Headlines

- Concerns regarding a potential US government shutdown intensified as President Trump downplayed the likelihood of reaching a funding agreement with Democratic leadership before the October 1 deadline.

- The administration announced a new policy imposing a $100,000 fee on new H-1B visa petitions, marking a substantial shift in policy for skilled foreign workers.

- A cyberattack on aerospace firm Collins Aerospace led to significant disruptions in check-in operations at major airports in London, Berlin, Brussels, and Dublin.

- In an act of direct industrial intervention, the Trump administration blocked U.S. Steel from proceeding with the closure of a plant in Illinois.

Global Economics

United States

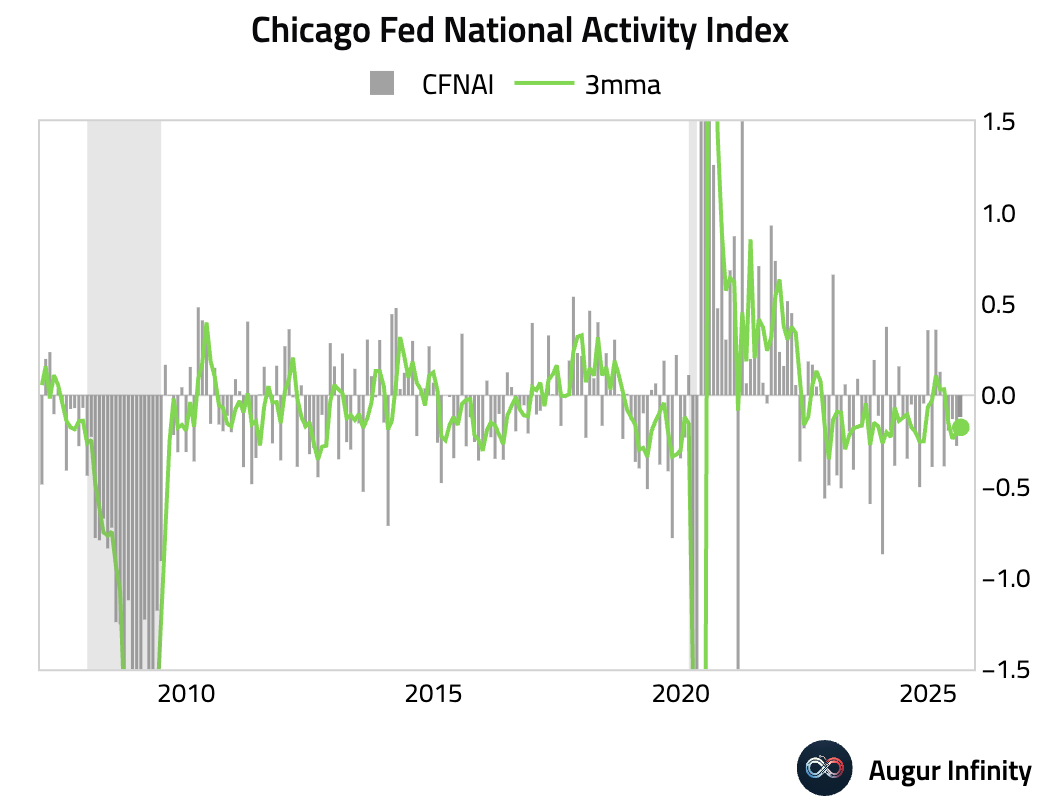

- The Chicago Fed National Activity Index improved in August but remained in negative territory for the fifth consecutive month, suggesting continued below-trend economic growth (act: -0.12, prev: -0.28).

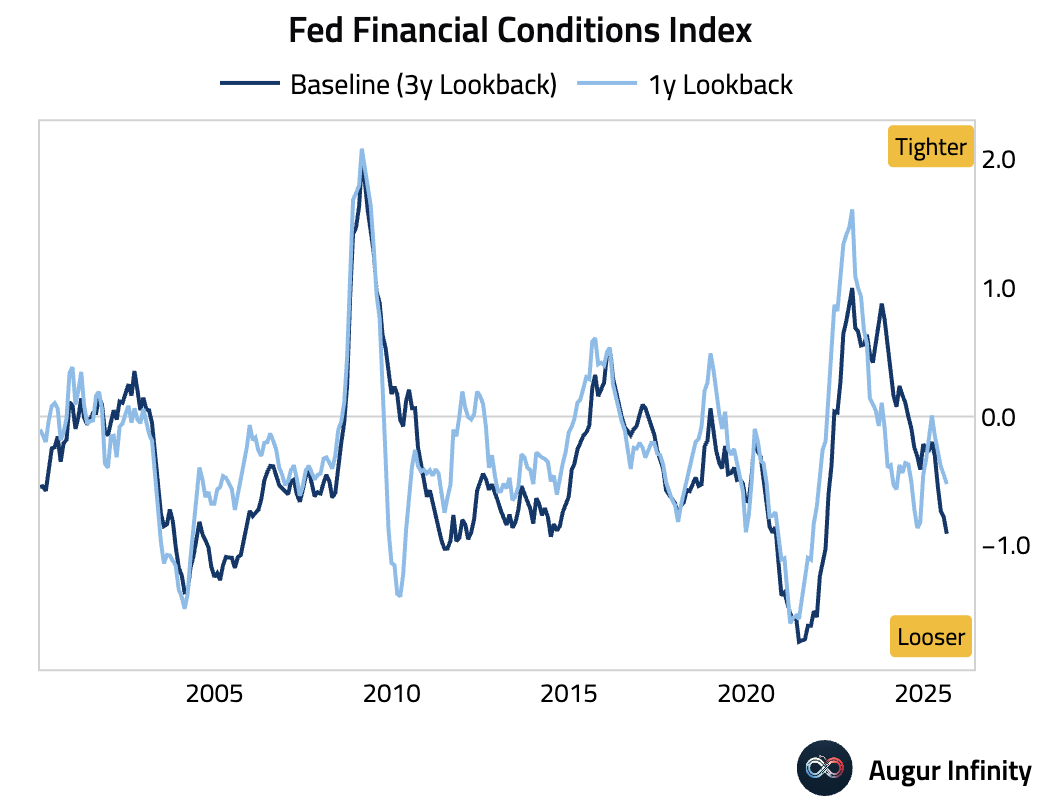

- According to the Fed’s FCI-G Index, financial conditions loosened further in August, reaching their most accommodative level since March 2022.

Canada

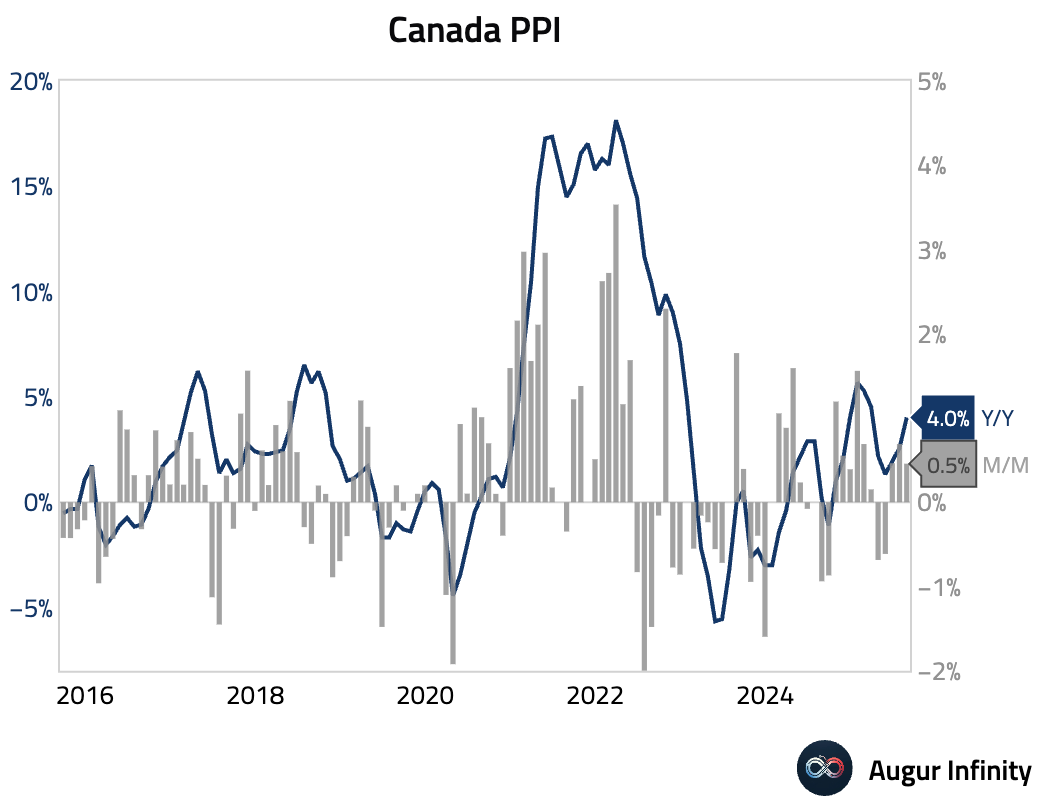

- Canadian producer price inflation accelerated to 4.0% Y/Y in August from 2.6% in the prior month. On a monthly basis, prices rose 0.5%, coming in below the 0.9% consensus estimate.

Europe

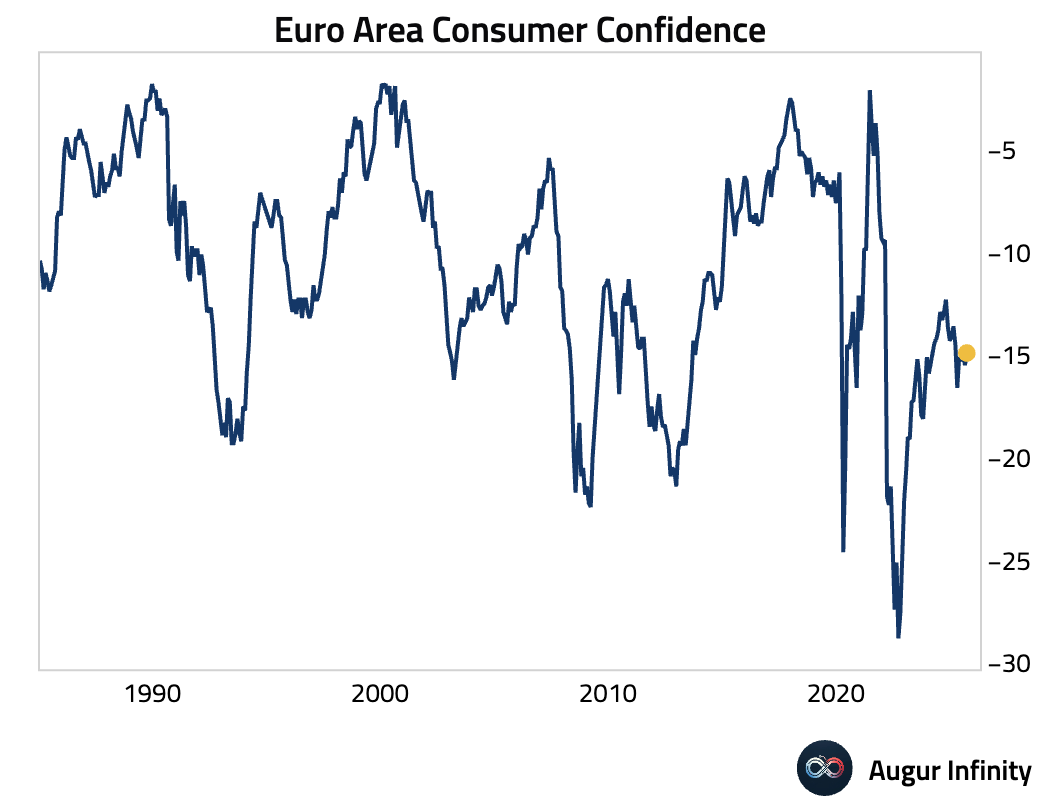

- Eurozone consumer confidence improved slightly in September but remained deeply pessimistic, consistent with subdued household spending (act: -14.9, est: -15.3).

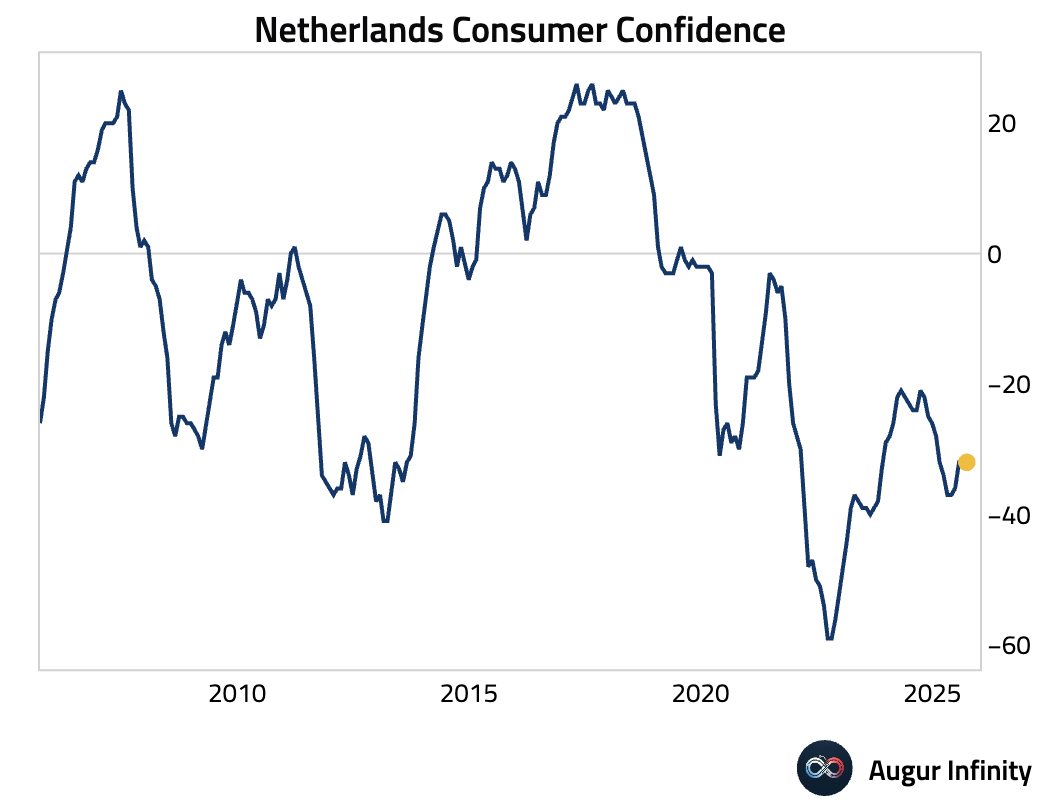

- Dutch consumer confidence was unchanged at a deeply negative reading in September, pointing to continued caution among households (act: -32.0, prev: -32.0).

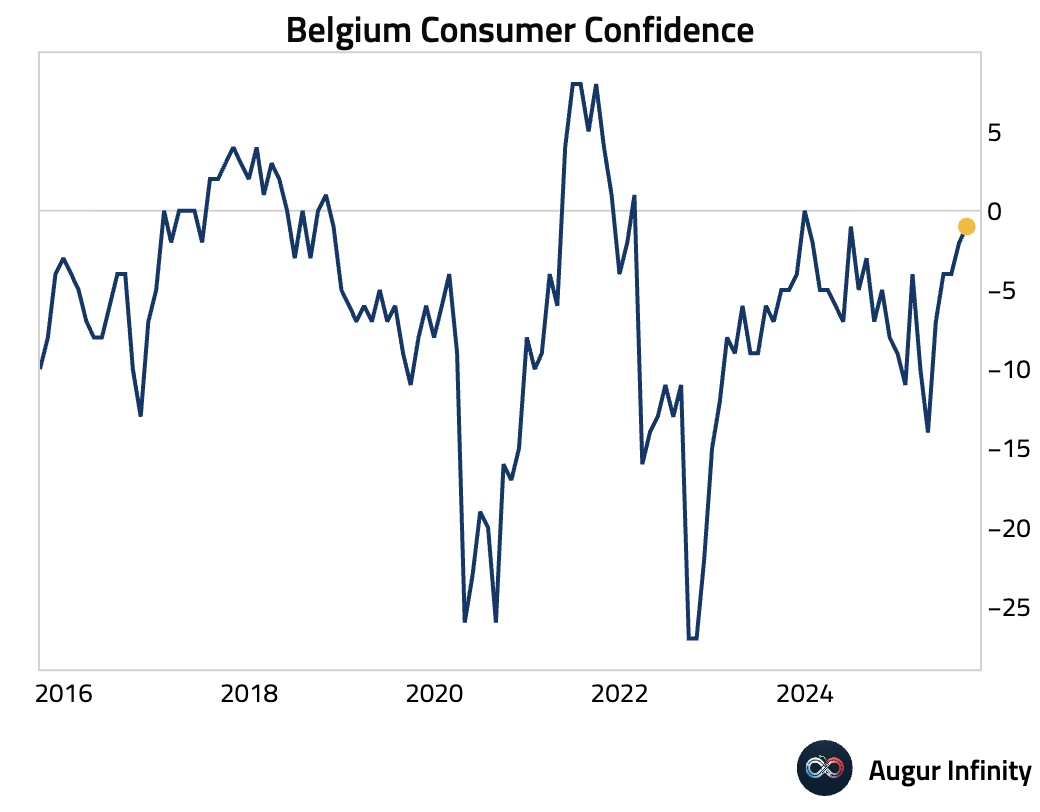

- Belgian consumer sentiment improved in September, reaching its highest level in over a year and a half, though it remains in negative territory (act: -1.0, prev: -2.0).

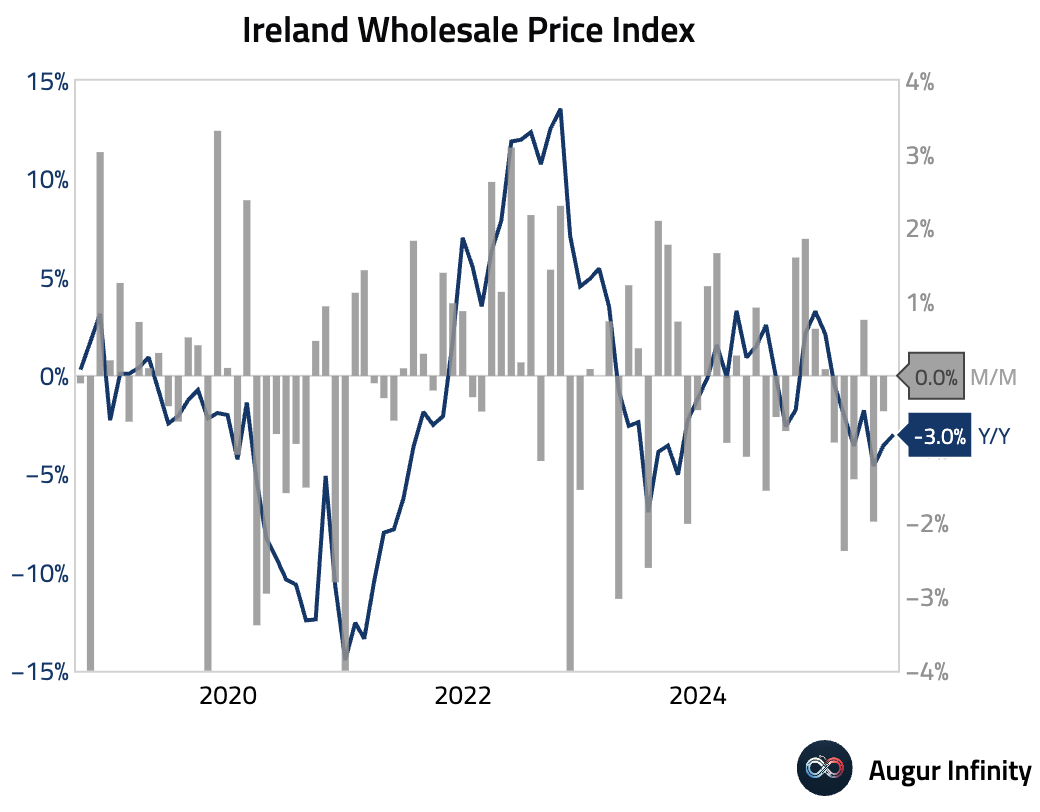

- Irish wholesale price deflation eased in August, with prices falling 3.0% Y/Y compared to -3.5% in July. Prices were flat month-over-month.

Asia-Pacific

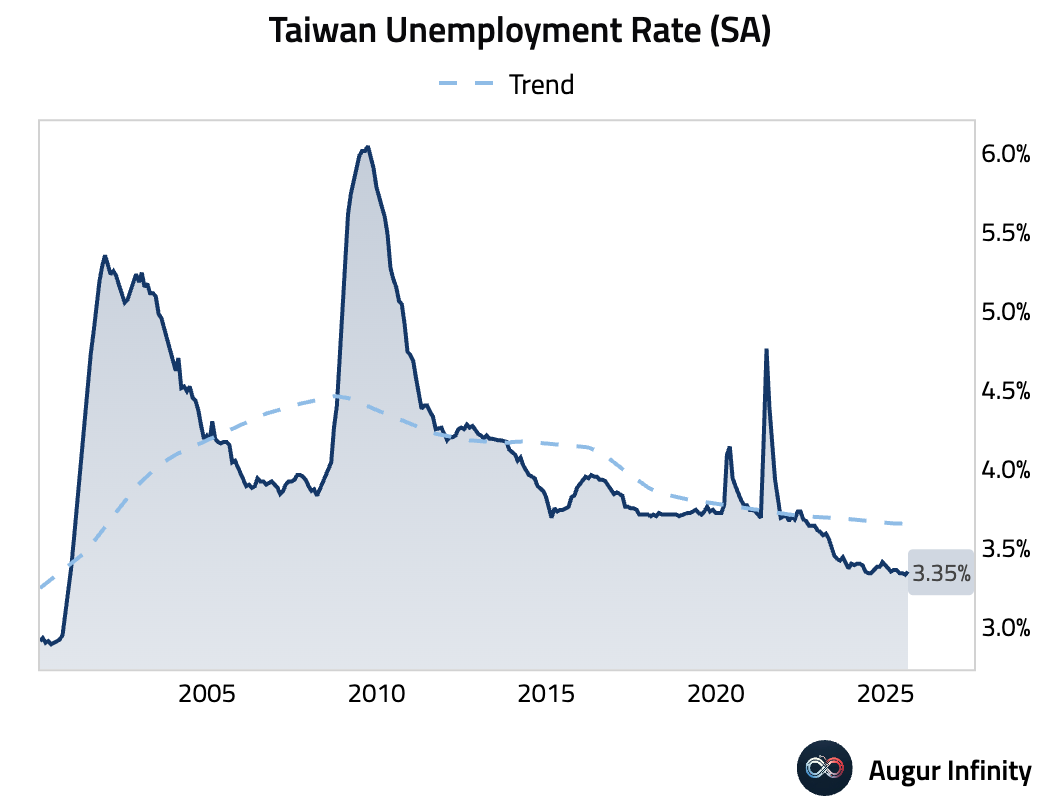

- Taiwan's unemployment rate edged slightly higher in August, though it remains near historical lows (act: 3.35%, prev: 3.33%).

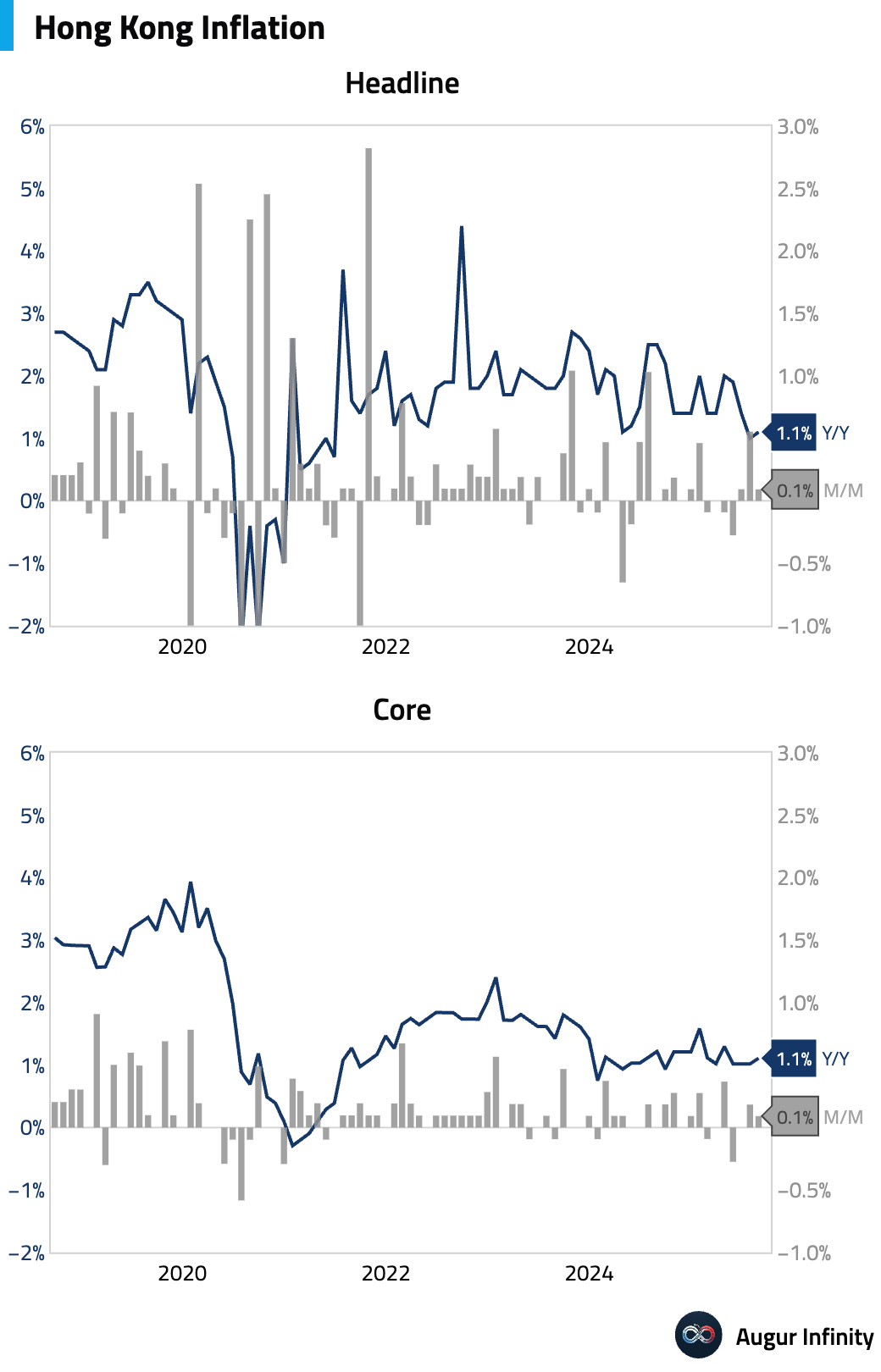

- Hong Kong's annual inflation rate ticked up to 1.1% in August from 1.0%, in line with consensus. Prices rose 0.1% M/M, a notable slowdown from the 0.6% increase in July.

China

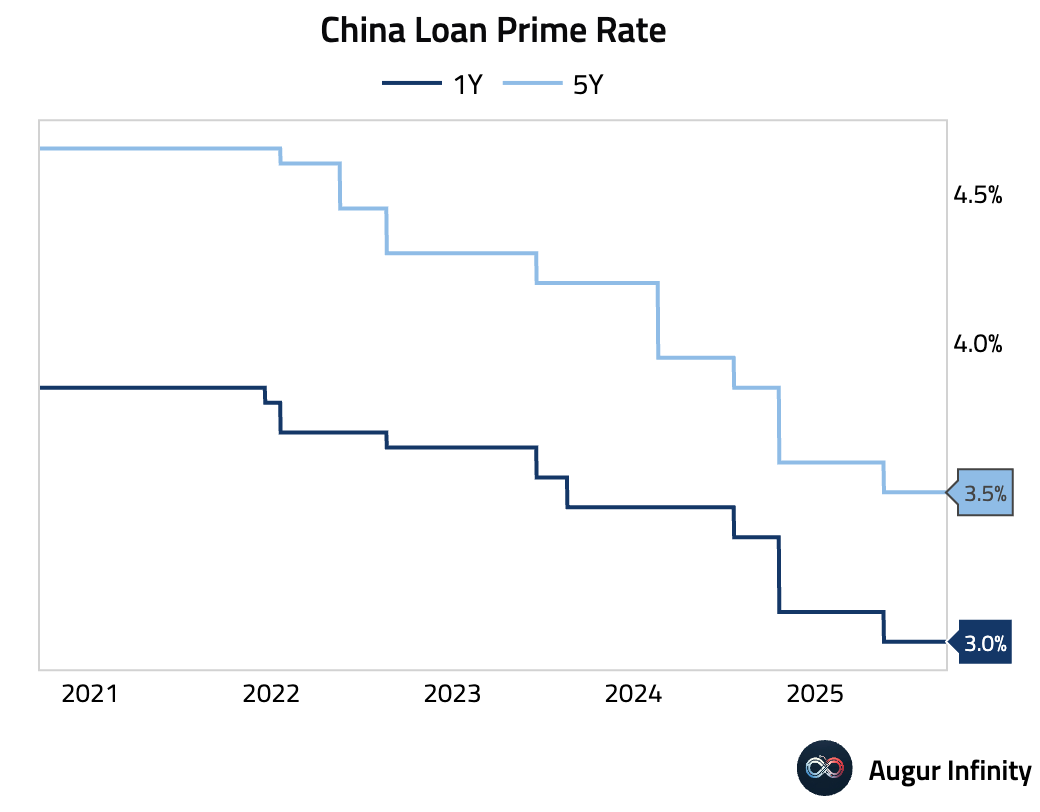

- China's benchmark lending rates were held steady, with the 1-year and 5-year Loan Prime Rates (LPR) remaining at record lows of 3.0% and 3.5%, respectively.

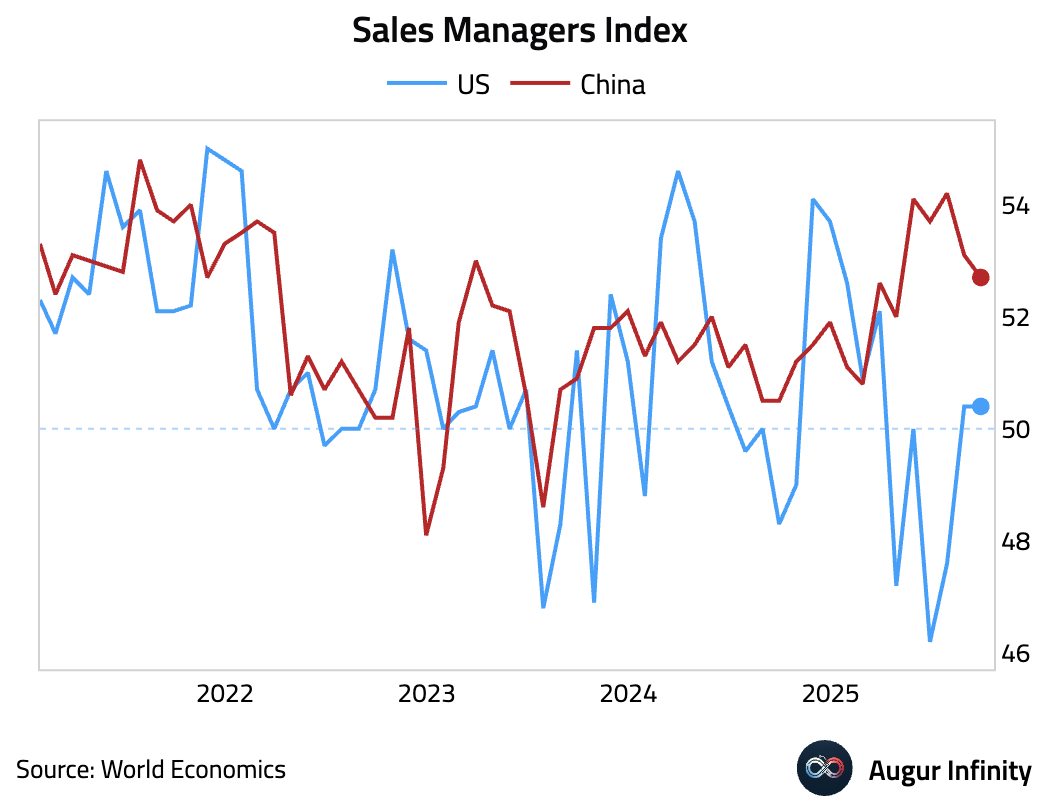

- China's Sales Manager Business Confidence Index declined in September. One level down, manufacturing is showing signs of a resurgence, while the previously strong services sector is cooling.

Source: World Economics

Emerging Markets ex China

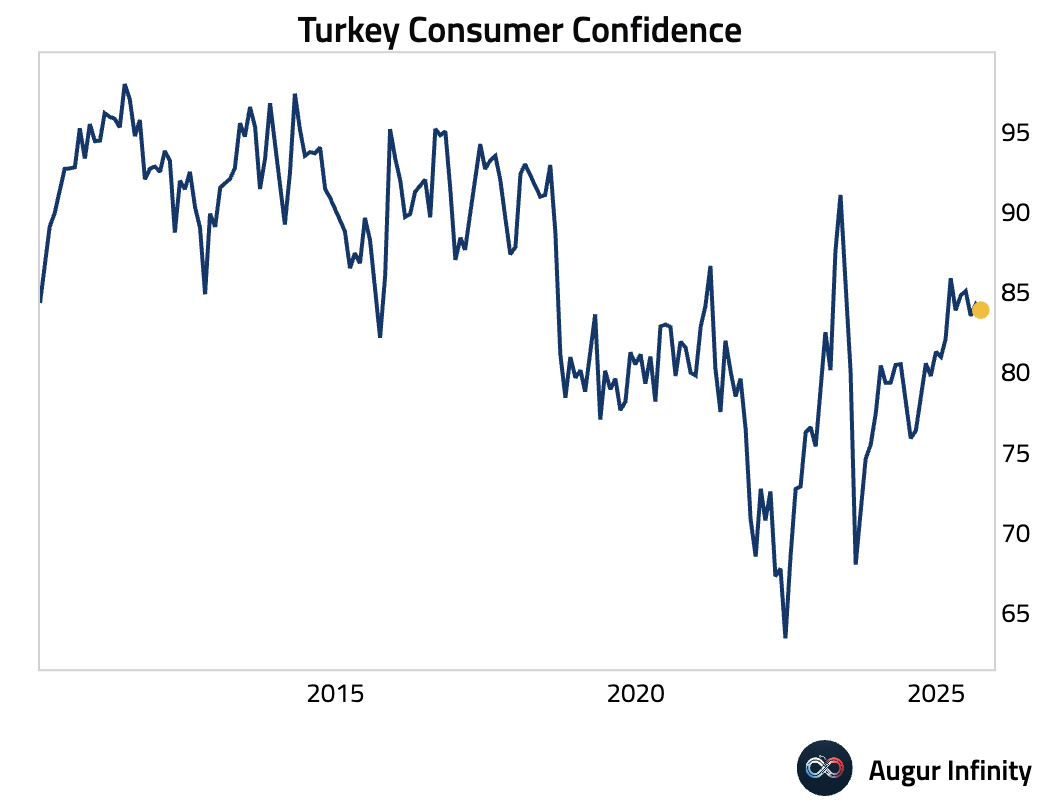

- Turkish consumer confidence edged down in September but remained near recent highs (act: 83.9, prev: 84.3).

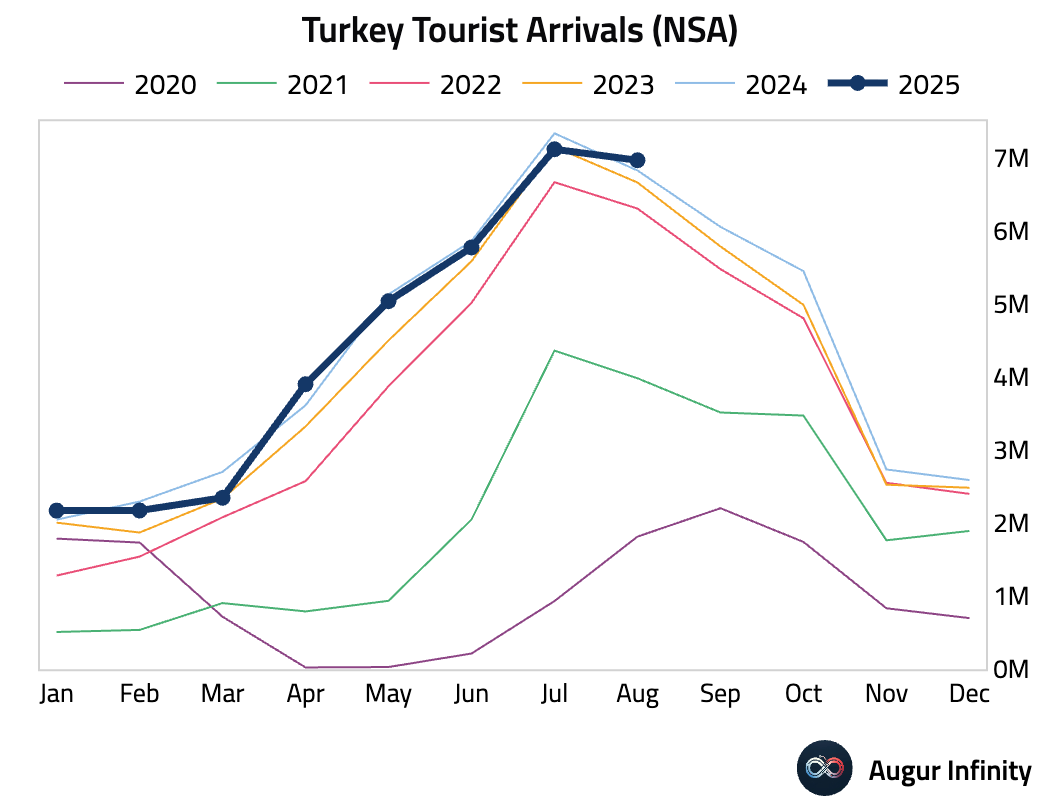

- Tourist arrivals in Turkey rebounded in August, rising after a decline in the previous month (act: 2.05% Y/Y, prev: -2.97%).

- Polish retail sales growth slowed to 3.1% Y/Y in August from 4.8% previously, missing the consensus forecast of 3.3%.

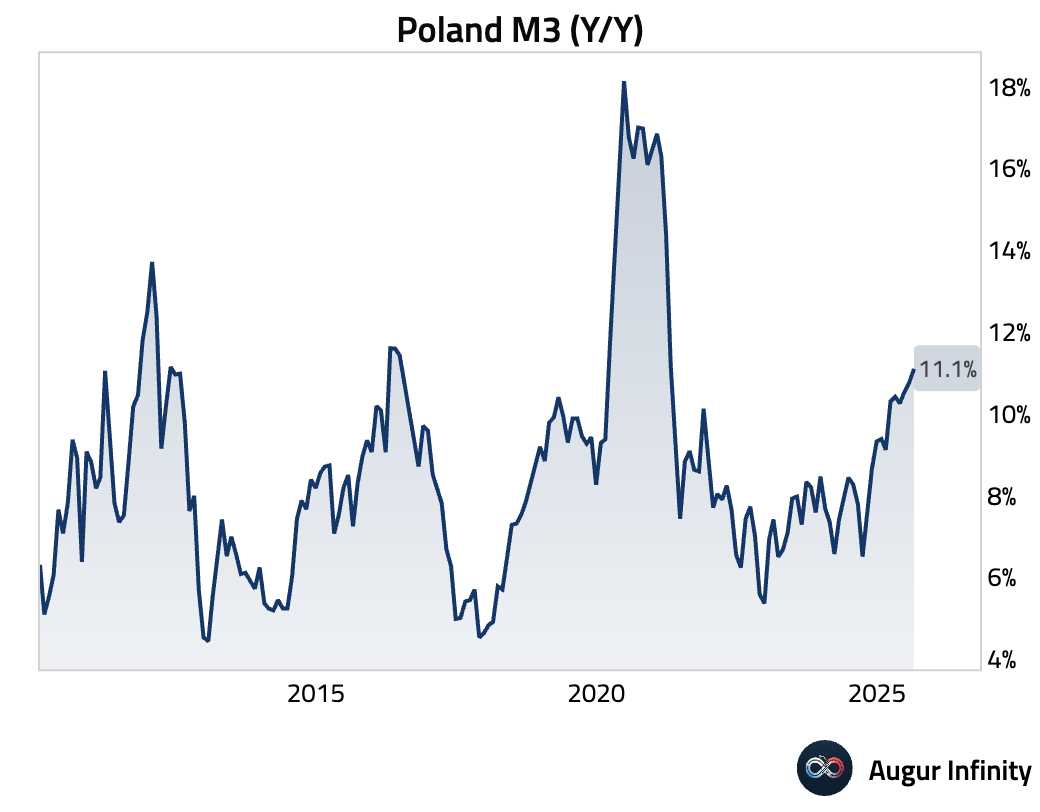

- Poland's M3 money supply growth accelerated to 11.1% Y/Y in August, its fastest pace since April 2021.

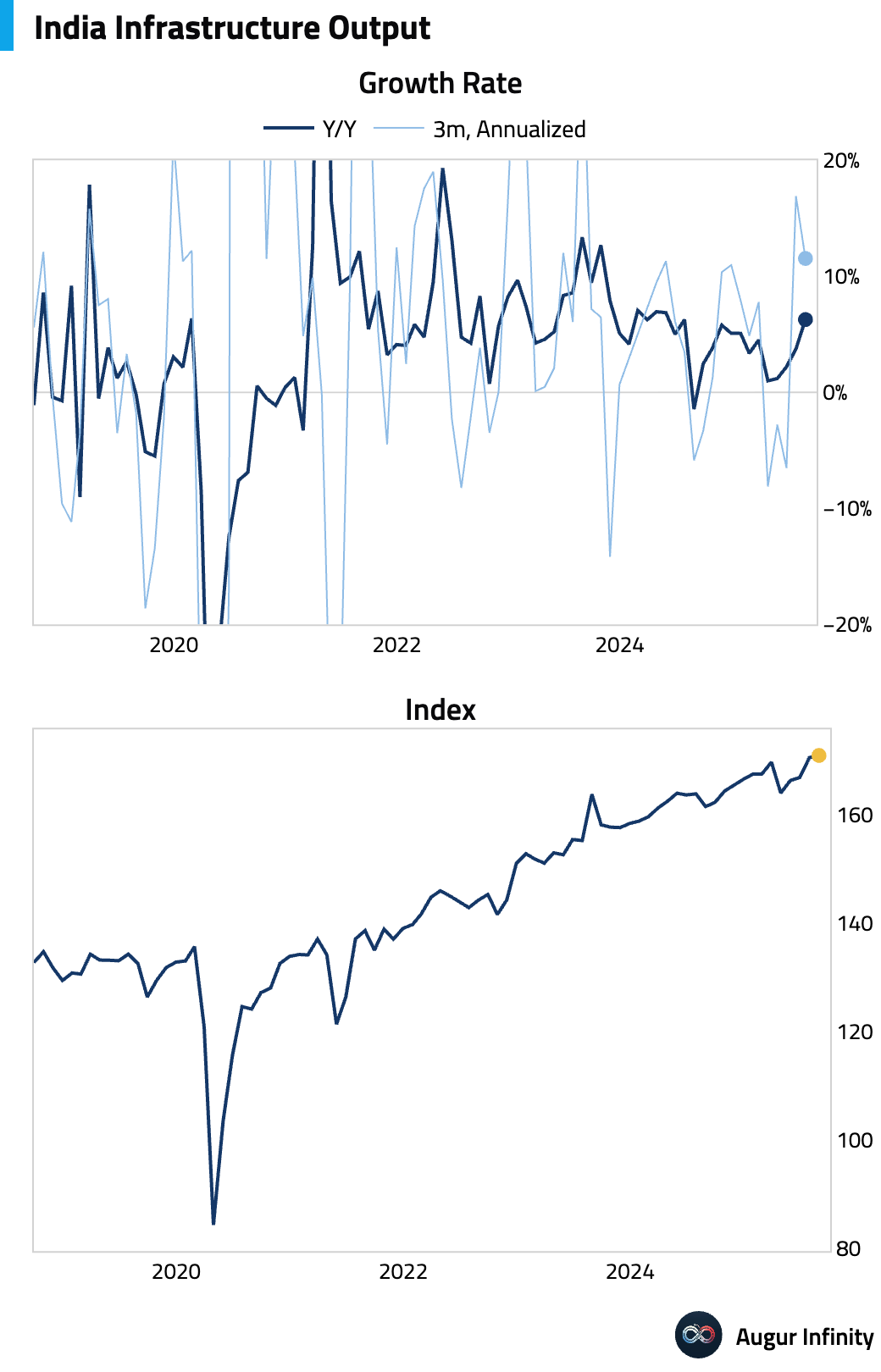

- India's infrastructure output growth accelerated sharply to 6.3% Y/Y in August from 3.7% in the prior month, signaling strength in core sectors of the economy.

Global Markets

Equities

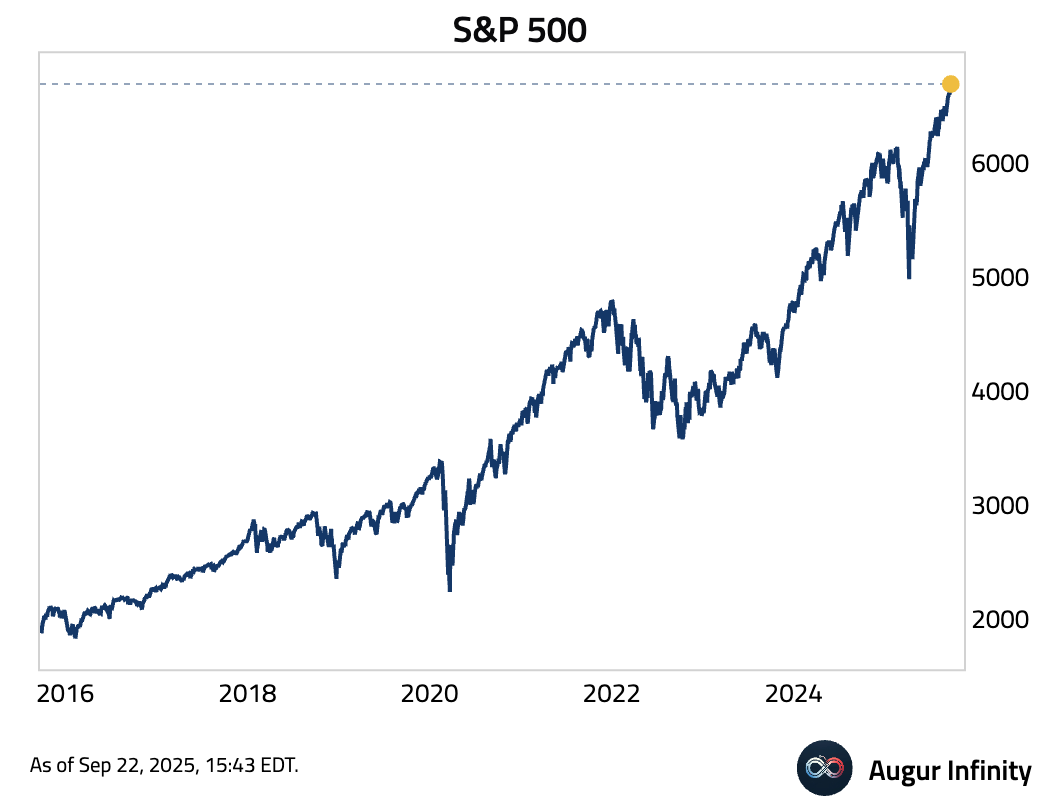

- US equities indices are extending their rallies and making new highs. S&P 500 has reached yet another all-time high. Global stocks also posted a third straight day of gains. South Korea was a notable outperformer, climbing 1.7%, while Chinese equities extended their decline to a third day, falling 0.7%.

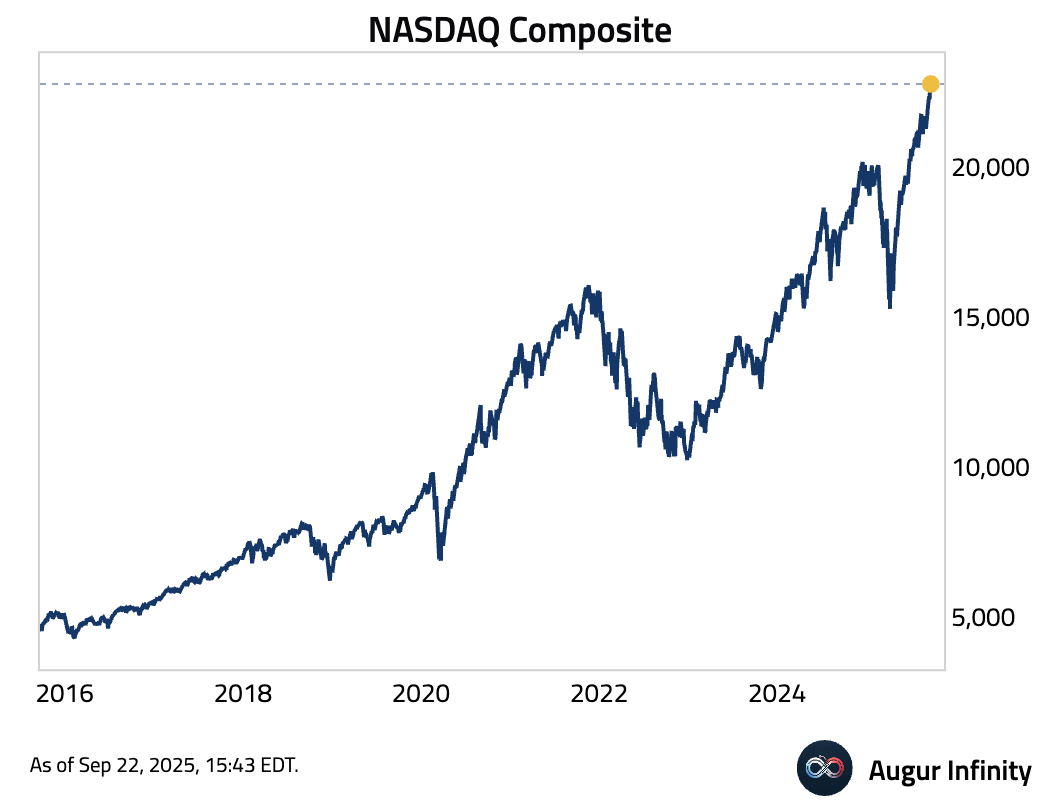

NASDAQ Composite is at all-time high as well …

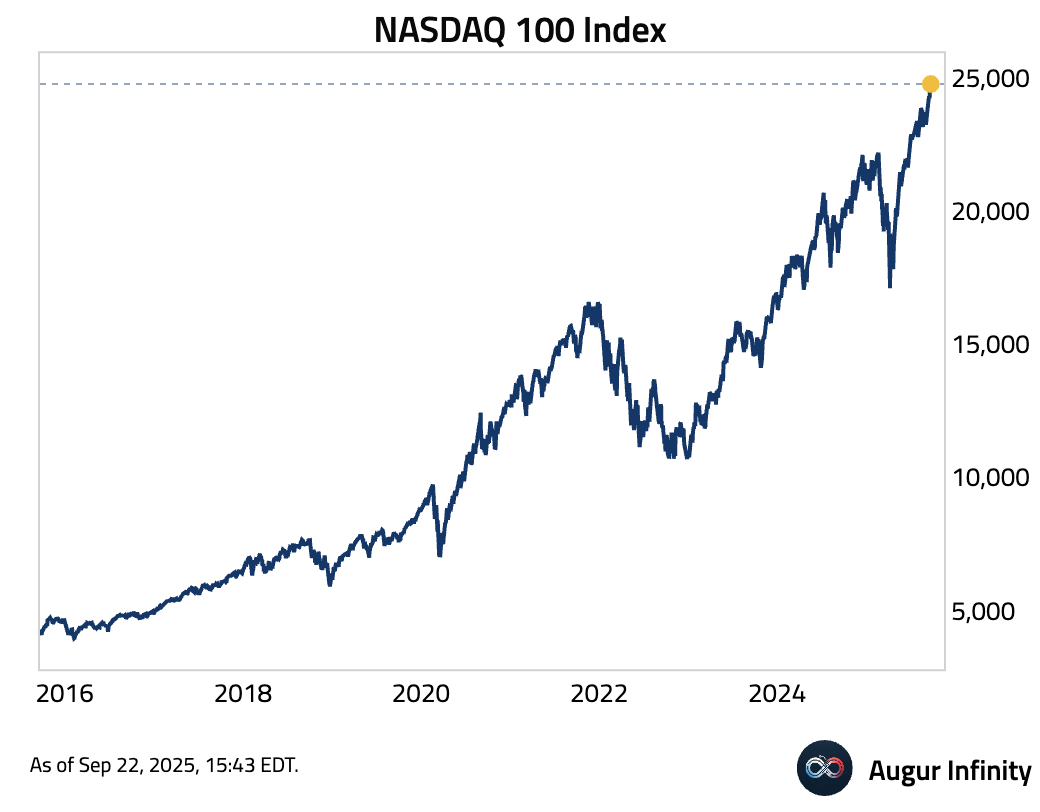

… so is the NASDAQ 100 Index.

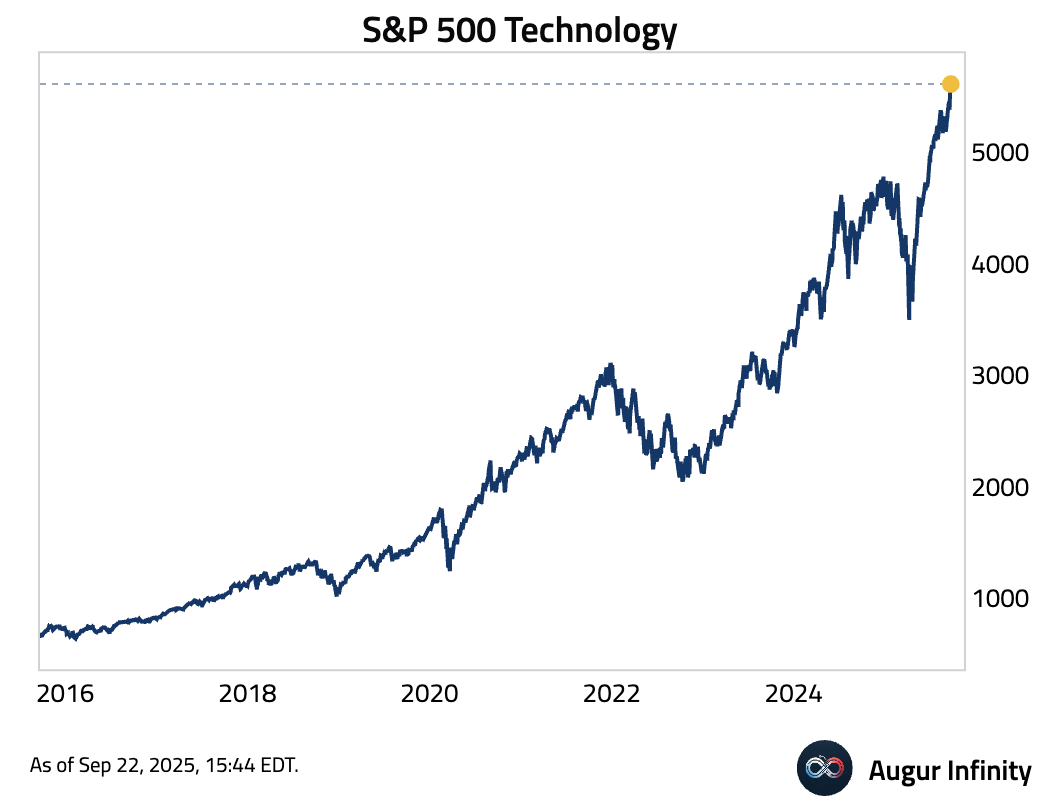

- Looking at individual sectors, the S&P 500 Technology has reached an all-time high …

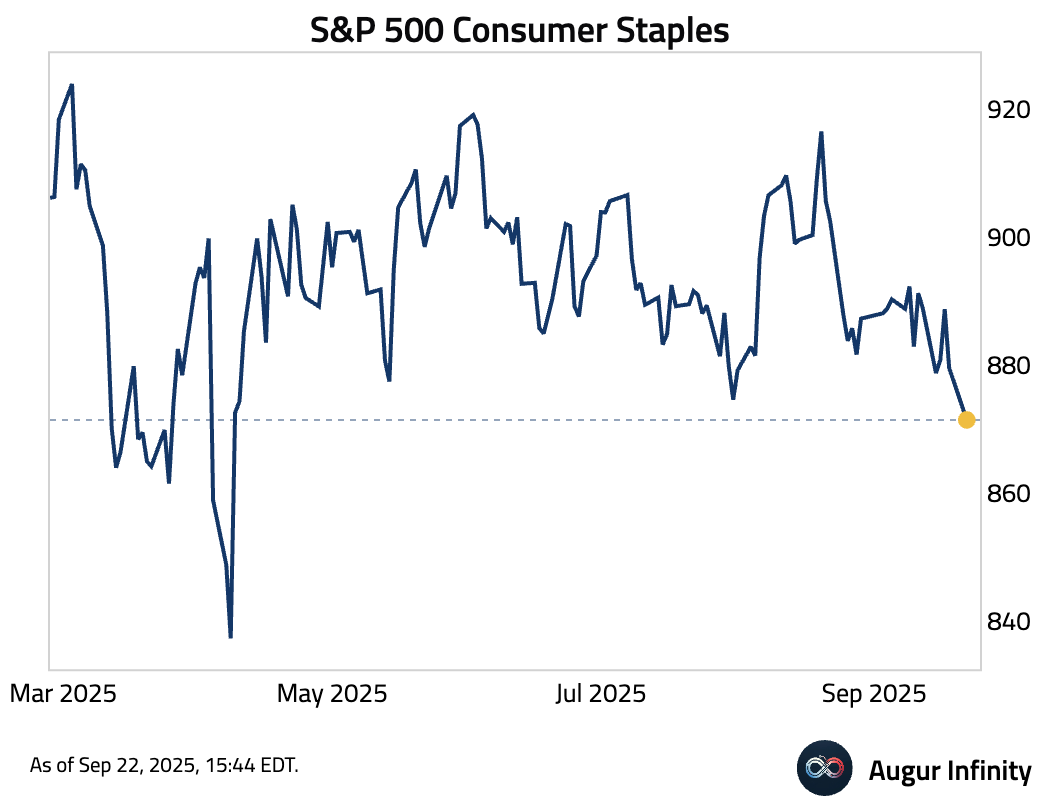

… but S&P 500 Consumer Staples has fallen to the lowest level since April.

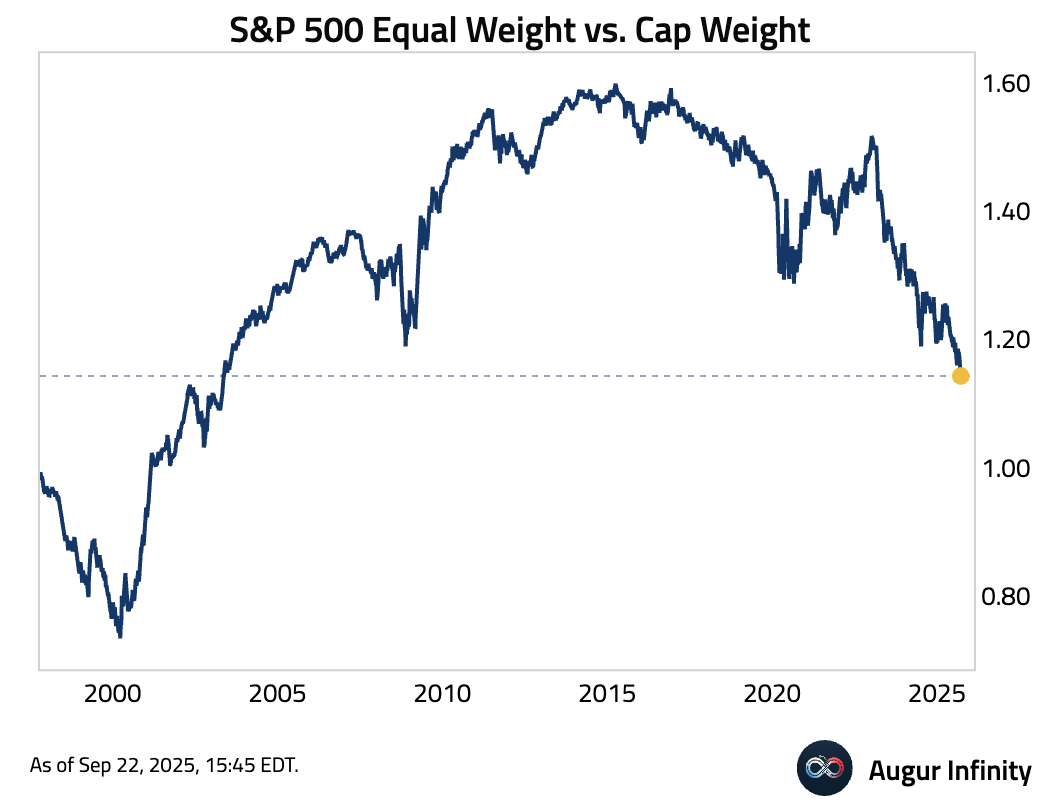

- S&P 500 Equal Weight vs. Cap Weight is at the lowest level since May 2003.

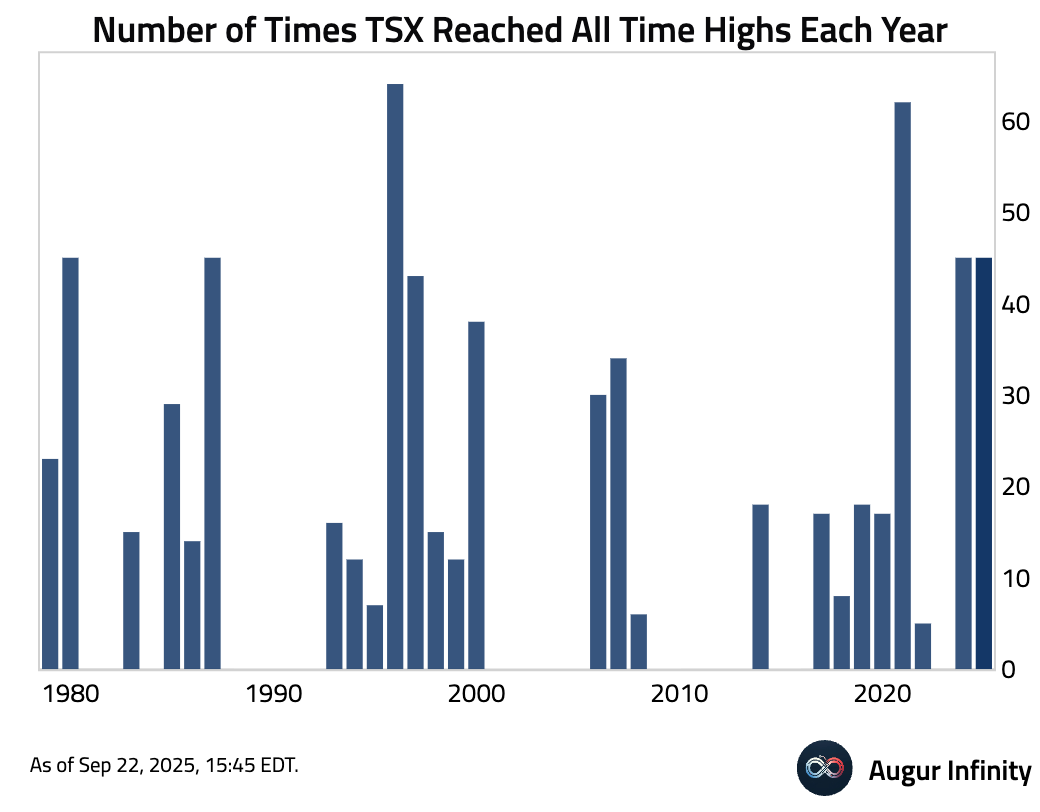

- S&P/TSX Composite for Canada has reached all-time highs 45 times this year.

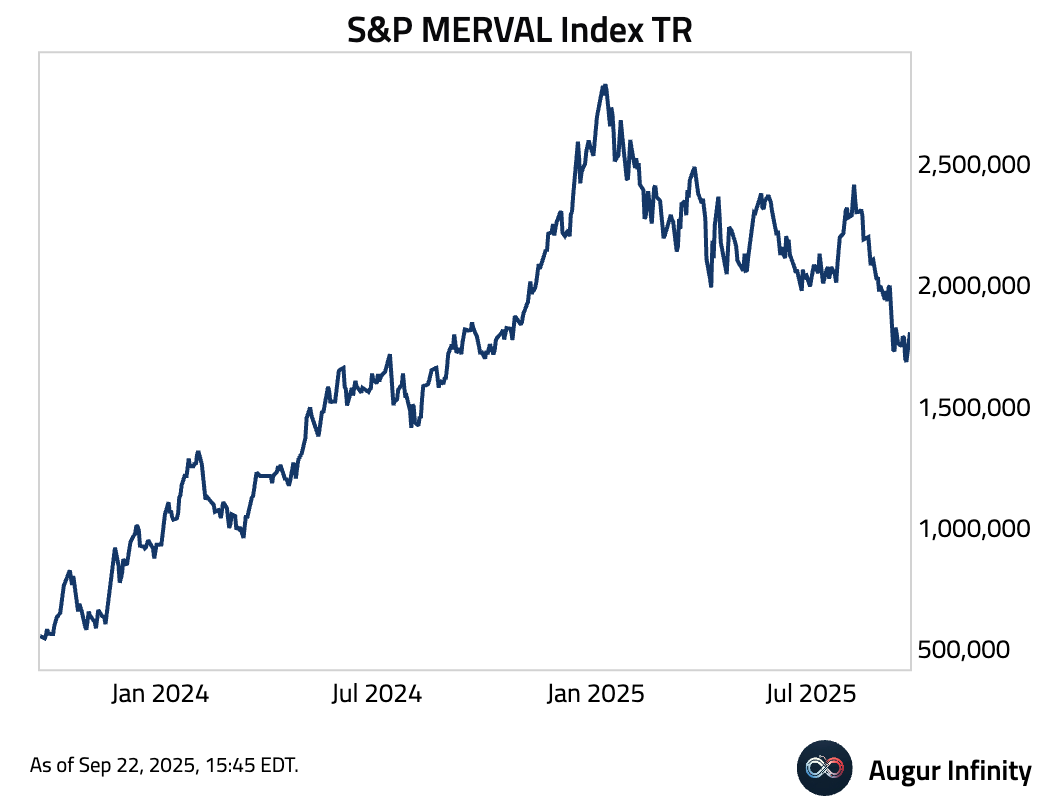

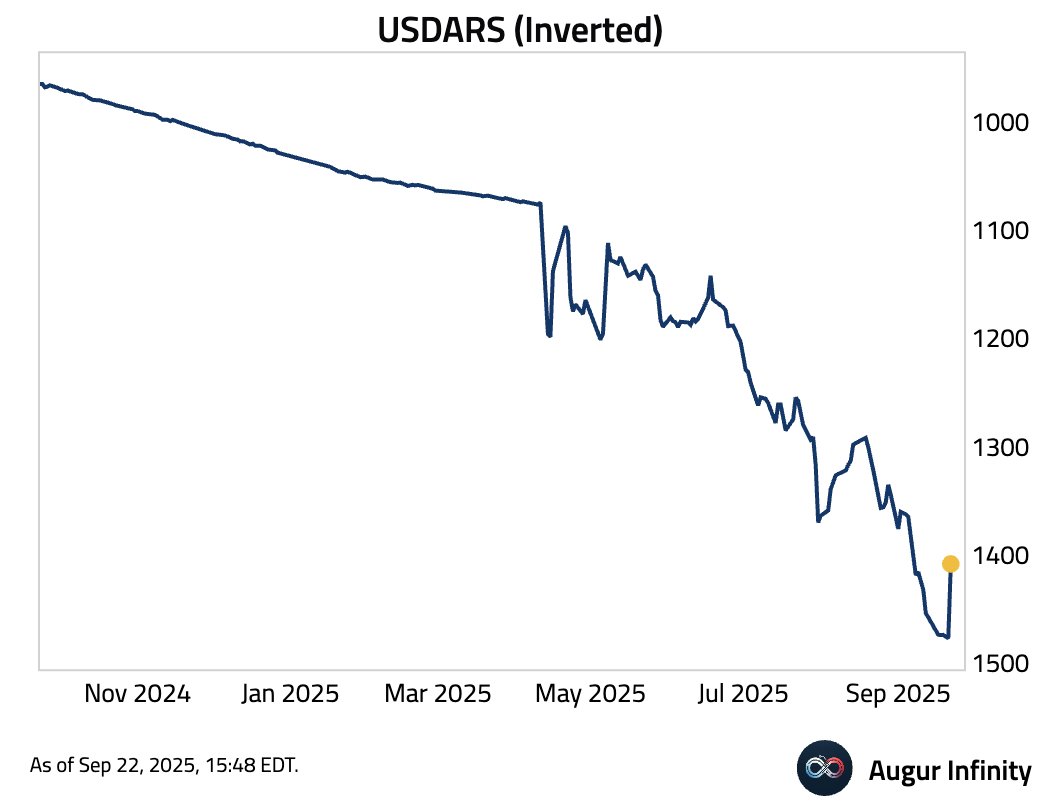

- S&P MERVAL Index for Argentina surged over 7% today.

Fixed Income

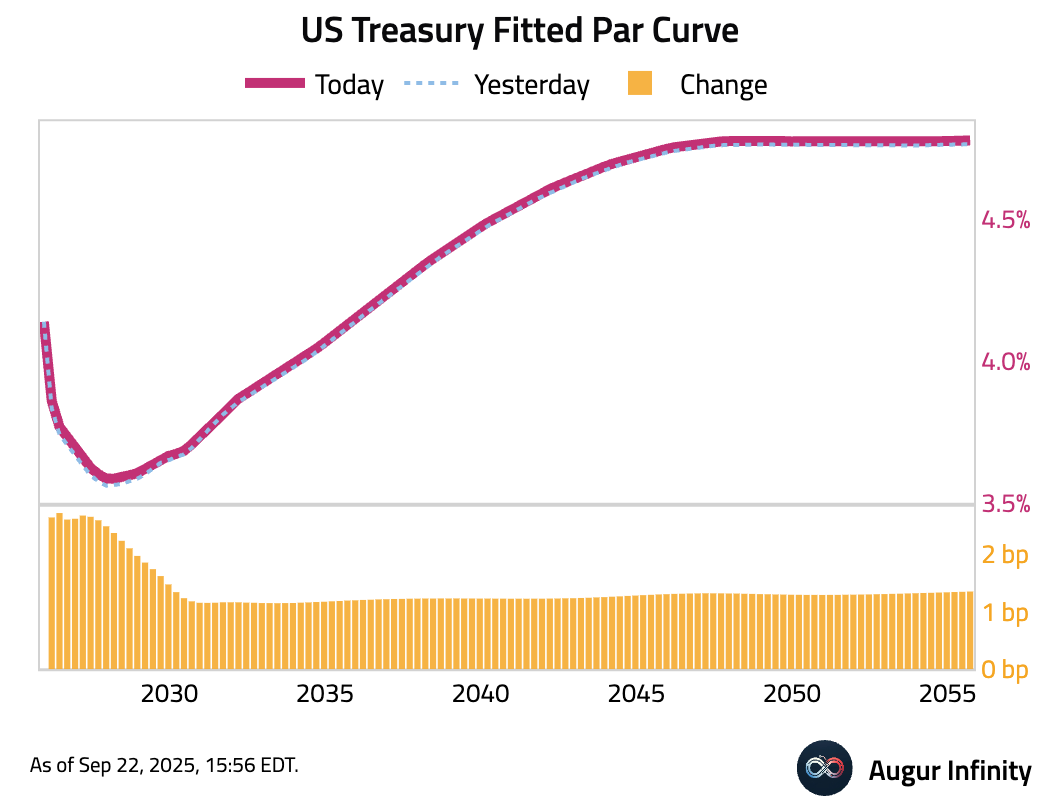

- US Treasury yields increased across the curve, with the move led by the front end. The 2-year yield rose 2.6 bps, while the 10-year yield was up 1.1 bps.

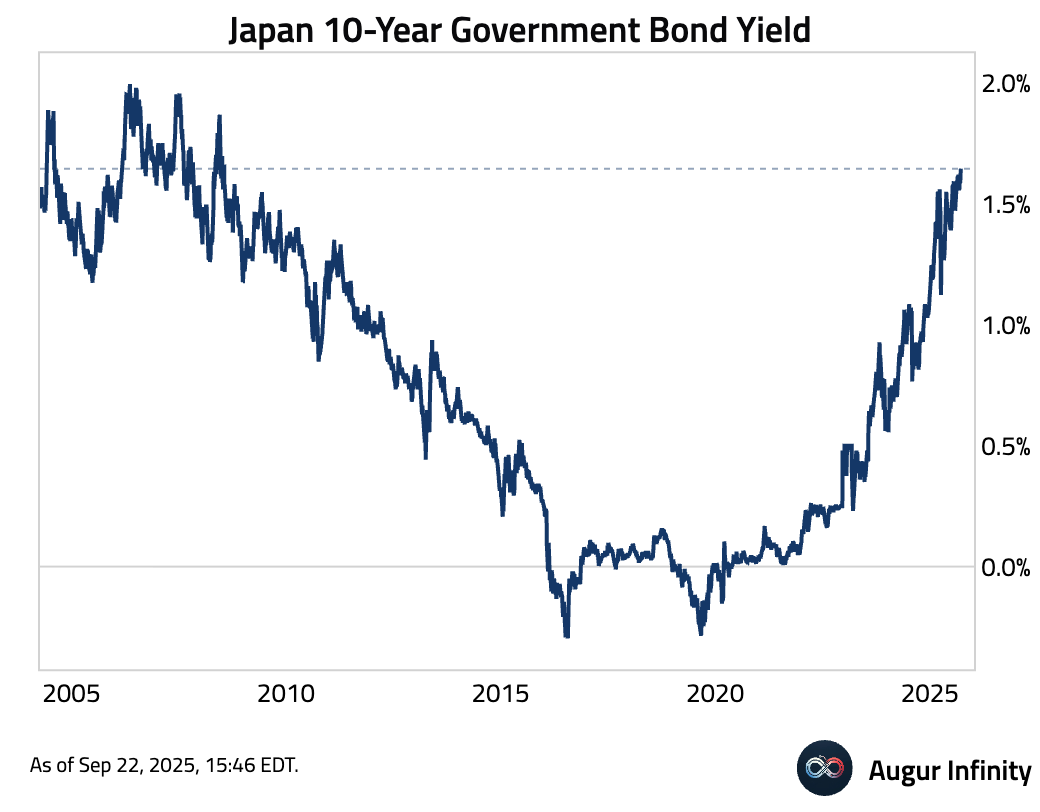

- Japan 10-Year government bond yield is at the highest level since July 2008.

Commodities

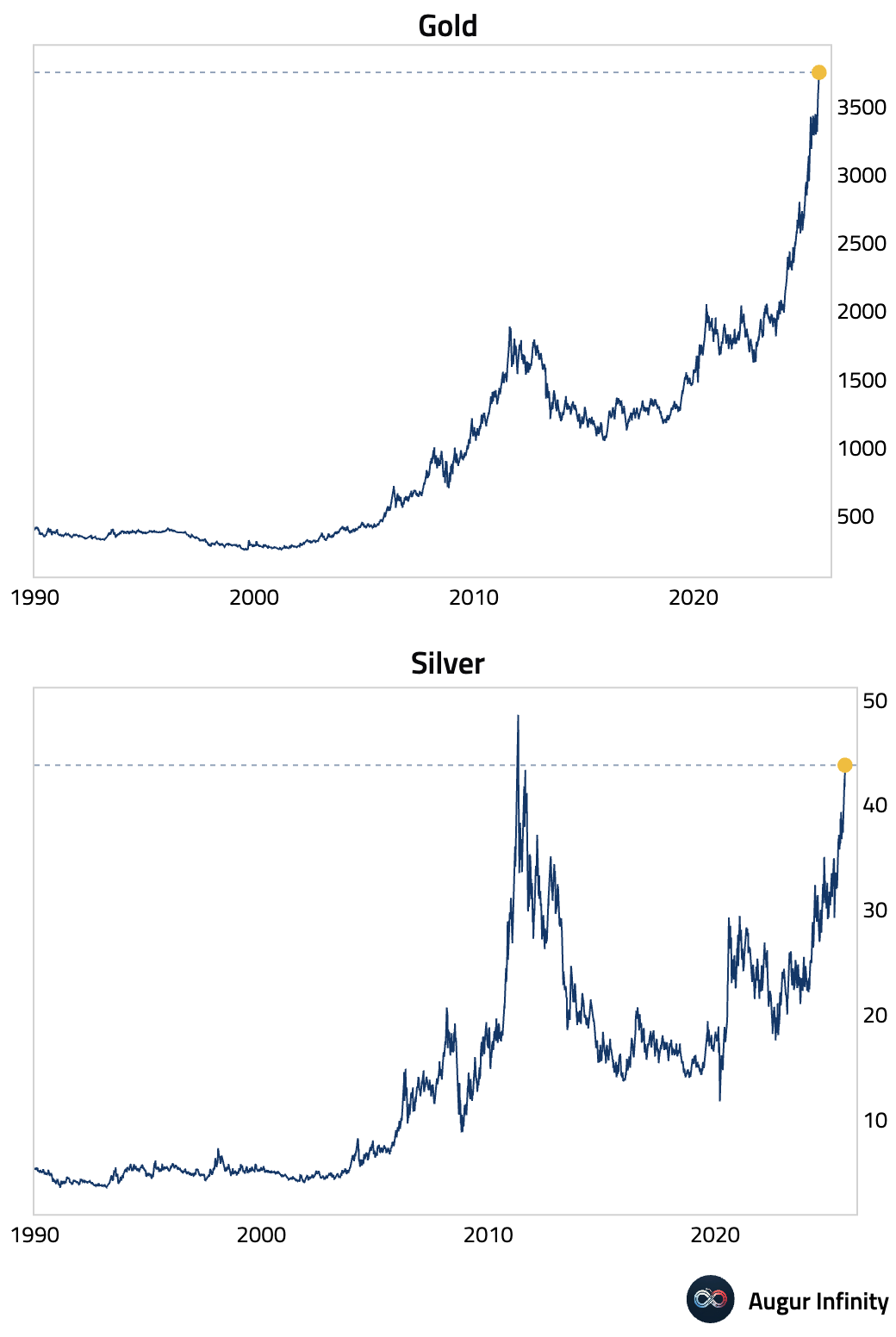

- Gold has climbed to a fresh all-time high.

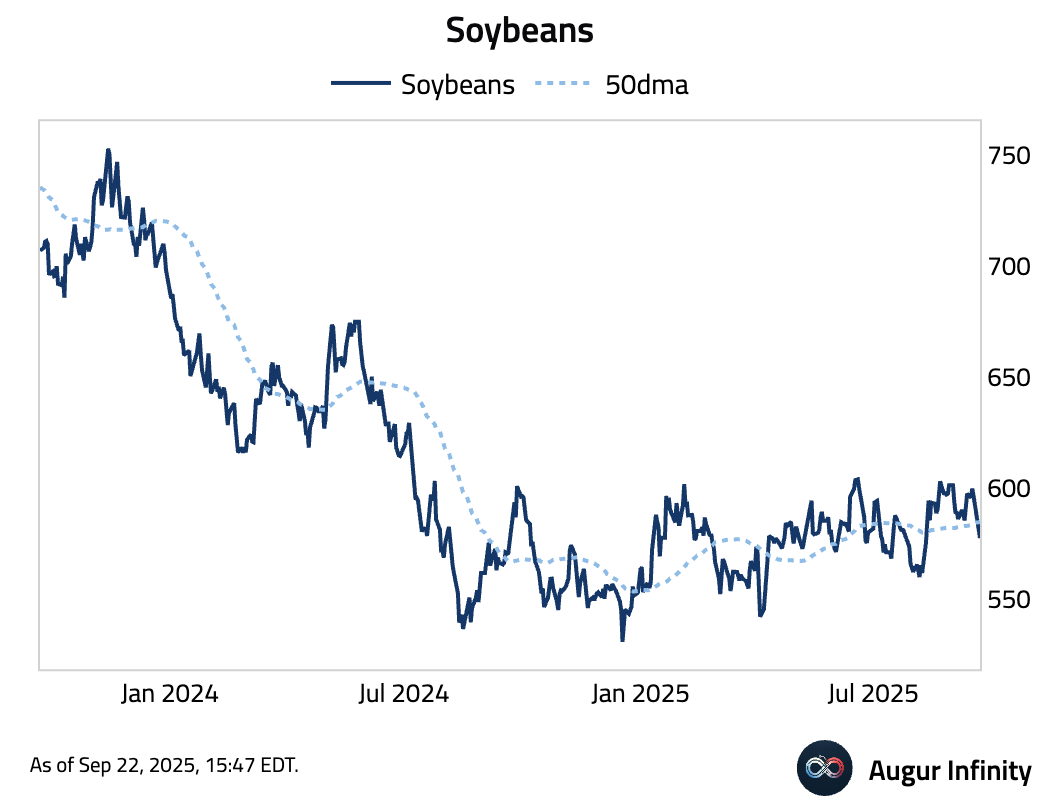

- Soybeans index fell below its 50-day moving average.

FX

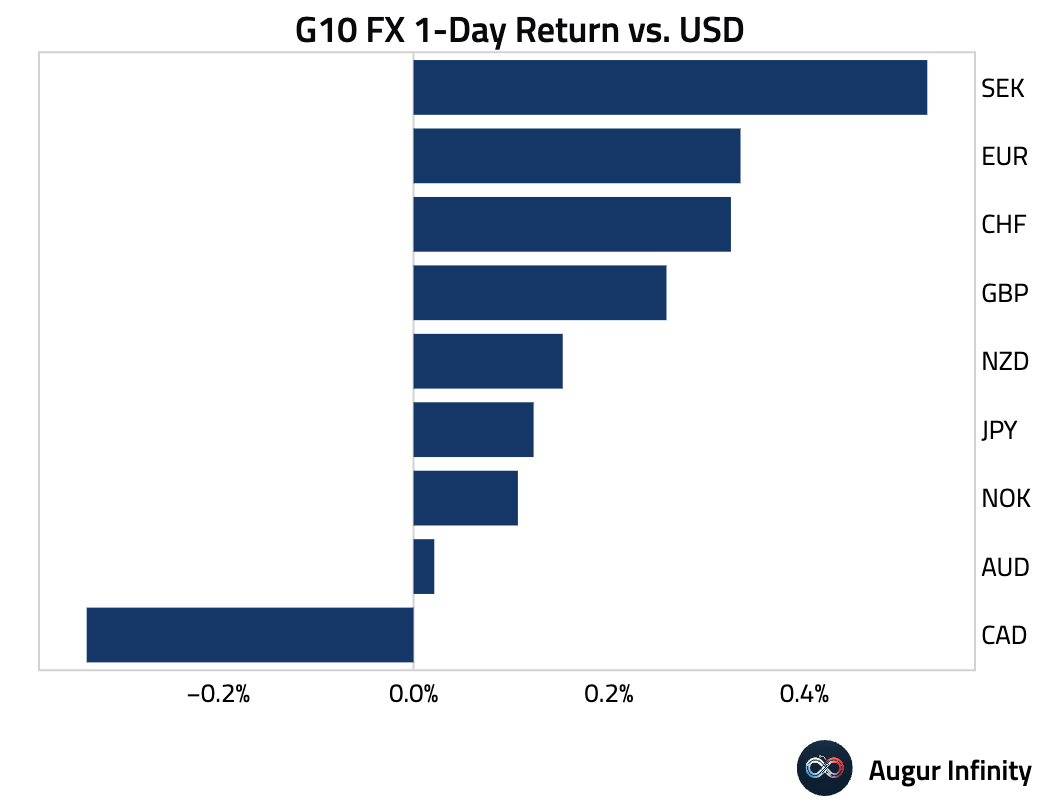

- The US dollar was mixed against its G10 peers in a quiet session. The Swedish krona (+0.5%) and the euro (+0.3%) were the strongest performers, while the Canadian dollar (-0.3%) was the primary laggard.

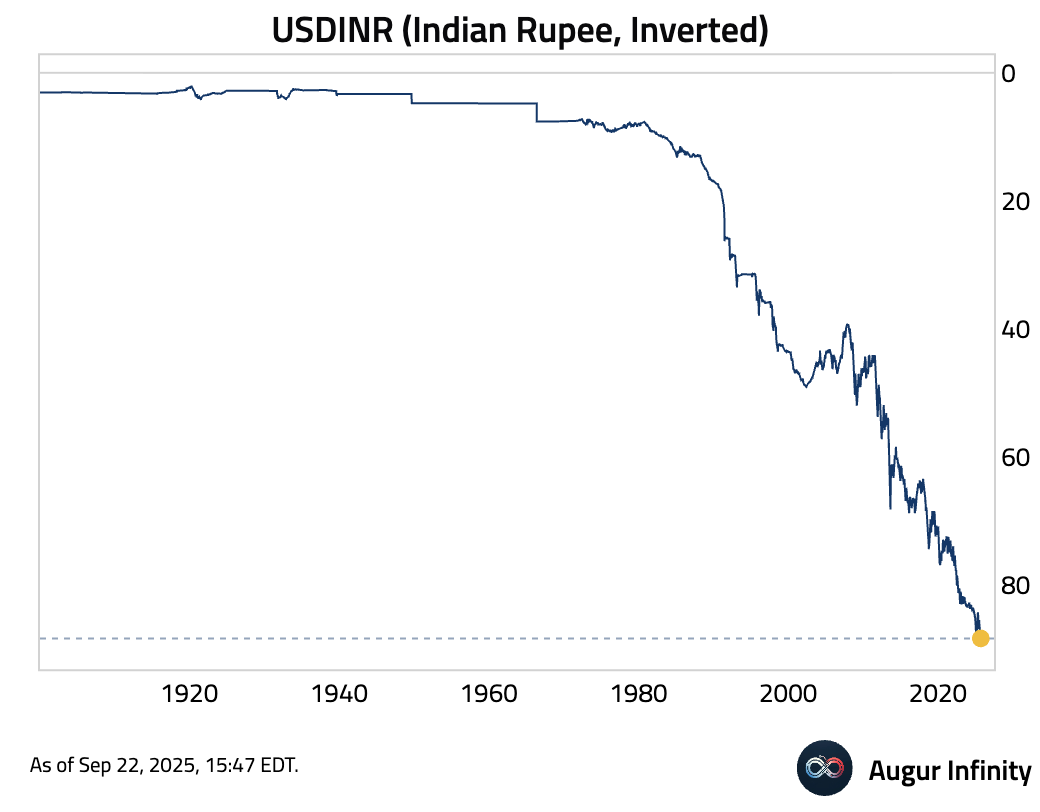

- USDINR (Indian Rupee) depreciated against the dollar, marking a new record.

- Argentina's Peso is rebounding on headlines that the US could intervene to support the Peso.

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.