Headlines

- China is considering implementing new restrictions on stock speculation after its domestic market reached the best level in a decade.

- Japan’s Ministry of Finance reported that budget requests for the next fiscal year have increased by approximately 6.3% Y/Y.

Global Economics

United States

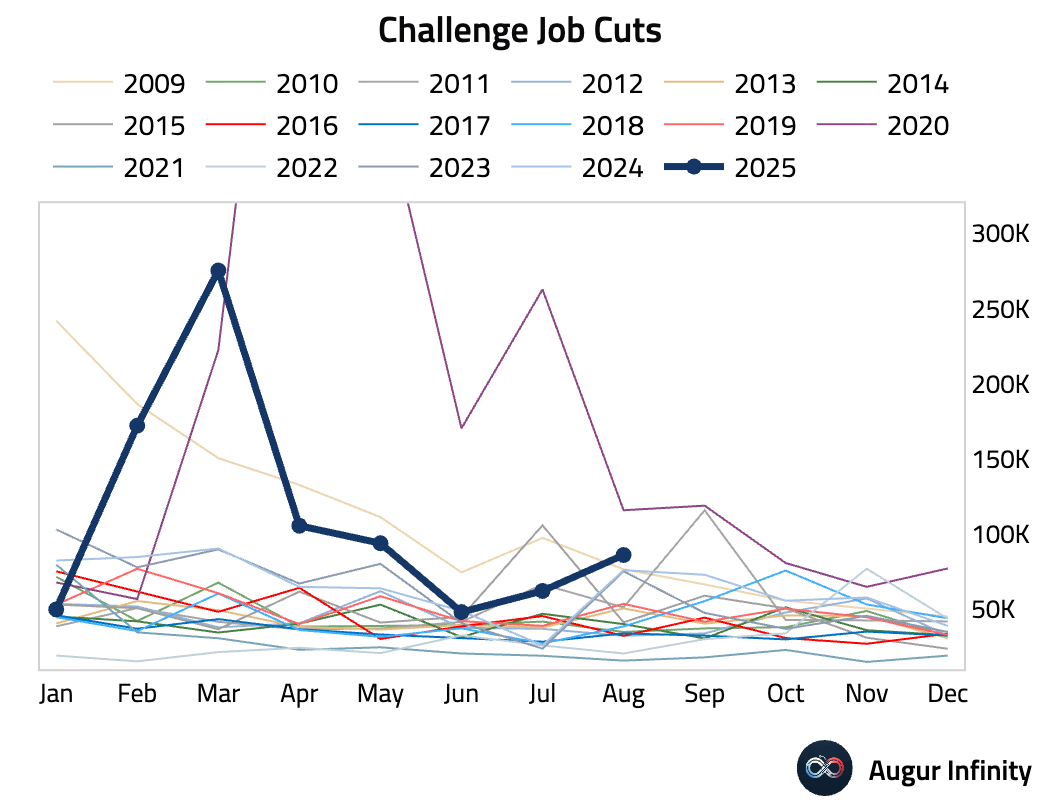

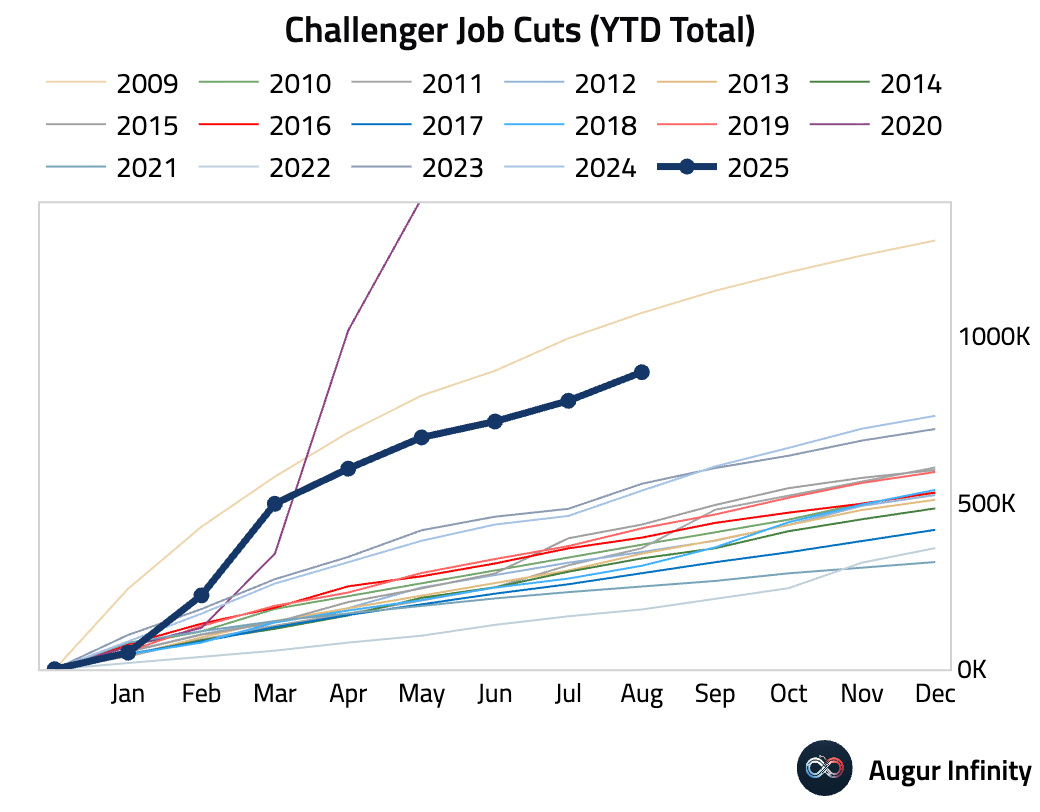

- US companies announced 85,979 job cuts in August, an increase from 62,075 in July and the highest number since May. The cumulative job cuts announced YTD is the highest since 2009.

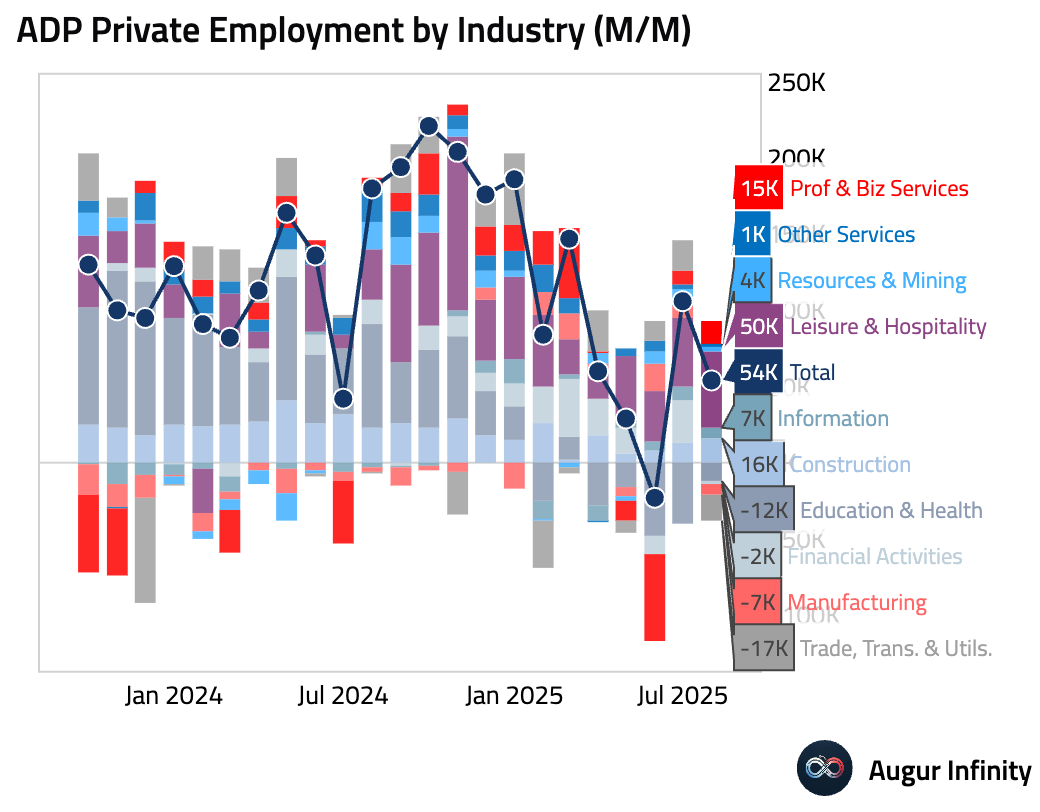

- According to ADP, private payrolls rose by only 54k in August, well below the consensus of 65k and a significant slowdown from July’s 106k. The 50k surge in leisure and hospitality was offset by trade and transportation (-17k) and health and education (-12k).

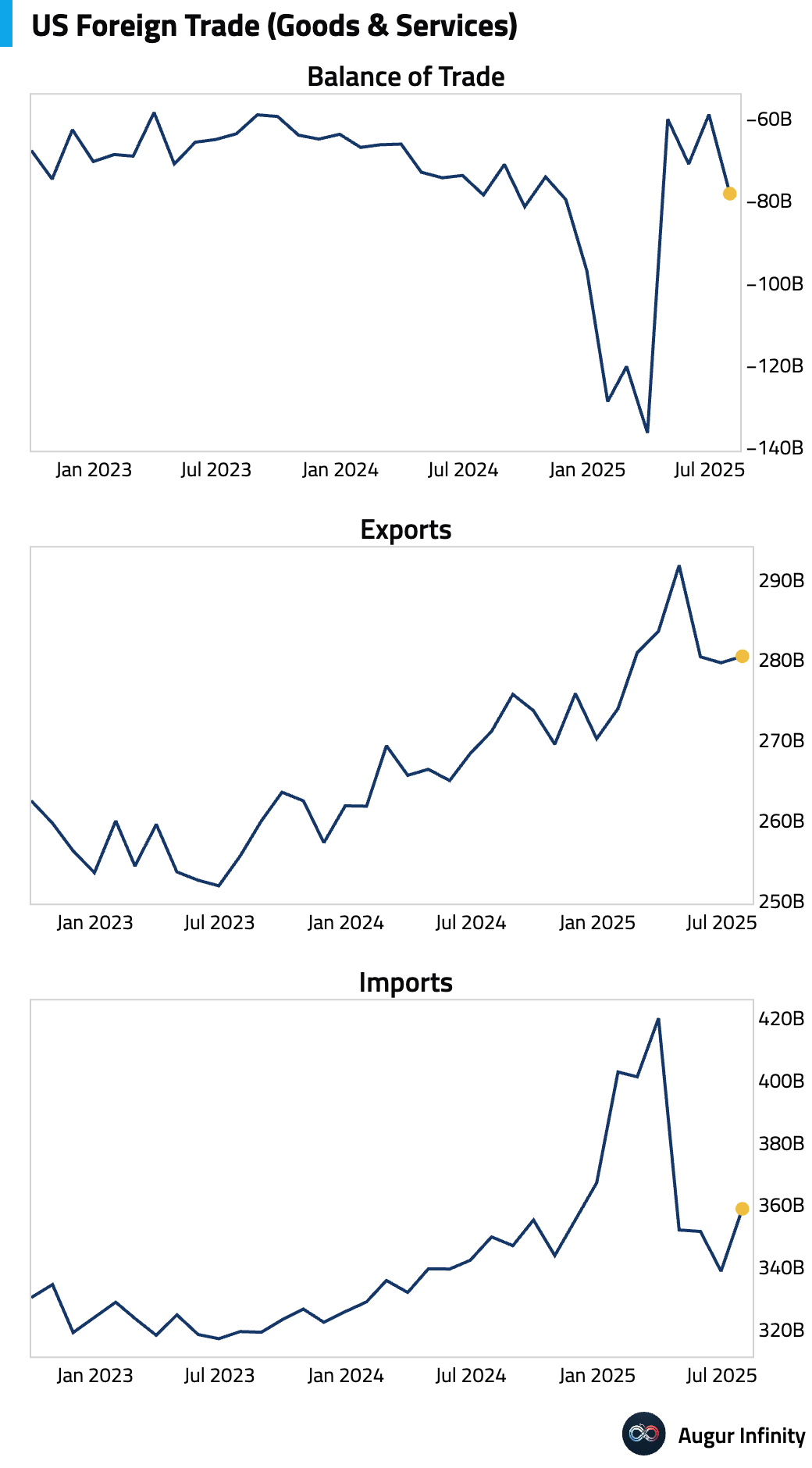

- The US trade deficit widened to $78.3 billion in July from a revised $59.1 billion in June, larger than the $75.7 billion expected. Imports rose to $358.8 billion while exports edged up to $280.5 billion.

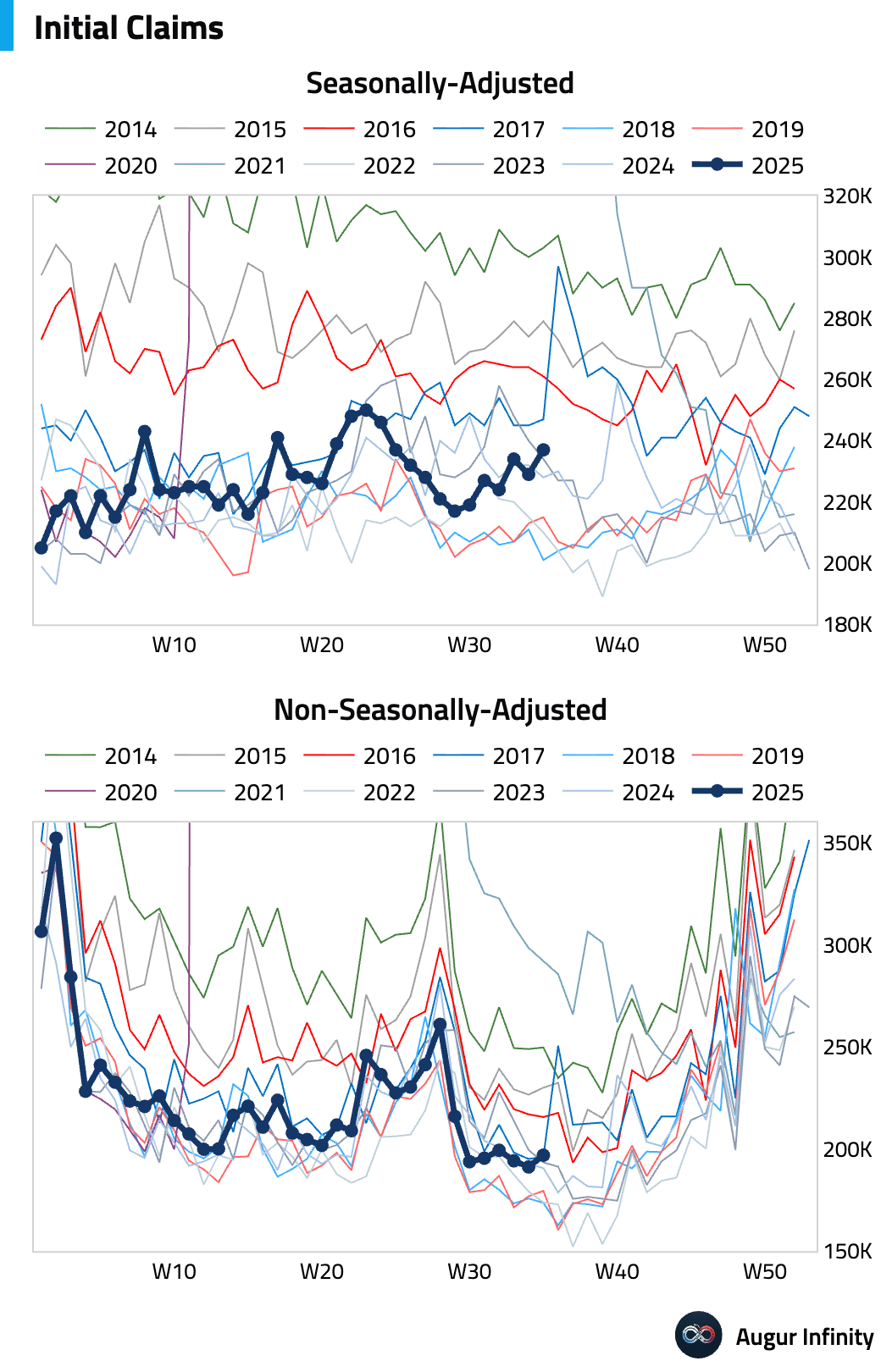

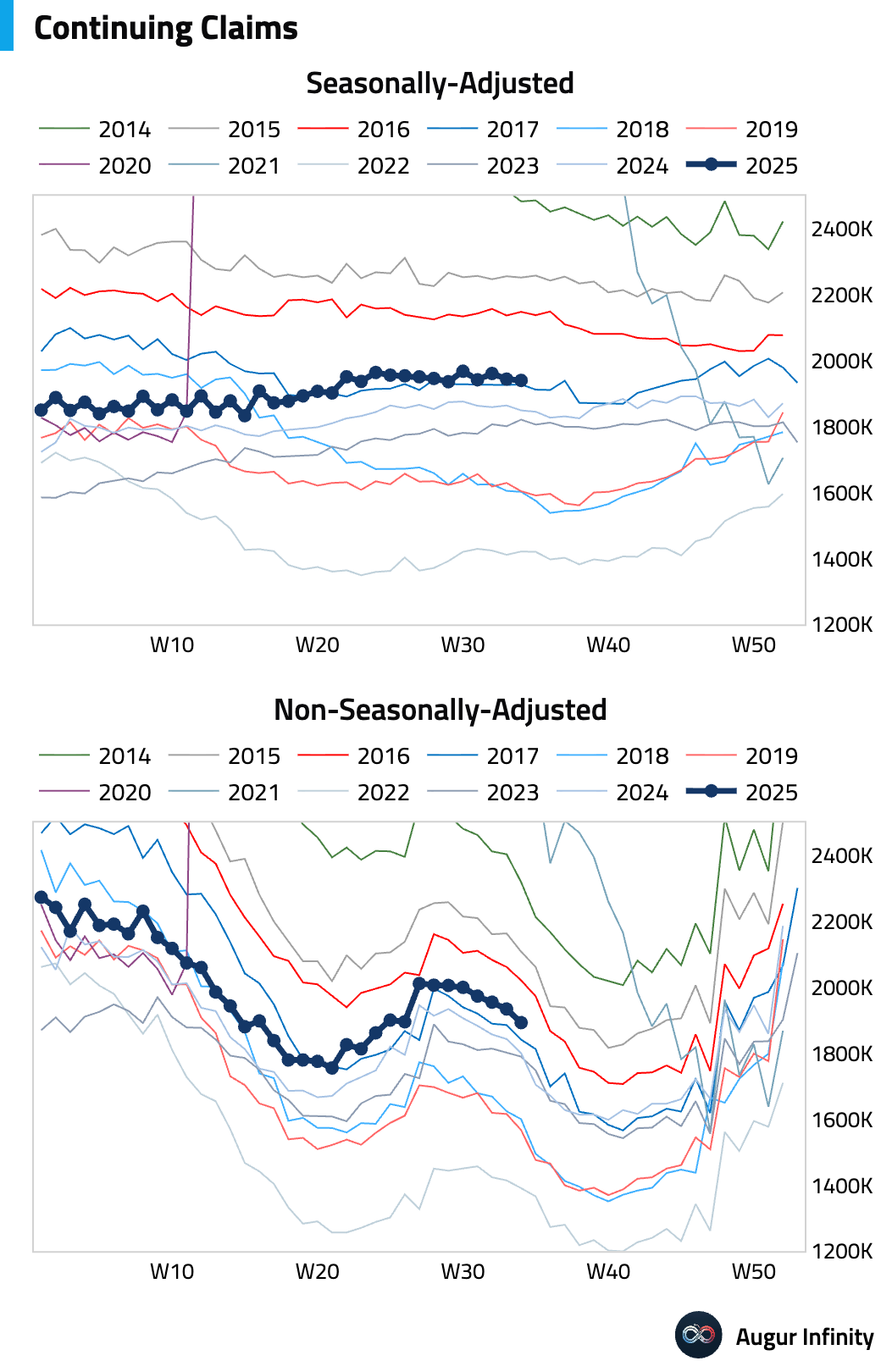

- Initial jobless claims rose to 237,000 for the week ending August 30, slightly above the consensus of 230,000. The increase was concentrated in Connecticut and Tennessee, suggesting it may not reflect a broad weakening in the national labor market. Continuing claims fell to 1.94 million.

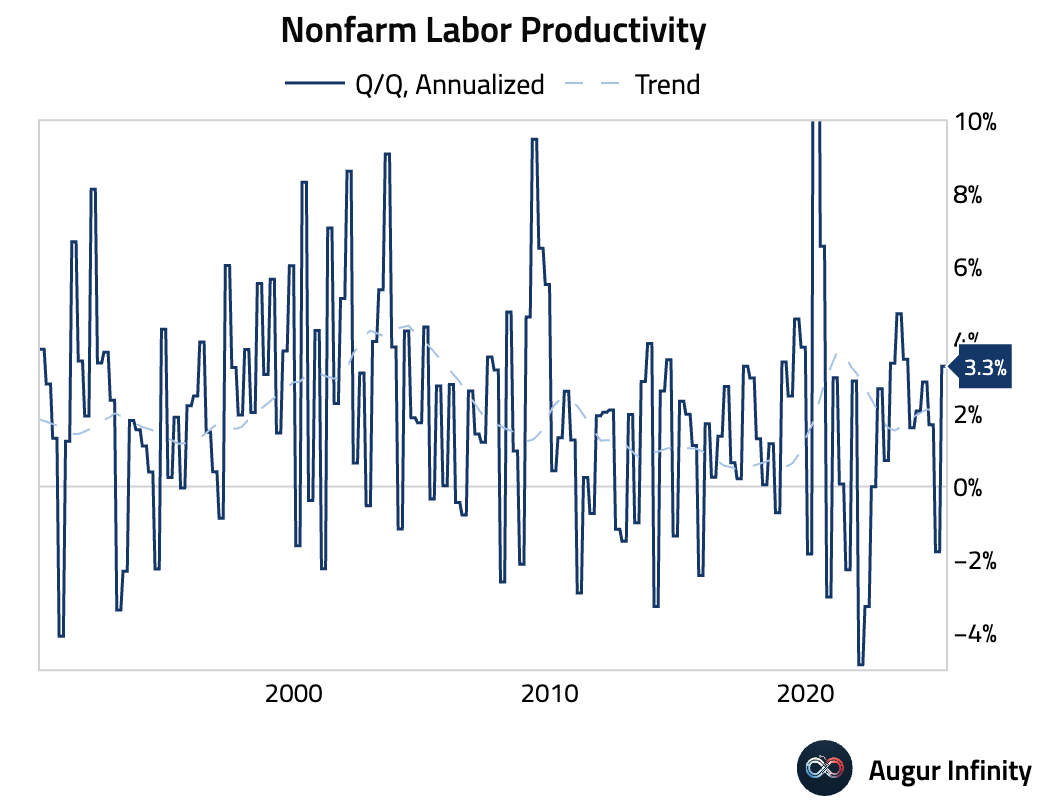

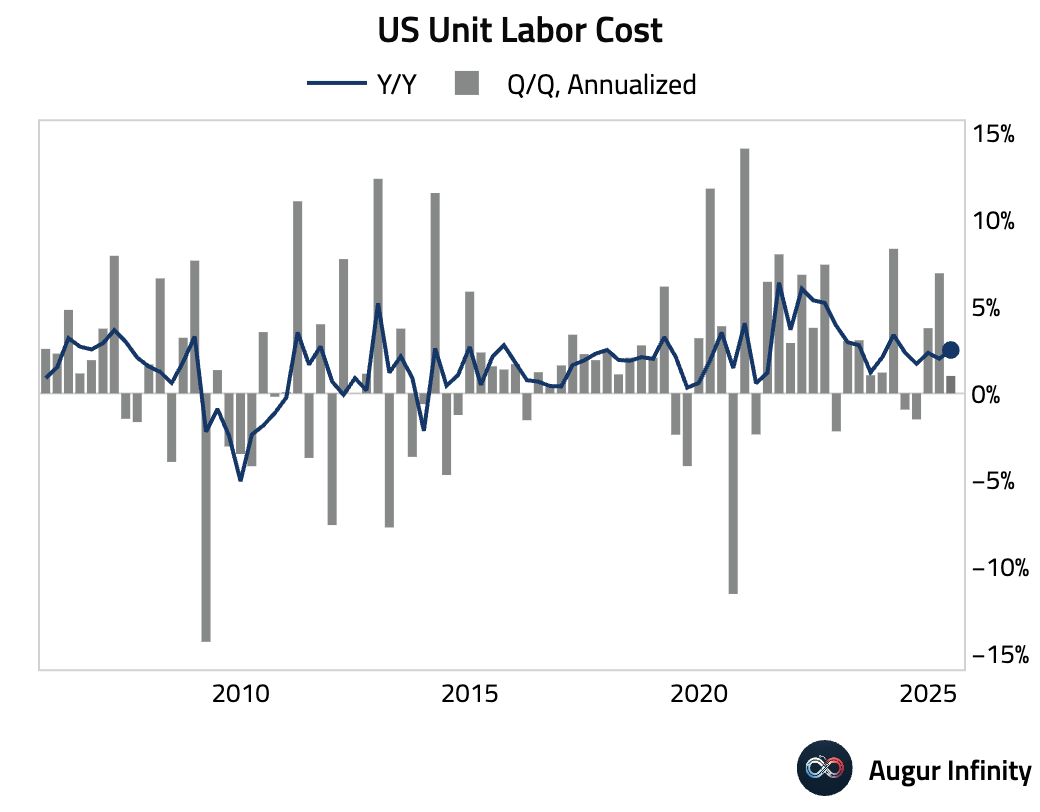

- Final nonfarm productivity for Q2 was revised higher to a 3.3% annualized rate, beating the 2.7% consensus. Unit labor costs were revised down to a 1.0% annualized increase, below the 1.2% estimate.

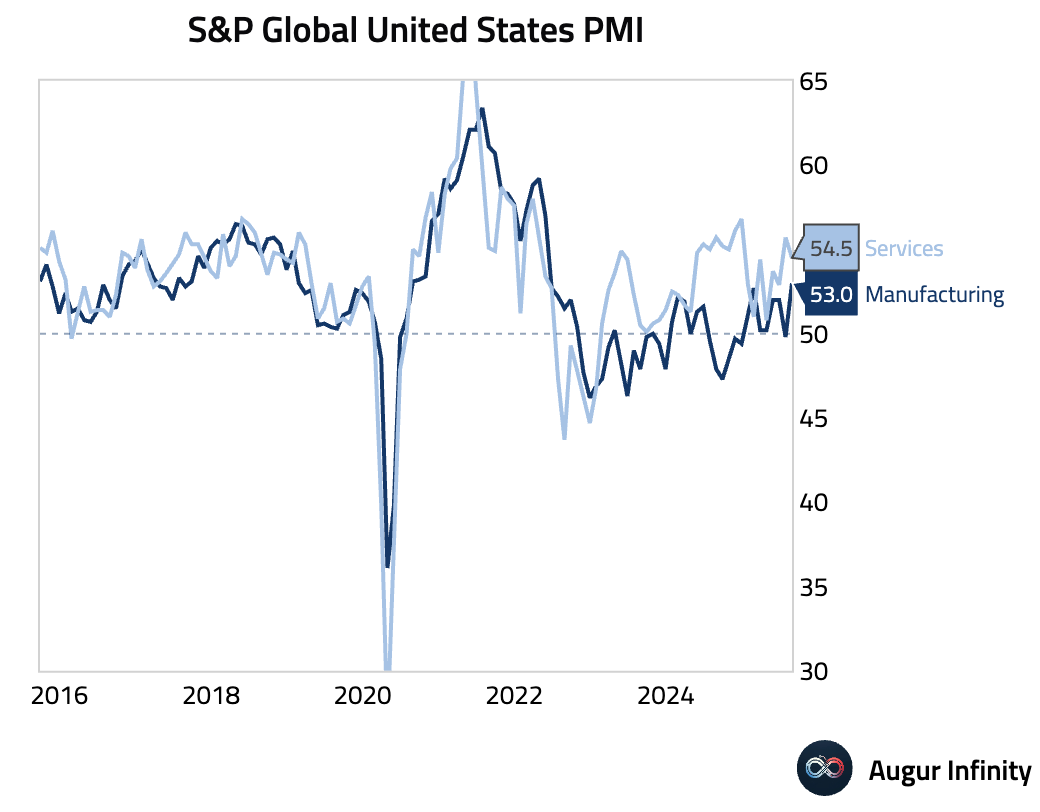

- The final S&P Global Services PMI for August was 54.5, a slight downward revision from the preliminary 55.4 but still indicating strong expansion.

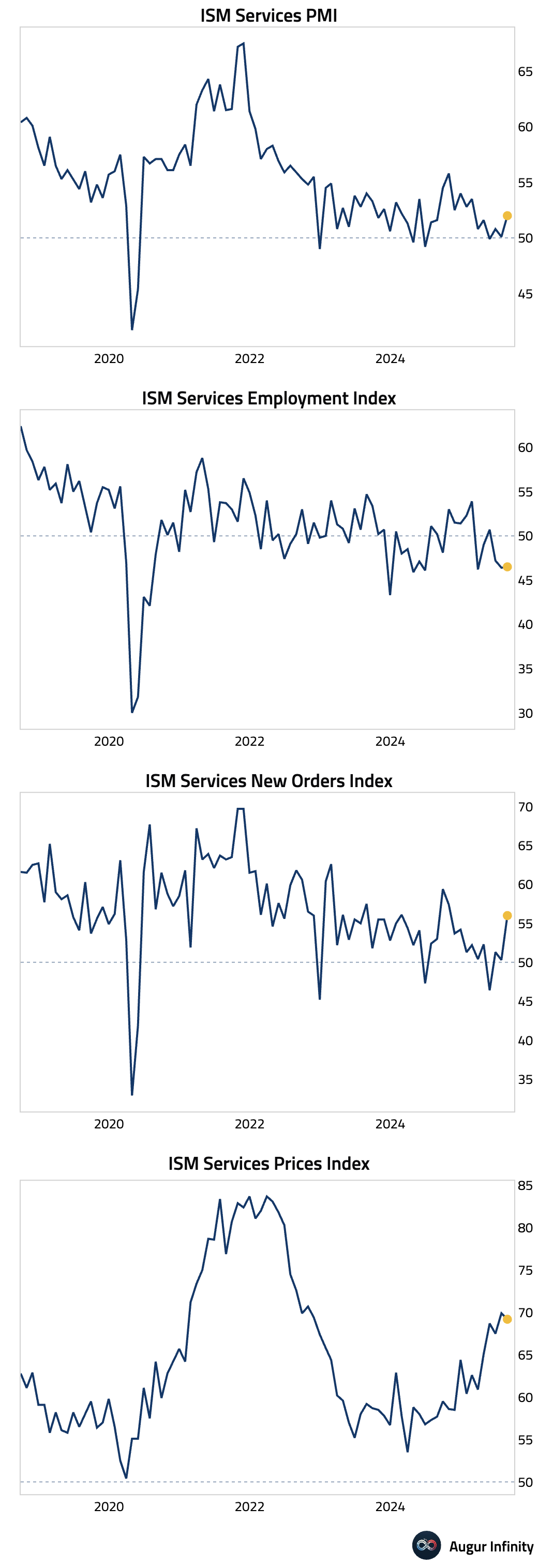

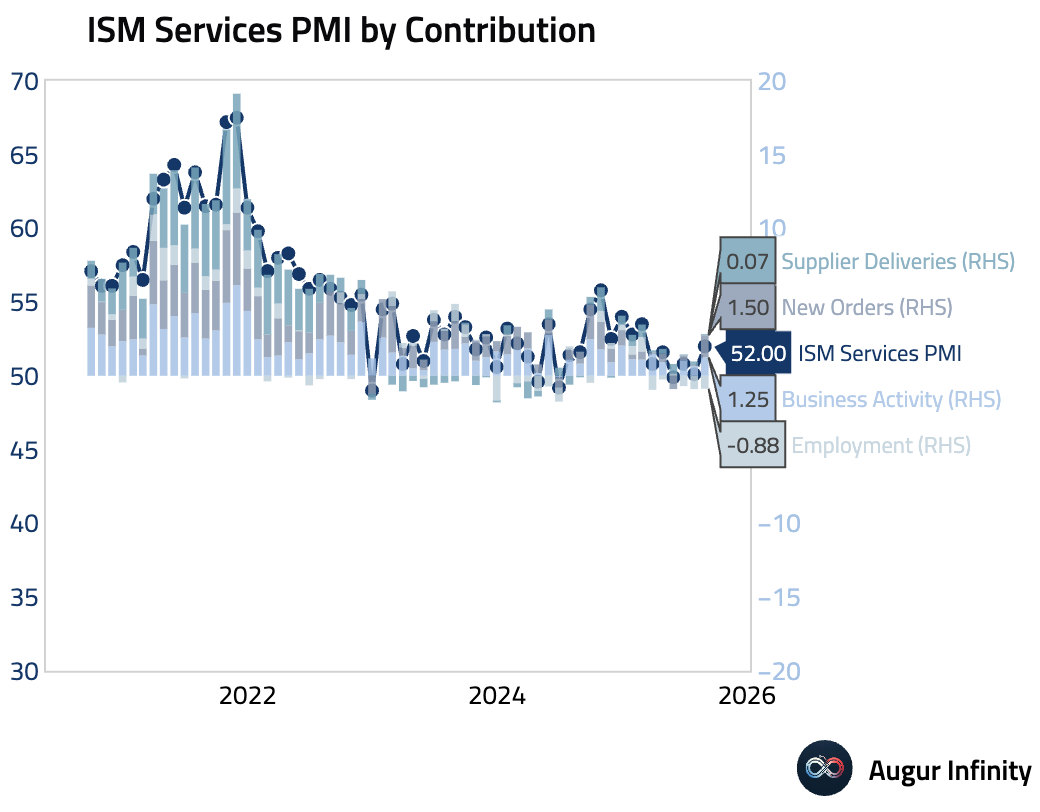

- The ISM Services PMI unexpectedly rose to 52.0 in August from 50.1, beating the consensus estimate of 51.0. The increase was driven by a sharp acceleration in New Orders, which jumped 5.7 points to 56.0, and a rise in Business Activity to 55.0, partly reflecting firms pulling orders forward to get ahead of tariff increases. However, the employment index remained in contraction for a third consecutive month at 46.5, signaling continued softness in the services labor market. The prices paid index remains highly elevated at 69.2, indicating persistent inflationary pressure.

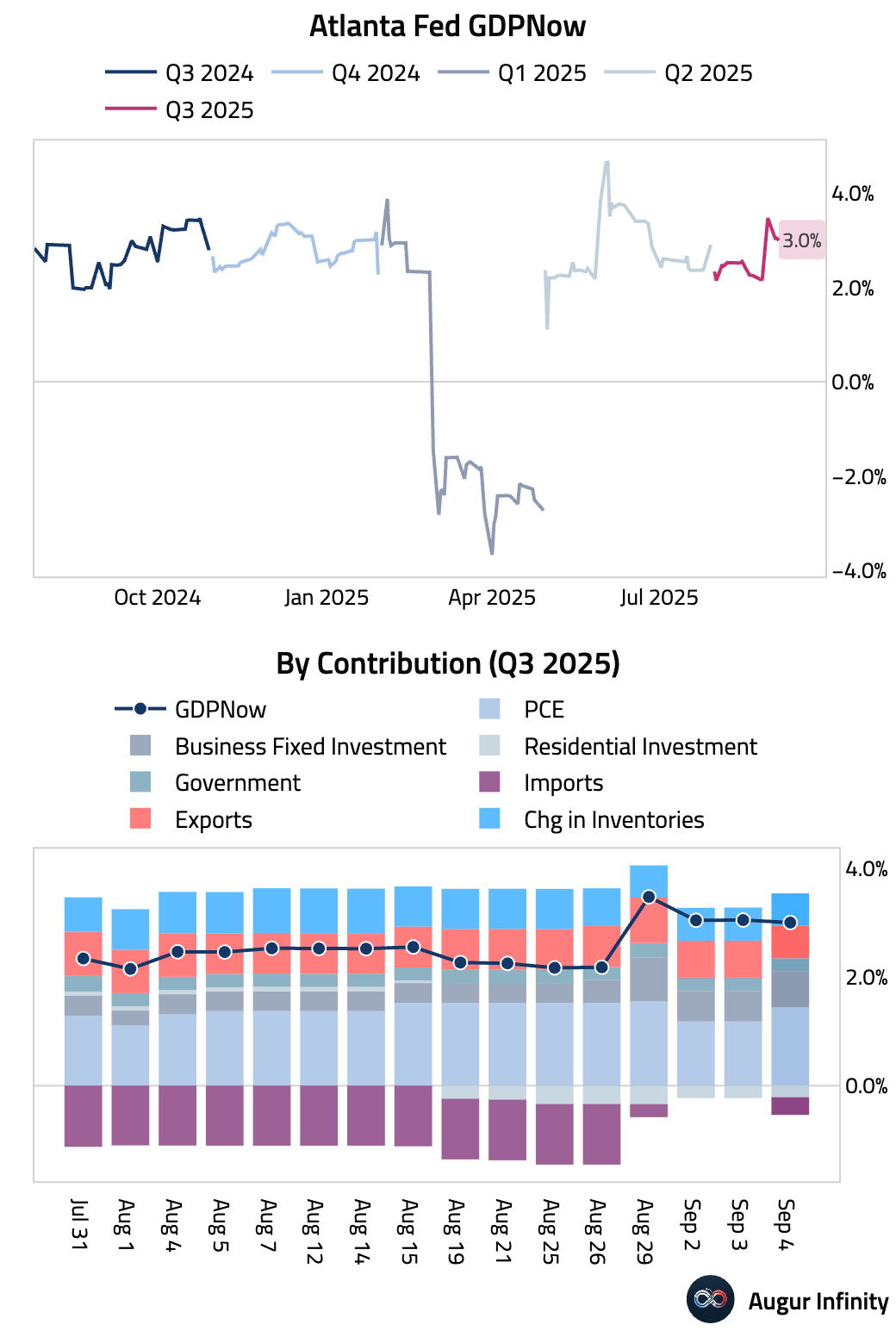

- The Atlanta Fed's GDPNow model is still tracking Q2 GDP at 3.0%, unchanged from September 2.

Canada

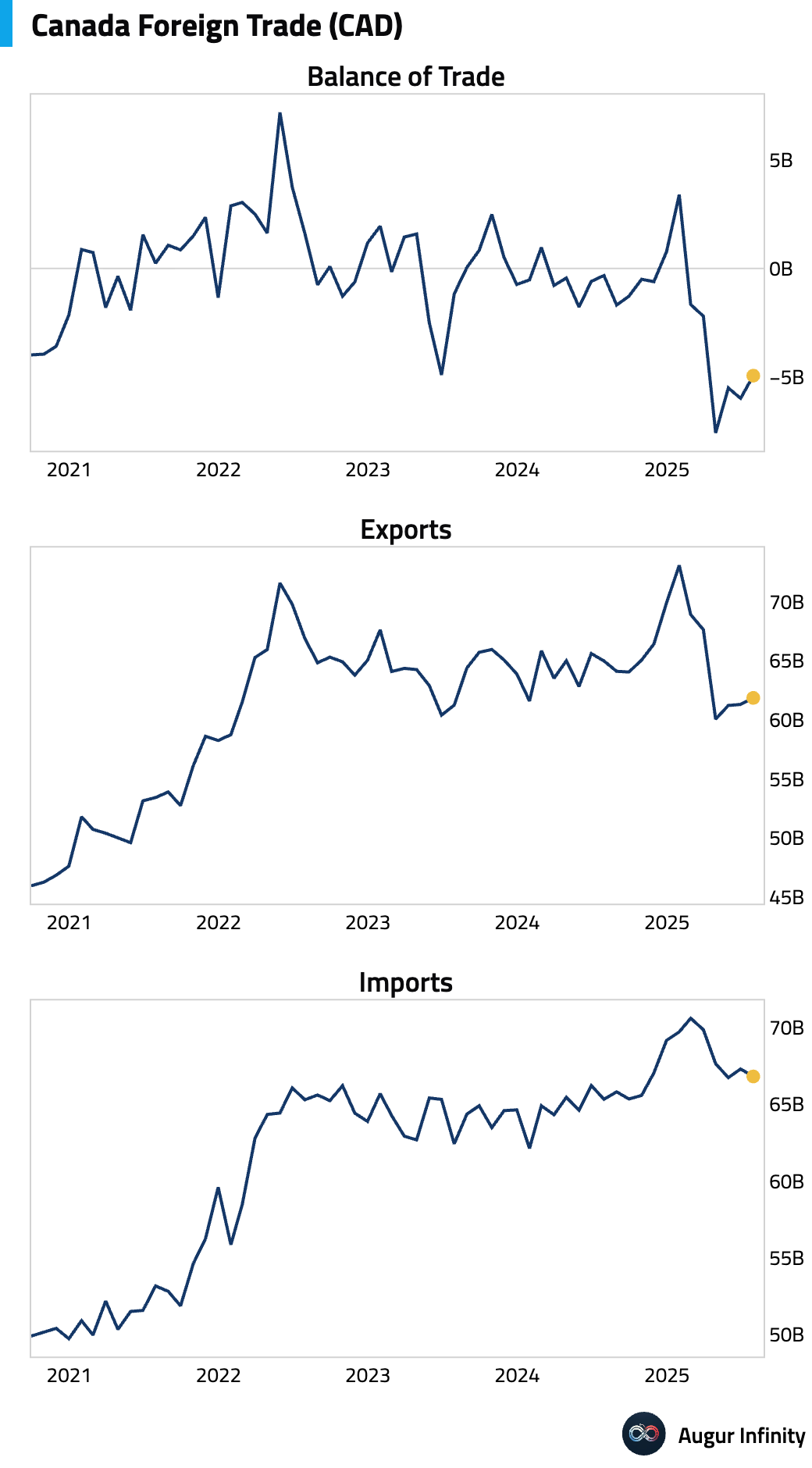

- Canada’s trade deficit narrowed slightly to C$4.94 billion in July from C$5.98 billion in June. Exports rose to C$61.86 billion, while imports decreased to C$66.80 billion.

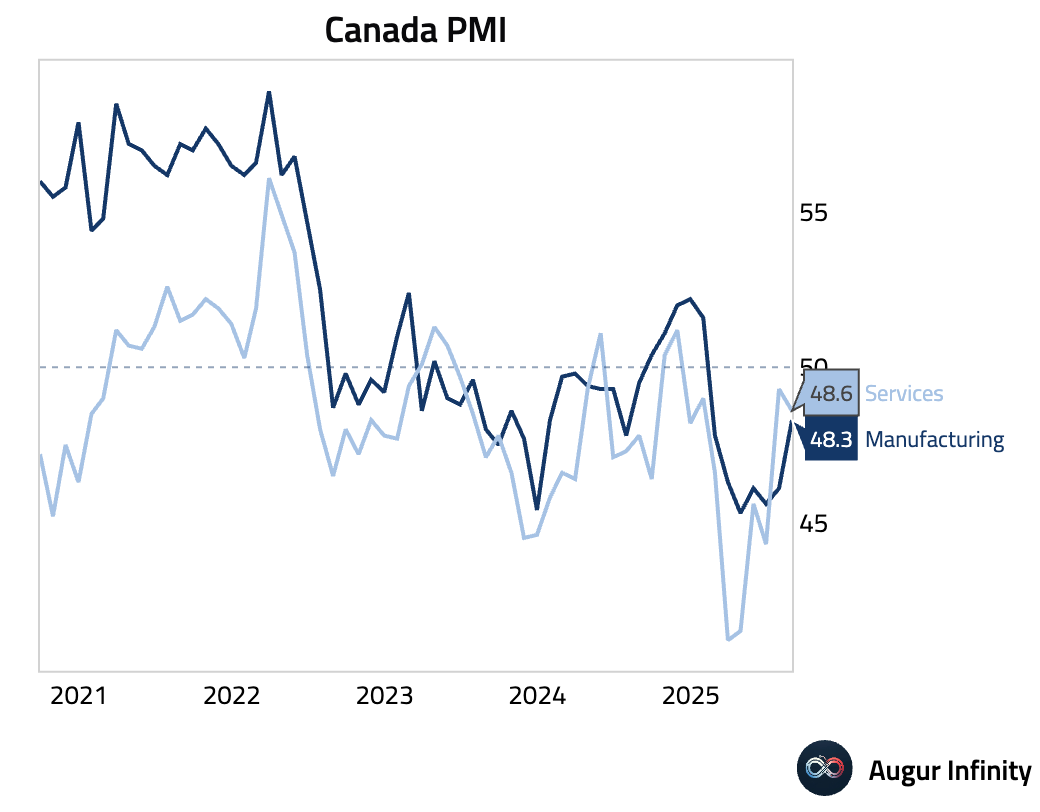

- The S&P Global Services PMI for Canada fell to 48.6 in August from 49.3, indicating a faster pace of contraction in the services sector.

Europe

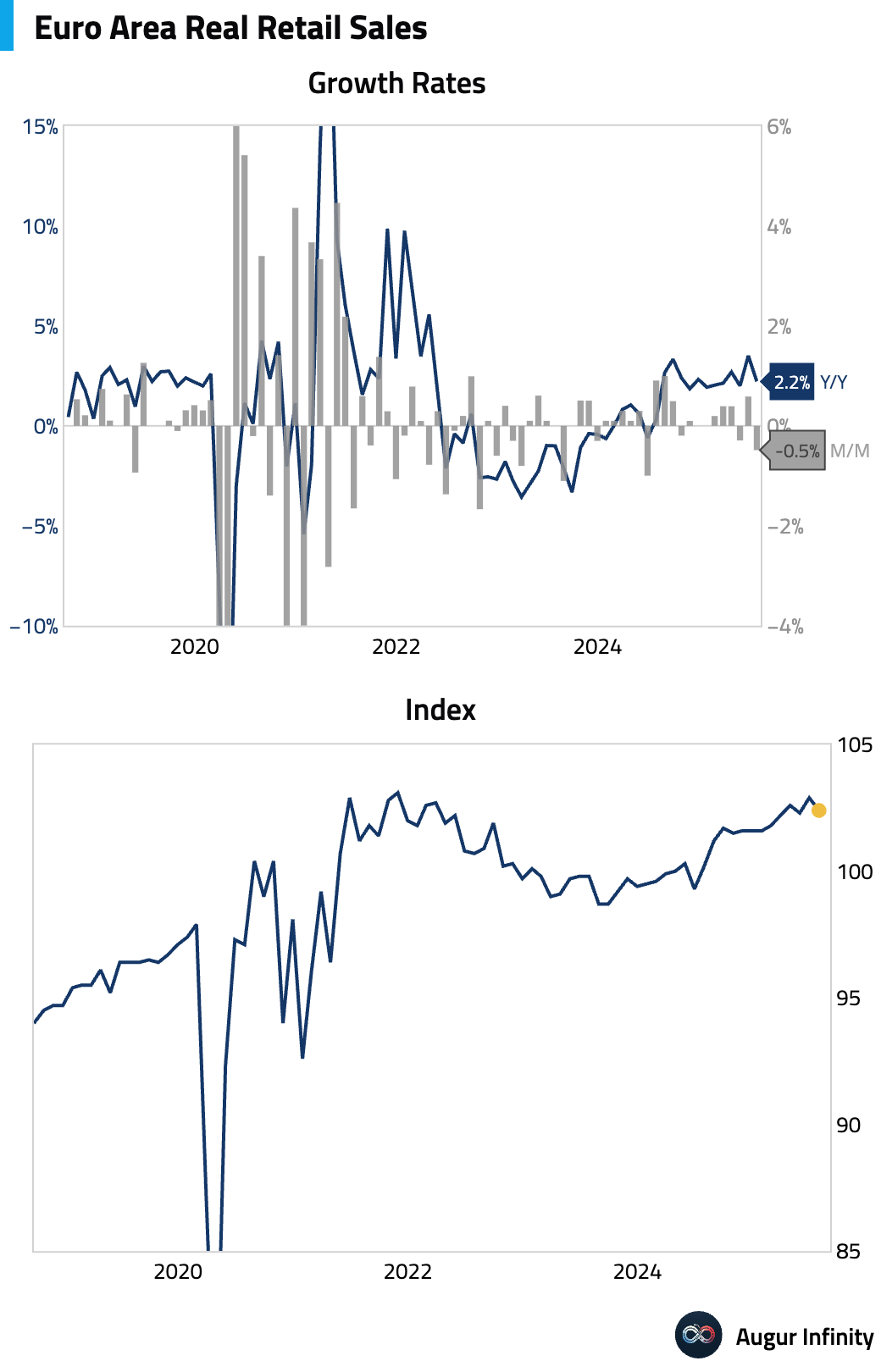

- Retail sales in the Euro Area fell by 0.5% M/M in July, missing the consensus for a 0.2% decline. Year-over-year, sales growth slowed to 2.2% from 3.5% in June.

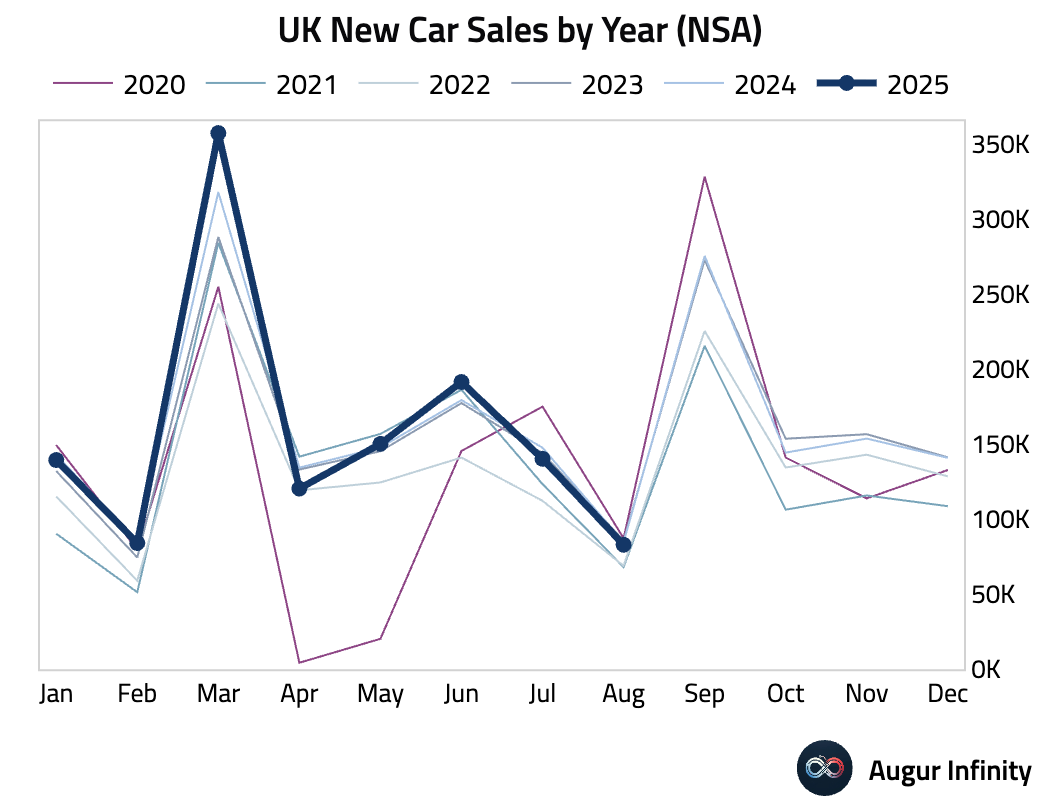

- UK new car sales fell 2.0% Y/Y in August, a smaller decline than the 5.0% drop seen in July.

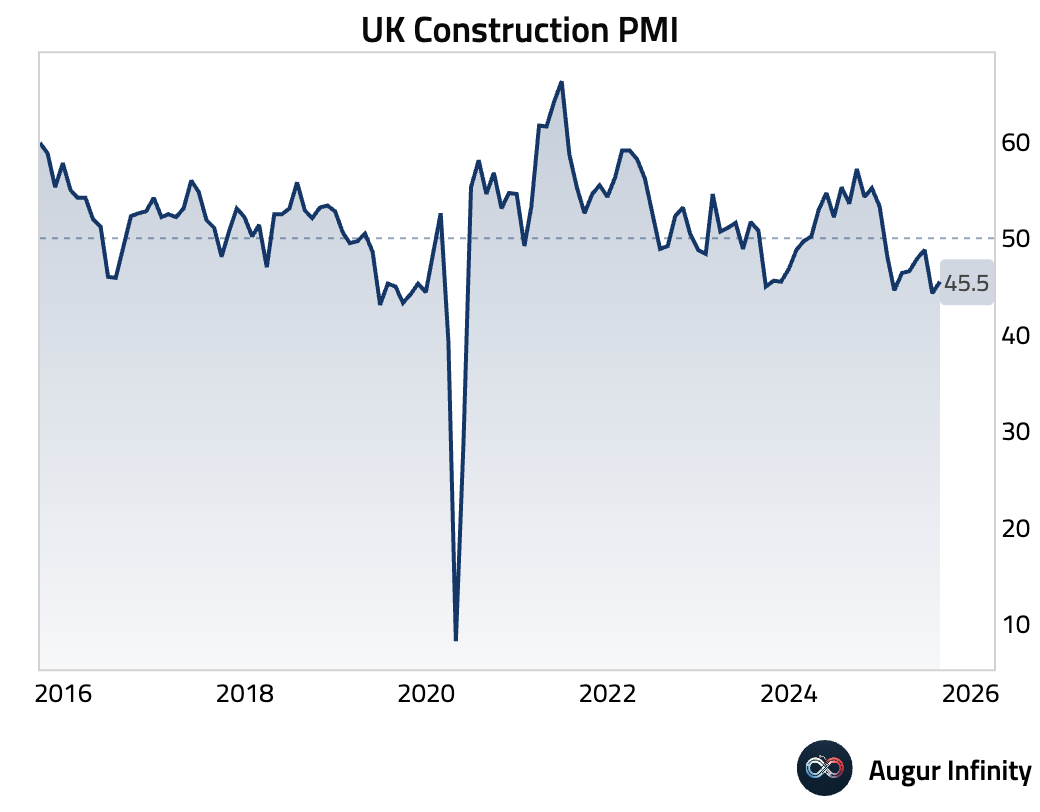

- The S&P Global/CIPS Construction PMI for the UK rose to 45.5 in August from 44.3, slightly beating the consensus of 45.0 but still signaling a contraction in activity.

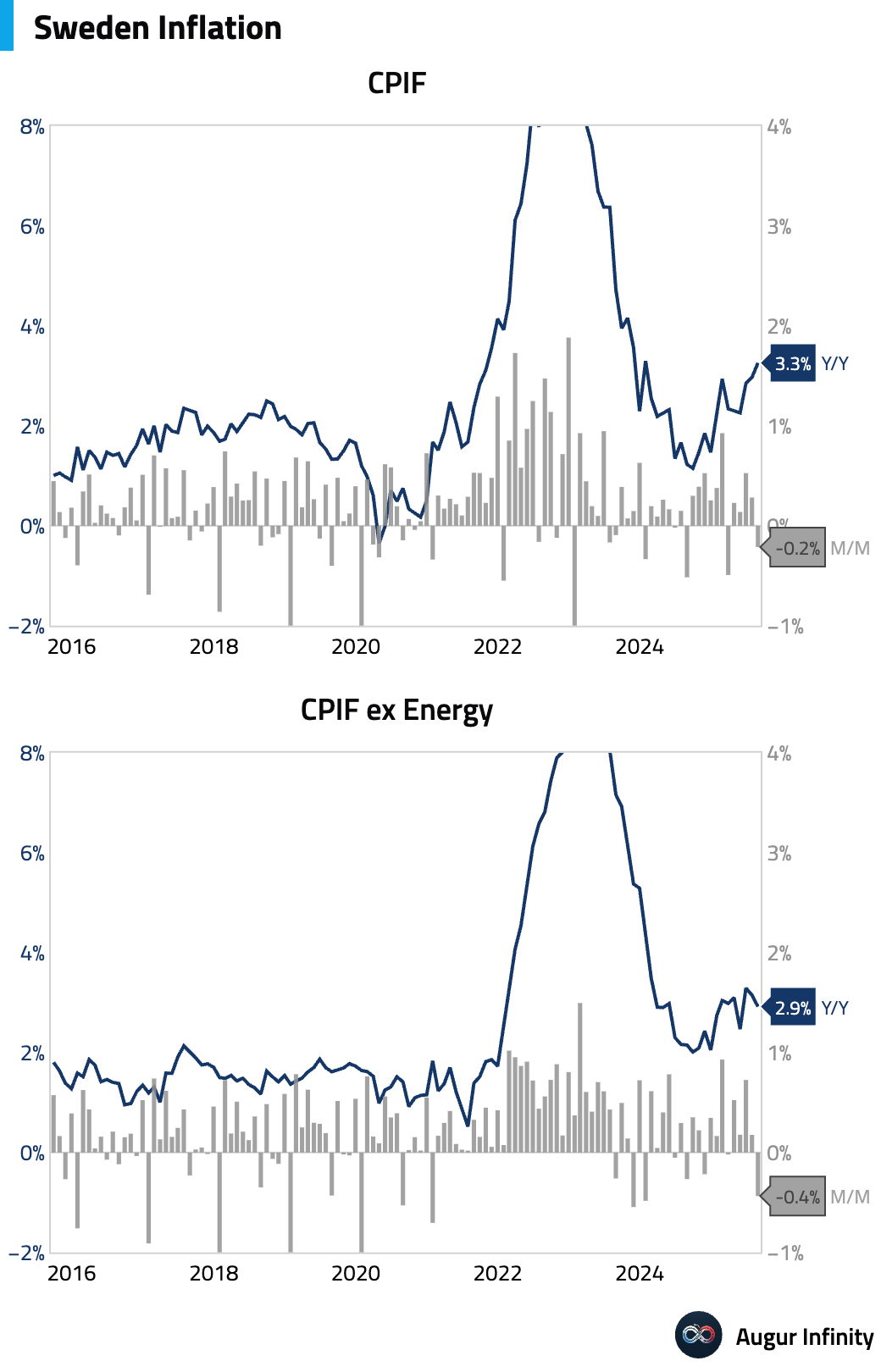

- Preliminary data for August showed Sweden’s CPIF inflation rising to 3.3% Y/Y from 3.0%, while declining 0.2% M/M.

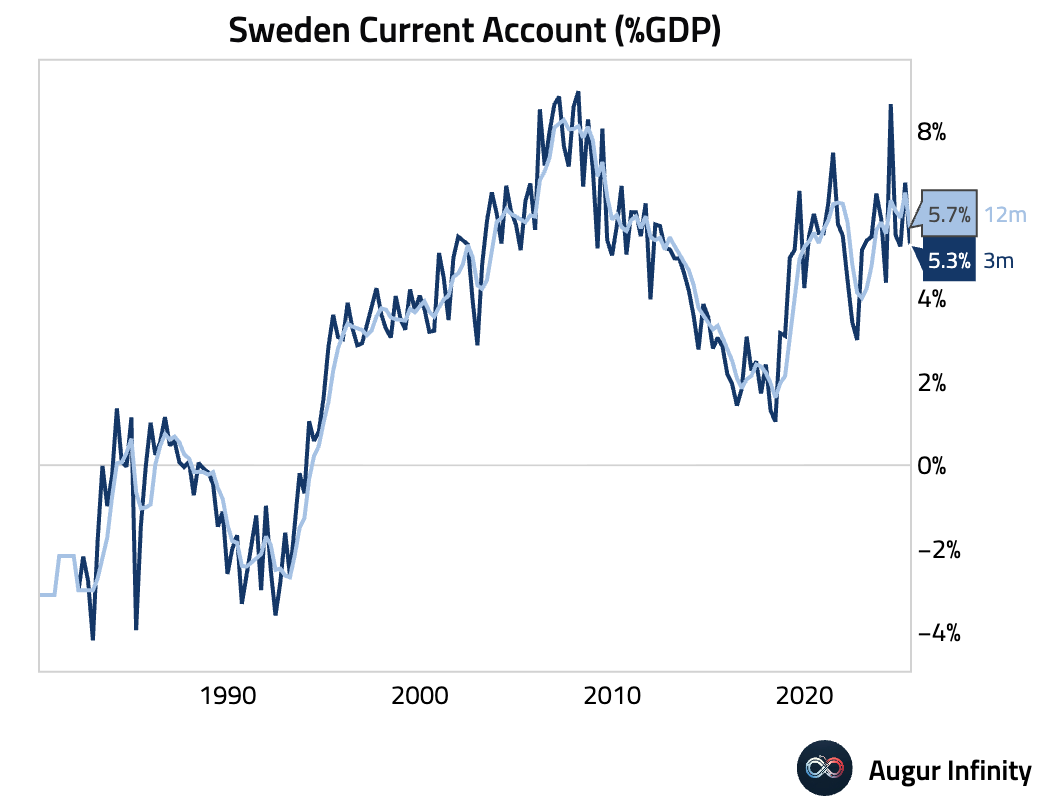

- Sweden’s current account surplus decreased to SEK 84.5 billion in Q2 from SEK 125.4 billion in the prior quarter.

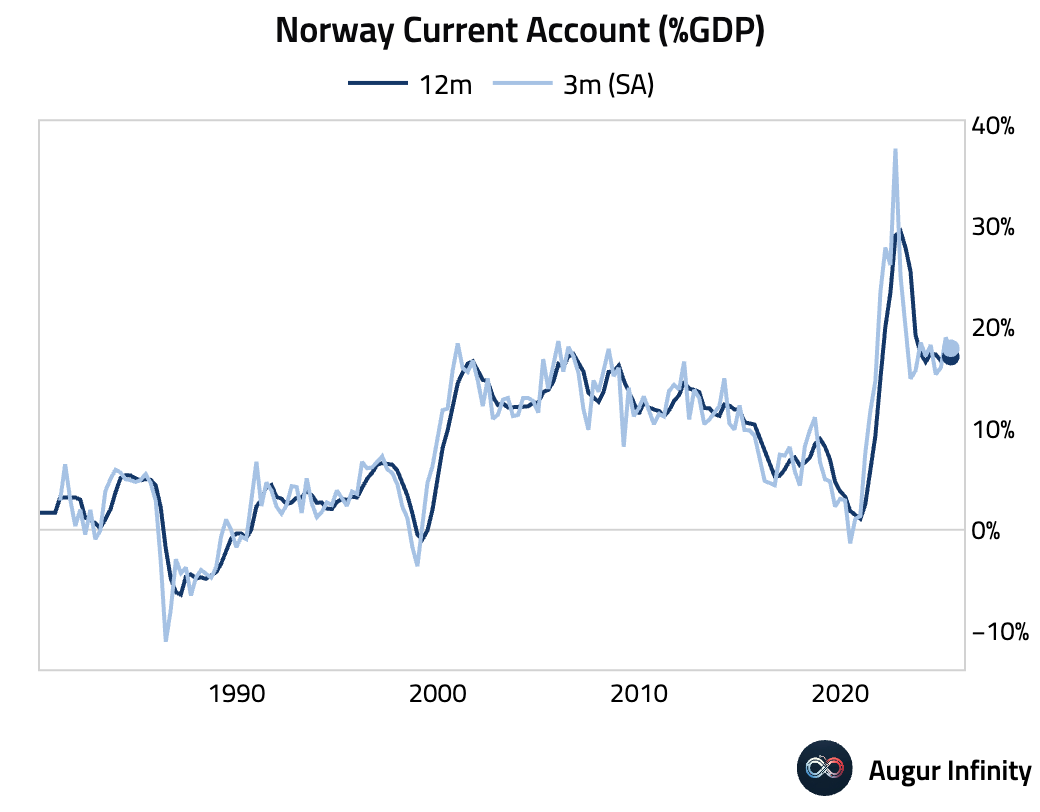

- Norway’s current account surplus narrowed to NOK 217.9 billion in Q2 from NOK 285.3 billion in Q1.

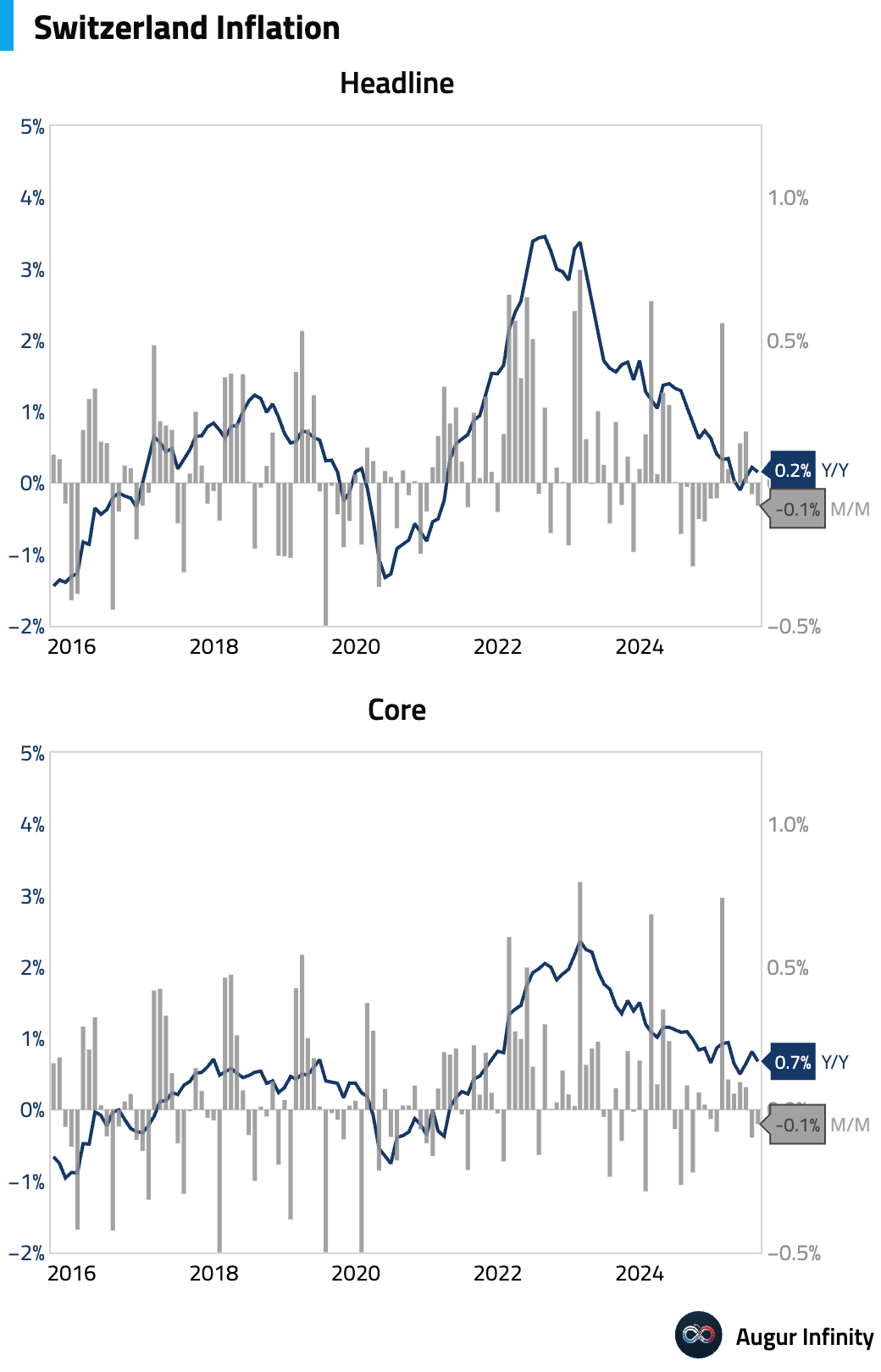

- Switzerland’s annual inflation rate held steady at 0.2% Y/Y in August, matching consensus. On a monthly basis, prices fell 0.1%.

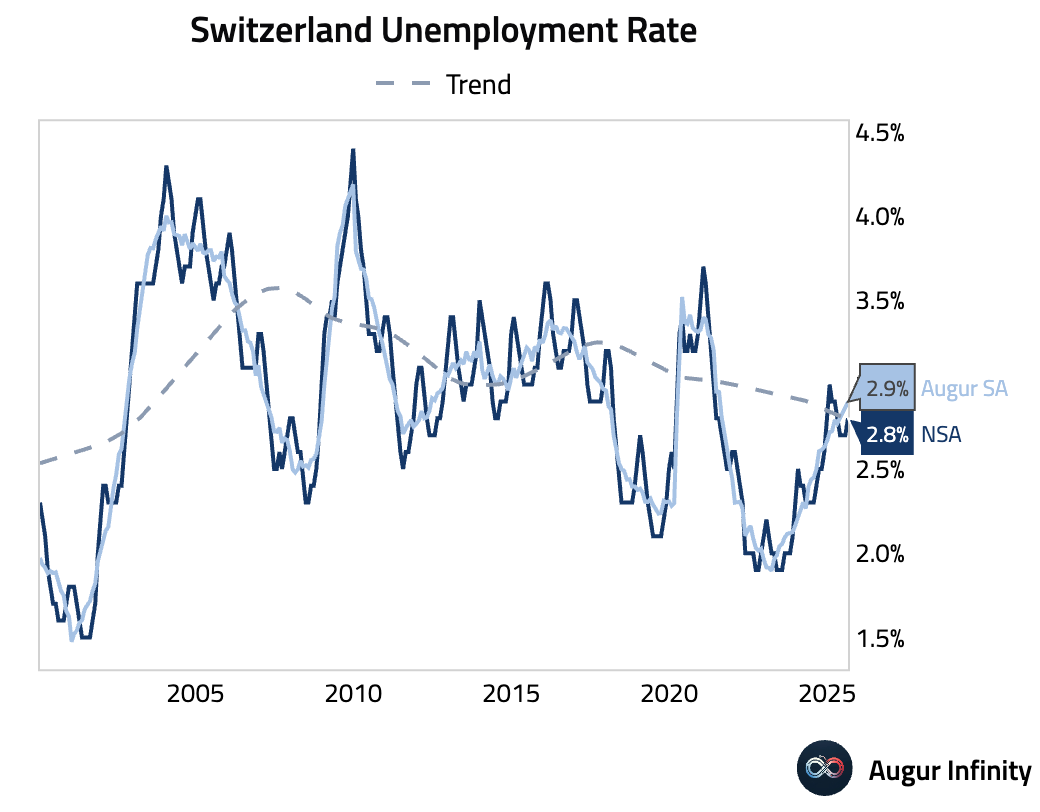

- The Swiss unemployment rate ticked up to 2.8% in August from 2.7%.

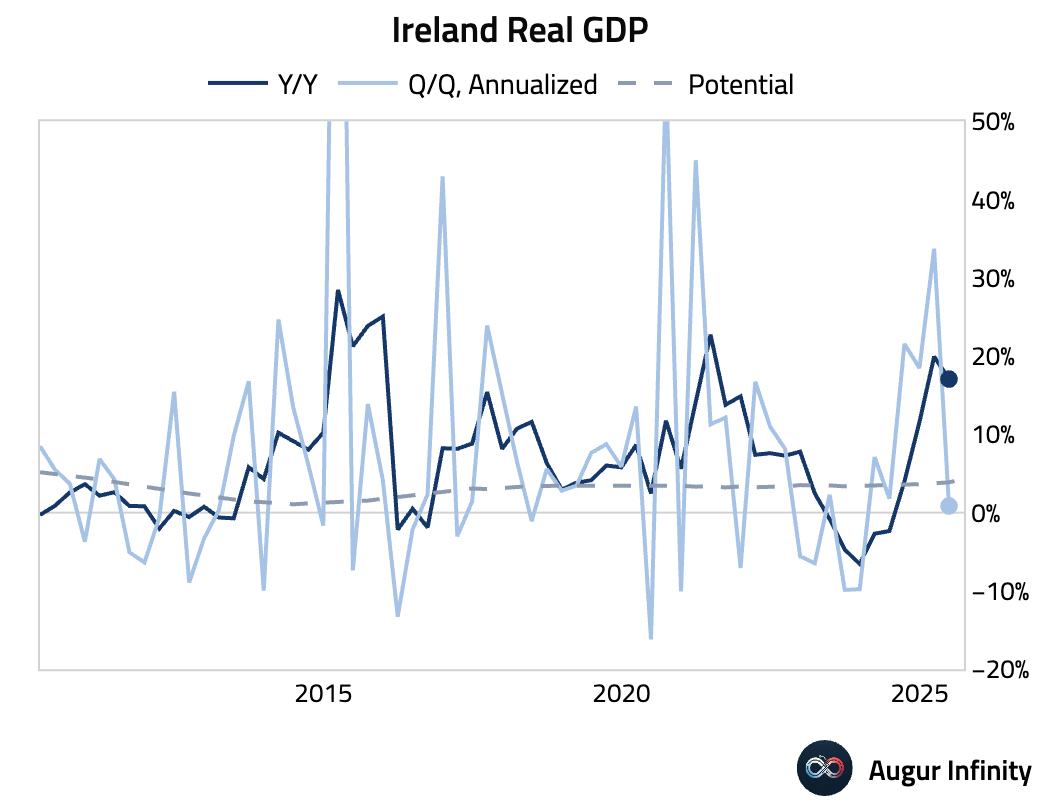

- Ireland’s final Q2 GDP growth was confirmed at 0.2% Q/Q (or 0.9% annualized) and 17.1% Y/Y, well above consensus expectations.

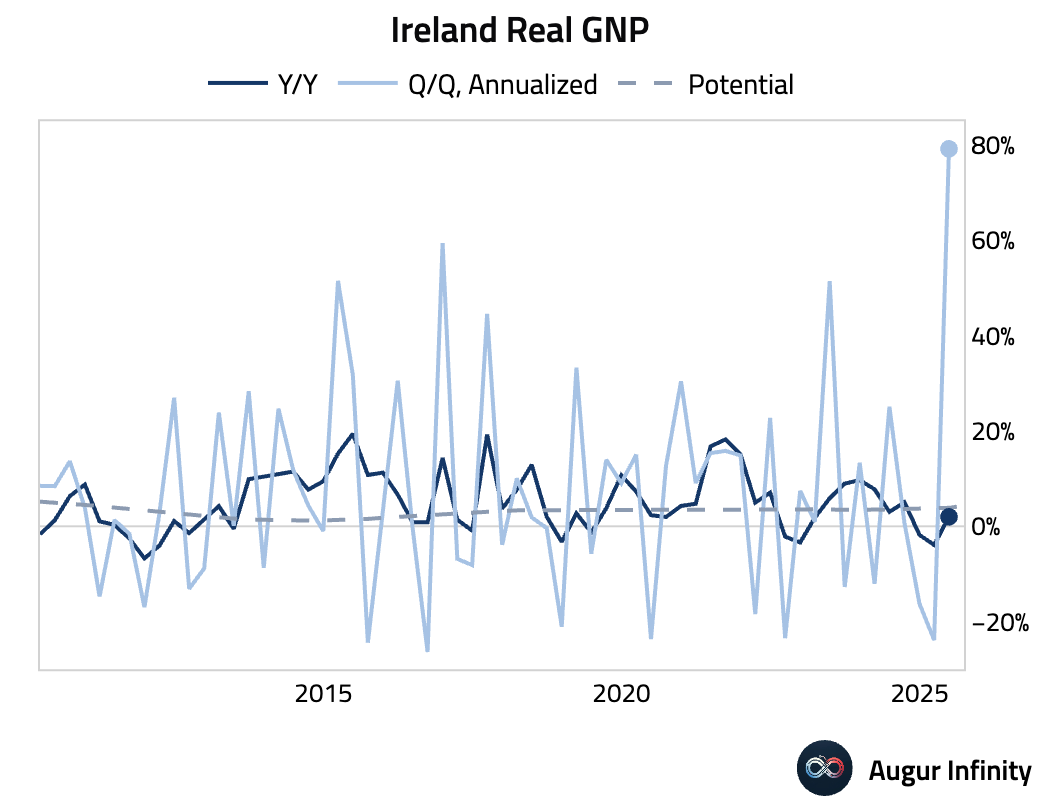

- Ireland’s Gross National Product (GNP) surged in Q2, posting growth of 15.7% Q/Q (or 79% annualized) and 2.0% Y/Y.

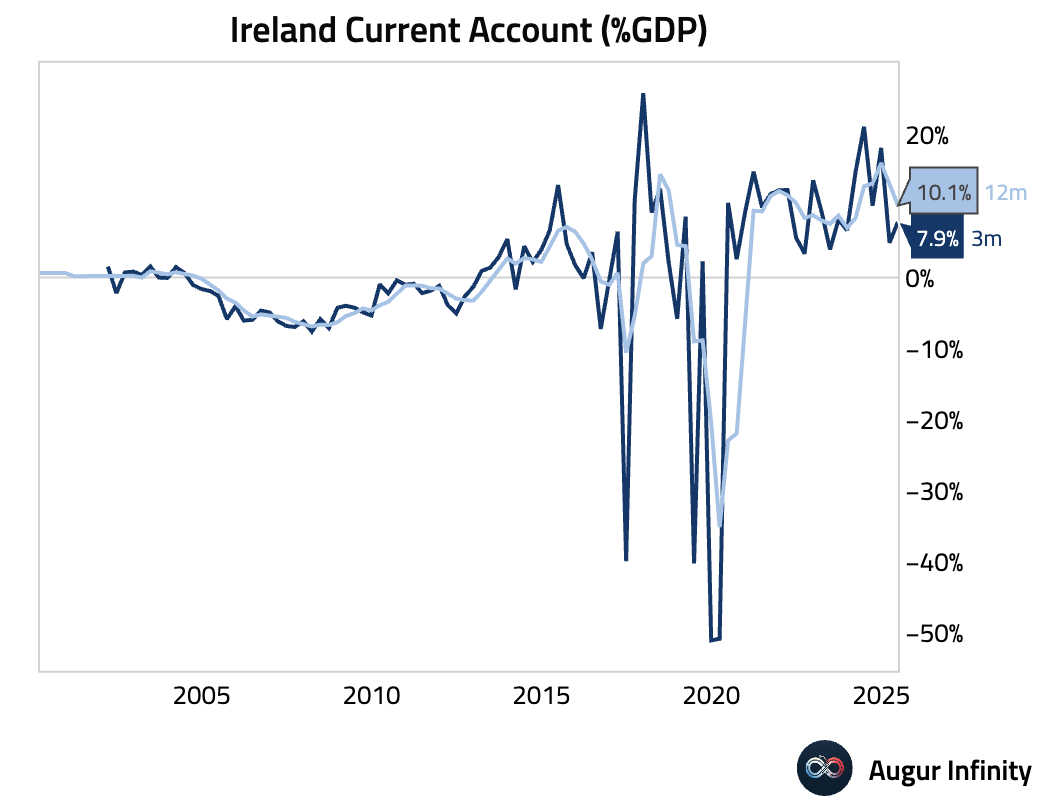

- Ireland’s current account surplus expanded significantly to €19.5 billion in Q2 from €5.8 billion in Q1.

Asia-Pacific

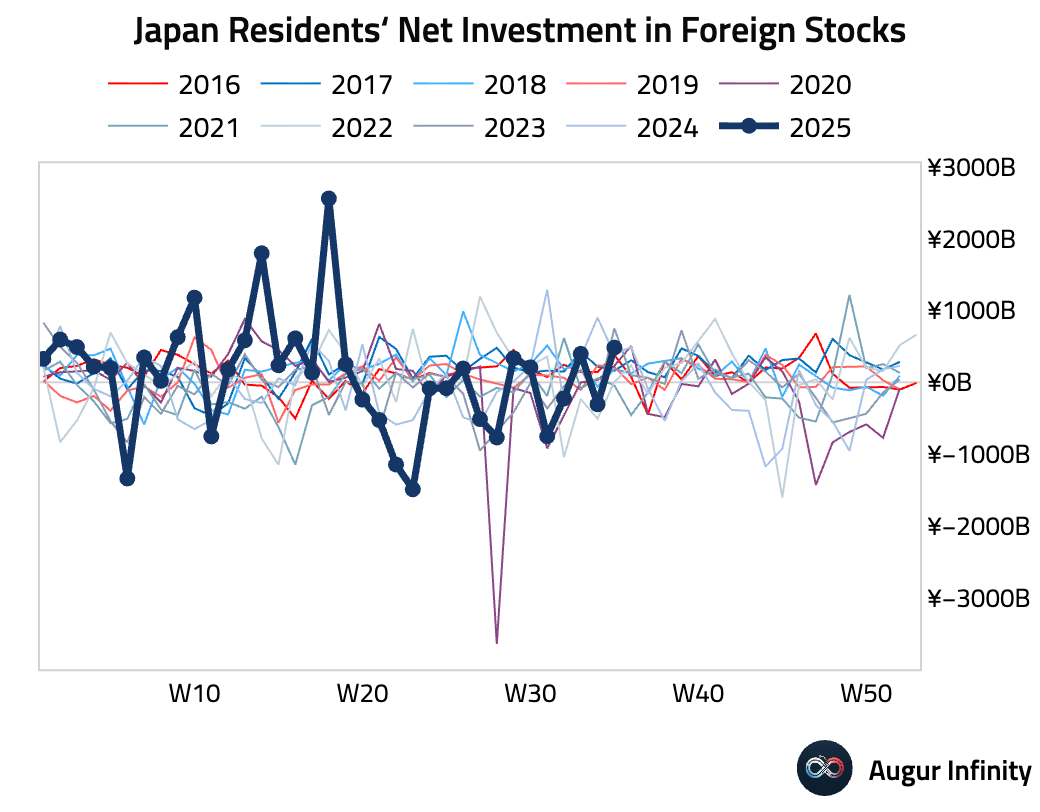

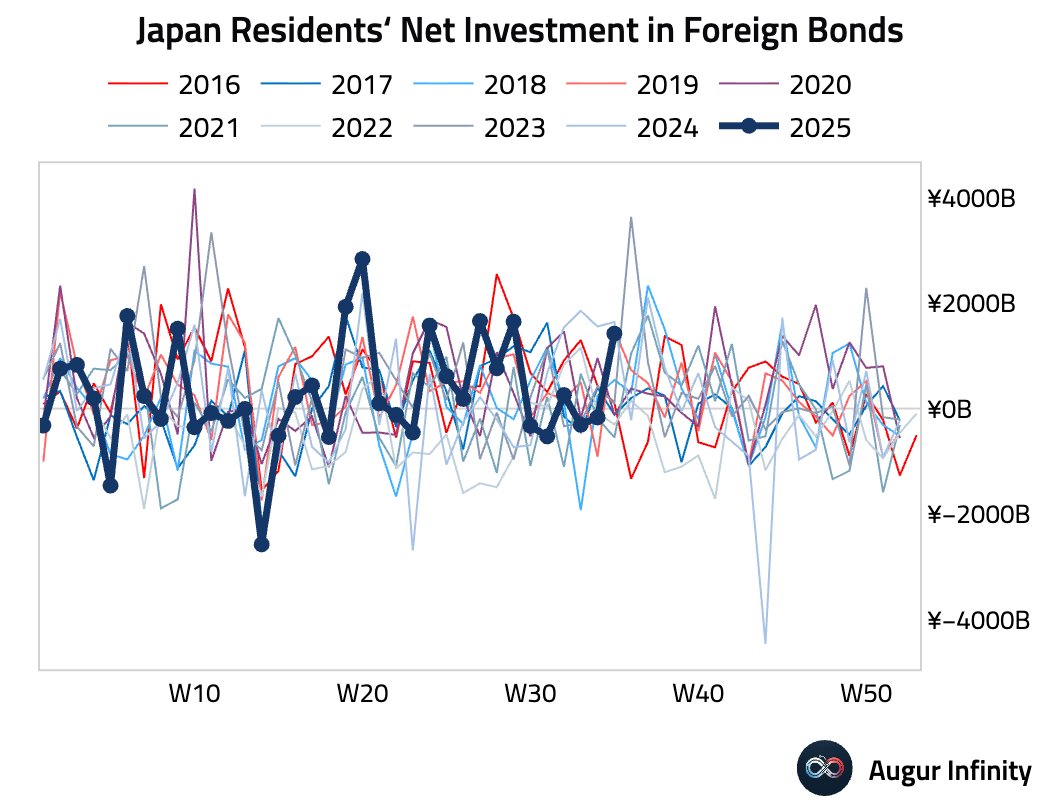

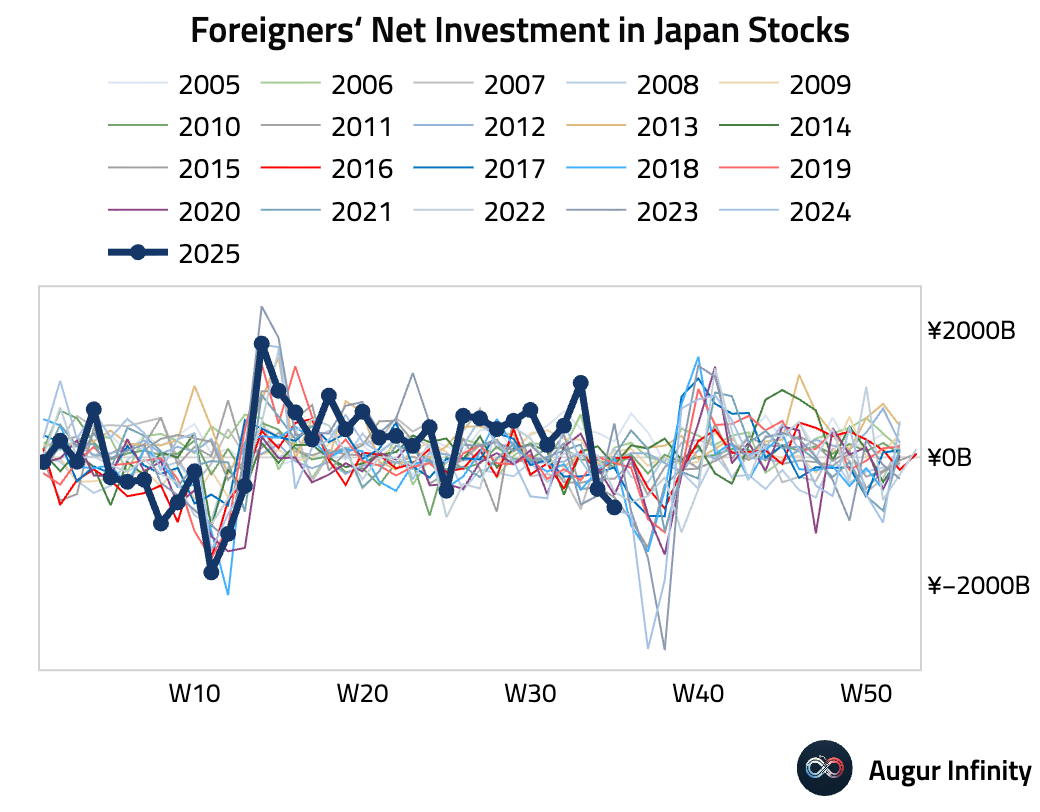

- Japanese investors were net buyers of foreign bonds to the tune of ¥1.42 trillion in the last week of August, while foreign investors were net sellers of Japanese stocks, offloading ¥785.7 billion.

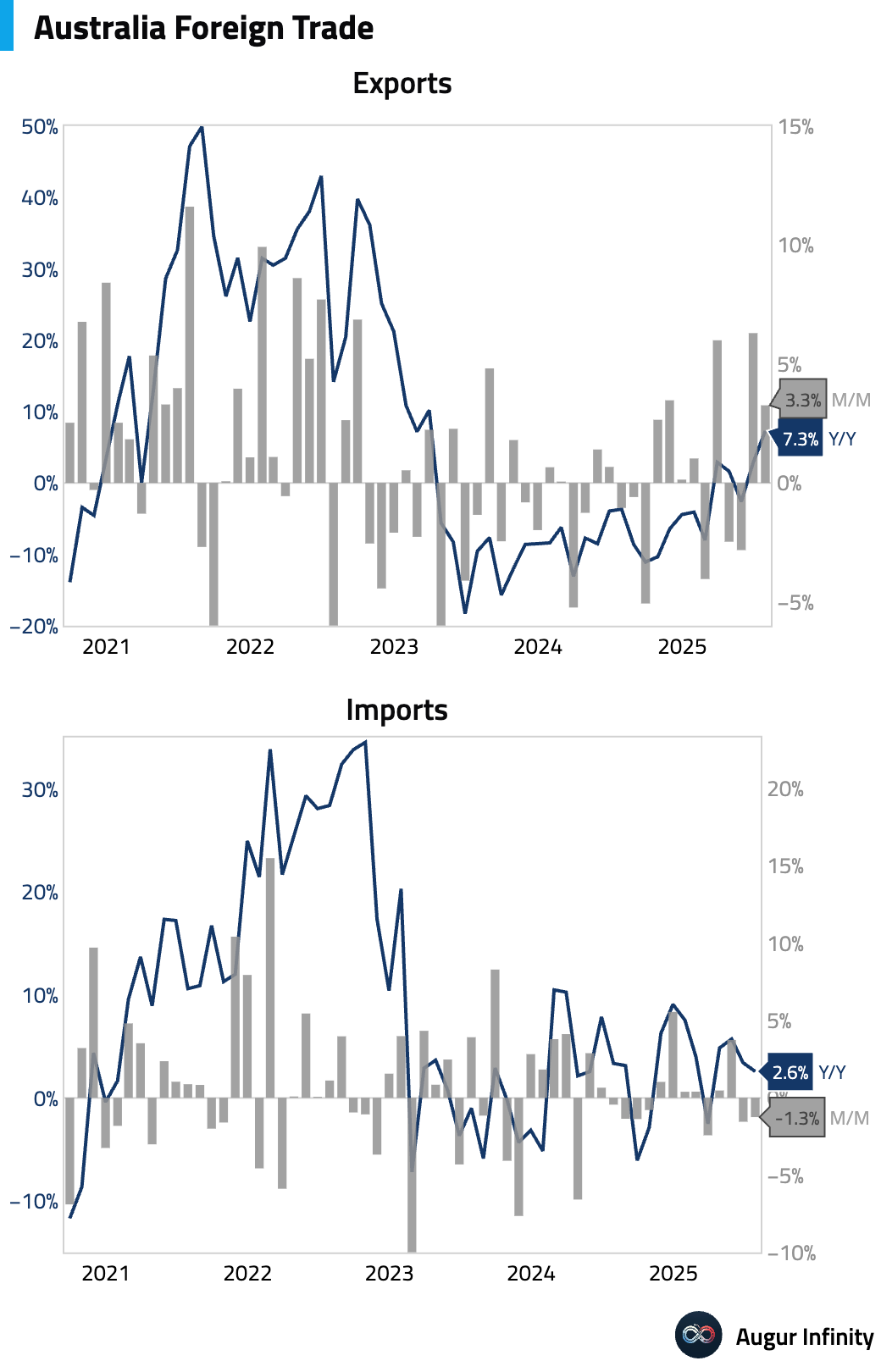

- Australia’s trade surplus widened to A$7.31 billion in July, significantly exceeding the A$5.0 billion consensus. The result was driven by a 3.3% M/M rise in exports, led by strong commodity shipments, while imports fell 1.3% M/M. The drop in imports was notable in consumer goods (-2.6%), suggesting softer domestic demand.

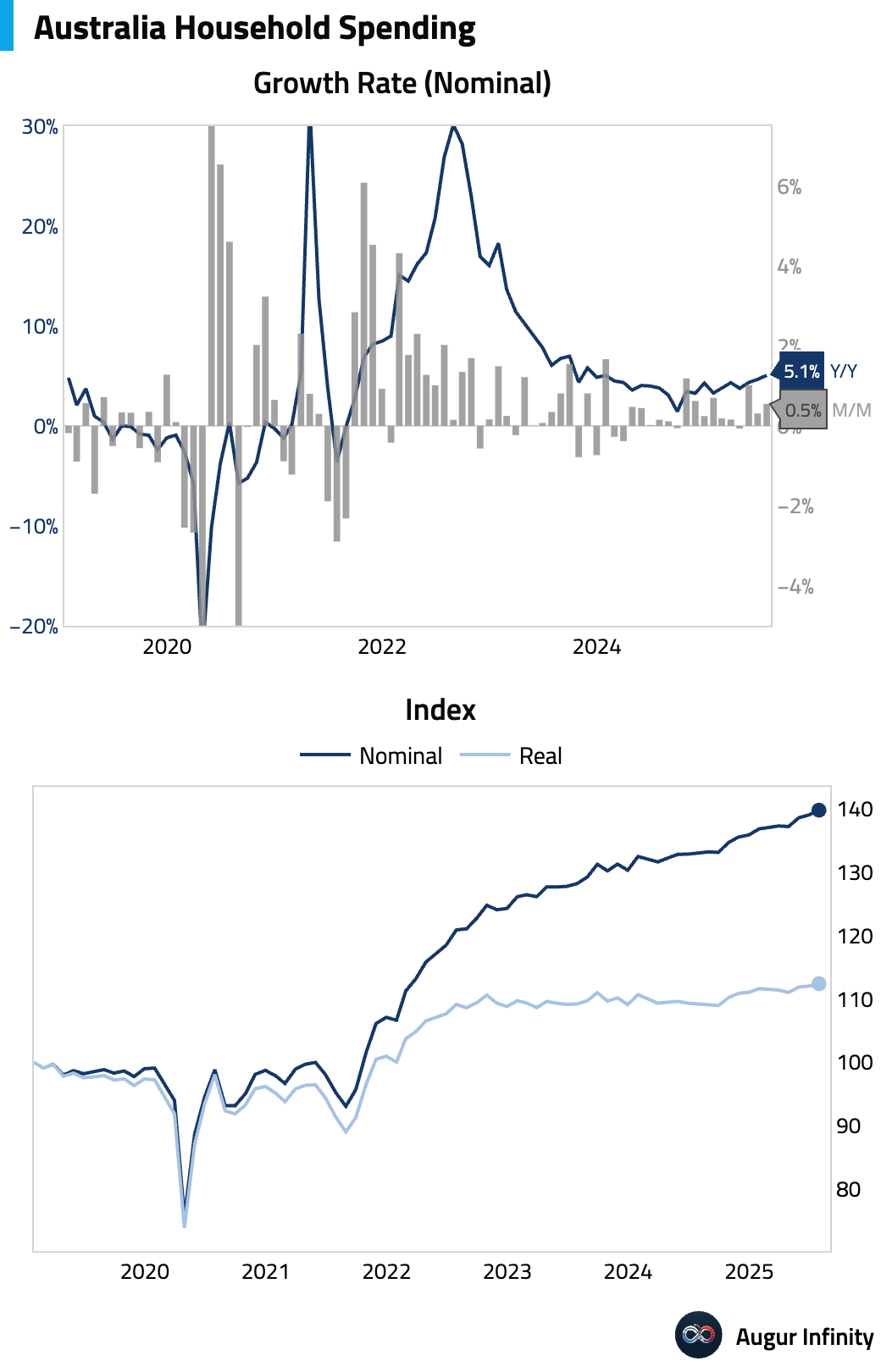

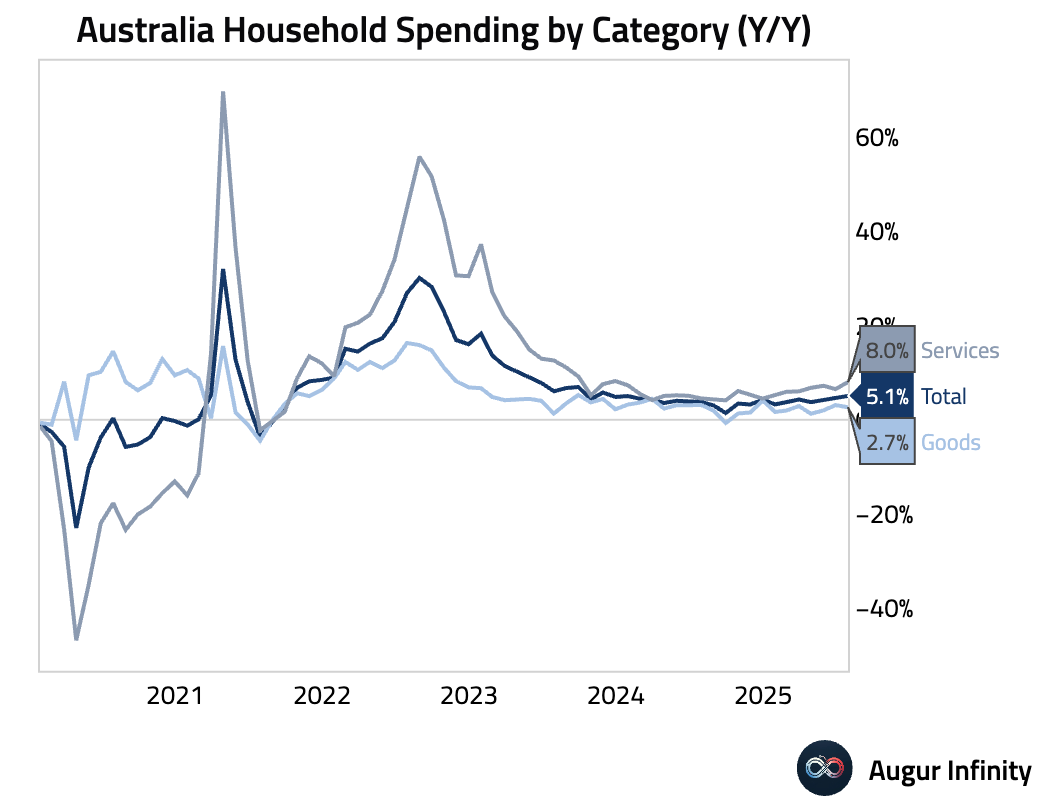

- Australian household spending increased by 0.5% M/M and 5.1% Y/Y in July. The rise was led by non-discretionary spending (+0.8%), while discretionary spending was softer (+0.4%). Spending on clothing (-1.2%) and furnishings (-1.4%) declined, reflecting a pullback after end-of-financial-year sales.

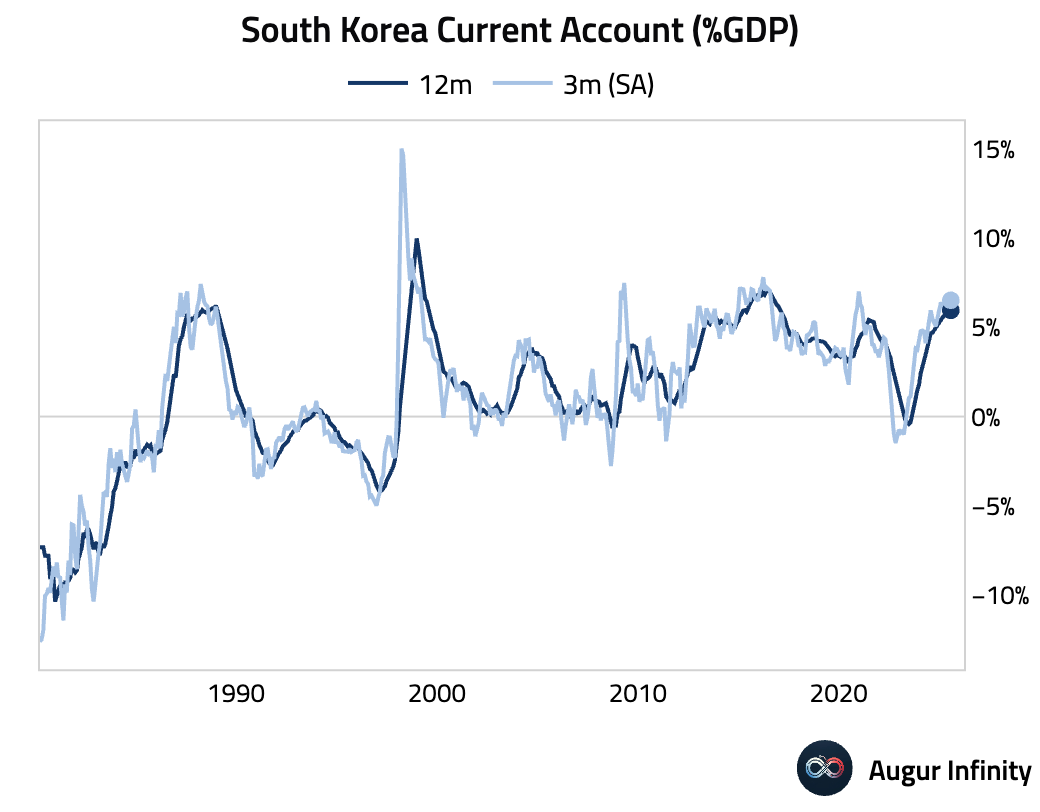

- South Korea’s current account surplus fell to $10.78 billion in July from $14.27 billion in June.

Emerging Markets ex China

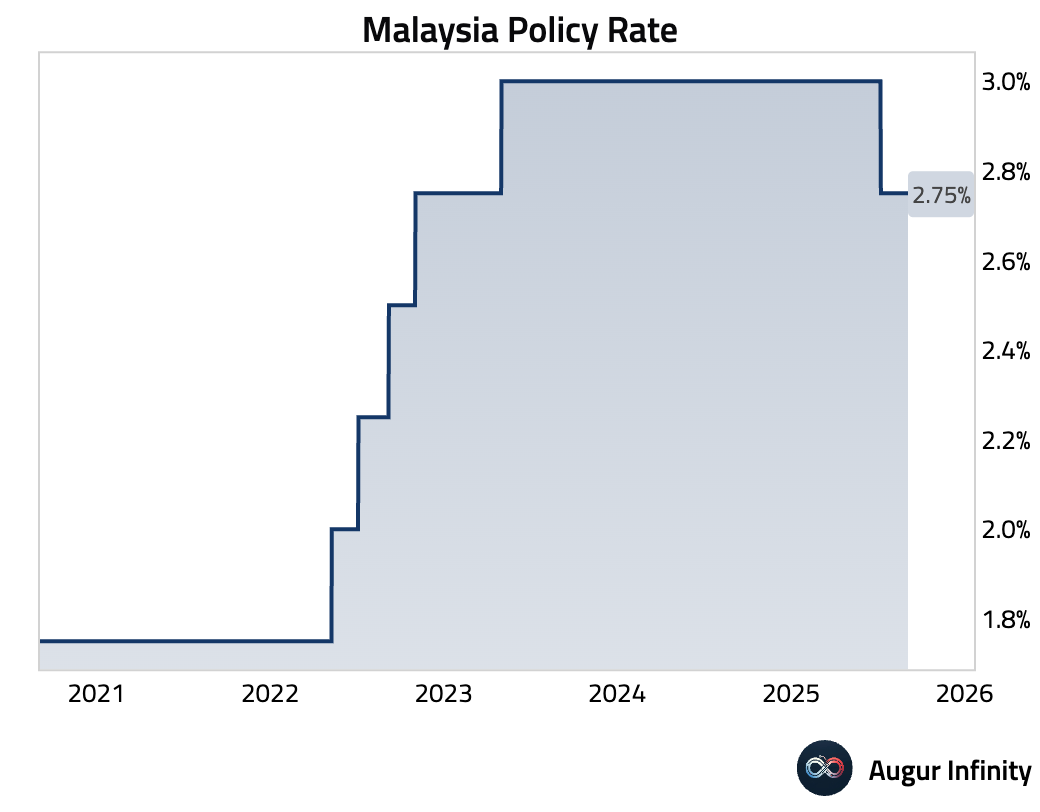

- Bank Negara Malaysia (BNM) held its overnight policy rate at 2.75%, as expected. The central bank adopted a more balanced tone, removing prior warnings of “downside risks” to growth and softening its forward guidance. The statement noted that the current policy stance is “appropriate and supportive,” signaling less urgency for future rate moves.

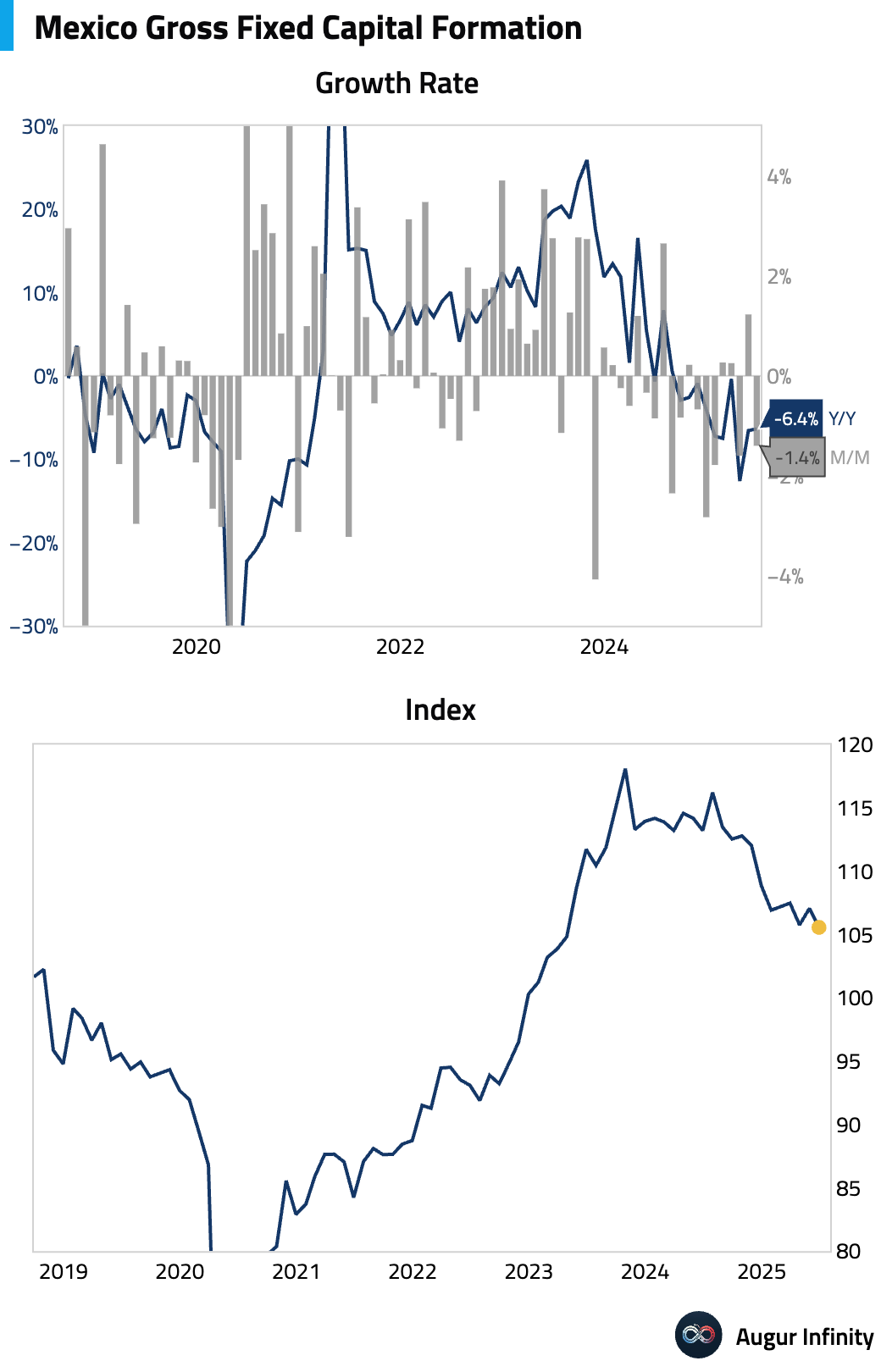

- Mexico’s gross fixed investment unexpectedly fell 1.4% M/M in June, sharply missing expectations for a flat reading. On an annual basis, investment was down 6.4%. The weakness was broad-based, with declines in both construction (-0.8% M/M) and machinery/equipment (-1.6% M/M).

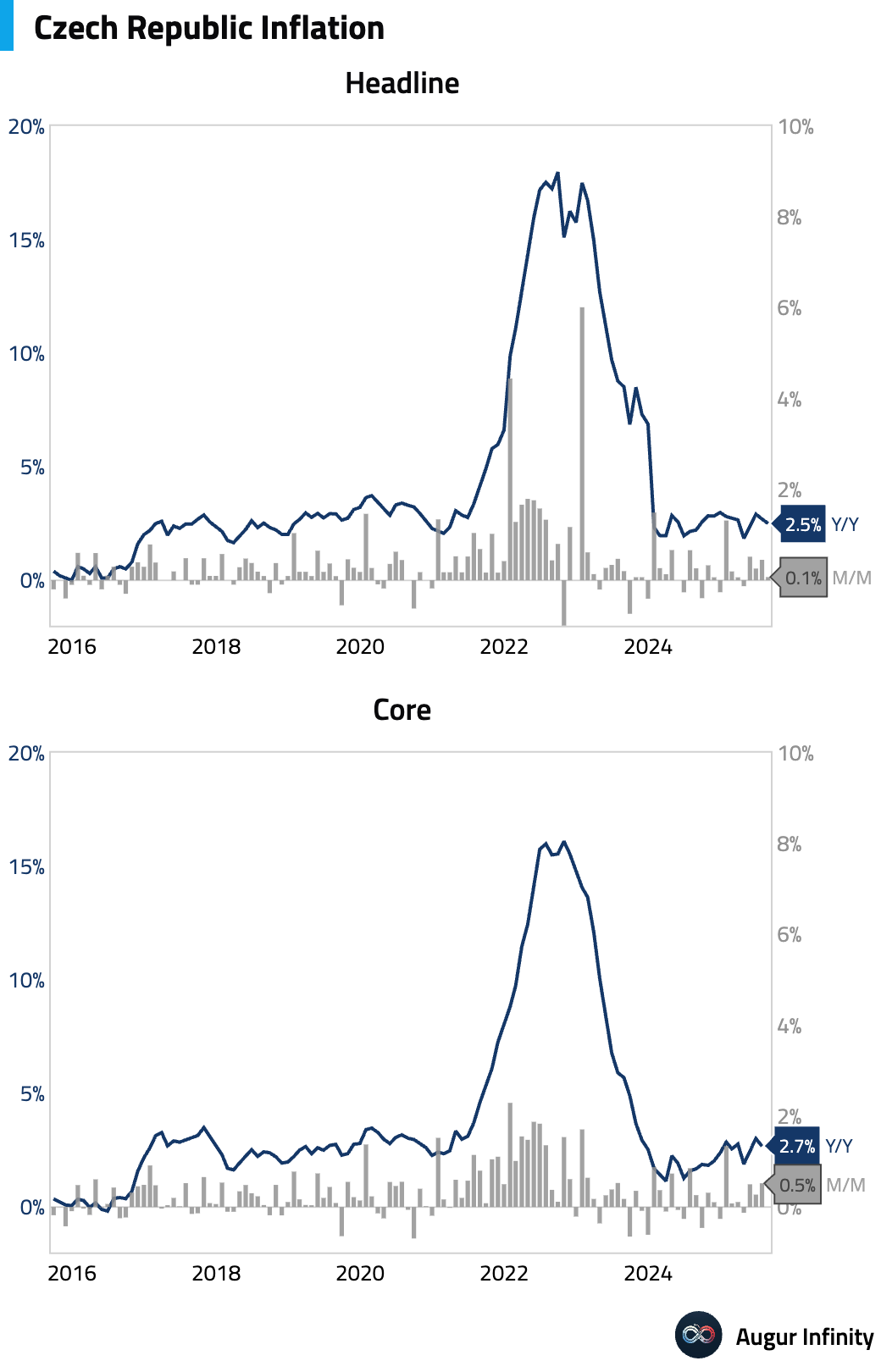

- Preliminary headline CPI in the Czech Republic eased to 2.5% Y/Y in August, down from 2.7% and below the central bank’s forecast of 2.7%. The decline was broad-based, driven by falling goods prices and slowing services momentum, reinforcing expectations for further disinflation.

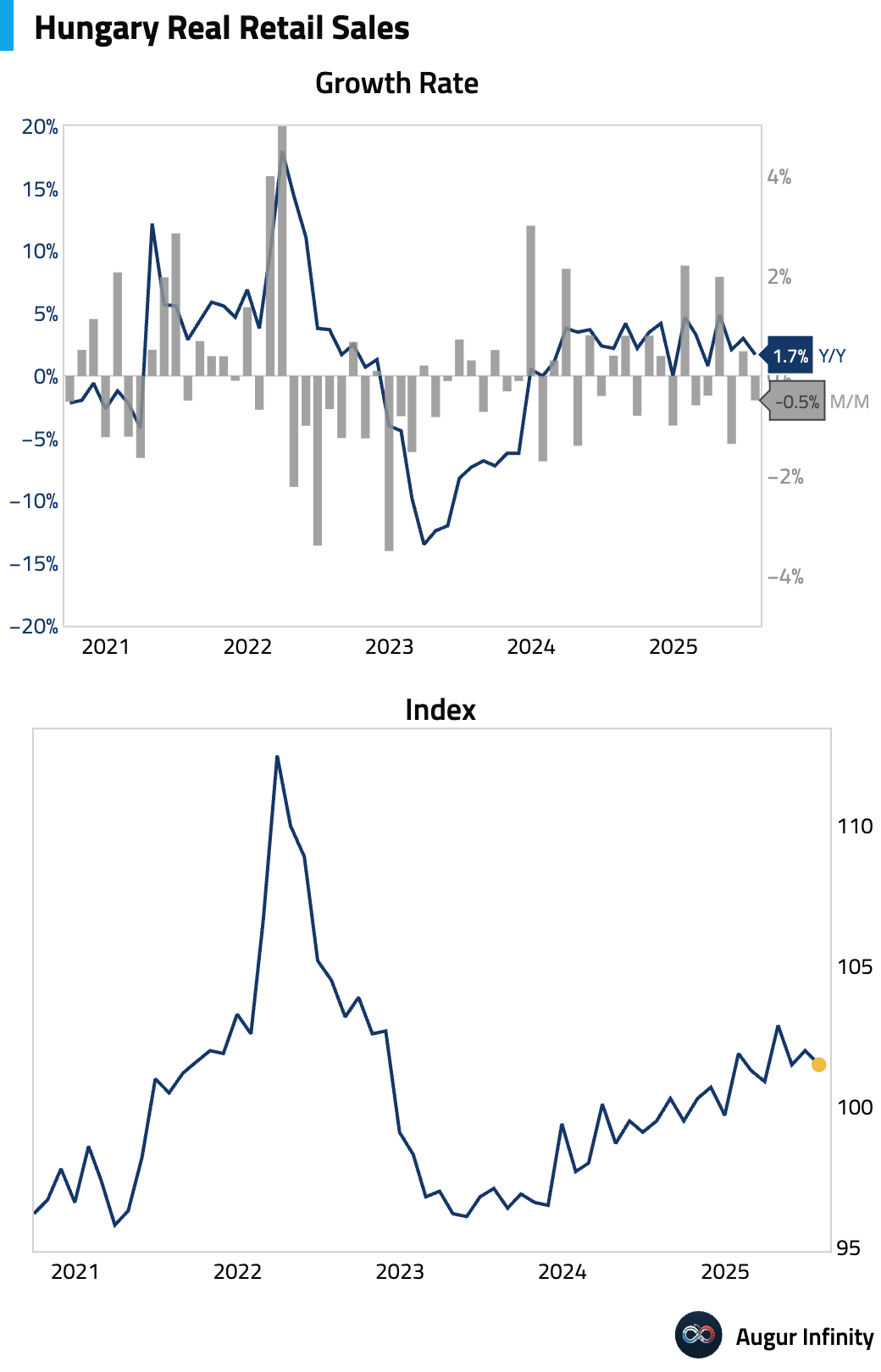

- Hungarian retail sales growth slowed to 1.7% Y/Y in July from 3.0% in June.

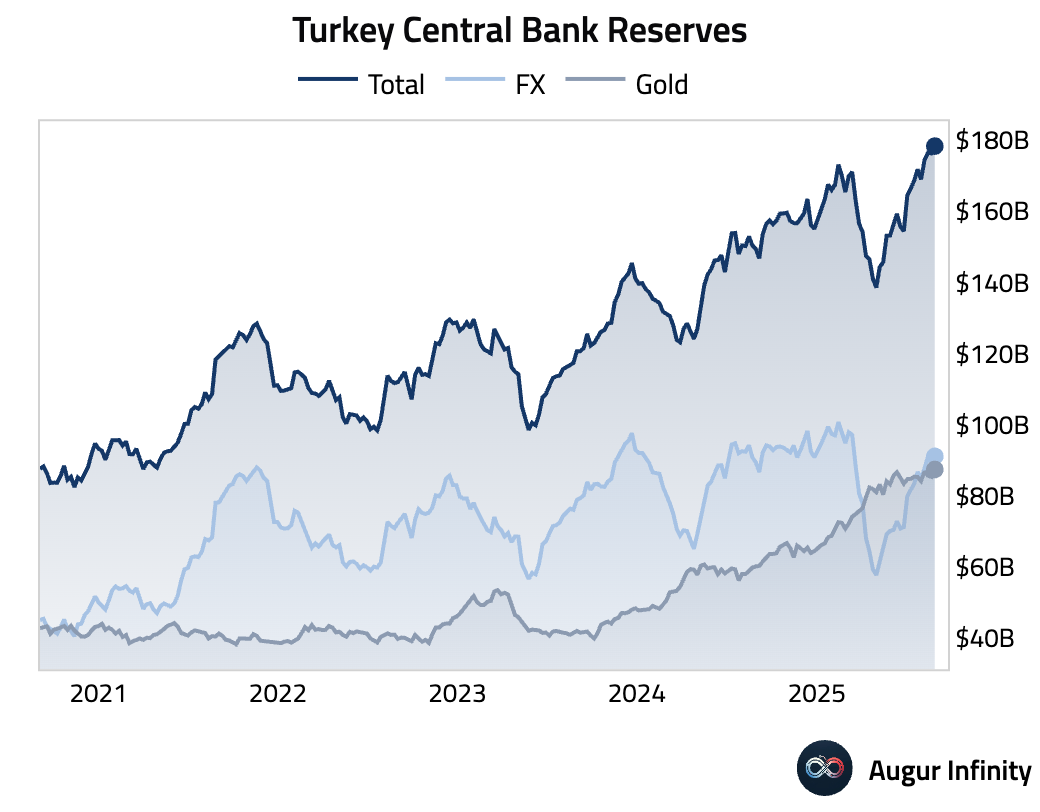

- Turkey’s foreign exchange reserves edged down to $91.03 billion in the week ending August 29 from $91.09 billion the prior week.

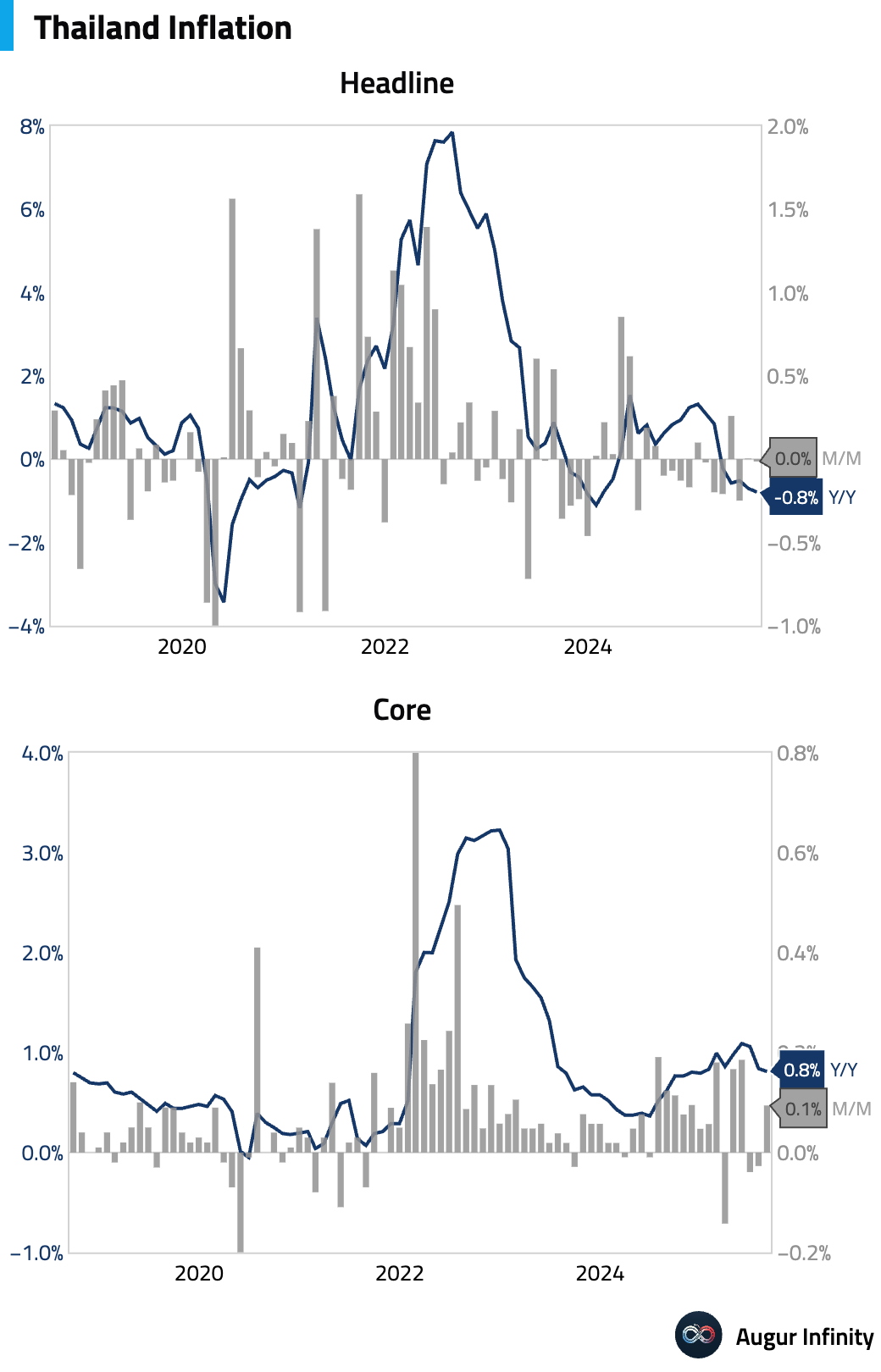

- Thailand’s headline CPI deflation deepened to -0.79% Y/Y in August, driven by a sharp slowdown in food inflation. However, core CPI, which excludes food and energy, was stable at 0.81% Y/Y, suggesting underlying price pressures remain contained.

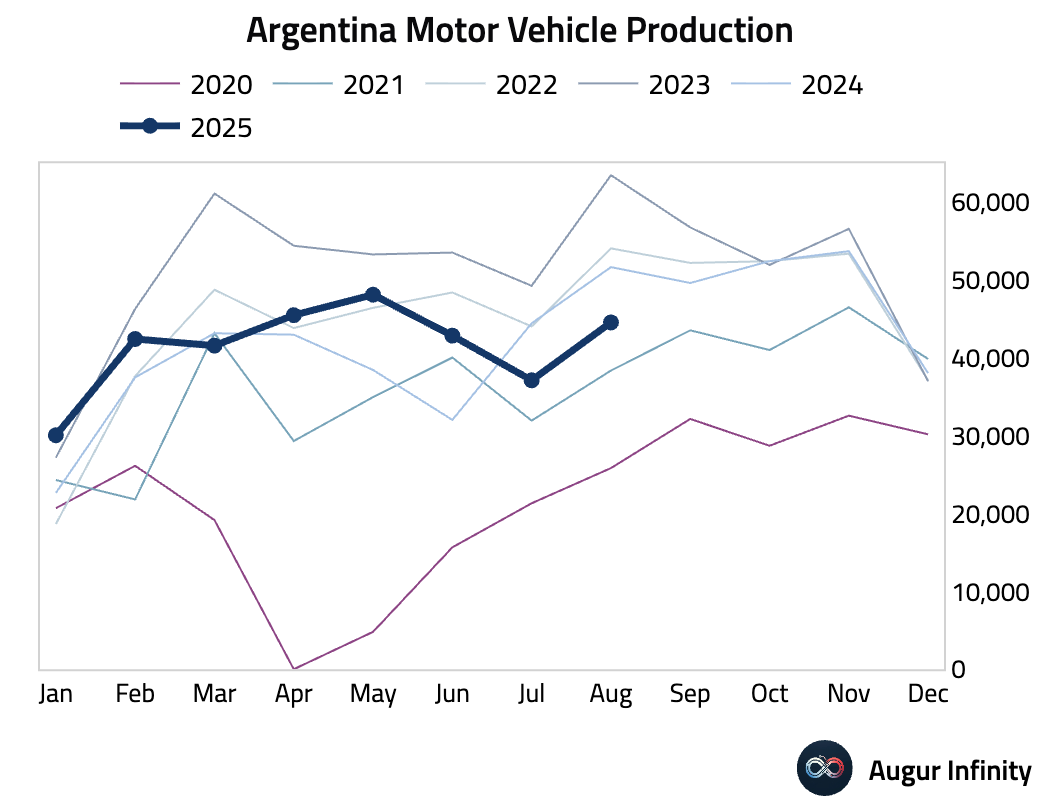

- Argentina motor vehicle production declined by 13.8% Y/Y in August. This is the worst August production level since 2021.

Global Markets

Equities

- US equities advanced, with the S&P 500 and Nasdaq Composite gaining 0.8% and 1.0%, respectively, reportedly driven by a rally in the technology sector. Conversely, Chinese markets fell sharply by 1.5% amid news that authorities are considering new measures to curb speculation after recent strong gains. Elsewhere, Australian (+1.0%) and Brazilian (+0.8%) markets also recorded solid performance.

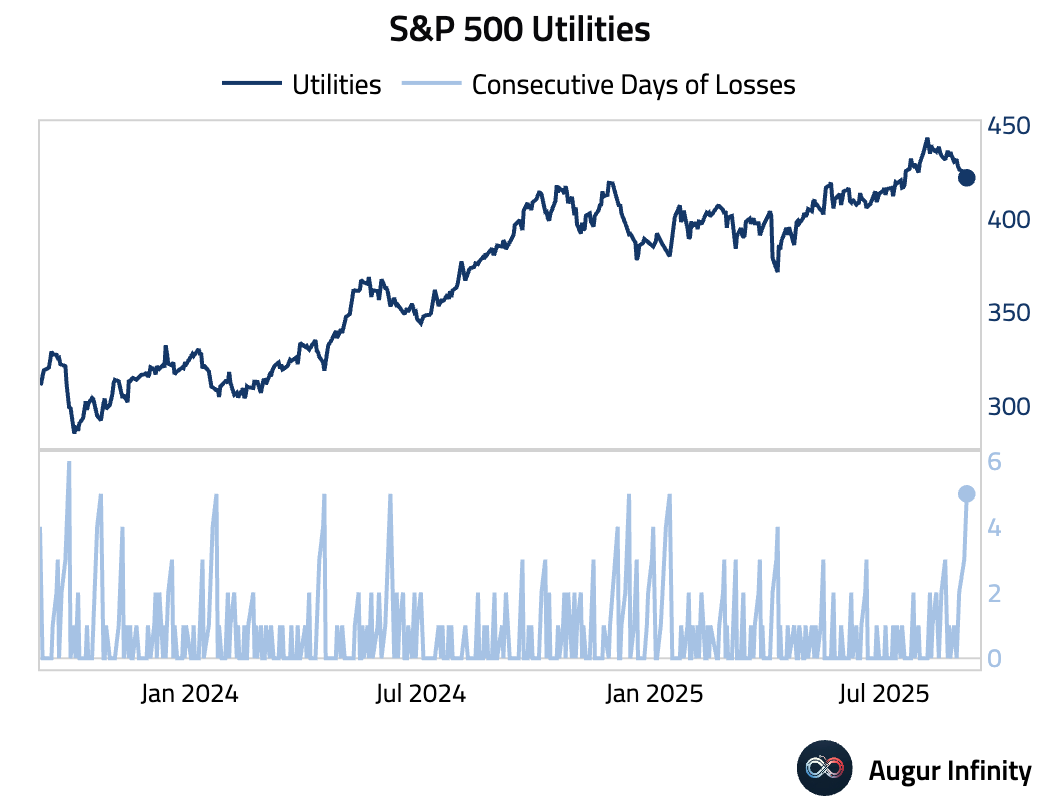

- S&P 500 Utilities extended its losing streak to five sessions, the longest since January.

- Shanghai Shenzhen CSI 300 was down 2.5% today due to a combination of profit-taking after a rapid August rally, concerns about impending regulatory curbs, and heightened selling in technology shares. This is the worst 1-day loss since April.

Fixed Income

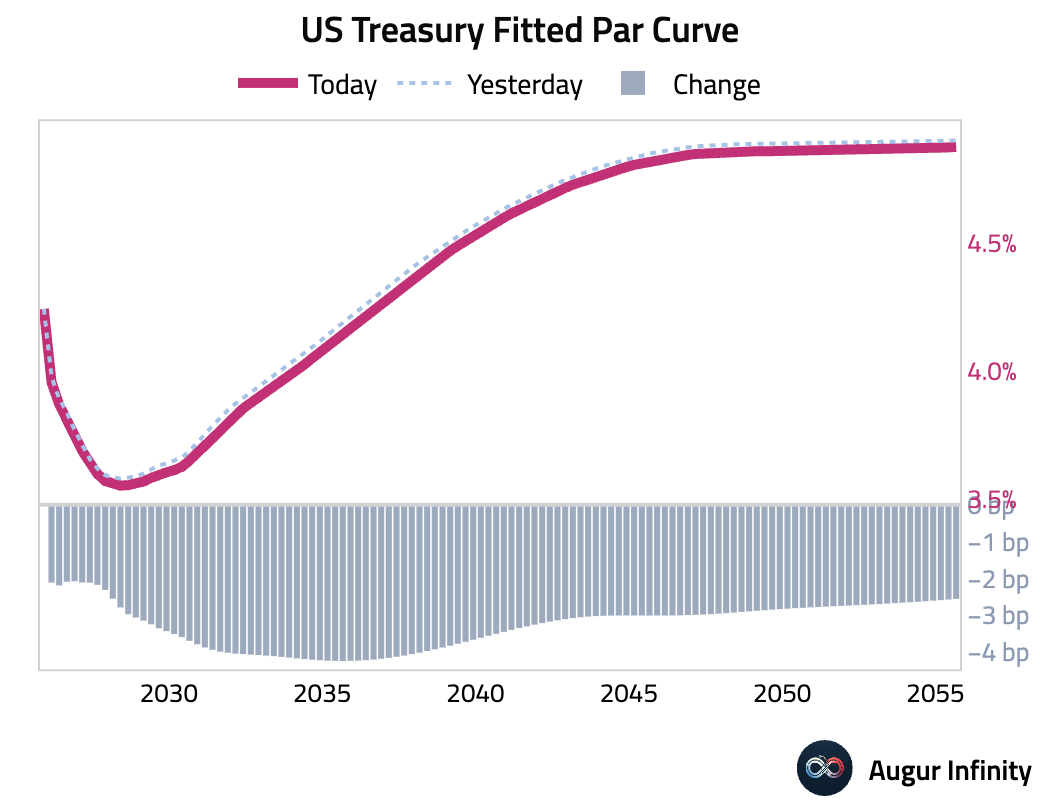

- US Treasury yields declined across the curve for a second consecutive day, with the 10-year yield falling 4.5 bps.

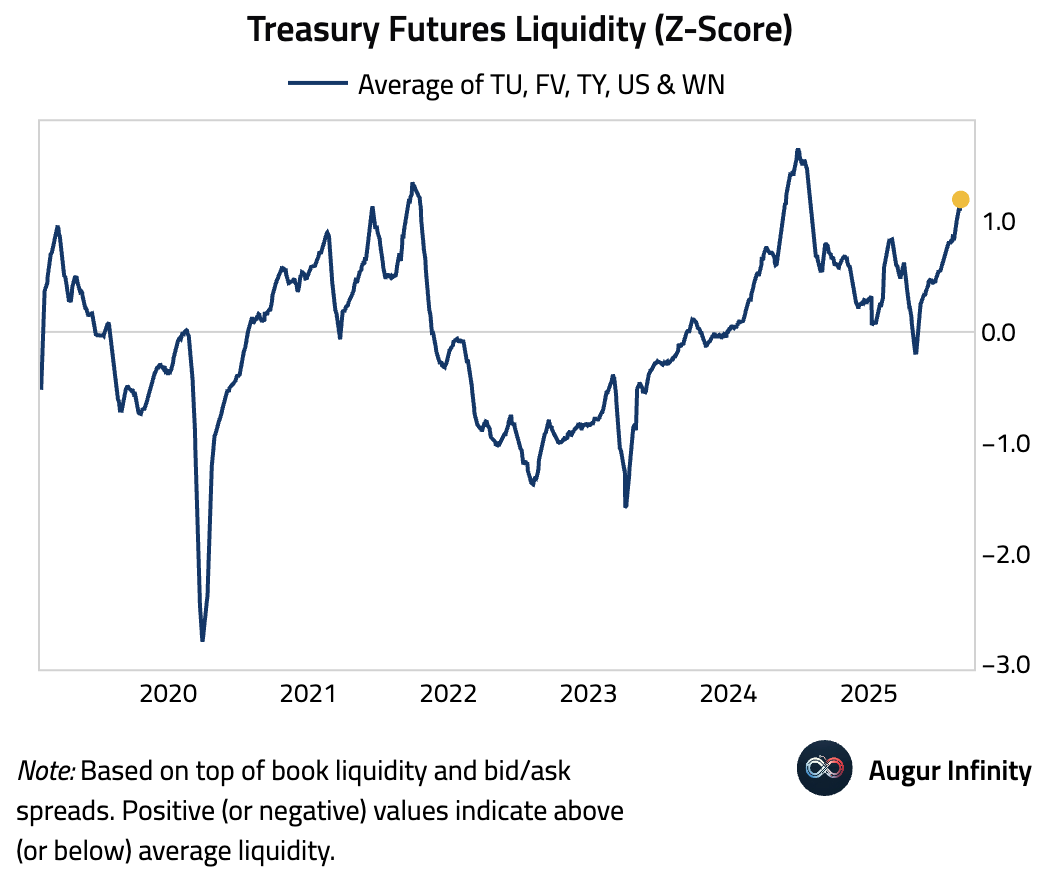

- Treasury futures liquidity has improved meaningfully over the past few months.

FX

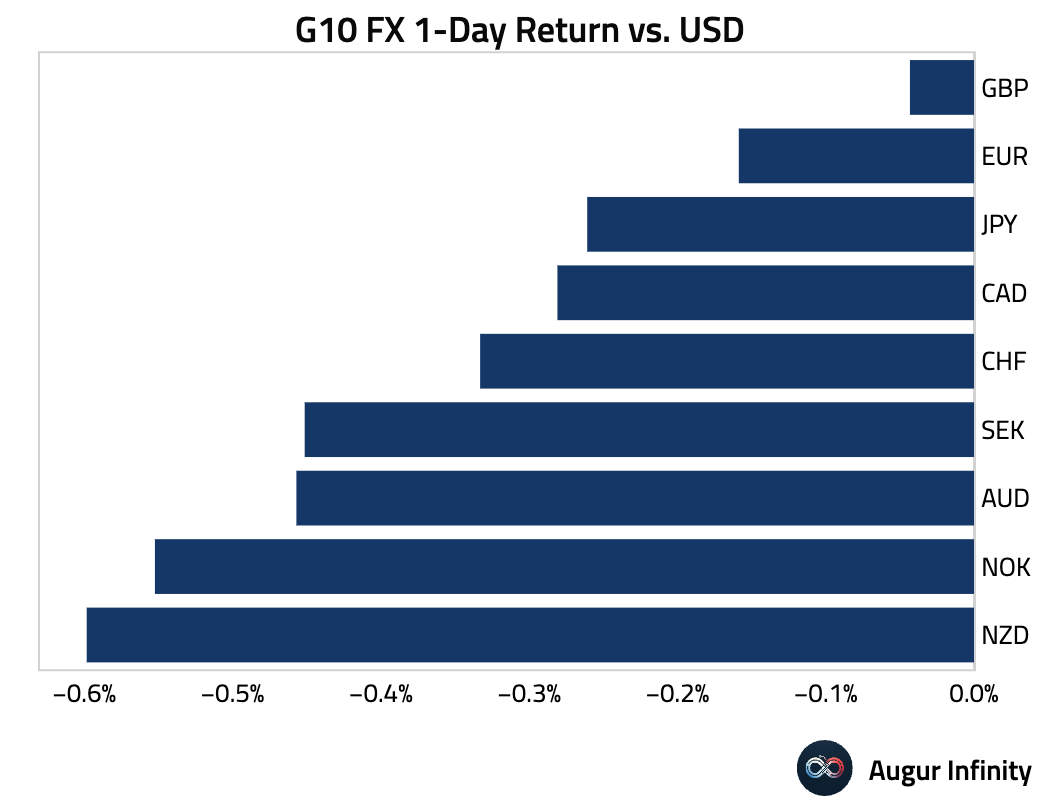

- The US dollar broadly strengthened against its G10 peers. The New Zealand dollar (-0.6%), Norwegian krone (-0.6%), and Australian dollar (-0.5%) led the declines. The Swiss franc has now weakened for four consecutive sessions, while the Japanese yen has depreciated for three straight days.

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.