Headlines

- US Treasury Secretary Bessent announced that he anticipates a “pretty big breakthrough” in trade negotiations with China scheduled for later this month.

- The ongoing US government shutdown has begun to affect economic reporting.

- The British government is reportedly considering a stamp duty exemption for new listings on the London Stock Exchange to enhance the competitiveness of its financial markets.

Global Economics

United States

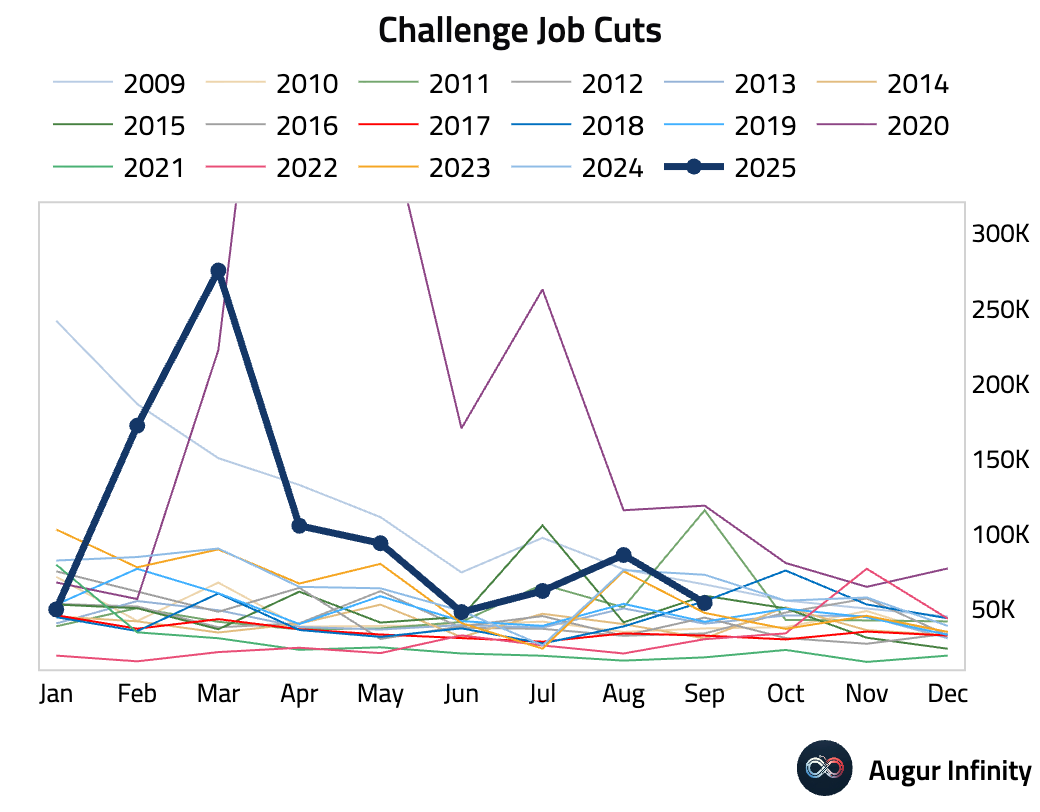

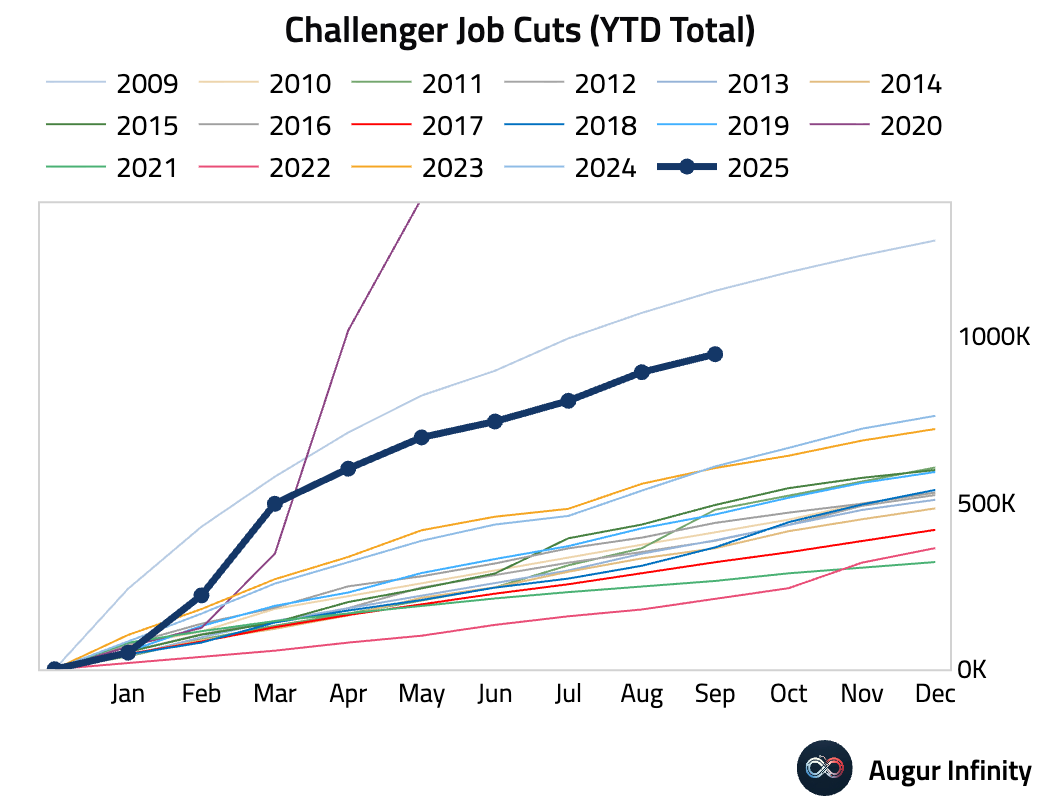

- Announced job cuts fell in September but the underlying trend points to labor market weakness. Year-to-date cuts of 946k are the highest since 2020, up 55% Y/Y. The government sector was the primary driver of cuts, while retail sector layoffs surged. Forward-looking hiring plans dropped to the weakest since 2009.

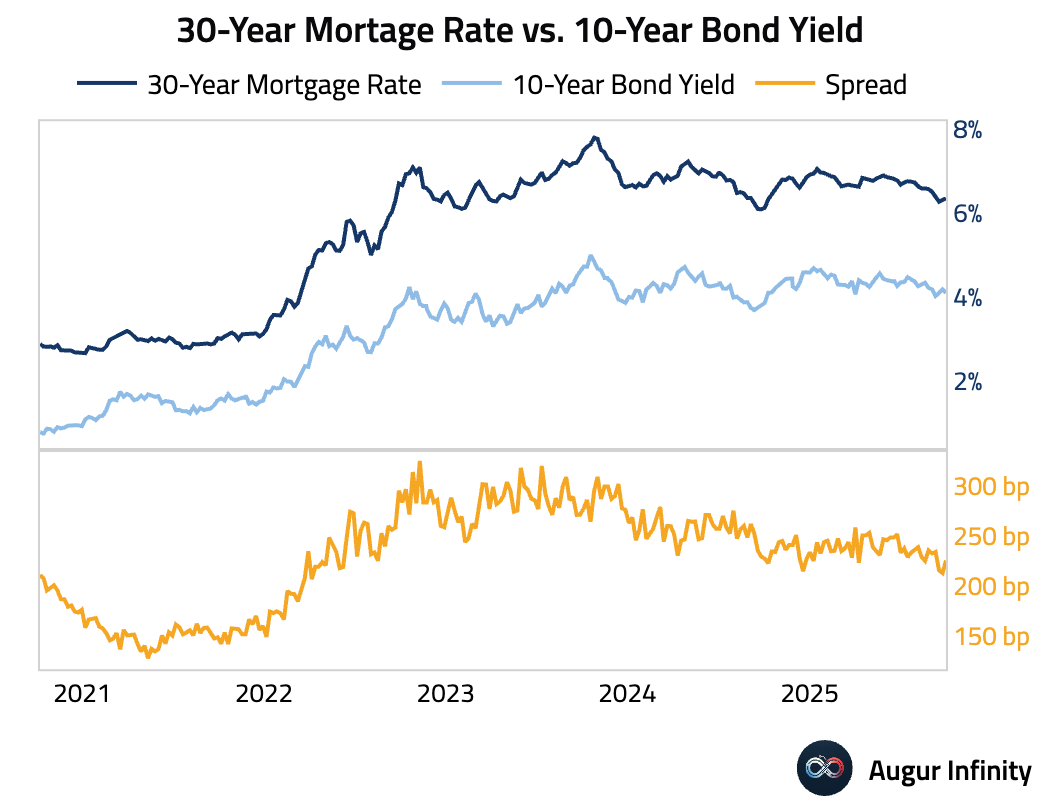

- US 30-year mortgage rate rose by 4 bps to 6.34%.

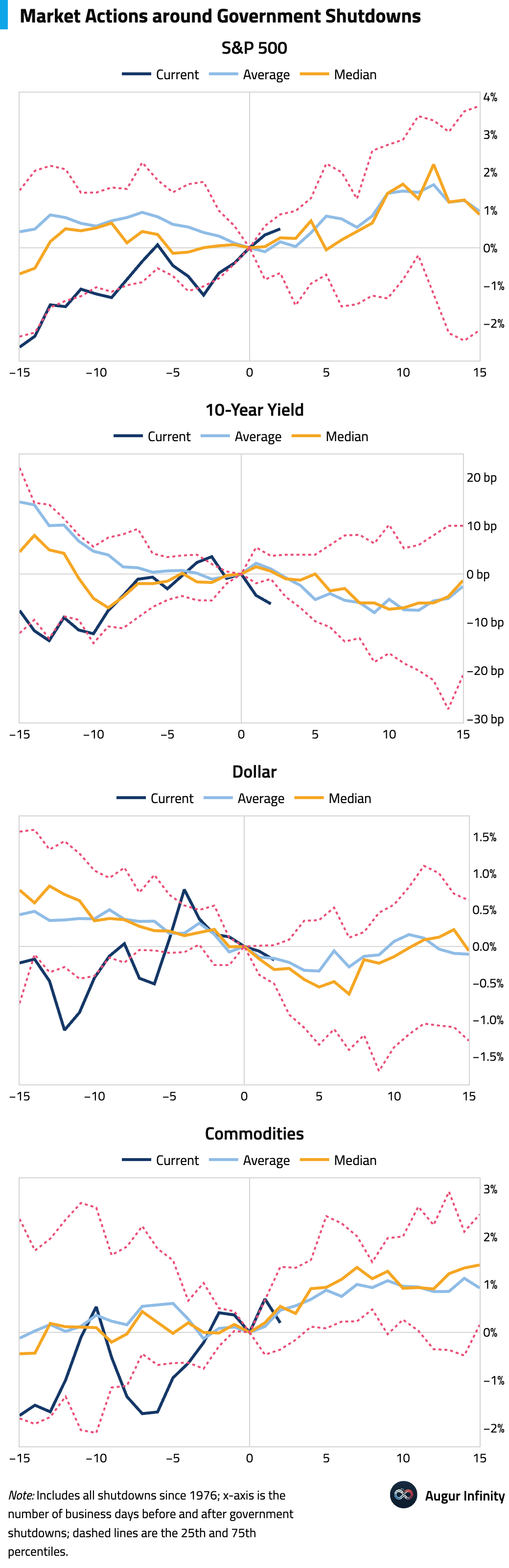

- Here’s how markets are moving compared to their typical patterns following past government shutdowns.

Europe

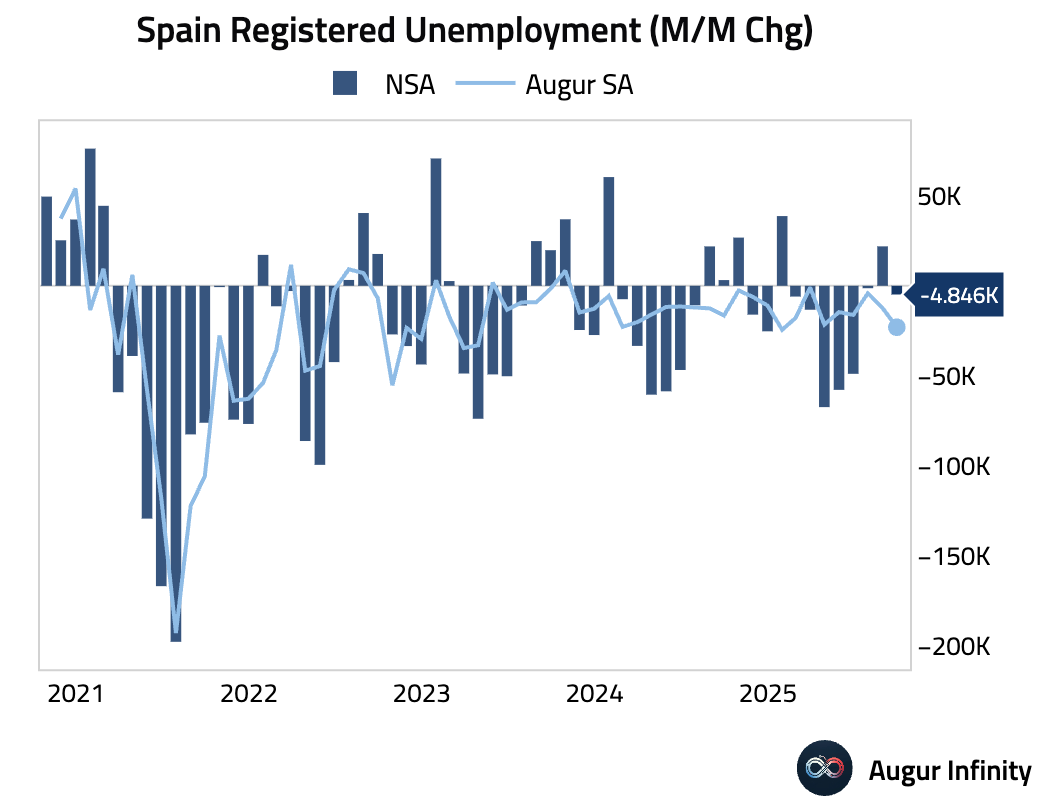

- Spain’s registered unemployment unexpectedly fell in September, a significant beat versus consensus expectations for an increase (act: -4.8k, est: 15.4k).

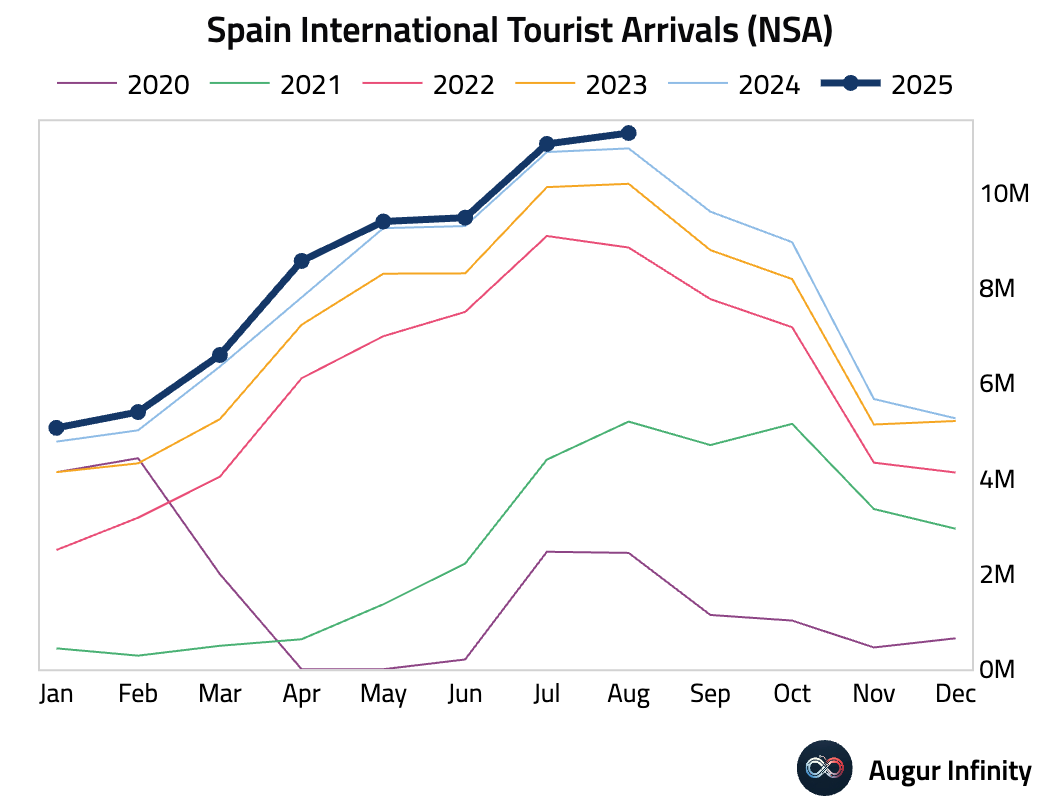

- The recovery in Spain’s tourism sector gathered pace, with international arrivals growing at a faster year-over-year rate in August (act: 2.9% Y/Y, prev: 1.6%).

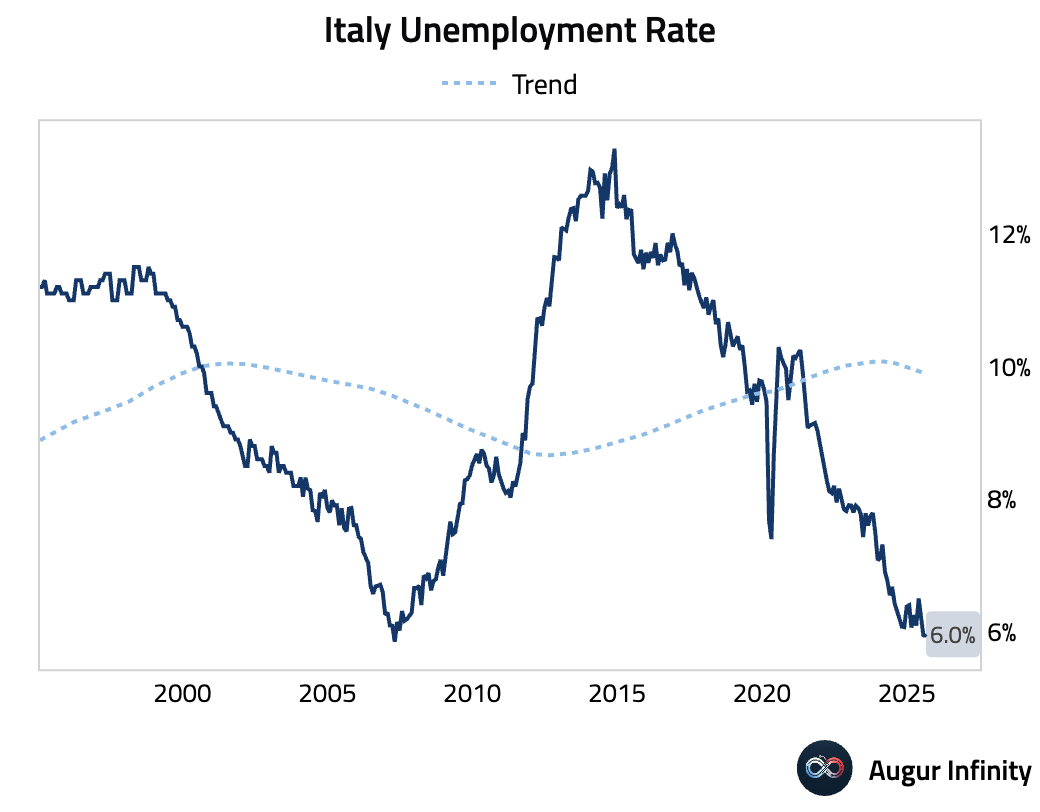

- Italy’s unemployment rate edged up to 6.0% in August from 5.9%, matching consensus expectations.

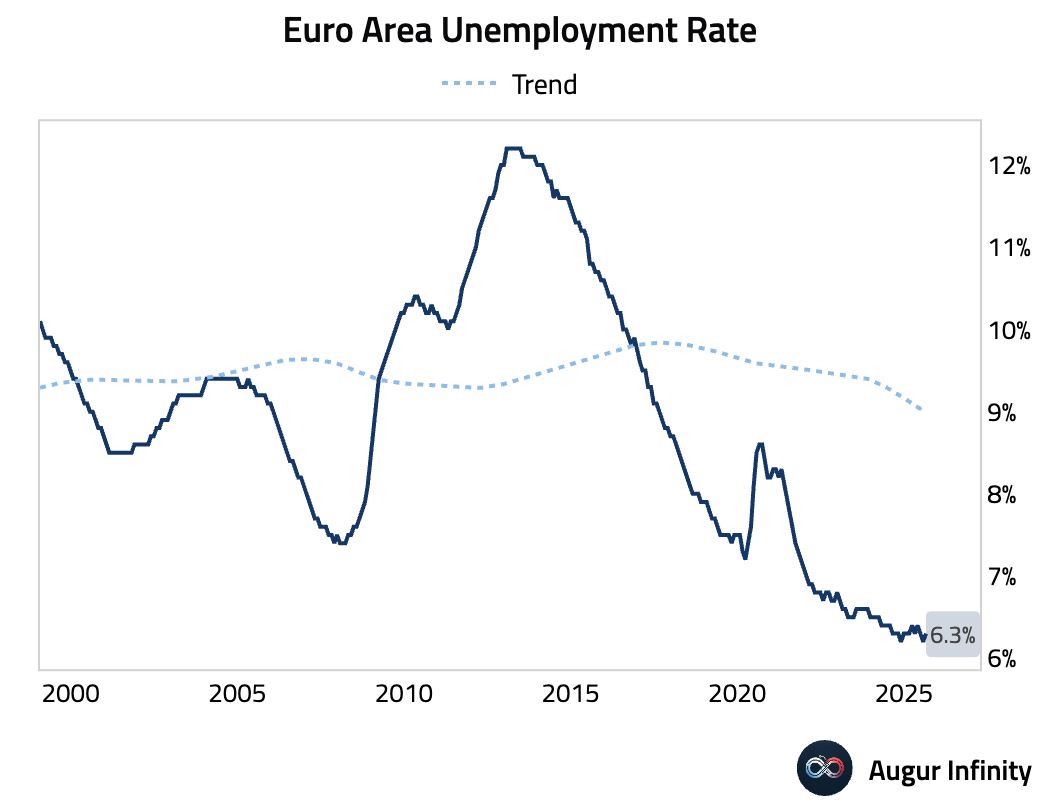

Interactive chart on Augur Infinity

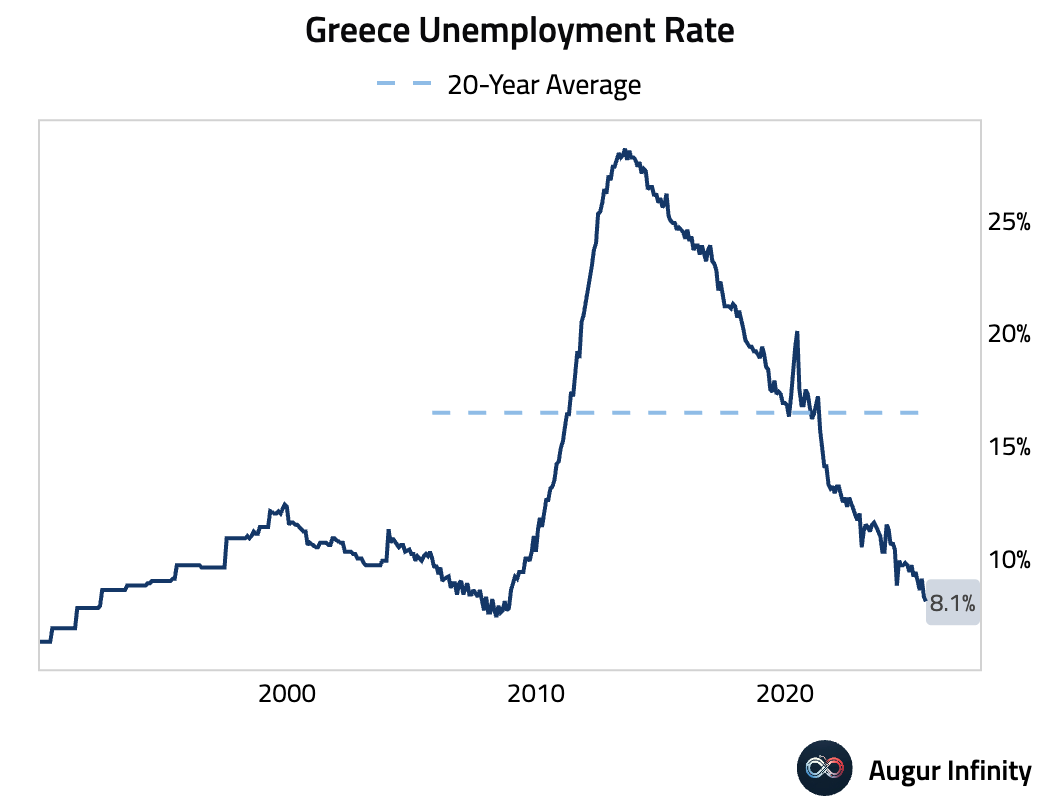

- Greece’s unemployment rate fell to 8.1% in August, its lowest level since November 2008.

- The Eurozone unemployment rate ticked up to 6.3% in August, in line with consensus.

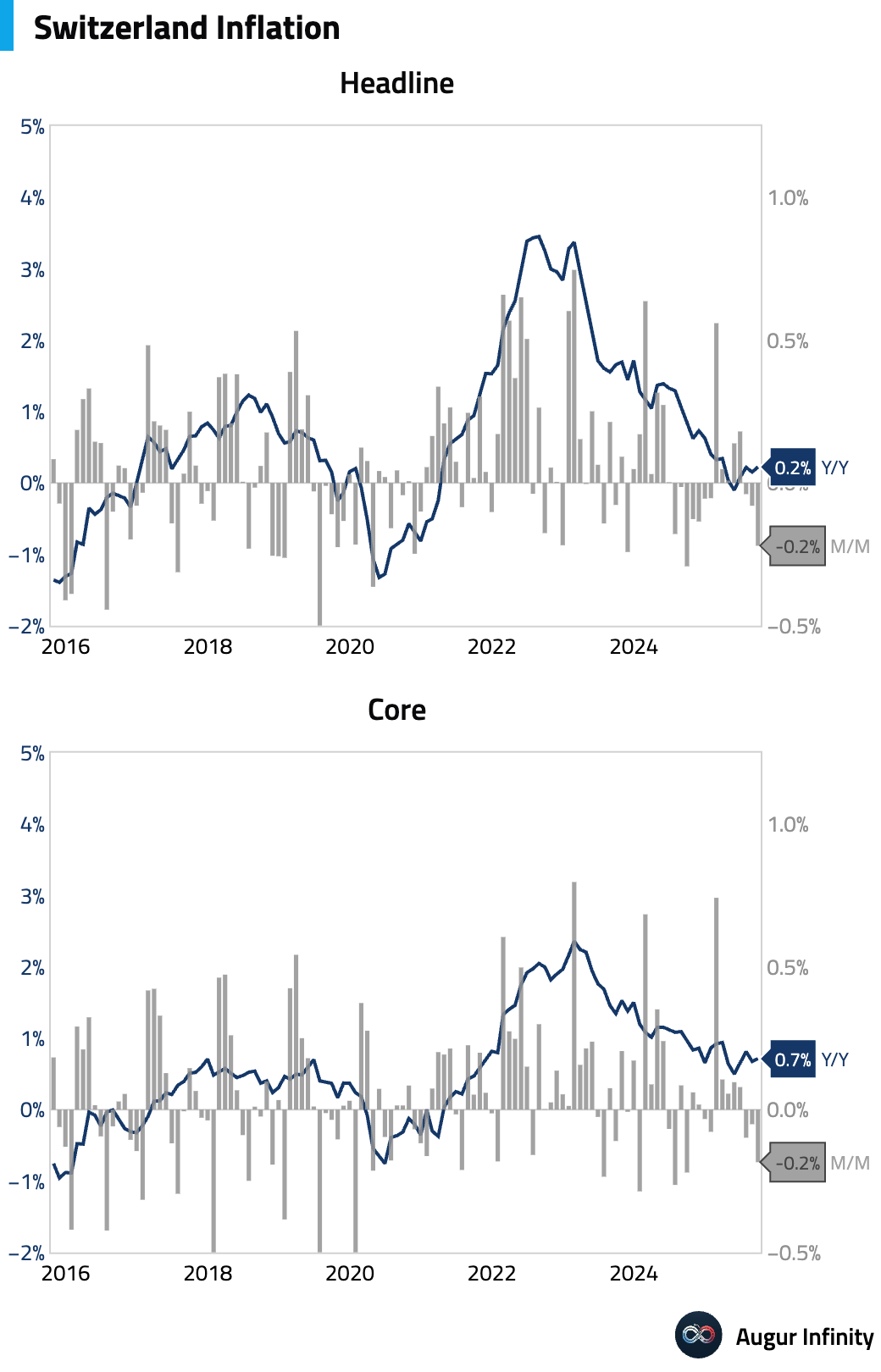

- Swiss inflation was unchanged at 0.2% Y/Y in September, slightly missing the 0.3% consensus estimate. On a monthly basis, prices fell 0.2%, matching expectations and the prior month’s reading.

Interactive chart on Augur Infinity

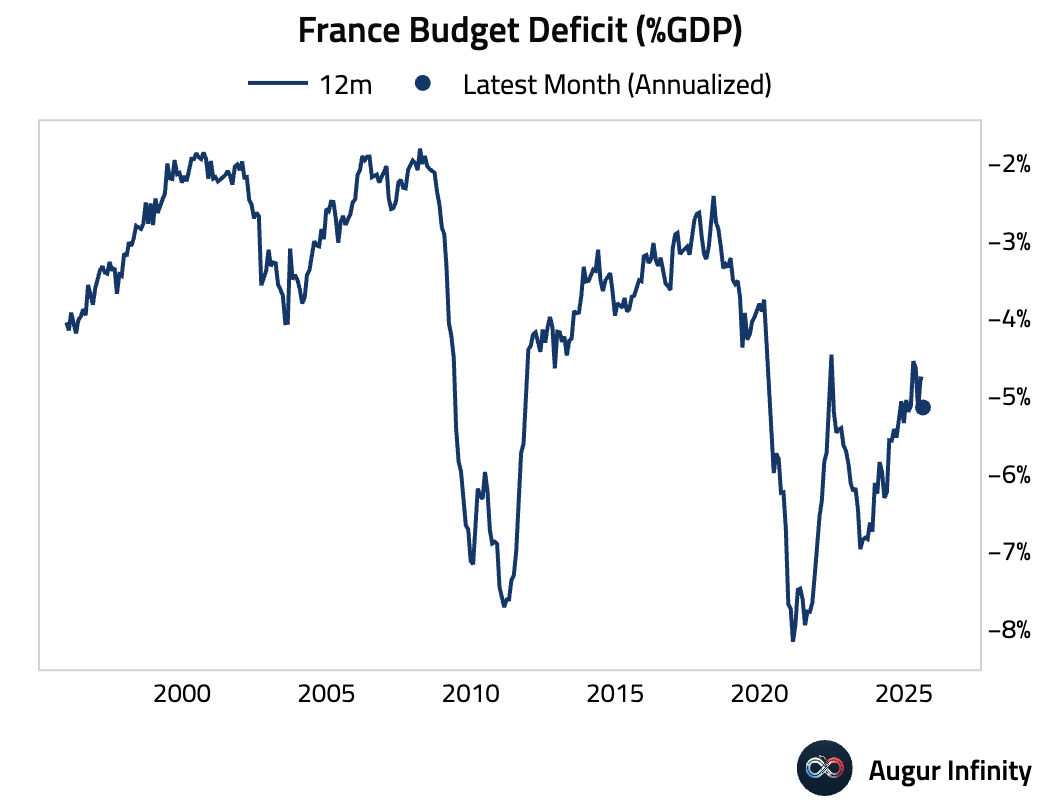

- France’s year-to-date budget deficit widened in August (act: -€157.5B, prev: -€142.0B).

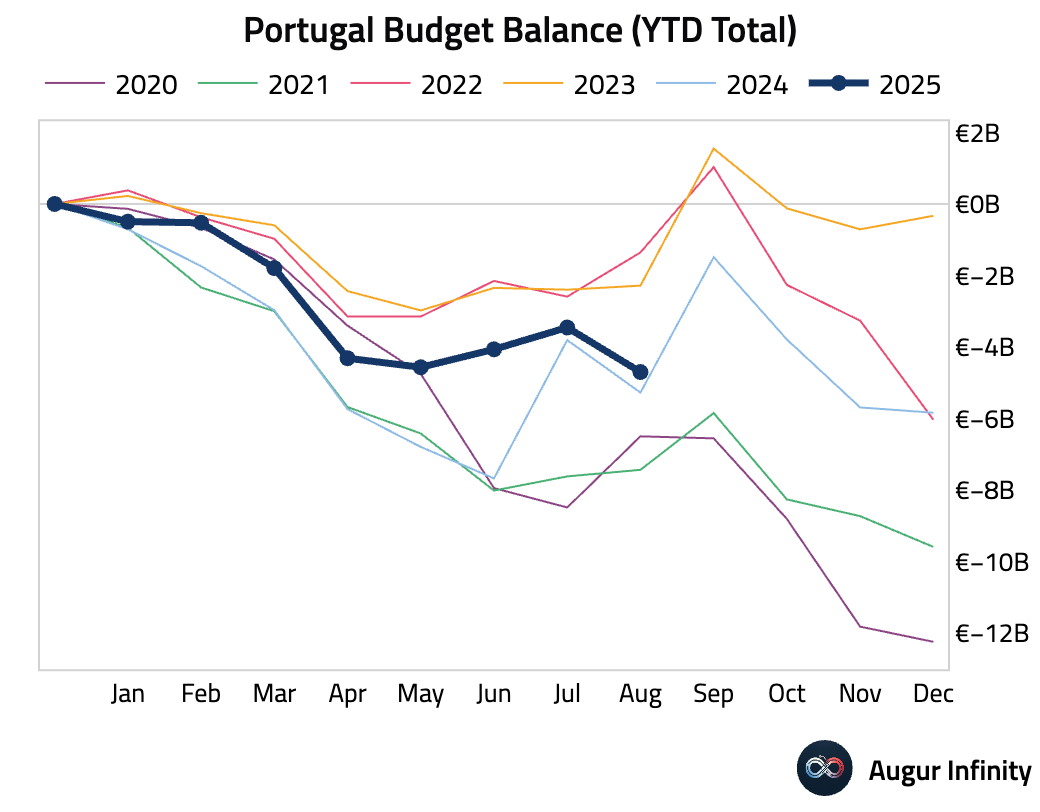

- Portugal's year-to-date budget deficit also widened in August (act: -€4.7B, prev: -€3.5B).

Asia-Pacific

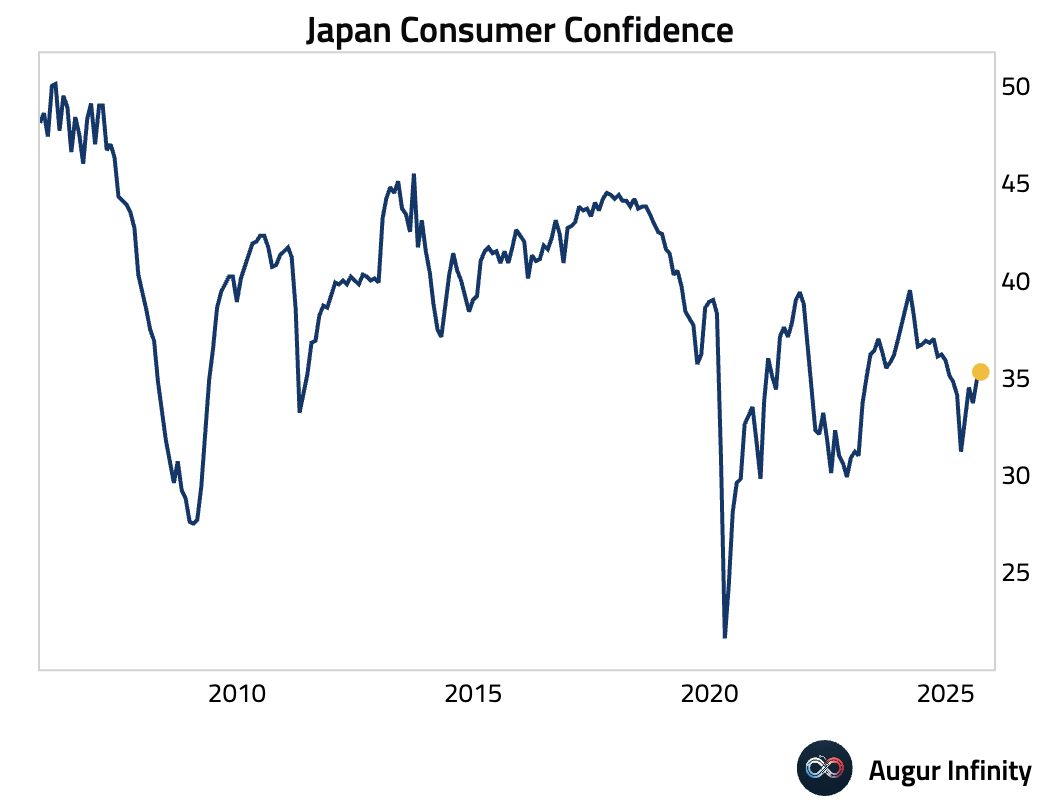

- Japanese consumer confidence improved for the first time in three months, reaching its highest level since December 2024 (act: 35.3, prev: 34.9).

Interactive chart on Augur Infinity

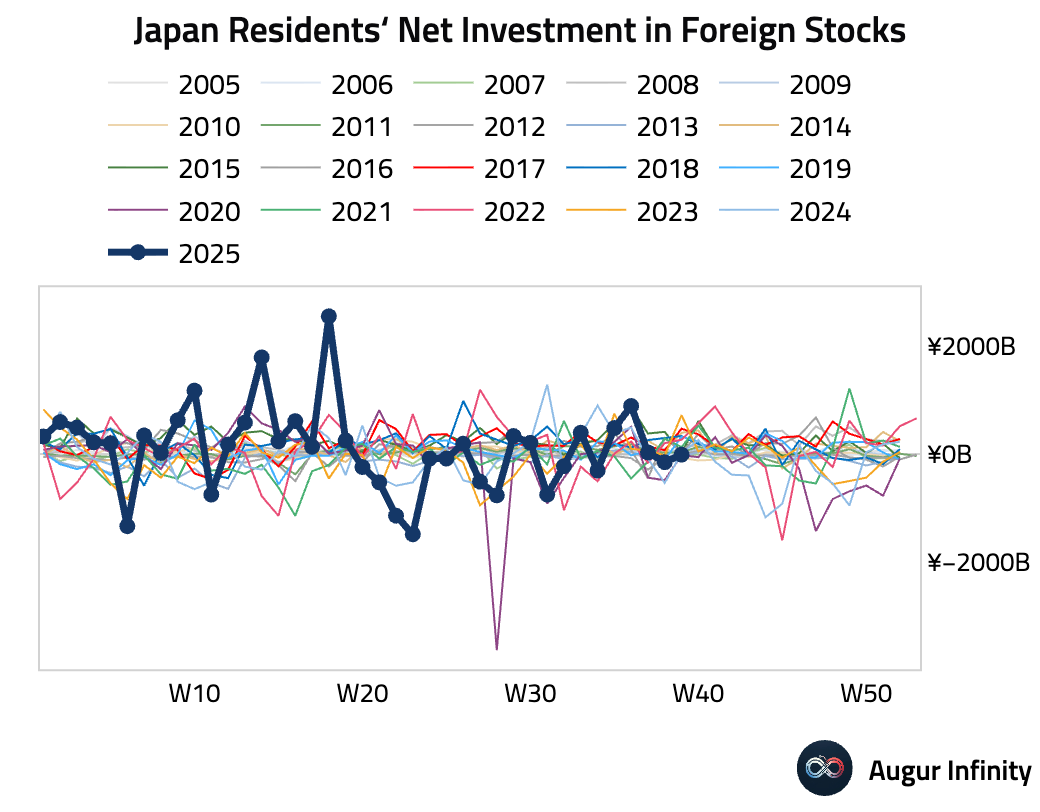

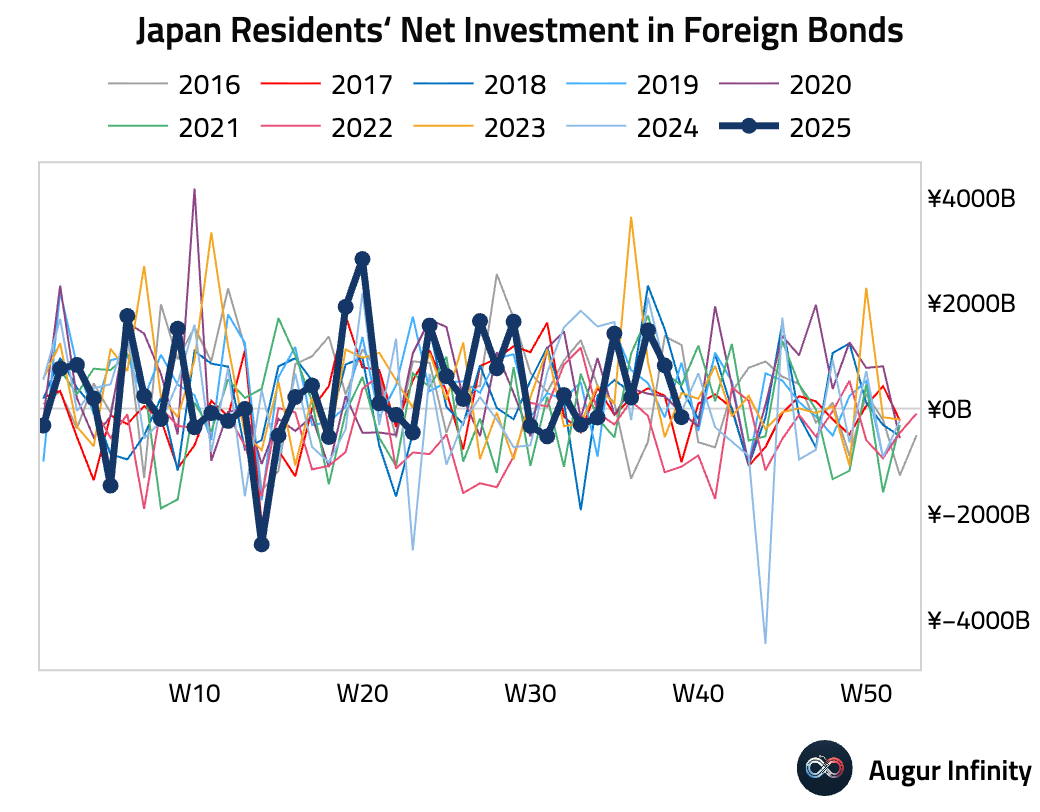

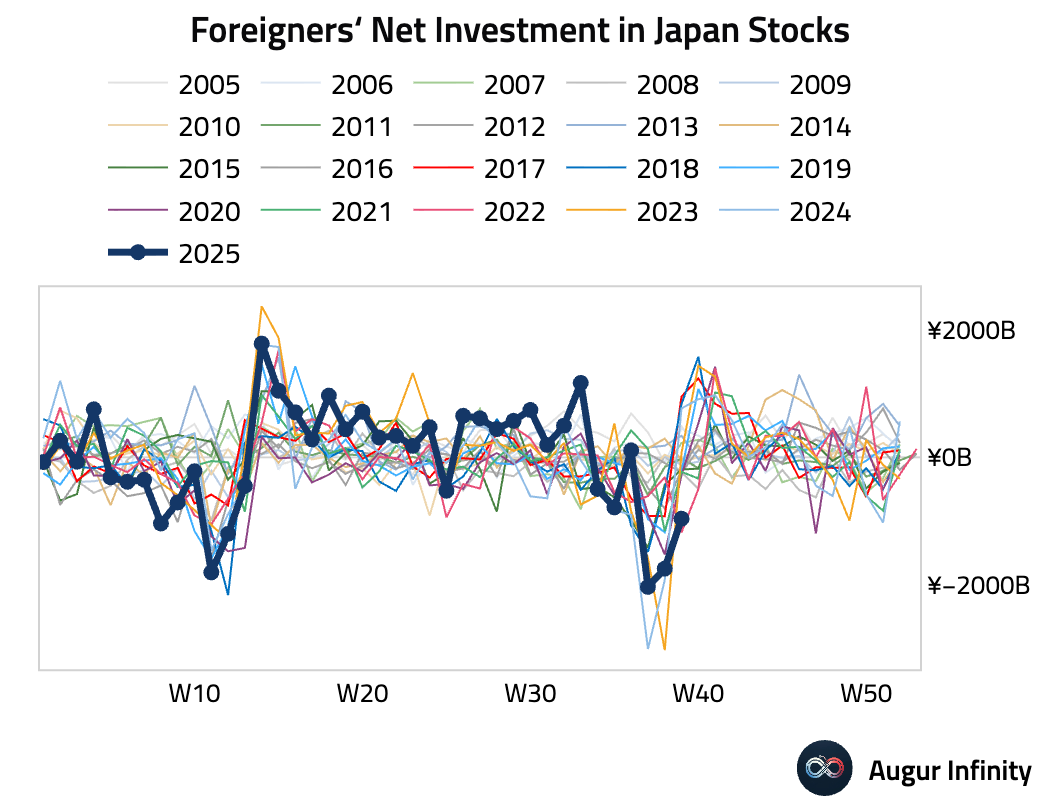

- Weekly portfolio flow data showed Japanese investors turned net sellers of foreign bonds, while foreign investors continued to be net sellers of Japanese stocks, albeit at a slower pace than the prior week.

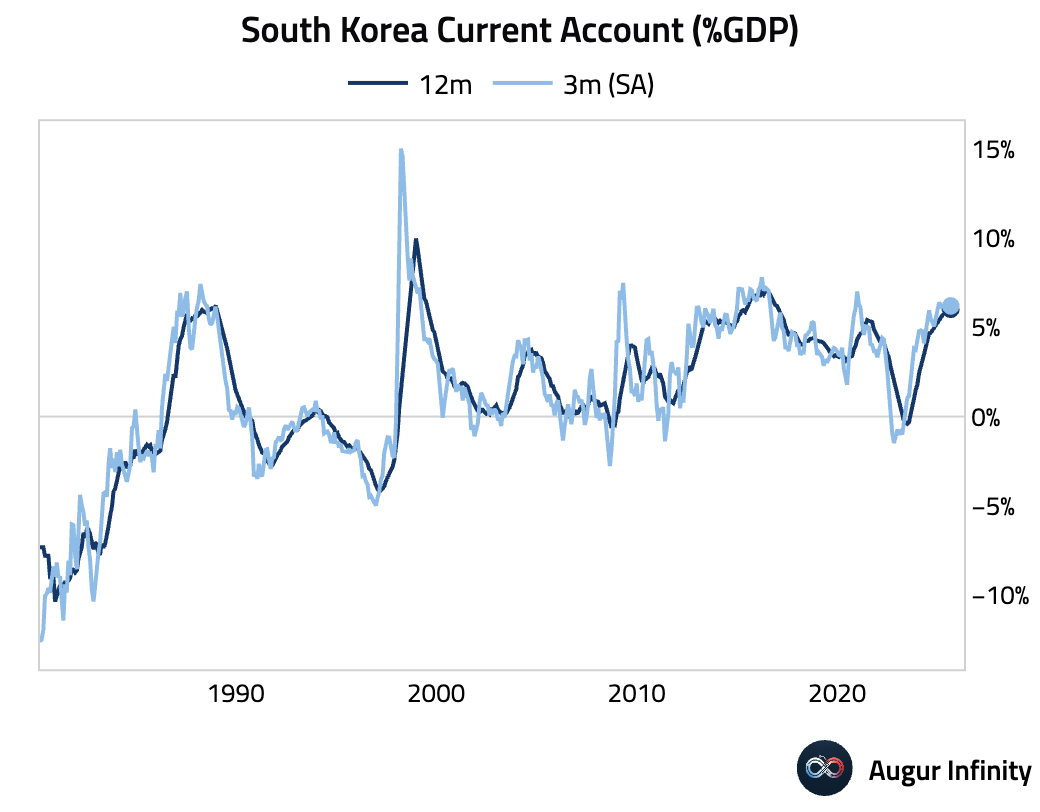

- South Korea’s current account surplus narrowed in August (act: $9.15B, prev: $10.78B).

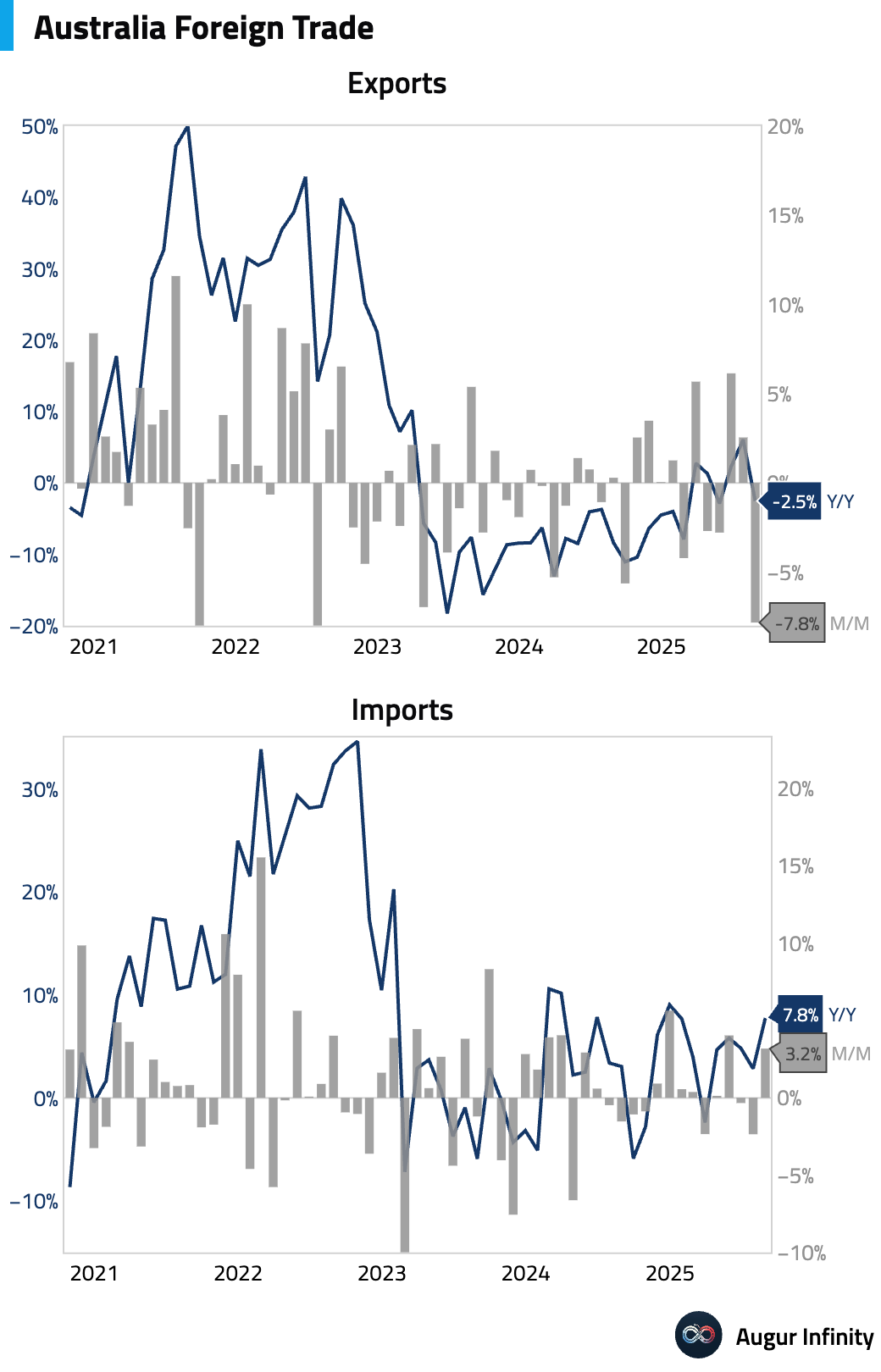

- Australia’s trade surplus plunged to its lowest level in over seven years, significantly missing market expectations (act: A$1.8B, est: A$6.2B). The sharp decline was driven by a steep 47.2% drop in volatile non-monetary gold exports, which masked declines in coal and metal ore exports. The M/M drop in exports was the largest in over three years. Meanwhile, imports rose, showing broad strength across consumption, capital, and intermediate goods, signaling resilient domestic demand.

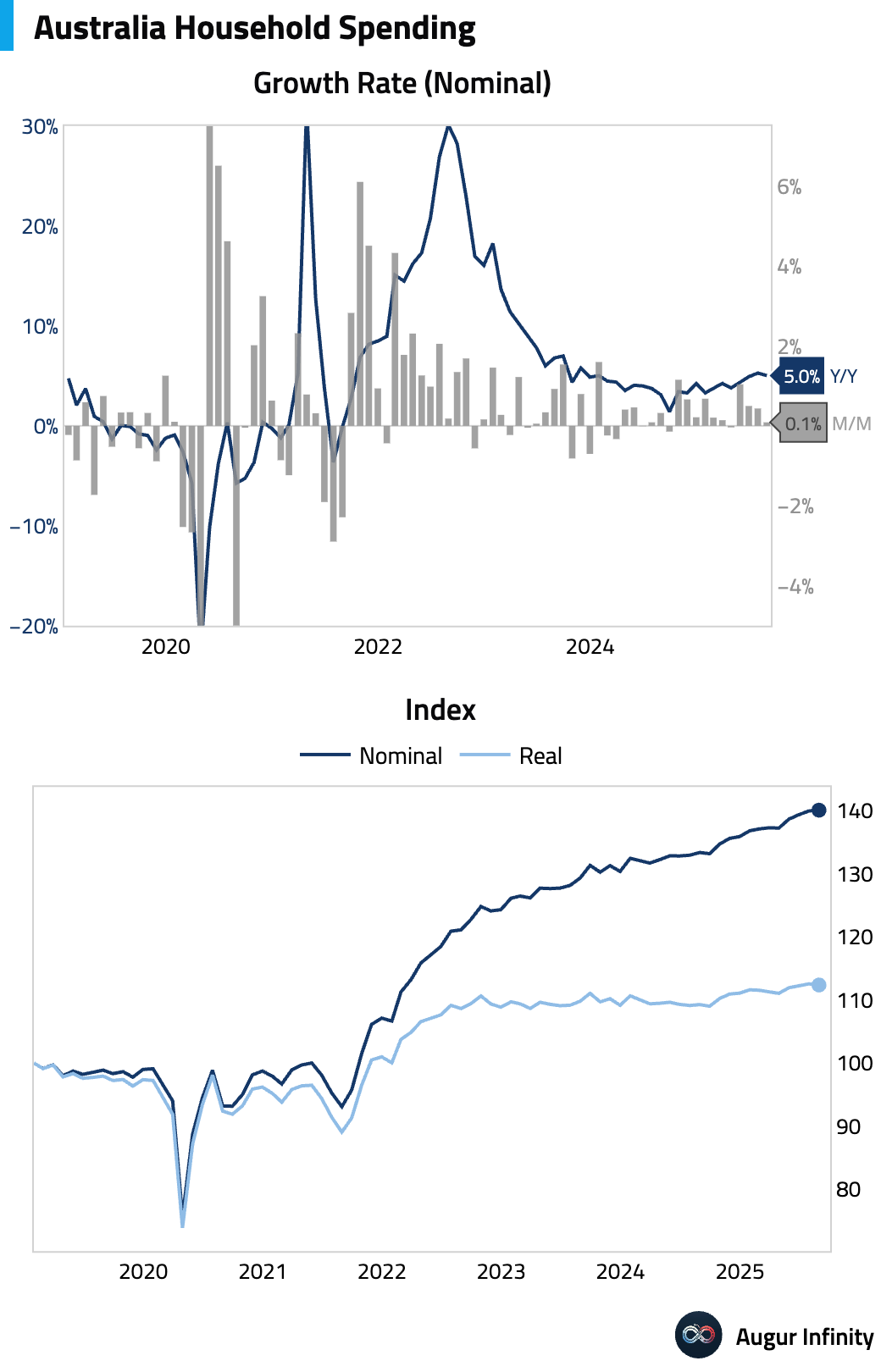

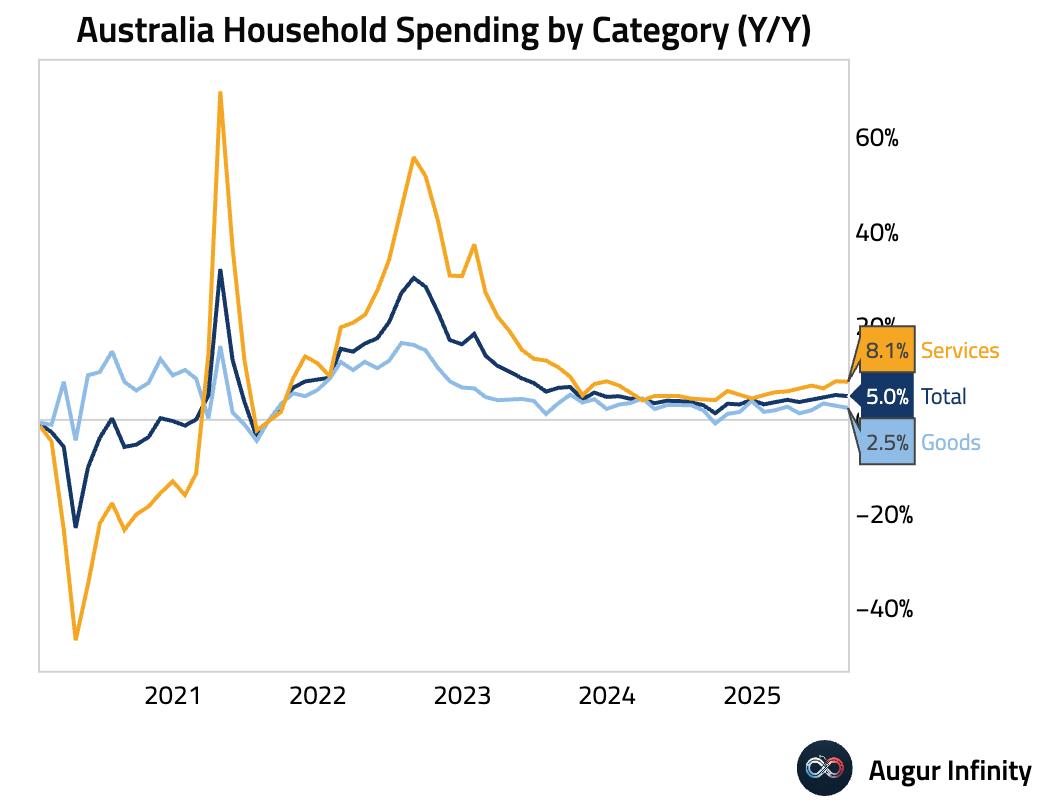

- Australian household spending growth stalled in August, missing consensus for the weakest reading since April (act: 0.1% M/M, est: 0.3%). The modest gain was led by discretionary spending, while non-discretionary spending unexpectedly fell.

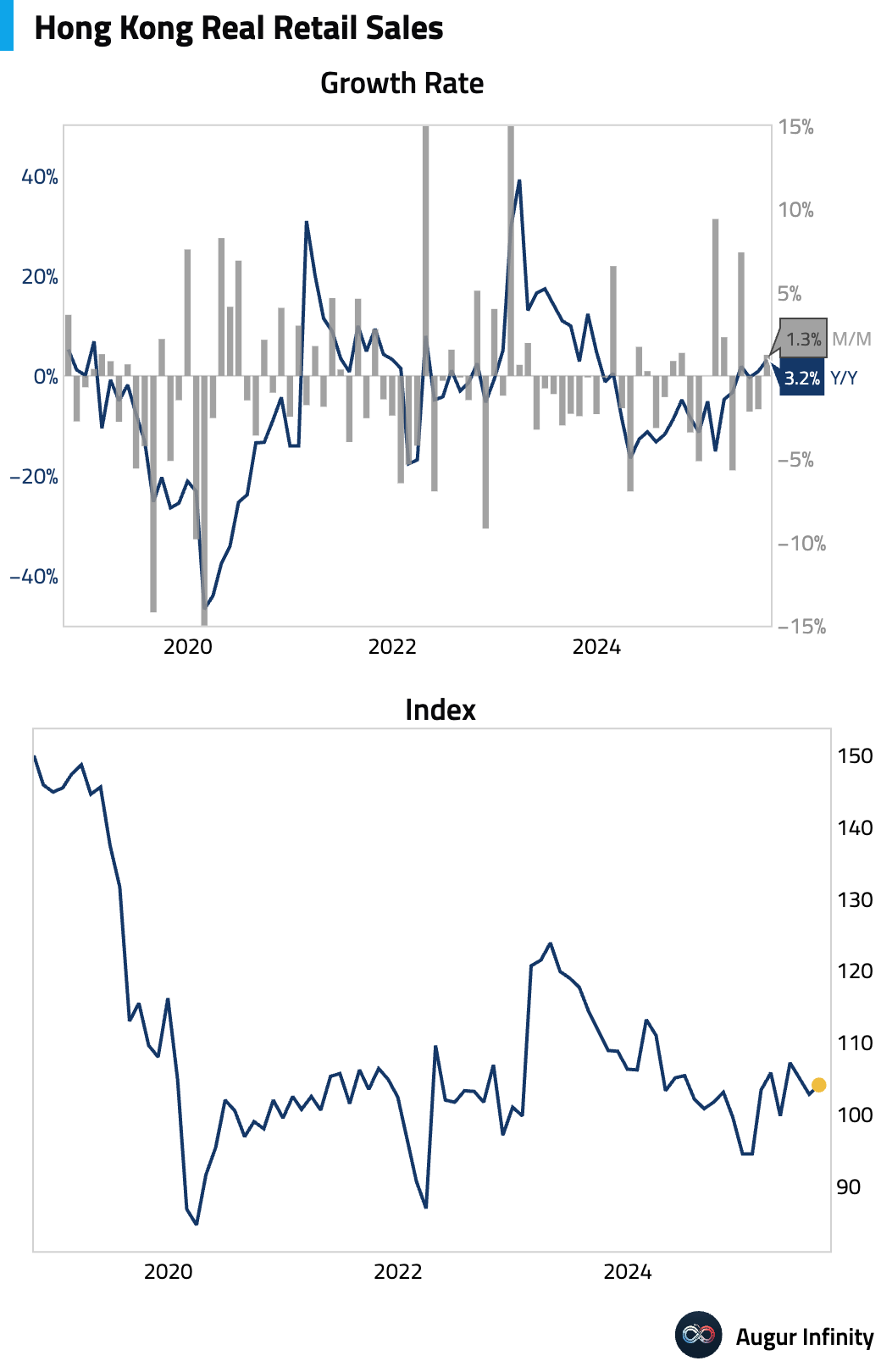

- Hong Kong retail sales growth accelerated in August, beating consensus expectations (act: 3.2% Y/Y, est: 2.0%). The increase was broad-based, led by a strong rebound in spending on jewelry and watches. Despite the growth, sales volumes for department stores and jewelry remain nearly 50% below 2018 levels.

Interactive chart on Augur Infinity

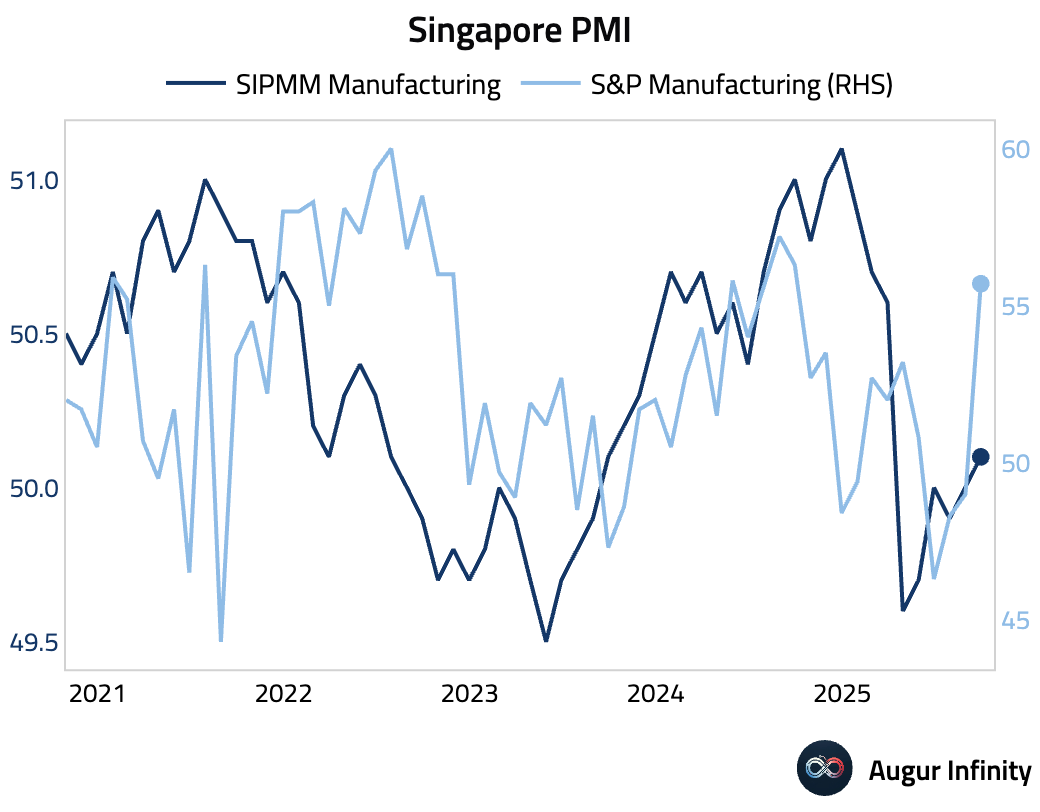

- Singapore’s manufacturing sector returned to expansion in September, with the PMI edging up to 50.1 from 50.0.

Emerging Markets ex China

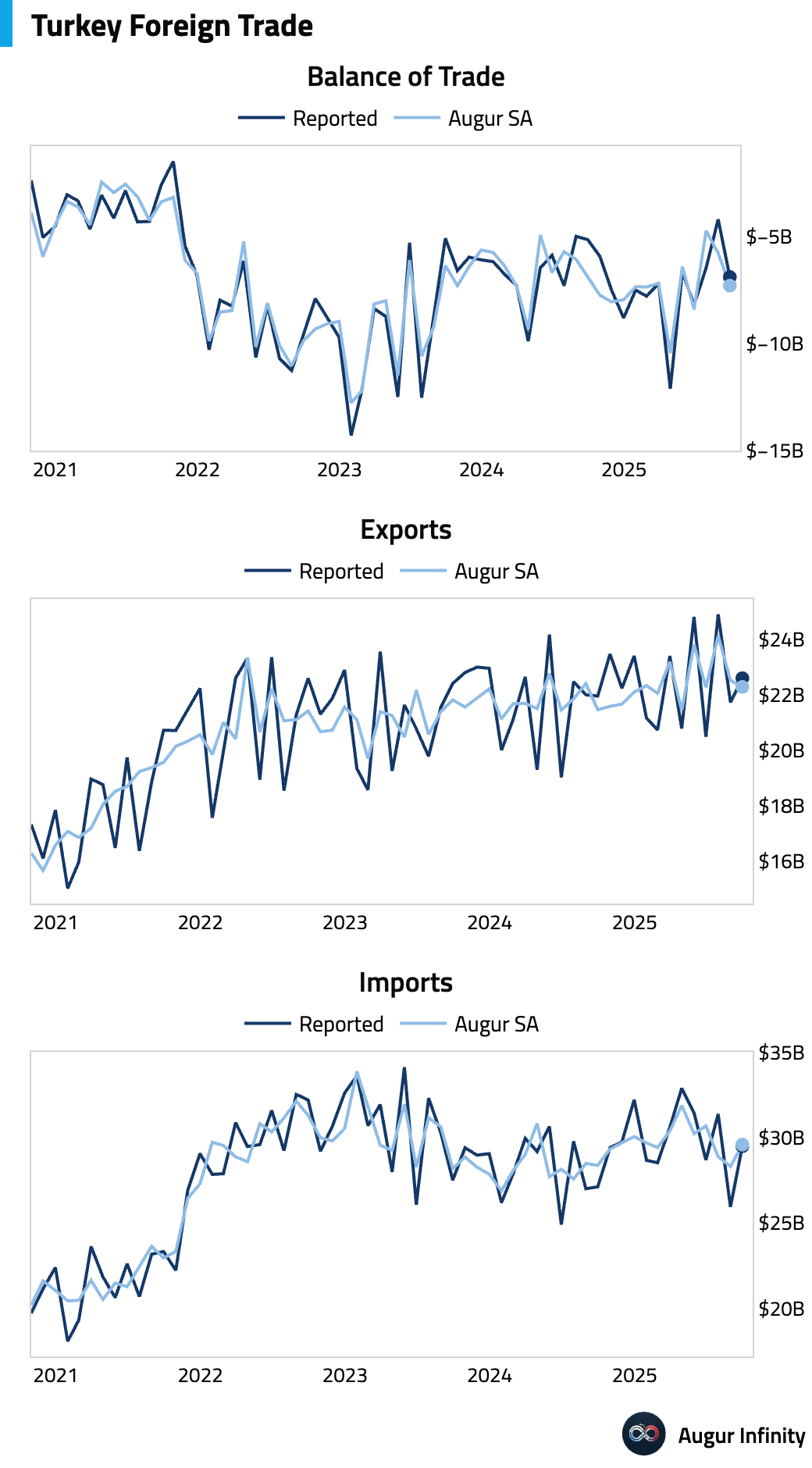

- Turkey’s preliminary trade deficit widened in September as imports grew more than exports (act: -$6.9B, prev: -$4.2B).

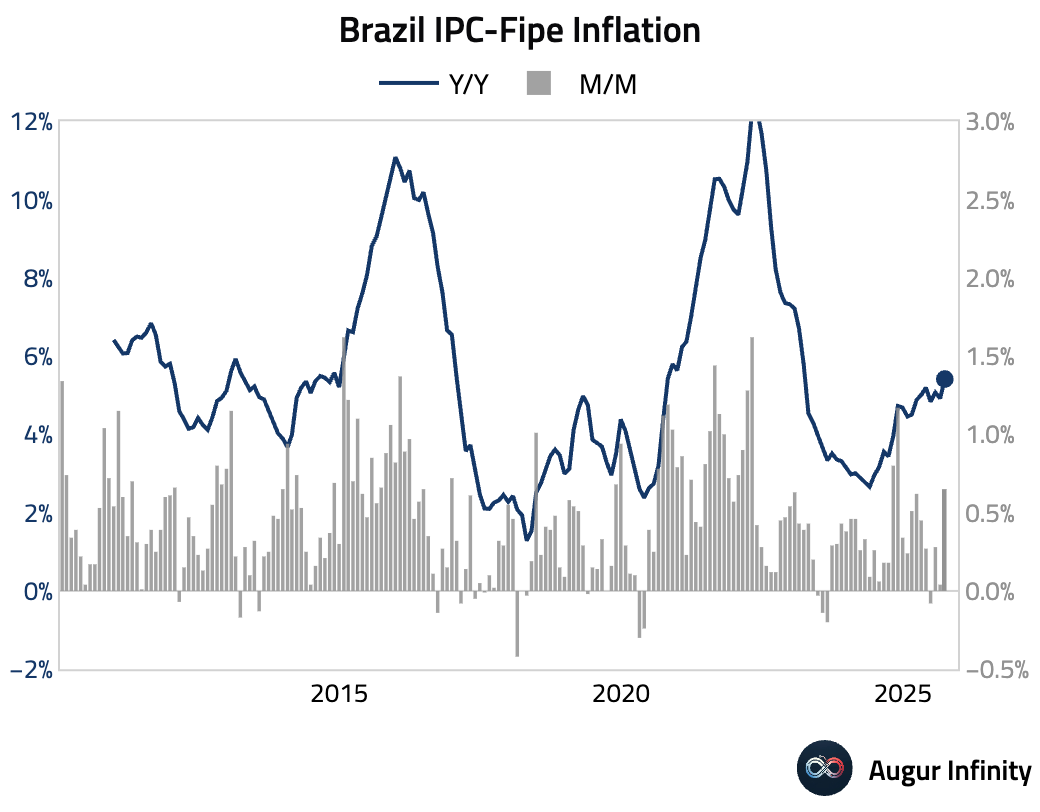

- Inflation in São Paulo, Brazil accelerated sharply in September (act: 0.65% M/M, prev: 0.04%).

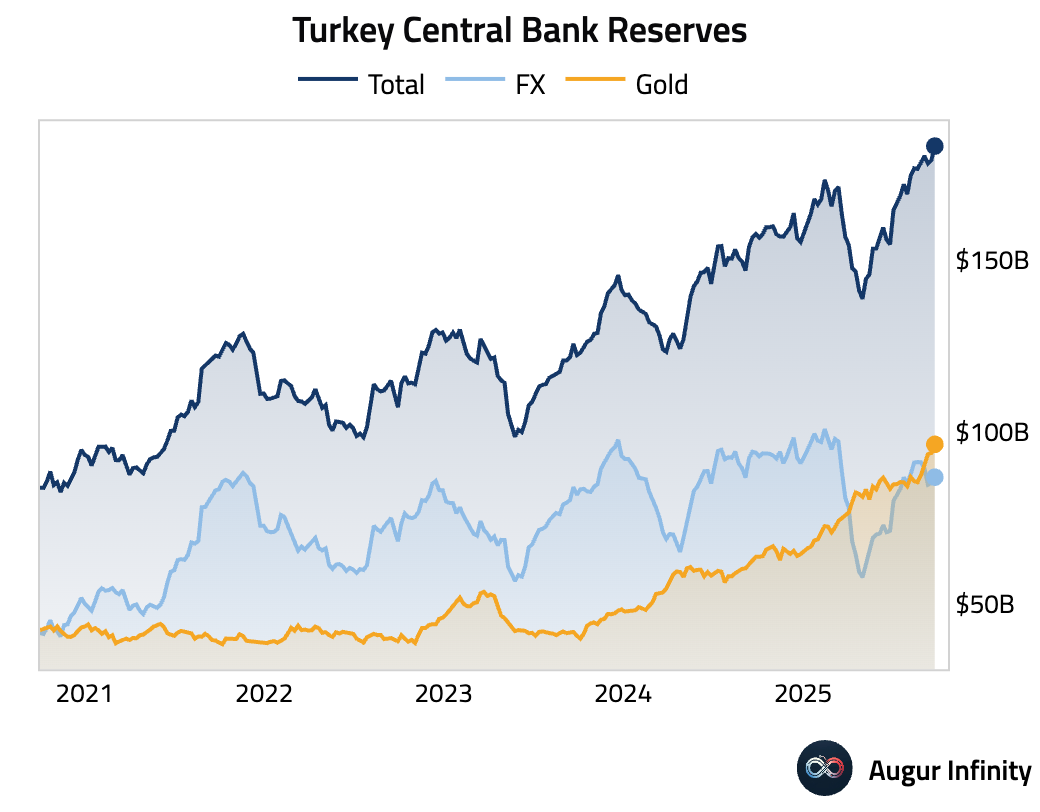

- Turkey’s foreign exchange reserves increased in the latest reporting week (act: $86.7B, prev: $85.1B).

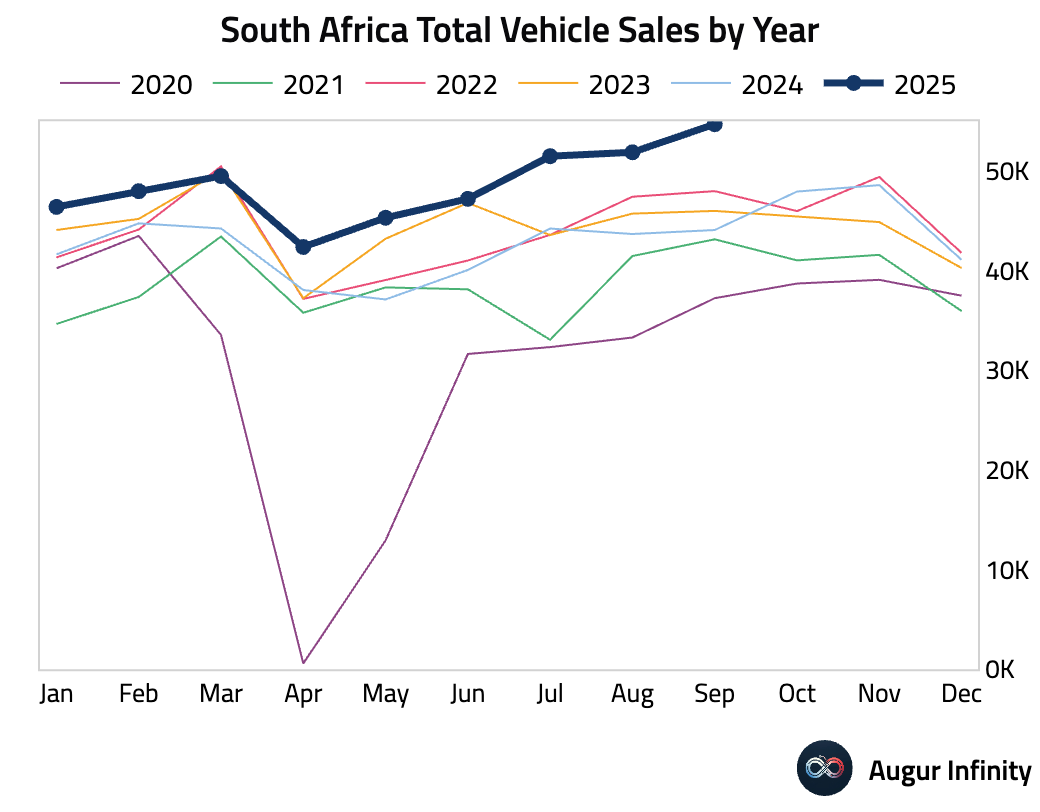

- South African new vehicle sales rose in September, reaching a 10-year high for the month.

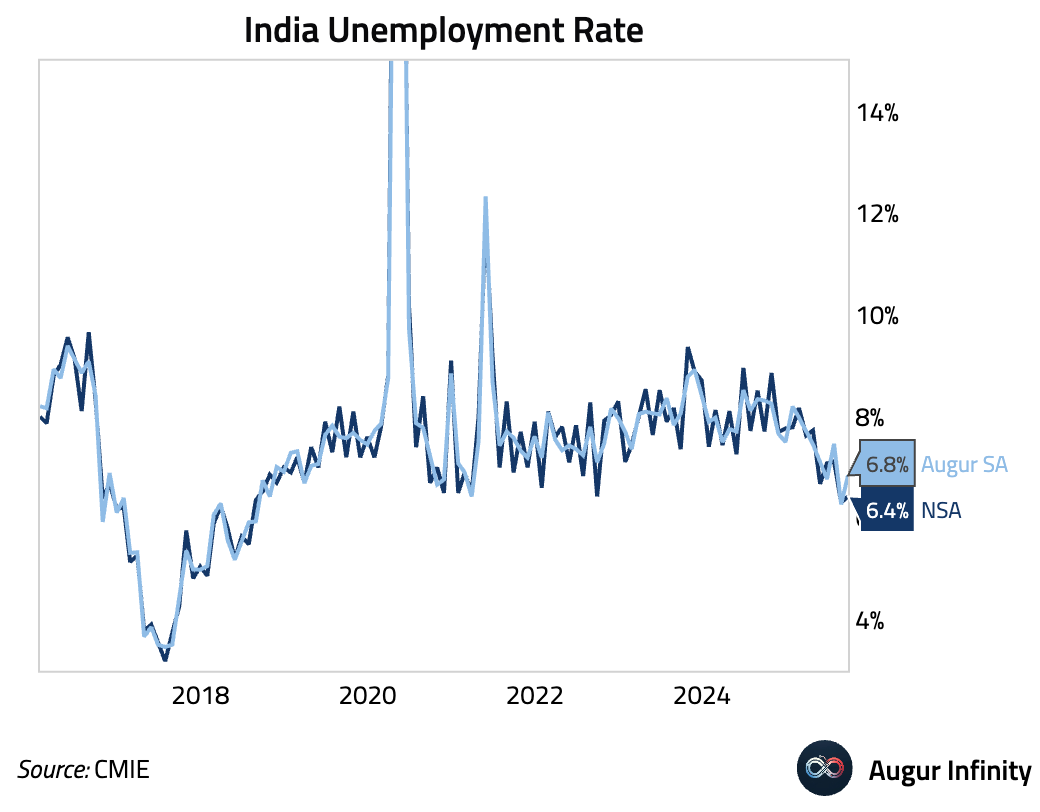

- The CMIE unemployment rate for India rose to 6.4% in September (or 6.8% on a seasonally-adjusted basis).

Global Markets

Equities

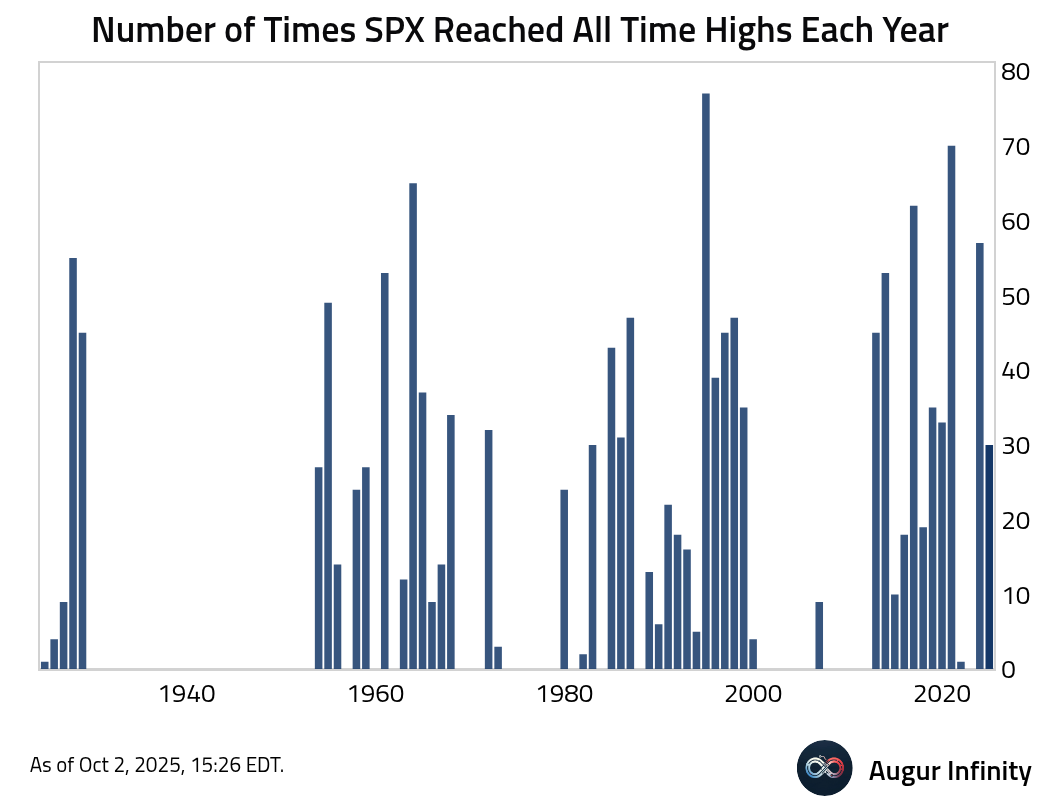

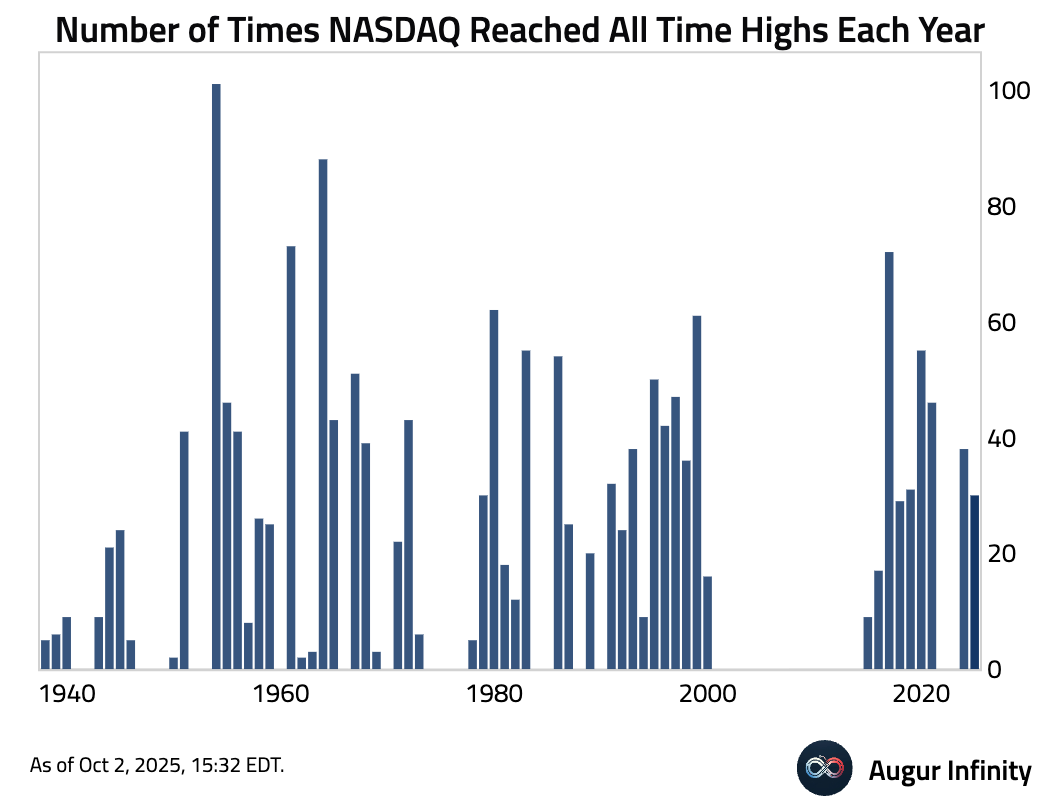

- S&P 500 has reached all-time highs 30 times this year.

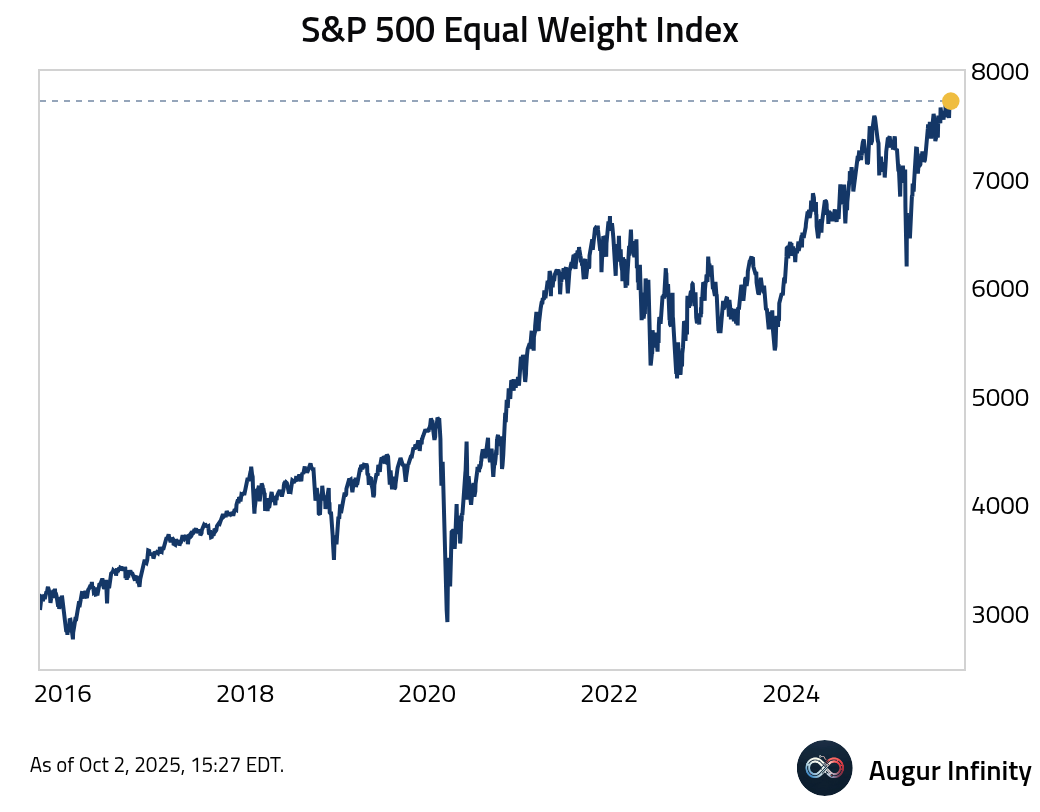

- S&P 500 Equal Weight Index rose for five consecutive sessions, also reaching an all-time high.

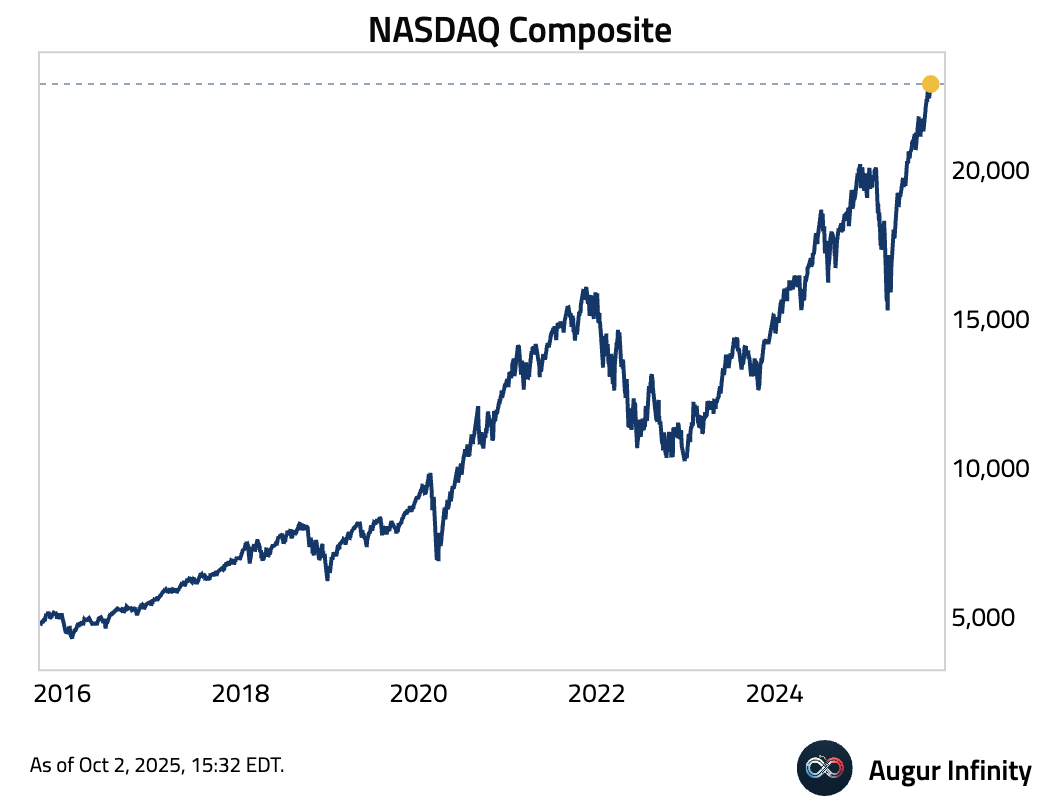

- The NASDAQ Composite posted decent gains, reaching the 30th ATH of 2025 as well.

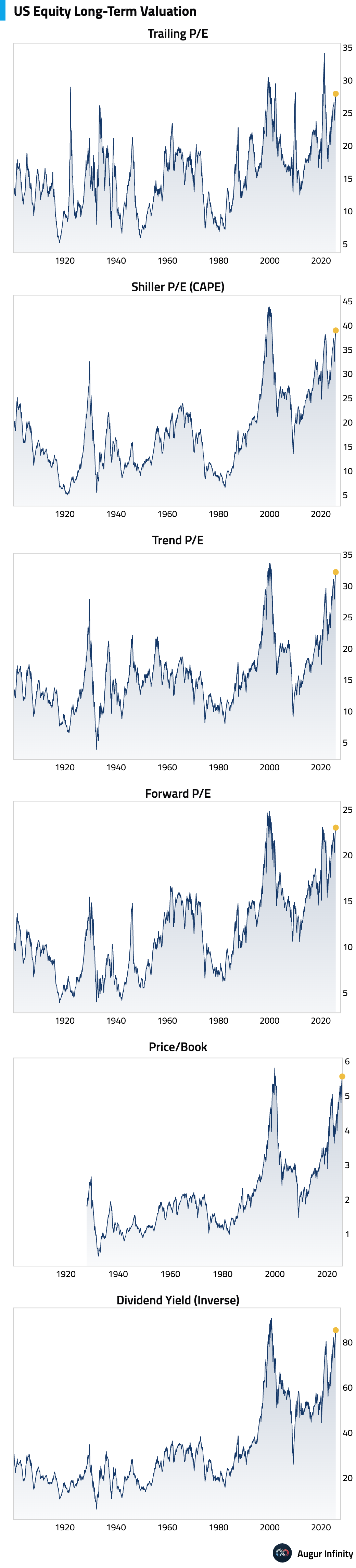

- No matter what measure you look at, US equity valuation is elevated.

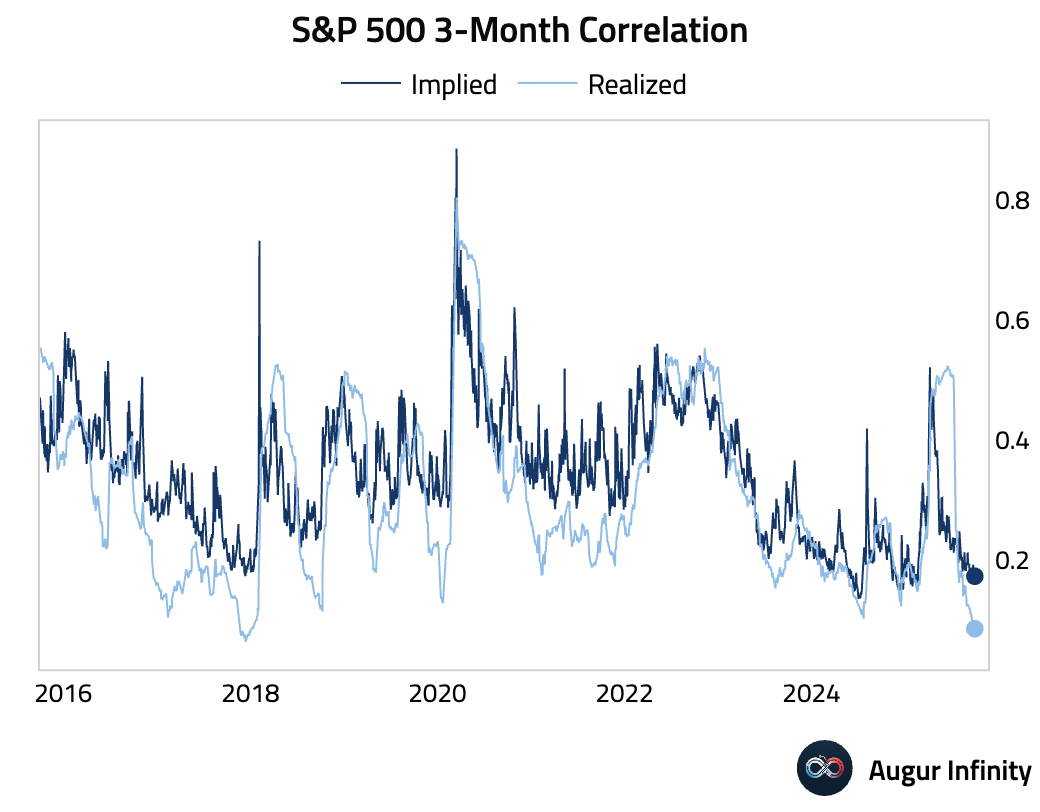

- The realized correlation for members of the S&P 500 Index has declined to the lowest level since January 2018.

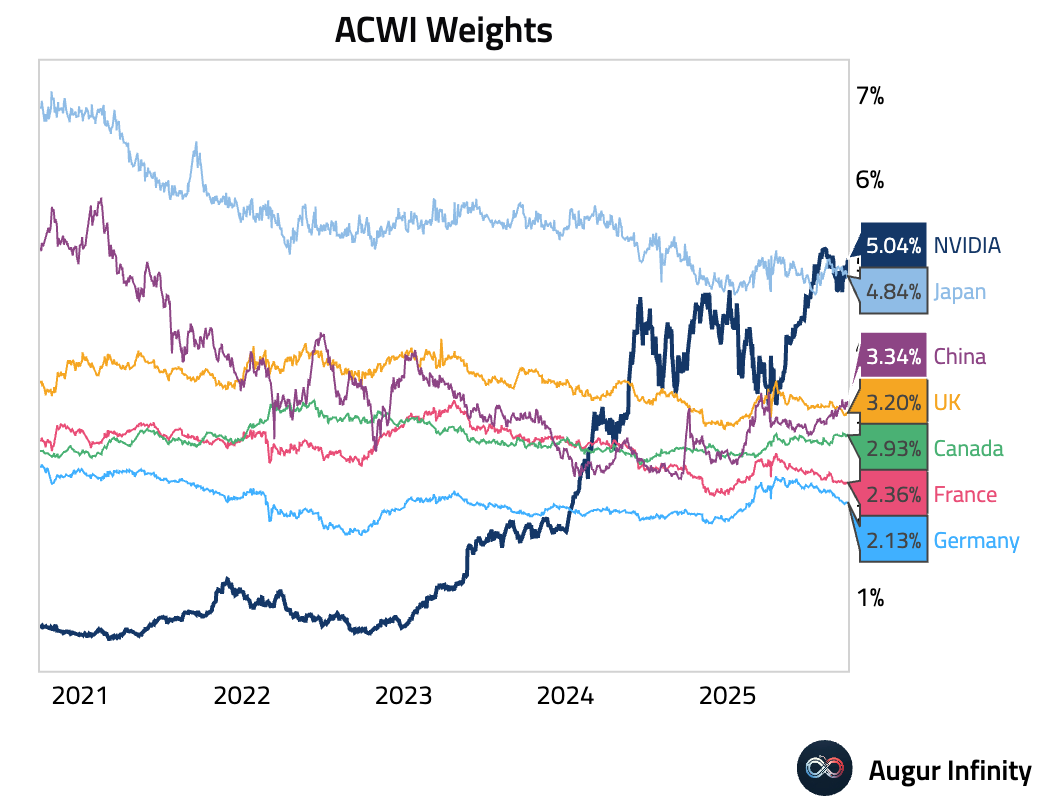

- NVIDIA’s weighting in ACWI—the ETF that tracks the MSCI All Country World Index—has now surpassed that of Japan again. In other words, if NVIDIA were considered a country, it would rank as the second-largest in ACWI, behind only the United States.

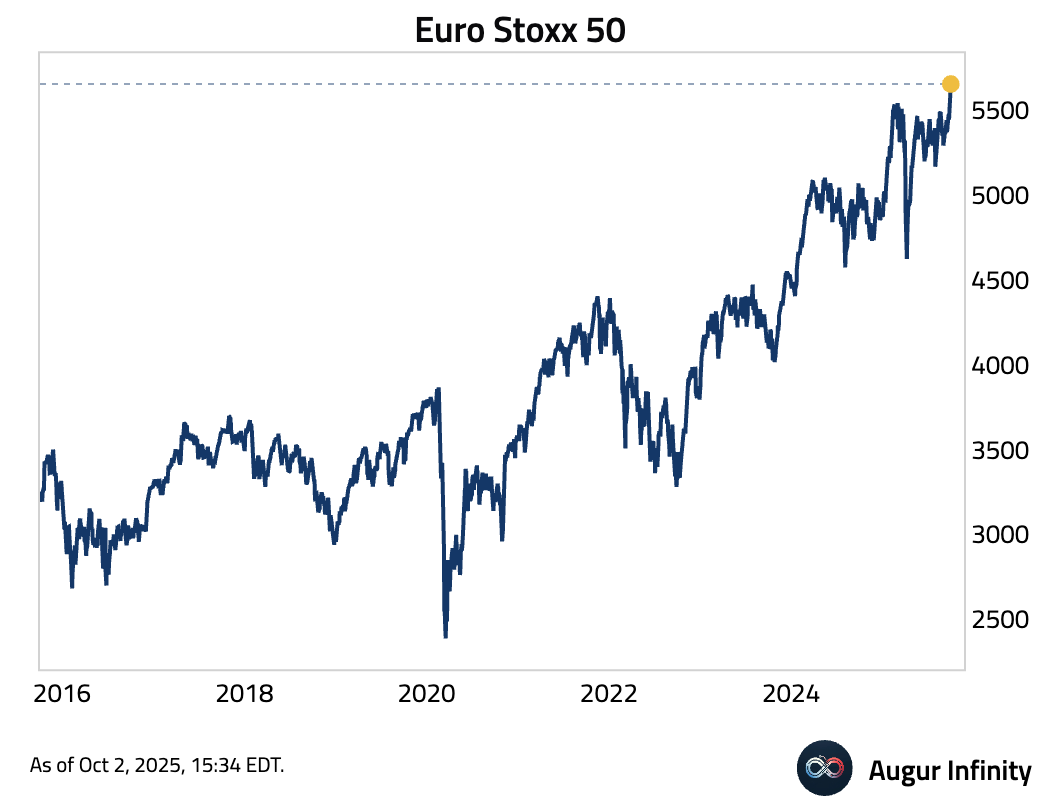

- Euro Stoxx 50 also gained for the fifth day to claim another ATH.

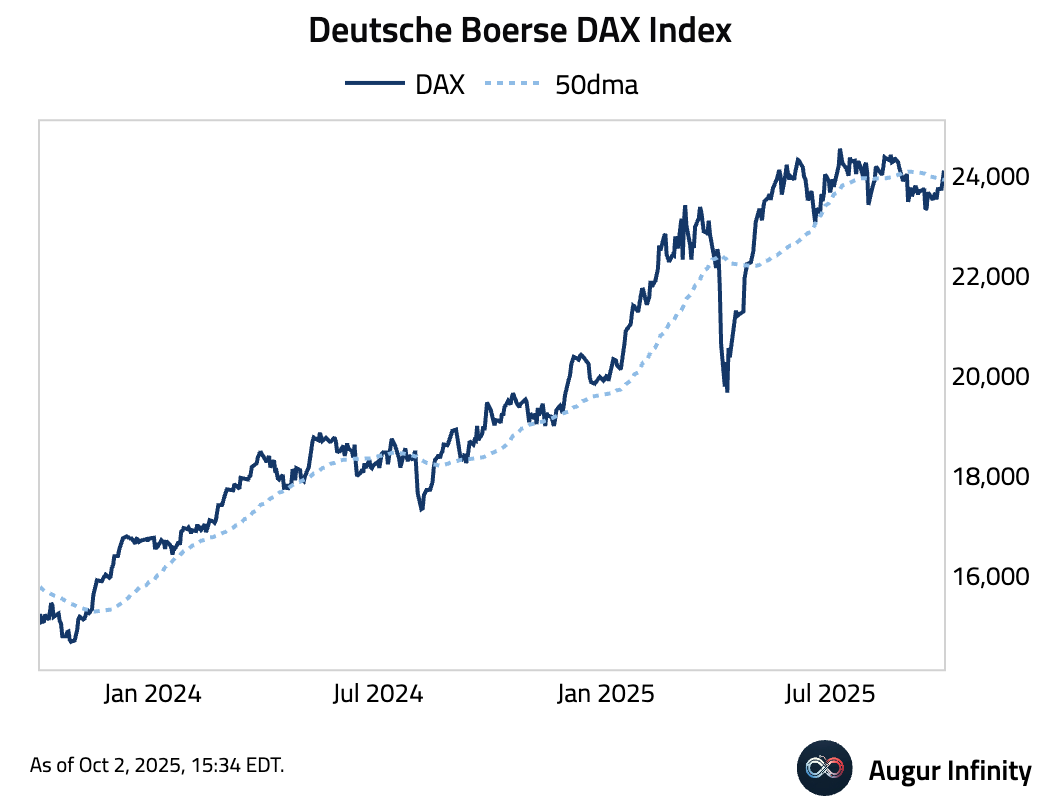

- Deutsche Boerse DAX Index is above its 50-day moving average.

Fixed Income

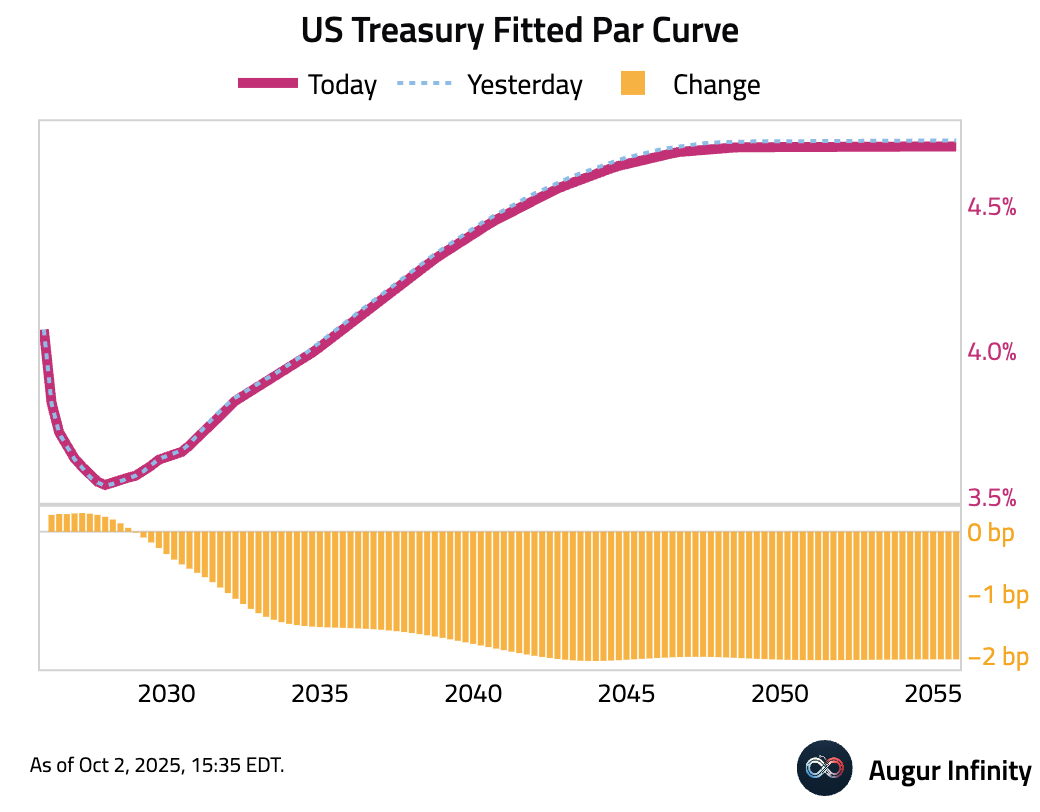

- The US Treasury curve flattened as longer-dated yields declined amid investor caution surrounding the ongoing US government shutdown and the related delay in economic data. The 5-year yield fell 0.4 bps, its fourth consecutive daily decrease, while 10-year and 30-year yields dropped 1.6 bps and 1.8 bps, respectively. The 2-year yield was little changed, rising just 0.5 bps.

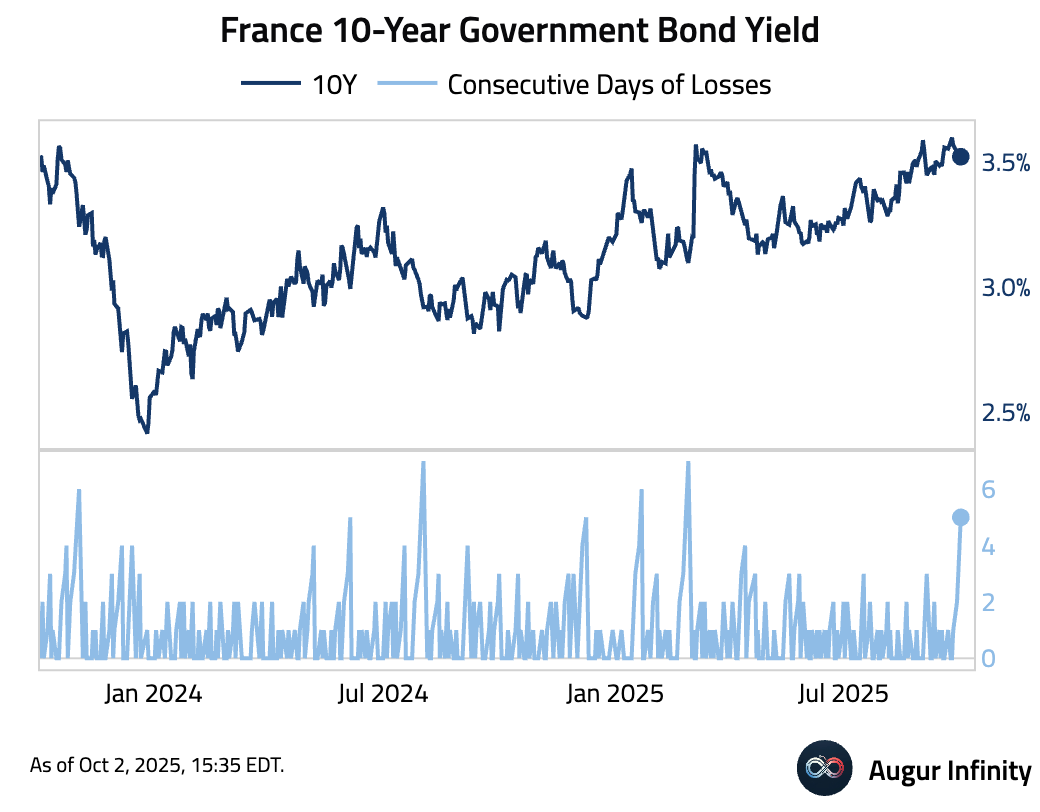

- France 10-year government bond yield has declined for five consecutive sessions.

FX

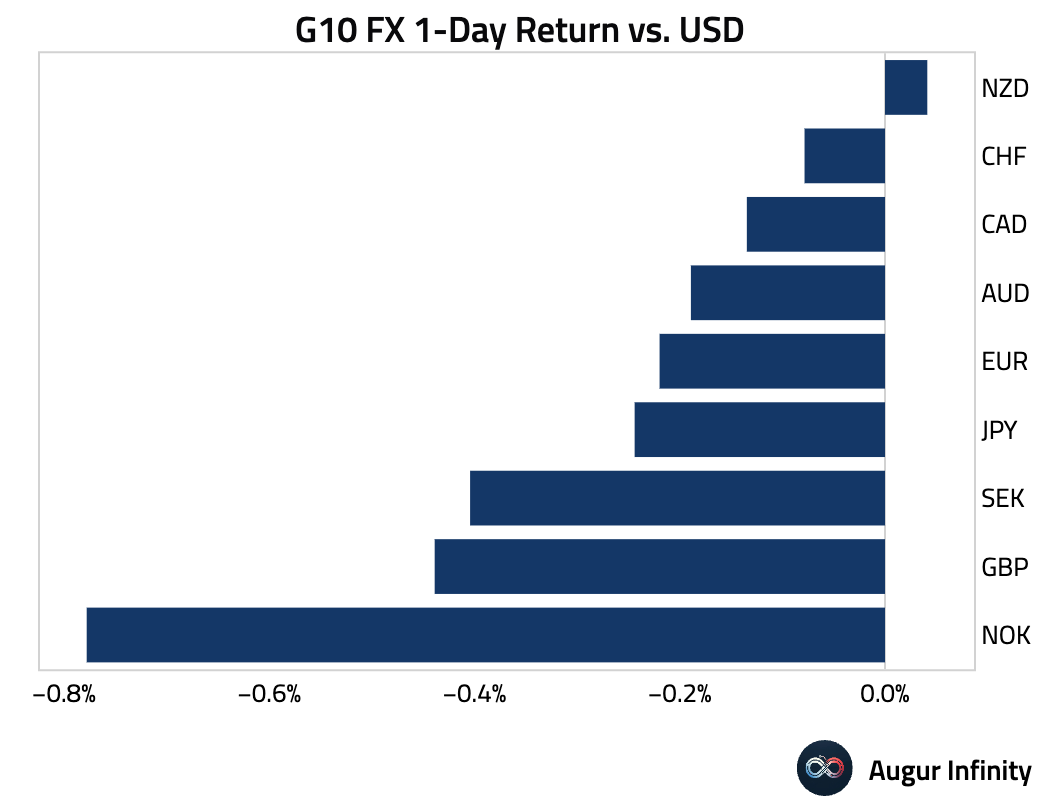

- The US dollar strengthened against most of its G10 peers, buoyed by uncertainty over the duration of the US government shutdown. The Norwegian krone (-0.8%) was the session’s worst performer, followed by the Swedish krona (-0.4%) and British pound (-0.4%). The New Zealand dollar was the outlier, finishing unchanged against the greenback after four consecutive days of gains.

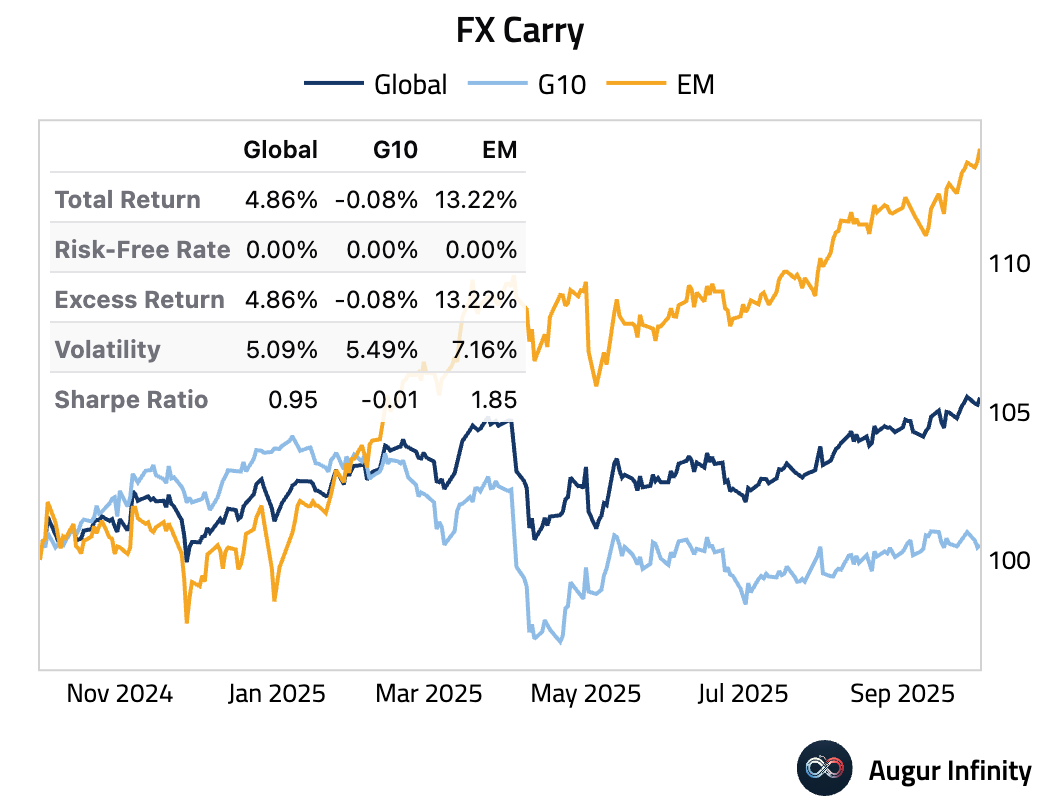

- EM FX carry strategy (long high yielding FX while shorting low yielding FX) has preformed quite well over the past year, while G10 carry strategy has suffered.

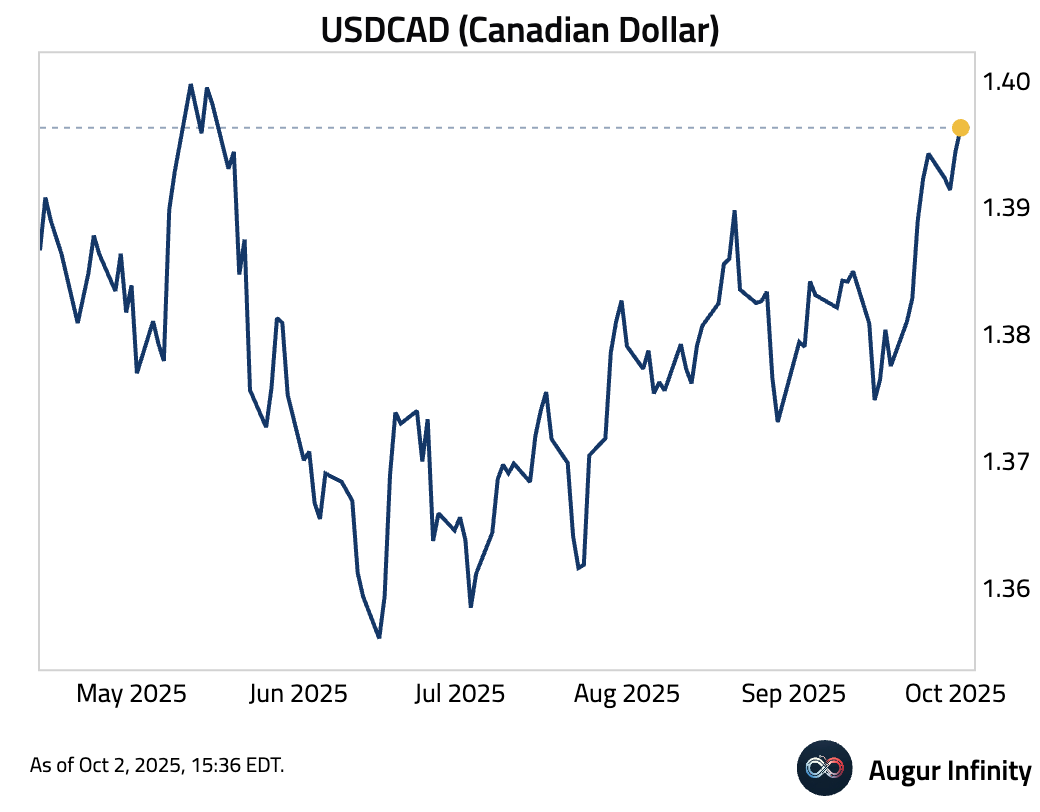

- The Canadian dollar has depreciated to the weakest level against USD since May 2025.

Commodities

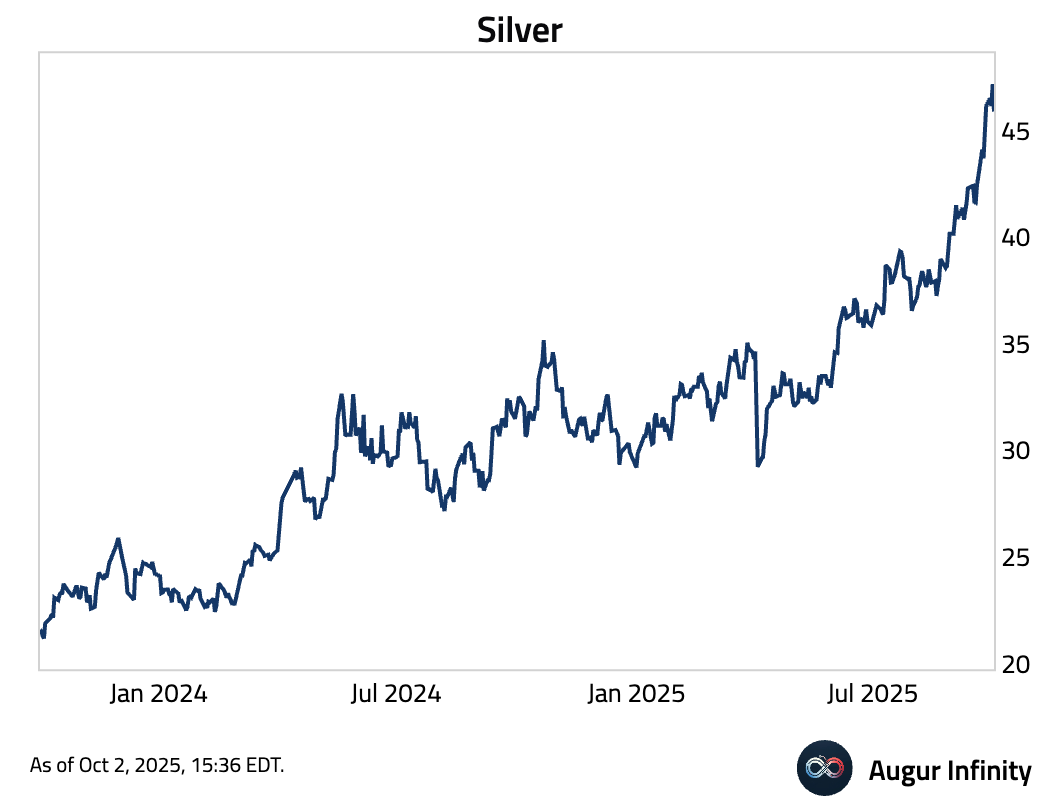

- Silver declined by -2.7% today, a 2.1σ move.

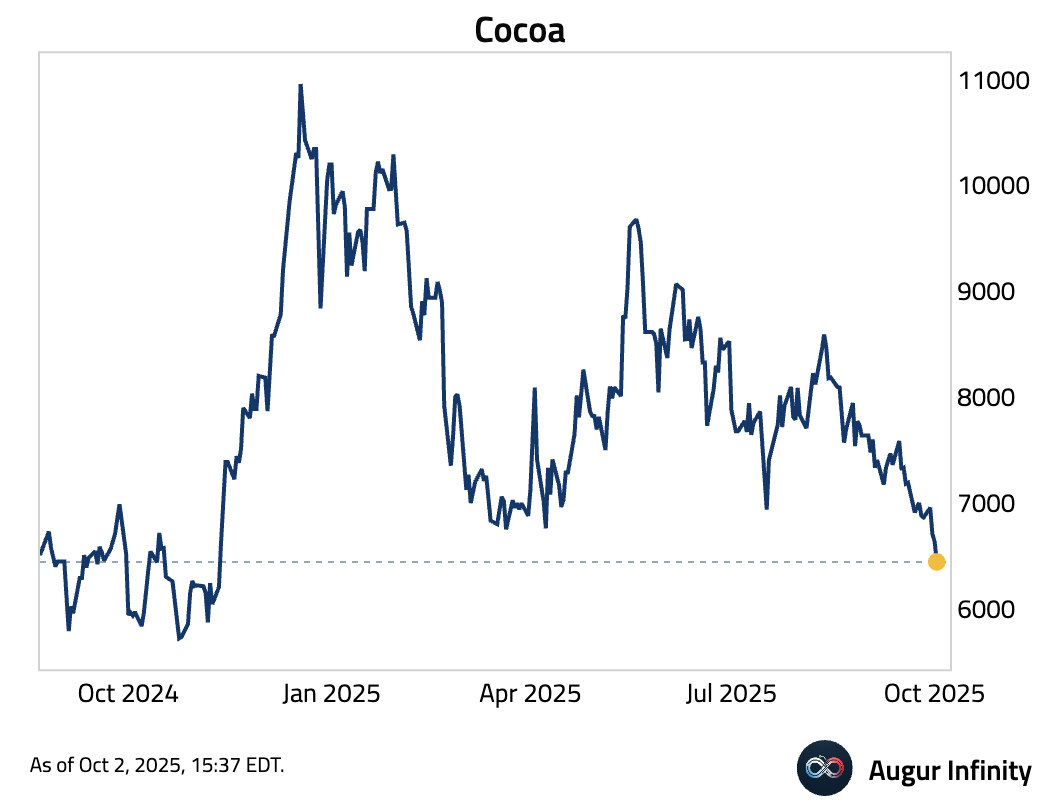

- Cocoa continued to decline.

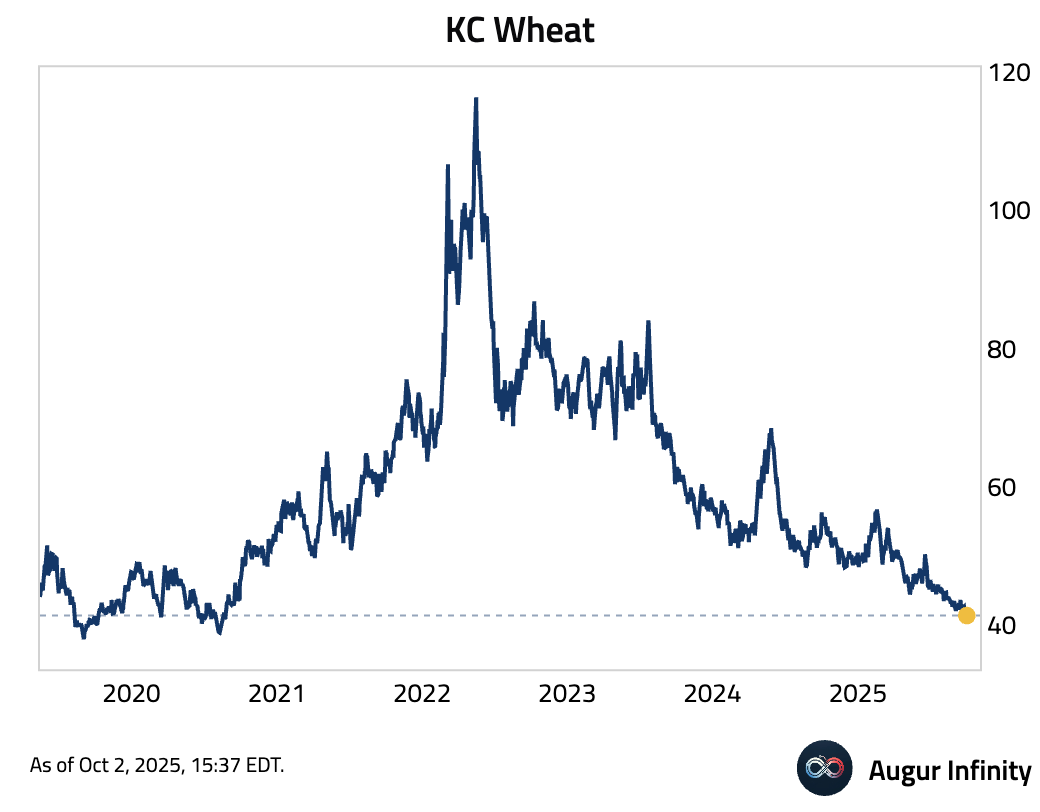

- So did wheat.

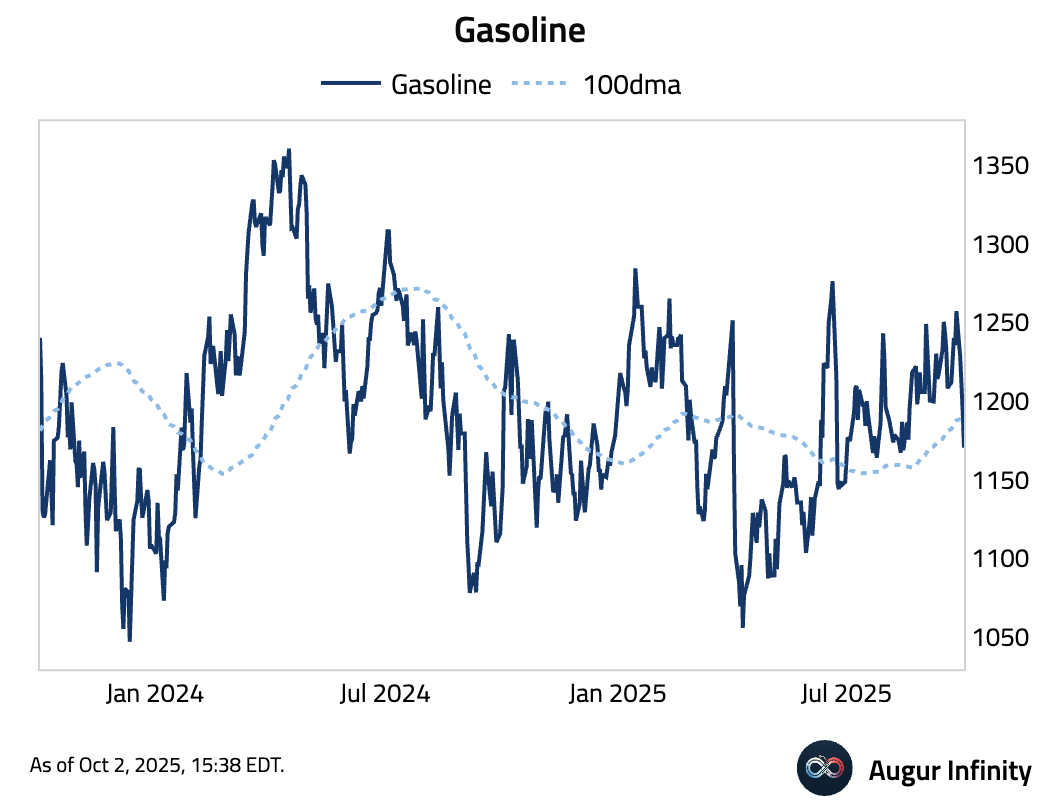

- Gasoline fell below its 100-day moving average.

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans. It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.