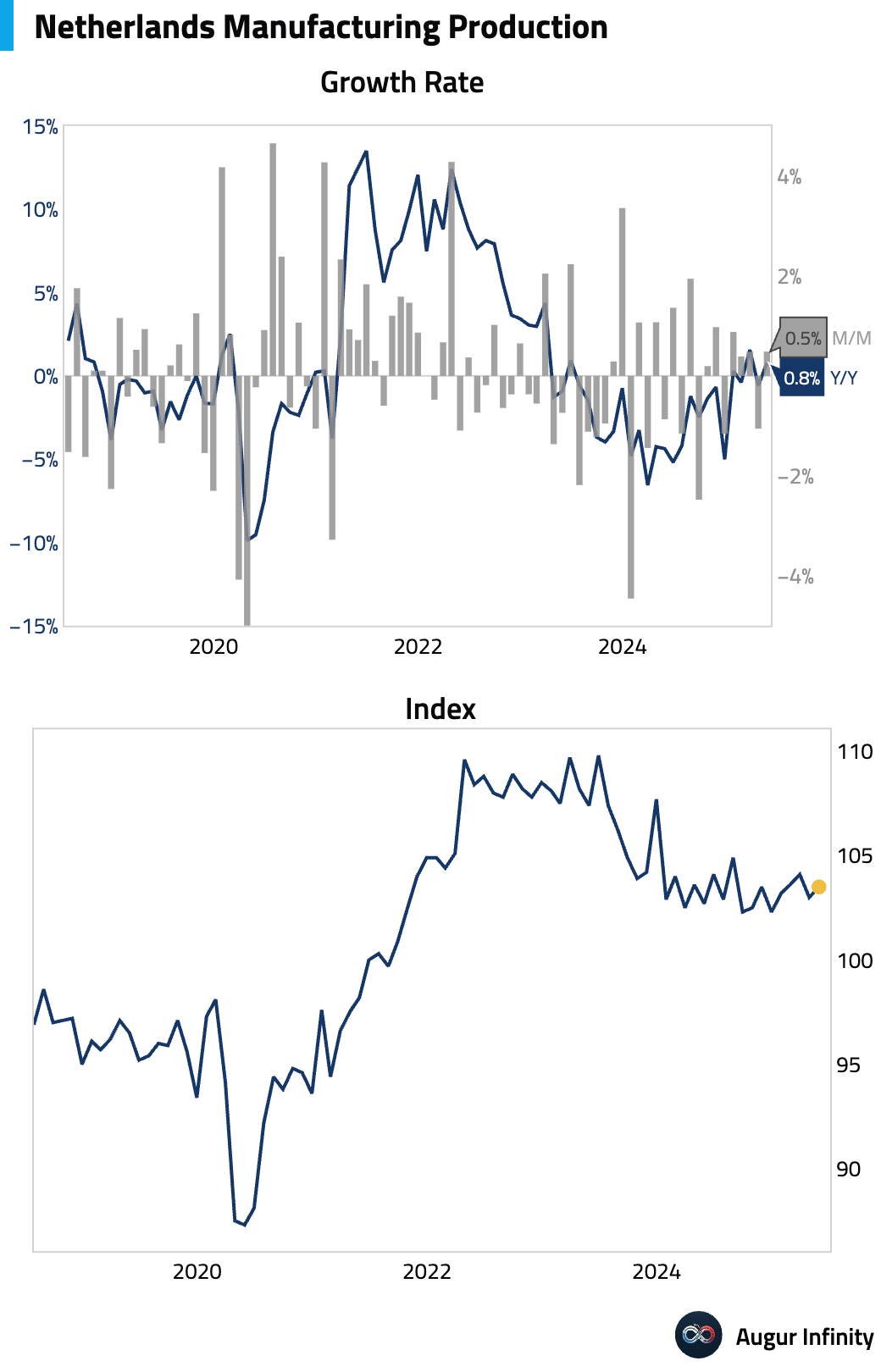

- Dutch manufacturing output rose 0.5% M/M in May, rebounding from a 1.1% decline in April.

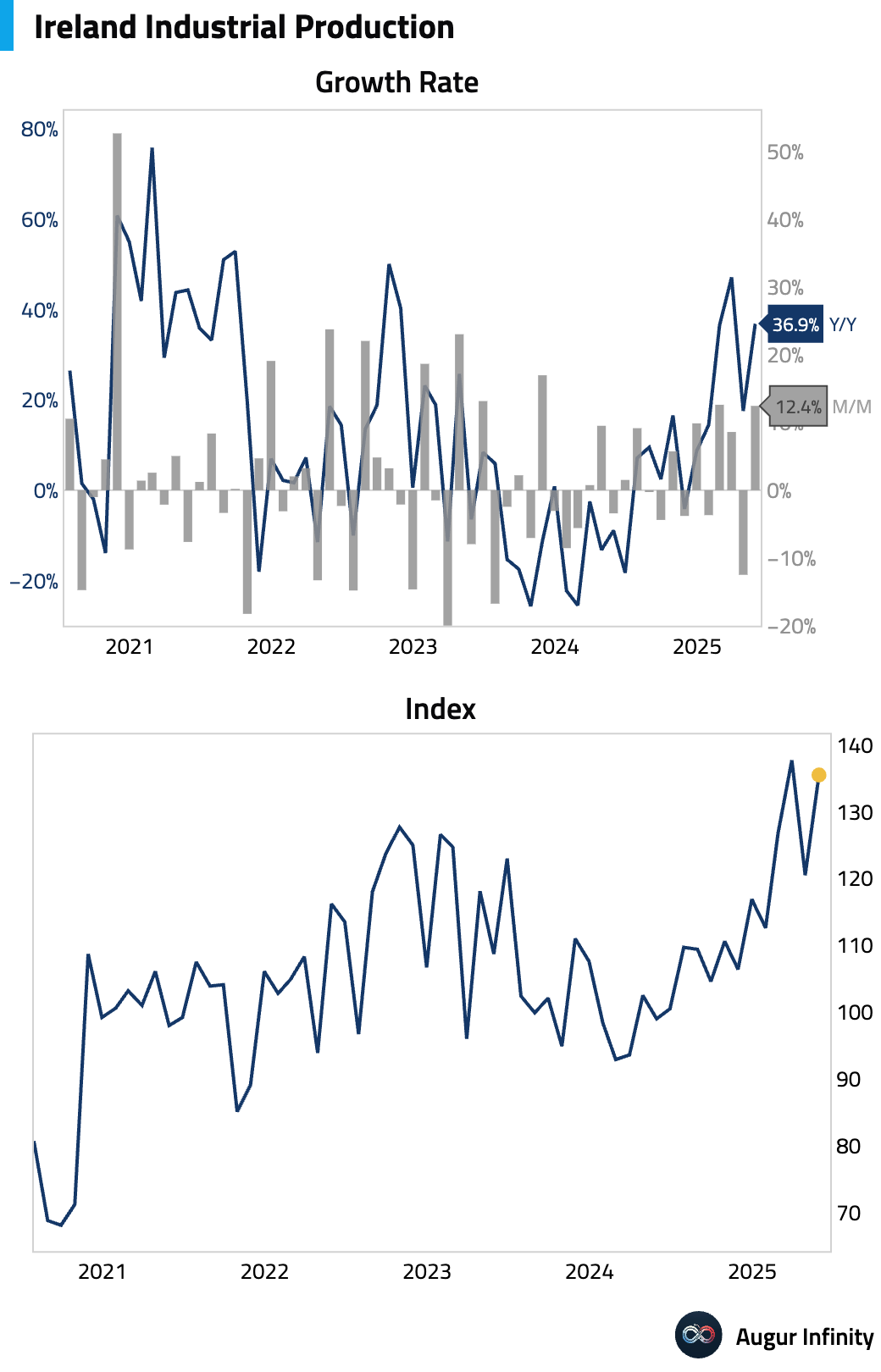

- Irish industrial production surged 36.8% Y/Y in May, a significant acceleration from the 17.7% pace in April, driven by volatile components of the index.

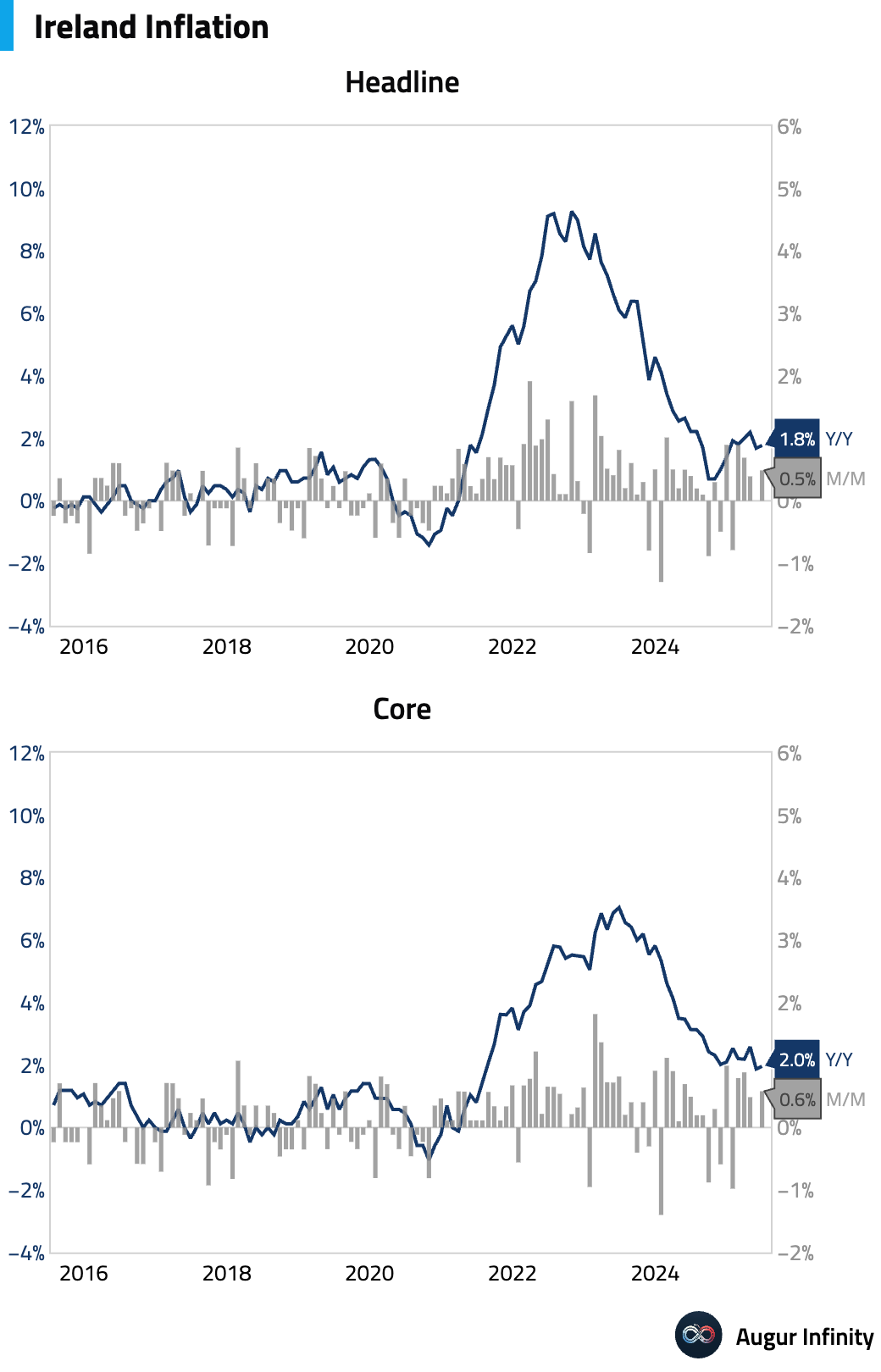

- Ireland's final inflation data for June showed the headline rate ticked up to 1.8% Y/Y from 1.7%, while the M/M rate was 0.5%.

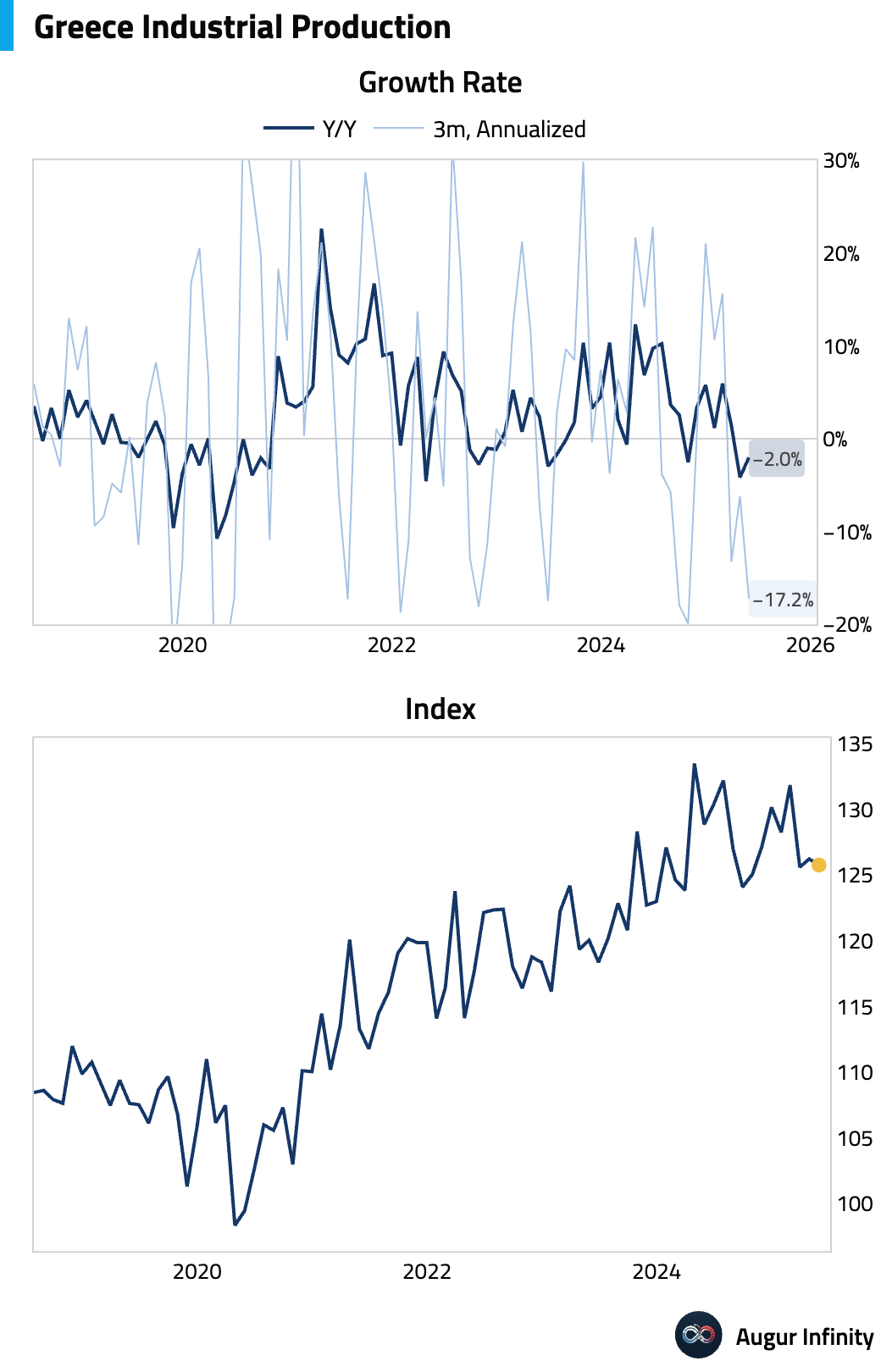

- Greek industrial production fell 2.0% Y/Y in May, though this marked an improvement from the 4.2% decline in April.

Asia-Pacific

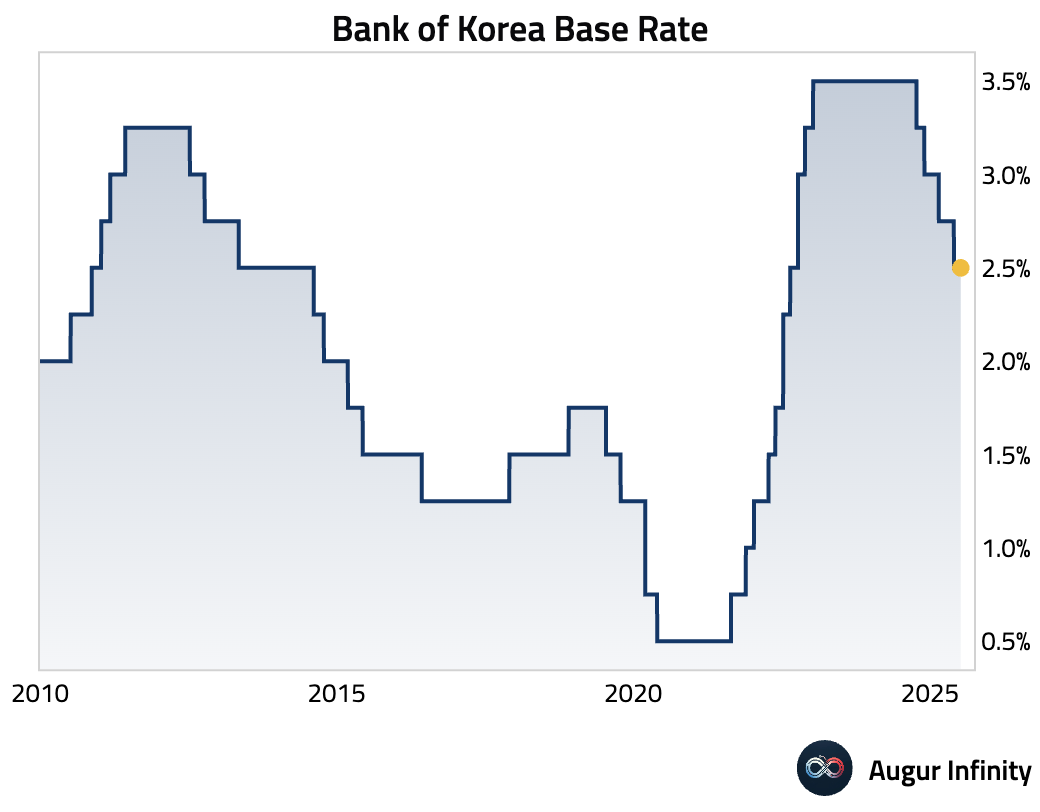

- The Bank of Korea held its policy rate steady at 2.50%, as widely expected. This is the second consecutive meeting the rate has been maintained at this level, which has been in place since May 2025.

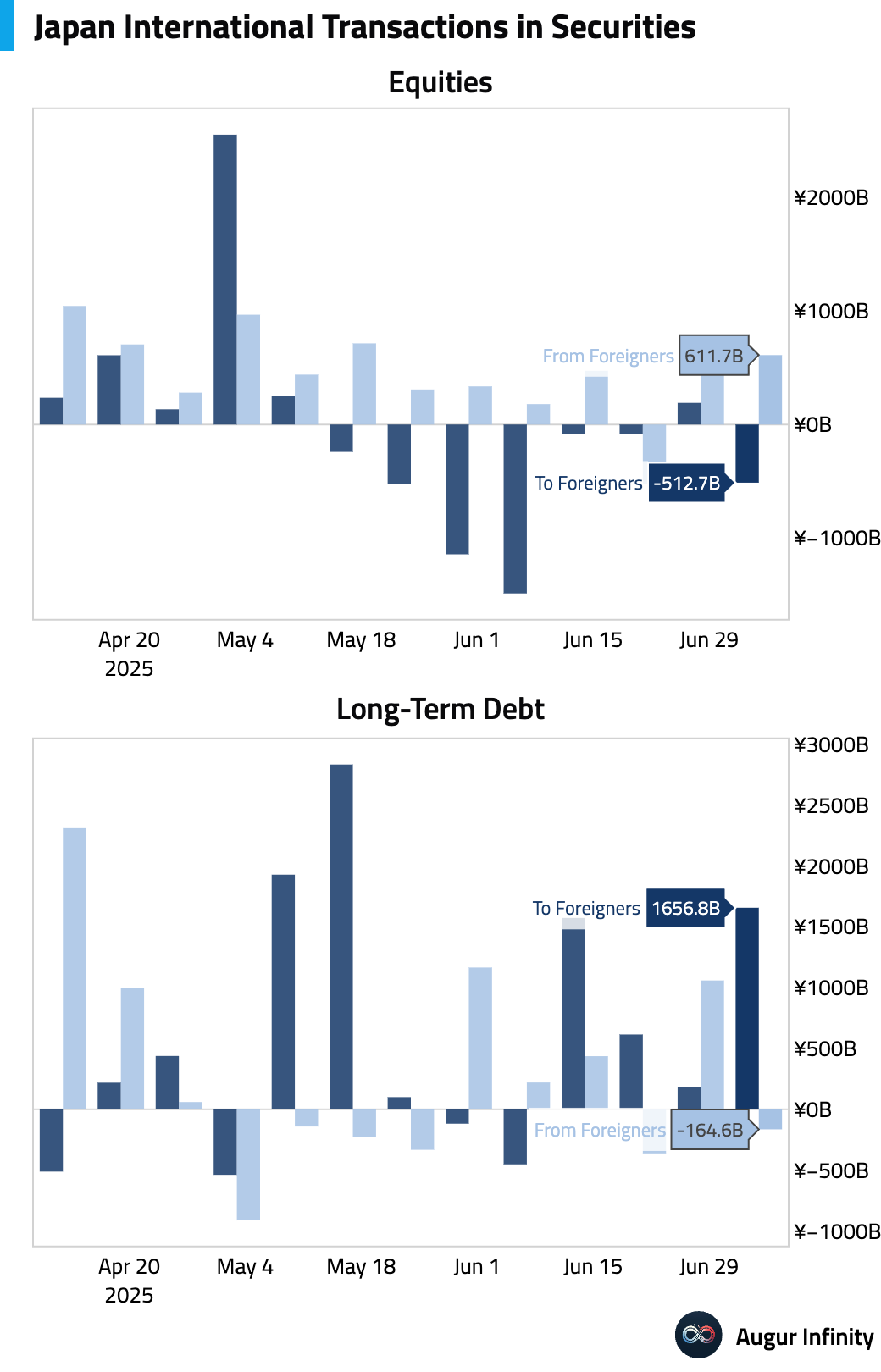

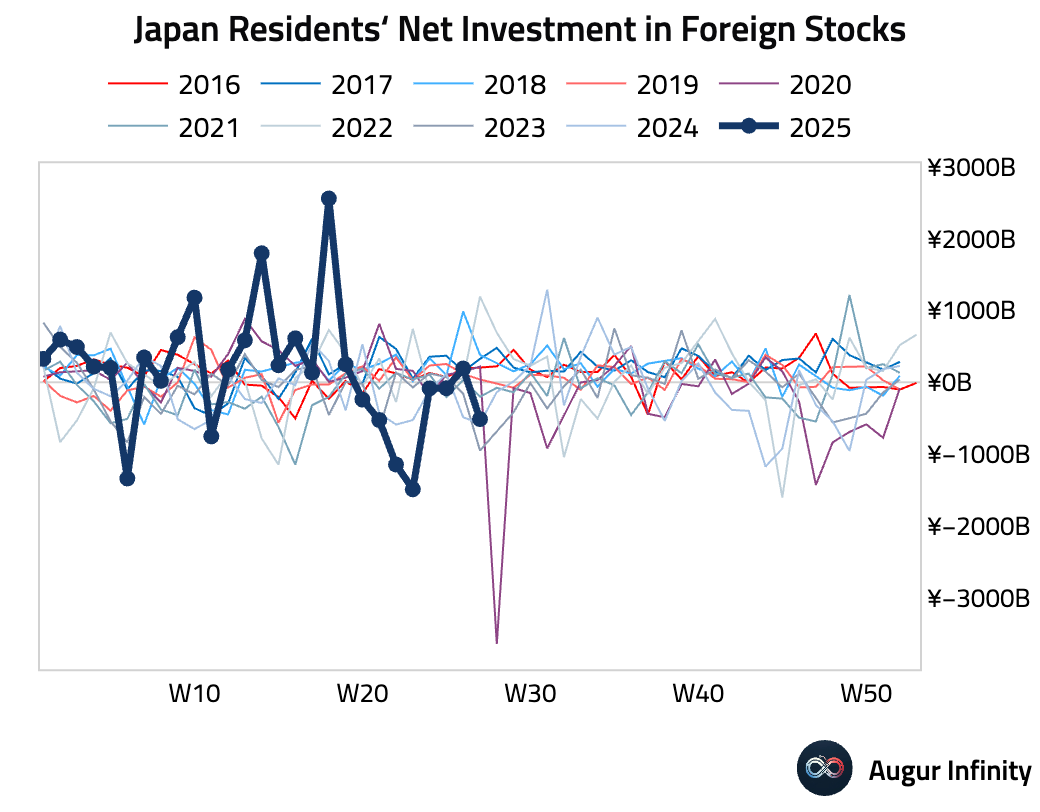

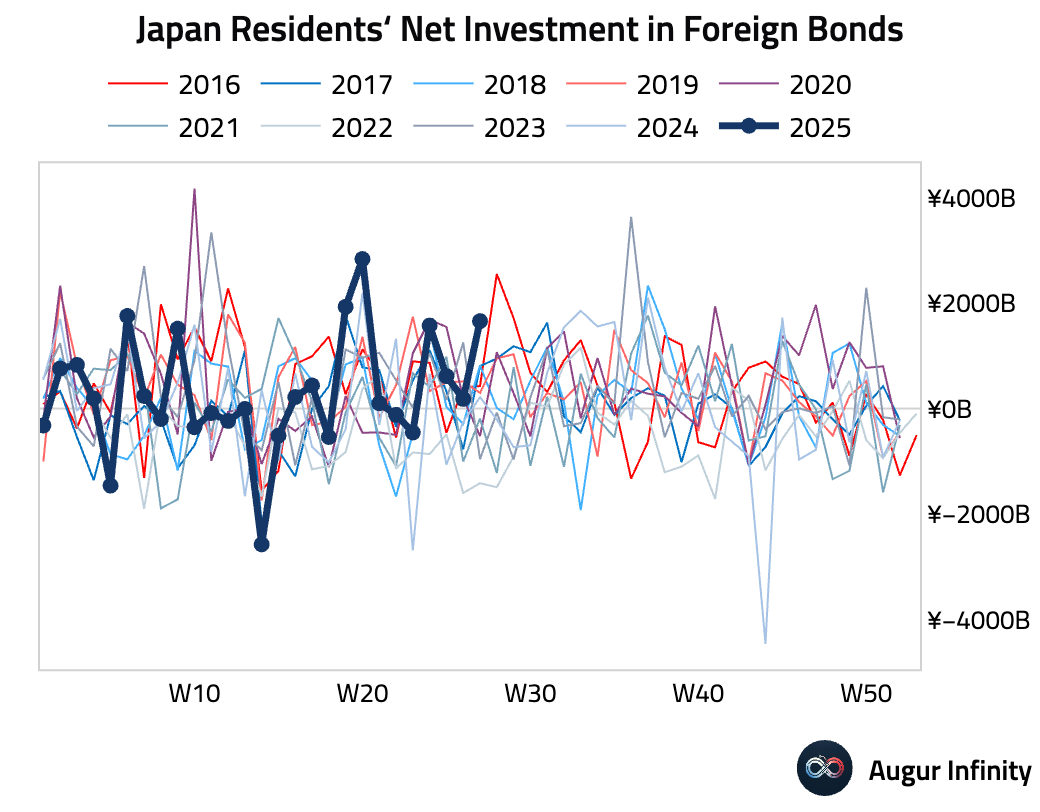

- Japanese investors were significant net buyers of foreign bonds in the week ending July 5, with purchases totaling ¥1.66 trillion. Meanwhile, foreign investors purchased ¥611.7 billion of Japanese equities.

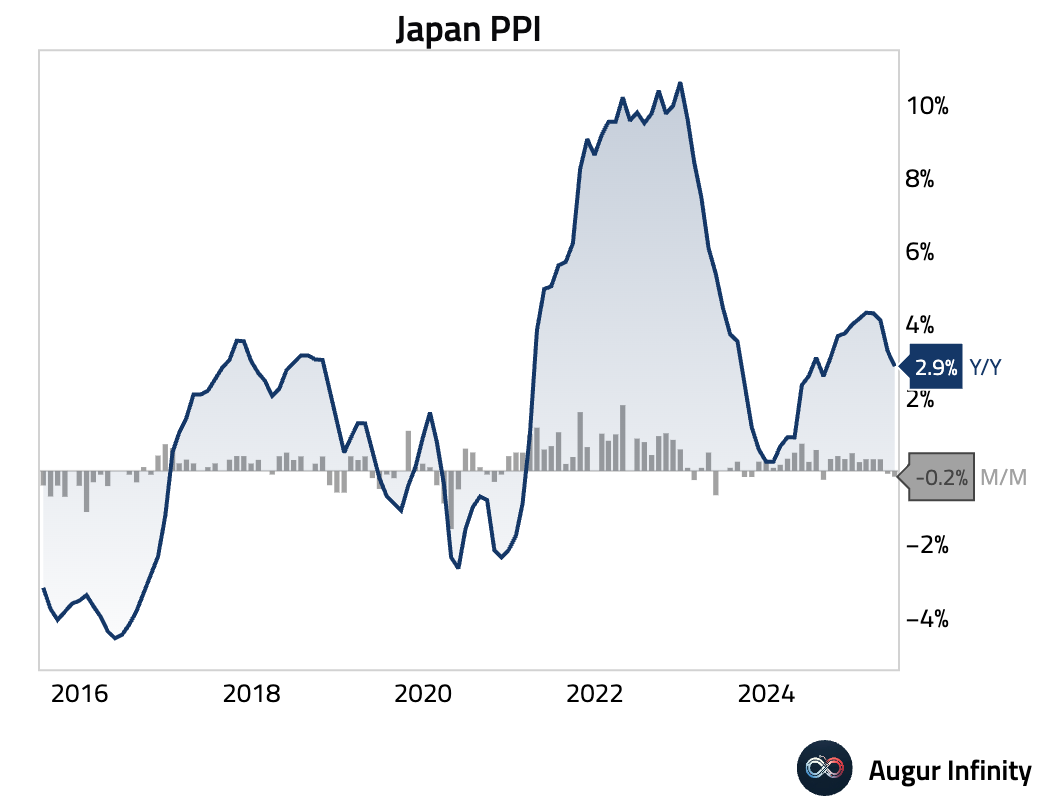

- Japan's Producer Price Index (PPI) for June fell 0.2% M/M, in line with consensus. The Y/Y rate decelerated to 2.9% from 3.3%, also matching expectations, suggesting producer price pressures are easing.

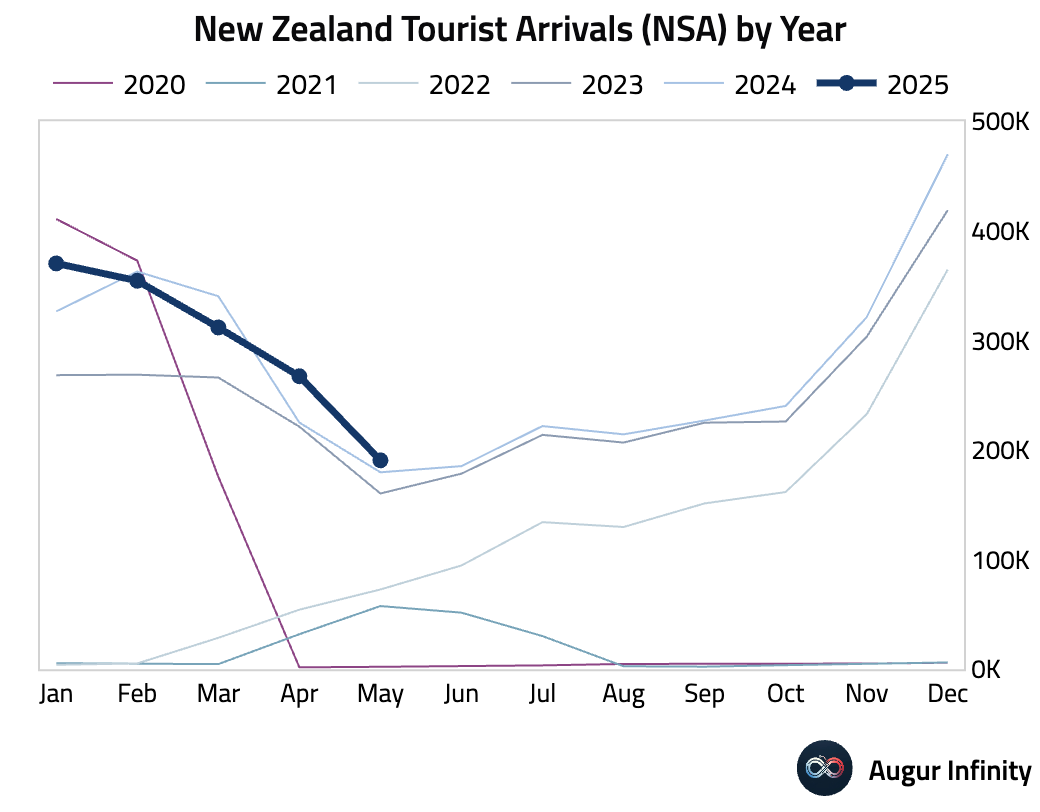

- New Zealand's visitor arrivals growth slowed to 6.1% Y/Y in May from 18.8% in April, indicating a moderation in tourism recovery.

China

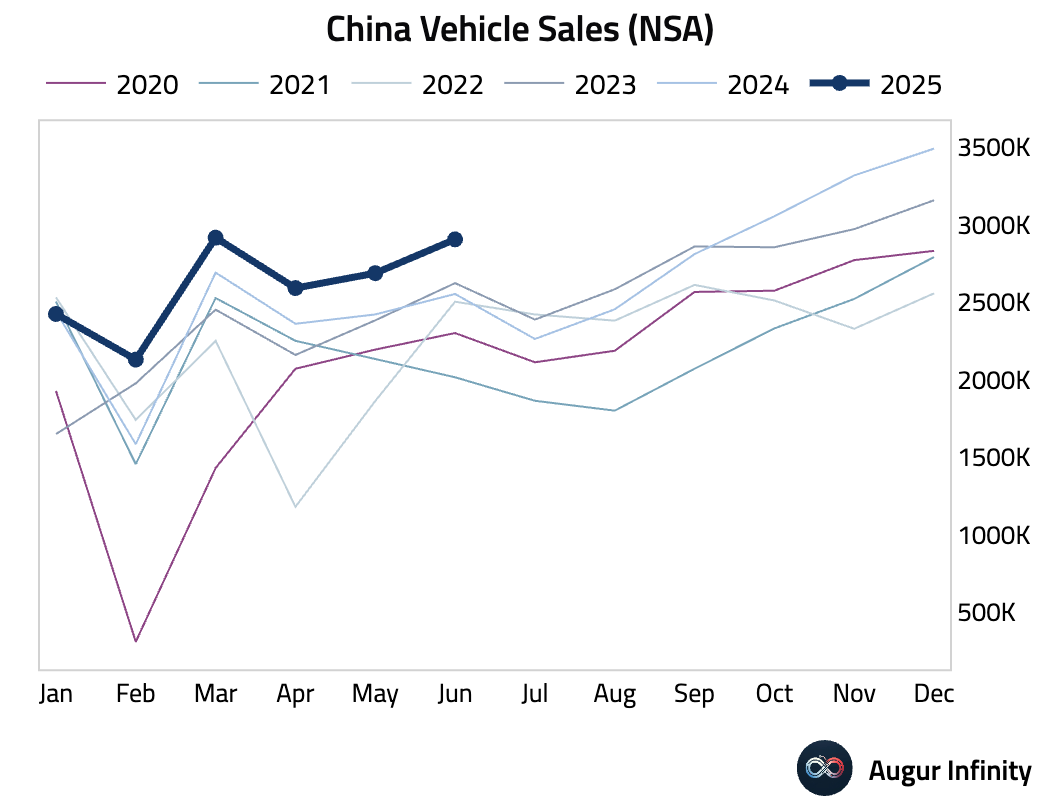

- Vehicle sales in China accelerated in June, rising 13.8% Y/Y compared to 11.2% in May, signaling robust domestic demand in the automotive sector.

Emerging Markets ex China

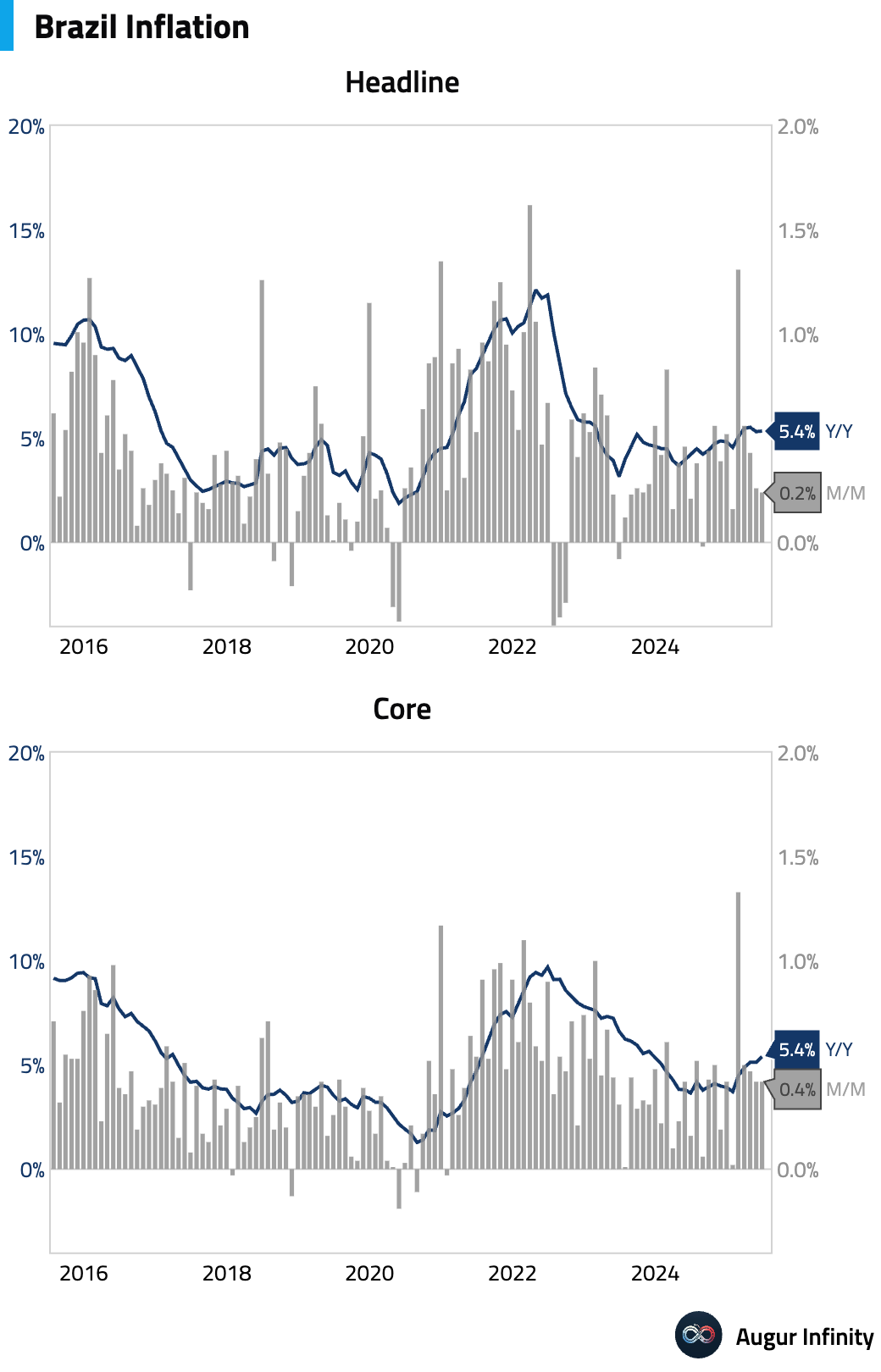

- Brazil's headline inflation rate for June came in slightly hotter than anticipated. The IPCA index rose to 5.35% Y/Y, slightly above the 5.32% consensus, while the M/M rate of 0.24% also exceeded the 0.20% forecast.

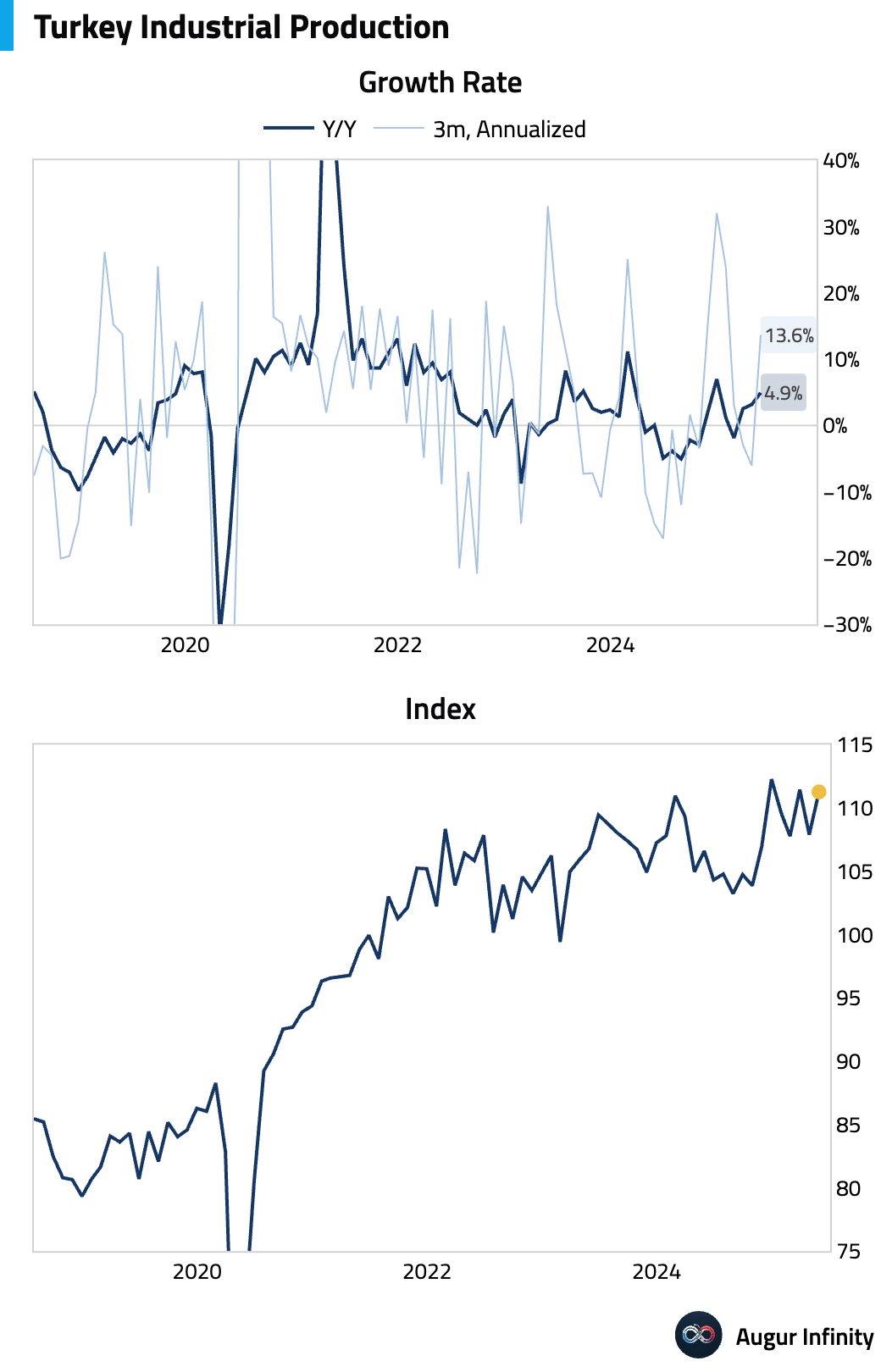

- Turkish industrial production rebounded strongly in May, rising 3.1% M/M after a 3.2% fall in April. Y/Y growth accelerated to 4.9% from 3.1%, the strongest pace since December 2024.

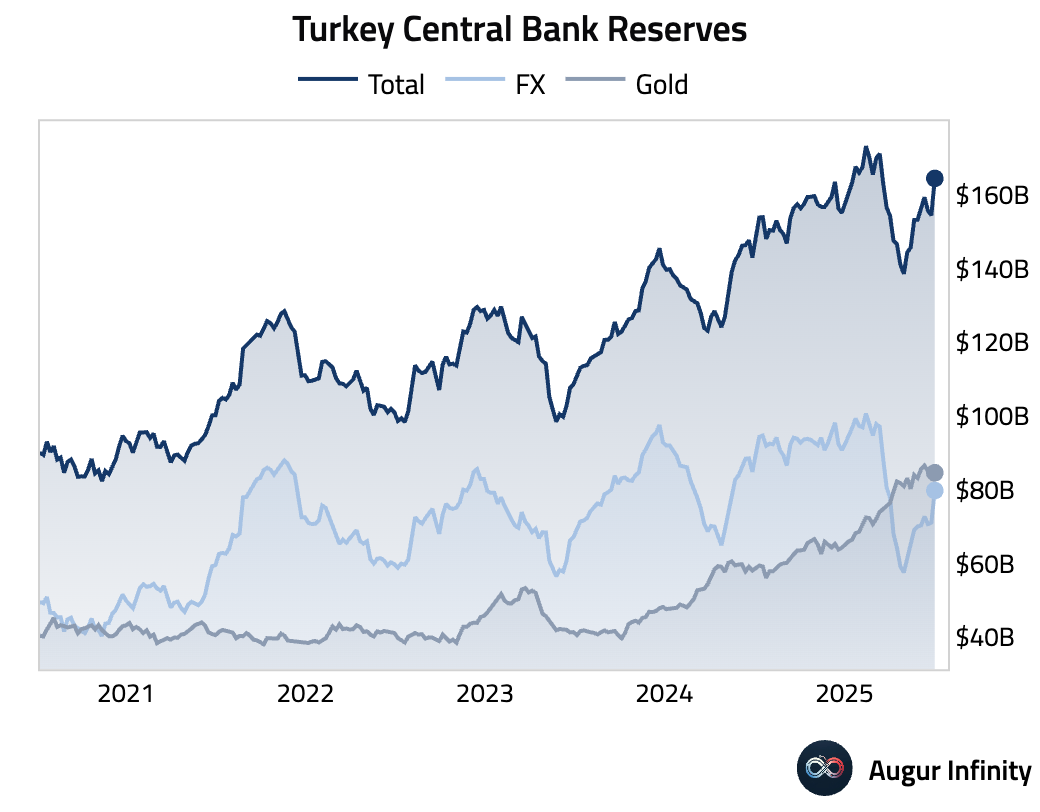

- Turkey's foreign exchange reserves increased to $79.79 billion in the week ending July 4, up from $71.09 billion the prior week.

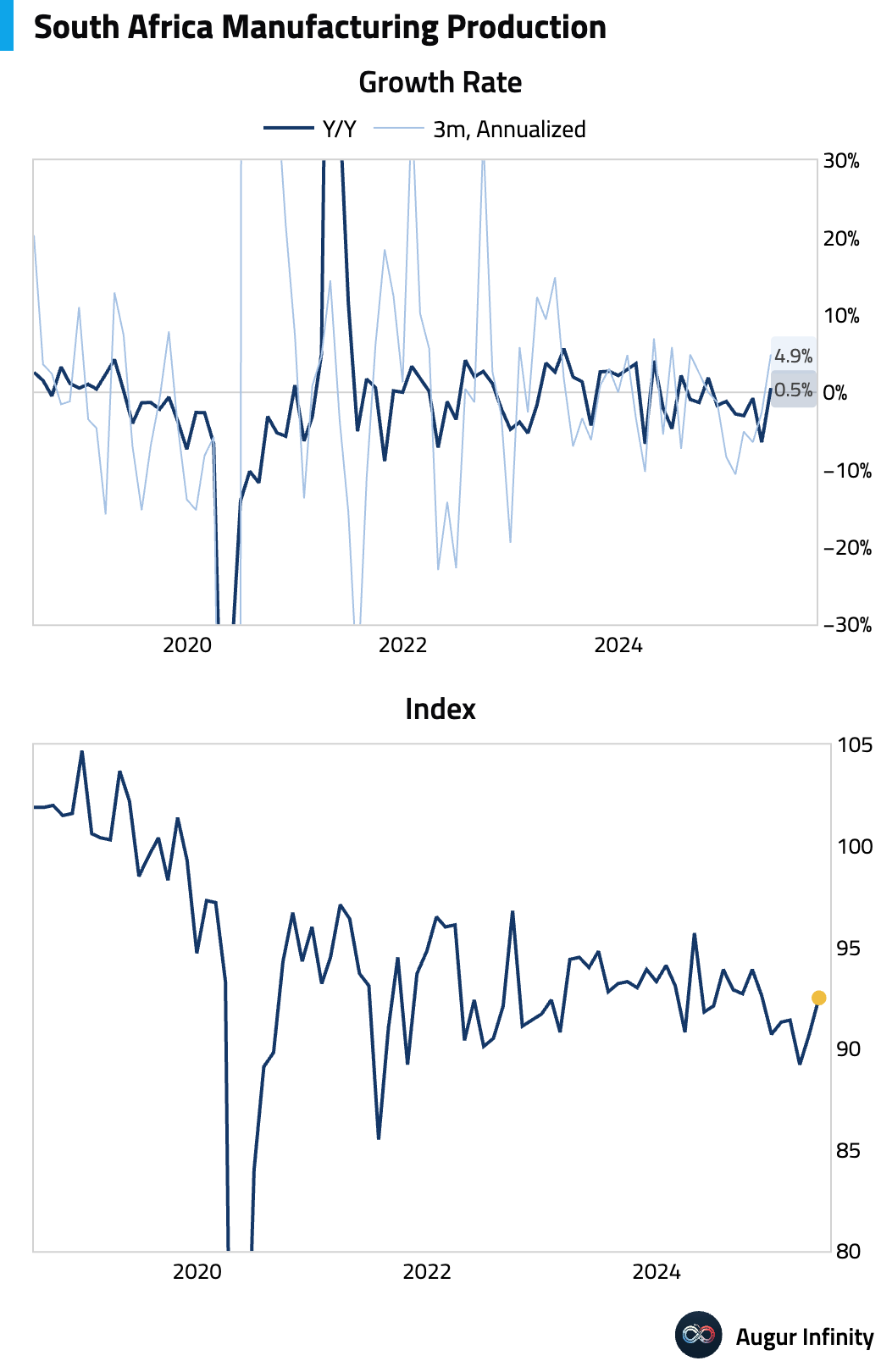

- South Africa’s manufacturing sector showed a significant recovery in May. Production rose 2.0% M/M, accelerating from a 1.7% gain. Y/Y production jumped to 0.5%, sharply reversing April's 6.4% drop and beating the consensus of a 1.5% decline.

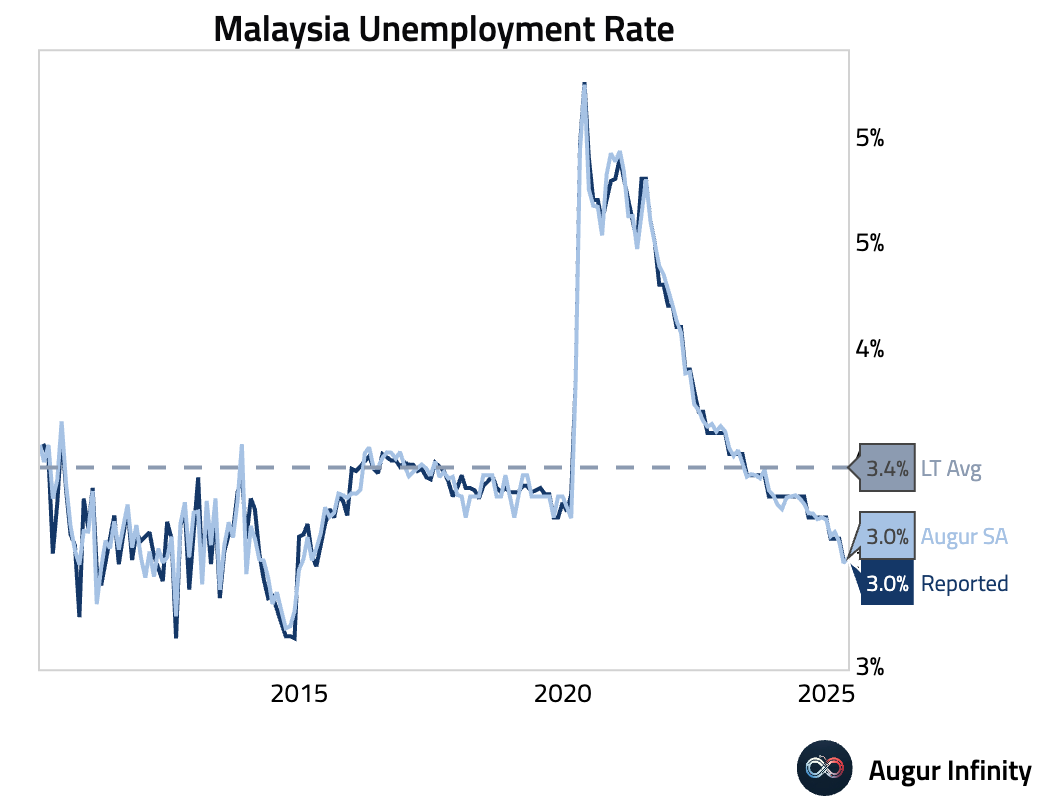

- Malaysia's unemployment rate held steady at a multi-decade low of 3.0% in May, unchanged from April.

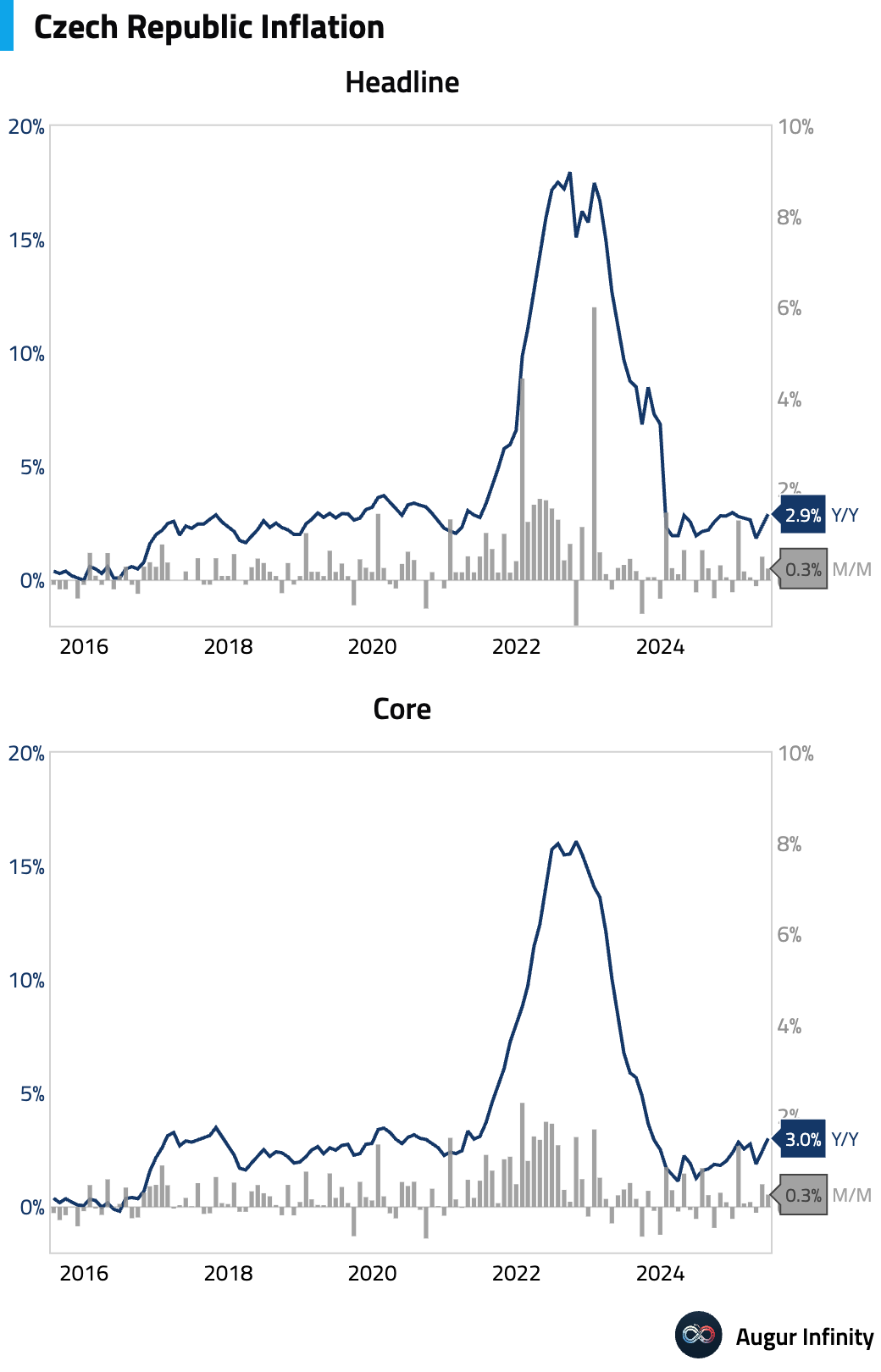

- The final Czech inflation rate for June was confirmed at 2.9% Y/Y, accelerating from 2.4% in May and matching the flash estimate.

Global Markets

Equities

- Global equity markets were broadly positive, though gains in the US were modest despite optimism around AI developments. The S&P 500 rose 0.3% and the Nasdaq Composite added 0.1%. The UK market gained 0.6%, marking its third straight day of advances. In Asia, South Korea rallied 1.5% after its central bank held rates, while China gained 0.9%. Conversely, Brazilian equities fell sharply by 1.6% for a second consecutive day amid news of impending US tariffs.

Fixed Income

- US Treasury yields edged higher across the front and middle of the curve. The 2-year and 10-year yields both rose by less than 1 basis point, while the 30-year yield declined by 1.1 bps.

FX

- The US dollar showed mixed performance against its G10 peers. Commodity-linked currencies were outperformers, with the Australian dollar leading the pack with a 0.4% gain for its third consecutive advance. The New Zealand dollar also strengthened by 0.2%. In contrast, the major European currencies, including the euro, Swiss franc, and British pound, all posted modest losses against the greenback. The Japanese yen was little changed.

Disclaimer

Augur Digest is an automated newsletter written by an AI. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.