Global Economics

United States

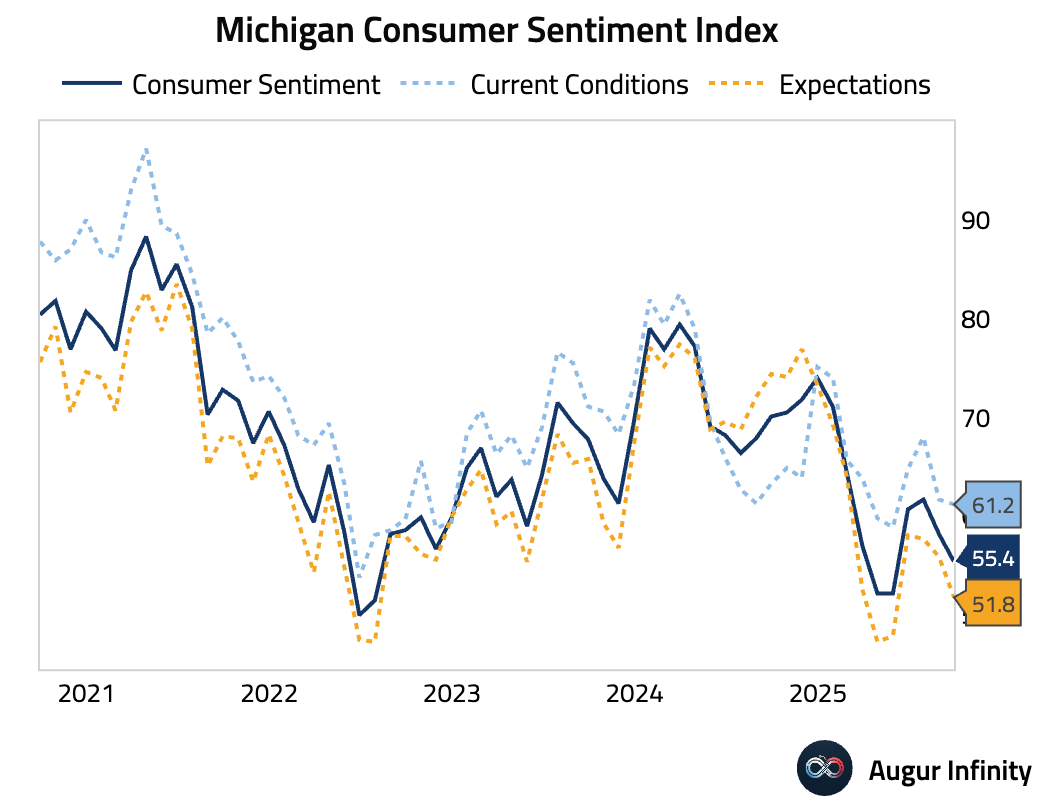

- The preliminary University of Michigan Consumer Sentiment index for September fell to 55.4 from 58.2, missing the consensus forecast of 58.0. The decline was driven by a sharp drop in the future expectations component, with consumers citing growing risks to business conditions, the labor market, and inflation. Trade policy remains a significant concern, with 60% of consumers mentioning tariffs as a risk to their personal finances.

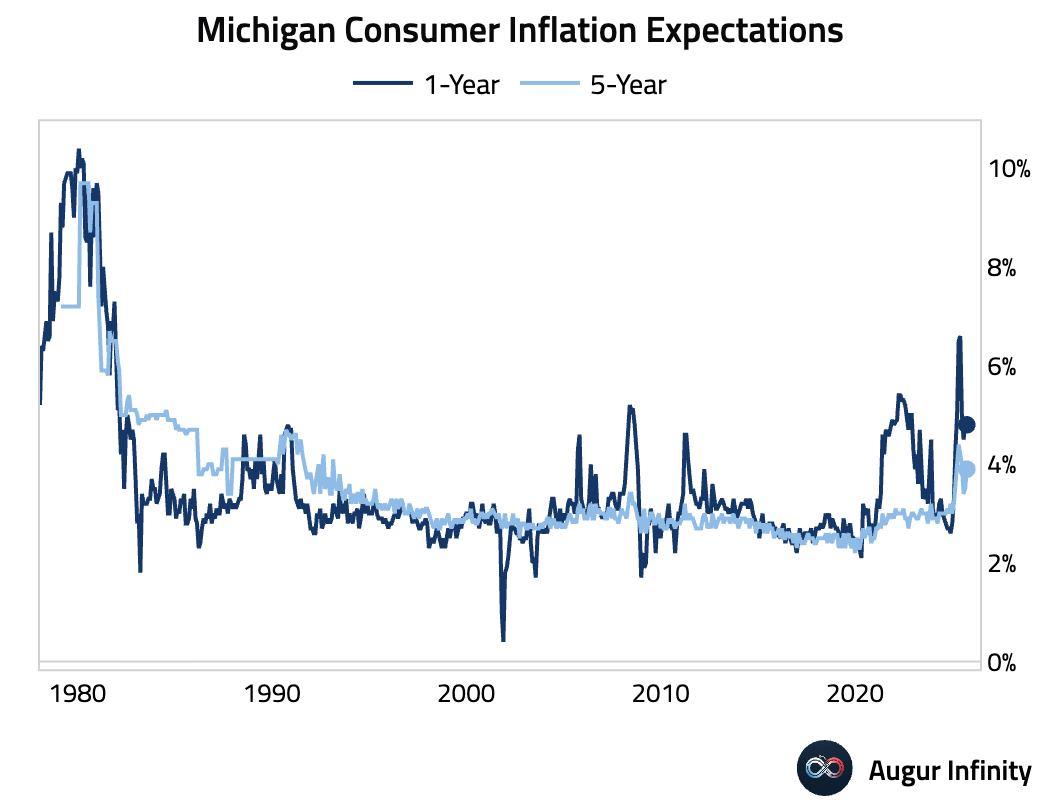

- The preliminary University of Michigan 1-year inflation expectation held steady at 4.8%, but the 5-year outlook jumped 0.4 percentage points to 3.9%, a major upside surprise relative to the 3.4% consensus.

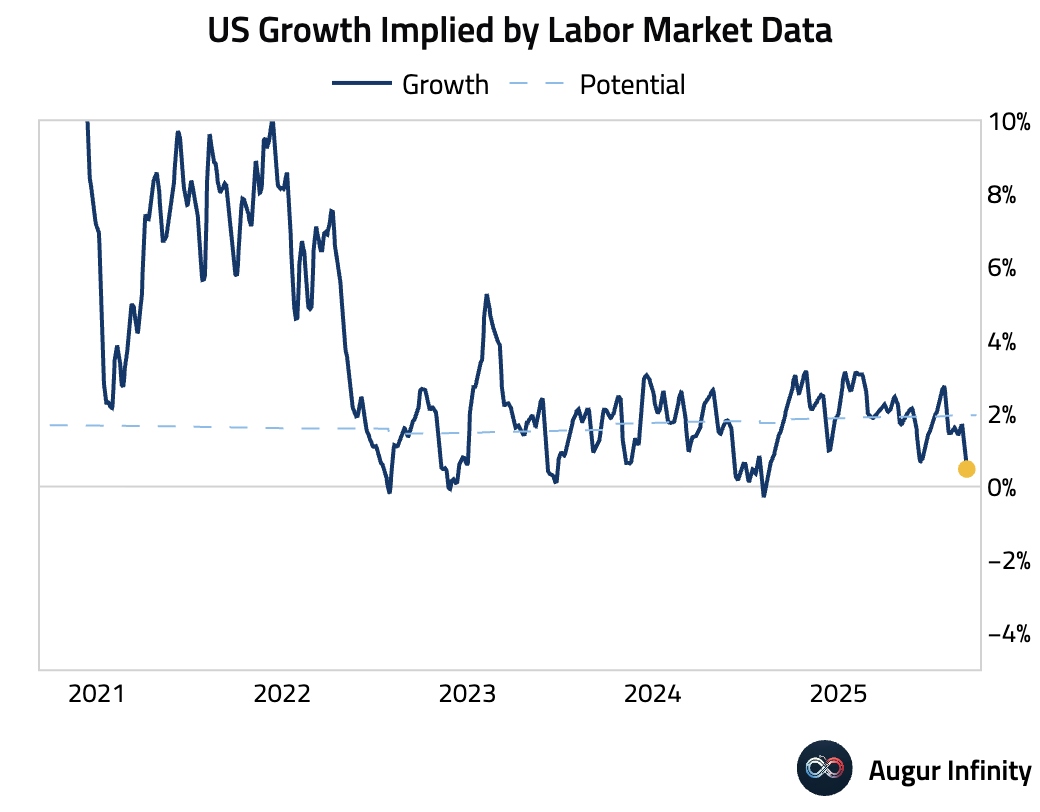

- US growth rate implied by labor market data has deteriorated quite a bit and is now barely above zero.

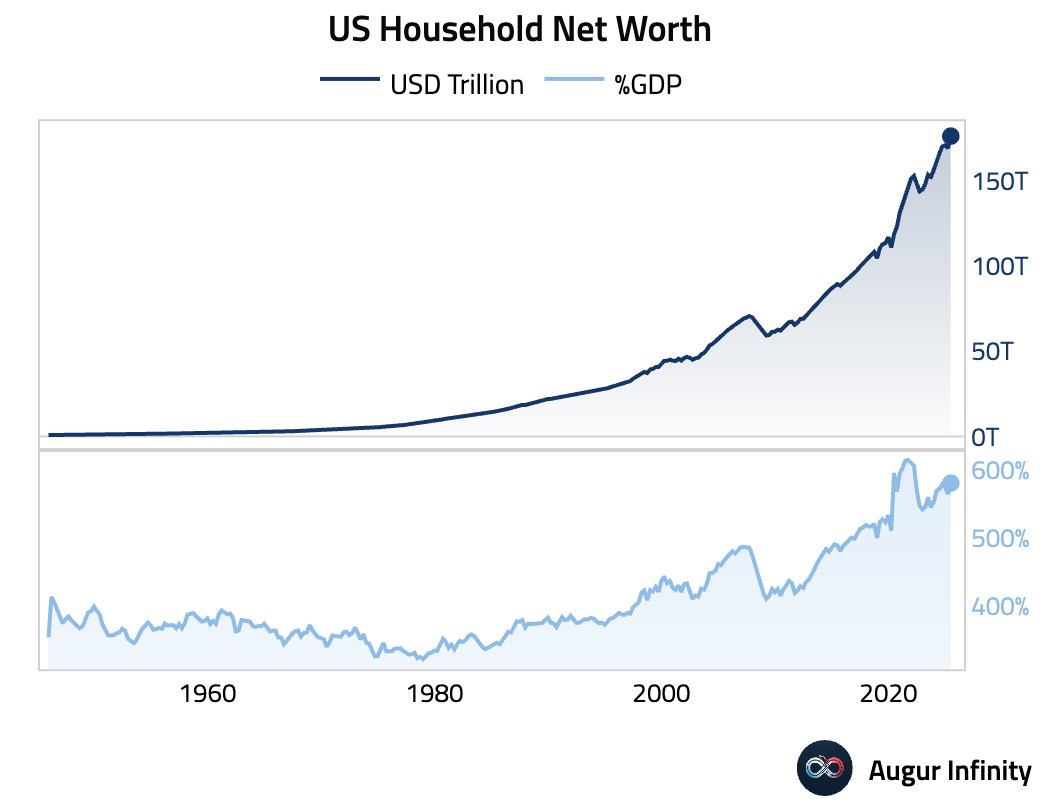

- US household net worth rose by $7.1 trillion to $176.3 trillion in Q2, equating to 580.8% of US GDP.

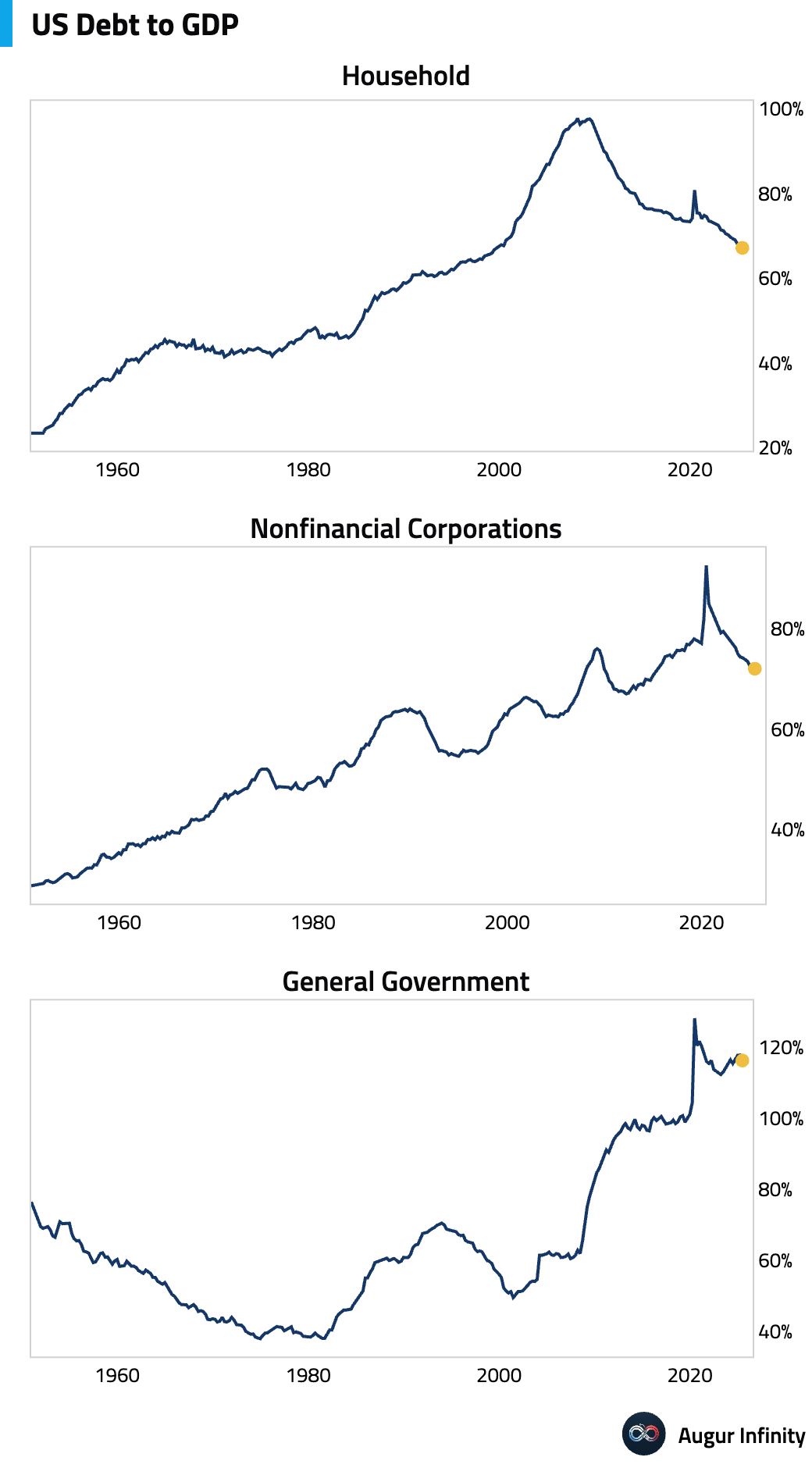

- Debt-to-GDP edged lower across households, businesses, and the government. While consumers and firms continue to deleverage, the government’s debt trajectory remains concerning.

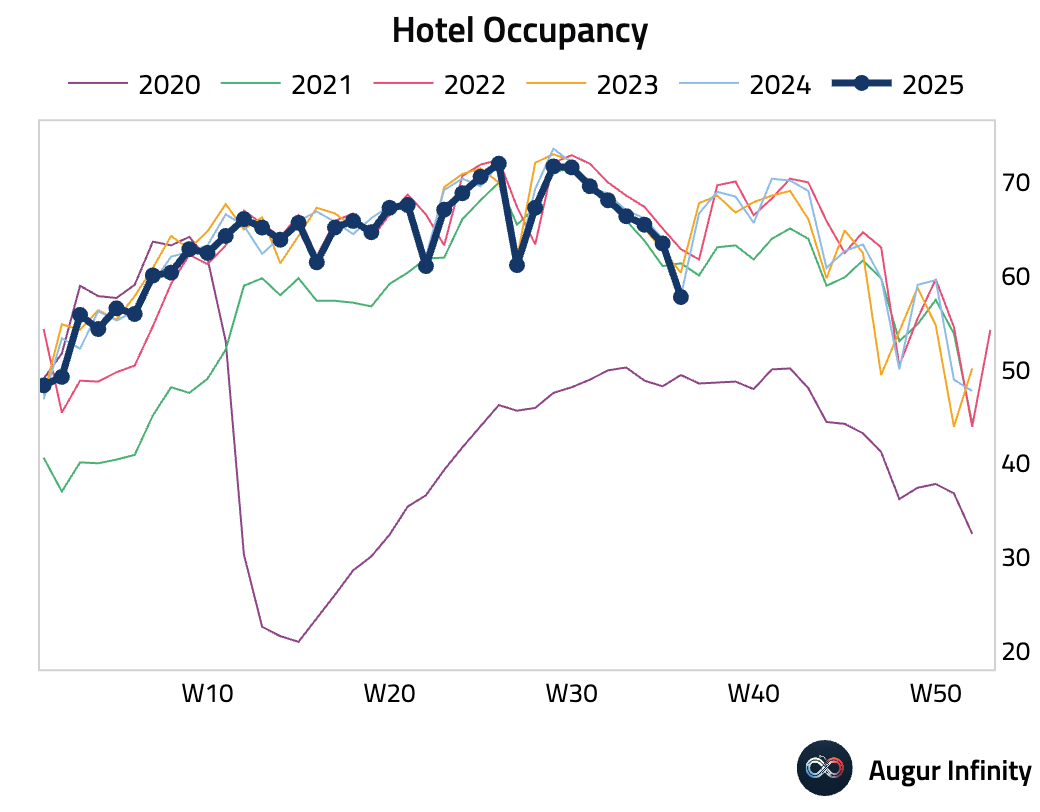

- US hotel occupancy declined to 57.7% in the week ending September 6. This is the worst performance for comparable weeks since the COVID pandemic.

Source: CoStar Group

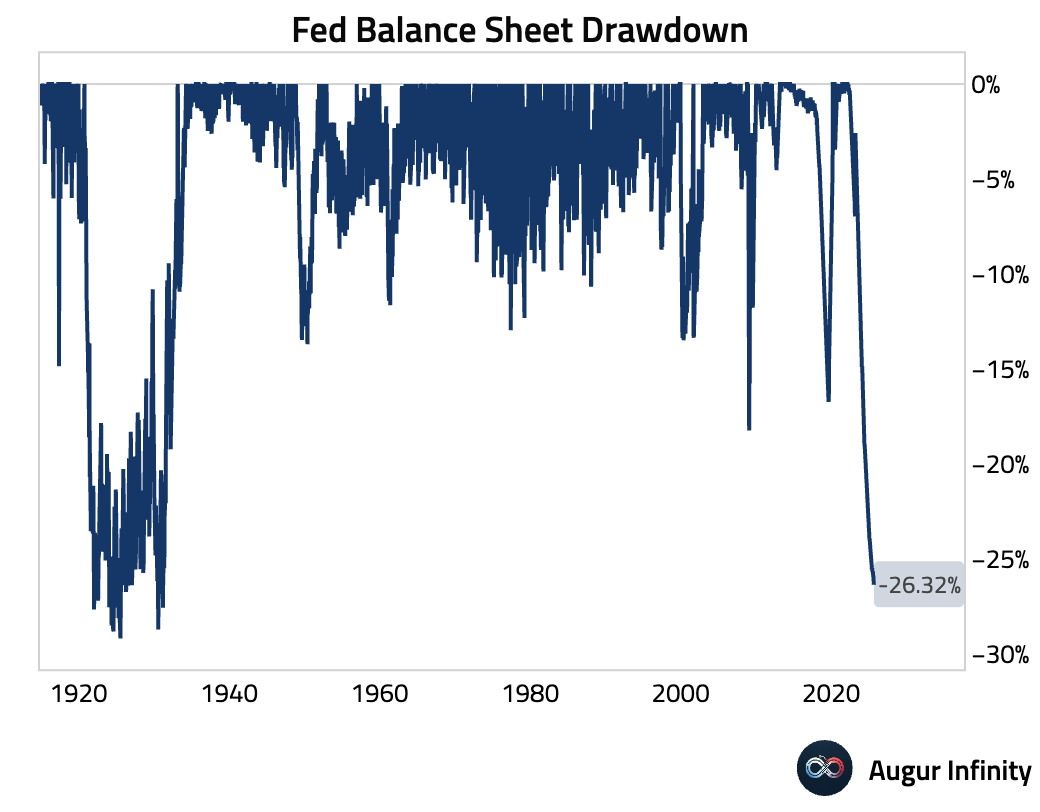

- The Federal Reserve’s balance sheet held steady at $6.6 trillion but was down 26% since the peak.

Canada

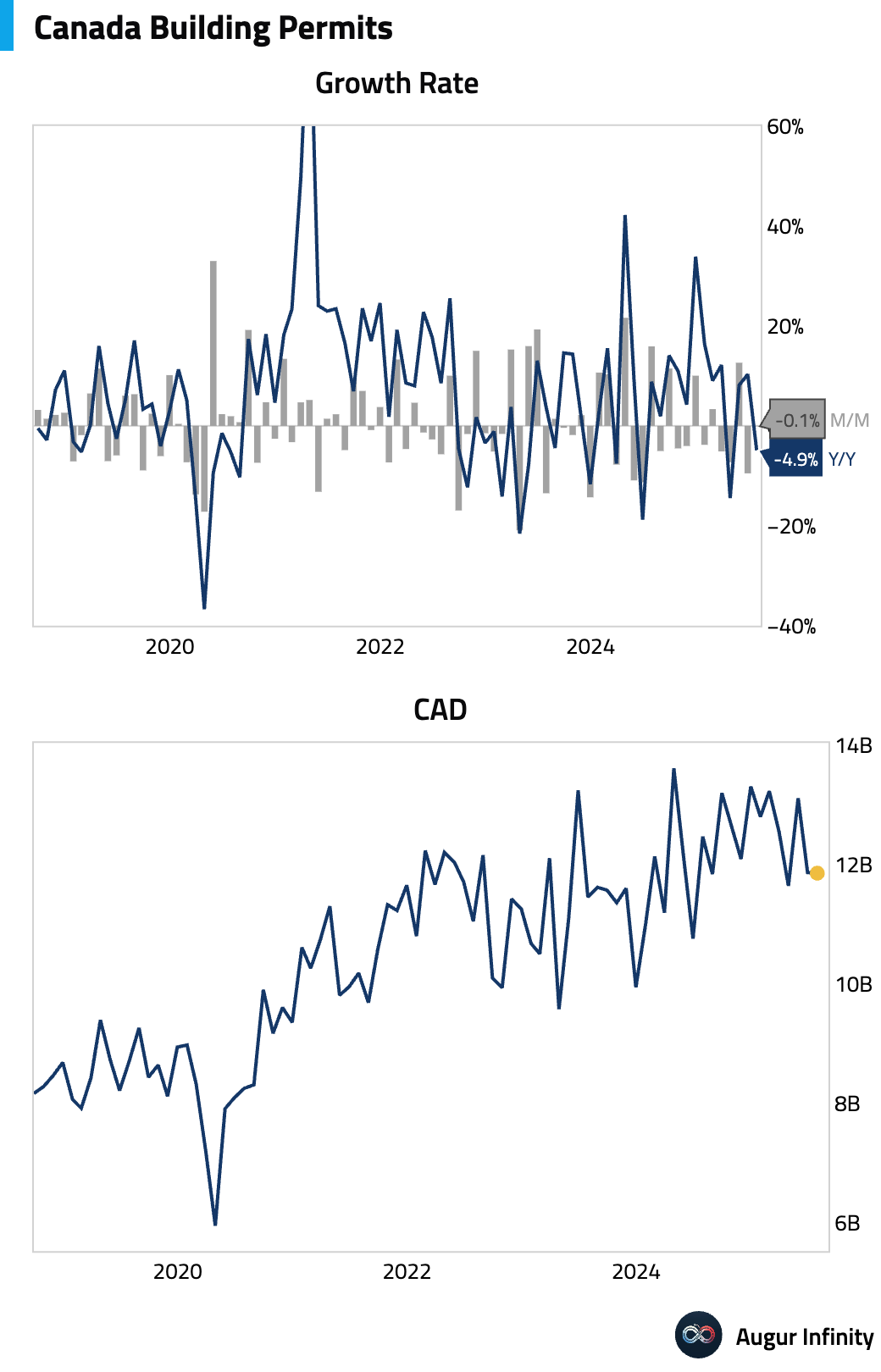

- Building permits unexpectedly declined 0.1% M/M, a significant miss compared to the 4.0% consensus forecast.

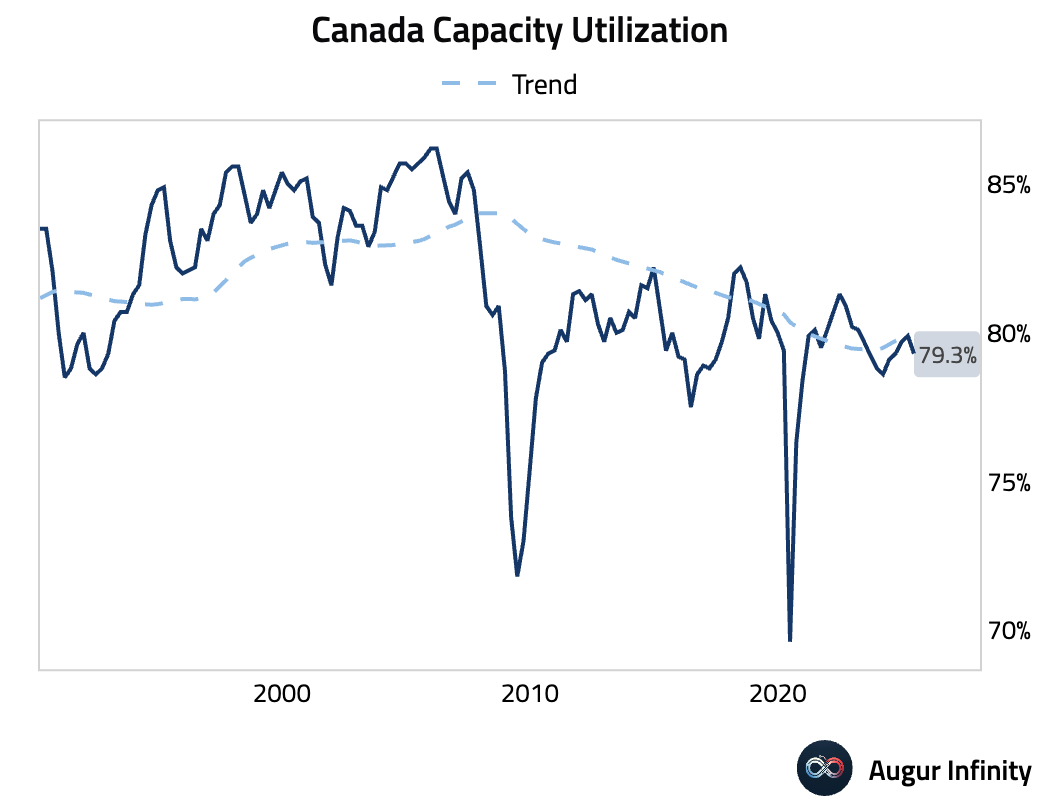

- Capacity utilization edged down to 79.3% from 79.9%, though it slightly beat the consensus of 78.8%.

Europe

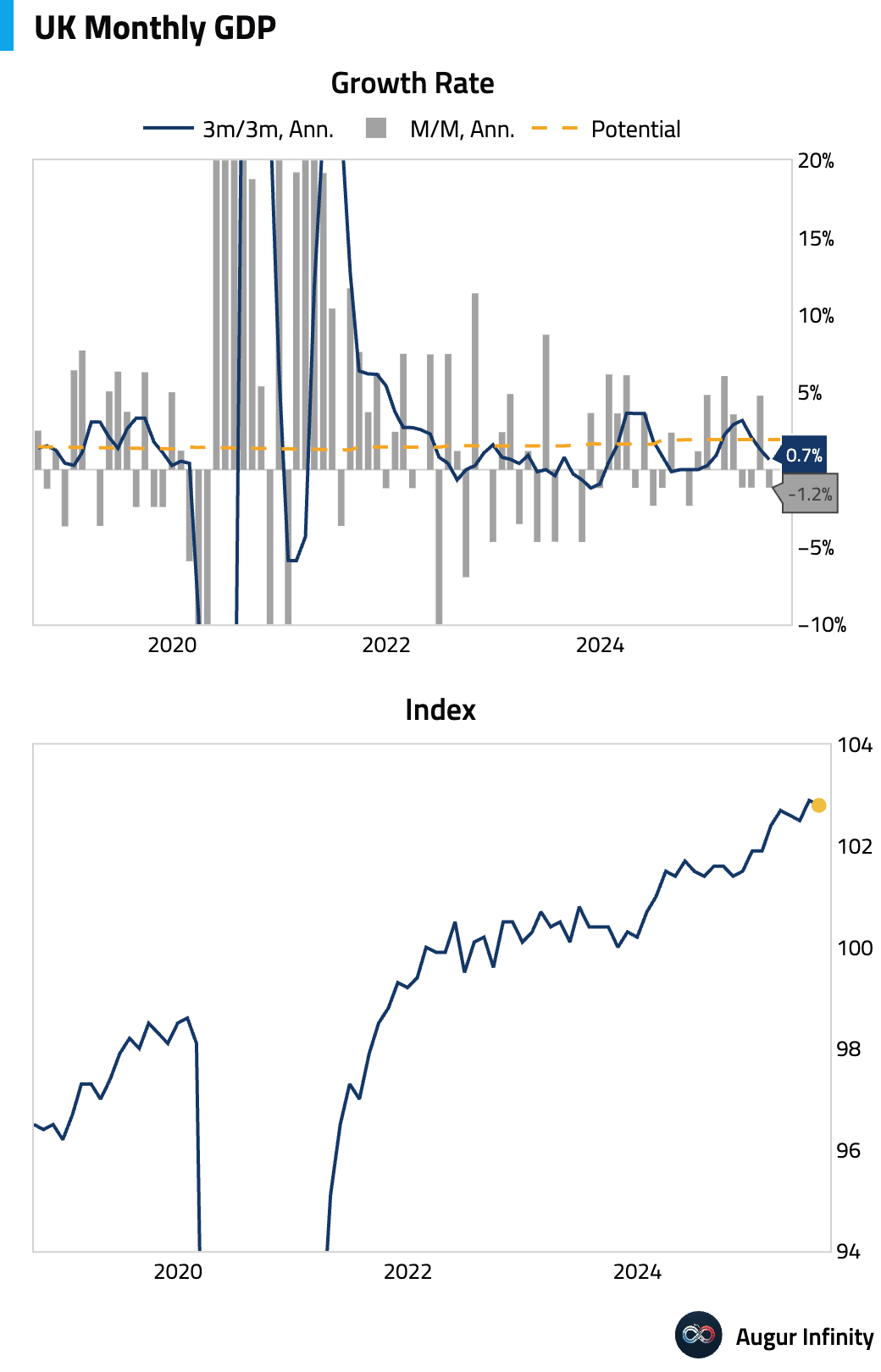

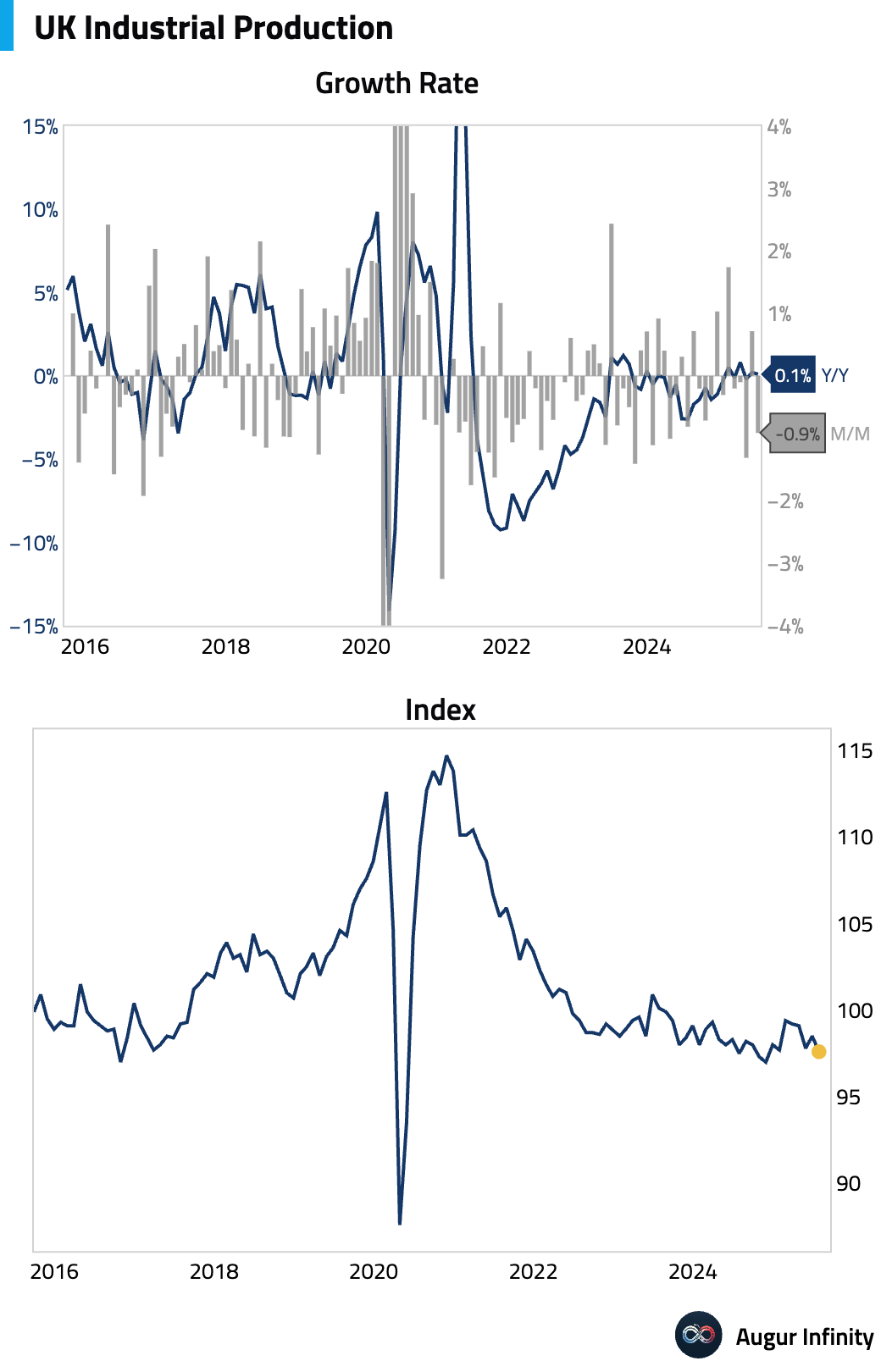

- The UK economy stalled in July. Growth in the services (+0.1%) and construction (+0.2%) sectors was offset by a sharp 0.9% contraction in industrial production.

- UK industrial production fell 0.9% M/M in July, a sharp reversal from June’s 0.7% gain and a significant miss of the 0.0% consensus. The year-over-year rate slowed to 0.1%, also well below expectations of 1.1%.

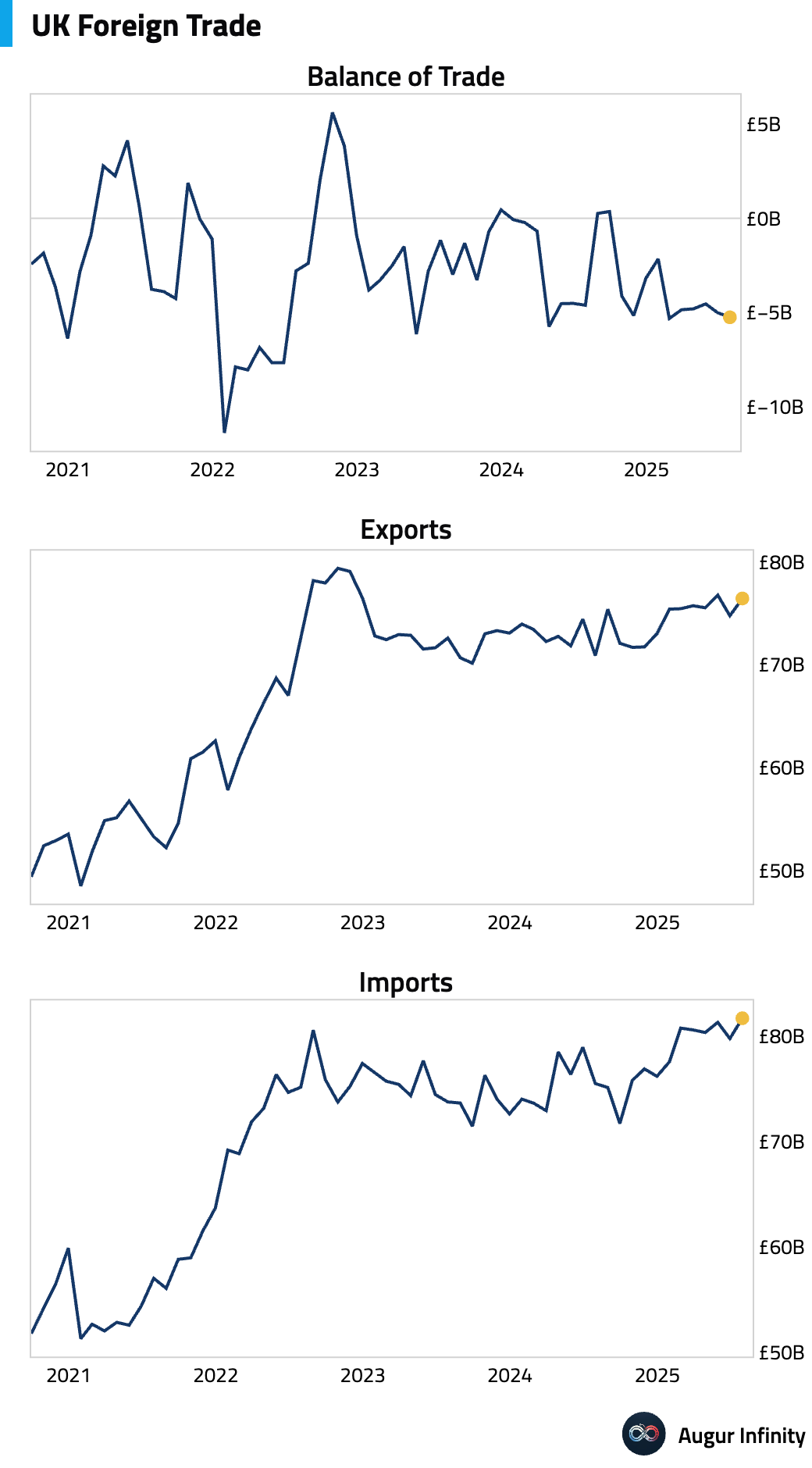

- The UK’s goods trade deficit widened to £22.2 billion, larger than the £21.8 billion expected. The total trade deficit also widened to £5.3 billion.

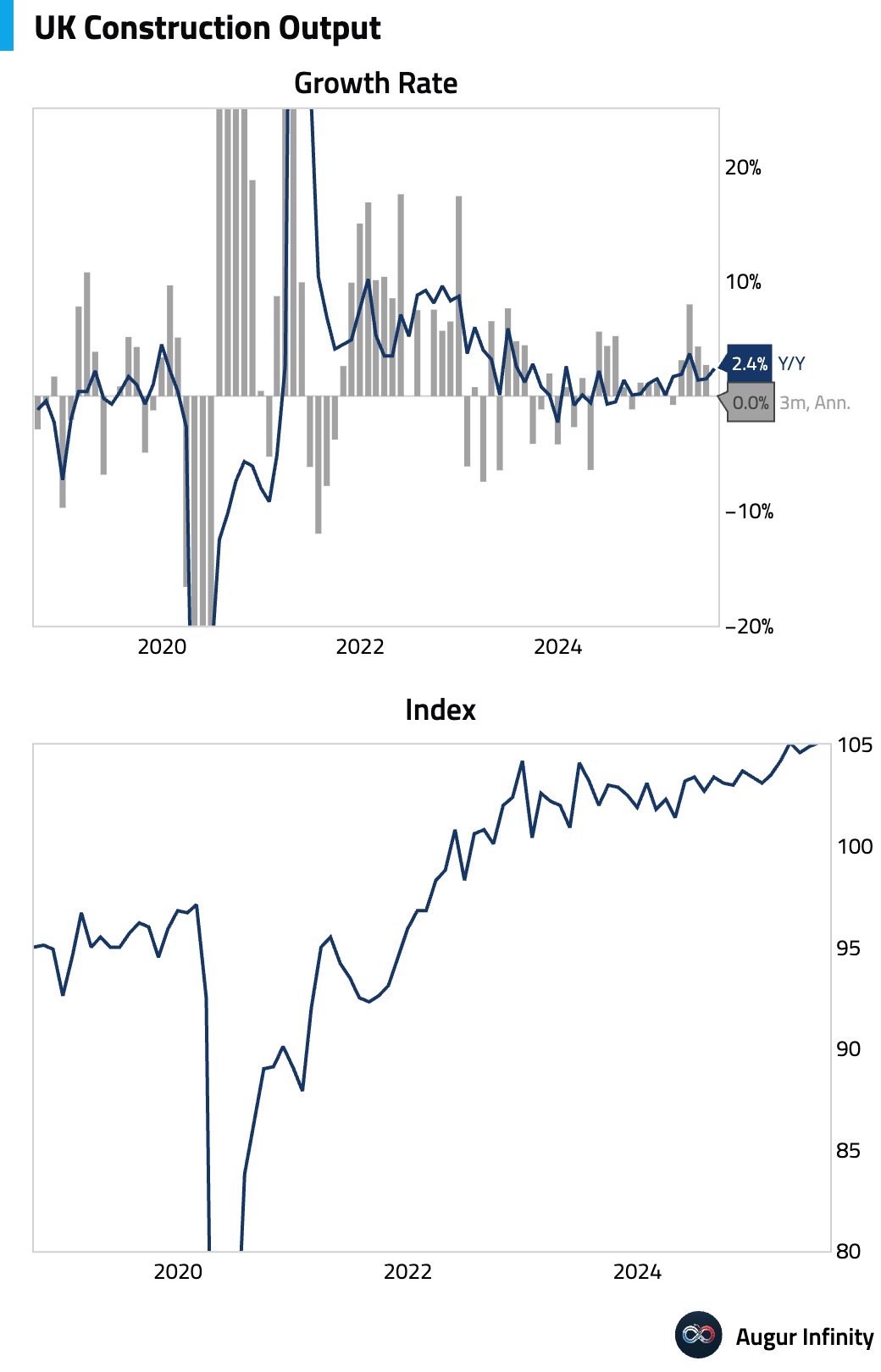

- UK construction output grew 2.4% Y/Y in July, accelerating from 1.5% in June and beating consensus estimates of 1.9%.

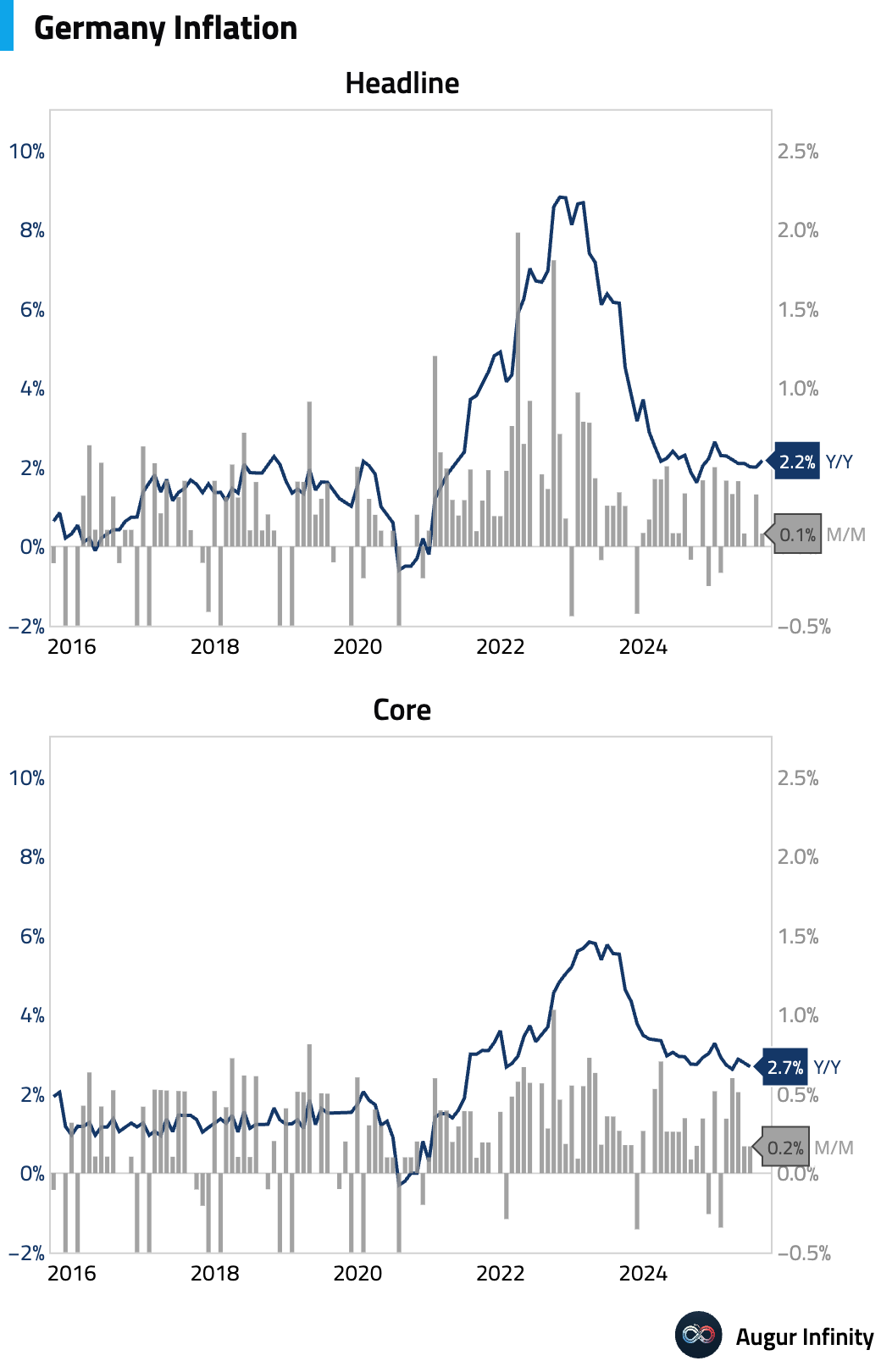

- Germany’s final inflation figures for August were confirmed at 0.1% M/M and 2.2% Y/Y, both matching preliminary estimates. The annual rate rose from 2.0% in July.

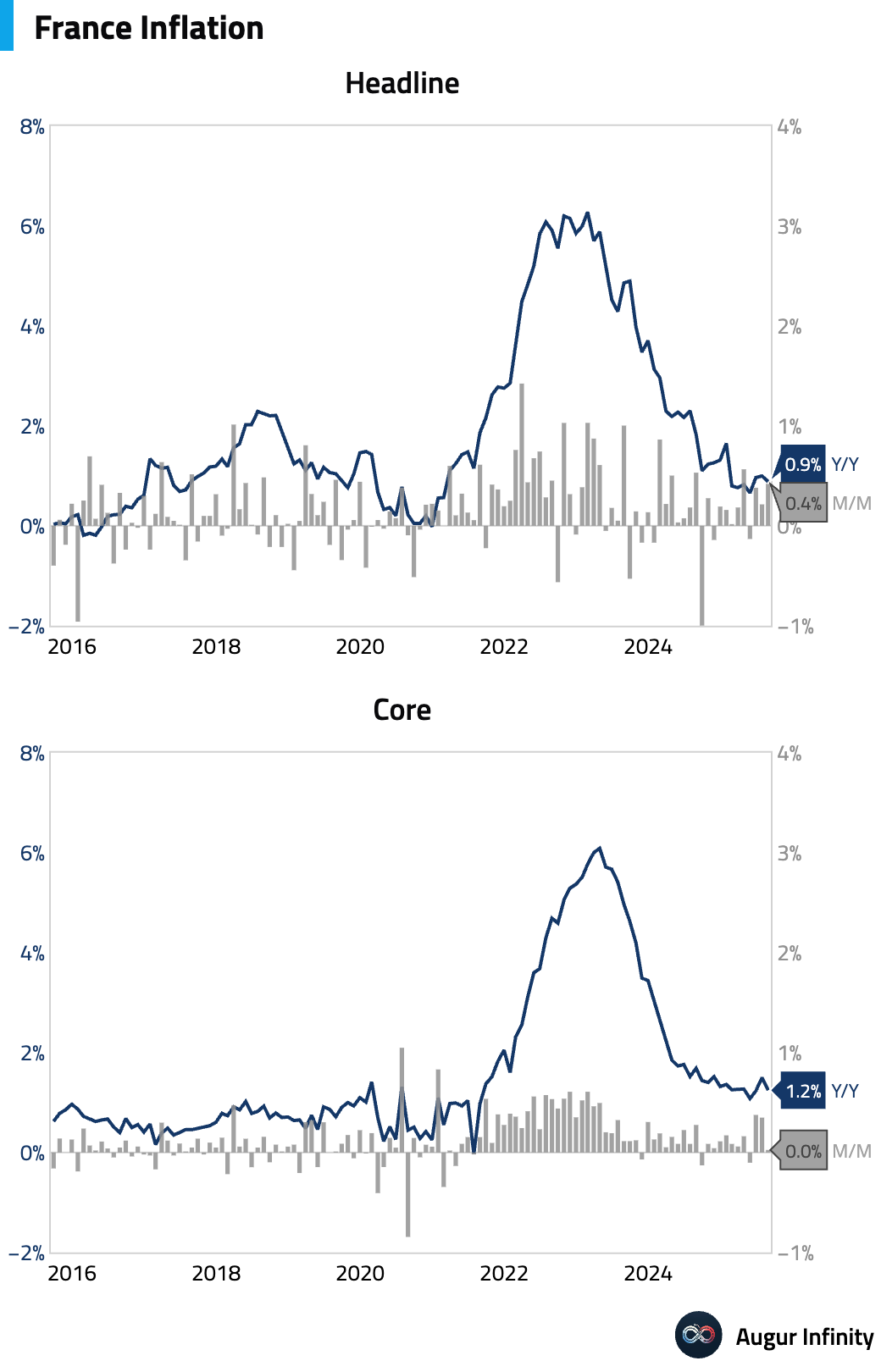

- France’s final August inflation was confirmed at 0.4% M/M and 0.9% Y/Y, in line with preliminary data.

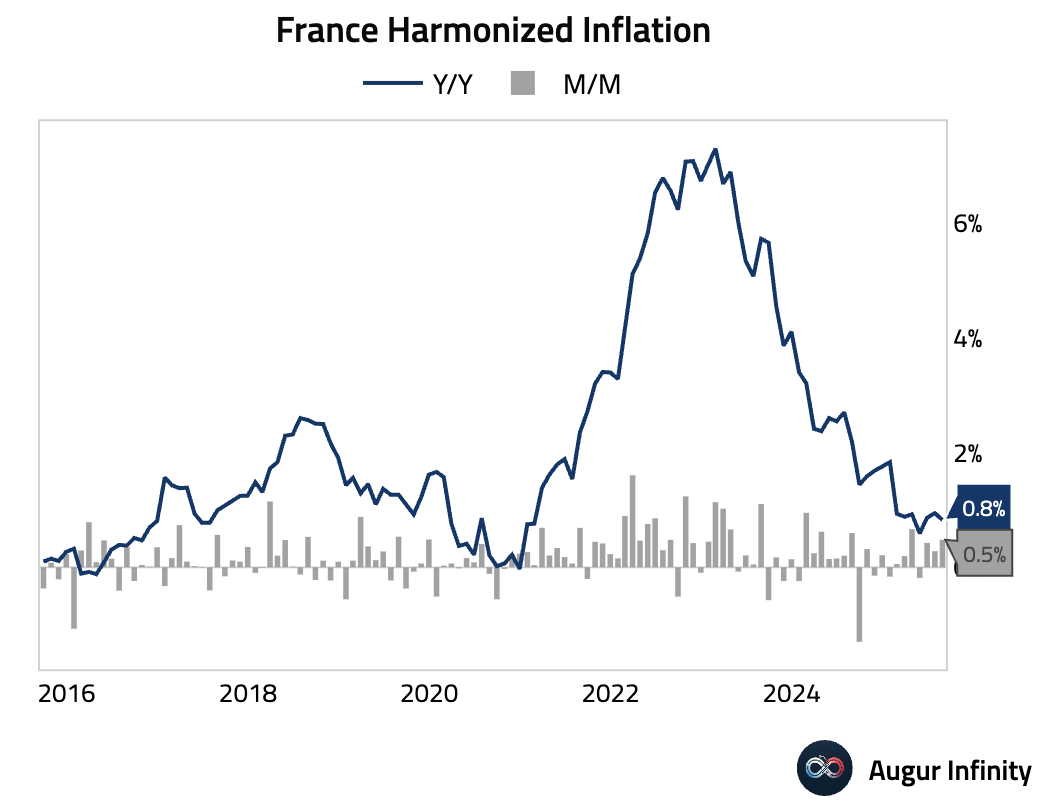

- France’s final harmonized inflation rate (HICP) for August was confirmed at 0.5% M/M and 0.8% Y/Y.

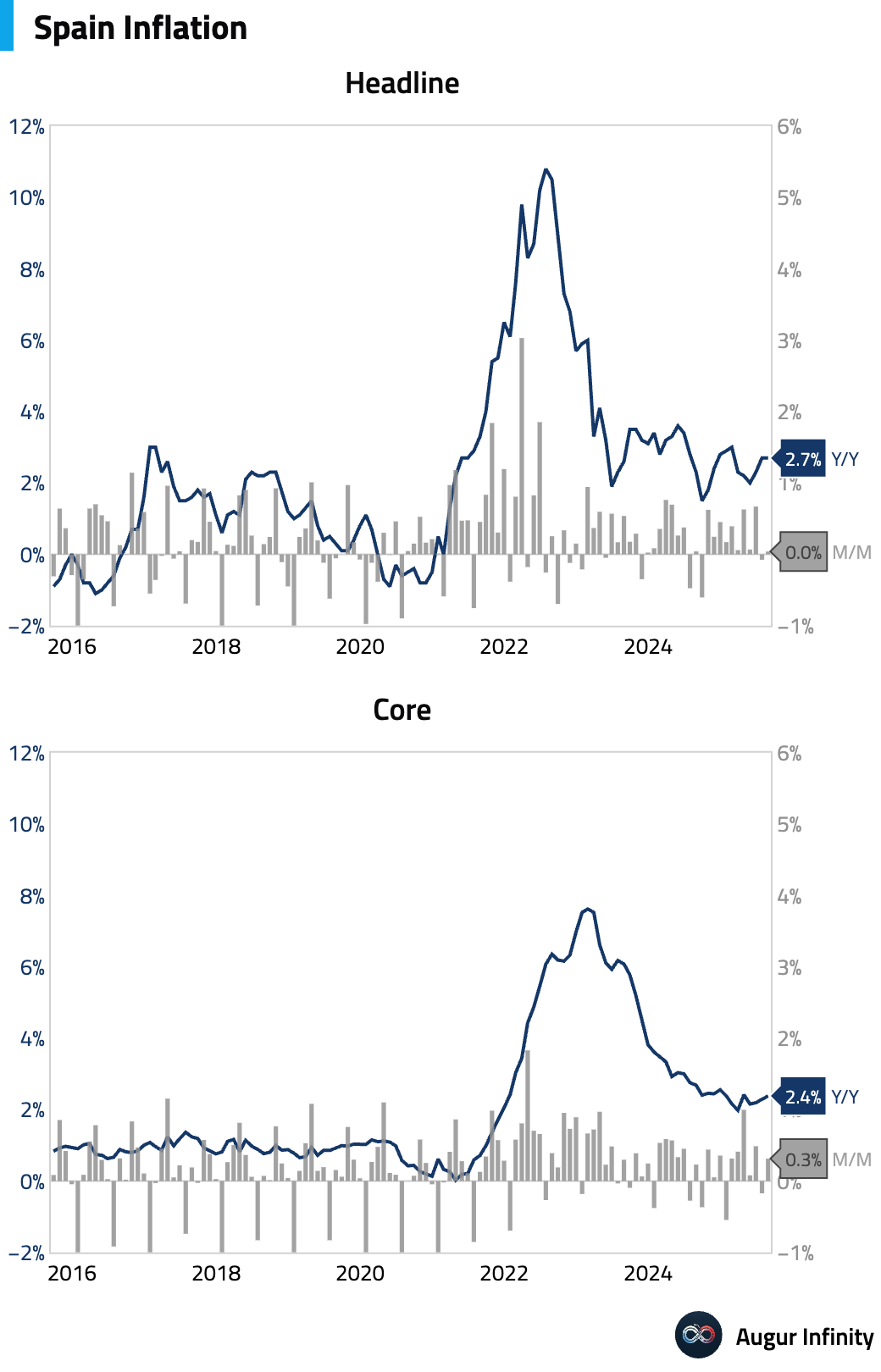

- Spain's final August inflation was confirmed at 0.0% M/M and 2.7% Y/Y, unchanged from the prior month and in line with preliminary readings.

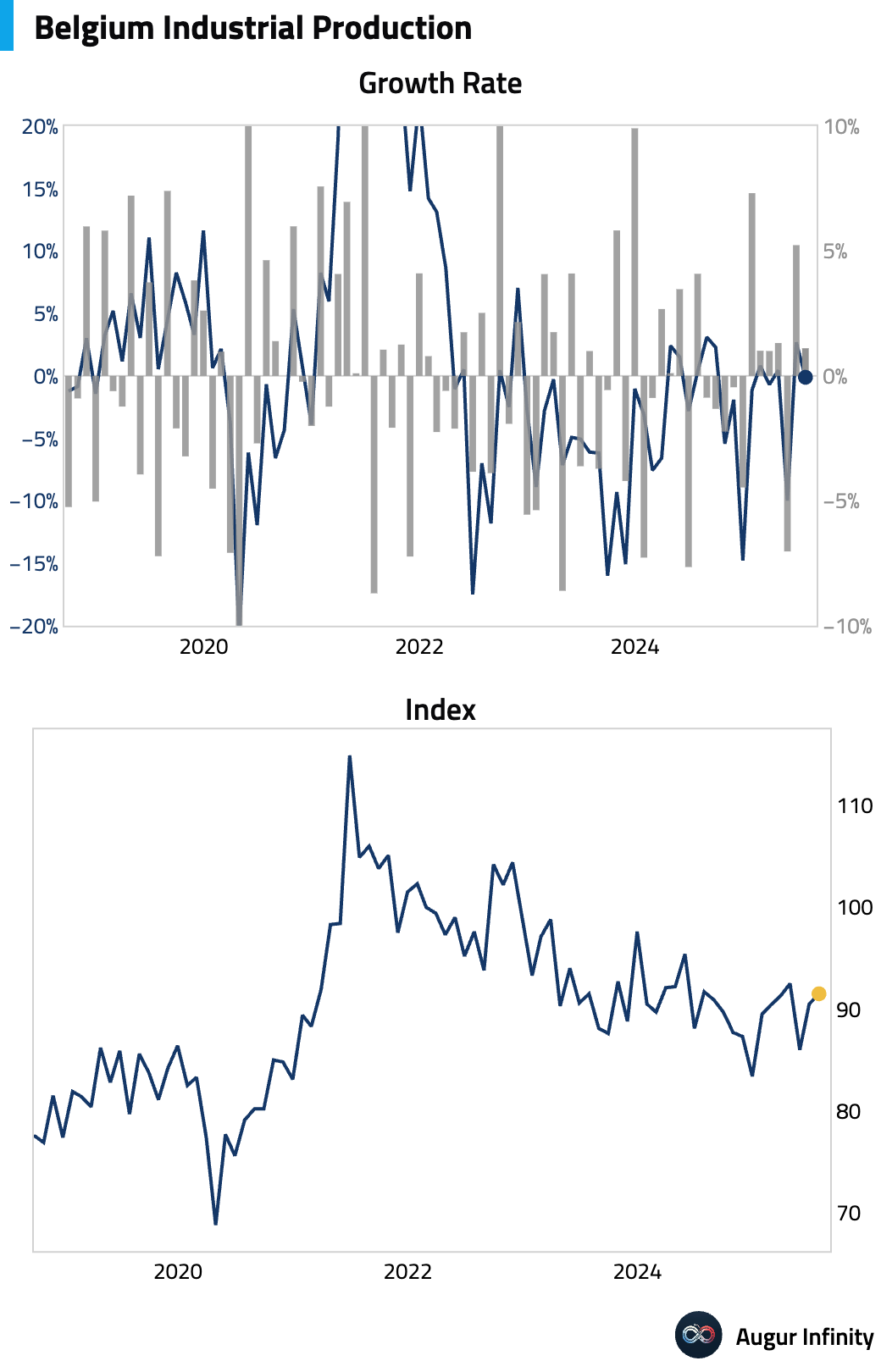

- Belgium's industrial production rose 1.1% M/M in July, but fell 0.1% Y/Y.

Asia-Pacific

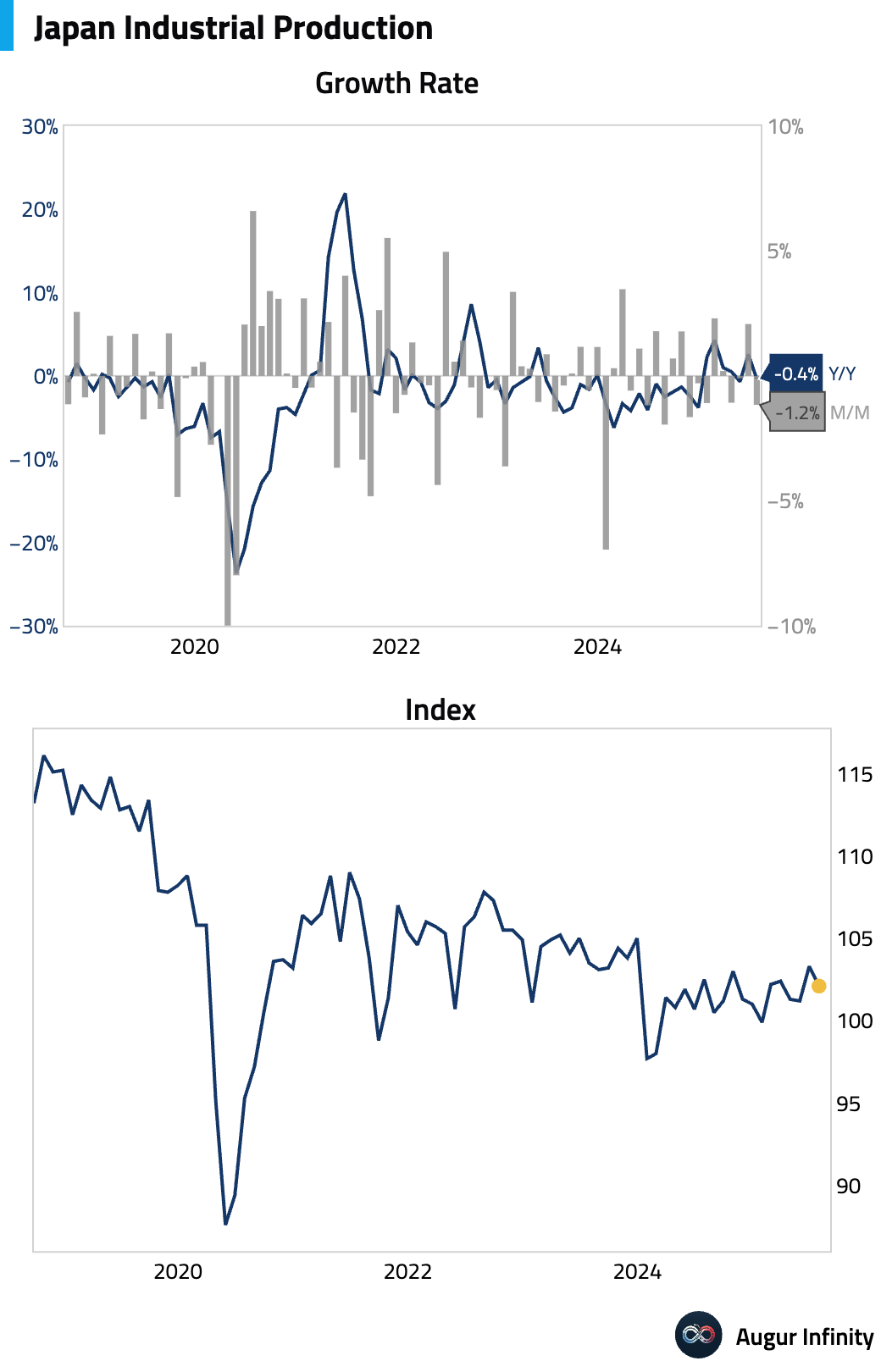

- Japan's final industrial production figures for July showed a 1.2% M/M decline, an improvement from the -1.6% preliminary estimate. Year-over-year, production fell 0.4%.

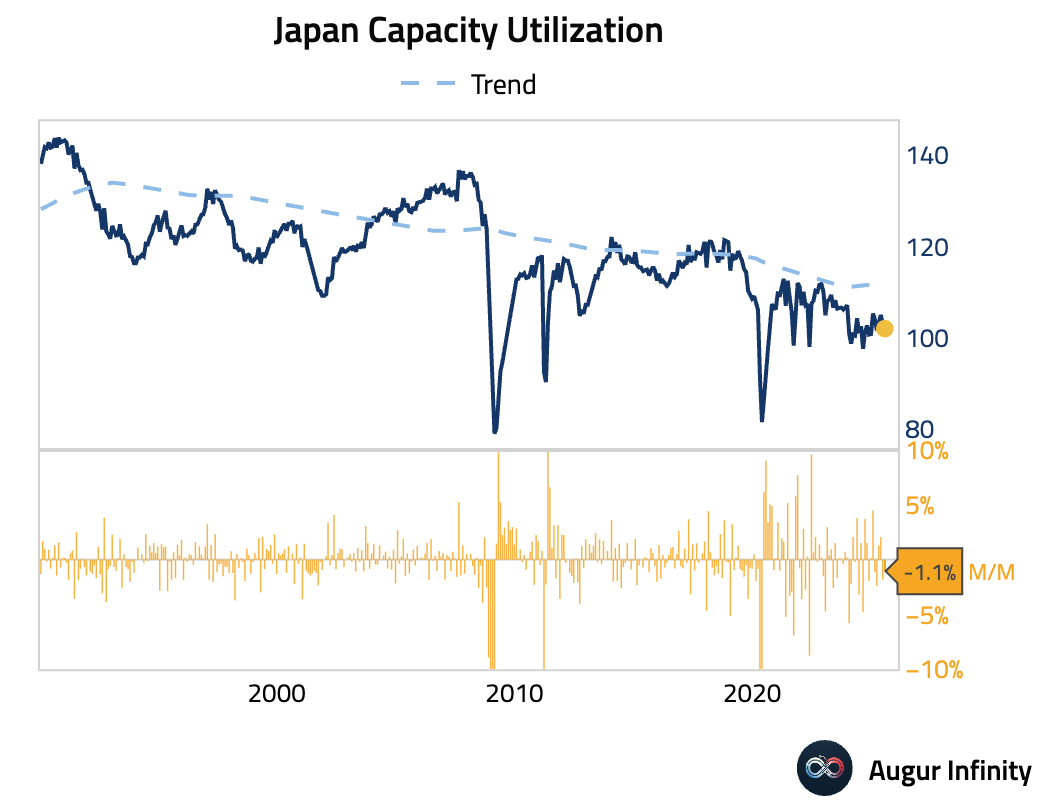

- Japan’s capacity utilization fell for a second consecutive month, declining 1.1% M/M in July.

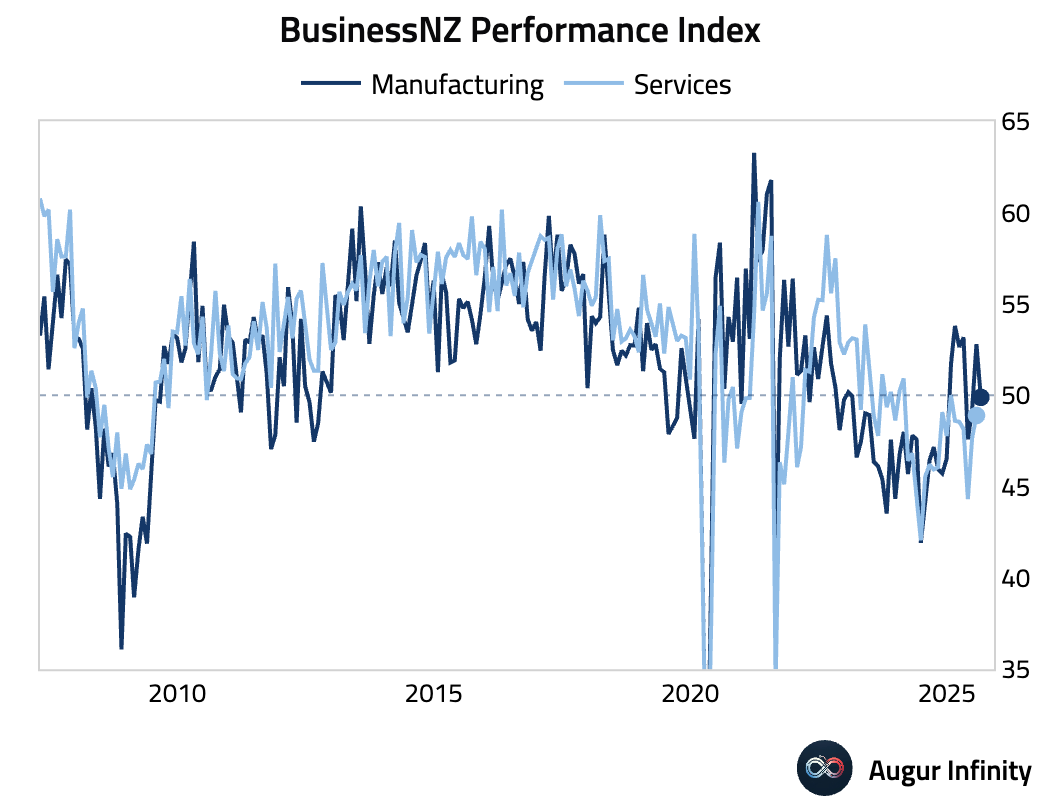

- New Zealand's Business NZ Performance of Manufacturing Index fell to 49.9 in August from 52.8, slipping into contractionary territory for the first time in two months.

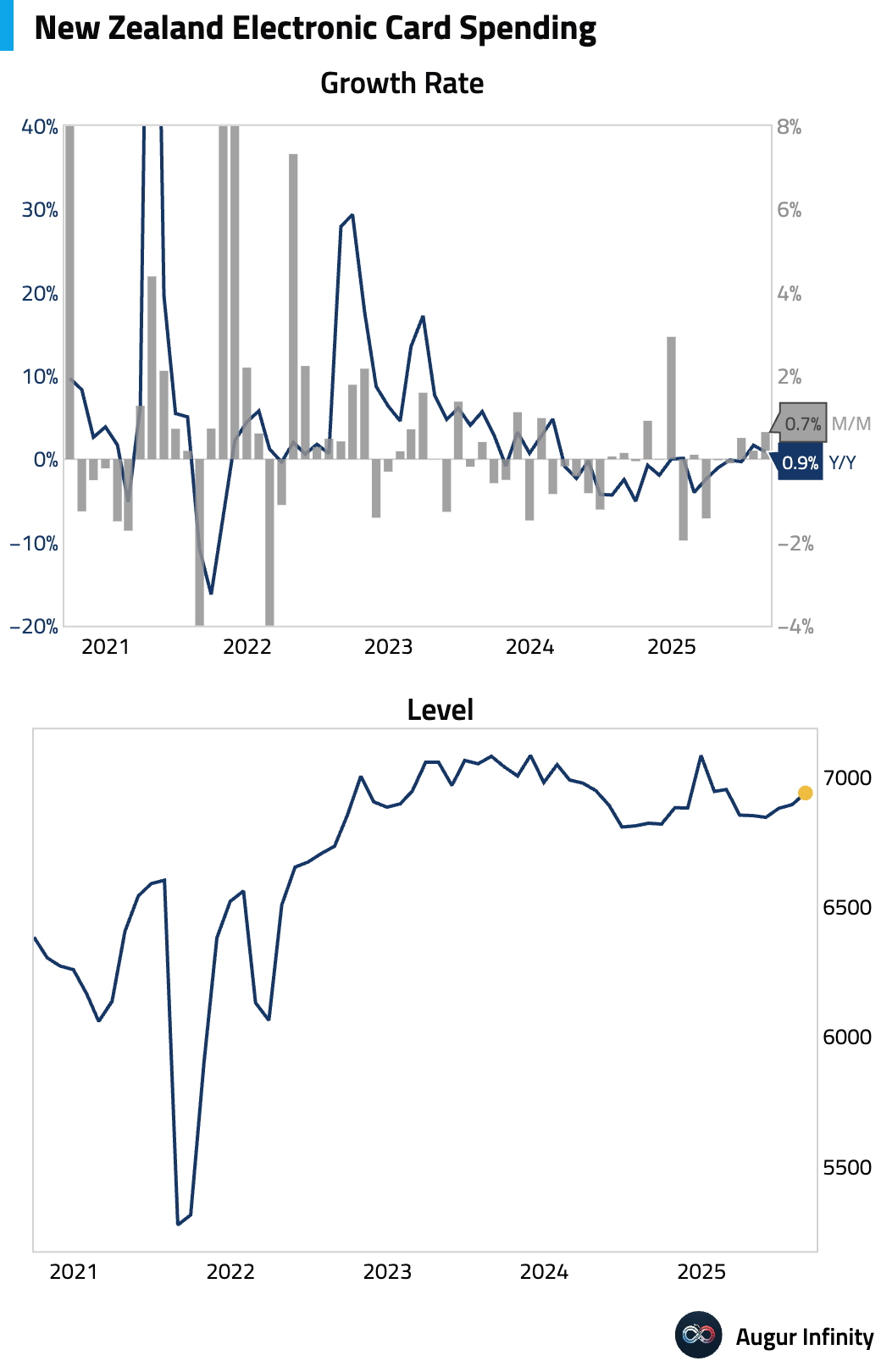

- New Zealand’s electronic retail card spending accelerated to 0.7% M/M in August, its fastest pace since December. However, the year-over-year growth slowed to 0.9% from 1.7%.

China

- China’s government announced it will provide more than $1 trillion to assist local governments with outstanding financial obligations.

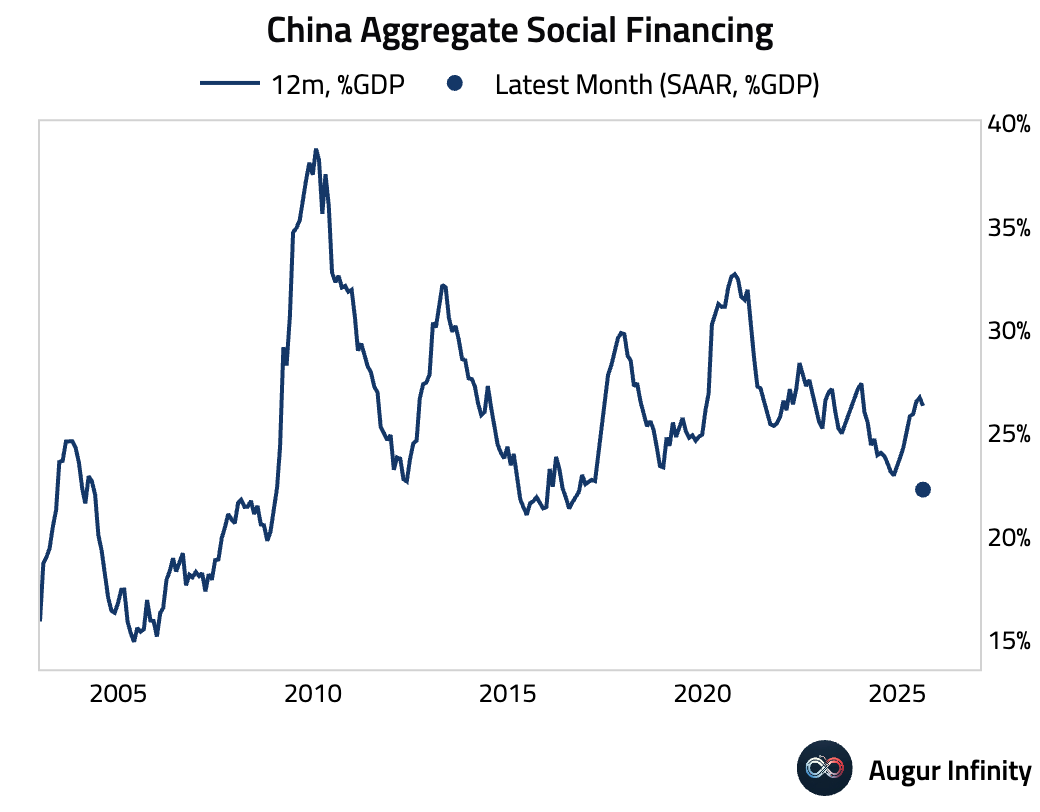

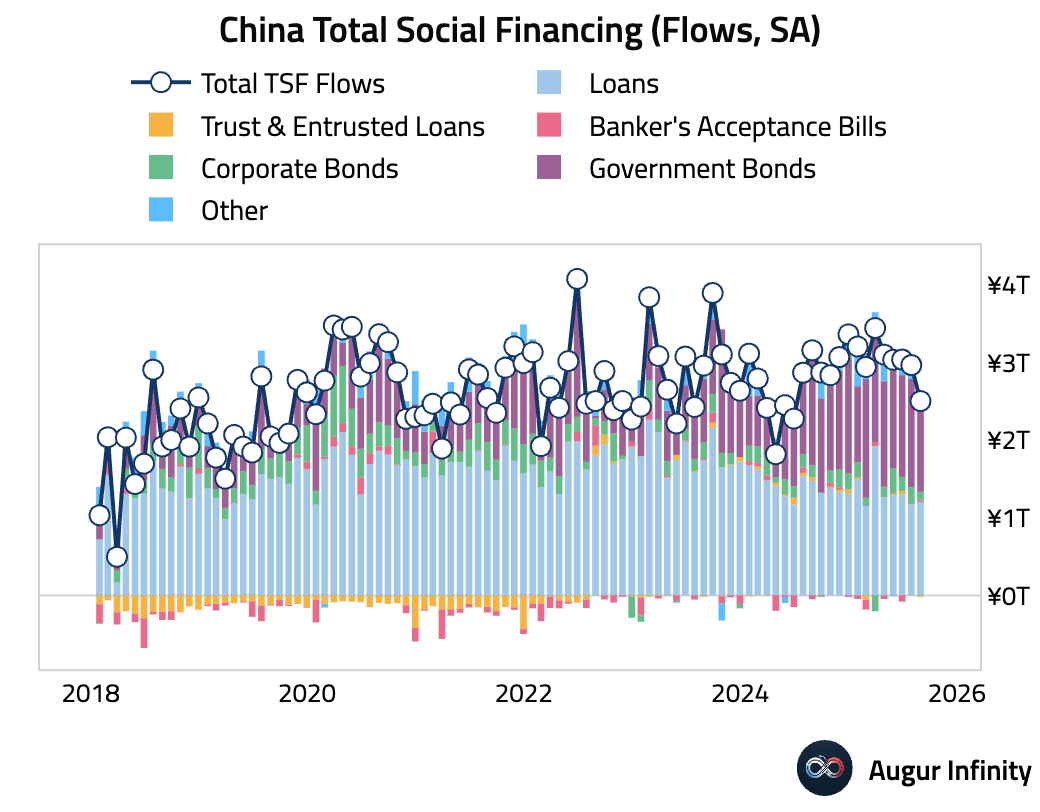

- Total Social Financing (TSF) was ¥2.57 trillion in August, beating low expectations. However, the beat was driven by volatile shadow banking rather than core credit growth. Seasonally-adjusted TSF declined meaningfully from the prior months.

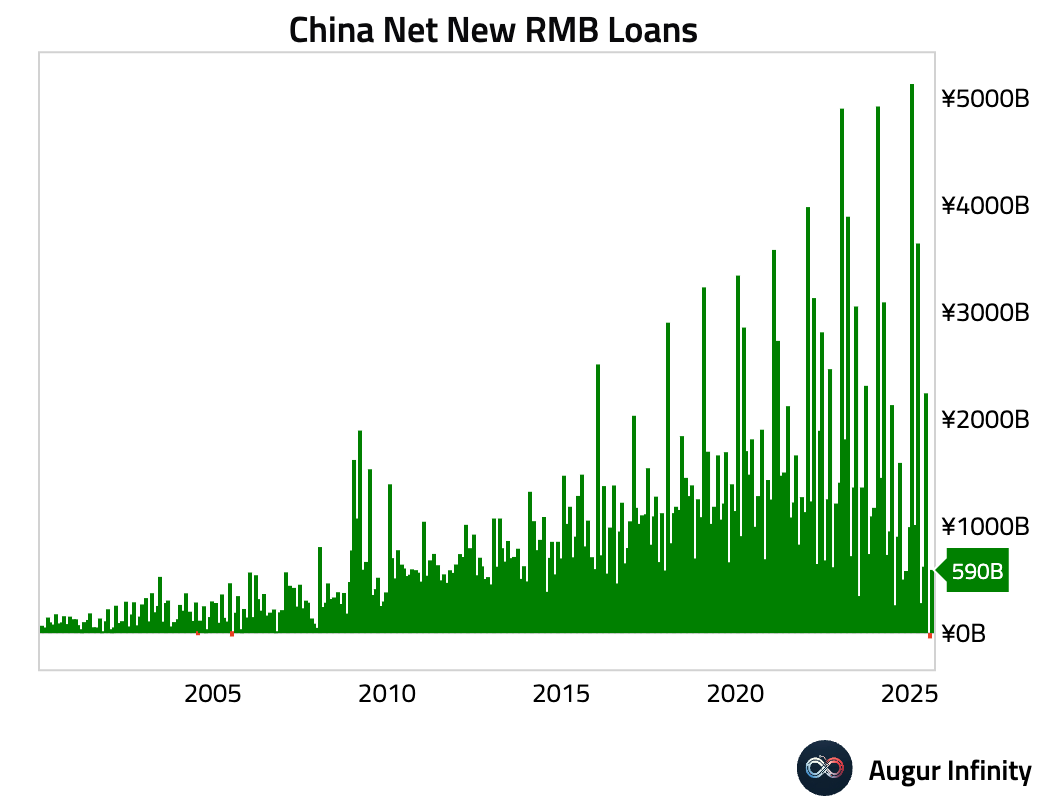

- New yuan loans of ¥590 billion significantly missed forecasts of ¥800 billion, revealing extremely weak private sector demand. Household loan growth was particularly soft, signaling low consumer confidence.

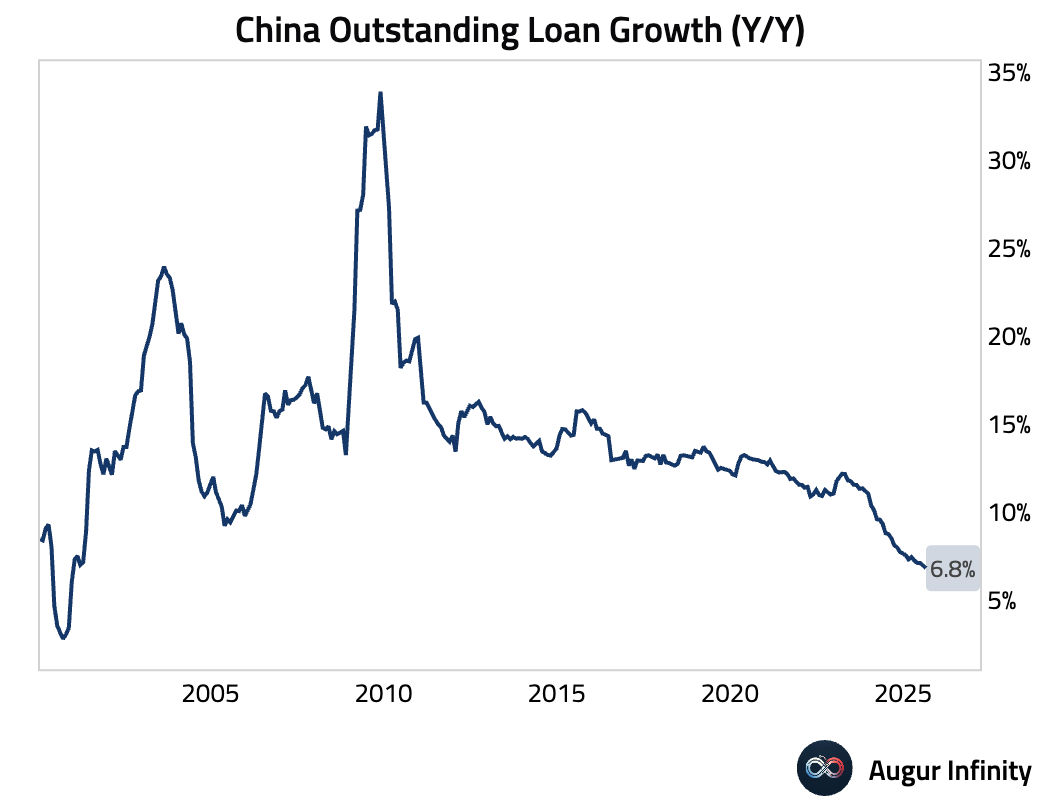

- Outstanding loan growth slowed to 6.8% Y/Y from 6.9%, its lowest level since December 2000.

- M2 money supply growth was stable at 8.8% Y/Y. The stability was notable given weak credit growth, suggesting government support is actively flowing into the economy via fiscal spending.

Emerging Markets ex China

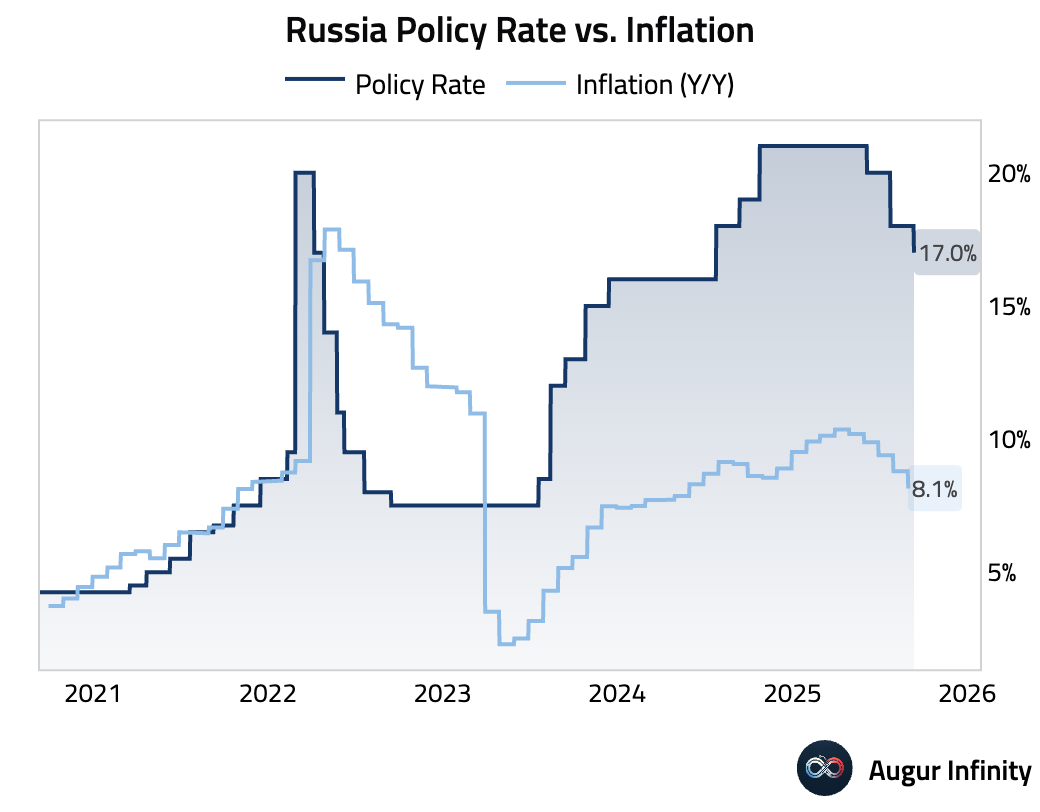

- The Central Bank of Russia cut its key interest rate by 100 basis points to 17.0% from 18.0%.

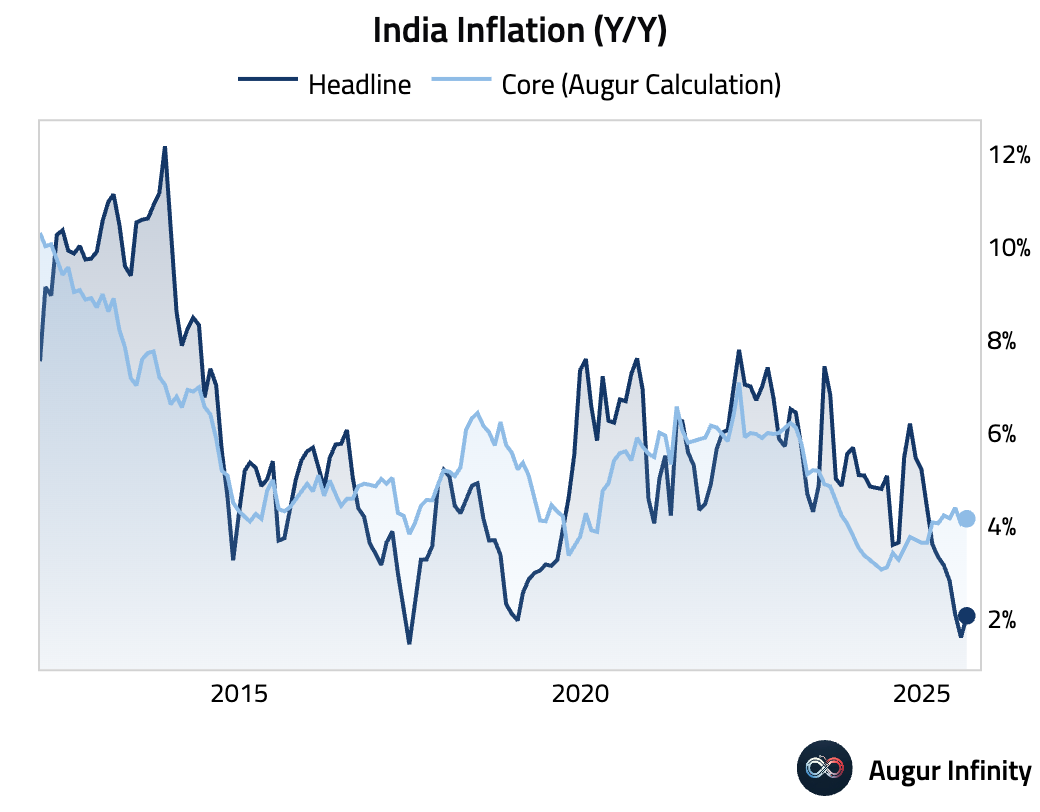

- India's headline CPI rose to 2.1% Y/Y in August from 1.6%, matching consensus. The increase was driven by higher food inflation. Core inflation was more or less unchanged.

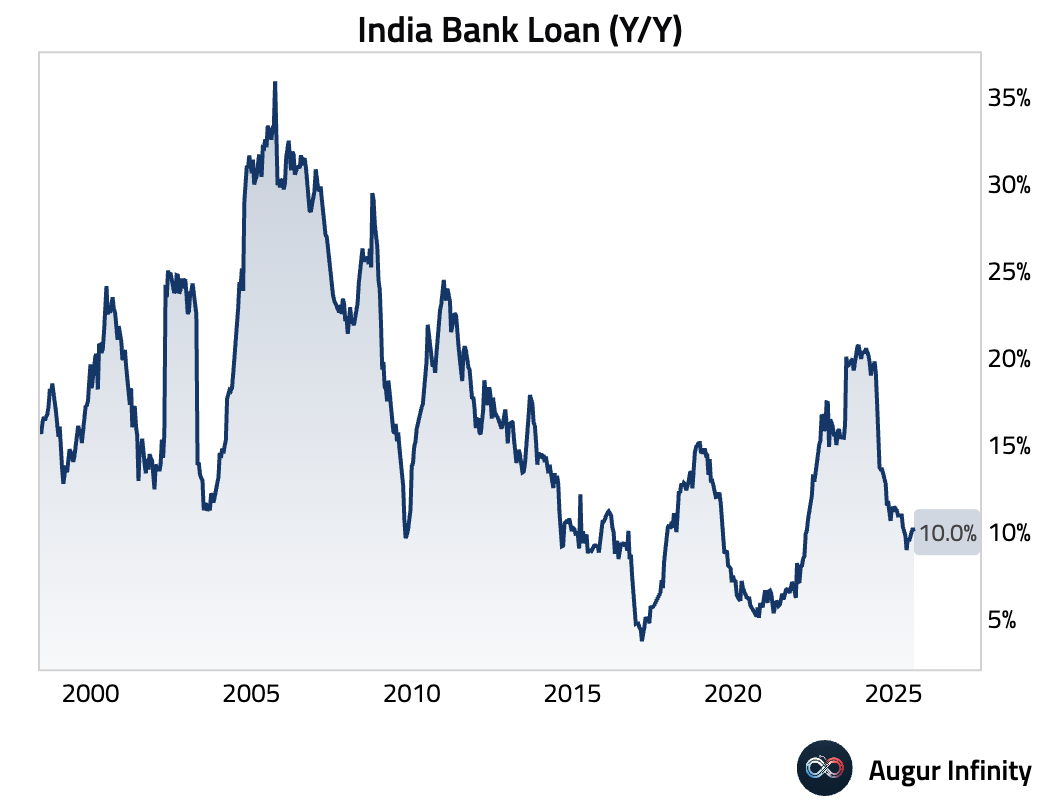

- India's bank loan growth slowed slightly to 10.0% Y/Y from 10.2%.

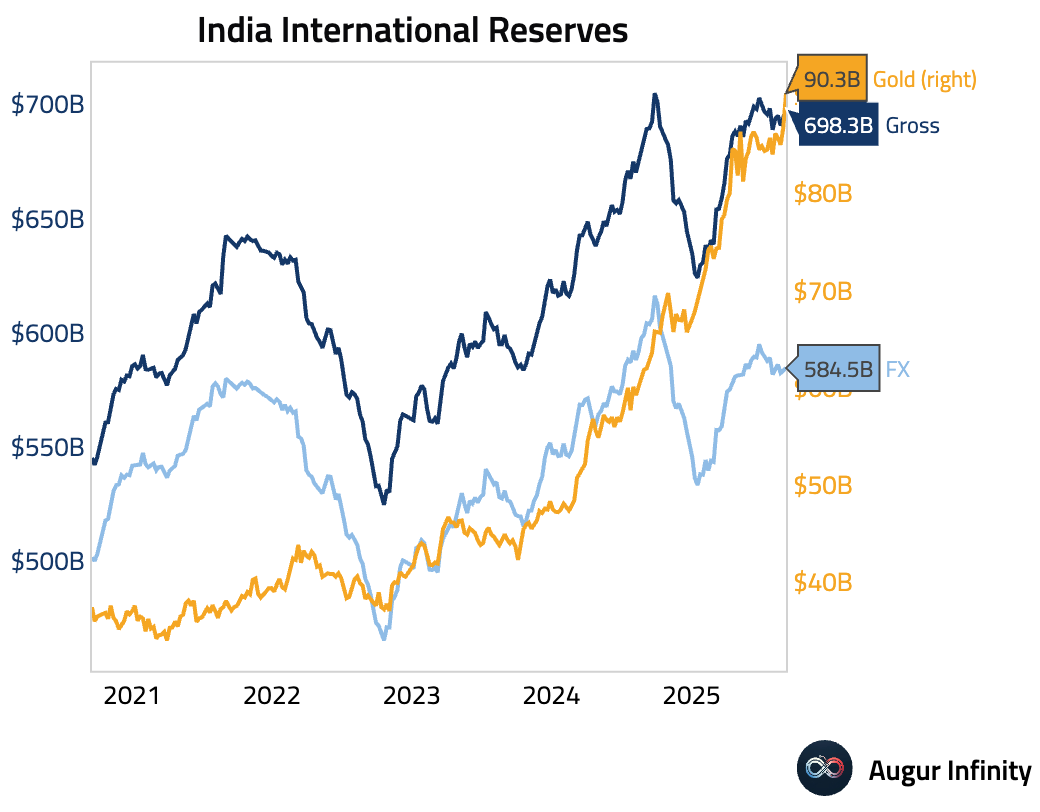

- India’s official reserve assets increased to $698.3 billion from $694.2 billion.

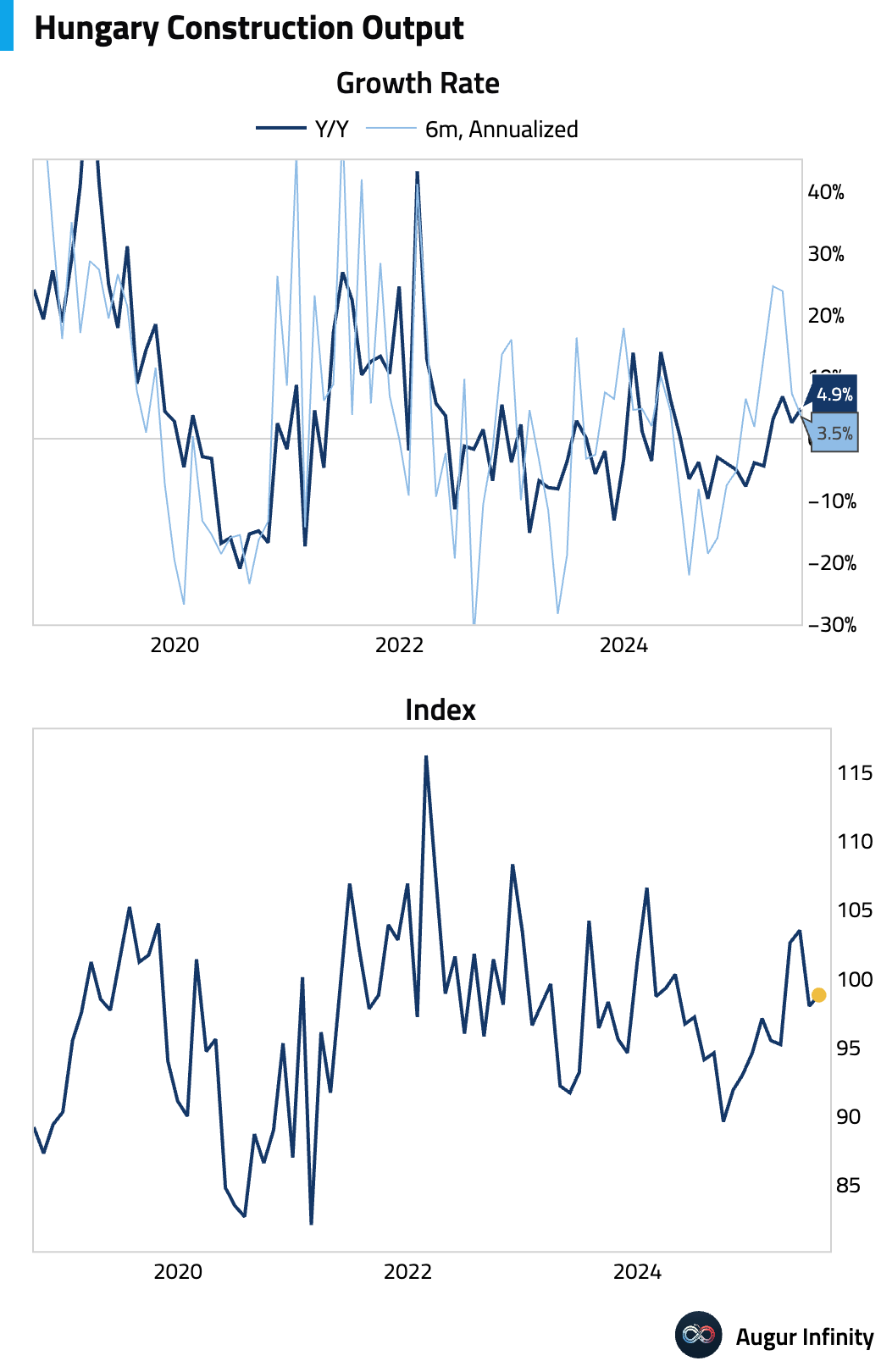

- Hungary's construction output accelerated to 4.9% Y/Y in July from 2.6%.

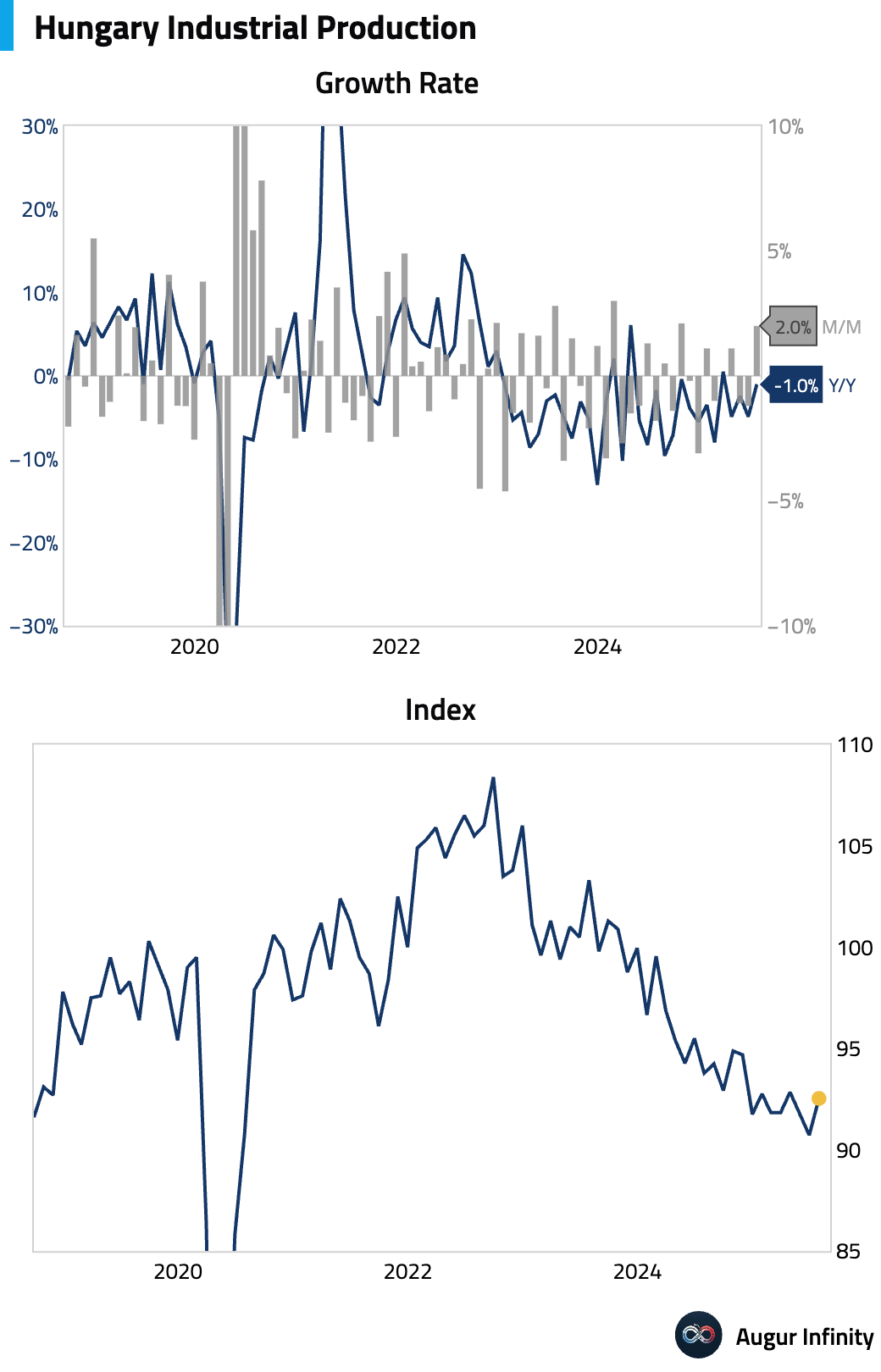

- Hungary's final industrial production figure confirmed a 1.0% Y/Y decline in July, an improvement from the 4.9% drop in June.

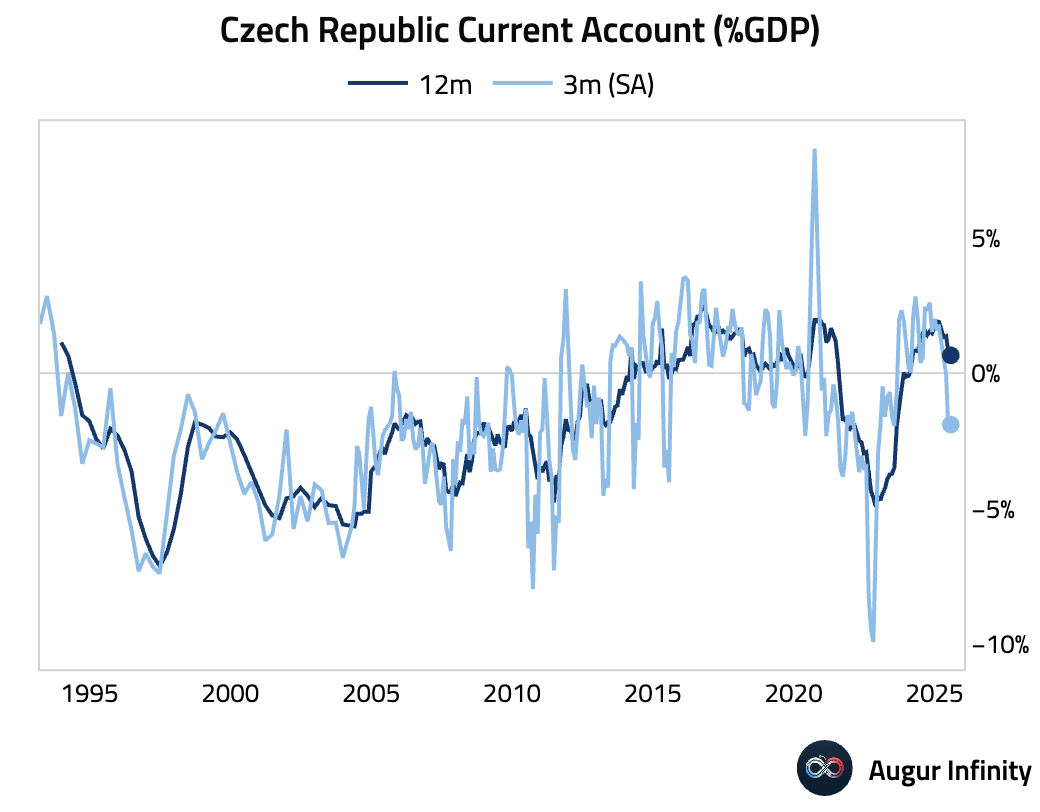

- The Czech Republic's current account deficit narrowed to CZK 14.9 billion in July from CZK 73.4 billion in June.

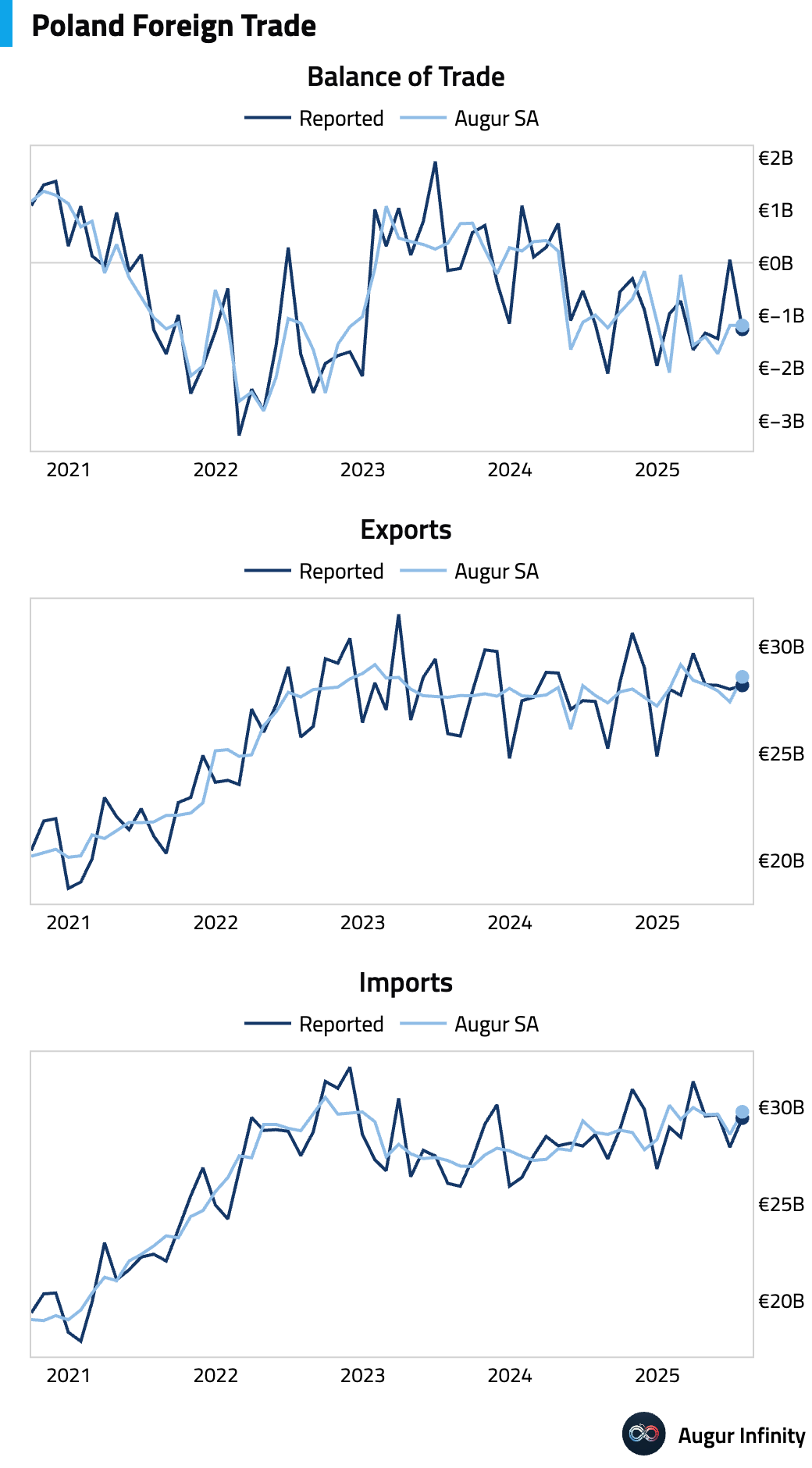

- Poland reported a trade deficit of €1.27 billion in July, swinging from a surplus of €59 million in June. After seasonal adjustment, howevrer, trade balance was little changed.

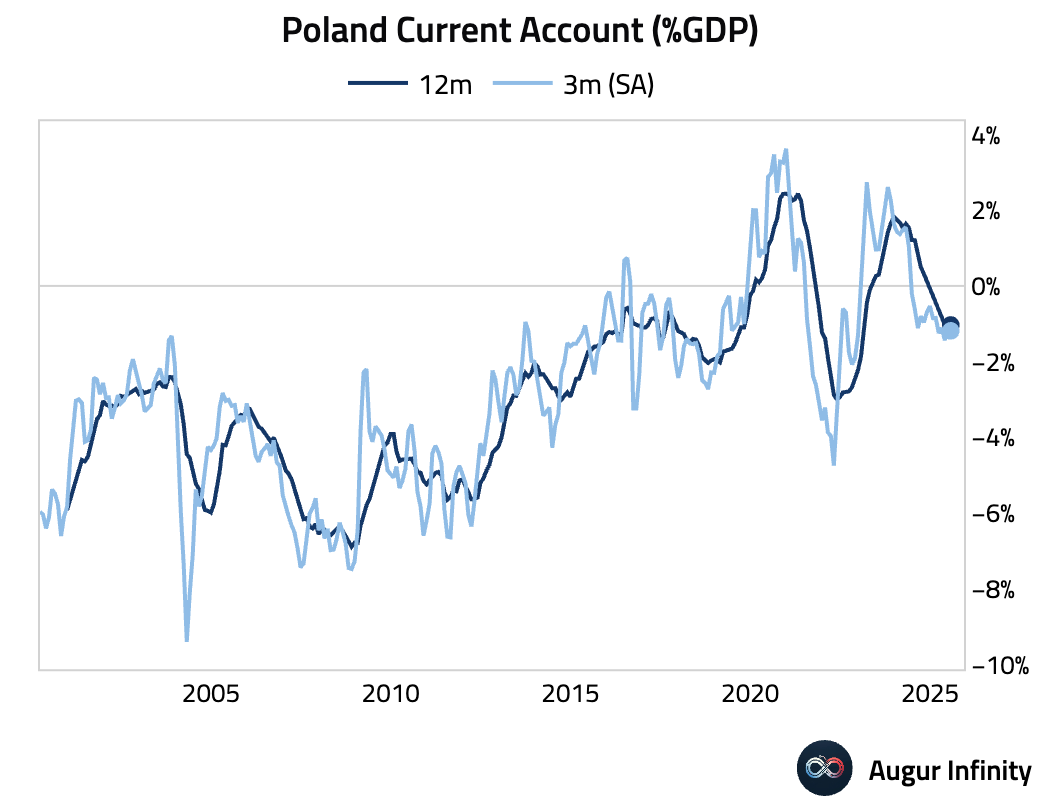

- Poland’s current account balance fell to a deficit of €1.34 billion in July from a surplus of €651 million in the previous month.

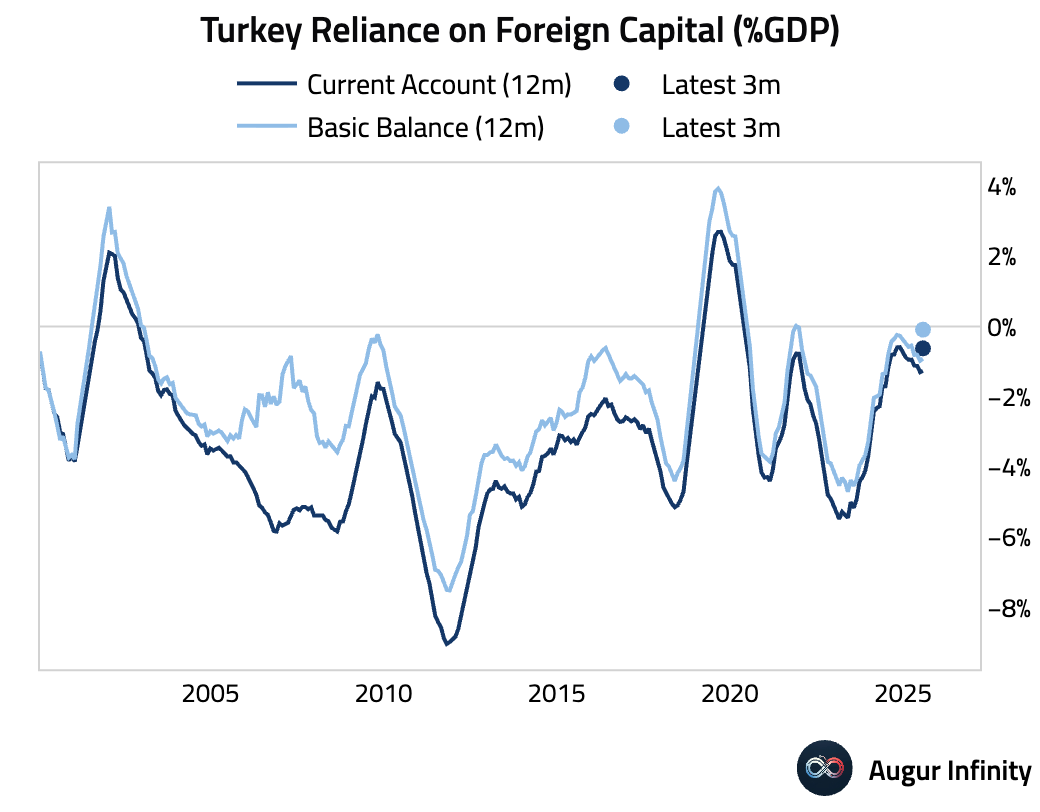

- Turkey's current account swung to a $1.77 billion surplus in July, a significant improvement from the $2.01 billion deficit in June and better than the $1.60 billion surplus expected.

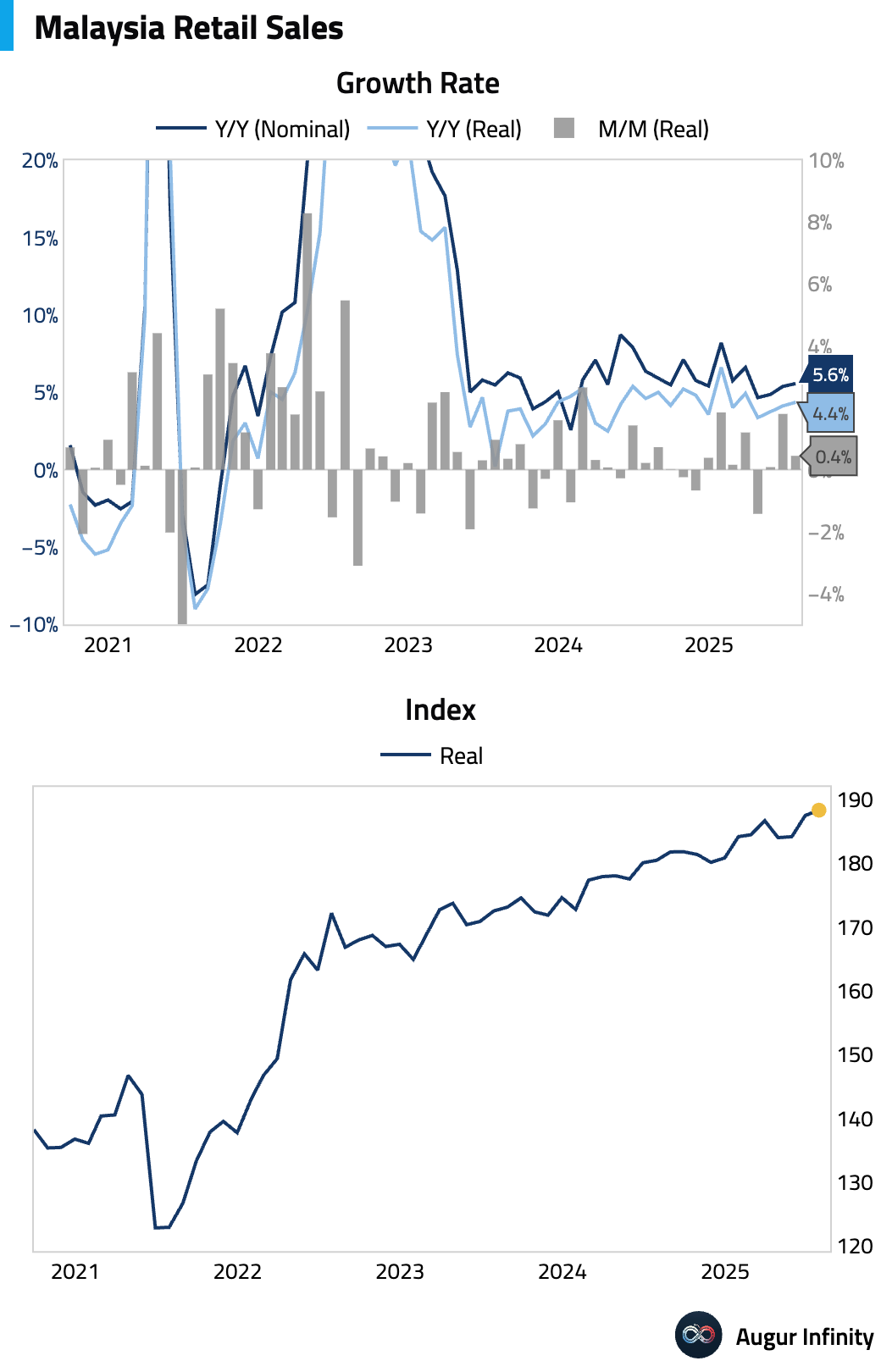

- Malaysian retail sales growth accelerated to 5.6% Y/Y in July from 5.4%.

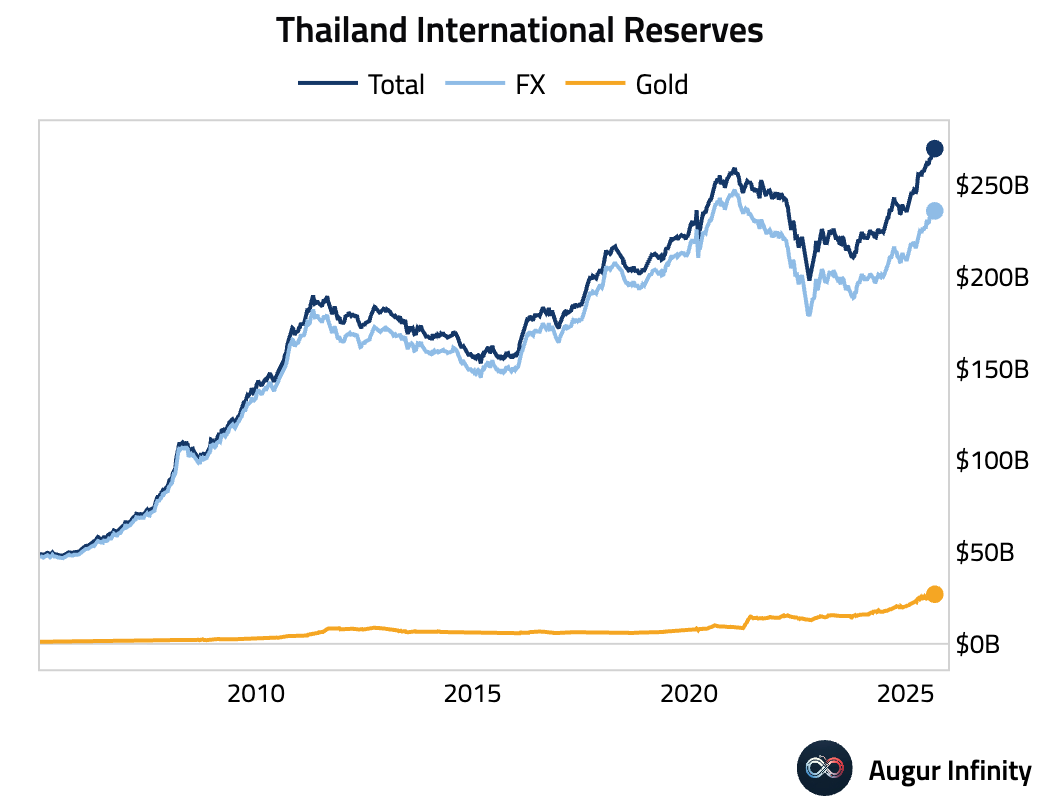

- Thailand’s official reserve assets rose to a record high of $267.4 billion.

Global Markets

Equities

- US equities stalled their advance, with the S&P 500 falling just short of a fifth consecutive day of gains. South Korea and Mexico extended their winning streaks to eight and seven days, respectively. Conversely, equities in China, Canada, Australia, and the United Kingdom finished the session lower.

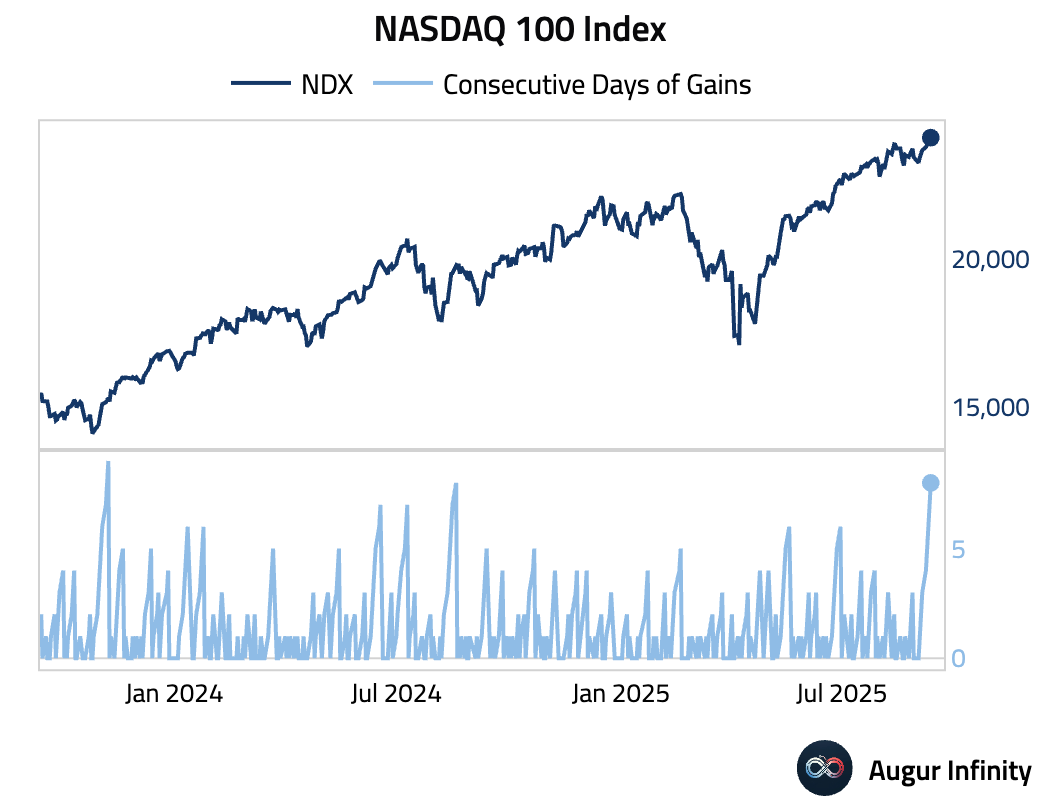

- The NASDAQ 100 Index has rallied for eight days straight.

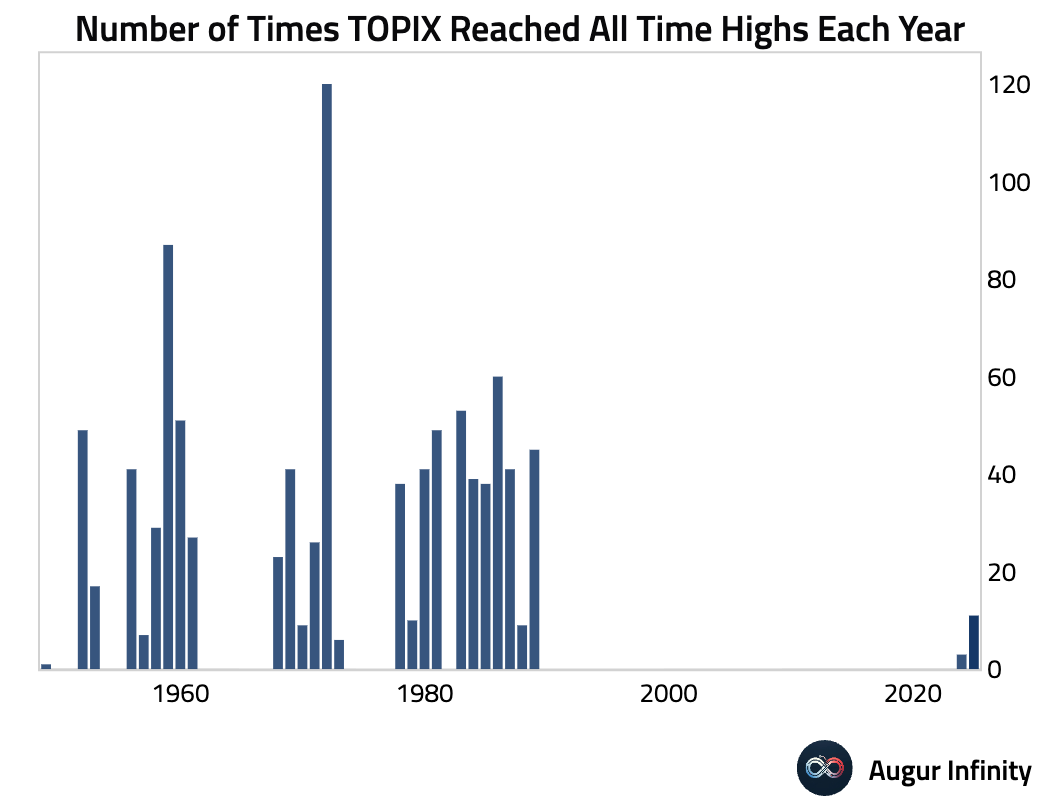

- Japan's TOPIX Index has reached all-time highs 11 times this year.

- Shanghai Shenzhen CSI 300 closed at the highest level since March 2022.

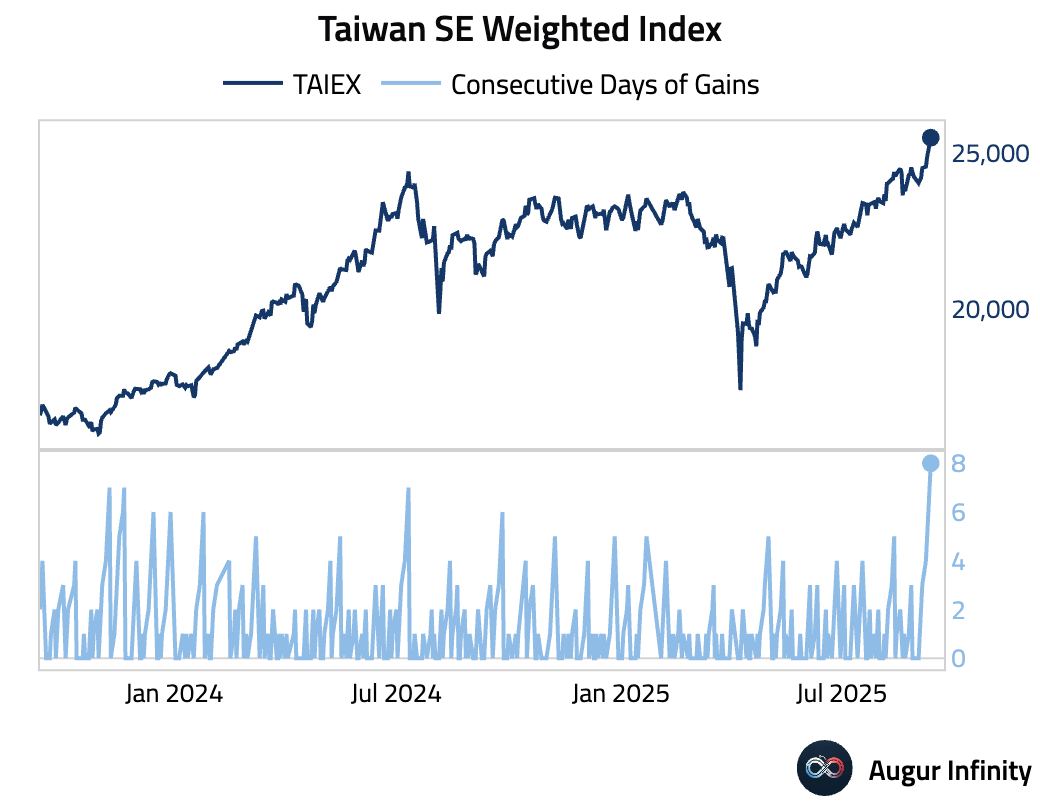

- Taiwan SE Weighted Index has also rallied for eight sessions.

Fixed Income

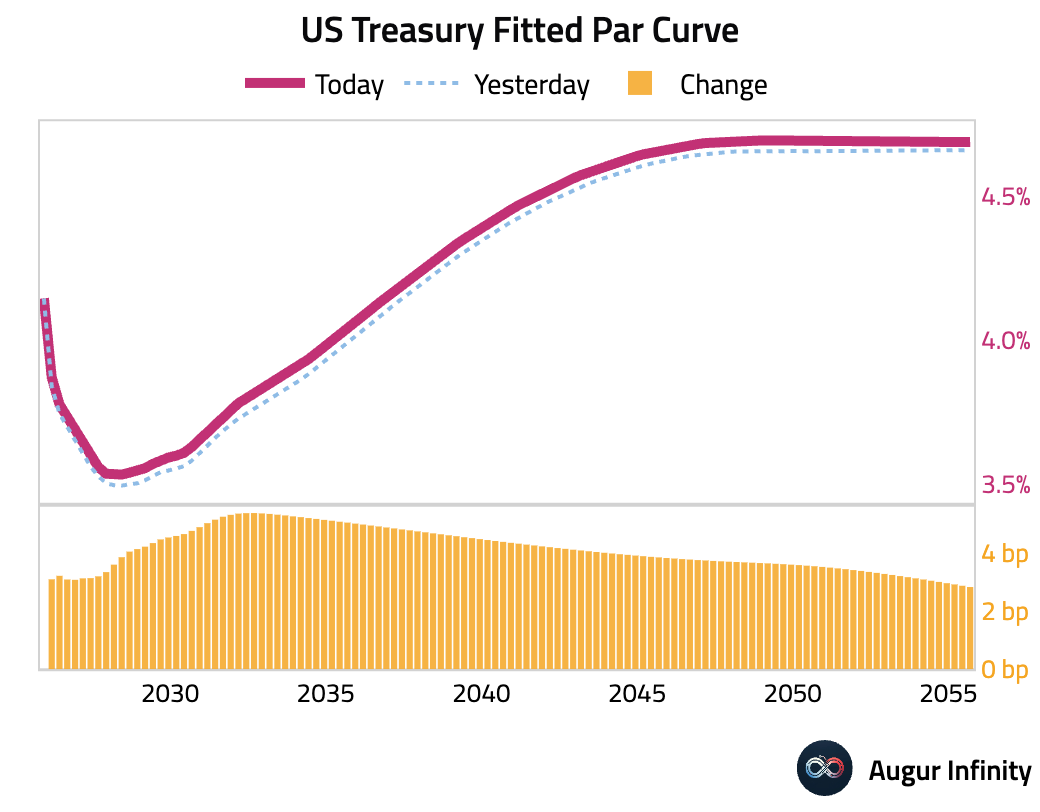

- US Treasury yields rose across the curve, with the 10-year yield climbing 4.9 bps and the 2-year yield increasing by 2.8 bps.

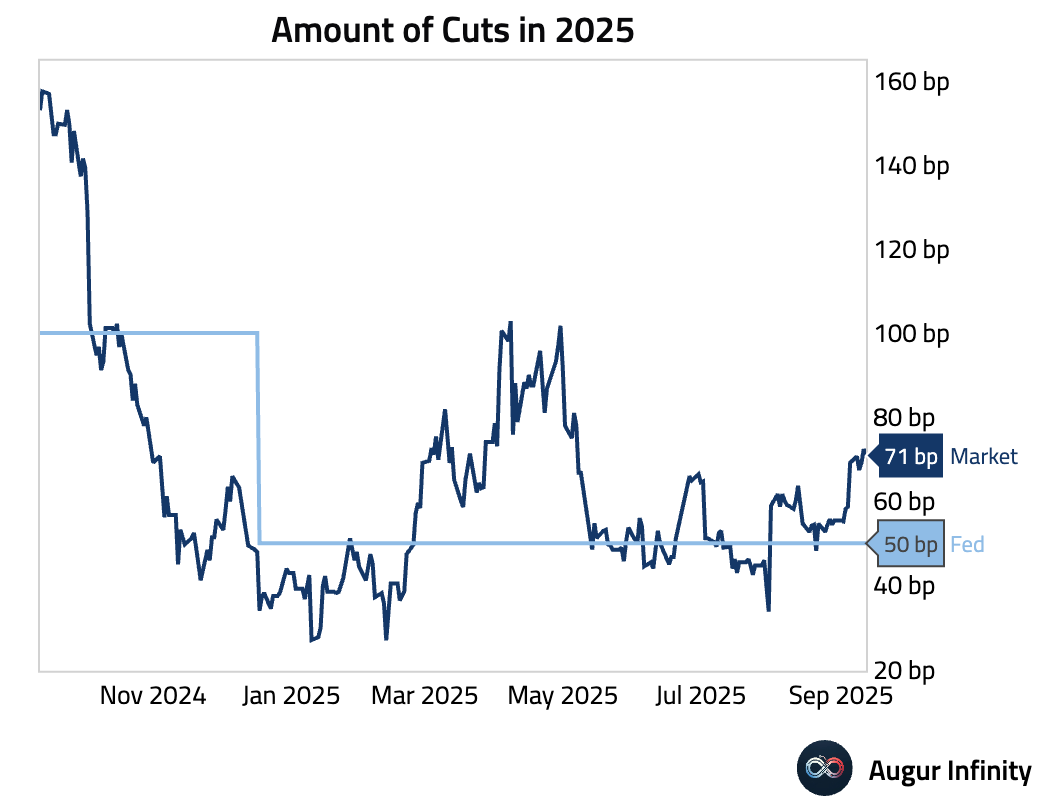

- The market is now pricing for 71 bps of rate cuts in 2025, just shy of three 25 bps cuts.

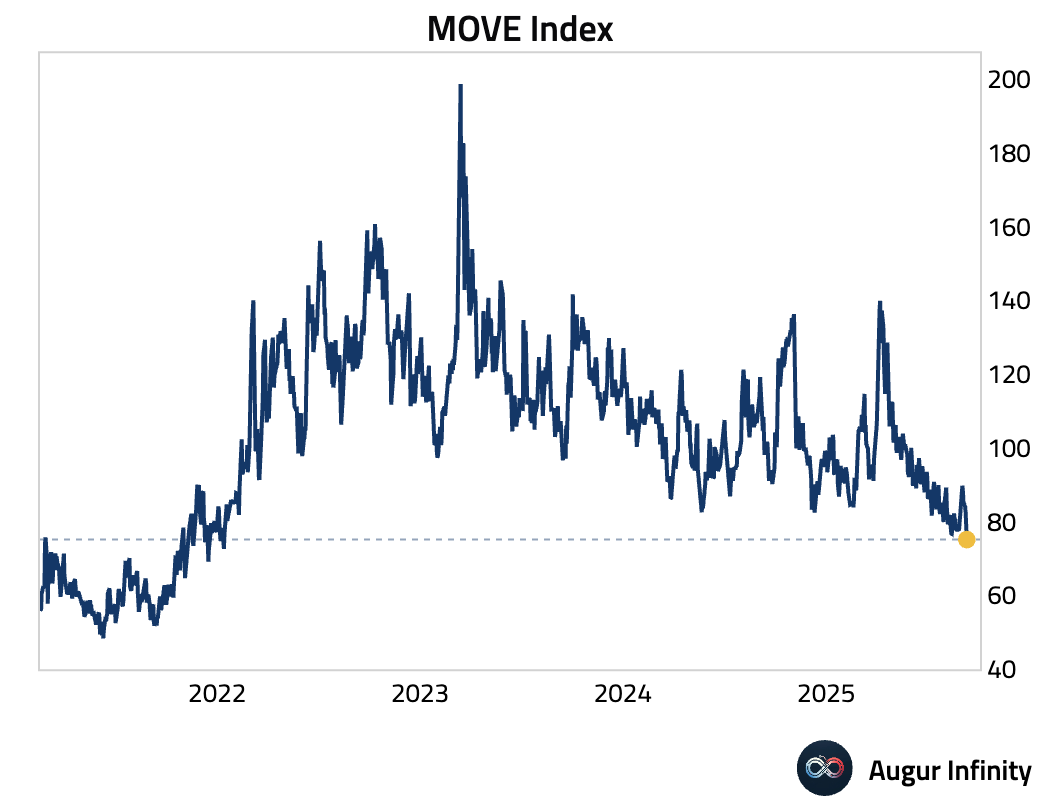

- The MOVE Index declined to the lowest level since January 2022.

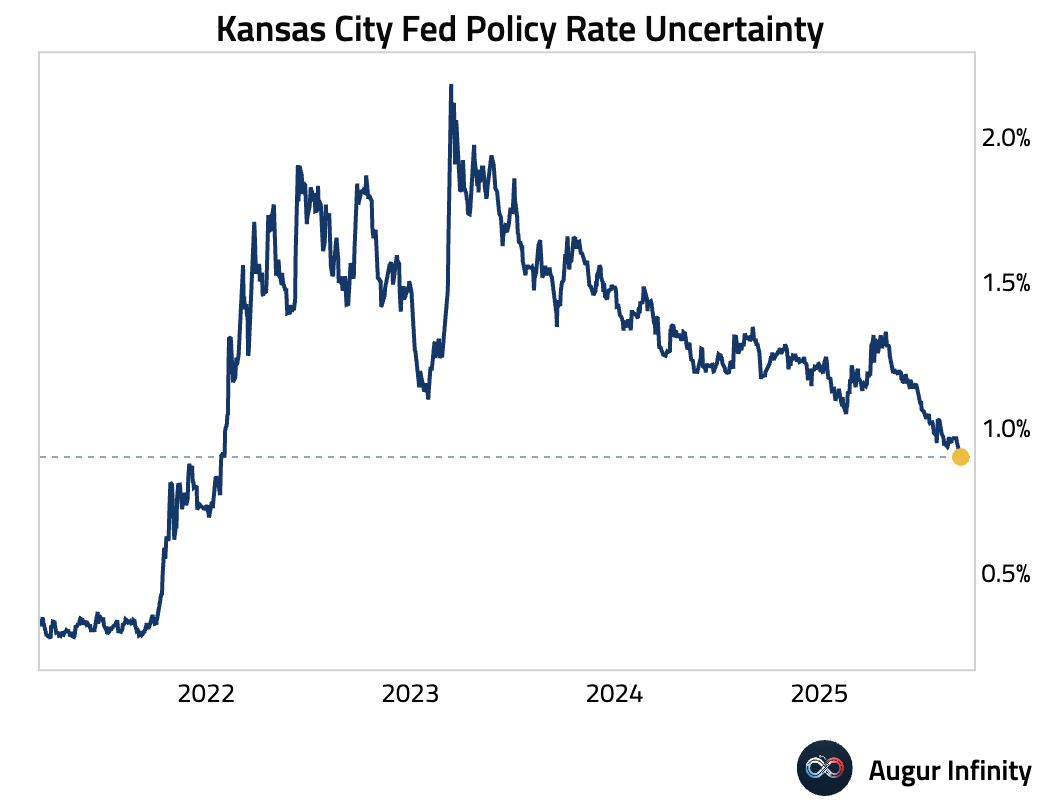

- Kansas City Fed Policy Rate Uncertainty is at the lowest level since February 2022.

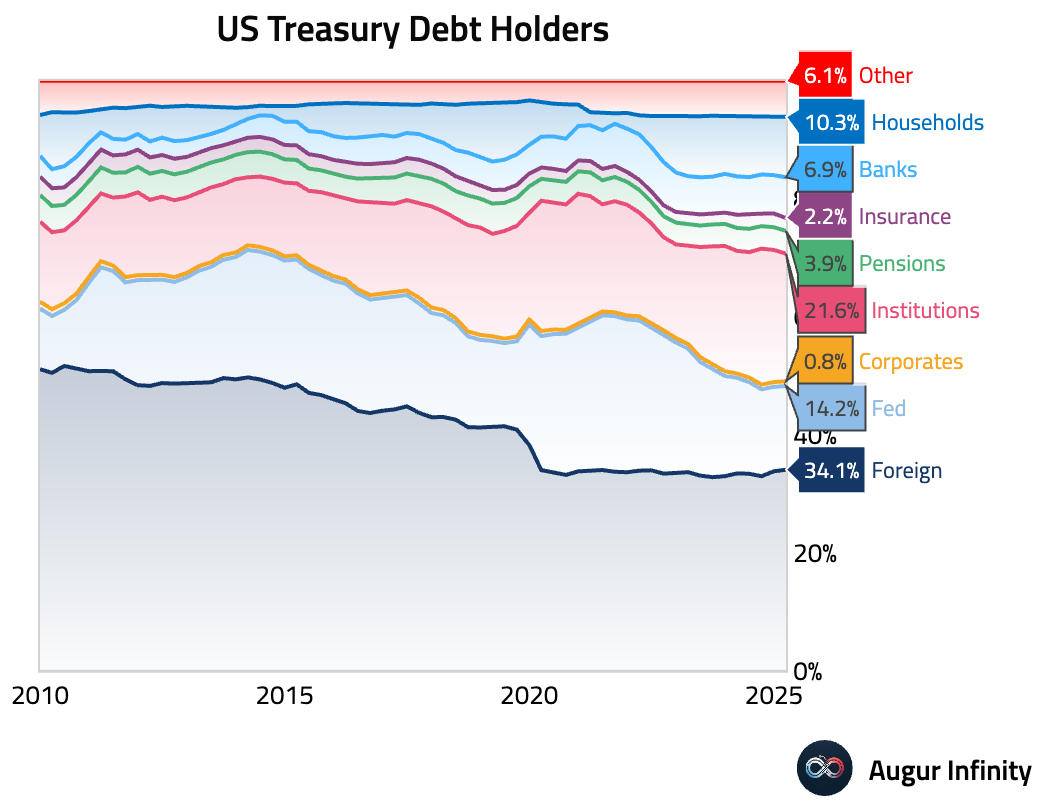

- Foreign investors remain the largest holders of US Treasuries, accounting for 34% at the end of Q2.

FX

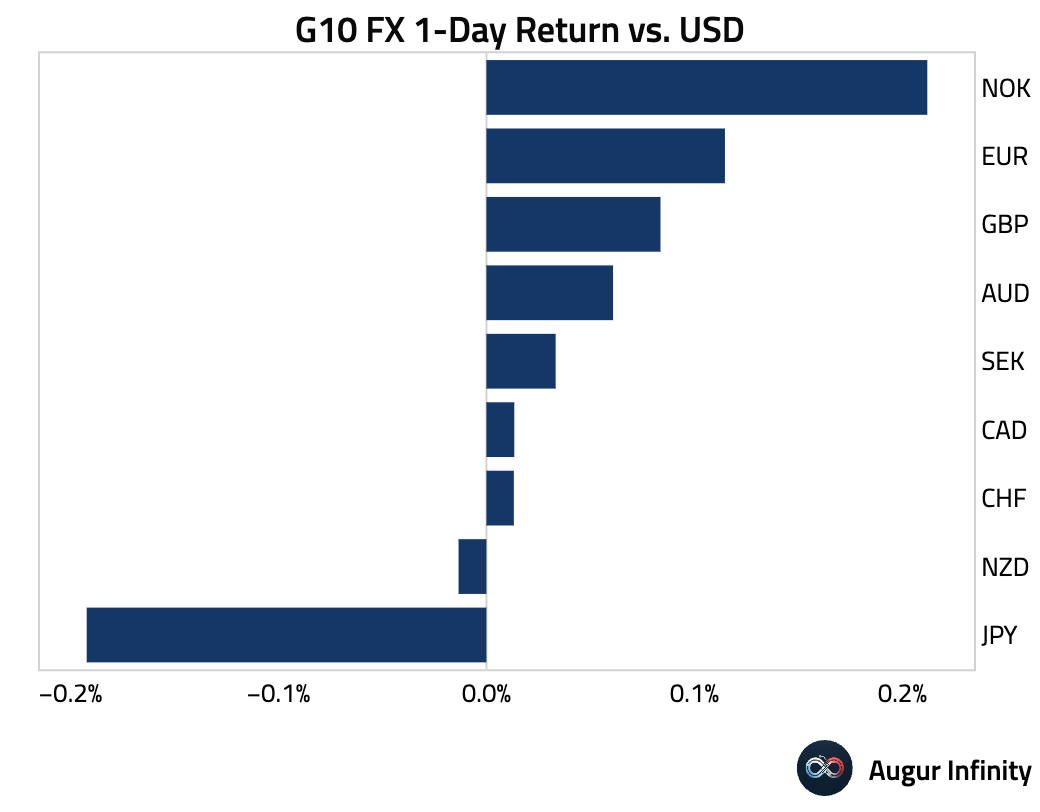

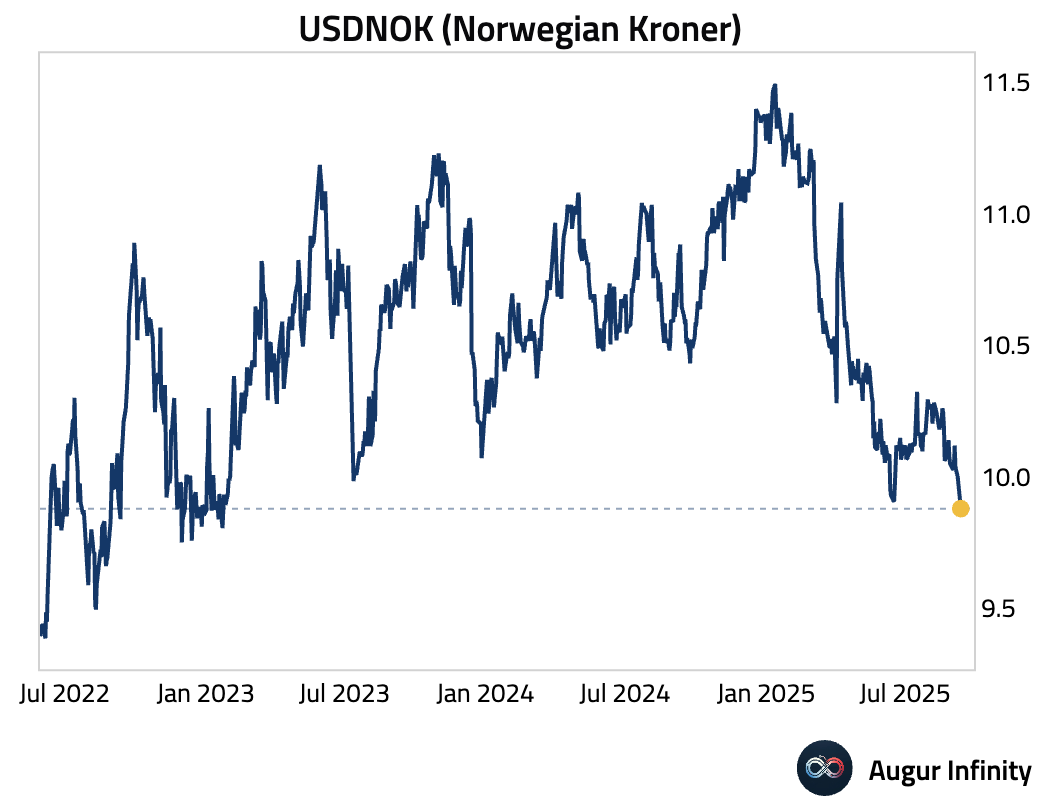

- The US dollar was mixed against its G10 peers. The Norwegian krone, Australian dollar, and British pound all strengthened for a sixth consecutive session against the greenback. The Japanese yen was the primary underperformer on the day.

- The Norwegian Kroner has appreciated to the highest level since January 2023.

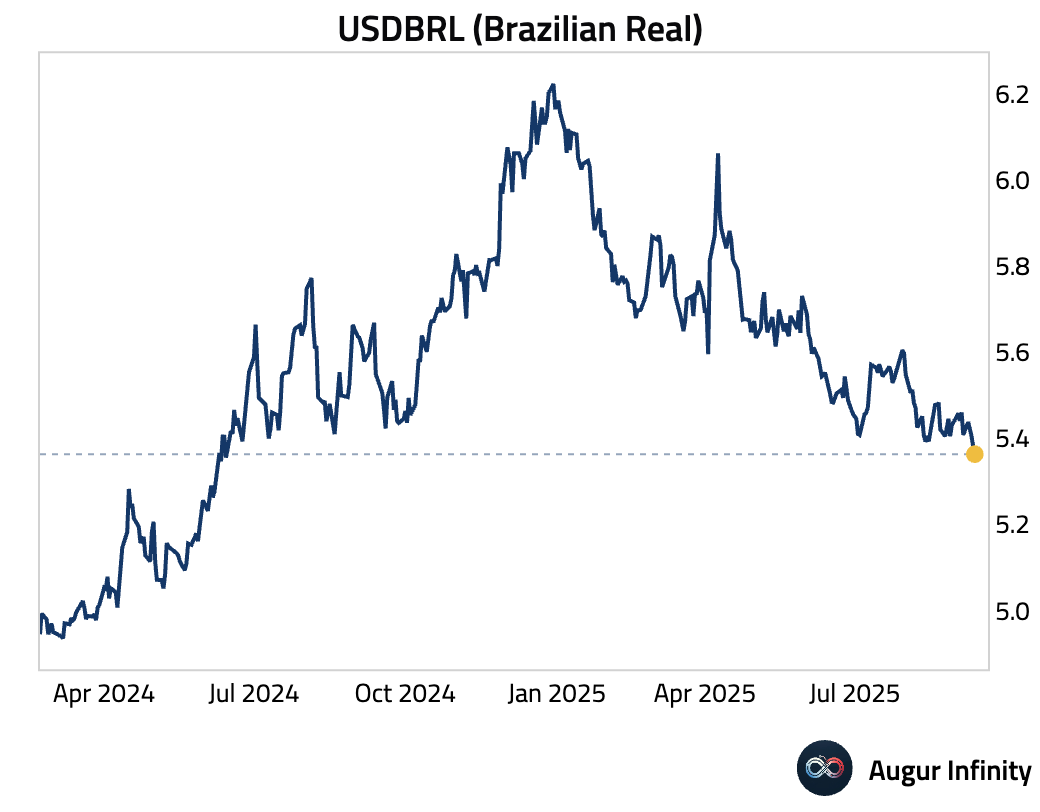

- The Brazilian Real has also reached the best level against USD in over a year.

Commodities

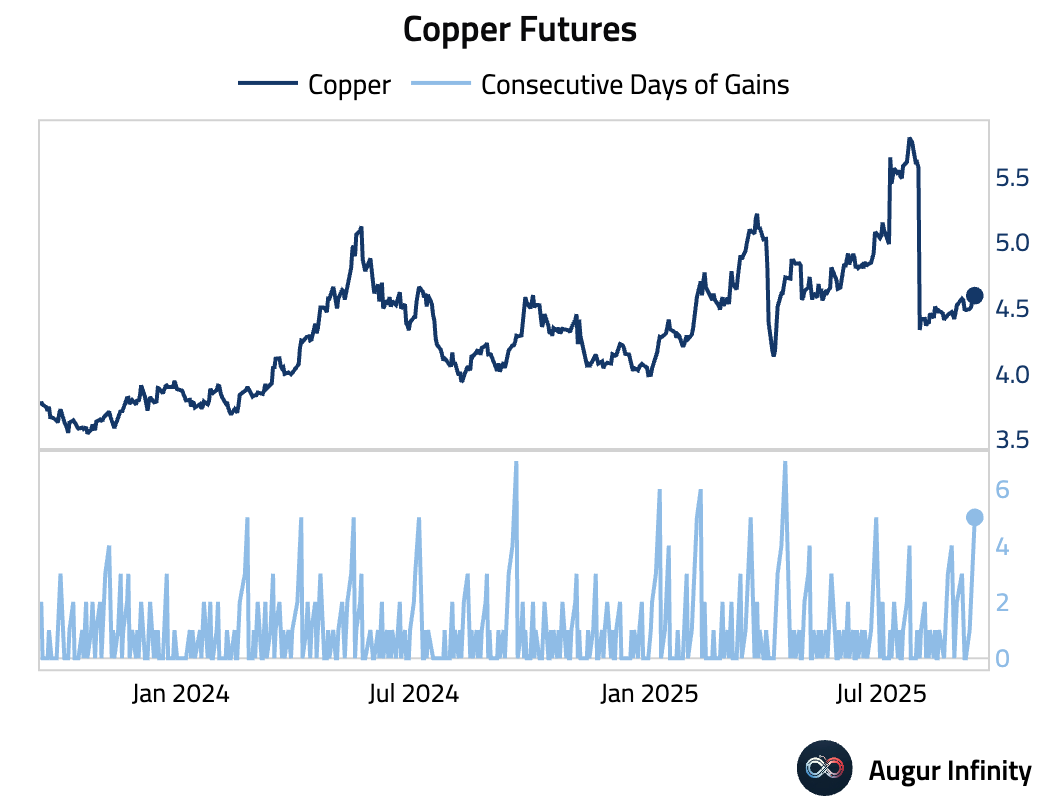

- Copper futures gained for the fifth session.

Musings

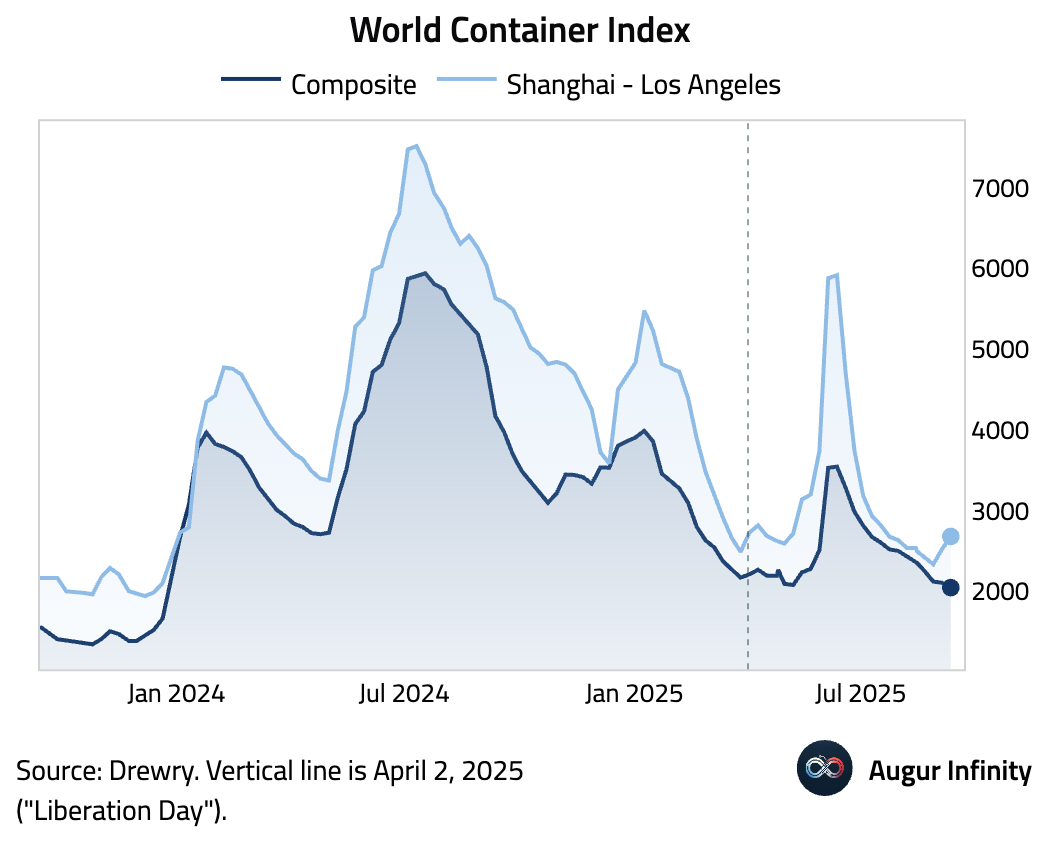

- While the overall composite of the World Container Index declined for the fourteenth consecutive week, freight rates from Shanghai to Los Angeles jumped 6% last week.

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.